UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. __________)

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials. |

| o | Soliciting Material Pursuant to Rule 14a-12 |

| International Fuel Technology, Inc. |

| (Name of Registrant as Specified in its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement if Other Than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | | | |

| | (5) | Total fee paid: |

| | | | | |

| o | Fee paid previously with preliminary materials. |

| | | | | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

INTERNATIONAL FUEL TECHNOLOGY, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 14, 2010

To the Stockholders of International Fuel Technology, Inc.:

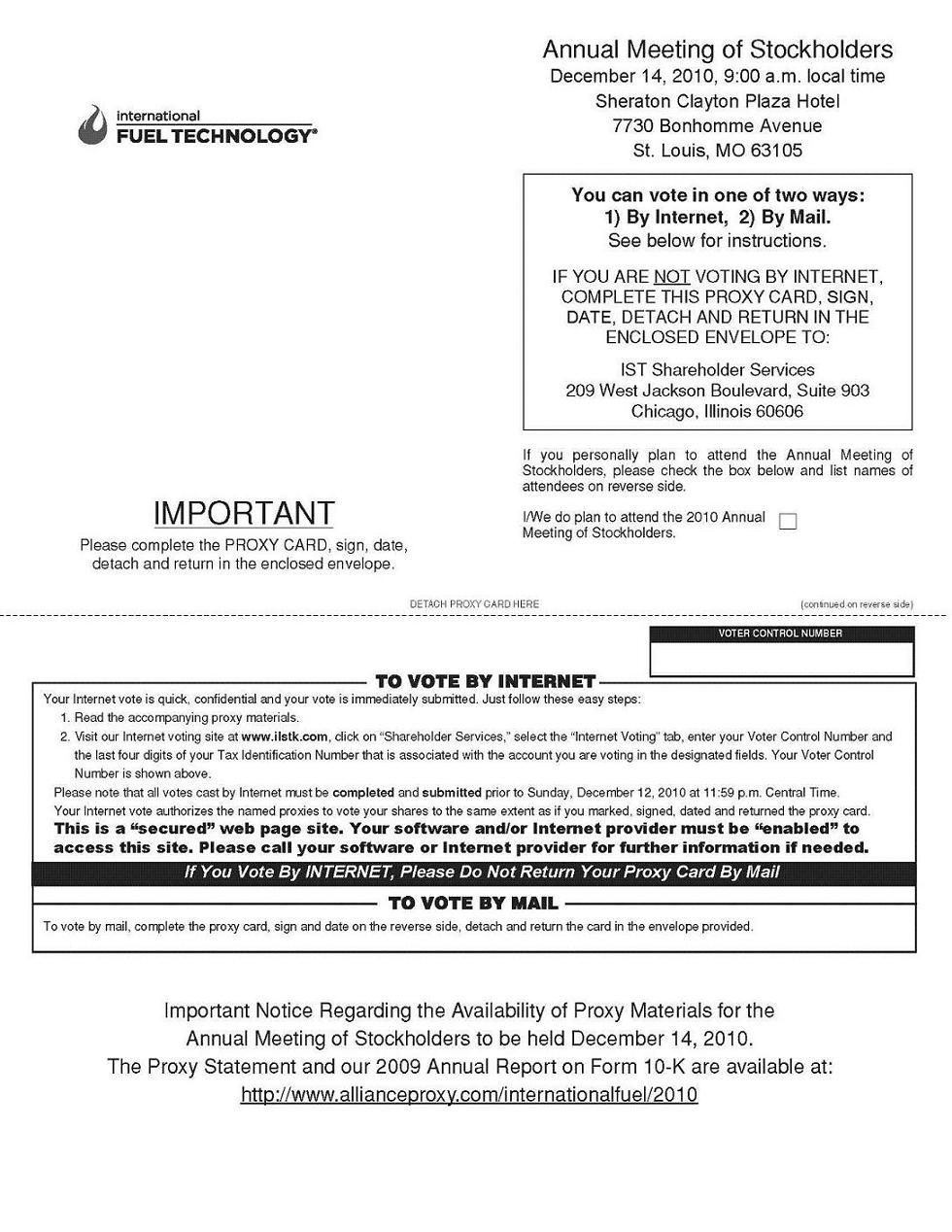

Notice is hereby given that the annual meeting of the stockholders of International Fuel Technology, Inc. will be held on Tuesday, December 14, 2010 at 9:00 a.m., local time, at the Sheraton Clayton Plaza Hotel, located at 7730 Bonhomme Avenue, St. Louis, Missouri, for the following purposes:

| (1) | To elect five directors to serve until the 2011 annual meeting of stockholders. |

| (2) | To ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2010. |

| (3) | To transact such other business as may properly come before the annual meeting of stockholders or any adjournment thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this notice.

Our board of directors has fixed the close of business on October 20, 2010 as the record date for determining the stockholders entitled to notice of and to vote at this annual meeting and at any adjournment thereof.

We have decided to take advantage of the rules of the Securities and Exchange Commission that allow issuers to furnish proxy materials to their stockholders on the Internet. We believe that the rules will allow us to provide our stockholders with the information they need, while lowering the costs of delivery. Whether or not you expect to attend the annual meeting of stockholders in person, it is important that your shares are represented. Please vote as soon as possible.

| | By Order of the Board, | |

| | | |

| | Thomas M. Powell | |

| | | |

| | Thomas M. Powell, Corporate Secretary | |

St. Louis, Missouri

November 1, 2010

INTERNATIONAL FUEL TECHNOLOGY, INC.

7777 BONHOMME AVENUE, SUITE 1920

ST. LOUIS, MISSOURI 63105

PROXY STATEMENT

GENERAL INFORMATION

Proxy Solicitation

This proxy statement is furnished to stockholders of International Fuel Technology, Inc., a Nevada corporation (the “Company”), in connection with our solicitation of proxies for use in voting at our annual meeting of stockholders (the “annual meeting”) to be held on Tuesday, December 14, 2010 at 9:00 a.m., local time, at the Sheraton Clayton Plaza Hotel, 7730 Bonhomme Avenue, St. Louis, Missouri or at any adjournment thereof. The purposes of the meeting and the matters to be acted upon are set forth in the accompanying notice relating to the annual meeting. Our board of directors is not currently aware of any other matters that will come before the meeting.

Pursuant to the rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders. All stockholders will have the ability to access the proxy materials on a website referenced in the Notice or request to receive a printed set of the proxy materials. Instructions regarding how to access the proxy materials over the Internet or to request a printed copy may be found on the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

The Notice was mailed to stockholders, and the proxy materials were first given to stockholders via Internet access, on or about November 1, 2010. On or before the time that the Notice was sent to stockholders, all materials identified in the Notice were publicly accessible, free of charge, at the website address specified in the Notice (http://www.allianceproxy.com/internationalfuel/2010). Such materials will remain available on that website for twelve months subsequent to the conclusion of the 2010 annual meeting.

Our officers, agents and employees may communicate with stockholders, banks, brokerage houses and others by telephone, facsimile or in person to request that proxies be furnished. All expenses incurred in connection with this solicitation will be borne by us.

Voting and Proxy Revocability

If you are a stockholder of record, you may vote in person at the 2010 annual meeting. We will give you a ballot when you arrive. If you are a record stockholder, but you do not wish to vote in person or if you will not be attending the annual meeting, you may vote by proxy. You can vote by proxy over the Internet by following the instructions provided in the Notice. If you are a beneficial owner of shares held in street name, follow the voting instructions provided in the Notice and in any correspondence from the record stockholder.

You may revoke the authority granted by your execution and delivery of a proxy at any time before its effective exercise by delivering to the Company a written notice of revocation or a duly executed proxy bearing a later date, or by voting in person at the annual meeting. If you deliver an executed proxy, and it is not subsequently revoked, your shares will be voted in the manner you direct on your proxy card. If no specifications are given, your shares will be voted in favor of Proposals No. 1 and No. 2 and in the discretion of the proxy holders as to any other matters that may properly come before the meeting.

Record Date and Voting Rights

Only stockholders of record at the close of business on October 20, 2010 are entitled to notice of and to vote at the annual meeting or any adjournment thereof. On October 20, 2010, there were 101,322,284 shares of our common stock outstanding, each of which is entitled to one vote on each of the matters to be presented at the annual meeting.

A majority of the outstanding shares entitled to vote must be present in person or represented by proxy at the annual meeting in order to have a quorum for transaction of business. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum. “Broker non-votes” are shares held by brokers or nominees which are not voted on a particular matter because instructions have not been received from the beneficial owner. If there is a quorum:

| ● | the five director nominees who receive the highest number of affirmative votes cast will be elected, and |

| ● | upon the approving vote of a majority of the votes cast, the board’s appointment of BDO USA, LLP will be ratified. |

If you are a beneficial holder and do not provide specific voting instructions to your broker, under a recent rule change, the organization that holds your shares will not be authorized to vote on the election of directors. Accordingly, we encourage you to vote promptly, even if you plan to attend the annual meeting.

Stockholder Proposals

All stockholder proposals which are intended to be presented at the 2011 annual meeting must be received by the Company no later than July 4, 2011 for inclusion in the board’s proxy statement and on the proxy card relating to the 2011 annual meeting.

A stockholder proposal that will not appear in the proxy statement may be considered at a meeting of stockholders only if the Company has received timely notice of the proposal. In order to be timely, for the 2011 annual meeting, the Company must receive notice of the proposal no later than September 17, 2011.

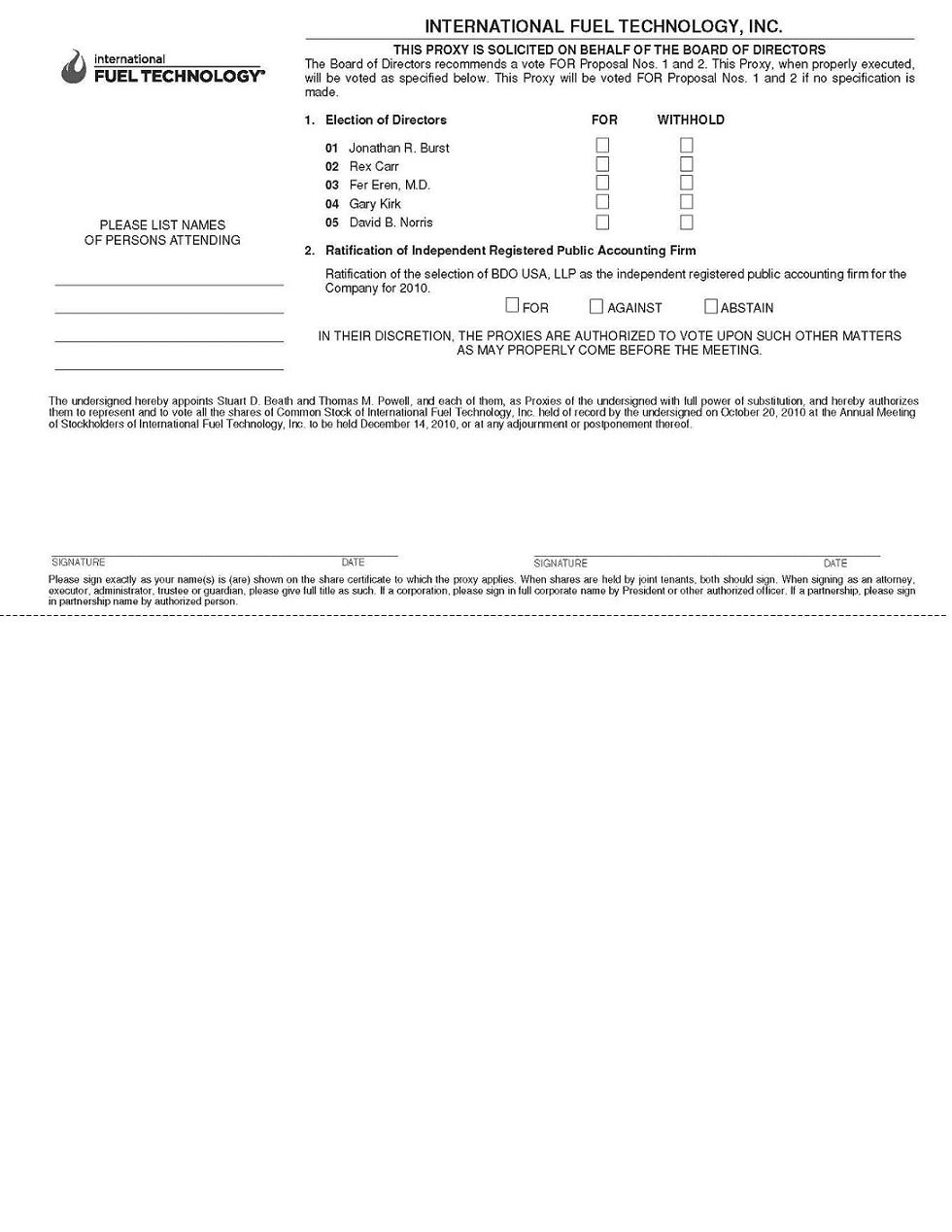

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Under our Articles of Incorporation, the board has the authority to fix the number of directors, provided that the board must have between one and nine members. The board has set the number of directors at five members. Unless otherwise specified, your proxy will be voted in favor of the persons named below to serve until the next annual meeting and until their successors shall have been duly qualified and elected. In the event any of these nominees shall be unable to serve as a director, the shares represented by the proxy will be voted for the person, if any, who is designated by the board to replace the nominee. All nominees have consented to be named and have indicated their intent to serve if elected. The board has no reason to believe that a ny of the nominees will be unable to serve.

Below is biographical and other information about each nominee for election as a director. Following each nominee’s biographical information is information concerning the particular experience, qualifications, attributes and/or skills that led the board to determine that each nominee should serve as a director.

The board’s director nominees are listed below.

| Name | | Age | | Positions and Offices Held

with International Fuel

Technology, Inc. | | Dates in Position or

Office |

| Jonathan R. Burst | | | 52 | | Chairman of the Board Chief Executive Officer | | 2000-Present 1999-Present |

| | | | | | | | |

| Rex Carr | | | 83 | | Director | | 2002-Present |

| | | | | | | | |

| Fer Eren, M.D. | | | 47 | | Director | | 2009-Present |

| | | | | | | | |

| Gary Kirk | | | 49 | | Director | | 2003-Present |

| | | | | | Director of Sales and Marketing * | | 2003-Present |

| | | | | | | | |

| David B. Norris | | | 62 | | Director | | 1999-Present |

| | | | | | | | |

* This is a non-executive officer position.

Jonathan R. Burst. Mr. Burst has served as our Chief Executive Officer since 1999 and as our President from 1999 to 2000 and 2002 to 2005. Mr. Burst has also served as a director of the Company and as our Chairman of the Board since 2000. Mr. Burst founded Burcor International in 1998 and has served as President since its inception. Mr. Burst received his bachelor of arts degree in economics from the University of Missouri in 1981. The board believes that Mr. Burst’s qualifications to serve on our board include his eleven years as our Chief Executive Officer, providing him with intimate knowledge of our day-to-day operations, our business and competitive environment and the Company’s opportunities, challenges and risks.

Rex Carr. Mr. Carr has been the managing partner of the Rex Carr Law Firm, a law firm with offices in East St. Louis, Illinois, St. Louis, Missouri and Belleville, Illinois, since 2004. Until 2003, Mr. Carr was the senior partner of a 36-person law firm, Carr, Korein, and Tillery, with offices in Missouri and Illinois, for more than five years. Mr. Carr is admitted to practice in the U.S. Supreme Court and the Illinois and Missouri Supreme Courts. The board believes that Mr. Carr’s qualifications to serve on our board include extensive experience in investing, consulting and management. Mr. Carr’s legal education and experience also assists the board in fulfilling its responsibilities related to the oversight of the CompanyR 17;s legal and regulatory compliance.

Fer Eren, M.D. Dr. Eren is a member of and a practicing physician in the medical practice of Eren and Atluri, M.D.s, LLC, having served in such role since 2003. Previously, Dr. Eren founded and was the Managing Director of Medcheck Diagnostic Center, Inc., a diagnostic clinic, and an owner of Medplus, a medical equipment sales and distribution company. The board believes that Dr. Eren’s qualifications to serve on our board include extensive experience in investing, consulting and management.

Gary Kirk. Mr. Kirk has served as our Director of Sales and Marketing since 2003. Mr. Kirk has extensive experience (1980 to 2003) in the petroleum industry, all with Petrochem Carless Ltd., a United Kingdom-based refiner and marketer of petroleum products. Mr. Kirk spent his first eight years as a research chemist and the remainder in Petrochem Carless’ marketing department. From 1988 to 2003, Mr. Kirk reported directly to the President of Petrochem Carless as the Marketing Manager for Performance Fuels, covering accounts in Europe and elsewhere throughout the world. The board believes that Mr. Kirk’s qualifications to serve on the board include his extensive experience in the petroleum industry. His experience enables him to bring valua ble insight regarding the fuel additive industry to the board.

David B. Norris. Mr. Norris founded and owns Addicks Services, Inc., a construction company, and has served as its Vice-President since 1983. The board believes that Mr. Norris’ qualifications to serve on the board include the knowledge and experience obtained through years of owning and managing Addicks Services, Inc.

Vote Required

The five nominees receiving the highest number of affirmative votes of the shares present in person or represented by proxy and entitled to vote for them shall be elected as directors. Only votes cast for a nominee will be counted, except that your proxy will be voted for all nominees in the absence of instruction to the contrary. Abstentions, broker non-votes and instructions to withhold authority to vote for one or more nominees will result in the respective nominees receiving fewer votes. However, the number of votes otherwise received by the nominee will not be reduced by such action.

Our board recommends a vote in favor of each named nominee.

Board Leadership Structure and the Board’s Role in Risk Oversight

The board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. The board also recognizes that depending on the circumstances, other leadership models may be appropriate, and that no single leadership model is right for all companies and at all times. Accordingly, the board periodically reviews its leadership structure.

The board oversees and guides the Company’s management and its business affairs. Committees assist the board in discharging its responsibilities on issues that benefit from consideration by a smaller, more focused subset of directors. All committee members are elected by and serve at the pleasure of the board. The board currently combines the role of chairman of the board with the role of chief executive officer. The board believes this provides an efficient and effective leadership model for the Company. Combining the chairman and chief executive officer roles fosters clear accountability, effective decision-making and alignment on corporate strategy. The board does not have a lead independent director at this time.

The board’s role in the Company’s risk oversight process includes regular reviews of information from senior management regarding the areas of material risk to the Company. The oversight is conducted primarily through committees of the board, as disclosed in the descriptions of each of the board committees below and in the charters of each of the committees, but the full board has retained responsibility for general oversight of risks. The compensation committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and arrangements. The audit committee oversees management of financial and information technology risks. While each committee is responsible for evaluating certain risks and overseeing the management of such ris ks, the entire board is regularly informed about such risks. The full board also manages additional risks, including those associated with corporate governance, independence of board members and potential conflicts of interest.

Board Committees and Meetings

During the fiscal year ended December 31, 2009, the board did not hold any formal meetings but acted by unanimous written consent on twenty-five occasions. Our board has an audit committee and a compensation committee.

We do not have a policy regarding board members’ attendance at annual meetings. One board member attended our 2009 annual meeting.

Our current board committee members are listed below.

| Director | | Audit

Committee | | Compensation Committee |

| | | | | |

| David B. Norris | | Chairman | | Member |

Each of Dr. Eren and Mr. Norris is an “independent” director, as such term is defined in the listing standards of The Nasdaq Stock Market (“Nasdaq”) and the rules and regulations promulgated by the SEC. Each of Messrs. Burst, Carr and Kirk is not an independent director.

Audit Committee

The audit committee meets with our independent registered public accounting firm at least annually to review the results of the annual audit and discuss the financial statements; recommends to the board the independent registered public accounting firm to be retained; oversees the independence of the independent registered public accounting firm; evaluates the independent registered public accounting firm’s performance; consults with the independent registered public accounting firm and discusses with senior management the scope and quality of controls; and reviews and considers the cooperation received by the independent registered public accounting firm during their audit examination and quarterly reviews. The board has adopted a written audit committee charter that requires at leas t semi-annual meetings. The charter is not available on our website, but it was included as Appendix A to the proxy statement filed in connection with our 2008 annual meeting. The audit committee met five times during 2009.

Although our audit committee charter mandates composition consisting of three board members, including two independent members, we currently only have one (independent) board member on our audit committee.

Compensation Committee

The compensation committee has the primary authority to determine our compensation philosophy and to make recommendations regarding compensation for our executive officers. The compensation committee makes recommendations to the board concerning salaries and incentive compensation for executive officers, awards equity compensation to employees and consultants under our Consultant and Employee Stock Compensation Plan and our Amended and Restated 2001 Long-Term Incentive Plan (the “Amended and Restated LTIP”) and otherwise determines compensation levels and performs such other functions regarding compensation as the board may delegate.

The compensation committee has recommended to the board, and the board has implemented, compensation policies, plans and programs that seek to enhance stockholder value by aligning the financial interests of the executive officers with those of the stockholders. We rely heavily on incentive, including equity, compensation to attract, retain, motivate and reward executive officers. Historically, annual base salaries have been set at the time of hire and are subject to adjustment. Initial base salaries are recommended by the Chief Executive Officer to the compensation committee. After review, the compensation committee recommends to the full board the compensation package

as part of the overall board consideration of the full employment package offered to the prospective officer. The compensation package is based on the amount deemed necessary to attract and retain the services of the executive officer candidate. Incentive compensation is variable and tied to corporate and individual performance. The incentive compensation program is designed to provide incentive to management to grow revenues, provide quality returns on investment, enhance stockholder value and contribute to our long-term growth. The incentive compensation program is reviewed at least annually to ensure it meets our current strategies and needs. The Chief Executive Officer aids the compensation committee by providing input regarding the annual compensation of all executive office rs, other than himself. The performance of our Chief Executive Officer is reviewed annually by the compensation committee.

The board has not adopted a written compensation committee charter. The compensation committee had several informal discussions during 2009.

Director Nominations

The board does not have a standing nominating committee. Director nominees to our board are recommended to the full board by a majority of the independent directors, as such term is defined in the Nasdaq listing standards and the rules and regulations promulgated by the SEC. The board, as a whole, then approves or rejects such director nominees. The board believes that this process is appropriate due to the relatively small number of directors on the board and the opportunity to benefit from a variety of opinions and perspectives in determining director nominees. The independent directors who participate in the nomination of director nominees to our board are Dr. Eren and Mr. Norris. We do not retain a third party to assist in the identification of directors.

The identification of director nominees may occur in various ways, including through recommendation by our directors, management and stockholders. Although there are no specific minimum qualifications applicable to director nominees, in recommending director nominees, the independent directors evaluate the qualifications of identified director nominees in light of the skills, experience, perspective and background required for the effective functioning of our board. While there is no formal policy with respect to diversity, the board does consider such issues as diversity of education, professional experience, differences of viewpoints and skills when assessing individual director nominees. Director nominee recommendations from stockholders can be submitted by followin g the instructions in the “Communication with the Board” section below. Nominations must also comply with the rules relating to stockholder proposals, as described under “Stockholder Proposals” above. All director nominee recommendations and the subsequent nomination process are evaluated using the same guidelines described above.

Compensation of Directors

Our board is responsible for consideration and determination of director compensation. Each non-employee and employee director is entitled to an annual award of 10,000 restricted shares or 10,000 options to purchase shares of our common stock, at each director’s option, for membership on the board. In addition, each board member is entitled to receive 1,000 shares of restricted stock or 1,000 options to purchase shares of our common stock, at each director’s option, for every three telephonic board meetings attended. Directors do not receive any cash compensation for their services as members of the board, although they are reimbursed for certain expenses incurred in connection with attendance at board and committee meetings.

Board members are also eligible to receive discretionary grants of common stock under our Consultant and Employee Stock Compensation Plan and grants of stock options, stock appreciation rights and restricted stock pursuant to our Amended and Restated LTIP. The Company made discretionary equity grants to directors in their capacity as directors during the fiscal year ended December 31, 2009. Messrs. Burst, Kirk, Carr, Norris and Eren each received 100,000 options to purchase shares of our common stock during 2009.

Communication with the Board

Our board has adopted a policy pursuant to which stockholders may communicate with any and all members of the board by transmitting correspondence by mail addressed to one or more directors by name (or to the Chairman of the Board, for a communication addressed to the entire board) at the following address: Name of the director(s), c/o Corporate Secretary, International Fuel Technology, Inc., 7777 Bonhomme Avenue, Suite 1920, St. Louis, Missouri 63105.

Communications from our stockholders to one or more directors will be monitored by our Corporate Secretary and the Chairman of the Board. The Corporate Secretary and the Chairman of the Board will bring any issues that they deem to be significant to the attention of the appropriate board member or members.

PROPOSAL NO. 2 – RATIFICATION OF APPOINTMENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The board, based on the recommendation of the audit committee, has selected BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010 and recommends that the stockholders ratify such selection. Although not required, we believe that it is good corporate practice to request stockholder ratification of the board’s appointment of our independent registered public accounting firm. In the event that a majority of the shares are not voted in favor of ratification, the audit committee will reconsider its selection. Unless otherwise instructed, the proxy holders will vote the proxies they receive for the ratification of BDO USA, LLP’s appointment as our independent registered public acc ounting firm for the fiscal year ending December 31, 2010. A representative of BDO USA, LLP is expected to be present telephonically at the annual meeting, will have an opportunity to make a statement if he desires to do so, and is expected to be available to respond to appropriate questions from stockholders.

Services Provided by Our Independent Registered Public Accounting Firm

BDO USA, LLP serves as our independent registered public accounting firm for the fiscal year ending December 31, 2010, and acted in such capacity for the fiscal years ended December 31, 2009 and 2008. Aggregate fees for professional services rendered for the Company by BDO USA, LLP for the fiscal years ended December 31, 2009 and 2008 were as follows:

| | | Fiscal Year Ended December 31, 2009 | | | Fiscal Year Ended December 31, 2008 | |

| Audit Fees | | $ | 117,054 | | | $ | 127,268 | |

| Audit-Related Fees | | | - | | | | - | |

| Tax Fees | | | - | | | | - | |

| All Other Fees | | | - | | | | - | |

| | | $ | 117,054 | | | $ | 127,268 | |

Audit Fees

Audit fees were for professional services rendered for the audits of our financial statements and for the review of financial statements included in our quarterly reports on Form 10-Q for the quarterly periods during the 2009 and 2008 fiscal years.

Audit-Related Fees

During the 2009 and 2008 fiscal years, BDO USA, LLP did not provide any assurance and related services that are reasonably related to the performance of the audit or review of our financial statements that are not reported under the caption “Audit Fees” above. Therefore, there were no audit-related fees billed or paid during those fiscal years.

Tax Fees

As BDO USA, LLP did not provide any services to the Company for tax compliance, tax advice and tax planning during the fiscal years ended December 31, 2009 and 2008, no tax fees were billed or paid during those fiscal years.

All Other Fees

BDO USA, LLP did not provide any other products or services during the 2009 and 2008 fiscal years. As a result, there were no other fees billed or paid during those fiscal years.

Audit Committee Pre-Approval Policies and Procedures

Our audit committee has certain policies and procedures in place requiring the pre-approval of audit and non-audit services to be performed by our independent registered public accounting firm. Such pre-approval can be given as part of the audit committee’s approval of the scope of the engagement of the independent registered public accounting firm or on an individual basis. The approved non-audit services must be disclosed in our periodic reports filed with the SEC. Our independent registered public accounting firm cannot be retained to perform specified non-audit functions, including (i) bookkeeping, financial information systems design and implementation; (ii) appraisal or valuation services, fairness opinions, or contribution-in-kind reports; (iii) actuarial services; and (iv) internal audit outsourcing services. All work perfo rmed by BDO USA, LLP for us in 2009 was pre-approved by our audit committee.

Our board recommends a vote FOR the ratification of the appointment of

BDO USA, LLP to serve as our independent registered public accounting firm for the fiscal

year ending December 31, 2010.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD

The following is the report of the audit committee with respect to our audited financial statements for the fiscal year ended December 31, 2009, which include the balance sheets of the Company as of December 31, 2009 and 2008, and the related statements of operations, stockholders’ equity and cash flows for each of the years then ended. The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, or incorporated by reference into any future filing with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act of 1933, as amended, o r the Securities Exchange Act of 1934, as amended.

Review With Management

The audit committee has reviewed and discussed our audited financial statements with management.

Review and Discussion with Independent Registered Public Accounting Firm

The audit committee has discussed with BDO USA, LLP, our independent registered public accounting firm, the matters required to be discussed by the Codification of Statements of Auditing Standards, AU § 380 (“SAS 61”).

The audit committee has also received written disclosures and the letter from BDO USA, LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding BDO USA, LLP’s communications with the audit committee concerning independence and has discussed with BDO USA, LLP its independence.

Conclusion

Based on the review and discussions referred to above, the audit committee recommended to the board that our audited financial statements be included in our annual report on Form 10-K for the fiscal year ended December 31, 2009 for filing with the SEC.

Audit Committee

David B. Norris, Chairman

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table sets forth information regarding the ownership of our common stock as of October 20, 2010 by (i) each person known by the Company to own beneficially more than five percent (5%) of our common stock; (ii) each director and nominee for director of the Company; (iii) each executive officer named in the Summary Compensation Table (see “Executive Compensation”); and (iv) all directors and executive officers of the Company as a group.

Name of Beneficial Owner 1 | | Amount and

Nature of

Beneficial

Ownership | | | Percent of Common Stock 2 | |

| | | | | | | | |

| Jonathan R. Burst | | | 9,878,344 | | 3 | | | 9.08 | % |

| David B. Norris | | | 1,662,265 | | 4 | | | 1.63 | % |

| Gary Kirk | | | 2,405,520 | | 5 | | | 2.32 | % |

| Rex Carr | | | 19,457,159 | | 6 | | | 19.17 | % |

| Fer Eren, M.D. | | | 752,899 | | 7 | | | 0.74 | % |

| Stuart D. Beath | | | 2,359,024 | | 8 | | | 2.29 | % |

| | | | | | | | | | |

| All directors and executive officers as a group (6 persons) | | | 36,515,211 | | 9 | | | 32.05 | % |

| | | | | | | | | | |

| John M. Hennessy | | | 6,000,000 | | 10 | | | 5.81 | % |

| Observor Acceptances, Ltd. | | | 5,259,840 | | 11 | | | 5.14 | % |

1This table is based upon information supplied by officers, directors and principal stockholders. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, we believe that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Unless otherwise indicated, the principal address of each of the stockholders named in this table is: c/o International Fuel Technology, Inc., 7777 Bonhomme Avenue, Suite 1920, St. Louis, Missouri 63105. The number of shares beneficially owned includes shares of common stock that the owner or owners had the right to acquire on or within 60 days of October 20, 2 010, including through the exercise of options or warrants. Also included are restricted shares of common stock, over which the owner or owners have voting power, but no investment power.

2Calculation based on 101,322,284 common shares outstanding as of October 20, 2010 and calculated in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended.

3Includes 52,000 restricted shares of common stock owned by Burcor Capital, LLC, of which Mr. Burst is an executive officer. Mr. Burst is deemed to be the beneficial owner of such shares. It also includes 7,501,200 shares issuable upon the exercise of options.

4 Includes 417,840 shares issuable upon exercise of options.

5Represents 2,405,520 shares issuable upon exercise of options.

6Includes 14,820,298 shares of restricted common stock owned by R.C. Holding Company, of which Mr. Carr is a director, President and 41% stockholder. Mr. Carr is deemed to be the beneficial owner of these shares. Also includes 130,000 shares of common stock and 4,329,901 shares of restricted common stock owned by Mr. Carr. Amount also includes 176,960 shares issuable upon exercise of options.

7Represents 642,899 shares of common stock and 110,000 shares issuable upon exercise of options.

8Represents 349,024 shares of common stock and 2,010,000 shares issuable upon exercise of options.

9Includes 12,621,520 shares issuable upon exercise of options.

10Represents 2,000,000 shares of common stock held directly by Mr. Hennessy, 2,000,000 shares of common stock held by a grantor retained annuity trust, of which Mr. Hennessy serves as trustee (the "GRAT"), 1,000,000 shares issuable upon exercise of warrants held directly by Mr. Hennessy, and 1,000,000 shares issuable upon exercise of warrants held by the GRAT. Mr. Hennessy's principal address is 47 West Lake Road, Tuxedo Park, NY 10987.

11Includes 4,160,000 shares of restricted common stock and 1,099,840 shares issuable upon the exercise of options. Observor Acceptances, Ltd.’s principal address is C/O Rob Douglas, Sir Walter Raleigh House, 48/50 Esplanade, St. Helier, Jersey JE1 4HH, Channel Islands.

Background Information about Executive Officers

Brief biographies of our executive officers are set forth below:

Jonathan R. Burst, age 52, has served as our Chief Executive Officer since 1999. Additional background information about Mr. Burst is located on page 3 of this proxy statement.

Stuart D. Beath, age 51, was appointed as our Chief Financial Officer in July 2007. From 2001 until June 30, 2007, Mr. Beath served as our Director of Corporate Development. Mr. Beath has an extensive background in finance, having served in the Corporate Finance Department of A.G. Edwards & Sons, Inc., a brokerage and investment banking firm, from 1987 to 1993, where he was an Assistant Vice-President of the firm. Mr. Beath also served in the Corporate Finance Department of Stifel, Nicolaus & Company, Incorporated, a brokerage and investment banking firm, from 1993 to 1997, where he was a First Vice-President. He was also a member of the b oard of directors of Anchor Gaming from 1994 to 2001, where he served on the board's audit committee. Mr. Beath earned a bachelor of arts degree from Williams College in 1981 and a masters in business administration degree from the Darden School at the University of Virginia in 1987.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our executive officers and directors, and persons who beneficially own more than ten percent (10%) of our common stock, to file initial reports of Company stock ownership and reports of changes in ownership with the SEC. Executive officers, directors and greater than ten percent (10%) beneficial shareholders are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file.

Based solely upon our review of copies of Section 16(a) reports received by us and written representations from the Company’s executive officers and directors, we believe that, during the fiscal year ended December 31, 2009, the following persons did not timely file Section 16(a) reports reporting transactions affecting their beneficial ownership:

Reporting Person | Number of Known

Failures to File

Required Form | Number of

Transactions Not Reported |

| Mr. Burst | 3 | 2 |

| Mr. Carr | 4 | 3 |

| Mr. Kirk | 3 | 2 |

| Mr. Norris | 3 | 2 |

| Mr. Demetriou | 5 | 4 |

| Mr. Beath | 2 | 2 |

Certain Relationships and Related Transactions

During the fourth quarter of 2007, we obtained a $500,000 loan from Harry F. Demetriou, a director of the Company and the holder of over five percent (5%) of the Company’s common stock. Pursuant to the terms of the loan, a promissory note was executed by the Company in favor of Mr. Demetriou in connection with the loan. The loan was to accrue interest at the rate of fifteen percent (15%) per year in arrears, was to become due and payable on January 1, 2009, and was guaranteed by Rex Carr, a director of the Company and the holder of over five percent (5%) of the Company’s common stock. The Company also was obligated to pay any related loan fees incurred by Mr. Demetriou. On March 31, 2008, Mr. Demetriou agreed to accept 1,040,000 shares of Company common stock in settlement of the $500,000 note. The trading price of the common stock was $0.41 per share as of March 31, 2008. As such, the settlement represented a twenty-two percent (22%) premium compared to the current stock price. The premium was incentive for the settlement in shares rather than in cash and was based on negotiations between the Company and Mr. Demetriou. On June 18, 2008, the Company repurchased 520,000 of the shares granted for the debt settlement described above for $250,000. During the first quarter of 2009, the Company repurchased the remaining 520,000 shares granted for the debt settlement for $250,000. In conjunction with these transactions, the Company reimbursed Mr. Demetriou $56,000 in 2009 for accumulated loan and bank fees.

On December 11, 2007, the Company obtained an investment commitment from Mr. Carr for up to $1,000,000 of equity purchases from time to time commencing after March 1, 2008. During the first quarter of 2008, the Company sold 416,000 shares to Mr. Carr under this arrangement for $200,000. 400,000 of these shares were subsequently repurchased by the Company for $200,000 during 2009.

Executive Compensation

2009 Summary Compensation Table

The following table sets forth information concerning all cash and non-cash compensation paid or to be paid by us as well as certain other compensation awarded, earned by and paid, during the indicated fiscal year, to the Chief Executive Officer and Chief Financial Officer.

Name and Principal

Position | Year | | Salary ($) | | | Bonus ($) | | | Option Awards ($) | | | All Other Compensation ($) | | | Total

($) |

| | | | | | | | | | | | | | | | | |

| Jonathan R. Burst, | 2009 | | $ | 400,000 | | | $ | - | | | $ | 1,111,003 | 1 | | $ | 52,512 | 2 | | $ | 1,563,515 |

| CEO | 2008 | | $ | 334,615 | | | $ | - | | | $ | - | | | $ | 21,496 | | | $ | 356,111 |

| | | | | | | | | | | | | | | | | | | | | |

| Stuart D. Beath, | 2009 | | $ | 168,269 | | | $ | - | | | $ | 102,497 | 3 | | $ | 21,981 | 4 | | $ | 292,747 |

| CFO | 2008 | | $ | 135,885 | | | $ | 10,000 | | | $ | - | | | $ | 16,633 | | | $ | 162,518 |

1) The Company granted Mr. Burst options to purchase 350,000 shares of our common stock during 2009 for employment services that vest June 30, 2010. The grant date fair value of these options was $91,700 based on the closing price of our stock on grant date ($0.36 on April 3, 2009). Assumptions used in determining the value of these options are disclosed in Note 4 to our financial statements for the fiscal year ended December 31, 2009, filed with our annual report on Form 10-K for the fiscal year ended December 31, 2009. This amount also includes $1,019,303 of non-cash expense recorded during 2009 for the fair value differentiation related to the modification of terms for options previously granted.

2) Represents $22,192 of health insurance coverage for Mr. Burst and his family, $2,320 of life insurance premiums paid by the Company, $26,200 for a discretionary grant of 100,000 options for board services provided and $1,800 for the grant of 10,000 shares of our common stock for 2009 board services provided. These fully-vested shares were valued based on the closing price of our stock on grant date ($0.18 on December 31, 2009).

3) Represents the grant date fair value for a total of 450,000 options to purchase shares of our common stock granted to Mr. Beath during 2009. 250,000 of these options vest June 30, 2010 and were valued based on the closing price of our stock on the grant date ($0.36 on April 3, 2009). The remaining 200,000 options vested immediately upon grant and were valued based on the closing price of our stock on the grant date ($0.24 on August 3, 2009). Assumptions used in determining the value of these options are disclosed in Note 4 to our financial statements for the fiscal year ended December 31, 2009, filed with our annual report on Form 10-K for the fiscal year ended December 31, 2009.

4) Represents $21,981 of health insurance coverage for Mr. Beath and his family.

Executive Officer Employment Agreements

Jonathan R. Burst

2002 Burst Agreement

In January 2002, we entered into an employment agreement (the “2002 Burst Agreement”) with Mr. Burst to serve as our Chief Executive Officer with an initial annual base salary of $250,000,

options to purchase 780,000 shares of our common stock, with 260,000 shares vesting on the first anniversary of his employment and the remaining 520,000 shares vesting on the last day of the employment period and a bonus award as deemed appropriate by the board. The initial three-year agreement expired on December 31, 2004. With the exception of an increase in salary effective July 1, 2008, Mr. Burst continued to serve as our Chief Executive Officer under the terms of the 2002 Burst Agreement through May 15, 2009 (the effective date of the 2009 Burst Agreement).

Under the 2002 Burst Agreement, if Mr. Burst’s employment was terminated by us for “cause,” or if Mr. Burst terminated his employment other than for “good reason,” as defined in the 2002 Burst Agreement, and which includes the occurrence of a change in control, we would pay Mr. Burst the salary accrued for the pay period in which the termination occurred and would issue the accrued stock compensation. “Cause” is defined in the 2002 Burst Agreement as (i) any fraud, embezzlement or other dishonesty of Mr. Burst that materially and adversely affects our business or reputation, or (ii) Mr. Burst’s felony conviction or entering into a plea of nolo contendere with respect to a felony.

Pursuant to the terms of the 2002 Burst Agreement, if we terminated Mr. Burst other than for cause, death or disability, or if Mr. Burst terminated his employment for good reason, the Company would (i) pay Mr. Burst’s accrued but unpaid portion of his annual base salary in a lump sum, (ii) continue to pay Mr. Burst’s annual base salary through the remainder of the term of the agreement, (iii) issue the accrued stock compensation, and (iv) issue the stock compensation for the remainder of the term of the agreement. In addition, if we did not extend Mr. Burst’s contract beyond the terms of the 2002 Burst Agreement, we would pay Mr. Burst his current salary over the one-year period after the 2002 Burst Agreement expired.

Under the 2002 Burst Agreement, if Mr. Burst’s employment was terminated by us by reason of his death or disability, we would pay Mr. Burst’s accrued but unpaid portion of his annual base salary in a lump sum and issue the accrued stock compensation. In addition, if Mr. Burst’s employment was terminated by reason of disability, we would continue to pay Mr. Burst’s annual base salary, less any amounts received by Mr. Burst under any disability insurance coverage maintained by us, until the earlier of (i) expiration of Mr. Burst’s employment period under the 2002 Burst Agreement, or (ii) the date of Mr. Burst’s death.

In addition, Mr. Burst was entitled to receive additional compensation for serving on our board of directors.

2009 Burst Agreement

On May 15, 2009, we entered into an employment agreement with Mr. Burst (the “2009 Burst Agreement”) to serve as our Chief Executive Officer. The 2009 Burst Agreement has a term beginning May 15, 2009 through May 14, 2012.

Pursuant to the terms of the 2009 Burst Agreement, Mr. Burst will receive an annual base salary of $400,000. Mr. Burst is also eligible to receive a cash bonus and stock options at the discretion of our board.

Under the 2009 Burst Agreement, if Mr. Burst’s employment is terminated by us for “cause,” or if Mr. Burst terminates his employment other than for “good cause shown,” as defined in the 2009 Burst Agreement, and which includes the occurrence of a change in control, we will pay Mr. Burst the salary accrued for the pay period in which the termination occurred, unless termination was for cause and the cause involved fraud, embezzlement or disclosure of confidential information, in which case, the Company would not be liable for any payments to Mr. Burst. “Cause” is defined in the 2009 Burst Agreement as (i) any fraud, embezzlement or other dishonesty of Mr. Burst that materially and adversely affects our business or reputation, (ii) disclosure of confidential information to any third part y, (iii) Mr. Burst’s refusal to perform his material duties and obligations under the 2009 Burst Agreement, or (iv) Mr. Burst’s willful and intentional misconduct in the performance of his material duties and obligations.

Pursuant to the terms of the 2009 Burst Agreement, if we terminate Mr. Burst other than for cause, death or disability, or if Mr. Burst terminates his employment for good cause shown, the Company must pay Mr. Burst’s accrued but unpaid portion of his annual base salary in a lump sum, and will continue to pay Mr. Burst’s annual base salary through May 14, 2012. In addition, if we do not extend Mr. Burst’s contract beyond the terms of the 2009 Burst Agreement, we will pay Mr. Burst his current salary over the one-year period after the 2009 Burst Agreement expires.

Under the 2009 Burst Agreement, if Mr. Burst’s employment is terminated by us by reason of his death or disability, we will pay Mr. Burst’s accrued but unpaid portion of his annual base salary in a lump sum. In addition, if Mr. Burst’s employment is terminated by reason of disability, we will continue to pay Mr. Burst’s annual base salary, less any amounts received by Mr. Burst under any disability insurance coverage maintained by us, until the earlier of (i) May 14, 2012, (ii) six months after a determination of disability has been made, or (iii) the date of Mr. Burst’s death.

Pursuant to the 2009 Burst Agreement, during Mr. Burst’s employment, and for a period of five years following termination of Mr. Burst’s employment (i) by Mr. Burst other than for good cause shown, or (ii) by us for cause, Mr. Burst is bound by a non-competition clause. The 2009 Burst Agreement also provides for a non-solicitation period ending one year following Mr. Burst’s termination for any reason.

In addition, Mr. Burst is entitled to receive additional compensation for serving on our board of directors.

Stuart D. Beath

2007 Beath Agreement

In connection with Mr. Beath’s appointment as Chief Financial Officer, we entered into an employment agreement (the “2007 Beath Agreement”) with Mr. Beath dated July 2, 2007. Pursuant to the 2007 Beath Agreement, Mr. Beath was employed as our Chief Financial Officer from June 30, 2007 until June 30, 2009.

Pursuant to the terms of the 2007 Beath Agreement, we agreed to pay Mr. Beath an initial annual base salary of $100,000, to be reviewed annually. Pursuant to the terms of the 2007 Beath Agreement and a non-statutory stock option agreement dated July 2, 2007, Mr. Beath received options to purchase 208,000 shares of our common stock with an exercise price of $0.75 per share in accordance with the terms of the Amended and Restated LTIP. Pursuant to the terms of the option agreement, Mr. Beath’s options vested twenty-four (24) months from the date of grant and expire on June 30, 2012.

Under the 2007 Beath Agreement, if Mr. Beath’s employment was terminated by us for “cause,” or if Mr. Beath terminated his employment other than for “good cause shown,” as defined in the 2007 Beath Agreement, and which includes the occurrence of a change in control, we would pay Mr. Beath the salary accrued for the pay period in which the termination occurred, unless termination was for cause and the cause involved fraud, embezzlement or disclosure of confidential information, in which case, the Company would not be liable for any payments to Mr. Beath. “Cause” is defined in the 2007 Beath Agreement as (i) any fraud, embezzlement or other dishonesty of Mr. Beath that materially and adversely affects our business or reputation, (ii) Mr. Beath’s felony conviction or entering into a plea of nolo contendere with respect to a felony, (iii) disclosure of confidential information to any third party, (iv) any actions taken by Mr. Beath deemed by our Chief Executive Officer to be detrimental to our well-being, (v) Mr. Beath’s refusal to perform his material duties and obligations under the 2007 Beath Agreement, or (vi) Mr. Beath’s willful and intentional misconduct in the performance of his material duties and obligations.

Pursuant to the terms of the 2007 Beath Agreement, if we terminated Mr. Beath other than for cause, death or disability, or if Mr. Beath terminated his employment for good cause shown, the Company would pay Mr. Beath’s accrued but unpaid portion of his annual base salary in a lump sum, and would continue to pay Mr. Beath’s annual base salary through June 30, 2009.

Under the 2007 Beath Agreement, if Mr. Beath’s employment was terminated by us by reason of his death or disability, we would pay Mr. Beath’s accrued but unpaid portion of his annual base salary in a lump sum. In addition, if Mr. Beath’s employment was terminated by reason of disability, we would continue to pay Mr. Beath’s annual base salary, less any amounts received by Mr. Beath under any disability insurance coverage maintained by us, until the earlier of (i) June 30, 2009, (ii) six months after a determination of disability has been made, or (iii) the date of Mr. Beath’s death.

Pursuant to the 2007 Beath Agreement, during Mr. Beath’s employment, and for a period of two years following termination of Mr. Beath’s employment (i) by Mr. Beath other than for good cause shown, or (ii) by us for cause, Mr. Beath was bound by a non-competition clause. The 2007 Beath Agreement also provided for a non-solicitation period ending one year following Mr. Beath’s termination for any reason.

Mr. Beath received increases in his annual base salary to $150,000 effective July 1, 2008 and to $175,000 effective April 1, 2009.

2009 Beath Agreement

On May 15, 2009, we entered into an employment agreement with Mr. Beath that replaced the 2007 Beath Agreement (the “2009 Beath Agreement”). Pursuant to the 2009 Beath Agreement, Mr. Beath is to serve as our Chief Financial Officer. The term of the 2009 Beath Agreement begins May 15, 2009 and extends to May 14, 2012.

Pursuant to the terms of the 2009 Beath Agreement, Mr. Beath will receive an annual base salary of $175,000. Mr. Beath is also eligible to receive a cash bonus and stock option grants at the discretion of our board.

Under the 2009 Beath Agreement, if Mr. Beath’s employment is terminated by us for “cause,” or if Mr. Beath terminates his employment other than for “good cause shown,” as defined in the 2009 Beath Agreement, and which includes the occurrence of a change in control, we will pay Mr. Beath the salary accrued for the pay period in which the termination occurred, unless termination was for cause and the cause involved fraud, embezzlement or disclosure of confidential information, in which case, the Company would not be liable for any payments to Mr. Beath. “Cause” is defined in the 2009 Beath Agreement as (i) any fraud, embezzlement or other dishonesty of Mr. Beath that materially and adversely affects our business or reputation, (ii) disclosure of confidential information to any third part y, (iii) Mr. Beath’s refusal to perform his material duties and obligations under the 2009 Beath Agreement, or (iv) Mr. Beath’s willful and intentional misconduct in the performance of his material duties and obligations.

Pursuant to the terms of the 2009 Beath Agreement, if we terminate Mr. Beath other than for cause, death or disability, or if Mr. Beath terminates his employment for good cause shown, the Company must pay Mr. Beath’s accrued but unpaid portion of his annual base salary in a lump sum, and will continue to pay Mr. Beath’s annual base salary through May 14, 2012.

Under the 2009 Beath Agreement, if Mr. Beath’s employment is terminated by us by reason of his death or disability, we will pay Mr. Beath’s accrued but unpaid portion of his annual base salary in a lump sum. In addition, if Mr. Beath’s employment is terminated by reason of disability, we will continue to pay Mr. Beath’s annual base salary, less any amounts received by Mr. Beath under any disability insurance coverage maintained by us, until the earlier of (i) May 14, 2012, (ii) six months after a determination of disability has been made, or (iii) the date of Mr. Beath’s death.

Pursuant to the 2009 Beath Agreement, during Mr. Beath’s employment, and for a period of five years following termination of Mr. Beath’s employment (i) by Mr. Beath other than for good cause shown, or (ii) by us for cause, Mr. Beath is bound by a non-competition clause. The 2009 Beath Agreement also provides for a non-solicitation period ending one year following Mr. Beath’s termination for any reason.

| | Outstanding Equity Awards at 2009 Fiscal Year-End |

The following table provides information on all restricted stock, stock options and stock appreciation rights awards (if any) held by our named executive officers (“NEOs”) as of December 31, 2009.

| | Option Awards |

Name | No. of Securities

Underlying Unexercised

Options Exercisable (#) | No. of Securities

Underlying Unexercised

Options Unexercisable (#) | Option Exercise

Price ($) | Option Expiration

Date |

| Jonathan R. Burst | 10,400 | - | $ 0.49 | 12/28/2011 |

| | 10,400 | - | $ 0.15 | 12/31/2012 |

| | 10,400 | - | $ 0.21 | 12/31/2013 |

| | - | 450,000 | $ 0.50 | 12/31/2013 |

| | 780,000 | - | $ 0.13 | 12/31/2014 |

| | 1,040,000 | - | $ 0.24 | 12/31/2014 |

| | 5,200,000 | - | $ 0.48 | 12/31/2014 |

| | | | | |

| Stuart D. Beath | 208,000 | - | $ 0.72 | 6/30/2012 |

| | - | 250,000 | $ 0.50 | 12/31/2013 |

| | 200,000 | - | $ 0.25 | 8/2/2014 |

| | 1,352,000 | - | $ 0.48 | 12/31/2014 |

2009 Director Compensation

Directors do not receive any cash compensation for their services as members of the board, although they are reimbursed for certain expenses incurred in connection with attendance at board and committee meetings.

Each non-employee and employee director is entitled to an annual award of 10,000 restricted shares or 10,000 immediately vesting options to purchase shares of our common stock for membership on the board. In addition, each board member is entitled to receive 1,000 shares of restricted stock or 1,000 options to purchase shares of our common stock for every three telephonic board meetings attended. For 2009 board services, Messrs. Burst and Carr elected restricted shares and Messrs. Norris, Kirk and Eren elected options as compensation for their services.

Board members are also eligible to receive discretionary grants of common stock under the Consultant and Employee Stock Compensation Plan and grants of stock options, stock appreciation rights and restricted stock pursuant to the Amended and Restated LTIP. We did not make discretionary equity grants pursuant to our Amended and Restated LTIP to any directors in their capacity as directors during the fiscal year ended December 31, 2009. We did, however, make discretionary grants (not pursuant to our Amended and Restated LTIP) in the aggregate total of 500,000 options to purchase shares of our common stock to directors in their capacity as directors during the fiscal year ended December 31, 2009.

The following table provides information related to the compensation of our non-NEO directors for fiscal 2009. For information regarding our Chairman and Chief Executive Officer’s 2009 compensation, see the 2009 Summary Compensation table.

| Name | | | Stock Awards

($) | | | Option Awards ($) 1 | | | All Other Compensation

($) | | Total ($) | |

| | | | | | | | | | | | | | | |

| Rex Carr | 2 | | $ | 7,400 | | | $ | 26,200 | | | $ | 22,000 | | | | $ | 55,600 | |

| Fer Eren, M.D. | 3 | | $ | - | | | $ | 13,625 | | | $ | - | | | | $ | 13,625 | |

| David B. Norris | 4 | | $ | - | | | $ | 27,441 | | | $ | - | | | | $ | 27,441 | |

| Gary Kirk | 5 | | $ | - | | | $ | 27,441 | | | $ | 189,467 | | 6 | | $ | 216,908 | |

| | (1) | Assumptions used in determining the value of these options are disclosed in Note 4 to our financial statements for the fiscal year ended December 31, 2009, filed with our annual report on Form 10-K for the fiscal year ended December 31, 2009. |

| | (2) | Mr. Carr’s Company equity holdings as of December 31, 2009 included 14,820,298 shares of restricted common stock owned by R.C. Holding Company, of which Mr. Carr is a director, President and 41% stockholder. Mr. Carr is deemed to be the beneficial owner of these shares. Mr. Carr also owned 130,000 shares of common stock, 4,319,901 shares of restricted common stock. Mr. Carr also had 76,960 vested options to purchase shares of Company common stock and 10,000 restricted common shares obtained from board services provided from 2002 to 2009. Mr. Carr also received a discretionary grant of 100,000 options to purchase shares of our common stock for board services (fair value of $26,200 at grant date) during 2009. |

| | (3) | Dr. Eren’s Company equity holdings as of December 31, 2009 included 642,899 shares of common stock. Dr. Eren received a discretionary grant of 100,000 options to purchase shares of our common stock for board services (fair value of $12,384 at grant date) and 10,000 options to purchase shares of our common stock for 2009 board services provided (fair value of $1,241 at grant date). |

| | (4) | Mr. Norris’ Company equity holdings as of December 31, 2009 included 1,244,425 shares of restricted common stock. Mr. Norris also held 208,000 vested options to purchase shares of Company common stock for non-director related services provided. Mr. Norris also received a discretionary grant of 100,000 options to purchase shares of our common stock for board services (fair value of $26,200 at grant date) during 2009. Mr. Norris also held 109,840 vested options to purchase shares of Company common stock obtained from board services provided from 2000 to 2009. |

| | (5) | Mr. Kirk’s Company equity holdings as of December 31, 2009 included 2,080,000 vested options to purchase shares of Company common stock and 250,000 unvested options to purchase shares of Company common stock, granted for employee services. Mr. Kirk also held 75,520 vested options to purchase shares of Company common stock, obtained from board services provided from 2003 to 2009. Mr. Kirk received a discretionary grant of 100,000 options to purchase shares of our common stock for board services (fair value of $26,200 at grant date) and 10,000 options to purchase shares of our common stock for 2009 board services provided (fair value of $1,241 at grant date). |

| | (6) | Pursuant to his employment agreement in effect during 2009, Mr. Kirk was to receive an annual salary of 75,000 British Pounds, receive 3,750 British Pounds for retirement contributions, receive a health insurance stipend of 3,000 British Pounds and receive an annual auto allowance of $9,600. Effective April 2009, Mr. Kirk received an incremental annual salary increase of 5,000 British Pounds and 250 British Pounds for retirement contributions. Effective November 2009, Mr. Kirk received another incremental annual salary increase of $10,000. Amount represents $150,167 for Mr. Kirk’s employment salary considering foreign currency conversion to U.S. dollars based on when payments were made to Mr. Kirk throughout the year and $39,300 (gran t date fair value) for 150,000 options granted for employment services during 2009. |

OTHER MATTERS

We participate in a procedure known as "householding." This means that if you share the same last name with other stockholders living in your household, you may receive only one copy of our Notice. Pursuant to the SEC rules, stockholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of our Notice, unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of the Notice, or if you hold stock in more than one account, and in either case you wish to receive only a single copy of each of the Notice for your household, please contact our Corporate Secretary at International Fuel Technology, Inc., Attn: Thomas M. Powell, 7777 Bonhomme Avenue, Suite 1920, St. Louis, Missouri 63105, or by telephone at (314) 727-3333.

If you participate in householding and wish to receive a separate copy of the Notice, or if you do not wish to participate in householding and prefer to receive separate copies in the future, please contact our Corporate Secretary as indicated above.

Beneficial owners can request information about householding from their banks, brokers or other holders of record.

The board knows of no other matters that will be presented for consideration at our annual meeting. However, if other matters are properly brought before the meeting, the proxy holders will vote your shares in their discretion.

A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K WILL BE SENT WITHOUT CHARGE TO ANY STOCKHOLDER REQUESTING IT IN WRITING FROM: INTERNATIONAL FUEL TECHNOLOGY, INC., ATTENTION: THOMAS M. POWELL, 7777 BONHOMME AVENUE, SUITE 1920, ST. LOUIS, MISSOURI 63105.

| | By Order of the Board, | |

| | | |

| | Thomas M. Powell | |

| | | |

| | Thomas M. Powell | |

| | Corporate Secretary | |

Dated November 1, 2010

18