China Valves Technology, Inc.

No. 93 West Xinsong Road

Kaifeng City, Henan Province

China 475002

December 24, 2008

By EDGAR Transmission and by Hand Delivery

Edward M. Kelly, Esq.

Division of Corporate Finance

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

Re: China Valves Technology, Inc.

Registration Statement on Form S-1

Filed October 10, 2008

File No. 333-154159

Annual Report on Form 10-K for the fiscal year ended December 31, 2007 and

Subsequent Exchange Act Reports

File No. 0-28481

Dear Mr. Kelly:

On behalf of China Valves Technology, Inc. (“China Valves” or the “Company”), we hereby submit the Company’s responses to the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) set forth in the Staff’s letter, dated November 10, 2008, providing the Staff’s comments with respect to the above referenced to registration statement on Form S-1 (the “Registration Statement”).

For the convenience of the Staff, each of the Staff’s comments is included and is followed by the corresponding response of the Company. Unless the context indicates otherwise, references in this letter to “we”, “us” and “our” refer to the Company on a consolidated basis.

Edward M. Kelly, Esq.

December 24, 2008

Page 2

S-1

Registration Statement’s Facing Cover Page

| 1. | You indicate that China Valves’ SIC code number is 3390. Since our EDGAR system’s records indicate that China Valves’ SIC code number is 3490, please revise or advise. |

China Valves Response: We have revised the Company’s SIC code number to reflect the correct SIC Code (3490).

Prospectus Summary page 1

Our Industry

| 2. | Please tell us whether China Valves commissioned the information provided by the China Valve Industry or otherwise paid a fee for the information. Similarly, please provide the same information for the statements made by American Watts Water Technologies Group on page 36. |

China Valves Response: We did not commission the information provided by the China Valve Industry or Watts Water Technologies Group or otherwise pay any fee for the information.

| 3. | Please provide the basis for the statements in the second paragraph on page 2. Please also provide the basis for the statements you make in the fourth paragraph on page 35. |

| | China Valves Response: Both the statements in the second paragraph on page 2 and in the fourth paragraph on page 35 are based on the statistics derived from www.zhulong.com, a website dedicated to providing statistics and a communication platform for the construction industry in China. |

Risk Factors, page 6

| 4. | We note your disclosure on page 14 that you may be classified as a resident enterprise of China. Please provide us with your analysis as to whether you believe you are or are not a resident enterprise. If you believe you are a resident enterprise, please disclose the accounting impact this will have on you beginning on January 1, 2008, the effective date of the Enterprise Income Tax Law. Also, please address in your MD&A the impact of this law on your results of operations for the period ended June 30, 2008, and disclose what the effective income tax rates are for each period and why. |

China Valves Response: The Company’s two operating subsidiaries High Pressure Valve and Zhengdie Valve were classified as resident enterprises of China and are subject to the effective tax rate of 25% in 2008. We have added the following disclosure regarding the impact of this law on our results of operations under the subheading “Taxation” in our MD&A :

Edward M. Kelly, Esq.

December 24, 2008

Page 3

“Our Operating Subsidiaries are classified as resident enterprises under the EIT law. High Pressure Valve was exempt from income tax in 2007 due to a Kaifeng city tax incentive for the privatization of companies. However, beginning in January 2008 both High Pressure Valve and Zhengdie Valve became subject to an income tax at an effective rate of 25% because High Pressure Valve no longer enjoys the tax incentive and under the EIT law, the uniform rate for enterprise income tax in China is 25% for both domestic and foreign invested enterprises. The accounting impact of being classified as a resident enterprise beginning in January 2008, the effective date of the EIT law, is that we incurred income taxes of $2,825,542 for the nine month period ended on September 30, 2008, an increase of $1,982,130 or 235.01% from the taxes we incurred in the same 2007 period, which were $843,412. The impact that this law has on our results of operations for the period ended September 30, 2008 is not material as our sales revenue for the nine months ended September 30, 2008 amounted to $46,208,006, which is approximately $20,190,768 or 78% more than that of the same period ended on September 30, 2007, where we had revenue of $26,017,238.”

| 5. | If material, please address how the recent financial crisis may affect the Chinese market or your company’s business operations. |

China Valves Response: We have added the following analysis on how the recent financial crisis may affect the Company’s business operations under the subheading “Our Business” in our MD&A session:

“While the United States and Europe have been most affected by the recent financial crisis, governments throughout the Asia-Pacific region have also taken steps to stabilize their markets. To offset slowing global growth, on November 5, 2008, at the State Council meeting, Premier Wen Jiabao offered a RMB4 trillion ($586 billion) stimulus package for the next two years and announced that the government would move to a proactive fiscal and a moderately relaxed monetary policy.

Pursuant to the stimulus package, the Chinese government has committed to launch more projects related to people’s livelihood and infrastructure and decided to invest RMB100 billion ($14.49 billion) in these projects for the fourth quarter of 2008. (source: China Daily). The actions taken by the Chinese government should significantly increase the demand for valve products which are essential for infrastructure construction and will provide market opportunities for the Company.

In addition, although the financial crises have affected Chinese enterprises that rely on overseas markets, China Valves has not been materially affected by the financial crisis as less than 10% of our revenue is generated from exports and the relatively strong domestic market demand has positioned us to continue to grow notwithstanding the current financial crisis.

Management believes that the recent financial crisis in the US and Europe will not have any materially negative impact on our business, and management believes we will benefit from the stimulus plan of the central government of China.”

Edward M. Kelly, Esq.

December 24, 2008

Page 4

Our rapid expansion could significantly strain our resources management and operational infrastructure...page 8

| 6. | Disclosure states that China Valves will need to accommodate its anticipated growth by expending capital resources and dedicating personnel to implement and upgrade its accounting, operational, and internal management systems and enhance its record keeping and contract tracking system. Quantify the known or estimated amount of capital resources and the known or anticipated number of personnel that China Valves will require for the enumerated purposes. |

China Valves Response: We have added the following disclosures under the subheading “Our rapid expansion could significantly strain our resources management and operational infrastructure …” in the Risk Factors:

“China Valves manufacturing operations have been operating at close to full capacity and, accordingly, we began constructing a new manufacturing facility in Kaifeng in September 2008 and expect it to be completed in January 2009. The total budget for the project will be approximately $17 million, of which $6.7 million will be spent in fiscal year 2008 and $10.3 million in fiscal year 2009. Other capital expenditures in the first nine months of 2008 were $3.3 million for the purchase of equipment. Thus, the total capital expenditures in fiscal year 2008 are $10.0 million.

In fiscal year 2009, we will upgrade the facilities of our subsidiary Zhengdie Valve. The total budget for the upgrade will be approximately $3.9 million. We also began to upgrade our financial and ERP systems at the end of 2008 with a projected budget of $765,000.

At September 30, 2008, we had 1,002 employees including 114 technicians and researchers, 521 production workers, 105 sales personnel, 154 engineering and technical support personnel and 108 administrative personnel. In fiscal year 2009, to support our expected revenue growth, we expect to hire an additional 130 production workers and 45 staff members in other departments excluding corporate, fiscal and accounting personnel. As we will further enhance the internal control system in fiscal year 2009, we expect to hire an additional 9 corporate, fiscal and/or accounting staff members including IT expertise. Total incremental staffing in 2009 is expected to be 184 employees.”

We may never pay any dividends to shareholders, page 9; We do not intend to pay dividends on shares of our common stock for the foreseeable future, page 16

| 7. | Since these two risk factors appear to discuss the same risk, consider combining the two risk factors into a single risk factor discussion. |

China Valves Response: We have combined the two risk factors into the following risk factor discussion:

Edward M. Kelly, Esq.

December 24, 2008

Page 5

“We do not intend to pay dividends on shares of our common stock for the foreseeable future.

We have never declared or paid any cash dividends on shares of our common stock. The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements and other factors the board of directors considers relevant. Our board of directors does not intend to distribute dividends in the near future. We intend to retain any future earnings to fund the operation and expansion of our business.”

Fluctuations in exchange rates could adversely affect our business and the value of our securities, page 13

| · | “Because substantially all of our earnings and cash assets are denominated in RMB and the net proceeds from this offering will be denominated in U.S. dollars, fluctuations in the exchange rate between the U.S. dollar and the RMB will affect the relative purchasing power of these proceeds...” |

| · | “Fluctuations in the exchange rate will also affect the relative value of any dividend we issue after this offering...” |

Since China Valves will not receive any of the proceeds from the sale of shares of common stock sold by the selling stockholders in this offering and will receive funds from the exercise of warrants held by the selling stockholders if and when those warrants are exercised for cash, revise the disclosure in the first bullet point above to make those facts clear. Similarly, since China Valves has no plans to pay dividends “for the foreseeable future,” revise the disclosure in the second bullet point above to make that fact clear.

China Valves Response: We have revised as follows the disclosures, in relevant part, under “Fluctuations in exchange rates could adversely affect our business and the value of our securities.”:

“Because substantially all of our earnings and cash assets are denominated in RMB and the net proceeds from the private placement were, and the proceeds from the exercise of warrants held by the selling stockholders if and when those warrants are exercised for cash will be, denominated in U.S. dollars, fluctuations in the exchange rate between the U.S. dollar and the RMB will affect the relative purchasing power of these proceeds, our balance sheet and our earnings per share in U.S. dollars. In addition, appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Although we have no current intention to pay any dividends in the foreseeable future, fluctuations in the exchange rate would also affect the relative value of any dividend we issue in the future that will be exchanged into U.S. dollars as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.”

Edward M. Kelly, Esq.

December 24, 2008

Page 6

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 20

General

| 9. | We note that the reporting currency of the Company is the U.S. dollar and that the functional currency of its Chinese operating entities, Henan Kaifeng Pressure Valve Co., Ltd, and Zhengzhou City Zhengdie Valve Co., Ltd., is the Renminbi (RMB). Please disclose for each period presented the impact that foreign currency translations had on your results of operations, including separate presentation of the impact on your revenues and expenses. |

China Valves Response: We added the following discussion regarding the impact of foreign currency translations on the Company’s results of operationsunder the subheading “Nine Months Ended September 30, 2008 Compared to Nine Months Ended September 30, 2007” in the MD&A:

“Foreign Currency Translation Gains

We had a foreign currency translation gain of $2.38 million for the nine month period ended September 30, 2008 as compared with a $780,000 currency translation gain in the same period ended September 30, 2007. In July 2005, China reformed its foreign currency exchange policy and allowed the Renminbi to fluctuate as much as 0.3 percent per day against the U.S. dollar. We use period-end exchange rates in translating our assets and liabilities denominated in Renminbi into U.S. dollars and average exchange rates for the period to translate our income and expenses. At September 30, 2008, the period end exchange rate was RMB1 to US$0.1459, and the average exchange rate for the nine month period ended September 30, 2008 was RMB1 to US$0.14337. At September 30, 2007 and for the nine month period ended September 30, 2007, the exchange rates were RMB1 to US$0.13340 and RMB1 to US$0.13064, respectively.”

Under the subheading “Fiscal Year Ended December 31, 2007 Compared to Fiscal Year Ended December 31, 2006”, we have added the following discussion:

“Foreign Currency Translation Gains

We had a foreign currency translation gain of $1.87 million for the fiscal year 2007 as compared with an $823,057 currency translation gain in the fiscal year 2006.”

Edward M. Kelly, Esq.

December 24, 2008

Page 7

Revenue

| 10. | Please clarify whether you actually experienced a 25% increase in the average selling price of products sold and a 75% increase in the volume of products sold as you disclosed on page 20, or if the increase in revenue was due in part (25%) to price increases and due in part (75%) to volume increases. |

China Valves Response: We actually experienced a 25% increase in the average selling price of our products sold and a 75% increase in the volume of products sold. We believe that the disclosure in the Registration Statement is clear on this point, but would welcome the Staff’s suggestions as to how it may be improved if the Staff believes that there is an ambiguity.

Liquidity and Capital Resources, page 25

Operating Activities, page 25

| 11. | Please enhance your disclosure to further discuss why you had less bank acceptance bills to suppliers and purchased a larger amount of raw materials in the first half of 2008 as compared to the first half of 2007. Also, please expand your disclosure to discuss all material changes in your operating activities as depicted in your statement of cash flows, including the changes in accounts receivable, other receivables, and customer deposits. |

China Valves Response: We had less bank acceptance bills to suppliers in the first nine months of 2008 as compared to the same period of 2007 for the following reasons: In December, 2006, we acquired a quota of RMB4.6 million ($675,477) of restricted bank acceptance bills from China CITIC Bank Corporation Limited which expired in May 2007 and which were not renewed due to the tightened monetary policy of the Central Bank. In the first nine month of 2008, we did not have any bank acceptance bills.

We have added the following disclosures under the subheading “Operating Activities:

“Net cash provided by operating activities was $2,292,751 in the nine months ended September 30, 2008, compared to net cash provided by operating activities of $5,586,774 in the same period in fiscal year 2007. The decrease of $3,294,023 in operating activities was primarily attributable to decreases in inventory purchases, other payables due to third parties, customer deposits and an increase in income taxes paid for the nine months ended September 30, 2008.

Prices of raw materials such as steel and iron experienced significant increases during the period June 2007 to September 2008. The company purchased larger amounts of raw materials in the first half of 2008 at a favorable price to mitigate the impact of increased costs of raw materials and to meet the sales increase in the same period.

The increase in account receivables - trade was attributable to increased revenue. Our sales revenue increased by $20.2 million, or 77.7% to $46.2 million for the nine-month period ended September 30, 2008 from $26.0 million for the same period in 2007.

Edward M. Kelly, Esq.

December 24, 2008

Page 8

The decrease in customer deposits was attributable to our increasing number of repeat customers with good credit histories from whom we do not request deposits, based on their good credit history. These customers accounted for 60% to 70% of our customer base.

The increase of other receivables was mainly attributable to increased cash advances to sales staff as a result of the sales volume increase.”

Capital Expenditures, page 26

| 12. | Please disclose how you anticipate funding your expected capital expenditures of $10 million in fiscal year 2008. See Item 303(a)(2) of Regulation S-K. |

China Valves Response: We plan to fund our expected capital expenditure of $10 million in fiscal year 2008 through the money we raised in our August 2008 private placement.

We have added the following sentence, in relevant part, under “Capital Expenditures”:

“We used part of the net proceeds of $27 million from the private placement to fund the new manufacturing facility construction which has a 2008 budgeted cost of $6.7 million. As of September 30, 2008, we had spent $1.4 million for construction costs. We also spent $3.3 million on the purchase of equipment through September 30, 2008. The total capital expenditures in 2008 will be approximately $10 million.”

Critical Accounting Policies, page 26

| 13. | As indicated on page F-30, we note that you use a fair-value-based approach to test for impairment. Given the significance of your goodwill, please provide a comprehensive critical accounting policy regarding the underlying assumptions and estimates you use in assessing goodwill for recoverability, including a discussion of your reporting units. Refer to SFAS 142 and Section 501.14 of the Financial Reporting Codification for guidance. |

China Valves Response: We have included the following accounting policy regarding the underlying assumptions and estimates we use in assessing goodwill for recoverability:

“Goodwill

We test goodwill for impairment annually and whenever events or circumstances make it more likely than not that impairment may have occurred, such as a significant adverse change in the business climate or a decision to sell or dispose of all or a portion of a reporting unit. Our two operating subsidiaries are considered separate reporting units for purposes of this evaluation. Determining whether an impairment has occurred requires valuation of the respective reporting unit, which we estimate using a discounted cash flow method. In applying this methodology, we rely on a number of factors, including actual operating results, future business plans, economic projections and market data.

Edward M. Kelly, Esq.

December 24, 2008

Page 9

We test other identified intangible assets with defined useful lives and subject to amortization by comparing the carrying amount to the sum of undiscounted cash flows expected to be generated by the asset. We test any other intangible assets with indefinite lives annually for impairment using a fair value method such as discounted cash flows.”

Our Corporate History, page 32

| 14. | Please more specifically address why the company engaged in each of the transactions in the reorganization plan, including the purpose of the Chinese laws that you intended to comply with and how each transaction accomplished that purpose. |

| | China Valves Response: We have added the following disclosures under the heading “Our Corporate History”: |

“Following our acquisition of China Valves Samoa (and indirectly, the Operating Subsidiaries) and in anticipation of our August 2008 private placement transaction, we developed a group reorganization plan to ensure that the manner in which we acquired our Operating Subsidiaries complied with PRC merger and acquisition, or M&A, related regulations. The group reorganization plan involved modifying our acquisition of our Operating Subsidiaries previously acquired as a result of our acquisition of China Valves Samoa and the concurrent re-acquisition of the Operating Subsidiaries through newly established entities incorporated by Bin Li (a person then unaffiliated with the Company, but who is the first cousin of our Chairman Siping Fang) which entities were then transferred to the Company. Bin Li is a Canadian citizen.

These M&A regulations were promulgated on August 8, 2006 by six Chinese regulatory agencies (including the PRC Ministry of Commerce, or MOFCOM, and China Securities Regulatory Commission, or CSRC). The jointly issued M&A regulations, known as Circular 10, were captioned “Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors” and they became effective on September 8, 2006. Under Circular 10, an offshore special purpose vehicle, or SPV, formed for purposes of overseas listing of equity interests in China-based companies and controlled directly or indirectly by Chinese companies or individuals must obtain the approval of the CSRC prior to the listing of such SPV’s securities on an overseas stock exchange. Circular 10 also requires approval from MOFCOM for “round-trip” investment transactions in which a China-based company or a PRC resident, or Acquirer, using an offshore entity controlled by the Acquirer, acquires any PRC local company that is an affiliate of the Acquirer. The group reorganization plan was designed in consultation with our PRC legal advisors to ensure that the acquisition of the Operating Subsidiaries was completed in a manner that did not need us to obtain CSRC or MOFCOM approvals.

Edward M. Kelly, Esq.

December 24, 2008

Page 10

As part of the original acquisition of the Operating Subsidiaries, China Valve Samoa’s wholly owned subsidiary, China Valve Hong Kong, which was incorporated on June 11, 2007, established Henan Tonghai Valve, a wholly-owned subsidiary, in the People’s Republic of China, on September 5, 2007. Neither China Valve Samoa nor China Valve Hong Kong had any active business operations other than their ownership of Henan Tonghai Valve. Henan Tonghai Valve acquired 100% of the equity of the Operating Subsidiaries from Mr. Siping Fang, the Chief Executive Officer of the Company, and the other individual owners of those companies. The acquisition of the Operating Subsidiaries by Henan Tonghai Valve was considered to be a transaction between entities under common control.

Pursuant to a group reorganization plan, on April 1 and 3, 2008, the Company transferred 100% of the equity of the Operating Subsidiaries back to Mr. Fang and the other original owners, with the intention that Mr. Fang would thereafter transfer the Operating Subsidiaries to a new entity incorporated by Mr. Bin Li, and that Mr. Li would then sell such entity to the Company for nominal consideration, thereby allowing the Company to reacquire legal ownership of the Operating Subsidiaries, in a manner that did not need us to obtain CSRC or MOFCOM approvals.

On April 10, 2008, Mr. Fang sold 24,300,000 shares of the Company’s common stock beneficially owned by him (the "Shares") and which he had received in the exchange transaction involving China Valves Samoa described above, to Mr. Li for HKD $10,000. In connection with his acquisition of the shares, Mr. Li issued to Mr. Fang a HKD $10,000 note. The note, which does not bear interest, is due sixty days after a written demand for payment is made by Mr. Fang to Mr. Li, provided that such demand is made on or after October 15, 2008. The sale represents a change of control of the Company and the Shares acquired by Mr. Li represent approximately 60.75% of the issued and outstanding capital stock of the Company calculated on a fully-diluted basis. Prior to the transaction, Mr. Li was not affiliated with the Company. However following the acquisition, Mr. Li was deemed an affiliate of the Company as a result of his stock ownership interest in the Company. In connection with Mr. Li’s acquisition of the Shares from Mr. Fang, Mr. Fang and Mr. Li entered into an Earn-In Agreement (the “Earn-In Agreement”), pursuant to which Mr. Fang obtained the right and option to re-acquire the Shares back from Mr. Li, subject to the satisfaction of four conditions, namely, (A) Mr. Fang will have the option to re-acquire 12,150,000 of the Shares, upon the later occurrence of either (i) the date that is six months after April 10, 2008 or (ii) the date upon which Mr. Fang and Henan Tonghai Valve enter into a binding employment agreement for a term of not less than five years for Mr. Fang to serve as Henan Tonghai Valve’s chief executive officer and chairman of its board of directors; (B) Mr. Fang will have the option to re-acquire 4,050,000 of the Shares upon the declaration of effectiveness of a registration statement filed by the Company under the Securities Act of 1933, as amended;

Edward M. Kelly, Esq.

December 24, 2008

Page 11

(C) Mr. Fang will have the option to re-acquire 4,050,000 of the Shares when Henan Tonghai Valve and its subsidiaries achieve after-tax net income of not less than $3,000,000, as determined under United States Generally Accepted Accounting Principles (“GAAP”) consistently applied for the six-month period ended June 30, 2008; and (D) Mr. Fang will have the option to re-acquire 4,050,000 of the Shares when Henan Tonghai Valve achieves not less than $7,232,500 in pre tax profits, as determined under GAAP for the fiscal year ended December 31, 2008. These conditions would be able to be satisfied only if the Company reacquires and operates the Operating Subsidiaries. The sale of Mr. Fang’s common stock and the Earn-In Agreement were disclosed in a Current Report on Form 8-K filed with the Commission on April 16, 2008. The purpose of the Earn-In Agreement is to ensure that the manner in which Mr. Fang obtains his ownership interest in the Company complies with PRC regulations. At the time of the Agreement, it was fully expected that the conditions under which the shares would be returned to Mr. Fang would be able to be met. At this time, conditions (A) and (C) have been satisfied and it is expected, based on the Company’s current operating results, that condition (D) will be met. Although it is recognized that there is no assurance that condition (B) can be met, the Company will obviously endeavor to take whatever steps are necessary to achieve effectiveness of the registration statement. If and when that happens, Mr. Fang will regain ownership of all the shares in the Company that he originally acquired when he transferred to the Company his interest in the Operating Subsidiaries. The Earn-In Agreement will simply enable Mr. Fang to regain ownership of the Company’s shares originally transferred by him to Mr. Li as part of the reorganization arrangements and, accordingly, the Company does not believe his re-acquisition of those shares from Mr. Li represents compensation cost to the Company, as the Company had previously issued those shares to him in exchange for his interest in the Operating Subsidiaries.

Pursuant to the group reorganization plan, Mr. Li established China Fluid Equipment on April 18, 2008, to serve as the 100% owner of a new PRC subsidiary, Henan Tonghai Fluid. On June 30, 2008, Henan Tonghai Fluid acquired the Operating Subsidiaries from Mr. Fang and the other original owners. The acquisitions were consummated under the laws of the PRC. The former Hong Kong holding company, China Valve Hong Kong and its subsidiary Henan Tonghai Valve, which no longer held any assets, are in the process of being dissolved.

On July 31, 2008, the Company and Mr. Li completed the reorganization plan when Mr. Li transferred all of the capital stock of China Fluid Equipment to the Company pursuant to an Instrument of Transfer for a nominal consideration of HKD$10,000 (approximately $1,281). As a result of these transactions, the Operating Subsidiaries are again the Company’s indirect wholly-owned subsidiaries.

Edward M. Kelly, Esq.

December 24, 2008

Page 12

As part of these reorganization transactions, no significant amounts were paid to or received from Mr. Fang or Mr. Li. Mr. Li was not at risk during these transactions and no new capital was introduced. As a result, no new basis in the net assets of the Operating Subsidiaries was established. During this reorganization, Mr. Fang continued to serve as Chairman and Chief Executive of the Company and, together with other management of the Company, continued to direct both the day-to-day operating and management of the Operating Subsidiaries, as well as their strategic direction. Because of this operating and management control and because the reorganization plan effectively resulted in the Company continuing to bear the residual risks and rewards related to the Operating Subsidiaries, the Company continued to consolidate the Operating Subsidiaries during the reorganization.”

We have deleted the existing paragraphs 4 to 8 under the subheading “Our Corporate History.”

In connection with this reorganization, please also see our response to comment 45.

Our Manufacturing Process, page 38

| 15. | Explain the meaning of each of these abbreviations or acronyms: CAD, CNC, API, DNV, and CE. |

| | China Valves Response: We now explain the meaning of each of the abbreviations or acronyms as follows: |

CAD: computer aided design

CNC: computer numerical control

API: American Petroleum Institute

DNV: Det Norske Veritas, a leading international certification body

CE: The CE marking (also known as CE mark) is a mandatory conformity mark on many products sold in the single market in the European Economic Area (EEA). By affixing the CE marking, the manufacturer or person placing the product on the market or putting it into service asserts that the item meets all the essential requirements of the relevant European Directive(s).

We have also added the meaning of these abbreviations or acronyms in our discussions under the heading “Our Manufacturing Process.”

Board Composition and Committees, page 44

| 16. | Disclosure in the first paragraph that the board consists of five members appears inconsistent with disclosure in the second paragraph that China Valves’ sole director handles the functions that would otherwise be handled by each of the committees. Please reconcile the disclosures. |

Edward M. Kelly, Esq.

December 24, 2008

Page 13

China Valves Response: On November 22, 2008, the board of directors of the Company appointed two new directors William Haus and Peter Li to fill the vacancies created by the resignations of Huifeng Chen and Renrui Tang. Accordingly, we have revised the disclosure regarding board composition and committees to read as follows:

“We currently have standing audit, corporate governance and nominating and compensation committees. Our audit committee is comprised of Peter Li, William Haus and Zengbiao Yu. Peter Li serves as the chairman of the audit committee. The audit committee is primarily responsible for reviewing the services performed by our independent auditors, evaluating our accounting policies and our system of internal controls.

The corporate governance and nominating committee is comprised of William Haus, Siping Fang and Zengbiao Yu with Mr. Yu as the chairman. The committee is primarily responsible for nominating directors and setting policies and procedures for the nomination of directors. The committee is also responsible for overseeing the creation and implementation of our corporate governance policies and procedures.

The compensation committee is comprised of Peter Li, William Haus and Zengbiao Yu with William Haus as the chairman. The compensation committee is primarily responsible for reviewing and approving our compensation and benefit policies, including compensation of executive officers.”

On December 4, 2008, the Company appointed a new Chief Technology Officer, Qizhong Xiang, to fill the vacancy created by the resignation of Zhiyuan Jia. Accordingly, we have revised the disclosures regarding Qizhong Xiang, William Haus and Peter Li under the headings “Management” and “Executive Compensation.”

Director Compensation, page 46

| 17. | Since Messrs. Siping Fang and Binjie Fang are both members of the board of directors, expand the disclosure in the second paragraph to clarify whether either receives any additional compensation for his service as a director. |

China Valves Response: We have revised the applicable sentence to provide that “Mr. Siping Fang and Mr. Binjie Fang are paid in their capacity as executive officers of the Company and they do not receive any additional compensation for their service as directors.”

Edward M. Kelly, Esq.

December 24, 2008

Page 14

Change in Accountants, page 48

| 18. | Please revise your disclosure to state whether there were any disagreements with Chisholm, Bierwolf & Nilson, LLC through the date of dismissal, which appears to be December 16, 2007. Your current disclosure states there were no disagreements through September 30, 2007. Refer to Item 304(a)(1)(iv) of Regulation S-K. |

China Valves Response: We have revised the date from September 30, 2007 to December 16, 2007.

| 19. | Please also revise your disclosure to state whether there were any consultations with Madsen & Associates CPAs, Inc. up through the date of engagement, which appears to be December 16, 2007, as opposed to your current disclosure of consultations through September 30, 2007. |

China Valves Response: We have revised the date from September 30, 2007 to December 16, 2007.

| 20. | Regarding the dismissal of Madsen, please disclose whether the accountant’s report on the financial statements for either of the past two years contained an adverse opinion or a disclaimer of opinion or was qualified or modified as to uncertainty, audit scope, or accounting principles; and a description of the nature of each such adverse opinion, disclaimer of opinion, modification, or qualification. See Item 304(a)(1)(ii) of Regulation S-K. |

China Valves Response: We have added the following disclosure under “CHANGE IN ACCOUNTANTS”:

“For fiscal year 2006 and any subsequent interim period through Madsen’s termination on February 19, 2008, neither us nor anyone acting on our behalf consulted Madsen with respect to (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on our financial statements, and neither a written report was provided to us or oral advice was provided that Madsen concluded was an important factor considered by us in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was the subject of a disagreement or reportable events set forth in Item 304(a) (1)(iv) and (v), respectively, of Regulation S-K.

Madsen’s reports on China Valve Holdings Limited’s balance sheets as of December 31, 2006 and 2005, and the related statements of income, stockholders’ equity and comprehensive income, and cash flows for each of the years ended December 31, 2006 and 2005 did not contain an adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles.”

| 21. | Please also include as an exhibit the letters from your former accountants indicating whether or not they agree with your disclosures. See Item 304(a)(3) of Regulation S-K. |

China Valves Response: We have included as an exhibit the letters from Madsen & Associates CPAs, Inc. indicating they agree with our disclosures.

Edward M. Kelly, Esq.

December 24, 2008

Page 15

Selling Stockholders, page 49

Warrants Issued to CCG Investor Relations

| 22. | Please clarify whether you issued shares of stock or warrants in the first sentence. If the securities were issued as consideration for services rendered, please state this. |

China Valves Response: We have revised the first sentence under “Warrants Issued to CCG Investor Relations” to :“On December 12, 2007, in connection with CCG’s investors relations service, we issued warrants to CCG to purchase 100,000 shares of our common stock for an exercise price of $3 per share with a term of three years.”

Experts, page 59

| 23. | Please also identify Madsen & Associates CPA’s, Inc. as an expert since they audited your financial statements for the two years ended December 31, 2006. |

China Valves Response: We have added Madsen & Associates CPA’s Inc. as an expert and revised the disclosure under “Experts” to :

“The audited financial statements for the fiscal year ended December 31, 2007 included in this prospectus and in the registration statement have been audited by Moore Stephens Wurth Frazer and Torbet, LLP, an independent registered public accounting firm, to the extent and for the periods set forth in their report appearing elsewhere herein and in the registration statement, and are included in reliance on such report, given on the authority of said firm as experts in auditing and accounting.

The audited financial statements for the fiscal year ended December 31, 2006 included in this prospectus and in the registration statement has been audited by Madsen & Associates CPA’s Inc., an independent registered public accounting firm, to the extent and for the periods set forth in their report appearing elsewhere herein and in the registration statement, and are included in reliance on such report, given on the authority of said firm as experts in auditing and accounting.”

Financial Statements for the Period Ended June 30, 2008

General

| 24. | Please address the comments related to your financial statements for the year ended December 31, 2007 in your interim financial statements as well, as applicable. |

China Valves Response: We have addressed the comments related to our financial statements in our interim financial statements.

Edward M. Kelly, Esq.

December 24, 2008

Page 16

| 25. | Please include interim financial statements for the period ended September 30, 2008. Please similarly update your financial information throughout the filing. See Rule 8-08 of Regulation S-X. |

China Valves Response: We have included interim financial statements for the period ended September 30, 2008 and updated our financial information throughout the filing.

| 26. | Please disclose in your footnotes the nature of the capital contribution from a shareholder in the amount of $1,317,095 as presented in your statement of shareholder’s equity on page F-3. Also, disclose whether this amount is related to the proceeds from a shareholder in the amount of $1,280,444 as presented in your statement of cash flows on page F-4. |

China Valves Response: The capital contribution from a shareholder in the amount of $1,317,095 in the Statement of Shareholders’ Equity is the same transaction that is presented in the amount of $1,280,444 in financing cash flows in the Statement of Cash Flows. The difference between the capital contribution and the proceeds from the shareholder is $36,651, which is caused by different foreign exchange rates between the historical rate of the contribution of RMB 1 to US$ 0.1459 used in the Statement of Stockholders’ Equity and the period end average translation rate of RMB 1 to US$ 0.14184 used in the Statement of Cash Flows. We have changed the proceeds from shareholder of $1, 280,444 as stated in the Statement of Stockholders’ Equity to $1,317,095 to reflect the historical rate of the contribution.

Per the Staff’s comment, we have made the following disclosure in our footnotes No. 13 for the period ended June 30, 2008:

“In addition, Mr. Fang Si Ping contributed $1,317,095 to the Company’s subsidiary, ZhengZhou ZhengDie Valve, to fulfill its registered capital requirement.”

Consolidated Statements of Cash Flows, page F-4

| 27. | It appears that you have included $40,856 and $142,071 of restricted cash in your beginning of period and end of period cash balances for your 2008 statement of cash flows. Please refer to SFAS 95, and advise or revise. |

China Valves Response: We have revised the Consolidated Statement of Cash Flows to exclude restricted cash, such that the beginning and ending balances (which will be re-titled as “Cash and Cash Equivalents”) match the corresponding line item in the Consolidated Balance Sheet. The nature and purpose of the Restricted Cash is already disclosed in the footnotes.

Edward M. Kelly, Esq.

December 24, 2008

Page 17

Note 1. Organization, page F-5

| 28. | Please provide us with a comprehensive analysis as to the basis of your accounting for the group reorganization plan as entities under common control. Please address the following: |

| · | Identify each entity involved in the group reorganization plan and clarify each respective ownership structure. In addition, please identify who the other original owners are as disclosed on page F-6. |

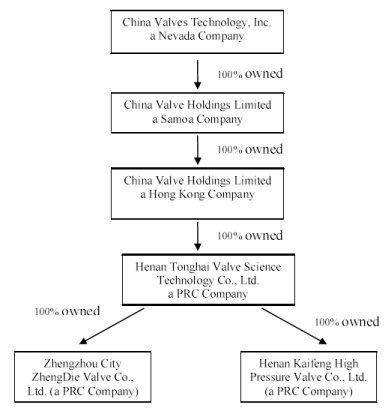

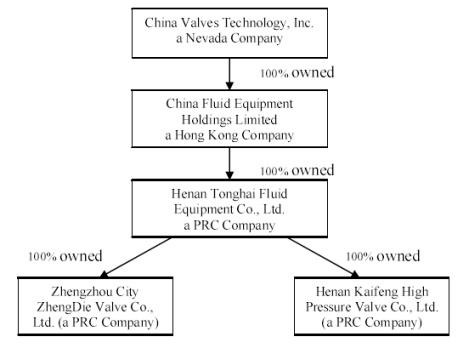

China Valves Response: We have laid out the organization charts before and after the group reorganization and identified who the original owners are.

a) The organization chart before the group reorganization:

Edward M. Kelly, Esq.

December 24, 2008

Page 18

b) The organization chart after the group reorganization:

c) Owners of the Operating Subsidiaries:

| Kaifeng High Pressure | 67% owned by Siping Fang |

| 33% owned by Xiuying Wei |

| Zhengdie Valve | 84% owned by Siping Fang |

| 16% owned by Binjie Fang |

| · | Clearly explain the nature and business purpose of each transaction that occurred in 2008 and your basis of accounting for each transaction. |

China Valves Response: The 2008 transactions were undertaken to ensure that our acquisition of the Operating Subsidiaries had complied with PRC regulations. Those transactions did not involve the exchange of any significant consideration and as a result no new basis in the net assets of the Operating Subsidiaries was established.

| · | Disclose how the operating subsidiaries continued to be under your operating and management control such that continued consolidated was appropriate and all the transactions were between entities under common control such that no step up basis is required. |

China Valves Response: As part of these reorganization transactions, no significant amounts were paid to or received from Siping Fang or Bin Li. Bin Li was not at risk during these transactions and no new capital was introduced. As a result, no new basis in the net assets of the Operating Subsidiaries was established. During this reorganization, Siping Fang continued to serve as Chairman and Chief Executive of the Company and, together with other management of the Company, continued to direct both the day-to-day operating and management of the Operating Subsidiaries, as well as their strategic direction. Because of this operating and management control and because the reorganization plan effectively resulted in the Company continuing to bear the residual risks and rewards related to the Operating Subsidiaries, the Company continued to consolidate the Operating Subsidiaries during the reorganization.

Edward M. Kelly, Esq.

December 24, 2008

Page 19

| · | Explain why you believe the re-acquisition of shares by Mr. Fang pursuant to the Earn-In Agreement does not represent compensation cost to you. |

China Valves Response: We believe the re-acquisition of shares by Mr. Fang pursuant to the Earn-In Agreement does not represent compensation cost to the Company because the Company had previously issued those shares to him in exchange for his interest in the Operating Subsidiaries.

| · | Expand your disclosures as necessary for a reader’s understanding of each |

| | transaction, the related accounting, and your basis for such accounting. |

China Valves Response: We have expanded disclosures regarding each transaction of the reorganization plan, the related accounting, and our basis for such accounting under the heading “Our Corporate History.”

Note 2. Summary of significant accounting policies, Basis of Presentation, page F-7; Note 12. Commitments and contingencies, page F-20

| 29. | We assume the statement “The information included in this Form 10-Q should be read in conjunction with information included in the 2007 annual report filed on Form 10-K” is included inadvertently. Similarly, we assume the phrase “As of the date of 10Q report” is included inadvertently. Please revise. |

China Valves Response: We have deleted the statement “The information included in this Form 10-Q should be read in conjunction with information included in the 2007 annual report filed on Form 10-K” and the phrase “As of the date of 10Q report”.

Note 12. Commitments and Contingencies, page F-20

| 30. | Please revise your disclosure to clarify what you mean by “...the Company’s subsidiary Henan Tonghai Fluid Equipment Co., obtained a business license on June 11, 2008 with its registered capital of US$1,459,000 (RMB 10,000,000).” Clarify the nature of this license and the related accounting for this transaction. Clarify the relationship between China Fluid Equipment and Henan Tonghai Fluid Equipment Co. |

Edward M. Kelly, Esq.

December 24, 2008

Page 20

China Valves Response: China Fluid Equipment is the Hong Kong holding company of Henan Tonghai Fluid Equipment. Henan Tonghai Fluid Equipment was established as a wholly foreign owned enterprise under PRC law and obtained the required business license from Henan Industrial and Commercial Administrative Bureau. The total amount of registered capital has to be received from China Fluid Equipment (the Company’s subsidiary and the parent company of Henan Tonghai Fluid Equipment) within 24 months from the date of approval.

Per the Staff’s comment, we have revised our disclosure as follows:

“After the group reorganization, the Company’s indirect subsidiary Henan Tonghai Fluid Equipment Co. obtained a business license on June 11, 2008 as a wholly foreign owned enterprise based on its approved registered capital of US$1,459,000 (RMB10, 000,000). The total amount of registered capital has to be received from China Fluid Equipment (the Company’s subsidiary and the parent company of Henan Tonghai Fluid Equipment) within 24 months from the date of approval. As of June 30, 2008, the Company has not received its actual contribution for the registered capital; therefore, no accounting treatment is necessary.”

Financial Statements for the Year Ended December 31, 2007

Report of Independent Registered Public Accounting Firm, page F-22

| 31. | Please obtain a consent from Madsen & Associates, and file as an exhibit to your Form S-1. |

China Valves Response: We obtained a consent from Madsen & Associates and filed the consent as an exhibit to our Registration Statement.

| 32. | Please ask Madsen & Associates to delete their reference to your 2005 balance sheet and the related 2005 statements of income, stockholders’ equity, comprehensive income, and cash flows as they are not presented in this filing. |

China Valves Response: We have included in the Registration Statement a revised report from Madsen & Associates that does not contain a reference to the 2005 balance sheet or the related 2005 statements of income, stockholders’ equity, comprehensive income, and cash flows.

General

| 33. | You indicate on page 56 that you plan to amend your articles of incorporation to effect a 1-for-2 reverse split of your outstanding common stock. Please note that pursuant to SAB Topic 4C you should give retroactive effect for a stock split or reverse split that occurs after the date of the latest reported balance sheet but before the release of the financial statements or the effective date of the registration statement, whichever is later. |

China Valves Response: The reverse split has not yet occurred. When it does, we will give retroactive effect to it if it occurs before the release of our financial statements or the effective date of the registration statement, whichever is later.

Edward M. Kelly, Esq.

December 24, 2008

Page 21

| 34. | We note your disclosure on page 23 that you include depreciation within general and administrative expenses. Please disclose the line item(s) in which you include depreciation and amortization as well as the amounts included in each line item for each period presented. If you do not allocate depreciation and amortization to cost of goods sold, please revise your presentation to comply with SAB Topics 11:B and 7:D and remove your presentations of gross profit throughout the filing. |

China Valves Response: We have clarified on page 23 that we allocate depreciation and amortization between cost of sales and general administrative expenses based on the used of the asset being depreciated.

We also added the following table of the amounts of depreciation and amortization included in cost of goods sold and general and administrative expenses for each period presented:

| | | Nine Months Ended September 30, | | | Fiscal Year Ended December 31, | |

| | | | | | | | | | | | | |

| | | 2008 | | | 2007 | | | 2007 | | | 2006 | |

| Cost of Goods Sold | | | 316,736 | | | | 303,658 | | | | 374,124 | | | | 277,880 | |

| | | | | | | | | | | | | | | | | |

| General and Administrative Expenses | | | 413,078 | | | | 201,693 | | | | 196,045 | | | | 149,324 | |

| | | | | | | | | | | | | | | | | |

| Total | | | 729,814 | | | | 505,351 | | | | 570,169 | | | | 427,204 | |

| 35. | We note your disclosure on page 34 that the valve market is divided into five primary segments and your disclosure on page 37 regarding your main product lines. Please provide the disclosures required by paragraph 26(a) of SFAS 131. These should include a discussion of your internal structure, how you are organized, what your operating segments are, and whether operating segments have been aggregated in accordance with paragraph 17 of SFAS 131. Please also provide the disclosures required by paragraph 37 of SFAS 131 regarding products and services, as applicable. |

China Valves Response: We have not organized our operations around differences in products and services, geographic areas, regulatory environments, or a combination of those factors, as discussed in paragraph 26(a) of SFAS 131. Our two operating subsidiaries in the People's Republic of China have been aggregated because they have similar economic characteristics for the nature of their products.

Edward M. Kelly, Esq.

December 24, 2008

Page 22

In relation to the five primary market segments discussed on page 34, our revenue provided by Water Supply products was $13,474,841, Petro Chemical products was $3,912,051, Power Supply products was $9,722,001, Metallurgy products was $4,576,710 and Chemical products was $5,262,510 in the nine months end September 30, 2008.

Consolidated Statements of Cash Flows, page F-26

| 36. | Please revise your statement of cash flows to present the changes in other payables separately from the changes in accrued liabilities. Also, revise to separately present the changes in accounts receivable - trade, other receivables, and prepaid expenses. Please refer to paragraph 29 of SFAS 95. |

China Valves Response: We have revised the Statement of Cash Flows to separately present these amounts, as follows:

As of December 31,

| | | 2007 | | | 2006 | |

| Accounts receivable – trade | | | (6,704,495 | ) | | | (1,362,120 | ) |

| other receivables | | | (664,963 | ) | | | (2,760,864 | ) |

| Advance on inventory purchases | | | (440,532 | ) | | | - | |

| prepaid expenses | | | 277,882 | | | | (472,771 | ) |

| Total | | | (8,087,872 | ) | | | (4,595,754 | ) |

| Accrued liabilities | | | 1,831,323 | | | | 38,619 | |

| Other payables | | | 974,596 | | | | 178,098 | |

| Total | | | 2,805,919.00 | | | | 216,717 | |

| | | | | | | | | |

| 37. | Please tell us what consideration you gave to presenting the change in other payables - related party within cash flows from financing activities. See paragraphs 18-20 of SFAS 95. In addition, please provide us with a reconciliation of the changes in other payables - related party and proceeds from short term loans - related party as presented on your statements of cash flows to the amounts presented on the face of your balance sheet and Note 13. Related Party Transactions on page F-41. |

Edward M. Kelly, Esq.

December 24, 2008

Page 23

| | China Valves Response: As discussed in Note 13 Related Party Transactions, the Other Payables - Related Party balance consists solely of cash advances from the Company’s CEO, Siping Fang, for the Company’s cash flow purposes. Repayments are in the form of cash. Short Term Loans - Related Parties consist solely of borrowings from the Company’s employees. |

Below are the Short Term Loans – Related Parties and other Payables - Related Party reconciliations.

| | Short Term Loans – Related Parties reconciliation |

| | | | | |

| Short term loans - related parties balance as of 12/31/2006 | | $ | 491,366 | |

| Add: | | | | | |

| | proceeds from employee loans | | | 139,939 | |

| | difference due to translation rate | | | 39,883 | |

| Short term loans - related parties balance as of 12/31/2007 | | $ | 671,188 | |

Other payables – related party reconciliation

| Other payables - related party balance as of 12/31/2006 | | $ | 1,805,389 | |

| Add: | | | | | |

| | Cash advance from Siping Fang | | | 880,977 | |

| | Difference due to translation rate | | | 161,666 | |

| Other payables - related party balance as of 12/31/2007 | | $ | 2,848,032 | |

Per SEC Comment, we have moved other payables- related parties balance stated in the cash flow statement from operating activities to financing activities.

Note 1. Organization, page F-27

| 38. | Please enhance your disclosures to clarify who the $490,000 was paid to pursuant to the terms of the Exchange Agreement. In addition, please tell us how this payment is presented in your statement of cash flows. |

| | China Valves Response: We have added the following disclosures in Note 1: |

| | “The $490,000 was paid to Intercontinental Resources, Inc. pursuant to the terms of the Exchange Agreement. Of such amount, $300,000 was forwarded to Belmont Partners for its financial services rendered in the reverse merger transaction.” |

Edward M. Kelly, Esq.

December 24, 2008

Page 24

Because the $490,000 was paid by Siping Fang on behalf of the Company, the payment was included in the other payables- related parties line item in the cash flow statement.

Note 2. Summary of Significant Accounting Policies, page F-28

General

| 39. | Please disclose the types of expenses that you include in the cost of goods sold line item, the selling expense line item, and the general and administrative expenses line item. Please also disclose whether you include inbound freight charges, purchasing and receiving costs, inspection costs, warehousing costs, internal transfer costs, and the other costs of your distribution network in the cost of goods sold line item. With the exception of warehousing costs, if you currently exclude a portion of these costs from cost of goods sold, please disclose: |

| · | In a footnote the line items that these excluded costs are included in and the amounts included in each line item for each period presented. |

| | China Valves Response: The types of expenses we include in the cost of goods sold are: raw materials, fuel and power, freight charges, purchasing and receiving costs, inspection costs, warehousing costs, internal transfer costs, staff costs, manufacturing costs, and depreciation. |

The types of expenses we include in the selling expense line item are: transportation expense, salary, conference fees and commission.

The types of expenses we include in the general and administrative expenses are: labor insurance expense, salary, bad debt, depreciation from non-manufacturing fixed assets, rent, travel expense, welfare expense, research and development expense, administration expense, meal and entertainment expense, and conference expense.

We include freight charges, purchasing and receiving costs, inspection costs, warehousing costs, internal transfer costs, and the other costs of our distribution network in the cost of goods sold line item. With the exception of warehousing costs, we currently do not exclude a portion of these costs from cost of goods sold.

Per SEC staff comment, we have updated our Cost of Sales accounting policy under Note 2 – summary of significant accounting policies as follow:

“Cost of sales consists primarily of direct material costs, direct labor costs, direct depreciation and related direct expenses attributable to the production of the products. Inbound freight costs and purchasing are included in direct material costs. Manufacturing overhead includes expenses such as indirect labor, depreciation as it relates to cost of production, rental, utilities, receiving costs, and equipment maintenance and repair costs.”

Edward M. Kelly, Esq.

December 24, 2008

Page 25

| · | In MD&A that your gross margins may not be comparable to those of other entities since some entities include all of the costs related to their distribution network in cost of goods sold and others like you exclude a portion of them from gross margin, including them instead in a line item such as selling expenses. |

China Valves Response: We include all of the costs related to our distribution network in cost of goods sold.

Revenue Recognition, page F-29

| 40. | As indicated in Note 6, we note that retainage represents portions held for payment by customers pending quality inspection ranging from 12-18 months after shipment of products. Please tell us supplementally, and expand your accounting policy to discuss how retainage impacts your revenue recognition. Specifically discuss how you are able to conclude that the ability to collect is reasonably assured at time of shipment. Quantify the amounts of retainage not paid by customers after the 12-18 month inspection period for each period presented. |

| | China Valves Response: As of September 30, 2008 and December 31, 2007, total retainage not paid by customers was $705,000 and 148,000 respectively. According to our accounting policy, we accrue bad debt expense based on operating circumstances and a continuous review of our outstanding receivables. |

The Company allows its customers to retain 5% to 10% of the contract prices as retainage during the warranty period, usually 12 or 18 months, to guarantee product quality. When a proper warranty claim occurs, the Company will repair the product at its expense. Historically, the Company has experienced very few actual warranty claims resulting in the Company having to repair or exchange a defective product. The Company has experienced on average approximately $3,377 of actual warranty claims per year. As a result of the small amount of warranty claims, the Company records such expenses as they are incurred. Due to the infrequency of warranty claims, the Company believes that the ability to collect on its retainage is reasonably assured at time of shipment.

Per SEC staff comment, we have expanded our revenue recognition policy in Note 2- Summary of significant accounting policies:

“The Company allows its customers to retain 5% to 10% of the contract prices as retainage during the warranty period, usually 12 or 18 months, to guarantee product quality.. Historically, the Company has experienced very few actual warranty claims resulting in the Company having to repair or exchange a defective product. Due to the infrequency and insignificant amount of warranty claims, the ability to collect retainage is reasonably assured and is recognized at time of shipment.”

Edward M. Kelly, Esq.

December 24, 2008

Page 26

Long Term Investment, page F-33

| 41. | Regarding your long term investments, please disclose the percentage of each company that you own. Also, please tell us supplementally, and enhance your disclosures to provide a comprehensive discussion regarding how you concluded there was no impairment for each period presented. |

China Valves Response: We have added the following information to long term investment under Note 2 as follows:

“The Company owns approximately 0.14% of China Perfect Machinery Industry Co. Ltd. and approximately 4.01% of Kaifeng Commercial Bank.

Long term investments are tested for impairment in accordance with SFAS No. 142. We periodically evaluate potential impairment whenever events or changes in circumstances indicate that the carrying amount of the investments may not be recoverable. For investments carried at cost, we recognize impairment of long term investments in the event that the carrying value of the investment exceeds our proportionate share of the net book value of the investee. During the reporting periods, we have not identified any indicators that would require testing for impairment.

As at June 30, 2008, net book value of the 4.01% interest in Kaifeng City Commercial Bank was $2.16M which was 1.4M above the carrying value of initial investment of $729,500.”

| 42. | We note your disclosure on page 29 that you determined the fair value of your long term investments based on the capital investments that you made in 1996 and 1997. Please help us understand why you believe it is appropriate to use the amounts contributed over 10 years ago as the basis for fair value. Also, please ensure you meet the disclosure requirements set forth in paragraphs 32-35 of SFAS 157, as applicable. |

China Valves Response: We invested RMB5M and RMB200,000 at the par value of RMB1.0 in Kaifeng City Commercial Bank and China Perfect Machinery Industry Co. Ltd. respectively at the time of their founded.

Please refer to our answer to question 41. As at June 30, 2008, net book value of the 4.01% interest in Kaifeng City Commercial Bank was $2.16M which was $1.4M above the carrying value of initial investment. Kaifeng City Commercial Bank now is one of the subsidiaries of Zhongyuan Commercial Banking Group planned to list in China stock market in year 2009.

As at December 31, 2007, net book value of the 0.14% interest in China Perfect Machinery Co. Ltd. was $59,750 which was $30,770 above the carrying value of initial investment of $28,980. We periodically received the dividend from China Perfect Machinery Co. Ltd. since year 1999. Therefore, we believe it is appropriate to use the amounts contributed as the basis for fair value.

Edward M. Kelly, Esq.

December 24, 2008

Page 27

Note 8. Loans, page F-38

| 43. | Please revise your disclosure to discuss any restrictive covenants that may be related to your loans. If you do have any financial covenants that you must meet, please provide a tabular presentation of the required ratio as well as your actual ratio as of each reporting date. This disclosure should be provided for any additional covenants which are material to an understanding of your financial structure. Please show the specific computations used to arrive at the actual ratios with corresponding reconciliations to US GAAP amounts, if necessary. |

| | China Valves Response: We have included the following disclosures in our financial statements: |

“As of September 30, 2008, there are no restrictive covenants in any of the agreements relating to our loans.”

Note 9. Income Taxes, page F-39

| 44. | Please help us understand why you have not recognized any deferred tax assets or deferred tax liabilities. See paragraphs 17-25 of SFAS 109. Expand your disclosures to clarify as well. |

China Valves Response: We have added the following disclosures in Note 9:

“The Company is governed by the Income Tax Laws of the PRC. The Company accounts for income taxes in accordance with FAS 109, “Accounting for Income Taxes” which requires the company to use the assets and liability method of accounting for income taxes. Under the assets and liability method, deferred income taxes are recognized for the tax consequences of temporary differences by applying enacted statutory tax rates applicable to future years to differences between financial statement carrying amounts and the tax bases of existing assets and liabilities. Under SFAS 109, the effect on deferred income taxes of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is recognized if it is more likely than not that some portion, or all of, a deferred tax asset will not be realized. Because the Company’s operations are outside of the United States and were not subject to United States income tax in 2007 or prior years, the Company did not have any provision for United States income taxes, including any deferred income taxes, as of and for the years ended December 31, 2007 and 2006.”

Edward M. Kelly, Esq.

December 24, 2008

Page 28

Note 12. Commitments and contingencies, page F-41

| 45. | As indicated on page 14, we note that on August 8, 2006, six PRC regulatory agencies, including the CSRC, promulgated the Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rule, which became effective on September 8, 2006. The M&A Rule, among other things, requires that an offshore company controlled by PRC companies or individuals that have acquired a PRC domestic company for the purpose of listing the PRC domestic company’s equity interest on an overseas stock exchange must obtain the approval of the CSRC prior to the listing and trading of such offshore company’s securities on an overseas stock exchange. On September 21, 2006, the CSRC, pursuant to the M&A Rule, published on its official website procedures specifying documents and materials required to be submitted to it by offshore companies seeking CSRC approval of their overseas listings. Please expand your disclosures herein and on page 15 to address the following: |

| · | Whether the company obtained the necessary CRC approvals, and, if not, why not. |

China Valves Response: The Company did not obtain the CSRC approval as the M&A rule does not apply to the Company’s corporate structure. The M&A Rule is applicable where an offshore company controlled by PRC companies or PRC citizens acquires a related PRC domestic company to prepare for future overseas listing. However, the Company’s offshore company is not controlled by any PRC company or individual, as Siping Fang, the Company’s CEO who is a PRC citizen, sold all the shares of the Company’s common stock beneficially owned by him to Mr. Bin Li, a Canadian citizen, in April 2008, pursuant to a common stock purchase agreement. The transaction resulted in a change of control of the Company to Bin Li. Similarly, the M&A rule does not apply when the three PRC shareholders of the Company’s Operating Subsidiaries sold their interests in the Operating Subsidiaries in June 2008 to Henan Tonghai Fluid controlled by Bin Li. When Bin Li transferred shares of China Fluid Equipment, the Hong Kong holding company of Henan Tonghai Fluid, to the Company in June 2008, none of the companies involved in the transfer was controlled by a PRC citizen or a PRC company. Therefore, the M&A rule does not apply to the transfer of China Fluid Equipment to the Company either.

| · | Please clarify whether you believe it is remote, reasonably possible, or probable that the CSRC or the other PRC regulatory agencies will impose fines and penalties and your basis for such conclusions. Please clarify if you have accrued any amount related to this contingency. If not, clarify why not. If there is at least a reasonable possibility that a loss or an additional loss in excess of amounts accrued may have been incurred, please disclose such amounts. If you have determined that it is not possible to estimate the range of loss, please provide an explanation as to why this is not possible. See paragraphs 8-10 of SFAS 5. |

China Valves Response: We are aware of several China-based US public companies that have undertaken similar reorganization plans in the last couple of years. The CSRC or other PRC regulatory agencies have not imposed fines and penalties on these companies. Similarly, we believe it is only a remote possibility that the CSRC or the other PRC regulatory agencies might impose fines and penalties on the Company and therefore we have not accrued any amount related to this contingency.

Edward M. Kelly, Esq.

December 24, 2008

Page 29

Note 13. Related Party Transactions, page 41

| 46. | Please disclose in your footnotes the nature of the capital contribution from a shareholder in the amount of $1,249,999 as presented in your statement of shareholders’ equity on page F-25 and your statement of cash flows on page F-26. |

China Valves Response: Per Staff comment, we have added the following to Note 12 – Related party transactions:

“In November 2007, the Company received capital contribution of $1,249,999 from Mr. Siping Fang to fulfill the Operating Subsidiaries, Zhengdie’s registered capital.”

Undertakings, page II-5

| 47. | Include the Rule 430C undertaking required by Item 512(a)(5)(ii) of Regulation S-K. |

China Valves Response: We have included the Rule 430C undertaking required by Item 512(a)(5)(ii).

| 48. | Since China Valves is not primary Form S-3 eligible, Rule 430B is inapplicable to this offering. Please remove the Rule 430B undertakings under (A)(4). |

China Valves Response: We have removed the Rule 430B undertakings under (A)(4).

| 49. | Since this is not a primary offering, please remove the undertakings under (A)(5). |

China Valves Response: We have removed the undertakings under (A)(5).

| 50. | Since the registration statement is not incorporating by reference any Exchange Act document filed after the registration statement’s effective date, please remove the undertaking under (B). |

China Valves Response: We have removed the Rule 430B undertakings under (B).

Signatures, page II-7

| 51. | At least a majority of the board of directors or persons performing similar functions also must sign the registration statement. See Instruction 1 to signatures on Form S-1, and revise. |

China Valves Response: We have added the signatures of the board of directors. Now a majority of the board members have signed the signature page of the Registration Statement.

Edward M. Kelly, Esq.

December 24, 2008

Page 30

Exhibit Index, page II-8

| 52. | We note that China Valves is incorporating by reference exhibits 3.1 and 3.2. Include within the parentheses the exhibit numbers assigned to these exhibits in the registration statement from which they are being incorporated. Similarly, revise the descriptions under Item 16 on page II-3. |

China Valves Response: We have revised the descriptions as follows:

3.1 Articles of Incorporation of the Company as filed with the Secretary of State of Nevada on August 1, 1997 (incorporated herein by reference to Exhibit 3.1 to the SB-2 Registration Statement filed on November 1, 2001).

3.2 Certificate of Amendment to Certificate of Incorporation changing the corporate name filed with the Secretary of State of Nevada (incorporated herein by reference to

Exhibit 3.2 to the registrant’s current report on Form 8-K filed on December 21, 2007).

3.3 Bylaws of the registrant, as amended to date, (incorporated herein by reference to Exhibit 3.2 to the SB-2 Registration Statement filed on November 1, 2001).

10-K and March 31, 2008 and June 30, 2008 10-Qs

General

| 53. | Please address the above comments as they relate to your Forms 10-K and 10-Qs. |

China Valves Response: We will address the above comments as they relate to our Forms 10-K and 10-Qs in our amendments to Forms 10-K and 10-Qs, which we expect to file as soon as the Staff’s comments have been resolved.

Item 10. Directors, Executive Officers of and Corporate Governance, page 39.

| 54. | Provide in future filings compliance with Section 16(a) of the Exchange Act disclosure as required by Item 405 of Regulation S-K. Please confirm that there were no delinquent filings during the most recent fiscal year. |

China Valves Response: We will provide in future filings compliance with Section 16(a) of the Exchange Act disclosure as required by Item 405 of Regulation S-K. We have confirmed that there were no delinquent filings under Section 16(a) of the Exchange Act during the most recent fiscal year.

Edward M. Kelly, Esq.

December 24, 2008

Page 31

Exhibits 31.1 and 31.2

| 55. | We note that the certifying individuals included their titles in the introductory sentence of the certifications required by Item 601(b)(31) of Regulation S-K and that the titles of the certifying individuals were included in the introductory sentence of the certifications required by Item 601(b)(31) of Regulation S-K in exhibits 31.1 and 31.2 to the 10-K and exhibits 31.1 and 31.2 to the June 30, 2008 10-Q. Confirm that the individuals certified the reports in their individual capacities, and remove their titles from the introductory sentence of the certifications required by Item 601(b)(31) of Regulation S-K in future filings. |

China Valves Response: We confirm that the certifying individuals certified the reports in their individual capacities and have removed the titles of the certifying individuals.

| 56. | The certifications included in your Forms 10-K and 10-Qs omit the internal control over financial reporting language from the introductory portion of paragraph 4 as well as paragraph 4(b) of the certifications and also include other modifications from the format provided in Item 601(b)(31) of Regulation S-K. Please file amendments to your Forms 10-K and 10-Qs to include certifications that do not exclude the introductory portion of paragraph 4 as well as paragraph 4(b). Please also ensure that the revised certifications refer to the Form 10-K/A or 10-Q/A as applicable, are currently dated, and conform to the format provided in Item 601(b)(31) of Regulation S-K. Please refile the Forms 10-K and 10-Qs in their entirety, along with the updated certifications. |

China Valves Response: We have revised the certifications in our Forms 10-K and 10-Qs and will file our Forms 10-K and 10-Qs in their entirety, along with the updated certifications.

If you would like to discuss any of the responses to the Staff’s comments or if you would like to discuss any other matters, please contact the undersigned at (01186-378) 2925211 or Louis A. Bevilacqua of Pillsbury Winthrop Shaw Pittman LLP, our outside special securities counsel at (202) 663-8158.

| Sincerely, |

| |

| China Valves Technology, Inc. |

| |

| |

By:/s/ Siping Fang |

| Siping Fang |

| Chief Executive Officer |