Fixed assets relating to the operations acquired from Circle K (see Note 4) are amortized according to the straight-line method and the following periods:

Given that Circle K uses different methods and rates for amortizing fixed assets, as is explained above, and given the large number of acquisitions which have been made recently in the U.S., the Company will perform an analysis of the estimated useful lives of all of its fixed assets. This could result in amendments being made to the amortization methods currently being used.

Goodwill is the excess of the purchase price of an acquired business over the fair value of underlying net assets acquired at the time of acquisition. Goodwill is not amortized. It is rather tested for impairment annually, or more frequently if events or changes in circumstances indicate that it might be impaired. The impairment test consists of a comparison of the fair value of the Company’s reporting units with their carrying amount. The fair value of the reporting units is determined according to an estimate of future discounted cash flows. When the carrying amount of a reporting unit is greater than its fair value, the Company compares the fair value of the goodwill related to the reporting units with its carrying amount. Any impairment in the carrying amount of goodwill is charged to income.

Trademarks, licenses and permits are recorded at cost and are not amortized; rather, they are tested for impairment annually, or more frequently, if events or circumstances indicate that the asset might be impaired.

Other assets include deferred charges at amortized cost and deposits.

Deferred charges are mainly financing costs amortized using the current interest rate method over the period of the corresponding debt and expenses incurred in connection with the analysis and signing of operating leases which are deferred are amortized over the lease term. Other deferred charges are amortized on a straight-line basis over a period of five to seven years.

The Company accrues its obligations under employee pension plans and the related costs, net of plan assets. The Company has adopted the following policies with respect to the defined benefit plans:

The pension costs recorded in earnings for the defined contribution plan is equivalent to the contributions which the Company is required to pay in exchange for services provided by employees.

Allowances for site restoration costs represent the estimated future cost of ensuring that the soil and sub-soil meet government standards for sites for which it is the Company’s responsibility to restore. The obligation is recognized on the earlier of the following dates: the date on which the contaminant is discovered or the date on which operations on the site are discontinued. The estimated amount of future restoration costs is reviewed regularly based on available information and governing legislation. Where the forecast restoration costs, less any amount to be recovered from third parties, exceed existing provisions, an expense is recognized in the year during which the shortfall has been identified.

The Company offers a stock option plan as described in Note 18. No amount is recognized for this plan when the share purchase options are issued to employees, managers and directors. Any consideration received when holders exercise their options is credited to capital stock. Since the Company does not account for stock options awarded to employees using the fair value based method, it discloses pro forma information regarding net earnings and earnings per share which are calculated as if the fair value based accounting method had been used to account for stock options awarded (See Note 18).

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

as at April 25, 2004, April 27, 2003 and April 28, 2002

(in thousands of Canadian dollars, except per share amounts) |

|

3 - | ACCOUNTING POLICIES (continued) |

Financial instruments

The Company uses derivative financial instruments by way of interest “swaps” to manage current and forecast risks related to interest rate fluctuations associated with the Company’s debt. The Company does not use speculative derivative financial instruments.

Accordingly, the Company adheres to AcG-13 regarding the identification, designation, documentation and effectiveness of hedge relationships for the purposes of applying hedge accounting.

Based on the Company’s policy, it designates each derivative financial instrument as a hedge against a recognized loan instrument. The Company estimates that derivative financial instruments are efficient hedges, at the time of the establishment of the hedge and the duration of the instrument, since the date to maturity, the reference amount and interest rate of the instruments corresponds to all the conditions of a loan instrument.

The Company uses interest rate swaps as part of its program for managing the combination of fixed and variable interest rates of its debt and the corresponding aggregate loan rate. Interest rate swaps result in an exchange of interest payments without an exchange of principal underlying the interest payments. They are accounted for as an adjustment of accrued interest expense on loan instruments. The corresponding amount to be paid to counterparties or to be received from counterparties is accounted for as an adjustment of accrued interest.

Gains and losses on interest rate swaps, when completed, will be recognized under other current assets or liabilities or under long-term assets or liabilities in the balance sheet and are amortized as an adjustment of accrued interest related to the obligation over the period corresponding to the remaining initial life of the completed swap. In the event of early extinguishment of the debt, any realized or unrealized gains or losses related to the swap will be recognized in the consolidated earnings at the time of the extinguishment of the debt.

During the past three fiscal years, the Company has realized business acquisitions that were recorded using the acquisition method. Income from business acquisitions is included in the consolidated financial statements as of the date of acquisition.

Year ended April 25, 2004

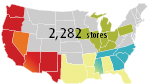

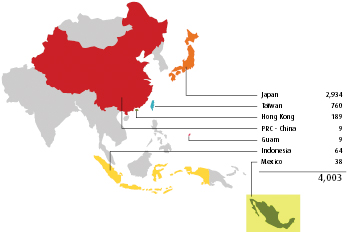

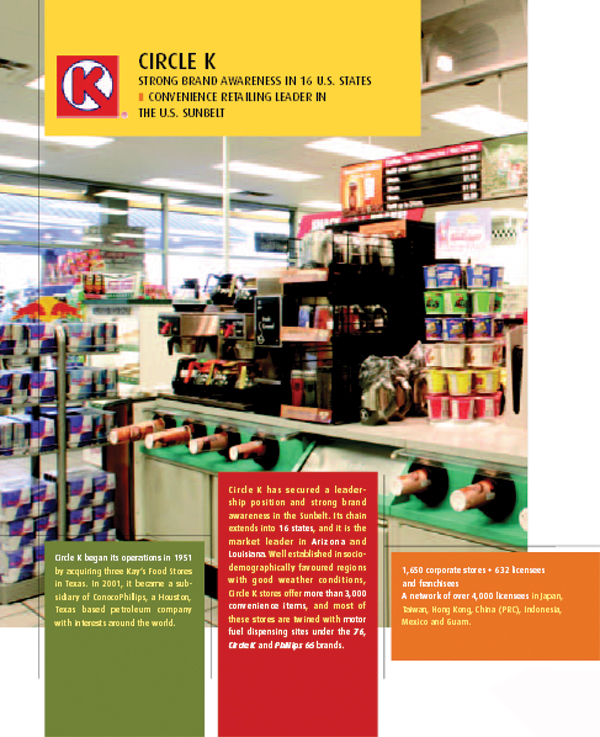

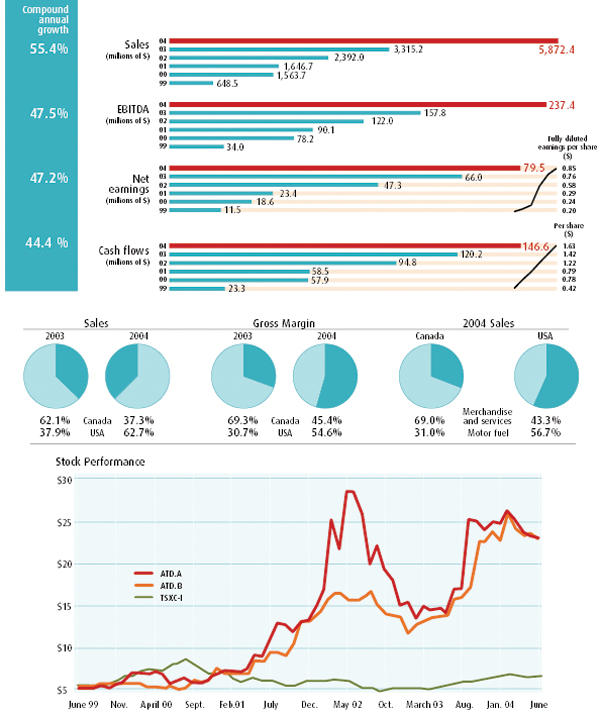

On December 17, 2003, the Company acquired all of the outstanding shares of The Circle K Corporation (Circle K) from ConocoPhillips Company and became the owner of a chain of 1,663 stores in 16 U.S. states, mainly in the southern United States. Circle K also holds franchise or licensing agreements with 627 stores in the United States and 4,003 international license agreements.

Considering the acquisition costs and the amounts payable in accordance with a price adjustment clause, based on the working capital acquired, this acquisition was made for a total consideration of US$831,767 (CA$1,102,507). The transaction was financed in part by issuing 13,555,538 new Class “B” subordinate voting shares (see Note 17), by issuing unsecured subordinate notes maturing in 2014 totalling US$350,000, by new secured credit facilities comprising of revolving term credit of $50,000 and US$75,000, as well as a five-year US$265,000 term loan and a seven-year US$245,000 term loan. These credit facilities replaced the preceding ones in effect as at December 17, 2003. The deferred financing costs relating to the former credit facilities have been written off.

On September 4, 2003, the Company concluded the acquisition of assets of Clark Retail Enterprises Inc. and became the owner of 43 stores in the states of Illinois, Indiana, Iowa, Michigan and Ohio.

Considering the transaction costs, this acquisition was made for a total cash consideration of $41,017. The transaction was financed along with the Company’s existing credit facilities.

Most of the goodwill related to this transaction is expected to be deductible for tax purposes.

The preliminary allocations of the purchase prices of the acquisitions which follow were established based on information available and on the basis of preliminary evaluations. These allocations are subject to change should new information become available and that the strategies of integrating and restructuring assets have been completed. Furthermore, tax consequences of the assets acquired are also preliminary.

| | Circle K | | Clark | | Total | |

| |

|

| |

|

| |

|

| |

| | $ | | $ | | $ | |

| | | | | | | | | | |

| Current assets | | | 314,603 | | | | 4,943 | | | 319,546 | | |

| Fixed assets | | | 778,812 | | | | 29,900 | | | 808,712 | | |

| Goodwill | | | — | | | | 7,312 | | | 7,312 | | |

| Trademarks, licenses, permits and other assets | | | 210,966 | | | | — | | | 210,966 | | |

| Future income taxes | | | 37,004 | | | | 88 | | | 37,092 | | |

| |

|

| | |

|

| |

|

| | |

| | | 1,341,385 | | | | 42,243 | | | 1,383,628 | | |

| |

|

| | |

|

| |

|

| | |

| Current liabilities assumed | | | 218,315 | | | | 632 | | | 218,947 | | |

| Long-term debt assumed | | | 8,913 | | | | — | | | 8,913 | | |

| Deferred revenues and other liabilities assumed | | | 11,650 | | | | 594 | | | 12,244 | | |

| |

|

| | |

|

| |

|

| | |

| | | 238,878 | | | | 1,226 | | | 240,104 | | |

| |

|

| | |

|

| |

|

| | |

| Net assets and total consideration | | | 1,102,507 | | | | 41,017 | | | 1,143,524 | | |

| Less: Cash from the acquisition | | | 106,770 | | | | — | | | 106,770 | | |

| |

|

| | |

|

| |

|

| | |

| Net assets excluding cash from the acquisition | | | 995,737 | | | | 41,017 | | | 1,036,754 | | |

| Less: Balance to be paid to vendors | | | 11,414 | | | | — | | | 11,414 | | |

| |

|

| | |

|

| |

|

| | |

| Cash consideration | | | 984,323 | | | | 41,017 | | | 1,025,340 | | |

| |

|

| | |

|

| |

|

| | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

as at April 25, 2004, April 27, 2003 and April 28, 2002

(in thousands of Canadian dollars, except per share amounts) |

|

4 - | BUSINESS ACQUISITIONS (continued) |

Circle K was acquired by paying amounts totalling US$823,156. As at April 25, 2004, an amount of US$8,611 remains payable to vendors.

Clark was acquired by paying the total consideration in cash at the date of acquisition.

Subsequent to the acquisitions of Circle K and Clark, the Company entered into sale leaseback agreements under which certain property, plant and equipment acquired were sold to financial institutions and re-leased to the Company under long-term leases. Most of these long-term leases are for periods of 15 to 17 years, with the possibility of renewal. Minimum lease payments under the leases amount to approximately US$25,500 per year, subject to indexation clauses.

These transactions did not result in any gains or losses for the Company. Proceeds related to these transactions totalled US$267,695, net of related expenses, and was used to repay a portion of the long-term debt incurred for the acquisitions. The portion of deferred financing costs relating to the repaid debt was written off.

Year ended April 27, 2003

On August 20, 2002, the Company acquired certain assets of Dairy Mart Convenience Stores Inc. (“Dairy Mart”) and became the owner of a chain of 285 stores in the states of Ohio, Kentucky, Pennsylvania, Michigan and Indiana. Taking acquisition costs into account, this acquisition was for a total cash consideration of $120,152. The full amount of the transaction was financed through bank loans subsequent to changes in the Company’s long-term credit agreement.

This transaction included a one-year management agreement for 169 additional stores in this network, some of which could, under certain conditions, be acquired by the Company in the months following the acquisition, sold on behalf of Dairy Mart Convenience Stores Inc. or closed. Given the temporary nature of the management agreement, the net amount of sales, cost of sales and other operating costs associated with this agreement are shown under operating, selling, administrative and general expenses. For the year ended April 27, 2003, the management agreement generated sales of $129,344 and operating income of $852.

During the year, the Company made four acquisitions of other store networks in Canada and the United States, for a cash consideration of $36,822 including certain stores managed under the above-mentioned management agreement.

All of these acquisitions, except for the Dairy Mart acquisition, are shown under “Other” in the following table.

Most of the goodwill related to these transactions is expected to be deductible for tax purposes.

The allocation of the purchase price of the above-mentioned acquisitions was determined as follows:

| | Dairy Mart | | Other | | Total | |

| |

|

| |

|

| |

|

| |

| | $ | | $ | | $ | |

| | | | | | | |

| Current assets | | | 18,814 | | | | 1,628 | | | 20,442 | |

| Fixed assets | | | 73,174 | | | | 27,597 | | | 100,771 | |

| Goodwill | | | 31,342 | | | | 7,963 | | | 39,305 | |

| Other assets | | | — | | | | 308 | | | 308 | |

| Future income taxes | | | 590 | | | | — | | | 590 | |

| |

|

| | |

|

| |

|

| |

| | | 123,920 | | | | 37,496 | | | 161,416 | |

| |

|

| | |

|

| |

|

| |

| Current liabilities assumed | | | 3,768 | | | | 674 | | | 4,442 | |

| |

|

| | |

|

| |

|

| |

| Net assets | | | 120,152 | | | | 36,822 | | | 156,974 | |

| Less: Cash from the acquisition | | | 627 | | | | 99 | | | 726 | |

| |

|

| | |

|

| |

|

| |

| Cash consideration | | | 119,525 | | | | 36,723 | | | 156,248 | |

| |

|

| | |

|

| |

|

| |

Year ended April 28, 2002

On June 22, 2001, the Company acquired some of the operating assets of Johnson Oil Company Inc., which operates a network of convenience stores under the Bigfoot banner in the states of Indiana, Kentucky and Illinois. Considering the transaction costs, this acquisition was made for a total cash consideration of $119,324.

In addition, during the year ended April 28, 2002, the Company acquired three other networks for a cash consideration of $8,815.

All of these acquisitions mentioned above, except the June 22, 2001 acquisition, are shown under “Other” in the following table:

| | Johnson Oil

Company Inc. | | Other | | Total | |

| |

|

| |

|

| |

|

| |

| | $ | | $ | | $ | |

| | | | | | | |

| Current assets | | | | 36,961 | | | | 2,647 | | | 39,608 | |

| Fixed assets | | | | 60,137 | | | | 7,779 | | | 67,916 | |

| Goodwill | | | | 57,312 | | | | 1,907 | | | 59,219 | |

| | |

|

| | |

|

| |

|

| |

| | | | 154,410 | | | | 12,333 | | | 166,743 | |

| | |

|

| | |

|

| |

|

| |

| Current liabilities assumed | | | | 34,638 | | | | 3,206 | | | 37,844 | |

| Note payable | | | | 448 | | | | 312 | | | 760 | |

| | |

|

| | |

|

| |

|

| |

| | | | 35,086 | | | | 3,518 | | | 38,604 | |

| | |

|

| | |

|

| |

|

| |

| Net assets acquired and cash consideration | | | | 119,324 | | | | 8,815 | | | 128,139 | |

| | |

|

| | |

|

| |

|

| |

In connection with the Johnson Oil Company Inc. acquisition, the Company has signed leases for the rental of commercial space and petroleum facilities. Under these leases, the Company is required to pay approximately US$11,300 annually over 20 years. The leases include clauses for an annual indexation of 2%.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

as at April 25, 2004, April 27, 2003 and April 28, 2002

(in thousands of Canadian dollars, except per share amounts)

5 - | INFORMATION INCLUDED IN THE CONSOLIDATED STATEMENT OF EARNINGS |

| | | 2004 | | 2003 | | 2002 | |

| | |

| |

| |

| |

| | $ | | $ | | $ | |

| | | | | | | |

| Depreciation and amortization of fixed and other assets | | | | | | | |

| | Fixed assets | | 74,026 | | 44,108 | | 33,195 | |

| | Other assets | | 440 | | 840 | | 530 | |

| | |

| |

| |

| |

| | | 74,466 | | 44,948 | | 33,725 | |

| | |

| |

| |

| |

| | | | | | | | |

| Financial expenses | | | | | | | |

| | Interest on long-term debt | | 27,440 | | 12,669 | | 13,700 | |

| | Interest on short-term debt | | 782 | | 1,228 | | 755 | |

| | Depreciation of deferred financing cost | | 2,915 | | 997 | | 612 | |

| | |

| |

| |

| |

| | | 31,137 | | 14,894 | | 15,067 | |

| | |

| |

| |

| |

Interest expenses

| | Interest expenses on long-term debt are net of interest income. Interest income totalled $477 in 2004, $51 in 2003 and $360 in 2002. |

Supplementary information related to the rental expenses included in operating, selling, administrative and general expenses.

| | | 2004 | | 2003 | | 2002 | |

| | |

| |

| |

| |

| | $ | | $ | | $ | |

| | | | | | | |

| Rent expenses | | | | | | | |

| | Rent expenses | | 127,207 | | 93,313 | | 72,670 | |

| | Sub-leasing income | | 9,265 | | 3,781 | | 2,440 | |

| | |

| |

| |

| |

| | | 117,942 | | 89,532 | | 70,230 | |

| | |

| |

| |

| |

| | | 2004 | | 2003 | | 2002 | |

| | |

| |

| |

| |

| | | $ | | $ | | $ | |

| | | | | | | | |

| Current income taxes | | 54,802 | | 22,223 | | 9,843 | |

| Future income taxes | | (14,930 | ) | 9,719 | | 15,991 | |

| | |

| |

| |

| |

| | | 39,872 | | 31,942 | | 25,834 | |

| | |

| |

| |

| |

| Earnings before income taxes | | | | | | | |

| | Domestic | | 57,538 | | 81,725 | | 66,901 | |

| | Foreign | | 61,839 | | 16,258 | | 6,270 | |

| | |

| |

| |

| |

| | | 119,377 | | 97,983 | | 73,171 | |

| | |

| |

| |

| |

| | | | | | | | |

| | 2004 | | 2003 | | 2002 | |

| |

| |

| |

| |

| | | $ | | $ | | $ | |

| | | | | | | | |

| Current income taxes | | | | | | | |

| | Domestic | | 29,190 | | 19,718 | | 7,392 | |

| | Foreign | | 25,612 | | 2,505 | | 2,451 | |

| | |

| |

| |

| |

| | | 54,802 | | 22,223 | | 9,843 | |

| | |

| |

| |

| |

| Future income taxes | | | | | | | |

| | Domestic | | (10,612 | ) | 5,021 | | 16,280 | |

| | Foreign | | (4,318 | ) | 4,698 | | (289 | ) |

| | |

| |

| |

| |

| | | (14,930 | ) | 9,719 | | 15,991 | |

| | |

| |

| |

| |

The principal items which resulted in differences between the Company’s effective income tax rates and the combined statutory rates in Canada are detailed as follows:

| | | 2004 | | 2003 | | 2002 | |

| | |

| |

| |

| |

| | | % | | % | | % | |

| | | | | | | | |

| Combined statutory income tax rate in Canada (a) | | 35.70 | | 37.62 | | 39.90 | |

| Impact of the announced tax rate increases (reductions) | | 0.22 | | (1.19 | ) | (2.99 | ) |

| Other permanent differences | | (2.52 | ) | (3.83 | ) | (1.60 | ) |

| | |

| |

| |

| |

| Effective income tax rate | | 33.40 | | 32.60 | | 35.31 | |

| | |

| |

| |

| |

| (a) | The Company’s combined statutory income tax rate in Canada includes the appropriate provincial income tax rates. |

The components of future tax assets (liabilities) are as follows:

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | $ | | $ | |

| | | | | | |

| Short-term future tax assets (liabilities) | | | | | |

| | Expenses deductible in future years | | 21,952 | | 5,997 | |

| | Deferral of GST and QST receivable | | — | | (16,614 | ) |

| | Deferred revenues | | 835 | | 500 | |

| | Non-capital losses | | — | | 1,301 | |

| | Other | | 3,752 | | 3,538 | |

| | |

| |

| |

| | | 26,539 | | (5,278 | ) |

| | |

| |

| |

| Long-term future tax assets (liabilities) | | | | | |

| | Fixed assets | | (9,315 | ) | (20,649 | ) |

| | Non-capital losses | | 2,267 | | 800 | |

| | Deferred revenues | | 4,757 | | 2,050 | |

| | Borrowing and share issue costs | | 4,580 | | 448 | |

| | Goodwill | | 5,253 | | 8,645 | |

| | Other assets | | (2,320 | ) | (2,645 | ) |

| | Other | | 5,848 | | — | |

| | |

| |

| |

| | | 11,070 | | (11,351 | ) |

| | |

| |

| |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

as at April 25, 2004, April 27, 2003 and April 28, 2002

(in thousands of Canadian dollars, except per share amounts) |

| |

7 - | EARNINGS PER SHARE |

| | | 2004 | | 2003 | | 2002 | |

| | |

| |

| |

| |

| | $ | | $ | | $ | |

| | | | | | | |

| Basic earnings attributable to Class “A” and “B” shareholders | | 79,505 | | 66,041 | | 47,337 | |

| | |

| |

| |

| |

| Weighted average number of shares (in thousands) | | 89,702 | | 84,525 | | 77,580 | |

| Dilutive effect of stock-based compensation (in thousands) | | 4,030 | | 2,757 | | 3,797 | |

| | |

| |

| |

| |

| Weighted average number of diluted shares (in thousands) | | 93,732 | | 87,282 | | 81,377 | |

| | |

| |

| |

| |

| Basic net earnings per share available for Class “A” and “B” shareholders | | 0.89 | | 0.78 | | 0.61 | |

| | |

| |

| |

| |

| Diluted net earnings available for Class “A” and “B” shareholders | | 0.85 | | 0.76 | | 0.58 | |

| | |

| |

| |

| |

In calculating diluted earnings per share for 2004, 0 stock options (1,725,000 in 2003 and 0 in 2002) were excluded due to their antidilutive effect.

8 - | INFORMATION INCLUDED IN THE CONSOLIDATED STATEMENT OF CASH FLOWS |

The changes in working capital items are detailed as follows:

| | | 2004 | | 2003 | | 2002 | |

| | |

| |

| |

| |

| | | $ | | $ | | $ | |

| | | | | | | | |

| Accounts receivable | | 8,049 | | (59,423 | ) | (7,062 | ) |

| Inventories | | (10,195 | ) | (27,754 | ) | (13,019 | ) |

| Prepaid expenses | | (8,693 | ) | (1,831 | ) | 2,291 | |

| Accounts payable | | 143,529 | | 100,066 | | 10,708 | |

| Income taxes payable | | 26,297 | | 9,527 | | (9,740 | ) |

| | |

| |

| |

| |

| | | 158,987 | | 20,585 | | (16,822 | ) |

| | |

| |

| |

| |

Cash flows relating to interest and income taxes of operating activities are detailed as follows:

| | | 2004 | | 2003 | | 2002 | |

| | |

| |

| |

| |

| | | $ | | $ | | $ | |

| | | | | | | | |

| Interest paid | | 17,727 | | 12,591 | | 12,280 | |

| | | | | | | | |

| Income taxes paid | | 31,895 | | 11,570 | | 18,556 | |

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | $ | | $ | |

| | | | | | |

| Trade accounts receivable and supplier discounts receivable | | 75,617 | | 44,511 | |

| Credit card receivable | | 37,011 | | 12,399 | |

| Environmental costs receivable | | 1,420 | | 2,482 | |

| Sales tax receivable | | — | | 42,820 | |

| Other accounts receivable | | 14,470 | | 5,796 | |

| | |

| |

| |

| | | 128,518 | | 108,008 | |

| | |

| |

| |

| | 2004 | | 2003 | |

| |

| |

| |

| | $ | | $ | |

| | | | | |

| Merchandise - distribution centers | | 36,553 | | 10,659 | |

| Merchandise - retail | | 273,814 | | 147,023 | |

| Motor fuel | | 64,476 | | 22,192 | |

| | |

| |

| |

| | | 374,843 | | 179,874 | |

| | |

| |

| |

| | | 2004 | |

| | |

| |

| | | Cost | | Accumulated

depreciation | | Net | |

| | |

| |

| |

| |

| | | $ | | $ | | $ | |

| | | | | | | | |

| Land | | 240,015 | | | — | | | 240,015 | |

| Buildings and parking lots | | 167,415 | | | 33,583 | | | 133,832 | |

| Leasehold improvements | | 160,979 | | | 46,257 | | | 114,722 | |

| Petroleum infrastructure | | 123,004 | | | 26,309 | | | 96,695 | |

| Equipment | | 464,452 | | | 170,983 | | | 293,469 | |

| Signs | | 29,331 | | | 10,561 | | | 18,770 | |

| | |

| | |

| | |

| |

| | | 1,185,196 | | | 287,693 | | | 897,503 | |

| Buildings under capital lease | | 4,607 | | | 3,627 | | | 980 | |

| | |

| | |

| | |

| |

| | | 1,189,803 | | | 291,320 | | | 898,483 | |

| | |

| | |

| | |

| |

| | 2003 | |

| |

| |

| | Cost | | Accumulated

depreciation | | Net | |

| |

| |

| |

| |

| | $ | | $ | | $ | |

| | | | | | | |

| Land | | 42,400 | | | — | | | 42,400 | |

| Buildings and parking lots | | 90,051 | | | 29,687 | | | 60,364 | |

| Leasehold improvements | | 142,137 | | | 37,890 | | | 104,247 | |

| Petroleum infrastructure | | 73,945 | | | 19,307 | | | 54,638 | |

| Equipment | | 303,592 | | | 131,896 | | �� | 171,696 | |

| Signs | | 15,430 | | | 8,504 | | | 6,926 | |

| | |

| | |

| | |

| |

| | | 667,555 | | | 227,284 | | | 440,271 | |

| Buildings under capital lease | | 4,533 | | | 3,545 | | | 988 | |

| | |

| | |

| | |

| |

| | | 672,088 | | | 230,829 | | | 441,259 | |

| | |

| | |

| | |

| |

| | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

as at April 25, 2004, April 27, 2003 and April 28, 2002

(in thousands of Canadian dollars, except per share amounts) |

| | |

12 - | OTHER ASSETS |

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | $ | | $ | |

| | | | | | |

| Deferred charges, at unamortized cost | | 43,808 | | 8,619 | |

| Deferred pension expense | | 3,218 | | 3,905 | |

| Deposits | | 2,917 | | 2,512 | |

| Other, at cost | | 3,332 | | 1,131 | |

| | |

| |

| |

| | | 53,275 | | 16,167 | |

| | |

| |

| |

Bank indebtedness reflects the used portion of the credit facilities available to the Company. Available credit facilities were unused as at April 25, 2004, with the exception of certain letters of guarantee.

On December 17, 2003, the Company implemented a new credit agreement consisting of a 5-year renewable operating credit, maturing in December 2008, in the amount of CA$50,000 available in Canadian or U.S. dollars or as letters of guarantee not exceeding CA$10,000 or the equivalent in U.S. dollars bearing interest at the Canadian or U.S. prime rate plus 0.75% to 1.50% or at LIBOR plus 1.75% to 2.50%, depending on whether certain financial ratios are achieved. The operating credit is also available in the form of bankers’ acceptances with stamping fees of 1.75% to 2.50%, depending on whether certain financial ratios are achieved. As at April 25, 2004, an amount of CA$48,782 was available under this operating credit and the effective interest rate was 3.63%. The credit agreement also provides for a 5-year renewable operating credit, maturing in December 2008, in the amount of US$75,000 available in U.S. dollars and as letters of guarantee not exceeding US$30,000, bearing interest at the U.S. prime rate plus 0.75% to 1.50% or at LIBOR plus 1.75% to 2.50% depending on whether certain financial ratios are achieved. As at April 25, 2004, an amount of US$70,160 was available under this operating credit and the effective interest rate was 3.63%. These credit facilities are subject to the same guarantees and restrictive covenants which apply to the term loans described in Note 15.

As at April 27, 2003, the Company had a renewable operating credit in the amount of CA$60,000 available in Canadian or U.S. dollars or as letters of guarantee bearing interest at the Canadian or U.S. prime rate plus 0% to 0.50% or at LIBOR plus 0.75% to 1.50%, depending on whether certain financial ratios were achieved. The operating credit was also available in the form of bankers’ acceptances with stamping fees of 0.75% to 1.50%, depending on whether certain financial ratios were achieved. As at April 27, 2003, an amount of $59,644 was available under this credit facility and the effective interest rate was 2.31%. Furthermore, the Company had access to a margin of credit totalling US$3,000 bearing interest at the U.S. prime rate. As at April 27, 2003, an amount of US$3,000 was available under this facility and the effective interest rate was 4.25%.

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | $ | | $ | |

| | | | | | |

| Accounts payable and accrued expenses | | 474,960 | | 213,518 | |

| Taxes payable | | 52,703 | | 42,168 | |

| Environmental expenses payable | | 1,858 | | 2,266 | |

| Salaries and social benefits | | 45,745 | | 14,312 | |

| Deferred revenues | | 10,862 | | 4,349 | |

| Other | | 71,737 | | 17,150 | |

| | |

| |

| |

| | | 657,865 | | 293,763 | |

| | |

| |

| |

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | $ | | $ | |

| | | | | | |

| Subordinated unsecured debt (a) | | 476,245 | | — | |

| Secured term loans granted under the new credit arrangement (b) | | | | | |

| | Term loan “A” (US$27, 977 as at April 25, 2004) | | 38,069 | | — | |

| | Term loan “B” (US$149, 976 as at April 25, 2004) | | 204,072 | | — | |

| Note payable, secured by the assets of certain stores, 8.75%, repayable in monthly instalments maturing in 2019 | | 7,469 | | — | |

| Note payable without interest, repayable in two equal instalments in May 2004 and 2005 | | 500 | | — | |

| Mortgage loans secured by land and buildings,rates varying from 7% to 13.25% (7% to 13.25% in 2003), payable in monthly instalments, maturing on various dates until 2016 | | 273 | | 335 | |

| Note payable, 9% | | | | 249 | |

| Obligations related to buildings under capital lease,rates varying between 8.18% to 13.25% (8.18% and 13.25% for 2003), payable on various dates until 2018 | | 3,904 | | 2,968 | |

| Unsecured term loans granted under the previous credit arrangement (c) | | | | | |

| | Credit A (including US$23,000 as at April 27, 2003) | | — | | 53,306 | |

| | Credit B | | — | | 50,000 | |

| | Credit C (US$98,226 as at April 27, 2003) | | — | | 142,241 | |

| | Credit D (US$32,604 as at April 27, 2003) | | — | | 47,214 | |

| | |

| |

| |

| | | 730,532 | | 296,313 | |

| Short-term instalments | | 6,032 | | 17,986 | |

| | |

| |

| |

| | | 724,500 | | 278,327 | |

| | |

| |

| |

| | | | | | | | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

as at April 25, 2004, April 27, 2003 and April 28, 2002

(in thousands of Canadian dollars, except per share amounts) |

| |

15 - | LONG-TERM DEBT (continued) |

(a) | Subordinated debt |

| |

| Unsecured subordinated debt of US$350,000, maturing December 15, 2013, bearing interest at a rate of 7.5%. Redeemable under certain conditions as of December 15, 2008. |

| |

| The total amount of the loan is subject to interest rate swaps (See Note 22). |

| |

(b) | Loans granted under the new credit agreement |

| |

| • | Term loan A: |

| | |

| | US$27,997 maximum authorized term loan maturing on December 17, 2008, payable in quarterly instalments increasing gradually from 2.5% of the balance to 7.5% as of July, 2008, bearing interest at the Canadian prime rate plus 0.75% to 1.5% or the LIBOR rate plus 1.75% to 2.5%, depending on whether certain financial ratios have been achieved. As at April 25, 2004, the effective interest rate was 3.63% |

| | |

| • | Term loan B: |

| | |

| | US$149,976 maximum authorized term loan maturing on December 17, 2010, payable in quarterly instalments of 0.25% of the balance of the loan for the six first years and 23.50% for the seventh year, of the balance bearing interest at the prime U.S. rate plus 1.25% or the LIBOR rate plus 2.25%. As at April 25, 2004, the effective interest rate was 3.38%. |

| | |

| | Substantially all of the Company’s assets have been pledged to secure these term loans. |

Under the new credit agreement, the Company must meet certain commitments and achieve certain financial ratios. Furthermore, the new credit agreement limits notably the amount of fixed assets that the Company may acquire, the business acquisitions the Company may take part in, the amount of the repayments of term loan “A” and “B” that the Company may make as well as dividend payments.

As well, the subordinated debt limits notably the business acquisitions that the Company may make and dividend payments.

| (c) | Loans granted under the previous credit arrangement: |

| | • | Credit A: |

| | | |

| | | Revolving credit for a maximum authorized amount of CA$80,000 available in Canadian or U.S. dollars, maturing on April 23, 2005, bearing interest at the Canadian or U.S. prime rate plus 0.75% to 1.50%, or LIBOR plus 1.75% to 2.50%, depending on whether certain financial ratios are achieved. This credit was also available in the form of bankers’ acceptances with stamping fees of 1.75% to 2.50% depending on whether certain financial ratios are achieved. As at April 27, 2003, the effective rate was 4.08%; |

| | |

| | • | Credit B: |

| | | |

| | | Term credit for a maximum authorized amount of CA$50,000 maturing on April 16, 2006 and bearing interest at the prime rate plus 2.75% or the bankers’ acceptances rate with stamping fees of 3.75%. As at April 27, 2003, the effective rate was 6.66%; |

| | | |

| | | An amount of $25,000 of Credit B was subject to an interest rate swap in order to establish the annual rate for the related bankers’ acceptances at 5.25% until May 2004. This agreement was cancelled following the repayment of the debt in December 2003. |

| | | |

| | • | Credit C: |

| | | |

| | | Term credit for a maximum authorized amount of US$98,226 payable in annual instalments of US$12,000 as of May 1, 2003 with the balance payable on May 1, 2006. This credit was available in Canadian or U.S. dollars in the form of advances or bankers’ acceptances according to the same rates as Credit A. As at April 27, 2003, the effective interest rate was 3.38%; |

| | | |

| | • | Credit D: |

| | | |

| | | Term credit for a maximum authorized amount of US$32,604 maturing on June 20, 2007, bearing interest at the U.S. prime rate plus 2% or at LIBOR plus 3%. As at April 27, 2003, the effective interest rate was 4.38%. |

Instalments on long-term debt for the next years are as follows:

| | | Obligations

under capital

leases | | Others

loans | |

| | |

| |

| |

| | | $ | | $ | |

| | | | | | | | |

| 2005 | | | 1,249 | | | 5,422 | |

| 2006 | | | 1,042 | | | 9,243 | |

| 2007 | | | 898 | | | 10,924 | |

| 2008 | | | 701 | | | 11,906 | |

| 2009 | | | 598 | | | 12,889 | |

| 2010 and subsequent years | | | 3,192 | | | 676,244 | |

| | | |

| | | | |

| | | | 7,680 | | | | |

| Interest expense included in minimum lease payments | | | 3,776 | | | | |

| | | |

| | | | |

| | | | 3,904 | | | | |

| | | |

| | | | |

| | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

as at April 25, 2004, April 27, 2003 and April 28, 2002

(in thousands of Canadian dollars, except per share amounts) |

| | |

16 - | DEFERRED REVENUES AND OTHER LIABILITIES |

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | $ | | $ | |

| | | | | | |

| Deferred revenues | | 17,097 | | 7,957 | |

| Provision for site restoration costs | | 4,441 | | 1,008 | |

| Provision for workers’ compensation | | 5,710 | | — | |

| Other liabilities | | 12,829 | | — | |

| | |

| |

| |

| | | 40,077 | | 8,965 | |

| | |

| |

| |

Authorized

Unlimited number of shares without par value

| First and second preferred shares issuable in series, ranking prior to other classes of shares with respect to dividends and payment of capital upon dissolution, non-voting. The Board of Directors is authorized to determine the designation, rights, privileges, conditions and restrictions relating to each series of shares prior to their issuance. |

| |

| Class “A” multiple voting and participating shares, ten votes per share except for certain situations which provide for only one vote per share, convertible into Class “B” subordinate voting shares on a share-for-share basis at the holder’s option. Under the articles of amendment, no new Class “A” multiple voting share can be issued. |

| |

| Class “B” subordinate voting and participating shares, convertible automatically into Class “A” multiple voting shares on a share-for-share basis upon the occurrence of certain events. |

The order of priority for the payment of dividends is as follows:

• | First preferred shares; |

| |

• | Second preferred shares; |

| |

• | Class “B” subordinate voting shares and Class “A” multiple voting shares, ranking pari passu. |

Issued and fully paid |

| The number of shares outstanding changed as follows: |

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | Number of

shares | | $ | | Number of

shares | | $ | |

| | |

| |

| |

| |

| |

Class “A” multiple voting shares | | | | | | | | | |

| | Balance, beginning of year | | 28,548,824 | | 12,029 | | 28,548,824 | | 12,029 | |

| | Conversion into Class “B”shares | | (27,963 | ) | (12 | ) | — | | — | |

| | |

| |

| |

| |

| |

| | | 28,520,861 | | 12,017 | | 28,548,824 | | 12,029 | |

| | |

| |

| |

| |

| |

| | | | | | | | | | |

Class “B” subordinate voting shares | | | | | | | | | |

| | Balance, beginning of year | | 56,046,088 | | 246,507 | | 54,383,088 | | 242,054 | |

| | Issued as part of the acquisition of Circle K | | 13,555,538 | | 223,666 | | — | | — | |

| | Issued on conversion of Class “A”shares | | 27,963 | | 12 | | — | | — | |

| | Stock options exercised for cash | | 659,400 | | 3,487 | | 1,663,000 | | 4,453 | |

| | |

| |

| |

| |

| |

| | | 70,288,989 | | 473,672 | | 56,046,088 | | 246,507 | |

| | |

| |

| |

| |

| |

| Total issued and fully paid | | | | 485,689 | | | | 258,536 | |

| | | | |

| | | |

| |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

as at April 25, 2004, April 27, 2003 and April 28, 2002

(in thousands of Canadian dollars, except per share amounts) |

|

17 - | CAPITAL STOCK (continued) |

| | | 2002 | |

| | |

| |

| | | Number of

shares | | $ | |

| | |

| |

| |

Class “A” multiple voting shares | | | | | |

| | Balance, beginning of year | | 28,549,224 | | 12,029 | |

| | Conversion into Class “B” shares | | (400 | ) | — | |

| | |

| |

| |

| | | 28,548,824 | | 12,029 | |

| | |

| |

| |

Class “B” subordinate voting shares | | | | | |

| | Balance, beginning of year | | 45,973,688 | | 139,202 | |

| | Issuance | | 8,000,000 | | 101,600 | |

| | Issued on conversion of Class “A” shares | | 400 | | — | |

| | Stock options exercised for cash | | 409,000 | | 1,252 | |

| | |

| |

| |

| | | 54,383,088 | | 242,054 | |

| | |

| |

| |

| Total issued and fully paid | | | | 254,083 | |

| | | | |

| |

On December 17, 2003, the Company exchanged 13,555,538 warrants for Class ‘’B’’ subordinate voting shares on a share-for-share basis. These warrants were issued on October 6, 2003 at a price of $16.50 each for a total consideration of $223,666. The issue costs, net of related future income taxes, amount to $2,157.

During the year ended April 27, 2003 and the year ended April 28, 2002, the Company split all of its shares on a two-for-one basis. All share and per-share information in these consolidated financial statements has been adjusted retroactively to reflect both stock splits.

On December 20, 2001, the Company issued 8,000,000 Class “B” subordinate voting shares for $12.70 per share, for total gross proceeds of $101,600. The share issue expenses, net of the related future income taxes, total $3,036.

18 - | STOCK-BASED COMPENSATION |

During the year ended April 27, 2003, the Company amended its two existing stock-based compensation plans by merging them into a single plan. The plan provides for granting stock options for the purchase of Class “B” subordinate voting shares. As at April 25, 2004, 10,640,600 subordinate shares were reserved for issue and a total of 4,327,500 subordinate shares were available for issuance as stock options. The conditions governing the granting and exercise of the options are established by the Board of Directors, as is the term of the options, which cannot exceed 10 years. The options granted can generally be exercised as follows: 20% on the day following the grant, the remaining options, 20% on each anniversary of the grant date, over the next four years. The options cannot be granted at a price that is less than the market price on the grant date.

The table below presents the status of the Company’s stock option plan as at April 25, 2004, April 27, 2003 and April 28, 2002 and the changes therein during the years then ended.

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | Number of

options | | Weighted

average

exercise

price | | Number of

options | | Weighted

average

exercise

price | |

| | |

| |

| |

| |

| |

| | | | | $ | | | | $ | |

| | | | | | | | | | |

| Balance, beginning of year | | 6,156,500 | | 8.14 | | | 7,563,000 | | 6.70 | | |

| Granted | | 840,000 | | 20.57 | | | 265,000 | | 14.79 | | |

| Options exercised | | (659,400 | ) | 5.29 | | | (1,663,000 | ) | 2.68 | | |

| Cancelled | | (24,000 | ) | 8.07 | | | (8,500 | ) | 5.93 | | |

| | |

| | | | |

| | | | |

| Balance, end of year | | 6,313,100 | | 10.09 | | | 6,156,500 | | 8.14 | | |

| | |

| | | | |

| | | | |

| Exercisable options at end of year | | 4,371,320 | | | | | 3,652,900 | | | | |

| | |

| | | | |

| | | | |

| | 2002 | |

| |

| |

| | Number of

options | | Weighted

average

exercise

price | |

| |

| |

| |

| | | | | $ | |

| Balance, beginning of year | | 5,788,000 | | 4.27 | | |

| Granted | | 2,200,000 | | 12.42 | | |

| Options exercised | | (409,000 | ) | 3.06 | | |

| Cancelled | | (16,000 | ) | 5.34 | | |

| | |

| | | | |

| Balance, end of year | | 7,563,000 | | 6.70 | | |

| | |

| | | | |

| Exercisable options at end of year | | 3,975,000 | | | | |

| | |

| | | | |

The following table presents information on the stock options outstanding as at April 25, 2004:

| | | Options outstanding | |

| | |

| |

Range of

exercise prices | | Number of

outstanding

options as at

April 25, 2004 | | Weighted

average

remaining

contractual life | | Weighted

average

exercise

price | |

| |

| |

| |

| |

| | | | | | | | $ | |

| $4 - $6 | | | 3,070,000 | | | 2.55 | | | 5.11 | | |

| $6 - $9 | | | 620,000 | | | 7.09 | | | 7.21 | | |

| $12 -$16 | | | 1,893,100 | | | 8.04 | | | 14.70 | | |

| $20 -$25 | | | 730,000 | | | 9.60 | | | 21.56 | | |

| | | |

| | | | | | | | |

| | | | 6,313,100 | | | | | | | | |

| | | |

| | | | | | | | |

| | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

as at April 25, 2004, April 27, 2003 and April 28, 2002

(in thousands of Canadian dollars, except per share amounts) |

| | |

18 - | STOCK-BASED COMPENSATION (continued) |

| | Options exercisable | |

| |

| |

Range of

exercise prices | | Number of

exercisable

options as at

April 25, 2004 | | Weighted

average

exercise

price | |

| |

| |

| |

| | | | $ | |

| $4 - $6 | | | 2,814,000 | | | 5.14 | | |

| $6 - $9 | | | 372,000 | | | 7.21 | | |

| $12 - $16 | | | 1,039,320 | | | 14.71 | | |

| $20 - $25 | | | 146,000 | | | 21.56 | | |

| | |

| | | | | |

| | | 4,371,320 | | | | | |

| | |

| | | | | |

On May 25, 2004, subsequent to year-end, 1,790,000 options were exercised for a total consideration of $9,563.

The Company does not record any compensation cost. If the compensation cost had been determined using the fair value method at the date of attribution of stock options granted beginning on April 29, 2002 to employees, net earnings and earnings per share information would have been reduced to the pro forma amounts shown in the following table:

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | Disclosed | | Pro forma | | Disclosed | | Pro forma | |

| | |

| |

| |

| |

| |

| | $ | | $ | | $ | | $ | |

| | | | | | | | | |

| Net earnings | | 79,505 | | | 76,907 | | | 66,041 | | | 65,408 | | |

| Earnings per share | | 0.89 | | | 0.86 | | | 0.78 | | | 0.77 | | |

| Diluted earnings per share | | 0.85 | | | 0.82 | | | 0.76 | | | 0.75 | | |

For purposes of calculating the compensation cost, the fair value of stock options is recognized using the straight-line method over the vesting period of the stock options.

The pro forma impact on net earnings for the period is not representative of the pro forma net earnings of future periods because it does not take into account the pro forma compensation relating to options granted prior to April 29, 2002.

The fair value of options granted is estimated at the attribution date using the Black-Scholes options pricing model on the basis of the following assumptions for attributions granted during the year:

| | | 2004 | | 2003 | |

| | |

| |

| |

| Expected dividend on shares | | None | | None | |

| Expected average volatility | | 30 | % | 30 | % |

| Weighted average risk-free interest rate | | 4.45 | | 5.26 | |

| Expected life | | 8 years | | 8 years | |

The weighted average fair value of options granted in the year ended April 25, 2004 is $9.22 ($7.03 in 2003).

19 - | CUMULATIVE TRANSLATION ADJUSTMENTS |

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | $ | | $ | |

| | | | | | |

| Balance, beginning of year | | (2,626 | ) | (106 | ) |

| Effect of change in exchange rate during the year | | | | | |

| | On the net investment in the self-sustaining foreign subsidiaries | | 4,264 | | (18,416 | ) |

| | On the long-term debt denominated in U.S. dollars designated as a hedge of the net investment in the self-sustaining foreign subsidiaries | | (2,588 | ) | 15,896 | |

| | |

| |

| |

| Balance, end of year | | (950 | ) | (2,626 | ) |

| | |

| |

| |

20 - | EMPLOYEE FUTURE BENEFITS |

The Company has defined benefit pension plans and a defined contribution pension plan for certain employees.

Information about the Company’s defined benefit plans, in aggregate, is as follows:

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | $ | | $ | |

| | | | | | |

Accrued benefit obligations | | | | | |

| | Balance, beginning of year | | 29,606 | | 30,766 | |

| | Current service cost | | 662 | | 586 | |

| | Past service cost | | — | | 3,215 | |

| | Interest cost | | 1,890 | | 1,916 | |

| | Benefits paid | | (2,387 | ) | (2,251 | ) |

| | Actuarial (gains) losses | | 1,670 | | (4,626 | ) |

| | | |

| |

| |

| | Balance, end of year | | 31,441 | | 29,606 | |

| | | |

| |

| |

| | | | | | | |

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | $ | | $ | |

Plan assets | | | | | |

| | Fair value, beginning of year | | 25,077 | | 30,288 | |

| | Actual return on plan assets | | 3,369 | | (3,588 | ) |

| | Employees contributions | | 108 | | 112 | |

| | Benefits paid | | (1,871 | ) | (1,735 | ) |

| | | |

| |

| |

| | Fair value, end of year | | 26,683 | | 25,077 | |

| | |

| |

| |

| | Funded status-plan deficit | | (4,758 | ) | (4,529 | ) |

| | Unamortized net actuarial loss | | 9,350 | | 10,051 | |

| | Unamortized transitional net asset | | (3,943 | ) | (4,509 | ) |

| | Unamortized past service cost | | 2,569 | | 2,892 | |

| | | |

| |

| |

| Accrued benefit asset | | 3,218 | | 3,905 | |

| | |

| |

| |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

as at April 25, 2004, April 27, 2003 and April 28, 2002

(in thousands of Canadian dollars, except per share amounts) |

| | |

20 - | EMPLOYEE FUTURE BENEFITS (continued) |

As at April 25, 2004, the accrued benefit obligation for pension plans with a funding deficit amounted to $10,754 ($9,715 in 2003). These plans are not funded and, accordingly, there are no assets.

Information about pension expense (income) for the Company’s defined benefit plan for the year is as follows:

| | | 2004 | | 2003 | | 2002 | |

| | |

| |

| |

| |

| | | $ | | $ | | $ | |

| | | | | | | | |

Pension expense (income) | | | | | | | |

| | Current service cost, net of employee contributions | | 554 | | 474 | | 436 | |

| | Interest cost | | 1,890 | | 1,916 | | 2,080 | |

| | Expected return on plan assets | | (1,694 | ) | (2,063 | ) | (2,721 | ) |

| | Amortized transitional asset | | (566 | ) | (566 | ) | (565 | ) |

| | Amortized net actuarial loss | | 696 | | 93 | | — | |

| | Amortized past service cost | | 323 | | 323 | | — | |

| | |

| |

| |

| |

| Pension expense (income) for the year | | 1,203 | | 177 | | (770 | ) |

| | |

| |

| |

| |

The significant actuarial assumptions which management considers the most likely to be used to determine the accrued benefit obligation are the following:

| | | 2004 | | 2003 | | 2002 | |

| | |

| |

| |

| |

| | | % | | % | | % | |

| | | | | | | | |

| Discount rate | | 6.25 | | 6.50 | | 6.75 | |

| Expected rate of return on plan assets | | 7.00 | | 7.00 | | 8.00 | |

| Rate of compensation increase | | 4.00 | | 4.00 | | 4.00 | |

The Company’s total pension expense under its defined contribution plan for the year 2004 is $1,005 ($870 in 2003 and $655 in 2002).

The Company is subject to Canadian and American legislation governing the storage, handling and sale of gasoline and related products. The Company considers that it is generally in compliance with current environmental legislation.

The Company has an on-going training program for its employees on environmental issues which includes preventive site testing and site restoration in cooperation with regulatory authorities. The Company also examines its gasoline equipment annually to make the necessary investments. In connection with the closure of certain business locations, the Company is required to remove its petroleum equipment.

In all U.S. states in which the Company operates, except Michigan, Florida, Texas and Washington, there is a state fund to cover the cost of certain rehabilitation and removing of gasoline tanks. These state funds provide insurance for gasoline facilities operations to cover the cost of cleaning up damage to the environment caused by the usage of underground gasoline equipment. Gasoline equipment tank registration fees and a gasoline tax in each of the states finance the trust funds. The Company paid the registration fees and remits the sales tax to the states where it is a member of the trust fund. Insurance coverage is different in the various states and can be as much as US$1,000 per site. The Company’s deductible ranges from US$15 to US$55. There is no trust fund in the states of Michigan, Florida, Texas and Washington.

In order to provide for the above-mentioned restoration costs, the Company has recorded a $6,299 allowance for environmental costs as at April 25, 2004 ($3,274 as at April 27, 2003). Of this amount, $1,858 ($2,266 as at April 27, 2003) has been presented on a current basis.

22 - | FINANCIAL INSTRUMENTS |

a) Description of derivative financial instruments

Management of interest rate risk

The Company has entered into interest rate swaps to manage interest rate fluctuations. It has agreed to swap the amount of the difference between the variable interest rate and the fixed rate, calculated based on the reference amounts.

The amounts outstanding at year-end, classified by subsidiary and by currency, are as follows:

Maturity(i) | | Reference | | Pays/receives | | Fixed rate | | Variable rate |

| |

| |

| |

| |

|

| | US$ | | | | % | | |

| December 2013 | | 100,000 | | | pays variable receives fixed | | 7.50 | | | LIBOR 6 months plus 3.0% |

| December 2013 | | 100,000 | | | pays variable receives fixed | | 7.50 | | | LIBOR 6 months plus 2.98% |

| December 2013 | | 150,000 | | | pays variable receives fixed | | 7.50 | | | LIBOR 6 months plus 2.89% |

(i) Under certain conditions, the maturity date of the swaps can be altered to correspond with the repurchase conditions of the corresponding subordinated notes.

b) Fair value of financial instruments

The fair value of cash and cash equivalents, accounts receivable and accounts payable is comparable to their carrying amount given that they will mature in less than one year.

| | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

as at April 25, 2004, April 27, 2003 and April 28, 2002

(in thousands of Canadian dollars, except per share amounts) |

| | |

22 - | FINANCIAL INSTRUMENTS (continued) |

b) Fair value of financial instruments (continued)

With the exception of the unsecured subordinated debt, there is no material difference between the fair value and the carrying amount of the Company’s long-term debt as at April 25, 2004 and April 27, 2003, given that the largest loans bear interest at the floating rate.

The fair value of the unsecured subordinated debt was $496,485 as at April 25, 2004.

The fair value of the interest rate swap, as determined by the Company’s bank based on quoted market prices for similar instruments was $27,175 payable by the Company ($577 payable by the Company in 2003).

23 - | CONTRACTUAL OBLIGATIONS |

As at April 25, 2004, the Company has entered into lease agreements expiring on various dates until 2027 which call for the payment of $1,809,034 for the rental of commercial space, equipment and a warehouse. Several of these leases contain renewal options and certain sites are subleased to franchise-holders. The minimum lease payments for the next five years are $187,698 in 2005, $176,087 in 2006, $163,342 in 2007, $142,356 in 2008 and $114,250 in 2009.

Moreover, the Company has concluded agreements to acquire equipment and franchise rights which call for the payment of $7,241. The minimum payments for the next five years are $2,061 in 2005, $560 from 2006 to 2008 and $700 in 2009.

Various claims and legal proceedings have been initiated against the Company in the normal course of its operations that relate to human resources and the environment. In management’s opinion, these claims and proceedings are unfounded. Although the outcome of these proceedings cannot be determined with certainty, management estimates that any payments resulting from their outcome are not likely to have a substantial negative impact on the Company’s results and financial position.

25 - | SEGMENTED INFORMATION |

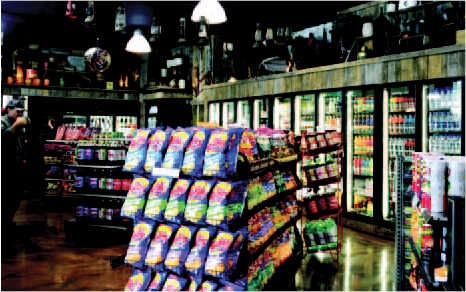

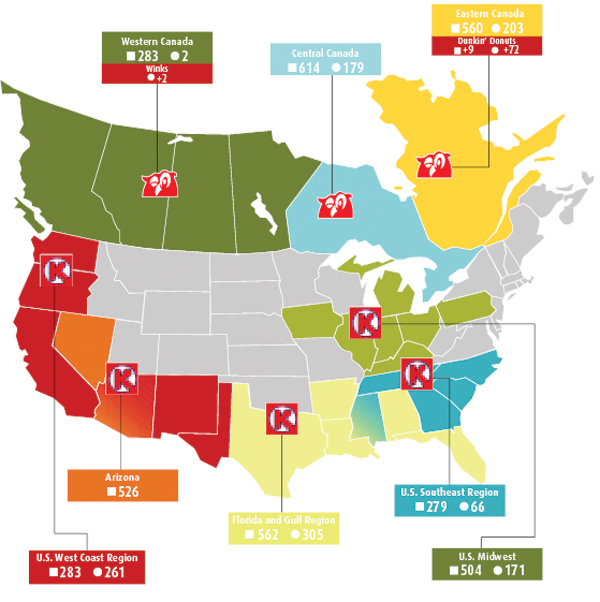

The Company essentially operates in one reportable segment, the sale of goods for immediate consumption and motor fuel through corporate stores or franchise operations. It operates a convenience store chain under several banners, including Couche-Tard, Mac’s, Bigfoot, Dairy Mart and Circle K. Revenues from outside sources mainly fall into two categories: merchandise and motor fuel. The Company operates convenience stores in Canada and, since June 2001, in the United States.

Information on the principal revenue classes as well as geographic information is as follows:

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | Canada | | U.S. | | Total | | Canada | | U.S. | | Total | |

| | |

| |

| |

| |

| |

| |

| |

| | | $ | | $ | | $ | | $ | | $ | | $ | |

| | | | | | | | | | | | | | |

External customer revenues (a) | | | | | | | | | | | | | |

| Merchandise and services | | 1,510,589 | | 1,597,085 | | 3,107,674 | | 1,428,646 | | 514,660 | | 1,943,306 | |

| Motor fuel | | 677,507 | | 2,087,213 | | 2,764,720 | | 630,144 | | 741,744 | | 1,371,888 | |

| | |

| |

| |

| |

| |

| |

| |

| | | 2,188,096 | | 3,684,298 | | 5,872,394 | | 2,058,790 | | 1,256,404 | | 3,315,194 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | |

Gross margin | | | | | | | | | | | | | |

| Merchandise and services | | 491,283 | | 521,156 | | 1,012,439 | | 462,503 | | 169,639 | | 632,142 | |

| Motor fuel | | 63,351 | | 147,184 | | 210,535 | | 57,499 | | 60,236 | | 117,735 | |

| | |

| |

| |

| |

| |

| |

| |

| | | 554,634 | | 668,340 | | 1,222,974 | | 520,002 | | 229,875 | | 749,877 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | |

Fixed assets and goodwill (a) | | 484,785 | | 692,609 | | 1,177,394 | | 459,756 | | 251,030 | | 710,786 | |

| | |

| |

| |

| |

| |

| |

| |

| | | 2002 | |

| | |

| |

| | | Canada | | U.S. | | Total | |

| | |

| |

| |

| |

| | | $ | | $ | | $ | |

External customer revenues (a) | | | | | | | |

| Merchandise and services | | 1,298,603 | | 204,519 | | 1,503,122 | |

| Motor fuel | | 532,203 | | 356,674 | | 888,877 | |

| | |

| |

| |

| |

| | | 1,830,806 | | 561,193 | | 2,391,999 | |

| | |

| |

| |

| |

Gross margin | | | | | | | |

| Merchandise and services | | 426,538 | | 65,029 | | 491,567 | |

| Motor fuel | | 54,484 | | 36,735 | | 91,219 | |

| | |

| |

| |

| |

| | | 481,022 | | 101,764 | | 582,786 | |

| | |

| |

| |

| |

| | | | | | | | |

Fixed assets and goodwill (a) | | 428,018 | | 122,696 | | 550,714 | |

| | |

| |

| |

| |

(a) | Geographic areas are determined according to where the Company generates operating income (where the sale takes place) and according to the location of the fixed assets and goodwill. |

The Company is not dependent on one major customer as a revenue source.

Certain comparative figures have been reclassified to conform with the presentation adopted in the current year.

DIRECTORS |

|

Alain Bouchard(1) |

Chairman of the Board |

President and Chief Executive Officer |

|

Richard Fortin(1) |

Executive Vice-President

and Chief Financial Officer |

|

|

Réal Plourde(1) |

Executive Vice-President

and Chief Operating Officer |

|

Jacques D’Amours(1) |

Vice-President, Administration |

|

Robert Brunet(3) (4) |

President |

Socoro (Robert Brunet Consulting) |

|

Roger Desrosiers, F.C.A.(3) |

Corporate Director |

|

Jean Élie(2) |

Corporate Director |

|

Josée Goulet |

Director of Marketing Services |

Bell Canada |

|

Roger Longpré(2) (3) |

President |

Mergerac Inc. |

|

Jean-Pierre Sauriol, Eng.(2) |

President and Chief Executive Officer |

Dessau-Soprin Inc. |

|

Jean Turmel |

President |

Financial Markets |

Treasury and Investment |

National Bank of Canada |

(1) | Member of the Executive Committee |

(2) | Member of the Human Resources and Corporate Governance Committee |

(3) | Member of the Audit Committee |

(4) | Lead Director |

|

OFFICERS |

|

Alain Bouchard |

Chairman of the Board |

President and Chief Executive Officer |

|

Richard Fortin |

Executive Vice-President

and Chief Financial Officer |

|

Réal Plourde |

Executive Vice-President

and Chief Operating Officer |

|

Jacques D’Amours |

Vice-President, Administration |

|

Canadian Operations |

|

Stéphane Gonthier |

Vice-President, Operations |

Central Canada |

|

Jean-Luc Meunier |

Vice-President, Operations |

Eastern Canada |

|

Kim J. Trowbridge |

Vice-President, Operations |

Western Canada |

|

U.S. Operations |

|

Brian P. Hannasch |

Vice-President, Integration |

|

Michel Bernard |

Vice-President, Operations |

U.S. Midwest Region |

|

Robert G. Campau |

Vice-President, Operations |

U.S. Southeast Region |

|

Geoffrey C. Haxel |

Vice-President, Operations |

Arizona Region |

|

Charles M. Parker |

Vice-President, Operations |

Florida and Gulf Region |

|

Joy A. Powell |

Vice-President, Operations |

U.S. West Coast Region |

|

Brigitte K. Catellier |

Corporate Secretary |

|

Michael Guinard |

Vice-President, Development |

|

Dale Pettit |

Vice-President and Treasurer |

OTHER INFORMATION

Head Office |

1600 Saint-Martin Boulevard East |

Tower B, Suite 200 |

Laval, Quebec H7G 4S7 |

Telephone: (450) 662-3272 |

Fax: (450) 662-6648 |

|

Auditors |

Raymond Chabot Grant Thornton |

600 de la Gauchetière West |

Suite 1900 |

Montreal, Quebec H3B 4L8 |

|

Transfer Agent |

National Bank Trust |

1100 University Street |

Suite 900 |

Montreal, Quebec |

H3B 2G7 |

|

Investor Relations |

|

Richard Fortin |

Executive Vice-President

and Chief Financial Officer |

|

For any additional information about Alimentation Couche-Tard Inc., shareholders, investors and analysts are requested to contact the Corporate Secretary at the head office address or to use the following e-mail address. |

|

E-mail: |

info@couche-tard.qc.ca |

|

www.couche-tard.com |

Lefebvre Financial Communications Inc.

Design: Susan Séguin

Graphic production: Kathy Nadal and Denis Michaud

Officers’ photos: François Roy

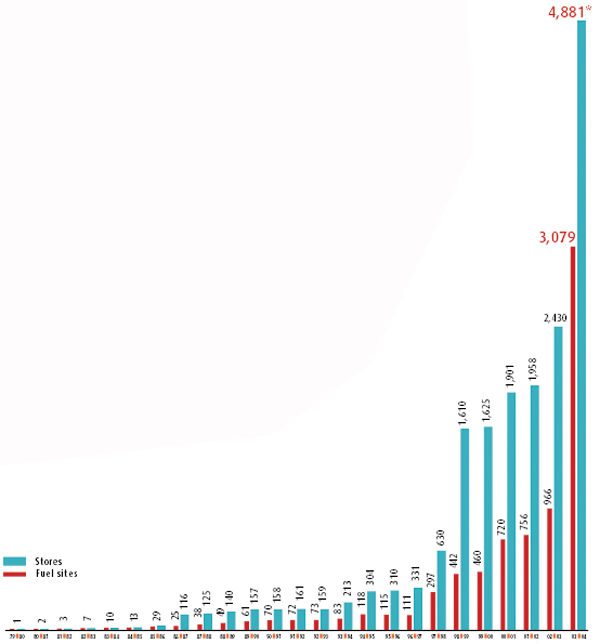

Corporate stores

Corporate stores  Licensed and franchised stores

Licensed and franchised stores

® and

® and ® proprietary brands. We also started to improve our coffee service by installing new equipment and offering a loyalty card that is popular with customers. In addition, we renewed our supply agreements with two major breweries.

® proprietary brands. We also started to improve our coffee service by installing new equipment and offering a loyalty card that is popular with customers. In addition, we renewed our supply agreements with two major breweries.