UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: Registrant is making a filing for 2 of its series.

Wells Fargo Advantage Absolute Return Fund and Wells Fargo Advantage Asset Allocation Fund. Each series has an April 30 fiscal year end.

Date of reporting period: October 31, 2014

| ITEM 1. | REPORT TO STOCKHOLDERS |

Wells Fargo Advantage Absolute Return Fund

Semi-Annual Report

October 31, 2014

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of October 31, 2014, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Advantage Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements; the views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Advantage Absolute Return Fund | | Letter to shareholders (unaudited) |

Karla M. Rabusch

President

Wells Fargo Advantage Funds

Major central banks continued to inject liquidity into global banks and markets through various accommodative monetary policies, including quantitative easing.

Dear Valued Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo Advantage Absolute Return Fund for the six-month period that ended October 31, 2014. The period was marked by continued accommodative monetary policy in developed countries, broader economic growth, low inflation, and equity market gains.

Within equities, U.S. stocks (measured by the S&P 500 Index1) returned 7.12% over the past six months and developed-country international shares (measured by the MSCI EAFE Index (Net)2) declined 4.83%. The U.S. was the fastest-growing developed country, which benefited U.S. companies. In addition, a strong U.S. dollar held back the returns of non-U.S. investments in dollar terms. Most bond sectors gained modestly amid renewed confidence in economic growth that drove outperformance in credit-sensitive sectors as solid economic growth boosted company revenue and profits and kept default rates low. The Barclays U.S. Aggregate Bond Index3 returned 2.35% during the period. Short-term interest rates remained ultralow.

Major central banks continued to provide stimulus.

Major central banks continued to inject liquidity into global banks and markets through various accommodative monetary policies, including quantitative easing. In the U.S., the U.S. Federal Reserve (Fed) kept its key interest rate near zero in order to support the economy and the financial system. It tapered the size of its quantitative easing program each month until the program ended in October 2014 and discussed changes to its forward guidance as it begins to normalize monetary policy. Meanwhile, European markets continued to benefit from the European Central Bank’s (ECB’s) willingness to maintain low interest rates. In September 2014, the ECB cut its key rate to a historic low of 0.05%. In addition to its targeted longer-term refinancing operations that are designed to increase bank lending, the ECB released details of its asset-backed securities purchase program and the new covered bond purchase program, which are scheduled to begin in the fourth quarter of 2014. In Japan, the Bank of Japan maintained an aggressive monetary program aimed at combating deflation.

Economic growth was sluggish outside the U.S.

In the U.S., economic activity continued to expand. The unemployment rate ticked lower to 5.8% as of October 2014. More than 200,000 jobs were added to payrolls each month between February 2014 and October 2014. On the inflation front, the personal consumption expenditures price index rose from a deflationary danger zone toward the Fed’s longer-run objective of a 2% pace.

Elsewhere, economic data continued to show sluggish growth. The European Union’s gross domestic product was unchanged in the second quarter of 2014 and was up only 0.7% from a year earlier. The region’s unemployment rate remained high at 11.5% in September 2014. In Japan, its economy faltered in

| 1. | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2. | The Morgan Stanley Capital International Europe, Australasia, and Far East (MSCI EAFE) Index (Net) is an unmanaged group of securities widely regarded by investors to be representations of the stock markets of Europe, Australasia, and the Far East. Calculations for EAFE use net dividends, which reflect the deduction of withholding taxes. You cannot invest directly in an index. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. |

| 3. | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. You cannot invest directly in an index. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Advantage Absolute Return Fund | | | 3 | |

reaction to a sales tax increase despite Prime Minister Abe’s economic plans to promote growth.

While yields have been at historically low levels, there is a risk of rising rates and negative bond returns. However, fixed-income markets appear to have functioned well over the past year with sufficient liquidity and muted volatility.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Advantage Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Advantage Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs. For current information about your fund investments, contact your investment professional, visit our website at wellsfargoadvantagefunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Advantage Funds

Periods of uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future.

| | | | |

| 4 | | Wells Fargo Advantage Absolute Return Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks a positive total return.

Adviser

Wells Fargo Funds Management, LLC

Portfolio managers

Ben Inker, CFA1

Sam Wilderman, CFA1

Average annual total returns2 (%) as of October 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (WARAX) | | 3-1-2012 | | | (4.06 | ) | | | 4.56 | | | | 6.68 | | | | 1.75 | | | | 5.80 | | | | 7.31 | | | | 1.57 | | | | 1.57 | |

| Class C (WARCX) | | 3-1-2012 | | | 0.03 | | | | 5.01 | | | | 6.51 | | | | 1.03 | | | | 5.01 | | | | 6.51 | | | | 2.32 | | | | 2.32 | |

| Class R6 (WARRX) | | 10-31-2014 | | | – | | | | – | | | | – | | | | 2.21 | | | | 6.09 | | | | 7.54 | | | | 1.09 | | | | 1.09 | |

| Administrator Class (WARDX) | | 3-1-2012 | | | – | | | | – | | | | – | | | | 1.94 | | | | 5.99 | | | | 7.49 | | | | 1.41 | | | | 1.41 | |

| Institutional Class (WABIX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 2.21 | | | | 6.09 | | | | 7.54 | | | | 1.14 | | | | 1.14 | |

| MSCI World Index (Net)5 | | – | | | – | | | | – | | | | – | | | | 8.67 | | | | 11.41 | | | | 6.93 | | | | – | | | | – | |

| Barclays U.S. TIPS 1-10 Year Index6 | | – | | | – | | | | – | | | | – | | | | 0.60 | | | | 3.21 | | | | 3.96 | | | | – | | | | – | |

| Consumer Price Index7 | | – | | | – | | | | – | | | | – | | | | 1.66 | | | | 1.89 | | | | 2.21 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R6, Administrator Class, and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Absolute return funds are not intended to outperform stocks and bonds in strong markets, and there is no guarantee of positive returns or that the fund’s objectives will be achieved. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. In general, when interest rates rise, bond values fall and investors may lose principal value. Alternative investments such as, commodities and merger arbitrage strategies are speculative and entail a high degree of risk. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. The fund will indirectly be exposed to all of the risks of an investment in the underlying funds and will indirectly bear expenses of the underlying funds. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This fund is exposed to high-yield risk, mortgage- and asset-backed securities risk, and smaller-company securities risk. Consult the fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 6.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Absolute Return Fund | | | 5 | |

|

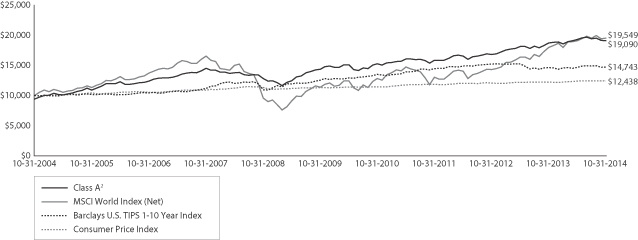

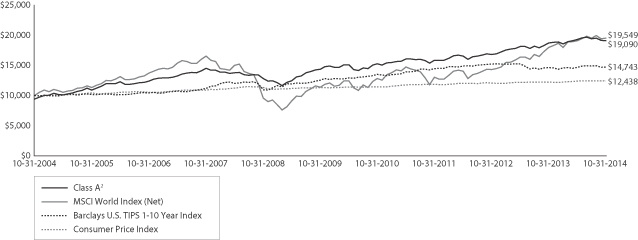

| Growth of $10,000 investment8 as of October 31, 2014 |

|

|

Please see footnotes on page 6.

| | | | |

| 6 | | Wells Fargo Advantage Absolute Return Fund | | Performance highlights (unaudited) |

| | | | |

| Ten largest holdings9 (%) as of October 31, 2014 | |

GMO Alpha Only Fund, Class IV | | | 9.65 | |

U.S. Treasury Inflation Indexed Bonds, 1.88%, 07/15/2015 | | | 7.27 | |

GMO Systematic Global Macro Opportunity Fund, Class III | | | 4.97 | |

GMO Debt Opportunities Fund, Class VI | | | 4.25 | |

GMO Emerging Country Debt Fund, Class IV | | | 3.47 | |

Amazon.com Incorporation | | | 2.72 | |

GMO Special Opportunities Fund, Class VI | | | 2.05 | |

Philip Morris International Incorporation | | | 2.03 | |

Covidien plc | | | 1.94 | |

Express Scripts Holding Company | | | 1.59 | |

|

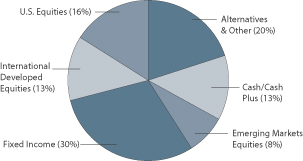

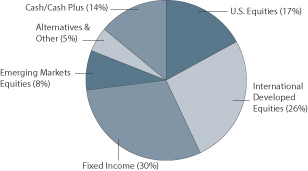

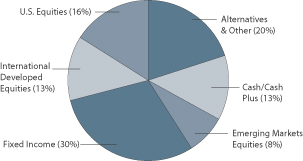

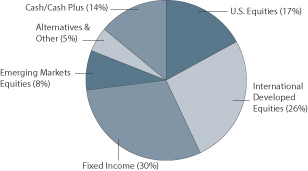

| Portfolio allocation10 as of October 31, 2014 |

|

|

| 1. | The Fund invests substantially all of its investable assets directly in GMO Benchmark-Free Allocation Fund, an investment company advised by Grantham, Mayo, Van Otterloo & Co. LLC (GMO). Mr. Inker and Mr.Wilderman, co-heads and senior members of GMO’s Asset Allocation Team, have been primarily responsible for coordinating the portfolio management of GMO Benchmark-Free Allocation Fund since 2003 and 2012, respectively. |

| 2. | Historical performance shown for Class A, Class C, and Administrator Class prior to their inception is based on the performance of Class III shares of GMO Benchmark-Free Allocation Fund (GBMFX), in which the Fund invests all of its investable assets. The inception date of GMO Benchmark-Free Allocation Fund Class III shares is July 23, 2003. Returns for the Class III shares do not reflect GMO Benchmark-Free Allocation Fund’s current fee arrangement and have been adjusted downward to reflect the higher expense ratios applicable to Class A, Class C, and Administrator Class at their inception. These ratios were 1.66% for Class A, 2.41% for Class C, and 1.50% for Administrator Class. Historical performance shown for Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns would be higher. Historical performance shown for Institutional Class prior to its inception reflects the performance of the Administrator Class, and is not adjusted to reflect Institutional Class expenses. If these expenses had been included, returns for Institutional Class would be higher. |

| 3. | Reflects the expense ratios as stated in the most recent prospectuses, which includes the expenses of GMO Benchmark-Free Allocation Fund and other acquired fund fees and expenses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report, which do not include the expenses of GMO Benchmark-Free Allocation Fund and other acquired fund fees and expenses. |

| 4. | The Adviser has committed through August 31, 2015, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses at 0.76% for Class A, 1.51% for Class C, 0.28% for Class R6, 0.57% for Administrator Class, and 0.33% for Institutional Class. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (including the expenses of GMO Benchmark-Free Allocation Fund), and extraordinary expenses are excluded from the cap. Without these caps, the Fund’s returns would have been lower. |

| 5. | The Morgan Stanley Capital International World Index (Net) (“MSCI World Index (Net)”) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. You cannot invest directly in an index. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. |

| 6. | The Barclays U.S. TIPS 1-10 Year Index is an independently maintained and widely published index comprised of inflation-protected securities issued by the U.S. Treasury having a maturity of 1-10 years. You cannot invest directly in an index. |

| 7. | The Consumer Price Index for All Urban Consumers in U.S. All Items (Consumer Price Index) is published monthly by the U.S. government as an indicator of changes in price levels (or inflation) paid by urban consumers for a representative basket of goods and services. You cannot invest directly in an index. |

| 8. | The chart compares the performance of Class A shares for the most recent ten years with the performance of the MSCI World Index (Net), Consumer Price Index, and Barclays U.S. TIPS 1-10 Year Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

| 9. | The ten largest holdings are calculated based on the value of the securities in the GMO Benchmark-Free Allocation Fund allocable to the Fund divided by the total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 10. | Portfolio allocation is subject to change and represents the portfolio allocation of the GMO Benchmark-Free Allocation Fund, which is calculated based on the investment exposures of the underlying GMO funds and holdings of GMO Benchmark-Free Allocation Fund. |

| | | | | | |

| Fund expenses (unaudited) | | Wells Fargo Advantage Absolute Return Fund | | | 7 | |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, redemption fees (if any) and exchange fees (if any), and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from May 1, 2014 to October 31, 2014.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

05-01-2014 | | | Ending

account value

10-31-2014 | | | Expenses

paid during

the period1 | | | Net annualized

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 987.71 | | | $ | 3.56 | | | | 0.71 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.63 | | | $ | 3.62 | | | | 0.71 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 984.03 | | | $ | 7.30 | | | | 1.46 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.85 | | | $ | 7.43 | | | | 1.46 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1.41 | | | | 0.28 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.79 | | | $ | 1.43 | | | | 0.28 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 988.62 | | | $ | 2.76 | | | | 0.55 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.43 | | | $ | 2.80 | | | | 0.55 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 989.51 | | | $ | 1.40 | | | | 0.28 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.79 | | | $ | 1.43 | | | | 0.28 | % |

Please see footnotes on page 8.

| | | | |

| 8 | | Wells Fargo Advantage Absolute Return Fund | | Fund expenses (unaudited) |

| | | | | | | | | | | | | | | | |

Expenses including GMO Benchmark-Free Allocation Fund and

underlying fund expenses | | Beginning

account value

05-01-2014 | | | Ending

account value

10-31-2014 | | | Expenses

paid during

the period1 | | | Net annualized

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 987.71 | | | $ | 7.36 | | | | 1.47 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.80 | | | $ | 7.48 | | | | 1.47 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 984.03 | | | $ | 11.10 | | | | 2.22 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,014.01 | | | $ | 11.27 | | | | 2.22 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 5.24 | | | | 1.04 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.96 | | | $ | 5.30 | | | | 1.04 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 988.62 | | | $ | 6.57 | | | | 1.31 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.60 | | | $ | 6.67 | | | | 1.31 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 989.51 | | | $ | 5.22 | | | | 1.04 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.96 | | | $ | 5.30 | | | | 1.04 | % |

| 1. | Expenses paid is equal to the annualized expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | | | |

| Portfolio of investments—October 31, 2014 (unaudited) | | Wells Fargo Advantage Absolute Return Fund | | | 9 | |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | |

Investment Companies: 99.94% | | | | | | | | | | | | |

GMO Benchmark-Free Allocation Fund, Class MF (l) | | | | | | | 451,555,075 | | | $ | 12,201,018,116 | |

| | | | | | | | | | | | |

| | | | |

Total Investment Companies (Cost $11,895,335,900) | | | | | | | | | | | 12,201,018,116 | |

| | | | | | | | | | | | |

| | | | | | | | |

| Total investments (Cost $11,895,335,900) * | | | 99.94 | % | | | 12,201,018,116 | |

Other assets and liabilities, net | | | 0.06 | | | | 6,892,493 | |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 12,207,910,609 | |

| | | | | | | | |

| | | | | | | | |

(l) | | The security represents an affiliate of the Fund as defined in the Investment Company Act of 1940. |

* | | Cost for federal income tax purposes is $11,896,380,488 and unrealized gains (losses) consists of: |

| | Gross unrealized gains | | $ | 304,637,628 | | | |

| | Gross unrealized losses | | | 0 | | | |

| | | | | | | | |

| | Net unrealized gains | | $ | 304,637,628 | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo Advantage Absolute Return Fund | | Statement of assets and liabilities—October 31, 2014 (unaudited) |

| | | | |

| | | | |

| |

Assets | | | | |

Investment in affiliated investment companies, at value (cost $11,895,335,900) | | $ | 12,201,018,116 | |

Cash | | | 100,000 | |

Receivable for Fund shares sold | | | 43,037,372 | |

Prepaid expenses and other assets | | | 815,442 | |

| | | | |

Total assets | | | 12,244,970,930 | |

| | | | |

| |

Liabilities | | | | |

Payable for Fund shares redeemed | | | 30,238,013 | |

Advisory and fund level administration fee payable | | | 2,012,921 | |

Distribution fees payable | | | 1,223,059 | |

Administration fees payable | | | 1,572,055 | |

Shareholder servicing fees payable | | | 1,959,453 | |

Accrued expenses and other liabilities | | | 54,820 | |

| | | | |

Total liabilities | | | 37,060,321 | |

| | | | |

Total net assets | | $ | 12,207,910,609 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 11,761,073,120 | |

Undistributed net investment income | | | 26,621,150 | |

Accumulated net realized gains on investments | | | 114,534,123 | |

Net unrealized gains on investments | | | 305,682,216 | |

| | | | |

Total net assets | | $ | 12,207,910,609 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE PER SHARE | | | | |

Net assets – Class A | | $ | 2,033,071,353 | |

Shares outstanding – Class A1 | | | 180,674,112 | |

Net asset value per share – Class A | | | $11.25 | |

Maximum offering price per share – Class A2 | | | $11.94 | |

Net assets – Class C | | $ | 1,835,812,163 | |

Shares outstanding – Class C1 | | | 165,550,057 | |

Net asset value per share – Class C | | | $11.09 | |

Net assets – Class R6 | | $ | 25,000 | |

Shares outstanding – Class R61 | | | 2,208 | |

Net asset value per share – Class R6 | | | $11.32 | |

Net assets – Administrator Class | | $ | 4,945,600,795 | |

Shares outstanding – Administrator Class1 | | | 438,176,712 | |

Net asset value per share – Administrator Class | | | $11.29 | |

Net assets – Institutional Class | | $ | 3,393,401,298 | |

Shares outstanding – Institutional Class1 | | | 299,733,961 | |

Net asset value per share – Institutional Class | | | $11.32 | |

| 1. | The Fund has an unlimited number of authorized shares. |

| 2. | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of operations—six months ended October 31, 2014 (unaudited) | | Wells Fargo Advantage Absolute Return Fund | | | 11 | |

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends from affiliated investment companies | | $ | 85,179,985 | |

| | | | |

| |

Expenses | | | | |

Advisory and fund level administration fee | | | 10,959,196 | |

Administration fees | | | | |

Class A | | | 2,907,749 | |

Class C | | | 2,321,121 | |

Class R61 | | | 0 | |

Administrator Class | | | 2,392,654 | |

Institutional Class | | | 1,153,044 | |

Shareholder servicing fees | | | | |

Class A | | | 2,795,913 | |

Class C | | | 2,231,847 | |

Administrator Class | | | 5,911,132 | |

Distribution fees | | | | |

Class C | | | 6,695,542 | |

Custody and accounting fees | | | 17,292 | |

Professional fees | | | 19,790 | |

Registration fees | | | 481,119 | |

Shareholder report expenses | | | 290,223 | |

Trustees’ fees and expenses | | | 4,224 | |

Interest expense | | | 276 | |

Other fees and expenses | | | 54,290 | |

| | | | |

Total expenses | | | 38,235,412 | |

| | | | |

Net investment income | | | 46,944,573 | |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

| |

Net realized gains (losses) on: | | | | |

Sale of affiliated investment companies | | | (612,867 | ) |

Capital gain distributions from affiliated investment companies | | | 73,005,656 | |

| | | | |

Net realized gains on investments | | | 72,392,789 | |

| | | | |

Net change in unrealized gains (losses) on investments | | | (283,107,174 | ) |

| | | | |

Net realized and unrealized gains (losses) on investments | | | (210,714,385 | ) |

| | | | |

Net decrease in net assets resulting from operations | | $ | (163,769,812 | ) |

| | | | |

| 1. | Class commenced operations on October 31, 2014. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Advantage Absolute Return Fund | | Statement of changes in net assets |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

October 31, 2014

(unaudited) | | | Year ended

April 30, 20141 | | | Year ended

September 30, 2013 | |

| | | | | | |

Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | | $ | 46,944,573 | | | | | | | $ | 74,067,536 | | | | | | | $ | 32,051,082 | |

Net realized gains on investments | | | | | | | 72,392,789 | | | | | | | | 42,187,940 | | | | | | | | 12,418 | |

Net change in unrealized gains (losses) on investments | | | | | | | (283,107,174 | ) | | | | | | | 343,524,892 | | | | | | | | 207,533,309 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | | | | | (163,769,812 | ) | | | | | | | 459,780,368 | | | | | | | | 239,596,809 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | 0 | | | | | | | | (27,507,548 | ) | | | | | | | (1,729,307 | ) |

Class C | | | | | | | 0 | | | | | | | | (13,062,348 | ) | | | | | | | (641,104 | ) |

Administrator Class | | | | | | | 0 | | | | | | | | (52,881,692 | ) | | | | | | | (4,342,591 | ) |

Institutional Class | | | | | | | 0 | | | | | | | | (24,136,169 | ) | | | | | | | (26,050 | )2 |

Net realized gains | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | 0 | | | | | | | | (509,966 | ) | | | | | | | 0 | |

Class C | | | | | | | 0 | | | | | | | | (355,267 | ) | | | | | | | 0 | |

Administrator Class | | | | | | | 0 | | | | | | | | (929,933 | ) | | | | | | | 0 | |

Institutional Class | | | | | | | 0 | | | | | | | | (352,503 | ) | | | | | | | 0 | 2 |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | | | | | 0 | | | | | | | | (119,735,426 | ) | | | | | | | (6,739,052 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | 45,176,937 | | | | 517,092,660 | | | | 79,282,579 | | | | 883,615,839 | | | | 116,931,716 | | | | 1,250,575,310 | |

Class C | | | 33,158,328 | | | | 375,124,990 | | | | 52,611,704 | | | | 580,341,664 | | | | 74,738,531 | | | | 790,852,229 | |

Class R6 | | | 2,208 | 3 | | | 25,000 | 3 | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

Administrator Class | | | 113,974,196 | | | | 1,307,833,960 | | | | 154,904,463 | | | | 1,731,111,195 | | | | 229,252,464 | | | | 2,445,179,878 | |

Institutional Class | | | 133,142,867 | | | | 1,533,477,629 | | | | 113,083,882 | | | | 1,264,358,346 | | | | 93,667,103 | 2 | | | 1,009,719,128 | 2 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 3,733,554,239 | | | | | | | | 4,459,427,044 | | | | | | | | 5,496,326,545 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | 0 | | | | 0 | | | | 2,363,014 | | | | 26,302,913 | | | | 154,929 | | | | 1,588,018 | |

Class C | | | 0 | | | | 0 | | | | 995,262 | | | | 10,978,267 | | | | 51,550 | | | | 525,814 | |

Administrator Class | | | 0 | | | | 0 | | | | 3,800,981 | | | | 42,347,513 | | | | 342,110 | | | | 3,510,050 | |

Institutional Class | | | 0 | | | | 0 | | | | 1,978,847 | | | | 22,066,693 | | | | 218 | 2 | | | 2,239 | 2 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 0 | | | | | | | | 101,695,386 | | | | | | | | 5,626,121 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | (64,388,991 | ) | | | (739,503,194 | ) | | | (20,013,523 | ) | | | (222,913,694 | ) | | | (18,062,305 | ) | | | (192,797,252 | ) |

Class C | | | (9,607,831 | ) | | | (108,129,279 | ) | | | (7,927,993 | ) | | | (87,444,171 | ) | | | (4,998,352 | ) | | | (53,053,507 | ) |

Administrator Class | | | (45,686,878 | ) | | | (520,840,993 | ) | | | (40,834,972 | ) | | | (455,697,237 | ) | | | (67,556,840 | ) | | | (722,769,141 | ) |

Institutional Class | | | (24,062,718 | ) | | | (275,635,257 | ) | | | (13,829,658 | ) | | | (154,375,173 | ) | | | (4,246,580 | )2 | | | (46,292,073 | )2 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | (1,644,108,723 | ) | | | | | | | (920,430,275 | ) | | | | | | | (1,014,911,973 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net increase in net assets resulting from capital share transactions | | | | | | | 2,089,445,516 | | | | | | | | 3,640,692,155 | | | | | | | | 4,487,040,693 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total increase in net assets | | | | | | | 1,925,675,704 | | | | | | | | 3,980,737,097 | | | | | | | | 4,719,898,450 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 10,282,234,905 | | | | | | | | 6,301,497,808 | | | | | | | | 1,581,599,358 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

End of period | | | | | | $ | 12,207,910,609 | | | | | | | $ | 10,282,234,905 | | | | | | | $ | 6,301,497,808 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Undistributed (overdistributed) net investment income | | | | | | $ | 26,621,150 | | | | | | | $ | (20,323,423 | ) | | | | | | $ | 23,184,069 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| 1. | For the seven months ended April 30, 2014. The Fund changed its fiscal year end from September 30 to April 30, effective April 30, 2014. |

| 2. | For the period from November 30, 2012 (commencement of class operations) to September 30, 2013 |

| 3. | Class commenced operations on October 31, 2014. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Advantage Absolute Return Fund | | | 13 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | |

| | | Six months ended

October 31, 2014

(unaudited) | | | Year ended

April 30, 20141 | | | Year ended

September 30 | |

| CLASS A | | | | 2013 | | | 20122 | |

Net asset value, beginning of period | | $ | 11.39 | | | $ | 10.94 | | | $ | 10.16 | | | $ | 10.00 | |

Net investment income (loss) | | | 0.06 | | | | 0.10 | | | | 0.08 | | | | (0.02 | )3 |

Net realized and unrealized gains (losses) on investments | | | (0.20 | ) | | | 0.51 | | | | 0.73 | | | | 0.18 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.14 | ) | | | 0.61 | | | | 0.81 | | | | 0.16 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | (0.16 | ) | | | (0.03 | ) | | | 0.00 | |

Net realized gains | | | 0.00 | | | | (0.00 | )4 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | 0.00 | | | | (0.16 | ) | | | (0.03 | ) | | | 0.00 | |

Net asset value, end of period | | $ | 11.25 | | | $ | 11.39 | | | $ | 10.94 | | | $ | 10.16 | |

Total return5 | | | (1.23 | )% | | | 5.66 | % | | | 8.02 | % | | | 1.60 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | |

Gross expenses6 | | | 0.71 | % | | | 0.72 | % | | | 0.73 | % | | | 0.79 | % |

Net expenses6 | | | 0.71 | % | | | 0.72 | % | | | 0.73 | % | | | 0.78 | % |

Net investment income (loss) | | | 0.95 | % | | | 1.55 | % | | | 0.92 | % | | | (0.36 | )% |

Supplemental data | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

Net assets, end of period (000s omitted) | | | $2,033,071 | | | | $2,277,448 | | | | $1,512,891 | | | | $398,557 | |

| 1. | For the seven months ended April 30, 2014. The Fund changed its fiscal year end from September 30 to April 30, effective April 30, 2014. |

| 2. | For the period from March 1, 2012 (commencement of class operations) to September 30, 2012 |

| 3. | Calculated based upon average shares outstanding |

| 4. | Amount is less than $0.005. |

| 5. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

| 6. | Ratios do not include the expenses of GMO Benchmark-Free Allocation Fund, Class MF which were as follows: |

| | | | |

Six months ended October 31, 2014 (unaudited) | | | 0.55 | % |

Year ended April 30, 20141 | | | 0.54 | % |

Year ended September 30, 2013 | | | 0.50 | % |

Year ended September 30, 20122 | | | 0.49 | % |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Advantage Absolute Return Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | |

| | | Six months ended October 31, 2014 (unaudited) | | | Year ended April 30, 20141 | | | Year ended

September 30 | |

| CLASS C | | | | 2013 | | | 20122 | |

Net asset value, beginning of period | | $ | 11.27 | | | $ | 10.82 | | | $ | 10.11 | | | $ | 10.00 | |

Net investment income (loss) | | | 0.01 | | | | 0.06 | | | | 0.03 | | | | (0.06 | )3 |

Net realized and unrealized gains (losses) on investments | | | (0.19 | ) | | | 0.50 | | | | 0.70 | | | | 0.17 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.18 | ) | | | 0.56 | | | | 0.73 | | | | 0.11 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | (0.11 | ) | | | (0.02 | ) | | | 0.00 | |

Net realized gains | | | 0.00 | | | | (0.00 | )4 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | 0.00 | | | | (0.11 | ) | | | (0.02 | ) | | | 0.00 | |

Net asset value, end of period | | $ | 11.09 | | | $ | 11.27 | | | $ | 10.82 | | | $ | 10.11 | |

Total return5 | | | (1.60 | )% | | | 5.23 | % | | | 7.20 | % | | | 1.10 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | |

Gross expenses6 | | | 1.46 | % | | | 1.47 | % | | | 1.48 | % | | | 1.54 | % |

Net expenses6 | | | 1.46 | % | | | 1.47 | % | | | 1.48 | % | | | 1.53 | % |

Net investment income (loss) | | | 0.00 | % | | | 0.78 | % | | | 0.14 | % | | | (1.11 | )% |

Supplemental data | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

Net assets, end of period (000s omitted) | | | $1,835,812 | | | | $1,600,482 | | | | $1,042,487 | | | | $268,171 | |

| 1. | For the seven months ended April 30, 2014. The Fund changed its fiscal year end from September 30 to April 30, effective April 30, 2014. |

| 2. | For the period from March 1, 2012 (commencement of class operations) to September 30, 2012 |

| 3. | Calculated based upon average shares outstanding |

| 4. | Amount is less than $0.005. |

| 5. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

| 6. | Ratios do not include the expenses of GMO Benchmark-Free Allocation Fund, Class MF which were as follows: |

| | | | |

Six months ended October 31, 2014 (unaudited) | | | 0.55 | % |

Year ended April 30, 20141 | | | 0.54 | % |

Year ended September 30, 2013 | | | 0.50 | % |

Year ended September 30, 20122 | | | 0.49 | % |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Advantage Absolute Return Fund | | | 15 | |

(For a share outstanding throughout each period)

| | | | |

| CLASS R6 | | Period ended

October 31, 20141

(unaudited) | |

Net asset value, beginning of period | | $ | 11.32 | |

Net investment income | | | 0.00 | |

Net realized and unrealized gains (losses) on investments | | | 0.00 | |

| | | | |

Total from investment operations | | | 0.00 | |

Net asset value, end of period | | $ | 11.32 | |

Total return2 | | | 0 | % |

Ratios to average net assets (annualized) | | | | |

Gross expenses3 | | | 0.00 | % |

Net expenses3 | | | 0.00 | % |

Net investment income | | | 0.00 | % |

Supplemental data | | | | |

Portfolio turnover rate | | | 0 | % |

Net assets, end of period (000s omitted) | | | $25 | |

| 1. | Class commenced operations on October 31, 2014. |

| 2. | Returns for periods of less than one year are not annualized. |

| 3. | Ratios do not include the expenses of GMO Benchmark-Free Allocation Fund. The expenses of GMO Benchmark-Free Allocation Fund, Class MF were 0.55%. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Advantage Absolute Return Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | |

| | | Six months ended

October 31, 2014

(unaudited) | | | Year ended

April 30, 20141 | | | Year ended

September 30 | |

| ADMINISTRATOR CLASS | | | | 2013 | | | 20122 | |

Net asset value, beginning of period | | $ | 11.42 | | | $ | 10.97 | | | $ | 10.17 | | | $ | 10.00 | |

Net investment income (loss) | | | 0.05 | | | | 0.11 | | | | 0.09 | | | | (0.01 | )3 |

Net realized and unrealized gains (losses) on investments | | | (0.18 | ) | | | 0.51 | | | | 0.75 | | | | 0.18 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.13 | ) | | | 0.62 | | | | 0.84 | | | | 0.17 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | (0.17 | ) | | | (0.04 | ) | | | 0.00 | |

Net realized gains | | | 0.00 | | | | (0.00 | )4 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | 0.00 | | | | (0.17 | ) | | | (0.04 | ) | | | 0.00 | |

Net asset value, end of period | | $ | 11.29 | | | $ | 11.42 | | | $ | 10.97 | | | $ | 10.17 | |

Total return5 | | | (1.14 | )% | | | 5.74 | % | | | 8.25 | % | | | 1.70 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | |

Gross expenses6 | | | 0.55 | % | | | 0.55 | % | | | 0.55 | % | | | 0.62 | % |

Net expenses6 | | | 0.55 | % | | | 0.55 | % | | | 0.55 | % | | | 0.59 | % |

Net investment income (loss) | | | 0.91 | % | | | 1.69 | % | | | 1.03 | % | | | (0.16 | )% |

Supplemental data | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

Net assets, end of period (000s omitted) | | | $4,945,601 | | | | $4,223,678 | | | | $2,763,630 | | | | $914,872 | |

| 1. | For the seven months ended April 30, 2014. The Fund changed its fiscal year end from September 30 to April 30, effective April 30, 2014. |

| 2. | For the period from March 1, 2012 (commencement of class operations) to September 30, 2012 |

| 3. | Calculated based upon average shares outstanding |

| 4. | Amount is less than $0.005. |

| 5. | Returns for periods of less than one year are not annualized. |

| 6. | Ratios do not include the expenses of GMO Benchmark-Free Allocation Fund, Class MF which were as follows: |

| | | | |

Six months ended October 31, 2014 (unaudited) | | | 0.55 | % |

Year ended April 30, 20141 | | | 0.54 | % |

Year ended September 30, 2013 | | | 0.50 | % |

Year ended September 30, 20122 | | | 0.49 | % |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Advantage Absolute Return Fund | | | 17 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | |

| INSTITUTIONAL CLASS | | Six months ended

October 31, 2014

(unaudited) | | | Year ended

April 30, 20141 | | | Year ended

September 30, 20132 | |

Net asset value, beginning of period | | $ | 11.44 | | | $ | 10.99 | | | $ | 10.18 | |

Net investment income | | | 0.06 | 1 | | | 0.12 | | | | 0.14 | 3 |

Net realized and unrealized gains (losses) on investments | | | (0.18 | ) | | | 0.52 | | | | 0.71 | |

| | | | | | | | | | | | |

Total from investment operations | | | (0.12 | ) | | | 0.64 | | | | 0.85 | |

Distributions to shareholders from | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | (0.19 | ) | | | (0.04 | ) |

Net realized gains | | | 0.00 | | | | (0.00 | )4 | | | 0.00 | |

| | | | | | | | | | | | |

Total distributions to shareholders | | | 0.00 | | | | (0.19 | ) | | | (0.04 | ) |

Net asset value, end of period | | $ | 11.32 | | | $ | 11.44 | | | $ | 10.99 | |

Total return5 | | | (1.05 | )% | | | 5.93 | % | | | 8.41 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | |

Gross expenses6 | | | 0.28 | % | | | 0.29 | % | | | 0.30 | % |

Net expenses6 | | | 0.28 | % | | | 0.29 | % | | | 0.30 | % |

Net investment income | | | 1.01 | % | | | 1.84 | % | | | 1.56 | % |

Supplemental data | | | | | | | | | | | | |

Portfolio turnover rate | | | 0 | % | | | 0 | % | | | 0 | % |

Net assets, end of period (000s omitted) | | | $3,393,401 | | | | $2,180,627 | | | | $982,490 | |

| 1. | For the seven months ended April 30, 2014. The Fund changed its fiscal year end from September 30 to April 30, effective April 30, 2014. |

| 2. | For the period from November 30, 2012 (commencement of class operations) to September 30, 2013 |

| 3. | Calculated based upon average shares outstanding |

| 4. | Amount is less than $0.005. |

| 5. | Returns for periods of less than one year are not annualized. |

| 6. | Ratios do not include the expenses of GMO Benchmark-Free Allocation Fund, Class MF which were as follows: |

| | | | |

Six months ended October 31, 2014 (unaudited) | | | 0.55 | % |

Year ended April 30, 20141 | | | 0.54 | % |

Year ended September 30, 20132 | | | 0.50 | % |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Wells Fargo Advantage Absolute Return Fund | | Notes to financial statements (unaudited) |

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). These financial statements report on the Wells Fargo Advantage Absolute Return Fund (the “Fund”) which is a diversified series of the Trust.

The Fund invests all of its investable assets in the GMO Benchmark-Free Allocation Fund (the “Benchmark-Free Allocation Fund”), an investment company managed by Grantham, Mayo, Van Otterloo & Co. LLC (“GMO”). Benchmark-Free Allocation Fund is a fund-of-funds that gains its investment exposures primarily by investing in GMO Implementation Fund. In addition, Benchmark-Free Allocation Fund may invest in other GMO Funds (together with GMO Implementation Fund, the “underlying funds”), whether now existing or created in the future. These additional underlying Funds may include, among others, GMO Alpha Only Fund, GMO Debt Opportunities Fund, GMO Emerging Country Debt Fund, GMO Special Opportunities Fund, and GMO Systematic Global Macro Opportunity Fund. GMO Implementation Fund is permitted to invest in any asset class. Benchmark-Free Allocation Fund also may invest in securities or derivatives directly. As of October 31, 2014, the Fund owned 62% of Benchmark-Free Allocation Fund. Because the Fund invests all of its assets in Benchmark-Free Allocation Fund, the shareholders of the Fund bear the fees and expense of Benchmark-Free Allocation Fund which are not included in the Statements of Operations but are incurred indirectly because they are considered in the calculation of the net asset value of Benchmark-Free Allocation Fund. As a result, the Fund’s actual expenses may be higher than those of other mutual funds that invest directly in securities.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time).

The Fund values its investment in Benchmark-Free Allocation Fund at net asset value. The valuation of investments in securities and the underlying funds held by Benchmark-Free Allocation Fund is discussed in the semi-annual report of Benchmark-Free Allocation Fund which is included in the mailing of this shareholder report. An unaudited Consolidated Statement of Assets and Liabilities and an unaudited Consolidated Schedule of Investments for Benchmark-Free Allocation Fund as of October 31, 2014 have also been included as an Appendix in this report for your reference. The unaudited Consolidated Schedule of Investments for Benchmark-Free Allocation Fund includes the holdings of its wholly owned investment in GMO Implementation Fund.

Investment transactions and income recognition

Investment transactions are recorded on a trade date basis. Realized gains and losses resulting from investment transactions are determined on the identified cost basis.

Income dividends and capital gain distributions from Benchmark-Free Allocation Fund are recorded on the ex-dividend date. Capital gain distributions from Benchmark-Free Allocation Fund are treated as realized gains.

Distributions to shareholders

Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with federal income tax regulations, which may differ in amount or character from net investment income and realized gains recognized for purposes of U.S. generally accepted accounting principles.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo Advantage Absolute Return Fund | | | 19 | |

Fund’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

As of April 30, 2014, the Fund had a qualified late-year ordinary loss of $20,323,423 which was recognized on the first day of the current fiscal year.

Class allocations

The separate classes of shares offered by the Fund differ principally in applicable sales charges, distribution, shareholder servicing, and administration fees. Class specific expenses are charged directly to that share class. Investment income, common expenses, and realized and unrealized gains (losses) on investments are allocated daily to each class of shares based on the relative proportion of net assets of each class.

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to significant unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| n | | Level 1 – quoted prices in active markets for identical securities |

| n | | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, use of amortized cost, etc.) |

| n | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions |

in determining the fair value of investments)

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

As of October 31, 2014, Level 2 inputs were used in valuing the Fund’s investment in Benchmark-Free Allocation Fund.

Transfers in and transfers out are recognized at the end of the reporting period. At October 31, 2014, the Fund did not have any transfers into/out of Level 1, Level 2, or Level 3.

4. TRANSACTIONS WITH AFFILIATES

Advisory and administration fee

The Trust has entered into an advisory and administration contract with Wells Fargo Funds Management, LLC (“Funds Management”), an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”). The adviser is responsible for implementing investment policies and guidelines.

Pursuant to the contract, Funds Management is entitled to receive an annual advisory and fund level administration fee starting at 0.225% and declining to 0.175% as the average daily net assets of the Fund increase. For the six months ended October 31, 2014, the advisory and fund level administration fee was equivalent to an annual rate of 0.19% of the Fund’s average daily net assets.

Funds Management also provide class level administrative services which includes paying fees and expenses for services provided by the transfer agent, sub-transfer agents, omnibus account servicers and record-keepers, Funds Management is entitled to receive from the Fund an annual class level administration fee which is calculated based on the average daily net assets of each class as follows:

| | | | |

| | | Class level

administration fee | |

Class A, Class C | | | 0.26 | % |

Class R6 | | | 0.03 | |

Administrator Class | | | 0.10 | |

Institutional Class | | | 0.08 | |

| | | | |

| 20 | | Wells Fargo Advantage Absolute Return Fund | | Notes to financial statements (unaudited) |

Funds Management has contractually waived and/or reimbursed advisory and administration fees to the extent necessary to maintain certain net operating expense ratios for the Fund. Waiver of fees and/or reimbursement of expenses by Funds Management were made first from fund level expenses on a proportionate basis and then from class specific expenses. Funds Management has committed through August 31, 2015 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s expenses at 0.76% for Class A shares, 1.51% for Class C shares, 0.28% for Class R6 shares, 0.57% for Administrator Class shares, and 0.33% for Institutional Class shares. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

Distribution fees

The Trust has adopted a Distribution Plan for Class C shares of the Fund pursuant to Rule 12b-1 under the 1940 Act. Distribution fees are charged to Class C shares and paid to Wells Fargo Funds Distributor, LLC (“Funds Distributor”), the principal underwriter, at an annual rate of 0.75% of the average daily net assets of Class C shares.

In addition, Funds Distributor is entitled to receive the front-end sales charge from the purchase of Class A shares and a contingent deferred sales charge on the redemption of certain shares. Funds Distributor is also entitled to receive the contingent deferred sales charges from redemptions of Class B and Class C shares. For the six months ended October 31, 2014, Funds Distributor received $522,849 from the sale of Class A shares and $18,668 and $30,497 in contingent deferred sales charges from redemptions of Class A and Class C shares, respectively.

Shareholder servicing fees

The Trust has entered into contracts with one or more shareholder servicing agents, whereby Class A, Class C, and Administrator Class of the Fund is charged a fee at an annual rate of 0.25% of the average daily net assets of each respective class.

A portion of these total shareholder servicing fees were paid to affiliates of Wells Fargo.

5. INVESTMENT TRANSACTIONS

For the six months ended October 31, 2014, the Fund made aggregate purchases and sales of $2,255,836,372 and $7,403,309, respectively, in its investment in Benchmark-Free Allocation Fund.

As a result of its investment in Benchmark-Free Allocation Fund, the Fund incurs purchase premium and redemption fees. These purchase premium and redemption fees are paid by the Fund to Benchmark-Free Allocation Fund to help offset estimated portfolio transaction and related costs incurred as a result of a purchase or redemption order by allocating estimated transaction costs to the purchasing or redeeming shareholder. The Fund is currently charged 0.13% for purchases and redemptions which are reflected in paid in capital. Prior to June 30, 2014, the Fund was charged 0.11% for purchases and redemptions. GMO reassesses these fees annually.

6. BANK BORROWINGS

The Trust (excluding the money market funds and certain other funds in the Trust) and Wells Fargo Variable Trust are parties to a $150,000,000 revolving credit agreement whereby the Fund is permitted to use bank borrowings for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest under the credit agreement is charged to the Fund based on a borrowing rate equal to the higher of the Federal Funds rate in effect on that day plus 1.25% or the overnight LIBOR rate in effect on that day plus 1.25%. In addition, an annual commitment fee equal to 0.10% of the unused balance is allocated to each participating fund. For the six months ended October 31, 2014, the Fund paid $14,472 in commitment fees.

During the six months ended October 31, 2014, the Fund had average borrowings outstanding of $20,146 (on an annualized basis) at an average rate of 1.37% and paid interest in the amount of $276.

7. INDEMNIFICATION

Under the Trust’s organizational documents, the officers and Trustees are indemnified against certain liabilities that may arise out of performance of their duties to the Trust. Additionally, in the normal course of business, the Trust may enter into contracts with service providers that contain a variety of indemnification clauses. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated.

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo Advantage Absolute Return Fund | | | 21 | |

8. SUBSEQUENT DISTRIBUTION

On December 11, 2014, the Fund declared distributions from long-term capital gains to shareholders of record on December 10, 2014. The per share amounts payable on December 12, 2014 were as follows:

| | | | |

| | | Long-term capital gains | |

Class A | | $ | 0.10662 | |

Class C | | | 0.10662 | |

Class R6 | | | 0.10662 | |

Administrator Class | | | 0.10662 | |

Institutional Class | | | 0.10662 | |

These distributions are not reflected in the accompanying financial statements. The final determination of the source of all distributions is subject to change and made after the Fund’s tax year-end.

| | | | |

| 22 | | Wells Fargo Advantage Absolute Return Fund | | Other information (unaudited) |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-222-8222, visiting our website at wellsfargoadvantagefunds.com, or visiting the SEC website at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Fund’s website at wellsfargoadvantagefunds.com or by visiting the SEC website at sec.gov.

PORTFOLIO HOLDINGS INFORMATION

The complete portfolio holdings for the Fund are publicly available monthly on the Fund’s website (wellsfargoadvantagefunds.com), on a one-month delayed basis. In addition, top ten holdings information (excluding derivative positions) for the Fund is publicly available on the Fund’s website on a monthly, seven-day or more delayed basis. The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q, which is available without charge by visiting the SEC website at sec.gov. In addition, the Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and at regional offices in New York City, at 233 Broadway, and in Chicago, at 175 West Jackson Boulevard, Suite 900. Information about the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| | | | | | |

| Other information (unaudited) | | Wells Fargo Advantage Absolute Return Fund | | | 23 | |

BOARD OF TRUSTEES AND OFFICERS

Each of the Trustees and Officers1 listed in the table below acts in identical capacities for each fund in the Wells Fargo Advantage family of funds, which consists of 133 mutual funds comprising the Wells Fargo Funds Trust, Wells Fargo Variable Trust, Wells Fargo Master Trust and four closed-end funds (collectively the “Fund Complex”). This table should be read in conjunction with the Prospectus and the Statement of Additional Information2. The mailing address of each Trustee and Officer is 525 Market Street, 12th Floor, San Francisco, CA 94105. Each Trustee and Officer serves an indefinite term, however, each Trustee serves such term until reaching the mandatory retirement age established by the Trustees.

Independent Trustees

| | | | | | |

Name and year of birth | | Position held and length of service* | | Principal occupations during past five years or longer | | Other directorships during

past five years |

| Peter G. Gordon (Born 1942) | | Trustee, since 1998; Chairman, since 2005 | | Co-Founder, Retired Chairman, President and CEO of Crystal Geyser Water Company. Trustee Emeritus, Colby College. | | Asset Allocation Trust |

| Isaiah Harris, Jr. (Born 1952) | | Trustee, since 2009 | | Retired. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy. Mr. Harris is a certified public accountant. | | CIGNA Corporation; Asset Allocation Trust |

| Judith M. Johnson (Born 1949) | | Trustee, since 2008;

Audit Committee Chairman, since 2008 | | Retired. Prior thereto, Chief Executive Officer and Chief Investment Officer of Minneapolis Employees Retirement Fund from 1996 to 2008. Ms. Johnson is an attorney, certified public accountant and a certified managerial accountant. | | Asset Allocation Trust |

| Leroy Keith, Jr. (Born 1939) | | Trustee, since 2010** | | Chairman, Bloc Global Services (development and construction). Trustee of the Evergreen Funds complex (and its predecessors) from 1983 to 2010. Former Managing Director, Almanac Capital Management (commodities firm), former Partner, Stonington Partners, Inc. (private equity fund), former Director, Obagi Medical Products Co. and former Director, Lincoln Educational Services. | | Trustee, Virtus Fund Complex (consisting of 50 portfolios as of 12/16/2013); Asset Allocation Trust |

| David F. Larcker (Born 1950) | | Trustee, since 2009 | | James Irvin Miller Professor of Accounting at the Graduate School of Business, Stanford University, Morgan Stanley Director of the Center for Leadership Development and Research and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | | Asset Allocation Trust |

| Olivia S. Mitchell (Born 1953) | | Trustee, since 2006 | | International Foundation of Employee Benefit Plans Professor, Wharton School of the University of Pennsylvania since 1993. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously, Cornell University Professor from 1978 to 1993. | | Asset Allocation Trust |

| Timothy J. Penny (Born 1951) | | Trustee, since 1996 | | President and CEO of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007 and Senior Fellow at the Humphrey Institute Policy Forum at the University of Minnesota since 1995. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, since 2007. | | Asset Allocation Trust |

| Michael S. Scofield (Born 1943) | | Trustee, since 2010 | | Served on the Investment Company Institute’s Board of Governors and Executive Committee from 2008-2011 as well the Governing Council of the Independent Directors Council from 2006-2011 and the Independent Directors Council Executive Committee from 2008-2011. Chairman of the IDC from 2008-2010. Institutional Investor (Fund Directions) Trustee of Year in 2007. Trustee of the Evergreen Funds complex (and its predecessors) from 1984 to 2010. Chairman of the Evergreen Funds from 2000-2010. Former Trustee of the Mentor Funds. Retired Attorney, Law Offices of Michael S. Scofield. | | Asset Allocation Trust |

| | | | |

| 24 | | Wells Fargo Advantage Absolute Return Fund | | Other information (unaudited) |

| | | | | | |

Name and year of birth | | Position held and length of service* | | Principal occupations during past five years or longer | | Other directorships during

past five years |

| Donald C. Willeke (Born 1940) | | Trustee, since 1996 | | Principal of the law firm of Willeke & Daniels. General Counsel of the Minneapolis Employees Retirement Fund from 1984 until its consolidation into the Minnesota Public Employees Retirement Association on June 30, 2010. Director and Vice Chair of The Tree Trust (non-profit corporation). Director of the American Chestnut Foundation (non-profit corporation). | | Asset Allocation Trust |

| * | Length of service dates reflect the Trustee’s commencement of service with the Trust’s predecessor entities, where applicable. |

| ** | Leroy Keith, Jr. will retire as a Trustee effective December 31, 2014. |

Officers

| | | | | | |

Name and year of birth | | Position held and

length of service | | Principal occupations during past five years or longer | | |

| Karla M. Rabusch (Born 1959) | | President, since 2003 | | Executive Vice President of Wells Fargo Bank, N.A. and President of Wells Fargo Funds Management, LLC since 2003. | | |

| Jeremy DePalma1 (Born 1974) | | Treasurer, since 2012 | | Senior Vice President of Wells Fargo Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010. Vice President, Evergreen Investment Services, Inc. from 2004 to 2007. Head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010. | | |

| C. David Messman (Born 1960) | | Secretary, since 2000; Chief Legal Officer, since 2003 | | Assistant General Counsel of Wells Fargo Bank, N.A. since 2013 and Vice President and Managing Counsel of Wells Fargo Bank N.A. from 1996 to 2013. Senior Vice President and Secretary of Wells Fargo Funds Management , LLC since 2001. | | |

Debra Ann Early (Born 1964) | | Chief Compliance Officer, since 2007 | | Senior Vice President and Chief Compliance Officer of Wells Fargo Funds Management, LLC since 2007. Chief Compliance Officer of Parnassus Investments from 2005 to 2007. Chief Financial Officer of Parnassus Investments from 2004 to 2007. | | |

David Berardi (Born 1975) | | Assistant Treasurer, since 2009 | | Vice President of Wells Fargo Funds Management, LLC since 2009. Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010. Assistant Vice President of Evergreen Investment Services, Inc. from 2004 to 2008. Manager of Fund Reporting and Control for Evergreen Investment Management Company, LLC from 2004 to 2010. | | |

| 1. | Jeremy DePalma acts as Treasurer of 60 funds and Assistant Treasurer of 73 funds in the Fund Complex. |

| 2. | The Statement of Additional Information includes additional information about the Trustees and is available, without charge, upon request, by calling 1-800-222-8222 or by visiting the website at wellsfargoadvantagefunds.com. |

| | | | | | |

| Other information (unaudited) | | Wells Fargo Advantage Absolute Return Fund | | | 25 | |

BOARD CONSIDERATION OF INVESTMENT ADVISORY AGREEMENT:

Under Section 15 of the Investment Company Act of 1940 (the “1940 Act”), the Board of Trustees (the “Board”) of Wells Fargo Funds Trust (the “Trust”), all the members of which have no direct or indirect interest in the investment advisory and sub-advisory agreements and are not “interested persons” of the Trust, as defined in the 1940 Act (the “Independent Trustees”), must determine whether to approve the continuation of the Trust’s investment advisory agreement. In this regard, at in-person meetings held on March 27-28, 2014 (the “March Meeting”) and May 15-16, 2014 (the “May Meeting”, and together with the March Meeting, the “Meetings”), the Board reviewed an investment advisory agreement (the “Advisory Agreement”) with Wells Fargo Funds Management, LLC (“Funds Management”) for Wells Fargo Advantage Absolute Return Fund (the “Fund”).

The Fund is a gateway feeder fund that invests substantially all of its assets in the GMO Benchmark-Free Allocation Fund (the “GMO Fund”), a series of the GMO Trust, which is overseen by a different board of trustees. The GMO Fund is managed by Grantham Mayo Van Otterloo & Co. LLC (“GMO”). The Fund’s investment objective and principal investment strategies are substantially similar to those of the GMO Fund. References to the Fund and its performance and characteristics are also applicable to the GMO Fund, as relevant.

At the May Meeting, the Board received the information, considered the factors and reached the conclusions discussed below, and unanimously approved the renewal of the Advisory Agreements, as it had done at the March Meeting.

At the Meetings, the Board considered the factors and reached the conclusions described below relating to the selection of Funds Management and the continuation of the Advisory Agreement. Prior to the Meetings, the Trustees conferred extensively among themselves and with representatives of Funds Management about these matters. Also, the Board has adopted a team-based approach, with each team consisting of a sub-set of Trustees, to assist the full Board in the discharge of its duties in reviewing performance and other matters throughout the year. The Independent Trustees were assisted in their evaluation of the Advisory Agreement by independent legal counsel, from whom they received separate legal advice and with whom they met separately.

In providing information to the Board, Funds Management was guided by a detailed set of requests for information submitted to them by independent legal counsel on behalf of the Independent Trustees at the start of the Board’s annual contract renewal process earlier in 2014. In considering and approving the Advisory Agreement, the Trustees considered the information they believed relevant, including but not limited to the information discussed below. The Board considered not only the specific information presented in connection with the Meetings, but also the knowledge gained over time through interaction with Funds Management about various topics. In this regard, the Board reviewed reports at each of its quarterly meetings, which included, among other things, portfolio reviews and performance reports. In addition, the Board and the teams mentioned above confer with portfolio managers at various times throughout the year. The Board did not identify any particular information or consideration that was all-important or controlling, and each individual Trustee may have attributed different weights to various factors.

After its deliberations, the Board unanimously approved the continuation of the Advisory Agreement and determined that the compensation payable to Funds Management is reasonable. The Board considered the continuation of the Advisory Agreement for the Fund as part of its consideration of the continuation of advisory agreements for funds across the complex, but its approvals were made on a fund-by-fund basis. The following summarizes a number of important, but not necessarily all, factors considered by the Board in support of its approvals.

Nature, extent and quality of services

The Board received and considered various information regarding the nature, extent and quality of services provided to the Fund by Funds Management under the Advisory Agreement. This information included, among other things, a summary of the background and experience of senior management of Funds Management.