SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2005

Commission file number: 000-32665

Oglebay Norton Company

(Exact name of Registrant as specified in its charter)

| | |

| Ohio | | 34-1888342 |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer

Identification No.) |

| | |

North Point Tower 1001 Lakeside Avenue, 15th Floor

Cleveland, Ohio | | 44114-1151 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (216) 861-3300

Securities registered pursuant to Section 12(g) of the Act:

| | |

Common Stock

$0.01 Par Value | | Series A Convertible Preferred Stock $0.01 Par Value |

Indicate by check mark if the Registrant is a well known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes¨ Nox

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes¨ Nox

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of Registrant’s knowledge, in any amendment to this Form 10-K.x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definitions of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark whether the Registrant is a shell company (as defined in Exchange Act Rule 12b-2).

Yes¨ Nox

The aggregate market value of voting stock held by non-affiliates of the Registrant at June 30, 2005 was $39,996,542.

Indicate by check mark whether the Registrant has filed all documents and reports required to be filed by Section 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yesx No¨

Number of Shares of Common Stock outstanding at March 10, 2006: 3,601,842.

PART I

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains statements concerning certain trends and other forward-looking information within the meaning of the federal securities laws. The words “believe,” “may,” “will,” “estimate,” “assert,” “continue,” “anticipate,” “intend,” “expect,” and similar expressions identify these forward-looking statements. Such forward-looking statements are subject to uncertainties and factors relating to the Company’s operations and business environment and a number of other risks, uncertainties and assumptions, including those described in “Risk Factors”, all of which are difficult to predict and many of which are beyond the control of the Company. The Company believes that the following factors, among others, could affect its future performance and cause actual results to differ materially from those expressed or implied by forward-looking statements made by or on behalf of the Company: (1) the effectiveness of the Company having restructured its debt to provide adequate liquidity to sufficiently improve the Company’s financial position; (2) the Company’s ability to complete its cost reduction initiatives; (3) weather conditions, particularly in the Great Lakes region, flooding, and/or water levels; (4) fluctuations in energy, fuel and oil prices; (5) fluctuations in integrated steel production in the Great Lakes region; (6) fluctuations in Great Lakes and Mid-Atlantic construction activity; (7) economic conditions in California or population growth rates in the southwestern United States; (8) the outcome of periodic negotiations of labor agreements; (9) changes in the demand for the Company’s products due to changes in technology; (10) the loss, insolvency or bankruptcy of major customers, insurers or debtors; (11) difficulty in hiring sufficient staff that is appropriately skilled and licensed, particularly for the vessel operations; (12) changes in environmental laws; (13) an increase in the number and cost of asbestos and silica product liability claims filed against the Company and its subsidiaries and determinations by a court or jury against the Company’s interest; (14) the insolvency of insurers, the effects of any coverage litigation with insurers or the adequacy of insurance; (15) changes in Federal or State law with respect to asbestos or silica product liability claims; and (16) risks related to the low trading volume of the Company’s stock and the possibility of the Company de-registering its common and convertible preferred stock with the United States Securities and Exchange Commission.

The Company does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You should also consult the risk factors listed from time to time in the Company’s other Securities and Exchange Commission filings.

2

A. (1) Oglebay Norton Company

The Company mines, processes, transports and markets industrial minerals and aggregates. The Company owns strategically located, proven long-life reserves of high-quality limestone and industrial sand and owns related mineral extraction equipment, processing plants and transportation equipment, including marine vessels and docks, trucks, railway lines and equipment. With these assets, the Company serves a broad customer base primarily in four major categories: building materials, energy, environmental and industrial. The Company’s mission is to be the minerals company that processes, purifies, packages and provides high quality chemical stone and sand for its customers, rewards the work of its employees and creates sustained long-term value for its investors. The Company enjoys a significant market share in each of the core markets, benefiting from long-term relationships with market-leading customers, many of whom have multi-year purchase contracts with the Company. The primary North American Industry Classification System (NAICS) codes for the Company are 21231, 21232 and 48311.

On January 31, 2005, the Company and all of its direct and indirect wholly owned subsidiaries emerged from protection under Chapter 11 of the United States Bankruptcy Code pursuant to the Company’s Plan of Reorganization (the “Plan”). The Plan became effective and the Company legally emerged from Chapter 11 on January 31, 2005 (the “Effective Date”). However, the Company satisfied all material conditions precedent to the effectiveness of the Plan on December 27, 2004 and, therefore, used December 31, 2004 as the date for adopting Fresh-Start reporting in order to coincide with the Company’s normal financial closing for the month of December. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition—Overview—Bankruptcy Overview” for further discussion.

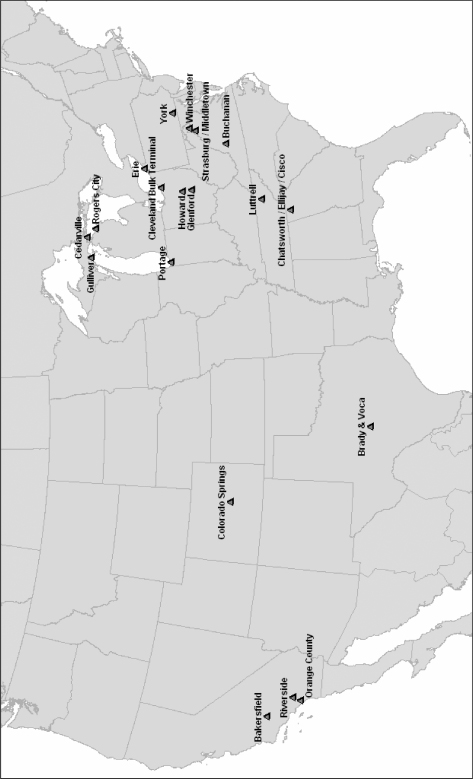

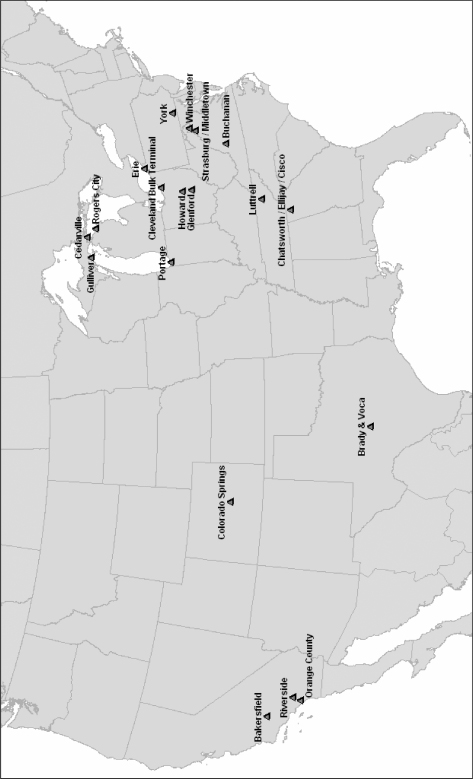

The Company has aligned its businesses into three reporting segments that share business strategies, are related by geography and product mix and reflect the way management evaluates the operating performance of the businesses. The operations are reported as: O-N Minerals Great Lakes Operations, O-N Minerals Inland Operations and Industrial Sands:

| | • | | O-N Minerals Great Lakes Operations mines and distributes limestone from three facilities located in northern Michigan, processes limestone from a location in Indiana and has a bulk commodity dock in Pennsylvania. It also holds one of the largest fleets of self-unloading vessels on the Great Lakes, which at December 31, 2005 was comprised of 10 vessels, operates two trans-loading dock facilities, and provides transportation services for limestone, as well as for coal and iron ore. One of the 10 self-unloading vessels was sold in March 2006. |

| | • | | O-N Minerals Inland Operations mines and processes limestone and manufactures lime at five operations in the mid-Atlantic and southeastern United States. |

| | • | | Industrial Sands mines and processes industrial sands at six operations located in Ohio, Colorado, Texas and California. |

The Company believes that it is one of the five largest suppliers of lime and in the top twenty of the largest suppliers of limestone in the United States. The Company also believes that it is the third largest supplier of industrial sands in the United States.

For the fiscal years ended December 31, 2005, 2004 and 2003, the Company generated consolidated net sales and operating revenues of approximately $440 million, $421 million and $391 million, respectively. As of December 31, 2005 and 2004, the Company had approximately $651 million and $861 million, respectively, in assets and $538 million and $751 million, respectively, in liabilities on a consolidated book basis. At December 31, 2005, the Company’s workforce consisted of approximately 1,500 employees (excluding vessel relief employees), of which 42% were covered by collective bargaining agreements.

In 2005, the Company also announced that it had engaged Jefferies & Company to assist in the evaluation of potential transactions related to its Great Lakes fleet. The decision to hire an investment banker is in response to

3

recently received expressions of interest. The Company is exploring the possibility of redeploying the capital invested in vessels for the reduction of debt and for capital investments consistent with its strategy.

Additional information relating to the financial and operating data on a segment basis is set forth under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in Part II hereof and in Note B and Note K to the consolidated financial statements contained in Part II hereof. For a description of revenues and other financial information by geographic region, see Note K to the consolidated financial statements contained in Part II hereof.

During 2005, the Company operated in four primary end-markets with the following approximate gross revenue percentages: building materials (42%), industrial (30%), energy (18%), and environmental (10%). The Company’s strategy is to enhance its market leadership position and maximize profitability and cash flows through the following actions:

Capitalize on the Company’s strategic location and ownership of quality limestone reserves in the Great Lakes region. The strategic location of the Company’s limestone reserves on the Great Lakes allows the Company to leverage logistics services and delivery of its limestone to customers in the Great Lakes region. The Company mines, processes and transports limestone to its own docks or directly to customers on a delivered cost per ton basis at highly competitive rates. This can be accomplished by means of long-term contracts.

Capitalize on demand for industrial minerals for building materials. The Company has secured significant regional market share in the building materials market, particularly with respect to construction aggregates and industrial fillers markets. Limestone and industrial sands are used to varying degrees by building materials manufacturers as filler material in paint, joint compound, roofing shingles, carpet backing and floor and ceiling tiles. Additionally, the Company’s limestone is used as aggregates in major construction projects such as highways, schools, hospitals, shopping centers and airport expansions. The Company intends to capitalize on its strong presence in selected regional building materials markets by increasing its business with existing customers, expanding its customer base and providing a broader selection of products for customers to purchase.

Capitalize on increasing demand for minerals for environmental remediation. Public focus over environmental issues has resulted in an increase in the demand for lime and limestone used in environmental clean-up applications, including flue gas desulphurization, municipal waste sludge treatment, industrial water treatment, drinking water treatment and hazardous waste remediation. The Clean Air Act, for example, requires the reduction of emissions, particularly sulfur, from coal-fired power plants and certain other industrial processes. Ground limestone and lime are the principal agents used in the desulphurization process. These applications require limestone with specific chemical composition and a high degree of reactivity. The Company believes that its strategically located, long-lived mineral reserves of high quality calcium carbonate and dolomitic limestone are well positioned to meet these requirements, enabling the Company to capitalize on this increasing demand now and well into the future.

Capitalize on market opportunities in the energy segment. The Company believes its industrial sands products are well positioned in the market place to serve the demand for high-purity silica sands used by oil and gas well service companies in the shallow-well and deep-well fracturing process.

| B. | Principal Products and Services |

| (1) | O-N Minerals Great Lakes Operations Segment |

The Company’s O-N Minerals Great Lakes Operations segment mines limestone at three operations with a total of four quarries located in northern Michigan and distributes it throughout the Great Lakes region. Limestone from the mines is also processed by an operation in Indiana. All of these quarries have access to the

4

Great Lakes and ship a majority of their output via bulk freighters. The segment holds one of the largest reserves of metallurgical and chemical quality high-calcium carbonate and dolomitic limestone in the world and distributes these reserves on one of the largest fleets of self-unloading vessels on the Great Lakes. The fleet, which at December 31, 2005 was comprised of 10 vessels, provides transportation services for limestone as well as for coal and iron ore. One of the 10 vessels was sold in March 2006. Additionally, the segment operates (1) dock terminals in Cleveland, Ohio, and Erie, Pennsylvania, which are important points of distribution on the Great Lakes, and (2) a sand dredging operation in Erie, Pennsylvania.

Industry

Limestone accounts for about three-quarters of crushed stone production in the United States. Crushed limestone has five primary end uses: construction aggregates and building materials, chemical and metallurgical processes, cement and lime manufacturing, environmental and agricultural. As transportation costs are significant in this industry, competition is limited based on geography. The chemical make-up of limestone varies by deposit, resulting in certain quarries having limited ability to meet performance specifications of certain end uses, such as flue gas desulphurization in coal fired power plants and for scrubbers in waste-to-energy incineration. Products from the O-N Minerals Great Lakes Operations segment are used primarily as aggregate for construction of schools, hospitals, shopping centers and highways; as an environmental cleaning agent for flue gas desulphurization, waste water treatment and soil stabilization; and as an essential chemical component in the manufacture of steel, paper and glass.

In general, demand for crushed limestone correlates with general economic cycles, principally new construction demand and government spending on highway construction and other infrastructure projects. The segment’s long-lived mineral reserves and processing facilities allow capacity to meet increased demand during up-turns in general economic activity. Demand for vessel transportation on the Great Lakes is also related to general economic cycles and more particularly to construction activity and industrial production in the Great Lakes region. The business in the O-N Minerals Great Lakes Operations segment is seasonal. It is affected by weather conditions, such as the waterways freezing over, the closing/opening of the locks between the Great Lakes, and water levels of the Great Lakes and rivers. These factors cause the actual number of days of operation to vary each year. Annually, the locks are required by law to close on January 15 and re-open around March 25, unless otherwise prescribed by the U.S. Coast Guard. Management believes that the overall Great Lakes shipping market in which the Company’s fleet competes operated at less than full capacity in 2001 through 2005 after approaching full capacity for the prior five years.

Operations

The O-N Minerals Great Lakes Operations segment had three operations that have four open pit quarries, a limestone processing facility in Indiana, 10 self-unloading vessels, two dock facilities and had access to several additional docks on the Great Lakes as of December 31, 2005. The Company assesses mineral reserves at all of its quarries and mines utilizing external consulting geologists and mining engineers. The large reserves of the O-N Minerals Great Lakes Operations segment have been extensively mapped, and this mapping is regularly updated to provide the customer with specified, consistent-quality product. Limestone is extracted from the quarries by traditional drilling and blasting techniques. Following extraction, trucks or trains are used to deliver the “as-blasted” limestone to a primary crusher. It is then processed through several stages of crushing and screening to size products that can be sold as chemical limestone or aggregates.

Transportation costs represent a significant portion of the overall delivered price of limestone. Limestone quarried at the segment’s operations is delivered, for the most part, by marine vessel, enabling the stone to be shipped to major markets located in excess of 800 miles away at a competitive price. The Company is the largest and only fully integrated producer and bulk transporter of limestone on the Great Lakes. The Company can mine, process and transport stone to the Company’s own docks or directly to customers on a delivered cost per ton basis using its own services or under long-term contracts.

5

The majority of the transportation services of the Company’s vessel fleet are conducted between U.S. ports on the Great Lakes. The largest vessels in the fleet transport primarily coal and iron ore. Smaller vessels can be scheduled with more flexibility and tend to be better suited to transport limestone. The Company operated its vessels over the past four years under a pooling agreement with American Steamship Company, which maintains a fleet of 11 modern, self-unloading Great Lakes vessels comparable in size to the Company’s fleet. The agreement combines the operations and customers of the two fleets to achieve more efficient overall operations and better customer service. With the pooling of vessels, the Company realizes improved trade patterns for all cargo, including limestone, resulting in more efficient deployment and reduced delays across the combined fleet and better service to the customers of both companies. The agreement provides for the coordination of dispatch and other fleet operations but does not involve any transfer of assets. This agreement was terminated in January 2006. In March 2006, the company sold one of its 10 vessels.

The O-N Minerals Great Lakes Operations segment operates a bulk material dock facility in Cleveland, Ohio, under an agreement with the Cleveland-Cuyahoga County Port Authority through March 2017. The dock facility operates throughout the year, receiving cargo from Great Lakes vessels, storing it as needed, and transferring it for further shipment via rail or water transportation. In 2003, the Port Authority concluded the relocation of an automated vessel loader to the dock facility. The new loader enables the Company to trans-load iron ore pellets from its larger vessels to smaller vessels for delivery up the Cuyahoga River to a major customer. As a result of the vessel loader project, the Port Authority has postponed prior plans to construct a new access road that will enable the facility to trans-ship cargoes by truck as well as rail and water. If the access road is constructed, the Company expects that the new road will enable limestone delivery by truck, expanding its ability to serve the limestone market. It is uncertain at this time when the Port Authority will resume plans for the access road construction.

The O-N Minerals Erie operation maintains an inventory; with the majority of its product received from the segment’s quarries in Michigan via marine vessel to a bulk materials dock in Erie, Pennsylvania, for distribution into local markets. The operation has a vessel that dredges sand from Lake Erie, which is screened and sold into local markets as a filler in concrete and other construction applications. Additionally, the Erie dock is a distribution point for other products including salt and coke breeze. O-N Minerals Erie expands the geographic scope of the segment to the northwest Pennsylvania and western New York regions.

Customers

The segment’s primary customers include purchasers and producers of construction aggregate and chemical limestone, integrated steel manufacturers, for whom the fleet transports iron ore, limestone and coal, and electric utility companies, for whom the fleet transports coal. The Company has long-established relationships with many of these customers and provides services to many of them pursuant to long-term contracts.

For 2005 and 2004, the Company estimates that approximately 85% of the tonnage hauled by the vessel fleet was shipped pursuant to multi-year contracts. The Company estimates that, for 2005, industrial, building materials, energy and environmental customers accounted for approximately 42%, 33%, 19% and 6%, respectively, of this business segment’s revenue.

In 2005, iron ore shipments accounted for approximately 38% of the fleet’s revenues, compared to 51% and 48% in 2004 and 2003, respectively. Coal accounted for approximately 41% of the fleet’s revenues in 2005 compared with 32% in 2004 and 36% in 2003. Shipments of limestone accounted for an estimated 17% of the fleet’s revenues in 2005 and 2004, compared with approximately 16% in 2003. Shipments of grain accounted for an estimated 4% of the fleet’s revenues in 2005. Approximately 69% and 71% of the limestone transported by the pooled fleet in 2005 and 2004, respectively, came from the segment’s quarries.

6

Competition

The building materials and construction aggregate industry in North America is highly fragmented. Many active operations are small scale or wayside locations operated by state or local governments, usually to meet the requirements of highway contracts in more remote locations. There also are a number of large companies in the industry, including Vulcan Materials Corporation, Martin Marietta Materials Inc. and Lafarge Corporation, whose operations are often centered on a particular geographic region. The Company’s O-N Minerals Great Lakes Operations operations are centered on the Great Lakes region in this fashion and compete primarily with Lafarge Corporation, which has facilities in the same geographic region. Given that transportation costs represent a significant portion of the overall cost of lime and limestone products, competition generally occurs among participants in close geographic proximity. Additionally, the scarcity of high-purity limestone deposits for which the required zoning, extraction and emission permits can be obtained serves to limit competition from startup operations within this limestone market. The physical characteristics and purity of the limestone can be a distinguishing competitive factor for chemical limestone and price is an important factor for both chemical limestone and construction aggregate.

The most important competitive factors impacting the segment’s marine transportation services are price, customer relationships and customer service. Management believes that customers are generally willing to continue to use the same carrier assuming such carrier provides satisfactory service with competitive pricing. The Company’s fleet directly competes only among U.S. flag Great Lakes vessels because of the U.S. federal law known as the Jones Act. The Jones Act requires that cargo moving between U.S. ports be carried in a vessel that was built in the United States, has a U.S. crew, and is owned (at least 75%) by U.S. citizens or corporations. As a result, Canadian-flagged Great Lakes vessels or foreign-flag oceanic vessels do not carry dry bulk cargo between U.S. ports. Moreover, the size limitation imposed by the Welland Canal prevents large oceanic vessels from entering the Great Lakes. The competitive landscape has remained relatively stable over the last ten years. There were approximately 57 and 58 U.S. flag vessels in service in 2005 and 2004, respectively. In November 2005, the Company sold an idled self-unloading vessel and used the proceeds of the sale of the vessel to reduce debt and in March 2006 sold one additional vessel. In 2005, the Company also announced that it had engaged Jefferies & Company, Inc. to assist it in evaluating potential transactions related to the balance of its Great Lakes fleet. The decision to hire an investment banker is in response to recently received expressions of interest. The Company is exploring the possibility of redeploying the capital invested in the remainder of the vessels for the reduction of debt and for capital investments consistent with its strategy.

| (2) | O-N Minerals Inland Operations Segment |

Through a series of transactions in 1998, 1999 and 2000, the Company acquired businesses that now form its O-N Minerals Inland Operations segment. These operations supply lime, crushed and ground limestone, construction aggregates and chemical limestone to a broad customer base in a variety of industries. The segment’s products are used primarily as a filler in building materials, as an environmental cleaning agent for flue gas desulphurization, waste water treatment and soil stabilization, as a chemical in steel-making, paper-making and glass-making and as an aggregate for construction of highways, shopping centers, hospitals and schools.

Industry

Lime is a value-added product derived from limestone, and is widely used in a variety of manufacturing processes and industries, including iron and steel, pulp and paper, chemical, air purification, sewage, water and waste treatments, agricultural and construction. The wide range of end-uses and markets for lime offers some protection from the economic cycles experienced by individual sectors such as the steel industry. Additionally, a high proportion of lime is sold into end-uses that, unlike some construction-related end-uses, have year-round requirements largely unaffected by the weather. Limestone accounts for about three-quarters of crushed stone production in the United States. Transportation costs can be significant in this industry; therefore, competition is limited based on geography. Additionally, many of these applications require stone with specific chemical

7

composition and a high degree of reactivity. Crushed limestone has five primary end uses: construction aggregates and building materials; chemical and metallurgical processes; cement and lime manufacturing; environmental and agricultural purposes. High-purity chemical limestone like that processed by the segment may be processed into value-added products, such as lime or limestone fillers, or sold as chemical limestone for use in manufacturing products as diverse as poultry feed mixtures, fiberglass and roofing shingles. Fillers, which are finely ground limestone powders, are used in a wide range of manufacturing processes including vinyl flooring, carpet backing, adhesives, sealants and joint compound.

Operations

The Company’s O-N Minerals Inland Operations business segment produces products for the following primary end uses: construction aggregates and building materials, environmental, chemical and metallurgical processes, cement and lime manufacturing, and agricultural. The segment has five lime and/or limestone operations in North America that collectively extract and process high-purity limestone. These operations are primarily centered in northwest Georgia and along the Interstate 81 corridor from southern Pennsylvania through Virginia and Tennessee. The Company sold its St. Clair lime operation in December 2005.

The segment currently operates eight open pit quarries and three underground mines. Limestone is extracted from the quarries and mines by traditional drilling and blasting techniques. In an open pit quarrying operation, the high-purity limestone is often covered by an overburden of construction grade limestone that must first be removed. This overburden is used whenever possible to produce construction aggregates, usually in a dedicated crushing plant, in order to offset the overall cost of extracting high-purity limestone. Following extraction, trucks are used to deliver the “as-blasted” limestone to a primary crusher. It is then processed through several stages of crushing and screening to size products that are saleable as chemical limestone and aggregates or ready for further processing into lime, fillers and other value-added products. The Company assesses mineral reserves at all of its quarries and mines utilizing external consulting geologists and mining engineers.

High-purity limestone is processed into lime by heating it in a kiln. At December 31, 2005, the Company believes its daily lime production capacity was approximately 2,000 tons. The capacity over a 24-hour period cannot be projected over a full calendar year because kilns require regular planned outages for maintenance and equipment and are subject to unplanned outages customary with any mechanical plant. Typically, a kiln will operate between 92% and 96% of the available hours in any year. High-purity limestone is processed into fillers through grinding into coarse, medium or fine grades. The segment primarily competes in coarse ground filler products used in the manufacture of roofing shingles and carpet backing.

Customers

In general, demand for lime and limestone correlates to general economic cycles, principally new construction demand, population growth rates and government spending on highway construction and other infrastructure projects, which affect the demand for our customers’ products and services. This business segment has a broad customer base covering all sectors of the demand for lime and limestone. These customers vary by the type of limestone products they demand: lime, chemical limestone or construction aggregate. The Company estimates that building materials, industrial and environmental customers accounted for approximately 62%, 21% and 17%, respectively, of this business segment’s revenue for 2005.

Transportation cost represents a significant portion of the overall cost of lime and limestone. As a result, the majority of lime and limestone production is sold within a 500-mile radius of the producing facility, while aggregates tend to be sold within a 50-mile radius. At certain of the segment’s locations asphalt manufacturing customers have located their processing plants on the Company’s property. The Company believes that its O-N Minerals Inland Operations lime and limestone operations are strategically located near major markets for its products and that it holds a significant share of these markets.

8

Competition

The building materials and construction aggregate industry in North America is highly fragmented. Many of the active operations are small scale or wayside locations operated by state or local governments, usually to meet the requirements of highway contracts in more remote locations. There also are a number of large companies in the industry, including Vulcan Materials Corporation, Martin Marietta Materials Inc. and Lafarge Corporation, whose operations are often centered on a particular geographic region.

Lime is primarily purchased under annual contracts. For many customers, the cost of lime is quite small in comparison to their overall production costs. For 2005, the Company estimates that it was the fifth-largest producer of lime in North America, with the eight largest producers accounting for approximately 80% of total industry capacity. The Company’s business segment accounted for approximately 4% of the total North American market. The four largest companies with which the Company competes are privately owned. The most important competitive factors are the inherent quality and characteristics of the lime, price and ability to meet spikes in demand.

Given that transportation cost represents a significant portion of the overall cost of lime and limestone products, competition generally occurs among participants in close geographic proximity. In addition, the scarcity of high-purity limestone deposits for which the required zoning, extraction and emission permits can be obtained serves to limit competition from startup operations within the limestone market.

| (3) | Industrial Sands Segment |

The Company’s Industrial Sands business segment is engaged in the mining and processing of high-purity silica sands. The segment’s businesses are focused on markets where excellent technical service and support are important to customers. Additionally, the segment’s businesses share common end-use markets in building materials and a geographic focus on the southwestern United States. The Company believes that the segment is the third-largest producer of industrial sands in the United States.

Industrial Sands’ products include: (i) proppant sands, which are used by oil and gas well service and exploration companies in the well fracturing process to hold rock structures open; (ii) specialty construction/industrial sands, which are used in the construction industry; (iii) silica flour used in the manufacture of building materials such as roofing shingles, stucco, mortar and grout, and in fiberglass and ceramics; (iv) whole grain sands and silica flour used in glass-making; (v) recreational sands, which are used in the construction of golf courses and other recreation fields, as well as in general landscaping applications; (vi) foundry sands, which are used in ferrous and non-ferrous metal die casting; (vii) filtration sands, which are used in liquid filtration systems; and (viii) coated sand for industrial abrasive uses.

Industry

Industrial sands, often termed “silica,” “silica sand” and “quartz sand,” are defined as high silicon dioxide content sands. While deposits of more common construction sand and gravel are widespread, industrial sand deposits are limited. The special properties of industrial sands—purity, grain size, color, inertness, hardness and resistance to high temperatures—make them often irreplaceable in a variety of industrial applications. Higher silica content allows for more specialized, higher-margin applications than construction sand and gravel.

In general, demand for Industrial Sands’ products is driven by a number of factors depending on end use. The three most important factors are demand for oil and natural gas, housing starts, and golf course construction activity in the southwestern United States where most of the Company’s industrial sand facilities are located. Oil and gas usage correlates with demand from oil and gas drilling service companies for fracturing, or proppant sands, which is the largest single market for the Company’s industrial sands. Housing starts correlate with demand for building materials such as joint compound, paint, roofing shingles and grout, which are important end-uses for industrial sands. Demand for sand used in golf course construction and maintenance relates primarily to southern California locations.

9

Operations

The Industrial Sands segment has six operations, three of which having strategically located, long-lived reserves of high-purity industrial sands. Three of the segment’s operations function as distribution and/or processing points and are supplied by either the segment’s quarries or by third parties. The segment’s operations are located in Ohio, Texas, Colorado and California.

The industrial sands operations include five open pit sand quarries with integrated processing plants and/or remote processing plants. In an industrial sand quarry, the extracted sand is first washed to remove impurities like clay and dirt. The sand is then dried, screened and separated into different gradations. At certain of the facilities, the sand is also pulverized into powder for use in ceramic and other applications. All of the segment’s industrial sands operations have highway access and four have railway access.

Customers

The segment has a broad customer base for its many industrial sands. The Company has a long relationship with the majority of its large customers in this segment. Industrial sands customers participate in the oil and gas well service, building materials, glass, fiberglass, ceramic, foundry, filtration, and golf course and recreational industries.

For bulk industrial sands materials, transportation cost represents a significant portion of the overall cost, and the majority of production is sold within a 200-mile radius of the producing facility. In contrast, for proppant sands, transporting the materials long distances is not economically prohibitive because of their high unit value. Proppant sands are transported throughout the entire North American continent to satisfy current supply needs. The Company estimates that the energy, building materials, industrial and environmental markets accounted for approximately 46%, 28%, 20% and 6%, respectively, of the business segment’s total revenue for 2005.

Competition

Competition is not limited to participants in close geographic proximity. However, the scarcity of high-purity sand deposits for which the required zoning and extraction permits can be obtained serves to limit competition. Management estimates that the Company is the third-largest industrial sand producer in the country and the leader in the southwestern U.S. market. The principal competition comes primarily from three companies: Unimin Corp., U.S. Silica Co., a wholly-owned subsidiary of Better Minerals, Inc., and Fairmount Minerals Ltd. The most competitive factors include the inherent physical characteristics of the sand, price and ability to meet spikes in demand.

| C. | Environmental, Health and Safety Considerations |

The Company is subject to various environmental health and safety laws and regulations imposed by federal, state and local governments. The Company is continually updating its long-term environmental, health and safety initiatives to achieve the goal of no losses to people, properties or processes, and no damage to the environment. During the year 2005, the Company has incurred and may, in the future, be responsible for certain expenses related to closures of former operations, including those for applicable reclamation of land to its original condition or to a condition as may be required by contract or law.

At December 31, 2005, the Company employed approximately 1,500 people, not including temporary relief workers, of whom 315 were salaried employees. Approximately 42% of the Company’s employees are unionized, and the Company is party to eleven collective bargaining agreements with various labor unions. The Company believes that it maintains good relations with each of these unions. The collective bargaining agreement that expired during 2005 was ratified without any work stoppages. In 2006, two collective bargaining agreements representing approximately 130 employees will expire. Management expects to be able to negotiate new contracts with these labor unions.

10

As discussed above under “Forward-Looking Statements,” the Company provides the following risk factor disclosures in connection with its continuing efforts to qualify its forward-looking statements for certain safe harbor protections. Important factors currently known to management that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, the following:

Risks Related to Our Financing and Recently Completed Reorganization

We emerged from Chapter 11 reorganization and have a history of recent losses.

We sought protection under Chapter 11 of the Bankruptcy Code in February 2004. We incurred net losses of $2.336 million, $106.075 million and $33.192 million during the three fiscal years ended December 31, 2005, 2004 and 2003, respectively. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Selected Historical Consolidated Financial Data.”

Our equity ownership and Board of Directors was replaced in connection with our reorganization. While our current senior management has concentrated on refining our business strategy, there can be no assurance that we will attain profitability or achieve growth in its operating performance.

We have substantial indebtedness and the covenants that are contained in our credit facility may significantly impact our future operations.

Although implementation of the Plan significantly reduced our debt service obligations, we have indebtedness pursuant to our credit facility that is substantial in relation to our shareholders’ equity. Although no assurances can be given, we believe that we will generate sufficient cash flow to meet our operating requirements, including the payment of interest under the credit facility when due.

The credit facility contains restrictive financial and operating covenants and prohibitions, including provisions that restrict the payment of dividends on our Common Stock, par value $0.01 per share (the “common stock”) and cash dividends on our Series A Convertible Preferred Stock, par value $0.01 per share (the “convertible preferred stock”), and otherwise limit our ability to make distributions to holders of convertible preferred stock. Our leverage and restrictions contained in the credit facility require that a substantial portion of our cash flow be dedicated to service interest expense and to make mandatory payments of principal, which may impair our ability to finance our future operations and capital needs and may limit our flexibility in responding to changing business and economic conditions and to business opportunities.

Substantially all of our assets are subject to various liens and security interests.

Substantially all of our cash, receivables, equipment, inventory, real property and other assets are currently subject to various liens and security interests in favor of the lenders under the credit facility and in favor of other creditors. If a holder of a security interest becomes entitled to exercise its rights as a secured party, it would have the right to foreclose upon and sell or otherwise transfer the collateral subject to its security interest, and the collateral accordingly would be unavailable to us or our subsidiary owning the collateral and to other of our creditors or creditors of such subsidiary, except to the extent, if any, that such other creditors have a superior or equal security interest in the affected collateral or the value of the affected collateral exceeds the amount of indebtedness in respect of which such foreclosure rights are exercised.

We have announced our intention to possibly sell a significant portion of our assets, including our marine vessels, and if successful, we will rely upon 3rd parties for transportation of stone across the Great Lakes.

11

As a result of Fresh-Start reporting rules, our historical financial information will not be comparable with our financial information for periods ending after our emergence from bankruptcy.

As a result of the consummation of the Plan and the transactions contemplated thereby, we were subject to the Fresh-Start reporting rules as of December 31, 2004. Accordingly, the reported historical financial statements prior to the adoption of Fresh-Start reporting (the “Predecessor Company”) for periods ended prior to

December 31, 2004 are not comparable to those of the Reorganized Company. In this Annual Report on Form 10-K, references to our operations and cash flows during the periods ended in fiscal 2004 and 2003 refer to the Predecessor Company.

We intend to become a non-registrant pursuant to the federal securities laws.

We intend to seek approval to terminate that certain Registration Rights Agreement dated as of January 31, 2005 between us and certain holders of the convertible preferred stock and to de-register our common and convertible preferred stock. If we become a non-registrant, we will not be obligated to file periodic reports with the Securities and Exchange Commission or comply with most provisions of the Sarbanes–Oxley Act of 2002. Although the stock will continue to trade over the counter, it may become difficult to trade and will not qualify for listing on a major exchange or system such as the NASDAQ National Market System.

The risks related to our business, combined with our leverage and limited capital resources, could negatively impact our future.

Our principal sources of funds are expected to be operating revenues, cash and cash equivalents and funds available for borrowing under the credit facility. There can be no assurance that these funds will be sufficient to enable us to meet our cash requirements on a consolidated basis. If the anticipated levels of revenues are not achieved because of decreased demand for our product or weakness in the overall market for minerals and aggregates, or if expenses exceed the level we contemplate, the current sources of funds may be insufficient to meet our cash requirements in the future. Further, our operations will be subject to the risks discussed below in “Risk Factors—Risks Related to Our Business.” Should any of the potential adverse developments referred to in those risk factors occur, our available capital resources may prove insufficient. In the event that our available capital resources are insufficient, we would need to take additional steps to increase revenues, curtail expenses, sell assets or raise additional capital. There is no assurance that these approaches would be successful, and even if successful, these approaches could trigger other adverse effects on our business or operating results or financial condition.

A major portion of our bank debt consists of variable-rate obligations, which subjects us to interest rate fluctuations.

Our credit facility is secured by accounts receivable, inventory and property, plant and equipment. Our credit facility contains variable-rate obligations, which expose us to interest rate risks. If interest rates increase, our debt service obligations on our variable-rate indebtedness would increase even if the amount borrowed remained the same, resulting in a decrease in our net income.

Risks Related to Our Business

Our operations are cyclical and demand for our products fluctuates, which could adversely affect our results of operations.

All of our operations are cyclical. Further, we experience increases and decreases in profitability throughout the year resulting mostly from fluctuating demand for our products. Demand in the markets served by our industries is influenced by many factors, including the following:

| | • | | global and regional economic conditions; |

| | • | | fluctuations in energy, fuel, oil and natural gas prices and the availability of such fuels; |

| | • | | declines in steel production; |

12

| | • | | changes in residential and commercial construction demands, driven in part by fluctuating interest rates and demographic shifts, especially in the Great Lakes and Mid-Atlantic regions; |

| | • | | changes in demand for our products due to technological innovations; |

| | • | | changes in environmental laws and regulations; |

| | • | | prices, availability and other factors relating to our products; |

| | • | | demand for automobiles and other vehicles; |

| | • | | the substitution of plastic or other materials for glass; |

| | • | | labor strikes and costs at our customers; |

| | • | | population growth rates; |

| | • | | government spending on road and other infrastructure construction; and |

| | • | | Great Lakes water levels. |

We cannot predict or control the factors that affect demand for our products and services. Negative developments in the above factors, among others, would cause the demand for and supply of our products and services to suffer, which could adversely affect our results of operations.

We sell our products and services in highly competitive markets, and if we fail to compete effectively, our results of operations could be adversely affected.

We sell our products and services in highly competitive markets. We believe that, for all of our business segments, price, product quality, product characteristics, location and customer service are the most significant competitive considerations. In many of our markets, we may face competition from large companies that have greater financial resources and less debt, which may enable them to commit larger amounts of capital in response to changing market conditions. We expect competitive pressures in our markets to remain strong. If we fail to compete effectively, our result of operations could be adversely affected.

Natural disasters, equipment failures, unavailability of fuel sources and other unexpected events could increase the cost of operating our business.

The mineral production and the marine transportation industries are inherently risky businesses the operations of which are subject to conditions beyond our control. Our mining operations are affected by weather and natural disasters, such as heavy rains and flooding, equipment failures and other unexpected maintenance problems, variations in the amount of rock and soil overlying mineral deposits, variations in geological conditions, fires, explosions and other accidents, fluctuations in the price or availability of supplies and other matters. We operate three underground limestone mines and in recent years, our O-N Minerals Inland Operations segment’s operations were negatively impacted by some of these events, including flooding, equipment failures and other maintenance problems. In addition, recent increases in the price of fuel necessary for mining, processing and shipping operations have adversely affected, and may continue to adversely affect, operating costs. Any of these risks could result in damage to, or destruction of, our mining properties or processing facilities, personal injury to our employees, environmental damage, delays in mining or processing, losses or possible legal liability. We cannot predict whether we will suffer the impact of these and other conditions in the future.

We rely on the estimates of our mineral reserves, and if those estimates are inaccurate, our results of operations could be adversely affected.

Our future success depends, in part, upon our ability to develop or acquire additional industrial mineral reserves and to profitably extract those reserves. Although we believe that the depletion of our existing mineral

13

reserves is unlikely for many years, we cannot state with certainty how long it will be profitable for us to extract our reserves in the future. To increase the reserves and mining production, we must continue to develop and acquire reserves. It is difficult for us, and for other mining companies, to estimate quantities of additional recoverable reserves. Our estimates of reserve data are based on independent studies as well as on our own studies. Our estimates of industrial mineral reserves and future net cash flows, however, depend upon a number of factors and assumptions which include:

| | • | | historical production from the areas; |

| | • | | interpretation of geological, geophysical and chemical quality data; |

| | • | | assumptions concerning effects of regulations by governmental agencies; |

| | • | | assumptions concerning future industrial mineral prices; |

| | • | | assumptions concerning future market conditions and competitive environment; |

| | • | | assumptions concerning future operating costs, severance costs and excise taxes; and |

| | • | | assumptions concerning development costs and reclamation costs. |

These factors and assumptions may vary considerably from actual results. For these reasons, our reserve data may not be accurate. Our actual production, revenues and expenditures likely will vary from these estimates, and these variances may be material. We cannot provide assurances that its attempts to maintain adequate reserves in the future will be successful.

Mine closures entail substantial costs, and if we close one or more of our mines sooner than anticipated, our results of operations may be adversely affected.

If we close any of our mines, revenues would be reduced unless we were able to increase production at any of our other mines, which may not be possible. The closure of an open pit mine involves significant fixed closure costs, including accelerated employment legacy costs, severance-related obligations, reclamation and other environmental costs, and the costs of terminating long-term obligations, including energy contracts and equipment leases. We base our assumptions regarding the life of our mines on detailed studies we perform from time to time, but those studies and assumptions do not always prove to be accurate. We accrue for the costs of reclaiming open pits, stockpiles, tailings ponds, roads and other mining support areas over the estimated mining life of our property. If we were to reduce the estimated life of any of our mines, the fixed mine closure costs would be applied to a shorter period of production, which would increase production costs per ton produced and could significantly and adversely affect our results of operations and financial condition. Further, if we were to close one or more of our mines prematurely, we would incur significant accelerated employment legacy costs, severance-related obligations, reclamation and other environmental costs, as well as asset impairment charges, which could materially and adversely affect our financial condition.

Applicable statutes and regulations require that mining property be reclaimed following a mine closure in accordance with specified standards and an approved reclamation plan. The plan addresses matters such as removal of facilities and equipment, regrading, prevention of erosion and other forms of water pollution, revegetation and post-mining land use. We may be required to post a surety bond or other form of financial assurance equal to the cost of reclamation as set forth in the approved reclamation plan. The establishment of the final mine closure reclamation liability is based upon permit requirements and requires various estimates and assumptions, principally associated with reclamation costs and production levels. Although we believe, based on currently available information, we are making adequate provisions for all expected reclamation and other costs associated with mine closures for which we will be responsible, our business, results of operations and financial condition would be adversely affected if such accruals were later determined to be insufficient.

14

Our business and our customers’ businesses are subject to extensive environmental and health and safety regulations that impose, and will continue to impose, significant costs and liabilities, and future regulations could increase those costs and liabilities, which could adversely affect our results of operations.

We are subject to a variety of federal, state and local regulatory requirements relating to the environment, including those relating to our handling of hazardous materials and air and wastewater emissions. Some environmental laws impose substantial penalties for noncompliance, and others, such as the federal Comprehensive Environmental Response, Compensation, and Liability Act and the Resource Conservation and Recovery Act, impose strict, retroactive and joint and several liability upon persons responsible for releases of hazardous substances. If we fail to comply with present and future environmental laws and regulations, we could be subject to liabilities or our operations could be interrupted. In addition, future environmental laws and regulations could restrict our ability to expand our facilities or extract our mineral deposits or could require us to acquire costly equipment or to incur other significant expenses in connection with our business. There can be no assurance that future events, including changes in any environmental requirements and the costs associated with complying with such requirements, will not have a material adverse effect on us.

In addition to environmental regulation, we are subject to laws relating to human exposure to crystalline silica. We believe that we comply with governmental requirements for crystalline silica exposure and emissions and other regulations relating to silica and plans to continue to comply with these regulations. Several federal and state regulatory authorities, including the Mining Safety and Health Administration, may continue to propose changes in their regulations regarding workplace exposure to crystalline silica. We cannot guarantee that we will be able to comply with any new standards that are adopted or that these new standards will not have a material adverse effect on our operating results by requiring us to modify our operations or equipment or shut down some of our plants. Additionally, we cannot guarantee that our customers will be able to comply with any new standards or that any such new standards will not have a material adverse effect on our customers by requiring them to shut down old plants or to relocate plants to locations with less stringent regulations that are further away from us. Accordingly, we cannot at this time reasonably estimate our costs of compliance or the timing of any costs associated with any new standards, or any material adverse effect that any new standards will have on our customers and, consequently, on our operations.

We are subject to various lawsuits relating to the exposure of persons to asbestos and silica. See “Risk Factors—Health issues and litigation relating to silica and asbestos could adversely affect our financial results.”

Our mining business is subject to other extensive regulations, including licensing, plant and wildlife protection and reclamation, that impose, and will continue to impose, significant costs and liabilities, and future regulations could increase those costs and liabilities, which could adversely affect our results of operations.

In addition to the regulatory matters described above, the industrial minerals and aggregates industries are subject to extensive governmental regulation on matters such as permitting and licensing requirements, plant and wildlife protection, wetlands protection, reclamation and restoration of mining properties after mining is completed, the discharge of materials into the environment, surface subsidence from underground mining and the effects that mining has on groundwater quality and availability. Our future success depends, among other things, upon the quantity of our industrial minerals and aggregates deposits and our ability to extract these deposits profitably. As discussed above, it is difficult for us to estimate quantities of recoverable deposits, in part due to future permitting and licensing requirements. We believe we have obtained all material permits and licenses required to conduct our present mining operations. However, we will need additional permits and renewals of permits in the future. We may be required to prepare and present data to governmental authorities pertaining to the impact that any proposed exploration or production activities may have upon the environment. New site approval procedures may require preparation of archaeological surveys, endangered species studies and other studies to assess the environmental impact of new sites. Compliance with these regulatory requirements is expensive, requires an investment of funds well before the potential producer knows if our operations will be economically successful and significantly lengthens the time needed to develop a new site. Finally, obtaining or

15

renewing required permits is sometimes delayed or prevented due to community opposition and other factors beyond our control. New legal requirements, including those related to the protection of the environment, could be adopted that could materially adversely affect our mining operations (including the ability to extract mineral deposits), our cost structure or our customers’ ability to use our industrial minerals or aggregates products. Accordingly, there can be no assurance that current or future mining regulation will not have a material adverse effect on our business or that we will be able to obtain or renew permits in the future.

We rely heavily on third party transportation, which is subject to rate fluctuations and rail, shipping and trucking hazards.

Other than in the Great Lakes region, we rely heavily on railroads and trucking companies to ship our industrial minerals and aggregates products to customers. Because freight costs represent a significant portion of the total cost to the customer, fluctuations in freight rates can change the relative competitive position of our production facilities. Rail, shipping and trucking operations are subject to various hazards, including extreme weather conditions and operating hazards, as well as slowdowns due to labor strikes and other work stoppages. If we are unable to ship our products as a result of the railroads or shipping or trucking companies failing to operate or if there are material changes in the cost or availability of rail, shipping or trucking services, we may not be able to arrange alternative and timely means to ship our products, which could lead to interruptions or slowdowns in our businesses and, therefore, have a material adverse effect on us.

We depend on our seamen employees, and on our existing vessels, which require regular and unanticipated maintenance and impose significant costs on us.

Our newest Great Lakes vessel was commissioned in 1981 and the oldest in 1943. The relatively long life of our vessels is due to a scheduled program of regular winter maintenance, periodic renovation and minimal corrosion because they operate only in fresh water. In general, we must spend more money to maintain a vessel in good operating condition as the age of our vessel increases. However, our Great Lakes shipping operations might not be profitable enough in the future to justify spending the necessary money on maintenance to keep the vessels in service. Our vessels depend upon complex mechanical systems for both propulsion and unloading cargo. If any of these systems fail, we may be forced to take the affected vessel out of service. If we do this, we will lose the revenue and earnings associated with that vessel. Currently, there is a shortage of skilled and licensed merchant seamen. If we cannot hire qualified seamen to operate our vessels, we may be forced to reduce our shipping operations. If we do this, we will lose the associated expected revenues and earnings. In addition, although our vessels are insured, if we suffer catastrophic damage to a vessel or loss of life of seamen employees, the insurance proceeds may not cover the cost of a new vessel or any damages related to such loss of life.

In 2005, we also announced that we had engaged Jefferies & Company to assist in evaluation potential transactions related to our Great Lakes fleet. The decision to hire an investment banker is in response to recently received expressions of interest. We are exploring the possibility of redeploying the capital invested in the remainder of the vessels for the reduction of debt and for capital investments consistent with our strategy.

We are subject to potential increases in competitive pressure from other modes of transportation.

Aside from dealing with the impact on profitability resulting from such factors as changes in water levels and the congestion of the ports and locks serving the Great Lakes, the shipping component of the O-N Minerals Great Lakes Operations segment must compete with the price and availability of other ships and other modes of transportation, including railroads and trucks. The shipping component of the O-N Minerals Great Lakes Operations segment could face additional competitive pressures if the Merchant Marine Act of 1920 as amended, otherwise known as the Jones Act, is repealed. The Jones Act requires that cargo moving between U.S. ports be carried in a vessel that was built in the United States, has a U.S. crew and is owned, at least 75%, by U.S. citizens or corporations. If the Jones Act is repealed, we may be unable to compete successfully with new competitors that could enter the market.

16

Our sales and earnings are subject to significant fluctuations as a result of the cyclical nature of the steel industry.

Our net sales to the steel industry accounted for 17% of our total revenue in each year of 2005, 2004 and 2003. The steel industry is highly cyclical, sensitive to general economic conditions and dependent on the condition of certain other industries. As a result, the demand for steel products is generally affected by macroeconomic fluctuations in the United States and global markets in which steel companies sell their products. Over the past few years, a significant number of domestic steel companies, some of which had been our customers, entered bankruptcy proceedings. The continued or future loss of customers in the steel industry could have an adverse impact on our results of operations.

Because we experience seasonal fluctuations in our sales, our quarterly results will fluctuate, and our annual performance will be affected by those fluctuations.

Our businesses are seasonal, meaning that we experience higher levels of activity in some periods of the year than in others. For example, our mining operations experience weaker demand during the winter months, when weather conditions can affect the shipping, road and rail distribution of products and the use of industrial sands, lime and limestone for construction. In addition, we are ordinarily able to operate our vessels on the Great Lakes for about 259 days per year beginning in early April and continuing through mid-December. However, weather conditions and customer demand cause increases and decreases in the number of days our vessels actually operate.

We depend on a limited number of customers, and the loss of, or significant reduction in, purchases by our largest customers could adversely affect our operations.

During 2005, our top ten customers represented 33% of our sales from continuing operations. These customers might not continue to purchase these levels of our products and services in the future due to a variety of reasons. For example, some of our top customers could go out of business or, alternatively, be acquired by other companies who purchase the same products and services provided by us from other third party providers. Although we believe we have a diverse customer base, if certain major customers substantially reduce or stop purchasing our products or services, we could suffer a material adverse effect on our operating results.

Our profitability could be negatively affected if we fail to maintain satisfactory labor relations.

As of December 31, 2005, various labor unions represented about 42% of our employees. The collective bargaining agreement that expired during 2005 was ratified without any work stoppages. In 2006, two collective bargaining agreements representing approximately 130 employees will expire. Management expects to be able to negotiate new contracts with these labor unions. If we are unable to renegotiate acceptable collective bargaining agreements with these unions in the future, we could experience, among other things, strikes, work stoppages or other slowdowns by our workers and increased operating costs as a result of higher wages, health care costs or benefits paid to our union employees. Although we consider our current relations with the employees to be good, if we do not maintain these good relations, we could suffer a material adverse effect on our operating results.

Our expenditures for post-retirement and pension obligations could be materially higher than predicted if the Pension Benefit Guaranty Corporation asserts a claim against us or if our underlying estimates prove to be incorrect.

We sponsor qualified defined benefit pension plans that (1) are covered by Title IV of ERISA and (2) are subject to the minimum funding standards of the Internal Revenue Code and ERISA (the “qualified pension plans”). According to regulations issued by the United States Treasury Department and the Pension Benefit Guaranty Corporation, we are liable for (1) any funding deficiency or unpaid Pension Benefit Guaranty Corporation premiums with respect to any of the qualified pension plans and (2) any unfunded benefit liabilities if any of the qualified pension plans are terminated, either by the plan sponsor or by the Pension Benefit

17

Guaranty Corporation. Although we do not currently intend to terminate the qualified pension plans, they are not all fully funded. The Pension Benefit Guaranty Corporation has the right to seek available remedies under applicable law against us. If the Pension Benefit Guaranty Corporation were to enforce such a claim, the claim could significantly adversely affect our financial condition and results of operations.

Changing market or economic conditions, regulatory changes or other factors may increase our pension expenses or our funding obligations, diverting funds we would otherwise apply to other uses. We provide defined benefit pension plans and post-retirement health and life insurance benefits to eligible union and non-union employees. Our pension expense and our required contributions to our pension plans are directly affected by the value of plan assets, the projected rate of return on plan assets, the rate of return on plan assets and the actuarial assumptions we use to measure our defined benefit pension plan obligations, including the rate that future obligations are discounted to a present value. If our assumptions do not materialize as expected, cash expenditures and costs that we incur could be materially higher. Moreover, we cannot ensure that regulatory changes will not increase our obligations to provide these or additional benefits. These obligations also may increase substantially in the event of adverse medical cost trends or unexpected rates of early retirement, particularly for bargaining unit employees for whom there is no retiree health care cost cap. Early retirement rates likely would increase substantially in the event of a mine closure.

Additionally, our pension and postretirement health and life insurance benefits obligations, expenses and funding costs would increase significantly if one or more of the mines in which we have invested is closed. A mine closure would trigger accelerated pension and defined benefit pension plans and post-retirement health and life insurance benefits obligations. Any of these events could significantly adversely affect our financial condition and results of operations.

Health issues and litigation relating to silica and asbestos could adversely affect our financial results.

We are a defendant in various lawsuits related to our businesses. These matters include lawsuits relating to the exposure of persons to asbestos and silica. With respect to silica claims, at December 31, 2005, we were a co-defendant in cases involving about 15,219 claimants. At December 31, 2005, we were a co-defendant in cases alleging asbestos-induced illness involving claims of about 46,585 claimants.

The severity of the risk of a potential material adverse effect on our operating results from future asbestos claims cannot be measured, and is highly dependent on the rate of future claims, the cost to defend, settle or otherwise resolve claims, the length of time to resolve claims and the impact of future legislative or other developments in the asbestos litigation arena. Our ability to fund asbestos settlements or judgments will be subject to the availability of our remaining insurance coverage and to funds from operations, asset sales or capital-raising transactions. We have about $236 million of insurance resources available to address both current and future asbestos liabilities. We have had an average of 12,120 asbestos claims asserted against us each year for the past five years. The average cost per claim for settlement or other resolution for the past five years was about $1,000. The length of time to resolve claims varies on a case-by-case basis and can be affected by decisions of management and opposing counsel. If there are no developments that reduce the impact of asbestos litigation or its costs to us, our available insurance may be insufficient to cover all future claims, and there could be a material adverse affect on our results of operations, liquidity and financial position.

The plaintiffs in these cases generally seek compensatory and punitive damages of unspecified sums based upon common law or statutory product liability claims. Some of these claims have been brought by plaintiffs against us and other product manufacturer co-defendants, some of whom have also filed for bankruptcy protection. In addition, we have been the target of hundreds of lawsuits relating to the exposure by seamen employees to asbestos on the Company’s vessels. All but two of these seaman claims have been resolved and dismissed. Considering our past operations relating to the use of asbestos and our past and present operations in which we mined or mines silica, it is possible that additional claims may be made against us based upon similar or different legal theories seeking similar or different types of damages and relief.

18

Litigation is inherently unpredictable and subject to many uncertainties. Adverse court rulings, determinations of liability or retroactive or prospective changes in the law could affect claims made against us and encourage or increase the number and nature of future claims and proceedings. Therefore, due to the uncertainties involved in any litigation, management is unable to predict the outcome of litigation or the number of possible future claims and proceedings. There can be no assurance, however, that our insurers will not become insolvent or that we will not be involved in certain circumstances in coverage litigation with our insurers. In addition, even if the product liability claims are covered by insurance, there is no assurance that the amount paid in connection with a product liability claim will be sufficient to cover the entire amount of the claim.

On April 19, 2005, asbestos personal injury claims reform legislation was introduced to the United States Senate as Senate Bill 852, the “Fairness in Asbestos Injury Resolution Act of 2005.” The FAIR Act is problematic for us in its present form in that it appears that we would be in the bottom sub-tier of tier 2 companies and we would not receive credit for insurance assets we have relied upon to date. The insurance assets owned by us would be taken away and would not be available to us to use toward our annual contribution amount. In addition, we, as well as other similarly situated well-insured smaller companies, are disproportionately impacted by the proposed legislation in that it requires us to contribute approximately 4% of our 2002 revenue each year, while larger, and often less well-insured companies, will be required to contribute a fraction of one percent of their respective 2002 revenues each year. On April 26, 2005, the Senate Judiciary Committee held a hearing on this bill, and through the Coalition for Asbestos Reform, we were represented. On May 26, 2005, the Senate Judiciary Committee voted the bill out of Committee to be heard on the Senate floor. The Senate went into summer recess on August 1, 2005 before the bill was introduced onto the Senate floor. The bill was introduced on the Senate floor on February 6, 2006; however, the bill was returned to Committee without further action on February 15, 2006 after failing to survive a budget point of order. Since the legislative process is unpredictable and constantly changing, it is unclear whether the FAIR Act will be enacted with or without significant amendment. If the FAIR Act is enacted in its present form, it would have a material adverse effect on our results of operations, liquidity and financial position.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

19

20

The Company’s principal operating properties are described below. The Company’s executive offices are located at North Point Tower, 1001 Lakeside Avenue, 15th Floor, Cleveland, Ohio 44114-1151, under a lease expiring on December 31, 2013. The total area involved is approximately 22,329 square feet.

| | | | | | |

Location | | Use | | Owned/ Leased | | Reserves (1) (years remaining) |

| Corporate Headquarters | | | | | | |

| Cleveland, Ohio | | Offices | | Leased | | N/A |

| | | |

| O-N Minerals Great Lakes Operations | | | | | | |

| Cleveland, Ohio | | Marine transportation bulk commodity dock | | Leased | | N/A |

| | | |

| Cleveland, Ohio | | Offices | | Subleased | | N/A |

| | | |

Rogers City, Cedarville and Gulliver, Michigan | | Limestone quarries, vessel loading facility and processing plant | | Owned(2) | | See Chart |

| | | |

| Erie, Pennsylvania | | Marine transportation bulk commodity dock | | Leased | | N/A |

| | | |

| Portage, Indiana | | Limestone processing plant | | Owned | | N/A |

| | | |

| Toledo, Ohio | | Warehouse of spare parts | | Owned | | N/A |

| | | |

O-N Minerals Inland Operations | | | | | | |