Exhibit 99.1 A Diversified Oncology Drug Development Company Presentation to HC Wainwright Global Investment Conference New York, NY 14 September 2022 ASX: KZA | NASDAQ: KZIA | Twitter: @KaziaTx

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve substantial risks and uncertainties, not all of which may be known at the time. All statements contained in this presentation, other than statements of historical fact, including statements regarding our strategy, research and development plans, collaborations, future operations, future financial position, future revenues, projected costs, prospects, plans, and objectives of management, are forward-looking statements. Not all forward-looking statements in this presentation are explicitly identified as such. Many factors could cause the actual results of the Company to differ materially from the results expressed or implied herein, and you should not place undue reliance on the forward-looking statements. Factors which could change the Company’s expected outcomes include, without limitation, our ability to: advance the development of our programs, and to do so within any timelines that may be indicated herein; the safety and efficacy of our drug development candidates; our ability to replicate experimental data; the ongoing validity of patents covering our drug development candidates, and our freedom to operate under third party intellectual property; our ability to obtain necessary regulatory approvals; our ability to enter into and maintain partnerships, collaborations, and other business relationships necessary to the progression of our drug development candidates; the timely availability of necessary capital to pursue our business objectives; and our ability to attract and retain qualified personnel; changes from anticipated levels of customer acceptance of existing and new products and services and other factors. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, there can therefore be no assurance that such expectations will prove to be correct. The Company has no obligation as a result of this presentation to clinical trial outcomes, sales, partnerships, future international, national or regional economic and competitive conditions, changes in relationships with customers, access to capital, difficulties in developing and marketing new products and services, or marketing existing products. In addition, the extent to which the COVID-19 outbreak continues to impact our workforce and our discovery research, supply chain and clinical trial operations activities, and the operations of the third parties on which we rely, will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration and severity of the outbreak, additional or modified government actions, and the actions that may be required to contain the virus or treat its impact. Any forward-looking statements contained in this presentation speak only as of the date this presentation is made, and we expressly disclaim any obligation to update any forward-looking statements, whether because of new information, future events or otherwise. 1

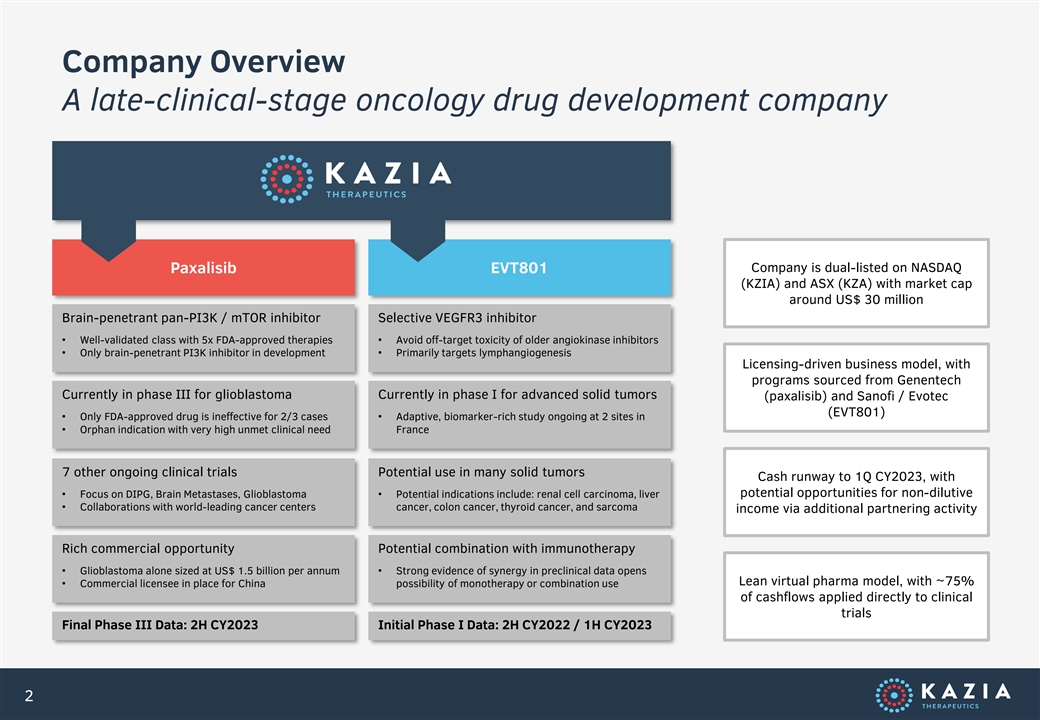

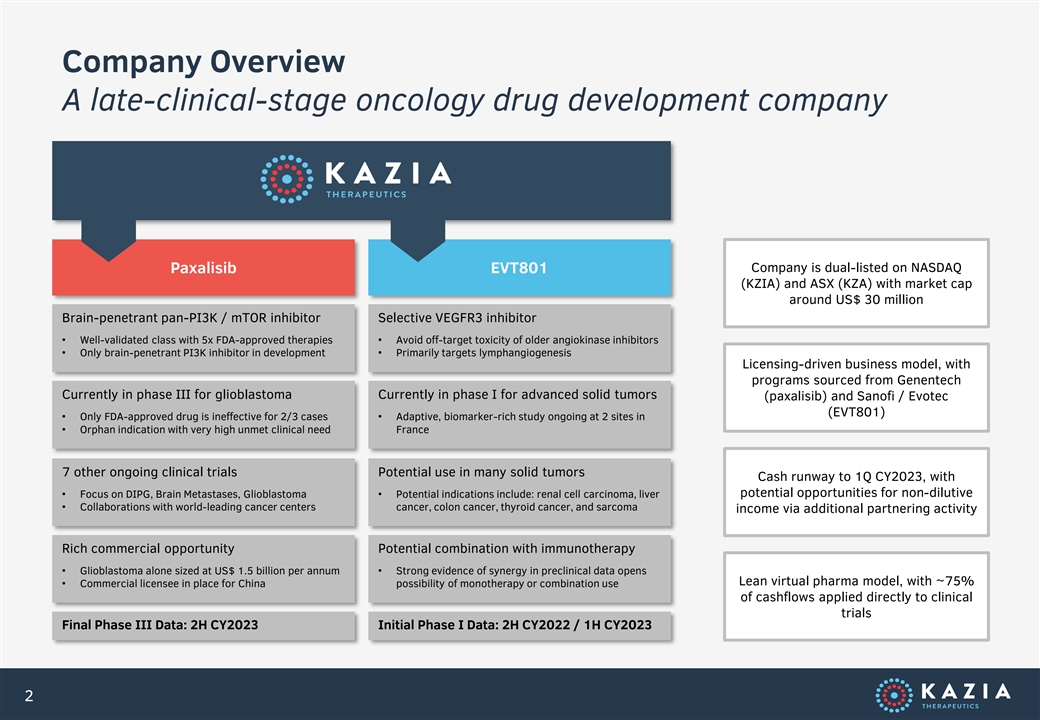

Company Overview A late-clinical-stage oncology drug development company Company is dual-listed on NASDAQ Paxalisib EVT801 (KZIA) and ASX (KZA) with market cap around US$ 30 million Brain-penetrant pan-PI3K / mTOR inhibitor Selective VEGFR3 inhibitor • Well-validated class with 5x FDA-approved therapies• Avoid off-target toxicity of older angiokinase inhibitors • Only brain-penetrant PI3K inhibitor in development• Primarily targets lymphangiogenesis Licensing-driven business model, with programs sourced from Genentech Currently in phase III for glioblastoma Currently in phase I for advanced solid tumors (paxalisib) and Sanofi / Evotec (EVT801) • Only FDA-approved drug is ineffective for 2/3 cases• Adaptive, biomarker-rich study ongoing at 2 sites in • Orphan indication with very high unmet clinical need France 7 other ongoing clinical trials Potential use in many solid tumors Cash runway to 1Q CY2023, with potential opportunities for non-dilutive • Focus on DIPG, Brain Metastases, Glioblastoma• Potential indications include: renal cell carcinoma, liver • Collaborations with world-leading cancer centers cancer, colon cancer, thyroid cancer, and sarcoma income via additional partnering activity Rich commercial opportunity Potential combination with immunotherapy • Glioblastoma alone sized at US$ 1.5 billion per annum• Strong evidence of synergy in preclinical data opens Lean virtual pharma model, with ~75% • Commercial licensee in place for China possibility of monotherapy or combination use of cashflows applied directly to clinical trials Final Phase III Data: 2H CY2023 Initial Phase I Data: 2H CY2022 / 1H CY2023 2

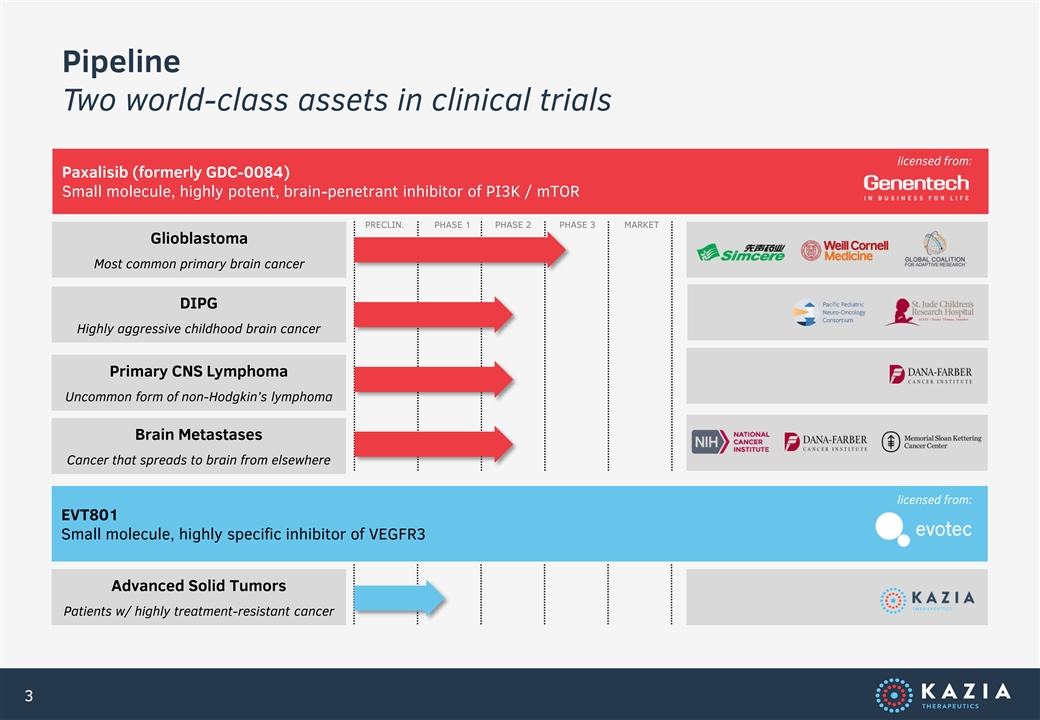

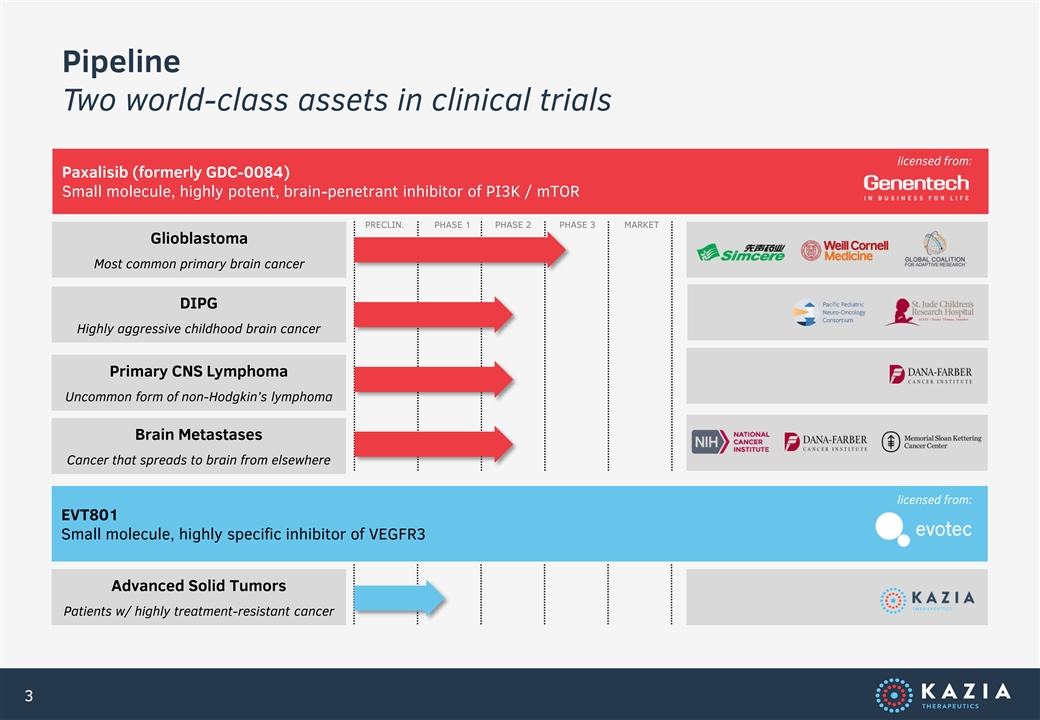

Pipeline Two world-class assets in clinical trials licensed from: Paxalisib (formerly GDC-0084) Small molecule, highly potent, brain-penetrant inhibitor of PI3K / mTOR PRECLIN. PHASE 1 PHASE 2 PHASE 3 MARKET Glioblastoma Most common primary brain cancer DIPG Highly aggressive childhood brain cancer Primary CNS Lymphoma Uncommon form of non-Hodgkin’s lymphoma Brain Metastases Cancer that spreads to brain from elsewhere licensed from: EVT801 Small molecule, highly specific inhibitor of VEGFR3 Advanced Solid Tumors Patients w/ highly treatment-resistant cancer 3

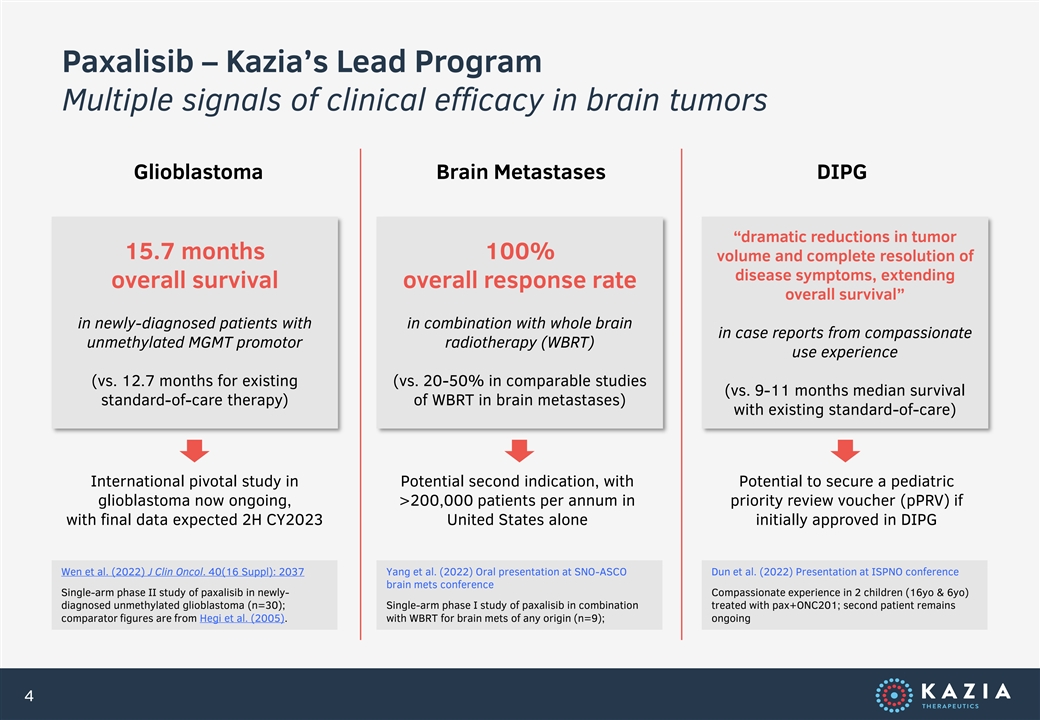

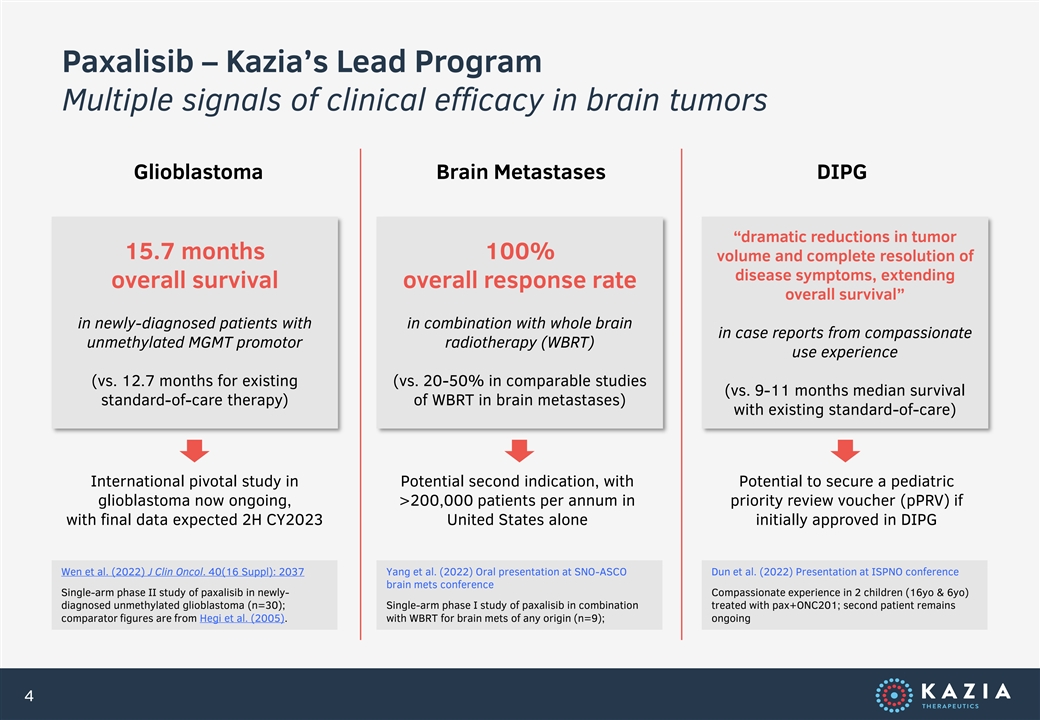

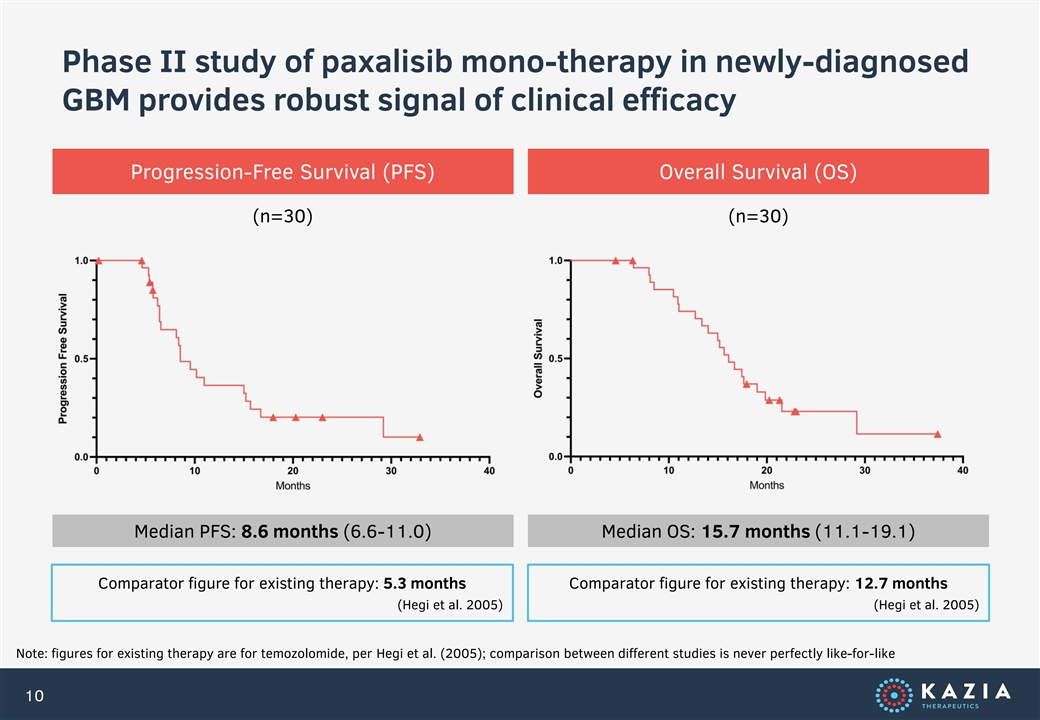

Paxalisib – Kazia’s Lead Program Multiple signals of clinical efficacy in brain tumors Glioblastoma Brain Metastases DIPG “dramatic reductions in tumor 15.7 months 100% volume and complete resolution of disease symptoms, extending overall survival overall response rate overall survival” in newly-diagnosed patients with in combination with whole brain in case reports from compassionate unmethylated MGMT promotor radiotherapy (WBRT) use experience (vs. 12.7 months for existing (vs. 20-50% in comparable studies (vs. 9-11 months median survival standard-of-care therapy) of WBRT in brain metastases) with existing standard-of-care) International pivotal study in Potential second indication, with Potential to secure a pediatric glioblastoma now ongoing, >200,000 patients per annum in priority review voucher (pPRV) if with final data expected 2H CY2023 United States alone initially approved in DIPG Wen et al. (2022) J Clin Oncol. 40(16 Suppl): 2037 Yang et al. (2022) Oral presentation at SNO-ASCO Dun et al. (2022) Presentation at ISPNO conference brain mets conference Single-arm phase II study of paxalisib in newly- Compassionate experience in 2 children (16yo & 6yo) diagnosed unmethylated glioblastoma (n=30); Single-arm phase I study of paxalisib in combination treated with pax+ONC201; second patient remains comparator figures are from Hegi et al. (2005). with WBRT for brain mets of any origin (n=9); ongoing 4

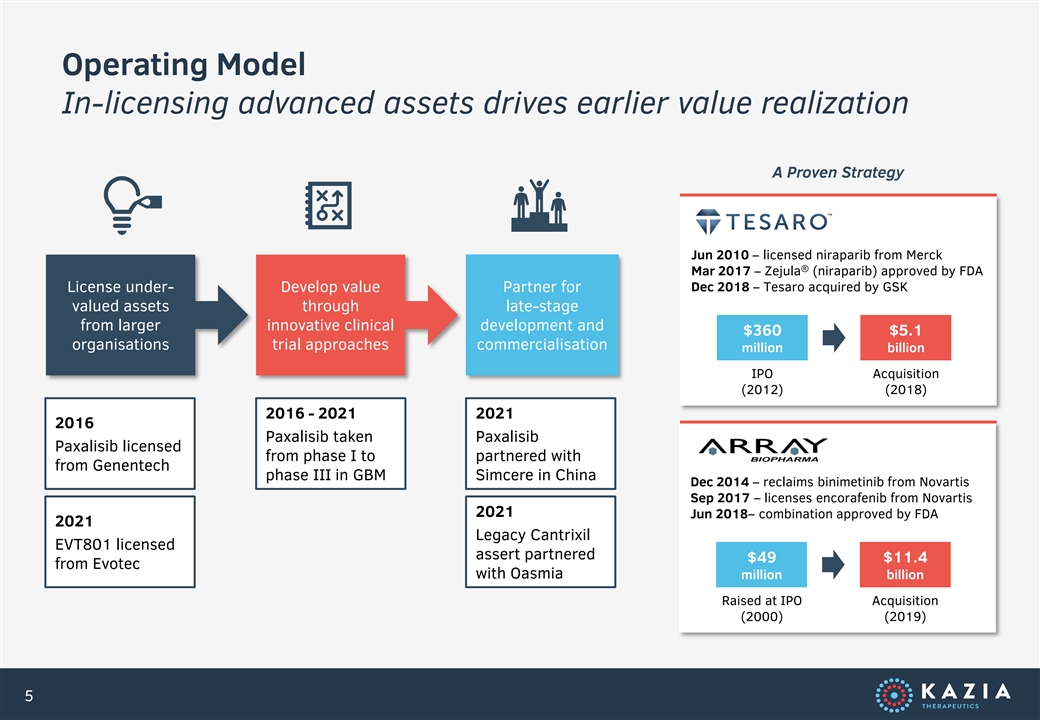

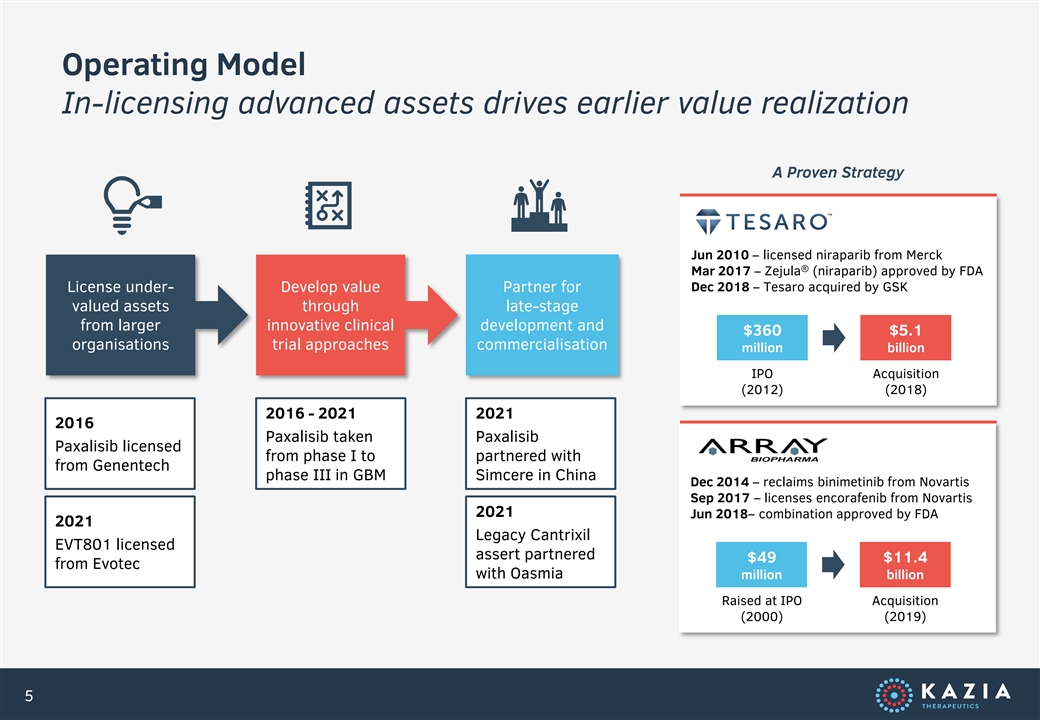

Operating Model In-licensing advanced assets drives earlier value realization A Proven Strategy Jun 2010 – licensed niraparib from Merck ® Mar 2017 – Zejula (niraparib) approved by FDA License under- Develop value Partner for Dec 2018 – Tesaro acquired by GSK valued assets through late-stage from larger innovative clinical development and $360 $5.1 organisations trial approaches commercialisation million billion IPO Acquisition (2012) (2018) 2016 - 2021 2021 2016 Paxalisib taken Paxalisib Paxalisib licensed from phase I to partnered with from Genentech phase III in GBM Simcere in China Dec 2014 – reclaims binimetinib from Novartis Sep 2017 – licenses encorafenib from Novartis 2021 Jun 2018– combination approved by FDA 2021 Legacy Cantrixil EVT801 licensed assert partnered $49 $11.4 from Evotec with Oasmia million billion Raised at IPO Acquisition (2000) (2019) 5

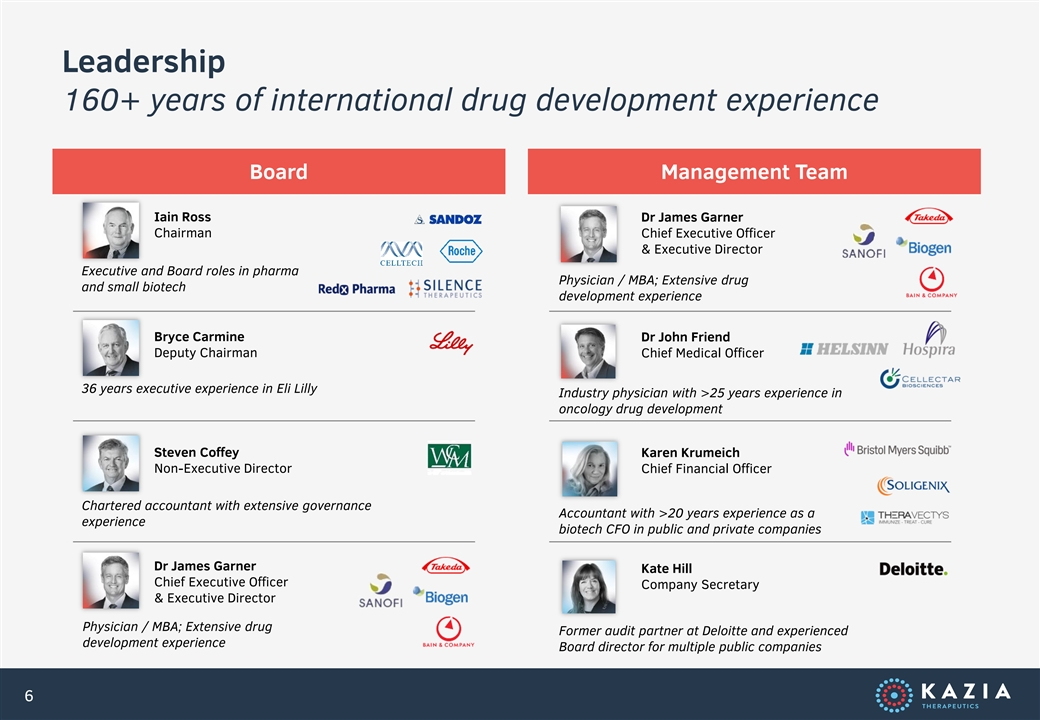

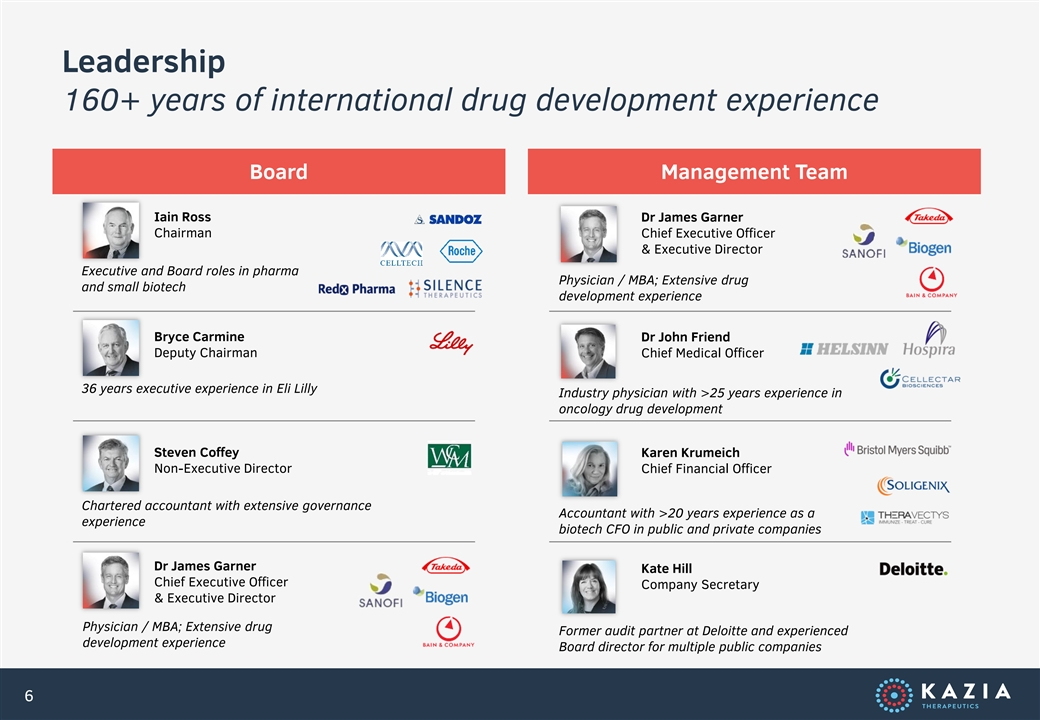

Leadership 160+ years of international drug development experience Board Management Team Iain Ross Dr James Garner Chairman Chief Executive Officer & Executive Director Executive and Board roles in pharma Physician / MBA; Extensive drug and small biotech development experience Bryce Carmine Dr John Friend Deputy Chairman Chief Medical Officer 36 years executive experience in Eli Lilly Industry physician with >25 years experience in oncology drug development Steven Coffey Karen Krumeich Non-Executive Director Chief Financial Officer Chartered accountant with extensive governance Accountant with >20 years experience as a experience biotech CFO in public and private companies Dr James Garner Kate Hill Chief Executive Officer Company Secretary & Executive Director Physician / MBA; Extensive drug Former audit partner at Deloitte and experienced development experience Board director for multiple public companies 6

Scientific Advisory Board World-leading experts in brain cancer Priscilla K Brastianos, MD John de Groot, MD Alan Olivero, PhD Patrick Y Wen, MD Associate Professor of Medicine Division Chief, Neuro-Oncology Drug Development Consultant Professor of Neurology Harvard Medical School UCSF Harvard Medical School formerly Assistant Physician in Medicine, formerly Senior Director, Discovery Director of the Center for Neuro- Hematology/Oncology Director of Clinical Research Chemistry & Head of Research Oncology Massachusetts General Hospital MD Anderson Cancer Center Operations Dana-Farber Cancer Institute Genentech, Inc >400 peer- >100 brain Extensive relationships reviewed cancer clinical >40 patent with NIH, NCI, SNO, academic trials as principal inventorships NBTS, and other publications investigator organizations 7

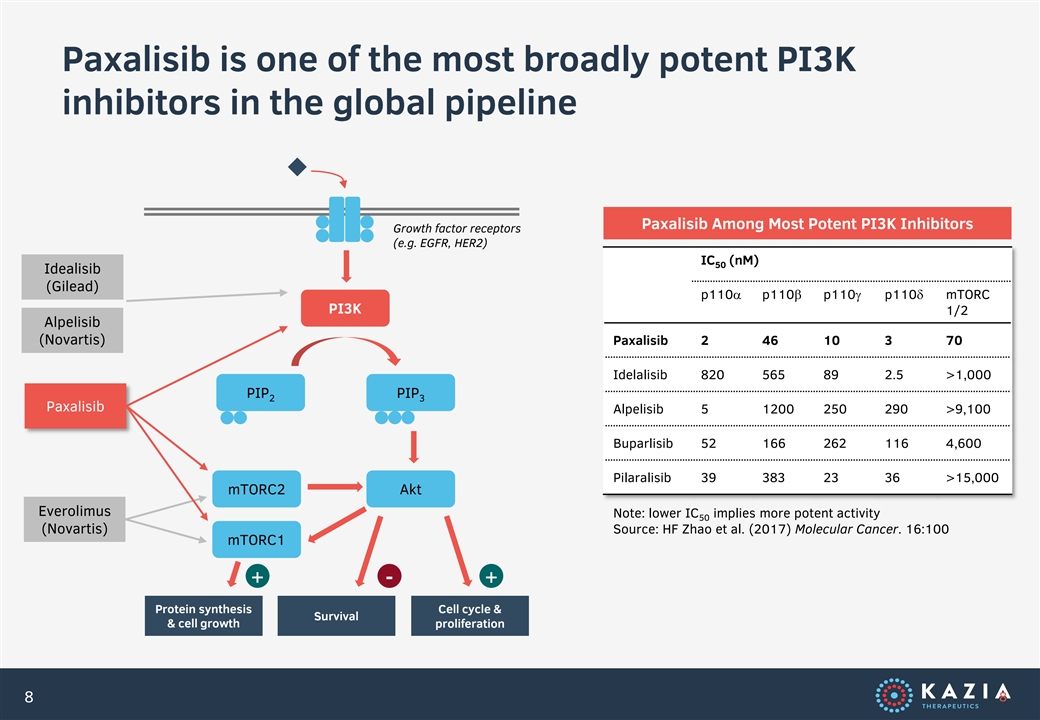

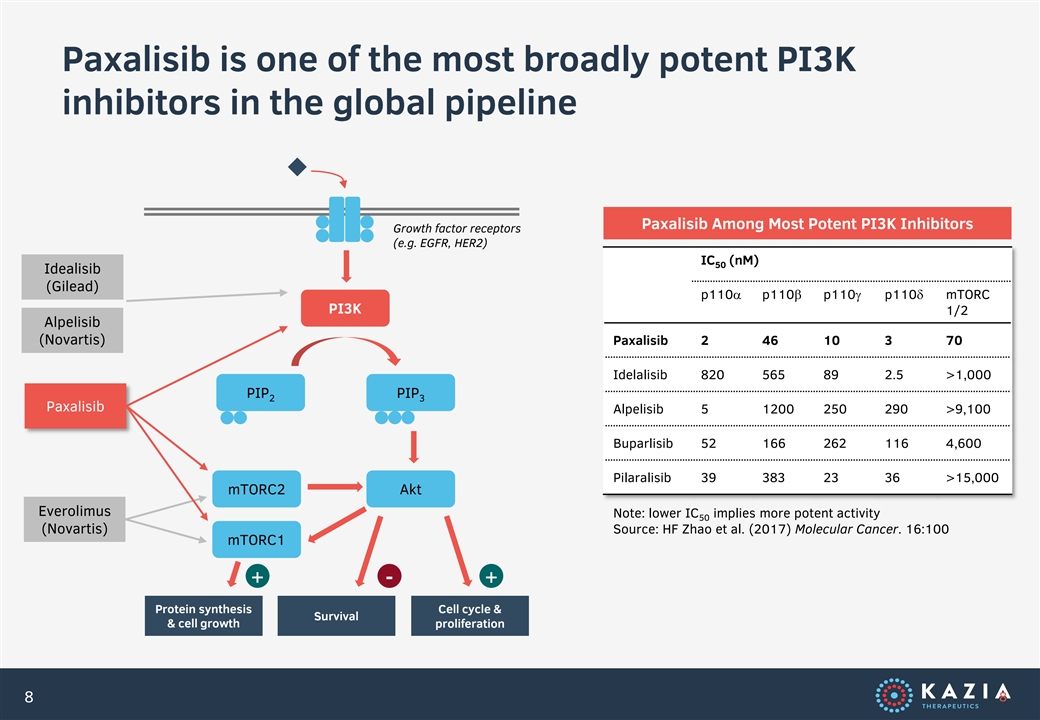

Paxalisib is one of the most broadly potent PI3K inhibitors in the global pipeline Paxalisib Among Most Potent PI3K Inhibitors Growth factor receptors (e.g. EGFR, HER2) IC (nM) 50 Idealisib (Gilead) p110a p110b p110g p110d mTORC PI3K 1/2 Alpelisib (Novartis) Paxalisib 2 46 10 3 70 Idelalisib 820 565 89 2.5 >1,000 PIP PIP 2 3 Paxalisib Alpelisib 5 1200 250 290 >9,100 Buparlisib 52 166 262 116 4,600 Pilaralisib 39 383 23 36 >15,000 mTORC2 Akt Everolimus Note: lower IC implies more potent activity 50 (Novartis) Source: HF Zhao et al. (2017) Molecular Cancer. 16:100 mTORC1 + - + Protein synthesis Cell cycle & Survival & cell growth proliferation 8 8

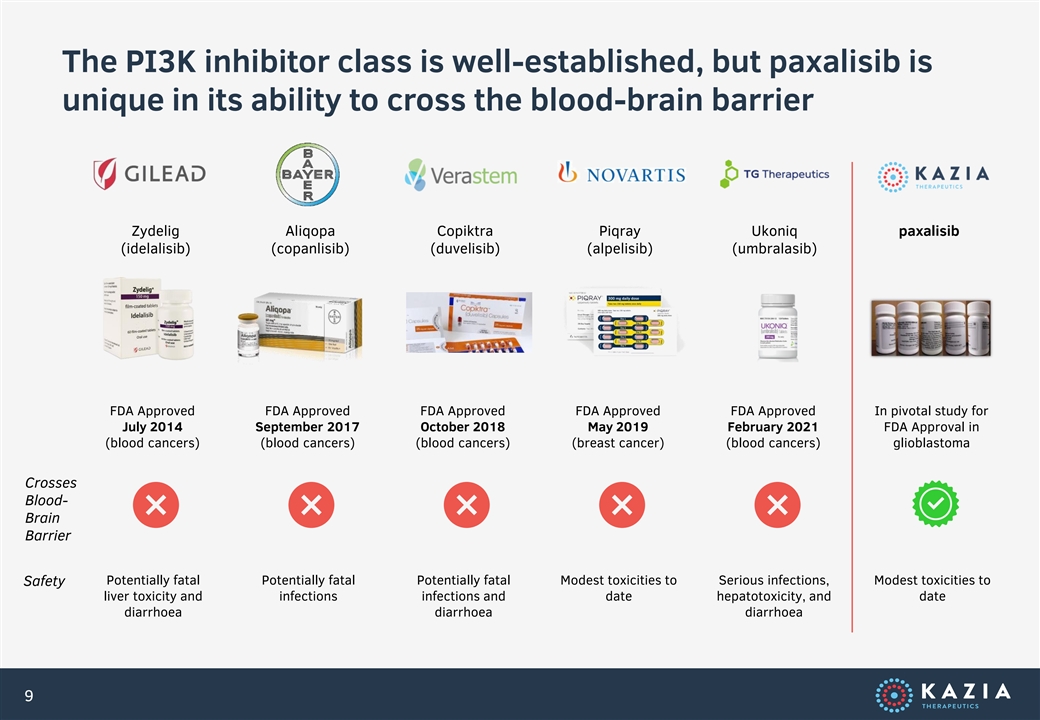

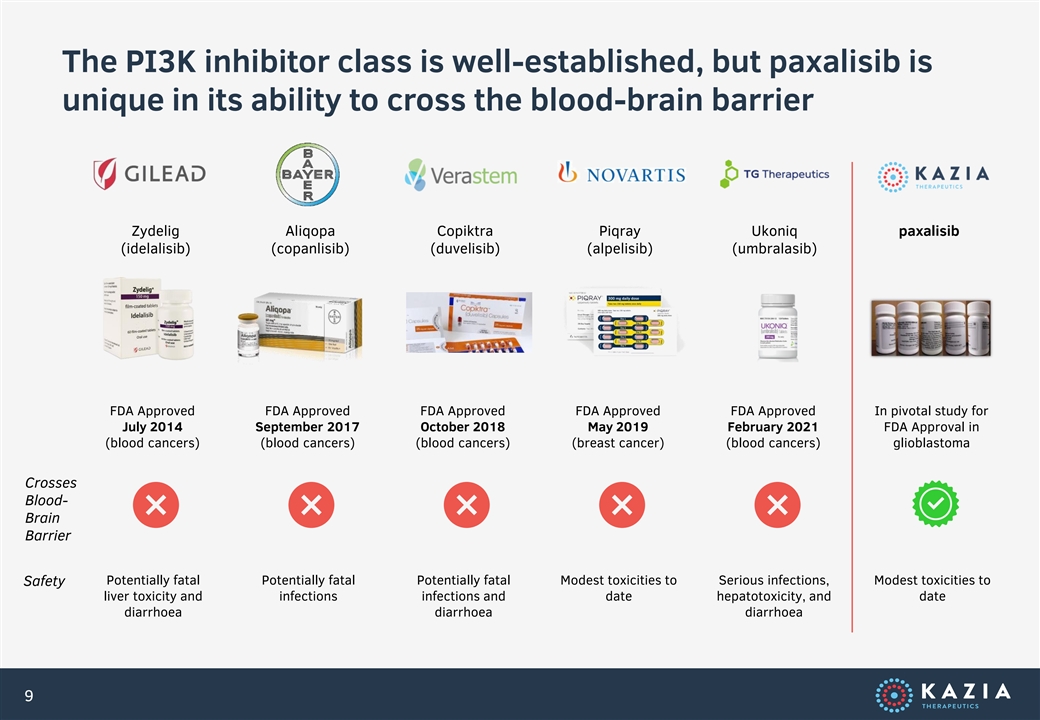

The PI3K inhibitor class is well-established, but paxalisib is unique in its ability to cross the blood-brain barrier Zydelig Aliqopa Copiktra Piqray Ukoniq paxalisib (idelalisib) (copanlisib) (duvelisib) (alpelisib) (umbralasib) FDA Approved FDA Approved FDA Approved FDA Approved FDA Approved In pivotal study for July 2014 September 2017 October 2018 May 2019 February 2021 FDA Approval in (blood cancers) (blood cancers) (blood cancers) (breast cancer) (blood cancers) glioblastoma Crosses Blood- Brain Barrier Potentially fatal Potentially fatal Potentially fatal Modest toxicities to Serious infections, Modest toxicities to Safety liver toxicity and infections infections and date hepatotoxicity, and date diarrhoea diarrhoea diarrhoea 9

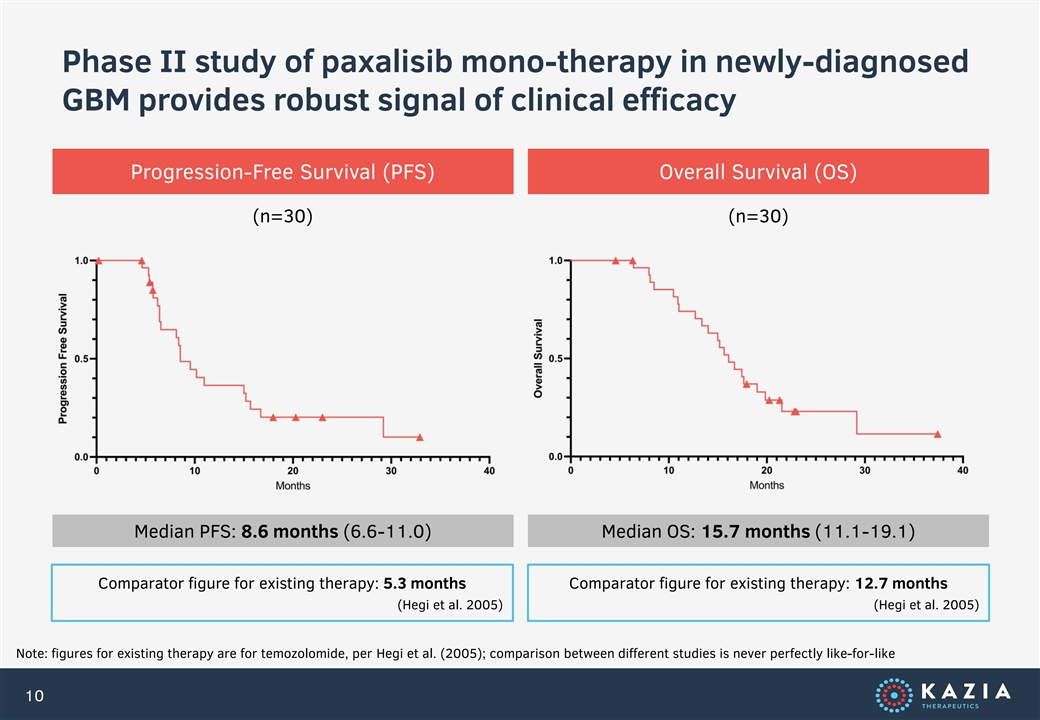

Phase II study of paxalisib mono-therapy in newly-diagnosed GBM provides robust signal of clinical efficacy Progression-Free Survival (PFS) Overall Survival (OS) (n=30) (n=30) Median PFS: 8.6 months (6.6-11.0) Median OS: 15.7 months (11.1-19.1) Comparator figure for existing therapy: 5.3 months Comparator figure for existing therapy: 12.7 months (Hegi et al. 2005) (Hegi et al. 2005) Note: figures for existing therapy are for temozolomide, per Hegi et al. (2005); comparison between different studies is never perfectly like-for-like 10

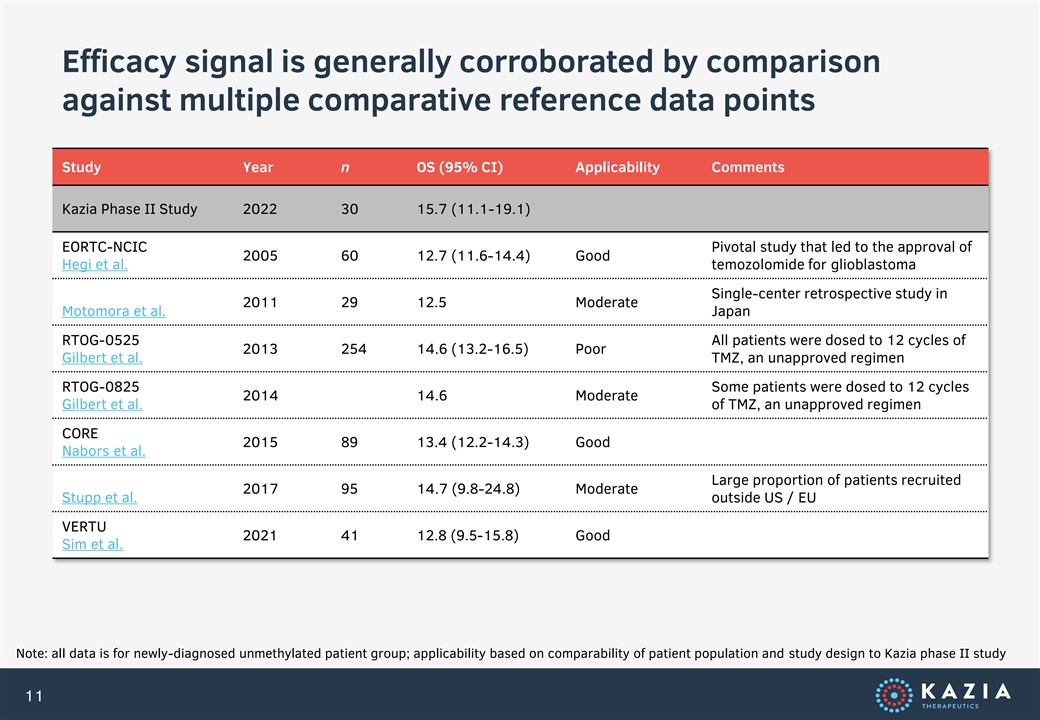

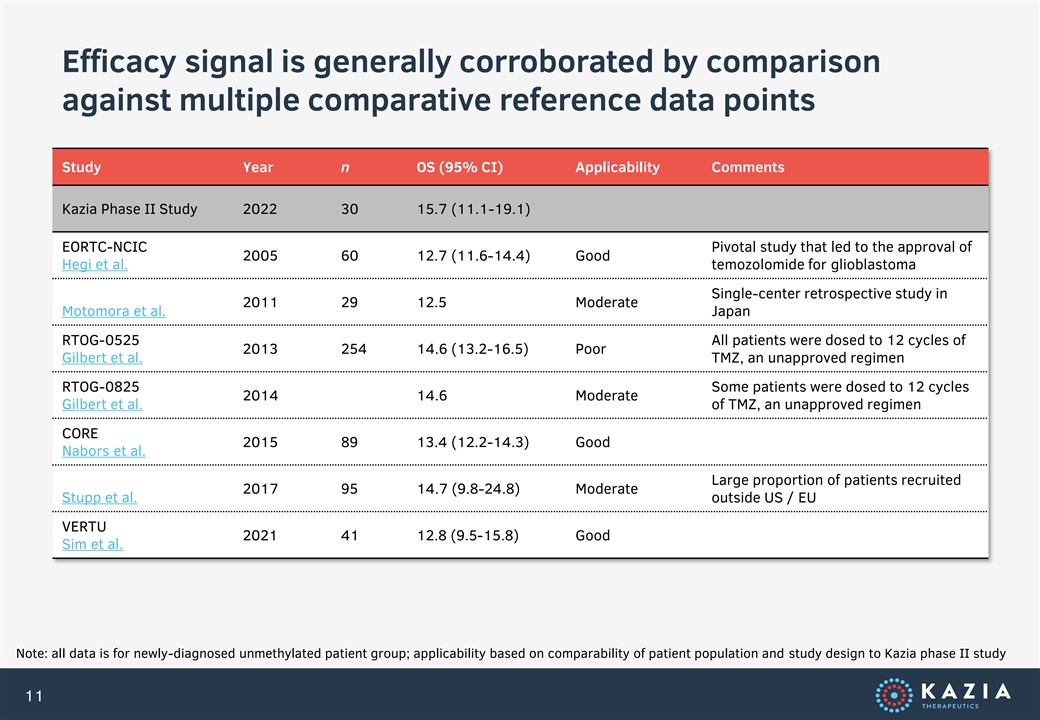

Efficacy signal is generally corroborated by comparison against multiple comparative reference data points Study Year n OS (95% CI) Applicability Comments Kazia Phase II Study 2022 30 15.7 (11.1-19.1) EORTC-NCIC Pivotal study that led to the approval of 2005 60 12.7 (11.6-14.4) Good Hegi et al. temozolomide for glioblastoma Single-center retrospective study in 2011 29 12.5 Moderate Motomora et al. Japan RTOG-0525 All patients were dosed to 12 cycles of 2013 254 14.6 (13.2-16.5) Poor Gilbert et al. TMZ, an unapproved regimen RTOG-0825 Some patients were dosed to 12 cycles 2014 14.6 Moderate Gilbert et al. of TMZ, an unapproved regimen CORE 2015 89 13.4 (12.2-14.3) Good Nabors et al. Large proportion of patients recruited 2017 95 14.7 (9.8-24.8) Moderate Stupp et al. outside US / EU VERTU 2021 41 12.8 (9.5-15.8) Good Sim et al. Note: all data is for newly-diagnosed unmethylated patient group; applicability based on comparability of patient population and study design to Kazia phase II study 11

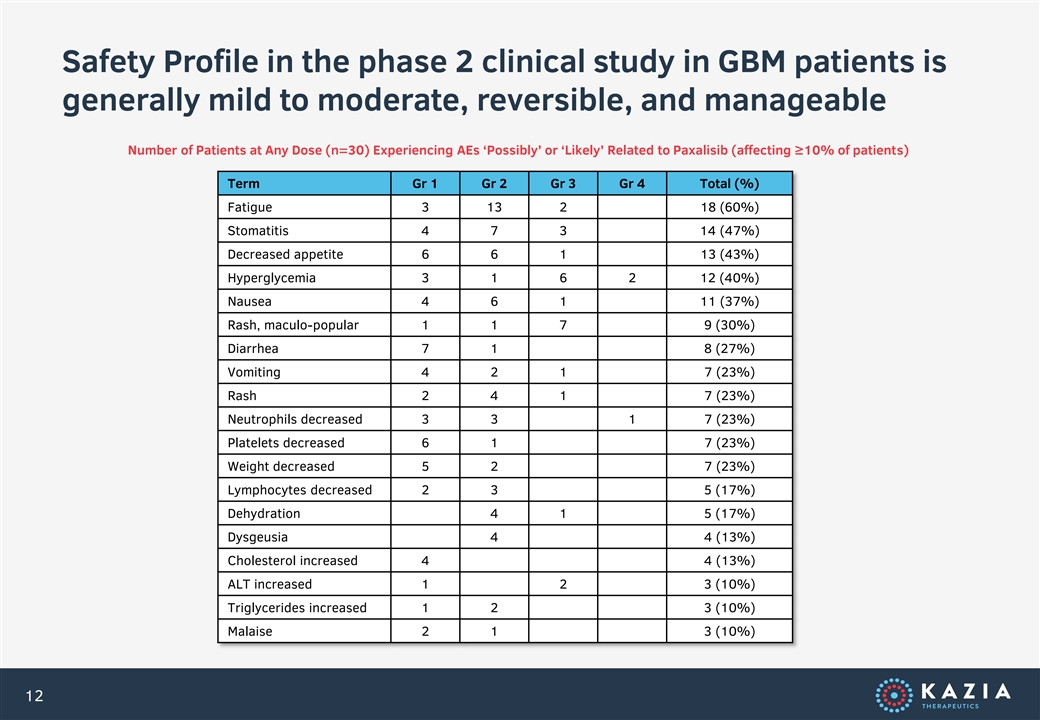

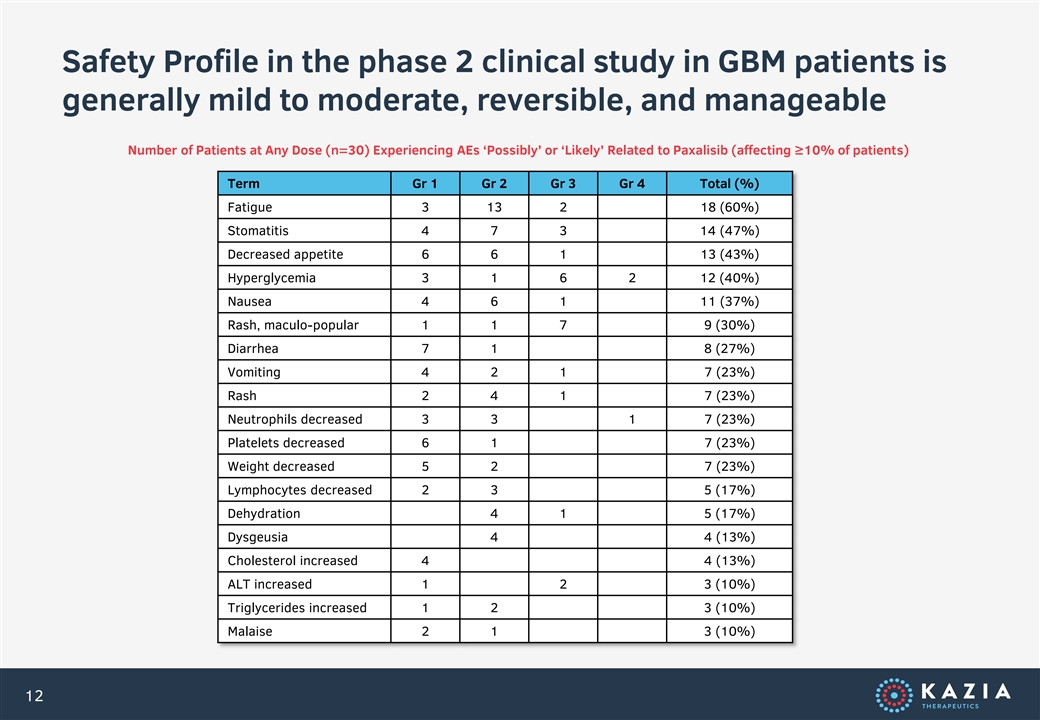

Safety Profile in the phase 2 clinical study in GBM patients is generally mild to moderate, reversible, and manageable Number of Patients at Any Dose (n=30) Experiencing AEs ‘Possibly’ or ‘Likely’ Related to Paxalisib (affecting ≥10% of patients) Term Gr 1 Gr 2 Gr 3 Gr 4 Total (%) Fatigue 3 13 2 18 (60%) Stomatitis 4 7 3 14 (47%) Decreased appetite 6 6 1 13 (43%) Hyperglycemia 3 1 6 2 12 (40%) Nausea 4 6 1 11 (37%) Rash, maculo-popular 1 1 7 9 (30%) Diarrhea 7 1 8 (27%) Vomiting 4 2 1 7 (23%) Rash 2 4 1 7 (23%) Neutrophils decreased 3 3 1 7 (23%) Platelets decreased 6 1 7 (23%) Weight decreased 5 2 7 (23%) Lymphocytes decreased 2 3 5 (17%) Dehydration 4 1 5 (17%) Dysgeusia 4 4 (13%) Cholesterol increased 4 4 (13%) ALT increased 1 2 3 (10%) Triglycerides increased 1 2 3 (10%) Malaise 2 1 3 (10%) 12

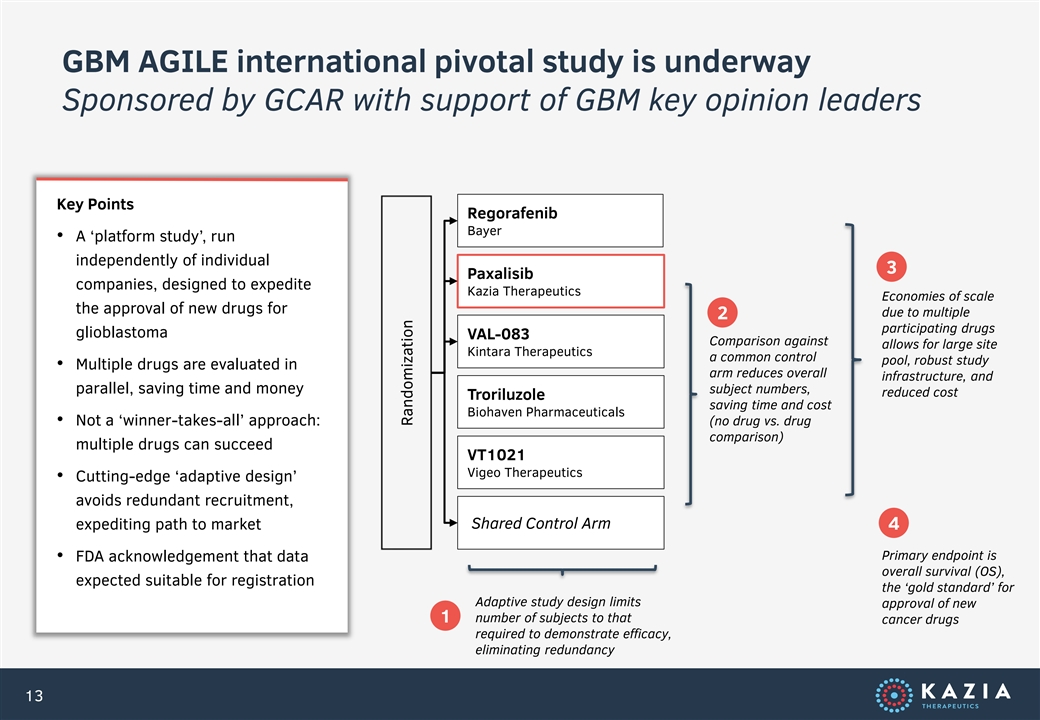

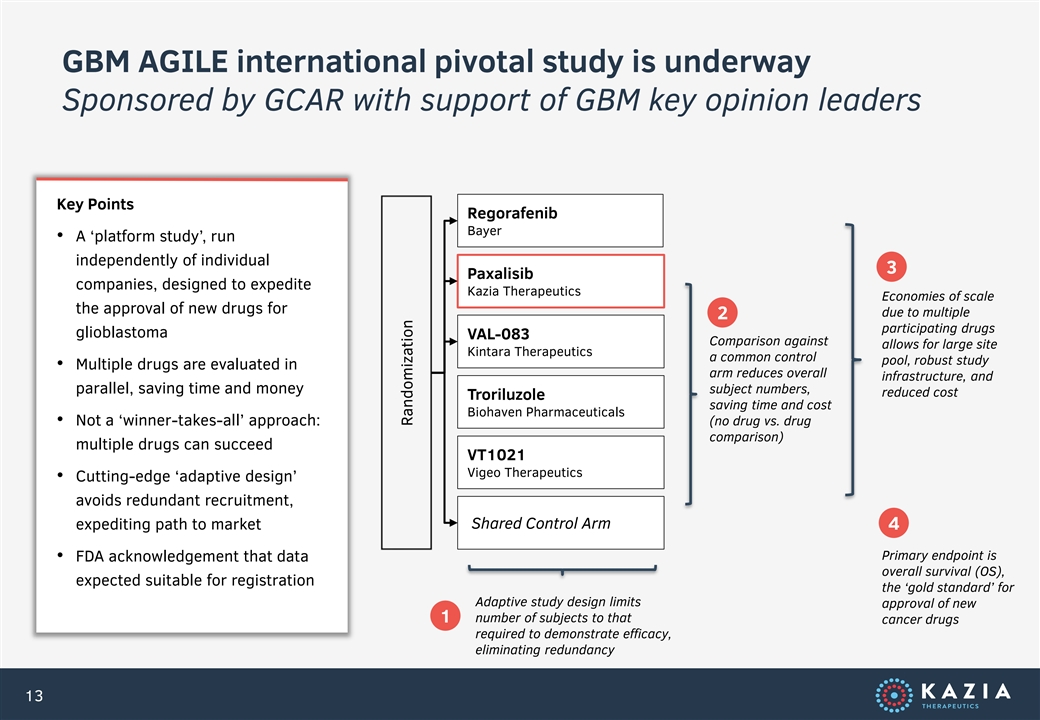

GBM AGILE international pivotal study is underway Sponsored by GCAR with support of GBM key opinion leaders Key Points Regorafenib Bayer • A ‘platform study’, run independently of individual 3 Paxalisib companies, designed to expedite Kazia Therapeutics Economies of scale the approval of new drugs for due to multiple 2 participating drugs glioblastoma VAL-083 Comparison against allows for large site Kintara Therapeutics a common control pool, robust study • Multiple drugs are evaluated in arm reduces overall infrastructure, and parallel, saving time and money subject numbers, reduced cost Troriluzole saving time and cost Biohaven Pharmaceuticals • Not a ‘winner-takes-all’ approach: (no drug vs. drug comparison) multiple drugs can succeed VT1021 Vigeo Therapeutics • Cutting-edge ‘adaptive design’ avoids redundant recruitment, expediting path to market Shared Control Arm 4 Primary endpoint is • FDA acknowledgement that data overall survival (OS), expected suitable for registration the ‘gold standard’ for Adaptive study design limits approval of new 1 number of subjects to that cancer drugs required to demonstrate efficacy, eliminating redundancy 13 Randomization

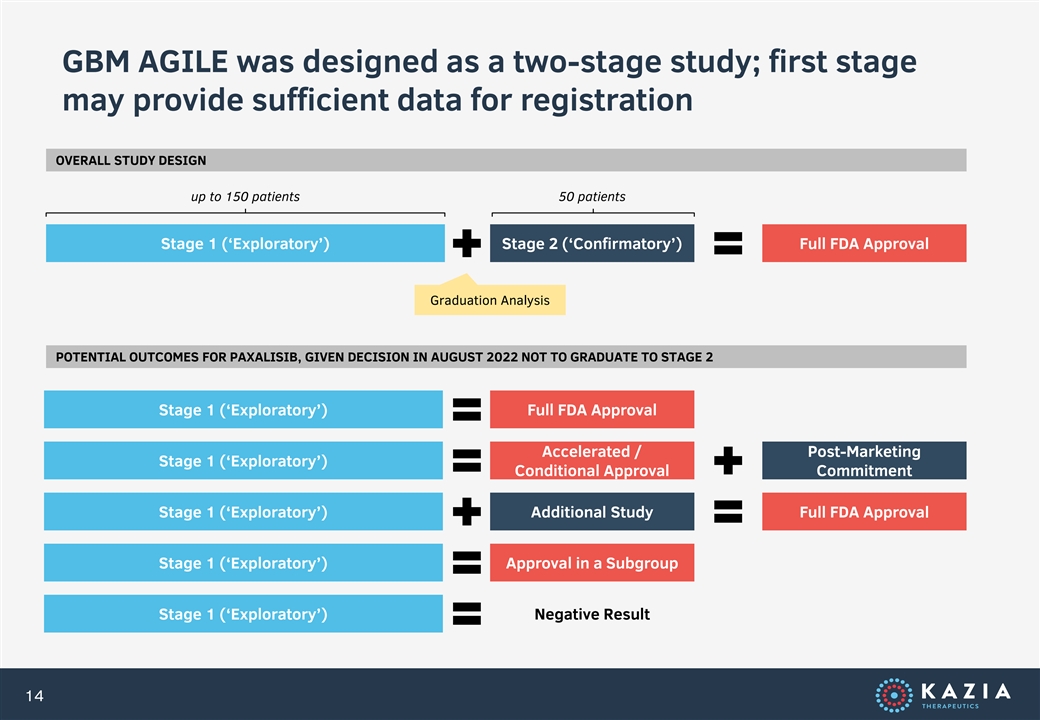

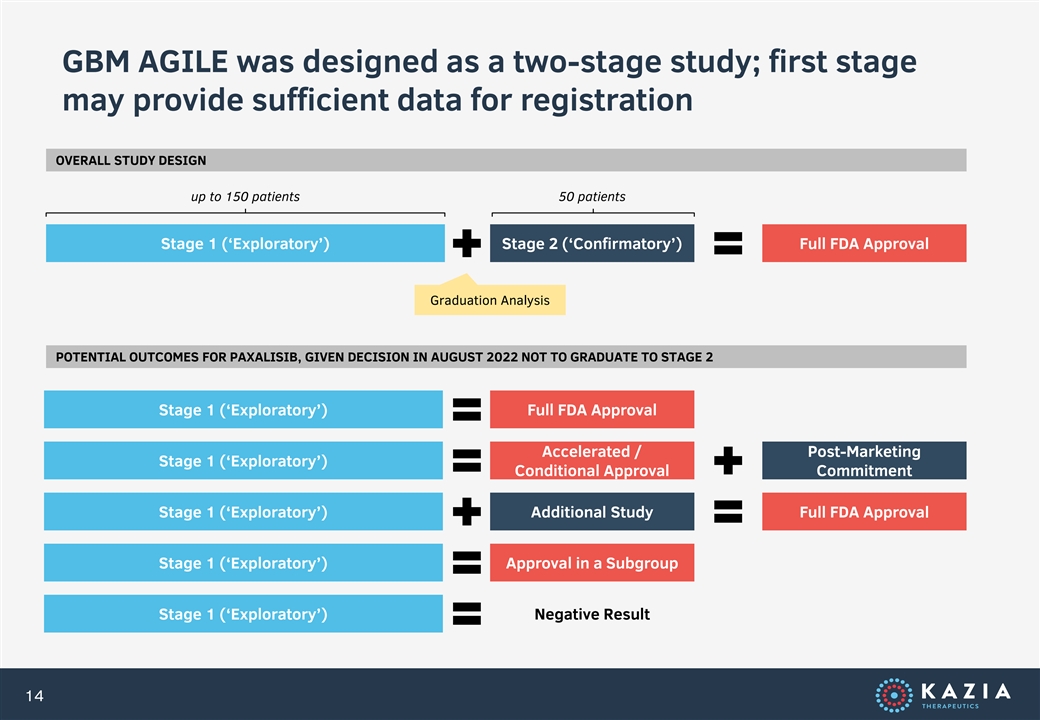

GBM AGILE was designed as a two-stage study; first stage may provide sufficient data for registration OVERALL STUDY DESIGN up to 150 patients 50 patients Stage 1 (‘Exploratory’) Stage 2 (‘Confirmatory’) Full FDA Approval Graduation Analysis POTENTIAL OUTCOMES FOR PAXALISIB, GIVEN DECISION IN AUGUST 2022 NOT TO GRADUATE TO STAGE 2 Stage 1 (‘Exploratory’) Full FDA Approval Accelerated / Post-Marketing Stage 1 (‘Exploratory’) Conditional Approval Commitment Stage 1 (‘Exploratory’) Additional Study Full FDA Approval Stage 1 (‘Exploratory’) Approval in a Subgroup Stage 1 (‘Exploratory’) Negative Result 14

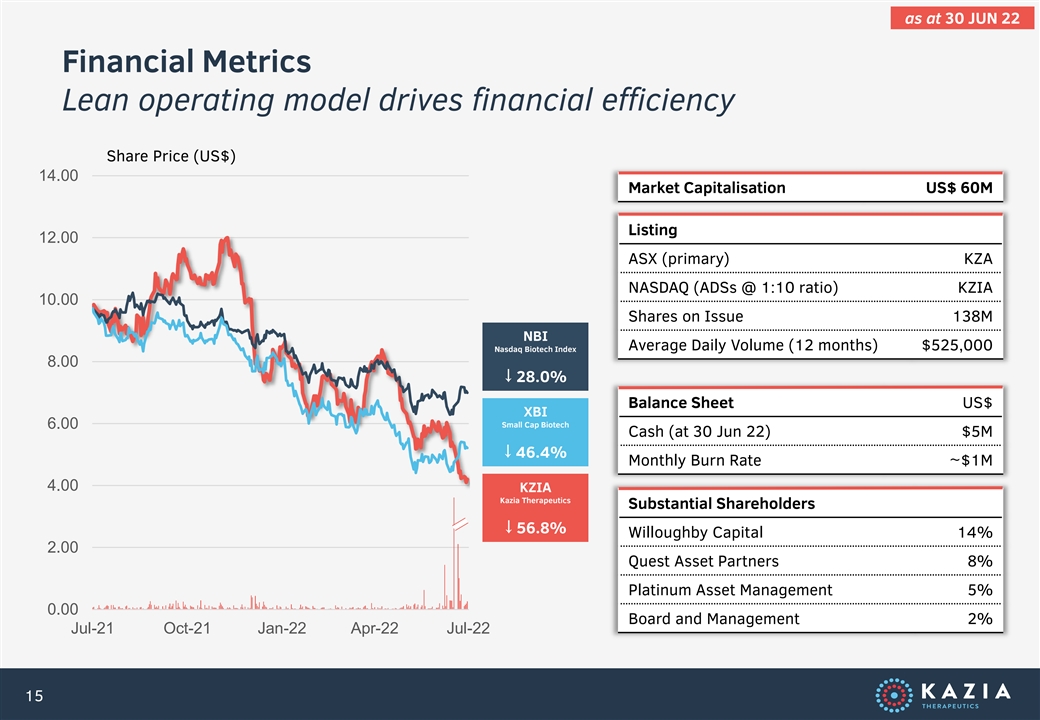

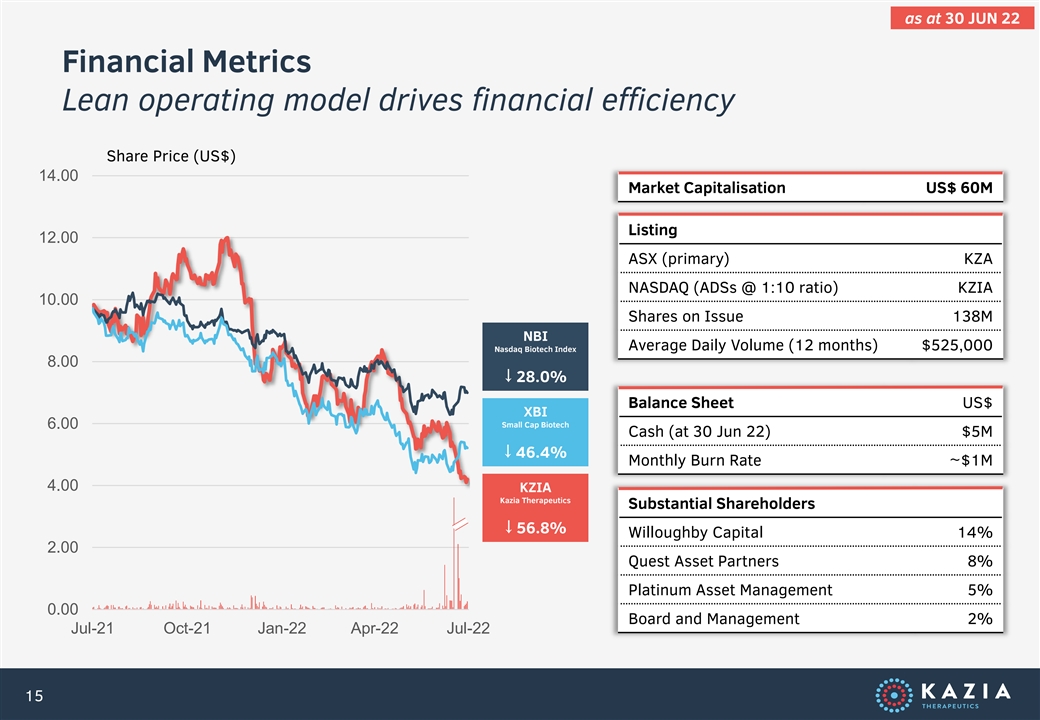

as at 30 JUN 22 Financial Metrics Lean operating model drives financial efficiency Share Price (US$) 14.00 Market Capitalisation US$ 60M Listing 12.00 ASX (primary) KZA NASDAQ (ADSs @ 1:10 ratio) KZIA 10.00 Shares on Issue 138M NBI Average Daily Volume (12 months) $525,000 Nasdaq Biotech Index 8.00 ↓ 28.0% Balance Sheet US$ XBI Small Cap Biotech 6.00 Cash (at 30 Jun 22) $5M ↓ 46.4% Monthly Burn Rate ~$1M 4.00 KZIA Kazia Therapeutics Substantial Shareholders ↓ 56.8% Willoughby Capital 14% 2.00 Quest Asset Partners 8% Platinum Asset Management 5% 0.00 Board and Management 2% Jul-21 Oct-21 Jan-22 Apr-22 Jul-22 15

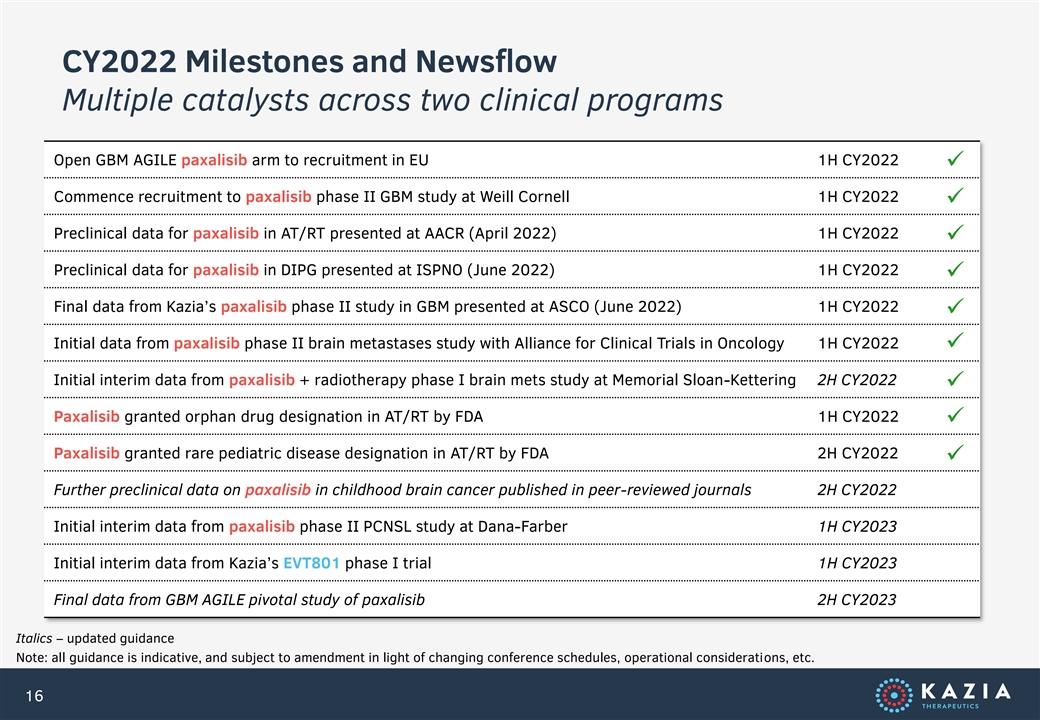

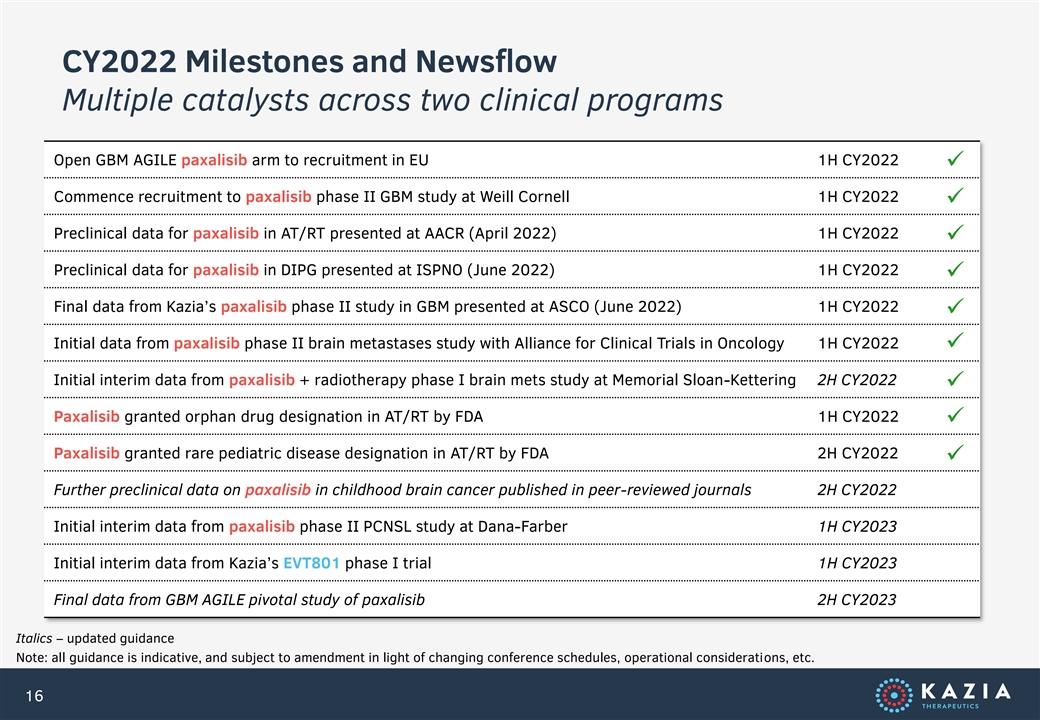

CY2022 Milestones and Newsflow Multiple catalysts across two clinical programs Open GBM AGILE paxalisib arm to recruitment in EU 1H CY2022 ✓ Commence recruitment to paxalisib phase II GBM study at Weill Cornell 1H CY2022 ✓ Preclinical data for paxalisib in AT/RT presented at AACR (April 2022) 1H CY2022 ✓ Preclinical data for paxalisib in DIPG presented at ISPNO (June 2022) 1H CY2022 ✓ Final data from Kazia’s paxalisib phase II study in GBM presented at ASCO (June 2022) 1H CY2022 ✓ Initial data from paxalisib phase II brain metastases study with Alliance for Clinical Trials in Oncology 1H CY2022 ✓ Initial interim data from paxalisib + radiotherapy phase I brain mets study at Memorial Sloan-Kettering 2H CY2022 ✓ Paxalisib granted orphan drug designation in AT/RT by FDA 1H CY2022 ✓ Paxalisib granted rare pediatric disease designation in AT/RT by FDA 2H CY2022 ✓ Further preclinical data on paxalisib in childhood brain cancer published in peer-reviewed journals 2H CY2022 Initial interim data from paxalisib phase II PCNSL study at Dana-Farber 1H CY2023 Initial interim data from Kazia’s EVT801 phase I trial 1H CY2023 Final data from GBM AGILE pivotal study of paxalisib 2H CY2023 Italics – updated guidance Note: all guidance is indicative, and subject to amendment in light of changing conference schedules, operational considerations, etc. 16

www.kaziatherapeutics.com info@kaziatherapeutics.com