The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Preliminary Prospectus Dated January 25, 2023

TRANSAMERICA STRUCTURED INDEX ADVANTAGESM ANNUITY

An Individual Flexible Premium Deferred Index-Linked Annuity Policy

Issued by Transamerica Life Insurance Company

This prospectus includes important information about the Transamerica Structured Index AdvantageSM Annuity (the “Policy”), which you can use to accumulate funds for retirement or other long-term financial planning purposes on a tax-deferred basis. This prospectus describes all material terms of the Policy, including material state variations. You should carefully read this prospectus and speak with your financial professional about whether the Policy is appropriate for you. You should also consult with a tax professional.

The Policy allows you to allocate your premium payments and earnings (if any) among the Policy’s investment options, which currently include index-linked investment options (“Index Account Options”) and a fixed interest option (“Fixed Account Option”).

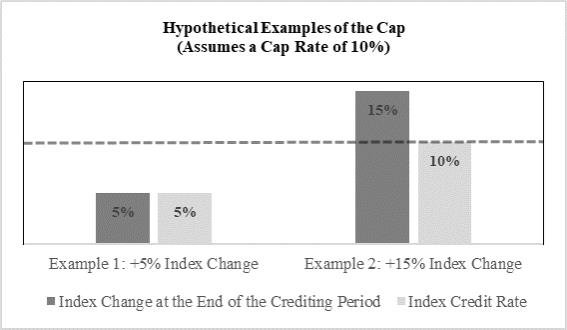

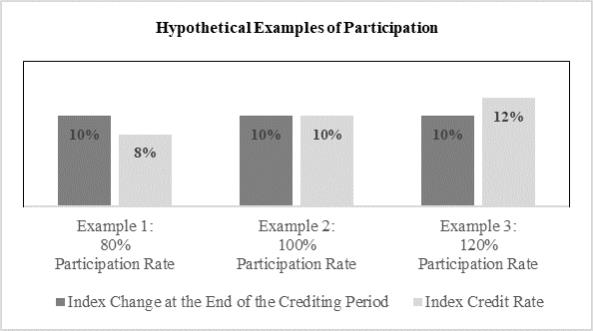

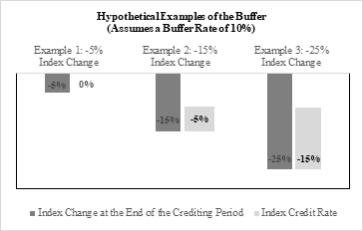

| | • | | Index Account Options. Each Index Account Option is tied (or “linked”) to the performance of a specific market index or exchange-traded fund for a defined time period (a “Crediting Period”). Each Index Account Option currently has a Buffer downside feature that provides limited protection against any negative Index rate of return that may be charged to your investment for a Crediting Period. Each Index Account Option currently also has a Cap or Participation upside feature that may limit any positive Index rate of return that may be credited to your investment for a Crediting Period. |

| | • | | Fixed Account Option. The Fixed Account Option guarantees principal and a rate of interest for a 1-year Crediting Period. |

We expect to add and remove investment options from time to time. We will always offer the following Index Account Option: S&P 500® Index, 1-Year Crediting Period, Buffer (Buffer Rate: 10%), Cap (Cap Rate: No lower than 2.00%), no Credit Advantage Fee.

You should not buy this Policy if you are not willing to assume its investment risks. See PRODUCT RISK FACTORS beginning on page 20. Index-linked annuities are complicated investments. You may lose money, including your principal investment and previously credited earnings. Charges and adjustments under the Policy could cause your losses to be greater than the downside protection of the Index Account Options. Your losses may be significant.

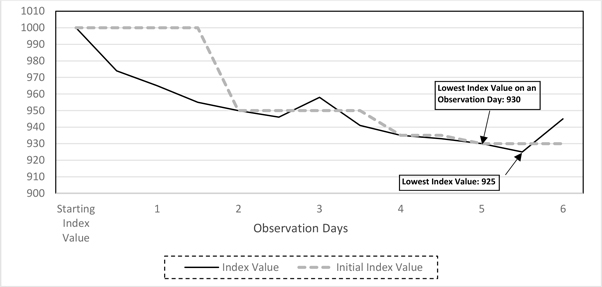

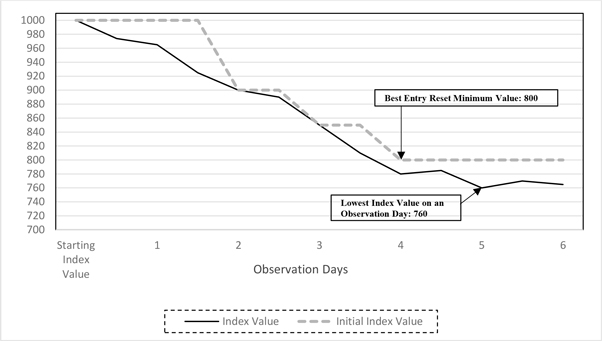

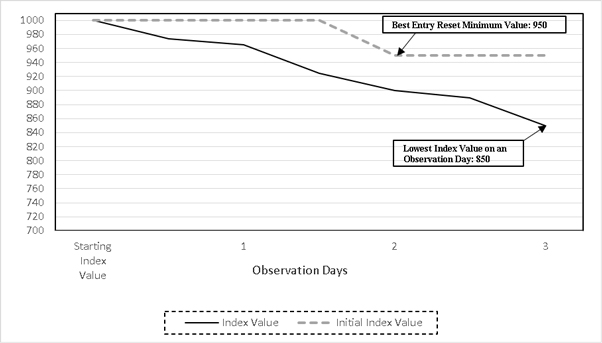

Before the end of a Crediting Period for an Index Account Option, if you take a surrender or withdrawal, or if you exercise the Performance Lock feature, or if you annuitize, or if the death benefit is paid, or if a fee or charge is deducted, the transaction will be based on the interim value of your investment in that Index Account Option. Interim values fluctuate daily, positively or negatively. Interim values could reflect significantly less gain or more loss than would be applied at the end of a Crediting Period. For as long as you have multiple ongoing Crediting Periods for Index Account Options, there may be no time that any such transaction listed above can be performed without the application of at least one interim value.

Before the end of a Crediting Period for an Index Account Option, if you take any type of partial withdrawal, or if a fee or charge is deducted from that Index Account, your investment base will be proportionately reduced. This negative adjustment could be greater than the amount withdrawn or deducted and could negatively impact your gains or losses significantly.

A six-year surrender charge period applies to the initial and any additional premium payment. In addition, a surrender or withdrawal may be subject to federal and state income taxes and a 10% federal penalty tax if made before age 591⁄2.

You may be able to pay investment advisory fees directly from this Policy. Advisory fee withdrawals will reduce your Policy value and will be subject to the same risks and consequences of withdrawals, including surrender charges, interim value adjustments, negative adjustments, and income taxes and tax penalties and proportionate reductions to the death benefit. For tax-qualified Policies, there is no maximum limit on advisory fee withdrawals. For non-qualified Policies, advisory fee withdrawals are subject to a maximum limit of 1.5% of the Policy’s cash value (determined without regard to any surrender charges) each Policy Year. We will not report advisory fee withdrawals as taxable distributions to the IRS. However, we cannot guarantee that federal and/or state taxing authorities will not subject advisory fee withdrawals to income taxes or tax penalties. You should consult a tax professional.

Our financial obligations under the Policy are subject to our financial strength and claims-paying ability.

The Securities and Exchange Commission (the “SEC”) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

If you are a new investor in the Policy, you may cancel your Policy within 10 days (30 days for replacement Policies). In some states or circumstances, this period may be longer. Upon cancellation, you will receive the value of your Policy, plus any fees or charges deducted on the date of cancellation, unless a different amount is required by law. If you invest in an Index Account Option, you will be subject to risk of loss during the right to cancel period because the amount refunded will be based on an interim value. State law may require us to refund the greater of your Policy value or your premium payment(s). For IRAs, we will refund your premium payment(s) if cancelled within the first seven days of the right to cancel period.

Transamerica Capital, Inc. is the principal underwriter for the Policy. The minimum initial premium is $25,000. This prospectus is not an offer to sell the securities, and it is not soliciting an offer to buy the securities, in any state where offers or sales are not permitted.

Prospectus Date: May 1, 2023