Our consolidated statements of operations data for the years ended December 31, 2004, 2005 and 2006 are set forth below:

Our historical operating results as a percentage of net revenues for the years ended December 31, 2004, 2005 and 2006 are set forth below:

Year Ended December 31, 2006 compared to Year Ended December 31, 2005

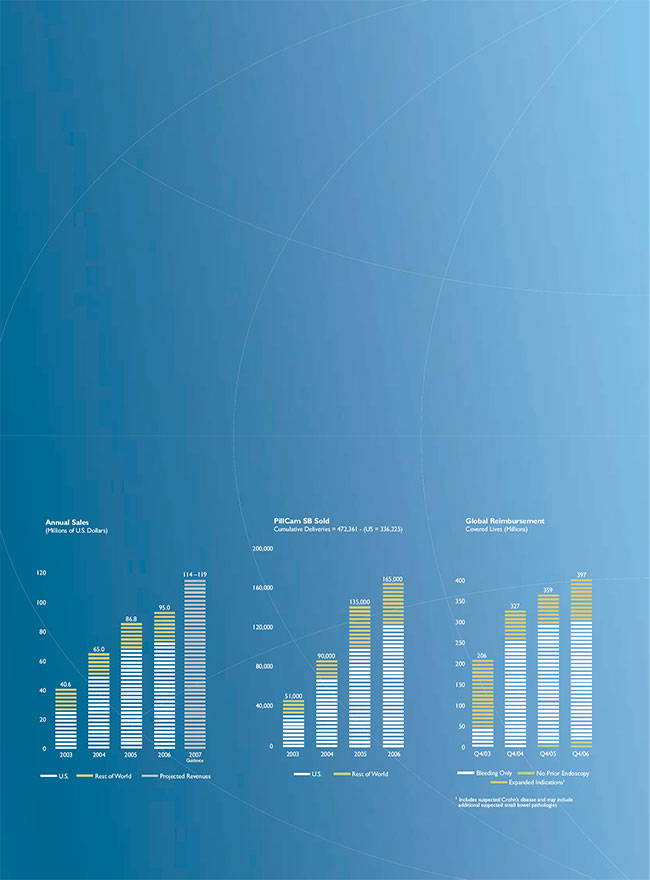

Revenues. Revenues increased by $8.2 million, or 9.5%, to $95.0 million in 2005 from $86.8 million in 2005. This increase was primarily due to an increase of $13.8 million, or 22.1%, in sales of our PillCam SB capsule and an increase of $0.8 million in service contract revenues. Approximately 97% of the $13.8 million increase in sales of the PillCam SB capsule was attributable to increases in number of capsules sold, and approximately 3% was attributable to the higher average selling price of capsules compared to 2005. The increase in service contract revenues was attributable mainly to the increased number of maintenance agreements in the United States. These increases were partially offset by a decrease of $3.6 million, or 22.5%, in revenues from sales of capital equipment, namely workstation and data recorder, and by a decrease of $3.0 million in revenues from our PillCam ESO capsules. Approximately 52% of the decrease in revenues from capital equipment sales is attributable to lower quantities and 48% of the decrease is attributable to lower average selling price. We sold a smaller number of capital equipment items primarily because a majority of gastroenterologists in the United States already have access to a capsule endoscopy system. The lower selling price is mainly due to promotional activities during the year and an increase of second systems sold to existing customers, which were sold at a significant discount.

Cost of revenues and gross margins.Cost of revenues increased to $24.2 million in 2006 compared to $22.1 million in 2005, while gross margins remained at 74.6% in 2006, similar to 2005. The increase in cost of revenues was mainly due to an increase of $1.4 million in consumption of raw materials, an increase of $0.3 million in labor expenses and an increase of $0.6 in other manufacturing costs. The increase was slightly offset by a decrease of $0.2 million in royalties payable to the Office of the Chief Scientist.

Research and development.Gross research and development expenses increased by $3.9 million, or 43.5%, to $12.7 million in 2006 from $8.8 million in 2005. This increase was due mainly to a $1.4 million increase in labor expenses, $0.6 million of stock-options compensation expenses as a result of the adoption of FAS 123R, an increase of $0.6 million in investments in R&D projects, an increase of $0.7 million in investments in clinical trials and an increase of $0.5 million in other expenses.

Research and development expenses, net of grants received from the office of the Israeli Chief Scientist, totaled $10.8 million in 2006, compared to $7.6 million in 2005. Grants totaling $1.9 million were received in 2006 compared to $1.2 million received in 2005. In both years, the grants were received for new products under development.

Sales and marketing.Sales and marketing expenses increased by $7.4 million, or 28.6%, to $50.7 million in 2006 from $43.3 million in 2005. This increase consisted primarily of an increase of $6.1 million in employment-related expenses due to increased number of sales and marketing employees, mainly in the United States, an additional $1.8 million of stock options-related compensation expenses as a result of the adoption of FAS 123R, an increase of $1.0 million in expenses related to our participation in trade shows and other marketing events, an increase of $0.5 million in clinical and regulatory activities in Japan and an increase of $0.8 in travel expenses. These increases were offset by a decrease of $1.5 million in commissions to Ethicon Endo-Surgery for sales of our PillCam ESO capsule and ancillary products, and a decrease of $1.3 million in the provision for uncollectible sales tax at our U.S. subsidiary of 2005.

General and administrative.General and administrative expenses increased by $6.3 million, or 66.0%, to $16.0 million in 2006 from $9.7 million in 2005. This increase was primarily due to an expense of $2.8 million resulting from additional stock-options compensation expense following the adoption of FAS 123R, an increase of $2.3 million in salaries and fringe benefits, resulting mainly from turnover in management, an increase of $0.7 million in legal and other professional expenses and an increase of $0.5 million in investments in information systems.

Financing income, net.Financing income, net, increased by $3.2 million to $4.0 million in 2006 from $0.8 million in 2005. The increase was due mainly to a change in our investment policy. Financing income in 2006 was generated from interest income of $1.6 million from short-term deposits, income of $1.8 million from marketable securities and $0.8 million of exchange gains, offset by bank expenses of $0.3 million.

19

Taxes on income.We had a tax expense of $0.1 million in 2006 compared to a tax benefit of $0.3 million in 2005.

Minority share in losses of subsidiary.Minority share in losses of a subsidiary, Given Imaging K.K., was $1.3 million in 2006 compared to $1.1 million in 2005. Given Imaging K.K. did not generate any significant revenues in 2005 and 2006 because at that time the Given System had not yet been approved for marketing by the relevant regulatory authority in Japan.

Year Ended December 31, 2005 compared to Year Ended December 31, 2004

Revenues. Revenues increased by $21.8 million, or 33.5%, to $86.8 million in 2005 from $65.0 million in 2004. This increase was primarily due to an increase of $20.9 million, or 50.2%, in PillCam SB capsule sales, an increase of $2.6 million in PillCam ESO sales and an increase of $0.4 million in service contract revenues. We estimate that all of the increase in revenues from sales of the PillCam SB capsule was attributable to increases in the number of capsules sold. In addition, we estimate that 83% of the $2.6 million increase in sales of the PillCam ESO capsule was attributable to increases in product sales and approximately 17% was attributable to the higher average selling price of the PillCam ESO capsules compared to 2004. These increases were partially offset by a decrease of $2.1 million, or 10.7%, in workstation and data recorder sales. We estimate that approximately 19% of the decrease was attributable to lower product sales, and 81% of the decrease was attributable to lower average selling prices resulting mainly from promotional activities during the year and an increase of second systems sold to existing customers, which were sold at a significantly lower price. These increases in sales of PillCam capsules were also partially offset by a reduction of approximately $0.1 million, or 0.7%, in selling prices resulting from changes in exchange rates between the U.S. dollar and other currencies.

Cost of revenues and gross margin.Cost of revenues increased to $22.1 million in 2005 compared to $17.7 million in 2004, but was lower in 2005 as a percentage of total revenues than in 2004. Consequently, gross margins were 74.6% in 2005 compared to 72.7% in 2004. The improvement in gross margins is attributable mainly to our efforts to reduce manufacturing costs by using advanced and lower cost components, by implementing more efficiency measures in our manufacturing process, and by terminating our technical services agreement with Pemstar and the resulting reduction in the scope of manufacturing and technical services Pemstar provides us and our payments for these services. The increase in quantities of capsules manufactured and sold during the year had an additional positive effect on gross margins. The improvement in gross margins was partially offset by an increase of $0.7 million in royalties payable to the Office of the Chief Scientist, or OCS, and an increase of $1.0 million related to manufacturing expenses, including depreciation.

Research and development.Gross research and development expenses increased by $1.4 million, or 20.0%, to $8.8 million in 2005 from $7.4 million in 2004. This increase was due mainly to a $0.5 million increase related to additional personnel and employee-related expenses, an increase of $0.5 million in investments in R&D projects and to an increase of $0.4 million in expenses related to patent registration, maintenance and depreciation.

Research and development expenses, net of grants received from OCS, totaled $7.6 million in 2005, compared to $6.2 million in 2004. Grants totaling $1.2 million were received in 2005 compared to $1.1 million received in 2004. In both years, the grants were received for new products under development.

Sales and marketing.Sales and marketing expenses increased by $9.6 million, or 28.6%, to $43.3 million in 2005 from $33.7 million in 2004. This increase, which was consistent with our growth in revenues, consisted primarily of an increase of $4.0 million related to the hiring of additional personnel, increase in salaries and other employment-related expenses, mainly in the United States, the initial payment of $2.2 million in commissions to Ethicon Endo-Surgery for sales of our PillCam ESO capsule and ancillary products, an increase of $0.3 million due to participation in trade shows and other marketing events, an increase of $0.6 million due to clinical and regulatory activities in Japan of our Japanese subsidiary, Given Imaging K.K., an increase of $0.4 in legal and accounting expenses of our U.S. subsidiary, an increase of $0.7 million in payments to outside service providers

20

at our subsidiaries and a $1.8 million provision, before tax effect, for uncollectible sales tax at our U.S. subsidiary.

General and administrative.General and administrative expenses increased by $2.8 million, or 39.6%, to $9.7 million in 2005 from $6.9 million in 2004. This increase was primarily due to an increase of $0.7 million in legal and other professional expenses related to the investigation of our failure to collect and remit sales tax in the United States and the implementation of remedial measures, as more fully described under Item 15 below, an increase of $0.7 million in salaries and fringe benefits, resulting mainly from turnover in management, and an increase of $0.6 million in investments in information systems. Other general and administrative expenses increased by $0.8 million.

Financing income, net.Financing income, net, decreased by $0.2 million, or 20.3% to $0.8 million in 2005 from $1.0 million in 2004. Financing income in 2005 was generated from interest income of $2.4 million from short-term deposits and from marketable securities, offset by currency translation losses of $0.8 million, interest on sales tax of $0.5 million and bank expenses of $0.2 million.

Taxes on income.We had a tax benefit of $0.3 million in 2005 compared to a tax benefit of $0.7 million in 2004.

Minority share in losses of subsidiary.Minority share in losses of a subsidiary, Given Imaging K.K, was $1.1 million in 2005 compared to $0.7 million in 2004. Given Imaging K.K. did not generate any significant revenues in 2005 because at that time the Given System had not yet been approved for marketing by the relevant regulatory authority in Japan.

Quarterly Results of Operations

We believe that some of our customers delay purchasing until the end of the fiscal quarter because they believe this will enable them to negotiate more favorable terms. Therefore, a significant portion of our revenues is frequently concentrated at the end of each fiscal quarter making it difficult for us to determine the revenues for each quarter until its end and resulting in lower than expected quarterly revenues if external or other events cause a large number of potential customers to defer their purchasing decisions even for a short period of time. In addition, we believe that demand for systems and capsules is affected by seasonal factors during the summer months when physicians and administrators are more likely to postpone purchasing decisions relating to the Given System due to summer vacations, and patients are more likely to postpone less urgent diagnostic procedures until later in the year. We believe that the seasonal effect in the third quarter may become more pronounced assuming the portion of our revenues derived from reorders continues to grow.

21

The tables below set forth unaudited consolidated statement of operations data for each of the eight consecutive quarters ended December 31, 2006. In management’s opinion, the unaudited consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements contained elsewhere in this Form 20-F and include all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of such financial information.

| | Three months ended | |

| | March 31, | | | June 30, | | | Sept. 30, | | | Dec. 31, | | | March 31, | | | June 30, | | | Sept. 30, | | | Dec. 31, | |

| | 2005 | | | 2005 | | | 2005 | | | 2005 | | | 2006 | | | 2006 | | | 2006 | | | 2006 | |

| | | | | | | | | | | | | | (In thousands) | | | | | | | | | | | | | |

| Revenue | $ | 22,009 | | | $ | 20,526 | | | $ | 19,841 | | | $ | 24,400 | | | $ | 20,268 | | | $ | 23,239 | | | $ | 24,050 | | | $ | 27,472 | |

| Cost of revenues | | (6,401 | ) | | | (5,051 | ) | | | (4,618 | ) | | | (6,000 | ) | | | (5,140 | ) | | | (5,771 | ) | | | (6,058 | ) | | | (7,185 | ) |

| Gross profit | | 15,608 | | | | 15,475 | | | | 15,223 | | | | 18,400 | | | | 15,128 | | | | 17,468 | | | | 17,992 | | | | 20,287 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Research and | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| development, net. | | (1,903 | ) | | | (1,617 | ) | | | (1,687 | ) | | | (2,382 | ) | | | (3,046 | ) | | | (2,735 | ) | | | (2,306 | ) | | | (2,724 | ) |

| Sales and marketing | | (10,812 | ) | | | (11,637 | ) | | | (9,778 | ) | | | (11,054 | ) | | | (12,693 | ) | | | (13,191 | ) | | | (11,239 | ) | | | (13,609 | ) |

| General and | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| administrative | | (2,039 | ) | | | (2,435 | ) | | | (2,539 | ) | | | (2,644 | ) | | | (3,726 | ) | | | (4,118 | ) | | | (4,410 | ) | | | (3,773 | ) |

| Total operating expenses | | (14,754 | ) | | | (15,689 | ) | | | (14,004 | ) | | | (16,080 | ) | | | (19,465 | ) | | | (20,044 | ) | | | (17,955 | ) | | | (20,106 | ) |

| Operating profit (loss) | | 854 | | | | (214 | ) | | | 1,219 | | | | 2,320 | | | | (4,337 | ) | | | (2,576 | ) | | | 37 | | | | 181 | |

| Financing income (expenses), | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| net | | 51 | | | | (415 | ) | | | 519 | | | | 607 | | | | 959 | | | | 1,418 | | | | 581 | | | | 1,022 | |

| Taxes on income. | | 74 | | | | (16 | ) | | | (53 | ) | | | 281 | | | | 271 | | | | (45 | ) | | | (254 | ) | | | (99 | ) |

| Minority share in losses of | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| subsidiary | | 269 | | | | 281 | | | | 253 | | | | 313 | | | | 61 | | | | 539 | | | | 377 | | | | 357 | |

| Net profit (loss) | $ | 1,248 | | | $ | (364 | ) | | $ | 1,938 | | | $ | 3,521 | | | $ | (3,046 | ) | | $ | (664 | ) | | $ | 741 | | | $ | 1,461 | |

Impact of Currency Fluctuations

Currency Risk.Our sales to our customers in 2006 were denominated 73% in U.S. dollars, 22% in Euros and 5% in other currencies, depending on the location of the customer or the distributor used to fulfill our customers’ orders. In 2006, 25% of our expenses, principally salaries and related personnel expenses were denominated in Shekels, and we expect this level of Shekel expenses to continue for the foreseeable future. During 2006 the U.S. dollar weakened against the Shekel by 8.2%. In addition, 58% of our expenses were denominated in U.S. dollars, 12% were denominated in Euros and 5% were denominated in Yen or other currencies. If the value of a currency in which our revenues are denominated weakens against the value of a currency in which our expenses are denominated, there will be a negative impact on the profit margins for sales of our products. In addition, as of December 31, 2006, 42% of our cash and cash equivalents were denominated in currencies other than U.S. dollar and we are therefore subject to the risk of exchange rate fluctuations between the U.S. dollar, Yen, the Shekel, the Australian dollar and the Euro. In 2006, we have used different hedging tools in order to minimize the effect of currency fluctuations on our income. If we wish to maintain the dollar-denominated value of our product in non-U.S. markets, devaluation in the local currencies of our customers relative to the U.S. dollar could cause our customers to cancel or decrease orders or default on payment.

B. LIQUIDITY AND CAPITAL RESOURCES

From our inception through December 31, 2006, we raised a total of $151 million through public and private sales of our equity securities. As of December 31, 2006, we had $44.5 million in cash and cash equivalents and an additional amount of $52 million invested in marketable securities. Our working capital, which we calculate by subtracting our current liabilities from our current assets, was $79 million.

We believe that our cash reserves and expected cash from operations will be sufficient to meet our anticipated cash needs for working capital and capital expenditures in 2007. We have also applied to the Office of Chief Scientist for a grant to support our research and development activities in 2007.

22

The following table sets forth the components of our cash flows for the periods indicated:

| | | Year ended December 31, | |

| | | 2004 | | | 2005 | | | 2006 | |

| | | (In thousands) | |

| Net cash provided by operating activities | | $ | 11,868 | | | $ | 13,488 | | | $ | 2,861 | |

| Net cash used in investing activities | | | (3,230 | ) | | | (29,883 | )(1) | | | (30,757 | )(1) |

| Net cash provided by financing activities | | | 46,816 | | | | 1,069 | | | | 6,795 | |

| Effect of exchange rate changes on cash | | | 40 | | | | (179 | ) | | | 255 | |

| Increase (decease) in cash and cash equivalents | | $ | 55,494 | | | $ | (15,505 | ) | | $ | (20,846 | ) |

_____________

|

| (1) | Includes $21.9 million net invested in marketable securities in 2005 and $24.9 million net in 2006. |

Net cash provided by operating activities was $2.9 million in 2006, compared to $13.5 million in 2005 and $11.9 million in 2004. The decrease in net cash in 2006 resulted primarily from a reduction of $2.6 million in net income (excluding compensation expenses which do not have an effect on cash flow) to $3.7 million, compared to a net income of $6.3 million in 2005, an increase of $2.0 million in inventories, a net increase in trading securities of $5.1 million and a decrease of $4.8 in accounts receivable due to $5.0 million received in 2006 from Ethicon Endo - Surgery for the milestone achieved in 2005 under our agreement with Ethicon. The increase in net cash in 2005 resulted primarily from net income of $6.3 million, a $3.4 million improvement compared to the $2.9 million net income in 2004, and an increase of $2.4 million in inventories and of $5.8 in accounts payable due to increased sales and operating expenses during the year. The increase in net cash provided by operations in 2005 was partially offset by an increase of $6.1 million in our accounts receivable due to increased sales and a longer collection cycle in the United States due to our efforts to correct our errors in sales tax collection and an increase of $5.0 million in other accounts receivable due to accounting for the milestone achieved in 2005 but payable by Ethicon Endo-Surgery on or before April 1, 2006.

Net cash used in investing activities was $30.8 million in 2006 compared to $29.9 million in 2005 and $3.2 million in 2004. Investing activities in 2006 consisted primarily of investing $24.9 million in marketable securities and $5.9 million in capital expenditures and the capitalization of costs associated with our patents and trademarks. Our capital expenditures in 2006 consisted primarily of $1.9 million in machinery and equipment, $0.5 million in new real property leases on our facilities, $1.3 million in computers and software, $0.4 million in office furniture and equipment and $1.2 million in patents. Our capital expenditures in 2005 consisted primarily of $2.3 million in machinery and equipment, $2.8 million in new real property leases on our facilities, $0.9 million in computers and software, $0.5 million in office furniture and equipment and $0.9 million in patents. Our capital expenditures in 2004 consisted primarily of $1.4 million in machinery and equipment, $0.3 million in a new real property lease on our facilities and $0.8 million in patents. We expect to continue investing significant amounts in 2007 in order to support our growth plans.

Net cash provided by financing activities was $6.8 million in 2006, compared to $1.1 million in 2005 and $46.8 million in 2004. In 2006, net cash provided by financing activities resulted primarily from proceeds of $2.0 million received from the exercise of employee stock options and an amount of $4.8 million representing a minority investment in our Japanese subsidiary, Given Imaging K.K. In 2005, net cash provided by financing activities resulted primarily from proceeds from the exercise of employee stock options. The high level of net cash from financing activities in 2004 was primarily attributable to the completion of our follow-on public equity offering in June 2004 in which we raised net proceeds of $44.3 million.

Market Risk

We invest our some of our excess cash in short-term bank accounts and deposits located with a number of banks inside and outside of Israel. These instruments have maturities of three months or less when acquired. Due to the short-term nature of these investments, we believe that there is no

23

material exposure to interest rate risk arising from our investments. We invest the majority of our excess cash in longer-term financial instruments in order to achieve a higher yield. Based on our investment policy, such instruments are highly rated by rating agencies and therefore we believe that there is no material exposure to the principal amount nor to interest rate risks arising from these longer-term investments.

Corporate Tax

Israeli companies were generally subject to income tax at the corporate rate of 31% in 2006. This tax rate has been reduced to 29% in 2007 and is expected to be gradually reduced to a rate of 25% by 2010 As of December 31, 2006, our net operating loss carry-forwards for Israeli tax purposes amounted to $13.9 million. Under Israeli law, net operating losses can be carried forward indefinitely and offset against certain future taxable income.

In addition, our investment program in equipment and leasehold improvements at our manufacturing facility in Yoqneam, Israel has been granted approved enterprise status and we are, therefore, eligible for tax benefits under the Law for the Encouragement of Capital Investments, 1959 (the “Investment Law”). Subject to compliance with applicable requirements, the portion of our undistributed income derived from our approved enterprise program will be exempt from corporate tax for a period of ten years commencing in the first year in which we generate taxable income. The ten-year period may not extend beyond the later of 14 years from the year in which approval was granted or 12 years from the year in which operations or production by the enterprise began. We received our approved enterprise status in 1999. According to a recent reform to the Investment Law, we are permitted to claim tax benefits in respect of future investments retroactively on our corporate tax returns instead of filing an application for tax benefits in advance with the Investment Center, the administrator of the Investment Law, and without prior approval and without submitting any reports to the Investment Center. Audits of any claim for tax benefits will take place by the Israeli income tax authority as part of the general tax audits it may perform from time to time. We cannot assure you that we will receive approvals in the future for approved enterprise status or that tax benefits for approved investments will continue at current levels or at all.

The period of tax benefits for our approved enterprise programs has not yet commenced because we are yet to realize taxable income. We expect that a substantial portion of the income we derive in the future will be from this approved enterprise program. These benefits should result in income recognized by us being tax exempt for a specified period after we begin to report taxable income and exhaust any net operating loss carry-forwards. These benefits may not be applied to reduce the tax rate for any income that is not derived from sales of our products manufactured at our facility in Yoqneam, Israel.

Our approved enterprise status imposes certain requirements on us, such as the location of our manufacturing facility, location of certain subcontractors and the extent to which we may outsource portions of our production process. These requirements limit our freedom to pursue production arrangements that may otherwise be more favorable to us if we want to maintain these tax benefits. Therefore, we may be required to weigh the possible loss of these benefits against other benefits from pursuing arrangements which are not, or which may not be considered by the relevant Israeli authorities to be, in compliance with these requirements. If we do not meet these requirements, the law permits the authorities to cancel the tax benefits retroactively.

As of December 31, 2006, the net operating loss carry-forwards of our subsidiaries for tax purposes amounted to $26.6 million. A subsidiary’s net operating loss carry-forwards for tax purposes relating to a jurisdiction are generally available to offset future taxable income of such subsidiary in that jurisdiction, subject to applicable expiration dates.

Government Grants

Our research and development efforts have been financed, in part, through grants from the Office of the Chief Scientist of the Israeli Ministry of Industry, Trade and Labor. We have received

24

approval for grants totaling $6.8 million from the Office of the Chief Scientist, including $1.9 million which was provided by the Office of Chief Scientist to support our 2006 research and development.

Under Israeli law, royalties on the revenues derived from sales of the Given System or any part of the Given System are payable to the Israeli government, generally at the rate of 3.0% during the first three years of sales and 3.5% beginning with the fourth year. The maximum aggregate royalties paid generally cannot exceed 100% of the grants made to us. The amount bears interest equal to the 12-month London Interbank Offered Rate (LIBOR) applicable to dollar deposits that is published on the first business day of each calendar year. Royalties are paid on our consolidated revenues. As of December 31, 2006, we paid a total of $2.5 million in royalties to the Office of the Chief Scientist, leaving our remaining royalty payment obligation at $4.3 million as of that date.

The government of Israel does not own proprietary rights in technology developed using its funding and there is no restriction on the export of products manufactured using the technology. The technology is, however, subject to other legal restrictions, including the obligation to manufacture the products based on this technology in Israel and to obtain the Office of the Chief Scientist’s consent to transfer the technology or product rights to a third party. These restrictions may impair our ability to outsource manufacturing or enter into similar arrangements for those products or technologies and these restrictions continue to apply even after we have paid the full amount of royalties payable for the grants. If the Office of the Chief Scientist consents to the manufacture of the products outside Israel, the regulations allow the Office of the Chief Scientist to require the payment of increased royalties, ranging from 120% to 300% of the amount of the grant plus interest, depending on the percentage of foreign manufacture. If the manufacturing is performed outside of Israel by us, the rate of royalties payable by us on revenues from the sale of products manufactured outside of Israel will increase by 1% over the regular rates. If the manufacturing is performed outside of Israel by a third party, the rate of royalties payable by us on those revenues will be a percentage equal to the percentage of our total investment in the Given System that was funded by grants. In response to our request, the Office of the Chief Scientist has approved the manufacture of limited quantities of the PillCam capsules using the back-up production line that we have installed at Pemstar’s facilities in Ireland without increasing royalty rates.

C. RESEARCH AND DEVELOPMENT

Our research and development expenditures, excluding grants received from the Office of the Chief Scientist, were $12.7 million for the year ended December 31, 2006, $8.8 million for the year ended December 31, 2005 and $7.4 million for the year ended December 31, 2004. Our research and development activities are conducted by our research and development and regulatory affairs staff primarily at our headquarters in Israel. As of December 31, 2006, our research and development, clinical and regulatory and engineering staff consisted of 78 employees. Our research and development efforts are focused primarily on developing new capsules to be used in the detection of abnormalities in the stomach and the colon, improvements to our existing products and new technologies for future expansion of our product offering. In 2006, we completed the development of the newest version of our AGILE Patency capsule and received FDA clearance to market this product in the United States in May 2006. In addition, we completed the development of RAPID Access and received FDA clearance for this product in May 2006. Finally, during 2006, we completed the development of the first generation PillCam COLON capsule for diagnosis of disorders in the colon and received the CE mark to market this product in Europe and submitted it for clearance by the FDA.

We view our innovation and focus on capsule endoscopy technology as an important competitive advantage and intend to continue our focus on research and development activities. During 2007, we intend to complete the development of and obtain regulatory clearance to several new or improved products. For example, we intend to introduce a new version of our RAPID software, RAPID 5.0, which is required for optimal performance of capsule endoscopy of the colon with our PillCam COLON capsule and new versions of our PillCam SB and PillCam ESO capsules, which we also expect will become commercially available in the second half of 2007.

25

In addition to our own research and development activities, we are involved in government-funded research programs. One important program is our leadership of a European consortium that will develop an integrated imaging and bio-sensing system to screen for cancer of the gastrointestinal (GI) tract. This “Nano-based capsule-Endoscopy with Molecular Imaging and Optical biopsy,”or NEMO project, began in December 2006.

In addition to Given Imaging, this consortium includes other European companies and institutions. The NEMO group will invest a total of 4.7 million over the next three years in this research, of which the European Commission will contribute2.8 million. Given Imaging’s expected gross and net contribution during this period is1.3 million and0.6 million, respectively.

The objective of the NEMO project is to increase patient compliance with currently recommended screening guidelines by developing an advanced cancer screening system that is patient-friendly, highly-sensitive and specific for early detection of cancer. To achieve this, NEMO will attempt to integrate optical technologies with Nano-technologies, bio-sensing and maneuvering technologies to create a unique PillCam capsule endoscope capable of secretion analysis and the detection of marked and deep tissue disorders. We believe that the combination of the image and molecular analysis to mark the tumor may provide a novel and effective medical device for mass screening of gastrointestinal cancer.

D. TREND INFORMATION

See discussion in Parts A and B of Item 5 “Operating Results and Financial Review and Prospects.”

E. OFF-BALANCE SHEET ARRANGEMENTS

N/A

F. CONTRACTUAL OBLIGATIONS

The following table of our material contractual obligations as of December 31, 2006, summarizes the aggregate effect that these obligations are expected to have on our cash flows in the periods indicated:

| | | Payments due by period |

| Contractual obligations | | Total | | 2007 | | 2008 | | 2009 | | 2010 | | Later Years |

| | | | | | | | | | (In thousands) | | | | | | |

| Capital leases(1) | | $ | 33 | | $ | 13 | | $ | 20 | | $ | — | | | | | | |

| Operating leases(2) | | | 15,212 | | | 2,884 | | | 2,432 | | | 1,880 | | | 1,439 | | | 6,577 |

| Purchasing Obligations | | | 15,138 | | | 3,808 | | | 2,329 | | | 2,250 | | | 2,250 | | | 4,500 |

| Total | | $ | 30,383 | | $ | 6,705 | | $ | 4,781 | | $ | 4,130 | | $ | 3,689 | | $ | 11,077 |

(1) Consists of capital leases for motor vehicles.

(2) Consists of operating leases for office and manufacturing space and motor vehicles.

See Note 8 to our consolidated financial statements included in this annual report for our royalty commitments to the Office of the Chief Scientist in Israel.

26

| Somekh Chalkin | Telephone | 972 3 684 8000 |

| KPMG Millennium Tower | Fax | 972 3 684 8444 |

| 17 Ha’arba’a Street, PO Box 609 | Internet | www.kpmg.co.iI |

| Tel Aviv 61006 Israel | | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Shareholders

Given Imaging Ltd.:

We have audited the accompanying consolidated balance sheets of Given Imaging Ltd. (the “Company”) and its subsidiaries as of December 31, 2006 and 2005, and the related consolidated statements of operations, changes in shareholders’ equity and cash flows for each of the years in the three year period ended December 31, 2006. These consolidated financial statements are the responsibility of the Company’s Board of Directors and of its management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statements presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company and its subsidiaries as of December 31, 2006 and 2005, and the consolidated results of their operations and their cash flows for each of the years in the three year period ended December 31, 2006, in conformity with U.S. generally accepted accounting principles.

As discussed in Note 1K to the consolidated financial statements, effective January 1, 2006, the Company has adopted Statement of Financial Accounting Standard No. 123 (revised 2004), “Share-Based Payment”.

| | Somekh Chaikin

Certified Public Accountants (Israel)

Member Firm of KPMG International |

Tel-Aviv, Israel

April 12, 2007

27

Given Imaging Ltd. and its Subsidiaries

Consolidated Balance Sheets

(In thousands except per share data)

| | | | | December 31 |

| | | Note | | 2005 | | 2006 |

| Assets | | | | | | | | |

| Current assets | | | | | | | | |

| Cash and cash equivalents | | 1D; 2 | | $ | 65,356 | | $ | 44,510 |

| Short-term investments | | 5 | | | 288 | | | 17,245 |

| Accounts receivable: | | | | | | | | |

| Trade, net | | 1E | | | 18,325 | | | 18,887 |

| Other | | 3 | | | 6,264 | | | 1,463 |

| Inventories | | 1F; 4 | | | 16,172 | | | 18,168 |

| Advances to suppliers | | | | | 332 | | | 82 |

| Deferred taxes. | | 1P; 14C | | | 1,219 | | | 1,374 |

| Prepaid expenses | | | | | 1,020 | | | 1,340 |

| Total current assets | | | | | 108,976 | | | 103,069 |

| Deposits | | | | | 401 | | | 469 |

| Assets held for employees’ severance payments | | 1G; 10 | | | 1,690 | | �� | 1,984 |

| Marketable securities | | 1H; 5 | | | 21,664 | | | 34,769 |

| Fixed assets, at cost, less accumulated depreciation | | 1I; 6 | | | 13,862 | | | 14,811 |

| Other assets, at cost, less accumulated amortization | | 1J; 7 | | | 2,517 | | | 3,075 |

| |

| Total Assets | | | | $ | 149,110 | | $ | 158,177 |

The accompanying notes are an integral part of these consolidated financial statements.

28

Given Imaging Ltd. and its Subsidiaries

Consolidated Balance Sheets

(In thousands except share data)

| | | | | | | December 31 | |

| | | Note | | | 2005 | | | 2006 | |

| Liabilities and shareholders’ equity | | | | | | | | | | | |

| Current liabilities | | | | | | | | | | | |

| Current installments of obligation under capital lease | | 8B | | | $ | 11 | | | $ | 13 | |

| Accounts payable: | | | | | | | | | | | |

| Trade | | | | | | 5,529 | | | | 5,550 | |

| Other | | 9 | | | | 13,886 | | | | 14,620 | |

| Deferred income | | 1N; 8C | | | | 3,333 | | | | 3,871 | |

| Total current liabilities | | | | | | 22,759 | | | | 24,054 | |

| |

| Long-term liabilities | | | | | | | | | | | |

| Deferred income | | 8C | | | | 22,172 | | | | 20,411 | |

| Obligation under capital lease. | | 8B | | | | 34 | | | | 20 | |

| Liability in respect of employees’ severance payments | | 10 | | | | 2,040 | | | | 2,407 | |

| Total long-term liabilities. | | | | | | 24,246 | | | | 22,838 | |

| Total liabilities | | | | | | 47,005 | | | | 46,892 | |

| |

| Commitments and contingencies. | | 8 | | | | | | | | | |

| Minority interest | | | | | | 61 | | | | 3,499 | |

| Shareholders’ equity | | | | | | | | | | | |

| Share capital: | | 11 | | | | | | | | | |

| Ordinary Shares, NIS 0.05 par value each (90,000,000 shares | | | | | | | | | | | |

| authorized as of December 31, 2005 and 2006, 27,950,281 and | | | | | | | | | | | |

| 28,641,291 shares issued and fully paid as of December 31, 2005 | | | | | | | | | | | |

| and 2006, respectively) | | | | | | 327 | | | | 335 | |

| Additional paid-in capital | | | | | | 148,955 | | | | 156,197 | |

| Capital reserve | | | | | | 2,166 | | | | 2,166 | |

| Accumulated deficit | | | | | | (49,404 | ) | | | (50,912 | ) |

| Total shareholders’ equity | | | | | | 102,044 | | | | 107,786 | |

| Total liabilities and shareholders’ equity | | | | | $ | 149,110 | | | $ | 158,177 | |

The accompanying notes are an integral part of these consolidated financial statements.

29

Given Imaging Ltd. and its Subsidiaries

Consolidated Statements of Operations

(In thousands except share and per share data)

| | | | | Year Ended December 31, | |

| | | Note | | 2004 | | | 2005 | | | 2006 | |

| |

| Revenues | | 1N; 12 | | $ | 65,020 | | | $ | 86,776 | | | $ | 95,029 | |

| Cost of revenues | | | | | 17,734 | | | | 22,070 | | | | 24,154 | |

| Gross profit | | | | | 47,286 | | | | 64,706 | | | | 70,875 | |

| Operating expenses | | | | | | | | | | | | | | |

| Research and development, gross | | 1Q | | | (7,363 | ) | | | (8,833 | ) | | | (12,678 | ) |

| Royalty bearing government grants | | 1O; 8A | | | 1,140 | | | | 1,244 | | | | 1,867 | |

| Research and development, net | | | | | (6,223 | ) | | | (7,589 | ) | | | (10,811 | ) |

| Sales and marketing | | | | | (33,652 | ) | | | (43,281 | ) | | | (50,732 | ) |

| General and administrative | | | | | (6,916 | ) | | | (9,657 | ) | | | (16,027 | ) |

| Total operating expenses | | | | | (46,791 | ) | | | (60,527 | ) | | | (77,570 | ) |

| Operating profit (loss) | | | | | 495 | | | | 4,179 | | | | (6,695 | ) |

| Financial income, net | | 13 | | | 956 | | | | 762 | | | | 3,980 | |

| Profit (loss) before taxes on income and minority | | | | | | | | | | | | | | |

| share | | | | | 1,451 | | | | 4,941 | | | | (2,715 | ) |

| Taxes on income | | 1P, 14 | | | 690 | | | | 286 | | | | (127 | ) |

| Profit (loss) before minority share | | | | | 2,141 | | | | 5,227 | | | | (2,842 | ) |

| Minority share in losses of subsidiary | | | | | 747 | | | | 1,116 | | | | 1,334 | |

| Net profit (loss) | | | | $ | 2,888 | | | $ | 6,343 | | | $ | (1,508 | ) |

| Profit (loss) per share | | | | | | | | | | | | | | |

| Basic profit (loss) per Ordinary Share | | 1L | | $ | 0.11 | | | $ | 0.23 | | | $ | (0.05 | ) |

| Diluted profit (loss) per Ordinary Share | | | | $ | 0.10 | | | $ | 0.21 | | | $ | (0.05 | ) |

| Weighted average number of Ordinary Shares | | | | | | | | | | | | | | |

| used to compute basic profit (loss) per | | | | | | | | | | | | | | |

| Ordinary Share | | 1L | | | 26,633,964 | | | | 27,781,223 | | | | 28,053,849 | |

| Weighted average number of Ordinary Shares | | | | | | | | | | | | | | |

| used to compute diluted profit (loss) per | | | | | | | | | | | | | | |

| Ordinary Share | | 1L | | | 29,353,448 | | | | 29,695,164 | | | | 28,053,849 | |

The accompanying notes are an integral part of these consolidated financial statements.

30

Given Imaging Ltd. and its Subsidiaries

Consolidated Statements of Changes in Shareholders’ Equity

(In thousands except share data)

| | | | | | | | Additional | | | | | | | | | | | | | |

| | | Ordinary shares | | Paid-In | | Capital | | Unearned | | Accumulated | | | | |

| | | Shares | | Amount | | Capital | | Reserve | | Compensation | | Deficit | | Total | |

| |

| Balance as of December 31, 2003 | | 25,649,188 | | $ | 301 | | $ | 100,996 | | $ | 2,166 | | $ | (30 | ) | $ | (58,635 | ) | $ | 44,798 | |

| Changes during the year 2004: | | | | | | | | | | | | | | | | | | | | | |

| Ordinary shares issued | | 1,500,000 | | | 17 | | | 44,250 | | | — | | | — | | | — | | | 44,267 | |

| Exercise of stock options | | 472,198 | | | 5 | | | 2,581 | | | — | | | — | | | — | | | 2,586 | |

| Forfeiture of stock options | | — | | | — | | | (11 | ) | | — | | | 3 | | | — | | | (8 | ) |

| Non-employees’ stock options | | — | | | — | | | 62 | | | — | | | — | | | — | | | 62 | |

| Amortization of unearned | | | | | | | | | | | | | | | | | | | | | |

| compensation | | — | | | — | | | — | | | — | | | 24 | | | — | | | 24 | |

| Net profit | | — | | | — | | | — | | | — | | | — | | | 2,888 | | | 2,888 | |

| Balance as of December 31, 2004 | | 27,621,386 | | $ | 323 | | $ | 147,878 | | $ | 2,166 | | $ | (3 | ) | $ | (55,747 | ) | $ | 94,617 | |

| Changes during the year 2005: | | | | | | | | | | | | | | | | | | | | | |

| Exercise of stock options | | 328,895 | | | 4 | | | 1,077 | | | — | | | — | | | — | | | 1,081 | |

| Amortization of unearned | | | | | | | | | | | | | | | | | | | | | |

| compensation | | — | | | ��� | | | — | | | — | | | 3 | | | — | | | 3 | |

| Net profit | | — | | | — | | | — | | | — | | | — | | | 6,343 | | | 6,343 | |

| Balance as of December 31, 2005 | | 27,950,281 | | $ | 327 | | $ | 148,955 | | $ | 2,166 | | $ | — | | $ | (49,404 | ) | $ | 102,044 | |

| Changes during the year 2006: | | | | | | | | | | | | | | | | | | | | | |

| Exercise of stock options | | 591,010 | | | 7 | | | 2,029 | | | — | | | — | | | — | | | 2,036 | |

| Restricted shares issued | | 100,000 | | | 1 | | | — | | | — | | | — | | | — | | | 1 | |

| Stock based compensation | | — | | | — | | | 5,213 | | | — | | | — | | | — | | | 5,213 | |

| Net loss | | — | | | — | | | — | | | — | | | — | | | (1,508 | ) | | (1,508 | ) |

| Balance as of December 31, 2006 | | 28,641,291 | | $ | 335 | | $ | 156,197 | | $ | 2,166 | | $ | — | | $ | (50,912 | ) | $ | 107,786 | |

The accompanying notes are an integral part of these consolidated financial statements.

31

Given Imaging Ltd. and its Subsidiaries

Consolidated Statements of Cash Flows

(In thousands)

| | Year Ended December 31, | |

| | 2004 | | | 2005 | | | 2006 | |

| Cash flows from operating activities: | | | | | | | | | | | |

| Net profit (loss) | $ | 2,888 | | | $ | 6,343 | | | $ | (1508 | ) |

| Adjustments required to reconcile net profit (loss) to net cash | | | | | | | | | | | |

| provided by operating activities: | | | | | | | | | | | |

| Minority share in losses of subsidiary | | (747 | ) | | | (1,116 | ) | | | (1,334 | ) |

| Depreciation and amortization. | | 3,147 | | | | 3,596 | | | | 4,237 | |

| Deferred taxes. | | (737 | ) | | | (482 | ) | | | (155 | ) |

| Employees’ stock option compensation | | 16 | | | | 3 | | | | 5,213 | |

| Non-employees’ stock option compensation | | 62 | | | | — | | | | — | |

| Other | | 48 | | | | 98 | | | | 18 | |

| Net increase in trading securities | | — | | | | — | | | | (5,060 | ) |

| Increase in accounts receivable–trade | | (5,316 | ) | | | (6,064 | ) | | | (562 | ) |

| Decrease (increase) in other accounts receivable | | (804 | ) | | | (4,993 | ) | | | 4,801 | |

| Decrease (increase) in prepaid expenses | | 360 | | | | (66 | ) | | | (320 | ) |

| Decrease (increase) in advances to suppliers | | (508 | ) | | | 223 | | | | 250 | |

| Increase in inventories | | (5,648 | ) | | | (2,378 | ) | | | (1,996 | ) |

| Increase in accounts payable | | 7,107 | | | | 5,769 | | | | 500 | |

| Increase (decrease) in deferred income | | 12,000 | | | | 12,555 | | | | (1,223 | ) |

| Net cash provided by operating activities | $ | 11,868 | | | $ | 13,488 | | | $ | 2,861 | |

| |

| Cash flows from investing activities: | | | | | | | | | | | |

| Purchase of fixed assets and other assets | $ | (3,245 | ) | | $ | (7,948 | ) | | $ | (5,876 | ) |

| Proceeds from sales of fixed assets | | 57 | | | | — | | | | — | |

| Deposits, net | | (42 | ) | | | (16 | ) | | | (41 | ) |

| Proceeds from sales of marketable securities | | — | | | | — | | | | 13,120 | |

| Investments in marketable securities | | — | | | | (21,919 | ) | | | (37,960 | ) |

| Net cash used in investing activities | $ | (3,230 | ) | | $ | (29,883 | ) | | $ | (30,757 | ) |

| |

| Cash flows from financing activities: | | | | | | | | | | | |

| Principal payments on capital lease obligation | $ | (37 | ) | | $ | (12 | ) | | $ | (14 | ) |

| Proceeds from the issuance of Ordinary Shares | | 46,853 | | | | 1,081 | | | | 2,037 | |

| Issuance of shares by consolidated company | | — | | | | — | | | | 4,772 | |

| Net cash provided by financing activities | $ | 46,816 | | | $ | 1,069 | | | $ | 6,795 | |

| Effect of exchange rate changes on cash | $ | 40 | | | $ | (179 | ) | | $ | 255 | |

| Increase (decrease) in cash and cash equivalents | $ | 55,494 | | | $ | (15,505 | ) | | $ | (20,846 | ) |

| Cash and cash equivalents at beginning of year | | 25,367 | | | | 80,861 | | | | 65,356 | |

| Cash and cash equivalents at end of year | $ | 80,861 | | | $ | 65,356 | | | $ | 44,510 | |

| Supplementary cash flow information | | | | | | | | | | | |

| Income taxes paid | $ | 107 | | | $ | 163 | | | $ | 300 | |

The accompanying notes are an integral part of these consolidated financial statements.

32

Given Imaging Ltd. and its Subsidiaries

Notes To The Consolidated Financial Statements

(In thousands except share and per share data)

Note 1—Organization and Summary of Significant Accounting Policies

A. General

Given Imaging Ltd. (the “Company”) was incorporated in Israel in January 1998.

The Company has developed the Given System, a proprietary wireless imaging system that represents a new approach to visual examination of the gastrointestinal tract. The system uses a miniaturized video camera contained in a capsule, referred to as the PillCam capsule, which is ingested by the patient and delivers high quality color images in a painless and noninvasive manner.

The Given System consists of three principal components:

a single-use, disposable PillCam color-imaging capsule that is ingested by the patient;

a portable data recorder and array of sensors that are worn by the patient; and

a computer workstation with a proprietary RAPID software for downloading, processingand analyzing recorded data.

After receiving marketing clearance from the United States Food and Drug Administration (“FDA”) in August of 2001, the Company commenced the marketing of the Given System with its first video capsule, the PillCam Small Bowel Capsule, or PillCam SB, for detection of disorders of the small bowel. In November 2004, following receipt of FDA marketing clearance, the Company began marketing and sales of its second video capsule, PillCam ESO, for detection of disorders in the esophagus. The Company markets the PillCam ESO capsule through a strategic marketing alliance with InScope, a division of Ethicon Endo-Surgery, a Johnson & Johnson company (see Note 8C). In late 2006, the Company completed the development of its third video capsule, PillCam Colon, for visual examination of the colon and received the regulatory clearance that permits the Company to market and sell this capsule in Europe. The Company has also submitted this capsule for FDA clearance in the United States.

The medical device industry in which the Company is involved is characterized by the risks of regulatory barriers and reimbursement issues. Penetration into the world market requires the investment of considerable resources and continuous development efforts. The Company’s future success is dependent upon several factors including technological quality, regulatory approvals, sufficient reimbursement for its products and the cost and diagnostic-effectiveness of its products compared to other methods for the examination of the gastrointestinal tract.

B. Basis of presentation

The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and include the accounts of the Company and its wholly-owned subsidiaries in the United States, Germany, France, the Netherlands and Australia and its 51% owned subsidiary in Japan. The accounts of its subsidiaries are consolidated from the date of their inception. All the subsidiaries were established for the purpose of marketing and selling the Given System. All intercompany balances and transactions have been eliminated in consolidation. The Company considers that it operates in only one segment.

C. Functional and reporting currency

The Company’s functional and reporting currency is the U.S. dollar.

Transactions denominated in foreign currencies other than the U.S. dollar are translated into the functional currency using current exchange rates. Gains and losses from the translation of foreign currency transactions are recorded in other income or expenses.

33

Given Imaging Ltd. and its Subsidiaries

Notes To The Consolidated Financial Statements—(Continued)

(In thousands except share and per share data)

D. Cash and cash equivalents

All highly-liquid investments with original maturity of three months or less from the date of deposit are considered to be cash equivalents.

E. Provision for doubtful accounts receivable

The provision for doubtful accounts receivable is calculated on the basis of specific identification of balances, the collection of which, in management’s opinion, is doubtful. In determining the adequacy of the provision, management bases its opinion on the estimated risk, in reliance on available information with respect to the debtor’s financial position and an evaluation of the collateral received.

The activity in the provision for doubtful accounts for the three years ended December 31, 2006 is as follows:

| | | Year ended December 31, |

| | | 2004 | | 2005 | | 2006 |

| Opening balance | | $ — | | $115 | | $431 |

| Additions during the year. | | 115 | | 316 | | 356 |

| Closing balance | | $115 | | $431 | | $787 |

F. Inventories

Inventories are stated at lower of cost or market. Cost is determined using the average cost method for raw materials and components and finished goods and on the basis of actual manufacturing costs for work in progress.

G. Assets held for employees’ severance payments

Assets held for employees’ severance payments represent contributions to insurance policies that are recorded at their current redemption value.

H. Marketable securities

The Company accounts for marketable securities under Statement of Financial Accounting Standards (SFAS) No. 115 “Accounting for Certain Investments in Debt and Equity Securities (“Statement 115”). Marketable securities consist of U.S. government bonds and corporate bonds, which the Company classified as “held to maturity” and auction rate securities and money market funds, which the Company classified as “trading”, all in accordance with the guidance of statement 115.

Held-to-maturity debt securities are securities that the Company has the ability and intent to hold until maturity and are recorded at amortized cost, adjusted for the amortization or accretion of premiums or discounts. Premiums and discounts are amortized or accreted over the life of the related held-to-maturity security as an adjustment to yield using the effective-interest method.

Trading securities are bought and held principally for the purpose of selling them in the near term. Trading securities are recorded at fair value and changes in the fair value, based on closing market prices of the at balance sheet date, represent unrealized gains and losses which are included in earnings.

34

Given Imaging Ltd. and its Subsidiaries

Notes To The Consolidated Financial Statements—(Continued)

(In thousands except share and per share data)

A decline in the market value of any “held-to-maturity” security below cost that is deemed to be other than temporary results in a reduction in the carrying amount to fair value. The impairment is charged to earnings and a new cost basis for the security is established.

I. Fixed assets

Fixed assets are stated at cost. Depreciation is computed by the straight-line method over the estimated useful lives of the assets at the following annual rates:

| | | % | |

| Computers and software | | 33 | |

| Instruments and laboratory equipment | | 15 | |

| Leasehold improvements | | 10 | |

| Motor vehicles | | 15 | |

| Machinery and equipment. | | 15 | |

| Communication equipment. | | 15 | |

| Office furniture and equipment | | 10–15 | |

Motor vehicles purchased under capital lease arrangements are recorded at the present value of the minimum lease payments at lease inception. Such assets and leasehold improvements are depreciated and amortized respectively, using the straight-line method over the shorter of the lease term or estimated useful life of the asset.

The Company accounts for long-lived assets and certain intangible assets in accordance with the provisions of SFAS No. 144, “Accounting for the Impairment of or Disposal of Long-Lived Assets” (“Statement 144”). This Statement requires that long-lived assets and certain identifiable intangible assets be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to undiscounted future net cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets.

J. Other assets |

| |

| a. | The Company developed proprietary software for its computer workstations that permits downloading and viewing recorded data from the portable data recorder. The costs of developing this software were capitalized in accordance with SFAS No. 86, “Accounting for Costs of Computer Software to be Sold, Leased or Otherwise Marketed” (“Statement 86”). As such, capitalization of software development costs begins upon the establishment of technological feasibility as defined in Statement 86 and continues up to the time the software is available for general release to customers, at which time capitalized software costs are amortized on a straight-line basis over the expected life of the related product, which is generally five years. |

| |

| b. | Legal expenses related to patent and trademark registration have been capitalized and amortized over the remaining life of the asset, which is generally eight years. |

| |

| c. | Technology and content costs are generally expensed as incurred, except for certain costs relating to the development of the Company’s web site that are capitalized and amortized over their estimated useful lives which are generally three years. |

| |

35

Given Imaging Ltd. and its Subsidiaries

Notes To The Consolidated Financial Statements—(Continued)

(In thousands except share and per share data)

K. Stock compensation plans

Employees and directors

Effective January 1, 2006, the Company adopted the fair value recognition provisions of SFAS No. 123 (revised 2004), “Share-Based Payment” (“SFAS No. 123R”). This Statement requires compensation expense relating to share-based payments to be recognized in net income using a fair-value measurement method. Under the fair value method, the estimated fair value of awards is charged to income on a straight-line basis over the requisite service period, which is generally the vesting period. The Company elected the modified-prospective method and therefore prior periods were not restated. Under the modified-prospective method, compensation costs recognized in 2006 include also compensation costs for all share-based payments granted prior to, but not yet vested, as of December 31, 2005.

Stock-based compensation recognized in the Consolidated Statement of Operations for the year ended December 31, 2006 is based on awards ultimately expected to vest. As a result the expense has been reduced for estimated forfeitures. SFAS No. 123R required forfeitures to be estimated at the time of grant and revised, in necessary, in subsequent periods if actual forfeitures differ from those estimates. In the Company’s pro forma information required under SFAS No. 123, “Accounting for Stock-Based Compensation” (“SFAS No. 123”) for the periods prior to fiscal 2006, the Company accounted for forfeitures as they occurred.

The effect of the implementation of SFAS No. 123R was to increase expenses by $5,213, which changed the profit before taxes and net profit to losses by the same amount. The per share effect $(0.19) was to turn the basic and diluted earnings per share into loss per share.

Prior to January 1, 2006, the Company has followed SFAS No. 123, which permitted entities to recognize as an expense over the vesting period, the fair value on the date of grant of all stock-based awards. Alternatively, Statement 123 allowed entities to continue to apply the provisions of Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees and related interpretations” (“APB Opinion No. 25”) and provide pro forma net income and pro forma earnings per share disclosures for employee stock option grants as if the fair-value based method defined in Statement 123 had been applied.

The Company elected to apply the intrinsic value-based method prescribed in APB Opinion No. 25 for its stock compensation to employees and directors and provide the pro forma disclosure provisions of SFAS No. 123, as amended by SFAS No. 148, “Accounting for Stock-Based Compensation - Transition and Disclosure, an amendment of SFAS No. 123”.

As such, the Company computed and recorded compensation expense for grants whose terms were fixed with respect to the number of shares and option price only if the market price on the date of grant exceeded the exercise price of the stock option. The compensation cost for the fixed plans was recorded over the period the employee performs the service to which the stock compensation relates.

36

Given Imaging Ltd. and its Subsidiaries

Notes To The Consolidated Financial Statements—(Continued)

(In thousands except share and per share data)

The following table shows the effect on net profit and profit per Ordinary Share if the Company had applied the fair value recognition provisions of Statement 123:

| | | Year ended December 31, | |

| | | 2004 | | | 2005 | |

| Net profit as reported | | $ | 2,888 | | | $ | 6,343 | |

| —Compensation expenses according to APB 25 included in the | | | | | | | | |

| reported net profit | | | 16 | | | | 3 | |

| —Application of compensation expenses according to Statement 123. | | | (13,432 | ) | | | (10,327 | ) |

| Pro forma net loss. | | $ | (10,528 | ) | | $ | (3,981 | ) |

| Basic profit (loss) per Ordinary Share: | | | | | | | | |

| As reported | | $ | 0.11 | | | $ | 0.23 | |

| Pro forma | | $ | (0.39 | ) | | $ | (0.14 | ) |

| Diluted profit (loss) per ordinary share: | | | | | | | | |

| As reported | | $ | 0.10 | | | $ | 0.21 | |

| Pro forma | | $ | (0.39 | ) | | $ | (0.14 | ) |

Non-Employees

Effective January 1, 2006, the Company applies the provisions of SFAS No. 123R to account for stock based compensation to non-employees. Prior to January 1, 2006, the Company applied the fair value-based method of accounting set forth in Statement 123 and Emerging Issues Task Force (“EITF”) Issue No. 96-18, “Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services” for such compensation expenses. Using the fair value method, the total compensation expense is computed based on the fair value of the options on the date the options are granted to the non-employees and are recognized over the vesting period.

The Company recorded compensation expense of $62 in the year ended December 31, 2004 related to the above options. There were no such expenses in 2005 or 2006.

L. Profit (loss) per Ordinary Share

Basic and diluted profit (loss) per Ordinary Share is presented in conformity with SFAS No. 128, “Earnings Per Share”, for all years presented. Basic profit (loss) per Ordinary Share is calculated by dividing the net profit (loss) attributable to Ordinary Shares, by the weighted average number of Ordinary Shares outstanding. Diluted profit (loss) per Ordinary share calculation is similar to Basic Earnings Per Share except that the weighed average of common shares outstanding is increased to include the number of additional common shares that would have been outstanding if the dilutive potential common shares from options had been exercised.

37

Given Imaging Ltd. and its Subsidiaries

Notes To The Consolidated Financial Statements—(Continued)

(In thousands except share and per share data)

The following table summarizes information related to the computation of basic and diluted profit (loss) per Ordinary Share for the years indicated.

| | | Year ended December 31, | |

| | | 2004 | | 2005 | | 2006 | |

| Net profit (loss) attributable to Ordinary Shares | | $ | 2,888 | | $ | 6,343 | | $ | (1,508 | ) |

| Weighted average number of Ordinary Shares | | | | | | | | | | |

| outstanding Used in basic profit (loss) per Ordinary | | | | | | | | | | |

| Share calculation | | | 26,633,964 | | | 27,781,223 | | | 28,053,849 | |

| Add assumed exercise of outstanding dilutive potential | | | | | | | | | | |

| Ordinary Shares | | | 2,719,484 | | | 1,913,941 | | | — | |

| Weighted average number of Ordinary Shares | | | | | | | | | | |

| outstanding Used in diluted profit (loss) per | | | | | | | | | | |

| Ordinary Share calculation | | | 29,353,448 | | | 29,695,164 | | | 28,053,849 | |

| |

| Basic profit (loss) per Ordinary Share | | $ | 0.11 | | $ | 0.23 | | $ | (0.05 | ) |

| |

| Diluted profit (loss) per Ordinary Share | | $ | 0.10 | | $ | 0.21 | | $ | (0.05 | ) |

| |

| Number of options excluded from the diluted earning | | | | | | | | | | |

| per share calculation because of anti-dilutive effect | | | 165,500 | | | 2,448,114 | | | 4,114,604 | |

M. Use of estimates

The preparation of the consolidated financial statements requires management of the Company to make a number of estimates and assumptions relating to the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from these estimates.

N. Revenue recognition

Revenues from sales of products are recognized upon delivery provided that the collection of the resulting receivable is reasonably assured, there is persuasive evidence of an arrangement, no significant obligations in respect of installation remain and the price is fixed or determinable.

For sales contracts, which include a Post Contract Customer Support (“PCS”) component, revenues allocated to PCS in accordance with EITF 00-21 “Revenue Arrangements with Multiple Deliverables”, are deferred and recognized ratably over the term of the support period, which is generally one year.

The Company accrues estimated warranty costs at time of shipment based on contractual rights and historical experience. The Company’s policy is not to grant return rights.

Taxes collected from customers and remitted to Governmental Authorities are presented in the financial statements on a net basis.

The Company routinely evaluates its products for inclusion of any embedded software that is more than incidental thereby requiring consideration of AICPA Statements of Position 97-2, “Software Revenue Recognition”. Based on such evaluation, the Company has concluded that none of its products have such embedded software.

O. Government-Sponsored Research and Development

The Company records grants received from the Office of the Chief Scientist of the Israeli Ministry of Industry and Trade (the “OCS”) as a reduction of research and development expenses.

38

Given Imaging Ltd. and its Subsidiaries

Notes To The Consolidated Financial Statements—(Continued)

(In thousands except share and per share data)

Royalties payable to OCS are recognized pursuant to sale of related products and are classified under cost of revenues.

P. Taxes on income

The Company accounts for income taxes under SFAS No. 109 “Accounting for Income Taxes” (“Statement 109”).

Under Statement 109 deferred tax assets or liabilities are recognized in respect of temporary differences between the tax bases of assets and liabilities and their financial reporting amounts as well as in respect of tax losses and other deductions which may be deductible for tax purposes in future years, based on enacted statutory tax rates applicable to the periods in which such deferred taxes will be realized. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized.

Q. Research and development costs

Research and development costs are expensed as incurred.

R. Allowance for product warranty

It is the Company’s policy to grant a warranty for certain products. The balance sheet provision for warranties for all periods through December 31, 2006 is determined based upon the Company’s experience regarding the relationship between sales and warranty expenses.

S. Concentration of credit risk

Financial instruments that may subject the Company to significant concentrations of credit risk consist principally of cash and cash equivalents, trade accounts receivable and marketable securities.

Cash and cash equivalents are deposited with major financial institutions in Europe, the United States, Japan, Australia and Israel.

The Company performs ongoing credit evaluations of the financial condition of its customers. The risk of collection associated with trade receivables is reduced by the large number and geographical dispersion of the Company’s customer base and the Company’s policy of requiring collateral or security with respect to receivables due from distributors.

T. Recent accounting pronouncements

In June 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement No. 109” (“FIN 48”), which clarifies the accounting for uncertainty in income taxes. This Interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. This Interpretation also provides guidance on de-recognition, classification, accounting in interim periods, disclosure, and transition. This Interpretation is effective for fiscal years beginning after December 15, 2006. The Company is currently evaluating the impact of FIN 48 on its consolidated financial position, results of operations and cash flows.

39

Given Imaging Ltd. and its Subsidiaries

Notes To The Consolidated Financial Statements—(Continued)

(In thousands except share and per share data)

Note 2—Cash and Cash Equivalents

| | | Interest rate | | | | | | |

| | | as of | | | | | | |

| | | December 31 | | | December 31 |

| | | 2006 | | | 2005 | | | 2006 |

| | | % | | | | | | |

| Denominated in U.S. dollars | | 5.15–5.26 | | | $ | 57,912 | | $ | 25,794 |

| Denominated in New Israeli Shekels | | 4.7–5.0 | | | | 2,855 | | | 3,099 |

| Denominated in Euro. | | 2.95 | | | | 3,396 | | | 7,766 |

| Denominated in Australian dollars | | | | | | 732 | | | 469 |

| Denominated in Japanese Yen. | | | | | | 461 | | | 7,382 |

| | | | | | $ | 65,356 | | $ | 44,510 |

Note 3—Accounts Receivable—Other

| | | December 31 |

| | | 2005 | | 2006 |

| Government institutions | | $ | 921 | | $ | 1,389 |

| InScope (Note 8C) | | | 5,000 | | | — |

| Other | | | 343 | | | 74 |

| | | $ | 6,264 | | $ | 1,463 |

| |

| |

| Note 4—Inventories | | | |

| |

| | | December 31 |

| | | 2005 | | 2006 |

| Raw materials and components | | $ | 7,399 | | $ | 7,721 |

| Work in progress | | | 3,251 | | | 3,533 |

| Finished goods | | | 5,522 | | | 6,914 |

| | | $ | 16,172 | | $ | 18,168 |

Note 5—Marketable Securities

As of December 31, 2006 and 2005, marketable securities consist U.S. government bonds and corporate bonds, which the Company classified as “held-to-maturity” (“the Bonds”). As of December 31, 2006, marketable securities also included auction rate securities and money market funds, which are classified as “trading”.

The amortized cost, gross unrealized losses and fair value of the “held-to-maturity” Bonds by major interest type were as follows:

| | | December 31, 2006 |

| | | Amortized | | Gross Unrealized | | | Fair |

| | | Cost | | Holding Losses | | | Value |

| Up to 5% | | $ | 33,574 | | $ | (601 | ) | | $ | 32,973 |

| 5.1%–6%, 8.125% | | | 13,380 | | | (212 | ) | | | 13,168 |

| | | $ | 46,954 | | $ | (813 | ) | | $ | 46,141 |

40

Given Imaging Ltd. and its Subsidiaries

Notes To The Consolidated Financial Statements—(Continued)

(In thousands except share and per share data)

| | | December 31, 2005 |

| | | Amortized | | Gross Unrealized | | Fair |

| | | Cost | | Holding Losses | | Value |

| 3.375%–4.3% | | $ | 17,697 | | $(198) | | $ | 17,499 |

| 5.9%–6% | | | 4,255 | | (86) | | | 4,169 |

| | | $ | 21,952 | | $(284) | | $ | 21,668 |

Maturities of the “held-to-maturity” Bonds were as follows at December 31, 2006 and 2005:

| | | Amortized | | Fair |

| | | Cost | | Value |

| | | 2006 | | 2006 |

| Current maturities | | $ | 12,185 | | $ | 12,063 |

| Due after one year through five years | | | 34,769 | | | 34,078 |

| | | $ | 46,954 | | $ | 46,141 |

| |

| | | Amortized | | Fair |

| | | Cost | | Value |

| | | 2005 | | 2005 |

| Current maturities | | $ | 288 | | $ | 284 |

| Due after one year through five years | | | 21,664 | | | 21,384 |

| | | $ | 21,952 | | $ | 21,668 |

As of December 31, 2006, marketable securities also included $5,060 in bonds classified as “trading” (2005 - $0). These investments are subject to price volatility associated with any interest-bearing instrument. Net realized gains on trading securities during the year ended December 31, 2006 were $133, and are included in financial income. Net unrealized losses on trading securities held as of December 31, 2006 were $15 and are included in financial income.

Short-term investments are comprised of:

| | | December 31 |

| | | 2005 | | 2006 |

| Current maturities of “held-to-maturity” securities | | $ | 288 | | $ | 12,185 |

| Trading securities | | | — | | | 5,060 |

| | | $ | 288 | | $ | 17,245 |

41

Given Imaging Ltd. and its Subsidiaries

Notes To The Consolidated Financial Statements—(Continued)

(In thousands except share and per share data)

Note 6—Fixed Assets, at Cost, Less Accumulated Depreciation

| | | | December 31 | |

| | | 2005 | | | 2006 | |

| Computers and software. | | $ | 4,942 | | | $ | 6,234 | |

| Instruments and laboratory equipment | | | 682 | | | | 791 | |

| Leasehold improvements | | | 3,847 | | | | 4,259 | |

| Motor vehicles. | | | 55 | | | | 155 | |

| Machinery and equipment | | | 12,702 | | | | 14,952 | |

| Communication equipment | | | 388 | | | | 418 | |

| Office furniture and equipment | | | 1,273 | | | | 1,248 | |

| Fixed assets | | | 23,889 | | | | 28,057 | |

| Accumulated depreciation | | | (10,027 | ) | | | (13,246 | ) |

| Fixed assets less accumulated depreciation | | $ | 13,862 | | | $ | 14,811 | |

| | | | | | | | | |

| Depreciation expenses for the years ended December 31, | | | | | | | | |

| 2004, 2005 and 2006 were $2,561, $2,936 and $3,599, | | | | | | | | |

| respectively. | | | | | | | | |

Note 7—Other Assets, at Cost, Less Accumulated Amortization

| | | | December 31 | |

| | | | 2005 | | | | 2006 | |

| Software development costs | | $ | 647 | | | $ | 647 | |

| Patents and trademarks | | | 3,425 | | | | 4,594 | |

| Web site application | | | 895 | | | | 922 | |

| Other assets | | | 4,967 | | | | 6,163 | |

| Accumulated amortization | | | (2,450 | ) | | | (3,088 | ) |

| Other assets, net | | $ | 2,517 | | | $ | 3,075 | |

Amortization expenses for the years ended December 31, 2004, 2005 and 2006 were $586, $660 and $638, respectively.. Estimated amortization expense for the next five years is: $573 in 2007, $560 in 2008, $516 in 2009, $453 in 2010, and $381 in 2011.

Note 8—Commitments and Contingencies

A. Office of the Chief Scientist Grants

The Company’s research and development efforts have been partially financed through grants from the Office of the Chief Scientist of the Israeli Ministry of Industry and Trade (the “OCS”). In return for the OCS’s participation, the Company is committed to pay royalties to the Israeli Government at the rate of 3% for each of the first three years and, from the fourth year onwards, at the rate of 3.5% of the sales of its product, up to 100% of the amount of the grants received, plus LIBOR interest. The grants are presented as an off-set to related research and development expenses. The Company is entitled to the grants only upon incurring research and development expenditures. There are no future performance obligations related to the grants received from the OCS. However, under certain limited circumstances, the OCS may withdraw its approval of a research program or amend the terms of its approval.

Upon withdrawal of approval, the grant recipient may be required to refund the grant, in whole or in part, with or without interest, as the OCS determines. As of December 31, 2006, the Company has received from the OCS office a total cumulative amount of $6,751 of which

42

Given Imaging Ltd. and its Subsidiaries

Notes To The Consolidated Financial Statements—(Continued)

(In thousands except share and per share data)

the Company has already repaid $2,534 as royalties. The total outstanding future obligation, for royalties, based on royalty-bearing government participation totaled, before interest, approximately $4,217 as of December 31, 2006. Royalties payable to the OCS are recognized pursuant to sale of related products and are classified under cost of revenues.

B. Leases

Capital lease for motor vehicles

The capital lease is to be repaid in five years and bears interest of 7.47%. The vehicles are pledged as collateral.

Operating leases