1099 18 th Street, Suite 2300 Denver, Colorado 80202 303.293.9100, fax 303.291.0420 www.billbarrettcorp.com NYSE: BBG Lehman Brothers Conference Fred Barrett, Chairman and Chief Executive Officer September 2006 Exhibit 99.2 |

Except for the historical information contained herein, the matters discussed in this presentation are forward-looking statements. These forward-looking statements reflect our current views with respect to future events, based on what we believe are reasonable assumptions. These statements, however, are subject to risks and uncertainties that could cause actual results to differ materially including, among other things, exploration results, market conditions, oil and gas price levels and volatility, the availability and cost of services, drilling rigs, transportation and processing, the ability to obtain industry partners to jointly explore certain prospects, uncertainties inherent in oil and gas production operations and estimating reserves, unexpected future capital expenditures, competition, the success of our risk management activities, governmental regulations and other factors discussed in our filings with the Securities and Exchange Commission (SEC). We refer you to the “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” sections of these filings. The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operation conditions. Bill Barrett Corporation may use certain terms in this presentation and other communications relating to reserves and production that the SEC’s guidelines strictly prohibit the Company from including in filings with the SEC. It is recommended that U.S. investors closely consider the Company’s disclosures in Bill Barrett Corporation’s Form 10-K for the year ended December 31, 2005 filed with the SEC. This document is available through the SEC by calling 1-800-SEC-0330 (U.S.) and on the SEC website at www.sec.gov. Discretionary cash flow is computed as net loss plus depreciation, depletion, amortization and impairment expenses, deferred income taxes, exploration expenses, non-cash stock based compensation, losses (gains) on sale of properties, and certain other non-cash charges. The non-GAAP measure of discretionary cash flow is presented because management believes that it provides useful additional information to investors for analysis of the Company's ability to internally generate funds for exploration, development and acquisitions. In addition, discretionary cash flow is widely used by professional research analysts and others in the valuation, comparison and investment recommendations of companies in the oil and gas exploration and production industry, and many investors use the published research of industry research analysts in making investment decisions. Discretionary cash flow should not be considered in isolation or as a substitute for net income, income from operations, net cash provided by operating activities or other income, profitability, cash flow or liquidity measures prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Because discretionary cash flow excludes some, but not all, items that affect net income and net cash provided by operating activities and may vary among companies, the discretionary cash flow amounts presented may not be comparable to similarly titled measures of other companies. Forward-Looking and Other Cautionary Statements |

3 9/2/2006 4:16 AM FOCUS: Pure Rockies E&P Company Corporate Profile DEVELOPMENT GROWTH: Extensive, low risk, development inventory OPERATIONAL EXCELLENCE: Experienced teams with strong focus on operations EXPLORATION EXPOSURE: Multiple, large-scale (multi-Tcfe), high-quality exploration plays TRACK RECORD: Double-digit annual growth, multiple exploration discoveries TECHNOLOGY: Leader in utilization of emerging technologies FINANCIAL STRENGTH: Strong balance sheet and flexibility to grow |

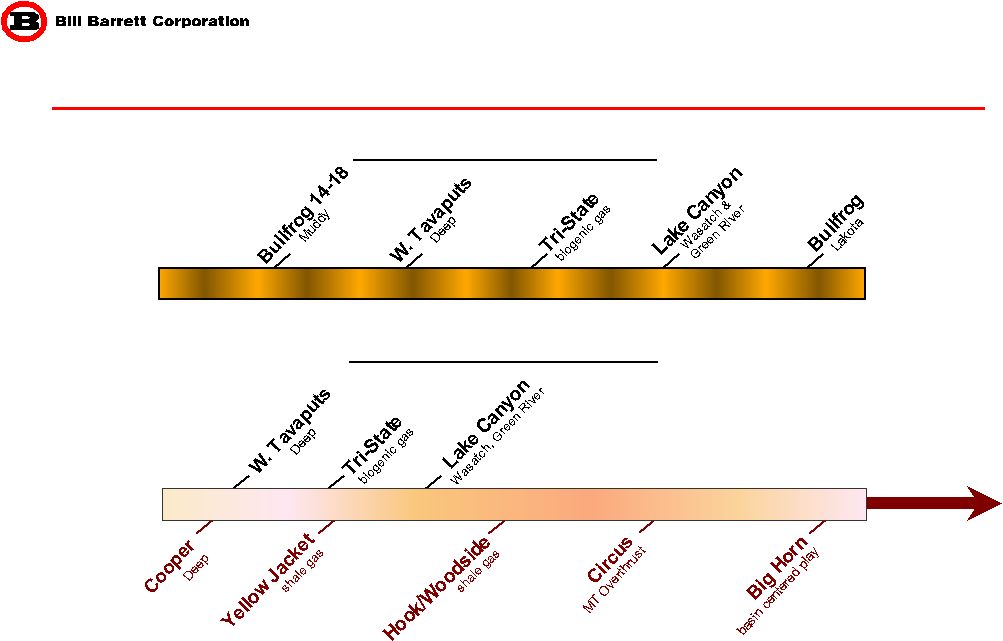

4 9/2/2006 4:04 AM Exploration 8+ Tcfe Unrisked Upside EXPLORATION EXPLORATION DEVELOPMENT DEVELOPMENT Discovery Delineate Optimize Harvest Concept Acreage Seismic Drill Joint Expl. Converting Geologic Concept to Value Development Growth 1+ Tcfe Lower Risk Potential Powder River Basin Powder River Basin Piceance Piceance Wind River Wind River W. Tavaputs W. Tavaputs Williston Target Williston Target deep deep shallow shallow *Areas not named for competitive reasons 1Q ‘07 4Q 1Q '07 X X X X Williston Red Bank Ext Wind River Cooper Deep Circus Yellow Jacket Big Horn Hook/Woodside Three Projects* Multiple Projects* testing X X 3Q - 4Q 3Q Lake Canyon Program Tri-State (delineating) (delineating) |

5 9/2/2006 4:12 AM Development Programs Extensive Low Risk Inventory |

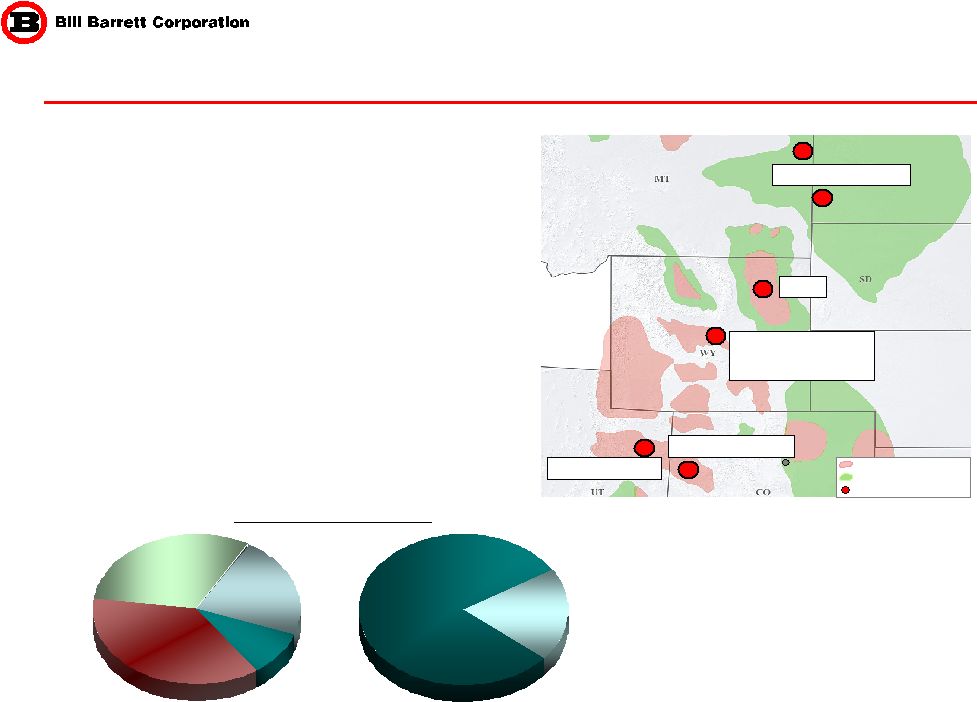

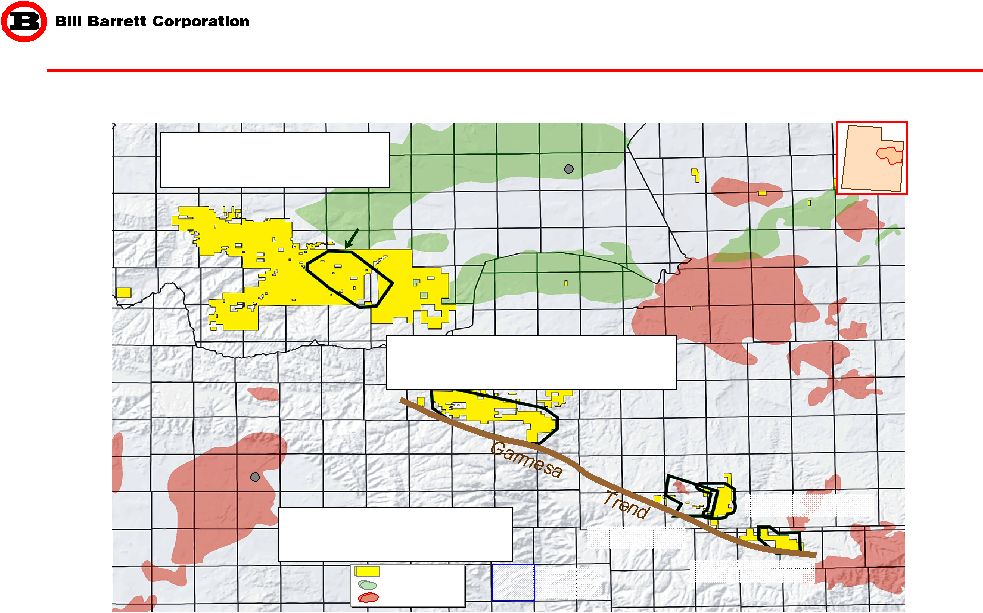

6 9/2/2006 4:39 AM Extensive Development Inventory Growth Visibility Denver Powder River Basin Piceance Basin Williston Basin Wind River Basin CBM Gibson Gulch Uinta Basin W. Tavaputs Waltman Arch Cave Gulch, Bullfrog, Cooper Gas Prone Area Oil Prone Area Development Project • 341 Bcfe proved reserves (YE ’05) • 1+ Tcfe 3P resources • Approximately 2,700 locations (YE ’05) • 8 - 10 year drilling inventory 2006 Net Capex Piceance 37% Piceance 37% Uinta 31% Wind River 10% Wind River 10% Other 22% Exploration 20% Development 80% Development 80% |

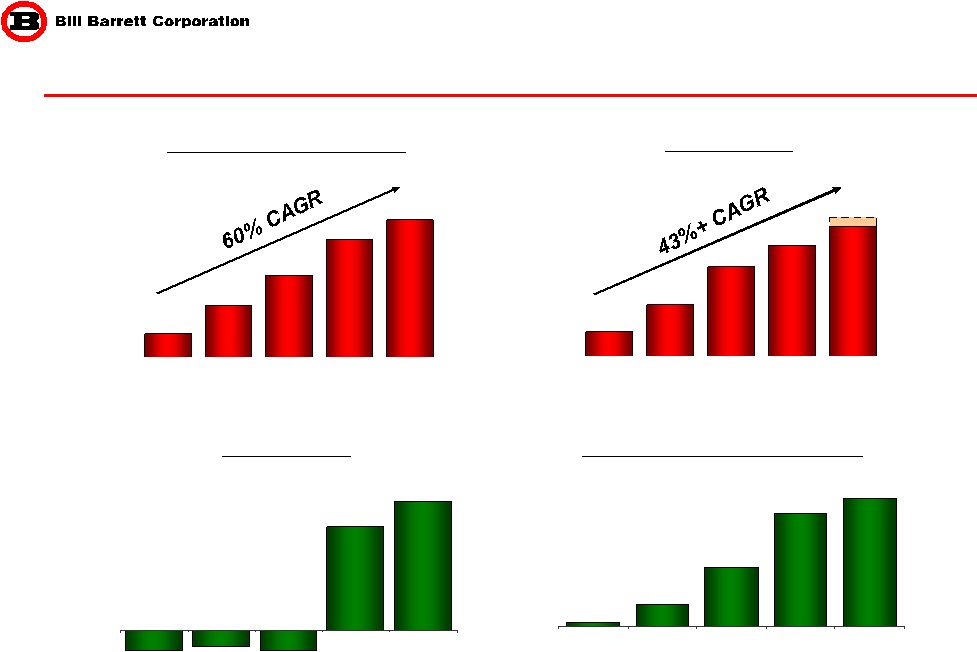

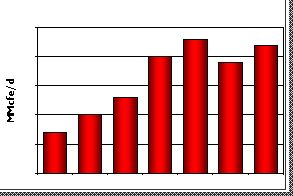

7 9/2/2006 4:30 AM 2002 2003 2004 2005 $24 - $5 - $4 - $5 Net Income (millions) $30 H1 2006 Extensive Development Inventory Consistent Strong Growth Mar 2002 Dec 2002 Dec 2003 Dec 2004 292 130 58 204 Net Proved Reserves (Bcfe) 341 Dec 2005 Production (MMcfe/d) 2005 24 69 2004 2002 2003 89 2006 E 136 108 Discretionary Cash Flow (millions) 2002 2004 2005 $7 $102 $195 2003 $38 2006 E 127 127 |

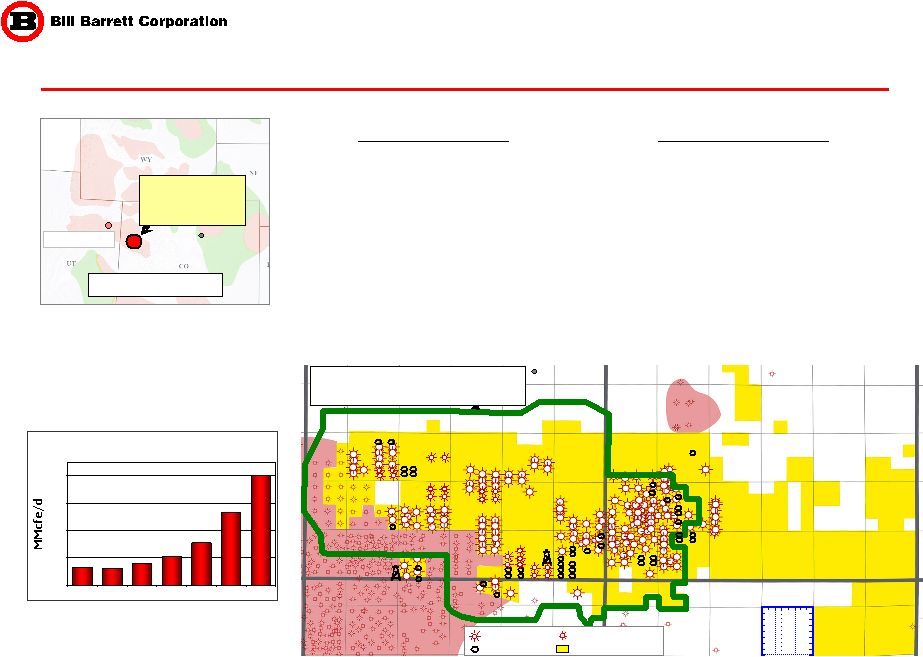

8 9/2/2006 4:32 AM Scale: 640 ac = 1 Mile (with 40 ac grid) Compressor site Eight winter drilling locations BBC Acreage Seismic Option Acreage Gas Well 2006 Shallow Location Potential 160-acre Location Existing Pipeline Proposed Pipeline Questar interconnect Uinta Basin West Tavaputs Shallow (Wasatch/Mesaverde) Gibson Gulch Piceance Basin Denver Powder River Basin Williston Basin Wind River Basin CBM Nameless/ Indian Hills/ Harding Target/Red Bank Waltman Arch Uinta Basin W. Tavaputs Key Information • Add 2 compressors Sept. 2006 • 32,626 net undeveloped acres (June 2006) • 75 Bcfe proved reserves @ 12/31/05 • WI: 100% Program Potential • 150 drilling locations (160 acre density) • 500+ locations on 40 acre • D&C cost: $3 million per well • IPs: 2-5 MMcfe/d per well • EUR: 2+ Bcfe per well 0 10 20 30 40 Jun-02 Dec-02 Jun-03 Dec-03 Jun-04 Dec-04 Jun-05 Dec-05 Aug-06 W. Tavaputs Net Production (All Depths) Prickly Pear Structure Peter’s Point Structure • Production increased nearly 500% since Dec 2004 |

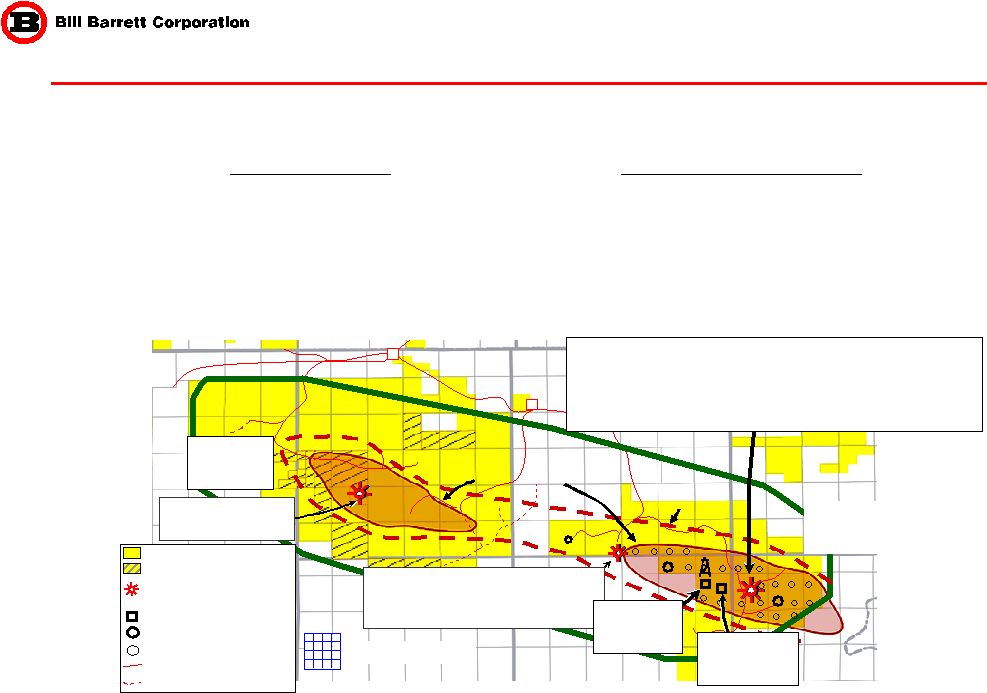

9 9/2/2006 5:19 AM Deep West Tavaputs Deep - Upper Cretaceous Dakota/Jurassic Entrada, Triassic Navajo Questar interconnect Compresso r site Deep show well (1967) Area of Jurassic 3-D Four-way Closure Getty deep show well (1980) Tested: Dakota 315 Mcf Entrada 1,800 Mcf Area of Dakota Potential Prickly Pear Structure Peter’s Point Structure 4-12 Drilling 7-12 location Scale: 640 ac = 1 Mile (with 40 ac grid) Peters Point 6-7 Deep Discovery IP 11.4 MMcfe/d (gross) (10/05) 100% WI, TD 15,349’-directional Dakota, Entrada and Navajo BBC acreage Seismic option acreage Gas well (Wasatch, North Horn, Price River) 2006 deep location 2007 deep location Potential 160-acre location Existing pipeline Proposed pipeline Key Information • Hart’s Oil and Gas Investor “Best Discovery” 2005 award (east structure) • 32,626 net undeveloped acres (June 2006) • Dakota-Entrada-Navajo: 13,000-15,000’+ depth • 2 deep wells in 2006 Deep Program Potential • 2 deep structures (east and west) • 20-25 drilling locations – east structure • 14 potential locations – west structure • D&C cost: $10-11 million per well • IPs: 11+ MMcfe/d per well • EUR: 5-6+ Bcfe (excludes shallow zones) |

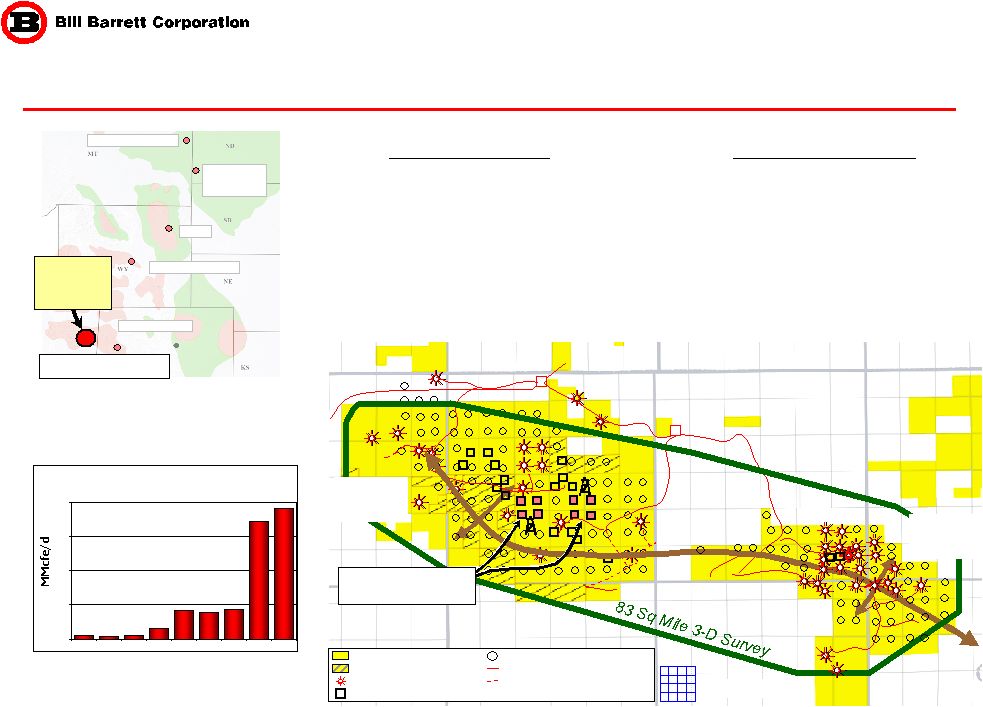

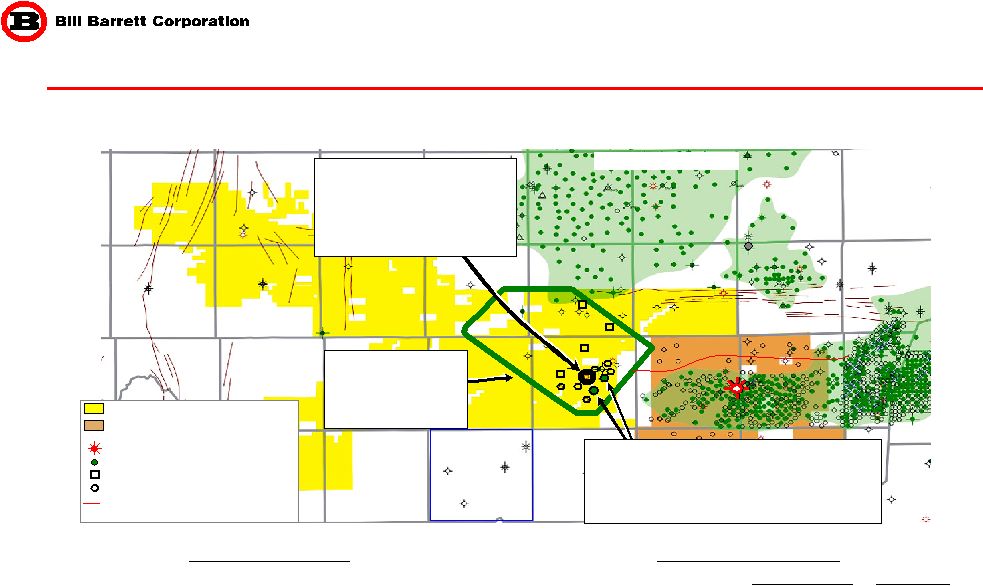

10 9/2/2006 4:59 AM Scale: 640 ac = 1 Mile (with 10 ac grid) Silt Processing 3-Component 3-D Seismic 0 10 20 30 40 Sep-04 Dec-04 Mar-05 Jun-05 Sep-05 Dec-05 Jun-06 Piceance Net Production Gibson Gulch Piceance Basin Denver Uinta Basin W. Tavaputs Piceance Basin - Gibson Gulch Mesaverde Formation - Colorado Non-BBC gas well BBC acreage BBC gas well 2006 location Key Information • 14,377 net undeveloped acres (June 2006) • 115 Bcfe proved reserves @ 12/31/05 • WI: 25-100%, avg: 99% • 62 gross wells in 2006 Program Potential • Gas-in-place: 80 Bcfe per 640 acres • 735 drilling locations (20-acre well density) • Upside: 10-acre downspacing approved • D&C cost: $2 million per well • IP: 2-4 MMcfe/d per well • EUR: Consistent improvement, increasing to 1+ Bcfe per well • Production increased nearly 600% since Dec 2004 |

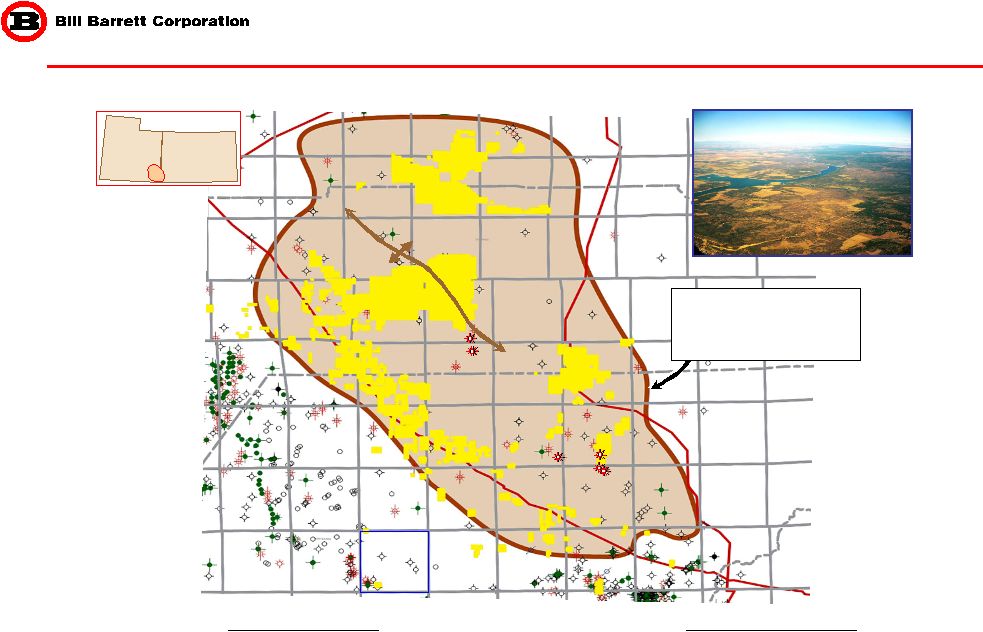

11 9/2/2006 3:07 AM Waltman Field Cooper Reservoir Field SCALE 640 ac = 1 Sq Mile Cave Gulch Field Cave Gulch – Bullfrog – Cooper Reservoir Fields Waltman Arch, Wind River Basin, Wyoming 2006 Location Potential Future Deep Loc. Historical Deep Producers Deep Gas Show Well Deep Structural Axes 0 5 10 15 20 25 30 35 40 Jun-02 Dec-02 Jun-03 Dec-03 Jun-04 Dec-04 Jun-05 Dec-05 Jun-06 Cooper and Cave Gulch Net Production Multi-pay “Deep” Program Bullfrog 33-19 TD ~19,450’; 93% WI Lakota IP (6/06): 4 MMcfe/d Muddy/Frontier pay behind pipe 2006 Lakota Discovery Testing Cooper Deep 1 TD 16,245’, 50% WI Frontier/Muddy/Lakota Key Information • High impact, high volume deep wells • 2 key discoveries within past 12 months • 23,245 net undeveloped acres (June 2006) • 71 Bcfe proved reserves @ 12/31/05 (shallow & deep) • WI: 50-100% Program Potential • 25-30 deep locations • Additional inventory if Cooper successful • D&C cost: $13-16 million per well • IP: 5-20 MMcfe/d per well • EUR: 6-8+ Bcfe gross per well Wind River Basin Waltman Arch Cave Gulch, Bullfrog, Cooper Cave Gulch 1-29 Recompletion; 70% WI Muddy IP (6/05): 19 MMcfe/d (gross) EUR: 28 Bcfe Frontier pay behind pipe 2005 Muddy Discovery Bullfrog 14-18 TD 19,400’; 94% WI Muddy IP (7/05): 20 MMcfe/d (gross) Lakota/Frontier pay behind pipe |

12 9/2/2006 2:55 AM Cat Creek Cat Creek Amos Draw Amos Draw Deadhorse Deadhorse Willow Creek Willow Creek Porcupine Porcupine Palmtree Palmtree BIG BIG GEORGE GEORGE PLAY PLAY Gillette, WY SCALE 1 Township = 36 sq mi Tuit Tuit Pumpkin Creek Pumpkin Creek Hartzog Draw Hartzog Draw Pine Tree Pine Tree Program Potential • Provides lower risk drilling with strong rate of return • Targeting primarily Big George • 1,200 locations • 0.25 – 0.35 Bcfe EUR per well • $0.15 – 0.25 million D&C cost Powder River Basin – CBM Development Wyoming BBC Acreage CH4 Acreage Acquisition Gas Producing Area Dewatering 0 5 10 15 20 25 Jun-03 Dec-03 Jun-04 Dec-04 Jun-05 Dec-05 Jun-06 NET PRODUCTION Divested acreage Key Information • Low risk drilling, Big George coals • 122,000 total net acres (Aug 2006) • 25 Bcfe proved reserves @ 12/31/05 4 Bcfe added with CH4 acquisition • 5 active rigs • WI: 40 to 100% operated |

13 9/2/2006 3:09 AM Exploration Programs Potential Future Development Growth Taking the Company to the Next Level |

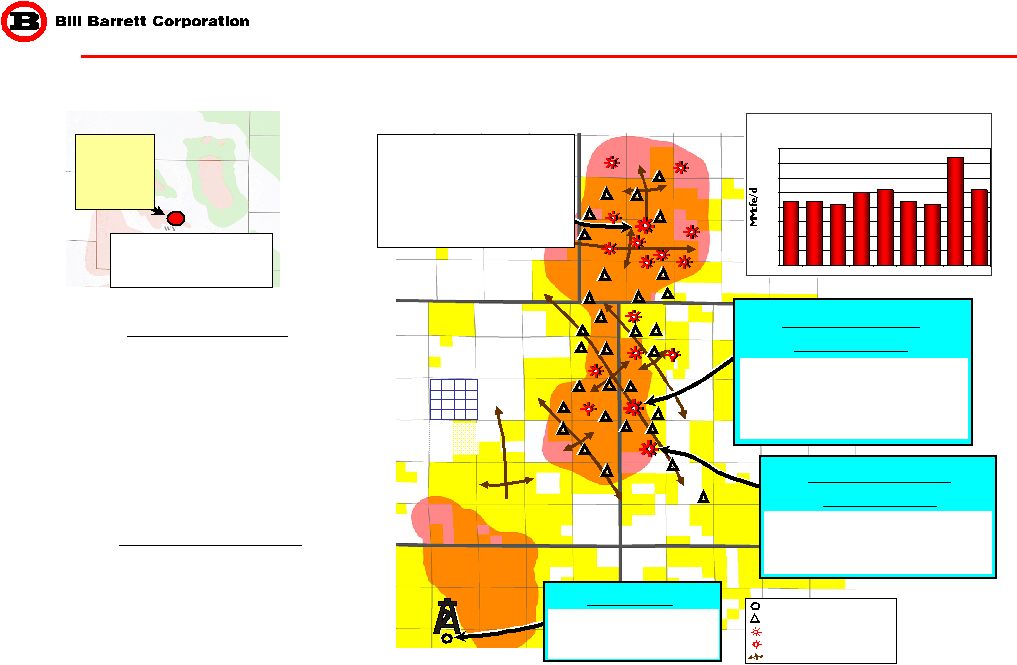

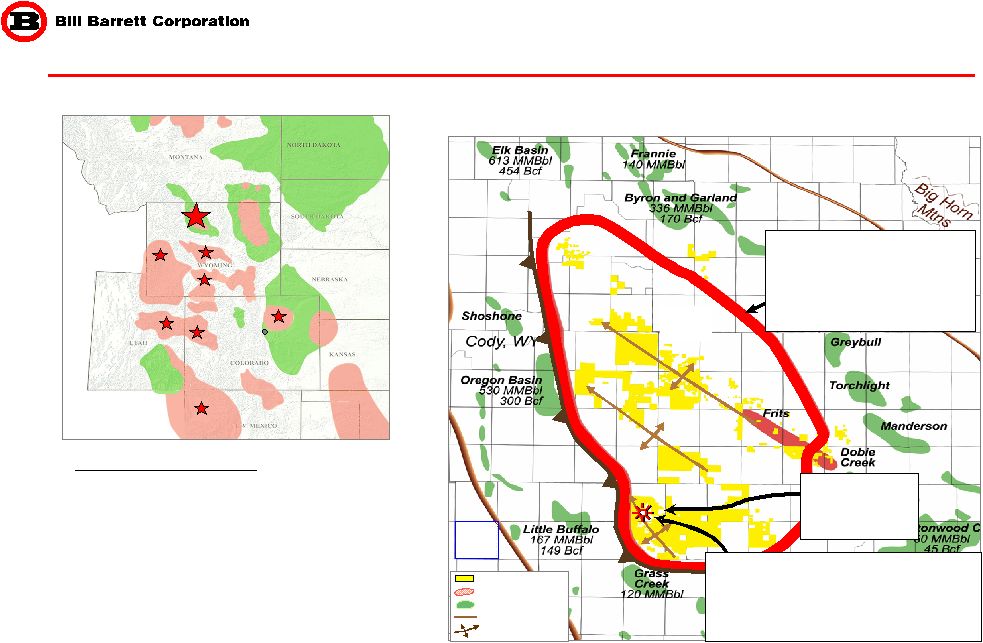

14 9/2/2006 3:25 AM 2005/2006 discovery and/or established production Existing exploration project Project in delineating phase Substantial Exploration Upside Lake Canyon Talon Tri-State Red Bank Extension Mondak Denver, CO Big Horn Basin Powder River Basin Green River Basin Piceance Basin Paradox Basin Williston Basin DJ Basin Wind River Basin Uinta Basin Target/Red Bank Hook/ Woodside W. Tavaputs ultra deep Hebron Indian Hills West Grand River Big Horn Circus Waltman Arch Cooper deep Wallace Creek CBM Pine Ridge • 26 exploration projects including: • 8 projects are drilling or to be drilled within 12 months • Over 8 Tcfe of unrisked exploration upside • 1.3 million net undeveloped acres (August 2006) Hingeline Mar 02 Dec 02 Dec 03 Dec 04 Dec 05 1,210* 959 667 160 46 *1.3 million August 2006 Substantial Acreage Position Net Undeveloped Acres (thousands) Yellowjacket Planned exploration drilling within 8 - 12 months |

15 9/2/2006 3:38 AM Track Record of Discoveries Sept 2006 Q2 ‘05 Q2 ‘05 Q3 ‘05 Q3 ‘05 Q4 ‘05 Q4 ‘05 Q1 ‘06 Q1 ‘06 Q2 ‘06 Q2 ‘06 Recent Discoveries Sept 2006 Looking Forward ... next 12 months New Projects: Delineation Drilling: IPO Dec 2004 |

16 9/2/2006 3:57 AM San Arroyo 381 Bcfe Monument Butte 289 Bcfe Natural Butte 2 Tcfe Altamont/Bluebell 3.1 Tcfe Drunkards Wash 278 Bcfe West Tavaputs Development & Exploratory Lake Canyon Exploratory discovery Price, UT Hill Creek Tumbleweed Cedar Camp Roosevelt, UT SCALE 1 Township = 36 sq mi 3C, 3-D Seismic Survey Hook/Woodside Exploratory Uinta Basin BBC Acreage Oil Field Gas Field UTAH Uinta Basin |

17 9/2/2006 3:51 AM Lake Canyon Exploration Project 1 Wasatch, 2 Green River Discoveries – Uinta Basin, Utah Altamont/Bluebell Duchesne 50 sq mi 3C, 3-D seismic survey in processing 2 Green River formation (shallow) discoveries IPs: 98 to 163 Boe/d 18.75% WI SCALE 1 Township = 36 sq mi #1 DLB Wasatch discovery TD 14,325’, 75% WI 315 Bopd test rate (5/06) BBC Acreage BBC Acreage earned deep rights 75% WI Mesaverde penetration Oil producer 2006 Wasatch (deep) location 2006 Green River (shallow) location Pipeline Fault Key Information • 229,581 gross, 158,659 net acres (June 2006) • 56.25- 75% working interest (deep), 18.75- 25% working interest (Green River, shallow) • Pay zones: Green River 4,000’-6,000’, Wasatch, Price River, Lower Mesaverde and Emery 8,000 – 13,000’ Program Potential Green River Wasatch • D&C per well (million) $1.5 $2.25 • Boe/d (IPs) 100 250 • Boe EURs 75-100,000 150-250,000 • Upside: Mesaverde, breadth of play Delineating Play |

18 9/2/2006 5:42 AM Tri-State – Niobrara Discovery Denver-Julesburg Basin Goodland Burlington K S C O SCALE 1 Township = 36 sq mi St. Francis Prairie Star field WY CO KS NE DJ Basin Tri-State Project Celia 2,613 MBbls Pennsylvanian Goodland EUR: 13 Bcfe Niobrara Cahoj 8,878 MBbls Pennsylvanian Beecher Island EUR: 130 Bcfe Niobrara Bonny EUR: 79 Bcfe Niobrara Republican EUR: 87 Bcfe Niobrara Cherry Creek EUR: 15 Bcfe Niobrara Bird City 3-D 3-D surveys Big Timber 3-D Orlando 3-D Key Information • 430,143 gross, 204,129 net undeveloped acres (June 2006); 50% WI • Pay zones: Niobrara ± 2,500’ gas; Permian/Pennsylvanian ± 5,500’ oil • 1,502 miles 2-D seismic; 86 sq. miles 3-D seismic Program Potential • $0.15 -0.3 million D&C per well (vertical/horizontal) • 75 -150 Mcfe/d (IPs) • 0.1 – 0.2 Bcfe EURs Delineating Play Prairie Star Niobrara discovery 7 wells combined IP 450 Mcfe/d (gross) (Feb 2006) |

19 9/2/2006 4:09 AM Potential High Graded Shale Gas Area SCALE 1 Township = 36 sq mi Yellow Jacket Shale Gas Prospect Paradox Basin, Colorado UT CO Paradox Basin Key Information • 105,175 net undeveloped acres (June 2006) • 100% working interest, subject to joint exploration • 2 exploratory wells Q4 2006 Program Potential • Potential pay zone: Gothic Shale, 5,500’-7,500’; - Estimated shale thickness: 100-150’ • Targeting 1- 3 Bcfe per well |

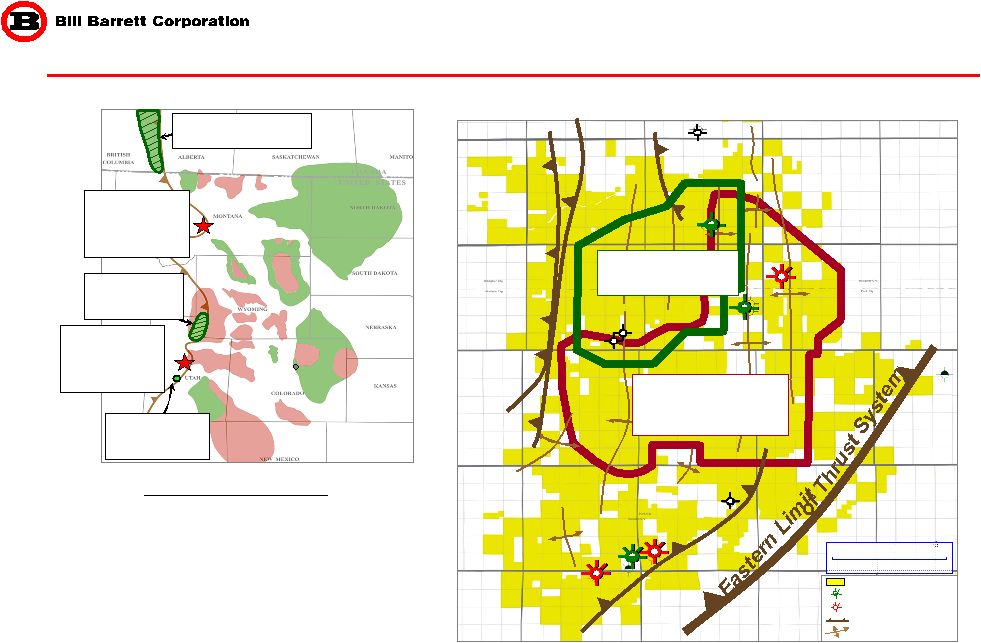

20 9/2/2006 4:17 AM Scale in Miles 0 6 64 sq. mi. 3-D (interpreted) 115 sq. mi. 3-D (currently acquiring) Program Highlights • 108,090 net undeveloped acres (August 2006) • 50% working interest • Potential pay zones: Cretaceous 2,200’-7,000’, Mississippian 8,000’-11,000’ Devonian 9,000’-11,500’ • Targeting large, four-way closures • 2 exploratory tests in 2007 • Multi Tcfe potential Montana Overthrust - Circus Project BBC Acreage Dry with Oil Show Dry with Gas Show Thrust Fault Structural Axes Rocky Mountain Overthrust Projects Wolverine Discovery Covenant Field Denver, CO Powder River Basin Green River Basin Uinta Basin Piceance Basin Paradox Basin Williston Basin DJ Basin Wind River Basin San Juan Basin Big Horn Basin Hingeline 17,346 Net Undeveloped Acres Circus 108,090 Net Undeveloped Acres Wyoming Overthrust EUR: 10+ Tcfe Canadian Overthrust EUR: 20+ Tcfe |

21 9/2/2006 4:25 AM SCALE 1 Township = 36 sq mi Area of Basin-Centered Gas Play Potential Planned 3-D seismic 2006 Sellers Draw #1 (1976), TD 23,081 Muddy EUR: 3.4 Bcfe 2006 Mesaverde recompletion Red Point Rocky Mountain Basin-Centered Gas Denver, CO Powder River Basin Green River Basin Uinta Basin Piceance Basin Paradox Basin Williston Basin DJ Basin Wind River Basin San Juan Basin Big Horn Basin Project Highlights • Large undrilled region • 123,007 net undeveloped acres (August 2006) • 50-100% working interest, subject to joint exploration • Potential pay zones: Lance 8,000’- 14,500’, Meeteetse 9,500’-16,000’, Mesaverde 10,000’-17,500’ • Muddy 18,000’ – 19,000’ • Targeting 3 - 5 Bcfe EUR wells Big Horn Basin – Basin-Centered Gas Project Wyoming BBC Acreage Gas Field Oil Field Outcrop Structural Axes |

22 9/2/2006 4:36 AM Success in the Rockies Legacy Positions in Resource Plays Established Resource Plays Piceance * Pinedale/Jonah Powder River- CBM* Wattenberg Moxa Arch Wamsutter Region San Juan Natural Buttes Baaken * Madden * Cave Gulch * * BBC Bill Barrett Corp’s Potential Emerging Resource Plays West Tavaputs Lake Canyon (basin centered oil & gas) Tri-State (biogenic gas) Yellow Jacket (shale gas)* Hook (shale gas)* Cody – Mancos (shale gas)* Mowry (shale gas)* Big Horn Basin (basin centered gas)* Williston (Mississippian horizontal) Montana Overthrust (structural)* Woodside (structural)* Wallace Creek (CBM Rockies 388 Tcf 85% Remaining 85% Remaining 15% Produced Source: National Petroleum Council, 1999 * Not yet drilled |