UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: March 31 Registrant is making a filing for 9 of its series:

Wells Fargo Advantage Intrinsic Small Cap Value Fund, Wells Fargo Advantage Small Cap Opportunities Fund, Wells Fargo Advantage Small Cap Value Fund, Wells Fargo Advantage Small/Mid Cap Value Fund, Wells Fargo Advantage Special Small Cap Value Fund, Wells Fargo Advantage Traditional Small Cap Growth Fund, Wells Fargo Advantage Precious Metals Fund, Wells Fargo Advantage Specialized Technology Fund, and Wells Fargo Advantage Utility and Telecommunications Fund.

Date of reporting period: September 30, 2014

| ITEM 1. | REPORT TO STOCKHOLDERS |

Wells Fargo Advantage

Intrinsic Small Cap Value Fund

Semi-Annual Report

September 30, 2014

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of September 30, 2014, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Advantage Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements; the views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | Letter to shareholders (unaudited) |

Karla M. Rabusch

President

Wells Fargo Advantage Funds

Despite geopolitical challenges, U.S. economic numbers showed improvement.

Dear Valued Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo Advantage Intrinsic Small Cap Value Fund for the six-month period that ended September 30, 2014. The period was marked by heightened geopolitical uncertainty as the U.S. and Europe continued to confront Russia over Ukraine and as Islamic militants (formerly known as ISIS) gained territory in Iraq and Syria. Toward the end of the reporting period, market volatility increased as renewed fears of slowing global growth took hold, and investors began to price in expectations that the U.S. Federal Reserve (Fed) was finally looking to raise short-term interest rates. Although mid-cap stocks (measured by the Russell Midcap® Index1) ended the period with a single-digit gain, small-cap stocks (measured by the Russell 2000® Index2) ended with a loss.

Major central banks continued to provide stimulus.

Throughout the reporting period, the Federal Open Market Committee (FOMC)—the U.S. Federal Reserve’s monetary policymaking body—kept its key interest rate near zero. Prior to the reporting period, in January 2014, the FOMC began to reduce (or taper) its bond-buying program by $10 billion per month and continued the taper throughout the reporting period. Some anticipated this action would lead to higher interest rates, however, interest rates followed a downward trend, despite short-term volatility. European markets continued to benefit from the European Central Bank’s (ECB’s) actions. In June 2014, the ECB announced a variety of measures aimed at encouraging lending, including cutting its key rate and imposing for the first time a negative interest rate on bank deposits held at the central bank. In September 2014, the ECB cut its key rate again—to 0.05%—and pushed the deposit rate for banks to -0.20%.

Although the geopolitical situation presented challenges, U.S. stock markets gained on positive economic data.

Geopolitical events were major obstacles throughout the reporting period. The ongoing standoff between the West (the U.S., Europe, and their allies) and Russia over Ukraine began in late 2013 and fed into stock market volatility early in 2014. The situation’s effect on the stock market faded as investors began to believe that the situation would not result in war, but as of September 2014, the situation had resulted in economic sanctions from the West against Russia. However, even as the market began to focus less on that situation, the advance of Islamic militants in Iraq and Syria led to airstrikes by the U.S. and its allies and fears of a regional war in the Middle East.

Despite geopolitical challenges, U.S. economic numbers showed improvement. The unemployment rate continued its slow improvement, declining from 6.3% in April 2014 to 5.9% in September 2014. Although investors received an unpleasant surprise when gross domestic product (GDP) growth for the first quarter of 2014 declined by 2.1% on an annualized basis, several commentators suggested that harsh winter weather may have dampened economic activity. Economic growth did accelerate in the second quarter of 2014, with an annualized GDP growth rate of 4.6%.

| 1. | The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000® Index, which represent approximately 25% of the total market capitalization of the Russell 1000 Index. You cannot invest directly in an index. |

| 2. | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. You cannot invest directly in an index. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | | 3 | |

Investors’ positive outlook for the U.S. economy contributed to a solid domestic stock market for most of the period. However, slowing global economic growth, combined with renewed geopolitical concerns (including protests in Hong Kong), caused stock market weakness in September 2014. The Russell Midcap Index ended the period with a 3.2% gain. Small-cap stocks, however, were hit harder by the late-period uncertainty and the Russell 2000 Index ended with a -5.5% return. Growth stocks outperformed value stocks in both the small-cap and the mid-cap space.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Advantage Funds offers more than 100 mutual funds and other investments spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Advantage Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs. For current information about your fund investments, contact your investment professional, visit our website at wellsfargoadvantagefunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Advantage Funds

Investors’ positive outlook for the U.S. economy contributed to a solid domestic stock market for most of the period.

| | | | |

| 4 | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks long-term capital appreciation.

Adviser

Wells Fargo Funds Management, LLC

Subadviser

Metropolitan West Capital Management, LLC

Portfolio managers

Samir Sikka

Alex Alvarez, CFA

Average annual total returns1 (%) as of September 30, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios2 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net3 | |

| Class A (WFSMX) | | 3-31-2008 | | | 0.92 | | | | 12.39 | | | | 5.86 | | | | 7.06 | | | | 13.73 | | | | 6.49 | | | | 1.59 | | | | 1.41 | |

| Class C (WSCDX) | | 3-31-2008 | | | 5.28 | | | | 12.88 | | | | 5.75 | | | | 6.28 | | | | 12.88 | | | | 5.75 | | | | 2.34 | | | | 2.16 | |

| Administrator Class (WFSDX) | | 4-8-2005 | | | – | | | | – | | | | – | | | | 7.29 | | | | 14.00 | | | | 6.77 | | | | 1.43 | | | | 1.21 | |

| Institutional Class (WFSSX) | | 4-8-2005 | | | – | | | | – | | | | – | | | | 7.53 | | | | 14.25 | | | | 6.98 | | | | 1.16 | | | | 1.01 | |

| Investor Class (SCOVX) | | 3-28-2002 | | | – | | | | – | | | | – | | | | 6.98 | | | | 13.67 | | | | 6.46 | | | | 1.65 | | | | 1.47 | |

| Russell 2000® Value Index4 | | – | | | – | | | | – | | | | – | | | | 4.13 | | | | 13.02 | | | | 7.25 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Administrator Class, Institutional Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Smaller-company stocks tend to be more volatile and less liquid than those of larger companies. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 5.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | | 5 | |

| | | | |

| Ten largest equity holdings5 (%) as of September 30, 2014 | |

Kar Auction Services Incorporated | | | 3.85 | |

Office Depot Incorporated | | | 3.66 | |

AMN Healthcare Services Incorporated | | | 2.53 | |

Landstar System Incorporated | | | 2.45 | |

Pike Electric Corporation | | | 2.38 | |

DSW Incorporated Class A | | | 2.29 | |

Silgan Holdings Incorporated | | | 2.11 | |

Zions Bancorporation | | | 2.10 | |

FirstMerit Corporation | | | 2.04 | |

EVERTEC Incorporated | | | 2.02 | |

|

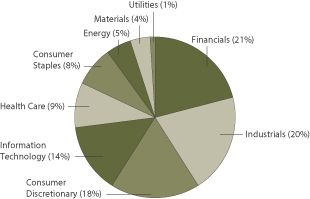

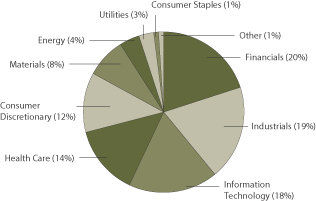

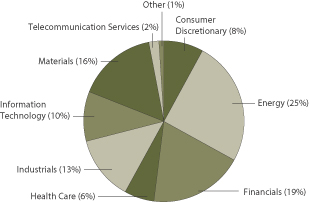

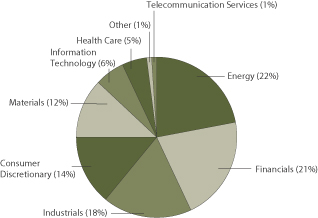

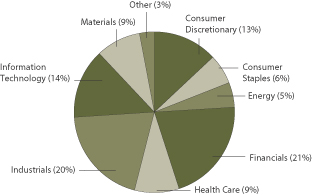

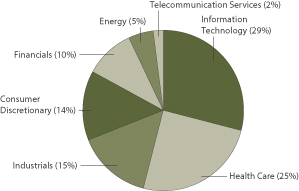

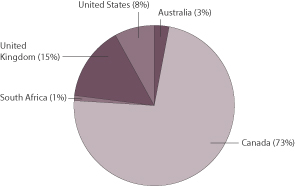

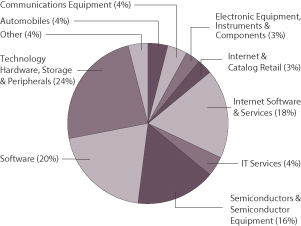

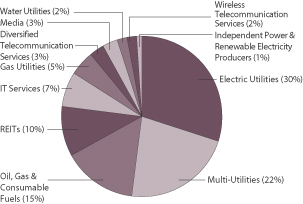

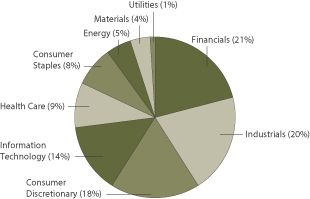

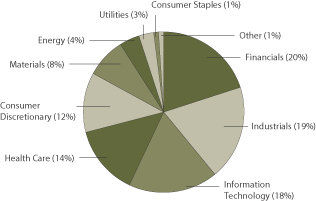

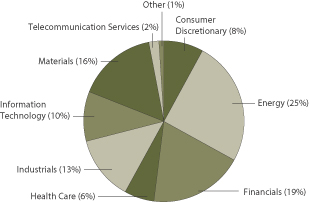

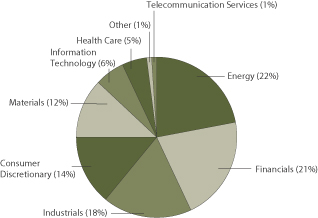

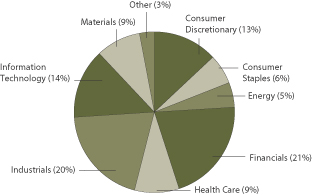

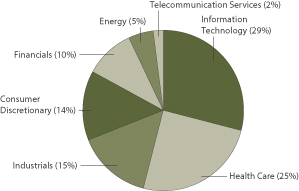

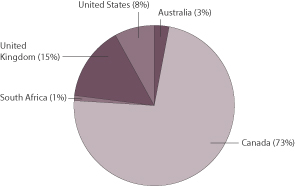

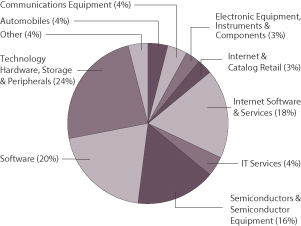

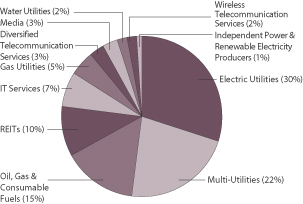

| Sector distribution6 as of September 30, 2014 |

|

|

| 1. | Prior to June 1, 2010, the Fund was named Wells Fargo Advantage Small Cap Disciplined Fund. Metropolitan West Capital Management, LLC replaced Wells Capital Management as a subadviser for the Fund effective June 1, 2010. Accordingly, performance figures shown prior to June 1, 2010, do not reflect the principal investment strategies or performance of Metropolitan West Capital Management, LLC. Historical performance shown for Class A, Administrator Class, and Institutional Class shares prior to their inception reflects the performance of Investor Class shares, and includes the higher expenses applicable to Investor Class shares. If these expenses had not been included, returns would be higher. Historical performance shown for Class C shares prior to their inception reflects the performance of Investor Class shares and has been adjusted to reflect the higher expenses applicable to Class C shares. |

| 2. | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.01% in acquired fund fees and expenses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report, which do not include acquired fund fees and expenses. |

| 3. | The Adviser has committed through July 31, 2015, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at 1.40% for Class A, 2.15% for Class C, 1.20% for Administrator Class, 1.00% for Institutional Class, and 1.46% for Investor Class. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. Without this cap, the Fund’s returns would have been lower. |

| 4. | The Russell 2000® Value Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. You cannot invest directly in an index. |

| 5. | The ten largest equity holdings are calculated based on the value of the securities divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 6. | Sector distribution is subject to change and is calculated based on the total long-term investments of the Fund. |

| | | | |

| 6 | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from April 1, 2014 to September 30, 2014.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

4-1-2014 | | | Ending

account value

9-30-2014 | | | Expenses

paid during

the period¹ | | | Net annualized

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 980.02 | | | $ | 6.95 | | | | 1.40 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.05 | | | $ | 7.08 | | | | 1.40 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 976.73 | | | $ | 10.65 | | | | 2.15 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,014.29 | | | $ | 10.86 | | | | 2.15 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 981.17 | | | $ | 5.96 | | | | 1.20 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.05 | | | $ | 6.07 | | | | 1.20 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 982.64 | | | $ | 4.97 | | | | 1.00 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.05 | | | $ | 5.06 | | | | 1.00 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 979.83 | | | $ | 7.25 | | | | 1.46 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.75 | | | $ | 7.38 | | | | 1.46 | % |

| 1. | Expenses paid is equal to the annualized expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | | | |

| Portfolio of investments—September 30, 2014 (unaudited) | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | | 7 | |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

| | | | |

Common Stocks: 98.64% | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 17.51% | | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure: 4.84% | | | | | | | | | | | | |

Interval Leisure Group Incorporated | | | | | | | 141,650 | | | $ | 2,698,433 | |

Seaworld Entertainment Incorporated | | | | | | | 147,590 | | | | 2,838,156 | |

Six Flags Entertainment Corporation | | | | | | | 43,350 | | | | 1,490,807 | |

| | | | |

| | | | | | | | | | | 7,027,396 | |

| | | | | | | | | | | | |

| | | | |

| Household Durables: 1.17% | | | | | | | | | | | | |

Taylor Morrison Home Corporation Class A † | | | | | | | 104,826 | | | | 1,700,278 | |

| | | | | | | | | | | | |

| | | | |

| Multiline Retail: 1.02% | | | | | | | | | | | | |

Big Lots Incorporated | | | | | | | 34,550 | | | | 1,487,378 | |

| | | | | | | | | | | | |

| | | | |

| Specialty Retail: 10.48% | | | | | | | | | | | | |

Abercrombie & Fitch Company Class A | | | | | | | 50,900 | | | | 1,849,706 | |

Ann Incorporated † | | | | | | | 36,157 | | | | 1,487,137 | |

Ascena Retail Group Incorporated † | | | | | | | 138,000 | | | | 1,835,400 | |

Chico’s FAS Incorporated | | | | | | | 95,230 | | | | 1,406,547 | |

DSW Incorporated Class A | | | | | | | 110,590 | | | | 3,329,865 | |

Office Depot Incorporated † | | | | | | | 1,035,500 | | | | 5,322,470 | |

| | | | |

| | | | | | | | | | | 15,231,125 | |

| | | | | | | | | | | | |

| | | | |

Consumer Staples: 7.71% | | | | | | | | | | | | |

| | | | |

| Beverages: 1.75% | | | | | | | | | | | | |

Treasury Wine Estates ADR | | | | | | | 676,700 | | | | 2,537,625 | |

| | | | | | | | | | | | |

| | | | |

| Food Products: 5.96% | | | | | | | | | | | | |

Dean Foods Company « | | | | | | | 176,045 | | | | 2,332,596 | |

Flowers Foods Incorporated | | | | | | | 117,593 | | | | 2,159,007 | |

J & J Snack Foods Corporation | | | | | | | 16,200 | | | | 1,515,672 | |

Post Holdings Incorporated † | | | | | | | 80,100 | | | | 2,657,718 | |

| | | | |

| | | | | | | | | | | 8,664,993 | |

| | | | | | | | | | | | |

| | | | |

Energy: 5.35% | | | | | | | | | | | | |

| | | | |

| Energy Equipment & Services: 2.47% | | | | | | | | | | | | |

Forum Energy Technologies Incorporated † | | | | | | | 64,900 | | | | 1,986,589 | |

Helix Energy Solutions Group Incorporated † | | | | | | | 72,415 | | | | 1,597,475 | |

| | | | |

| | | | | | | | | | | 3,584,064 | |

| | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 2.88% | | | | | | | | | | | | |

Energy XXI (Bermuda) Limited « | | | | | | | 113,750 | | | | 1,291,063 | |

Oasis Petroleum Incorporated † | | | | | | | 69,400 | | | | 2,901,614 | |

| | | | |

| | | | | | | | | | | 4,192,677 | |

| | | | | | | | | | | | |

| | | | |

Financials: 20.45% | | | | | | | | | | | | |

| | | | |

| Banks: 8.36% | | | | | | | | | | | | |

Associated Banc-Corp | | | | | | | 12,054 | | | | 209,981 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 8 | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | Portfolio of investments—September 30, 2014 (unaudited) |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

| | | | |

| Banks (continued) | | | | | | | | | | | | |

Cathay General Bancorp | | | | | | | 61,730 | | | $ | 1,532,756 | |

FirstMerit Corporation | | | | | | | 168,450 | | | | 2,964,720 | |

Hancock Holding Company | | | | | | | 49,270 | | | | 1,579,104 | |

Umpqua Holdings Corporation | | | | | | | 170,640 | | | | 2,810,441 | |

Zions Bancorporation | | | | | | | 104,995 | | | | 3,051,155 | |

| | | | |

| | | | | | | | | | | 12,148,157 | |

| | | | | | | | | | | | |

| | | | |

| Consumer Finance: 1.33% | | | | | | | | | | | | |

Encore Capital Group Incorporated †« | | | | | | | 43,737 | | | | 1,937,986 | |

| | | | | | | | | | | | |

| | | | |

| Real Estate Management & Development: 1.52% | | | | | | | | | | | | |

Jones Lang LaSalle Incorporated | | | | | | | 17,450 | | | | 2,204,633 | |

| | | | | | | | | | | | |

| | | | |

| REITs: 5.83% | | | | | | | | | | | | |

Equity Commonwealth | | | | | | | 68,539 | | | | 1,762,138 | |

Parkway Properties Incorporated | | | | | | | 117,584 | | | | 2,208,228 | |

Pennymac Mortgage Investment Trust | | | | | | | 120,000 | | | | 2,571,600 | |

Redwood Trust Incorporated « | | | | | | | 116,330 | | | | 1,928,751 | |

| | | | |

| | | | | | | | | | | 8,470,717 | |

| | | | | | | | | | | | |

| | | | |

| Thrifts & Mortgage Finance: 3.41% | | | | | | | | | | | | |

Essent Group Limited † | | | | | | | 125,250 | | | | 2,681,603 | |

Ladder Capital Corporation Class A † | | | | | | | 120,550 | | | | 2,278,395 | |

| | | | |

| | | | | | | | | | | 4,959,998 | |

| | | | | | | | | | | | |

| | | | |

Health Care: 8.73% | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 3.69% | | | | | | | | | | | | |

Integra LifeSciences Holdings † | | | | | | | 49,100 | | | | 2,437,324 | |

Steris Corporation | | | | | | | 54,250 | | | | 2,927,330 | |

| | | | |

| | | | | | | | | | | 5,364,654 | |

| | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 2.53% | | | | | | | | | | | | |

AMN Healthcare Services Incorporated † | | | | | | | 233,915 | | | | 3,672,466 | |

| | | | | | | | | | | | |

| | | | |

| Life Sciences Tools & Services: 2.51% | | | | | | | | | | | | |

Bio-Rad Laboratories Incorporated Class A † | | | | | | | 19,300 | | | | 2,188,620 | |

Charles River Laboratories International Incorporated † | | | | | | | 24,500 | | | | 1,463,630 | |

| | | | |

| | | | | | | | | | | 3,652,250 | |

| | | | | | | | | | | | |

| | | | |

Industrials: 20.17% | | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies: 7.88% | | | | | | | | | | | | |

Herman Miller Incorporated | | | | | | | 62,895 | | | | 1,877,416 | |

Kar Auction Services Incorporated | | | | | | | 195,550 | | | | 5,598,597 | |

Tetra Tech Incorporated | | | | | | | 64,997 | | | | 1,623,625 | |

United Stationers Incorporated | | | | | | | 62,800 | | | | 2,359,396 | |

| | | | |

| | | | | | | | | | | 11,459,034 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—September 30, 2014 (unaudited) | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | | 9 | |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

| | | | |

| Construction & Engineering: 3.23% | | | | | | | | | | | | |

EMCOR Group Incorporated | | | | | | | 30,970 | | | $ | 1,237,561 | |

Pike Electric Corporation † | | | | | | | 290,500 | | | | 3,454,045 | |

| | | | |

| | | | | | | | | | | 4,691,606 | |

| | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 0.89% | | | | | | | | | | | | |

Babcock & Wilcox Company | | | | | | | 46,792 | | | | 1,295,670 | |

| | | | | | | | | | | | |

| | | | |

| Machinery: 2.11% | | | | | | | | | | | | |

Harsco Corporation | | | | | | | 79,550 | | | | 1,703,166 | |

IDEX Corporation | | | | | | | 18,800 | | | | 1,360,556 | |

| | | | |

| | | | | | | | | | | 3,063,722 | |

| | | | | | | | | | | | |

| | | | |

| Professional Services: 2.49% | | | | | | | | | | | | |

Korn/Ferry International † | | | | | | | 51,440 | | | | 1,280,856 | |

Resources Connection Incorporated | | | | | | | 168,000 | | | | 2,341,920 | |

| | | | |

| | | | | | | | | | | 3,622,776 | |

| | | | | | | | | | | | |

| | | | |

| Road & Rail: 2.45% | | | | | | | | | | | | |

Landstar System Incorporated | | | | | | | 49,300 | | | | 3,558,967 | |

| | | | | | | | | | | | |

| | | | |

| Trading Companies & Distributors: 1.12% | | | | | | | | | | | | |

Beacon Roofing Supply Incorporated † | | | | | | | 63,900 | | | | 1,628,172 | |

| | | | | | | | | | | | |

| | | | |

Information Technology: 13.64% | | | | | | | | | | | | |

| | | | |

| Communications Equipment: 1.03% | | | | | | | | | | | | |

Plantronics Incorporated | | | | | | | 31,248 | | | | 1,493,029 | |

| | | | | | | | | | | | |

| | | | |

| Electronic Equipment, Instruments & Components: 1.62% | | | | | | | | | | | | |

Jabil Circuit Incorporated | | | | | | | 116,850 | | | | 2,356,865 | |

| | | | | | | | | | | | |

| | | | |

| IT Services: 5.96% | | | | | | | | | | | | |

CoreLogic Incorporated † | | | | | | | 108,510 | | | | 2,937,366 | |

EVERTEC Incorporated | | | | | | | 131,513 | | | | 2,938,000 | |

VeriFone Systems Incorporated † | | | | | | | 81,250 | | | | 2,793,375 | |

| | | | |

| | | | | | | | | | | 8,668,741 | |

| | | | | | | | | | | | |

| | | | |

| Software: 3.62% | | | | | | | | | | | | |

Fair Isaac Corporation | | | | | | | 42,100 | | | | 2,319,710 | |

Informatica Corporation † | | | | | | | 85,800 | | | | 2,937,792 | |

| | | | |

| | | | | | | | | | | 5,257,502 | |

| | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 1.41% | | | | | | | | | | | | |

Avid Technology Incorporated † | | | | | | | 203,000 | | | | 2,050,300 | |

| | | | | | | | | | | | |

| | | | |

Materials: 3.83% | | | | | | | | | | | | |

| | | | |

| Containers & Packaging: 3.83% | | | | | | | | | | | | |

Berry Plastics Group Incorporated † | | | | | | | 99,300 | | | | 2,506,332 | |

Silgan Holdings Incorporated | | | | | | | 65,300 | | | | 3,069,100 | |

| | | | |

| | | | | | | | | | | 5,575,432 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | Portfolio of investments—September 30, 2014 (unaudited) |

| | | | | | | | | | | | | | |

| Security name | | | | | | | Shares | | | Value | |

| | | | | | | | | | | | | | |

| | | | |

Utilities: 1.25% | | | | | | | | | | | | | | |

| | | | |

| Electric Utilities: 1.25% | | | | | | | | | | | | | | |

Westar Energy Incorporated | | | | | | | | | 53,250 | | | $ | 1,816,886 | |

| | | | | | | | | | | | | | |

| | | | |

Total Common Stocks (Cost $131,722,822) | | | | | | | | | | | | | 143,375,099 | |

| | | | | | | | | | | | | | |

| | | Yield | | | | | | | | | |

| | | | |

Short-Term Investments: 3.81% | | | | | | | | | | | | | | |

| | | | |

| Investment Companies: 3.81% | | | | | | | | | | | | | | |

Wells Fargo Advantage Cash Investment Money Market Fund, Select Class (l)(u) | | | 0.07 | % | | | | | 1,872,065 | | | | 1,872,065 | |

Wells Fargo Securities Lending Cash Investments, LLC (l)(r)(u) | | | 0.11 | | | | | | 3,665,075 | | | | 3,665,075 | |

| | | | |

Total Short-Term Investments (Cost $5,537,140) | | | | | | | | | | | | | 5,537,140 | |

| | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities | | | | | | | | |

| (Cost $137,259,962) * | | | 102.45 | % | | | 148,912,239 | |

Other assets and liabilities, net | | | (2.45 | ) | | | (3,567,809 | ) |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 145,344,430 | |

| | | | | | | | |

| † | Non-income-earning security |

| « | All or a portion of this security is on loan. |

| (l) | The security represents an affiliate of the Fund as defined in the Investment Company Act of 1940. |

| (u) | The rate represents the 7-day annualized yield at period end. |

| (r) | The investment is a non-registered investment vehicle purchased with cash collateral received from securities on loan. |

| * | Cost for federal income tax purposes is $137,526,780 and unrealized gains (losses) consists of: |

| | | | |

Gross unrealized gains | | $ | 18,563,981 | |

Gross unrealized losses | | | (7,178,522 | ) |

| | | | |

Net unrealized gains | | $ | 11,385,459 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of assets and liabilities—September 30, 2014 (unaudited) | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | | 11 | |

| | | | |

| | | | |

| |

Assets | | | | |

Investments | | | | |

In unaffiliated securities (including $3,580,866 of securities loaned), at value (cost $131,722,822) | | $ | 143,375,099 | |

In affiliated securities, at value (cost $5,537,140) | | | 5,537,140 | |

| | | | |

Total investments, at value (cost $137,259,962) | | | 148,912,239 | |

Receivable for investments sold | | | 1,697,305 | |

Receivable for Fund shares sold | | | 6,844 | |

Receivable for dividends | | | 171,371 | |

Receivable for securities lending income | | | 897 | |

Prepaid expenses and other assets | | | 15,366 | |

| | | | |

Total assets | | | 150,804,022 | |

| | | | |

| |

Liabilities | | | | |

Payable for investments purchased | | | 1,552,703 | |

Payable for Fund shares redeemed | | | 74,585 | |

Payable upon receipt of securities loaned | | | 3,665,075 | |

Advisory fee payable | | | 95,527 | |

Distribution fees payable | | | 232 | |

Administration fees payable | | | 28,537 | |

Accrued expenses and other liabilities | | | 42,933 | |

| | | | |

Total liabilities | | | 5,459,592 | |

| | | | |

Total net assets | | $ | 145,344,430 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 194,387,809 | |

Undistributed net investment income | | | 371,194 | |

Accumulated net realized losses on investments | | | (61,066,850 | ) |

Net unrealized gains on investments | | | 11,652,277 | |

| | | | |

Total net assets | | $ | 145,344,430 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE PER SHARE | | | | |

Net assets – Class A | | $ | 709,274 | |

Shares outstanding – Class A1 | | | 30,754 | |

Net asset value per share – Class A | | | $23.06 | |

Maximum offering price per share – Class A2 | | | $24.47 | |

Net assets – Class C | | $ | 262,372 | |

Shares outstanding – Class C1 | | | 12,021 | |

Net asset value per share – Class C | | | $21.83 | |

Net assets – Administrator Class | | $ | 9,751,482 | |

Shares outstanding – Administrator Class1 | | | 415,852 | |

Net asset value per share – Administrator Class | | | $23.45 | |

Net assets – Institutional Class | | $ | 77,069,069 | |

Shares outstanding – Institutional Class1 | | | 3,242,972 | |

Net asset value per share – Institutional Class | | | $23.76 | |

Net assets – Investor Class | | $ | 57,552,233 | |

Shares outstanding – Investor Class1 | | | 2,520,702 | |

Net asset value per share – Investor Class | | | $22.83 | |

| 1. | The Fund has an unlimited number of authorized shares. |

| 2. | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | Statement of operations—six months ended September 30, 2014 (unaudited) |

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends (net of foreign withholding taxes of $3,942) | | $ | 1,108,852 | |

Securities lending income, net | | | 6,028 | |

Income from affiliated securities | | | 1,602 | |

| | | | |

Total investment income | | | 1,116,482 | |

| | | | |

| |

Expenses | | | | |

Advisory fee | | | 610,943 | |

Administration fees | | | | |

Fund level | | | 38,184 | |

Class A | | | 1,112 | |

Class C | | | 519 | |

Administrator Class | | | 5,178 | |

Institutional Class | | | 31,970 | |

Investor Class | | | 97,919 | |

Shareholder servicing fees | | | | |

Class A | | | 1,069 | |

Class C | | | 499 | |

Administrator Class | | | 12,946 | |

Investor Class | | | 76,498 | |

Distribution fees | | | | |

Class C | | | 1,498 | |

Custody and accounting fees | | | 8,782 | |

Professional fees | | | 21,233 | |

Registration fees | | | 11,826 | |

Shareholder report expenses | | | 20,452 | |

Trustees’ fees and expenses | | | 5,885 | |

Other fees and expenses | | | 3,422 | |

| | | | |

Total expenses | | | 949,935 | |

Less: Fee waivers and/or expense reimbursements | | | (31,134 | ) |

| | | | |

Net expenses | | | 918,801 | |

| | | | |

Net investment income | | | 197,681 | |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

Net realized gains on investments | | | 10,114,803 | |

Net change in unrealized gains (losses) on investments | | | (13,087,278 | ) |

| | | | |

Net realized and unrealized gains (losses) on investments | | | (2,972,475 | ) |

| | | | |

Net decrease in net assets resulting from operations | | $ | (2,774,794 | ) |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of changes in net assets | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | | 13 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended September 30, 2014

(unaudited) | | | Year ended

March 31, 20141 | | | Year ended

October 31, 2013 | |

| | | | | | |

Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | | $ | 197,681 | | | | | | | $ | 261,684 | | | | | | | $ | 271,746 | |

Net realized gains on investments | | | | | | | 10,114,803 | | | | | | | | 3,201,803 | | | | | | | | 15,318,277 | |

Net change in unrealized gains (losses) on investments | | | | | | | (13,087,278 | ) | | | | | | | 5,627,885 | | | | | | | | 10,493,223 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | | | | | (2,774,794 | ) | | | | | | | 9,091,372 | | | | | | | | 26,083,246 | |

| | | | |

| | | | | | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | | | | | | | | | |

Administrator Class | | | | | | | 0 | | | | | | | | (2,091 | ) | | | | | | | 0 | |

Institutional Class | | | | | | | 0 | | | | | | | | (115,243 | ) | | | | | | | 0 | |

| | | | |

Total distributions to shareholders | | | | | | | 0 | | | | | | | | (117,334 | ) | | | | | | | 0 | |

| | | | |

| | | | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | 3,719 | | | | 88,121 | | | | 3,664 | | | | 82,865 | | | | 32,482 | | | | 619,008 | |

Class C | | | 1,479 | | | | 33,536 | | | | 1,360 | | | | 29,564 | | | | 15,685 | | | | 299,291 | |

Administrator Class | | | 11,221 | | | | 270,398 | | | | 22,226 | | | | 511,210 | | | | 309,532 | | | | 5,936,505 | |

Institutional Class | | | 57,865 | | | | 1,424,246 | | | | 211,621 | | | | 4,945,124 | | | | 3,394,484 | | | | 72,965,758 | |

Investor Class | | | 58,460 | | | | 1,379,662 | | | | 82,795 | | | | 1,865,197 | | | | 788,890 | | | | 14,982,958 | |

| | | | |

| | | | | | | 3,195,963 | | | | | | | | 7,433,960 | | | | | | | | 94,803,520 | |

| | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | | | | | | | | | |

Administrator Class | | | 0 | | | | 0 | | | | 36 | | | | 802 | | | | 0 | | | | 0 | |

Institutional Class | | | 0 | | | | 0 | | | | 4,460 | | | | 102,144 | | | | 0 | | | | 0 | |

| | | | |

| | | | | | | 0 | | | | | | | | 102,946 | | | | | | | | 0 | |

| | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | (11,574 | ) | | | (277,257 | ) | | | (8,673 | ) | | | (191,642 | ) | | | (11,243 | ) | | | (231,447 | ) |

Class C | | | (8,639 | ) | | | (192,330 | ) | | | (1,957 | ) | | | (41,683 | ) | | | (1,737 | ) | | | (33,644 | ) |

Administrator Class | | | (34,654 | ) | | | (835,916 | ) | | | (80,157 | ) | | | (1,860,405 | ) | | | (233,269 | ) | | | (4,566,109 | ) |

Institutional Class | | | (92,953 | ) | | | (2,270,012 | ) | | | (95,359 | ) | | | (2,220,641 | ) | | | (2,692,015 | ) | | | (45,602,942 | ) |

Investor Class | | | (220,561 | ) | | | (5,153,943 | ) | | | (192,968 | ) | | | (4,346,409 | ) | | | (966,481 | ) | | | (18,948,279 | ) |

| | | | |

| | | | | | | (8,729,458 | ) | | | | | | | (8,660,780 | ) | | | | | | | (69,382,421 | ) |

| | | | |

Net increase (decrease) in net assets resulting from capital share transactions | | | | | | | (5,533,495 | ) | | | | | | | (1,123,874 | ) | | | | | | | 25,421,099 | |

| | | | |

Total increase (decrease) in net assets | | | | | | | (8,308,289 | ) | | | | | | | 7,850,164 | | | | | | | | 51,504,345 | |

| | | | |

| | | | | | |

Net assets | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 153,652,719 | | | | | | | | 145,802,555 | | | | | | | | 94,298,210 | |

| | | | |

End of period | | | | | | $ | 145,344,430 | | | | | | | $ | 153,652,719 | | | | | | | $ | 145,802,555 | |

| | | | |

Undistributed net investment income | | | | | | $ | 371,194 | | | | | | | $ | 173,513 | | | | | | | $ | 117,292 | |

| | | | |

| 1. | For the five months ended March 31, 2014. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2014. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended September 30, 2014 (unaudited) | | | Year ended March 31, 20141 | | | Year ended October 31 | |

| CLASS A | | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of period | | $ | 23.53 | | | $ | 22.16 | | | $ | 15.96 | | | $ | 14.06 | | | $ | 13.81 | | | $ | 11.52 | | | $ | 11.08 | |

Net investment income (loss) | | | 0.01 | | | | 0.02 | | | | 0.03 | | | | (0.06 | )2 | | | (0.06 | )2 | | | (0.06 | ) | | | (0.02 | )2 |

Net realized and unrealized gains (losses) on investments | | | (0.48 | ) | | | 1.35 | | | | 6.17 | | | | 1.96 | | | | 0.31 | | | | 2.35 | | | | 0.47 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.47 | ) | | | 1.37 | | | | 6.20 | | | | 1.90 | | | | 0.25 | | | | 2.29 | | | | 0.45 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tax basis return of capital | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.01 | ) |

Net asset value, end of period | | $ | 23.06 | | | $ | 23.53 | | | $ | 22.16 | | | $ | 15.96 | | | $ | 14.06 | | | $ | 13.81 | | | $ | 11.52 | |

Total return3 | | | (2.00 | )% | | | 6.33 | % | | | 38.66 | % | | | 13.51 | % | | | 1.81 | % | | | 19.88 | % | | | 4.09 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.45 | % | | | 1.57 | % | | | 1.56 | % | | | 1.48 | % | | | 1.44 | % | | | 1.54 | % | | | 1.57 | % |

Net expenses | | | 1.40 | % | | | 1.44 | % | | | 1.45 | % | | | 1.45 | % | | | 1.42 | % | | | 1.45 | % | | | 1.45 | % |

Net investment income (loss) | | | 0.04 | % | | | 0.19 | % | | | 0.11 | % | | | (0.38 | )% | | | (0.41 | )% | | | (0.49 | )% | | | (0.17 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 26 | % | | | 22 | % | | | 75 | % | | | 33 | % | | | 54 | % | | | 147 | % | | | 64 | % |

Net assets, end of period (000s omitted) | | | $709 | | | | $908 | | | | $967 | | | | $357 | | | | $189 | | | | $354 | | | | $290 | |

| 1. | For the five months ended March 31, 2014. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2014. |

| 2. | Calculated based upon average shares outstanding |

| 3. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | | 15 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended September 30, 2014 (unaudited) | | | Year ended March 31, 20141 | | | Year ended October 31 | |

| CLASS C | | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of period | | $ | 22.35 | | | $ | 21.12 | | | $ | 15.32 | | | $ | 13.60 | | | $ | 13.45 | | | $ | 11.31 | | | $ | 10.95 | |

Net investment loss | | | (0.08 | )2 | | | (0.05 | ) | | | (0.13 | )2 | | | (0.16 | )2 | | | (0.17 | )2 | | | (0.18 | ) | | | (0.09 | )2 |

Net realized and unrealized gains (losses) on investments | | | (0.44 | ) | | | 1.28 | | | | 5.93 | | | | 1.88 | | | | 0.32 | | | | 2.32 | | | | 0.45 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.52 | ) | | | 1.23 | | | | 5.80 | | | | 1.72 | | | | 0.15 | | | | 2.14 | | | | 0.36 | |

Net asset value, end of period | | $ | 21.83 | | | $ | 22.35 | | | $ | 21.12 | | | $ | 15.32 | | | $ | 13.60 | | | $ | 13.45 | | | $ | 11.31 | |

Total return3 | | | (2.33 | )% | | | 6.02 | % | | | 37.60 | % | | | 12.65 | % | | | 1.12 | % | | | 18.92 | % | | | 3.29 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 2.20 | % | | | 2.33 | % | | | 2.30 | % | | | 2.22 | % | | | 2.19 | % | | | 2.30 | % | | | 2.31 | % |

Net expenses | | | 2.15 | % | | | 2.19 | % | | | 2.20 | % | | | 2.20 | % | | | 2.17 | % | | | 2.20 | % | | | 2.20 | % |

Net investment loss | | | (0.70 | )% | | | (0.54 | )% | | | (0.66 | )% | | | (1.12 | )% | | | (1.19 | )% | | | (1.24 | )% | | | (0.90 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 26 | % | | | 22 | % | | | 75 | % | | | 33 | % | | | 54 | % | | | 147 | % | | | 64 | % |

Net assets, end of period (000s omitted) | | | $262 | | | | $429 | | | | $418 | | | | $89 | | | | $108 | | | | $142 | | | | $132 | |

| 1. | For the five months ended March 31, 2014. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2014. |

| 2. | Calculated based upon average shares outstanding |

| 3. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended September 30, 2014 (unaudited) | | | Year ended March 31, 20141 | | | Year ended October 31 | |

| ADMINISTRATOR CLASS | | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of period | | $ | 23.90 | | | $ | 22.49 | | | $ | 16.16 | | | $ | 14.20 | | | $ | 13.91 | | | $ | 11.58 | | | $ | 11.10 | |

Net investment income (loss) | | | 0.03 | 2 | | | 0.04 | 2 | | | 0.09 | | | | (0.02 | )2 | | | (0.05 | )2 | | | (0.02 | ) | | | 0.02 | 2 |

Net realized and unrealized gains (losses) on investments | | | (0.48 | ) | | | 1.37 | | | | 6.24 | | | | 1.98 | | | | 0.34 | | | | 2.35 | | | | 0.46 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.45 | ) | | | 1.41 | | | | 6.33 | | | | 1.96 | | | | 0.29 | | | | 2.33 | | | | 0.48 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | (0.00 | )3 | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Net asset value, end of period | | $ | 23.45 | | | $ | 23.90 | | | $ | 22.49 | | | $ | 16.16 | | | $ | 14.20 | | | $ | 13.91 | | | $ | 11.58 | |

Total return4 | | | (1.88 | )% | | | 6.43 | % | | | 38.99 | % | | | 13.80 | % | | | 2.08 | % | | | 20.12 | % | | | 4.32 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.29 | % | | | 1.42 | % | | | 1.40 | % | | | 1.30 | % | | | 1.22 | % | | | 1.37 | % | | | 1.38 | % |

Net expenses | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % | | | 1.19 | % | | | 1.20 | % | | | 1.20 | % |

Net investment income (loss) | | | 0.26 | % | | | 0.45 | % | | | 0.52 | % | | | (0.12 | )% | | | (0.30 | )% | | | (0.23 | )% | | | 0.18 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 26 | % | | | 22 | % | | | 75 | % | | | 33 | % | | | 54 | % | | | 147 | % | | | 64 | % |

Net assets, end of period (000s omitted) | | | $9,751 | | | | $10,498 | | | | $11,182 | | | | $6,801 | | | | $9,722 | | | | $5,774 | | | | $5,730 | |

| 1. | For the five months ended March 31, 2014. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2014. |

| 2. | Calculated based upon average shares outstanding |

| 3. | Amount is less than $0.005. |

| 4. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | | 17 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended September 30, 2014 (unaudited) | | | Year ended March 31, 20141 | | | Year ended October 31 | |

| INSTITUTIONAL CLASS | | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of period | | $ | 24.19 | | | $ | 22.78 | | | $ | 16.32 | | | $ | 14.32 | | | $ | 14.00 | | | $ | 11.63 | | | $ | 11.15 | |

Net investment income (loss) | | | 0.06 | 2 | | | 0.06 | 2 | | | 0.12 | 2 | | | 0.01 | 2 | | | 0.00 | 2,3 | | | (0.00 | )2,3 | | | 0.04 | 2 |

Net realized and unrealized gains (losses) on investments | | | (0.49 | ) | | | 1.39 | | | | 6.34 | | | | 1.99 | | | | 0.32 | | | | 2.37 | | | | 0.47 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.43 | ) | | | 1.45 | | | | 6.46 | | | | 2.00 | | | | 0.32 | | | | 2.37 | | | | 0.51 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | (0.04 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Tax basis return of capital | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.03 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | 0.00 | | | | (0.04 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.03 | ) |

Net asset value, end of period | | $ | 23.76 | | | $ | 24.19 | | | $ | 22.78 | | | $ | 16.32 | | | $ | 14.32 | | | $ | 14.00 | | | $ | 11.63 | |

Total return4 | | | (1.74 | )% | | | 6.50 | % | | | 39.40 | % | | | 13.97 | % | | | 2.29 | % | | | 20.38 | % | | | 4.61 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.02 | % | | | 1.15 | % | | | 1.10 | % | | | 1.05 | % | | | 1.01 | % | | | 1.10 | % | | | 1.11 | % |

Net expenses | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 0.98 | % | | | 1.00 | % | | | 1.00 | % |

Net investment income (loss) | | | 0.47 | % | | | 0.64 | % | | | 0.58 | % | | | 0.07 | % | | | 0.02 | % | | | (0.03 | )% | | | 0.36 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 26 | % | | | 22 | % | | | 75 | % | | | 33 | % | | | 54 | % | | | 147 | % | | | 64 | % |

Net assets, end of period (000s omitted) | | | $77,069 | | | | $79,312 | | | | $71,934 | | | | $40,073 | | | | $41,861 | | | | $72,200 | | | | $65,014 | |

| 1. | For the five months ended March 31, 2014. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2014. |

| 2. | Calculated based upon average shares outstanding |

| 3. | Amount is less than $0.005. |

| 4. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended September 30, 2014 (unaudited) | | | Year ended

March 31, 20141 | | | Year ended October 31 | |

| INVESTOR CLASS | | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of period | | $ | 23.30 | | | $ | 21.95 | | | $ | 15.81 | | | $ | 13.94 | | | $ | 13.70 | | | $ | 11.43 | | | $ | 10.99 | |

Net investment income (loss) | | | (0.00 | )2,3 | | | 0.01 | 2 | | | 0.04 | 2 | | | (0.06 | )2 | | | (0.07 | )2 | | | (0.06 | )2 | | | (0.01 | )2 |

Net realized and unrealized gains (losses) on investments | | | (0.47 | ) | | | 1.34 | | | | 6.10 | | | | 1.93 | | | | 0.31 | | | | 2.33 | | | | 0.45 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.47 | ) | | | 1.35 | | | | 6.14 | | | | 1.87 | | | | 0.24 | | | | 2.27 | | | | 0.44 | |

Net asset value, end of period | | $ | 22.83 | | | $ | 23.30 | | | $ | 21.95 | | | $ | 15.81 | | | $ | 13.94 | | | $ | 13.70 | | | $ | 11.43 | |

Total return4 | | | (2.02 | )% | | | 6.30 | % | | | 38.56 | % | | | 13.49 | % | | | 1.75 | % | | | 19.86 | % | | | 4.00 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.51 | % | | | 1.64 | % | | | 1.62 | % | | | 1.54 | % | | | 1.50 | % | | | 1.63 | % | | | 1.67 | % |

Net expenses | | | 1.46 | % | | | 1.48 | % | | | 1.49 | % | | | 1.49 | % | | | 1.48 | % | | | 1.49 | % | | | 1.49 | % |

Net investment income (loss) | | | (0.00 | )% | | | 0.16 | % | | | 0.19 | % | | | (0.42 | )% | | | (0.48 | )% | | | (0.47 | )% | | | (0.12 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 26 | % | | | 22 | % | | | 75 | % | | | 33 | % | | | 54 | % | | | 147 | % | | | 64 | % |

Net assets, end of period (000s omitted) | | | $57,552 | | | | $62,505 | | | | $61,302 | | | | $46,977 | | | | $51,927 | | | | $79,132 | | | | $180,060 | |

| 1. | For the five months ended March 31, 2014. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2014. |

| 2. | Calculated based upon average shares outstanding |

| 3. | Amount is less than $0.005. |

| 4. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | | 19 | |

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). These financial statements report on the Wells Fargo Advantage Intrinsic Small Cap Value Fund (the “Fund”) which is a diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time).

Equity securities that are listed on a foreign or domestic exchange or market are valued at the official closing price or, if none, the last sales price. If no sale occurs on the primary exchange or market for the security that day, the prior day’s price will be deemed “stale” and fair values will be determined in accordance with the Fund’s Valuation Procedures.

Investments in registered open-end investment companies are valued at net asset value. Non-registered investment vehicles are fair valued at net asset value.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees of the Fund. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Management Valuation Team of Wells Fargo Funds Management, LLC (“Funds Management”). The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Management Valuation Team which may include items for ratification.

Valuations of fair valued securities are compared to the next actual sales price when available, or other appropriate market values, to assess the continued appropriateness of the fair valuation methodologies used. These securities are fair valued on a day-to-day basis, taking into consideration changes to appropriate market information and any significant changes to the inputs considered in the valuation process until there is a readily available price provided on an exchange or by an independent pricing service. Valuations received from an independent pricing service or independent broker-dealer quotes are periodically validated by comparisons to most recent trades and valuations provided by other independent pricing services in addition to the review of prices by the adviser and/or subadviser. Unobservable inputs used in determining fair valuations are identified based on the type of security, taking into consideration factors utilized by market participants in valuing the investment, knowledge about the issuer and the current market environment.

Security loans

The Fund may lend its securities from time to time in order to earn additional income in the form of fees or interest on securities received as collateral or the investment of any cash received as collateral. The Fund continues to receive interest or dividends on the securities loaned. The Fund receives collateral in the form of cash or securities with a value at least equal to the value of the securities on loan. The value of the loaned securities is determined at the close of each business day and any additional required collateral is delivered to the Fund on the next business day. In a securities lending transaction, the net asset value of the Fund will be affected by an increase or decrease in the value of the securities loaned and by an increase or decrease in the value of the instrument in which collateral is invested. The amount of securities lending activity undertaken by the Fund fluctuates from time to time. In the event of default or bankruptcy by the borrower, the Fund may be prevented from recovering the loaned securities or gaining access to the collateral or may experience delays or costs in doing so. In addition, the investment of any cash collateral received may lose all or part of its value. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

| | | | |

| 20 | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | Notes to financial statements (unaudited) |

The Fund lends its securities through an unaffiliated securities lending agent. Cash collateral received in connection with its securities lending transactions is invested in Wells Fargo Securities Lending Cash Investments, LLC (the “Securities Lending Fund”). The Securities Lending Fund is exempt from registration under Section 3(c)(7) of the 1940 Act and is managed by Funds Management and is subadvised by Wells Capital Management Incorporated (“WellsCap”). Funds Management receives an advisory fee starting at 0.05% and declining to 0.01% as the average daily net assets of the Securities Lending Fund increase. All of the fees received by Funds Management are paid to WellsCap for its services as subadviser. The Securities Lending Fund seeks to provide a positive return compared to the daily Fed Funds Open rate by investing in high-quality, U.S. dollar-denominated short-term money market instruments. Securities Lending Fund investments are fair valued based upon the amortized cost valuation technique. Income earned from investment in the Securities Lending Fund is included in securities lending income on the Statement of Operations.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Dividend income is recognized on the ex-dividend date. Dividend income from foreign securities is recorded net of foreign taxes withheld where recovery of such taxes is not assured.

Distributions to shareholders

Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with federal income tax regulations, which may differ in amount or character from net investment income and realized gains recognized for purposes of U.S. generally accepted accounting principles.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the Fund’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

As of March 31, 2014, the Fund had capital loss carryforwards available to offset future net realized capital gains in the amount of $70,869,788 with $63,180,078 expiring in 2017 and $7,689,710 expiring in 2018.

Class allocations

The separate classes of shares offered by the Fund differ principally in applicable sales charges, distribution, shareholder servicing, and administration fees. Class specific expenses are charged directly to that share class. Investment income, common expenses, and realized and unrealized gains (losses) on investments are allocated daily to each class of shares based on the relative proportion of net assets of each class.

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to significant unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| n | | Level 1 – quoted prices in active markets for identical securities |

| n | | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, use of amortized cost, etc.) |

| n | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | | 21 | |

The following is a summary of the inputs used in valuing the Fund’s assets and liabilities as of September 30, 2014:

| | | | | | | | | | | | | | | | |

| | | Quoted prices

(Level 1) | | | Other significant

observable inputs

(Level 2) | | | Significant

unobservable inputs

(Level 3) | | | Total | |

Assets | | | | | | | | | | | | | | | | |

Investments in : | | | | | | | | | | | | | | | | |

| | | | |

Common stocks | | | | | | | | | | | | | | | | |

Consumer discretionary | | $ | 25,446,177 | | | $ | 0 | | | $ | 0 | | | $ | 25,446,177 | |

Consumer staples | | | 11,202,618 | | | | 0 | | | | 0 | | | | 11,202,618 | |

Energy | | | 7,776,741 | | | | 0 | | | | 0 | | | | 7,776,741 | |

Financials | | | 29,721,491 | | | | 0 | | | | 0 | | | | 29,721,491 | |

Health care | | | 12,689,370 | | | | 0 | | | | 0 | | | | 12,689,370 | |

Industrials | | | 29,319,947 | | | | 0 | | | | 0 | | | | 29,319,947 | |

Information technology | | | 19,826,437 | | | | 0 | | | | 0 | | | | 19,826,437 | |

Materials | | | 5,575,432 | | | | 0 | | | | 0 | | | | 5,575,432 | |

Utilities | | | 1,816,886 | | | | 0 | | | | 0 | | | | 1,816,886 | |

| | | | |

Short-term investments | | | | | | | | | | | | | | | | |

Investment companies | | | 1,872,065 | | | | 3,665,075 | | | | 0 | | | | 5,537,140 | |

Total assets | | $ | 145,247,164 | | | $ | 3,665,075 | | | $ | 0 | | | $ | 148,912,239 | |

Transfers in and transfers out are recognized at the end of the reporting period. At September 31, 2014, the Fund did not have any transfers into/out of Level 1, Level 2, or Level 3.

4. TRANSACTIONS WITH AFFILIATES

Advisory fee

The Trust has entered into an advisory contract with Funds Management, an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”). The adviser is responsible for implementing investment policies and guidelines and for supervising the subadviser, who is responsible for day-to-day portfolio management of the Fund.

Pursuant to the contract, Funds Management is entitled to receive an annual advisory fee starting at 0.80% and declining to 0.68% as the average daily net assets of the Fund increase. For the six months ended September 30, 2014, the advisory fee was equivalent to an annual rate of 0.80% of the Fund’s average daily net assets.

Funds Management has retained the services of a subadviser to provide daily portfolio management to the Fund. The fee for subadvisory services is borne by Funds Management. Metropolitan West Capital Management, LLC, an affiliate of Funds Management and an indirect wholly owned subsidiary of Wells Fargo, is the subadviser to the Fund and is entitled to receive a fee from Funds Management at an annual rate starting at 0.55% and declining to 0.40% as the average daily net assets of the Fund increase.

Administration fees

The Trust has entered into an administration agreement with Funds Management. Under this agreement, for providing administrative services, which includes paying fees and expenses for services provided by the transfer agent, sub-transfer agents, omnibus account servicers and record-keepers, Funds Management is entitled to receive from the Fund an annual fund level administration fee starting at 0.05% and declining to 0.03% as the average daily net assets of the Fund increase and a class level administration fee which is calculated based on the average daily net assets of each class as follows:

| | | | |

| | | Class level

administration fee | |

Class A, Class C | | | 0.26 | % |

Administrator Class | | | 0.10 | |

Institutional Class | | | 0.08 | |

Investor Class | | | 0.32 | |

| | | | |

| 22 | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | Notes to financial statements (unaudited) |

Funds Management has contractually waived and/or reimbursed advisory and administration fees to the extent necessary to maintain certain net operating expense ratios for the Fund. Waiver of fees and/or reimbursement of expenses by Funds Management were made first from fund level expenses on a proportionate basis and then from class specific expenses. Funds Management has committed through July 31, 2015 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s expenses at 1.40% for Class A shares, 2.15% for Class C shares, 1.20% for Administrator Class shares, 1.00% for Institutional Class shares, and 1.46% for Investor Class shares. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

Distribution fees

The Trust has adopted a Distribution Plan for Class C shares of the Fund pursuant to Rule 12b-1 under the 1940 Act. Distribution fees are charged to Class C shares and paid to Wells Fargo Funds Distributor, LLC (“Funds Distributor”), the principal underwriter, at an annual rate of 0.75% of the average daily net assets of Class C shares.

In addition, Funds Distributor is entitled to receive the front-end sales charge from the purchase of Class A shares and a contingent deferred sales charge on the redemption of certain shares. Funds Distributor is also entitled to receive the contingent deferred sales charges from redemptions of Class B and Class C shares. For the six months ended September 30, 2014, Funds Distributor received $379 from the sale of Class A shares.

Shareholder servicing fees

The Trust has entered into contracts with one or more shareholder servicing agents, whereby Class A, Class C, Administrator Class, and Investor Class of the Fund is charged a fee at an annual rate of 0.25% of the average daily net assets of each respective class.

A portion of these total shareholder servicing fees were paid to affiliates of Wells Fargo.

5. INVESTMENT PORTFOLIO TRANSACTIONS

Purchases and sales of investments, excluding U.S. government obligations (if any) and short-term securities, for the six months ended September 30, 2014 were $40,661,849 and $38,374,688, respectively.

6. BANK BORROWINGS

The Trust (excluding the money market funds and certain other funds in the Trust) and Wells Fargo Variable Trust are parties to a $150,000,000 revolving credit agreement whereby the Fund is permitted to use bank borrowings for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest under the credit agreement is charged to the Fund based on a borrowing rate equal to the higher of the Federal Funds rate in effect on that day plus 1.25% or the overnight LIBOR rate in effect on that day plus 1.25%. In addition, an annual commitment fee equal to 0.10% of the unused balance is allocated to each participating fund. For the six months ended September 30, 2014, the Fund paid $141 in commitment fees.

For the six months ended September 30, 2014, there were no borrowings by the Fund under the agreement.

7. INDEMNIFICATION

Under the Trust’s organizational documents, the officers and Trustees are indemnified against certain liabilities that may arise out of performance of their duties to the Trust. Additionally, in the normal course of business, the Trust may enter into contracts with service providers that contain a variety of indemnification clauses. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated.

| | | | | | |

| Other information (unaudited) | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | | 23 | |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-222-8222, visiting our website at wellsfargoadvantagefunds.com, or visiting the SEC website at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Fund’s website at wellsfargoadvantagefunds.com or by visiting the SEC website at sec.gov.

PORTFOLIO HOLDINGS INFORMATION

The complete portfolio holdings for the Fund are publicly available monthly on the Fund’s website (wellsfargoadvantagefunds.com), on a one-month delayed basis. In addition, top ten holdings information (excluding derivative positions) for the Fund is publicly available on the Fund’s website on a monthly, seven-day or more delayed basis. The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q, which is available without charge by visiting the SEC website at sec.gov. In addition, the Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and at regional offices in New York City, at 233 Broadway, and in Chicago, at 175 West Jackson Boulevard, Suite 900. Information about the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| | | | |

| 24 | | Wells Fargo Advantage Intrinsic Small Cap Value Fund | | Other information (unaudited) |

BOARD OF TRUSTEES AND OFFICERS

Each of the Trustees and Officers1 listed in the table below acts in identical capacities for each fund in the Wells Fargo Advantage family of funds, which consists of 133 mutual funds comprising the Wells Fargo Funds Trust, Wells Fargo Variable Trust, Wells Fargo Master Trust and four closed-end funds (collectively the “Fund Complex”). This table should be read in conjunction with the Prospectus and the Statement of Additional Information2. The mailing address of each Trustee and Officer is 525 Market Street, 12th Floor, San Francisco, CA 94105. Each Trustee and Officer serves an indefinite term, however, each Trustee serves such term until reaching the mandatory retirement age established by the Trustees.

Independent Trustees

| | | | | | |

Name and year of birth | | Position held and length of service* | | Principal occupations during past five years or longer | | Other directorships during

past five years |

| Peter G. Gordon (Born 1942) | | Trustee, since 1998; Chairman, since 2005 | | Co-Founder, Retired Chairman, President and CEO of Crystal Geyser Water Company. Trustee Emeritus, Colby College. | | Asset Allocation Trust |

Isaiah Harris, Jr.

(Born 1952) | | Trustee, since 2009 | | Retired. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy. Mr. Harris is a certified public accountant. | | CIGNA Corporation; Asset Allocation Trust |

Judith M. Johnson

(Born 1949) | | Trustee, since 2008; Audit Committee Chairman, since 2008 | | Retired. Prior thereto, Chief Executive Officer and Chief Investment Officer of Minneapolis Employees Retirement Fund from 1996 to 2008. Ms. Johnson is an attorney, certified public accountant and a certified managerial accountant. | | Asset Allocation Trust |

Leroy Keith, Jr.

(Born 1939) | | Trustee, since 2010 | | Chairman, Bloc Global Services (development and construction). Trustee of the Evergreen Funds complex (and its predecessors) from 1983 to 2010. Former Managing Director, Almanac Capital Management (commodities firm), former Partner, Stonington Partners, Inc. (private equity fund), former Director, Obagi Medical Products Co. and former Director, Lincoln Educational Services. | | Trustee, Virtus Fund Complex (consisting of 50 portfolios as of 12/16/2013); Asset Allocation Trust |

David F. Larcker