UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

July 7, 2006

Date of Report

(Date of earliest event reported)

GENWORTH LIFE AND ANNUITY INSURANCE COMPANY

(exact name of registrant as specified in charter)

| | | | |

| Virginia | | 001-32709 | | 54-0283385 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | |

| 6610 West Broad Street, Richmond, VA | | 23230 |

| (Address of principal executive offices) | | (Zip Code) |

(804) 281-6000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ¨ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act |

As previously disclosed in our Current Report on Form 8-K filed on July 6, 2006, Genworth Life and Annuity Insurance Company (the “Company,” “we,” “us,” or “our”), a stock life insurance company operating under a charter granted by the Commonwealth of Virginia, requested that the State Corporation Commission, Bureau of Insurance of the Commonwealth of Virginia review and ultimately approve the proposed mergers of Federal Home Life Insurance Company (“FHL”) and First Colony Life Insurance Company (“FCL”) into the Company (“GLAIC Merged”). The Company would be the surviving entity. FHL and FCL are both stock life insurance companies operating under charters granted by the Commonwealth of Virginia and both are affiliates of the Company. The proposed mergers are subject to state insurance regulatory approval. Should these proposed mergers be consummated, the anticipated effective date is January 1, 2007. Upon consummation of the contemplated mergers involving FHL and FCL and subject to regulatory approval, it is anticipated that GLAIC Merged would transfer its shares of American Mayflower Life Insurance Company of New York (“AML”) to Genworth Life Insurance Company of New York (“GLICNY”), an affiliate, in exchange for a non-majority ownership interest in GLICNY. Upon transfer, AML would be merged into GLICNY. GLICNY would be the surviving entity. These mergers are part of the continuing efforts of Genworth Financial, Inc. (“Genworth”), our ultimate parent company, to simplify its operations, reduce its costs and build its brand.

The purpose of this Current Report on Form 8-K, including exhibits, is to provide information regarding the proposed mergers and should not be construed to suggest that the mergers will be consummated at all or in the manner proposed.

Attached as exhibits to this Current Report on Form 8-K are the audited statutory financial statements of the Company, FHL and FCL as of and for the years ended December 31, 2005 and 2004 and the unaudited interim condensed statutory basis financial information as of and for the period ended March 31, 2006. Financial statements for FHL and FCL were not historically prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) but instead were prepared in accordance with statutory accounting principles as prescribed or permitted by the State Corporation Commission, Bureau of Insurance of the Commonwealth of Virginia (“SAP”). SAP differs materially from U.S. GAAP. These differences are explained in Footnote 1 to each of the audited statutory basis financial statements of the Company, FHL and FCL as of and for the years ended December 31, 2005 and 2004. Although the Company does prepare audited U.S. GAAP financial statements, its SAP financial information is included for informational purposes. Attached as an exhibit to this Current Report on Form 8-K is a supplemental business description of GLAIC reflecting the proposed mergers, supplemental risk factors reflecting the proposed mergers and pro forma statutory financial information reflecting the proposed mergers for the year ended December 31, 2005 (the “Pro Forma Information”). As of the date of this Current Report on Form 8-K, management is not aware of any transaction occurring or contemplated since December 31, 2005 that would require any material adjustments to the Pro Forma Information. The pro forma adjustments do not include any transaction costs that may be associated with the mergers as the amounts are not deemed to be material.

This Current Report on Form 8-K should be read in conjunction with the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005 including the audited financial statements contained therein and the Company’s Quarterly Report on Form 10-Q for the period ended March 31, 2006 including the unaudited financial statements contained therein.

2

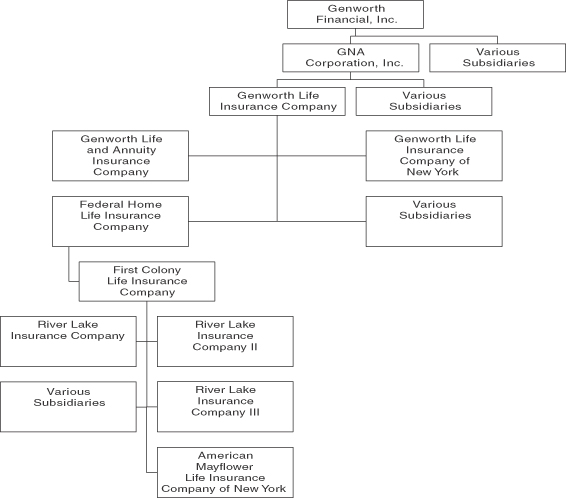

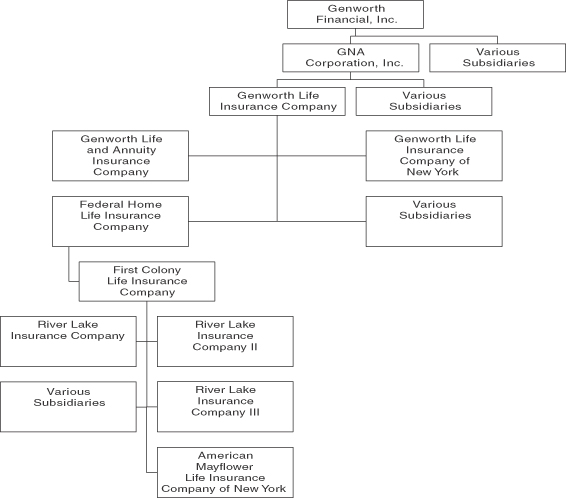

Existing organizational structure:

The following reflects the current organizational structure of Genworth prior to the proposed mergers:

3

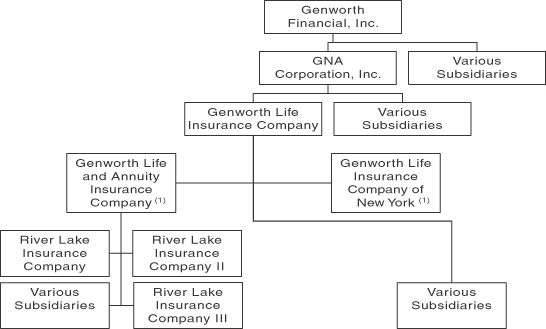

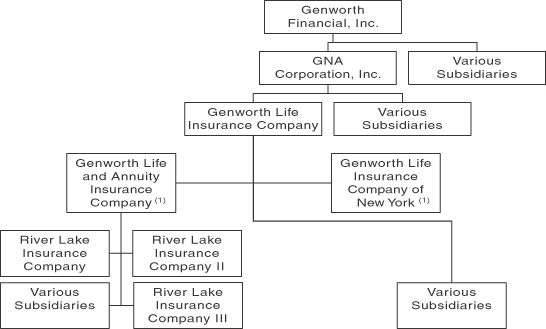

Proposed organizational structure after merger:

The following reflects the contemplated organizational structure after the proposed mergers:

| (1) | As part of a separate transaction and subject to regulatory approval, the Company intends to transfer American Mayflower Life Insurance Company of New York (“AML”) to Genworth Life Insurance Company of New York (“GLICNY”) in exchange for a non-majority ownership in GLICNY. Upon transfer, AML would be merged into GLICNY. GLICNY would be the surviving entity. |

Cautionary note regarding forward-looking statements

This Current Report on Form 8-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will,” or words of similar meaning and include, but are not limited to, statements regarding the outlook for our future business and financial performance. Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially due to global political, economic, business, competitive, market, regulatory and other factors, including the items identified under “Item 1A—Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005 and in Exhibit 99.2 to this Current Report on Form 8-K.

We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | | GENWORTH LIFE AND ANNUITY INSURANCE COMPANY |

| | | | |

| | | | | | By: | | /s/ J. KEVIN HELMINTOLLER |

| Date: July 7, 2006 | | | | | | J. Kevin Helmintoller Senior Vice President—Chief Financial Officer |

5

EXHIBIT INDEX

| | |

| 23.1 | | Consent of KPMG LLP |

| |

| 99.1 | | Supplemental Business Description Reflecting Proposed Mergers |

| |

| 99.2 | | Supplemental Risk Factors Reflecting Proposed Mergers |

| |

| 99.3 | | Statutory Financial Statements of GE Life and Annuity Assurance Company (renamed Genworth Life and Annuity Insurance Company effective January 1, 2006) as of and for the years ended December 31, 2005 and 2004 |

| |

| 99.4 | | Statutory Financial Statements of Federal Home Life Insurance Company as of and for the years ended December 31, 2005 and 2004 |

| |

| 99.5 | | Statutory Financial Statements of First Colony Life Insurance Company as of and for the years ended December 31, 2005 and 2004 |

| |

| 99.6 | | Unaudited Statutory Financial Statements of Genworth Life and Annuity Insurance Company as of and for the periods ended March 31, 2006 and 2005 |

| |

| 99.7 | | Unaudited Statutory Financial Statements of Federal Home Life Insurance Company as of and for the periods ended March 31, 2006 and 2005 |

| |

| 99.8 | | Unaudited Statutory Financial Statements of First Colony Life Insurance Company as of and for the periods ended March 31, 2006 and 2005 |

| |

| 99.9 | | 2005 Unaudited Statutory Pro Forma Financial Information Reflecting Proposed Mergers |

6