INTERNATIONAL FUEL TECHNOLOGY, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 9, 2005

To the Stockholders of International Fuel Technology, Inc.:

Notice is hereby given that the Annual Meeting of the Stockholders of International Fuel Technology, Inc. (the “Company”) will be held on Monday, December 9, 2005 at 9:00 a.m., local time, at the Crowne Plaza Hotel Clayton, located at 7750 Carondelet Avenue, St. Louis, Missouri, for the following purposes:

| (1) | | To elect seven directors to serve until the 2006 Annual Meeting of Stockholders. |

| (2) | | To ratify the appointment of BDO Seidman, LLP as registered independent public accountants for the audit engagement for the fiscal year ending December 31, 2005. |

| (3) | | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors (“Board”) has fixed the close of business on October 11, 2005, as the record date for determining the stockholders entitled to notice of and to vote at this Annual Meeting and at any adjournment thereof.

Whether or not you expect to attend the Annual Meeting in person, you are urged to mark, sign, date and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope provided to ensure your representation and the presence of a quorum at the Annual Meeting. If you send in your proxy card and then decide to attend the Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

By Order of the Board,

Gary S. Hirstein, Secretary

St. Louis, Missouri

November 21, 2005

INTERNATIONAL FUEL TECHNOLOGY, INC.

7777 BONHOMME AVENUE, SUITE 1920

ST. LOUIS, MISSOURI 63105

PROXY STATEMENT

Proxy Solicitation

This proxy statement is furnished to stockholders of International Fuel Technology, Inc., a Nevada corporation (the “Company”), in connection with the solicitation by the Company of proxies for use in voting at the annual meeting of stockholders of the Company to be held on Monday, December 9, 2005 at 9:00 a.m., local time, at the Crowne Plaza Hotel Clayton, 7750 Carondelet Avenue, St. Louis, Missouri or at any adjournment thereof. The purposes of the meeting and the matters to be acted upon are set forth in the accompanying notice relating to the annual meeting. The Company’s Board is not currently aware of any other matters which will come before the meeting.

Proxy materials were mailed to stockholders on or about November 21, 2005 and proxies are being solicited principally by mail. We have engaged Automatic Data Processing Investor Communications Services (“ADP”) to send proxy materials to the Company’s stockholders entitled to vote at the meeting, and the Company will reimburse them for their expenses in so doing. In addition, the Company’s officers, agents and employees may communicate with stockholders, banks, brokerage houses and others by telephone, facsimile or in person to request that proxies be furnished. All expenses incurred in connection with this solicitation will be borne by the Company.

Revocability and Voting Proxy

A proxy card for use at the annual meeting and a return envelope for the proxy card are enclosed. You may revoke the authority granted by your execution and delivery of a proxy at any time before its effective exercise by delivering to the Company a written notice of revocation or a duly executed proxy bearing a later date, or by voting in person at the meeting. If you deliver an executed proxy, and it is not subsequently revoked, your shares will be voted in the manner you direct on your proxy card. If no specifications are given, your shares will be voted in favor of Proposals No. 1 and No. 2 and in the discretion of the proxy holders as to any other matters which may properly come before the meeting.

Record Date and Voting Rights

Only stockholders of record at the close of business on October 11, 2005 are entitled to notice of and to vote at the annual meeting or any adjournment thereof. On October 11, 2005, there were 84,719,727 shares of common stock outstanding, each of which is entitled to one vote on each of the matters to be presented at the annual meeting.

A majority of the outstanding shares entitled to vote must be present in person or represented by proxy at the meeting in order to have a quorum for transaction of business at the meeting. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum. “Broker non-votes” are shares held by brokers or nominees which are not voted on a particular matter because instructions have not been received from the beneficial owner. If there is a quorum:

| • | | the seven director nominees who receive the highest number of affirmative votes cast will be elected, and |

| • | | upon the approving vote of a majority of the votes cast, ratification of the Company’s appointment of BDO Seidman, LLP will be approved. |

Stockholder Proposals

All stockholder proposals which are intended to be presented at the 2006 annual meeting of stockholders must be received by the Company no later than July 24, 2006 for inclusion in the Board’s proxy statement and on the proxy card relating to that meeting.

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

Under the Company’s Articles of Incorporation, the Board has the authority to fix the number of directors, provided that the board must have between one and nine members. The number of directors is currently fixed at seven. Unless otherwise specified, the enclosed proxy will be voted in favor of the persons named below to serve until the next annual meeting of stockholders and until their successors shall have been duly elected and qualified. In the event any of these nominees shall be unable to serve as a director, the shares represented by the proxy will be voted for the person, if any, who is designated by the Board to replace the nominee. All nominees have consented to be named and have indicated their intent to serve if elected. The Board has no reason to believe that any of the nominees will be unable to serve or that any vacancy on the Board will occur.

The Company’s director nominees are listed below.

Name

| | | | Age

| | Positions and Offices

Held with International

Fuel Technology, Inc.

| | Dates in Position

or Office

|

|---|

| Jonathan R. Burst | | | | 47 | | Chairman of the Board | | 2000–Present |

| | | | | | | Director | | 2000–Present |

| | | | | | | Chief Executive Officer | | 1999–Present |

| | | | | | | President | | 1999–2000; 2002–2005 |

| Rex Carr | | | | 78 | | Director | | 2002–Present |

| Tony Cross | | | | 57 | | Director | | 2002–Present |

| Harry Demetriou | | | | 61 | | Director | | 2000–Present |

| Gary Kirk | | | | 43 | | Director | | 2003–Present |

| | | | | | | Director of Sales

and Marketing | | 2003–Present |

| David B. Norris | | | | 57 | | Director | | 1999–Present |

| Charles Stride | | | | 64 | | Director | | November 2005–Present |

Business Experience of Nominees

Jonathan R. Burst. Mr. Burst has served as Chief Executive Officer of the Company since July 1999 and as the President of the Company from July 1999 to February 2000 and January 2002 to April 2005. Mr. Burst has also served as a Director of the Company since February 2000 and Chairman of the Board since 2000. Mr. Burst founded Burcor International in 1998 and has served as President since its inception. Mr. Burst received his Bachelor of Arts degree in Economics from the University of Missouri in 1981.

Rex Carr. Mr. Carr has served as a Director of the Company since August 2002. Mr. Carr has been the managing partner of the Rex Carr Law Firm, a law firm with offices in East St. Louis, Illinois, St. Louis, Missouri and Belleville, Illinois, since 2004. Until 2003, Mr. Carr was the senior partner of a 36-person law firm, Carr, Korein, and Tillery, with offices in Missouri and Illinois, for more than five years. He is admitted to practice in the U.S. Supreme Court and the Illinois and Missouri Supreme Courts.

Tony Cross. Mr. Cross has served as a Director of the Company since October 2002. Mr. Cross is a graduate Chemical Engineer from the University of Sheffield, UK. In 1996, Mr. Cross was named Managing Director of Repsol, a Spanish oil company, overseeing the divestiture of Carless Refining @ Marketing Ltd. as part of Repsol’s divestment program in 2000.

Harry Demetriou. Mr. Demetriou has served as a Director of the Company since February 2000. Mr. Demetriou is currently the Chairman for Observor Acceptances, Ltd., an investment company. Mr. Demetriou was a ship owner of bulk carriers for over 25 years, however, he has retired from active management in the shipping industry prior to 1999.

Gary Kirk. Mr. Kirk has served as a Director of the Company since November 2003. Mr. Kirk has served as the Company’s Director of Sales and Marketing since January 1, 2003. Mr. Kirk has extensive experience (1980 to 2003) in the petroleum industry, all with Petrochem Carless Ltd., a United Kingdom-based refiner and marketer of petroleum products. Mr. Kirk spent his first eight years as a research chemist and the remainder in Petrochem

2

Carless’ marketing department. From 1988 to 2003, Mr. Kirk reported directly to the President of Petrochem Carless as the Marketing Manager for Performance Fuels, covering accounts in Europe and the rest of the world.

David B. Norris. Mr. Norris has served as a Director of the Company since April 1999. Mr. Norris founded and owns Addicks Services, Inc., a construction company, and has served as its President since 1983.

Charles Stride. Mr. Stride is currently the President of one of the Company’s distributors, Fuel Technologies Ltd (FTL), formed for the purpose of marketing and distributing Company additives in South Africa, Europe and other selected countries. During 2003 Mr. Stride was appointed by the World Bank, advising and assisting the Swaziland Ministry of Finance. In 2003, Mr. Stride was also appointed consultant to the Economic Development Agency of the Industrial Development Corporation (IDC) of South Africa. Mr. Stride continues to serve in this consulting role with the IDC. Mr. Stride was also a founding board member of the state-owned Export Credit Insurance Corporation of South Africa, retiring during 2005. Mr. Stride has served as financial advisor to numerous private corporations, where he has been involved in restructuring and establishing companies. He has extensive experience in the international hedge fund and private equity fund industries (1994–2005) and is on the boards of several funds. Mr. Stride qualified as a Chartered Accountant in 1963, having studied at the University of Witwatersrand.

If elected, each director will hold office until the next annual meeting of the stockholders of the Company and until his successor is elected and qualified.

Vote Required

The seven nominees receiving the highest number of affirmative votes of the shares present in person, or represented by proxy and entitled to vote a quorum being present, shall be elected as directors. Only votes cast for a nominee will be counted, except that the accompanying proxy will be voted for all nominees in the absence of instruction to the contrary. Abstentions, broker non-votes and instructions on the accompanying proxy card to withhold authority to vote for one or more nominees will result in the respective nominees receiving fewer votes. However, the number of votes otherwise received by the nominee will not be reduced by such action.

The Company’s Board recommends a vote in favor of each named nominee.

Board Committees and Meetings

During the fiscal year ended December 31, 2004, the Board held two meetings and acted by unanimous written consent on one occasion. Each Board member attended 100% of the meetings of the Board and of the committees of the Board on which each served during the 2004 fiscal year. The Company’s Board has an Audit Committee and a Compensation Committee.

The Company does not have a policy regarding Board members’ attendance at annual meetings. One Board member attended the 2004 annual meeting. All Board members are expected to attend this year’s annual meeting (either in person or by telephonic conference call).

The Company’s current committee members are listed below.

Director

| | | | Audit

Committee

| | Compensation

Committee

|

|---|

| Tony Cross | | | | | Member | | | | Member | |

| Harry Demetriou | | | | | Member | | | | Chairman | |

| David B. Norris | | | | | Chairman | | | | Member | |

Mr. Rex Carr served as a member of the Audit Committee and as Chairman of the Compensation Committee during the 2004 fiscal year and during the majority of the 2005 fiscal year. Mr. Carr resigned as a member of both committees effective November 1, 2005, although he continues to serve as a member of the Board.

3

Audit Committee

The Audit Committee meets with the Company’s registered independent public accountants at least annually to review the results of the annual audit and discuss the financial statements; recommends to the Board the registered independent public accountants to be retained; oversees the independence of the registered independent public accountants; evaluates the registered independent public accountants’ performance; consults with the registered independent public accountants and discusses with senior management the scope and quality of controls; and receives and considers the cooperation received by the registered independent public accountants during their audit examination. The Board has adopted a written Audit Committee charter that requires at least semi-annual meetings. The charter is included as Appendix A to this proxy statement. The Audit Committee met four times during 2004. Messrs. Cross, Demetriou and Norris are “independent” directors, as such term is defined in the listing standards of The Nasdaq Stock Market and the rules and regulations promulgated by the Securities and Exchange Commission (the “SEC”).

Compensation Committee

The Compensation Committee makes recommendations to the Board concerning salaries and incentive compensation for executive officers, awards equity compensation to employees and consultants under the Company’s Consultant and Employee Stock Compensation Plan and the Company’s Long-Term Incentive Plan and otherwise determines compensation levels and performs such other functions regarding compensation as the Board may delegate. The Compensation Committee met once during 2004. Messrs. Cross, Demetriou and Norris are “independent” directors, as such term is defined in the listing standards of The Nasdaq Stock Market and the rules and regulations promulgated by the SEC.

Director Nominations

The Board does not have a standing nominating committee. Director nominees to the Company’s Board are recommended to the full Board by a majority of the independent directors, as such term is defined in the listing standards of The Nasdaq Stock Market and the rules and regulations promulgated by the SEC. The Board, as a whole, then approves or disapproves such director nominees. The Board believes that this process is appropriate due to the relatively small number of directors on the Board and the opportunity to benefit from a variety of opinions and perspectives in determining director nominees by involving the full Board. The independent directors who participate in the nomination of director nominees to the Company’s Board are Messrs. Cross, Demetriou and Norris. The Company does not retain a third party to assist in the identification of directors.

The identification of director nominees may occur in various ways, including through recommendation by the Company’s directors, management and shareholders. In recommending director nominees, the independent directors evaluate the qualifications of identified director nominees in light of the skills, experience, perspective and background required for the effective functioning of the Company’s Board. Director nominee recommendations from stockholders can be submitted by following the instructions in the Communication with the Board section below. All director nominee recommendations and the subsequent nomination process are evaluated using the same guidelines described above.

Messrs. Cross, Demetriou and Norris recommended the director nominees contained in this proxy statement to the full Board. The Board, as a whole, then approved such recommendations.

4

Compensation of Directors

During the 2004 fiscal year and currently, directors did not receive any cash compensation for their services as members of the Board, although they are reimbursed for certain expenses incurred in connection with attendance at Board and committee meetings.

Each non-employee and employee director is entitled to an annual award of 10,000 restricted shares of the Company’s common stock for membership on the Board. In addition, each Board member is entitled to receive 1,000 shares of restricted stock for every three telephonic Board meetings attended. Although the directors were entitled to such compensation, between 2000 and 2004, the Company did not issue any equity compensation to directors for service on the Board. In order to properly compensate directors for their service between 2000 and 2004, the Company anticipates issuing stock options or restricted stock to each director, other than Mr. Cross, during the fourth quarter of 2005. The amounts of the respective issuances will correspond to the grants that the respective directors should have received for their service as directors between 2000 and 2004. In March, 2005, Mr. Cross received 33,000 shares of restricted common stock as compensation for his service on the Board and attendance at Board meetings through 2004.

Board members are also eligible to receive discretionary grants of common stock under the Consultant and Employee Stock Compensation Plan and grants of stock options, stock appreciation rights and restricted stock pursuant to the 2001 Long-Term Incentive Plan. The Company did not make discretionary equity grants to any directors in their capacity as directors during the fiscal year ended December 31, 2004.

Communication with the Board

The Company’s Board has adopted a policy pursuant to which stockholders may communicate with any and all members of the Board by transmitting correspondence by mail addressed to one or more directors by name (or to the Chairman of the Board, for a communication addressed to the entire Board) at the following address: Name of the Director(s), c/o Corporate Secretary, International Fuel Technology, Inc., 7777 Bonhomme Avenue, Suite 1920, St. Louis, Missouri 63105.

Communications from the Company’s stockholders to one or more directors will be monitored by the Company’s Corporate Secretary and the Chairman of the Board. The Corporate Secretary and the Chairman of the Board will bring any issues that they deem to be significant to the attention of the appropriate board member or members.

5

PROPOSAL NO. 2 — RATIFICATION OF APPOINTMENT

OF REGISTERED INDEPENDENT PUBLIC ACCOUNTANTS

The Board, based on the recommendation of the Audit Committee, has selected BDO Seidman, LLP, Chicago, Illinois to audit the financial statements of the Company for the year ending December 31, 2005 and recommends that the stockholders ratify such selection. Although not required, the Company believes that it is good corporate practice to request stockholders ratification of the Company’s independent auditors. In the event that a majority of the shares are not voted in favor of ratification, the Audit Committee will reconsider its selection. Unless otherwise instructed, the proxy holders will vote the proxies they receive for the ratification of BDO Seidman, LLP as the registered independent public accountants for the year ending December 31, 2005. A representative of BDO Seidman, LLP is expected to be present (either in person or via telephonic conference call) at the annual meeting, will have an opportunity to make a statement if he desires to do so, and is expected to be available to respond to appropriate questions from stockholders.

Services Provided by the Company’s Registered Independent Public Accountants

BDO Seidman, LLP serves as the Company’s registered independent public accountants for the fiscal year ending December 31, 2005, and acted in such capacity for the fiscal years ended December 31, 2004 and 2003. Aggregate fees for professional services rendered for the Company by BDO Seidman, LLP for the fiscal years ended December 31, 2004 and 2003 were as follows:

| | | | Fiscal Year Ended

December 31, 2004

| | Fiscal Year Ended

December 31, 2003

|

|---|

| Audit Fees | | | | $ | 66,800 | | | $ | 66,595 | |

| Audit-Related Fees | | | | | — | | | | — | |

| Tax Fees | | | | | — | | | | — | |

| All Other Fees | | | | | — | | | | — | |

| | | | | $ | 66,800 | | | $ | 66,595 | |

Audit Fees

Audit fees were for professional services rendered for the audits of the Company’s consolidated financial statements and for the review of financial statements included in the Company’s quarterly reports on Form 10-Q for the quarterly periods during the 2004 and 2003 fiscal years.

Audit-Related Fees

During the 2004 and 2003 fiscal years, BDO Seidman, LLP did not provide any assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements that are not reported under the caption “Audit Fees” above. Therefore, there were no audit-related fees billed during those fiscal years.

Tax Fees

As BDO Seidman, LLP did not provide any services to the Company for tax compliance, tax advice and tax planning during the fiscal years ended December 31, 2004 and 2003, no tax fees were billed during such years.

All Other Fees

BDO Seidman, LLP did not provide any products and services not disclosed in the table above during the two most recently completed fiscal years. As a result, there were no other fees billed during the 2004 and 2003 fiscal years.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee has certain policies and procedures in place requiring the pre-approval of audit and non-audit services to be performed by the Company’s independent public accountants. Such pre-approval can be given as part of the Audit Committee’s approval of the scope of the engagement of the independent public accountants or on an individual basis. The approved non-audit services must be disclosed in the Company’s periodic reports filed with the SEC. All work performed in 2004 was pre-approved by the Audit Committee.

6

The Company’s Board recommends a vote FOR the ratification of

the appointment of BDO Seidman, LLP to serve as the Company’s independent public

accountants for the fiscal 2005 year.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD

The following is the report of the Audit Committee with respect to the Company’s audited financial statements for the fiscal year ended December 31, 2004, which include the balance sheets of the Company as of December 31, 2004 and 2003, and the related statements of operations, stockholders’ deficit and cash flows for the twelve months ended December 31, 2004, 2003 and 2002. The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, or incorporated by reference into any future filing with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934.

Review With Management

The Audit Committee has reviewed and discussed the Company’s audited financial statements with management.

Review and Discussion with Registered independent public accountants

The Audit Committee has discussed with BDO Seidman, LLP, the Company’s registered independent public accountants, the matters required to be discussed by SAS 61 and SAS 90 (Statements on Accounting Standards), that includes, among other items, matters related to the conduct of the audit of the Company’s financial statements.

The Audit Committee has also received written disclosures and the letter from BDO Seidman, LLP required by Independence Standards Board Standard No. 1 (that relates to the accountant’s independence from the Company and its related entities) and has discussed with BDO Seidman, LLP its independence from the Company.

Conclusion

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004 for filing with the SEC.

Audit Committee

Rex Carr, Chairman

David B. Norris

7

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table sets forth certain information regarding the ownership of the Company’s common stock as of October 11, 2005 by: (i) each person known by the Company to own beneficially more than five percent of the Company’s common stock; (ii) each director and nominee for director of the Company; (iii) each executive officer named in the Summary Compensation Table (see “Executive Compensation”); and (iv) all directors and executive officers of the Company as a group.

Name of Beneficial Owner

| | | | Amount of

Beneficial Ownership1

| | Percent of

Common Stock

|

|---|

Jonathan R. Burst2 | | | | | 8,886,000 | | | | 9.8 | % |

| David B. Norris | | | | | 2,914,572 | | | | 3.4 | % |

Harry F. Demetriou3 | | | | | 5,500,000 | | | | 6.5 | % |

Tony Cross4 | | | | | 283,000 | | | *

|

Gary Kirk5 | | | | | 1,500,000 | | | | 1.7 | % |

Rex Carr6 | | | | | 20,250,355 | | | | 23.9 | % |

Charles Stride7 | | | | | 43,750 | | | *

|

All directors and executive

officers as a group (7 persons)8 | | | | | 39,377,677 | | | | 42.6 | % |

Dion Friedland9 | | | | | 7,701,915 | | | | 8.7 | % |

| * | | Represents less than 1% of outstanding shares of common stock. |

1 | | This table is based upon information supplied by officers, directors and principal stockholders. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Unless otherwise indicated, the principal address of each of the stockholders named in this table is: c/o International Fuel Technology, Inc., 7777 Bonhomme Avenue, Suite 1920, St. Louis, Missouri 63105. The number of shares beneficially owned includes shares of common stock that the owner or owners had the right to acquire on or within 60 days of October 11, 2005, including through the exercise of options or warrants. Also included are restricted shares of common stock, over which the owner or owners have voting power, but no investment power. |

2 | | Includes 50,000 restricted shares of common stock owned by Burcor Capital, LLC, of which Mr. Burst is an executive officer. Mr. Burst is deemed to be the beneficial owner of such shares. It also includes 6,000,000 of vested options. |

3 | | Includes 5,500,000 shares of restricted common stock owned by Observor Acceptances, Ltd. of which Mr. Demetriou is the sole owner. Mr. Demetriou is deemed to be the beneficial owner of such shares. |

4 | | Includes 250,000 shares issuable upon exercise of options. |

5 | | Includes 1,500,000 shares issuable upon exercise of options. |

6 | | Includes 14,250,286 shares of restricted common stock owned by R.C. Holding Company, of which Mr. Carr is a director, President and 41% stockholder. Mr. Carr is deemed to be the beneficial owner of these shares. Also includes 860,100 shares of common stock and 5,139,969 shares of restricted common stock owned by Mr. Carr. |

7 | | Includes 8,750 shares issuable upon exercise of warrants. |

8 | | Includes 7,750,000 shares issuable upon exercise of options and 8,750 shares issuable upon exercise of warrants. |

9 | | Includes 541,655 shares of common stock, 3,328,208 shares of restricted common stock, 3,000,000 shares issuable upon exercise of options and 832,052 shares issuable upon exercise of warrants owned by Magnum Growth, Magnum Select, FT Marketing, Ltd. and Giant Trading of which Mr. Friedland is a director and/or President. Mr. Friedland is deemed to be the beneficial owner of these shares. Mr. Friedland is Chairman of Fuel Technologies Ltd. (FTL), one of the Company’s distributors. |

8

Background Information about Executive Officers

Brief biographies of the Company’s executive officers as of December 31, 2004 are set forth below:

Jonathan R. Burst, age 47, has served as Chief Executive Officer of the Company since July 1999. Additional background information about Mr. Burst is on page 4 of this proxy statement.

Gary S. Hirstein, age 52, has served as Executive Vice President and Chief Financial Officer of the Company since April 2005. Mr. Hirstein also was appointed Corporate Secretary in November 2005. Prior to joining the Company, Mr. Hirstein was employed by Shell Oil Company for twenty-seven years serving in various accounting, finance and operating roles of increasing responsibility, most recently as Manager—Portfolio and Network Planning. Mr. Hirstein holds a B.S. degree in Economics from MacMurray College and has accumulated credit hours towards a M.S. degree in Finance from St. Louis University.

Michael F. Obertop, age 35, served as the Company’s Chief Financial Officer and Secretary from October 2001 until April 2005. From April 2005 until September 2005, Mr. Obertop held the position of General Counsel and Secretary. From 1998 until September 2001, Mr. Obertop provided tax consulting services for PricewaterhouseCoopers LLP. Mr. Obertop ceased to be an employee of the Company in September, 2005.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s executive officers and directors, and persons who beneficially own more than ten percent of the Company’s common stock, to file initial reports of Company stock ownership and reports of changes in ownership with the SEC. Executive officers, directors and greater than ten percent beneficial owners are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely upon a review of Section 16(a) reports furnished to the Company and written representations from the Company’s executive officers and directors, the Company believes that Mr. Carr filed five change in ownership reports outside of the filing time under SEC regulations during the 2004 fiscal year. One of the late reports contained information relating to one transaction in Company stock effected in 2004. Each of the other four late reports filed by Mr. Carr contained information relating to two transactions effected in 2004. In addition, Mr. Burst also filed two change in ownership reports outside of the filing time under SEC regulations during 2004. Each report contained information relating on one transaction in Company stock effected during 2004.

EXECUTIVE COMPENSATION

The following table sets forth information concerning all cash and non-cash compensation paid or to be paid by the Company as well as certain other compensation awarded, earned by and paid, during the fiscal years indicated, to the Chief Executive Officer and for each of the Company’s other executive officers whose annual salary and bonus exceeds $100,000 for such period in all capacities in which they served.

Summary Compensation Table

Name and

Principal

Position

| | | | Year

| | Salary

| | Bonus

| | Other Annual

Compensation1

| | Securities

underlying

Options/SARs2

| |

|---|

| Jonathan R. Burst, | | | | | 2004 | | | $ | 250,000 | | | $ | 0 | | | $ | 0 | | | | 1,500,000 | | | | | |

| President & CEO | | | | | 2003 | | | $ | 250,000 | | | $ | 0 | | | $ | 0 | | | | 0 | | | | | |

| | | | | | 2002 | | | $ | 250,000 | | | $ | 0 | | | $ | 0 | | | | 750,000 | | | | | |

| (1) | | Perquisites and other personal benefits are omitted because they do not exceed either $50,000 or 10% of the total of annual salary and bonus for the named executive officer. |

| (2) | | On July 6, 2004, the Board granted Mr. Burst an option to purchase up to 750,000 shares of Company common stock at a purchase price of $1.00 per share. This option was fully vested at grant. On December 23, 2004, the Board granted Mr. Burst an option to purchase 750,000 shares of common stock at a per share purchase price of $2.00. This option becomes exercisable on December 31, 2005. These options were granted pursuant to the Long-Term Incentive Plan. Pursuant to an Employment Agreement dated January 2, 2002, Mr. Burst received an option to purchase up to 750,000 shares of Company common stock at a purchase price of $.14 per share. 250,000 of these options vested December 31, 2002 and the remaining 500,000 options vested December 31, 2004. |

9

Option Grants

The following table provides information with respect to the stock option grants made during the Company’s 2004 fiscal year to each named executive officer. No stock appreciation rights were granted to the named executive officers during the fiscal year.

Option Grants in Last Fiscal Year

| | | | Individual grants

| | Potential realizable value at

assumed annual rates of

stock price appreciation for

option term (1)

| |

|---|

Name

| | | | Number of

securities

underlying

options

granted

| | Percent of

total options

granted

to employees

in fiscal year

| | Exercise

Price

($/share)

| | Expiration

Date

| | 5%

| | 10%

|

|---|

| Jonathan R. Burst | | | | | 750,000 | | | | 21.74 | % | | $ | 1.00 | | | December,

2009

| | $ | — | | | $ | — | |

| Jonathan R. Burst | | | | | 750,000 | | | | 21.74 | % | | $ | 2.00 | | | December,

2010

| | $ | 339,281 | | | $ | 931,467 | |

| (1) | | Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on arbitrarily assumed rates of stock price appreciation of 5% and 10% compounded annually from the date the respective options are granted to their expiration date, as required under the rules of the Securities and Exchange Commission. Actual gains, if any, on stock option exercises will be dependent on, among other things, the future performance of the common stock and overall market conditions. There can be no assurance that the amounts reflected above will be achieved. |

Aggregated Option/SAR exercises in Last Fiscal Year and FY-End Option/SAR Values

The following table provides information regarding the value of each named executive officer’s unexercised options at December 31, 2004. Mr. Burst did not exercise any options during 2004.

| | | | Number of Securities Underlying

Unexercised Options/SARs At Fiscal

Year-End (#)

| | Value of Unexercised In-The-Money

Options/SARs At Fiscal Year-End ($)

| |

|---|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Jonathan R. Burst | | | | | 6,000,000 | | | | 750,000 | | | $ | 8,295,000 | | | $ | — | |

Compensation Committee Interlocks and Insider Participation

During the 2004 fiscal year, the Company’s Compensation Committee was composed of Messrs. Carr, Demetriou and Norris. Currently, Messrs. Cross, Demetriou and Norris serve as members of the Compensation Committee. None of the Compensation Committee members has ever served as an officer of the Company or of any of its subsidiaries. No executive officer of the Company has served on the board of directors or compensation committee of any other entity that has or has had one or more executive officers who served as a member of the Company’s Board or its Compensation Committee during the 2004 fiscal year.

Executive Officer Employment Contracts

In January 2002, the Company entered into an employment agreement with Mr. Burst to serve as the Company’s Chief Executive Officer with an initial annual base salary of $250,000, options to purchase 250,000 shares of the Company’s common stock, and a bonus award as deemed appropriate by the Board. The initial three-year agreement expired on December 31, 2004. Mr. Burst continues to serve as the Company’s Chief Executive Officer. The Company may terminate Mr. Burst’s employment with or without cause, as such terms are defined in the agreement. Mr. Burst may elect to terminate his employment with good cause, as defined by his agreement.

10

JOINT REPORT OF

THE BOARD OF DIRECTORS AND THE COMPENSATION COMMITTEE

ON EXECUTIVE COMPENSATION

Introduction

The Company’s executive compensation policies and practices are recommended to the Board by the Compensation Committee of the Board (the “Committee”) and approved by the Board.

Philosophy

The Committee has recommended to the Board, and the Board has implemented, compensation policies, plans and programs that seek to enhance stockholder value by aligning the financial interests of the executive officers with those of its stockholders. Annual base salaries are generally set at market-based competitive median levels. The Company relies heavily on annual incentive, including equity, compensation to attract, retain, motivate and reward executive officers. The Committee and the Board believe that the Chief Executive Officer’s equity incentives should be above the median for chief executive officers of similar companies. Incentive compensation is variable and tied to corporate and individual performance. The policies are designed to provide an incentive to management to grow revenues, provide quality returns on investment, enhance stockholder value and contribute to the long-term growth of the Company. All incentive compensation policies are reviewed at least annually to ensure they meet the current strategies and needs of the business.

Compensation Plans

The Company’s executive compensation is based on three components, each of which is intended to support the overall compensation philosophy: base salary, annual bonus and equity incentives.

Base Salary

Salaries for executive officers are reviewed by the Committee on an annual basis. Based on the recommendation of the Committee, the Board may change an officer’s salary based on the individual’s performance or a change in competitive pay levels in the marketplace.

Based on the recommendations of the Committee, the Board reviews with the Chief Executive Officer an annual salary plan for the Company’s executive officers other than the Chief Executive Officer. The salary plan is modified as deemed appropriate and approved by the Committee and the Board. The annual salary plan for executive officers other than the Chief Executive Officer is developed by the Company’s Chief Executive Officer based on publicly available information on organizations with similar characteristics and on performance judgments as to the past and expected future contributions of the individual executive. The Committee reviews and recommends to the Board, and the Board establishes, the base salary of the Chief Executive Officer based on similar competitive compensation data, the Committee’s and the Board’s assessments of his or her past performance and the expectation as to his or her future contributions in directing the long-term success of the Company.

Annual Bonus

The Committee and the Board believe that a substantial portion of an executive officer’s annual compensation should be in the form of a bonus. The bonus awarded, if any, are determined by the Board, based on the recommendations of the Committee, with reference to achievement of certain corporate financial performance goals and the executive’s individual contribution. No executive officer received a bonus for the 2004 fiscal year, as the Company did not meet its financial performance goals.

Equity Incentives

Long-term equity incentives are provided through the grants of restricted stock or by issuing stock options to executive officers, including the Chief Executive Officer. The stock component of compensation is intended to retain and motivate employees to improve long-term stockholder value. The restricted stock awards and options are granted at no less than fair market value and have increased value only if the Company’s stock price increases. The Committee and the Board believe this element of the total compensation program directly links the participant’s interests with those of the stockholders and the long-term performance of the Company.

The Committee and the Board believe that the executive compensation philosophy and components described above provide compensation that is competitive with comparable emerging companies, links executives’ and

11

stockholders’ interests and provides the basis for the Company to attract and retain qualified executives. The Committee and the Board will continue to monitor the relationship among executive compensation, the Company’s performance and stockholder value.

Consultant and Employee Stock Compensation Plan

Executive officers of the Company, including the Chief Executive Officer, are eligible to participate in, and receive awards of common stock under, the Company’s Consultant and Employee Stock Compensation Plan. There were no stock grants made during the 2004 fiscal year pursuant to the plan.

Long-Term Incentive Plan

Executive officers, including the Chief Executive Officer, are eligible to participate in and receive equity awards under, this plan. The plan provides for the grant of stock options, stock appreciation rights, performance awards and restricted stock. Mr. Burst received awards pursuant to the Long-Term Incentive Plan during 2004. Such awards are described below.

CEO Compensation

During the fiscal year ended December 31, 2004, Mr. Burst’s base salary was $250,000, which has remained in effect for the 2005 fiscal year. For the fiscal year ended December 31, 2004, the Board did not award Mr. Burst an annual bonus. The Compensation Committee and the Board believe that this was appropriate in light of the Company’s financial results for the fiscal year.

On July 6, 2004, the Board granted Mr. Burst an option to purchase up to 750,000 shares of Company common stock at a purchase price of $1.00 per share. This option was fully vested at grant. On December 23, 2004, the Board granted Mr. Burst an option to purchase 750,000 shares of common stock at a per share purchase price of $2.00. This option becomes exercisable on December 31, 2005. These options were granted pursuant to the Long-Term Incentive Plan. The Board, based on the recommendation of the Committee, has determined that this award is appropriate, given Mr. Burst’s base salary, bonus amount, and his expected contributions toward future growth of the Company.

Mr. Burst is also entitled to receive equity compensation for his service on the Board. As a director, Mr. Burst is entitled to an annual award of 10,000 restricted shares of the Company’s common stock for membership on the Board. In addition, each Board member, including Mr. Burst, is entitled to receive 1,000 shares of restricted stock for every three telephonic Board meetings attended. Although Mr. Burst was entitled to such compensation, between 2000 and 2004, the Company did not issue Mr. Burst or the other directors any equity compensation for their Board service. In order to properly compensate Mr. Burst for his service on the Board between 2000 and 2004, the Company anticipates issuing stock options or restricted stock to Mr. Burst during the fourth quarter of 2005. The amount of Mr. Burst’s issuance will correspond to the grants that Mr. Burst should have received for his service as a director between 2000 and 2004.

Deductibility of Compensation

Section 162(m) of the Internal Revenue Code denies a deduction for compensation in excess of $1 million paid to certain executive officers, unless certain performance, disclosure, and stockholder approval requirements are met. Restricted stock grants under the Company’s Employee and Consultant Stock Compensation Plan are intended to qualify as “performance-based” compensation not subject to the Section 162(m) deduction limitation.

| | | | Board of Directors

| | Compensation Committee

|

|---|

| | | | �� | Jonathan R. Burst, Chairman | | Rex Carr |

| | | | | Rex Carr | | Harry Demetriou, Chairman |

| | | | | Tony Cross | | David B. Norris |

| | | | | Harry Demetriou | | |

| | | | | Gary Kirk | | |

| | | | | David B. Norris | | |

| | | | | Charles Stride | | |

12

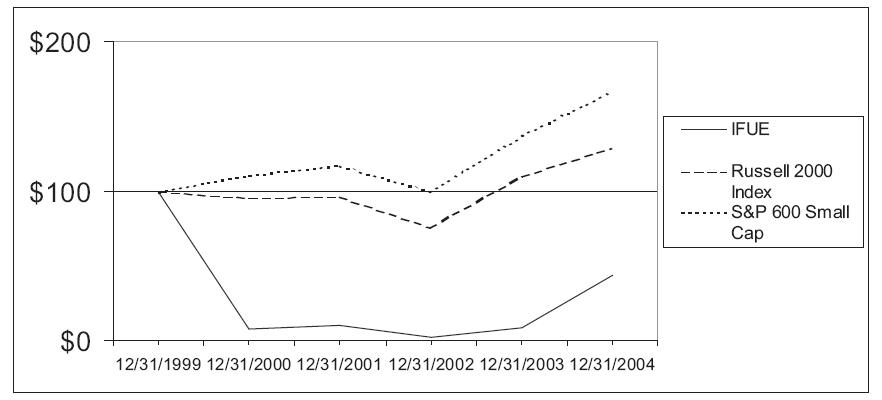

Performance Graph

The performance graph below and the information contained therein shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, or incorporated by reference into any future filing with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934.

| | | | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

|

|---|

| International Fuel Technology, Inc. | | | | $ | 100.00 | | | $ | 7.78 | | | $ | 10.76 | | | $ | 2.29 | | | $ | 8.92 | | | $ | 43.94 | |

| Russell 2000 Index | | | | $ | 100.00 | | | $ | 95.80 | | | $ | 96.78 | | | $ | 75.90 | | | $ | 110.33 | | | $ | 129.09 | |

| S&P 600 Small Cap Index | | | | $ | 100.00 | | | $ | 111.02 | | | $ | 117.39 | | | $ | 99.41 | | | $ | 136.72 | | | $ | 166.24 | |

The above graph compares the performance of the Company’s stock from December 1999 through December 31, 2004, against the performance of the Russell 2000 Index and the S&P 600 Small Cap Index for the same period. Historical stock price performance is not necessarily indicative of future stock price performance. The graph assumes an investment of $100 on December 31, 1999 in the Company’s common stock (at the last reported sale price on such date), the Russell 2000 Index and the S&P 600 Small Cap Index and assumes the reinvestment of any dividends.

OTHER MATTERS

The Board knows of no other matters that will be presented for consideration at the annual meeting. However, if other matters are properly brought before the meeting, the proxy holders will vote your shares in their discretion.

A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K WILL BE SENT WITHOUT CHARGE TO ANY STOCKHOLDER REQUESTING IT IN WRITING FROM: INTERNATIONAL FUEL TECHNOLOGY, INC., ATTENTION: GARY S. HIRSTEIN, 7777 BONHOMME AVENUE, SUITE 1920, ST. LOUIS, MISSOURI 63105.

By Order of the Board,

Gary S. Hirstein

Secretary

Dated November 21, 2005

13

APPENDIX A

INTERNATIONAL FUEL TECHNOLOGY, INC.

AUDIT COMMITTEE CHARTER

Committee Role

The Committee’s role is to act on behalf of the Board and oversee all material aspects of the company’s financial reporting, control and audit functions, except those specifically related to the responsibilities of another standing committee of the board. The Audit Committee’s role includes a particular focus on the qualitative aspects of financial reporting to the shareholders and on company processes for the management of business/financial risk and for compliance with significant applicable legal, ethical and regulatory requirements.

The role also includes coordination with other Board committees and maintenance of strong, positive working relationships with management, external auditors, counsel and other committee advisors.

Committee Membership

The Committee shall consist of three board members of which two of the board members must be independent, non-executive board members. Committee members shall have: (1) knowledge of the primary industries in which the company operates; (2) the ability to read and understand fundamental financial statements, including a company’s balance sheet, income statement, statement of cash flows and key performance indicators; and (3) the ability to understand key business and financial risks and related controls and control processes. The Committee shall have access to its own counsel and other advisors at the Committee’s sole discretion.

At least one member, preferably the chair, should be literate in business and financial reporting and control, including knowledge of the regulatory requirements, and should have past employment experience in finance or accounting or other comparable experience or background. Committee appointments shall be approved annually by the full board. The Committee chairperson shall be selected by the Committee members.

Committee Operating Principles

The Committee shall fulfill its responsibilities within the context of the following overriding principles:

Communications

The chair and others on the Committee shall, to the extent appropriate, maintain an open avenue of contact throughout the year with senior management, other Committee chairs and other key Committee advisors (external and internal auditors, etc.), as applicable, to strengthen the Committee’s knowledge of relevant current and prospective business issues.

Education/Orientation

The Committee, with management, shall develop and participate in a process for review of important financial and operating topics that present potential significant risk to the company. Additionally, the individual Committee members are encouraged to participate in relevant and appropriate self-study education to ensure understanding of the business and environment in which the company operates.

Annual Plan

The Committee, with input from management and other key Committee advisors, shall develop an annual plan responsive to the “primary Committee responsibilities” detailed herein. The annual plan shall be reviewed and approved by the full Board.

Meeting Agenda

Committee meeting agendas shall be the responsibility of the Committee chair, with input from the Committee members. It is expected that the chair would also ask for management and key Committee advisors, and perhaps others, to participate in this process.

14

Expectations and Information Needs

The Committee shall communicate Committee expectations and the nature, timing, and extent of committee information needs to management, internal auditors and external parties, including external auditors. Written materials, including key performance indicators and measures related to key business and financial risks, shall be received from management, auditors and others at least 3 business days in advance of meeting dates. Meeting conduct will assume Committee members have reviewed written materials in sufficient depth to participate in Committee/Board dialogue.

External Resources

The Committee shall be authorized to access internal and external resources, as the Committee requires, to carry out its’ responsibilities.

Meeting Attendees

The Committee shall request members of management, counsel, internal and external auditors, as applicable, to participate in Committee meetings, as necessary, to carry out the Committee’s responsibilities. Periodically and at least annually, the Committee shall meet in private session with only the Committee members. It shall be understood that either internal or external auditors, or counsel, may, at any time, request a meeting with the Audit Committee or Committee chair with or without management’s attendance. In any case, the Committee shall meet in executive session separately with internal and external auditors, at least annually.

Meeting Frequency

The Committee shall meet at least semi-annually. Additional meetings shall be scheduled as considered necessary by the Committee or chair.

Reporting to the Board

The Committee, through the committee chair, shall report periodically, as deemed necessary, but at least semiannually, to the full Board. In addition, summarized minutes from Committee meetings, separately identifying monitoring activities from approvals, shall be available to each Board member at least one week prior to the subsequent Board of Director’s meeting.

Self-Assessment

The Committee shall review, discuss and assess its own performance as well as its role and responsibilities, seeking input from senior management, the full Board and others. Changes in role and/or responsibilities, if any, shall be recommended to the full Board for approval.

Committee Responsibilities

Financial Reporting

| • | | Review and assess the annual and interim financial statements before they are released to the public or filed with the SEC. |

| • | | Review and assess the key financial statement issues and risks, their impact or potential effect on reported financial information, the processes used by management to address such matters, related auditors’ views, and the basis for audit conclusions. |

| • | | Approve changes in important accounting principles and the application thereof in both interim and annual financial reports. |

| • | | Advise financial management and the external auditors that they are expected to provide a timely analysis of significant current financial reporting issues and practices. |

Risks and Controls

| • | | Review and assess the Company’s business and financial risk management process, including the adequacy of the overall control environment and controls in selected areas representing significant risk. |

| • | | Review and assess the Company’s system of internal controls for detecting accounting and financial reporting errors, frauds and defalcations, legal violations, and noncompliance with the corporate code of |

15

| | conduct. In that regard, review the related findings and recommendations of the external and internal auditors, together with management’s responses. |

| • | | Review with legal counsel any regulatory matters that may have a material impact on the financial statements. |

External Auditors

| • | | Recommend the selection of the external auditors for approval by the Board. |

| • | | Instruct the external auditors that they are responsible to the Board and the Audit Committee as representatives of the shareholders. In that regard, confirm that the external auditors report all relevant issues to the Committee in response to agreed-upon expectations. |

| • | | Review the performance of the external and internal auditors. |

| • | | Obtain a formal written statement from the external auditors consistent with standards set by the Independence Standards Board. Additionally, discuss with the auditors any relationships or on audit services that may affect their objectivity or independence. |

| • | | Consider, in consultation with the external and internal auditors, their audit scopes and plans to ensure completeness of coverage, reduction of redundant efforts and the effective use of audit resources. |

| • | | Review and approve requests for any consulting services to be performed by the external auditors, and be advised of any other study undertaken at the request of management that is beyond the scope of the audit engagement letter. |

| • | | Review with management and the external auditors the results of the annual audits and related comments in consultation with other Committees as deemed appropriate, including any difficulties or disputes with management, any significant changes in the audit plans, the rationale behind adoptions and changes in accounting principles, and accounting estimates requiring significant judgments. |

| • | | Provide a medium for the external auditors to discuss with the Audit Committee their judgments about the quality, not just the acceptability, of accounting principles and financial disclosure practices used or proposed to be adopted by the Company. |

Other

| • | | Review and update the Committee’s charter. |

| • | | Review and update the Company’s code of conduct. |

| • | | Review and approve significant conflicts of interest and related party transactions. |

| • | | Conduct or authorize investigations into any matters within the Committee’s scope of responsibilities. The Committee will be empowered to retain independent counsel and other professionals to assist in conducting any investigation. |

16