QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

INAMED CORP. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

INAMED CORPORATION

5540 Ekwill Street, Suite D

Santa Barbara, California 93111

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 19, 2005

To the Stockholders of Inamed:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Inamed Corporation, a Delaware corporation (the "Company"), will be held on December 19, 2005 at 12:30 P.M., Pacific Time, at Fess Parker's DoubleTree Resort, 633 East Cabrillo Boulevard, Santa Barbara, California 93103, for the following purposes:

- 1.

- To elect six (6) directors to hold office for a one year term and until their respective successors are elected and qualified;

- 2.

- To ratify the appointment of KPMG LLP as our independent auditors for the fiscal year ending December 31, 2005; and

- 3.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on November 10, 2005 as the record date for the determination of stockholders entitled to notice of and to vote at this Annual Meeting and at any continuation, postponement or adjournment thereof. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices located at 5540 Ekwill Street, Suite D, Santa Barbara, California 93111.

| | | |

| | | By Order of the Board of Directors |

|

|

INAMED CORPORATION |

|

|

|

|

|

Joseph A. Newcomb

Secretary |

Dated: November 16, 2005

YOU ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. PLEASE SUBMIT A PROXY AS SOON AS POSSIBLE SO THAT YOUR SHARES CAN BE VOTED AT THE ANNUAL MEETING IN ACCORDANCE WITH YOUR INSTRUCTIONS. FOR SPECIFIC INSTRUCTIONS ON VOTING, PLEASE REFER TO THE INSTRUCTIONS ON THE PROXY CARD OR THE INFORMATION FORWARDED BY YOUR BROKER, BANK OR OTHER HOLDER OF RECORD. EVEN IF YOU HAVE VOTED YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE IN PERSON AT THE MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM SUCH BROKER, BANK OR OTHER NOMINEE.

INAMED CORPORATION

5540 Ekwill Street, Suite D

Santa Barbara, California 93111

2005 PROXY STATEMENT

INFORMATION CONCERNING VOTING AND SOLICITATION

General

The enclosed proxy is solicited on behalf of the Board of Directors (the "Board of Directors" or the "Board") of Inamed Corporation, a Delaware corporation (the "Company" or "Inamed"), for use at the Annual Meeting of Stockholders (the "Annual Meeting") to be held on December 19, 2005, at 12:30 P.M. Pacific Time, or at any continuation, postponement or adjournment thereof, for the purposes discussed in this proxy statement and in the accompanying Notice of Annual Meeting and any business properly brought before the Annual Meeting. Proxies are solicited to give all stockholders of record an opportunity to vote on matters properly presented at the Annual Meeting. The Company intends to mail this proxy statement and accompanying proxy card on or about November 18, 2005 to all stockholders entitled to vote at the Annual Meeting. The Annual Meeting will be held at Fess Parker's DoubleTree Resort, 633 East Cabrillo Boulevard, Santa Barbara, California 93103.

Who Can Vote

You are entitled to vote if you were a stockholder of record of Inamed common stock (the "Common Stock") as of the close of business on November 10, 2005. Your shares can be voted at the Annual Meeting only if you are present in person or represented by a valid proxy.

Shares Outstanding and Quorum

At the close of business on November 10, 2005, there were outstanding and entitled to vote 36,663,105 shares of Common Stock. A majority of the outstanding shares of Common Stock, represented in person or by proxy and entitled to vote, will constitute a quorum at the Annual Meeting.

Voting of Shares

Stockholders of record on November 10, 2005 are entitled to one vote for each share of Common Stock held on all matters to be voted upon at the meeting. You may vote by completing and mailing the enclosed proxy card. All shares entitled to vote and represented by properly executed proxies received before the polls are closed at the Annual Meeting, and not revoked or superseded, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies. YOUR VOTE IS IMPORTANT.

Proxy Card and Revocation of Proxy

If you sign the proxy card but do not specify how you want your shares to be voted, your shares will be voted in favor of the proposals. In their discretion, the proxy holders named in the enclosed proxy are authorized to vote on any other matters that may properly come before the Annual Meeting and at any continuation, postponement or adjournment thereof. The Board of Directors knows of no other business that will be presented for consideration at the Annual Meeting. In addition, since no stockholder proposals or nominations were received on a timely basis, no such matters may be brought at the Annual Meeting.

If you vote by proxy, you may revoke that proxy at any time before it is voted at the Annual Meeting. You can revoke your proxy by sending to the Secretary a written notice of revocation or a duly executed proxy bearing a later date or by attending the Annual Meeting in person and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

Counting of Votes

All votes will be tabulated by the inspector of elections appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, and any abstentions and broker non-votes. Shares represented by proxies that reflect abstentions as to a particular proposal will be counted as present and entitled to vote for purposes of determining a quorum. An abstention is counted as a vote against that proposal. Shares represented by proxies that reflect a broker "non-vote" will be counted as present and entitled to vote for purposes of determining a quorum. A broker "non-vote" will be treated as unvoted for purposes of determining approval of a proposal and will not be counted as "for" or "against" that proposal. A broker "non-vote" occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary authority or does not have instructions for the beneficial owner.

Solicitation of Proxies

The Company will bear the entire cost of solicitation of proxies, including preparation, assembly and mailing of this proxy statement, the proxy and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding shares of the Common Stock in their names that are beneficially owned by others to forward to these beneficial owners. The Company may reimburse persons representing beneficial owners for their costs of forwarding the solicitation material to the beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of the Company. No additional compensation will be paid to directors, officers or other regular employees for such services.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The terms of office of the current directors, Nicholas L. Teti, Joy A. Amundson, Malcolm R. Currie, John C. Miles II, Mitchell S. Rosenthal, and Terry E. Vandewarker expire in 2005 and all are nominees for election to the Board. The Board has two existing vacancies. If elected at the Annual Meeting, each director would serve until the 2005 Annual Meeting.

Required Vote and Board of Directors Recommendation

Directors are elected by a plurality of the shares present and entitled to vote, which means the six (6) nominees who receive the largest number of properly cast votes will be elected as directors. Each share of Common Stock is entitled to one vote for each of the six (6) director nominees. Cumulative voting is not permitted and abstentions and broker non-votes have no effect on the vote. It is the intention of the proxy holders named in the enclosed proxy to vote the proxies received by them for the election of the nominees named below unless authorization to do so is withheld. If any nominee should become unavailable for election prior to the Annual Meeting, an event which currently is not anticipated by the Board, the proxies will be voted for the election of a substitute nominee or nominees proposed by the Board. Each nominee has agreed to serve if elected and management has no reason to believe that any nominee will be unable to serve.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE "FOR" THE ELECTION OF EACH OF THE NOMINEES FOR DIRECTOR NAMED ABOVE.

The following table sets forth certain information with respect to age and background of the Company's directors and nominees for director:

Name

| | Position

| | Age

|

|---|

| Nicholas L. Teti | | Chairman, President and Chief Executive Officer | | 53 |

| Joy A. Amundson(2)(3) | | Director | | 51 |

| Malcolm R. Currie, Ph.D.(1)(3) | | Director | | 78 |

| John C. Miles II(1) | | Director | | 63 |

| Mitchell S. Rosenthal, M.D.(2)(3) | | Director | | 69 |

| Terry E. Vandewarker(1) | | Director | | 53 |

- (1)

- Member of Audit Committee.

- (2)

- Member of Compensation Committee.

- (3)

- Member of Nominating Committee.

Nicholas L. Teti |

|

Director since 2001 |

Mr. Teti has served as President, Chief Executive Officer and a director of Inamed since August 1, 2001. He was elected Chairman of the Board of Directors on July 23, 2002. He has over 25 years of management, operations and marketing experience in the pharmaceuticals industry. From January 1997 until December 2000, Mr. Teti was President, Chief Executive Officer and Chief Operating Officer of DuPont Pharmaceuticals Company, a company with $1.6 billion in sales in 1999. He spent 25 years at DuPont and DuPont Merck, which included a number of senior management positions. Several of these assignments were in leadership roles of DuPont's global pharmaceuticals business units. From January 2001 until July 2001, he was President and Director of Yamanouchi USA, Inc., a division of Yamanouchi Pharmaceuticals Co., where he was responsible for establishing its U.S. business. Mr. Teti holds an M.B.A. in Health Care Administration and a B.A. in Economics from St. Joseph's University. |

| | | |

3

Joy A. Amundson |

|

Director since 2003 |

Ms. Amundson has served as a director of Inamed since July 11, 2003. Since August 2004 she has served as Corporate Vice President of Baxter International Inc. and President of its BioScience business, a global market leader in recombinant and plasma-based specialty therapeutics and treatments. Ms. Amundson also is currently a principal in Amundson Partners, Inc., a healthcare consulting practice. From 1995 to October 2001, she was a Senior Vice President of Abbott Laboratories, a diversified health care products and services company, where she was involved with the company's financial planning and capital authorizations, strategic and long-range planning and investment strategies. Prior to that position, she held a number of management positions after joining Abbott Laboratories in 1982. Prior to Abbott, she was a brand manager at Procter and Gamble. Ms. Amundson is a director of Advocate Lutheran General Hospital. She has a Bachelor of Arts degree in Journalism and Advertising from the University of Wisconsin-Madison and a Master's degree in Management from Northwestern University, Kellogg School of Business. |

Malcolm R. Currie, Ph.D |

|

Director since 1999 |

Dr. Currie has served as a director of Inamed since June 3, 1999. He has served as the President and CEO of Currie Technologies Incorporated, an electric transportation company, since 1997. Dr. Currie has been the Chairman Emeritus of Hughes Aircraft Company since his retirement in 1992 as Chairman and CEO. He has had an extensive career in high technology research, engineering and management. Dr. Currie currently serves on the Boards of Directors of the following publicly traded companies: LSI Logic Corporation, Enova Systems Inc., Regal One Corp. and Innovative Micro Technologies, Inc. He is also a member and past chairman of the Board of Trustees of the University of Southern California. Dr. Currie has previously served as President and CEO of Delco Electronics Corporation, Chairman and CEO of GM Hughes Electronics Corporation and Undersecretary of Defense for Research and Engineering. Dr. Currie holds a Bachelor of Arts degree in Physics and a Ph.D. in Engineering Physics from the University of California at Berkeley. |

John C. Miles II |

|

Director since 2003 |

Mr. Miles has served as a director of Inamed since September 25, 2003. Mr. Miles is currently a director of Dentsply International Inc., where he was the Chairman of the Board from May 1998 until May 2005. Dentsply is a NASDAQ 100 Company with annual sales in excess of $1.5 billion that designs, develops, manufactures and markets a broad range of products for the dental market worldwide. From January 1996 to December 2003, Mr. Miles also served as Dentsply's Chief Executive Officer. Mr. Miles was President of Dentsply from September 1989 to January 1996. Prior to September 1989, Mr. Miles held several international senior management positions with increasing responsibilities with Dentsply. Prior to joining Dentsply in 1985, Mr. Miles held management positions with Rhone Poulenc, Inc., FDI, Inc., Pfizer, Inc., and Johnson & Johnson. In addition to Dentsply, Mr. Miles serves as a director of Respironics, Inc. He received his undergraduate degree in engineering from Lehigh University and his M.B.A. from New York University. |

| | | |

4

Mitchell S. Rosenthal, M.D. |

|

Director since 1999 |

Dr. Rosenthal has served as a director of Inamed since June 3, 1999. He is a psychiatrist and since 1970 has served as the President of Phoenix House Foundation, which he founded. Phoenix House is the nation's largest non-profit substance abuse services system, with nearly 80 programs in eight states: New York, California, Texas, Florida, Massachusetts, New Hampshire, Rhode Island and Vermont. Dr. Rosenthal has been a White House advisor on drug policy, a special consultant to the Office of National Drug Control Policy and chaired the New York State Advisory Council on Alcoholism and Substance Abuse Services from 1985 to 1997. He is a lecturer in psychiatry at Columbia University College of Physicians and Surgeons, a former president of the American Association of Psychoanalytic Physicians, a member of the Council on Foreign Relations. He is a graduate of Lafayette College and earned his M.D. from the Downstate Medical Center of State University of New York. |

Terry E. Vandewarker |

|

Director since 2003 |

Mr. Vandewarker has served as a director of Inamed since July 11, 2003. He is currently a partner with a privately held family business. From July 1997 through July 2002, he held a number of senior operations and financial management positions at Encad, Inc., a publicly traded NASDAQ company until its acquisition by Eastman Kodak in 2002. Mr. Vandewarker was President and Chief Executive Officer of Encad from July 2000 through January 2002 and continued as President until July 2002. Prior to that, Mr. Vandewarker was Encad's Vice President of Operations and Director of Finance. Prior to joining Encad, he received extensive experience in senior accounting and finance positions, including Vice President and Chief Financial Officer for NexCycle, Inc from 1995 through 1997 and Vice President and Chief Financial Officer for OCTUS, Inc. from 1993 through 1995. Prior to that he worked for a multi-national investment company, an entertainment company and for Price Waterhouse. He has served as a director for a number of public and private companies in various industries. Mr. Vandewarker is a Certified Public Accountant and holds a Bachelor of Science in Psychology from the University of California at Riverside and an M.B.A. in Accounting and Finance from the University of California at Los Angeles. |

Our Board has determined that, except for Mr. Teti, all of the members of the Board are "independent" as defined by the National Association of Securities Dealers, Inc. ("NASD"). Mr. Teti is not independent as he is employed by Inamed. |

Meetings of the Board of Directors

During the fiscal year ended December 31, 2004, the Board held ten (10) meetings and acted by unanimous written consent one (1) time. During the last fiscal year, no director attended fewer than 75% of the total number of meetings of the Board and all of the committees of the Board on which such director served during that period.

Committees of the Board of Directors

Currently, all of our directors hold office until the next annual meeting of our stockholders and until their successors have been duly elected and qualified. Our board of directors has established three standing committees: an audit committee; a compensation committee; and a nominating committee.

Audit Committee. The Audit Committee met five (5) times in 2004. The Audit Committee has oversight responsibilities with respect to the Company's annual audit and quarterly reviews, the Company's system of internal controls and the Company's audit, accounting and financial reporting processes. The Audit Committee selects the Company's independent auditors and meets with the independent auditors regularly in fulfilling the above responsibilities. All members of the Audit Committee are independent as defined by the NASD and meet the applicable NASD requirements for financial literacy and financial expertise. Dr. Currie has served as Chair and Mr. Vandewarker has

5

served as a member since January 2004. Mr. Miles has served as a member of the Audit Committee since August 2005. James E. Bolin (a former director who resigned from the Board in July 2005) served as a member from January 2004 to July 2005. The Board has determined that Mr. Vandewarker is an audit committee financial expert, as defined by the rules of the Securities and Exchange Commission ("SEC").

Compensation Committee. The Compensation Committee recommends to the Board all aspects of compensation arrangements for the executive officers of the Company and approves compensation recommendations for certain of the Company's other senior employees. The Compensation Committee also administers the Company's stock option and stock purchase plans and the Company's senior management bonus plan. The Compensation Committee met five (5) times in 2004. James E. Bolin (a former director who resigned from the Board in July 2005) served as Chair from January 2004 until July 2005. Mr. Miles served as a member of the Compensation Committee from January 2005 until August 2005. Ms. Amundson is currently the Chair of the Compensation Committee. Ms. Amundson and Dr. Rosenthal have served as members of the Compensation Committee since January 2004. All members of the Compensation Committee are independent as defined by the NASD.

Nominating Committee. The Nominating Committee identifies prospective board candidates, recommends nominees for election to our Board, and develops and recommends board member selection criteria. The Nominating Committee held no meetings during 2004. Since the beginning of fiscal year 2004, Dr. Rosenthal has served as the Chair and Dr. Currie and Ms. Amundson have served as members of the Nominating Committee. Each of the members of the Nominating Committee is independent as defined by the NASD. There is no written charter for the Nominating Committee; however, the Board has adopted the Director Nominations Policy as described below.

Director Nominations

The Nominating Committee evaluates and recommends to the Board director nominees for each election of directors.

In fulfilling its responsibilities, the Nominating Committee considers the following factors:

- •

- the appropriate size of the Company's Board and its committees;

- •

- the needs of the Company with respect to the particular talents and experience of its directors;

- •

- the knowledge, skills and experience of nominees, including experience in medical devices, business, finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board;

- •

- experience with accounting rules and practices;

- •

- applicable regulatory and securities exchange/association requirements;

- •

- appreciation of the relationship of the Company's business to the changing needs of society; and

- •

- a balance between the benefit of continuity and the desire for a fresh perspective provided by new members.

The Nominating Committee's goal is to assemble a Board that brings to the Company a variety of perspectives and skills derived from high quality business and professional experience. In doing so, the Nominating Committee also considers candidates with appropriate non-business backgrounds.

Other than the foregoing, there are no stated minimum criteria for director nominees. However, the Nominating Committee may also consider such other factors as it may deem are in the best interests of the Company and its stockholders. The Nominating Committee does, however, recognize that under applicable regulatory requirements at least one member of the Board must, and believes

6

that it is preferable that more than one member of the Board should, meet the criteria for an "audit committee financial expert" as defined by SEC rules, and that at least a majority of the members of the Board must meet the definition of an "independent director" under Nasdaq rules or the listing standards of any other applicable self regulatory organization. The Nominating Committee also believes it appropriate for certain key members of the Company's management to participate as members of the Board.

The Nominating Committee identifies nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company's business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board up for re-election at an upcoming annual meeting of stockholders does not wish to continue in service, the Nominating Committee identifies the desired skills and experience of a new nominee in light of the criteria above. Current members of the Nominating Committee and Board will be polled for suggestions as to individuals meeting the criteria of the Nominating Committee. Research may also be performed to identify qualified individuals. If the Nominating Committee believes that the Board requires additional candidates for nomination, the Nominating Committee may explore alternative sources for identifying additional candidates. This may include engaging, as appropriate, a third party search firm to assist in identifying qualified candidates.

The Nominating Committee will evaluate any recommendation for director nominee proposed by a stockholder who (i) has continuously held at least 1% of the outstanding shares of the Company's Common Stock entitled to vote at the annual meeting of stockholders for at least one year by the date the stockholder makes the recommendation and (ii) undertakes to continue to hold the Common Stock through the date of the meeting. In order to be evaluated in connection with the Company's established procedures for evaluating potential director nominees, any recommendation for director nominee submitted by a qualifying stockholder must be received by the Company no later than 120 days prior to the anniversary of the date proxy statements were mailed to stockholders in connection with the prior year's annual meeting of stockholders. Any stockholder recommendation for director nominee must be submitted to the Company's Chairman of the Nominating Committee in writing at 5540 Ekwill Street, Suite D, Santa Barbara, California 93111 and must contain the following information:

- •

- a statement by the stockholder that he/she is the holder of at least 1% of the Company's common stock and that the stock has been held for at least a year prior to the date of the submission and that the stockholder will continue to hold the shares through the date of the annual meeting of stockholders;

- •

- the candidate's name, age, contact information and current principal occupation or employment;

- •

- a description of the candidate's qualifications and business experience during, at a minimum, the last five years, including his/her principal occupation and employment and the name and principal business of any corporation or other organization in which the candidate was employed;

- •

- the candidate's resume; and

- •

- at least three (3) references for the candidate.

The Nominating Committee will evaluate recommendations for director nominees submitted by directors, management or qualifying stockholders in the same manner, using the criteria stated above.

All directors and director nominees will submit a completed form of directors' and officers' questionnaire as part of the nominating process. The process may also include interviews and additional

7

background and reference checks for non-incumbent nominees, at the discretion of the Nominating Committee.

Communications with Directors

The Company believes that it is good corporate practice to ensure that the views of the Company's stockholders are communicated to the Company and that appropriate responses are provided to the stockholders. The Company maintains an Investor Relations department and stockholders are encouraged to speak with the Investor Relations personnel. Stockholders can communicate with the Investor Relations department by calling (805) 683-6761.

Stockholders may also communicate appropriately with any and all Company directors by sending written correspondence addressed as follows:

The Corporate Secretary shall maintain a log of all correspondence so received and will deliver as soon as practicable such correspondence to the identified director addressee(s). The correspondence will not, however, be delivered if there are safety, security, appropriateness or other concerns that mitigate against delivery of the correspondence, as determined by the Corporate Secretary in consultation with legal counsel. The Board or individual directors so addressed shall be advised of any correspondence withheld. The Board or individual director, as applicable, will generate an appropriate response to all validly received stockholder correspondence and will direct the Corporate Secretary to send the response to the particular stockholder.

Director Attendance at Annual Meetings

The Company believes that the annual meeting of stockholders is a good opportunity for the stockholders to meet and, if appropriate, ask questions of the Board. It is also a good opportunity for the members of the Board to hear any feedback the stockholders may share with the Company at the meeting. All directors are strongly encouraged to attend the Company's annual meeting of stockholders. The Company will reimburse all reasonable out-of-pocket traveling expenses incurred by the directors in attending the annual meeting. All seven of the Company's directors attended last year's annual meeting of stockholders.

Directors' Compensation

Directors who are not employees of the Company receive an annual fee of $35,000 and a fee of $1,000 for each Board meeting attended, and are reimbursed for their expenses. In addition, upon their initial election, directors receive an option to purchase 7,500 shares of Common Stock, and thereafter receive an option to purchase 7,500 shares of Common Stock on each subsequent anniversary of their election to the Board of Directors for so long as they remain directors. Directors who are employees of the Company are not entitled to any compensation for their service as a director. Pursuant to a plan adopted in 1999, directors may elect to receive their compensation in Common Stock in lieu of cash. No directors elected this option in 2004.

8

Code of Ethics

The Board has adopted a Code of Ethics that applies to all of our employees, officers and directors. The Code of Ethics is available at the Company's website at: http://ir.inamed.com/phoenix.zhtml?c=90325&p=irol-govConduct.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board has selected KPMG LLP as independent auditors to audit the consolidated financial statements of the Company for the fiscal year ending December 31, 2005. KPMG LLP has acted in such capacity since its appointment in fiscal year 2002. A representative of KPMG LLP is expected to be present at the Annual Meeting, with the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions.

As part of its duties, the Audit Committee considers whether the provision of services, other than audit services, during the fiscal year ended December 31, 2004 by KPMG LLP, the Company's independent auditor for that period, is compatible with maintaining the auditor's independence. The following table sets forth the aggregate fees billed to the Company for the fiscal years ended December 31, 2003 and December 31, 2004 by KPMG LLP:

| | Fiscal 2003

| | Fiscal 2004

|

|---|

| Audit Fees(1) | | $ | 884,300 | | $ | 1,527,350 |

| Audit-Related Fees(2) | | | N/A | | $ | 556,200 |

| Tax Fees(3) | | $ | 85,503 | | $ | 78,450 |

| All Other Fees(4) | | | N/A | | $ | 25,000 |

- (1)

- Audit Fees for fiscal year 2003 consist of fees billed for professional services rendered for the audit of the Company's consolidated annual financial statements and review of the interim consolidated financial statements included in quarterly reports and services that are normally provided by KPMG LLP in connection with statutory and regulatory filings or engagements. Audit Fees for fiscal year 2004 consist of $745,000 of fees billed for professional services rendered for the audit of the Company's consolidated annual financial statements and review of the interim consolidated financial statements included in quarterly reports and $675,000 of fees billed for professional services rendered for the audit of the Company's internal controls over financial reporting. This amount also includes expenses related to the audits and services that are normally provided by KPMG in connection with statutory and regulatory filings or engagements.

- (2)

- Audit-Related Fees consist of fees billed for professional services rendered for consulting work for assistance with documentation required by the Sarbanes-Oxley Act of 2002.

- (3)

- Tax Fees consist of fees billed for professional services rendered for tax compliance, tax advice and tax planning. These services include assistance regarding federal and state tax compliance, international tax, research and unclaimed property services.

- (4)

- All Other Fees consist of fees billed for professional services rendered for other items and services in connection with other statutory and regulatory filings or engagements.

The Audit Committee's policy is to pre-approve all audit and permissible non-audit services provided by our independent auditors. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services. The independent auditor and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent auditor in accordance with this pre-approval.

9

Required Vote and Board of Director's Recommendation

The affirmative vote of a majority of the votes present and entitled to be cast on the proposal, at the annual meeting of stockholders at which a quorum is present, either in person or by proxy, is required for approval of this proposal. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum. Abstentions will have the effect of a no vote and broker non-votes will have no effect on the outcome of the proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2005.

EXECUTIVE OFFICERS

The following table sets forth the executive officers of the Company.

Name

| | Age

| | Position

|

|---|

| Nicholas L. Teti | | 53 | | President, Chief Executive Officer and Chairman of the Board |

Declan Daly |

|

43 |

|

Executive Vice President and Chief Financial Officer |

Joseph A. Newcomb |

|

55 |

|

Executive Vice President, Secretary and General Counsel |

Vicente Trelles |

|

50 |

|

Executive Vice President and Chief Operations Officer |

Robert S. Vaters |

|

45 |

|

Executive Vice President, Strategy and Corporate Development |

Patricia S. Walker, M.D., Ph.D. |

|

46 |

|

Executive Vice President, Clinical and Regulatory Affairs and Chief Scientific Officer |

Hani M. Zeini |

|

41 |

|

Executive Vice President, The Americas and Asia Pacific, Inamed Aesthetics |

For information regarding Mr. Teti, see the description following the table identifying the Company's directors.

Declan Daly was appointed Executive Vice President and Chief Financial Officer in November 2004 after being promoted to Senior Vice President in September 2002 and serving as the Corporate Controller and Principal Accounting Officer since March 2002. He was previously Vice President of Finance & Administration for Inamed International Corp. from 1998 to 2002. From 1996 to 1998, Mr. Daly was a Senior Manager with BDO Simpson Xavier, Chartered Accountants or BDO, in Dublin. Prior to joining BDO, he worked with PricewaterhouseCoopers in Dublin and London. Mr. Daly holds a B.A. in Management Science and Industrial Systems Studies from Trinity College, Dublin and he is also a Fellow of the Institute of Chartered Accountants in Ireland.

Joseph A. Newcomb has served as Senior Vice President, General Counsel and Secretary of Inamed since August 6, 2002 and was promoted to Executive Vice President in September 2003. From August 1997 until July 2002, Mr. Newcomb provided legal, tax and financial services to early stage and start-up companies. From May 1989 until July 1997, he was Vice President and General Counsel for the U.S. affiliate and portfolio companies of Brierley Investments Limited, an international holding company, where he was an active participant in the origination of investments and the management and operations of the portfolio companies. Mr. Newcomb received a B.B.A. from the University of Notre Dame, a J.D. from the University of Connecticut and an LL.M. from Georgetown University Law

10

Center. Mr. Newcomb is a Certified Public Accountant and a member of the Colorado, Connecticut, Massachusetts and District of Columbia bars.

Vicente Trelles has served as Executive Vice President and Chief Operations Officer of Inamed since August 1, 2001. Mr. Trelles was previously Chief Operating Officer of Inamed's McGhan Medical Division from October 1999 to July 2001. From June 1991 to September 1999, he held positions of increasing responsibility with Allergan Inc., including Vice President of Surgical Operations, January 1996 to September 1999, Vice President of Europe Operations, April 1993 to December 1995, Vice President Manufacturing Contact Lenses, July 1991 to March 1993. Prior to Allergan, Mr. Trelles worked for American Hospital Supply and Baxter Healthcare in different capacities, including General Manager of Baxter Healthcare V. Mueller Division in Puerto Rico. Mr. Trelles holds a B.S. in Industrial Engineering from the University of Mayaguez, Puerto Rico.

Robert S. Vaters was appointed Executive Vice President, Strategy and Corporate Development in November 2004 after serving as Inamed's Chief Financial Officer since August 20, 2002. From September 2001 to August 2002, Mr. Vaters worked on a variety of private merchant banking transactions. He was Executive Vice President and Chief Operating Officer at Arbinet Holdings, Inc., a leading telecom capacity exchange from January 2001 to July 2001. He served as Chief Financial Officer at Arbinet from January 2000 to December 2000. Prior to that he was at Premiere Technologies from July 1996 through January 2000, where he held a number of senior management positions, including Executive Vice President and Chief Financial Officer, Managing Director of the Asia Pacific business based in Sydney, Australia and Chief Financial Officer of Xpedite Systems Inc., formerly an independent public company that was purchased by Premiere. Additional experience includes Senior Vice President, Treasurer of Young and Rubicam Inc., a global communications firm with operations in 64 countries. Mr. Vaters was also an independent board member and chairman of the audit committee of Rockford Industries, a company providing healthcare equipment financing.

Patricia Walker, M.D., Ph.D. has served as Executive Vice President, Clinical and Regulatory Affairs and Chief Scientific Officer since September 2004. From July 1997 to September 2004, Ms. Walker held positions of increasing responsibility at Allergan Inc., including Vice President, Clinical Research and Development, Skin Care Pharmaceuticals, January 2001 to September 2004, Head, Oral Retinoid Clinical Development and Senior Medical Director, Skin and Oncology Therapeutics Area, October 1999 to December 2000, Senior Medical Director, Skin Therapeutic Area, December 1998 to October 1999, and Medical Director, Skin Therapeutic Area, July 1997 to November 1998. Prior to joining Allergan, Ms. Walker was a commissioned officer in the U.S. Public Health Service where she was assigned to the National Institute of Health, National Cancer Institute, Dermatology Branch. Ms. Walker received a B.S. in general science from the University of Iowa, and received her M.D. and Ph.D. in physiology and biophysics from the University of Iowa College of Medicine.

Hani M. Zeini is currently Executive Vice President, The Americas and Asia Pacific, Inamed Aesthetics. He previously served as Executive Vice President, North America, Inamed Aesthetics from October 1, 2001 through July 31, 2003. Prior to Joining Inamed, from 1988 to 2000, he held various sales, marketing and management positions of increasing responsibilities at The DuPont Pharmaceuticals Company's generics and branded pharmaceuticals divisions, including Senior Director, Marketing and Strategic Planning from September 1996 to May 1997, Vice President Worldwide Operations and Planning from May 1997 to May 1998, Vice President, Integrated Health Care from May 1998 to June 1999 and Senior Vice President, Global Health Systems from June 1999 to April 2000. Mr. Zeini also has held the positions of President and Chief Executive Officer of PharmasMarket.com, an internet-based healthcare marketplace from June 2000 to April 2001 and Chief Operating Officer for Acurian, Inc., a development stage clinical trials company until September 2001. He holds a degree in Electrical and Computer Engineering from the University of Miami in Florida, and in 2003 graduated from the Stanford Executive Program at Stanford University—Graduate School of Business.

There are no family relationships between any director, executive officer, or person nominated to become a director or executive officer.

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as to the shares of Common Stock of Inamed beneficially owned as of November 9, 2005, by (i) each person known by Inamed to be the beneficial owner of more than five percent of the outstanding Common Stock of Inamed, (ii) each person who is presently a director or a nominee for director of Inamed, (iii) each of the officers named in the Summary Compensation Table and (iv) all the directors and officers of Inamed as a group. Unless otherwise indicated in the table below, each person or entity named below has an address in care of the Company's principal executive offices.

Name and Address of Beneficial Owner

| | Number

of Shares

| | Percent of

Total(1)(2)

| |

|---|

American Century Companies, Inc.(3)

4500 Main Street, 9th Floor

Kansas City, MO 64111 | | 3,035,785 | | 8.3 | % |

Morgan Stanley(4)

1585 Broadway

New York, NY 10036 |

|

2,239,668 |

|

6.1 |

% |

Federated Investors, Inc.(5)

Federated Investors Tower

Pittsburgh, PA 15222-3779 |

|

2,000,774 |

|

5.5 |

% |

D.E. Shaw & Co., L.P.(6)

120 West 45th Street, Tower 45, 39th Floor

New York, NY 10036 |

|

2,447,837 |

|

6.7 |

% |

S.A.C. Capital Advisors, LLC(7)

72 Cummings Point Road

Stamford, CT 06902 |

|

2,314,942 |

|

6.3 |

% |

Officers and Directors and Nominees

| | Beneficially

Owned

| | Percent of

Total(1)(2)

| |

|---|

| Nicholas L. Teti(8) | | 68,000 | | * | |

Joy A. Amundson(9) |

|

15,000 |

|

* |

|

Malcolm Currie, Ph.D.(10) |

|

109,838 |

|

* |

|

John C. Miles II(11) |

|

15,000 |

|

* |

|

Mitchell Rosenthal, M.D.(12) |

|

17,501 |

|

* |

|

Terry E. Vandewarker(13) |

|

15,000 |

|

* |

|

Declan Daly(14) |

|

45,433 |

|

* |

|

Joseph Newcomb(15) |

|

26,650 |

|

* |

|

Vicente Trelles(16) |

|

33,775 |

|

* |

|

Hani M. Zeini(17) |

|

30,400 |

|

* |

|

All officers and Directors as a group (10 persons)(18) |

|

376,597 |

|

1.0 |

% |

- *

- Represents less than 1% of the total.

- (1)

- Information in this table regarding directors and executive officers is based on information provided by them. Unless otherwise indicated in the footnotes and subject to community property laws where applicable, each of the directors and executive officers has sole voting and/or investment power with respect to such shares.

12

- (2)

- The percentages are calculated on the basis of the number of outstanding shares of Common Stock as of November 9, 2005, which was 36,572,357.

- (3)

- Based solely upon the Schedule 13G filed jointly on February 11, 2005, by American Century Companies, Inc. (ACC), American Century Investment Management, Inc. (ACIM), and American Century Mutual Funds, Inc. ACIM is a wholly-owned subsidiary of ACC and an investment adviser registered under Section 203 of the Investment Advisers Act of 1940.

- (4)

- Based solely upon the Schedule 13G filed on February 15, 2005 by Morgan Stanley. Morgan Stanley is a parent holding company. Accounts managed on a discretionary basis by Morgan Stanley are known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from, the sale of such securities. No such account holds more than 5 percent of the class. Morgan Stanley filed its 13G solely in its capacity as the parent company of, and indirect beneficial owner of securities held by, one of its business units.

- (5)

- Based solely upon the Schedule 13G filed jointly on February 14, 2005 by Federated Investors, Inc., Voting Shares Irrevocable Trust (the "Trust"), John F. Donahue, Rhodora J. Donahue, and J. Christopher Donahue. Federated Investors, Inc. (the "Parent") is the parent holding company of Federated Equity Management Company of Pennsylvania and Federated Global Investment Management Corp. (the "Investment Advisers"), which act as investment advisers to registered investment companies and separate accounts that own shares of common stock in Inamed (the "Reported Securities"). The Investment Advisers are wholly-owned subsidiaries of FII Holdings, Inc., which is a wholly-owned subsidiary of the Parent. All of Parent's outstanding voting stock is held in the Trust for which John F. Donahue, Rhodora J. Donahue and J. Christopher Donahue act as trustees (collectively, the "Trustees"). The Trustees joined in filing this Schedule 13G because of the collective voting control that they exercise over the Parent. In accordance with Rule 13d-4 under the Securities Act of 1934, as amended, the Parent, the Trust, and each of the Trustees declared that their filing of a Schedule 13G should not be construed as an admission that they are the beneficial owners of the Reported Securities, and the Parent, the Trust, and each of the Trustees expressly disclaim beneficial ownership of the Reported Securities.

- (6)

- Based solely upon the Schedule 13G filed jointly on October 3, 2005 by D.E. Shaw & Co., L.P., D.E. Shaw Valance Portfolios, L.L.C., and David E. Shaw. David E. Shaw does not own any shares directly. By virtue of David E. Shaw's position as President and sole shareholder of D. E. Shaw & Co., Inc., which is the general partner of D. E. Shaw & Co., L.P., which in turn is the managing member and investment adviser of D. E. Shaw Investment Group, L.L.C. and D. E. Shaw Valence Portfolios, L.L.C., the general partner of D. E. Shaw Investments, L.P., and the managing member of D. E. Shaw Valance, L.L.C. and D. E. Shaw Investment Management, L.L.C., David E. Shaw may be deemed to have the shared power to vote or direct the vote of 2,447,517 shares, and the shared power to dispose or direct the disposition of 2,447,837 shares, the 2,447,837 shares as described above constituting 6.7% of the outstanding shares and, therefore, David E. Shaw may be deemed to be the beneficial owner of such shares. David E. Shaw disclaims beneficial ownership of such 2,447,837 shares.

- (7)

- Based solely upon the Schedule 13D filed jointly on November 4, 2005, by: (i) S.A.C. Capital Advisors, LLC ("SAC Capital Advisors") with respect to shares of Stock of the Company beneficially owned by S.A.C. Capital Associates, LLC ("SAC Capital Associates"), S.A.C. MultiQuant Fund, LLC ("SAC MultiQuant") and S.A.C. Meridian Fund, LLC ("SAC Meridian"); (ii) S.A.C. Capital Management, LLC ("SAC Capital Management") with respect to shares of Stock beneficially owned by SAC Capital Associates, SAC MultiQuant and SAC Meridian; (iii) SAC Capital Associates with respect to shares of Stock beneficially owned by it; (iv) SAC MultiQuant with respect to shares of Stock beneficially owned by it; (v) SAC Meridian with respect to shares of Stock beneficially owned by it; and (vi) Steven A. Cohen with respect to shares of Stock beneficially owned by SAC Capital Advisors, SAC Capital Management, SAC Capital Associates, SAC MultiQuant and SAC Meridian. SAC Capital Advisors has shared voting and dispositive powers with respect to 2,314,942 shares of common stock. SAC Capital Management has shared voting and dispositive powers with respect to 2,314,942 shares of common stock. SAC Capital Associates has shared voting and dispositive powers with respect to 2,300,178 shares of common stock. SAC MultiQuant has shared voting and dispositive powers with respect to 10,664 shares of common stock. SAC Meridian has shared voting and dispositive powers with respect to 4,100

13

shares of common stock. Steven A. Cohen has shared voting and dispositive powers with respect to 2,314,942 shares of common stock. SAC Capital Advisors, SAC Capital Management and Mr. Cohen own no shares of Stock directly. Pursuant to investment agreements, SAC Capital Advisors and SAC Capital Management share investment and voting power with respect to the securities held by SAC Capital Associates, SAC MultiQuant and SAC Meridian. Mr. Cohen controls SAC Capital Advisors and SAC Capital Management. By reason of the provisions of Rule 13d-3 of the Securities Exchange Act of 1934, as amended, each of (i) SAC Capital Advisors and SAC Capital Management may be deemed to own beneficially 2,314,942 shares of Stock (constituting approximately 6.4% of the shares outstanding) and, (ii) Mr. Cohen may be deemed to own beneficially 2,314,942 shares of stock (consisting approximately of 6.4% of the shares outstanding). Each of SAC Capital Advisors, SAC Capital Management and Mr. Cohen disclaim beneficial ownership of any of the securities covered by this statement.

- (8)

- Includes an aggregate of 65,000 shares of restricted stock which may not be sold or otherwise transferred or pledged until their restrictions lapse or are terminated.

- (9)

- Includes an aggregate of 15,000 shares of Common Stock issuable upon the exercise of options currently exercisable or exercisable within 60 days of November 9, 2005.

- (10)

- Includes an aggregate of 45,000 shares of Common Stock issuable upon the exercise of options currently exercisable or exercisable within 60 days of November 9, 2005.

- (11)

- Includes an aggregate of 15,000 shares of Common Stock issuable upon the exercise of options currently exercisable or exercisable within 60 days of November 9, 2005.

- (12)

- Includes an aggregate of 15,000 shares of Common Stock issuable upon the exercise of options currently exercisable or exercisable within 60 days of November 9, 2005.

- (13)

- Includes an aggregate of 15,000 shares of Common Stock issuable upon the exercise of options currently exercisable or exercisable within 60 days of November 9, 2005.

- (14)

- Includes an aggregate of 12,833 shares of Common Stock issuable upon the exercise of options currently exercisable or exercisable within 60 days of November 9, 2005, and an aggregate of 32,600 shares of restricted stock which may not be sold or otherwise transferred or pledged until their restrictions lapse or are terminated.

- (15)

- Includes an aggregate of 26,650 shares of restricted stock which may not be sold or otherwise transferred or pledged until their restrictions lapse or are terminated.

- (16)

- Includes an aggregate of 30,400 shares of restricted stock which may not be sold or otherwise transferred or pledged until their restrictions lapse or are terminated.

- (17)

- Includes an aggregate of 30,400 shares of restricted stock which may not be sold or otherwise transferred or pledged until their restrictions lapse or are terminated.

- (18)

- Includes an aggregate of 117,833 shares of Common Stock issuable upon the exercise of options currently exercisable or exercisable within 60 days of November 9, 2005.

14

Equity Compensation Plan Information as of December 31, 2004

| | Number of securities

to be issued upon

the exercise of

outstanding options

| | Weighted average

exercise price of

outstanding options

| | Number of securities

remaining available

for future issuance

| |

|---|

| Equity compensation plans approved by Stockholders(1) | | 1,694,168 | | $ | 40.65 | | 1,170,705 | (2) |

| Equity compensation plans not approved by Stockholders(3) | | 50,001 | | | 16.68 | | 0 | |

| | |

| |

| |

| |

| Total | | 1,744,169 | | | 39.99 | | 1,170,705 | |

| | |

| |

| |

| |

- (1)

- Consists of nine plans: the 1993 Stock Option Plan, the 1998 Stock Option Plan, the 1999 Program, the 1999 Stock Election Plan, the 2000 Stock Option Plan, the 2000 Employee Stock Purchase Plan, the 2003 Outside Director Compensation Plan, the 2003 Restricted Stock Plan and the 2004 Performance Option Plan.

- (2)

- Includes 195,544 shares reserved for issuance under our 2000 Employee Stock Purchase Plan and 157,500 shares reserved under the 2003 Restricted Stock Plan.

- (3)

- Consists of stand-alone stock option agreements discussed below.

Stand Alone Options Not Approved By Stockholders

In 2001, the Company granted a stand alone option for 450,000 shares of Common Stock to Nick Teti, the Company's President, Chief Executive Officer and Chairman of the Board, in connection with his hiring. The exercise price per share of $16.68 was the fair market value per share on the date of grant. These options vest ratably on the first, second and third anniversaries of the grant date. Some or all of these options may also vest immediately upon a change-of-control, as defined in the option agreement.

In 2001, the Company also granted a stand alone option for 150,000 shares of Common Stock to Hani Zeini, the Company's Executive Vice President, The Americas and Asia Pacific, Inamed Aesthetics, in connection with his hiring. The exercise price per share of $11.33 was the fair market value per share on the date of grant. These options vest ratably on the first, second and third anniversaries of the grant date. Some or all of these options may also vest immediately upon a change-of-control, as defined in the option agreement.

15

EXECUTIVE COMPENSATION AND OTHER MATTERS

Summary Compensation Table

The following table sets forth, for the fiscal years ended December 31, 2004, 2003 and 2002, all compensation awarded to, paid to, or earned for services rendered in all capacities by the Chief Executive Officer and each of the other top four executive officers whose salary and bonus exceeded $100,000 in 2004, 2003 and 2002. These five officers are referred to as the "named executive officers." Unless otherwise noted, the compensation table excludes other compensation in the form of perquisites and other personal benefits that constitute the lesser of $50,000 or 10% of the total annual salary and bonus earned by each of the named executive officers in 2004, 2003 and 2002.

| | Annual Compensation

| | Long-Term Compensation

| |

|---|

Name and Principal Positions

| | Year

| | Salary

$

| | Bonus

$

| | Other Annual

Compensation

$

| | Stock

Options

Granted

(In Shares)

(#)

| | Restricted

Stock

Grants

(In Shares)

(#)

| | All Other

Compensation

($)(1)

| |

|---|

Nicholas L. Teti(2)

Chairman, President, and Chief Executive Officer | | 2004

2003

2002 | | 536,159

452,698

400,000 | | 633,970

625,100

300,000 | (3)

(3)

| —

9,350

— |

(4)

| —

—

— | | —

45,000

— |

(5)

| 40,904

7,559

4,800 | |

Declan Daly(6)

Executive Vice President and Chief Financial Officer |

|

2004

2003

2002 |

|

246,095

217,724

160,096 |

|

182,700

166,000

125,000 |

|

—

—

12,600 |

(4) |

—

—

19,000 |

|

—

15,000

— |

(8)

|

94,403

29,567

82,341 |

(7)

(9)

(10) |

Joseph A. Newcomb(11)

Executive Vice President, Secretary |

|

2004

2003

2002 |

|

321,692

278,615

94,865 |

|

219,467

255,000

65,000 |

(12)

(12)

|

—

—

— |

|

—

—

150,000 |

|

—

18,750

— |

(13)

|

15,966

6,018

20,121 |

(14) |

Vicente Trelles(15)

Executive Vice President and Chief Operations Officer |

|

2004

2003

2002 |

|

309,897

296,345

273,561 |

|

251,629

290,000

165,000 |

(16)

(16)

|

—

—

— |

|

—

—

— |

|

—

22,500

— |

(17)

|

20,309

5,594

4,400 |

|

Hani Zeini(18)

Executive Vice President, The Americas and Asia Pacific Inamed Aesthetics |

|

2004

2003

2002 |

|

337,777

296,068

261,336 |

|

254,562

315,000

190,000 |

(19)

(19)

|

—

—

— |

|

—

—

— |

|

—

22,500

— |

(20)

|

505

477

23,633 |

(14) |

- (1)

- Amounts shown, unless otherwise noted, reflect employer contributions to group term life insurance premium and matching contributions made by Inamed under its 401(k) plan, and certain club dues.

- (2)

- Mr. Teti joined Inamed as President and Chief Executive Officer beginning August 1, 2001, and was elected Chairman of the Board on July 23, 2002.

- (3)

- Included in 2004 and 2003, respectively, is $53,970 and $156,100 of a deferred 2003 bonus payable 50% at March 1, 2005 and 50% at March 1, 2006, in each instance as adjusted proportionately for any increase or decrease in the price of Inamed's common stock as measured from February 20, 2004 to February 20, 2005 and 2006 respectively. The closing prices of Inamed's common stock on February 20, 2005 and 2004 were $70.45 and $46.97, respectively.

- (4)

- Amounts shown consist of an automobile allowance.

16

- (5)

- The total value of this award on the date of grant was $2,198,250, which is based on $48.85 per share, the last reported sales price of Inamed's Common Stock as reported on the NASDAQ National Market.

- (6)

- Mr. Daly joined Inamed in 1998 as Vice President of Finance and Administration for Inamed International Corp. He was appointed Executive Vice President and Chief Financial Officer of Inamed in November 2004 after being promoted to Senior Vice President in September 2002 and serving as the Corporate Controller and Principal Accounting Officer since March 2002.

- (7)

- Includes $34,996 in relocation expenses, an expatriate allowance of $19,471 and a pension contribution of $39,375.

- (8)

- The total value of this award on the date of grant was $732,750, which is based on $48.85 per share, the last reported sales price of Inamed's common stock on December 15, 2003 as reported on the NASDAQ National Market.

- (9)

- Consists of an expatriate allowance.

- (10)

- Consists of a relocation allowance.

- (11)

- Mr. Newcomb joined Inamed as Senior Vice President, General Counsel and Secretary of Inamed beginning August 6, 2002 and was promoted to Executive Vice President in September 2003.

- (12)

- Included in 2004 and 2003, respectively, is $18,717 and $54,000 of a deferred 2003 bonus payable 50% at March 1, 2005 and 50% at March 1, 2006, in each instance as adjusted proportionately for any increase or decrease in the price of Inamed's common stock as measured from February 20, 2004 to February 20, 2005 and 2006 respectively. The closing prices of Inamed's common stock on February 20, 2005 and 2004 were $70.45 and $46.97, respectively.

- (13)

- The total value of this award on the date of grant was $915,937.50, which is based on $48.85 per share, the last reported sales price of Inamed's common stock on December 15, 2003 as reported on the NASDAQ National Market.

- (14)

- Consists of relocation expenses.

- (15)

- Mr. Trelles joined Inamed as Chief Operating Officer of its McGhan Medical Division beginning in October 1999, and has served as Inamed's Executive Vice President and Chief Operating Officer since August, 1, 2001.

- (16)

- Included in 2004 and 2003, respectively, is $33,574 and $95,700 of a deferred 2003 bonus payable 50% at March 1, 2005 and 50% at March 1, 2006, in each instance as adjusted proportionately for any increase or decrease in the price of Inamed's common stock as measured from February 20, 2004 to February 20, 2005 and 2006 respectively. The closing prices of Inamed's common stock on February 20, 2005 and 2004 were $70.45 and $46.97, respectively.

- (17)

- The total value of this award on the date of grant was $1,099,125, which is based on $48.85 per share, the last reported sales price of Inamed's common stock on December 15, 2003 as reported on the NASDAQ National Market.

- (18)

- Mr. Zeini joined Inamed as Executive Vice President, North America, Inamed Aesthetics beginning October 1, 2001, and was appointed Executive Vice President, The Americas & Asia Pacific, Inamed Aesthetics beginning July 31, 2003.

- (19)

- Included in 2004 and 2003, respectively, is $36,097 and $103,950 of a deferred 2003 bonus payable 50% at March 1, 2005 and 50% at March 1, 2006, in each instance as adjusted proportionately for any increase or decrease in the price of Inamed's common stock as measured from February 20, 2004 to February 20, 2005 and 2006 respectively. The closing prices of Inamed's common stock on February 20, 2005 and 2004 were $70.45 and $46.97, respectively.

- (20)

- The total value of this award on the date of grant was $1,099,125, which is based on $48.85 per share, the last reported sales price of Inamed's common stock on December 15, 2003 as reported on the NASDAQ National Market.

17

Option Grants in Last Fiscal Year

There were no stock option grants made to any of the executive officers named in the Summary Compensation Table during the fiscal year ended December 31, 2004.

Restricted Stock Grants

There were no restricted stock grants made to any of the executive officers named in the Summary Compensation Table during the fiscal year ended December 31, 2004.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth certain information concerning exercises of stock options by the executive officers named in the Summary Compensation Table in fiscal year 2004 and unexercised stock options held by the executive officers named in the Summary Compensation Table as of December 31, 2004. Also reported are values for options that represent the positive spread between the respective exercise prices of outstanding stock options and the fair market value of the Company's Common Stock as of December 31, 2004.

| |

| |

| | Number of Securities

Underlying

Unexercised Options at

2003 Fiscal Year-End(#)

| | Value of Unexercised

In-The-Money

Options at 2003

Fiscal Year-End($)(1)

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Nicholas L. Teti | | 100,000 | | $ | 3,435,210 | | 50,001 | | — | | $ | 2,328,547 | | $ | — |

| Declan Daly | | 3,000 | | | 125,250 | | 9,500 | | 9,500 | | | 428,232 | | | 428,232 |

| Joseph A. Newcomb | | 40,000 | | | 1,609,762 | | 10,000 | | 50,000 | | | 519,900 | | | 2,599,500 |

| Vicente Trelles | | 3,000 | | | 130,050 | | 46,500 | | — | | | 2,128,530 | | | — |

| Hani M. Zeini | | 50,000 | | | 2,052,151 | | — | | — | | | — | | | — |

- (1)

- On December 31, 2004 (the last trading day of 2004), the last reported sales price of the Company's Common Stock as reported on the NASDAQ National Market was $63.25.

Employment Contracts and Termination of Employment and Change-in-Control Arrangements

On July 23, 2001, the Company entered into an employment agreement with Nicholas L. Teti in connection with his employment as Chief Executive Officer, which included, among other things, a grant of 450,000 options to purchase shares of the Company's Common Stock. On October 29, 2004, the Company entered into an Amended and Restated Employment Agreement with Mr. Teti, the Company's current Chief Executive Officer and Chairman of the Board. Under the five year agreement which is deemed effective as of July 25, 2004, Mr. Teti will receive a base salary at the annualized rate of $500,000, and he is eligible to receive an annual bonus which is targeted to be 70% of his base salary based on the performance of Mr. Teti and of the Company. Mr. Teti is also eligible to participate in our 2003 Performance Based Stock Option/Restricted Stock Plan and other standard benefit plans. Mr. Teti's employment agreement also provides that upon termination of Mr. Teti's employment by the Company without "cause" (as defined in the agreement), Mr. Teti will be entitled to severance compensation equal to payment of his base salary in effect during the post-employment period (as defined in the agreement). Additionally, Mr. Teti's employment agreement also provides that upon a "change in control" (as defined in the agreement) and a subsequent termination of Mr. Teti, Mr. Teti will be entitled to payment of his base salary through the date of his termination, a payment equal to the greater of (i) three times the sum of his base salary at the time of the change of control, or (ii) three times the sum of his base salary at the time of his termination and payment of any annual bonus awarded but not yet paid. Mr. Teti agreed not to compete with us for two years following any

18

future termination of his employment with us. The agreement also provides Mr. Teti with severance benefits in the event of his termination for certain reasons.

In August 2003, the Company entered into an employment agreement with Joseph A. Newcomb in connection with his employment as Senior Vice President and General Counsel. Mr. Newcomb's employment agreement provides that Mr. Newcomb will receive (i) a base salary of $275,000, (ii) a bonus up to 50 percent of his salary in the Management Incentive Plan and (iii) an initial grant of options to purchase 150,000 shares of the Company's Common Stock. Mr. Newcomb's employment agreement also provides that upon a "change in control" (as defined in the agreement) and a subsequent termination of Mr. Newcomb, Mr. Newcomb will be entitled to payment of his base salary through the date of his termination, and a payment equal to the greater of (i) two times the sum of his base salary at the time of the change of control, or (ii) two times the sum of his base salary at the time of his termination and payment of any annual bonus awarded but not yet paid. Mr. Newcomb will also be entitled to the continuation of certain insurance and other benefits for a period of time not exceeding twelve months.

Effective January 2003, the Company entered into an employment agreement with Vicente Trelles in connection with his employment as Executive Vice President and Chief Operations Officer. Mr. Trelles' employment agreement provides that Mr. Trelles will receive a base salary of $289,000. Mr. Trelles' employment agreement also provides that upon a "change in control" (as defined in the agreement) and a subsequent termination of Mr. Trelles, Mr. Trelles will be entitled to payment of his base salary through the date of his termination, and a payment equal to the greater of (i) two times the sum of his base salary at the time of the change of control, or (ii) two times the sum of his base salary at the time of his termination and payment of any annual bonus awarded but not yet paid. Mr. Trelles will also be entitled to the continuation of certain insurance and other benefits for a period of time not exceeding twelve months.

In September 2001, the Company entered into an employment agreement with Hani Zeini in connection with his employment as Executive Vice President, North America, Inamed Aesthetics. Mr. Zeini's employment agreement provides that Mr. Zeini will receive (i) a base salary of $245,000, (ii) a bonus up to 50 percent of his salary in the Management Incentive Plan, (iii) options to purchase 100,000 shares of the Company's Common Stock, (iv) a relocation package to defray his costs of moving to Santa Barbara, California and (v) a one time signing bonus of $40,000. In April, 2002, Mr. Zeini entered into a change of control agreement which provides that upon a "change in control" (as defined in the agreement) and a subsequent termination of Mr. Zeini, Mr. Zeini will be entitled to payment of his base salary through the date of his termination, and a payment equal to the greater of (i) two times the sum of his base salary at the time of the change of control, or (ii) two times the sum of his base salary at the time of his termination and payment of any annual bonus awarded but not yet paid. Mr. Zeini will also be entitled to the continuation of certain insurance and other benefits for a period of time not exceeding eighteen months.

19

COMPENSATION COMMITTEE REPORT

The Compensation Committee determines all aspects of compensation arrangements for the executive officers, including the Chief Executive Officer, of the Company, approves recommendations as to compensation for certain of the Company's other senior employees and administers the Company's employee stock option and stock purchase plans, restricted stock plan, and the Company's senior management bonus plan. All of the members of the Compensation Committee are outside directors as defined by Section 162(m) of the Internal Revenue Code of 1986, as amended and independent as defined by Rule 4200 of the NASD.

Compensation Policies and Goals

The Company's goal is to retain, motivate and reward management of the Company through its compensation policies and awards, while aligning management's interests more closely with those of the Company and its stockholders. Indeed, the Company believes that executive compensation should be closely related to the value delivered to stockholders. As a result, the Company has sought to develop incentive pay programs that provide competitive compensation and reflect Company performance. Both short-term and long-term incentive compensation are based on Company performance and the value received and to be received by stockholders.

The Company strives to provide a total compensation package that is competitive with opportunities for similarly-situated executives at comparable companies, without becoming a price leader. In order to monitor competitive conditions, the Company and the Compensation Committee utilize publicly available executive compensation reports for medical device companies, as well as regional executive compensation statistics and trends. From time to time, the Compensation Committee commissions studies by independent compensation firms.

Compensation Make-Up and Measurement

At present, the Company's executive compensation program consists of three components: base salary, short-term incentives and long-term incentives, each of which is intended to serve the Company's overall compensation philosophy.

Base Salary. The Company's salary levels are intended to be consistent with competitive pay practices and level of responsibility, with salary increases reflecting competitive trends, the overall financial performance of the Company and general economic conditions as well as a number of factors relating to the particular individual, including the performance of the individual executive, level of experience, ability and knowledge of the job.

Short-Term Incentives. In 2004, the Board of Directors adopted a system that tied bonuses to a specific minimum earnings target and key organizational goals and achievements, which were met.

Long-Term Incentives. Stock options are granted from time to time to reward key employees for their contributions. The grant of options is based primarily on the key employee's potential contribution to the Company's growth and profitability. During 2004, option grants were made primarily to new executives. The size and other terms and conditions of grants were based primarily on the Compensation Committee's assessment of competitive conditions for executives with similar skills and experience at comparable companies. Shares of restricted stock were granted to certain continuing executives based on the individual's contribution and the level of responsibility, experience and ability, as well as competitive conditions.

Compensation of Chief Executive Officer

The Board of Directors elected Mr. Teti to be Chief Executive Officer on August 1, 2001. Mr. Teti was elected Chairman of the Board of Directors on July 23, 2002. The Company entered into a three-year employment agreement with Mr. Teti in order to assure his long-term commitment to the

20

Company. The base compensation level in the employment agreement, and other terms, were determined based upon the anticipated responsibilities to be performed by Mr. Teti, his expected performance in managing and directing the Company's operations, and his efforts in assisting the Company to improve its capital base. On October 29, 2004, the Company entered into an Amended and Restated Employment Agreement with Mr. Teti. The amended agreement is deemed effective as of July 25, 2004 and has a five year term.

Mr. Teti's compensation, including his base salary, bonus, and stock option and restricted stock grants, was determined within the same framework established for all executive officers of the Company. Under the amended agreement, Mr. Teti will receive a base salary at the annualized rate of $500,000, and he is eligible to receive an annual bonus targeted to 70% of his base salary based on the performance of Mr. Teti and of the Company. Mr. Teti's bonus award for 2004 was $580,000. The amount of Mr. Teti's bonus award was determined based upon a review of his performance during the past fiscal year in managing and directing the Company's operations, managing and overseeing major regulatory activity, and growing and progressing the Company's product development pipeline.

On August 1, 2001, Mr. Teti was granted an option to purchase 300,000 shares of Common Stock. The exercise price of the stock option was set at fair market value on the grant date. Subject to the terms applicable to his grant, one-third of the stock option became exercisable on August 2, 2003. The option expires five years from the grant date. On December 15, 2003 the Board granted to Mr. Teti 45,000 shares of restricted stock pursuant to the terms of the 2003 Restricted Stock Plan, which was accepted by Mr. Teti in the first quarter of 2004.

Policy With Respect To Qualifying Compensation for Deductibility

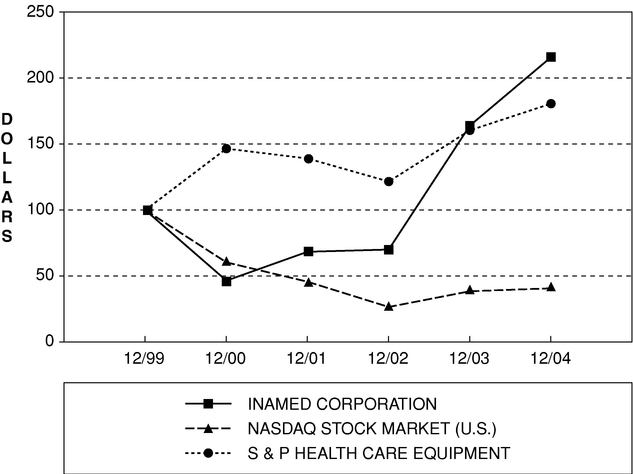

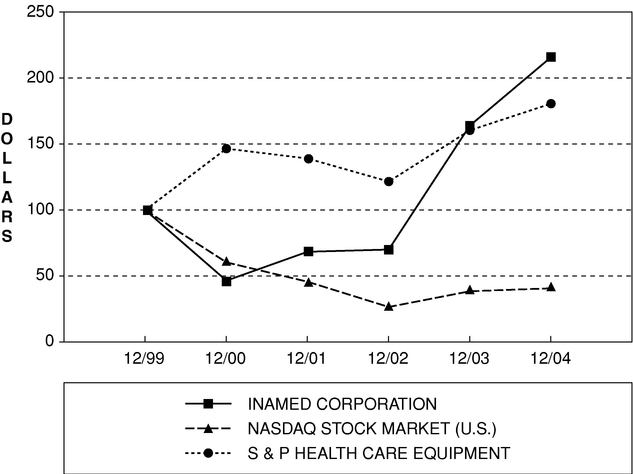

The Company's ability to deduct compensation paid to individual covered officers is generally limited by Section 162(m) of the Internal Revenue Code of 1986, as amended, to $1 million annually. However, performance-based compensation that has been approved by stockholders is excluded from the $1 million limit, if, among other requirements, the compensation is payable only upon attainment of pre-established, objective performance goals and the Board committee that establishes such goals consists only of "outside directors."