SCHEDULE 14C

(RULE 14C-101)

INFORMATION REQUIRED IN INFORMATION STATEMENT

SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14(c)

OF THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

oPreliminary Information Statement

oConfidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

xDefinitive Information Statement

DDS TECHNOLOGIES USA, INC.

————————————————————

(Name of Registrant As Specified in Charter)

Payment of Filing Fee (Check the appropriate box):

xNo Fee required.

oFee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

oFee paid previously with preliminary materials

oCheck box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Copies to:

Gary Epstein, Esq.

Greenberg Traurig, P.A.

1221 Brickell Avenue

Miami, FL 33131

Telephone: (305) 579-0500

Facsimile: (305) 579-0717

DDS TECHNOLOGIES USA, INC.

150 EAST PALMETTO PARK ROAD, SUITE 510

BOCA RATON, FL 33432

Dear Fellow Shareholder:

The purpose of this information statement is to inform you that on April 12, 2005, the Board of Directors of DDS Technologies USA, Inc. (the “Company”) unanimously approved and recommended that the Company’s Articles of Incorporation be amended to increase the number of authorized shares of the Company’s capital stock, $.0001 par value per share from 26,000,000 to 51,000,000 and increase the number of authorized shares of the Company’s common stock, $.0001 par value per share from 25,000,000 to 50,000,000 (the “Charter Amendments”).

On April 12, 2005, holders of a majority of the Company’s outstanding shares of capital stock executed a written consent adopting these Charter Amendments. Pursuant to the provisions of the General Corporation Law of Nevada and the Company’s Articles of Incorporation, the holders of at least a majority of the outstanding voting shares are permitted to approve the Charter Amendments by written consent in lieu of a meeting, provided that prompt notice of such action is given to the other shareholders of the Company. This written consent assures that the Charter Amendments will occur without your vote. Pursuant to the rules and regulations promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), an information statement must be sent to the holders of voting stock who do not sign the written consent at least twenty (20) days prior to the effective date of the action. This notice, which is being sent to all holders of record on April 12, 2005, is intended to serve as such notice under Nevada law and as the information statement required by the Exchange Act.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Please note that this is not an offer to purchase your shares.

The date of this information statement is May 2, 2005.

| | Sincerely, Spencer L. Sterling President and Chief Executive Officer |

TABLE OF CONTENTS TO SCHEDULE 14C INFORMATION STATEMENT

| SUBJECT | PAGE |

| | |

| INTRODUCTION | 4 |

| QUESTIONS AND ANSWERS ABOUT THE CHARTER AMENDMENTS | 5 |

| BOARD RECOMMENDATION AND APPROVAL BY SHAREHOLDERS | 6 |

| DESCRIPTION OF SECURITIES | 7 |

| Description Of Common Stock | 7 |

| Possible Anti-Takeover Effects | 8 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 8 |

| ANNEX A — Form of Certificate of Amendment | A-1 |

INTRODUCTION

On April 12, 2005, the Board of Directors of DDS Technologies USA, Inc. (the “Company”) unanimously approved and recommended that the Company’s Articles of Incorporation be amended to increase the number of authorized shares of the Company’s capital stock, $.0001 par value per share from 26,000,000 to 51,000,000 and increase the number of authorized shares of the Company’s common stock, $.0001 par value per share from 25,000,000 to 50,000,000 (the “Charter Amendments”).

On April 12, 2005, a majority of the Company’s outstanding shares of capital stock executed a written consent adopting these Charter Amendments. As of the close of business on April 12, 2005, Company records indicated that 19,235,542 shares of its capital stock were issued and outstanding of which 9,982,018 shares of capital stock executed the written consent adopting the Charter Amendments.

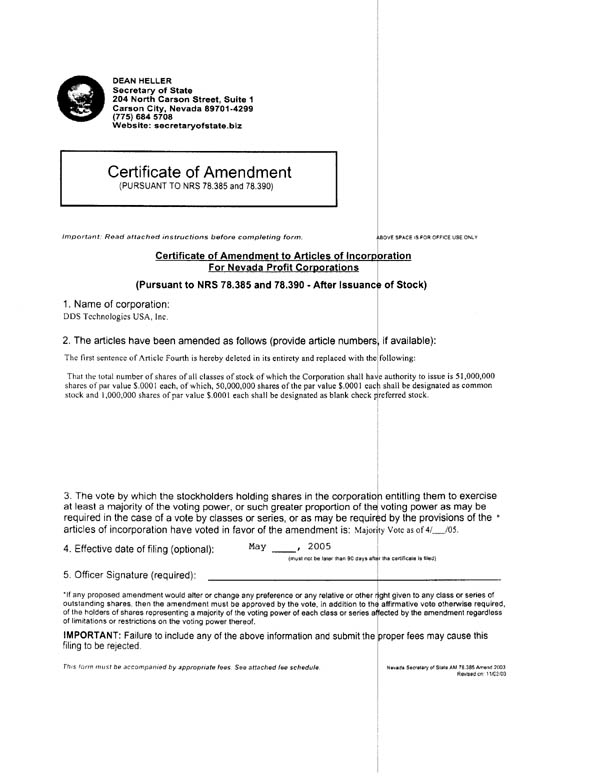

The Charter Amendments are reflected in the Form of Certificate of Amendment which is attached hereto as Annex A, and incorporated herein by reference.

Prior to the Charter Amendments, the Company has 25,000,000 authorized shares of common stock, 19,235,542 of which are issued and outstanding, with 5,764,458 available for issuance. The Company currently has outstanding shares of preferred stock, stock options and warrants which in the aggregate are convertible into or exercisable for 14,231,932 shares of common stock, of which 8,891,912 are attributable to the recent offering. On April 22, 2005, the closing price of the Company’s common stock on the OTC Bulletin Board was $.75 per share. Based upon such closing price, preferred stock, options and warrants convertible into or exercisable for in the aggregate 3,948,566 shares of common stock are in-the-money. As a result, the Company does not have sufficient shares of common stock available for issuance upon exercise or conversion of its outstanding preferred stock, stock options and warrants. The Company is obligated to reserve out of authorized capital stock sufficient shares of common stock available for issuance upon exercise or conversion of its outstanding preferred stock, stock options and warrants. Accordingly, the Board of Directors determined that the increase of authorized shares of capital stock and the increase in common stock is necessary to allow the Company to reserve for issuance shares of common stock required to be reserved pursuant to the Company’s outstanding preferred stock, stock options and warrants and to make available to the Company sufficient additional shares of common stock which may become issuable as a result of antidilution adjustments to the Company’s outstanding preferred stock, stock options and warrants and shares of common stock that may be issued as a result of in kind dividends paid on the preferred stock. The Company currently has no other plans for the issuance of the additional shares of common stock.

This information statement is being mailed on or about May 3, 2005 to holders of record of capital stock at the close of business on April 12, 2005 pursuant to Section 14(c) of the Exchange Act, and Regulation 14C promulgated thereunder. Pursuant to federal securities laws, none of the Charter Amendments will be effective until at least twenty (20) days following the mailing of this information statement.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

QUESTIONS AND ANSWERS ABOUT THE CHARTER AMENDMENTS

| Q | WHY DID I RECEIVE THIS INFORMATION STATEMENT? |

| A | Applicable laws require us to provide you information regarding the Charter Amendments even though your vote is neither required nor requested for the Charter Amendments to become effective. |

| Q | WHAT WILL I RECEIVE IF THE CHARTER AMENDMENTS ARE COMPLETED? |

| A | Nothing. The Charter Amendments will only modify the Articles of Incorporation. |

| Q | WHEN DO YOU EXPECT THE CHARTER AMENDMENTS TO BECOME EFFECTIVE? |

| A | We expect to file the Certificate of Amendment with the Secretary of State of Nevada prior to May 12, 2005, but the Certificate of Amendment will not become effective prior to the 20th day following the mailing of this information statement. A copy of the Form of Certificate of Amendment is attached to this information statement in Annex A. |

| Q | WHY AM I NOT BEING ASKED TO VOTE? |

| A | The holders of a majority of the issued and outstanding shares of capital stock have already approved the Charter Amendments pursuant to a written consent in lieu of a meeting. Such approval, together with the approval of the Company’s Board of Directors, is sufficient under Nevada law, and no further approval by our shareholders is required. |

| Q | WHAT DO I NEED TO DO NOW? |

| A | Nothing. This information statement is purely for your information, and does not require or request you to do anything. If you need information about the amendments, please contact the Information Agent. |

| Q | WHOM CAN I CALL WITH QUESTIONS? |

| A | If you have any questions about the amendments, please contact Joe Fasciglione, the Company’s Chief Financial Officer at (561) 750-4450 (the “Information Agent”). |

For more detailed information about the Company, including financial statements, you may refer to the Company's Form 10K-SB for the year ended December 31, 2004, filed with the SEC on April 15, 2005. This document is available on the SEC's EDGAR database at www.sec.gov or can be requested without cost by calling the Information Agent.

BOARD RECOMMENDATION

ANDAPPROVAL BY SHAREHOLDERS

Board Recommendation. On April 12, 2005, our Board of Directors, believing it to be in the best interests of the Company and its shareholders, approved, and recommended that the shareholders of the Company approve an amendment to the Company’s Articles of Incorporation to increase the number of authorized shares of the Company’s capital stock, $.0001 par value per share from 26,000,000 to 51,000,000 and increase the number of authorized shares of the Company’s common stock, $.0001 par value per share from 25,000,000 to 50,000,000. A copy of the Form of Certificate of Amendment is attached to this information statement in Annex A.

Prior to the Charter Amendments, the Company has 25,000,000 authorized shares of common stock, 19,235,542 of which are issued and outstanding, with 5,764,458 available for issuance. The Company currently has outstanding shares of preferred stock, stock options and warrants which in the aggregate are convertible into or exercisable for 14,231,932 shares of common stock, of which 8,891,912 are attributable to the recent offering. On April 22, 2005, the closing price of the Company’s common stock on the OTC Bulletin Board was $.75 per share. Based upon such closing price, preferred stock, options and warrants convertible into or exercisable for in the aggregate 3,948,566 shares of common stock are in-the-money. As a result, the Company does not have sufficient shares of common stock available for issuance upon exercise or conversion of its outstanding preferred stock, stock options and warrants. The Company is obligated to reserve out of authorized capital stock sufficient shares of common stock available for issuance upon exercise or conversion of its outstanding preferred stock, stock options and warrants. Accordingly, the Board of Directors determined that the increase of authorized shares of capital stock and the increase in common stock is necessary to allow the Company to reserve for issuance shares of common stock required to be reserved pursuant to the Company’s outstanding preferred stock, stock options and warrants and to make available to the Company sufficient additional shares of common stock which may become issuable as a result of antidilution adjustments to the Company’s outstanding preferred stock, stock options and warrants and shares of common stock that may be issued as a result of in kind dividends paid on the preferred stock. The Company currently has no other plans for the issuance of the additional shares of common stock.

Approval by Shareholders. As of April 12, 2005, the Company had 19,235,542 shares of its capital stock issued and outstanding. As of this same date, shareholders representing 9,982,018 shares of capital stock, or approximately 52% of the issued and outstanding shares of capital stock, approved the proposals to amend the Company’s Articles of Incorporation to increase the number of authorized shares of the Company’s capital stock, $.0001 par value per share from 26,000,000 to 51,000,000 and increase the number of authorized shares of the Company’s common stock, $.0001 par value per share from 25,000,000 to 50,000,000. The full text of the Charter Amendments is reflected in the Form of Certificate of Amendment which is attached as Annex A to this information statement. Pursuant to the provisions of Nevada law and the Company’s Articles of Incorporation, the holders of at least a majority of the outstanding voting shares are permitted to approve the Charter Amendments by written consent in lieu of a meeting, provided that prompt notice of such action is given to the other shareholders. Pursuant to the rules and regulations promulgated by the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), an information statement must be sent to the holders of voting stock who do not sign the written consent at least twenty (20) days prior to the effective date of the action. This notice, which is being sent to all holders of record on April 12, 2005, is intended to serve as such notice under Nevada law and as the information statement required by the Exchange Act.

The Company anticipates that the Charter Amendments will be effective twenty (20) days after the mailing of this Information Statement, which mailing is anticipated to occur on May 3, 2005 or shortly thereafter.

THE CHARTER AMENDMENTS HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE FAIRNESS OR MERIT OF THE CHARTER AMENDMENTS NOR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS INFORMATION STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

PLEASE NOTE THAT THIS IS NEITHER A REQUEST FOR YOUR VOTE NOR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT (THE “INFORMATION STATEMENT”) DESIGNED TO INFORM YOU OF THE AMENDMENTS THAT WILL OCCUR IF THE AMENDMENTS ARE COMPLETED AND TO PROVIDE YOU WITH INFORMATION ABOUT THE AMENDMENTS AND THE BACKGROUND OF THESE TRANSACTIONS.

PLEASE NOTE ALSO THAT THIS IS NOT AN OFFER TO PURCHASE YOUR SHARES.

DESCRIPTION OF SECURITIES

Description Of Common Stock

Number of Authorized and Outstanding Shares. After adoption of the Charter Amendments, the Company’s Articles of Incorporation will authorize the issuance of 50,000,000 shares of common stock, $.0001 par value per share, of which 19,235,542 shares were outstanding on April 12, 2005. All of the outstanding shares of common stock are fully paid and non-assessable.

Voting Rights. Each share of our common stock is entitled to one vote in the election of directors and other matters. A majority of shares of our voting stock constitute a quorum at any meeting of shareholders. Common shareholders are not entitled to cumulative voting rights.

Dividends; Liquidation. Dividends may be paid to holders of common stock as may be declared by our Board of Directors out of funds legally available for that purpose. If we liquidate, dissolve or wind-up our business, either voluntarily or involuntarily, common shareholders will receive pro rata all assets remaining after we pay our creditors and satisfy our liquidation obligations to the holders of our preferred stock.

Transfer Agent. Shares of common stock are registered at the transfer agent and are transferable at such office by the registered holder (or duly authorized attorney) upon surrender of the common stock certificate, properly endorsed. No transfer shall be registered unless the Company is satisfied that such transfer will not result in a violation of any applicable federal or state securities laws. The Company’s transfer agent for its common stock is Corporate Stock Transfer, located at 3200, Cherry Creek Drive, South, Suite 430, Denver, CO 80209.

Possible Anti-Takeover Effects

In addition to financing purposes, the Company could also issue shares of capital stock to make more difficult or discourage an attempt to obtain control of the Company by means of a merger, tender offer, proxy contest or other means. When, in the judgment of the Board of Directors, this action will be in the best interest of the shareholders and the Company, such shares could be used to create voting or other impediments or to discourage persons seeking to gain control of the Company. Such shares also could be privately placed with purchasers favorable to the Board of Directors in opposing such action. The existence of the additional authorized shares could have the effect of discouraging unsolicited takeover attempts. The issuance of new shares also could be used to dilute the stock ownership of a person or entity seeking to obtain control of the Company should the Board of Directors consider the action of such entity or person not to be in the best interest of the shareholders of the Company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding beneficial ownership of our capital stock as of March 31, 2005 for:

| (i) | each person, or group of affiliated persons, known by us to own beneficially 5% or more of our capital stock; |

| (ii) | each of our directors; |

| (iii) | each of our named executive officers; and |

| (iv) | all directors and executive officers as a group; |

The percentage of beneficial ownership is based on 19,235,542 shares of our common stock outstanding as of March 31, 2005. Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In computing the number of shares beneficially owned by a person and the percentage of ownership of that person, (i) shares of common stock subject to options held by that person that are currently exercisable or become exercisable within sixty (60) days of March 31, 2005 are considered to be beneficially owned by such person and (ii) shares of common stock which can be acquired upon the exercise of all outstanding warrants within sixty (60) days of March 31, 2005 are considered to be beneficially owned by such person. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person.

Name | | # of Shares Beneficially Owned (1) | | % of Total Common Stock |

Spencer L. Sterling (President, Chief Executive Officer and Director) c/o DDS Technologies USA, Inc. 150 E. Palmetto Park Road, Suite 510 Boca Raton, FL 33432 | | 150,000 (2) | | * |

Joseph Fasciglione (Secretary, Treasurer and Chief Financial Officer) 150 E. Palmetto Park Road, Suite 510 Boca Raton, FL 33432 | | 102,250 | | * |

Kerin Franklin (Chief Technology Officer) c/o DDS Technologies USA, Inc. 150 E. Palmetto Park Road, Suite 510 Boca Raton, FL 33432 | | 600,000 (3) | | 3.0 |

DDS Technologies Ltd. (4) c/o DDS Technologies USA, Inc. 150 East Palmetto Park Road, Suite 510 Boca Raton, FL 33432 | | 4,000,000 | | 20.1 |

Dr. Marc Mallis (5) (Director) 2975 Rolling Woods Drive Palm Harbor, FL 34683 and Mallis Limited Partnership (5) 2975 Rolling Woods Drive Palm Harbor, FL 34683 | | 1,245,500 (2) | | 6.5 |

James R. von der Heydt (Director) 603 West Polo Drive Clayton, MO 63105 | | 60,000 (2) | | * |

Robert J. Rosen (Director) c/o DDS Technologies USA, Inc. 150 East Palmetto Park Road, Suite 510 Boca Raton, FL 33432 | | 7,500 | | * |

Leo Paul Koulos (Director) 821 Marina Blvd. San Francisco, CA 94123 | | 60,000(2) | | * |

Charles F. Kuoni III (Director) c/o DDS Technologies USA, Inc. 150 East Palmetto Park Road, Suite 510 Boca Raton, FL 33432 | | 5,500 | | 0 |

Mr. & Mrs. Lee Rosen (6) 17698 Foxborough Lane Boca Raton, FL. 33496 | | 1,179,000 | | 6.1 |

| Directors and Executive Officers as a Group | | 2,230,750 | | 11.1 |

* Less than 1% of the outstanding shares of common stock of the Company.

| (1) | Unless otherwise stated, all shares of common stock are directly held with sole voting and dispositive power. |

| (2) | Includes options to purchase 50,000 shares of common stock of the Company at an exercise price of $8.00 per share, which are exercisable within 60 days. |

| (3) | Kerin Franklin holds options to purchase 600,000 shares of common stock of the Company at an exercise price of $5.00 per share, all of which are exercisable. |

| (4) | DDS Technologies Ltd. held the patent for the dry disaggregation system technology which was subsequently assigned to the Company. Umberto Manola holds 60% of the outstanding shares of common stock of DDS Technologies Ltd. |

| (5) | Dr. Marc Mallis, MD is the General Partner of The Mallis Limited Partnership and serves on the Board of Directors of the Company. Shares held by The Mallis Limited Partnership are owned beneficially by Dr. Mallis. |

| (6) | Of these 1,179,000 shares of common stock of the Company, 604,000 shares are owned by Lee Rosen and 575,000 shares are owned of record by Julia Rosen. Lee Rosen is a founder of, and consultant to, the Company and brother to Robert J. Rosen. |

ANNEX A

CERTIFICATE OF AMENDMENT

OF

DDS TECHNOLOGIES USA, INC.