Exhibit 99.3 Annual General Meeting of Shareholders CEO Presentation Sydney, NSW 16 November 2022 ASX: KZA | NASDAQ: KZIA | Twitter: @KaziaTx

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve substantial risks and uncertainties, not all of which may be known at the time. All statements contained in this presentation, other than statements of historical fact, including statements regarding our strategy, research and development plans, collaborations, future operations, future financial position, future revenues, projected costs, prospects, plans, and objectives of management, are forward-looking statements. Not all forward-looking statements in this presentation are explicitly identified as such. Many factors could cause the actual results of the Company to differ materially from the results expressed or implied herein, and you should not place undue reliance on the forward-looking statements. Factors which could change the Company’s expected outcomes include, without limitation, our ability to: advance the development of our programs, and to do so within any timelines that may be indicated herein; the safety and efficacy of our drug development candidates; our ability to replicate experimental data; the ongoing validity of patents covering our drug development candidates, and our freedom to operate under third party intellectual property; our ability to obtain necessary regulatory approvals; our ability to enter into and maintain partnerships, collaborations, and other business relationships necessary to the progression of our drug development candidates; the timely availability of necessary capital to pursue our business objectives; and our ability to attract and retain qualified personnel; changes from anticipated levels of customer acceptance of existing and new products and services and other factors. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, there can therefore be no assurance that such expectations will prove to be correct. The Company has no obligation as a result of this presentation to clinical trial outcomes, sales, partnerships, future international, national or regional economic and competitive conditions, changes in relationships with customers, access to capital, difficulties in developing and marketing new products and services, or marketing existing products. In addition, the extent to which the COVID-19 outbreak continues to impact our workforce and our discovery research, supply chain and clinical trial operations activities, and the operations of the third parties on which we rely, will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration and severity of the outbreak, additional or modified government actions, and the actions that may be required to contain the virus or treat its impact. Any forward-looking statements contained in this presentation speak only as of the date this presentation is made, and we expressly disclaim any obligation to update any forward-looking statements, whether because of new information, future events or otherwise. 1

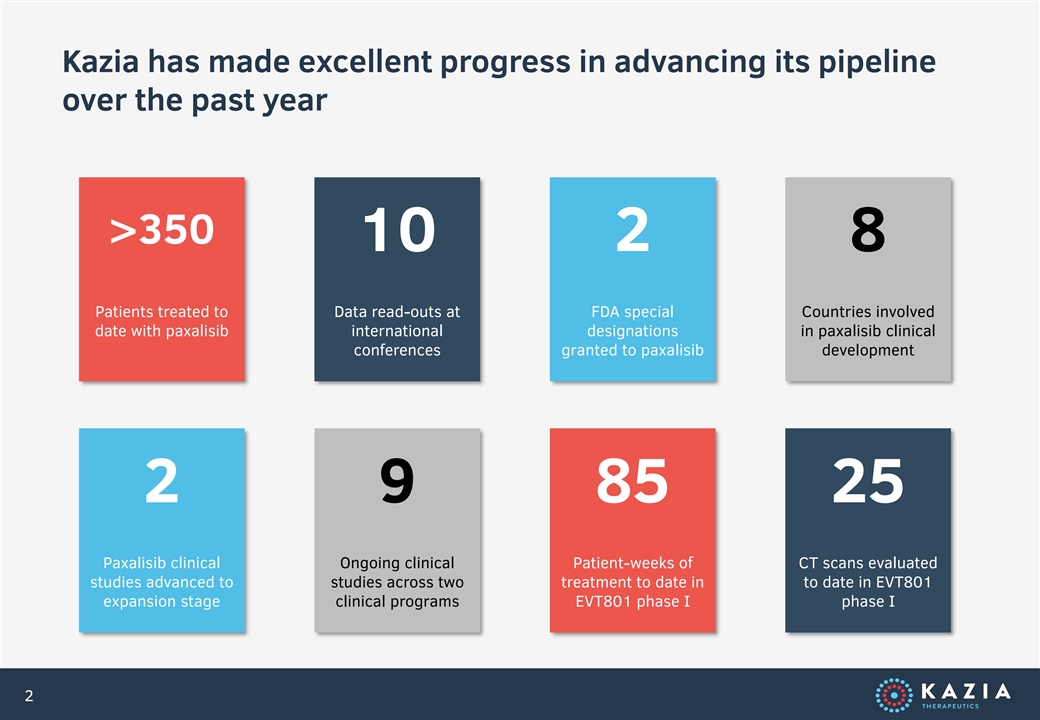

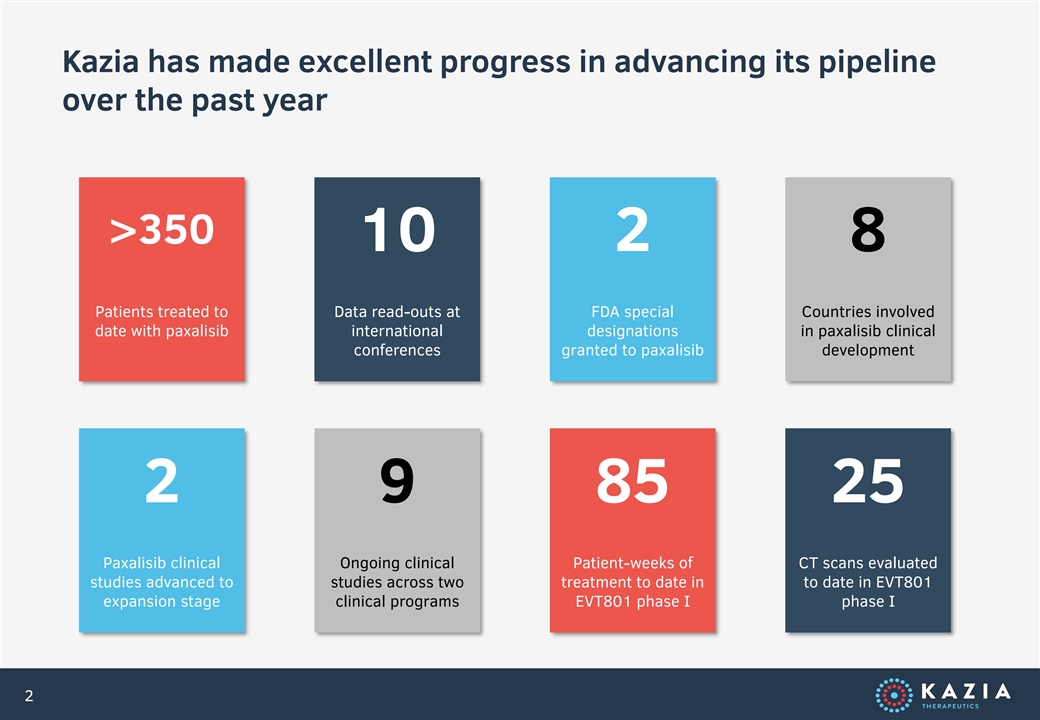

Kazia has made excellent progress in advancing its pipeline over the past year >350 10 2 8 Patients treated to Data read-outs at FDA special Countries involved date with paxalisib international designations in paxalisib clinical conferences granted to paxalisib development 2 9 85 25 Paxalisib clinical Ongoing clinical Patient-weeks of CT scans evaluated studies advanced to studies across two treatment to date in to date in EVT801 expansion stage clinical programs EVT801 phase I phase I 2

Paxalisib news flow during 2022 has been almost completely positive, with several promising new indications arising Disease Study Sponsor Key Developments Next Milestone Brain Radiotherapy Combination Positive data presented at SNO / ASCO conference Final data: ✓ Metastases Phase I in August 2022 – all patients respond to therapy CY2023 Brain Genomically-Guided Therapy Graduation to Stage 2 after positive efficacy Further data: ✓ Metastases Phase II signals in Stage 1 in breast cancer brain mets CY2023 Brain Breast Cancer Brain Mets Recruitment ongoing Initial data: u Metastases Phase II CY2023 Glioblastoma GBM AGILE Completion of recruitment to Stage 1; no Final data: 2H ? Phase II / III graduation to Stage 2 CY2023 Glioblastoma Newly Diagnosed GBM Positive final data presented at ASCO, ESMO, and Publication in ✓ Phase II SNO – OS of 15.7 mths, vs 12.7 for existing drug CY2023 Glioblastoma Ketogenesis Combination Recruitment ongoing Initial data: u Phase II CY2023 Diffuse Midline ONC201 Combination International expansion Initial data: ✓ Gliomas Phase II CY2023 Diffuse Midline Monotherapy Follow-up ongoing Final data: u Gliomas Phase I CY2023 Primary CNS Monotherapy Recruitment ongoing Initial data: u Lymphoma Phase II CY2023 Melanoma Preclinical Research Positive data presented at SMR conference in Further data: ✓ October 2022 CY2023 AT/RT Preclinical Research Positive data presented at AACR and ISPNO in Further data: ✓ June 2022 CY2023 DIPG Preclinical Research Positive data presented at ISPNO and SNO in Publication in ✓ combination with ONC201 CY2023 3

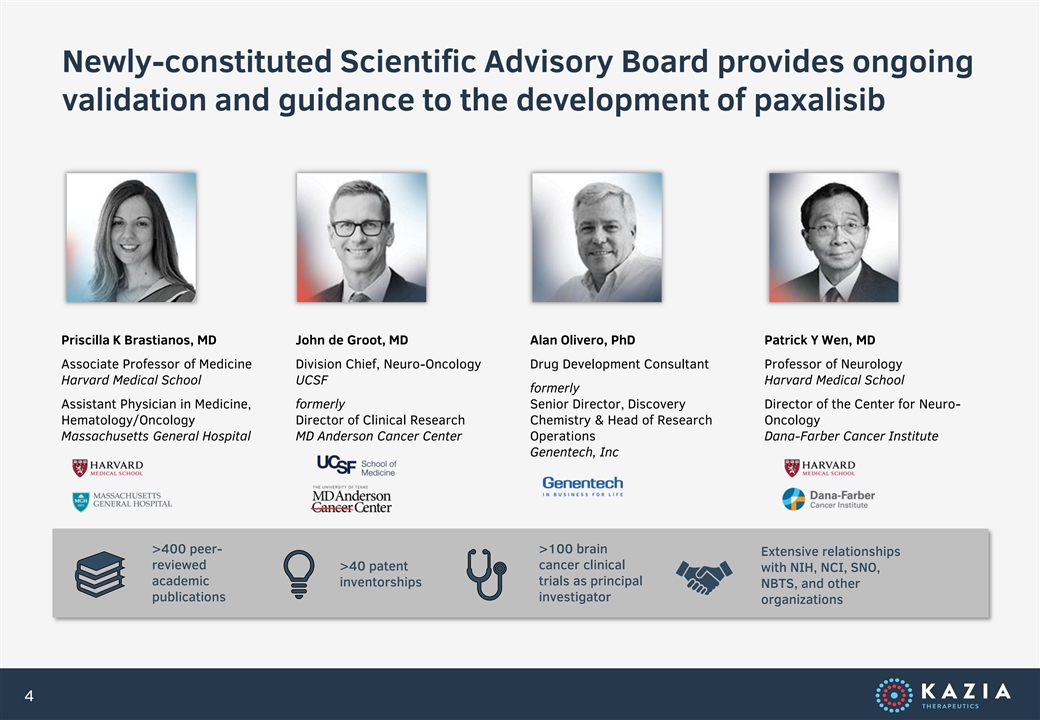

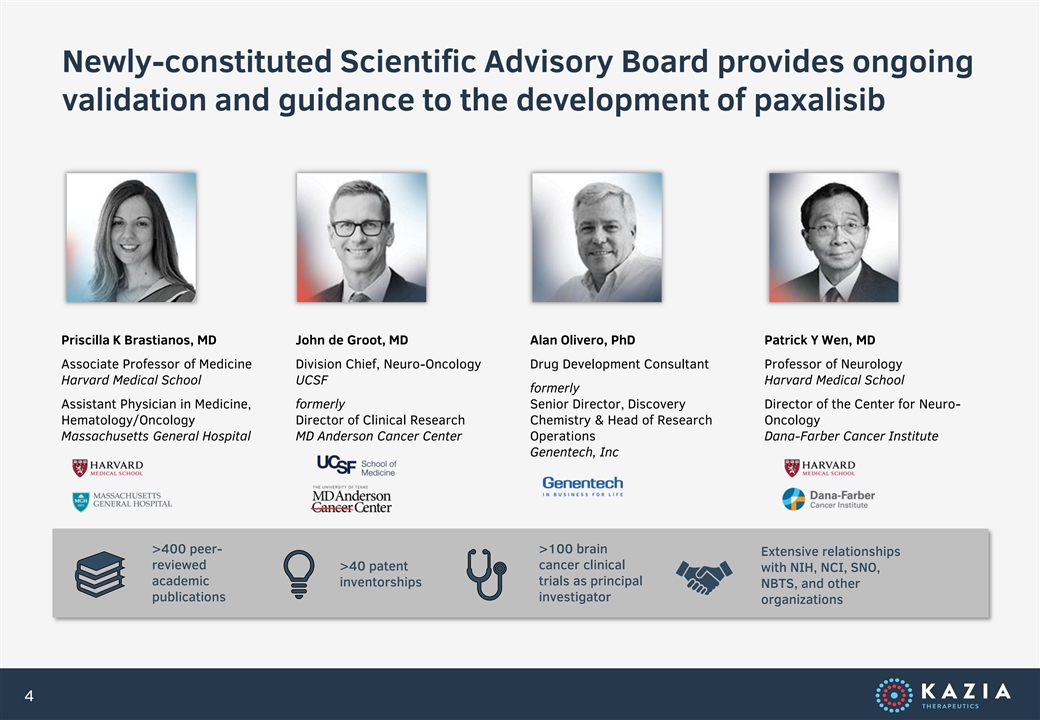

Newly-constituted Scientific Advisory Board provides ongoing validation and guidance to the development of paxalisib Priscilla K Brastianos, MD John de Groot, MD Alan Olivero, PhD Patrick Y Wen, MD Associate Professor of Medicine Division Chief, Neuro-Oncology Drug Development Consultant Professor of Neurology Harvard Medical School UCSF Harvard Medical School formerly Assistant Physician in Medicine, formerly Senior Director, Discovery Director of the Center for Neuro- Hematology/Oncology Director of Clinical Research Chemistry & Head of Research Oncology Massachusetts General Hospital MD Anderson Cancer Center Operations Dana-Farber Cancer Institute Genentech, Inc >400 peer- >100 brain Extensive relationships reviewed cancer clinical >40 patent with NIH, NCI, SNO, academic trials as principal inventorships NBTS, and other publications investigator organizations 4

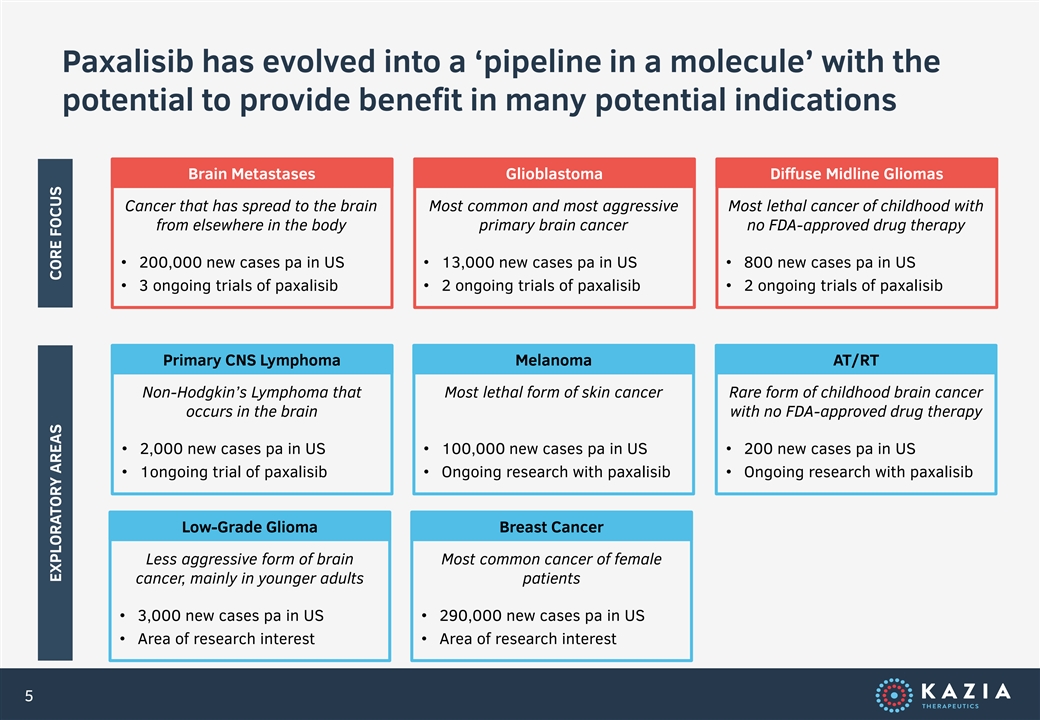

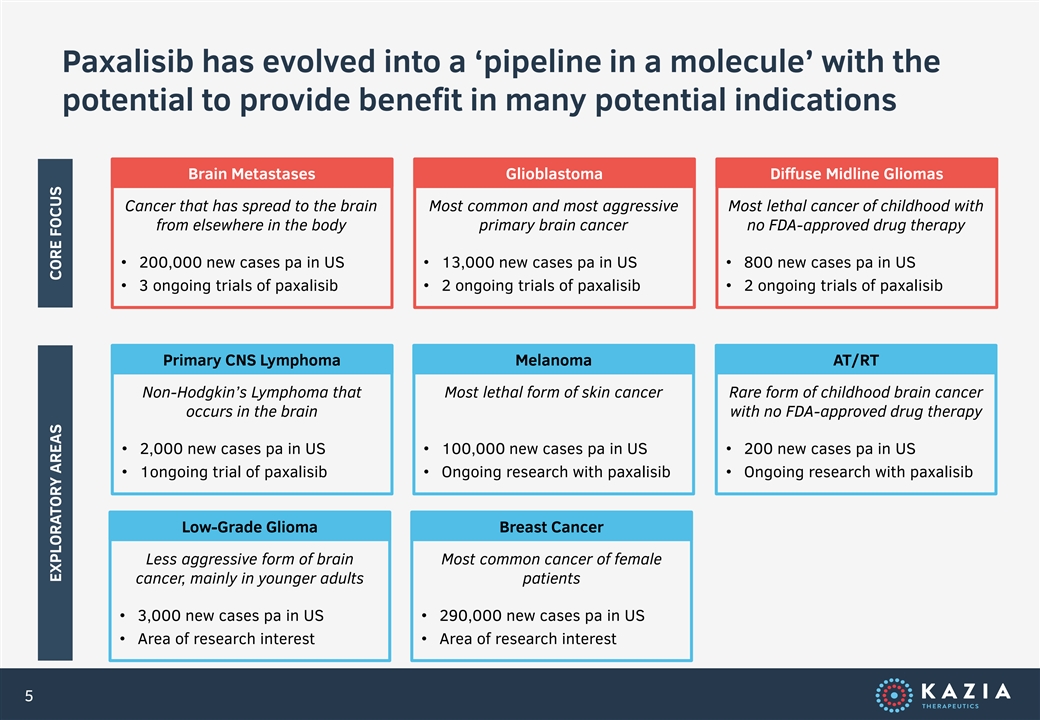

Paxalisib has evolved into a ‘pipeline in a molecule’ with the potential to provide benefit in many potential indications Brain Metastases Glioblastoma Diffuse Midline Gliomas Cancer that has spread to the brain Most common and most aggressive Most lethal cancer of childhood with from elsewhere in the body primary brain cancer no FDA-approved drug therapy • 200,000 new cases pa in US• 13,000 new cases pa in US• 800 new cases pa in US • 3 ongoing trials of paxalisib• 2 ongoing trials of paxalisib• 2 ongoing trials of paxalisib Primary CNS Lymphoma Melanoma AT/RT Non-Hodgkin’s Lymphoma that Most lethal form of skin cancer Rare form of childhood brain cancer occurs in the brain with no FDA-approved drug therapy • 2,000 new cases pa in US• 100,000 new cases pa in US• 200 new cases pa in US • 1ongoing trial of paxalisib• Ongoing research with paxalisib• Ongoing research with paxalisib Low-Grade Glioma Breast Cancer Less aggressive form of brain Most common cancer of female cancer, mainly in younger adults patients • 3,000 new cases pa in US• 290,000 new cases pa in US • Area of research interest• Area of research interest 5 EXPLORATORY AREAS CORE FOCUS

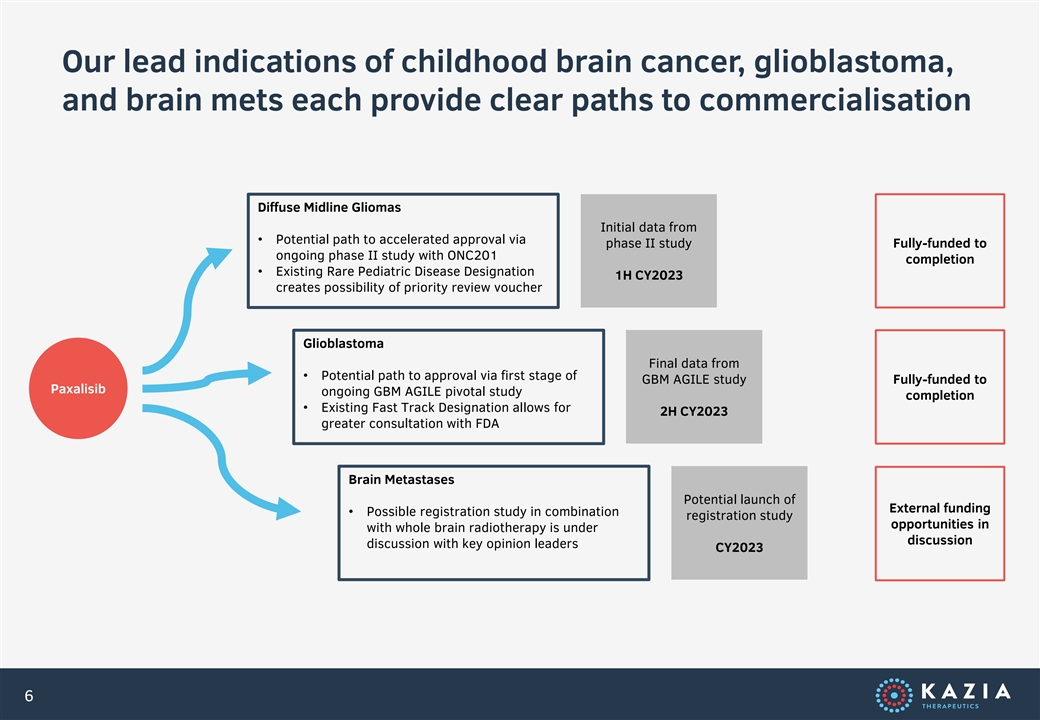

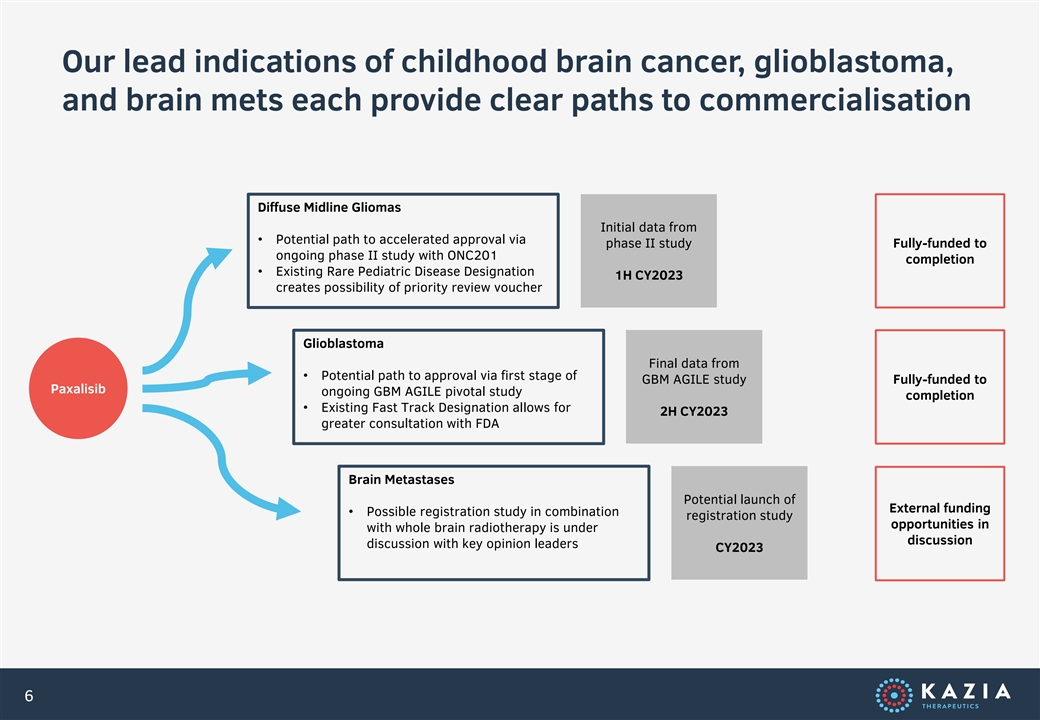

Our lead indications of childhood brain cancer, glioblastoma, and brain mets each provide clear paths to commercialisation Diffuse Midline Gliomas Initial data from • Potential path to accelerated approval via phase II study Fully-funded to ongoing phase II study with ONC201 completion • Existing Rare Pediatric Disease Designation 1H CY2023 creates possibility of priority review voucher Glioblastoma Final data from • Potential path to approval via first stage of GBM AGILE study Fully-funded to Paxalisib ongoing GBM AGILE pivotal study completion • Existing Fast Track Designation allows for 2H CY2023 greater consultation with FDA Brain Metastases Potential launch of External funding • Possible registration study in combination registration study opportunities in with whole brain radiotherapy is under discussion discussion with key opinion leaders CY2023 6

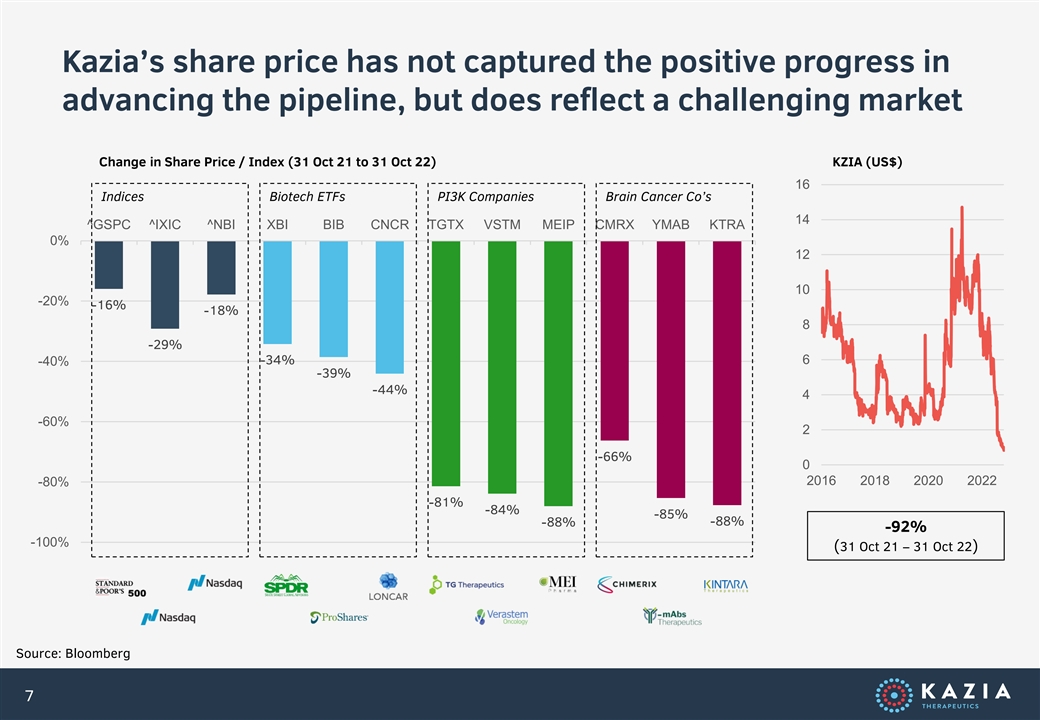

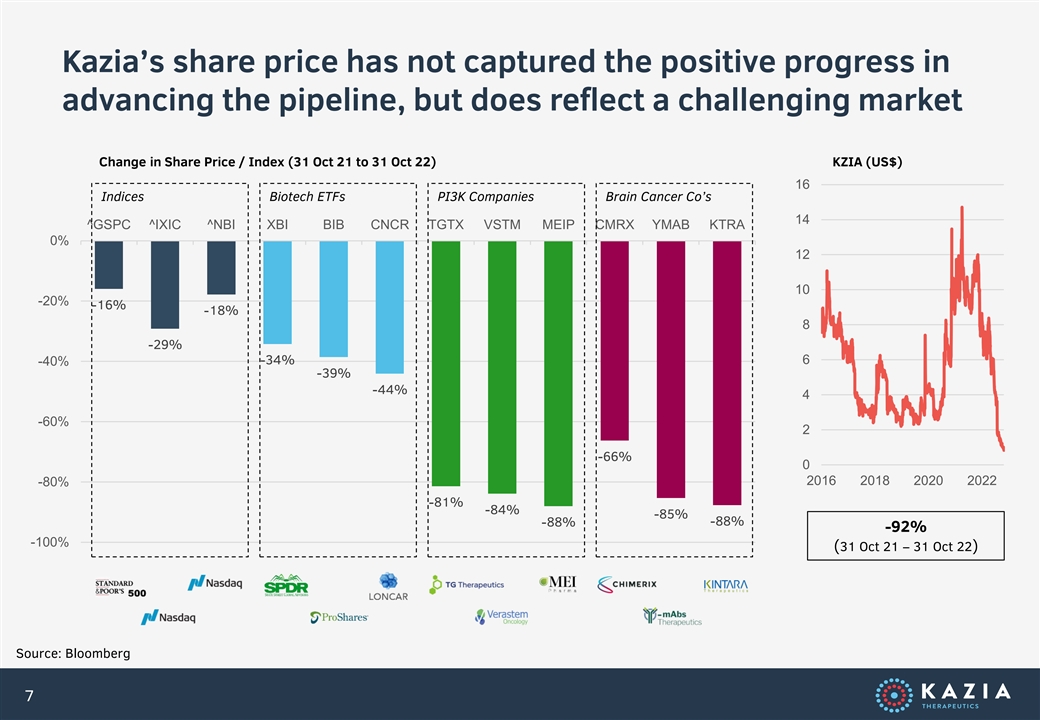

Kazia’s share price has not captured the positive progress in advancing the pipeline, but does reflect a challenging market Change in Share Price / Index (31 Oct 21 to 31 Oct 22) KZIA (US$) 16 Indices Biotech ETFs PI3K Companies Brain Cancer Co’s 14 ^GSPC ^IXIC ^NBI XBI BIB CNCR TGTX VSTM MEIP CMRX YMAB KTRA 0% 12 10 -20% -16% -18% 8 -29% -34% 6 -40% -39% -44% 4 -60% 2 -66% 0 2016 2018 2020 2022 -80% -81% -84% -85% -88% -88% -92% -100% (31 Oct 21 – 31 Oct 22) Source: Bloomberg 7

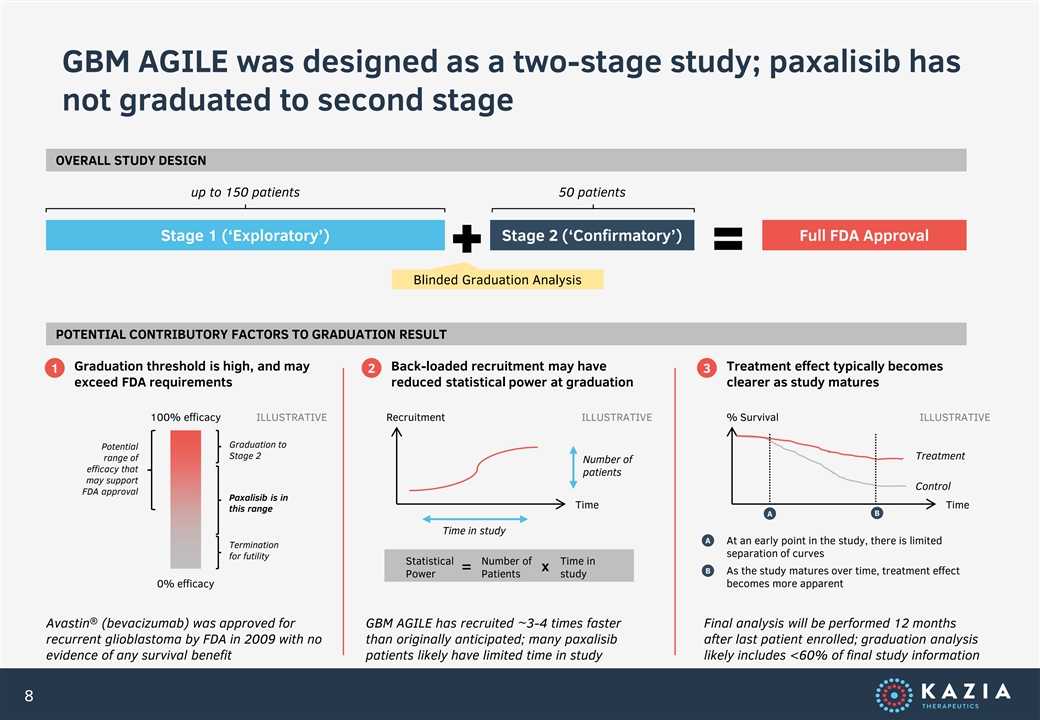

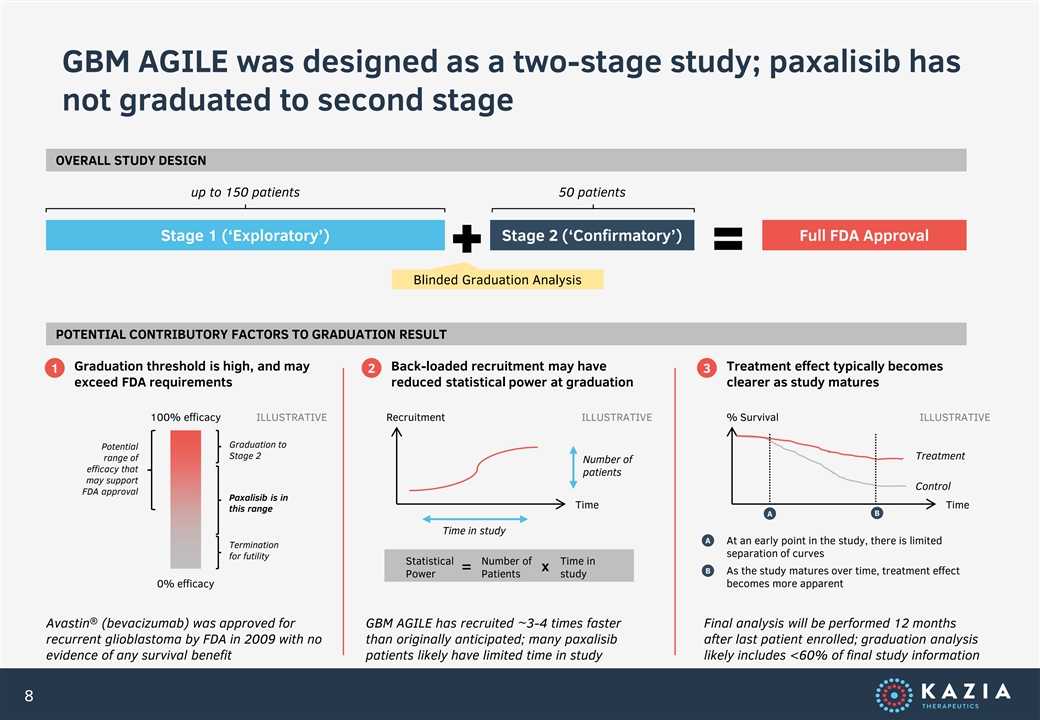

GBM AGILE was designed as a two-stage study; paxalisib has not graduated to second stage OVERALL STUDY DESIGN up to 150 patients 50 patients Stage 1 (‘Exploratory’) Stage 2 (‘Confirmatory’) Full FDA Approval Blinded Graduation Analysis POTENTIAL CONTRIBUTORY FACTORS TO GRADUATION RESULT Graduation threshold is high, and may Back-loaded recruitment may have Treatment effect typically becomes 1 2 3 exceed FDA requirements reduced statistical power at graduation clearer as study matures 100% efficacy ILLUSTRATIVE Recruitment ILLUSTRATIVE % Survival ILLUSTRATIVE Graduation to Potential Stage 2 Treatment range of Number of efficacy that patients may support Control FDA approval Paxalisib is in Time Time this range B A Time in study A At an early point in the study, there is limited Termination separation of curves for futility Statistical Number of Time in = x B As the study matures over time, treatment effect Power Patients study 0% efficacy becomes more apparent ® Avastin (bevacizumab) was approved for GBM AGILE has recruited ~3-4 times faster Final analysis will be performed 12 months recurrent glioblastoma by FDA in 2009 with no than originally anticipated; many paxalisib after last patient enrolled; graduation analysis evidence of any survival benefit patients likely have limited time in study likely includes <60% of final study information 8

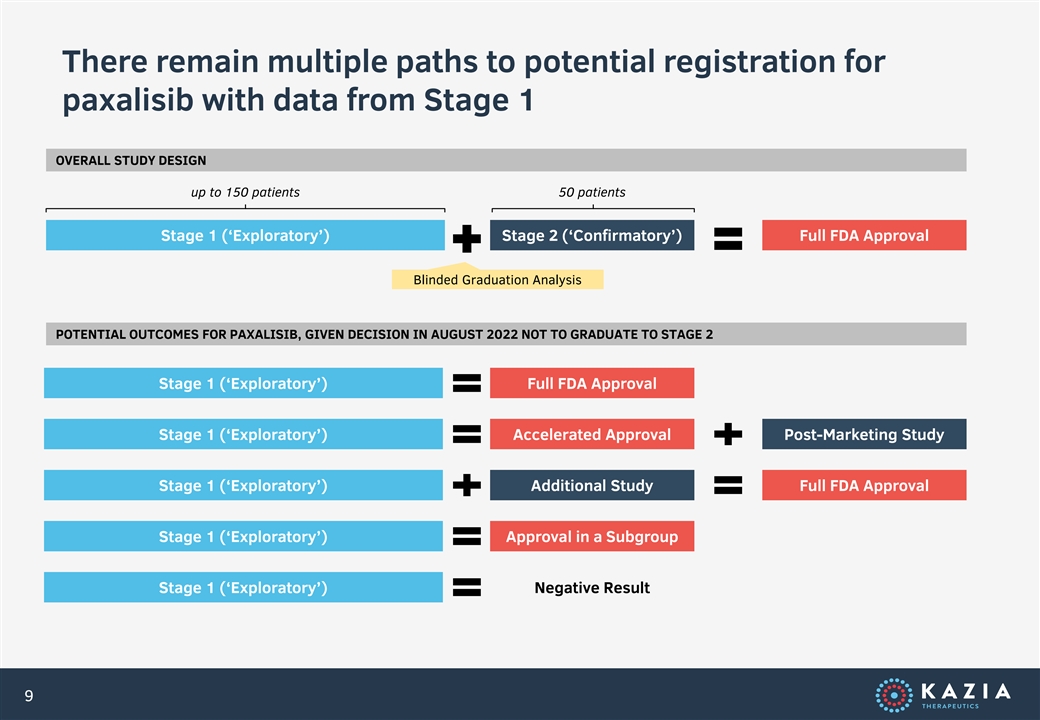

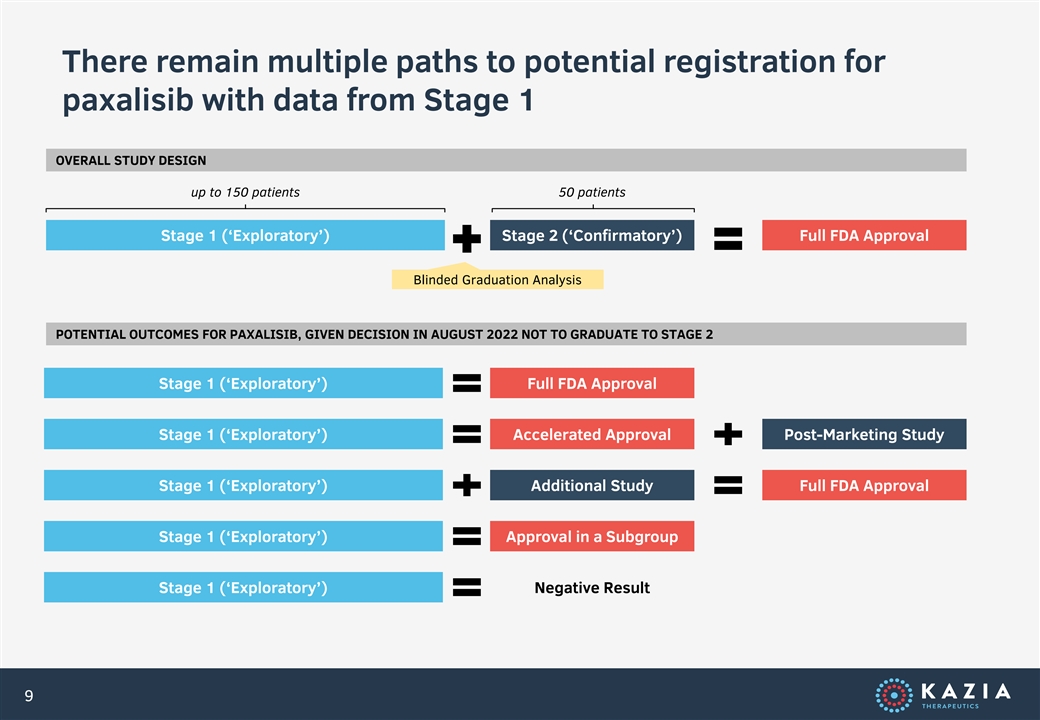

There remain multiple paths to potential registration for paxalisib with data from Stage 1 OVERALL STUDY DESIGN up to 150 patients 50 patients Stage 1 (‘Exploratory’) Stage 2 (‘Confirmatory’) Full FDA Approval Blinded Graduation Analysis POTENTIAL OUTCOMES FOR PAXALISIB, GIVEN DECISION IN AUGUST 2022 NOT TO GRADUATE TO STAGE 2 Stage 1 (‘Exploratory’) Full FDA Approval Stage 1 (‘Exploratory’) Accelerated Approval Post-Marketing Study Stage 1 (‘Exploratory’) Additional Study Full FDA Approval Stage 1 (‘Exploratory’) Approval in a Subgroup Stage 1 (‘Exploratory’) Negative Result 9

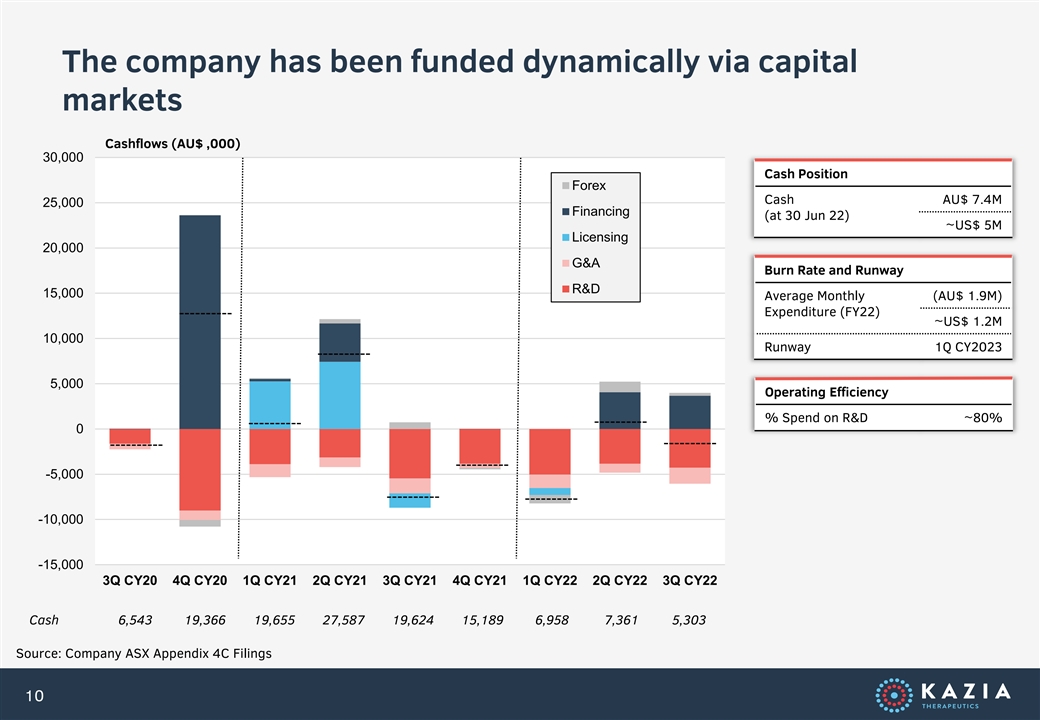

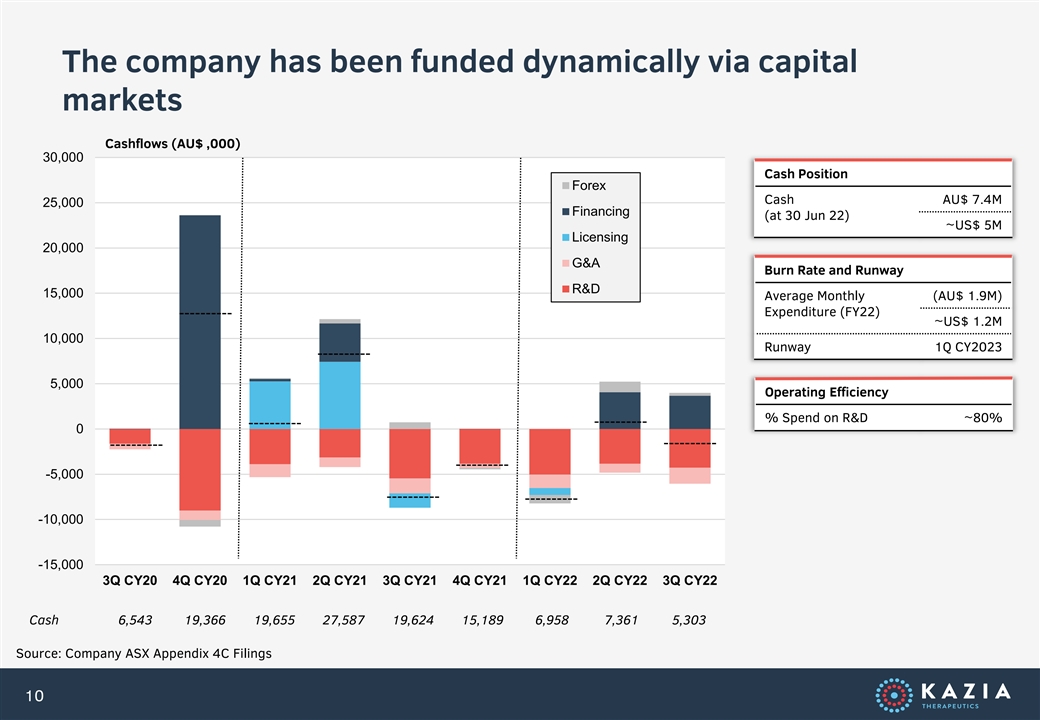

The company has been funded dynamically via capital markets Cashflows (AU$ ,000) 30,000 Cash Position Forex Cash AU$ 7.4M 25,000 Financing (at 30 Jun 22) ~US$ 5M Licensing 20,000 G&A Burn Rate and Runway R&D 15,000 Average Monthly (AU$ 1.9M) Expenditure (FY22) ~US$ 1.2M 10,000 Runway 1Q CY2023 5,000 Operating Efficiency % Spend on R&D ~80% 0 -5,000 -10,000 -15,000 3Q CY20 4Q CY20 1Q CY21 2Q CY21 3Q CY21 4Q CY21 1Q CY22 2Q CY22 3Q CY22 Cash 6,543 19,366 19,655 27,587 19,624 15,189 6,958 7,361 5,303 Source: Company ASX Appendix 4C Filings 10

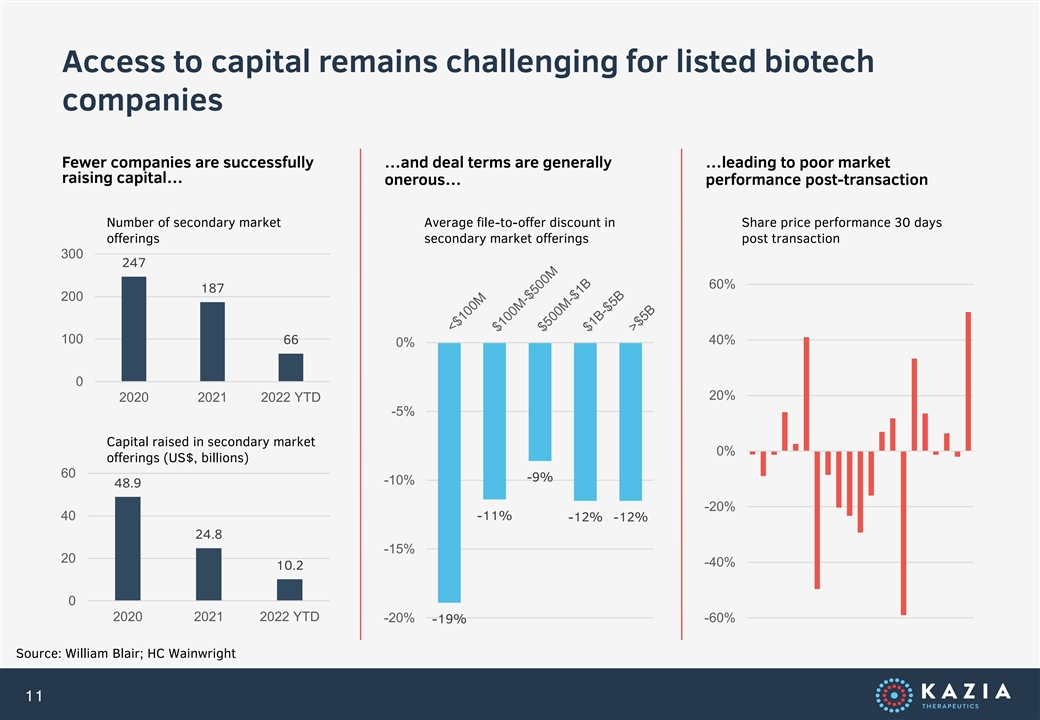

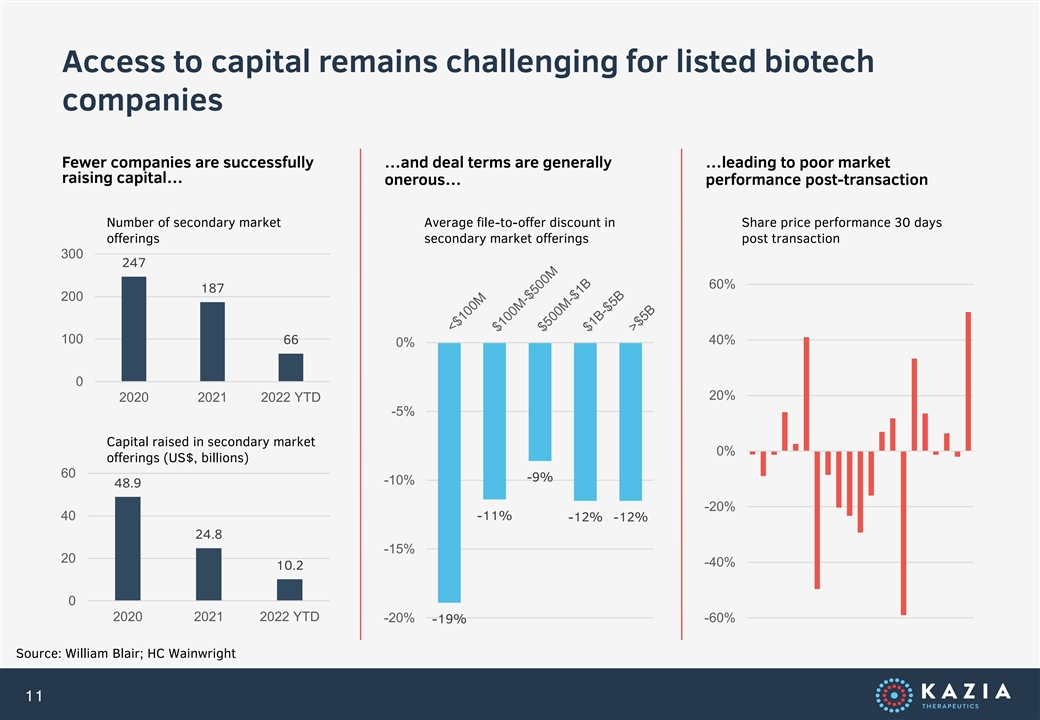

Access to capital remains challenging for listed biotech companies Fewer companies are successfully …and deal terms are generally …leading to poor market raising capital… onerous… performance post-transaction Number of secondary market Average file-to-offer discount in Share price performance 30 days offerings secondary market offerings post transaction 300 247 60% 187 200 100 66 40% 0% 0 20% 2020 2021 2022 YTD -5% Capital raised in secondary market 0% offerings (US$, billions) 60 -9% -10% 48.9 -20% 40 -11% -12% -12% 24.8 -15% 20 -40% 10.2 0 2020 2021 2022 YTD -20% -60% -19% Source: William Blair; HC Wainwright 11

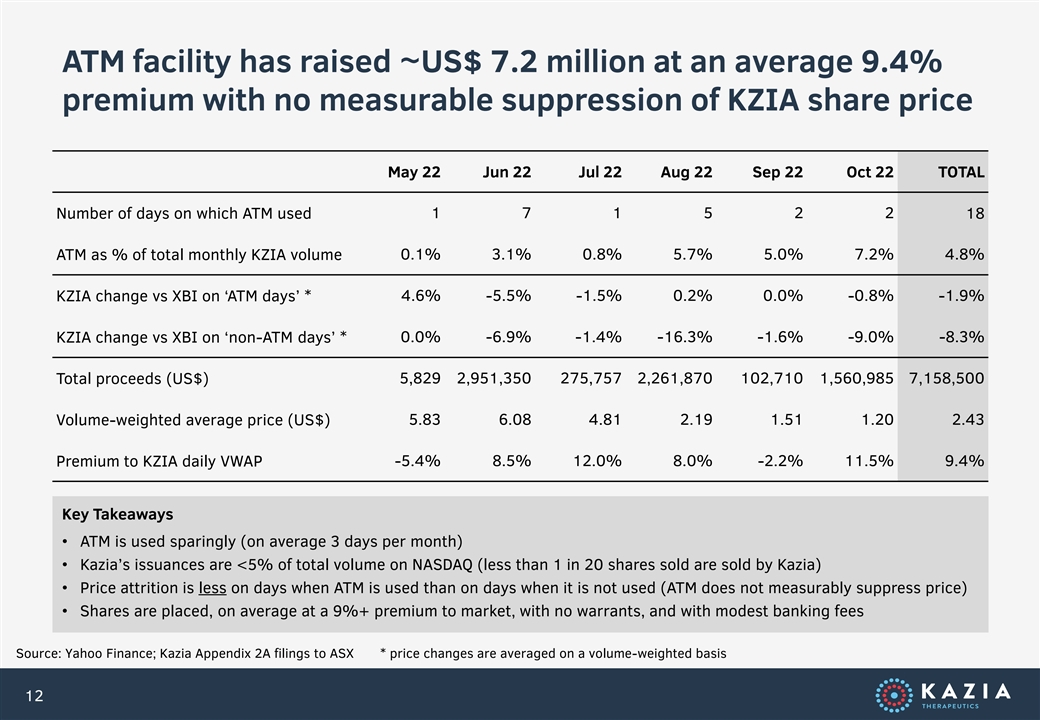

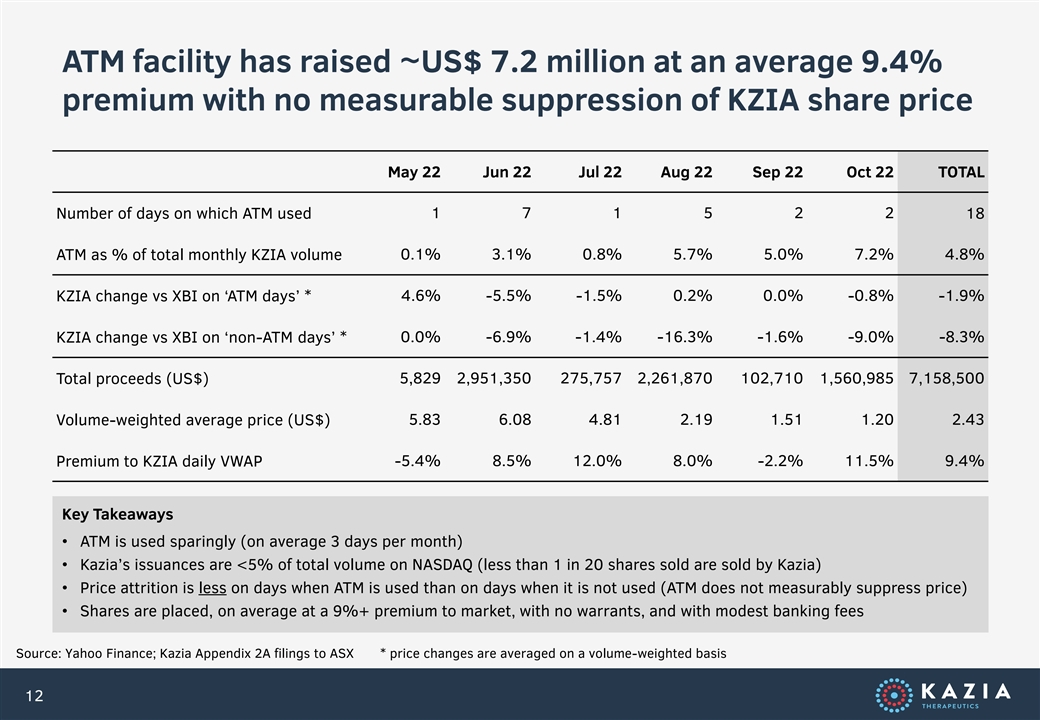

ATM facility has raised ~US$ 7.2 million at an average 9.4% premium with no measurable suppression of KZIA share price May 22 Jun 22 Jul 22 Aug 22 Sep 22 Oct 22 TOTAL Number of days on which ATM used 1 7 1 5 2 2 18 ATM as % of total monthly KZIA volume 0.1% 3.1% 0.8% 5.7% 5.0% 7.2% 4.8% KZIA change vs XBI on ‘ATM days’ * 4.6% -5.5% -1.5% 0.2% 0.0% -0.8% -1.9% KZIA change vs XBI on ‘non-ATM days’ * 0.0% -6.9% -1.4% -16.3% -1.6% -9.0% -8.3% Total proceeds (US$) 5,829 2,951,350 275,757 2,261,870 102,710 1,560,985 7,158,500 Volume-weighted average price (US$) 5.83 6.08 4.81 2.19 1.51 1.20 2.43 Premium to KZIA daily VWAP -5.4% 8.5% 12.0% 8.0% -2.2% 11.5% 9.4% Key Takeaways • ATM is used sparingly (on average 3 days per month) • Kazia’s issuances are <5% of total volume on NASDAQ (less than 1 in 20 shares sold are sold by Kazia) • Price attrition is less on days when ATM is used than on days when it is not used (ATM does not measurably suppress price) • Shares are placed, on average at a 9%+ premium to market, with no warrants, and with modest banking fees Source: Yahoo Finance; Kazia Appendix 2A filings to ASX * price changes are averaged on a volume-weighted basis 12

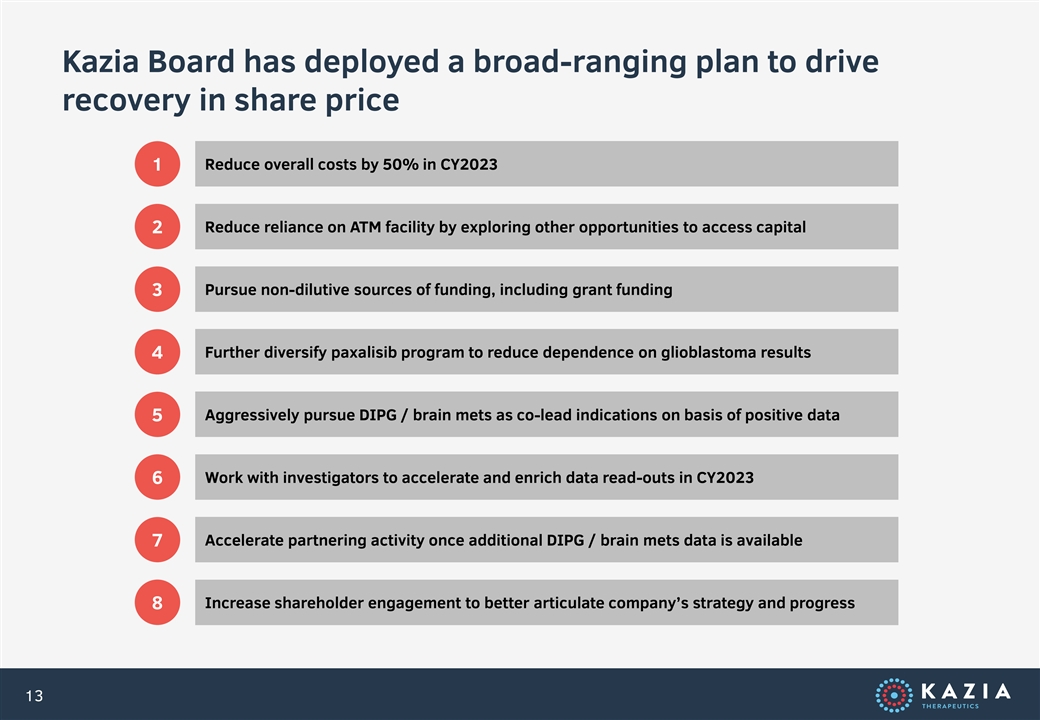

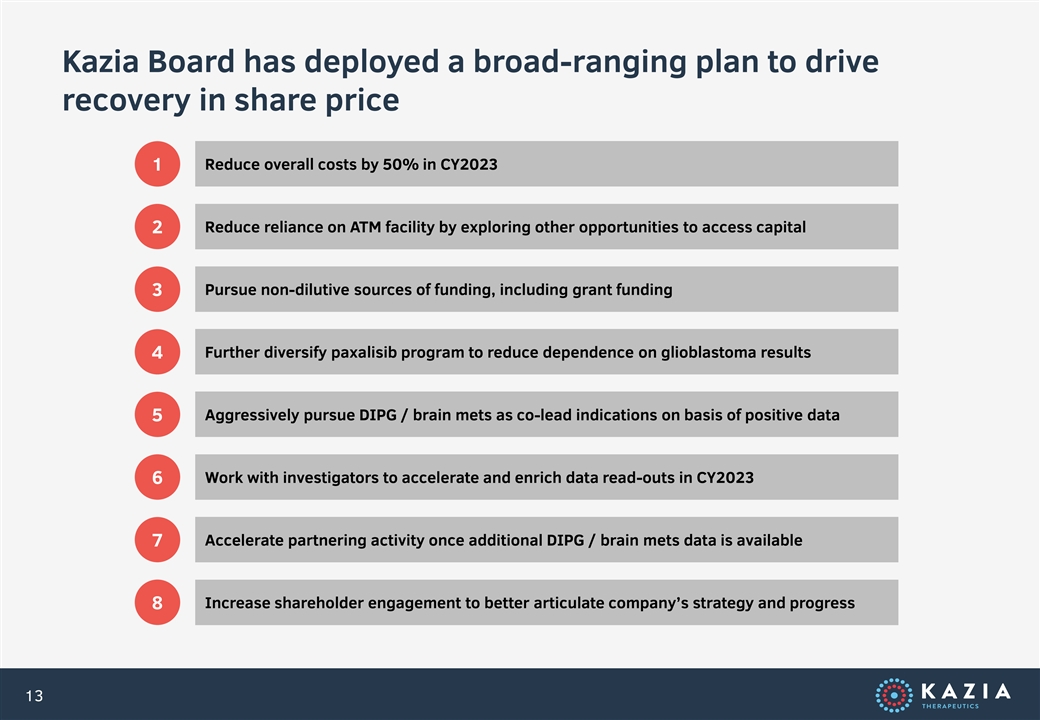

Kazia Board has deployed a broad-ranging plan to drive recovery in share price Reduce overall costs by 50% in CY2023 1 Reduce reliance on ATM facility by exploring other opportunities to access capital 2 Pursue non-dilutive sources of funding, including grant funding 3 Further diversify paxalisib program to reduce dependence on glioblastoma results 4 Aggressively pursue DIPG / brain mets as co-lead indications on basis of positive data 5 Work with investigators to accelerate and enrich data read-outs in CY2023 6 Accelerate partnering activity once additional DIPG / brain mets data is available 7 Increase shareholder engagement to better articulate company’s strategy and progress 8 13

www.kaziatherapeutics.com info@kaziatherapeutics.com