UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

Amendment No. 2

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(B) OR (G) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-31959

US Fuel Corporation

(Name of registrant as specified in its charter)

| NEVADA | | 88-0433815 |

| (State or other jurisdiction of | | (I.R.S. Employer Identification No.) |

| incorporation or organization) | | |

277 White Horse Pike #200 Atco, NJ 08004

(Address of principal executive offices, including zip code)

Registrant’s telephone number including area code: 856-322-6527

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: Common Stock, $0.0001 Par Value

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): ¨

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

TABLE OF CONTENTS

Explanatory Note : We are filing this Amendment No. 2 to the initial Registration Statement on Form 10 that we filed with the Securities and Exchange Commission (the "SEC") on May 1, 2014 (the "Initial Form 10"), as amended on May 22, 2014 with Amendment No. 1, to include our financial statements for the quarter ended March 31, 2014 .

Other than as it relates to the SEC comments, no other changes have been made to the Initial Form 10. This Amendment No. 2 speaks as of the original filing date of the Initial Form 10, and does not reflect events that may have occurred subsequent to the original filing date and does not modify or update in any way, disclosures made in the original Initial Form 10. Accordingly, this amendment should be read in conjunction with the original Initial Form 10 filing, Amendment No. 1 to the Initial Form 10 that we filed on May 22, 2014, as well as our other filings made with the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, subsequent to the original filing of the Initial Form 10.

Glossary

Throughout this Form 10, we use terms associated within the natural gas and conversion industry. The following glossary of terms is intended to assist readers who may not be familiar with these terms.

BBL/day - barrel per day, one barrel contains 42 US gallons.

BTU – British Thermal Unit, a traditional unit of energy.

CTL - coal-to-liquid, a process which produces syngas from coal and to produce FT liquids

EPC - Engineer Procure Construct; a form of construction agreement where the contractor designs the installation, procures the necessary materials and builds the project, either directly or by of the work. In some cases, the contractor carries the project risk for schedule as well as budget in return for a fixed price, called lump sum depending on the agreed scope of work.

FEED - Front End Engineering Design; The FEED is basic engineering which comes after the Conceptual design or Feasibility study. The FEED design focuses the technical requirements as well as rough investment cost for the project.

FT - Fischer–Tropsch a collection of chemical reactions that converts a mixture of carbon monoxide and hydrogen into liquid hydrocarbons

FT diesel – diesel fuel made by the Fischer–Tropsch process

FT liquids - a general term referring to all the products such as diesel, naptha, kerosene, waxes etc, that can be made with the Fischer–Tropsch process.

GTL - gas to liquid, a process which produces syngas from methane to produce FT liquids

HC - hydrocarbon

NOx – Nitrous Oxide a major criteria pollutants

NSOL - Nuclear Solutions, Inc.

PM - particulate matter, PM10 is 10 micron particulates

SOx - Sulfur Oxides, typically sulfur dioxide a major criteria pollutants

Syngas – synthesis gas, carbon monoxide and hydrogen

ULSD - ultra-low sulfur diesel

Item 1. Business

Corporate History

US Fuel Corporation (the “Company”) was organized on February 27, 1997, under the laws of the State of Nevada, as Stock Watch Man, Inc. The initial business strategy was to become an informative, comprehensive and user friendly Internet-based financial site by developing and then marketing a website through internet search engines and links to financial resources. Today, our business is focused on converting natural gas into non-petroleum based alternative fuels, such as diesel, gasoline and aviation (jet fuel) and other valuable products. The Company will capitalize on the projected spread in commodity prices between natural gas and ultra-low sulfur diesel (ULSD).

Due to capital constraints, we were not able to timely file all of our periodic reports during the past few fiscal years. However, over the past few months we have been working towards resolving that deficiency. Although we filed our annual report on Form 10-K for each of the years ended December 31, 2010 and 2011, as well as for the fiscal year ended December 31, 2012 as recently as December 2013, the Securities and Exchange Commission (the "Commission") felt that we failed to comply with Section 13(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and Rules 13a-1 and 13a-13 thereunder because we had not filed any periodic reports with the Commission since the period ended December 31, 2012. As a result, the registration of our securities was revoked on February 6, 2014.

On February 14, 2014, we filed a registration statement on Form 10 (the "Original Form 10") to once again register our common stock pursuant to Section 12(g) of the Exchange Act. On April 3, 2014, we filed an Amendment to the Original Form 10 in response to comments we received from the Commission regarding the Original Form 10. As per Section 12(g) of the Exchange Act, the Original Form 10 was set to automatically go effective on April 15, 2014, even though we did not receive clearance from the Commission regarding the Original Form 10, the Amendment or our responses to their comments.

As of April 15, 2014, the financial information in the Original Form 10 was required to be updated to include the audited financial statements as of the year ended December 31, 2013 (the "Audit"); due to our limited cash resources, we were unable to complete the Audit by such time. Therefore, following April 15, 2014, the comment period would have continued and we would have had the additional burden in both time and expense, of being subject to the Exchange Act's periodic reporting requirements. Furthermore, without the Audit, the Form 10 may have been considered materially deficient. In light of the above, we believe it was in the Company and our shareholders' best interest to withdraw the Original Form 10 and file a new Registration Statement on Form 10 as soon as the Audit is complete. The Audit was completed and we are therefore filing this Registration Statement on Form 10 to seek the re-registration of our common stock.

History

In 2001, the Company took actions to change the business focus from web services to nuclear waste remediation and entered into an Asset Purchase Agreement to acquire a Patent License Agreement that involved new technologies believed to be potentially effective in the remediation of nuclear waste products. On September 12, 2001, the Company amended its articles of incorporation to change its name from Stock Watch Man, Inc. to Nuclear Solutions, Inc. (“NSOL”) to ensure the corporate name properly reflected the new corporate business focus.

On September 2, 2005, NSOL formed a wholly owned subsidiary, Fuel Frontiers Inc. (“FFI”), to pursue alternative fuel technology and projects. However, in 2008, we elected to focus the company exclusively on the production of synthetic fuels and activities related to nuclear waste remediation were suspended. When we later re-focused our operations, we no longer needed the subsidiary and dissolved FFI on September 12, 2012.

On July 31, 2006, the Company formed another wholly owned subsidiary, Liquidyne Fuels, which has had no activity through June 2013.

On June 10, 2011, the Company's name was changed from Nuclear Solutions, Inc. to US Fuel Corporation, with a singular focus to design, build, own and operate facilities that produce synthetic fuels with the coal-to-liquid (“CTL”) process. In the fourth quarter of fiscal 2013, the Company recognized that the business model of producing synthetic fuels would be better accomplished with a model that leverages the abundance of natural gas to deliver superior fuel and chemical products to the market

As further described below, on June 14, 2011, the Company's Articles of Incorporation were amended to, among other things, increase the authorized common stock capital from 100,000,000 shares of common stock, par value $0.0001 to 800,000,000 shares of common stock (the Company also has 50,000,000 shares of preferred stock, par value $0.001).

On October 7, 2011, FINRA approved the name change to US Fuel Corporation and the symbol change from NSOL to USFF.

History & Progress of Business Plans/Operations

Between 2008 and 2011, the business of the Company has been to design, build, own and operate facilities to gasify coal and convert that coal-derived gas into liquid fuel. The Company’s initial plans involved developing a large scale CTL facility that combined a plasma gasification process with a Fischer-Tropsch process to convert coal to liquid fuel.

In 2008, to supplement internal planning activities, the Company retained Mr. Paul Adams and Mr. Steven Luck as consultants to develop a facility business plan and economic model to be used to obtain project financing. The initial focus was on building a large scale plasma gasification based CTL facility. A technically feasible plan was developed, but financing for such a large scale project in the economic environment of 2008 and 2009 was problematic. Accordingly, in 2008, the then Board of Directors elected to focus the Company exclusively on the production of synthetic fuels through the FFI subsidiary. Activities related to nuclear waste remediation were suspended and have not been in active development; historical data regarding those efforts is included in the Form 10-K for the year ended December 31, 2009.

In 2011, with new leadership in place, the Board of Directors evaluated the Company’s position. During 2011, the Company retained a new CEO - Harry Bagot, following termination of the prior CEO, and a new CFO - William Chady, following resignation of the prior CFO; both Mr. Bagot and Mr. Chady continue to serve us in these roles as of the date of this Registration Statement. Given the tough economy and other issues then facing the Company, i.e. not being current with its SEC filings, the skull and cross bones “Caveat Emptor” or “Buyer Beware” on the Company's ticker symbol, the pending lawsuits and the large debt on the Company's books, Management and the Board knew that it would be difficult to raise and receive the capital it needed to maintain operations. Finally, in May 2011, the Company entered into financing negotiations with G & A Capital, Development LLC, a New Jersey limited liability company (“G & A Capital”), which led to the execution of a Stock Purchase Agreement on May 12, 2011.

G & A Capital Agreement

The G & A Capital Stock Purchase Agreement, as amended on May 13, 2011 and May 15, 2011, provided, in pertinent part, as follows:

| 1. | G & A Capital would purchase 5,000,000 shares of the Company's preferred stock for an aggregate purchase price of $662,540.37 (the "G&A Preferred Stock"); |

| 2. | The Company agreed to amend its Articles of Incorporation to, among other things, increase the authorized common stock capital from 100,000,000 shares of common stock, par value $0.0001 to 800,000,000 shares of common stock (the Company also has 50,000,000 shares of preferred stock, par value $0.001). At the time of the Agreement, the Company had 97,980,981 shares of common stock and 0 shares of preferred stock issued and outstanding. |

| 3. | Immediately following the amendment of the Articles of Incorporation, G & A Capital agreed to exchange the G&A Preferred Stock for 164,402,076 shares of common shares, with the G&A Preferred Stock then being cancelled and returned to the treasury. |

| 4. | Upon the exchange of the G&A Preferred Stock for the common stock, the Company would also issue a warrant to purchase up to 496,277,915 shares of common stock for an aggregate price of $2,000,000. |

| 5. | G & A Capital agreed to distribute the shares of Company common stock that it owned to members of the Company's management and key individuals at their discretion. |

| 6. | G & A Capital agreed to relieve, discharge, assume and/or pay all of the outstanding debt, financial obligations and all other liabilities (collectively, the "Debts") incurred by the Company (including, among other things, accrued expenses and accrued compensation), excluding contingent liabilities (ie: Schrader Litigation (please see Legal Proceedings, below), subject to a limitation of liability, so long as the liability was incurred on or before September 31, 2011 and the total dollar amount is not greater than 8 Million Dollars (the "Assumption of Liabilities"). The circumstances under which G & A Capital would relieve, discharge, assume and/or pay the Debts is limited in that the Assumption of Liabilities does not extend to any claimed Debts, including accrued but unpaid salaries, that are later deemed not to be due in light of frivolous actions or unmet milestones or work product. Under the terms of the G & A Capital Purchase Agreement, as amended, G & A Capital maintains the right to determine whether or not it wants to pay a particular Debt, which decision shall be made at the sole discretion of the individual G & A Capital chooses to do same (the G & A Capital Appointee"); as of the date of this Form, G & A Capital selected Robert Schwartz - a current Board Observer - to serve in that role and appointed him for a term of 5 years ending May 15, 2016. |

As per the above terms, our Articles of Incorporation were amended on June 14, 2011 to increase our authorized capital and thereafter, all of G&A's 5,000,000 shares of preferred stock were exchanged for 164,402,076 shares of our common stock and G & A received the warrant to purchase up to 496,277,915 shares of our common stock. On May 15, 2012, G & A Capital exercised their Warrant to purchase 496,277,915 shares of our common stock via a cashless provision whereby G&A received 300,851,000 shares of common shares. As of the date of this Registration Statement, G & A Capital does not own any shares of our common stock.

In 2011, as a result of the G & A Capital Stock Purchase Agreement, the Company's liabilities were reduced by $372,500. Following the exchange the G&A's Preferred Stock, we do not have any shares of preferred stock outstanding and do not have a present intention to issue any such shares of stock.

During 2012, as part of their Assumption of Liabilities, due to our limited cash position and reluctance to further dilute our shareholders, G & A Capital agreed to provide the following aggregate accrued executive compensation as per their agreement:

| Name | | Share Amount | |

| | | | |

| Stanley Drinkwater, Chairman of the Board | | | 76,050,000 | |

| | | | | |

| Harry Bagot, CEO | | | 33,000,000 | |

| | | | | |

| William Chady, CFO (1) | | | 10,000,000 | |

| | | | | |

| Garry Sparks, Project Manager (2) | | | 7,500,000 | |

| | | | | |

| Steven Luck, Ex-Director(3) | | | 0 | |

| | | | | |

| Paul Adams, Ex-COO (3) | | | 0 | |

| 1) | Mr. Chady was a Vice President of Kentucky Fuel Associates, Inc. (“KFA”), a company with whom FFI entered into a collaborative arrangement for the development of coal-based gas-to-liquid fuel production facilities in the State of Kentucky; KFA was dissolved in September 2010. (See, “Note 2, Collaborative Agreement”). Prior to its dissolution, KFA's principal business was to support the coal industry in Kentucky with relation to development of CTL plants. |

| 2) | Mr. Sparks is the General Product Manager to Kentucky Fuel Associates, Inc. (“KFA”), a company with whom FFI entered into a collaborative arrangement for the development of coal-based gas-to-liquid fuel production facilities in the State of Kentucky. (See, “Note 2, Collaborative Agreement”). |

| 3) | During 2012 and 2013, G & Capital issued 10,000,000 and 15,000,000 of its shares to Mr. Luck and Mr. Adams, respectively. All of these 25,000,000 shares were later subject to an Executive Halt, which is now permanent and therefore the shares may be re-issued or returned to treasury. Each of Mr. Luck and Mr. Adams tendered his resignation from his respective position in July 2013. |

Starting in June 2011, the Company picked up from the earlier coal-to-liquid planning efforts and began working together to develop and refine a project plan that could be financed. The key to the new plan was a focus on a smaller, scalable facility, as financing was problematic for the typical large-scale plants previously considered by the Company.

During 2012, the Company entered into various agreements to carry out their operations. On August 14, 2012, the Company entered into a Master Services Agreement (“MSA”) with Global Private Funding, Inc.(“Global”), which included provisions for Global to provide the Company with business incubation services, legal & compliance services and underwriting services. The Company proceeded to achieve the milestones established by Global to obtain funding, but Global was unable to provide the funding as promised. Accordingly, on April 22, 2013, the Company terminated the Global MSA for cause. We are currently defending a federal case Global asserted against us. (See, Item 8. Legal Proceedings)

On May 3, 2013, we executed a Teaming Agreement with Woolpert, Inc. (“Woolpert”), pursuant to which Woolpert will be the Lead Design Consultant and Design-Build Program Manager to provide the necessary planning, design and preliminary design-build documents in coordination with the GTL process engineers for our GTL plants planned for Kentucky.

Current Business Model and Operations

Notwithstanding their efforts, it became apparent to Management that investors were not going to fund their CTL model to the extent required and without the necessary funding, the Company was unable to carry out the few agreements the Company did have in place. Accordingly, in the fourth quarter of fiscal 2013, after realizing that the previous business model was not producing sufficient revenues to provide our shareholders with adequate return or capital to carry out our operations, we decided to focus our operations on a model that leverages the abundance of natural gas to deliver superior fuel and chemical products to the market, which has lower capital costs than a coal to liquid model. We believe this model will provide more value to our shareholders than our prior model that focused on coal as the primary feedstock for our alternative fuel facilities because based on our preliminary talks with potential investors, this model seems more likely to provide enhanced cash flow and a stronger ability to attract financing. To bolster our strength, we engaged Core Strategic Services ("CSS") to assist in certain tactical initiatives and in executing corporate goals key to our strategic plan over the next 12 months. CSS is a multi-faceted consultancy firm providing a range of business development, project management, execution services, technical development and corporate planning; CSS also provides introductions to financing sources.

The Fischer–Tropsch process is a collection of chemical reactions that converts synthesis gas (syngas) a mixture of carbon monoxide and hydrogen into liquid hydrocarbons. US Fuel plans to produce syngas from natural gas and Fischer-Tropsch technology to produce diesel fuel, naphtha.

The high quality diesel fuel produced through the Fischer–Tropsch (FT) process contains near zero Sulfur and can be used directly in today’s diesel-powered vehicles. According to the "Evaluation of Ultra-Clean Fischer-Tropsch Diesel Fuel in Transit Bus Applications," FTA-OK-26-7015.2010.1, Technical Report, dated March 31, 2010, laboratory testing indicates that FT diesel delivers dramatic across-the-board reductions in all major criteria pollutants such as SOx, NOx, and hydrocarbon (HC) emissions and reduces the most harmful pollutant, PM 10 (10 micron particulates) by 34%.

These fuels are compatible with the current method of petroleum products distribution and do not require new or modified trucking, pipelines, storage tanks, or retail stations.

US Fuels will be competing for a share of the diesel fuel market. Diesel is normally made from oil and its price is largely determined by the price of oil, which is influenced by the world market. Since we will be producing FT diesel from natural gas, a less costly feedstock whose price is not determined by world markets, we believe that our strategy of locating small plants next to interstate natural gas pipelines will make us competitive and maximize returns by lowering feed stock prices and reducing transportation costs. US Fuel will contract with the local natural gas supplier to provide a connection to the interstate pipeline. The natural gas can be purchased through local providers, a gas marketer or directly from a producer. The smaller size will significantly reduce the time to permit each plant and therefore will shorten the construction period and make the projects easier to finance.

US Fuel plans to build, own and operate facilities which convert natural gas into non-petroleum based alternative fuels, such as FT diesel, gasoline and aviation (jet fuel) and other valuable products. US Fuels estimates that a 2000 barrel per day (bpd) plant will cost $200 million and could begin commercial operations as soon as twenty four months after the start of construction. Taking a fresh and practical approach to production and distribution, using new technologies, and leveraging existing infrastructure, USFuel will use one of America’s most abundant resources: natural gas, to economically produce manageable quantities (1000-2000 barrel per day (BBL/day)) of high quality synthetic fuel close to end use. These fuels can be used in all diesel engines deliver better performance, dramatic across-the-board reductions in all major criteria pollutants such as SOx, NOx, particulate matter (PM), and hydrocarbon (HC) emissions, and can be sold at existing retail outlets or to large diesel users with no changes to their equipment or distribution infrastructure and do not require new or modified pipelines, storage tanks, or retail stations. Although we expect to be able to negotiate a premium for the product once total platform volume levels have been achieved, we have made our projections using ULSD prices.

US Fuel will use a contracting strategy designed to assure the availability of critical resources required for the success of the Project while optimizing design flexibility and managing initial development capital. To that end, US Fuel has approached multiple suppliers of the goods and services required to develop the Project and considered a variety of different options with respect to technology and construction. As of the date of this Registration Statement, we have not yet entered into any formal agreements with any such suppliers or service providers.

The actions we expect to complete initially, during the development period before commencing with our Front End Engineering Design ("FEED") study is expected to cost approximately $750,000. During this period, US Fuel will pay current liabilities, fund general administration costs, start the permit process and secure the project sites for each plant. Subsequent plant development costs are expected to be somewhat less because the development resources (i.e., staff and consultants) will already be in place. A Principle Managing Contractor (“PMC”) will be engaged and contract negotiations with equipment suppliers and general contractors will begin. The development phase will be completed once the site(s) are secured and costs for the next stage are confirmed and funded. The development stage is expected to last approximately 8 months.

The FEED Study

FEED stands for Front End Engineering Design. The FEED is engineering which comes after the Development Stage and is expected to take approximately 8 months to complete. The FEED design focuses the technical requirements, as well as investment cost for the project. The FEED package is used as the basis for bidding the Engineer Procure Construct (EPC) Contract and is used as the design basis.

Research and Development

We have not conducted any research or development in the past two years.

Government Regulation and Environmental Compliance

Although we will need standard general construction permits for our plants and once we begin production, the final product will be required to meet certain quality standards set by the government, at this time we are not required to obtain any government approvals for our business or operations. If the government imposes any regulations on our business, then we will shall comply with same, noting that our inability to do so will adversely affect our operations. Our final product will also have to comply with various environmental laws.

Strategic Advantage

US Fuel will seek to achieve a competitive advantage, maximize benefits, minimize risks, and create value through the following means:

| · | Premium Product: The high quality diesel fuel produced through the Fischer–Tropsch (FT) process contains near zero Sulfur and can be used directly in today’s diesel-powered vehicles and jet powered aircraft. Laboratory testing indicates that F-T diesel provides superior vehicle performance than conventional diesel. These fuels are compatible with the current petroleum distribution infrastructure and do not require new or modified pipelines, storage tanks, or retail stations. Fischer-Tropsch diesel delivers dramatic across-the-board reductions in all major criteria pollutants such as SOx, NOx, particulate matter (PM), and hydrocarbon (HC) emissions See, Clean Product below. |

| · | Geographic Cost Advantages. Leverage strategic locations at industrial parks and brownfields, which typically already have utilities and infrastructure in place allowing for us to commence construction sooner. US Fuel will evaluate all regions of the U.S. to determine the highest areas of profit (including crack spreads and transportation) and focus on those project sites that maximize returns based upon all location-specific factors. Plants using natural gas will be connected directly to interstate pipelines to reduce transportation costs. |

| · | Manageable Size. Based on our prior experience, we have scaled down our project size to one that we believe will be more attractive and provide better funding results. |

| · | Time to market. Commercial operation of our scaled down projects can be achieved in approximately 24 months, which is about half the time for large-scale projects. The plants are expected to qualify as minor sources for the air permit, which also eases the burden - in both time and cost - of obtaining such permits. |

| · | Asset Synergies. A platform play comprised of 5 to 7 small scale FT plants provide the ability to leverage initial development costs, central operations, risk management, purchasing and hedging power (e.g., higher volume feedstock and off take), reduced financing costs, pooled maintenance and service, logistics management, etc. Strategic locations afford geographic and product manufacturing diversification as well as revenue optimization benefits. |

| · | Modular, Scalable Technology. The small scale FT technology allows easy adaptation to specific site conditions, repeatable plant design, reduced engineering risks, improved uptime due to phased maintenance and no single point of failure (our operations can continue to operate even if one of our reactors should break or fail for any reason). |

| · | Replicable. A model utilizing modular small-scale FT plants serving local markets is easily duplicated across the platform and will be able to compete effectively on price with large manufacturers. |

Clean Product

There have been many studies, both foreign and domestic, concluding that the FT fuel is a clean product. One such study published in March 2010 by the U.S. Department of Transportation entitled, "Evaluation of Ultra-Clean Fischer-Tropsch Diesel Fuel in Transit Bus Applications" also discussed the following as some advantages of FT Diesel are:

| · | FT Diesel contains virtually no sulfur or aromatics. In a properly tuned engine this is expected to lead to lower particle exhaust emissions. |

| · | The absence of sulfur means that oxidation catalysts and particulate traps will operate at maximum efficiency. |

| · | The existing diesel infrastructure can be used, unchanged, for Fischer-Tropsch Diesel. |

| · | FT Diesel can be used in existing diesel engines. |

| · | Diesel is one of the safest of the automotive fuels. |

Market Opportunity

US Fuels’ business plan is to build, own and operate 5 to 7, small scale (1000-2000 barrel per day (BBL/day)) gas to liquid (GTL) production facilities in strategic locations across the United States with access to abundant low cost feedstock and local markets large enough to absorb the product. We will capitalize on the projected $/BTU spread between natural gas and ultra-low sulfur diesel (ULSD), from which we expect to yield above average return.

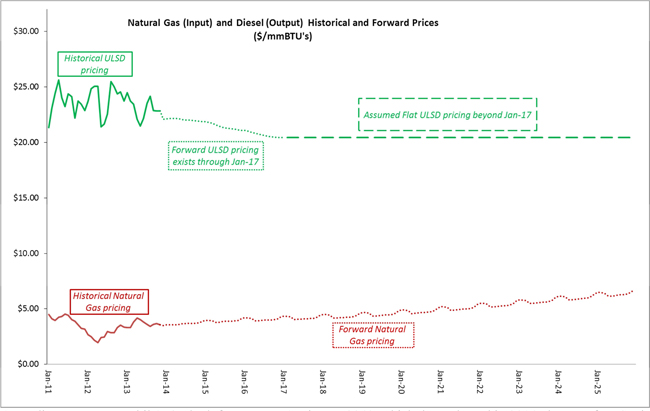

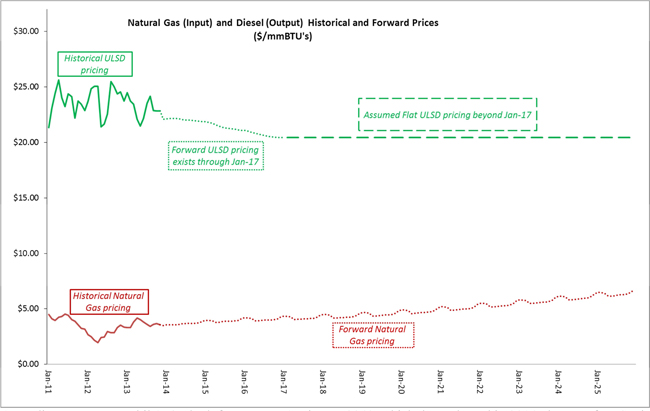

As the graph below depicts, market conditions for FT liquids are at historically favorable levels, with natural gas prices at historical lows coupled with robust, growing demand for distillate fuels (including diesel) projected to continue at least through the next few decades.

According to Exxon Mobile's Outlook for Energy: A View to 2040, which they released in 2014, the use of ULSD is expected to increase steadily in the United States over the next 20 years. The total production of the planned GTL plants will remain a small percentage of the total consumption.

Plant Locations

Since we made the decision to transition to a gas-to-liquids model, we have not yet settled on any particular location for our facilities, but we are focused on finding the most cost effective property for our plant. The criteria for plants not located at existing facilities, such as a refinery, is that the site should provide direct connection to interstate pipelines, allowing long term contracts with several providers, and be close to a larger city. As of the date of this Form, we have not yet settled on any particular location and remain dedicated to finding the most cost effective property for our plant.

Employees

As of April 28, 2014, we had no full time or part time employees. We believe that during the final phase of the development stage, we will begin to consider hiring full time employees.

Transfer Agent

As of April 1, 2014, Vstock Transfer, LLC is our stock transfer agent. Vstock is located at 77 Spruce Street, Suite 201, Cedarhurst, NY 11516, Phone number: 212-828-8436, website: www.VStockTransfer.com

Item 1A. Risk Factors

As a smaller reporting company, the Company is not required to provide the information required by this item.

Item 2. Financial Information

Management’s Discussion and Analysis of Financial Condition and Results of Operations

FORWARD-LOOKING INFORMATION

This report contains forward-looking statements regarding our plans, expectations, estimates and beliefs. Actual results could differ materially from those discussed in, or implied by, these forward-looking statements. Forward-looking statements are identified by words such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “will,” “may,” and other similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. We have based these forward-looking statements largely on our expectations.

Forward-looking statements are subject to risks and uncertainties, certain of which are beyond our control. Actual results could differ materially from those anticipated as a result of the risk factors detailed in our other Securities and Exchange Commission filings. Because of these risks and uncertainties, the forward-looking events and circumstances discussed in this report or incorporated by reference might not transpire. Factors that cause actual results or conditions to differ from those anticipated by these and other forward-looking statements include those described below and elsewhere in this report.

Plan of Operation

During 2012, the Company continued to work to develop coal-to-liquid facilities and has continued to do so in 2013. However, our development efforts have been and continue to be limited due to insufficient capital. The Company had a net losses of $1,040,164 and $10,006,558 for the years ended December 31, 2013 and 2012, respectively. As of March 31, 2014 and December 31, 2013, the Company had negative working capital of $2,952,430 and $2,853,968, respectively.

Plan for the next 12 months

Our plan is to build, own and operate facilities which convert hydrocarbons into non-petroleum based alternative fuels, such as diesel, gasoline and aviation (jet fuel) and other valuable products. Taking a fresh and practical approach to production and distribution, using the best new technologies, and leveraging existing infrastructure, the Company plans to use one of America’s most abundant resources to economically produce manageable quantities of high quality fuel close to end use. These fuels, which can be used exactly like petroleum derived fuels, deliver better performance, dramatic across-the-board reductions in all major criteria pollutants such as SOx, NOx, particulate matter (PM), and hydrocarbon (HC) emissions, and can be delivered through the existing distribution infrastructure with no changes to equipment, pipelines, storage tanks, or retail stations.

Over the next 12 months, we plan on raising working capital to fund development of these technological areas through private placements of debt or equity, using our common stock in lieu of cash, and applying for government grants, where appropriate. The implementation of Company's business development phases will be dependent on successful financing. Financing options may include a combination of debt and equity financing; any equity financing may result in equity dilution to existing shareholders. As of the date of this Form, we do not have any commitments to receive any such funds or financings.

More specifically, we plan to utilize invested funds to identify and procure commitments from commercially viable technology providers. Additionally, we will aim to identify and secure plant locations that are strategically located to access feedstock supplies and secure off take agreements for that plant location's fuel production. Secured funding is tied to specific achievable development benchmarks that will move plant development forward; funding is also specific to maintaining corporate governance.

Prior to commencing the FEED study for each specific plant, we will undergo a development period, which is expected to cost $750,000 and take approximately 8 months, per plant. However, we anticipate that after the first plant is secured, the development costs for subsequent plants will be a little less expensive since many of the resources needed for that phase (i.e., staff, consultants, engineers) will already be in place. The development phase will be completed once the site(s) for each plan is secured and costs for the next stage are confirmed and funded. We shall begin the development phase as soon as we receive the necessary funding. During the development phase, we hope to complete the following:

| - | Letter of Interest from potential offtake(s) |

| - | Meeting with State Representatives and EPA |

| - | Confirmation of Gas line capacity |

| o | Install cost estimate, contract scope, terms, lead time |

| o | Secured through options or other means |

| - | Select Project and FEED engineers |

| o | Construction – MOU, draft EPC |

| o | Project management – contract scope, cost estimate |

| - | - Environmental Contractor (permits) |

| o | estimate contract scope, timing |

| o | Maximum size of plant that fits under minor permit |

| - | Rebuild and Improve Web Site |

Once the development phase is complete, the FEED study will begin and our Principal Managing Contractor will works toward securing the air quality and other permits, as well as a construction contract, required to begin site work and plant construction. The first site will be secured with a purchase and sale agreement and the land closing will be timed to coincide with construction financing. We will need approximately $3,000,000 to maintain our everyday operations, general corporate upkeep and complete the FEED study. Plant construction costs are estimated at $200MM and we expect that will be financed with a combination of debt and equity private financings; however, as of the date of this Form, we have not received a commitment to receive any of those funds.

Progress

Progress has been slower than expected due to the lack of personnel and lack of working capital. We anticipate increasing staffing levels over the next 12 months. We estimate a working capital requirement of at least $1,125,000 over the next 12 months strictly to maintain our current every day activities, ie: corporate governance, offices, legal and accounting services, at a minimum level.

We believe that the success of our business will depend, in part, on our ability to attract, retain, and motivate highly qualified sales, technical and management personnel, and upon the continued service of our senior management and key sales and technical personnel. We cannot assure you that we will be able to successfully attract, retain, and motivate a sufficient number of qualified personnel to conduct our business in the future.

Risks

As mentioned above, we are faced with risks that may impact our ability to carry out our plans set forth above. The greatest risk factors to our business are the cost of construction, the time to build the plant, and the commodity prices of the feedstock and the final product.

Construction Cost: Our financial plan is based on an estimated cost, plus the cost of site acquisition and improvements, as well as start-up and development costs and reserves. If the cost of the Engineer Procure Construct ("EPC") contract or other costs increase due to economic factors, design modifications, construction delays or overruns, the total cost of our project and capital required could increase, perhaps significantly.

Construction Timetable: Our construction timetable, which we believe to be reasonable, assumes the commencement of construction after necessary financing and construction permits are available to us and a construction period of approximately 18 to 24 months. Our schedule depends upon several assumptions, including the effectiveness of agreements that remain to be negotiated and signed, including our EPC contract and others. We could also incur delays in the construction of our plant if we need to change the site for our plant due to permitting or zoning delays, opposition from local groups, adverse weather conditions, labor or material shortages, defects in materials or workmanship or other causes. In addition, the availability of financing, changes in interest rates or the credit environment or changes in political administrations at the federal, state or local level that result in policy changes towards FT liquids or our plant could result in delays in our timetable for construction and commencement of operations. Delays will hinder our ability to commence operations, generate revenue and service our debt.

Commodity Prices: The cost that we incur for our supplies of gas and the market prices for the FT liquids that we produce and sell will have a major impact on our financial results and profitability. Natural Gas, which will account for a major portion of our operating expenses, does not have a direct price relationship to the price of FT liquids in the marketplace. For an operating gas to liquids plant, falling FT liquids prices, coupled with a rise in natural gas prices, can result in significant reductions in cash flow. These prices will change based on available supplies, the supply and market prices for alternative products and many other market factors. There can be no assurance as to the price of these commodities in the future, and any increase in the price of gas or decrease in the price of FT liquids would very likely result in less profitability for us and a reduction in the value of USFF.

Comparison of Results of Operations for the three months ended March 31, 2014 to the three months ended March 31, 2013

Results of Operations

REVENUES: The Company reported revenues of $0 from our existing technology license agreement, for the three months ended March 31, 2014 and 2013.

OPERATING EXPENSES: Total operating expenses from continuing operations decreased to $112,412 for the three months ended March 31, 2014 from $195,907 for the three months ended March 31, 2013. The principal reason for this decrease was due to reduction of $93,250 in compensation in 2014 as compared to the same period last year.

NET LOSS: The Company incurred a net loss of $137,908 for the quarter ended March 31, 2014, compared with a net loss of $209,631 for the quarter ended March 31, 2013, which reflects a quarter-to-quarter decrease in the amount of loss for the period of $71,723. The principal reason for the reduction in the net loss is due to the significant decrease in operating expenses as described above.

LIQUIDITY AND CAPITAL RESOURCES

As of March 31, 2014, we had a working capital deficit of $2,952,430 which compares to a working capital deficit of $2,853,968 as of March 31, 2013. Due to limited funds, the majority of our losses were related to the issuance of stock transactions by the Company or G&A Capital. Cash flows used in investing activities was zero during the same period. Cash flows provided by financing activities were $20,000 from issuance of convertible debt.

Comparison of Results of Operations for the year ended December 31, 2013 to the year ended December 31, 2012

Results of Operations

REVENUES: The Company reported revenues of $0 from our existing technology license agreement, for the year ended December 31, 2013 and for the year ended December 31, 2012.

OPERATING EXPENSES: Total operating expenses from continuing operations decreased from $9,926,651 for the year ended December 31, 2012 to $947,079 for the year ended December 31, 2013. The principal reason for this decrease was due to reduction of $8,971,615 in stock based compensation from 2013 as compared to the same period last year.

NET LOSS: The Company incurred a net loss of $1,040,164 for the year ended December 31, 2013, compared with a net loss of $10,006,558 for the year ended December 31, 2012, which reflects a year-to-year decrease in the amount of loss for the period of $8,966,394. The principal reason for the reduction in the net loss is due to the significant decrease in operating expenses as described above.

LIQUIDITY AND CAPITAL RESOURCES

As of December 31, 2013, we had a working capital deficit of $2,853,968 which compares to a working capital deficit of $2,846,082 as of December 31, 2012. Due to limited funds, the majority of our losses were related to the issuance of stock transactions by the Company or G&A Capital. Cash flows used in investing activities was zero during the same period. Cash flows provided by financing activities were $50,000 from issuance of convertible debt and $263,000 contributed capital.

We believe that anticipated cash flows from operations will be insufficient to satisfy our ongoing capital requirements. We are seeking financing in the form of equity capital in order to provide the necessary working capital. Our ability to meet our obligations and continue to operate as a going concern is highly dependent on our ability to obtain new loans and/or successfully enter into settlement agreements with our vendors and/or former and current employees. We cannot predict whether this additional financing will be in the form of equity or debt, or be in another form. We may not be able to obtain the necessary additional capital on a timely basis, on acceptable terms, or at all. In any of these events, we may be unable to implement our current plans which circumstances would have a material adverse effect on our business, prospects, financial condition and results of operations.

If we are not successful in generating sufficient liquidity from operations or in raising sufficient capital resources, on terms acceptable to us, this could have a material adverse effect on our business, results of operations liquidity and financial condition.

Auditors' opinion expresses doubt about the Company's ability to continue as a going concern. The independent auditors report on the company's December 31, 2012 and 2013 financial statements included in this Report states that the Company's recurring losses raise substantial doubts about the Company's ability to continue as a going concern.

Item 3. Properties

Our office is located at 277 White Horse Pike, Atco, New Jersey, 08004. We sublet the office space from Drinkwater & Goldstein, LLP, of which one of our directors, Mr. Drinkwater, is a partner.

Item 4. Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding beneficial ownership of our common stock as of April 28, 2014 by (i) each person (or group of affiliated persons) who is known by us to own more than five percent (5%) of the outstanding shares of our common stock, (ii) each director, executive officer and director nominee, and (iii) all of our directors, executive officers and director nominees as a group.

Beneficial ownership is determined in accordance with SEC rules and generally includes voting or investment power with respect to securities. For purposes of this table, a person or group of persons is deemed to have “beneficial ownership” of any shares of common stock that such person has the right to acquire within 60 days of the date of the respective table. For purposes of computing the percentage of outstanding shares of our common stock held by each person or group of persons named above, any shares that such person or persons has the right to acquire within 60 days of the date of the respective table is deemed to be outstanding for such person, but is not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. The inclusion herein of any shares listed as beneficially owned does not constitute an admission of beneficial ownership.

The business address of each beneficial owner listed is in care of 277 White Horse Pike, Atco, New Jersey, 08004. Except as otherwise indicated, the persons listed below have sole voting and investment power with respect to all shares of our common stock owned by them, except to the extent that power may be shared with a spouse.

As of April 28, 2014, we had 564,374,057 shares of common stock issued and outstanding.

Between December 31, 2011, and August 21, 2013, G & A Capital distributed the shares of the common stock that it owned to our executive officers and key employees, as per the terms of the Stock Purchase Agreement that we maintain with them, and as a result they no longer own any shares of our Common Stock. G & A Capital never sold any of its shares on the open market or otherwise.

| Name of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | | Percent of Class | |

| | | | | | | |

| Harry Bagot | | | 33,600,000 | (1) | | | 5.95 | % |

| Stanley Drinkwater | | | 76,050,000 | | | | 13.47 | % |

| William Chady | | | 12,604,768 | (2) | | | 2.23 | % |

| All officers and directors as a group | | | 122,254,768 | | | | 21.66 | % |

| | | | | | | | | |

| Reyna & Associates, LLC (3) | | | 71,382,576 | | | | 12.64 | % |

| 1) | This amount includes 600,000 shares that Mr. Bagot purchased on the open market. |

| 2) | This amount includes: 10,031,155 shares Mr. Chady holds individually; 2,547,366 shares Mr. Chady holds jointly with his wife; and, 26,247 shares held by the Chady Living Trust, over which Mr. Chady is the trustee. |

| 3) | Reyna & Associates, LLC, submitted a proxy giving Mr. Bagot, Mr. Drinkwater and Mr. Chady (our current board members), collectively, voting power over the shares held by G & A Capital. |

Changes in Control

There are no present arrangements known to the Company the operation of which may result at a subsequent date in a change in control of the Company.

Item 5. Directors and Executive Officers

The following table and text set forth the names and ages of all directors and executive officers as of April 28, 2014. There are no family relationships among our directors and executive officers. Each director is elected at our annual meeting of shareholders and holds office until the next annual meeting of shareholders, or until his successor is elected and qualified. Also provided herein are brief descriptions of the business experience of each director, executive officer and advisor during the past five years and an indication of directorships held by each director in other companies subject to the reporting requirements under the Federal securities laws. None of our officers or directors is a party adverse to us or has a material interest adverse to us.

| Name | | Age | | Position(s) | | Term |

| | | | | | | |

| Harry Bagot | | 64 | | President, Chief Executive Officer and Member of the Board of Directors | | April 2011 – Present |

| William Chady | | 56 | | Chief Financial Officer, Principal Accounting Officer and Member of the Board of Directors | | October 2010 – Present |

| Stanley Drinkwater | | 58 | | Chairman of the Board of Directors | | October 2010 – Present |

Harry Bagot

Mr. Bagot, along with Mr. Drinkwater, were the initial presenters of a complete package for the production of carbon based materials into fuel using Fischer Tropsch technology to the Company. Prior to becoming our President, Mr. Bagot was the Project Manager for United Communities where he was a key member of the development and construction teams and managed an approximately $300M privatization project for joint base housing at McGuire Air Force base and Ft. Dix from 2006 through 2011; the privatization project received an Air Force award for the best privatized project in 2008 and again in 2010. From 2000-2006, Mr. Bagot was the Director of Property Management for First Montgomery Group. Mr. Bagot received his Associates Degree in Business Management from Spring Garden College and received Certified Property Manager designation from the Institute of Real Estate Management.

William Chady

Mr. Chady has been a board member of our company since 2011. For the past thirty years, Mr. Chady has operated William E. Chady, PSC, a full service accounting firm for small to medium size companies, many in the oil and gas industries, as its President and Owner. Mr. Chady maintains responsibility for the full accounting function for a number of his clients and has assisted in multiple initial public offerings and private placement memoranda. He is currently the Chairman of the Board of four Texas Roadhouse Restaurants in addition to serving or having served as a Managing Member, Director and or Officer of several other Kentucky corporations and limited liability companies. Mr. Chady was a Vice President of Kentucky Fuel Associates, Inc., at the time we conducted business with them, but it was later dissolved in September 2010. He is a member of The Kentucky Society of Certified Public Accountants as well as a member of the American Institute of Certified Public Accountants. Mr. Chady received his Associates degree in Accounting from Bellarmine University.

Stanley Drinkwater

Mr. Drinkwater, along with Mr. Bagot, were the initial presenters of a complete package for the production of carbon based materials into fuel using Fischer Tropsch technology to the Company. Mr. Drinkwater has been a Partner in Drinkwater & Goldstein, LLP since 2006. Prior to starting Drinkwater & Goldstien, Mr. Drinkwater was a partner at Maressa, Goldstein, Birsner, Patterson and Drinkwater from 1983 to 2006. Mr. Drinkwater is admitted to practice in New Jersey and Pennsylvania as well as before the U.S. Court of Appeals for the Federal Court and Third Circuit and the U.S. Supreme Court. Mr. Drinkwater received a Bachelor of Science in Political Science from Rutgers University at Stockton and a Juris Doctor from the Widener University School of Law.

Mrrs. Bagot and Drinkwater formed an LLC in 2006 that proposed a technology to the Company that would convert tires through a plasma arch technology that would convert tires to fuel. We had control of a fully permitted site in Toms River, NJ and had funding through the NJ Economic Redevelopment Authority. They released control of the project package to the Company and then had very little involvement with the company from that time forward. Mrrs. Bagot and Drinkwater believed that at that time, a publicly traded company was the best vehicle to raise capital to fund plant construction. However, they were the founders of what was then the Company's fuel division and what is now the whole company.

Mr. Drinkwater returned to the Company in 2010 as Chairman of the Board and began reshaping the Company into a more profitable vehicle. With the termination of the sitting President and CEO, Mr. Bagot returned and was appointed President and CEO. Mrrs. Bagot and Drinkwater bring the background and experience that is required to move the company forward; their past experience and ability to manage the on going issues of running a publicly traded company make them invaluable to our team.

Involvement in Certain Legal Proceedings

To the best of the Company's knowledge, none of the Company's directors, officers, promoters or control persons, if any, during the past ten years was:

| 1. | A general partner or executive officer of a business that had a bankruptcy petition filed by or against it either at the time of the bankruptcy or within the two years before the bankruptcy; |

| 2. | Convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| 3. | Subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; and, |

| 4. | Found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated. |

Board Observer

Mr. Robert Schwartz, who individually owns less than 5% of our common stock, is the only Board observer at this time. Mr. Schwartz represents some of our larger shareholders and is the G & A Capital Appointee, but does not maintain any voting power or control over our Board or management. Mr. Schwartz is permitted to attend all meetings of the Board of Directors in a nonvoting observer capacity, but we maintain the right to withhold any information and to exclude him from any meeting or portion thereof if (i) access to such information or attendance at such meeting could adversely affect the attorney-client privilege between us and our counsel or (ii) access to such information or attendance at such meeting could result in a conflict of interest between Mr. Schwartz and ourselves, or our counsel. Mr. Schwartz verbally agreed to hold in confidence all information provided to him or learned in connection with his observer rights, except to the extent otherwise required by law and any other regulatory process to which Observer is subject.

Significant Employees/Consultants

The following are employees or consultants who are not executive officers, but who are expected to make significant contributions to our business:

Mr. Craig Conner.

Mr. Conner was appointed as our Senior Energy Consultant in January 2014. Since 2013, Mr. Conner has been the Managing Principal at CNK Focus, Inc., which provides business development and management consulting services. From 2011 to 2013, Mr. Conner served as Vice President of Pallas Formed Fuels (2012), a Gas to Liquids plant development business. Mr. Conner served as the Vice President of Finance for BAARD Energy, in Vancouver, Washington from 2005 to 2011. Mr. Conner received his BS in mechanical engineering from The Ohio State University and has taken numerous executive training courses in finance, management, front-line leadership, and business systems.

Garry Sparks

Mr. Sparks has been working with the Company for about eight years. Mr. Sparks shall be the Lead Project Manager on our future projects. Additionally, Mr. Sparks is works closely with the office of State Representative Brent Yonts and the office of the Governor of Kentucky to coordinate project efforts. Mr. Sparks has an extensive thirty-five year background in construction, plant and project management. From 2006 to 2010 Mr. Sparks served as president of Kentucky Fuel Associates, Inc., a firm dedicated to the development of the first CTL fuel plant in Kentucky with emphasis on curtailing the country’s dependence on foreign oil. Additionally, Mr. Sparks served from 2003 to 2008 as President and co-owner of Mechanical Installations, Inc., a firm specializing in the construction and startup of water treatment plants, paper mills, steel manufacturing and processing plants.

Item 6. Executive Compensation

The following tables set forth, for each of the last two completed fiscal years of the Company, the total compensation awarded to, earned by or paid to any person who was a principal executive officer during the preceding fiscal year and every other highest compensated executive officers earning more than $100,000 during the last fiscal year (together, the “Named Executive Officers”).

Summary Compensation Table

Name and

Principal

Position | | Year

Ended

Dec. 31 | | | Salary

($) | | | Bonus

($) | | | Stock

Award(s)

($) | | | Option

Awards ($) | | | Non-

Equity

Incentive

Plan

Compen-

sation | | | Non-

Qualified

Deferred

Compen-

sation

Earnings ($) | | | All

Other

Compen-

sation ($) | | | Total

($) | |

| (a) | | (b) | | | (c) | | | (d) | | | (e) | | | (f) | | | (g) | | | (h) | | | (i) | | | (j) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Harry Bagot | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CEO | | | 2013 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | | |

| CEO | | | 2012 | | | | - | | | | | | | | 1,056,000 | (1) | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| William Chady | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CFO | | | 2013 | | | | 110,000 | (2) | | | | | | | - | | | | | | | | | | | | | | | | | | | | | |

| CFO | | | 2012 | | | | 110,000 | (2) | | | | | | | 320,000 | (1) | | | | | | | | | | | | | | | | | | | | |

(1) This represents the fair value of the shares G & A Capital issued to such Named Executive Officer pursuant to the Stock Purchase Agreement we entered into with G & A Capital. As discussed elsewhere in this Registration Statement, in May 2011, we entered into a Stock Purchase Agreement with G & A Capital. Pursuant to that agreement, they agreed - among other things - to relieve, discharge and assume certain of the Company's outstanding expenses, including accrued executive compensation, which they carried out in part, by distributing the shares of Company common stock that they owned to members of our management and key individuals at their discretion. As the shares were theirs, the decision to issue shares under the Stock Purchase Agreement rested with G & A Capital, however, they sometimes consulted with our Board to determine to whom and the amount of such issuances. (see, Item 1 "G & A Capital Agreement.")

(2) As disclosed elsewhere in this Registration Statement, pursuant to a unanimous written consent of the Board on September 10, 2012, Mr. Chady shall receive $110,000 per year; however, such amounts shall accrue until we are able to pay same. As of the date of this Form, Mr. Chady has not received any cash compensation from us.

Pension Benefits

Nonqualified Deferred Compensation

Retirement/Resignation Plans

As of the December 31, 2013, none of the persons included the table above are entitled to receive any pension benefits, nonqualified deferred compensation or are part of any other retirement/resignation plans.

Outstanding Equity Awards at 2012 Year-End

As of the year ended December 31, 2013, there were no unexercised options, stock that has not vested or equity incentive plan awards held by any of the Company’s named executive officers.

Independent Contractor and Executive Employment Agreements

As of the date of this Form, we do not maintain a formal employment agreement with any of our officers, or directors.

In January 2014, we entered into a consulting agreement with Mr. Conner, our Senior Energy Consultant. In light of the compensation payable to Mr. Conner under the agreement, he is now one of our most highly paid individuals. Upon signing the agreement, Mr. Conner was entitled to receive $50,000 (the "Signing Cash") and 5,000,000 shares of our common stock; Mr. Conner is also entitled to $12,500 per month (the "Monthly Cash," together with the Signing Cash, the "Cash Compensation") during the term of his service, which shall be until he completes all of the services enumerated in the agreement are completed; however, in light of the Company's cash position, Mr. Conner agreed that the Cash Compensation is payable in the future when capital allows and may also be paid in shares of common stock at Mr. Conner's written discretion. Accordingly, as of the date of this Registration Statement, Mr. Conner has not received any of the Cash Compensation. If Mr. Conner requests the Cash Compensation be paid in shares of common stock, it shall be valued on a 50 day moving average as of the time the obligation to make such payment became due. Mr. Conner is also entitled to certain bonuses, ranging from $50,000 to $250,000, based upon the completion of certain milestones set forth in the agreement. Either party may terminate the agreement upon 30 days written notice to the other.

Compensation of Directors

During the fiscal year ended December 31, 2013, we did not pay any compensation to any of our directors; nor was any compensation payable. However, pursuant to our Bylaws, our directors are entitled to be paid for all necessary expenses incurred in attending Board meetings and may receive compensation for their services as a director, as determined by the Board.

Compensation Policies and Practices as they Relate to Risk Management

We believe that our compensation policies and practices do not encourage excessive or unnecessary risk-taking and that the level of risk that they do encourage is not reasonably likely to have a material adverse effect on us. The design of our compensation policies and practices encourages our employees to remain focused on both our short- and long-term goals.

Item 7. Certain Relationships and Related Transactions, and Director Independence

Other than the G & A Capital Agreement, which is described elsewhere in this registration statement (see Item 1., G & A Capital Agreement”) , there were no transactions with any related persons (as that term is defined in Item 404 in Regulation S-K) since the beginning of our fiscal year ending December 31, 2013, or any currently proposed transaction (as of the date of this registration statement), in which we were or are to be a participant and the amount involved was in excess of $120,000 and in which any related person had a direct or indirect material interest.

Promoters

None of our management or other control persons were “promoters” (within the meaning of Rule 405 under the Securities Act), and none of such persons took the initiative in the formation of our business or in connection with the formation of our business and received 10% of our debt or equity securities or 10% of the proceeds from the sale of such securities in exchange for the contribution of property or services, during the last five years.

Director Independence

As of the date of this Registration Statement, our Board of Directors has three directors and has not established Audit, Compensation, and Nominating or Governance Committees as standing committees. The Board does not have an executive committee or any committees performing a similar function. We are not currently listed on a national securities exchange or in an inter-dealer quotation system that has requirements that a majority of the board of directors be independent and do not currently have any independent board members.

Due to our lack of operations and size, we do not have an Audit Committee. Furthermore, since we are not currently listed on a national securities exchange, we are not subject to any listing requirements mandating the establishment of any particular committees. For these same reasons, we did not have any other separate committees during fiscal 2013; all functions of a nominating committee, audit committee and compensation committee were performed by our whole board of directors. Our board of directors intends to appoint such persons and form such committees as are required to meet the corporate governance requirements imposed by the national securities exchanges as necessary. Therefore, we intend that a majority of our directors will eventually be independent directors and at least one director will qualify as an “audit committee financial expert.”

Item 8. Legal Proceedings

Other than as set forth herein, the Company is currently not a party to any material legal or administrative proceedings and is not aware of any pending or threatened legal or administrative proceedings against it.

On December 18, 2013, the SEC initiated proceedings under Section 12(j) of the Securities Exchange Act of 1934 for the failure to comply with Exchange Act Section 13(a) and Rules 13a-1 and 13a-13 thereunder because it had not filed any periodic reports with the Commission since the period ended December 31, 2012. On January 17, 2014, the Company executed an Offer of Settlement presented by the SEC to settle the proceedings. The SEC issued its Final Order on February 6, 2014.

On May 10, 2013, Global filed a civil action, number SC120696 in the Superior Court of the State of California, County of Los Angeles, West District. The named defendants are: Empyrean West, LLC (“EW”); Jay Carter, individually and as managing partner of EW; David Keller, individually and as CEO of EW; US Fuel Corporation; Harry Bagot, individually and as President and CEO of the Company; Stanley Drinkwater, individually and as Chairman of the Board of the Company; Steven Luck, individually and as a Member of the Company’s Board; William Chady, individually and as a member of the Company’s Board; Paul Adams, individually and as an officer of the Company; Robert Schwartz, individually and as majority stockholder of the Company; John Fairweather, individually and as Director of the Company; and Kenneth Faith, individually and as Treasurer of the Company.

The complaint alleges a total of twenty-one causes of action, twelve of which are directed to US Fuel Corporation. The allegations against the Company are: 1) breach of contract; 2) fraudulent concealment in violation of Civil Code §1710; 3) intentional misrepresentation in violation of Civil Code §1710; 4) unfair and deceptive practices; 5) contractual breach of implied covenant of good faith and fair dealing; 6) fraud; 7) negligent misrepresentation in violation of Civil Code §1572; 8) breach of non-competition covenant; 9) civil conspiracy; 10) breach of contract for failure of consideration of failure to perform; 11) breach of confidence; and 12) declaratory relief.

As of the date of this Registration Statement, the action was dismissed in California, but has been re-filed in Federal Court. Attempts to resolve our differences have been unsuccessful and we recently retained counsel to defend the federal action and assert viable counterclaims.

As disclosed in the Company's prior public filings, a former shareholder of FFI: Scott Schrader instituted litigation against the Company and FFI in the fall of 2010. Schrader is the Plan Sponsor, Plan Administrator Fiduciary and Participant of Schrader & Associates Defined Benefit Pension Plan ("Schrader"), the co-plaintiff, with whom we entered into a Stock Purchase Agreement and a Management Agreement in 2009. The litigation resulted in questionable actions by, and the ultimate termination of Mr. Fairweather on March 23, 2011. When Mr. Fairweather left the Company, he took many company files and refused to return them. Such actions are currently the subject of a criminal case against Mr. Fairweather entitled The State of New Jersey v. John Fairweather, pending in the Municipal Court of Waterford Township, Complaint number S 2012 00165, in which Mr. Fairweather is charged with theft of company property. At the first hearing of this matter on September 13, 2012, Mr. Fairweather failed to appear, but since he later returned all of the requested records, we later had the case dismissed.

On July 30, 2012, Schrader filed a complaint against FFI in the Commonwealth of Kentucky, Muhlenberg Circuit Court Division, as Civil Action No. 12-CI-352 to Quiet Title on property acquired by FFI. On September 10, 2012, the Board of Directors unanimously approved Mr. Bagot's execution of a quit claim deed to resolve the action.

On March 15, 2013, the Company executed an employment contract with Paul Adams as Chief Operating Officer. On July 5, 2013, Mr. Adams submitted his letter of resignation to terminate our relationship with him due to mutual misunderstandings and differences between the Company and Mr. Adams. Although the Company has not received any formal service as of the date of this Registration Statement, Mr. Adams has since threatened Management that he may sue the Company over compensation he believes is owed to him under his contract.

Item 9. Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

Our common stock is not currently traded. Prior to February 6, 2014, our stock traded on the OTC Pink market under the symbol “USFF.” Prior to October 7, 2011, we traded under the symbol, “NSOL.” The following table sets forth the high and low prices of our common stock for each quarter for the two most recently completed fiscal years. The quotations set forth below reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

| | | High | | | Low | |

| | | | | | | |

| 2014 | | | | | | | | |

| First quarter ended March 31, 2014 | | $ | 0.0 | | | $ | 0.0 | |

| | | | | | | | | |

| 2013 | | | | | | | | |

| First quarter ended March 31, 2013 | | $ | 0.075 | | | $ | 0.035 | |

| Second quarter ended June 30, 2013 | | $ | 0.06 | | | $ | 0.02 | |

| Third quarter ended September 30, 2013 | | $ | 0.04 | | | $ | 0.01 | |

| Fourth quarter ended December 31, 2013 | | $ | 0.06 | | | $ | 0.01 | |

| | | | | | | | | |

| 2012 | | | | | | | | |

| First quarter ended March 31, 2012 | | $ | 0.05 | | | $ | 0.0252 | |

| Second quarter ended June 30, 2012 | | $ | 0.049 | | | $ | 0.0252 | |

| Third quarter ended September 30, 2012 | | $ | 0.11 | | | $ | 0.022 | |

| Fourth quarter ended December 31, 2012 | | $ | 0.11 | | | $ | 0.051 | |

Holders

As of April 28, 2014, there were approximately 703 record owners of our common stock.

Dividends

There are no restrictions imposed on the Company which limit its ability to declare or pay dividends on its common stock, except for corporate state law limitations. No cash dividends have been declared or paid to date and none are expected to be paid in the foreseeable future.

Securities Authorized for Issuance Under Equity Compensation Plans

As of the date of this Registration Statement, we do not have any effective equity compensation plans from which we can issue any securities.

Item 10. Recent Sales of Unregistered Securities

The following is a summary of transactions by the Company in the past three years involving sales of our securities that were not registered under the Securities Act, as amended. Each transaction was exempt from the registration requirements of the Securities Act by virtue of Section 4(2) of the Securities Act or Rule 506 of Regulation D promulgated by the SEC. Unless stated otherwise: (i) the securities were offered and sold only to accredited investors; (ii) there was no general solicitation or general advertising related to the offerings; (iii) each of the persons who received these unregistered securities had knowledge and experience in financial and business matters which allowed them to evaluate the merits and risk of the receipt of these securities, and that they were knowledgeable about our operations and financial condition; (iv) no underwriter participated in, nor did we pay any commissions or fees to any underwriter in connection with the transactions; and, (v) each certificate issued for these unregistered securities contained a legend stating that the securities have not been registered under the Securities Act and setting forth the restrictions on the transferability and the sale of the securities.

In May 2011, we issued G & A Capital 5,000,000 shares of our preferred stock pursuant to the G & A Capital Agreement (Please see, Item 1 "G & A Capital Agreement").

On May 15, 2012, G & A Capital exercised a cashless provision related to the warrants issued in May 2011. The Company issued 300,851,000 common shares. Subsequent to the issuance of the 300,851,000 common shares, G & A Capital distributed such number of shares of the Common Stock it owned to our executive officers and key employees and other service providers on behalf of the Company. The majority of the common stock transferred was distributed to related parties including our Chairman of the Board, Chief Executive Officer and Chief Financial Officer. Accordingly, the Company has recorded a stock based compensation charge related to the shares issued for services rendered of $8,971,615 for the year ended December 31, 2012.

On December 13, 2013, the Company issued a secured convertible debenture for $100,000, with an original issue discount of $50,000 and net proceeds of $50,000 from 112359 Factor Fund LLC ("Factor Fund"), who also employs Core Strategic Services' ("CSS") as a consultant. The Debenture matures on December 31, 2015 with interest at 8% per annum and is convertible into the Company’s common stock, at the option of the holder, at a conversion price equal to the average of the five lowest market prices for the Company’s common stock for thirty days preceding conversion. The debenture is secured by personal property of the Company, as defined in the debenture. As of the date of this Form, because our stock ceased trading for more than 5 days and our registration was revoked, we are technically in default of the note; however, Factor Fund has not expressed an intent to declare a default or exercise any of their rights as a result thereof. Pursuant to the debenture, Factor Fund has an ownership cap, in which they shall not beneficially own more than 4.99% of our common stock at any one time. (See Note 6 to the 2013 Year End Financial Statements included below)

In January 2014, we issued 5,000,000 shares to Mr. Conner pursuant to the terms of his consulting agreement.