Filed by Corgentech Inc. Pursuant to Rule 425

Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: AlgoRx Pharmaceuticals, Inc.

Registration Statement No. on Form S-4: 333-129177

*** *** ***

The following is a slide presentation used at investor meetings on November 8, 2005.

Creating a Late-Stage Company Focused on Pain Management and Inflammation November 8, 2005 CIBC World Markets Healthcare Conference |

2 FORWARD LOOKING STATEMENTS This presentation includes "forward-looking statements" within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. Forward-looking statements in this presentation include, without limitation, forecasts of product development, FDA filings, benefits of the proposed merger, and other matters that involve known and unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to differ materially from results expressed or implied in this presentation. Such risk factors include, among others: difficulties encountered in integrating merged businesses; uncertainties as to the timing of the merger; approval of the transaction by the stockholders of the companies; the satisfaction of closing conditions to the transaction, including the receipt of regulatory approvals; whether certain market segments grow as anticipated; the competitive environment in the biotechnology industry; and whether the companies can successfully develop new products and the degree to which these gain market acceptance. Actual results may differ materially from those contained in the forward-looking statements in this presentation. Additional information concerning these and other risk factors is contained in Corgentech’s Form 10-K/A for the year ended December 31, 2004 and most recently filed Form10-Q. Corgentech and AlgoRx undertake no obligation and do not intend to update these forward-looking statements to reflect events or circumstances occurring after this press release. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. All forward-looking statements are qualified in their entirety by this cautionary statement. |

3 FORWARD LOOKING STATEMENTS (2) Additional Information and Where to Find It Corgentech Inc. has filed a registration statement on Form S-4, and Corgentech and AlgoRx Pharmaceuticals, Inc. have filed a related joint proxy statement/prospectus, in connection with the merger transaction involving Corgentech and AlgoRx. Investors and security holders are urged to read the registration statement on Form S-4 and the related joint proxy statement/prospectus because they contain important information about the merger transaction. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC at the SEC's web site at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by contacting Corgentech Investor Relations at the email address: investors@corgentech.com. Corgentech, AlgoRx and their directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Corgentech and AlgoRx in connection with the merger transaction. Information regarding the special interests of these directors and executive officers in the merger transaction is included in the joint proxy statement/prospectus of AlgoRx and Corgentech described above. Additional information regarding the directors and executive officers of Corgentech is also included in Corgentech's proxy statement for its 2005 Annual Meeting of Stockholders, which was filed with the SEC on April 27, 2005. This document is available free of charge at the SEC's web site at www.sec.gov and from Investor Relations at Corgentech as described above. |

4 DELIVERING ON OUR PROMISES File IND for Phase 1 Trial of ALGRX 1207 for Pain Relief Report Clinical Data from Phase 1/2 Trial of Avrina™ (NF-KB Decoy) for Eczema Report Clinical Data from Second Phase 3 Trial of ALGRX 3268 Report Clinical Data from Phase 2 Trial of ALGRX 4975 for Morton’s Neuroma Report Clinical Data from First Phase 3 Trial of ALGRX 3268 |

6 ALGRX 3268- TOPICAL LOCAL ANESTHESIA Key desirable product attributes – Sterile, pre-filled, needle-free disposable delivery system (Powderject ® ) – Rapid onset of action Within 1 minute with duration of about 10 minutes – No vasoconstriction with good dermal tolerability – Ease of use with no dressings Indication – Reduction of pain associated with venipunctures and intravenous line placements Two Phase 3 trials required for approval |

7 PHASE 3’s: PEDIATRIC TRIALS IDENTICAL PROTOCOLS Design – U.S. multicenter, randomized, double-blind, placebo-controlled Number of subjects – 500-600 subjects in each study Population – Pediatric subjects of either gender (ages 3-18) Objectives – Confirm efficacy, safety and tolerability of ALGRX 3268 vs. placebo administered on back of hand and antecubital fossa Primary endpoint – Assessment of pain on venipuncture or peripheral venous cannulation performed 1-3 minutes after ALGRX 3268 or placebo in total population (3-18 yrs.) using FACES rating scale |

8 POSITIVE RESULTS FROM TWO PHASE 3 TRIALS Primary endpoint achieved (p=0.007) – Statistically significantly less pain on needle insertion in treated group compared to placebo group assessed using FACES rating scale 574 patients at six U.S. clinical trial sites – ALGRX 3268 group = 289 patients (ages 3-18) – Placebo = 285 patients (ages 3-18) Safety – Well tolerated Primary endpoint achieved (p=0.002) – Statistically significantly less pain on needle insertion in treated group compared to placebo group assessed using FACES rating scale 535 patients at nine U.S. clinical trial sites – ALGRX 3268 group = 269 patients (ages 3-18) – Placebo = 266 patients (ages 3-18) Safety – Well tolerated Data from second Phase 3 trial announced TODAY |

9 -30 -20 -10 0 10 1 3 5 Time after administration, minutes ALGRX 3268 ALGRX 3268 has an onset within one minute, whereas EMLA is labeled for a pretreatment period of at least one hour Rapid Onset of Action Critical to Adoption of Product ALGRX 3268 Data from Phase 1 trial in 272 adults EMLA Package Insert for EMLA -30 -20 -10 0 10 3 60 Time after administration, minutes |

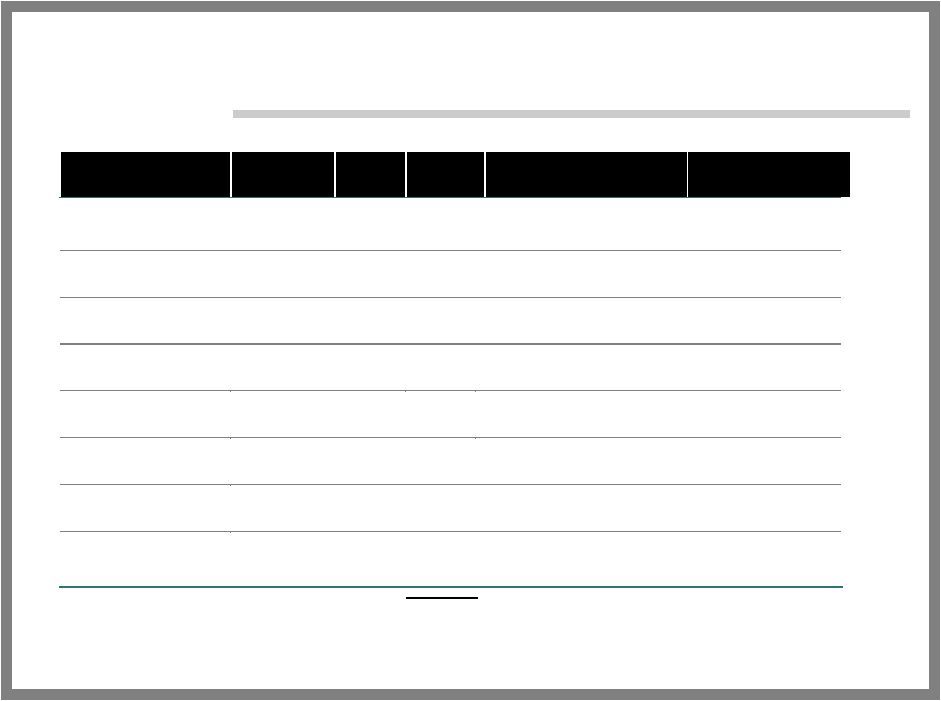

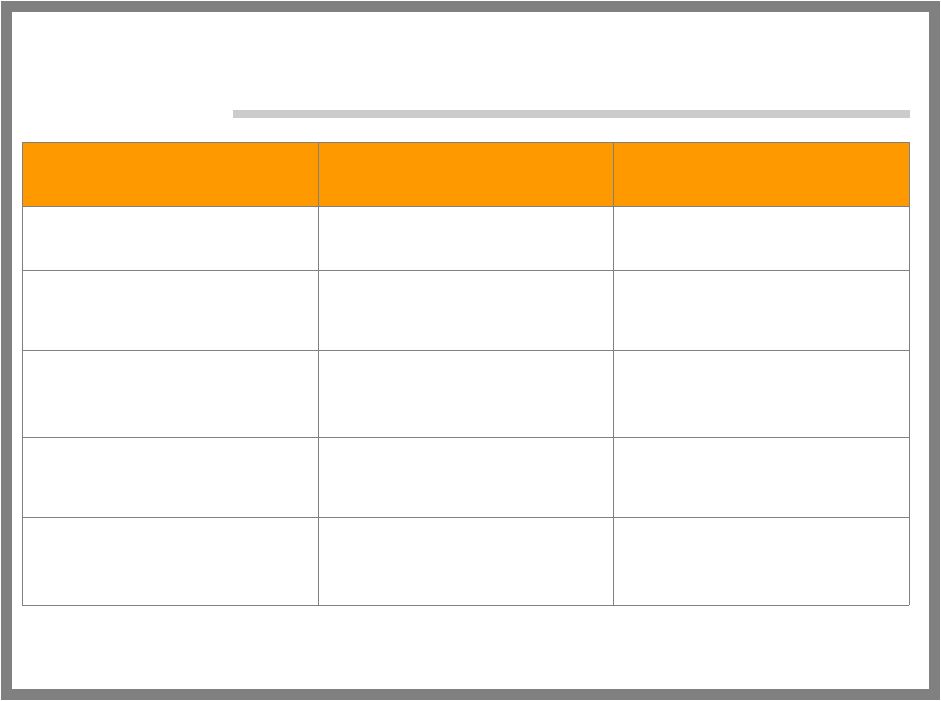

10 Protocol Age Group Phase Total Patients Primary Endpoint Status Antecubital Fossa Adults 1 272 Safety and Efficacy Primary Endpoint Achieved Back of Hand Adults 1 183 Safety and Efficacy Primary Endpoint Achieved Pharmacokinetics Adults 1 38 Evaluate Circulating Lidocaine Primary Endpoint Achieved Antecubital Fossa Children 2 195 Safety and Efficacy Primary Endpoint Achieved Back of Hand Children 2 145 Safety and Efficacy Primary Endpoint Achieved Back of Hand Children 2 306 Safety and Efficacy Primary Endpoint Achieved Antecubital Fossa and Back of Hand Children 3 574 Safety and Efficacy Primary Endpoint Achieved Antecubital Fossa and Back of Hand Children 3 535 Safety and Efficacy Primary Endpoint Achieved ALGRX 3268 DEVELOPMENT 2,248 |

11 PROJECTED TIMELINE FOR ALGRX 3268 Registration – File NDA in 2006 – Product approval in 2007 Regulatory – Reviewed as a drug by the FDA Analgesics and Acute Care Division |

COMMERCIAL OPPORTUNITIES FOR ALGRX 3268 |

13 ALGRX 3268: VENIPUNCTURE MARKETS Pediatric in-hospital procedures 18,000,000 Adult in-hospital emergency room visits 89,000,000 Hemodialysis patient visits 46,800,000 PROCEDURE NUMBERS Additional Target Market Includes the 66,000 Physician’s Offices, Clinical Labs and Blood Donation Centers in the U.S. |

14 PEDIATRIC IN-HOSPITAL MARKET Target market – Only 2.1MM out of 18MM venipuncture procedures in children’s hospitals and large academic institutions utilize a topical local anesthetic today Low utilization of topical local anesthetics (12% of pediatric procedures) due to: – slow onset of action – lack of promotion of currently available drugs Faster onset of action, needleless injection and promotion will allow significant penetration and growth into target market of 18MM pediatric procedures |

15 ALGRX 3268- DRUG CLASS COMPARISON 37% blanching, 30% erythema Minimal erythema Adverse Reactions 1-2 hours after removal 10-15 minutes Duration 60 minutes to several hours 1 minute Onset of Action Messy and requires covering Minimal Preparation Ease of Use +++ +++ Efficacy EMLA ALGRX 3268 |

16 ALGRX 3268: POTENTIAL PEDIATRIC MARKET $60mm - $80mm 5mm $12 - $16* $72mm - $96mm 6mm $12 - $16* $48mm - $64mm 4mm $12 - $16* $36mm - $48mm 3mm $12 - $16* $24mm - $32mm 2mm $12 - $16* POTENTIAL SALES POTENTIAL ANNUAL PROCEDURES STRAWMAN UNIT PRICE * Price for ALGRX 3268 has not yet been established. $12 - $16 represents cost of EMLA ($8.34 in 2004) plus a 50% - 100% premium Superior Product Profile + Promotional Efforts = Market Penetration and Market Growth |

17 ALGRX 3268: PHASED MARKETING APPROACH In-hospital Pediatric 18M |

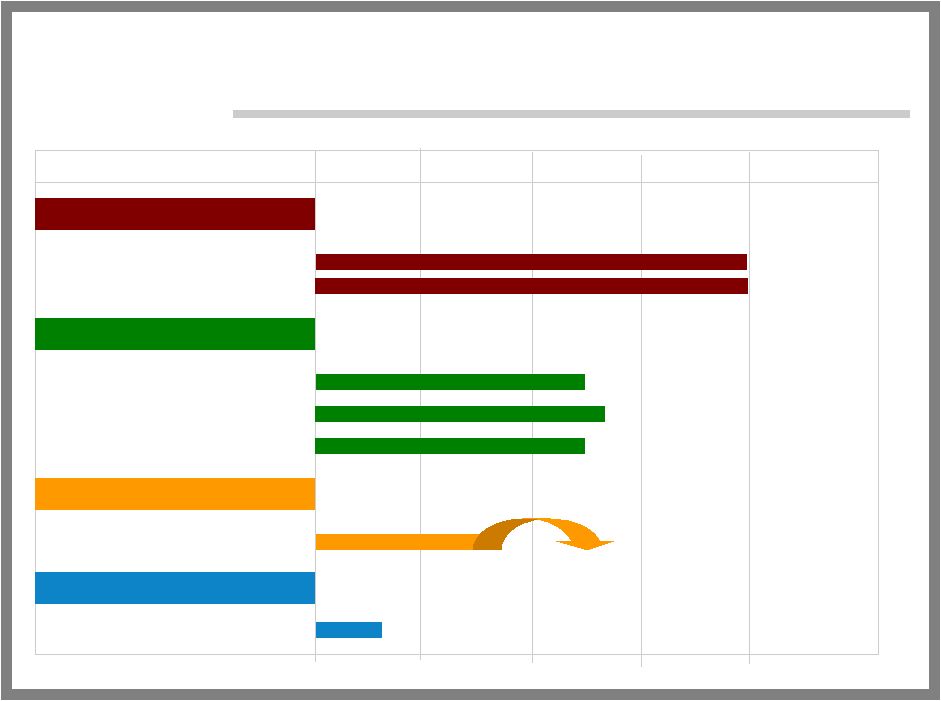

18 PRODUCT PIPELINE PRECLINICAL PHASE 1 PHASE 2 PHASE 3 ALGRX 3268 ALGRX 4975 * ALGRX 1207 * Pre-procedural analgesia (003) Pre-procedural analgesia (004) Post-surgical pain Morton’s neuroma Tendonitis Cutaneous neuropathic pain NF-KB Decoy * Atopic dermatitis (eczema) * Does not reflect comprehensive list of trials currently underway CTD |

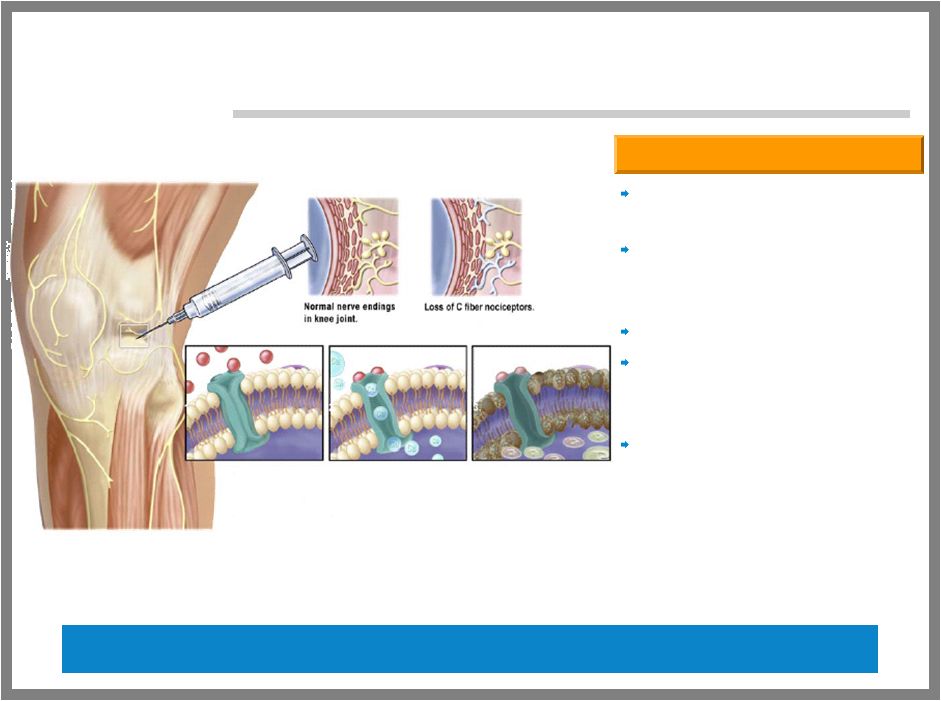

20 ALGRX 4975 – VR1 ANESTHETIC Administered locally at the site of pain Single administration may provide analgesia for weeks to months Non-opioid based Only reduces long-term noxious pain associated with C-neurons Does not affect other nerve fibers important for motor skills Capsaicin Overview Blocks noxious pain with long duration Activates the VR1 channel; expressed by pain receptor C-fibers |

21 ALGRX 4975 DEVELOPMENT Protocol Phase Total Patients Primary Endpoint Status Postsurgical Pain Bunion Removal Surgery 2 40 Time to Rescue Medication 72-hour Endpoint Achieved Bunion Removal Surgery 2 182 Magnitude of Pain Relief 24 and 72- hour Endpoints Achieved Hernia Repair 2 48 Magnitude and Duration of Pain Relief Ongoing Total Knee Replacement 2 60 Dosing Study Ongoing Cholecystectomy 2 40 Magnitude of Pain Relief Ongoing Neuropathic Pain Morton's Neuroma 2 60 Magnitude and Duration of Pain Relief Achieved 30 Day Endpoint; Ongoing Musculoskeletal Pain End-Stage Osteoarthritis 1 16 Safety Primary Endpoint Achieved End-Stage Osteoarthritis 2 12 Magnitude and Duration of Pain Relief Primary Endpoint Achieved Osteoarthritis of the Knee 2 52 Magnitude and Duration of Pain Relief Primary Endpoint Missed Tendonitis 2 40 Magnitude and Duration of Pain Relief Achieved 30 Day Endpoint; Ongoing |

22 ALGRX 4975: PROOF OF CONCEPT ESTABLISHED TARGET MARKETS MODEL FOR STUDY Delay progression to surgery Musculoskeletal Pain Tendonitis / Osteoarthritis Complex Regional Pain Syndrome (CRPS) Local Neuropathic Pain Morton’s Neuroma Joint Replacement Post-Surgical Pain Bunionectomy |

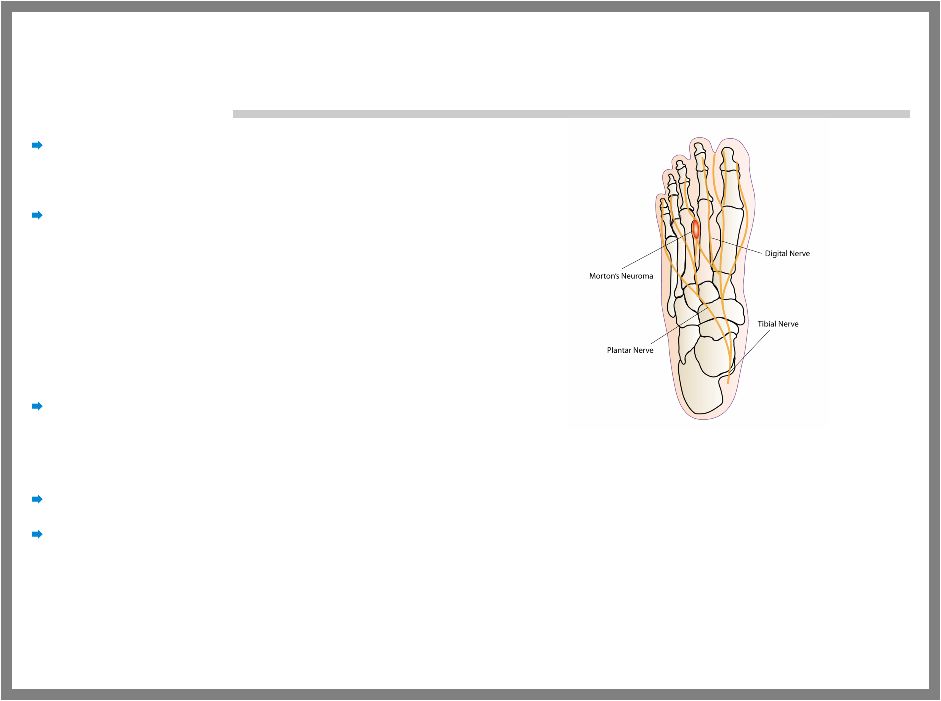

23 MORTON’S NEUROMA Type of localized post- trauma neuropathic pain Painful foot condition that typically occurs as a result of: – Running – Wearing high narrow shoes – Excessive standing Neuroma (thickened nerve tissue) – Forms as a result of injury to one of the nerves that leads to the toes – Leads to numbness and pain that can make walking unbearable Orthotics and oral analgesics have limited effectiveness over time Invasive treatments are often employed – Local corticosteroid injections to reduce swelling (poorly tolerated) – Local alcohol injections to kill the nerve which leads to permanent numbness – Surgical intervention to remove the nerve which leads to permanent numbness |

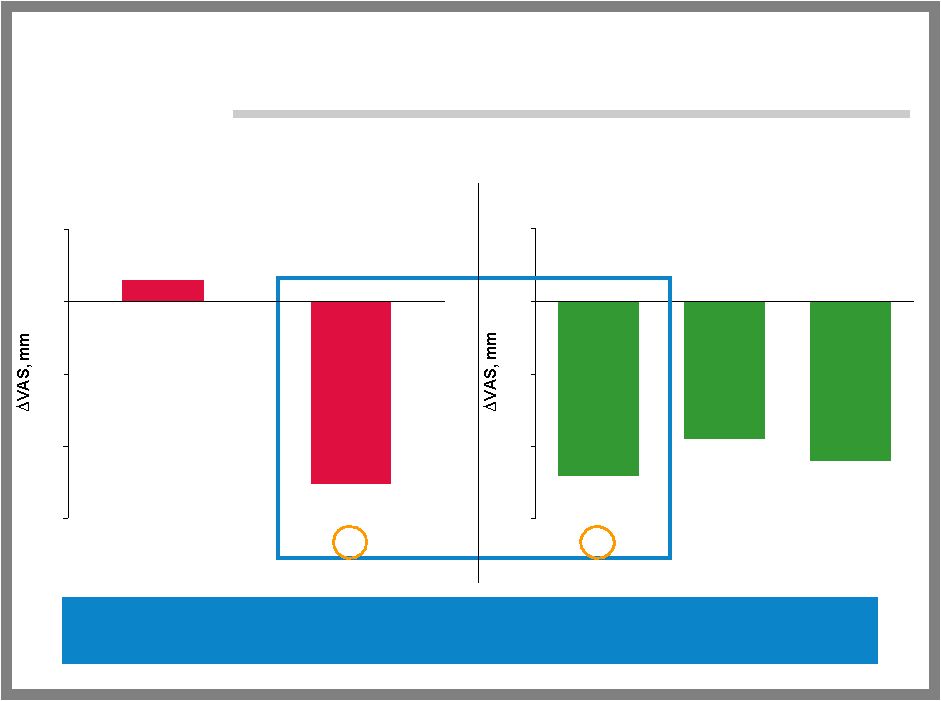

24 PHASE 2 RESULTS: MORTON’S NEUROMA Objectives – Confirm efficacy, safety and tolerability of ALGRX 4975 vs. placebo administered by single injection into neuroma Design and population – U.S. randomized, double-blind, placebo-controlled – 58 subjects of either gender at two U.S. clinical trial sites ALGRX 4975 group = 30 patients, placebo group = 28 patients Primary endpoint achieved (p=0.0188) – Statistically significant pain reduction in Morton’s neuroma four weeks after single injection of ALGRX 4975 – 63% pain reduction vs. 38% pain reduction in patients receiving ALGRX 4975 vs. placebo Safety – Well tolerated |

COMMERCIAL OPPORTUNITIES FOR ALGRX 4975 |

26 ALGRX 4975: U.S. POST-SURGICAL AND NEUROPATHIC PAIN MARKETS POST-SURGICAL PAIN Bunionectomy 709,000 Cholecystectomy 1,230,000 Total knee replacement 412,000 Total hip replacement 346,000 Hernia repair 825,000 Hysterectomy 789,090 LOCAL NEUROPATHIC PAIN 1,269,000 TOTAL 5,580,090 PROCEDURE NUMBERS |

27 POST-OP PAIN DRUG COMPARISON Hours Weeks Duration Rapid Rapid Onset of action Respiratory depression, nausea, vomiting, ileus Cannot inject near large nerves Safety Frequent Single application Dosing +++ +++ Efficacy Opioids ALGRX 4975 |

28 ALGRX 4975: POST-OPERATIVE PAIN MARKET U.S. post-operative pain market: $1.7 billion Virtually all patients experience some level of pain post operatively Pain in hospital associated with increased length of stay, longer recovery times, poorer patient outcomes |

29 POST-TRAUMA NEUROPATHIC PAIN: BACKGROUND Approximately 1.2 million Americans suffer from a localized form of neuropathic pain resulting from trauma or surgery – Pain lasting months and often severe and debilitating Occurs following 10% of general and 30% of orthopedic surgeries – Most commonly associated general surgeries: Hernia repairs Colon resections Laparotomy Breast surgery – Most commonly associated orthopedic surgeries: Total knee or joint replacement Rotator cuff surgery Ankle fusion Long bone fracture Back/spine surgery, laminectomy |

30 ALGRX 4975: NEUROPATHIC PAIN MARKET No drugs indicated for Morton’s neuroma or other post trauma neuropathic pain syndromes – Off label usage of Neurontin, Lidoderms, antidepressants and opioids U.S. neuropathic pain market: $1.9 billion Despite employing concomitant treatment with several drugs with different mechanisms existing treatments yield some improvement in only 50% of patients – All associated with significant side effects If drug treatment fails, neurolysis (alcohol, phenol) or sympathectomy performed |

31 ALGRX 4975: BLOCKBUSTER POTENTIAL Significant unmet medical need Attractive product profile Large surgical volume Small target audience Specialized sales forces |

AVRINA™ (NF-KB DECOY) FOR ECZEMA |

33 COMMON, CHRONIC PROBLEM Eczema (Atopic Dermatitis) – Red, cracked, and unbearably itchy skin caused by excess inflammation in the skin – Makes the person more susceptible to infection 90% of people with AD have staph bacteria on their skin compared to <5% of people without AD – Affects about 15 million people in the United States Affects about 10-20% of infants – Very common in all parts of the world |

34 ATTRACTIVE INDICATION Unmet medical need – Existing therapies are not satisfactory (steroid and calcineurin inhibitors) – Safety issues with long-term application of steroids, especially in children, and black box warning for cancer risk on calcineurin inhibitors Strong preclinical data showing effective treatment for eczema Two Phase 1/2 trials underway in 75 U.S. patients and 120 ex-U.S. patients testing different doses and dosing schedules – U.S. Phase1/2 trial fully enrolled – Data expected in 1Q06 |

35 LACK OF REBOUND WITH NF- B DECOY Start Daily Treatment Stop Treatment Placebo NF- B Decoy Betamethasone Days 20 30 40 50 60 70 80 0 7 14 21 28 35 42 49 |

36 DRUG COMPARISON None Limits use None Skin-thinning ++ +++ +++ Onset of action Black box warning for cancer risk May cause significant side effects Limited Systemic exposure Frequent Once/twice a day Short-term +++ Steroids Occasional None Rebound Twice a day Short-term/ intermittent long-term Once a day or less Dosing ++ +++ Efficacy Calcineurin Inhibitors NF- B Decoy Topical Agents |

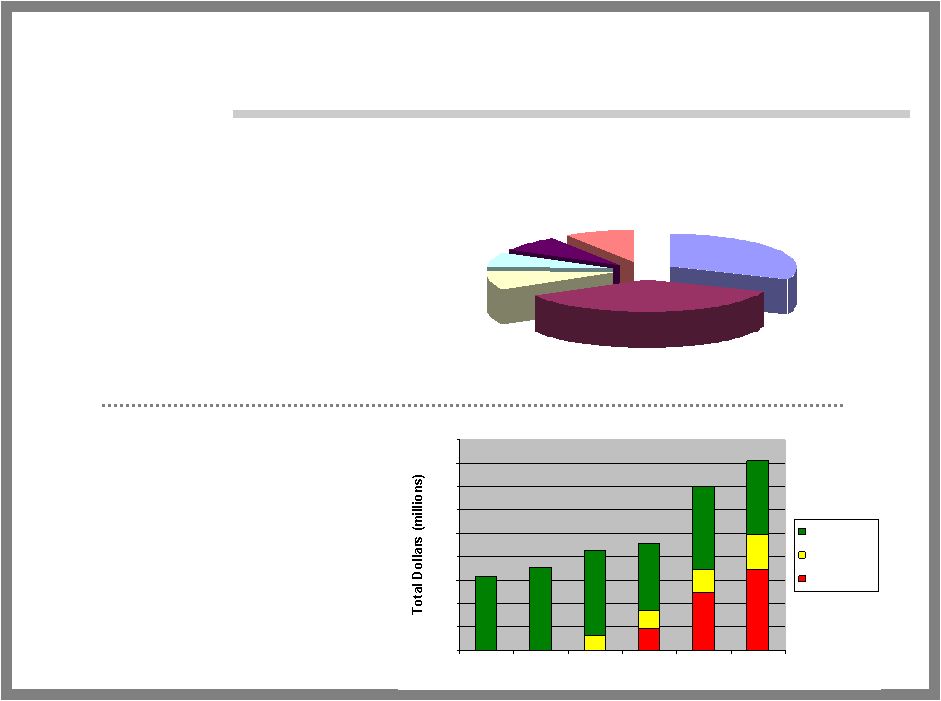

37 COMMERCIAL OPPORTUNITY Total Dollars $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 1999 2000 2001 2002 2003 2004 Corticosteroids Protopic Elidel Focused Prescriber Base •10-20% of all dermatological visits •70% of all pediatric visits to a dermatologist Growing Market with new, premium priced drugs Family Practice 9% Internal Med 7% Allergy 8% Pediatricians 36% Dermatologists 31% Others 9% |

39 ALGRX 1207 IND-enabling studies underway New chemical class of local anesthetic for topical analgesia Deep, rapid penetration of the skin and long duration of action Addresses a wide variety of procedures including: – Neuropathic pain – Dermatological surgery – Surgical incisions |

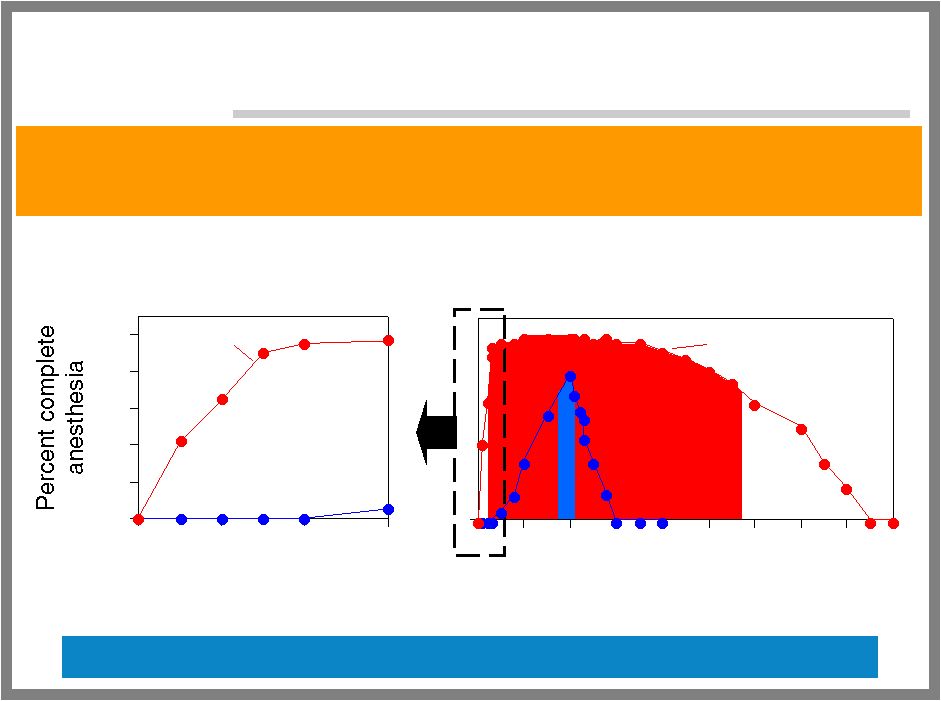

40 ALGRX 1207: NOVEL LOCAL ANESTHETIC Rapid, complete, and long-lasting topical anesthesia without exotic delivery Unique non-clinical results in relevant models Time (minutes) after single application Time (hours) after single application Rapid Onset of Complete Anesthesia Long Duration of Pain Relief Lidocaine ALGRX 1207 0 20 40 60 80 100 0 10 20 30 ALGRX 1207 0 0 1 2 3 4 5 6 7 8 9 |

41 ALGRX 1207:TARGET MARKET Drug 2004 US Sales ($ in MM) Patient Cost/ Year OxyContin $1,500 $2,730 Neurontin $2,198 $2,430 Duragesic $1,266 $2,420 Lidoderm $309 $1,450 Drug 2004 US Sales ($ in MM) Patient Cost/ Year OxyContin $1,500 $2,730 Neurontin $2,198 $2,430 Duragesic $1,266 $2,420 Lidoderm $309 $1,450 Neuropathic pain HIV and AIDS pain Diabetic neuropathic pain Post herpetic neuralgia Chemotherapy- induced neuropathy |

43 PREVALANCE OF PAIN IN SEVEN MAJOR COUNTRIES Prevalence of post-operative pain 75,068,000 Prevalence of back pain 208,996,000 Prevalence of HIV and AIDS pain 847,000 Prevalence of diabetic neuropathy pain 13,243,000 Prevalence of osteoarthritic pain 46,610,000 Source: Datamonitor Above indications are all targets of Corgentech pipeline PATIENT NUMBERS |

44 SHORTCOMINGS OF CURRENT TREATMENTS FOR PAIN Slow onset of action Insufficient efficacy Occurrence of side effects Need for frequent dosing Lack of site specificity Potential to cause physical dependence |

45 CREATING LATE-STAGE COMPANY Four product development programs focused on significant clinical problems with attractive market potential – Each drug has unique mechanism of action offering risk diversification – Each drug has potential for approval in multiple indications – Each drug can be commercialized with specialty sales force – All discovery and development programs 100% owned Phase 3 program ALGRX 3268 for the treatment of venipuncture – Statistically significantly less pain in two Phase 3 trials – Expect to file NDA in 1H06 – Expect product approval in 1H07 Development and commercial expertise in critical areas – Marketing, commercialization, regulatory affairs, manufacturing and clinical trials management Financial strength and flexibility |

46 COMBINED COMPANY Clear Regulatory Pathways Faster, Less Expensive Trials Substantial Body of Preclinical and Clinical Data Differentiated Products with Clear Advantages over Current Therapies Unmet or Underserved Medical Needs Sizable Patient Populations Pain Management and Inflammation |

Thank you for joining us for today’s presentation. For additional information about the proposed merger of Corgentech and AlgoRx, please visit www.corgentech.com and the other sources described in our forward looking statement slide. |