(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(If "Yes" is marked, indicate below the file number assigned to registrant in connection with Rule 12g3-2(b): 82-__________.)

A copy of 2022 annual report of China Petroleum & Chemical Corporation (the “Registrant”).

CONTENTS

| 3 | Principal Financial Data and Indicators |

| 9 | Business Review and Prospects |

| 16 | Management’s Discussion and Analysis |

| 48 | Environment and Social Responsibilities |

| 59 | Report of the Board of Directors |

| 68 | Report of the Board of Supervisors |

| 70 | Changes in Share Capital and Shareholdings of Principal Shareholders |

| 72 | Bond General Information |

| 74 | Principal Wholly-owned and Controlled Subsidiaries |

| 212 | Documents for Inspection |

This annual report includes forward-looking statements. All statements, other than statements of historical facts, that address activities, events or developments that the Company expects or anticipates will or may occur in the future (including but not limited to projections, targets, reserve and other estimates and business plans) are forward-looking statements. The Company’s actual results or developments may differ materially from those indicated by these forward-looking statements as a result of various factors and uncertainties. The Company makes the forward-looking statements referred to herein as at 24 March 2023 and unless required by regulatory authorities, the Company undertakes no obligation to update these statements.

COMPANY PROFILE

IMPORTANT NOTICE: THE BOARD OF DIRECTORS, THE BOARD OF SUPERVISORS, DIRECTORS, SUPERVISORS AND SENIOR MANAGEMENT OF SINOPEC CORP. WARRANT THAT THERE ARE NO FALSE REPRESENTATIONS, MISLEADING STATEMENTS OR MATERIAL OMISSIONS IN THIS ANNUAL REPORT, AND JOINTLY AND SEVERALLY ACCEPT FULL RESPONSIBILITY FOR THE AUTHENTICITY, ACCURACY AND COMPLETENESS OF THE INFORMATION CONTAINED IN THIS ANNUAL REPORT. THERE IS NO OCCUPANCY OF NON-OPERATING FUNDS BY THE CONTROLLING SHAREHOLDERS OF SINOPEC CORP. ALL DIRECTORS ATTENDED THE 15TH MEETING OF THE EIGHTH SESSION OF THE BOARD. MR. MA YONGSHENG, CHAIRMAN OF THE BOARD, MR. YU BAOCAI, PRESIDENT, MS. SHOU DONGHUA, CHIEF FINANCIAL OFFICER AND HEAD OF THE FINANCIAL DEPARTMENT OF SINOPEC CORP. WARRANT THE AUTHENTICITY AND COMPLETENESS OF THE FINANCIAL STATEMENTS CONTAINED IN THIS ANNUAL REPORT. THE AUDIT COMMITTEE OF SINOPEC CORP. HAS REVIEWED THE ANNUAL REPORT OF SINOPEC CORP. FOR THE YEAR ENDED 31 DECEMBER 2022.

THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2022 OF THE COMPANY PREPARED IN ACCORDANCE WITH THE PRC ACCOUNTING STANDARDS FOR BUSINESS ENTERPRISES (CASs) AND INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRS) HAVE BEEN AUDITED BY KPMG HUAZHEN LLP AND KPMG RESPECTIVELY. BOTH FIRMS HAVE ISSUED STANDARD UNQUALIFIED AUDITOR’S REPORT.

AS APPROVED AT THE 15TH MEETING OF THE EIGHTH SESSION OF THE BOARD OF DIRECTORS OF SINOPEC CORP., THE BOARD PROPOSED A FINAL CASH DIVIDEND OF RMB0.195 (TAX INCLUSIVE) PER SHARE FOR 2022, COMBINING WITH THE INTERIM CASH DIVIDEND OF RMB0.16 (TAX INCLUSIVE) PER SHARE, THE TOTAL CASH DIVIDEND FOR 2022 WILL BE RMB0.355 (TAX INCLUSIVE) PER SHARE. THE DIVIDEND PROPOSAL IS SUBJECT TO THE SHAREHOLDERS’ APPROVAL AT THE ANNUAL GENERAL MEETING FOR THE YEAR 2022.

COMPANY PROFILE

Sinopec Corp.’s H shares were listed in Hong Kong, New York and London exchanges on 18 and 19 October 2000, respectively, and A shares were listed in the Shanghai Stock Exchange on 8 August 2001. Sinopec Corp. is one of the largest integrated energy and chemical companies in China. Its principal operations include the exploration and production, pipeline transportation and sale of petroleum and natural gas; the production, sale, storage and transportation of refinery products, petrochemical products, coal chemical products, synthetic fibre, and other chemical products; the import and export, including an import and export agency business, of petroleum, natural gas, petroleum products, petrochemical and chemical products, and other commodities and technologies; and research, development and application of technologies and information; hydrogen energy business and related services such as hydrogen production, storage, transportation and sales; battery charging and swapping, solar energy, wind energy and other new energy business and related services.

DEFINITIONS:

In this report, unless the context otherwise requires, the following terms shall have the meaning as set out below:

Sinopec Corp.: China Petroleum & Chemical Corporation

Company: Sinopec Corp. and its subsidiaries

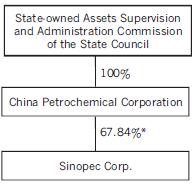

China Petrochemical Corporation: the controlling shareholder of Sinopec Corp., China Petrochemical Corporation

Sinopec Group: China Petrochemical Corporation and its subsidiaries

NDRC: China National Development and Reform Commission

RMC: Oil and Natural Gas Reserves Management Committee of the Company

Sinopec Finance Co.: Sinopec Finance Co., Ltd.

Century Bright: Sinopec Century Bright Capital Investment, Ltd.

CSRC: China Securities Regulatory Commission.

Hong Kong Stock Exchange: The Stock Exchange of Hong Kong Limited

Hong Kong Listing Rules: Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited

CONVERSION:

For domestic production of crude oil, 1 tonne = 7.1 barrels;

For overseas production of crude oil: 1 tonne = 7.26 barrels in 2022, 1 tonne = 7.22 barrels in 2021, 1 tonne = 7.20 barrels in 2020;

For production of natural gas, 1 cubic meter = 35.31 cubic feet;

Refinery throughput is converted at 1 tonne = 7.35 barrels.

PRINCIPAL FINANCIAL DATA AND INDICATORS

| 1. | FINANCIAL DATA AND INDICATORS PREPARED IN ACCORDANCE WITH CASs |

| (1) | Principal financial data |

| | For the year ended 31 December |

| | 2022 | 2021 | Change | 2020 |

| Items | RMB million | RMB million | (%) | RMB million |

| Operating income | 3,318,168 | 2,740,884 | 21.06 | 2,104,724 |

| Operating profit | 96,414 | 112,414 | (14.23) | 50,803 |

| Profit before taxation | 94,515 | 108,348 | (12.77) | 48,441 |

| Net profit attributable to equity shareholders of the Company | 66,302 | 71,208 | (6.89) | 33,271 |

| Net profit/(loss) attributable to equity shareholders of the Company excluding extraordinary gains and losses | 57,182 | 72,220 | (20.82) | (1,565) |

| Net cash flow from operating activities | 116,269 | 225,174 | (48.36) | 168,520 |

| | 2022 |

| | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | Total |

| | RMB million | RMB million | RMB million | RMB million | RMB million |

| Operating income | 771,386 | 840,740 | 841,196 | 864,846 | 3,318,168 |

| Net profit attributable to equity shareholders of the Company | 22,605 | 20,925 | 13,130 | 9,642 | 66,302 |

| Net profit attributable to equity shareholders of the Company excluding extraordinary gains and losses | 22,450 | 20,510 | 12,492 | 1,730 | 57,182 |

| Net cash flow (used in)/generate from operating activities | (46,781) | 51,728 | 54,297 | 57,025 | 116,269 |

| | For the year ended 31 December |

| | 2022 | 2021 | Change | 2020 |

| Items | RMB million | RMB million | (%) | RMB million |

| Total assets | 1,948,640 | 1,889,255 | 3.1 | 1,738,896 |

| Total liabilities | 1,011,487 | 973,214 | 3.9 | 850,176 |

| Total equity attributable to equity shareholders of the Company | 785,577 | 775,102 | 1.4 | 747,294 |

| Total number of shares (1,000 shares) | 119,896,408 | 121,071,210 | (1.0) | 121,071,210 |

| (2) | Principal financial indicators |

| | For the year ended 31 December |

| | 2022 | 2021 | Change | 2020 |

| Items | RMB Yuan | RMB Yuan | (%) | RMB Yuan |

| Basic earnings per share | 0.548 | 0.588 | (6.80) | 0.275 |

| Diluted earnings per share | 0.548 | 0.588 | (6.80) | 0.275 |

| Basic earnings per share (excluding extraordinary gains and losses) | 0.473 | 0.597 | (20.77) | (0.013) |

| Weighted average return on net assets (%) | 8.50 | 9.35 | (0.85) percentage points | 4.46 |

| Weighted average return (excluding extraordinary gains and losses) on net assets (%) | 7.33 | 9.49 | (2.16) percentage points | (0.21) |

| Net cash flow from operating activities per share | 0.962 | 1.860 | (48.28) | 1.392 |

| | For the year ended 31 December |

| | 2022 | 2021 | Change | 2020 |

| Items | RMB Yuan | RMB Yuan | (%) | RMB Yuan |

| Net assets attributable to equity shareholders of the Company per share | 6.552 | 6.402 | 2.34 | 6.172 |

| Liabilities to assets ratio (%) | 51.91 | 51.51 | 0.40 percentage points | 48.89 |

| (3) | Extraordinary items and corresponding amounts |

| | For the year ended 31 December (Income)/expenses |

| | 2022 | 2021 | 2020 |

| Items | RMB million | RMB million | RMB million |

| Net (gain)/loss on disposal of non-current assets | (672) | (665) | (973) |

| Donations | 447 | 165 | 301 |

| Government grants | (3,826) | (3,085) | (8,605) |

| Gain on holding and disposal of various investments | (13,902) | (259) | (37,520) |

| Other non-operating expenses, net | 2,178 | 4,720 | 2,992 |

| Net profit/(loss) acquired through business combination under common control during the reporting period | 0 | 101 | (472) |

| Subtotal | (15,775) | 977 | (44,277) |

| Tax effect | 2,304 | (72) | 6,736 |

| Total | (13,471) | 905 | (37,541) |

| Attributable to: Equity shareholders of the Company | (9,120) | 1,012 | (34,836) |

| Minority interests | (4,351) | (107) | (2,705) |

| (4) | Items measured by fair values |

Unit: RMB million

| Items | Beginning of the year | End of the year | Changes | Influence on the profit of the year |

| Other equity instruments investment | 767 | 730 | (37) | 76 |

| Receivables financing | 5,939 | 3,507 | (2,432) | 0 |

| Derivative financial instruments | 1,350 | (1,838) | (3,188) | (15,535) |

| Cash flow hedging | 13,798 | 13,860 | 62 | 12,609 |

| Financial assets held for trading | 0 | 2 | 2 | 11 |

| Total | 21,854 | 16,261 | (5,593) | (2,839) |

| (5) | Significant changes of items in the financial statements |

The table below sets forth reasons for those changes where the fluctuation was more than 30% during the reporting period:

| | As of 31 December | Increase/(decrease) | |

| | 2022 | 2021 | Amount | Percentage | |

| Items | RMB million | RMB million | RMB million | (%) | Reasons for change |

| Cash at bank and on hand | 145,052 | 221,989 | (76,937) | (34.7) | Expanded investment scale, increased dividend, and raised occupation of inventory capital resulting from increase of prices of crudes and other commodities |

| Accounts receivable | 46,364 | 34,861 | 11,503 | 33.0 | Increase in the account receivables due to the rising

prices of crude oil and refined oil products |

| Receivables financing | 3,507 | 5,939 | (2,432) | (40.9) | Improved efficiency in the use of capital and advanced turnover of bills |

| Derivative financial liabilities | 7,313 | 3,223 | 4,090 | 126.9 | Impact of changes in fair value of commodity-based hedging business including crude oil |

| Taxes payable | 28,379 | 81,267 | (52,888) | (65.1) | Impact of deferred payment of tax happened in the fourth quarter of last year |

| Non-current liabilities due within one year | 62,844 | 28,651 | 34,193 | 119.3 | Increase in long-term loans due within one year and debentures payable |

| Long-term loans | 94,964 | 49,341 | 45,623 | 92.5 | Increase in long-term loans to ensure investment and production and operation capital needs |

| Debentures payable | 12,997 | 42,649 | (29,652) | (69.5) | A result of partial amount of bonds payable reclassifying to non-current liabilities due within one year |

| Other comprehensive income | 3,072 | (690) | 3,762 | – | Increase in the translation difference of foreign currency statements due to the appreciation of US dollar against RMB |

| Refunds of taxes and levies | 12,010 | 4,641 | 7,369 | 158.8 | VAT credit refund in this year increased significantly year-on-year |

| Other cash received relating to operating activities | 269,895 | 158,049 | 111,846 | 70.8 | Impact of margin change of derivative business |

| Other cash paid relating to operating activities | (312,819) | (179,679) | (133,140) | 74.1 |

| Cash received from disposal of investments | 1,980 | 9,812 | (7,832) | (79.8) | Impact of year-on-year decreased in structured deposits due this year |

| Cash received from returns on investments | 13,969 | 10,134 | 3,835 | 37.8 | Increase in dividends received from associates and joint ventures |

| Net cash received from disposal of fixed assets, intangible assets and other long-term assets | 212 | 1,478 | (1,266) | (85.7) | Impact of disposal of fixed assets decreased year on year |

| Net cash received from disposal of subsidiaries and other business entities | 10,041 | 5,205 | 4,836 | 92.9 | Mainly due to cash consideration for equity transfer of Shanghai SECCO |

| Other cash received relating to investing activities | 103,157 | 38,208 | 64,949 | 170.0 | Increased time deposits with maturities of more than three months year-on-year |

| Net cash paid for the acquisition of subsidiaries and other business entities | (7,881) | (1,106) | (6,775) | 612.6 | Impact of payment on the purchase price of the acquisition happened previous year |

| Other cash paid relating to investing activities | (33,505) | (50,923) | 17,418 | (34.2) | Decrease in time deposits with maturities over more than three months year-on-year |

| Cash received from capital contributions | 3,946 | 1,001 | 2,945 | 294.2 | Increase in capital injection received from minority shareholders year-on-year |

| Cash received from borrowings | 564,417 | 356,459 | 207,958 | 58.3 | Increase in short-term financing bonds and bank loans year-on-year in order to supply liquidity and project funds |

| Cash repayments of borrowings | (514,275) | (338,232) | (176,043) | 52.0 | Due to the increase of matured borrowings |

| Cash paid for dividends, profits distribution or interest | (71,831) | (49,027) | (22,804) | 46.5 | Increase in dividends year-on-year in return for shareholders |

| Including: Subsidiaries’ cash payments for distribution of dividends or profits to minority shareholders | (5,249) | (8,068) | 2,819 | (34.9) | Impact of decrease in dividends paid by some subsidiaries year-on-year |

| 2 | FINANCIAL INFORMATION EXTRACTED FROM THE FINANCIAL STATEMENTS PREPARED IN ACCORDANCE WITH IFRS |

Unit: RMB million

| | For the year ended 31 December |

| Items | 2022 | 2021 | 2020 | 2019 | 2018 |

| Revenue | 3,318,168 | 2,740,884 | 2,104,724 | 2,957,868 | 2,879,192 |

| Operating profit | 75,835 | 94,628 | 13,669 | 86,516 | 82,884 |

| Profit before taxation | 94,400 | 109,169 | 48,615 | 90,161 | 99,658 |

| Profit attributable to shareholders of the Company | 66,153 | 71,975 | 33,443 | 57,517 | 61,920 |

| Basic earnings per share (RMB) | 0.547 | 0.594 | 0.276 | 0.475 | 0.511 |

| Diluted earnings per share (RMB) | 0.547 | 0.594 | 0.276 | 0.475 | 0.511 |

| Return on capital employed (%) | 8.66 | 11.29 | 6.22 | 8.94 | 9.21 |

| Return on net assets (%) | 8.43 | 9.30 | 4.48 | 7.73 | 8.57 |

| Net cash generated from operating activities per share (RMB) | 0.962 | 1.860 | 1.392 | 1.275 | 1.455 |

Unit: RMB million

| | As of 31 December |

| Items | 2022 | 2021 | 2020 | 2019 | 2018 |

| Non-current assets | 1,425,500 | 1,331,231 | 1,283,236 | 1,318,258 | 1,097,045 |

| Net current liabilities | 144,245 | 83,256 | 67,335 | 133,166 | 63,514 |

| Non-current liabilities | 345,017 | 332,901 | 328,199 | 303,014 | 170,803 |

| Non-controlling interests | 151,532 | 140,892 | 141,377 | 138,359 | 139,922 |

| Total equity attributable to shareholders of the Company | 784,706 | 774,182 | 746,325 | 743,719 | 722,806 |

| Net assets per share (RMB) | 6.545 | 6.394 | 6.164 | 6.143 | 5.970 |

| Adjusted net assets per share (RMB) | 6.307 | 6.225 | 5.954 | 5.993 | 5.787 |

| 3 | FOR MAJOR DIFFERENCES BETWEEN THE AUDITED FINANCIAL STATEMENTS PREPARED UNDER CASs AND IFRS, PLEASE REFER TO PAGE 204 OF THE REPORT. |

CHAIRMAN’S ADDRESS

Dear Shareholders and Friends:

First of all, on behalf of the board of directors, management and entire staff, I would like to express my sincere gratitude to our shareholders and all walks of life in the community for their caring and support for Sinopec Corp.

In 2022, the Company encountered complicated, fickle and severe conditions, including global economic slowdown, geopolitical conflicts and weak domestic market demand. We completely, accurately and comprehensively implemented new development concept, carried out the world’s leading development strategy, and made relentless efforts to stabilize operations and to expand market reach. Remarkable results were achieved in all aspects of work through our initiatives to drive innovation, business development and reform in conjunction with enhanced management and risk control. In accordance with IFRS, the Company’s turnover for the year was RMB3.32 trillion. Profit attributable to equity shareholders of the Company was RMB66.2 billion. The liability-to-asset ratio as of the end of the year was 51.95%. In view of the Company’s profitability, shareholder returns and sustainable development in the future, the board of directors recommended the distribution of a final dividend of RMB0.195 per share (tax included). Taking into account the interim dividend of RMB0.16 per share (tax included), the total dividend for the year was RMB0.355 per share (tax included), which, together with the amount of share repurchase during the year, resulted in a dividend payout ratio of 71% for 2022.

Over the past year, the Company’s corporate governance were further enhanced. With an aim of strengthening strategic planning, the board of directors reviewed and approved of the Company’s medium and long-term development plan. Our ADR were delisted in an orderly manner. Our debut share buyback program since our listing was well implemented to repurchase our A-shares and H-shares in order to advocate the Company’s fair valuation. All independent directors executed their duties and reviewed all resolutions with diligence. They carried out thematic site surveys on technology innovation and offered valuable suggestions for our reform and development. The Company revised a number of governance rules to reinforce the corporate governance. As the internal control system was further improved, its implementation turned more effective. Meanwhile, the Company maintained sound information disclosure and investor relations management. As a result, we have been awarded Grade A rating of information disclosure by the Shanghai Stock Exchange for nine consecutive years. We attached great importance to the incorporation of Party building into the corporate development, resulting in effective implementation of the decisions and strategies made by the board of directors.

Over the past year, significant progress was made in the Company’s high-quality development. As for the upstream business, we vigorously expanded the resource base and proactively increased our reserves and output. Major breakthroughs were made in the exploration of shale oil fields in East China and ultra-deep fields in West China. The domestic oil and gas reserve replacement ratio reached 165%. As for refining operation, we stepped up efforts in the development of competitive production facilities, steadily promoted adjustment to increase the yield of chemical feedstock and refining specialties. Development of the Zhenhai refining project, the Hainan ethylene project and the Gulei refining and chemical integrated complex progressed smoothly. The sales network of refined oil products was further optimized. We accelerated the transformation towards an integrated energy service provider of “petrol, gas, hydrogen, power and services”. New progress was made in the development of “Industrial Internet+” and the digital and smart transformation. At the same time, the Company promoted the development of hydrogen energy, photovoltaics, and battery charging and swapping businesses. The first CCUS project with capacity of 1 million tonnes in China was completed and put into operation. Sinopec Carbon Industry Technology Co., Ltd., the first company in China with complete value chain for carbon industry was established. Positive results were achieved in the promotion of transition to low-carbon energy development.

Over the past year, the Company’s production and operation were further improved. In the face of weak demand, the downward cycle of the chemical industry and dramatic fluctuations in product prices, we adhered to efficiency-centered, market-oriented approach and continuously improved the business operations. As for the upstream business, the Company strengthened cost control, and domestic oil and gas production hit a record high, achieving the best profit level since 2016. Regarding the refining business, we focused on trade, storage and transportation, and production coordination, closely monitored the market development to better coordinate resources, optimized operations, and reinforced the competitive edge of our industrial chain. As for the chemicals business, we optimized the structure of feedstocks, plants and products slates, promoting the integration of production, marketing, as well as research and application. The proportion of three high value-added synthetic material products steadily increased. Meanwhile, the quality and efficiency of the coal chemical operations were further improved. We gave full play to the integration advantages of refined oil marketing business, expanded the market reach with high-quality services. Non-fuel business maintained steady growth and its overall profitability realized a stable growth.

Over the past year, the Company’s science and technology innovation competitiveness continued to improve. We deepened the reform of science and technology mechanism to motivate the R&D team, stepped up the investment on R&D, pushed for breakthroughs in core technology development, and enhanced the frontier fundamental research. Significant achievements were made in technology innovation, along with new progress in the development of core technologies relating to the exploration and development of ultra-deep oil and gas reservoir, the geology and engineering integration of shale oil and gas fields, as well as specialty rubber products. In addition, major breakthroughs were made in a number of key technologies such as high-isotactic polybutene-1. The number of patents authorized both at home and abroad reached a new high during the year. The Company’s comprehensive patent advantages continued to rank at the forefront of state-owned enterprises. Our competence to support and lead scientific and technological innovation continued to improve.

Over the past year, our ESG efforts achieved solid results. The board of directors attached great importance to ESG, focused on incorporating ESG into strategic management, strengthened top-level design and the foundation of management, enhanced ESG communication and disclosure. As a result, the Company’s ESG performance has been acknowledged by the capital market. We actively responded to global climate change initiative by implementing the plan to achieve carbon peak by 2030, launched the campaign to prevent and control pollution, vigorously developed clean energy, and contributed our efforts to the construction of ecological civilization. Relentless efforts were made to safeguard the energy supply and to maintain the stability of the industrial and supply chains. The Company actively explored the model of assisting in rural revitalization, such as driving industrial development through sales, revitalized rural areas through industrial development, and promoted growth through education. We offered full-fledged support to Beijing Winter Olympics and the Winter Paralympics, pushed forward our charity programs such as the “Spring Blossom Filling Station Project”, and continued to promote the coordinated local development of economy, environment and the society in China and overseas so that the development results benefit more people.

At present, the instability and uncertainty of global environment are increasing significantly, leading to intensified market competition in the energy and chemical industry. But the fundamentals of the Chinese economy, characterized by strong resilience, enormous and long-term potential, sustainability, remain unchanged. The government prioritizes the task to resume and expand domestic consumption. Therefore, the Company is poised to benefit from valuable strategic opportunities for high-quality development. Setting off from a new development stage, Sinopec Corp. will initiate the high-quality development plan driven by the strategy of building a world-class enterprise, focusing on “excellent products, outstanding brands, leading innovation capability and advanced governance”. We will steadily promote the corporate upgrading from size expansion to strong competitiveness and then ascending to excellence, striving to achieve better quality, higher efficiency, greater competitiveness and influence.

In 2023, we will seize the favorable opportunity arising from steady development of domestic economy and the recovery of demand for petroleum and petrochemical products, insist on driving growth in a stable manner, and strive to achieve effective quality improvement in different businesses and reasonable volume growth. At the same time, we will accelerate the process of building ourselves towards a world-class enterprise, whereby leading the Company to a new stage of high-quality development. We will pay more attention to bringing the benefits of our integrated operation into full play, improving the business operations, and enhancing the synergies and efficiency resulted from our complete industrial chain. We will attach greater importance to business transition and upgrading, the promotion of digital transformation and intelligentization, strive to build green and low-carbon competitiveness, step up efforts to drive science and technology innovation and inspire the creativity from innovation, and accelerate the breakthroughs in core technologies in exploration and development, specialty oil products, chemical materials and new energy and other fields to enhance the driving force of science and technology innovation. We will pay more attention to the incorporation of ESG into our development strategy, deepen reform and improve governance, unleash the dynamism of our system and mechanism, consolidate our foundation, keep the risks under control and further enhance our corporate governance to a new level.

For the upstream business, we will focus on consolidating the resource base, make every effort to increase the reserves, stabilize oil output, boost gas production and reduce costs, and promote profitable exploration of crude oil and profitable production of natural gas, shift the refined oil products to chemical feedstock and refining specialities, expedite the production facility structure adjustments and the development of competitive production capacities. As for the chemicals business, we will adhere to the “basic + high-end” approach, strengthen the integrated management of production, marketing, research and application for high value-added products to enhance the product competitiveness, and cultivate the new advantage of high-quality development. For the marketing business, we will promote innovative business model, develop new energy terminals, and strive for new achievements in developing ourselves as a “petrol, gas, hydrogen, power and services” provider. The Company will continue to maintain a solid financial position, strengthen cash flow management, continuously optimize the capital structure, and improve the efficiency of capital fund utilization. In 2023, the Company’s planned capital expenditure will be RMB165.8 billion.

In the new year, we will strive for excellence and spare no effort to forge ourselves towards a world class enterprise. Relentless efforts will be made to write a new chapter of Sinopec’s high-quality development, whereby creating greater value for shareholders and the society.

Ma Yongsheng

Chairman

Beijing, China

24 March 2023

BUSINESS REVIEW AND PROSPECTS

BUSINESS REVIEW

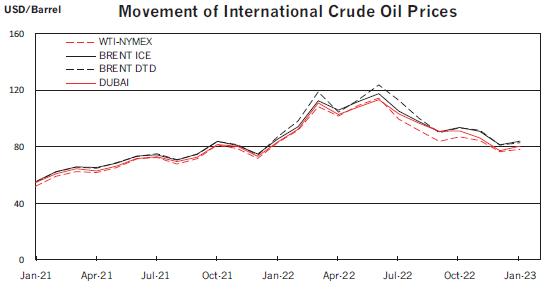

In 2022, global economy recorded slow growth and China registered a GDP growth of 3.0% year-on-year. International oil prices fluctuated widely, with a sharp rise in the first half and a remarkable drop in the second half. Affected by various factors, the domestic demand for natural gas, petrochemical products and oil products was weak.

Confronted with the severe and complex operating environment, the Company fully leveraged its integration advantages in coordinating all aspects of work, pressing ahead to stabilize operation, explore the market, develop through innovation, promote reform, strengthen management prevent risks and hold the bottom line, which helped yield high quality operating results.

| (1) | Crude Oil & Natural Gas |

In 2022, international crude oil prices fluctuated in a wide range, witnessing steep rise in the first half and sharp decline in the second half. The spot price of Platt’s Brent for the year averaged USD101.2 per barrel, up by 43.1% year on year. Based on the statistics of NDRC, the domestic apparent consumption of natural gas reached 366.3 billion cubic meters, down by 1.7% year on year.

In 2022, the domestic demand for refined oil products was weak. According to statistics released by NDRC, the domestic apparent consumption of refined oil products (including gasoline, diesel and kerosene) up by 0.9% from the previous year, with diesel up by 11.8%, gasoline down by 4.6% and kerosene down by 32.4%. Prices for domestic refined oil products were adjusted 23 times throughout the year with 13 increases and 10 decreases.

There was a contraction of domestic demand for chemicals in 2022. Based on our statistics, the domestic consumption of ethylene equivalent was down by 2.5% from the previous year, and the apparent consumption of synthetic fibre and synthetic rubber dropped by 2.8% and 3.2% respectively while that of synthetic resin kept flat. Domestic chemical product prices levelled off year on year.

| 2 | PRODUCTION & OPERATIONS REVIEW |

| (1) | Exploration and Production |

In 2022, the Company seized the favorable opportunity of high oil price, intensified efforts in high quality exploration and expanded the scale of profitable production capacity. Domestic oil and gas reserve replacement ratio amounted to 165% with domestic oil and gas equivalent production registering historical new high and profit reaching the best level in a decade. In terms of exploration, we focused on expanding resources, increasing reserve and obtaining more exploration licenses, launched the “Deep Earth” project, strengthened risk exploration and trap pre-exploration in new regions and areas, and achieved a number of oil and gas discoveries, including breakthroughs in Shunbei oil and gas in Tarim Basin, shale oil in Bohai Bay Basin and Subei Basin and shale gas in West and Southeast Sichuan. The Shengli Jiyang Shale Oil National Demonstration Zone progressed efficiently. In crude oil development, we accelerated the capacity building of major oilfields, such as Shunbei and Tahe, and strengthened fine-tuned development of mature oil fields. In natural gas development, we actively promoted the capacity building of key natural gas blocks in Shunbei Zone Two and continental facies gas in West Sichuan, scaled up mid-term and long-term LNG contracts, upgraded resources security and enhanced optimization, the profitability of whole natural gas business chain recorded a continuous growth. The Company’s production of oil and gas equivalent in 2022 was 488.99 million barrels, up by 1.9%, among which, domestic crude oil production totaled 250.79 million barrels, up by 0.5% and natural gas production reached 1,248.8 billion cubic feet, up by 4.1%.

Summary of Operations for the Exploration and Production Segment

| | | | | Change from |

| | 2022 | 2021 | 2020 | 2021 to 2022(%) |

| Oil and gas production (mmboe) | 488.99 | 479.74 | 459.02 | 1.9 |

| Crude oil production (mmbbls) | 280.86 | 279.76 | 280.22 | 0.4 |

| China | 250.79 | 249.60 | 249.52 | 0.5 |

| Overseas | 30.07 | 30.16 | 30.70 | (0.3) |

| Natural gas production (bcf) | 1,248.75 | 1,199.44 | 1,072.33 | 4.1 |

Summary of Reserves of Crude Oil and Natural Gas

| | Crude oil reserves (mmbbls) |

| Items | 31 December 2022 | 31 December 2021 |

| Proved reserves | 1,962 | 1,749 |

| Proved developed reserves | 1,766 | 1,578 |

| China | 1,489 | 1,291 |

| Consolidated companies | 1,489 | 1,291 |

| Shengli | 1,105 | 961 |

| Others | 384 | 330 |

| Overseas | 277 | 287 |

| Consolidated companies | 17 | 24 |

| Equity accounted entities | 260 | 263 |

| Proved undeveloped reserves | 196 | 171 |

| China | 153 | 125 |

| Consolidated companies | 153 | 125 |

| Shengli | 41 | 17 |

| Others | 112 | 108 |

| Overseas | 43 | 46 |

| Consolidated companies | 0 | 0 |

| Equity accounted entities | 43 | 46 |

| | Natural gas reserves (bcf) |

| Items | 31 December 2022 | 31 December 2021 |

| Proved reserves | 8,806 | 8,456 |

| Proved developed reserves | 7,138 | 6,740 |

| China | 7,135 | 6,734 |

| Consolidated companies | 7,135 | 6,734 |

| Puguang | 1,417 | 1,582 |

| Fuling | 1,632 | 1,529 |

| Others | 4,086 | 3,623 |

| Overseas | 3 | 6 |

| Consolidated companies | 0 | 0 |

| Equity accounted entities | 3 | 6 |

| Proved undeveloped reserves | 1,668 | 1,716 |

| China | 1,667 | 1,715 |

| Consolidated companies | 1,667 | 1,715 |

| Fuling | 99 | 99 |

| Others | 1,568 | 1,616 |

| Overseas | 1 | 1 |

| Consolidated companies | 0 | 0 |

| Equity accounted entities | 1 | 1 |

Exploration and Production Activities

| | Wells drilled (as of 31 December) |

| | 2022 | 2021 |

| | Exploratory | Development | Exploratory | Development |

| | Productive | Dry | Productive | Dry | Productive | Dry | Productive | Dry |

| China | 364 | 111 | 1,958 | 3 | 363 | 129 | 1,828 | 4 |

| Consolidated companies | 364 | 111 | 1,958 | 3 | 363 | 129 | 1,828 | 4 |

| Shengli | 159 | 48 | 1,029 | 2 | 170 | 58 | 944 | 2 |

| Others | 205 | 63 | 929 | 1 | 193 | 71 | 884 | 2 |

| Overseas | 5 | 1 | 200 | 0 | 2 | 1 | 114 | 0 |

| Consolidated companies | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 0 |

| Equity accounted entities | 5 | 1 | 200 | 0 | 2 | 1 | 112 | 0 |

| Total | 369 | 112 | 2158 | 3 | 365 | 130 | 1,942 | 4 |

| | Wells drilling (as of 31 December) |

| | 2022 | 2021 |

| | Gross | Net | Gross | Net |

| | Exploratory | Development | Exploratory | Development | Exploratory | Development | Exploratory | Development |

| China | 103 | 207 | 103 | 207 | 108 | 201 | 108 | 201 |

| Consolidated companies | 103 | 207 | 103 | 207 | 108 | 201 | 108 | 201 |

| Shengli | 29 | 61 | 29 | 61 | 33 | 55 | 33 | 55 |

| Others | 74 | 146 | 74 | 146 | 75 | 146 | 75 | 146 |

| Overseas | 0 | 2 | 0 | 1 | 0 | 123 | 0 | 62 |

| Consolidated companies | 0 | 0 | 0 | 0 | 0 | 3 | 0 | 1 |

| Equity accounted entities | 0 | 2 | 0 | 1 | 0 | 120 | 0 | 61 |

| Total | 103 | 209 | 103 | 208 | 108 | 324 | 108 | 263 |

| | Oil productive wells (as of 31 December) |

| | 2022 | 2021 |

| | Gross | Net | Gross | Net |

| China | 54,089 | 54,089 | 53,851 | 53,851 |

| Consolidated companies | 54,089 | 54,089 | 53,851 | 53,851 |

| Shengli | 35,171 | 35,171 | 34,991 | 34,991 |

| Others | 18,918 | 18,918 | 18,860 | 18,860 |

| Overseas | 5,460 | 2,313 | 5,534 | 2,372 |

| Consolidated companies | 30 | 11 | 30 | 11 |

| Equity accounted entities | 5,430 | 2,302 | 5,504 | 2,361 |

| Total | 59,549 | 56,402 | 59,385 | 56,223 |

| | Natural gas productive wells (as of 31 December) |

| | 2022 | 2021 |

| Region | Gross | Net | Gross | Net |

| China | 7,779 | 7,719 | 7,539 | 7,489 |

| Consolidated companies | 7,779 | 7,719 | 7,539 | 7,489 |

| Puguang | 82 | 82 | 79 | 79 |

| Fuling | 886 | 886 | 779 | 779 |

| Others | 6,811 | 6,751 | 6,681 | 6,631 |

| Total | 7,779 | 7,719 | 7,539 | 7,489 |

Unit: Square kilometers

| | Area under license (as of 31 December) |

| | 2022 | 2021 |

| Acreage with exploration licenses | 372,078 | 390,023 |

| China | 372,078 | 390,023 |

| Acreage with development licenses | 44,617 | 42,391 |

| China | 38,937 | 36,480 |

| Overseas | 5,680 | 5,911 |

In 2022, the Company actively addressed the challenges brought by the volatile fluctuation of crude oil price and slack market demand, strengthened coordination among procurement, storage and transportation as well as production, and focused on optimisation and integration of production and marketing. We enhanced global resources allocation and inventory management to reduce procurement cost. Closely following the market demand, we flexibly adjusted the utilisation rate, product mix and exports of refined oil products. Efforts were made to carry forward the adjustment to increase the yield of chemical feedstock and refining specialties, and to increase production of marketable products such as low-sulfur bunker fuel, base oil and needle coke etc. We accelerated the construction of world-class refining bases and advanced with structural adjustment projects in an orderly manner. We continued to increase high-purity hydrogen production capacity and have built up 9 hydrogen supply centers for hydrogen fuel cells. In 2022, the Company processed 242 million tonnes of crude oil and produced 140 million tonnes of refined oil products with diesel output up by 5.4% year on year.

| Summary of Operations for the Refining Segment | Unit: million tonnes |

| | | | | Change from |

| | 2022 | 2021 | 2020 | 2021 to 2022 (%) |

| Refinery throughput | 242.27 | 255.28 | 236.91 | (5.1) |

| Gasoline, diesel and kerosene production | 140.15 | 146.21 | 141.50 | (4.1) |

| Gasoline | 59.05 | 65.21 | 57.91 | (9.4) |

| Diesel | 63.09 | 59.85 | 63.21 | 5.4 |

| Kerosene | 18.01 | 21.15 | 20.38 | (14.8) |

| Light chemical feedstock production | 42.65 | 45.41 | 40.22 | (6.1) |

| Light product yield (%) | 74.06 | 73.83 | 74.34 | 0.23 percentage points |

| Refinery yield (%) | 94.96 | 94.65 | 94.77 | 0.31 percentage points |

Note: Includes 100% of the production from domestic joint ventures.

| (3) | Marketing and Distribution |

In 2022, facing the sluggish demand for refined oil products, the Company brought advantages in integrated business and distribution network into full play and expanded the market through high quality service. We reinforced market analysis and forecast, strengthened resources coordination and implemented targeted differentiation strategy. The sales volume of diesel rose by 8.6% and the retail volume of vehicle LNG up by 9.7% year on year. We vigorously expanded the low-sulfur bunker fuel market and further consolidated our market position. We rapidly developed online business and client satisfaction upgraded significantly. The quality and profitability for the non-fuel business were further boosted. We optimised the allocation of service stations and stepped up the construction of new energy service network. Our battery swapping stations, carbon-neutral service stations and oil product depots were put into operations, and the number of hydrogen refueling stations ranked No. 1 in the world, making continuous efforts for the transition to an integrated energy service provider of petrol, gas, hydrogen, power and services. Total sales volume of refined oil products for the year was 207 million tonnes, of which domestic sales volume accounted for 163 million tonnes.

Summary of Operations for the Marketing and Distribution Segment

| | | | | Change from |

| | 2022 | 2021 | 2020 | 2021 to 2022 (%) |

| Total sales volume of oil products (million tonnes)* | 206.74 | 220.79 | 217.91 | (6.4) |

| Total domestic sales volume of oil products (million tonnes) | 162.55 | 171.31 | 167.99 | (5.1) |

| Retail sales (million tonnes) | 106.91 | 114.30 | 113.19 | (6.5) |

| Direct sales and distribution (million tonnes) | 55.65 | 57.01 | 54.80 | (2.4) |

| Annual average throughput per station (tonne/station) | 3,470 | 3,720 | 3,686 | (6.7) |

| | 31 December 2022 | 31 December 2021 | 31 December 2020 | Change from the end of the previous year to the end of the reporting period (%) |

| Total number of service stations under the Sinopec brand | 30,808 | 30,725 | 30,713 | 0.3 |

| Number of company-operated stations | 30,808 | 30,725 | 30,707 | 0.3 |

Note: The total sales volume of refined oil products includes the amount of refined oil marketing and trading sales volume.

In 2022, in the face of the downward business cycle and high costs for feedstock, the Company closely followed the market demand, optimised the structure of feedstock, facilities and products with a profit-driven orientation, maintained high utilisation rate in profitable facilities, and reduced products with no marginal contribution. We sped up construction of advantageous and advanced production capacities and shutting down of none competitive capacities. Integration of production, marketing, research and application was further cemented to develop high-end products and new materials and to increase production of high value-added products such as PV-grade EVA, metallocene polyolefin and polybutadiene rubber. The coal chemical business also witnessed improvement in both quality and efficiency. Annual ethylene production was 13.44 million tonnes. By strengthening strategic customer cooperation and tailor-made product service, the total chemical sales volume reached 81.65 million tonnes with all products sold, up by 0.1%.

Summary of Operations for the Chemicals Segment Unit: thousand tonnes

| | | | | Change from |

| | 2022 | 2021 | 2020 | 2021 to 2022 (%) |

| Ethylene | 13,437 | 13,380 | 12,060 | 0.4 |

| Synthetic resin | 18,544 | 18,999 | 17,370 | (2.4) |

| Synthetic rubber | 1,284 | 1,252 | 1,067 | 2.6 |

| Synthetic fiber monomer and polymer | 8,886 | 9,201 | 9,057 | (3.4) |

| Synthetic fiber | 1,112 | 1,357 | 1,313 | (18.1) |

Note: Includes 100% of the production of domestic joint ventures.

| (5) | Science and Technology Innovation |

In 2022, the Company continued increasing input in science and technology innovation, sought breakthroughs in key and core technologies, beefed up front-end basic research and further deepened the reform of the science and technology system and mechanism to enhance innovation in supporting and leading the business growth. In upstream, breakthroughs were made in the exploration and development theory for deep and ultra-deep oil and gas as well as shale oil and gas. In refining, we realized scaled-up test production and application for bio-jet fuel. In chemicals, the scaled-up production of large tow carbon fibre was achieved, and POE and polybutene-1 pilot units were commissioned in one shot with on-spec products. In addition, the wet oxidation process for sulfur-containing waste alkali fluid for mega ethylene crackers was industrialized. The complete set of software for online real-time optimization (RTO) of S-Zorb unit was put into operation successfully. In 2022, the Company filed 8,687 patent applications at home and abroad with 6,289 granted. The Company also won one gold award, one silver award and four excellent awards in China for patents.

In 2022, the Company spared no effort to promote the HSE management system with professional management further strengthened. The Company enhanced the employee health and public safety and security management, improved operation conditions and enhanced the safety equipment allocation, thus the occupational, physical and psychological health of employees were safeguarded both at home and abroad. We implemented the all-staff safety production responsibility mechanism and further advanced the three-year safety production harnessing campaign. Specific measures were taken to tackle safety risk especially for hazardous chemicals, outdated production units and oil & gas storage facilities.

In 2022, focusing on quality and return of investment, the Company continuously optimised its investment projects, with total capital expenditures of RMB189.1 billion. Capital expenditure for the exploration and production segment was RMB83.3 billion, mainly for crude oil production capacity construction of Shunbei, Tahe and Shengli offshore, natural gas capacity build-up of West Sichuan, Fuling and Weirong, the development and test of Shengli Jiyang National Demonstration Zone and the construction of oil and gas storage and transportation facilities. Capital expenditure for the refining segment was RMB22.9 billion, mainly for expansion of Zhenhai Refining and Chemical project, refining structural adjustment projects in Anqing and Yangzi and the construction of hydrogen supply centers. RMB19.1 billion was spent in the marketing and distribution segment, mainly for the development of integrated energy station network covering petrol, gas, hydrogen, power and service, renovation of the existing stations and non-fuel business. The chemical segment saw a capital expenditure of RMB58.6 billion, mainly for ethylene projects in Zhenhai, Sinopec-SK, Hainan, and Tianjin Nangang, aromatics projects in Jiujiang and Zhenhai, large tow carbon fibre project in Shanghai, PTA project in Yizheng, and caprolactam relocation project in Baling, etc. Capital expenditure for the corporate and others segment was RMB5.2 billion, mainly for R&D facilities and information technology application projects.

BUSINESS OUTLOOK

Looking ahead to 2023, China is expected to achieve an overall upturn in economic performance. Domestic demand for natural gas, refined products and chemicals is expected to grow rapidly. International crude oil price is expected to fluctuate at medium and high price level due to the impacts of changes in global supply and demand, geopolitics and inventory.

| 2 | Production and Operation |

In 2023, guided by the strategy of building a world-class enterprise, the Company will proactively lead the industry transition and development, enhance science and technology innovation, improve production and operation, deepen reform, polish the governance and corporate image, consolidate the foundation of safety, and put focuses on the following work.

E&P: The Company will strengthen exploration in strategic areas, and increase high-quality reserves; strengthen efficient development and stabilize oil production while increasing gas production and reducing costs. In crude development, we will focus on production capacity increase, depletion control, recoverable reserves addition and costs reduction, accelerate the building of production capacity in Jiyang and Tahe, and strengthen the fine-tuned development of mature fields. In natural gas development, we will accelerate the building of production capacity of marine-face gas fields in west Sichuan and the northern part of Hubei, and improve natural gas production efficiency and profitability; diversify natural gas sourcing channels, cultivate high-loyalty customers, and continue to upgrade the natural gas production, supply, storage and marketing system. The planned annual production of crude oil is 280.23 million barrels, of which 29.03 million barrels from overseas. Planned natural gas production is 1,291.8 billion cubic feet.

Refining: Oriented by efficiency and profitability, the Company will coordinate production and marketing, and accelerate the optimization and upgrading of the business. We will deepen the implementation of differentiated procurement strategies, dynamically optimize the allocation of crude oil resources and reduce procurement costs; improve facility utilization, flexibly adjust the yield of refined oil products and the diesel-to-gasoline ratio; carry forward the adjustment to increase the yield of chemical feedstock in an orderly and cost effective manner, promote the shifting from refined products to specialty products, such as lube oil and grease, needle coke and other special products, and enhance overall profitability; optimize the structure and volume of export products. For the whole year, the Company plans to process 250 million tonnes of crude oil and produce 146 million tonnes of refined oil products.

Marketing: The Company will give full play to its advantages in integrated business, strengthen digital empowerment and expand market share. We will improve the market monitoring system, dynamically optimize the pricing strategy, and continuously improve the retail volume and profits; accurately make plans for incremental network layout, enhance the network integrity and stability; consolidate and enhance the marketing advantages of the low-sulphur bunker fuel, and accelerate the expansion of overseas markets and end-user retail; strengthen the development of Sinopec-brand products, improve the non-fuel business in both operation and profitability; innovate the business model, accelerate the development of new energy stations, and strive to make greater breakthroughs in building the company into an integrated energy service provider with business covering “petrol, gas, hydrogen, power and non-fuel services”. The annual domestic sales volume of refined oil products is planned to be 175 million tonnes.

Chemicals: The Company will take active response to the trough of the chemical business cycle, press ahead with the “basic + high-end” strategy and cultivate new advantages of “cost + value-added + green and low-carbon”. We will continue to diversify feedstocks and enhance cost advantages; adjust the facility utilization and product slate in a timely manner with market demand as our guide; continue to increase efforts in developing new materials and high value-added products to enhance profitability; accelerate the layout and development of large ethylene projects and the upgrading of the aromatics chain to continuously enhance market competitiveness. At the same time, the Company will optimize its marketing strategy based on demand, vigorously promote market development and enhance product value by providing customers with integrated solutions. The annual ethylene production plan is 14 million tonnes.

Science and Technology Development: The Company will firmly implement the innovation-driven strategy, make every effort to make breakthroughs in core technologies and promote the reform of the science and technology system to accelerate its progress towards becoming a world-leading clean energy and chemical company. Specific focuses include technology breakthroughs in oil and gas exploration and production with the emphases on oil and gas reserves increase, oil production stabilization, gas production increase, cost reduction, and efficiency improvement; coordinated development of integration of refining and chemical technologies, refined oil products structure optimization, clean, efficient and low-carbon utilization of resources; key technology development and application for the adjustment to increase the yield of chemical feedstock and refining specialties and hydrogen energy. We will accelerate the core technological breakthroughs for chemical and material upgrading, as well as those for diverse and clean-process basic chemicals and high value-added synthetic materials production.

Capex: The capital expenditure plan for 2023 is RMB165.8 billion, of which RMB74.4 billion will be spent in the E&P segment, mainly on the crude production capacity building in Jiyang and Tahe, natural gas production capacity building in west Sichuan and oil and gas storage and transportation facilities; RMB22.7 billion will be spent in the refining segment, mainly on the Yangzi refining restructuring and the Zhenhai expansion project; RMB16.6 billion will be spent in the marketing and distribution segment, mainly for the development of the integrated energy station network, the renovation of the existing stations and non-fuel business; RMB46.6 billion will be spent in the chemical segment, mainly for the ethylene projects in Zhenhai, Hainan, Tianjin Nangang and Maoming, PTA project in Yizheng and the relocation of CPL project in Baling; RMB5.5 billion will be spent in corporate and others, mainly for R&D and IT.

MANAGEMENT’S DISCUSSION AND ANALYSIS

THE FOLLOWING DISCUSSION AND ANALYSIS SHOULD BE READ IN CONJUNCTION WITH THE COMPANY’S AUDITED FINANCIAL STATEMENTS AND THE ACCOMPANYING NOTES. PARTS OF THE FOLLOWING FINANCIAL DATA WERE ABSTRACTED FROM THE COMPANY’S AUDITED FINANCIAL STATEMENTS THAT HAVE BEEN PREPARED ACCORDING TO THE IFRS. THE PRICES IN THE FOLLOWING DISCUSSION DO NOT INCLUDE VALUE-ADDED TAX.

| 1 | CONSOLIDATED RESULTS OF OPERATIONS |

In 2022, the Company’s revenue was RMB3,318.2 billion, increased by 21.1% compared with that of 2021. That was mainly due to increased prices of petroleum and petrochemical products resulting from increase of international crude oil prices. The Company actively deepened optimisation of production, stabilised operation, expanded market, enhanced adjustment of feedstocks, products and facilities to actively respond to unfavorable factors of weak demand, and realised RMB75.8 billion operating profit, down by 19.9% year on year.

The following table sets forth the main revenue and expenses from the Company’s consolidated financial statements:

| | Year ended 31 December |

| | 2022 | 2021 | Change (%) |

| | RMB million | RMB million | |

| Revenue | 3,318,168 | 2,740,884 | 21.1 |

| Revenue from primary business | 3,257,356 | 2,679,500 | 21.6 |

| Other operating revenues | 60,812 | 61,384 | (0.9) |

| Operating expenses | (3,242,333) | (2,646,256) | 22.5 |

| Purchased crude oil, products and operating supplies and expenses | (2,684,756) | (2,076,665) | 29.3 |

| Selling, general and administrative expenses | (55,809) | (54,978) | 1.5 |

| Depreciation, depletion and amortisation | (109,906) | (115,680) | (5.0) |

| Exploration expenses, including dry holes | (10,591) | (12,382) | (14.5) |

| Personnel expenses | (103,585) | (103,492) | 0.1 |

| Taxes other than income tax | (263,991) | (259,032) | 1.9 |

| Impairment reversals/(losses) on trade and other receivables | 1,084 | (2,311) | – |

| Other operating income/(expenses), net | (14,779) | (21,716) | (31.9) |

| Operating profit | 75,835 | 94,628 | (19.9) |

| Net finance costs | (9,974) | (9,010) | 10.7 |

| Investment income and share of profits less losses from associates and joint ventures | 28,539 | 23,551 | 21.2 |

| Profit before taxation | 94,400 | 109,169 | (13.5) |

| Income tax expense | (18,757) | (23,318) | (19.6) |

| Profit for the year | 75,643 | 85,851 | (11.9) |

| Attributable to: | | | |

| Shareholders of the Company | 66,153 | 71,975 | (8.1) |

| Non-controlling interests | 9,490 | 13,876 | (31.6) |

In 2022, the Company’s revenue from primary business was RMB3,257.4 billion, representing an increase of 21.6% over 2021. This was mainly due to the increased price in petroleum and petrochemical products.

The following table sets forth the external sales volume, average realised prices and respective rates of change of the Company’s major products in 2022 and 2021:

| | | Average realised price |

| | Sales volume (thousand tonnes) | (RMB/tonne, RMB/thousand cubic meters) |

| | Year ended 31 December | Change (%) | Year ended 31 December | Change (%) |

| | 2022 | 2021 | | 2022 | 2021 | |

| Crude oil | 8,171 | 7,162 | 14.1 | 4,449 | 3,049 | 45.9 |

| Natural gas (million cubic meters) | 30,845 | 29,953 | 3.0 | 1,808 | 1,606 | 12.6 |

| Gasoline | 80,884 | 90,836 | (11.0) | 9,319 | 7,731 | 20.5 |

| Diesel | 81,657 | 78,335 | 4.2 | 7,738 | 5,891 | 31.4 |

| Kerosene | 17,361 | 21,270 | (18.4) | 6,545 | 3,772 | 73.5 |

| Basic chemical feedstock | 36,053 | 36,173 | (0.3) | 6,204 | 5,486 | 13.1 |

| Monomer and polymer for synthetic fibre | 7,412 | 6,955 | 6.6 | 6,116 | 6,537 | (6.4) |

| Synthetic resin | 17,471 | 17,923 | (2.5) | 8,272 | 8,325 | (0.6) |

| Synthetic fibre | 1,193 | 1,457 | (18.1) | 8,119 | 7,521 | 8.0 |

| Synthetic rubber | 1,364 | 1,286 | 6.1 | 11,363 | 11,099 | 2.4 |

| Chemical fertiliser | 779 | 976 | (20.2) | 3,015 | 2,807 | 7.4 |

Most crude oil and a small portion of natural gas produced by the Company were internally used for refining and chemical production, with the remaining sold to external customers. In 2022, the turnover from crude oil, natural gas and other upstream products sold externally amounted to RMB192.3 billion, representing an increase of 23.3% over 2021. The change was mainly due to increases in crude oil and natural gas prices and sales volume.

In 2022, petroleum products (mainly consisting of refined oil products and other refined petroleum products) sold by Refining Segment and Marketing and Distribution Segment achieved external sales revenues of RMB1,855.8 billion (accounting for 55.9% of the Company’s revenue), representing an increase of 20.9% over 2021, mainly due to the increase in prices of refined oil products, which effectively offset the impact of decrease in sales volume. The sales revenue of gasoline, diesel and kerosene was RMB1,499.3 billion, representing an increase of 20.5% over 2021, and accounting for 80.8% of the total sales revenue of petroleum products. Sales revenue of other refined petroleum products was RMB356.5 billion, representing an increase of 22.3% compared with that of 2021, accounting for 19.2% of the total sales revenue of petroleum products.

The Company’s external sales revenue of chemical products was RMB449.9 billion, representing an increase of 5.9% over 2021, accounting for 13.6% of the Company’s total revenue. This was mainly due to the increase in price of certain chemical products.

In 2022, the Company’s operating expenses was RMB3,242.3 billion, increased by 22.5% compared with that of 2021. The operating expenses mainly consisted of the following:

Purchased crude oil, products and operating supplies and expenses was RMB2,684.8 billion, representing an increase of 29.3% over the same period of 2021, accounting for 82.8% of the total operating expenses, of which:

Crude oil purchasing expenses was RMB999.7 billion, representing an increase of 45.0% over the same period of 2021. Crude oil purchased externally used for processing in 2022 was 201.98 million tonnes (excluding the volume processed for third parties), representing a decrease of 5.0% over the same period of 2021. The average cost of processing crude oil purchased externally was RMB4,950 per tonne, representing an increase by 52.6% over 2021.

The Company’s other purchasing expenses was RMB1,685.0 billion, representing an increase of 21.5% over the same period of 2021. This was mainly attributable to the increased prices in naphtha and other feedstocks and traded crude oil and refined oil products.

Selling, general and administrative expenses was RMB55.8 billion, representing an increase of 1.5% over 2021.

Depreciation, depletion and amortisation was RMB109.9 billion, representing a decrease of 5.0% over the same period of 2021. That was mainly because that the proved reserve increased resulting from the increase of international crude oil prices in 2021, thus the depletion ratio of oil and gas assets decreased, which led to the depreciation and depletion decreased by RMB7.6 billion.

Exploration expenses was RMB10.6 billion, representing a decrease of 14.5% compared with 2021. That was mainly due to optimised drilling in shale gas and other unconventional resources, improved exploration success rate to effectively decrease the expenses in dry holes.

Personnel expenses was RMB103.6 billion, representing an increase of 0.1% over 2021.

Taxes other than income tax was RMB264.0 billion, representing an increase of 1.9% over the same period of 2021. That was mainly because that the special oil gain levy increased by RMB12.3 billion resulting from the increased crude oil price, and the consumption tax decreased by RMB7.1 billion resulting from the decreased sales volume of domestic refined oil products in the refining segment.

Impairment reversals on trade and other receivables was RMB1.1 billion. The impairment losses on trade and other receivables decreased by RMB3.4 billion over the same period of 2021, which was mainly due to the reversed provision in the impairment of entrusted loans in 2022.

Other operating expenses, net was RMB14.8 billion, representing a decrease of 31.9% over the same period of 2021. That was mainly due to the decrease of impairment in long-term assets.

| (3) | Operating profit was RMB75.8 billion, representing a decrease of 19.9% over the same period of 2021. That was mainly due to weak domestic demand of domestic petroleum and petrochemical products, and decreased operating margin for domestic refining and chemicals under high crude oil price circumstance. |

| (4) | Profit before taxation was RMB94.4 billion, representing a decrease of 13.5% compared with 2021. |

| (5) | Income tax expense was RMB18.8 billion, representing a decrease of 19.6% year on year. That was mainly because the profit in 2022 decreased year on year. |

| (6) | Profit attributable to non-controlling shareholders was RMB9.5 billion, representing a decrease of RMB4.4 billion and 31.6% over the same period of 2021. |

| (7) | Profit attributable to shareholders of the Company was RMB66.2 billion, representing a year-on-year decrease of 8.1%. |

| 2 | RESULTS OF SEGMENT OPERATIONS |

The Company manages its operations through four business segments, namely exploration and production segment, refining segment, marketing and distribution segment and chemicals segment, and corporate and others. Unless otherwise specified, the inter-segment transactions have not been eliminated from financial data discussed in this section. In addition, the operating revenue data of each segment include other operating revenues.

The following table shows the operating revenues by each segment, the contribution of external sales and inter-segment sales as a percentage of operating revenues before elimination of inter-segment sales, and the contribution of external sales as a percentage of consolidated operating revenues (i.e. after elimination of inter-segment sales) for the periods indicated.

| | Operating revenues Year ended 31 December | As a percentage of consolidated operating revenue before elimination of inter-segment sales Year ended 31 December | As a percentage of consolidated operating revenue after elimination of inter-segment sales Year ended 31 December |

| | 2022 | 2021 | 2022 | 2021 | 2022 | 2021 |

| | RMB million | RMB million | (%) | (%) | (%) | (%) |

| Exploration and Production Segment | | | | | | |

| External sales* | 197,499 | 162,700 | 3.3 | 3.4 | 6.0 | 5.9 |

| Inter-segment sales | 121,912 | 87,298 | 2.1 | 1.8 | | |

| Operating revenues | 319,411 | 249,998 | 5.4 | 5.2 | | |

| Refining Segment | | | | | | |

| External sales* | 198,714 | 173,109 | 3.3 | 3.6 | 6.0 | 6.3 |

| Inter-segment sales | 1,376,425 | 1,212,455 | 23.3 | 24.9 | | |

| Operating revenues | 1,575,139 | 1,385,564 | 26.6 | 28.5 | | |

| Marketing and Distribution Segment | | | | | | |

| External sales* | 1,700,453 | 1,404,469 | 28.6 | 29.0 | 51.2 | 51.2 |

| Inter-segment sales | 13,421 | 7,075 | 0.2 | 0.1 | | |

| Operating revenues | 1,713,874 | 1,411,544 | 28.8 | 29.1 | | |

| Chemicals Segment | | | | | | |

| External sales* | 459,824 | 435,261 | 7.7 | 9.0 | 13.8 | 16.0 |

| Inter-segment sales | 80,328 | 70,242 | 1.4 | 1.4 | | |

| Operating revenues | 540,152 | 505,503 | 9.1 | 10.4 | | |

| Corporate and Others | | | | | | |

| External sales* | 761,678 | 565,345 | 12.8 | 11.7 | 23.0 | 20.6 |

| Inter-segment sales | 1,028,800 | 732,356 | 17.3 | 15.1 | | |

| Operating revenues | 1,790,478 | 1,297,701 | 30.1 | 26.8 | | |

| Operating revenue before elimination of inter-segment sales | 5,939,054 | 4,850,310 | 100.0 | 100.0 | | |

| Elimination of inter-segment sales | (2,620,886) | (2,109,426) | | | | |

| Revenue | 3,318,168 | 2,740,884 | | | 100.0 | 100.0 |

* Other operating revenues are included.

The following table sets forth the operating revenues, operating expenses and operating profit by each segment before elimination of the inter-segment transactions for the periods indicated, and the percentage change of 2022 compared to 2021.

| | Year ended 31 December |

| | 2022 | 2021 | Change |

| | RMB million | RMB million | (%) |

| Exploration and Production Segment | | | |

| Operating revenues | 319,411 | 249,998 | 27.8 |

| Operating expenses | 265,695 | 245,313 | 8.3 |

| Operating profit | 53,716 | 4,685 | 1,046.6 |

| Refining Segment | | | |

| Operating revenues | 1,575,139 | 1,385,564 | 13.7 |

| Operating expenses | 1,562,928 | 1,320,285 | 18.4 |

| Operating profit | 12,211 | 65,279 | (81.3) |

| Marketing and Distribution Segment | | | |

| Operating revenues | 1,713,874 | 1,411,544 | 21.4 |

| Operating expenses | 1,689,337 | 1,390,340 | 21.5 |

| Operating profit | 24,537 | 21,204 | 15.7 |

| Chemicals Segment | | | |

| Operating revenues | 540,152 | 505,503 | 6.9 |

| Operating expenses | 554,279 | 494,397 | 12.1 |

| Operating (loss)/profit | (14,127) | 11,106 | – |

| Corporate and Others | | | |

| Operating revenues | 1,790,478 | 1,297,701 | 38.0 |

| Operating expenses | 1,789,160 | 1,300,926 | 37.5 |

| Operating profit/(loss) | 1,318 | (3,225) | – |

| Elimination of inter-segment profit/(loss) | (1,820) | (4,421) | – |

| (1) | Exploration and Production Segment |

Most crude oil and a small portion of the natural gas produced by the exploration and production segment were used for the Company’s refining and chemical production. Most of the natural gas and a small portion of crude oil were sold externally to other customers.

In 2022, the operating revenues of this segment was RMB319.4 billion, representing an increase of 27.8% over 2021. This was mainly attributed to the increase of both realised price and the sales volume of crude oil and natural gas.

In 2022, the segment sold 34.28 million tonnes of crude oil, representing an increase of 0.6% over 2021. Natural gas sales volume was 31.9 billion cubic meters (bcm), representing an increase of 3.3% over 2021. Regasified LNG sales volume was 21.5 bcm, representing an increase of 12.5% over 2021. LNG sales volume was 1.42 million tonnes, representing a decrease of 77.0% over 2021, as a result of flexible adjustment of sales strategy and structure based on purchase prices and market conditions to reduce sales volume of products with lower margin. Average realised prices of crude oil, natural gas, regasified LNG, and LNG were RMB4,312 per tonne, RMB1,816 per thousand cubic meters, RMB3,535 per thousand cubic meters, and RMB5,710 per tonne, respectively, representing an increase of 47.1%, 13.1%, 66.8%, and 46.1% respectively over 2021.

In 2022, the operating expenses of this segment was RMB265.7 billion, representing an increase of 8.3% over 2021. That was mainly due to the reasons that: special oil income levy and resource tax increased by RMB15.3 billion year on year; Procurement cost of LNG increased by RMB12.3 billion year on year; Depreciation, depletion and amortisation decreased by RMB7.6 billion year on year, as a result of the decrease of depletion ratio; Exploration expense decreased by RMB1.8 billion year on year.

In 2022, the oil and gas lifting cost was RMB773.1 per tonne, representing a year on year decrease of 0.5%.

In 2022, the operating profit of the exploration and production segment was RMB53.7 billion, representing an increase of RMB49.0 billion and 1,046.6% over the same period of 2021, which was mainly attributable to the fact that the segment seized the opportunity of high crude oil prices, improved proved reserve and production volume of oil and gas, enhanced cost control, optimized the operation of natural gas value chain, and realised in a significant rise in profitability.

Business activities of the refining segment include purchasing crude oil from third parties and the exploration and production segment of the Company, as well as processing crude oil into refined petroleum products. Gasoline, diesel and kerosene were sold internally to the marketing and distribution segment of the Company; part of the chemical feedstock was sold internally to the chemicals segment of the Company; and other refined petroleum products were sold externally to both domestic and overseas customers.

In 2022, the operating revenues of this segment was RMB1,575.1 billion, representing an increase of 13.7% over 2021. This was mainly attributed to the increases in prices of gasoline, diesel, kerosene, naphtha, and refining by-products.

The following table sets forth the sales volumes, average realised prices and the respective changes of the Company’s major refined oil products

of the segment in 2022 and 2021.

| | Sales Volume (thousand tonnes) | Average realised price (RMB/tonne) |

| | Year ended 31 December | Year ended 31 December |

| | 2022 | 2021 | Change (%) | 2022 | 2021 | Change (%) |

| Gasoline | 57,562 | 63,827 | (9.8) | 8,967 | 7,208 | 24.4 |

| Diesel | 61,169 | 58,807 | 4.0 | 7,376 | 5,563 | 32.6 |

| Kerosene | 14,782 | 17,313 | (14.6) | 6,468 | 3,734 | 73.2 |

| Chemical feedstock | 41,470 | 45,234 | (8.3) | 5,016 | 3,989 | 25.8 |

| Other refined petroleum products | 65,945 | 68,783 | (4.1) | 4,553 | 5,061 | (10.0) |

In 2022, sales revenue of gasoline was RMB516.2 billion, representing an increase of 12.2% over 2021.

The sales revenue of diesel was RMB451.2 billion, representing an increase of 37.9% over 2021.

The sales revenue of kerosene was RMB95.6 billion, representing an increase of 47.9% over 2021.

The sales revenue of chemical feedstock was RMB208.0 billion, representing an increase of 15.3% over 2021.

The sales revenue of refined petroleum products other than gasoline, diesel, kerosene and chemical feedstock was RMB300.2 billion, representing a decrease of 13.8% over 2021.

In 2022, the segment’s operating expenses was RMB1,562.9 billion, representing an increase of 18.4% over 2021. This was mainly due to the rising procurement cost resulting from the international crude oil prices increase year on year.

In 2022, the average processing cost for crude oil was RMB4,962 per tonne, representing an increase of 49.0% over 2021. Total crude oil and other feedstock processed was 247.57 million tonnes (excluding volume processed for third parties), representing a decrease of 6.2% over 2021. The total cost of crude oil processed was RMB1,228.3 billion, representing an increase of 39.8% over 2021.

In 2022, refining margin was RMB344 per tonne, representing a decrease of RMB188 per tonne compared with that of the same period of 2021. This was mainly attributed to the decrease in domestic gasoline and diesel processing margin under high crude oil prices circumstance, and the significant increase in spread of imported crude and overseas freight and insurance cost year-on-year.

In 2022, the refining unit cash operating cost (defined as operating expenses less the processing cost of crude oil and refining feedstock, depreciation and amortisation, taxes other than income tax and other operating expenses, then divided by the throughput of crude oil and refining feedstock) was RMB223 per tonne, representing an increase of 4.6% over 2021, which was mainly attributed to the increase of unit fixed cost resulting from significant increase in the prices of fuels, as well as the decrease of processing volume.

In 2022, the operating profit of the segment totalled RMB12.2 billion, representing a decrease of RMB53.1 billion and 81.3% compared with that of 2021. This is mainly due to the sharp decrease in refining margin resulting from rising crude procurement cost, weak domestic oil products demand and decreased domestic gross margin of gasoline and diesel under high crude price circumstance.

| (3) | Marketing and Distribution Segment |

The business activities of the marketing and distribution segment include purchasing refined oil products from the refining segment and the third parties, conducting direct sales and wholesale to domestic customers and retailing, distributing oil products through the segment’s retail and distribution network as well as providing related services.

In 2022, the operating revenues of this segment was RMB1,713.9 billion, up by 21.4% year-on-year. This was mainly attributed to the increase in the sales prices of refined oil products. The sales revenues of gasoline totalled RMB754.4 billion, up by 7.4% year-on-year; the sales revenues of diesel were RMB633.9 billion, up by 37.0% year-on-year; the sales revenues of kerosene were RMB114.4 billion, up by 42.4% year-on-year.

The following table sets forth the sales volumes, average realised prices and respective percentage changes of the segment’s four major refined oil products in 2022 and 2021, including detailed information about retail, direct sales and distribution of gasoline and diesel:

| | Sales volume (thousand tonnes) | Average realised price (RMB/tonne) |

| | Year ended 31 December | | Year ended 31 December | |

| | 2022 | 2021 | Change (%) | 2022 | 2021 | Change (%) |

| Gasoline | 80,957 | 90,873 | (10.9) | 9,318 | 7,730 | 20.5 |

| Retail | 56,989 | 64,325 | (11.4) | 9,938 | 8,223 | 20.9 |

| Direct sales and distribution | 23,968 | 26,548 | (9.7) | 7,845 | 6,537 | 20.0 |

| Diesel | 81,932 | 78,566 | 4.3 | 7,737 | 5,890 | 31.4 |

| Retail | 34,481 | 33,644 | 2.5 | 8,176 | 6,537 | 25.1 |

| Direct sales and distribution | 47,451 | 44,923 | 5.6 | 7,419 | 5,406 | 37.2 |

| Kerosene | 17,474 | 21,296 | (17.9) | 6,546 | 3,772 | 73.5 |

| Fuel oil | 26,162 | 25,847 | 1.2 | 4,817 | 3,437 | 40.1 |

In 2022, the operating expenses of the segment were RMB1,689.3 billion, up by RMB299.0 billion and 21.5% year-on-year. This was mainly due to the rising oil products procurement costs resulting from the increase of crude price.

In 2022, the segment’s marketing expense (defined as the operating expenses less the purchase costs, taxes other than income tax, depreciation and amortization, divided by sales volume) was RMB208.6 per tonne, up by 5.5% year on year. This was mainly due to the increase of unit fixed cost resulting from the weak demand in domestic refined oil products and decreased operating volume.

In 2022, the operating revenues of non-fuel business was RMB38.1 billion, up by RMB2.7 billion year-on-year and the profit of non-fuel business was RMB4.3 billion, up by RMB0.2 billion.

In 2022, facing the challenge of weak domestic demand in the refined oil market, the segment brought integrated and network advantages into full play, coordinated internal and external resources, enhanced the effort in expanding market, and realised an operating profit of RMB24.5 billion, representing an increase of 15.7% year on year.

The business activities of the chemicals segment include purchasing chemical feedstock from the refining segment and the third parties and producing, marketing and distributing petrochemical and inorganic chemical products.

In 2022, the operating revenues of this segment was RMB540.2 billion, up by 6.9% year-on-year. This was mainly due to the increase in prices of basic organic chemicals, synthetic fibers, synthetic rubber year on year.

In 2022, the sales revenue generated by the segment’s six major categories of chemical products (namely basic organic chemicals, synthetic resin, synthetic fiber monomer and polymer, synthetic fibre, synthetic rubber, and chemical fertiliser) was RMB509.1 billion, up by 6.4% year-on-year, accounting for 94.2% of the operating revenues of the segment.

The following table sets forth the sales volume, average realised prices and respective changes of each of the segment’s six categories of chemical products in 2022 and 2021.

| | Sales Volume (Thousand tonnes) | Average realised price (RMB/tonne) |

| | Year ended 31 December | | Year ended 31 December | |

| | 2022 | 2021 | Change (%) | 2022 | 2021 | Change (%) |

| Basic organic chemicals | 46,972 | 48,059 | (2.3) | 6,192 | 5,311 | 16.6 |

| Synthetic fibre monomer and polymer | 7,496 | 7,010 | 6.9 | 6,140 | 6,580 | (6.7) |

| Synthetic resin | 17,475 | 17,924 | (2.5) | 8,272 | 8,325 | (0.6) |

| Synthetic fibre | 1,193 | 1,457 | (18.1) | 8,122 | 7,521 | 8.0 |

| Synthetic rubber | 1,367 | 1,289 | 6.0 | 11,369 | 11,104 | 2.4 |

| Chemical fertiliser | 812 | 981 | (17.2) | 2,988 | 2,797 | 6.9 |

In 2022, the operating expenses of the chemicals segment was RMB554.3 billion, representing an increase of 12.1% over 2021, mainly because of the price increase of naphtha and other chemical feedstock and fuels.

In 2022, impacted by weak demand in chemical products and increased feedstock prices, chemical margin slumped. The operating loss of this segment was RMB14.1 billion, representing a decrease of profit of RMB25.2 billion over 2021.