Exhibit 99.3

2008 Annual Report

To Our Shareholders

While 2008 was a record year for earnings, reserve additions and production, it was a volatile year for our shareholders as broader market conditions and macro-economic factors reversed strong stock performance in the first half of the year. Today, our Company is well positioned to endure the recession and will be ready for improved market conditions when they occur.

A Look Back at 2008

Despite the challenges that confronted us in 2008, we enjoyed an exceptional year in terms of operational and financial results, which is a testament to the Bill Barrett Corporation team of employees and to the quality of our assets. In my letter last year, I said that our first priority was to deliver double digit growth in reserves, 20% to 25% growth in production and double digit growth in discretionary cash flow. We met and exceeded each of these goals, also exceeding the performance of the majority of our industry peers.

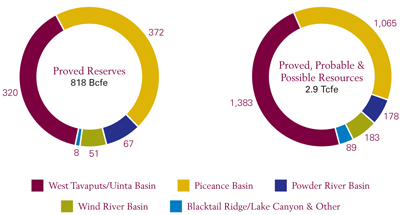

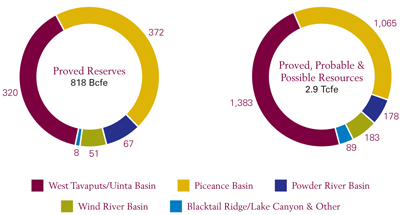

| | • | | Year-end proved reserves were 818 billion cubic feet equivalent (Bcfe), a 47% increase over year-end 2007. Reserves were added for an average finding and development cost of $1.76 per thousand cubic feet equivalent (Mcfe), which is a record low cost for our Company. |

| | • | | Net production of natural gas and oil was 77.6 Bcfe, a 27% increase over 2007. |

| | • | | Discretionary cash flow was $429.1 million, or $9.53 per diluted share, a 71% increase, reflecting increased production, higher realized prices and improved efficiencies that lowered lease operating costs. |

| | • | | Further, net income was $107.6 million, or $2.39 per diluted share, a nearly 300% increase over 2007. |

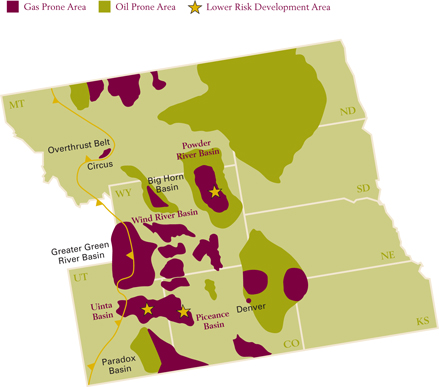

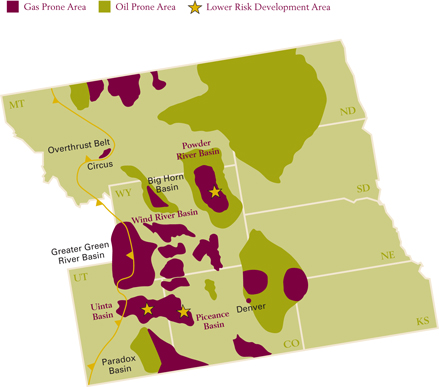

These outstanding results were achieved through continued expansion at our key development assets in the Piceance Basin in Colorado, the Uinta Basin in Utah and the Powder River Basin in Wyoming. We like to remind our stakeholders that these important assets offer visible and significant growth opportunity. The majority of our 2.9 trillion cubic feet equivalent (Tcfe) of proved, probable and possible resources are located in these areas and much of this resource base is associated with higher density drilling, which translates into lower risk resources.

In addition to successful expansion of our development assets, during 2008 our Company continued to build on its exciting portfolio of exploration prospects. In November, we announced our internally generated shale gas discovery located in the Paradox Basin in southwestern Colorado. We initiated natural gas sales by year-end 2008 and will continue to define this discovery during 2009. We also made progress on a number of other projects during 2008, including our Hook prospect in the Uinta Basin, the Circus prospect in the Montana overthrust area, and the Cave Gulch area in the Wind River Basin. We will continue with our exploration work in each of these areas in 2009.

Let’s take a look at the main challenges brought forward during 2008:

| | • | | First, there was a sizable decline in natural gas prices from their high in July. It is our Company’s policy to hedge up to 70% of forward production and, during 2008, we had hedges in place that supported stronger cash flows during the second half of the year. While regional market prices averaged $4.75 per million British thermal units (MMBtu) during the second half of 2008, our realized price was approximately $6.55 per MMBtu (or $7.21 per Mcf). Our hedge positions will continue to support our cash flow through 2009 and into 2010. |

Page 1

Bill Barrett Corporation

| | • | | Second, the financial crisis served to close capital markets in the fall of 2008. Our Company secured a 5% convertible notes offering of $172.5 million early in the year and expanded its credit facility in October 2008 from $467.0 million to $592.8 million, despite the difficult markets, providing additional liquidity and a solid balance sheet to position the Company well for 2009. |

| | • | | Third, the ensuing recession reduced national demand for an oversupplied natural gas market, further lowering gas prices into the first quarter of 2009. However, while supply and demand are currently out of balance, we have a positive outlook. |

Looking Ahead

What has our Company done to position itself to meet the current challenges and challenges that lie ahead? We have positioned our Company on a number of fronts, financially and operationally:

| | • | | We will align 2009 capital expenditures with expected cash flow. We have significantly scaled back our drilling activity in 2009 to maintain our strong balance sheet and plan to defer completing new wells until prices improve, providing a higher return on capital. Despite a reduced capital program, we plan to continue progress at our key exploration plays, which take years to bring to development. We have also structured our program to provide flexibility, so if market conditions improve sooner than expected, we can increase our activity. |

| | • | | In addition to being efficient with our capital deployment, we will take steps to leverage declining service sector costs. |

| | • | | We will remain focused on maintaining a solid financial position, with a strong balance sheet, ample liquidity throughout 2009, and a conservative debt profile. |

In addition, the recent deterioration in capital markets combined with declining commodity prices has driven a significant reduction in national and regional drilling activity. We believe that domestic natural gas production will begin declining as early as the middle of 2009 and possibly sooner for the Rocky Mountain region. A reversal of the current oversupply in natural gas should serve to increase the price. Looking ahead, growth on the demand side for natural gas would further support higher pricing. Natural gas is the cleanest carbon-based fuel, making it well suited to provide back-up capacity for renewable power sources such as wind, solar and hydro. As our new administration promotes domestic fuel sources, cleaner power generation and renewable resources, we believe that natural gas will be the natural choice.

2009 Goals

In 2009, we will continue to do what we do best. We will realize additional value from our development programs. We are committed to bringing our delineation projects, like Yellow Jacket, closer to the development stage and we will seek to expose our stakeholders to upside potential from new resource growth concepts through exploration.

We are challenged with a difficult environment but expect to:

| | • | | Deliver 8% to 12% growth in production; |

| | • | | Deliver double-digit growth in reserves; and |

| | • | | Execute on our exciting exploration portfolio. |

Our nation holds an abundance of natural gas, and we seek to be a premier exploration and production company. We are committed to responsible stewardship in exploring and developing this vast resource base with minimal effect to our environment and committed to leadership in technology, and in providing a safe, respectful and rewarding work environment for our employees. For our shareholders, we are committed to growing our reserves and net asset base while keenly monitoring and maintaining our capital investment returns.

Thank you to our shareholders and employees, and we look forward to a successful 2009.

Sincerely,

|

|

Fredrick J. Barrett |

| Chairman of the Board and Chief Executive Officer |

| March 16, 2009 |

Page 2

2008 Annual Report

2008 Financial Highlights and Operating Results

| | | | | | | | | | | | |

| | | 2008 | | | 2007 | | | 2006 | |

Proved Reserves and Acreage | | | | | | | | | | | | |

Natural Gas, Bcf | | | 784.3 | | | | 538.3 | | | | 377.7 | |

Oil, MMBbls | | | 5.7 | | | | 3.2 | | | | 8.5 | |

Natural Gas Equivalents, Bcfe1 | | | 818.3 | | | | 557.6 | | | | 428.4 | |

Percent Developed | | | 53 | % | | | 59 | % | | | 58 | % |

Percent Natural Gas | | | 96 | % | | | 97 | % | | | 88 | % |

Pre-Tax PV-10, millions | | $ | 1,039 | | | $ | 1,204 | | | $ | 603 | |

Net Undeveloped Acreage, rounded | | | 1,203,000 | | | | 1,186,000 | | | | 1,269,000 | |

| | | |

Production | | | | | | | | | | | | |

Bcfe | | | 77.6 | | | | 61.2 | | | | 52.1 | |

Average Daily Production, MMcfe | | | 212.0 | | | | 167.7 | | | | 142.8 | |

Percent Natural Gas | | | 95 | % | | | 94 | % | | | 92 | % |

| | | |

Average Realized Prices | | | | | | | | | | | | |

Natural Gas, including hedge effect, per Mcf | | $ | 7.61 | | | $ | 5.89 | | | $ | 6.40 | |

Oil Prices, including hedge effect, per Bbl | | $ | 69.55 | | | $ | 59.87 | | | $ | 53.50 | |

| | | |

Operating Statistics | | | | | | | | | | | | |

Reserve Replacement | | | 436 | % | | | 382 | % | | | 267 | % |

Capital Expenditures, millions | | $ | 601 | | | $ | 444 | | | $ | 501 | |

Producing Wells, gross/net | | | 1,463/1,140 | | | | 1,221/948 | | | | 1,147/838 | |

Wells Drilled, gross/net | | | 430/331 | | | | 314/237 | | | | 224/136 | |

| | | |

Financial Data | | | | | | | | | | | | |

Net Income (Loss), millions | | $ | 108 | | | $ | 27 | | | $ | 62 | |

Earnings Per Share, diluted | | $ | 2.39 | | | $ | 0.60 | | | $ | 1.40 | |

Discretionary Cash Flow2, millions | | $ | 429 | | | $ | 249 | | | $ | 239 | |

Production Revenue, per Mcfe | | $ | 7.81 | | | $ | 6.13 | | | $ | 6.60 | |

Lease Operating Expenses and Gathering and Transportation, per Mcfe | | $ | 1.08 | | | $ | 1.06 | | | $ | 0.87 | |

Production Taxes, per Mcfe | | $ | 0.57 | | | $ | 0.37 | | | $ | 0.50 | |

G&A, excluding non-cash stock based compensation, per Mcfe | | $ | 0.52 | | | $ | 0.52 | | | $ | 0.53 | |

Depletion, Depreciation, and Amortization, per Mcfe | | $ | 2.66 | | | $ | 2.87 | | | $ | 2.69 | |

Discretionary Cash Flow2, per Mcfe | | $ | 5.53 | | | $ | 4.06 | | | $ | 4.58 | |

Finding and Development Cost2, per Mcfe | | $ | 1.76 | | | $ | 1.83 | | | $ | 2.80 | |

Finding and Development Cost, three-year average2, per Mcfe | | $ | 1.99 | | | $ | 2.48 | | | $ | 3.00 | |

1 | One barrel of oil is the energy equivalent of six Mcf of natural gas. |

2 | A non-GAAP measure. See page facing inside back cover. |

Page 3

Bill Barrett Corporation

The Premier Rocky Mountain Exploration and Production Company

The United States is estimated to have 2,247 Tcf of natural gas reserves, much of it unlocked through new technologies and the rapid emergence of shale gas plays. Since inception, Bill Barrett Corporation has focused on unlocking the potential of the Rocky Mountain region by combining its geologic, operational, environmental and regulatory expertise with the application of existing and emerging technologies. The Company’s development and exploration assets are located in Colorado, Utah, Wyoming and Montana and 96% of the Company’s proved reserves are natural gas. The Company operates 98% of its assets, based on reserves, and key development properties offer a multi-year, low-risk drilling inventory of approximately 3,100 locations.

Page 6

2008 Annual Report

Piceance Basin, CO—Gibson Gulch

Play Type: Tight Gas Sands

Targeted Formation: Mesaverde

Gross Producing Wells: 424

Net Proved Reserves (Bcfe): 372

Proved, Probable and Possible Resources (Bcfe): 1,065

Net Undeveloped Acreage: 10,300

Powder River Basin, WY—Big George

Play Type: Coal Bed Methane (CBM)

Targeted Formations: Big George/Wyodak Coals

Gross Producing Wells: 666

Net Proved Reserves (Bcfe): 67

Proved, Probable and Possible Resources (Bcfe): 178

Net Undeveloped Acreage: 77,400

Uinta Basin, UT—West Tavaputs

Play Type: Structural/Stratigraphic

Targeted Formations: Wasatch, Mesaverde (shallow); Navajo, Entrada, Dakota (deep)

Gross Producing Wells: 130

Net Proved Reserves (Bcfe): 320

Proved, Probable and Possible Resources (Bcfe): 1,383

Net Undeveloped Acreage: 27,400

Wind River Basin, WY—Cave Gulch/Bullfrog

Play Type: Structural

Targeted Formations: Frontier, Muddy, Lakota

Gross Producing Wells: 165

Net Proved Reserves (Bcfe): 51

Proved, Probable and Possible Resources (Bcfe): 183

Net Undeveloped Acreage: 22,500

Uinta Basin, UT—Blacktail Ridge/Lake Canyon

Play Type: Fractured Oil Targeted Formations: Green River, Wasatch Gross Producing Wells: 21

Net Proved Reserves (Bcfe): 5 Proved, Probable and Possible Resources (Bcfe): 85

Net Undeveloped Acreage: 168,500 (including drill-to-earn)

Page 7

Bill Barrett Corporation

Development

Our three key development projects—Gibson Gulch, West Tavaputs and Big George—are in the early stages of their life cycles and offer low risk growth through a multi-year drilling inventory. Approximately 85% of year-end resources of 2.9 Tcfe relate to these key projects and increased density drilling, offering visibility to low-risk reserve growth in the years ahead.

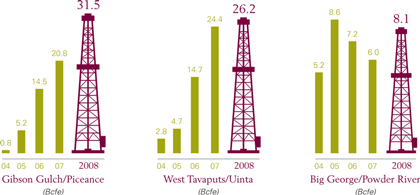

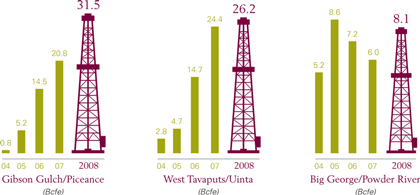

Gibson Gulch—Piceance Basin, Colorado

Our Gibson Gulch asset was acquired in 2004 and had proved reserves of 46 Bcfe. Our team has increased the proved reserve base to 372 Bcfe with an additional 693 Bcfe of probable and possible resources associated with ten-acre development. Net production from the area in 2008 totaled 31.5 Bcfe, up more than 50% from 2007. Members of our Piceance team have operated in this area for decades, bringing valuable experience that has made Bill Barrett Corporation a recognized leader in the area for our: understanding of the geology; application of fracture stimulation technology; operational efficiencies, including our water handling system; and reduced impact to the environment and improved cost savings from drilling up to 16 wells from a single pad. The Company has executed its program here to significantly improve economics through faster drill and completions, reduced operating expenses and improved recoveries. This is a long-term asset that will provide many years of growth for our Company.

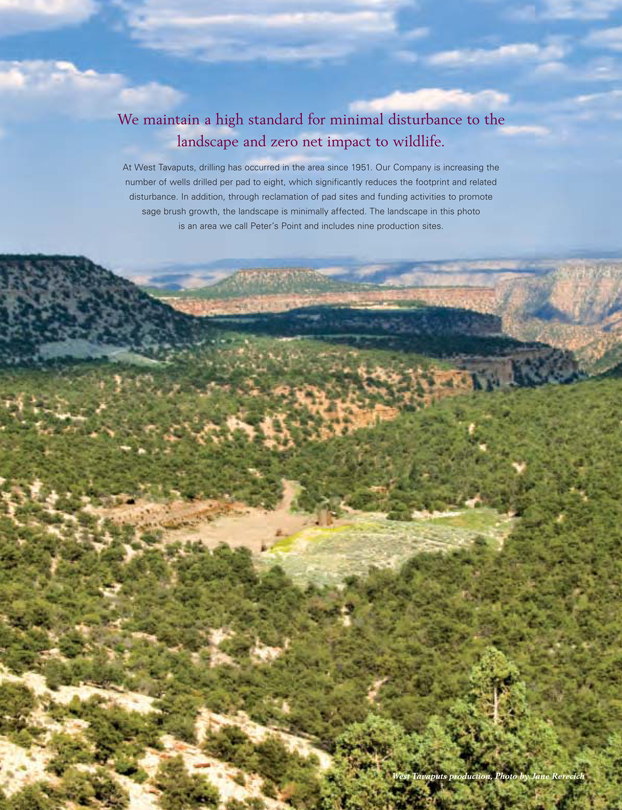

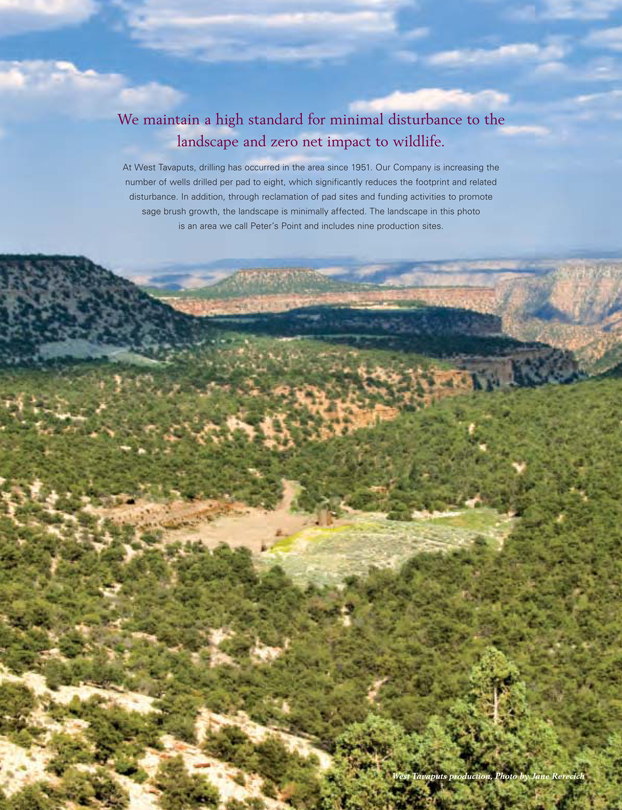

West Tavaputs—Uinta Basin, Utah

Our initial West Tavaputs asset was acquired in 2002 and had proved reserves of just over three Bcfe. Our team has added to the asset base and increased the proved reserve base here to 320 Bcfe, and the asset offers significant upside potential through its more than 1.0 Tcfe of probable and possible resources, further drilling in the deep structures and potential in the Mancos shale formation. Net production from the area in 2008 totaled 26.2 Bcfe, up approximately 7% from 2007. Success in West Tavaputs stems from application of modern fracture stimulation techniques not employed during previous drilling in this area and 3-dimensional seismic technology. The Company has substantially increased production from the area while reducing associated environmental effects. In seeking zero net effect from our activities, the Company has employed increased wells per pad, rerouted roads from wildlife habitats and local rock art, funded environmental studies and opened the area to the Department of Wildlife for wild turkey breeding.

Regional Production Growth

Page 8

2008 Annual Report

In order to increase the pace and provide flexibility for improved efficiencies in drilling and operating in this area, the Company has been working with the Bureau of Land Management on an environmental impact statement for the area for more than four years and expects to receive a Record of Decision on its environmental impact statement in 2009.

Big George—Powder River Basin, Wyoming

Acreage was first acquired in the Powder River Basin in 2002. Since then, the Company has grown its position to 127,423 net acres with 67 Bcfe of proved reserves. Net production from the area in 2008 totaled 8.1 Bcfe, up approximately 35% from 2007. CBM is natural gas found in coal seams and is abundant in certain areas of the Rocky Mountain region. The natural gas is trapped in the coal by water pressure and approximately six to 18 months of dewatering of the wells is required before the natural gas can be produced. CBM wells are shallow, relatively inexpensive to drill and leave a small surface footprint. Working in conjunction with landowners and regulatory agencies, the Company employs the highest standards for management of water produced from the coal, resulting in beneficial uses including irrigation and creation of wetlands and aquatic habitats. The Company drilled 203 gross wells in the area in 2008 and expects increasing production during 2009 as wells continue to dewater.

Exploration

Bill Barrett Corporation has a reputation for being a true exploration company, a title we uphold as we ended 2008 with an exciting portfolio of prospects. Our expertise in the region has led our team to find new fields as well as generate increased potential from underdeveloped fields.

Yellow Jacket & Green Jacket—Paradox Basin, Colorado

In the fall of 2008, we announced a discovery from the Gothic shale at our Yellow Jacket prospect in southwestern Colorado. This discovery was quickly converted to sales in December 2008. By year-end, the Company had completed three horizontal wells in the Gothic shale and drilled one horizontal well in the Hovenweep shale in the neighboring Green Jacket prospect. Shale gas plays offer the potential for large, repeatable resources that have become more prospective due to technological advances. The Company has a 55% working interest in the Yellow Jacket prospect and a 100% working interest in the Green Jacket prospect. During 2009, the Company plans to drill a multi-well program over its expansive 428,000 gross acre position to better determine the size and extent of its discovery.

Cave Gulch/Bullfrog— Wind River Basin, Wyoming

In 2008, the Company produced 9.6 Bcfe from the Wind River Basin and ended the year with 51 Bcfe in proved reserves. Production from the basin was primarily from shallow wells acquired or drilled during the early years in the Company’s history. Over the past few years, the Company has turned to exploring the deeper Frontier, Muddy and Lakota formations at 17,000 to 19,000 feet. During 2008, we recompleted the Bullfrog 14-18 well, which became a prolific producer sustaining gross rates predominantly between 28 and 14 MMcf/d from May through year-end. A second recompletion along the same fault block is scheduled for 2009. We also spud two deep exploration wells during the year, both of which produced natural gas and are undergoing testing with more conclusive results expected later in 2009.

Page 11

Bill Barrett Corporation

Natural gas is the preferred bridge fuel to a clean energy future: we have a vast domestic resource base; it is practical, affordable and clean; and it creates among the smallest environmental footprints to deliver energy.

Circus—Montana Overthrust, Montana

During 2008, the Company drilled four vertical appraisal wells to test the Cody shale for natural gas. One well was completed and tested gas at sustained rates of over 1 MMcf/d before operations were suspended for winter weather. We plan to continue completion work on these wells during 2009. The Company has a 50% working interest in this prospect and a large land position in the region with 384,000 gross acres.

Gas flare from discovery well, Paradox Basin, CO Photo by Monty Shed

Other active exploration prospects where we will continue work in 2009 are:

| | • | | Hook shale gas in the Uinta Basin, Utah |

| | • | | Red Point basin centered gas in the Big Horn Basin, Wyoming |

| | • | | Pine Ridge structural salt flank in the Paradox Basin, Utah |

Environment

As our nation’s concerns regarding climate change and energy independence continue to build, natural gas is the natural choice. Natural gas is the cleanest of fossil fuels emitting approximately one-half of the carbon dioxide emissions of coal per unit of energy produced. It is abundant in the United States and is the most widely used energy source to complement renewable but interruptible, and more expensive, forms of energy.

Bill Barrett Corporation is a leader in the application of technology to minimize our environmental impact. Examples include:

Piceance

| | • | | Increasing wells drilled per pad from three to 16 |

| | • | | Eliminating thousands of truck trips per year through our water management system |

| | • | | Pioneering the use of completion and production equipment that nearly eliminates air emissions |

West Tavaputs

| | • | | Applying the same directional drilling technology as in Piceance |

| | • | | Utilizing state-of-the-art production and gathering equipment that limits air emissions |

| | • | | Protecting archeological resources through extensive surveys that enable us to eliminate disturbance of treasured resources |

| | • | | Testing and applying new environmentally sensitive dust suppressants to protect rock art along the route to the field |

| | • | | Achieving no net impact to wildlife based on our mitigation plan |

| | • | | Improving wildlife habitats |

Powder

| | • | | Employing comprehensive planning efforts and creative water management that benefit surface owners and wildlife |

| | |

| | Left: Co-existing during drilling, Piceance Basin, Colorado Right: Production sites have minimal surface impact; West Tavaputs, Uinta Basin, Utah Photos by Jane Rerecich |

Page 12

Non-GAAP Measure

Discretionary cash flow is computed as net income plus depreciation, depletion, and amortization, impairment expenses, deferred income taxes, dry hole costs and abandonment expenses, exploration expenses, non-cash stock-based compensation, losses (gains) on disposals of properties, and certain other non-cash charges. The non-GAAP measure of discretionary cash flow is presented because management believes that it provides useful additional information to investors for analysis of the Company’s ability to internally generate funds for exploration, development and acquisitions. In addition, discretionary cash flow is widely used by professional research analysts and others in the valuation, comparison and investment recommendations of companies in the oil and gas exploration and production industry, and many investors use the published research of industry research analysts in making investment decisions. Discretionary cash flow should not be considered in isolation or as a substitute for net income, income from operations, net cash provided by operating activities or other income, profitability, cash flow or liquidity measures prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Because discretionary cash flow excludes some, but not all, items that affect net income and net cash provided by operating activities and may vary among companies, the discretionary cash flow amounts presented may not be comparable to similarly titled measures of other companies.

The Company calculates organic finding and development cost, or F&D cost, per thousand cubic feet of natural gas equivalent or Mcfe, by costs incurred adjusted to: subtract the asset retirement obligation amount; subtract material non-cash capital items; subtract proceeds received from joint exploration agreements and certain property sales; and subtract capitalize interest; divided by reserve additions for the year. Consistent with industry practice, future capital expenditures to develop proved undeveloped reserves or capital associated with furniture, fixtures and equipment are not included in costs incurred. The method the Company uses to calculate its F&D cost may differ significantly from methods used by other companies to compute similar measures. As a result, the Company’s F&D cost may not be comparable to similar measures provided by other companies. The Company believes that providing a non-GAAP measure of F&D cost is useful to investors in evaluating the cost, on a per Mcfe basis, to add proved reserves. However, this measure is provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in its financial statements prepared in accordance with GAAP. Due to various factors, including timing differences in the addition of proved reserves and the related costs to develop those reserves, F&D cost does not necessarily reflect precisely the costs associated with particular reserves. As a result of various factors that could materially affect the timing and amounts of future increases in reserves and the timing and amounts of future costs, the Company cannot assure you that its future F&D cost will not differ materially from those presented.

For a reconciliation of these non-GAAP measures to financial information prepared in accordance with GAAP, refer to our Current Reports on Form 8-K, including the February 24, 2009 Form 8-K, filed with the Securities and Exchange Commission (SEC).

Forward Looking Statements and Other Notices

This report contains forward-looking statements regarding Bill Barrett Corporation’s future plans and expected performance based on assumptions the Company believes to be reasonable. A number of risks and uncertainties could cause actual results to differ materially from these statements, including, without limitation, the success rate of exploration efforts and the timeliness of development activities, fluctuations in oil and gas prices, and other risk factors described in the Company’s accompanying Annual Report on Form 10-K for the year ended December 31, 2008.

The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. Bill Barrett Corporation may use certain terms in this report and other communications relating to reserves, resources and production that the SEC’s guidelines strictly prohibit the Company from including in filings with the SEC. It is recommended that U.S. investors closely consider the Company’s disclosures in the accompanying Annual Report on Form 10-K for the year ended December 31, 2008 filed with the SEC. This document is available through the SEC by calling 1-800-SEC-0330 (U.S.) and on the SEC website at www.sec.gov.

The New York Stock Exchange’s Rule 303A.12(a) requires chief executive officers of listed companies to certify that they are not aware of any violations by their companies of the exchange’s corporate governance listing standards. This annual certification by the chief executive officer of Bill Barrett Corporation has been filed with the New York Stock Exchange. In addition, Bill Barrett Corporation has filed, as exhibits to its most recently filed Form 10-K, the SEC certifications required for the chief executive officer and chief financial officer under Section 302 of the Sarbanes-Oxley Act.