| Source Capital Group, Inc. | Joe Blankenship 480-368-1488 jblankenship@sourcegrp.com |

April 12, 2004

PETROL OIL and GAS, Inc. (OTCBB:POIG - $3.60)

Initiating Coverage - Methane Gas Play- BUY

12-Month Price Target = 6.00

For Research Disclosures - See Page 8

OVERVIEW:

Statistical Data Shares outstanding 16.4 million Float 2.4 million Market Capitalization $59.0 million Avg. Daily Volume (10 days) 55,000 52-Week Range $1.00 - $4.00 Acres Under Lease (Approx) 155,000 Potential Gas Reserves (Est.) 400 bbcf 2004 EPS Est. ($0.12) 2005 EPS Est. $0.32 P/E 2004 Est. NA P/E 2005 EPS Est 11.2x www.poiginc.com |

Petrol Oil and Gas, Inc. ("Petrol" or the "Company") is a recent entry into the exploration, development and production of coal bed methane ("CBM"). The Company has mineral lease rights on approximately 155,000 acres in Eastern Kansas and Western Missouri. In late 2003, Petrol completed a public offering of 2.4 million shares of common stock at $1.00 per share. Proceeds from the private placement are being used to acquire additional lease acreage, purchase drilling and production equipment, and drill test wells that define the best producing areas in its leases. The Company is actively marketing field development partnerships to fund large-scale drilling and production activities.

HIGHLIGHTS - COMPANY

Successfully completed its public offering to fund transition from a development to an operating company.

Leasehold operations continue with the potential to expand beyond the approximately 165,000 acres on lease in Eastern Kansas and Western Missouri.

The Company's leases are in one of the hotbeds of CBM development and production.

Geological data from prior oil and gas drilling provides well-defined coal seams from which CBM can be recovered.

Flat terrain and easy access makes well drilling, completion and connection relatively low cost.

Major gas transmission lines run through the Company's properties, making collection and delivery to transmission fast and low cost.

Test wells have demonstrated the presence of CBM in several of the Company's leases. Dewatering operations are in process to determine the production capability of these wells.

The Company is in discussion with potential funding sources for working interest participation to allow a large scale drilling of production wells, completing the transition to an operating company.

HIGHLIGHTS - INDUSTRY

OPEC has instituted its one million-barrel per day cut in output even while it cites strong demand and continuing high prices.

Oil and Gas analysts at one major brokerage house have raised their price estimates for crude oil and natural gas for 2004 and 2005. These analysts have been predicting a reduction in prices for both oil and gas for these years. They have now concluded that supply and demand factors will keep prices high for both these years.

Oil imports to China grew by 1/3 in 2003 over 2002, (Source: New York Times). Continued strong demand for China's growth will provide competition for U.S. supplies, creating continual price pressures.

Russia's political stability is not assured. Russia is a growing supplier to world oil markets. Its recent presidential election was less than open and democratic. Political instability in Russia may create uncertainty about supplies from this source.

Saudi Arabia is reluctantly talking of opening "participation" in political activities. The government in Saudi has been a long time supporter of fundamentalist Islamic beliefs, and this transition will not come without political and social turmoil, possibly creating supply interruptions.

COMPANY BACKGROUND

Petrol, as a development company, was incorporated in March of 2000 as Euro Technology Outfitters. In August of 2002 the Company's exchanged shares for oil and gas mineral leases in an asset purchase and changed its name to Petrol Oil and Gas, Inc. The Company is structured to engage in the exploration, development, acquisition and operation of oil and gas properties. To date, the Company has been engaged in organization, the acquisition of oil and gas leases, completing its public offering, drilling test wells and marketing working interest partnerships to fund more extensive drilling. The Company has not generated any revenue, but has acquired and tested mineral leases in one of the most active areas of coal bed methane development in the United States.

THE BUSINESS DRIVER - - NATURAL GAS PRICES

The feature that has driven cycles in oil and gas exploration and drilling has been prices for gas and oil. After the OPEC embargo in 1973 there was a sustained period of oil and gas exploration and drilling in the United States. Crude oil prices spiked to above $40.00 per barrel during that period. When the political situation in the Middle East stabilized in the mid 1980's, and Russia entered world markets as a major oil producer, oil and gas prices drifted down, with crude oil dropping to as low as $11.00 per barrel in the recession of 1998. The average price for natural gas at the wellhead for all of 1998 was $1.98/mcf.

The next big spike in gas prices came with the electricity crisis in California. Concurrent with the increased demand in California, there was a gas line explosion in New Mexico that interrupted delivery of gas to California from Texas and Louisiana. In late 2000, spot prices for natural gas rose to over $10.00/mcf. Our chart below shows the average wellhead price in January of 2001 to be $6.82/mcf. Prices again drifted lower in 2001 and 2002, reaching a low point of $2.19/mcf in February of 2003. For all of 2002, wellhead prices averaged $2.95/mcf.

The next big spike in gas prices came with the electricity crisis in California. Concurrent with the increased demand in California, there was a gas line explosion in New Mexico that interrupted delivery of gas to California from Texas and Louisiana. In late 2000, spot prices for natural gas rose to over $10.00/mcf. Our chart below shows the average wellhead price in January of 2001 to be $6.82/mcf. Prices again drifted lower in 2001 and 2002, reaching a low point of $2.19/mcf in February of 2003. For all of 2002, wellhead prices averaged $2.95/mcf.

A recent surge in building electrical generation facilities using natural gas has expanded the demand for this clean burning fuel, but there has been a limited increased supply. Now it appears that the U.S. is in another long term cycle of higher energy prices and increased exploration, drilling and domestic production. Average wellhead prices for gas for 2003 was an estimated $4.97/mcf, an increase of 68% above the 2002 price. In January of 2004, wellhead prices were $5.53/mcf, Now analyst and the Energy Information Agency (EIA) are raising forecasts of prices for all of 2004 and 2005. Although there may be some seasonal fluctuations, the expectations are that natural gas prices will remain at these high levels for the foreseeable future.

KANSAS COAL BED METHANE

The majority of Petrol's lease acreage is in Coffey County, Kansas. The area is located on the Bourbon Arch, which separates the Cherokee Basin area to the South and the Forest City area to the North. The Cherokee Basin has been under active development and production of CBM for nearly a decade with well defined production and reserve characteristics. The Bourbon Arch and the Forest City area should be considered "developing" areas because of their lack of production and undeveloped reserves. The increase in natural gas prices has spurred several companies to begin exploring in the areas where Petrol is concentrating its efforts. Evergreen Resources, Quest Resources and Burlington Resources are actively leasing and drilling test wells in the area. Heartland Oil & Gas has been active in the Forest City area. There are attempts at consolidating leasehold rights in the area so that companies can obtain efficiencies in drilling, production operations and gathering of gas produced.

2

Eastern Kansas has previously been an active area for oil and gas development, and Coffey County has demonstrated oil and gas reserves. In previous exploration attempts the search was for oil, and small wells have been found and developed. As the price of oil declined, the smaller reservoir searches were discontinued and Eastern Kansas was idle until the recent boom in coal bed methane. The Cherokee Basin, to the South, has been the concentration of activity because of larger coal seams and more mature coal. These characteristics produce more methane per acre of lease and are economic at lower prices of gas. Now, with higher gas prices the Coffey County area becomes attractive and very economic. Even though there may be lower production of gas per ton of coal, i.e. 175 scf/ton vs. 220 scf/ton in more mature coals, the coal is usually at smaller depths. The terrain is flat and easily accessible resulting in lower drilling costs. Combine low cost drilling with ready access to major gas transmission lines and the economics of Coffey County become compelling.

Eastern Kansas has previously been an active area for oil and gas development, and Coffey County has demonstrated oil and gas reserves. In previous exploration attempts the search was for oil, and small wells have been found and developed. As the price of oil declined, the smaller reservoir searches were discontinued and Eastern Kansas was idle until the recent boom in coal bed methane. The Cherokee Basin, to the South, has been the concentration of activity because of larger coal seams and more mature coal. These characteristics produce more methane per acre of lease and are economic at lower prices of gas. Now, with higher gas prices the Coffey County area becomes attractive and very economic. Even though there may be lower production of gas per ton of coal, i.e. 175 scf/ton vs. 220 scf/ton in more mature coals, the coal is usually at smaller depths. The terrain is flat and easily accessible resulting in lower drilling costs. Combine low cost drilling with ready access to major gas transmission lines and the economics of Coffey County become compelling.

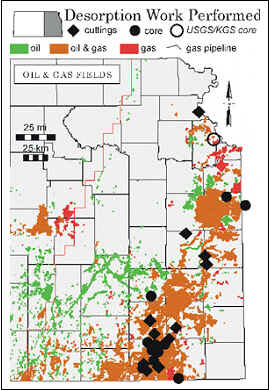

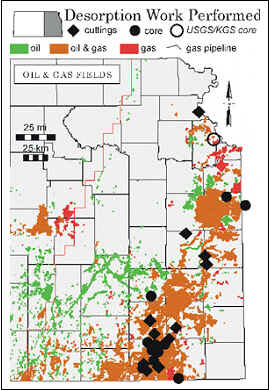

The map of Eastern Kansas, presented to the left, illustrates the desoprtion measurements on coal recorded by the Kansas Geological Department. Coffey County, fourth from the bottom, third from the right, is currently relatively undeveloped. However, previous oil and gas drilling has defined the geology that demonstrates the presence of coal seams, and therefore the potential for coal bed methane.

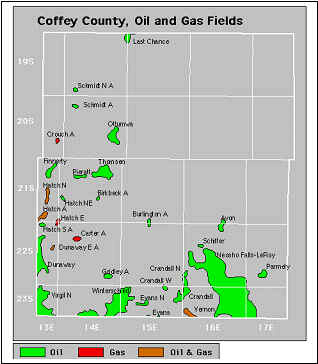

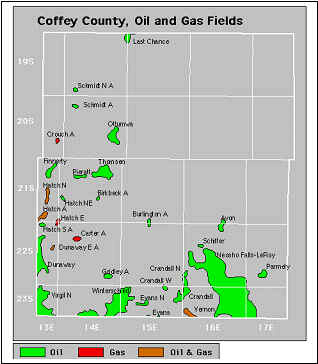

Previous development in Coffey County has concentrated on oil, as illustrated by the map on the right. Currently, oil exploration is beginning again in the County, and the discovery of oil may be the consequence of some Petrol's drilling activity.

The drilling activity that produced the geological maps of the County provide the basis for conclusive evidence of coal seams adequate to develop economic amounts of CBM in the leases acquired by Petrol.

PETROL TEST WELL RESULTS:

To date, Petrol has drilled seven test wells, six of which are in the Coffey County area. The Company has drilled one well on its Western Missouri leasehold and is evaluating the prospects of that area. Initial wells have demonstrated the presence of gas and evaluations are under way to determine the feasibility and most economical methods of production. The Company must assess the number of coal layers and thickness of coal in each of the areas drilled, the desorption rate for the gas to determine the best prospective areas to concentrate initial production drilling. The gas recovery data is well known in the Cherokee Basin area to the South, which has deeper and higher ranked coals than in the Bourbon Arch and Forest City area. Desorption tests in the Cherokee Basin report gas contents as high as 220 scf/ton to 239 scf/ton. The less mature coals in the Forest City area are expected to contain between 120 scf/ton to 190 scf/ton. The coals in the Forest City area are well described by geological sources and are generally at a more shallow depth than Cherokee Basin coals. These factors indicate that profitable production can be achieved in the Bourbon Arch and Forest City areas at gas prices in effect today and expected in the future.

PLAN OF OPERATION

Petrol's initial private placement did not provide sufficient cash for extensive drilling of production wells. To raise money for additional drilling, the Company is looking to sell working interests in the results of wells to be drilled. The Company prefers to create partnerships whereby it retains a net revenue interest in a group of wells that will have drilling and completion costs funded by the partner. The structure calls for Petrol to be the operator of the wells, manage the drilling, production and marketing of gas and be reimbursed for its expenses of managing the development, drilling, well completion and production. Our modeling of prospective results of target wells in the area of development indicate that the economics of drilling would support the partnerships favored by the Company or the issuance of additional equity. The low cost of drilling and completion and the close proximity of transmission pipelines indicate that individual well economics would provide for a return of capital within 12 to 18 months and the resulting cash generation would provide a substantial return to investors.

Recent financing for drilling in the area has built confidence in management's ability to achieve the necessary levels of funding. Quest Resources has just obtained $126 million for purchase of Cherokee Basin assets from Devon Energy. Evergreen Resources has budgeted $58 million for the Forest City area, to be spent in 2004. Heartland Oil and Gas recently closed a $12 million private placement for use in drilling is this area. Galaxy Energy announced in January of 2004 that it has completed a private placement of common stock and warrants to drill CBM wells in the Powder River Basin in Wyoming. There is an extensive infrastructure of financial resources dedicated to funding oil and gas exploration and production, and as demonstrated by Heartland, that resource can be brought to the Bourbon Arch and Forest City Gas Basin.

MANAGEMENT

As a development company, Petrol has been careful about its hiring. To drill test wells that would prove out the leaseholds in Kansas and Missouri, the Company has hired consultants for its initial operational period. Many of these consultants are available for hire when the Company is fully funded.

Paul Branagan, President: Mr. Branagan directs the strategy and operations of Petrol. He is a physicist by training and has nearly 30 years experience in in diagnosing and solving difficult reservoir production problems. His activities typically involve characterization of a reservoir or well, and development of an appropriate plan for production. Mr. Branagan's consulting clients have included AMOCO, CONOCO, PEMEX Exploration, Mobil Oil and Barrett Resources. Currently he is in charge of an experienced exploration and production team, most of who are consultants to the Company.

W. T. (Bill) Stoeckinger, Geologist: Mr. Stoeckinger is a licensed geologist with four decades in oil and gas exploration and development. He has been involved in Eastern Kansas and Oklahoma for the last fifteen years. He has created numerous drilling prospects in the area by mapping subsurface structure and buried coal pockets. Prior to settling in Northern Oklahoma, Mr. Stoeckinger worked for nearly 25 years in international exploration and production with Chevron-Texaco.

Gary K. Bridwell, Drilling and Production Specialist: Mr. Bridwell has nearly 25 years experience in drilling, completion, production and installation of gathering systems. Most of this experience has been in the Kansas and Colorado area and most has involved coal bed methane projects. Mr. Bridwell is in charge of sourcing and supervising the Company's drilling, completion, production and gas gathering systems.

FINANCIAL PROJECTIONS

Our financial projections are predicated upon Petrol obtaining additional financing. The Company is currently in discussion with several sources for the sale of working interests and/or equity. We have calculated our own estimates of what the financial results might be if the Company operated from additional equity, and increased the number of shares accordingly. Our assumptions provide for drilling a certain number of wells per quarter, building from 12 in the first quarter, 24 in the second quarter, 30 in the third quarter and leveling off at 36 wells per quarter. Allowing a quarter for dewatering before revenue production, our models indicate that by the 7th to 8th quarter the Company becomes self funding at a sustainable rate of drilling 36 wells per quarter. These assumptions provide for $112,000 per well for drilling and completion. Operating costs for gas delivery in our estimates are sufficient to pay for gathering lines to reach gas transmission points.

Our model uses gas prices that are a slight discount from the May 2004 futures for natural gas of $5.99/mcf. (Source:Wall St. Journal) We have used a production curve that accelerates recovery for the first ten months of production and gradually declines after that. This characteristic shows up in the fifth year of our estimates when the addition of 36 wells per quarter is not sufficient to replace the decline in production of an accumulated 500+ wells previously put on line. In our model, approximately $14 million of additional capital is necessary, with subsequent drilling being funded by cash from operations. To achieve the additional funding, we have added 3.0 million shares in 2004 and an additional 2.5 million shares in 2005.

These projections have the development of 642 wells in a five year period. The number of acres under lease by Petrol could provide for over 2,000 wells, at 80 acre spacing, to be developed within the next ten years.

5

VALUATION

We have chosen to use both comparable value and a valuation of reserves in place to determine a target price for Petrol.

Comparable Value: Heartland Oil and Gas Co. (HOGC.OB) is concentrating its CBM efforts in the Forest City Basin. The company has drilled seven test wells but currently has no producing properties. As of April 1, 2004, Heartland had approximately $10.0 million cash with which to conduct drilling operations. On April 12, 2004, common stock of Heartland was selling at $3.05 per share, producing a total market capitalization of $74.4 million. Using similar parameters of acreage and gas in place, the market capitalization of Heartland, less cash, would suggest a current value of $5.00 per share for Petrol. Any progress toward successful drilling and/or achievement of funding would increase this value.

A valuation based on estimated earnings per share and subsequent market value is as follows:

Based on the comparisons of companies in the industry, Petrol might be considered to be undervalued. However, the Company must still raise approximately $15.0 million to achieve the earnings per share shown above. With a reasonable assumption that funds will be available within the parameters of the 5.0+ million shares of stock built into our estimates, then our price target would be some multiple of 2005 expectations. Given the growth prospects of drilling almost 2,000 wells in the acerage held by the company and the fact that we have considered less than 600 wells in our estimates, we have begun our coverage with a BUY recommendation and a 12-month price target of $6.00 per share. The initial price target is based on a multiple of 20x our 2005 estimate of $0.32 per share.

Valuation of Gas in Place: Based on geological studies of coal seam thickness in the Coffey County, Kansas area, we have used an cumulative depth of 10 feet of coal for seams down to 2,000 feet. (Geological data for Franklin and Anderson Counties, immediately east of Coffey County, suggest that there is the prospect of occasionally finding fairly large pockets of conventional gas.) With desorption rates of 175 scf/ton of coal, the leases held by Petrol have an estimated 400 bbscf of gas in place. Since not all of this is produceable, we have used a recovery rate of 90%.

In December of 2003, Quest Resources purchased the operations of Devon Energy in the Cherokee Basin and proven reserves were allocated a price of $0.89/mcf. Evergreen Resources calculated its PV-10 value of proven reserves in the Raton Basin in Colorado as of December 31, 2002 at $1.29/mcf. To value unproven reserves, one must take into account the current price of gas, the cost of drilling, producing, gathering and transporting that gas, and then discounting the result based on the probability of finding gas and its production economics. We know the prospects of finding gas in the Petrol leases are high and the drilling and collection costs are reasonably low. Using the estimate of gas in place of 400 bbcf, a recovery rate of 90%, a proven gas reserve value of $1.00/mcf and discounting the results by 85%, our calculation suggests a current value of Petrol shares of $3.10 per share. Any drilling in the area that better defines the reserves will bring the discount factor up. Our estimates of over 500 wells drilled would accomplish that reduction in uncertainty. The valuation of gas in place and a probable increase in the definition of reserves supports our 12-month price expectation of $6.00 per share.

6

INVESTMENT RISKS

As a development Company transitioning to an operating Company, Petrol is subject to the normal risks of business development. The specific risks that apply to Petrol are:

Funding: The Company may not be able to raise the funds necessary to complete the production drilling and completions operations as envisioned in our estimates.

Gas Prices: Prices for natural gas may not remain as high as currently being experienced. Should prices go into a cyclical decline, the wells to be drilled may not be as economic as indicated in our estimates.

Area for Development: Coal bed methane has been developed in areas that are contigious to the leases owned by the Company. There has not been methane gas production in Coffey County in the past because of thinner coal seams and less mature coals. The current price of natural gas makes prospective development in this area economic. The Company may not be able to discover and develop commercial quantities of coal bed methane in the area that it is exploring.

Management: As a development Company, Petrol has secured most of its services from outside contractors. As the Company enters its operational phase, it may not be able to secure the services of competent management personnel to achieve the operational levels outlined in our estimates.

Liquidity: Petrol was successful in completing its initial public offering through a self directed offering. Current cash reserves and payment for operating expenses come from that offering. The Company may not be able to access the equity markets to replenish its cash reserves. Additionally, the Company may not be able to secure working interest funding that would allow continued operations without another equity placement.

7

RESEARCH DISCLOSURES FOR PETROL OIL & GAS, Inc (POIG)

The Analyst certifies that the views expressed in this report are his own, without undue influence by Source Capital Group, Inc. ("Source Capital"), the subject Company or the future prospects of business between Source Capital and the Company.

The analyst owns stock in the subject Company. Source Capital acted as placement Agent for a portion of the Company's self directed initial public offering. The Analyst has not received any compensation, either directly or indirectly, from investment banking services provided to the Company by Source Capital and does not expect to receive any compensation from such services in the next three months. The Analyst has received direct compensation from the Company for the preparation of this report which is detailed below. To the degree that the analyst receives direct or indirect compensation, it may effect the views expressed in this report.

Source Capital and its brokers and investment advisors offer individual account management and 401(k) advisory services for which they solicit the Company, its management and its board of directors as clients. The Analyst may receive compensation in the form of commissions or investment advisor fees from his role as broker or investment advisor to the Company, its management or members of its board of directors. The amount and timing of any indirect compensation received by the Analyst in the form of commissions and/or investment advisory fees cannot be determined at this time.

The Analyst manages a fund for private investors that may buy and sell shares of the subject-Company.

Source Capital is not a Market Maker in shares for the subject Company. Source Capital will solicit the subject Company for investment-banking services and may receive compensation for such services over the nest 12-months.

Meanings of Ratings:

The ratings used by Source Capital in its Research Reports have the following meaning:

BUY: The Analyst expects the stock price of the subject company to exceed the performance of the major market indices (Standard & Poor's 500 or Dow Jones Industrials) by 20% or more over the coming 12-18 months.

NEUTRAL: The Analyst expects the stock price of the subject company to perform at or near (plus 5% to minus 5%) of the major market averages over the coming 12-18 months.

SELL: The Analyst expects the stock of the subject company to decline or perform worse that the major market averages by 10% or more over the coming 12-18 months.

Rating Distribution: | BUY | NEUTRAL | SELL |

Percentage of covered companies assigned this rating | 75% | 25% | |

Percentage of covered companies for which Source Capital has | | | |

Provided investment banking services during the past 12 months. | 33% | (Two of six companies.) |

The Analyst has received direct compensation from the Company for the preparation of the report. Compensation was received before the report was written and the Agreement between the Company and the Analyst calls for the Analyst to maintain full discretion to report his own opinion about the investment prospects of the Company and its desirability for both individual and institutional investors. Compensation consisted of $6,000.00 cash received before the report was prepared; 10,000 shares of restricted stock to be issued and options for 25,000 shares at $2.50 per share and options for an additional 25,000 shares at $4.00 per share.

The next big spike in gas prices came with the electricity crisis in California. Concurrent with the increased demand in California, there was a gas line explosion in New Mexico that interrupted delivery of gas to California from Texas and Louisiana. In late 2000, spot prices for natural gas rose to over $10.00/mcf. Our chart below shows the average wellhead price in January of 2001 to be $6.82/mcf. Prices again drifted lower in 2001 and 2002, reaching a low point of $2.19/mcf in February of 2003. For all of 2002, wellhead prices averaged $2.95/mcf.

The next big spike in gas prices came with the electricity crisis in California. Concurrent with the increased demand in California, there was a gas line explosion in New Mexico that interrupted delivery of gas to California from Texas and Louisiana. In late 2000, spot prices for natural gas rose to over $10.00/mcf. Our chart below shows the average wellhead price in January of 2001 to be $6.82/mcf. Prices again drifted lower in 2001 and 2002, reaching a low point of $2.19/mcf in February of 2003. For all of 2002, wellhead prices averaged $2.95/mcf. Eastern Kansas has previously been an active area for oil and gas development, and Coffey County has demonstrated oil and gas reserves. In previous exploration attempts the search was for oil, and small wells have been found and developed. As the price of oil declined, the smaller reservoir searches were discontinued and Eastern Kansas was idle until the recent boom in coal bed methane. The Cherokee Basin, to the South, has been the concentration of activity because of larger coal seams and more mature coal. These characteristics produce more methane per acre of lease and are economic at lower prices of gas. Now, with higher gas prices the Coffey County area becomes attractive and very economic. Even though there may be lower production of gas per ton of coal, i.e. 175 scf/ton vs. 220 scf/ton in more mature coals, the coal is usually at smaller depths. The terrain is flat and easily accessible resulting in lower drilling costs. Combine low cost drilling with ready access to major gas transmission lines and the economics of Coffey County become compelling.

Eastern Kansas has previously been an active area for oil and gas development, and Coffey County has demonstrated oil and gas reserves. In previous exploration attempts the search was for oil, and small wells have been found and developed. As the price of oil declined, the smaller reservoir searches were discontinued and Eastern Kansas was idle until the recent boom in coal bed methane. The Cherokee Basin, to the South, has been the concentration of activity because of larger coal seams and more mature coal. These characteristics produce more methane per acre of lease and are economic at lower prices of gas. Now, with higher gas prices the Coffey County area becomes attractive and very economic. Even though there may be lower production of gas per ton of coal, i.e. 175 scf/ton vs. 220 scf/ton in more mature coals, the coal is usually at smaller depths. The terrain is flat and easily accessible resulting in lower drilling costs. Combine low cost drilling with ready access to major gas transmission lines and the economics of Coffey County become compelling.