The following table sets forth, as to those Named Executive Officers, certain information concerning the number of shares subject to both exercisable and unexercisable stock options as of December 31, 2008, and the number of shares of common stock received upon exercise of options during the last fiscal year.

In 2006, we cancelled option awards for 600,000 shares of common stock having exercise prices ranging from $6.45 to $10.00 and reissued the same number of option awards with an exercise price of $5.85 per share.

On July 10, 2008, 50,000 options to purchase shares of common stock at $5.85 per share, 50,000 options to purchase shares of common stock at $6.80 per share and 100,000 shares of restricted stock were cancelled in exchange for 200,000 options to purchase common stock at $1.39 per share.

Mr. Shupe resigned in February 2009.

Option awards were forfeited upon Mr. Shupe’s resignation.

Mr. Tougas resigned in October 2008.

All option awards were forfeited following Mr. Tougas’ resignation.

Employment Agreements

David C. Owen, our Chief Executive Officer, is employed pursuant to an Executive Employment Agreement dated August 10, 2006, as amended and restated effective March 16, 2008 and December 17, 2008, with annual compensation of $225,000 per year. On each anniversary of the agreement, commencing on March 16, 2009, one year will be added to the term of Mr. Owen’s employment with us so that as of each anniversary of the agreement, the term of Mr. Owen’s employment will be two years.

The agreement provides for increases in the base salary at the discretion of our Board of Directors. The agreement notwithstanding, effective October 20, 2004, Mr. Owen voluntarily agreed to reduce his salary to $125,000 annually until we reached accumulated gross revenues of $8 million, at which time his salary was to be restored to $225,000 and accrued but unpaid salary and other compensation (which totaled approximately $115,000) would be paid in full. The $8 million threshold was achieved in December 2006, Mr. Owen received payment of the unpaid compensation, and his salary was restored to $225,000 effective January 1, 2007. The agreement further provides that Mr. Owen is entitled to participate in our stock option and 401(k) plans, to receive a monthly car allowance of $850 or a company-provided vehicle, to be covered by our health insurance pl an and to reimbursement of reasonable out-of-pocket expenses. The agreement is renewable by mutual agreement.

Laura E. Owen, our President, Chief Operating Officer and Corporate Secretary, is employed pursuant to an Executive Employment Agreement dated August 10, 2006, as amended and restated effective March 16, 2008 and December 17,2008, with annual compensation of $175,000 per year. On each anniversary of the agreement, commencing on March 16, 2009, one year will be added to the term of Ms. Owen’s employment with us so that as of each anniversary of the agreement, the term of Ms. Owen’s employment thereunder will be two years.

The agreement notwithstanding, effective October 20, 2004, Ms. Owen voluntarily agreed to reduce her annual salary to $125,000 until we reached accumulated gross revenues of $8 million, at which time her salary would be restored to $175,000 and accrued but unpaid salary and other compensation (which totaled approximately $83,000) would be paid in full. The $8 million threshold was achieved in December 2006, Ms. Owen received payment of the unpaid compensation and her salary was restored to $175,000 effective January 1, 2007. The agreement further provides that Ms. Owen is entitled to participate in our stock option and 401(k) plans, to receive a monthly car allowance of $850 or a company-provided vehicle, to be covered by our health insurance plan and to reimbursement of reasonable out-of-pocket expenses. The agreement is renewable by mutual agreement.

On July 10, 2008, Mr. Owen and Ms. Owen were each granted 200,000 options to purchase shares of common stock at an exercise price of $1.39 per share, the closing price of our common stock on July 10, 2008, as reported on the Nasdaq Stock Market. These options are immediately exercisable, expire on July 9, 2018, and were granted pursuant to, and are subject to the terms, conditions and forfeiture provisions of, our 2002 Stock Option Plan. We granted these options in exchange for (i) Mr. Owen’s agreement to cancel 100,000 unvested shares of restricted stock, 50,000 options to purchase shares of common stock at $5.85 per share and 50,000 options to purchase shares of common stock at $6.80 per share, and (ii) Ms. Owen’s agreement to cancel 100,000 unvested shares of restricted stock, 37,500 options to purchase

26

shares of common stock at $5.85 per share and 50,000 options to purchase shares of common stock at $6.80 per share.

If Mr. Owen or Ms. Owen retires or is terminated for any reason, or upon the occurrence of a change of control or a material change in the duties or location of Mr. Owen or Ms. Owen's employment, he or she will be entitled to receive severance benefits, including (i) payment of an amount equal to the sum of 24 months of his or her base salary plus the average annual bonus amount for the 3 prior years, (ii) continuation of life, medical, dental and disability coverage for the longer of 24 months or the age he or she reaches the minimum age necessary to qualify for health insurance benefits under Medicare, (iii) receipt of vested benefits owing to him or her under any retirement, incentive, profit sharing, bonus, performance, disability or other employee benefit plan maintained by the Company, and (iv) immediate vesting of any unexercised stock options granted and held by Mr. Owen or Ms. Owen.

If a Company executive's employment terminates as a result of his or her death or disability, or upon a change of control, all or a portion of any unvested stock options granted to such executive may be subject to accelerated vesting in accordance with the terms of the 2002 Plan or any applicable employment, stock option, separation or severance agreement.

Director Compensation for 2008

| | |

Name | Fees Earned or Paid in Cash | Options Outstanding (1) |

L. Derrick Ashcroft (2) | $ 7,250 | 30,000 |

Bryan Ferguson | $ 8,300 | 25,000 |

Noel Koch | $ 12,750 | 30,000 |

Roger Mason | $ 12,750 | 30,000 |

(1)

As of December 31, 2008.

(2)

Mr. Ashcroft retired from the Board in August 2008.

Each non-employee director receives cash compensation in the form of Board and committee meeting fees. Currently, each of our non-employee directors is entitled to receive $500 for attendance at each meeting of the Board and $500 for attendance at each meeting of a Board committee. Telephonic attendance fees are $250. In addition, each committee chairman is entitled to receive $1,500 for each Board committee meeting that he attends as committee chairman. In 2007, in addition to fees, each non-employee director received options to purchase 15,000 shares as consideration for Board and committee service.

Stock Option Repricing

On June 12, 2009, our Compensation and Incentive Plan Committee authorized the repricing (“Repricing”) of an aggregate of 1,282,500 stock options previously issued to our employees, officers and independent directors pursuant to the 2002 Plan (the “options”). As a result, the exercise price of the options was reduced to $0.45 per share. There was no change in the number of shares subject to each option, nor any change in the vesting or other terms. The Repricing was implemented to realign the value of the options with their intended purpose,

27

which is to retain and motivate our employees, officers and directors. Prior to the Repricing, the option exercise prices were well above the recent trading prices of our common stock on the Nasdaq Stock Market. The closing price of our common stock on June 12, 2009, as reported by the Nasdaq Stock Market, was $0.45 per share.

Our executive officers and independent directors participated in the Repricing on the same terms as our employees.

Our equity compensation plan is designed to attract, retain and motivate high quality officers, directors and employees in a fast-moving and competitive industry.

We are a relatively young company that has invested heavily in developing sophisticated, high technology products for the protection of people, property and places. Our industry is intensely competitive, requiring us to compete with companies having significantly greater revenues, profits and name recognition than ICOP. To enable us to compete in this market, we require highly capable technical and sales personnel, and experienced, well-connected directors and Advisory Board members. Like many high technology growth companies, equity compensation has been a significant component of our total compensation program to attract and retain talented people, many of whom have opportunities with larger companies. We have also used equity compensation to supplement the very modest cash compensation we are able to pay to our executive officers and independent directors. High quality independent directors are imperative in helping us open new markets and capitalize on opportunities.

Like many companies, we have experienced a significant decline in our stock price over the last year in light of the current global financial and economic crisis. In addition, we have incurred continuing operating losses since inception as we have developed our product line and built customer loyalty with law enforcement agencies across the United States. We have announced exciting new products and significant potential opportunities in the Middle East and Mexico, and plan on announcing additional potential opportunities in the near future. Nevertheless, our stock price has continued to decline. The sustained decline in our stock price has significantly weakened the recruitment and retention value of a major component of our compensation structure. We believe that had we not implemented the Repricing, it would have become increasingly more challenging to attract and retain the talent required to grow our Company and achieve profitability.

We believe that to be successful, our employees need to think like owners, and that an effective and competitive incentive program is imperative for the growth and success of our business. Consistent with this philosophy, our equity program continues to be broad-based. We believe this broad-based equity program provides us with a competitive advantage, particularly in our efforts to hire and retain top talent in a highly competitive, high technology industry.

Due to the significant decline of our stock price during the last year, our officers, directors and many of our employees held stock options with exercise prices significantly higher than the current market price of our common stock. For example, the closing price of our common stock on the Nasdaq Stock Market on June 12, 2009, was $0.45, whereas the weighted average exercise price of all outstanding options held by our officers, directors and employees on that date was $4.01. As of June 12, 2009, all of the outstanding options held by our officers,

28

directors and employees were underwater. Although we continue to believe that equity awards are an important component of our employees’ total incentive benefits and provide us with a competitive advantage, we also believe that many of our employees viewed their options as having little or no value due to the significant difference between the exercise prices and the current market price of our common stock. The market for key employees remains extremely competitive, notwithstanding the current economic turmoil. Yet for many employees, we believe that the underwater options were no longer effective at providing the incentives that our Board and Compensation and Incentive Plan Committee believe are necessary to motivate and retain them.

Although it was not likely any of the underwater options would have been exercised in the foreseeable future, we have continued to incur noncash compensation expense for the underwater options. Without the Repricing, based upon the Black-Scholes valuation method, we would have continued to incur noncash compensation expense of approximately $197,000 per year for a period of 1.3 years (vesting life), the remaining life for underwater options that were unlikely to be exercised and thus of no benefit to our officers, directors, employees or the Company. Unless our stock price dramatically increases, we believe it is unlikely that any of the underwater options would be exercised. We believe it is not an efficient use of Company resources to recognize compensation expense on options that have little or no retention value because they are underwater.

We expect to incur only approximately $88,000 in additional noncash compensation expense for a period of 1.3 years, or an increase in noncash compensation expense of only 3%, as a result of the Repricing.

We believe the Repricing was in the best interest of our stockholders because:

·

The Repricing will drive improved retention and motivation of our officers, directors and employees.

·

Instead of simply issuing new options to officers, directors and employees with a lower exercise price, which would have increased stock overhang and stockholder dilution, we kept the same number of options and reduced the exercise price to increase the likelihood of their exercise if our stock price improves.

·

We are giving our officers, directors and employees a meaningful, significant and renewed stake in our future success, which we believe more closely aligns the interests of our offices, directors and employees with the interests of our stockholders.

·

We are recapturing the compensation expense from the options and incurring additional noncash compensation expense of only approximately $88,000 over the remaining life of the options.

29

The table below shows the number of underwater options that were repriced, the weighted average exercise price for the underwater options, and the new weighted average exercise price for the repriced options:

| | | | |

| Number of Participants | Aggregate Number of Options | Weighted Average Exercise Price Before Repricing | Weighted Average Exchange Price After Repricing |

Officers | 3 | 910,000 | 3.79 | $0.45 |

Non-Officer

Employees\Other |

25 | 345,000 |

4.12 | $0.45 |

Directors | 3 | 85,000 | 5.88 | $0.45 |

Federal Income Tax Consequences of Stock Option Repricing

Although the taxation impact to the Company for the stock option Repricing is expected to be minimal beyond the impact of any change in the deductible component for noncash compensation expenses in recognition of the valuation change for underwater options set forth above, the option Repricing determination could have a potential tax effect on each of the eligible participants under the 2002 Plan.

The most significant changes and impact to affected participants are due to the 2002 Plan’s status as a statutory “Incentive Stock Option” arrangement under Code Section 422. Under current IRS guidelines, a stock option repricing is generally considered as a grant of new options, and thus the “disqualifying disposition” holding period, and other applicable requirements under Section 422 were restarted as of the date of the option Repricing. However, for purposes of Code Section 422 requirements that limit the annual amount that can be exercised to $100,000 per year, both the “cancelled” and “replacement” options will be counted for purposes of satisfying the annual exercise limit each year, in comparison to the applicable fair market value during that period.

Code Section 162(m), could also have an impact on applicable executive compensation should such amounts, including any exercised stock option amounts during that period, reach or exceed $1 million. At the present time, the impact of these deduction limitations on executive compensation is expected to be minimal. Moreover, even though the option Repricing could be considered a modification of a previous stock option award arrangement, any applicable impact of Code Section 409A on “nonqualified deferred compensation arrangements” generally should not be applicable due to the Repricing of all options to the current fair market value of the underlying stock at the date of the Repricing. Under such circumstances, the final regulations under Code Section 409A make clear that such Repricing is treated as an award of a new option that is otherwise exempt from Code Section 409A.

30

PRINCIPAL STOCKHOLDERS

Set forth below is information regarding the beneficial ownership of our common stock, as of June 23, 2009 by (i) each person whom we know owned, beneficially, more than 5% of the outstanding shares of our common stock, (ii) each of our directors, (iii) each of our Named Executive Officers, and (iv) all of the current directors and executive officers as a group. We believe that, except as otherwise noted below, each named beneficial owner has sole voting and investment power with respect to the shares listed. Unless otherwise indicated herein, beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting or investment power with respect to shares beneficially owned. Shares issuable upon exercise of options or warrants currently exercisable or exercisable within 60 days of June 23, 2009 are deemed outstanding for computing the percentage ownership of the person holding such options or warrants, but are not deemed outstanding for computing the percentage ownership of any other person.

| | |

Name of Beneficial Owner (1) | Number of Shares Beneficially Owned | Percentage |

Named Executive Officers and Directors |

|

|

David C. Owen | 1,284,002(2) | 7.5% |

Laura E. Owen | 1,284,002(2) | 7.5% |

Derick Shupe | 4,902(3) | * |

Roger L. Mason | 95,000(4) | * |

Bryan Ferguson | 11,000(5) | * |

Noel Koch | 35,800(6) | * |

|

|

|

All directors and officers as a group (eight persons) | 1,434,704 | 8.3% |

(1)

Except as otherwise noted, the address of all persons named in this table is: c/o ICOP Digital, Inc., 16801 West 116th Street, Lenexa, Kansas 66219.

(2)

Mr. Owen and Ms. Owen beneficially own the following securities: nonstatutory options held by Owen Enterprises, LLC to purchase 100,000 shares of common stock; nonstatutory options held by Mr. Owen to purchase 450,000 shares of common stock; and nonstatutory options held by Ms. Owen to purchase 350,000 shares of common stock. In addition to options, Mr. and Ms. Owen beneficially own: 263,602 shares of common stock held by David & Laura Owen Trust dated 6/4/97; 60,400 shares of common stock held by Owen Enterprises, LLC; 25,000 shares of common stock held by Owen & Associates, Inc. Profit Sharing Plan; 5,000 shares of common stock held by DBM, LP; 5,000 shares of common stock held by Emerson B. Wells, LP; 25,000 shares of common stock held by MDN, LP.

(3)

Consists of 4,804 shares of common stock. Mr. Shupe resigned in February.

(4)

Consists of 60,000 shares of common stock, and a warrant to purchase 5,000 shares of common stock and options to purchase 30,000 shares or common stock that are exercisable within 60 days of June 23, 2009.

31

(5)

Consists of 1,000 shares of common stock and options to purchase 10,000 shares of common stock that are exercisable within 60 days of June 23, 2009.

(6)

Consists of 800 shares of common stock, and a warrant to purchase 5,000 shares of common stock and options to purchase 30,000 shares of common stock that are exercisable within 60 days of June 23, 2009.

32

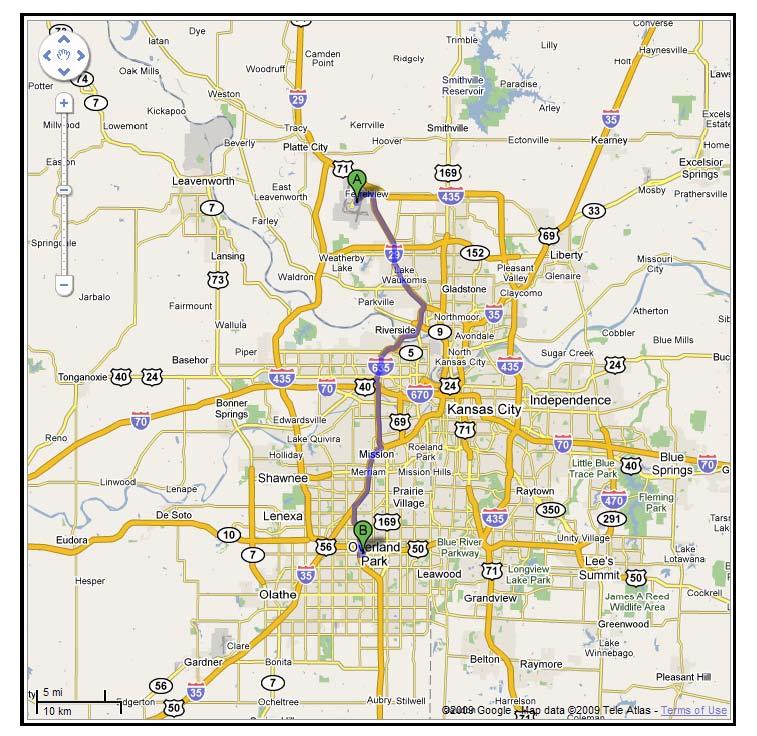

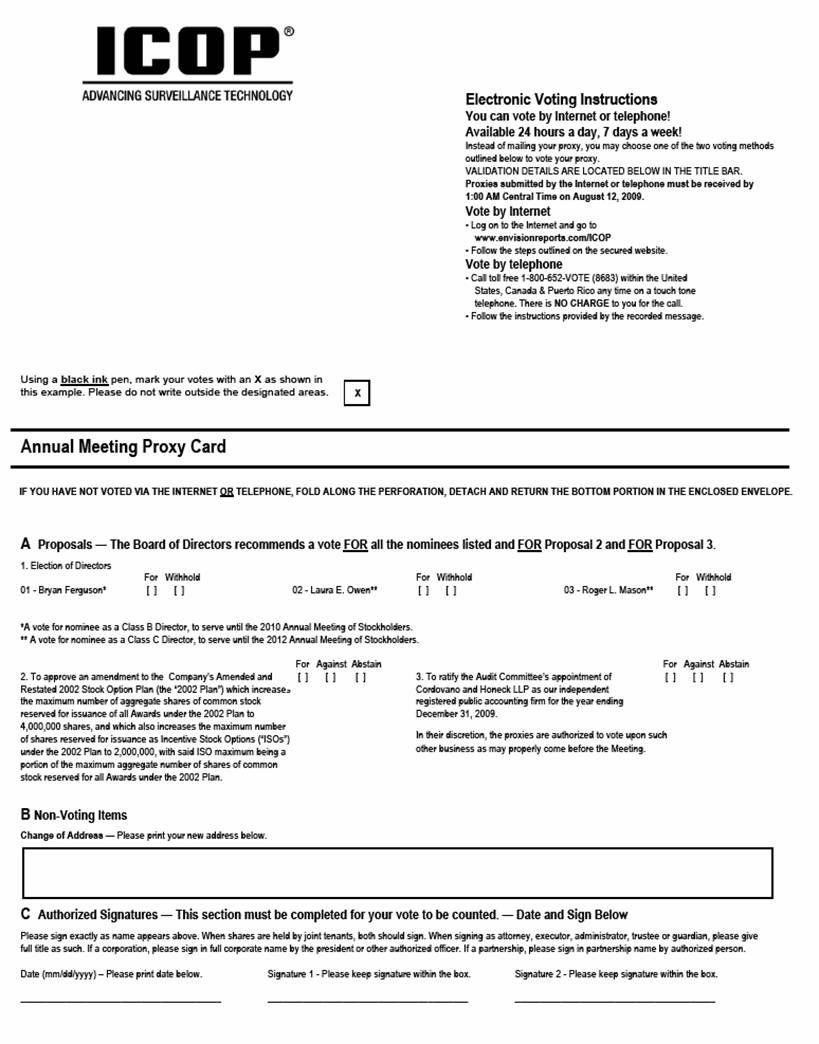

PROPOSAL NO. 1

ELECTION OF THE BOARD OF DIRECTORS

The Board of Directors has nominated Bryan Ferguson to serve as a Class B director for a term expiring at the 2010 Annual Meeting, and Laura E. Owen and Roger L. Mason to serve as Class C directors for a term expiring at the 2012 Annual Meeting, or until their successors are elected and qualified.

Vote Required

The candidate for Class B director receiving the highest number of votes cast in favor of his election shall be elected as a Class B director. The two candidates for Class C director receiving the highest number of votes cast in favor of their election shall be elected as Class C directors.

Recommendation

The Board recommends that stockholders vote FOR the election of Mr. Ferguson, Ms. Owen and Mr. Mason.

Unless marked otherwise, proxies received will be voted FOR the election of all three nominees.

* * * * *

PROPOSAL NO. 2

APPROVAL OF AMENDMENT TO 2002

AMENDED AND RESTATED STOCK OPTION PLAN

On June 16, 2009, the Board of Directors approved, subject to stockholder approval, an amendment to the Amended and Restated 2002 Stock Option Plan (the “2002 Plan”) which increases the maximum number of aggregate shares of common stock reserved for issuance of all Awards under the 2002 Plan to 4,000,000 shares, and which also increases the maximum number of shares reserved for issuance as Incentive Stock Options (“ISOs”) under the 2002 Plan to 2,000,000, with said ISO maximum being a portion of the maximum aggregate number of shares of common stock reserved for all Awards under the 2002 Plan. The Board approved the amendment of the 2002 Plan because it believes that the number of shares currently available under the 2002 Plan is not sufficient to satisfy the Company’s incentive compensation needs.

The 2002 Plan was originally allocated 500,000 shares of common stock for Awards, as adjusted for stock splits, stock dividends and other changes in capitalization occurring after the original effective date of the 2002 Plan. However, the number of shares of common stock reserved for Awards automatically increases on each anniversary of the effective date of the 2002 Plan by an amount equal to 0.5% of the then issued and outstanding shares of the Company’s common stock. The 2002 Plan originally required that no more than 300,000 shares of common stock available for Awards to be issued in connection with the exercise of ISOs, as adjusted for stock splits, stock dividends and other changes in capitalization occurring after the original effective date of the 2002 Plan. On November 20, 2005 and August 10, 2006, the Board

33

of Directors and stockholders, respectively, approved an increase in the number of shares of common stock reserved for Awards under the 2002 Plan to 1,500,000.

At the 2008 annual meeting of stockholders, our stockholders approved an amendment to the 2002 Plan to increase the maximum number of aggregate shares of common stock reserved for issuance under the 2002 Plan to 2,036,346 shares, which also increased the maximum number of shares reserved for issuance as ISOs under the 2002 Plan to 1,200,000.

After the 2002 Plan was amended last year, the maximum number of aggregate shares of common stock reserved for issuance under the 2002 Plan represented approximately 27% of the total number of shares of common stock then outstanding, without taking into account any outstanding but unexercised common stock purchase warrants. Since the date of the 2008 Annual Meeting, the number of shares of common stock of the Company issued and outstanding has increased from 7,462,937 shares to 16,276,232 shares (or approximately 118%) as a result of (1) our recently completed public offering of 747,500* Units, each containing 12 shares of common stock and 12 common stock purchase warrants for a total of 8,970,000 additional shares of common stock outstanding, (2) the exercise by the underwriter of the public offering of an over-allotment option to purchase an additional 97,500 Units, consisting of 1,170,000 shares of common stock and 1,170,000 common stock purchase warrants, and (3) 19,840 shares of common stock purchased by employees under our Employee Stock Purchase Plan. The foregoing share amounts do not take into consideration any outstanding but unexercised stock options or warrants.

Like many high technology growth companies, ICOP uses stock options to attract and retain high quality officers, directors and employees. Based upon our prior history, our officers, directors and employees have expected that the total option pool available for Awards under the 2002 Plan would constitute approximately 25% of the total number of shares of common stock issued and outstanding. To continue to meet this expectation and enable ICOP to attract and retain talented people in a highly competitive market, the Board considered it would be in the best interest of our stockholders to increase the size of the potential option pool to keep pace with the increase in our shares of common stock outstanding. If our stockholders approve Proposal 2 and increase the maximum number of aggregate shares of common stock reserved for issuance of all Awards under the 2002 Plan to 4,000,000 shares, the maximum number of aggregate shares reserved for all Awards under the 2002 Plan would represent approximately 24.5% of the total number of shares of common stock issued and outstanding as of June 23, 2009.

As of June 23, 2009, 1,365,000 shares of common stock were covered by outstanding Awards granted under the 2002 Plan. As of June 23, 2009, after taking the Repricing into effect, the aggregate market value of the securities underlying all outstanding Awards under the 2002 Plan was $2,363,359. To the extent there are Awards granted, if any, in excess of the then-existing pool of reserved shares, such shares were granted contingent on obtaining stockholder approval for the increase and, according to the terms of the 2002 Plan, any shares issued upon exercise of such Awards are to be held in escrow until stockholder approval is obtained, if necessary.

*Includes the 15% over allotment option of the Firm Units sold.

34

The Board of Directors considered the increase necessary to ensure that the 2002 Plan will continue to have the capacity to support future needs of the Company. The Board believes that the increase and the approval of the proposed amendment will be beneficial to the Company as it will allow us greater flexibility to incorporate equity components into compensation arrangements, which will assist us in the recruitment and retention of quality people and enable us to remain competitive for talented officers, directors and employees.

The Board of Directors has proposed amending the 2002 Plan to increase the maximum number of aggregate shares of common stock reserved for issuance of all Awards under the 2002 Plan to 4,000,000, subject to the annual increase of 0.5% of the Company’s issued and outstanding shares on each anniversary of the 2002 Plan’s effective date. The Board has further proposed amending the 2002 Plan to increase the maximum number of shares of common stock reserved for issuance of Awards in the form of ISOs to 2,000,000, with said ISO maximum being a portion of the maximum aggregate number of shares of common stock reserved for all Awards under the 2002 Plan.

Summary of Amended and Restated 2002 Stock Option Plan

The following is brief summary of the Amended and Restated 2002 Stock Option Plan, a copy of which is included as Appendix A to this proxy statement.

Plan Administration

The 2002 Plan is administered by the Compensation and Incentive Plan Committee (the “Committee”). The Committee currently consists of our three independent directors. The Committee has the authority to adopt such rules or guidelines as it deems appropriate to implement the 2002 Plan. Any action taken by the Committee with respect to the implementation, interpretation or administration of the 2002 Plan shall be final, conclusive and binding.

Subject to any applicable limitations contained in the 2002 Plan, the Committee has the authority to (a) select the employees, outside directors and consultants who are to receive Awards under the 2002 Plan, (b) determine the type, number, vesting requirements and other features and conditions of such Awards, (c) interpret the 2002 Plan and (d) make all other decisions relating to the operation of the 2002 Plan. Among other things, the Committee has the authority to effect the cancellation and regrant of any or all outstanding Awards.

The 2002 Plan provides that appropriate adjustments shall automatically be made to the 2002 Plan and any outstanding Awards to reflect stock splits, stock dividends, recapitalizations and other similar changes in capitalization. The 2002 Plan also contains provisions addressing the consequences of any change in control, which is defined as (a) the consummation of a stockholder-approved merger or consolidation of the Company in which (i) the Company is not the surviving entity or (ii) securities possessing more than 30% of the total combined voting power of the Company’s outstanding securities are transferred to a person or persons different than those holding those securities immediately prior to such transaction; (b) the sale, transfer or other disposition of all or substantially all of the Company’s assets; (c) a change in the composition of the Board over an 18-month period, as a result of which fewer than 50% of the

35

incumbent directors are directors who either (i) had been directors of the Company continuously since the beginning of such period or (ii) have been unanimously elected or nominated by the Board for election as directors during such period; or (d) any transaction as a result of which any person becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company representing at least 30% of the total combined voting power represented by the Company’s then outstanding voting securities.

Types of Awards

The 2002 Plan provides for the grant of incentive stock options intended to qualify under Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), nonqualified stock options, restricted stock and other stock-based awards as described below (collectively, “Awards”).

Incentive Stock Options and Nonqualified Stock Options

Optionees receive the right to purchase a specified number of shares of common stock at a specified option price and subject to such other terms and conditions as are specified in connection with the option grant. An option may be either an ISO or a nonqualified stock option (“NSO”). ISOs may be granted at an exercise price equal to or greater than the fair market value of the common stock on the date of grant (but no such restriction exists in the case of an NSO). All ISOs must be exercised within (i) five years of the grant thereof in the case of optionees holding 10% or more of the voting power of the Company, and (ii) ten years of the grant thereof in the case of optionees other than those holding 10% or more of the voting power of the Company. Options may not be granted for a term in excess of ten years. The Committee may at any time and in its discretion accelerate the vesting of any option by giving written notice to the optionee. Furthermore, if there is a change of control of the Company, as that term is defined in the 2002 Plan, the vesting of all outstanding options shall automatically accelerate and all such options would become immediately exercisable. The 2002 Plan permits payment of the exercise price of options by cash or cash equivalents, surrender of common stock already owned by the optionee, a “cashless exercise,” a recourse promissory note, or in any other form of payment that the Committee deems appropriate.

Restricted Stock

An award of Restricted Stock entitles recipients to acquire shares of restricted common stock, subject to the right of the Company to repurchase all or part of such shares from the recipient if the conditions specified in the applicable award are not satisfied prior to the end of the applicable restriction period established for such Award. The award may be subject to vesting requirements and the Committee may accelerate vesting in its discretion. Furthermore, if there is a change of control of the Company, the vesting of all outstanding restricted stock awards shall automatically accelerate.

Amendment and Termination

The Board may, at any time and for any reason, amend, suspend or terminate the 2002 Plan. An amendment of the 2002 Plan shall be subject to the approval of the Company’s stockholders only to the extent required by applicable laws, regulations or rules, including the

36

rules of the Nasdaq Stock Market. No Awards shall be granted under the Plan after the termination thereof. The termination of the Plan, or any amendment thereof, shall not affect any Award previously granted under the Plan.

Shares Available for Grants

As of August 7, 2008, 2,036,346 shares were reserved for issuance as Awards under the 2002 Plan. However, the number of shares reserved automatically increases on each anniversary of the effective date of the 2002 Plan by an amount equal to 0.5% of the then issued and outstanding shares of the Company’s common stock. As of June 23, 2009, 2,149,192 shares were reserved for issuance of Awards under the Plan. Awards made in excess of the maximum number of aggregate shares of common stock reserved for Awards, if any, were granted contingent on obtaining stockholder approval for the increase that is the subject of this Proposal 2; and, according to the terms of the 2002 Plan, any shares of common stock issued in connection with such an Award are to be held in escrow until stockholder approval is obtained.

Eligibility

Employees and consultants of the Company or its subsidiaries and the Company’s directors are eligible for Awards under the 2002 Plan. Under current law, however, incentive stock options may only be granted to employees of the Company and its subsidiaries. At December 31, 2008, approximately 62 persons were eligible to participate in the 2002 Plan.

Federal Income Tax Consequences

The following is a summary of the United States federal income tax consequences that generally will arise with respect to Awards granted under the 2002 Plan. This summary is based on the federal tax laws in effect as of the date of this proxy statement. In addition, this summary assumes that all awards are exempt from, or comply with, the rules under Section 409A of the Code regarding nonqualified deferred compensation. The 2002 Plan provides that no Award will provide for deferral of compensation that does not comply with Section 409A of the Code, unless the Board, at the time of grant, specifically provides that the Award is not intended to comply with Section 409A. Changes to these laws could alter the tax consequences described below.

Incentive Stock Options

A participant will not have income upon the grant of an ISO. Also, except as described below, a participant will not have income upon exercise of an ISO if the participant has been employed by the Company or its corporate parent or 50% or more-owned corporate subsidiary at all times beginning with the option grant date and ending three months before the date the participant exercises the option. If the participant has not been so employed during that time, then the participant will be taxed as described below under “Nonqualified Stock Options.” The exercise of an ISO may subject the participant to the alternative minimum tax.

A participant will have income upon the sale of the stock acquired under an ISO at a profit (if sales proceeds exceed the exercise price). The type of income will depend on when the participant sells the stock. If a participant sells the stock more than two years after the option was granted and more than one year after the option was exercised, then all of the profit will be

37

long-term capital gain. If a participant sells the stock prior to satisfying these waiting periods, then the participant will have engaged in a disqualifying disposition and a portion of the profit will be ordinary income and a portion may be capital gain. This capital gain will be long-term if the participant has held the stock for more than one year and otherwise will be short-term. If a participant sells the stock at a loss (sales proceeds are less than the exercise price), then the loss will be a capital loss. This capital loss will be long-term if the participant held the stock for more than one year and otherwise will be short-term.

Nonqualified Stock Options

A participant will not have income upon the grant of a NSO. A participant will have compensation income upon the exercise of a NSO equal to the value of the stock on the day the participant exercised the option less the exercise price. Upon sale of the stock, the participant will have capital gain or loss equal to the difference between the sales proceeds and the value of the stock on the day the option was exercised. This capital gain or loss will be long-term if the participant has held the stock for more than one year and otherwise will be short-term.

Restricted Stock Awards

A participant will not have income upon the grant of restricted stock unless an election under Section 83(b) of the Code is made within 30 days of the date of grant. If a timely 83(b) election is made, then a participant will have compensation income equal to the value of the stock less the purchase price. When the stock is sold, the participant will have capital gain or loss equal to the difference between the sales proceeds and the value of the stock on the date of grant. If the participant does not make an 83(b) election, then when the stock vests the participant will have compensation income equal to the value of the stock on the vesting date less the purchase price. When the stock is sold, the participant will have capital gain or loss equal to the sales proceeds less the value of the stock on the vesting date. Any capital gain or loss will be long-term if the participant held the stock for more than one year and otherwise will be short-term.

Other Stock-Based Awards

The tax consequences associated with any other stock-based Award granted under the 2002 Plan will vary depending on the specific terms of such Award. Among the relevant factors are whether or not the Award has a readily ascertainable fair market value, whether or not the Award is subject to forfeiture provisions or restrictions on transfer, the nature of the property to be received by the participant under the Award and the participant’s holding period and tax basis for the Award or underlying common stock.

Tax Consequences to the Company

The Company will incur compensation expense for ISOs, NSOs and restricted stock awards. There will be no tax consequences to the Company other than the Company being entitled to a deduction when a participant has compensation income. Any such deduction will be subject to the limitations of Section 162(m) of the Code.

38

The foregoing is only a summary of the federal income taxation of Awards granted under the 2002 Plan. Reference should be made to the applicable provisions of the Code. This Summary does not purport to be complete, and does not discuss the tax consequences of the participant’s death or the provisions of the income tax laws of any municipality, state, or foreign country in which the participant may reside.

PROPOSAL NO. 3

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has engaged the registered public accounting firm of Cordovano and Honeck LLP as our independent registered public accounting firm to audit our financial statements for the year ending December 31, 2009. Cordovano and Honeck LLP audited our financial statements for the years ended December 31, 2008 and 2007.

Fees paid to Cordovano and Honeck LLP during 2008 and 2007 were as follows:

| | |

| 2008 | 2007 |

1) Audit fees | $35,903 | $50,773 |

2) Audit related fees | $14,258 | 7,740 |

3) Tax fees | - | - |

4) All other fees | - | - |

Representatives of Cordovano and Honeck LLP are expected to be present at the Annual Meeting and will have the opportunity to make a statement if they desire and to respond to appropriate questions.

The Audit Committee pre-approves all audit and permissible non-audit services provided by the independent auditors. The Audit Committee has adopted a policy for the pre-approval of services provided by the independent auditors. Under the policy, pre-approval is detailed as to the scope and fees to be associated with the services. The Audit Committee may delegate pre-approval authority to one or more of its independent members. Such member must report any decisions to the Audit Committee at the Committee’s regularly scheduled meetings.

OTHER MATTERS

Management does not know of any other matters to be brought before the annual meeting of stockholders. If any other matters not mentioned in this proxy statement are properly brought before the meeting, the individuals named in the enclosed proxy intend to use their discretionary voting authority under the proxy to vote the proxy in accordance with their best judgment on those matters.

39

By Order of the Board of Directors

/s/ David C. Owen

David C. Owen

Chairman, Chief Executive Officer and Director

July 2, 2009

40

APPENDIX A

ICOP DIGITAL, INC.

AMENDED AND RESTATED 2002 STOCK OPTION PLAN

ARTICLE I

PURPOSE

The purpose of the ICOP Digital, Inc. Stock Option Plan (the “Plan”) is to attract and retain directors, officers, other employees and consultants of ICOP Digital, Inc. and its subsidiaries (collectively the “Company”) and to provide such persons with incentives to continue in the long-term service of the Company and to create in such persons a more direct interest in the future success of the operations of the Company by relating incentive compensation to increases in stockholder value.

ARTICLE II

STRUCTURE OF THE PLAN

The Plan is divided into three separate programs:

A.

The Discretionary Stock Option Grant Program under which eligible persons may, at the discretion of the Committee or the Board, be granted Stock Options;

B.

The Restricted Stock Program under which eligible persons may, at the discretion of the Committee or the Board, be granted rights to receive shares of Common Stock, subject to certain restrictions; and

C.

The Supplemental Bonus Program under which eligible persons may, at the discretion of the Committee or the Board, be granted a right to receive payment, in cash, shares of Common Stock, or a combination thereof, of a specified amount.

ARTICLE III

DEFINITIONS

As used in this Plan:

“10% Stockholder” shall mean any owner of stock (as determined under Section 424(d) of the Code) possessing more than ten percent (10%) of the total combined voting power of all classes of stock of the Company or any Subsidiary.

“Award” shall mean a grant made under this Plan in the form of Stock Options, Restricted Stock or Supplemental Bonuses.

“Board” shall mean the Company’s Board of Directors.

“Change in Control” shall mean a change in ownership or control of the Company effected through any of the following transactions:

1.

The acquisition, directly or indirectly by any person or group (within the meaning of Sections 13(d) and 14(d)(2) of the Exchange Act) other than a trustee or other fiduciary holding securities under an employee benefit plan of the Company, of beneficial ownership (within the meaning of Rule 13d-3 of the Exchange Act) of securities possessing more than thirty percent (30%) of the total combined voting power of the Company’s outstanding securities;

2.

A change in the composition of the Board over a period of eighteen (18) consecutive months or less such that fifty percent (50%) or more of the Board members cease to be directors who either (A) have been directors continuously since the beginning of such period or (B) have been unanimously elected or nominated by the Board for election as directors during such period;

3.

A stockholder-approved merger or consolidation to which the Company is a party and in which (A) the Company is not the surviving entity or (B) securities possessing more than thirty percent (30%) of the total combined voting power of the Company’s outstanding securities are transferred to a person or persons different from the persons holding those securities immediately prior to such transaction; or

4.

The sale, transfer or other disposition of all or substantially all of the Company’s assets in complete liquidation or dissolution of the Company.

“Code” shall mean the Internal Revenue Code of 1986, as amended from time to time.

“Committee” shall mean the Employee Committee and/or the Incentive Plan Committee, as applicable.

“Common Stock” shall mean the Company’s common stock, .01 par value.

“Company” shall mean ICOP Digital, Inc., a Colorado corporation.

“Date of Grant” shall mean the date specified by the Committee on which a grant of an Award shall become effective, which shall not be earlier than the date on which the Committee takes action with respect thereto.

“Employee” shall mean an individual who is in the employ of the Company or any Subsidiary.

“Employee Committee” shall mean a committee composed of at least one member of the Board of Directors who may, but need not, be a Non-Employee Director. The Employee Committee is empowered hereunder to grant Awards to Eligible Employees who are not directors or “officers” of the Company as that term is defined in Rule 16a-1(f) of the Exchange Act nor “covered employees” under Section 162(m) of the Code, and to establish the terms of such Awards at the time of grant, but shall have no other authority with respect to the Plan or outstanding Awards except as expressly granted by the Plan.

“Exchange Act” shall mean the Securities Exchange Act of 1934, as amended.

“Fair Market Value” of a share of Common Stock on any relevant date shall be determined in accordance with the following provisions:

1.

If the Common Stock is at the time listed on any stock exchange, or traded on the NASDAQ National Market, or any other securities trading market that reports daily the closing selling price per share of Common Stock, the Fair Market Value shall be deemed equal to the closing selling price per share of Common Stock on the date in question on the stock exchange or other securities trading market determined by the Committee to be the primary market for the Common Stock, as such price is officially quoted on such exchange or trading market.

2.

If there is no closing selling price for the Common Stock on the date in question, or if the Common Stock is neither listed on a stock exchange or traded on a securities trading market that

reports daily the closing selling price per share of the Common Stock, then the Fair Market Value shall be deemed to be the average of the representative closing bid and asked prices on the date on question as reported by the NASDAQ Stock Market or other reporting entity selected by the Committee.

3.

In the event the Common Stock is not traded publicly, the Fair Market Value of a share of Common Stock shall be determined, in good faith, by the Committee after such consultation with outside legal, accounting and other experts as the Committee may deem advisable, and the Committee shall maintain a written record of its method of determining such value.

“Incentive Plan Committee” shall mean a committee consisting entirely of Non-Employee Directors of the Board, who are empowered hereunder to take all action required in the administration of the Plan and the grant and administration of Awards hereunder. The Incentive Plan Committee shall be so constituted at all times as to permit the Plan to comply with Rule 16(a) 3 or any successor rule promulgated under the Exchange Act. Members of the Incentive Plan Committee shall be appointed from time to time by the Board, shall serve at the pleasure of the Board and may resign at any time upon written notice to the Board. Notwithstanding the foregoing, at any time that there are fewer than two Non-Employee Directors on the Board or when no Incentive Plan Committee has been appointed by the Board, all powers of the Incentive Plan Committee shall be vested in the Board.

“Incentive Stock Option” shall mean a Stock Option that (i) qualifies as an “incentive stock option” under Section 422 of the Code or any successor provision; and (ii) is intended to be an incentive stock option.

“Non-Employee Director” shall mean a director of the Company who meets the definition of (i) a “non-employee director” set forth in Rule 16b-3 under the Exchange Act, as amended, or any successor rule; and (ii) an “outside director” set forth in Treasury Regulation 1. 162-27, as amended, or any successor rule.

“Non-Statutory Option” shall mean a Stock Option that (i) does not qualify as an “incentive stock option” under Section 422 of the Code or any successor provision; or (ii) is not intended to be an incentive stock option.

“Optionee” shall mean the person so designated in an agreement evidencing an outstanding Stock Option.

“Option Price” shall mean the purchase price payable by a Participant upon the exercise of a Stock Option.

“Participant” shall mean a person who is selected by the Committee to receive benefits under this Plan and (i) is at that time a director, officer or other Employee of the Company or any Subsidiary; (ii) is at that time a consultant or other independent advisor who provides services to the Company or a Subsidiary; or (iii) has agreed to commence serving in any capacity set forth in (i) or (ii) of this definition.

“Plan” shall mean the Company’s Stock Option Plan as set forth herein.

“Plan Effective Date” shall mean June 19, 2002, the date on which this Plan was approved by the Company’s Board of Directors.

“Redemption Value” shall mean the amount, if any, by which the Fair Market Value of one share of Common Stock on the date on which the Stock Option is exercised exceeds the Option Price for such share.

“Restricted Stock” shall mean shares of Common Stock granted under Article VII that are subject to restrictions imposed pursuant to said Article.

“Retirement” shall mean the voluntary termination of employment due to attainment of the age of sixty-five (65) years.

“SEC” shall mean the U.S. Securities and Exchange Commission and any successor thereto.

“Stock Option” shall mean a right granted under the Plan to a Participant to purchase Common Stock at a stated price for a specified period of time.

“Subsidiary” shall mean a corporation, partnership, joint venture, unincorporated association or other entity in which the Company has a direct or indirect ownership or other equity interest; provided, however, for purposes of determining whether any person may be a Participant for purposes of any grant of Incentive Stock Options,

“Subsidiary” means any subsidiary corporation of the Company as defined in Section 424(f) of the Code.

“Supplemental Bonus” shall mean the right to receive payment in cash of an amount determined pursuant to Article IX of this Plan.

“Term” shall mean the length of time during which a Stock Option may be exercised.

ARTICLE IV

ADMINISTRATION OF THE PLAN

A.

Delegation to the Committee. This Plan shall be administered by the Incentive Plan Committee. References herein to the “Committee” shall mean the Employee Committee and/or the Incentive Plan Committee, as applicable. References herein to the Incentive Plan Committee refer solely to the Incentive Plan Committee.

Members of the Incentive Plan Committee and the Employee Committee shall serve for such period of time as the Board may determine and may be removed by the Board at any time. The action of a majority of the members of the Incentive Plan Committee and the Employee Committee present at any meeting, or acts unanimously approved in writing, shall be the acts of the Incentive Plan Committee and the Employee Committee, respectively.

B.

Powers of the Committee. The Incentive Plan Committee shall have full power and authority, subject to the provisions of this Plan, to establish such rules and regulations as it may deem appropriate for proper administration of this Plan and to make such determinations under, and issue interpretations of, the provisions of this Plan and any outstanding Awards as it may deem necessary or advisable. In addition, the Incentive Plan Committee shall have full power and authority to administer and interpret the Plan and make modifications as it may deem appropriate to conform the Plan and all actions pursuant to the Plan to any regulation or to any change in any law or regulation applicable to this Plan.

C.

Actions of the Committee. All actions taken and all interpretations and determinations made by the Committee in good faith (including determinations of Fair Market Value) shall be final and binding upon all Participants, the Company and all other interested persons. No director or member of the Committee shall be personally liable for any action, determination or interpretation made in good faith with respect to the Plan, and all directors and members of the Committee shall, in addition to their rights as directors, be fully protected by the Company with respect to any such action, determination or interpretation.

D.

Awards to Officers and Directors.

1.

All Awards to officers shall be determined by the Incentive Plan Committee. If the Incentive Plan Committee is not composed as prescribed in the definition of Incentive Plan Committee in Article III, the Board shall have the right to take such action with respect to any Award to an officer as it deems necessary or advisable to comply with Rule 16b-3 of the Exchange Act and any related rules, including but not limited to seeking stockholder ratification of such Award or restricting the sale of the Award or any shares of Common Stock underlying the Award for a period of six months.

2.

Discretionary awards to Non-Employee Directors, if any, shall be determined by the Board.

E.

Code Section 409A. Notwithstanding any other provision of the Plan, it is intended that the Plan and any Awards issued thereunder will comply with Code Section 409A to the extent the Awards are subject thereto, and the Plan and such Awards shall be interpreted on a basis consistent with such intent. Any Awards that are considered “deferred compensation” within the meaning of Code Section 409A shall be made in compliance with the requirements of Code Section 409A. Any provision of the Plan and any Awards issued thereunder, which are determined not to be in compliance therewith is hereby reformed to the least extent necessary to comply with the requirements of Code Section 409A.

ARTICLE V

ELIGIBILITY

A.

Discretionary Stock Option Grant Program, Restricted Stock Program and Supplemental Bonus Program. The persons eligible to participate in the Discretionary Stock Option Grant Program, the Restricted Stock Program and the Supplemental Bonus Program are as follows:

1.

Employees of the Company or a Subsidiary;

2.

Members of the Board; and

3.

Consultants and other independent advisors who provide services to the Company or a Subsidiary.

B.

Selection of Participants. The Committee shall from time to time determine the Participants to whom Awards shall be granted pursuant to the Discretionary Stock Option Grant Program, the Restricted Stock Program and the Supplemental Bonus Program.

ARTICLE VI

SHARES AVAILABLE UNDER THE PLAN

A.

Maximum Number. The number of shares of Common Stock issued or transferred and covered by outstanding awards granted under this Plan shall not in the aggregate exceed 2,073,661 shares of Common Stock, which may be Common Stock of original issuance or Common Stock held in treasury, or a combination thereof. This authorization shall be increased automatically on each succeeding annual anniversary of the Plan Effective Date by an amount equal to that number of shares equal to one-half of one percent of the Company’s then issued and outstanding shares of Common Stock. The shares may be divided among the various Plan components as the Incentive Plan Committee shall determine, except that no more than 1,200,000 shares shall be issued in connection with the exercise of Incentive Stock Options under the Plan. Any portion of the shares added on each succeeding anniversary of the Plan Effective Date which are unused during the Plan year beginning on such anniversary date shall be carried forward and be available for grant and issuance in subsequent Plan years, while up to 100% of the shares to be added in the

next succeeding Plan year (calculated on the basis of the current Plan year’s allocation) may be borrowed for use in the current Plan year. Shares of Common Stock that may be issued upon the exercise of Stock Options shall be applied to reduce the maximum number of shares remaining available for use under the Plan. The Company shall at all times during the term of the Plan, and while any Stock Options are outstanding, retain as authorized and unissued Common Stock or as treasury Common Stock, at least the number of shares of Common Stock required under the provisions of this Plan, or otherwise assure itself of its ability to perform its obligations hereunder.

B.

Unused and Forfeited Stock. The following shares of Common Stock shall automatically become available for use under the Plan: (i) any shares of Common Stock that are subject to an Award under this Plan that are not used because the terms and conditions of the Award are not met, including any shares of Common Stock that are subject to a Stock Option that expires or is terminated for any reason; (ii) any shares of Common Stock with respect to which a Stock Option is exercised that are used for full or partial payment of the Option Price; and (iii) any shares of Common Stock withheld by the Company in satisfaction of the withholding taxes incurred in connection with the exercise of a Non-Statutory Option.

C.

Capital Changes. If any change is made to the Common Stock by reason of any stock split, stock dividend, recapitalization, combination of shares, exchange of shares or other change affecting the outstanding Common Stock as a class without the Company’s receipt of consideration, appropriate adjustments shall be made to (i) the maximum number and/or class of securities issuable under the Plan; (ii) the number and/or class of securities for which grants are subsequently to be made pursuant to Article VI of this Plan; and (iii) the number and/or class of securities then included in each Award outstanding hereunder and the Option Price per share in effect under each outstanding Stock Option under this Plan. Such adjustments to the outstanding Stock Options are to be effected in a manner that shall preclude the enlargement or dilution of rights and benefits under such Stock Options. The adjustments determined by the Committee shall be final, binding and conclusive.

ARTICLE VII

DISCRETIONARY STOCK OPTION GRANT PROGRAM

A.

Discretionary Grant of Stock Options to Participants. The Committee may from time to time authorize grants to Participants of options to purchase shares of Common Stock upon such terms and conditions as the Committee may determine in accordance with the following provisions (in connection with any grants under this paragraph VII.A to Non-Employee Directors, “Committee” shall mean the entire Board of Directors):

1

Each grant shall specify the number of shares of Common Stock to which it pertains.

2.

Each grant shall specify the Option Price per share.

3.

Each grant shall specify the form of consideration to be paid in satisfaction of the Option Price and the manner of payment of such consideration, which may include (i) cash in the form of currency or check or other cash equivalent acceptable to the Company; (ii) shares of Common Stock that are already owned by the Optionee and have a Fair Market Value at the time of exercise that is equal to the Option Price; (iii) shares of Common Stock with respect to which a Stock Option is exercised; (iv) a recourse promissory note in favor of the Company; (v) any other legal consideration that the Committee may deem appropriate; and (vi) any combination of the foregoing.

4.

Any grant may provide for deferred payment of the Option Price from the proceeds of sale through a broker of some or all of the shares of Common Stock to which the exercise relates.

5.

Any grant may provide that shares of Common Stock issuable upon the exercise of

a Stock Option shall be subject to restrictions whereby the Company has the right or obligation to repurchase all or a portion of such shares if the Participant’s service to the Company is terminated before a specified time, or if certain other events occur or conditions are not met.

6.

Successive grants may be made to the same Participant regardless of whether any Stock Options previously granted to the Participant remain unexercised.

7.

Each grant shall specify the conditions to be satisfied before the Stock Option or installments thereof shall become exercisable, which conditions may include a period or periods of continuous service by the Optionee to the Company or any Subsidiary, the attainment of specified performance goals and objectives, or the occurrence of specified events; as may be established by the Committee with respect to such grant.

8.

All Stock Options that meet the requirements of the Code for incentive stock options shall be Incentive Stock Options unless (i) the option agreement clearly designates the Stock Options granted thereunder, or a specified portion thereof, as a Non-Statutory Option; or (ii) a grant of Incentive Stock Options to the Participant would be prohibited under the Code or other applicable law.

9.

Each grant shall specify the Term of the Stock Option, which Term shall not be greater than 10 years from the Date of Grant.

10.

Each grant shall be evidenced by an agreement, which shall be executed on behalf of the Company by any officer thereof and delivered to and accepted by the Optionee and shall contain such terms and provisions as the Committee may determine consistent with this Plan.

B.

Special Terms Applicable to Incentive Stock Options. The following additional terms shall be applicable to all Incentive Stock Options granted pursuant to this Plan. Stock Options that are specifically designated as Non-Statutory Options shall not be subject to the terms of this paragraph VII.B.

1.

Incentive Stock Options shall be granted only to Employees of the Company or a Subsidiary.

2.

The Option Price per share shall not be less than the Fair Market Value per share of Common Stock on the Date of Grant.

3.

The aggregate Fair Market Value of the shares of Common Stock (determined as of the respective Date(s) of Grant) with respect to which Incentive Stock Options granted to any Employee under the Plan (or any other plan of the Company or a Subsidiary) are exercisable for the first time during any one calendar year shall not exceed the sum of One Hundred Thousand Dollars ($100,000). To the extent the Employee holds two (2) or more such Stock Options that become exercisable for the first time in the same calendar year, the foregoing limitation on the treatment of such Stock Options as Incentive Stock Options shall be applied on the basis of the order in which such Stock Options are granted.

4.

If any Employee to whom an Incentive Stock Option is granted is a 10% Stockholder, then the Option Price per share shall not be less than one hundred ten percent (110%) of the Fair Market Value per share of Common Stock on the Date of Grant, and the Option Term shall not exceed five (5) years measured from the Date of Grant.

ARTICLE VIII

RESTRICTED STOCK PROGRAM

A.

Awards Granted. Coincident with or following designation for participation in the Plan, a Participant may be granted one or more Restricted Stock Awards consisting of shares of Common Stock. The number of shares granted as a Restricted Stock Award shall be determined by the Committee.

B.

Restrictions. A Participant’s right to retain a Restricted Stock Award granted to such Participant under Article VII.A shall be subject to such restrictions, including but not limited to his or her continuous employment by the Company for a restriction period specified by the Committee, or the attainment of specified performance goals and objectives, or the occurrence of specified events, as may be established by the Committee with respect to such Award. The Committee may in its sole discretion require different periods of employment or different performance goals and objectives with respect to different Participants, to different Restricted Stock Awards or to separate, designated portions of the shares constituting a Restricted Stock Award.

C.

Privileges of a Stockholder, Transferability. A Participant shall have all voting, dividend, liquidation and other rights with respect to shares of Common Stock in accordance with its terms received by him or her as a Restricted Stock Award under this Article VIII upon his or her becoming the holder of record of such shares; provided, however, that the Participant’s right to sell, encumber or otherwise transfer such shares shall be subject to the restrictions established by the Committee with respect to such Award.

D.

Enforcement of Restrictions. The Committee may in its sole discretion require a legend to be placed on the stock certificates referring to the restrictions referred to in paragraphs VIII.B. and VIII.C., in order to enforce such restrictions.

ARTICLE IX

SUPPLEMENTAL BONUSPROGRAM

A.

Non-Statutory Stock Options. The Committee, at the time of grant or at any time prior to exercise of any Non-Statutory Option, may provide for a Supplemental Bonus from the Company or a Subsidiary in connection with a specified number of shares of Common Stock then purchasable, or which may become purchasable, under such Non-Statutory Option. Such Supplemental Bonus shall be payable in cash upon the exercise of the Non-Statutory Option with regard to which such Supplemental Bonus was granted. A Supplemental Bonus shall not exceed the amount necessary to reimburse the Participant for the income tax liability incurred by him or her upon the exercise of the Non-Statutory Option, calculated using the maximum combined federal and applicable state income tax rates then in effect and taking into account the tax liability arising from the Participant’s receipt of the Supplemental Bonus.

B.

Restricted Stock Awards. The Committee, either at such time as the restrictions with respect to a Restricted Stock Award lapse or a Section 83(b) election is made under the Code by the Participant with respect to shares issued in connection with a Restricted Stock Award, may provide for a Supplemental Bonus from the Company or a Subsidiary. Such Supplemental Bonus shall be payable in cash and shall not exceed the amount necessary to reimburse the Participant for the income tax liability incurred by him or her with respect to shares issued in connection with a Restricted Stock Award, calculated using the maximum combined federal and applicable state income tax rates then in effect and taking into account the tax liability arising from the Participant’s receipt of the Supplemental Bonus.

ARTICLE X

TERMINATION OF SERVICE

A.

Incentive Stock Options. The following provisions shall govern the exercise of any Incentive Stock Options held by any Employee whose employment is terminated:

1.

If the Optionee’s employment with the Company is terminated for any reason other than such Optionee’s death, disability or Retirement, all Incentive Stock Options held by the Optionee shall terminate on the date and at the time the Optionee’s employment terminates, unless the Committee expressly provides in the terms of the Optionee’s Stock Option Agreement that such Stock Options shall remain exercisable, to the extent vested on such termination date, for a period of three (3) months following such termination of employment.

2.

If the Optionee’s employment with the Company is terminated because of such Optionee’s death or disability within the meaning of Section 22(e)(3) of the Code, all incentive Stock Options held by the Optionee shall become immediately exercisable and shall be exercisable for a period of twelve (12) months following such termination of employment.

3.

In the event Optionee’s employment is terminated due to Retirement, all incentive Stock Options held by the Optionee shall remain exercisable, to the extent such Stock Options were exercisable on the date the Optionee’s employment terminated, for a period of three (3) months following such termination of employment.

4.

In no event may any Incentive Stock Option remain exercisable after the expiration of the Term of the Stock Option. Upon the expiration of any three (3) or twelve (12) month exercise period, as applicable, or, if earlier, upon the expiration of the Term of the Stock Option, the Stock Option shall terminate and shall cease to be outstanding for any shares for which the Stock Option has not been exercised.

B.

Non-Statutory Options. The following provisions shall govern the exercise of any Non-Statutory Options:

1.

If the Optionee’s employment, service on the Board or consultancy is terminated for any reason other than such Optionee’s death, disability or Retirement, all Non-Statutory Options held by the Optionee shall terminate on the date of such termination, unless the Committee expressly provides in the terms of the Optionee’s Stock Option Agreement that such Stock Options shall remain exercisable, to the extent vested on such termination date, for a specified period following such termination.

2.

If the Optionee’s employment, service on the Board or consultancy is terminated because of such Optionee’s death or disability, all Non-Statutory Options held by the Optionee shall become immediately exercisable and shall be exercisable until the expiration of the Term of such Stock Options.

3.

If the Optionee’s employment service on the Board or consultancy is terminated because of such Optionee’s Retirement, all Non-Statutory Options held by the Optionee shall remain exercisable, to the extent such Stock Options were exercisable on the date of such termination, until the expiration of the Term of such Stock Options.

4.

In no event may any Non-Statutory Option remain exercisable after the expiration of the Term of the Stock Option. Upon the expiration of any specified exercise period following termination of Optionee’s employment, service on the Board or consultancy, or if earlier, upon the expiration of the Term of the Stock Option, the Stock Option shall terminate and shall cease to be outstanding for any shares for which the Stock Option has not been exercised.

C.

Restricted Stock Awards. In the event of the death or disability (within the meaning of Section 22(e) of the Internal Revenue Code) or Retirement of a Participant, all employment period and other restrictions applicable to Restricted Stock Awards then held by him or her shall lapse, and such Awards shall become fully non-forfeitable. Subject to Articles X and XIV, in the event of a Participant’s termination of employment for any other reason, any Restricted Stock Awards as to which the employment period or other restrictions have not been satisfied shall be forfeited.

ARTICLE XI

TRANSFERABILITY OF STOCK OPTIONS

During the lifetime of the Optionee, Incentive Stock Options shall be exercisable only by the Optionee and shall not be assignable or transferable. In the event of the Optionee’s death prior to the end of the Term, any Stock Option may be exercised by the personal representative of the Optionee’s estate, or by the person(s) to whom the Option is transferred pursuant to the Optionee’s will or in accordance with the laws of descent and distribution. Upon the prior written consent of the Board and subject to any conditions associated with such consent, a Non-Statutory Option may be assigned in whole or in part during the Optionee’s lifetime to one or more members of the Optionee’s immediate family (as that term is defined in Rule 16a-l(e) of the Exchange Act) or to a trust established exclusively for one or more such family members. In addition, the Board, in its sole discretion, may allow a Non-Statutory Option to be assigned in other circumstances deemed appropriate. The terms applicable to the assigned portion shall be the same as those in effect for the Stock Option immediately prior to such assignment and shall be set forth in such documents issued to the assignee as the Committee may deem appropriate. Notwithstanding any assignment or transfer of a Stock Option, in no event may any Stock Option remain exercisable after the expiration of the Term of the Stock Option.

ARTICLE XII

STOCKHOLDER RIGHTS

The holder of a Stock Option shall have no stockholder rights with respect to the shares subject to the Stock Option until such person shall have exercised the Stock Option, paid the Option Price and become a holder of record of the purchased shares of Common Stock.

ARTICLE XIII

ACCELERATION OF VESTING

The Committee may, at any time in its sole discretion, accelerate the vesting of any Award made pursuant to this Plan by giving written notice to the Participant. Upon receipt of such notice, the Participant and the Company shall amend the agreement relating to the Award to reflect the new vesting schedule. The acceleration of the exercise period of an Award shall not affect the expiration date of such Award.

Notwithstanding the foregoing, any acceleration of the vesting of any Awards that are considered “deferred compensation” within the meaning of Code Section 409A shall be made in compliance with the requirements of Treasury Regulation 1.409A-3(j)(4)

ARTICLE XIV

CHANGE IN CONTROL

In the event of a Change in Control of the Company, all Awards outstanding under the Plan as of the day before the consummation of such Change in Control shall automatically accelerate for all purposes under this Plan so that each Stock Option shall become fully exercisable with respect to the total number of shares subject to such Stock Option and may be exercised for any or all of those shares as fully-vested shares of Common Stock as of such date, without regard to the conditions expressed in the agreements relating to such Stock Option, and the restrictions on each Restricted Stock Award shall lapse and such shares of Restricted Stock shall no longer be subject to forfeiture.

Notwithstanding the foregoing, should a Change in Control result in the acceleration of the vesting of any Awards that are considered “deferred compensation” within the meaning of Code Section 409A, such acceleration shall be made in compliance with the requirements of Treasury Regulation 1.409A-3(j)(4)(ix).

ARTICLE XV

CANCELLATION AND REGRANT OF OPTIONS

The Committee shall have the authority, at any and from time to time, with the consent of the affected Optionees, to effect the cancellation of any or all outstanding Stock Options and/or any Restricted Stock Awards and grant in substitution new Stock Options and/or Restricted Stock Awards covering the same or different number of shares of Common Stock. In the case of such a regrant of a Stock Option, the Option Price shall be set in accordance with Article VII on the new Date of Grant.

ARTICLE XVI

FINANCING

The Committee may, in its sole discretion, authorize the Company to make a loan to a Participant in connection with the exercise of a Stock Option, and may authorize the Company to arrange or guaranty loans to a Participant by a third party in connection with the exercise of a Stock Option.

ARTICLE XVII

TAX TREATMENT

A.

Tax Withholding. The Company’s obligation to deliver shares of Common Stock upon the exercise of Stock Options under the Plan shall be subject to the satisfaction of all applicable federal, state and local income and employment tax withholding requirements.

B.

Surrender of Shares. The Committee may, in its discretion, provide any or all holders of Non-Statutory Options under the Discretionary Stock Option Grant Program with the right to use shares of Common Stock in satisfaction of all or part of the taxes incurred by such holders in connection with the exercise of such Stock Options. Such right may be provided to any such holder in either or both of the following formats:

1.

The election to have the Company withhold, from the shares of Common Stock otherwise issuable upon the exercise of such Non-Statutory Option, a portion of those shares with an aggregate Fair Market Value less than or equal to the amount of taxes due as designated by such holder; or

2.

The election to deliver to the Company, at the time the Non-Statutory Option is exercised, one or more shares of Common Stock previously acquired by such holder with an aggregate Fair Market Value less than or equal to the amount of taxes due as designated by such holder.

C.

No Guarantee of Tax Treatment. Notwithstanding any provision of the Plan, the Company does not guarantee to any Optionee or any other person with an interest in an Award that any Award intended to be exempt from Code Section 409A shall be so exempt, nor that any Award intended to comply with Code Section 409A, Code Section 422 or any other applicable tax law shall so comply, nor will the Company or any affiliate indemnify, defend or hold harmless any individual with respect to the tax consequences of any such failure.

ARTICLE XVIII

EFFECTIVE DATE AND TERM OF THE PLAN

This Plan shall become effective on the Plan Effective Date. This Plan shall terminate upon the earliest of (i) ten (10) years after the Plan Effective Date; or (ii) the termination of all outstanding Awards in connection with a Change in Control. Upon such plan termination, all outstanding Awards shall thereafter continue to have force and effect in accordance with the provisions of the documents evidencing such Awards.

ARTICLE XIX

AMENDMENT OF THE PLAN

A.