z Annual Shareholders’ Meeting May 17, 2022 2022 Shareholders’ Meeting

z Eugene Hearl Recognition WHEREAS, Eugene S. Hearl retired May 17, 2022, after completing outstanding service to New Peoples Bankshares , Inc. and Subsidiaries since 2010; and WHEREAS, Mr. Hearl provided excellent leadership and service to New Peoples Bankshares Inc. and Subsidiaries by serving as a Board member and made a number of significant contributions to the Company; and WHEREAS, Mr. Hearl has earned the admiration and respect of the Board of Directors, employees, shareholders, and customers at New People Bankshares , Inc. and Subsidiaries for his dedication, integrity, enthusiasm, professionalism, and hard work; NOW, THEREFORE, BE IT RESOLVED, that the Board of Directors herewith expresses its sincere gratitude for the invaluable contributions he has made to New Peoples Bankshares , Inc. and Subsidiaries; FURTHERMORE RESOLVED, this Board of Directors extends to Eugene S. Hearl and his family blessings for good health and best wishes for the future; and, BE IT FURTHER RESOLVED, this resolution be spread upon the permanent minutes of the Board and that copies be sent to Mr. Hearl to share with his family.

z Cautionary Statement Regarding Forward - Looking Statements This presentation includes forward - looking statements . These forward - looking statements are based on current expectations that involve risks, uncertainties, and assumptions . Should one or more of these risks or uncertainties materialize or should underlying assumptions prove incorrect, actual results may differ materially . These risks include : changes in business or other market conditions ; the timely development, production and acceptance of new products and services ; the challenge of managing asset/liability levels ; the management of credit risk and interest rate risk ; the difficulty of keeping expense growth at modest levels while increasing revenues ; and other risks detailed from time to time in the Company's Securities and Exchange Commission reports including, but not limited to, the most recent quarterly report filed on Form 10 - Q, current reports filed on Form 8 - K, and the Annual Report on Form 10 - K for the most recent fiscal year end . Pursuant to the Private Securities Litigation Reform Act of 1995 , the Company does not undertake to update forward - looking statements to reflect circumstances or events that occur after the date the forward - looking statements are made . 3

z Vision Statement New Peoples Bank will be the #1 financial institution of choice in Central Appalachia making our customers, investors, employees and communities dreams come true.

z Mission Statement New Peoples Bank provides high - quality, state - of - the - art, golden - rule banking services to our customers generating an excellent return to our stockholders and providing a challenging and rewarding work environment for our employee family.

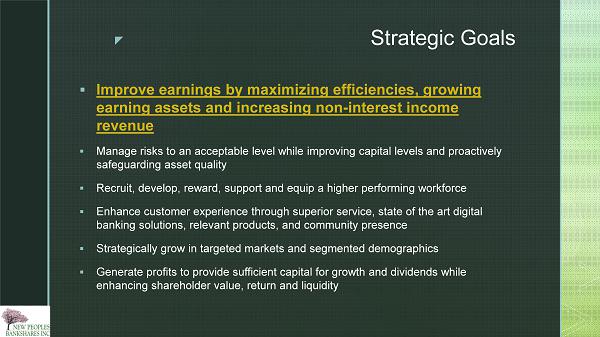

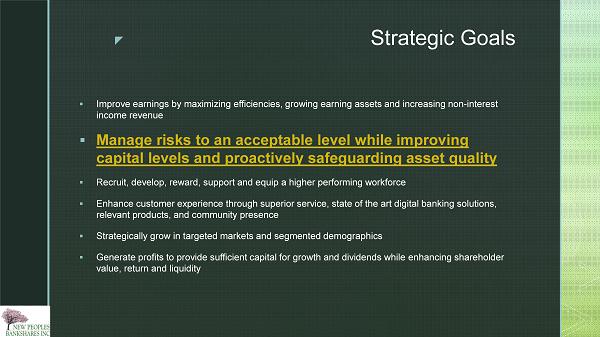

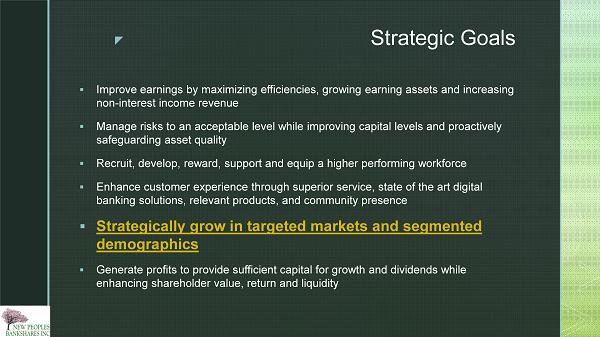

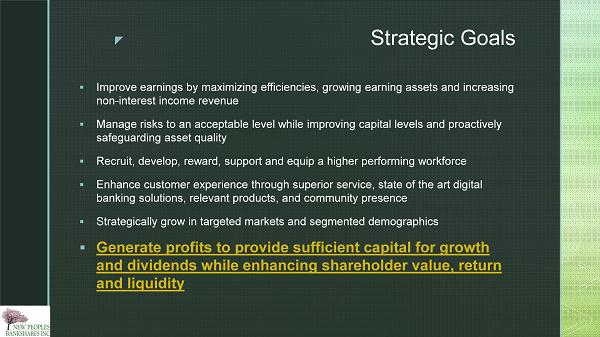

z Strategic Goals ▪ Improve earnings by maximizing efficiencies, growing earning assets and increasing non - interest income revenue ▪ Manage risks to an acceptable level while improving capital levels and proactively safeguarding asset quality ▪ Recruit, develop, reward, support and equip a higher performing workforce ▪ Enhance customer experience through superior service, state of the art digital banking solutions, relevant products, and community presence ▪ Strategically grow in targeted markets and segmented demographics ▪ Generate profits to provide sufficient capital for growth and dividends while enhancing shareholder value, return and liquidity

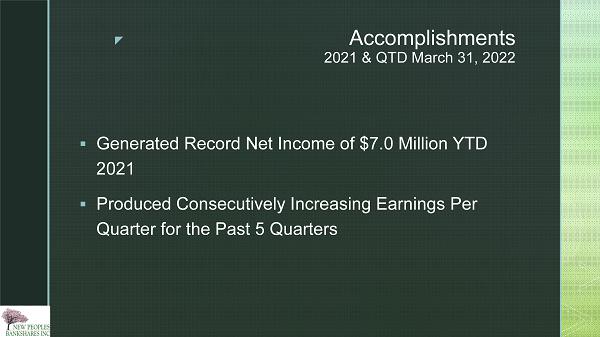

z Accomplishments 2021 & QTD March 31, 2022 ▪ Generated Record Net Income of $7.0 Million YTD 2021 ▪ Produced Consecutively Increasing Earnings Per Quarter for the Past 5 Quarters

z Net Income Trend 2019 $2.1M 2020 $2.9M 2021 $7.0M

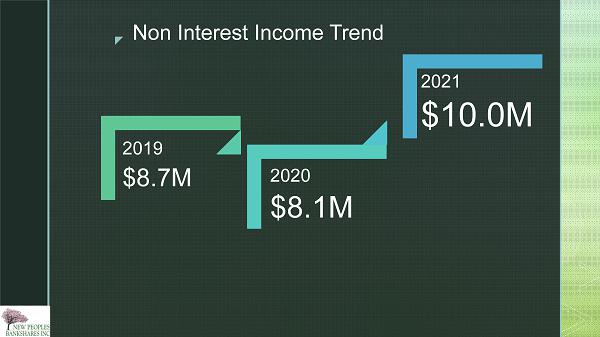

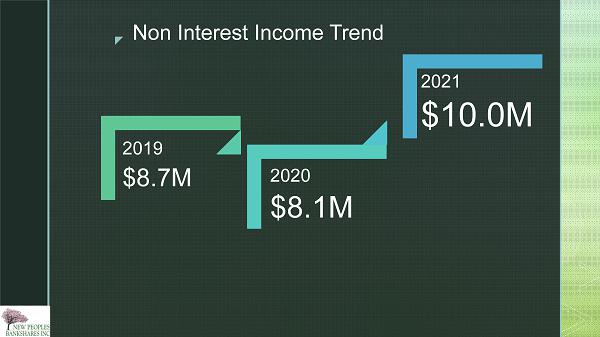

z Non Interest Income Trend 2019 $8.7M 2020 $8.1M 2021 $10.0M

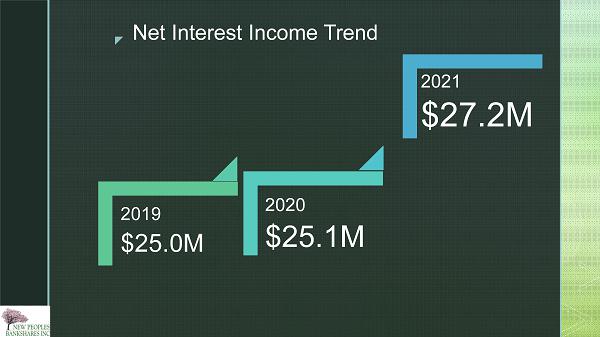

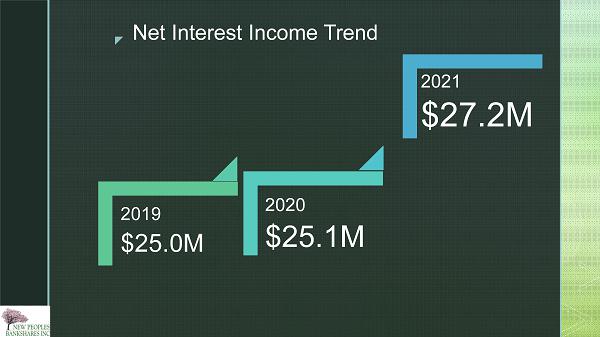

z Net Interest Income Trend 2019 $25.0M 2020 $25.1M 2021 $27.2M

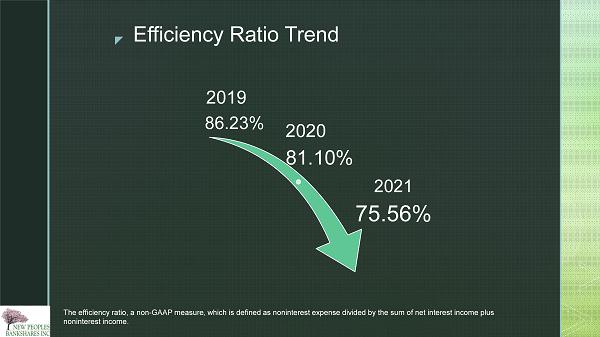

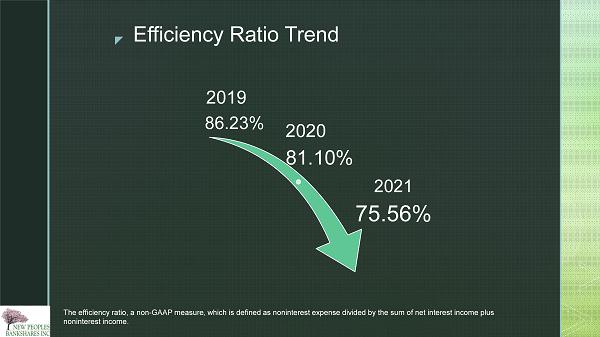

z Efficiency Ratio Trend 2019 86.23% 2020 81.10% 2021 75.56% The efficiency ratio, a non - GAAP measure, which is defined as noninterest expense divided by the sum of net interest income plus noninterest income.

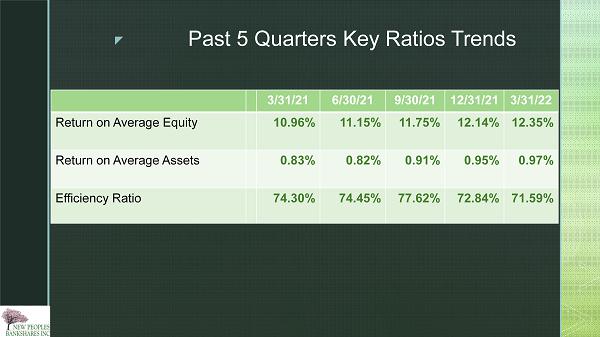

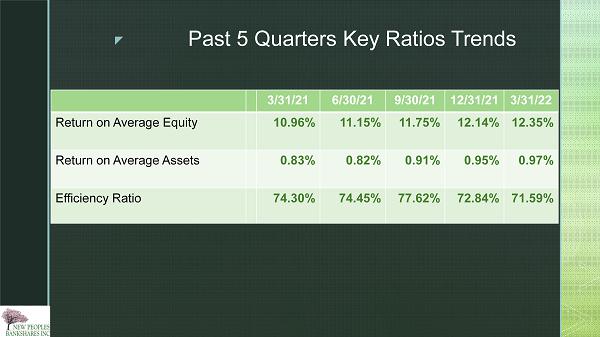

z Past 5 Quarters Key Ratios Trends 3/31/21 6/30/21 9/30/21 12/31/21 3/31/22 Return on Average Equity 10.96% 11.15% 11.75% 12.14% 12.35% Return on Average Assets 0.83% 0.82% 0.91% 0.95% 0.97% Efficiency Ratio 74.30% 74.45% 77.62% 72.84% 71.59%

z Strategic Goals ▪ Improve earnings by maximizing efficiencies, growing earning assets and increasing non - interest income revenue ▪ Manage risks to an acceptable level while improving capital levels and proactively safeguarding asset quality ▪ Recruit, develop, reward, support and equip a higher performing workforce ▪ Enhance customer experience through superior service, state of the art digital banking solutions, relevant products, and community presence ▪ Strategically grow in targeted markets and segmented demographics ▪ Generate profits to provide sufficient capital for growth and dividends while enhancing shareholder value, return and liquidity

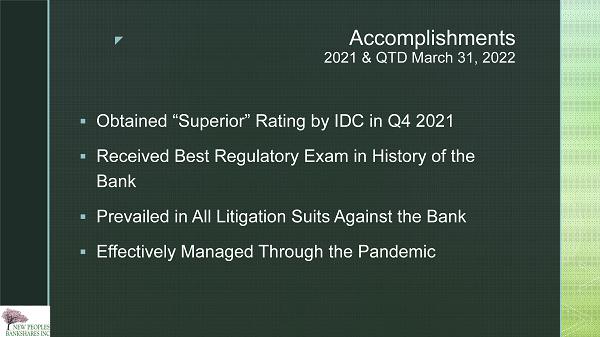

z Accomplishments 2021 & QTD March 31, 2022 ▪ Obtained “Superior” Rating by IDC in Q4 2021 ▪ Received Best Regulatory Exam in History of the Bank ▪ Prevailed in All Litigation Suits Against the Bank ▪ Effectively Managed Through the Pandemic

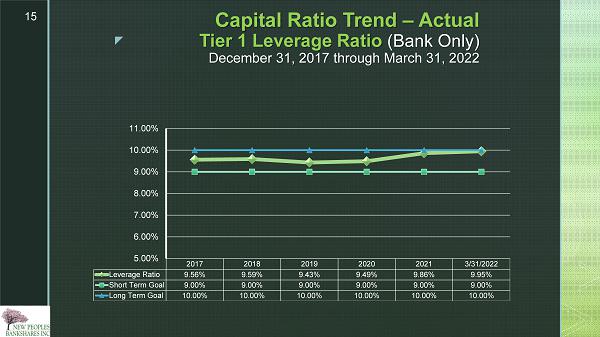

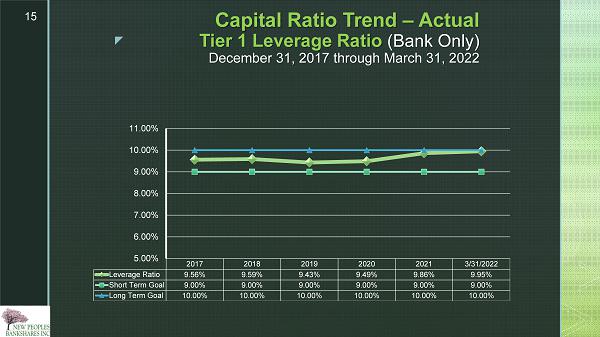

z Capital Ratio Trend – Actual Tier 1 Leverage Ratio (Bank Only) December 31, 2017 through March 31, 2022 2017 2018 2019 2020 2021 3/31/2022 Leverage Ratio 9.56% 9.59% 9.43% 9.49% 9.86% 9.95% Short Term Goal 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% Long Term Goal 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 15

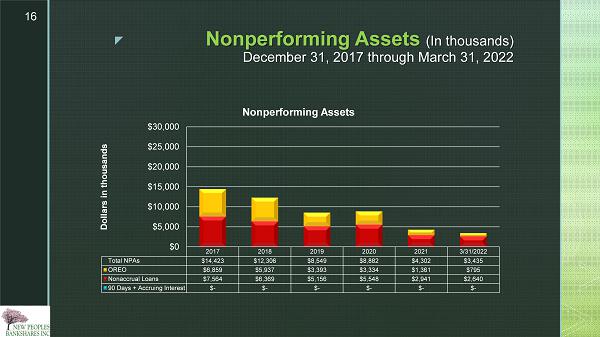

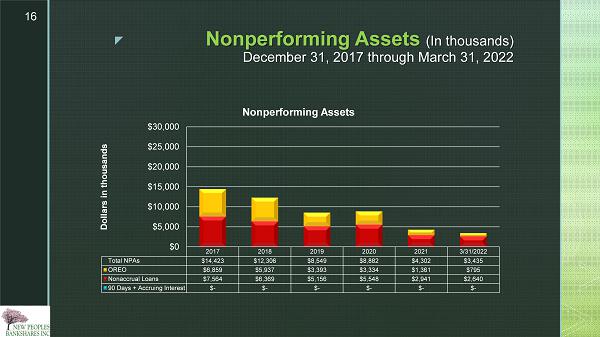

z Nonperforming Assets (In thousands) December 31, 2017 through March 31, 2022 2017 2018 2019 2020 2021 3/31/2022 Total NPAs $14,423 $12,306 $8,549 $8,882 $4,302 $3,435 OREO $6,859 $5,937 $3,393 $3,334 $1,361 $795 Nonaccrual Loans $7,564 $6,369 $5,156 $5,548 $2,941 $2,640 90 Days + Accruing Interest $- $- $- $- $- $- $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 Dollars in thousands Nonperforming Assets 16

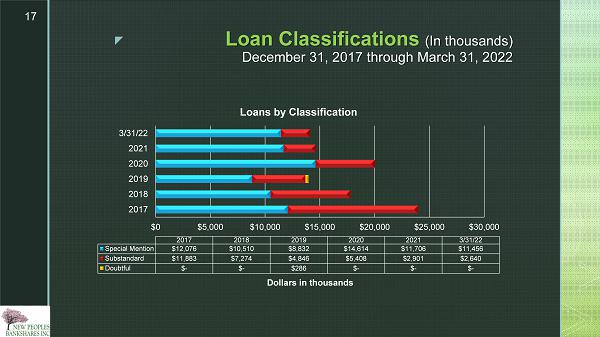

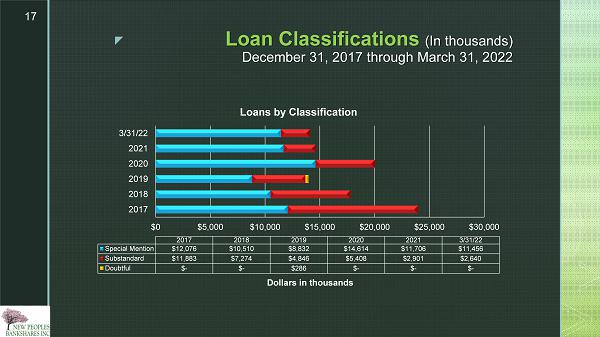

z Loan Classifications (In thousands) December 31, 2017 through March 31, 2022 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 2017 2018 2019 2020 2021 3/31/22 Dollars in thousands 2017 2018 2019 2020 2021 3/31/22 Special Mention $12,076 $10,510 $8,832 $14,614 $11,706 $11,456 Substandard $11,883 $7,274 $4,846 $5,408 $2,901 $2,640 Doubtful $- $- $286 $- $- $- Loans by Classification 17

z ALLL Trends (In thousands & percentage) December 31, 2017 through March 31, 2022 2017 2018 2019 2020 2021 3/31/2022 ALLL $6,196 $5,336 $5,368 $7,191 $6,735 $6,759 ALLL as % of Total Loans 1.21% 0.98% 0.95% 1.25% 1.13% 1.14% 1.21% 0.98% 0.95% 1.25% 1.13% 1.14% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 $10,000 Dollars in thousands ALLL Trends 18

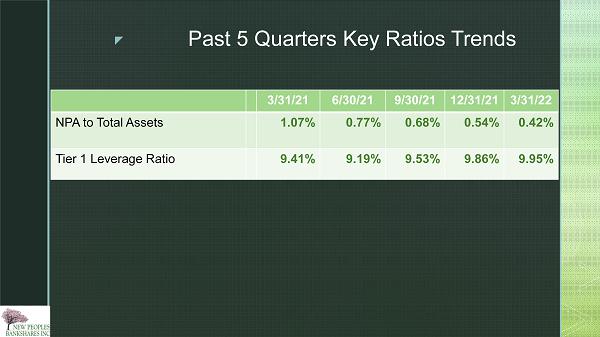

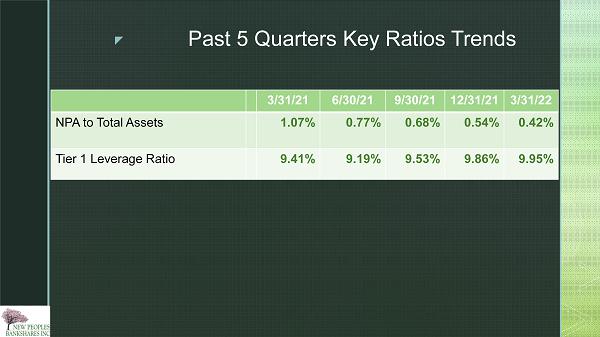

z Past 5 Quarters Key Ratios Trends 3/31/21 6/30/21 9/30/21 12/31/21 3/31/22 NPA to Total Assets 1.07% 0.77% 0.68% 0.54% 0.42% Tier 1 Leverage Ratio 9.41% 9.19% 9.53% 9.86% 9.95%

z Pandemic Management ▪ 2021 - Round 2 PPP Loans ▪ $25.3 million ▪ 567 Small Businesses ▪ Average Size Loan = $44,542

z Strategic Goals ▪ Improve earnings by maximizing efficiencies, growing earning assets and increasing non - interest income revenue ▪ Manage risks to an acceptable level while improving capital levels and proactively safeguarding asset quality ▪ Recruit, develop, reward, support and equip a higher performing workforce ▪ Enhance customer experience through superior service, state of the art digital banking solutions, relevant products, and community presence ▪ Strategically grow in targeted markets and segmented demographics ▪ Generate profits to provide sufficient capital for growth and dividends while enhancing shareholder value, return and liquidity

z Accomplishments 2021 & QTD March 31, 2022 ▪ Recruiting Top Performing Bankers ▪ Completed 13 Major Projects ▪ Rewarded Employees with Profit Sharing and Production Incentive Pay ▪ Further Developing Training Program ▪ Raised Minimum Wage to $15.00 per hour ▪ Improving Employee Benefits such as paying for Short Term Disability

z Strategic Goals ▪ Improve earnings by maximizing efficiencies, growing earning assets and increasing non - interest income revenue ▪ Manage risks to an acceptable level while improving capital levels and proactively safeguarding asset quality ▪ Recruit, develop, reward, support and equip a higher performing workforce ▪ Enhance customer experience through superior service, state of the art digital banking solutions, relevant products, and community presence ▪ Strategically grow in targeted markets and segmented demographics ▪ Generate profits to provide sufficient capital for growth and dividends while enhancing shareholder value, return and liquidity

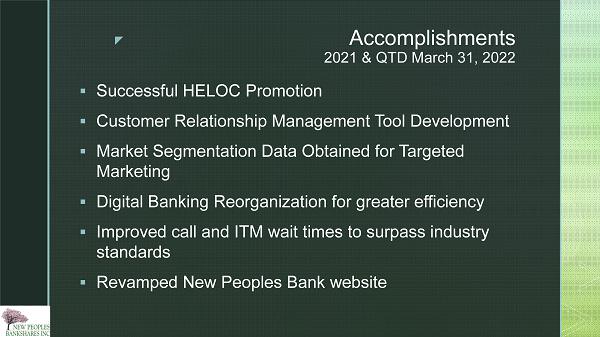

z Accomplishments 2021 & QTD March 31, 2022 ▪ Successful HELOC Promotion ▪ Customer Relationship Management Tool Development ▪ Market Segmentation Data Obtained for Targeted Marketing ▪ Digital Banking Reorganization for greater efficiency ▪ Improved call and ITM wait times to surpass industry standards ▪ Revamped New Peoples Bank website

z Community Involvement 2021 & QTD March 31, 2022 ▪ $7.6 million in Community Development Loans ▪ Financial Literacy in 36 Schools – 945 students with How To Do Your Banking resources ▪ VBA Community Bank Day for High School Seniors ▪ 31 Students ▪ 12 High Schools Represented ▪ 1 Regional Scholarship Winner ▪ Hundreds of Hours of Voluntary Service in Community Non - Profit Organizations, Development Boards, Charities, Foundations, Etc.

z Strategic Goals ▪ Improve earnings by maximizing efficiencies, growing earning assets and increasing non - interest income revenue ▪ Manage risks to an acceptable level while improving capital levels and proactively safeguarding asset quality ▪ Recruit, develop, reward, support and equip a higher performing workforce ▪ Enhance customer experience through superior service, state of the art digital banking solutions, relevant products, and community presence ▪ Strategically grow in targeted markets and segmented demographics ▪ Generate profits to provide sufficient capital for growth and dividends while enhancing shareholder value, return and liquidity

z Strategic Balance Sheet Trend (In Millions) December 31, 2017 – March 31, 2022 2017 2018 2019 2020 2021 3/31/2022 Total Assets 666.7 682.1 706.4 756.3 794.6 813.5 Total Loans 513.0 547.1 562.5 575.6 593.7 595.1 Total Deposits 582.5 596.0 621.5 668.0 707.5 731.0 813.5 595.1 731.0 $400 $450 $500 $550 $600 $650 $700 $750 $800 $850 $900 $950 $1,000 Dollars in millions 27

z Bristol – State Street Branch IMG_3113.CR2IMG_3113.CR2IMG_3113.CR2

z Strategic Goals ▪ Improve earnings by maximizing efficiencies, growing earning assets and increasing non - interest income revenue ▪ Manage risks to an acceptable level while improving capital levels and proactively safeguarding asset quality ▪ Recruit, develop, reward, support and equip a higher performing workforce ▪ Enhance customer experience through superior service, state of the art digital banking solutions, relevant products, and community presence ▪ Strategically grow in targeted markets and segmented demographics ▪ Generate profits to provide sufficient capital for growth and dividends while enhancing shareholder value, return and liquidity

z Retained Deficit / Earnings Trend (In thousands) December 31, 2010 through March 31, 2022 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 3/31/22 Retained (Deficit)/ Earnings (4,175) (13,085) (19,409) (17,925) (17,685) (15,023) (14,065) (10,847) (9,928) (7,869) (4,979) 2,031 2,756 2,756 -$20,000 -$15,000 -$10,000 -$5,000 $0 $5,000 $10,000 $15,000 $20,000 Dollars in thousands 30 At March 31, 2022, Retained Earnings has been reduced by the Dividend payment totaling $1.2 million.

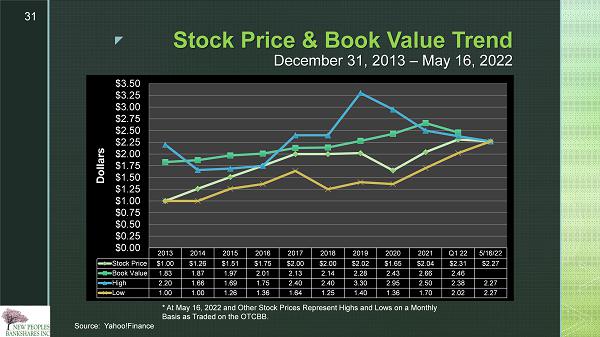

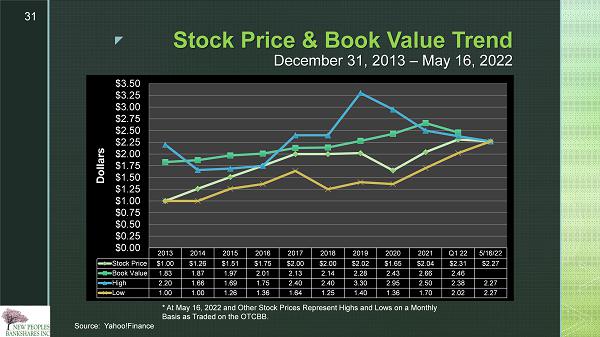

z 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q1 22 5/16/22 Stock Price $1.00 $1.26 $1.51 $1.75 $2.00 $2.00 $2.02 $1.65 $2.04 $2.31 $2.27 Book Value 1.83 1.87 1.97 2.01 2.13 2.14 2.28 2.43 2.66 2.46 High 2.20 1.66 1.69 1.75 2.40 2.40 3.30 2.95 2.50 2.38 2.27 Low 1.00 1.00 1.26 1.36 1.64 1.25 1.40 1.36 1.70 2.02 2.27 $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 $2.50 $2.75 $3.00 $3.25 $3.50 Dollars 31 Stock Price & Book Value Trend December 31, 2013 – May 16, 2022 * * At May 16, 2022 and Other Stock Prices Represent Highs and Lows on a Monthly Basis as Traded on the OTCBB. Source: Yahoo!Finance

z Accomplishments 2021 & QTD March 31, 2022 ▪ Returned to Positive Retained Earnings in Q3 2021 – first time since 2010 ▪ Declared and Paid $0.05 Dividend Per Share, or $1.2 million, in 2022 – first time in history of the company ▪ Implemented Stock Repurchase Plan

z Stock Repurchase Program ▪ The board of directors has given authorization to repurchase up to 500,000 shares of the Company’s outstanding common stock through March 31, 2023. ▪ Repurchases may be made through open market purchases or in privately negotiated transactions. ▪ The actual means and timing of any purchases, number of shares and prices or range of prices will be determined by the Company in its discretion and will depend on a number of factors, including the market price of the Company’s common stock, general market and economic conditions, and applicable legal and regulatory requirements. ▪ There is no assurance that the Company will purchase any shares under this program. ▪ If interested, please contact your broker or Kristy Northern, Assistant Secretary at 276 - 873 - 7023

z We ar e your bank . NEW PEOPLES BANK

z 35 Thank you! Janney Montgomery Scott LLC 1475 Peachtree St. NE, Suite 800 Atlanta, GA 30309 Office: 800.526.6397 DA Davidson & Co. 121 W. Forsyth St., Suite 820 Jacksonville, FL 32202 Office: 888.877.6807 Market Makers OTCMKTS: NWPP