Management’s Discussion and Analysis

The following Management’s Discussion and Analysis (“MD&A”) of the consolidated operating and financial performance of Claude Resources Inc. (“Claude” or the “Company”) for the three and nine months ended September 30, 2012 with the corresponding periods of 2011 is prepared as of November 7, 2012. This discussion is the responsibility of Management and has been prepared using International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board. This discussion should be read in conjunction with the Company’s September 30, 2012 condensed consolidated interim financial statements and notes thereto and the Company’s 2011 annual MD&A and 2011 audited consolidated financial statements and notes thereto. The Board of Directors has approved the disclosure presented herein. All amounts referred to in this discussion are expressed in Canadian dollars, except where otherwise indicated.

Overview

Claude Resources Inc., incorporated pursuant to the Canada Business Corporations Act, is a gold producer with shares listed on both the Toronto Stock Exchange (TSX-CRJ) and the NYSE MKT (NYSE MKT-CGR). The Company is also engaged in the exploration and development of gold mineral reserves and mineral resources. The Company’s entire asset base is located in Canada.

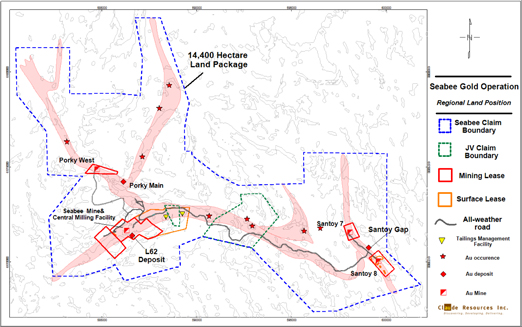

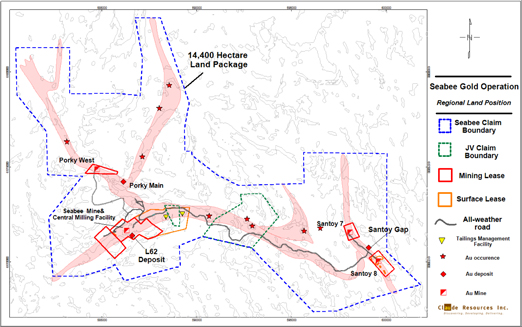

The Company’s revenue generating asset is the 100 percent owned Seabee Gold Operation, located in northern Saskatchewan, which includes 35,600 acres (14,400 hectares) and is comprised of five mineral leases and extensive surface infrastructure. Claude also owns 100 percent of the Amisk Gold Project in northeastern Saskatchewan. The Amisk Gold Project is located 20 kilometres southwest of Flin Flon, Manitoba and hosts the Amisk Gold Deposit and a large number of gold occurrences and prospects. At 99,800 acres (40,400 hectares), this gold and silver exploration property is one of the largest land positions in the Flin Flon mineral district. Claude also owns 100 percent of the Madsen Property located in the Red Lake gold camp of northwestern Ontario. The Madsen Project comprises over 10,000 acres (4,000 hectares) and boasts historical production in excess of 2.4 million ounces, making it the third largest gold producer in the Red Lake camp in Ontario, Canada. Infrastructure includes a fully functional 500 ton per day mill, a 4,125 foot deep shaft and permitted tailings facility. (1)

The Company’s Seabee, Amisk and Madsen properties contain large, long life mineral resources in the politically safe jurisdiction of Canada. All three properties, and their related deposits, contain over one million ounces of gold in the ground inventory and have significant leverage to the price of gold and provide valuable long-term opportunities for the Company and its shareholders. Management intends to further develop shareholder value by maintaining and advancing these projects in a financially prudent manner, which will include the monitoring of the attractiveness of these projects and the evaluation of alternatives to improve their economics.

Production, Exploration, and Financial Highlights

Seabee Gold Operation Production

| · | Q3 2012 production of 15,073 ounces (Q3 2011: 11,324 ounces). Year to date, production was 36,813 ounces (YTD 2011: 33,487 ounces). |

| · | For fiscal 2012, the Company expects to meet its production forecast of 48,000 to 50,000 ounces. |

| · | The Company is reviewing its operating processes and procedures to identify and implement efficiencies designed to increase production and lower operating costs. In addition to outside consultants being engaged to provide feedback and recommendations, a change in several mine management positions has taken place including safety, engineering, capital planning, supply chain management and environmental. Furthermore, a reduction in unit cash costs is also anticipated from a combination of higher grade ore at Seabee Deep and the L62 Zone and the effects of the shaft extension commissioning. |

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 2 |

| · | Completion of the Seabee Mine Shaft Extension Project, originally scheduled to be completed during the fourth quarter of 2012, has been deferred until the first quarter of 2013 in order to reduce interruption to operations. Down time is anticipated to be reduced from 40 days to approximately 20 days. |

| · | L62 Zone has been accessed and development is active on three levels. Development tonnage was accessed during the third quarter and production tonnage is scheduled for the fourth quarter. |

| · | Occupancy in newly upgraded Seabee Camp Facilities occurred during the third quarter. |

| · | During 2012, $18.0 million was budgeted in underground development, including access to the L62 Zone and advancement towards the Santoy Gap, to increase the number of working faces in 2013. |

Exploration

| · | Claude continued its extensive exploration programs at the Seabee, Amisk and Madsen Properties during the first nine months of 2012. |

| · | At the Seabee Gold Operation, the Company has completed approximately 40,000 metres of regional drilling and 44,000 metres of underground drilling year to date in 2012. |

| · | During the third quarter, exploration continued at Santoy Gap with one rig performing infill and step-out drilling. Santoy Gap drill results, released during the third quarter, extended the mineralized system up-dip, along strike to the north and at depth as well as confirmed continuity within the existing mineral resource. A highlight included drill hole JOY-12-677 which returned the widest intercept to date, 14.58 grams of gold per tonne over 29.74 metres, confirming a high grade core that hosts multiple vein sets over combined widths of between 20 and 30 metres. Results from this drilling will be included in the 2012 resource update which will be available in the first quarter of 2013. |

| · | Following on the discoveries of the L62 Zone and Santoy Gap, the inferred resource base at Seabee Gold Operation increased 236 percent and demonstrates the potential to add ounces that exists at the Seabee Gold Operation. The L62 Zone and Santoy Gap deposits are in close proximity to current mining infrastructure and will be integrated into an updated life of mine plan. |

| · | At the Amisk Gold Project, work on an external Preliminary Economic Assessment and an evaluation of the underground potential and detailed (as well as reconnaissance) exploration, continued during the third quarter. |

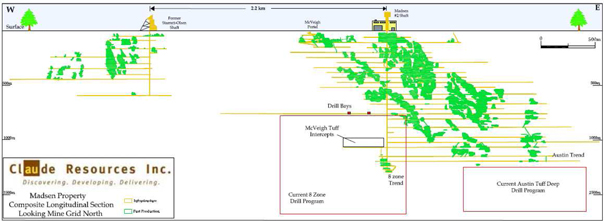

| · | Madsen exploration, which included two underground rigs and one surface rig, was completed in the third quarter. Testing focused on the 8 Zone Trend as well as the McVeigh and Austin Tuff depth continuity. Results are anticipated during the fourth quarter. |

Financial

| · | Net profit of $3.0 million, or $0.02 per share, for the three months ended September 30, 2012 (Q3 2011 – net profit of $2.6 million, or $0.02 per share). Year to date, net profit was $3.1 million, or $0.02 per share (YTD 2011 – $9.7 million, or $0.06 per share). |

| · | Cash flow from operations before net changes in non-cash operating working capital(2) of $8.6 million, or $0.05 per share, for the three months ended September 30, 2012, up 54 percent from $5.6 million, or $0.03 per share, for the three months ended September 30, 2011. Year to date, cash flow from operations before net changes in non-cash operating working capital was $16.4 million, or $0.09 per share (YTD 2011 - $17.6 million, or $0.11 per share). |

| · | Gold sales during the three months ended September 30, 2012 of 14,088 ounces at an average price of $1,663 (U.S. $1,671) for revenue of $23.4 million (Q3 2011 - 10,898 ounces at an average price of $1,670 (U.S. $1,704) for revenue of $18.2 million). Year to date, sales of 35,941 ounces at an average price of $1,657 (U.S. $1,654) generated revenue of $59.6 million (YTD 2011 – 32,777 ounces at an average price of $1,518 (U.S. $1,553) for revenue of $49.8 million). |

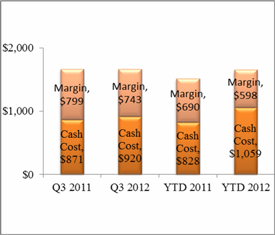

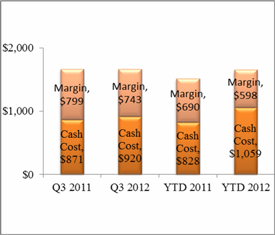

| · | Total Canadian dollar cash cost per ounce of gold(2)for the third quarter of 2012 increased six percent to CDN $920 (U.S. $924) per ounce from the third quarter of 2011 (Q3 2011: CDN $871 (U.S. $888)), primarily as a result of the higher operating costs period over period. Third quarter cash cost per ounce did improve over the first two quarters of the year (Q1 2012: CDN $1,236 (U.S. $1,234); Q2 2012: CDN $1,082 (U.S. $1,071)). Year to date, total cash cost per ounce of CDN $1,059 (U.S. $1,057) per ounce was 28 percent higher than the cash cost per ounce of CDN $828 (U.S. $847) reported during the first nine months of 2011. |

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 3 |

Outlook

Looking forward, the Company will continue to:

| i) | Pursue best practices in the areas of safety, health and the environment; |

| ii) | Increase production and improve unit operating costs at the Seabee Gold Operation by investing in capital projects and equipment to further develop satellite deposits; |

| iii) | Sustain or increase reserves and resources at the Seabee Gold Operation through further exploration and development; |

| iv) | Advance the Company's 100 percent owned Madsen Exploration Project; and |

| v) | Complete a Preliminary Economic Assessment on the Amisk Gold Project. |

Operating

The Company expects to meet its forecast gold production of 48,000 to 50,000 ounces at the Seabee Operation. Unit costs for 2012 are estimated to be about 10 percent higher than 2011 unit cash costs of $908 CDN.

Capital

Capital expenditures during 2012 include continued investment at Madsen and expected upgrades at the Seabee Gold Operation, including expansion to the Seabee Central Milling Facility, extension of the Seabee Shaft and expansion of the Seabee Gold Operation’s Camp Facilities.

Capital expenditures at the Seabee Gold Operation in 2012 are estimated to total approximately $45.0 million, funded from a combination of cash on hand, operating cash flow and demand loans.

During the first half of each year, the Company’s cash outflow is significant because of the Seabee Gold Operation’s annual winter ice road resupply which includes restocking diesel, propane and other large consumables as well as the continued upgrading of the mining fleet and mine infrastructure. At current gold prices and forecast production, Management believes that operating cash flows alone will not be sufficient to fund the 2013 Winter Ice Road resupply requirements at the Seabee Gold Operation, the Company’s debenture redemption in May of 2013 or continued exploration at the Seabee, Amisk and Madsen Properties. Accordingly, the Company expects that a combination of operating cash flows, debt financing and / or an equity issue may be required to provide sufficient funding.

Exploration

At the Seabee Gold Operation, the Company has drilled 40,000 metres regionally and 44,000 metres underground year to date in 2012. At Madsen, 19,000 metres were completed. Results from Claude’s underground and surface exploration, which focused on continued testing of the 8 Zone Trend as well as the McVeigh and Austin Tuff depth continuity, are expected during the fourth quarter. Finally, at the Amisk Gold Project, Claude will update its National Instrument 43-101 resource calculation and conduct a Preliminary Economic Assessment.

Continued success from the Company’s exploration programs should serve to:

| · | further extend the mine life at Seabee; |

| · | potentially improve the project economics at the Company’s Amisk and Madsen Projects; and |

| · | further increase the Company’s total resource base. |

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 4 |

Mining Operations Results

Seabee Gold Operation

At the Seabee Gold Operation, Claude is focused on executing the expansion of its production profile and lowering unit costs over the next several years by maximizing gold output from the near surface Santoy 8 and Santoy Gap deposits as well as increasing margins at the Seabee Mine via the shaft extension project which will provide more efficient transportation of ore and waste from the Seabee Deep and L62 deposits.

The Company is also continuing with its review of operating processes and procedures to identify and implement efficiencies designed to increase production and lower operating costs. In addition to outside consultants being engaged to provide feedback and recommendations, a change in several mine management positions has taken place including safety, engineering, capital planning, supply chain management and environmental.

For the three months ended September 30, 2012, Claude milled 66,173 tonnes at a grade of 7.34 grams of gold per tonne (Q3 2011 – 66,722 tonnes at 5.51 grams of gold per tonne). Produced ounces increased 33 percent period over period (Q3 2012 - 15,073; Q3 2011 – 11,324 ounces), a result of higher grade from the Seabee Mine and L62.

Year to date, the Company milled 205,537 tonnes at a grade of 5.83 grams of gold per tonne (YTD 2011 – 182,725 tonnes at a grade of 5.97 grams of gold per tonne). Year to date, produced ounces were 36,813 (YTD 2011 – 33,487 ounces), with mill recoveries relatively unchanged period over period, the increase in ounces is attributable to increased tonnes milled offset by slightly lower grade.

| Table 1: Seabee Gold Operation Quarterly Production and Cost Statistics |

| | | Three months ended | | | Nine months ended | |

| | | Sept 30 | | | Sept 30 | | | Sept 30 | | | Sept 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| | | | | | | | | | | | | |

| Tonnes Milled | | | 66,173 | | | | 66,722 | | | | 205,537 | | | | 182,725 | |

| Head Grade (grams per tonne) | | | 7.34 | | | | 5.51 | | | | 5.83 | | | | 5.97 | |

| Recovery (%) | | | 96.5 | % | | | 95.8 | % | | | 95.5 | % | | | 95.5 | % |

| Gold Produced (ounces) | | | 15,073 | | | | 11,324 | | | | 36,813 | | | | 33,487 | |

| Gold Sold (ounces) | | | 14,088 | | | | 10,898 | | | | 35,941 | | | | 32,777 | |

| Production Costs (CDN$ million) | | $ | 13.0 | | | $ | 9.5 | | | $ | 38.1 | | | $ | 27.1 | |

| Cash Operating Costs (CDN$/oz)(2) | | $ | 920 | | | $ | 871 | | | $ | 1,059 | | | $ | 828 | |

| Cash Operating Costs (U.S.$/oz)(2) | | $ | 924 | | | $ | 888 | | | $ | 1,057 | | | $ | 847 | |

Seabee Mine

During the third quarter of 2012, 11,442 ounces were produced from ore extracted from the Seabee Mine (Q3 2011 – 7,350 ounces). This increase was attributable to a 53 percent increase in grade.

Year to date, the Seabee Mine produced 25,367 ounces (YTD 2011 – 23,241 ounces). This increase was attributable to an eight percent increase in grade.

| Table 2: Seabee Mine Production Statistics |

| | | Three months ended | | | Nine months ended | |

| | | Sept 30 | | | Sept 30 | | | Sept 30 | | | Sept 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| | | | | | | | | | | | | |

| Tonnes Milled | | | 38,270 | | | | 37,981 | | | | 114,344 | | | | 113,172 | |

| Tonnes per Day | | | 416 | | | | 413 | | | | 417 | | | | 415 | |

| Head Grade (grams per tonne) | | | 9.64 | | | | 6.29 | | | | 7.21 | | | | 6.69 | |

| Gold Produced (ounces) | | | 11,442 | | | | 7,350 | | | | 25,367 | | | | 23,241 | |

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 5 |

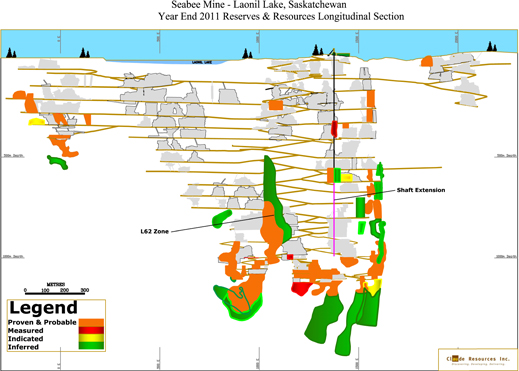

At the L62 Zone, the series of intercepts with above average true widths and economic gold grades represent a near term opportunity to improve operating margins at the Seabee Operation. These intercepts are near existing underground infrastructure. Production from the L62 Zone was initiated during the third quarter with long hole development anticipated during the fourth quarter.

Santoy 8 Mine

Claude views the Santoy 8 Mine as a key driver in the expansion of the Seabee Gold Operation and in lowering unit operating costs and increasing production over the life of mine plan.

Feedstock from the Santoy 8 Mine produced 3,631 ounces of gold during the three months ended September 30, 2012 (Q3 2011 – 3,974 ounces). Quarter over quarter, Santoy 8 results were attributable to slight decreases in tonnes per day and grade. Year to date, the Santoy 8 Mine produced 11,446 ounces of gold (YTD 2011 – 10,246). Year to date, results were attributable to increased tonnes per day from Santoy 8 partially offset by a decrease in grade. Santoy 8 tonnage throughput per day was in line with Management’s expectation for the third quarter and year to date.

| Table 3: Santoy 8 Mine Production Statistics |

| | | Three months ended | | | Nine months ended | |

| | | Sept 30 | | | Sept 30 | | | Sept 30 | | | Sept 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| | | | | | | | | | | | | |

| Tonnes Milled | | | 27,903 | | | | 28,741 | | | | 91,193 | | | | 69,553 | |

| Tonnes per Day | | | 303 | | | | 312 | | | | 333 | | | | 255 | |

| Head Grade (grams per tonne) | | | 4.19 | | | | 4.49 | | | | 4.10 | | | | 4.80 | |

| Gold Produced (ounces) | | | 3,631 | | | | 3,974 | | | | 11,446 | | | | 10,246 | |

Capital Projects

Mill

The Seabee Gold Operation’s Mill consists of a two stage crushing circuit, a three stage grinding circuit, followed by leaching. The Mill has been expanded to a peak capacity of 1,050 tonnes, with the operation capable of sustaining approximately 850 tonnes per day on average under the Seabee Gold Operation’s current Life of Mine Plan. During the first half of 2012, major upgrade work on the #1 regrind ball mill and an upgrade to the CIP tanks was completed. An eight day planned shutdown, originally scheduled for the third quarter, was completed early in the fourth quarter. Stockpiling of ore occurred during the shutdown and full year production numbers are not anticipated to be impacted.

Further expansions to the Mill are being evaluated to accommodate future sustained capacity and production increases expected from the L62 Zone and the Santoy Gap deposit.

Shaft Extension

During 2011, the Company commenced a shaft extension at the Seabee Mine which will see the shaft deepened from 600 metres to 980 metres. The shaft extension project was undertaken to provide more efficient transportation of ore and waste from underground to surface. With a combination of higher grade ore at Seabee Deep and the L62 Zone, it is anticipated that the shaft extension will provide a reduction in unit cash costs due to lower material movement costs.

On the vertical development portion of the extension, the Company has completed the majority of mining and timbering, with the pillar between the new and existing shaft remaining to be blasted. On the horizontal development portion of the extension, the Company has completed 620L, 720L, 860L, 1000L shaft bottom, the 950L rock breaker and the 975L loading pocket excavations.

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 6 |

The shaft extension is currently in the construction phase which involves the grizzly construction, rock breaker set up and loading pocket installation. The final phase of the shaft extension project is the upgrade to the hoist automation, shaft fibre cable installation and the shaft plug removal. These portions of the shaft extension, originally scheduled for completion during the latter half of 2012, have been deferred until the first quarter of 2013 in order to reduce interruption to operations from 40 days to approximately 20 days.

Camp

In order to accommodate the increased workforce at the Seabee Gold Operation, the Company’s Board of Directors approved upgrades to Seabee’s camp facilities. Modular accommodation facilities were purchased and transported to the Seabee Gold Operation over the annual winter ice road with installation completed early in the second quarter. In addition to the modular facilities, on site construction of other new accommodations began during the first quarter with occupancy beginning late in the third quarter.

Exploration Results

Claude continued to advance its exploration and development strategy during the third quarter of 2012. Exploration at the Seabee Gold Operation focused on expanding and delineating the L62 and Santoy Gap deposits and advancing several regional targets. At the Amisk Gold Project, exploration during the year continued to expand and confirm the National Instrument 43-101 open-pit resource estimate. At Madsen, the Company completed its three-rig, surface and underground drill program during the third quarter. The program focused on evaluating the 8 Zone Trend, the Austin and McVeigh Tuff and the Main Madsen Trend below the 4,000 foot level. Assays are pending with results anticipated during the fourth quarter.

All exploration activities were carried out under the direction of Qualified Person, Brian Skanderbeg, P. Geo., Senior Vice President and Chief Operating Officer.

Seabee Gold Operation

The Seabee Gold Operation is located northeast of La Ronge, Saskatchewan and is host to the producing Seabee and Santoy 8 Mines as well as the L62 Zone, Santoy Gap and Regional exploration targets.

Figure 1: Seabee Property regional map showing significant gold deposits and occurrences.

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 7 |

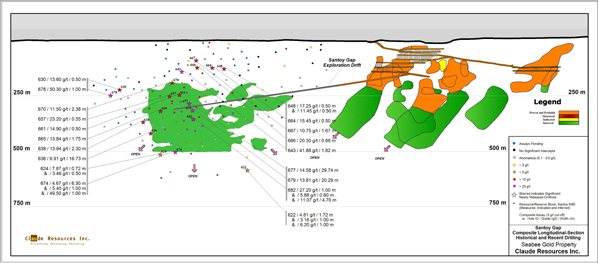

Santoy Region

Gold mineralization at the Santoy Region is hosted in siliceous, shear structures with sulfide-chlorite-quartz veins and in silicified granitoid sills. The mineralized lenses dip moderately to steeply eastward and are amenable to bulk mining techniques. Gold mineralization of the Santoy 8 ore lens occurs over a strike length of 600 metres, a depth of 500 metres and remains open along strike and down plunge to the north. The Santoy 8E ore lens has been intercepted over a strike length of 200 metres, depth of 250 metres and remains open along strike and down plunge to the north. The true thickness of the Santoy 8 deposits varies from 1.5 metres to 15 metres.

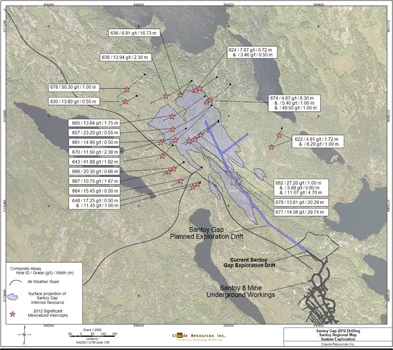

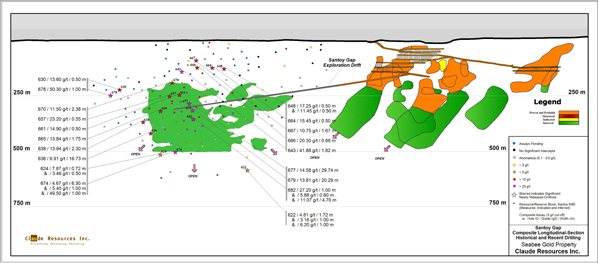

The Santoy Gap deposit is located 400 to 900 metres north of underground infrastructure, immediately on strike and adjacent to the Santoy 8 Mine. The Company’s 2012 exploration program focused on aggressively exploring the Santoy Gap deposit and its relationship to the Santoy 8 ore body to depths up to 750 metres. Infill and exploration drilling continued to confirm and expand the Santoy Gap system.

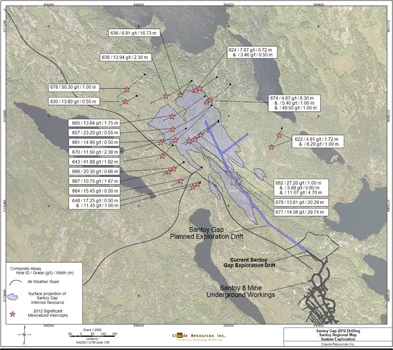

A total of 71 holes and 35,000 metres have been completed in and around the Santoy Gap during 2012. All of the infill holes completed during 2012 returned economic visible gold-bearing intercepts greater than or consistent with that of Santoy Gap’s existing resource. Drilling intercepted multiple high-grade intervals, significantly expanding the strike length, width and depth of the mineralized system.

Results of note from 2012 Santoy Gap drilling include:

| · | 6.91 grams of gold per tonne over 16.73 metres (JOY-12-636); |

| · | 14.58 grams of gold per tonne over 29.74 metres (JOY-12-677); and |

| · | 13.81 grams of gold per tonne over 20.29 metres (JOY-12-679). |

JOY-12-677 and JOY-12-679 are 40 and 75 metres along strike from the previously released JOY-11-556 that returned 19.10 grams of gold per tonne over 20.48 metres (see Claude Resources Inc. news releases dated November 15, 2011 and February 13, 2012). These results confirm a high grade core, hosting multiple vein sets over combined widths of between 20 and 30 metres.

Figure 2: Santoy Region Composite Longitudinal Section.

The system remains open in most directions and an exploration drift from the existing Santoy 8 infrastructure has been initiated to allow for underground infill drilling and initial bulk sampling. Additional highlights from drilling completed in 2012 are outlined below:

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 8 |

| Table 4: Highlights from 2012 Santoy Gap drilling |

| Hole ID | | | Easting | | | | Northing | | | From (m) | | | To (m) | | | Grade

(g/t) | | | Width (m) | |

| JOY-12-622 | | | 599436 | | | | 6170747 | | | | 403.57 | | | | 405.29 | | | | 4.81 | | | | 1.72 | |

| | | | | | | | And | | | | 722.00 | | | | 723.00 | | | | 6.20 | | | | 1.00 | |

| JOY-12-624 | | | 599148 | | | | 6170973 | | | | 519.71 | | | | 520.43 | | | | 7.87 | * | | | 0.72 | |

| JOY-12-630 | | | 598791 | | | | 6170890 | | | | 272.27 | | | | 272.77 | | | | 13.60 | | | | 0.50 | |

| JOY-12-636 | | | 599035 | | | | 6170957 | | | | 415.77 | | | | 432.50 | | | | 6.91 | | | | 16.73 | |

| JOY-12-638 | | | 599035 | | | | 6170957 | | | | 398.00 | | | | 400.30 | | | | 13.94 | | | | 2.30 | |

| JOY-12-643 | | | 598950 | | | | 6170670 | | | | 181.75 | | | | 183.57 | | | | 41.88 | | | | 1.82 | |

| JOY-12-648 | | | 599073 | | | | 6170506 | | | | 61.92 | | | | 62.42 | | | | 17.25 | | | | 0.50 | |

| | | | | | | | And | | | | 158.00 | | | | 159.00 | | | | 11.45 | | | | 1.00 | |

| JOY-12-657 | | | 599124 | | | | 6170848 | | | | 322.24 | | | | 322.79 | | | | 23.20 | * | | | 0.55 | |

| JOY-12-661 | | | 599124 | | | | 6170848 | | | | 345.20 | | | | 345.70 | | | | 14.90 | | | | 0.50 | |

| JOY-12-664 | | | 599080 | | | | 6170572 | | | | 135.14 | | | | 135.64 | | | | 15.45 | * | | | 0.50 | |

| JOY-12-665 | | | 599094 | | | | 6170889 | | | | 378.25 | | | | 380.00 | | | | 13.84 | | | | 1.75 | |

| JOY-12-666 | | | 599000 | | | | 6170595 | | | | 143.29 | | | | 143.95 | | | | 20.30 | * | | | 0.66 | |

| JOY-12-667 | | | 599000 | | | | 6170595 | | | | 124.57 | | | | 126.24 | | | | 10.75 | * | | | 1.67 | |

| JOY-12-670 | | | 599010 | | | | 6170745 | | | | 253.59 | | | | 255.97 | | | | 11.50 | | | | 2.38 | |

| JOY-12-674 | | | 599207 | | | | 6170942 | | | | 520.15 | | | | 526.45 | | | | 4.67 | | | | 6.30 | |

| | | | | | | | And | | | | 566.25 | | | | 567.25 | | | | 49.50 | | | | 1.00 | |

| JOY-12-677 | | | 599154 | | | | 6170781 | | | | 321.04 | | | | 350.78 | | | | 14.58 | | | | 29.74 | |

| JOY-12-678 | | | 598827 | | | | 6170985 | | | | 230.50 | | | | 231.50 | | | | 50.30 | | | | 1.00 | |

| JOY-12-679 | | | 599155 | | | | 6170775 | | | | 343.99 | | | | 364.28 | | | | 13.81 | | | | 20.29 | |

| JOY-12-682 | | | 599155 | | | | 6170775 | | | | 374.60 | | | | 375.60 | | | | 27.20 | | | | 1.00 | |

| | | | | | | | And | | | | 385.20 | | | | 386.00 | | | | 5.88 | | | | 0.80 | |

| | | | | | | | And | | | | 400.80 | | | | 405.50 | | | | 11.07 | | | | 4.70 | |

Note:* Partial result, certain assays within zone are pending.

Composites were calculated using a 3 g/t Au cut-off grade and may include internal dilution.

Figure 3: Santoy Gap 2012 Drilling

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 9 |

Additional drilling was completed late in the third quarter with results pending. All 2012 drill results will be incorporated into an updated National Instrument 43-101 resource statement during the first quarter of 2013.

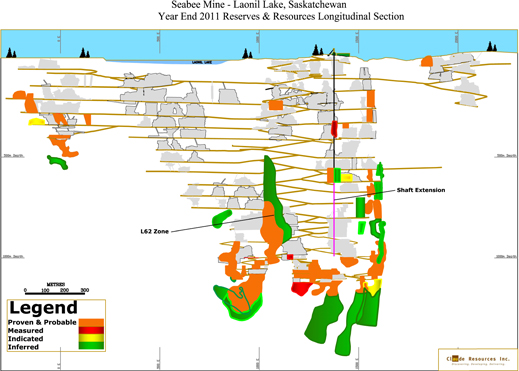

L62 Zone

The L62 Zone is located approximately 200 metres from existing Seabee Underground infrastructure on multiple levels. Exploration of this Zone defined a resource base between 500 and 1,000 metres below surface. The deposit remains open up dip and will be evaluated further late in the fourth quarter of 2012 and during the first quarter of 2013.

Figure 4: Seabee Mine Composite Longitudinal Section (L62 Zone Discovery)

Seabee Regional

Exploration of the Seabee Regional area has included work in the Pine, Pigeon and Laonil Lake areas. Grass roots work has focused on examining these prospective regional structures.

Amisk Gold Project

The potential of the Amisk Gold Project continues to be critically evaluated by the Company. The Amisk Gold Project is located in the Flin Flon-Snow Lake Greenstone Belt. The project is host to the Amisk Gold Deposit as well as a large number of gold occurrences and prospects. During the third quarter, work on the external Preliminary Economic Assessment at Amisk continued, including a technical site visit and an evaluation of the potential production rate. Results from the Preliminary Economic Assessment are expected late in the fourth quarter or early in the first quarter of 2013. An evaluation of the underground potential and detailed (as well as reconnaissance) exploration of the deposit also continued during the third quarter.

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 10 |

During the third quarter, on the Company’s newly acquired claims and western block of the Amisk Gold Project, reconnaissance work occurred with the goal of identifying similarities to Amisk’s historical geology and for potential drill targets.

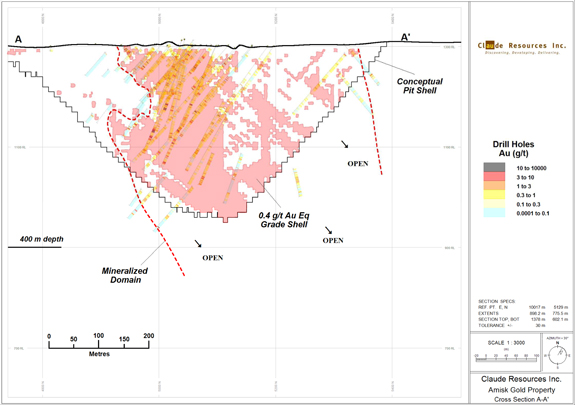

Figure 5: Amisk Gold Project

Results from a summer historic core sampling program and 2011 and 2012 drilling expanded the mineralized system and confirmed grade continuity of the resource model. Gold and silver mineralization is associated with a sequence of quartz porphyritic, rhyolitic lapilli tuffs and flows hosting disseminations and stringers of pyrite, sphalerite, galena, tetrahedrite and chalcopyrite. Drilling has intercepted the mineralized system over a strike length of 1,200 metres, width of 400 metres and depths of in excess of 600 metres. The system remains open to the southwest, southeast, northwest and at depth. In an effort to understand the geology of the region better, further mapping of Amisk’s conceptual pit continued during the third quarter.

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 11 |

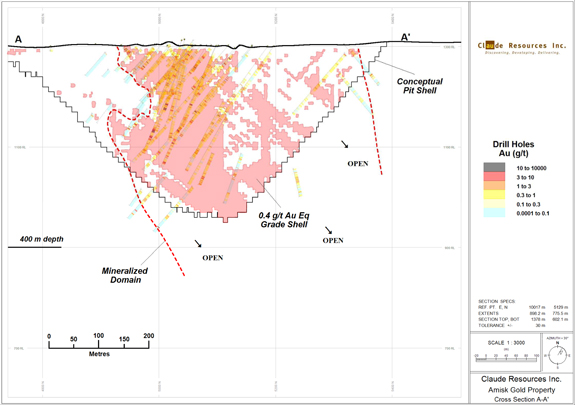

Figure 6: Cross Section A-A’ of the Amisk Gold Property

The Company’s 2011 and 2012 drill programs at Amisk focused specifically on testing the limits of the mineralized footprint north of the current pit outline, targeting depth extension below the pit bottom and infill drilling to evaluate potential upgrade of categories in the resource estimate completed by SRK. Drilling successfully confirmed continuity of gold mineralization within the northern and eastern portion of the deposit as well as demonstrated the potential for expansion to the east and southeast.

Mineralization intercepted in the drilling is consistent with the current resource model and is associated with a sequence of quartz porphyritic, rhyolitic lapilli tuffs and basaltic tuffs and argillite hosting disseminations, stringers and semi-massive intervals of pyrite, sphalerite, galena, tetrahedrite, pyrrhotite and chalcopyrite. Drill hole AL-11-319 confirmed continuity of gold mineralization within the southeastern portion of the deposit as well as demonstrated the potential for expansion to the east and southeast.

Mineralization intercepted in the drilling is consistent with the current resource model and is associated with a sequence of quartz porphyritic, rhyolitic lapilli tuffs and basaltic tuffs hosting disseminations and stringers of pyrite, sphalerite, galena, tetrahedrite and chalcopyrite. The program tested from surface to in excess of 700 metres depth and was designed to expand the limits of the Amisk Gold deposit as well as infill within the northern and eastern portion of the deposit.

In addition to focusing on growth of the gold and silver resource base, the presence of significant grades of zinc and lead in the hanging wall will continue to be evaluated during 2012.

During the third quarter of 2011, the Company reported positive metallurgical testwork results at the Amisk Gold Project. Initial metallurgical testing indicates that gold and silver mineralization is amenable to conventional cyanide leaching. Results from testing on three composite samples from the Amisk Gold Deposit have returned an average of 89.4 percent recovery for gold, ranging from 85.2 percent to 91.7 percent and an average of 80.8 percent recovery for silver, ranging from 66.4 percent to 92.8 percent. Detailed results are presented in the table below.

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 12 |

| Table 5: Metallurgical Testwork Results, Amisk Gold Project |

| | | Grade | | | Recovery

(Cyanidation) | | | Size

Fraction | |

| Composite ID | | Au

(g/T) | | | Ag

(g/T) | | | Au (%) | | | Ag (%) | | | P 80 (um)* | |

| Low Grade | | | 0.50 | | | | 7.4 | | | | 89.8 | | | | 70.9 | | | | 72 | |

| Medium Grade | | | 0.85 | | | | 9.2 | | | | 85.2 | | | | 88.9 | | | | 146 | |

| Medium Grade | | | 0.85 | | | | 9.2 | | | | 89.1 | | | | 84.8 | | | | 117 | |

| Medium Grade | | | 0.85 | | | | 9.2 | | | | 91.0 | | | | 92.8 | | | | 72 | |

| High Grade | | | 1.68 | | | | 8.4 | | | | 91.7 | | | | 66.4 | | | | 92 | |

* Denotes size fraction of grind that 80 percent of material passed.

Work on an external Preliminary Economic Assessment continued during the third quarter. Looking forward at Amisk, exploration will focus on expansion of the open pit resource, completion of preliminary economic studies and further evaluation of the underground potential.

Madsen Project

At the Madsen Project, exploration efforts continued to focus on the 8 Zone Trend which hosts the past-producing 8 Zone and is highly prospective for future high grade discoveries. Drilling was completed late in the third quarter, with visible gold noted in several of the drill targets. Assays from Phase II drilling are pending and are anticipated to be released during the fourth quarter.

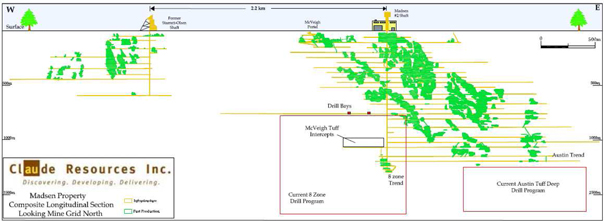

Figure 7: Madsen Longitudinal Section

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 13 |

Figure 8: Madsen Property Overview

Phase II underground drilling commenced from the 16th level which provides the ideal drill platform to explore both at depth as well as the strike potential of the 8 Zone Trend. A total of 14,800 metres and 9 holes, targeting the 8 zone plunge and strike continuity as well as sub-parallel footwall structures, were completed in 2011. Drill holes targeting the plunge continuity of the 8 Zone include MUG-11-12, 14 (14b) and 16. Drill hole 14b and drill hole 16, the deepest hole ever completed on the Madsen property, intercepted silicified and visible gold-bearing, basalt and returned 8.06 grams of gold per tonne over 2.02 metres and 5.69 grams of gold per tonne over 2.14 metres, respectively. These intercepts extend the 8 Zone system 250 metres down plunge from previous drilling to approximately 1,600 metres below surface. The system continues to remain open down plunge and will be the target of future drilling.

Drill holes targeting the strike continuity of the 8 Zone included MUG-11-10, 11, 13, 15, 17 and 19. Drill hole 13 and drill hole 17 intercepted silicified, biotite-altered basalt and returned 15.70 grams of gold per tonne over 2.00 metres and 53.70 grams of gold per tonne over 0.70 metres, approximately 950 metres below surface. These intercepts are in the hanging-wall of the 8 Zone system and interpreted to correlate with and be an extension of the McVeigh Tuff, located approximately 650 metres up-dip. The McVeigh Tuff hosts a current Indicated Resource of 115,000 ounces at 9.59 grams of gold per tonne and has seen very limited drill testing below 350 metres. In addition to the McVeigh mineralization, the 8 Zone structure is developed in all holes completed along strike and is characterized by anomalous gold associated with biotite-altered, variably silicified basaltic and ultramafic lithologies.

Table 6: Highlights from Phase II of the Madsen Underground 8 Zone

Drill Program |

| Hole ID | | Width (m) | | | Au (g/t) | | | Elevation * | | | Zone |

| | | | | | | | | | | | |

| MUG-11-13 | | | 2.00 | | | | 15.70 | | | | 927 | | | McVeigh |

| MUG-11-14 | | | 2.00 | | | | 6.27 | | | | 1,051 | | | McVeigh |

| MUG-11-14b | | | 2.02 | | | | 8.06 | | | | 1,543 | | | 8 Zone |

| MUG-11-16 | | | 2.14 | | | | 5.69 | | | | 1,595 | | | 8 Zone FW |

| MUG-11-17 | | | 0.70 | | | | 53.70 | | | | 927 | | | McVeigh |

| and | | | 2.00 | | | | 5.64 | | | | 1,079 | | | McVeigh |

| * | Elevation presented as metres below surface. Composites calculated using a 3 grams per tonne Au cut-off grade. Reported width is drilled length and interpreted to represent 75 - 85 percent of true width. Note, hole MUG-11-14 was lost with hole MUG-11-14b wedged off and completed. |

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 14 |

Results obtained from 2011 and 2012 drilling provide encouragement for the Company’s continuation of Phase II of the 8 Zone program in 2012 and continue to demonstrate that the 8 Zone is a high grade gold system that has strong vertical continuity and remains open at depth and along strike to the northeast. Furthermore, the discovery of economic grades and widths hosted within the depth continuity of the McVeigh Tuff opens up significant exploration potential. The Company is currently developing its 2013 exploration program for the project.

Quality Assurance and Quality Control Procedures

Rigorous quality assurance and quality control procedures have been implemented including the use of blanks, standards and duplicates. Geochemical analyses were submitted to ALS Chemex in Vancouver, British Columbia and or the Seabee minesite lab. The former laboratory is ISO approved. Core samples were analyzed by a 30 gram gold fire assay with an atomic absorption and gravimetric and or screen fire finish.

Mineral Reserves and Mineral Resources

The Mineral Reserves and Mineral Resources estimates are conducted under the direction of Qualified Persons Brian Skanderbeg, P.Geo., Senior Vice President and Chief Operating Officer and Peter Longo, P.Eng., Vice President Operations.

Seabee Gold Operation

Drill results from Santoy Gap and from the L62 Zone will further drive resource growth at the Seabee Operation. An updated National Instrument 43-101 resource statement is expected during the first quarter 2013.

Since discovery during the second quarter of 2011, the L62 Zone has been the focus of an aggressive exploration program and has grown rapidly. The L62’s high grade results obtained from drilling completed between September and December 2011 were incorporated into and had a material impact on the Seabee Mine’s updated National Instrument 43-101 resource calculation as at December 31, 2011 (Please see Claude news release “Claude Resources Inc. Increases Inferred Resource Base 236 Percent at Seabee Gold Operation” dated March 14, 2012).

At December 31, 2011, proven and probable reserves in the Seabee Gold Operation were 2,059,000 tonnes, grading 5.37 grams per tonne or 355,600 ounces of gold. At December 31, 2011, the Company’s mineral resources at its Seabee Gold Operation included Measured and Indicated Mineral Resources of 70,700 ounces and Inferred Mineral Resources totalling 873,400 ounces.

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 15 |

| Table 7: Seabee Gold Operation Mineral Reserves and Mineral Resources |

| Proven and Probable Reserves | |

| | | December 31, 2011 | | | December 31, 2010 | |

| Projects | | Tonnes | | | Grade (g/t) | | | Ozs | | | Tonnes | | | Grade (g/t) | | | Ozs | |

| Seabee | | | 1,062,900 | | | | 6.58 | | | | 224,900 | | | | 887,100 | | | | 6.69 | | | | 190,800 | |

| Santoy 8 | | | 997,100 | | | | 4.08 | | | | 130,600 | | | | 1,079,900 | | | | 4.66 | | | | 161,900 | |

| Totals | | | 2,059,900 | | | | 5.37 | | | | 355,600 | | | | 1,967,100 | | | | 5.58 | | | | 352,600 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Measured and Indicated Mineral Resources | |

| Projects | | Tonnes | | | Grade (g/t) | | | Ozs | | | Tonnes | | | Grade (g/t) | | | Ozs | |

| Seabee | | | 127,400 | | | | 4.65 | | | | 19,000 | | | | - | | | | - | | | | - | |

| Santoy 8 | | | 12,600 | | | | 5.04 | | | | 2,000 | | | | - | | | | - | | | | - | |

| Porky Main | | | 160,000 | | | | 7.50 | | | | 38,600 | | | | 160,000 | | | | 7.50 | | | | 38,600 | |

| Porky West | | | 111,000 | | | | 3.10 | | | | 11,000 | | | | 111,000 | | | | 3.10 | | | | 11,000 | |

| Totals | | | 410,900 | | | | 5.35 | | | | 70,600 | | | | 271,000 | | | | 5.70 | | | | 49,600 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Inferred Mineral Resources | |

| Projects | | Tonnes | | | Grade (g/t) | | | Ozs | | | Tonnes | | | Grade (g/t) | | | Ozs | |

| Santoy Gap | | | 2,321,000 | | | | 6.63 | | | | 495,000 | | | | - | | | | - | | | | - | |

| Seabee | | | 813,900 | | | | 6.83 | | | | 178,800 | | | | 705,500 | | | | 6.33 | | | | 143,600 | |

| Santoy 8 | | | 850,000 | | | | 5.46 | | | | 149,300 | | | | 384,800 | | | | 5.35 | | | | 66,200 | |

| Porky Main | | | 70,000 | | | | 10.43 | | | | 23,500 | | | | 70,000 | | | | 10.43 | | | | 23,500 | |

| Porky West | | | 138,300 | | | | 6.03 | | | | 26,800 | | | | 138,300 | | | | 6.03 | | | | 26,800 | |

| Totals | | | 4,193,200 | | | | 6.48 | | | | 873,400 | | | | 1,298,600 | | | | 6.23 | | | | 260,100 | |

For the above table of reserves, the following mining and economic factors have been applied:

| · | Mineral reserves and mineral resources were estimated by Claude personnel and audited by SRK in 2011. |

| · | Mineral reserves and mineral resources estimates have been completed in accordance with CIM Standards and are reported in accordance with Canadian Securities Administrators’ National Instrument 43-101. Mineral resources are exclusive of mineral reserves. |

| · | Seabee reserves and resources are estimated at a cut-off grade of 4.57 grams of gold per tonne and Santoy 8 and Santoy Gap reserves and resources are estimated at a cut-off grade of 3.0 grams of gold per tonne. |

| · | Cut-off grades were calculated using a two year trailing price of Can. $1,400 per ounce of gold, a U.S./CDN$ exchange rate of 1:1 and overall ore mining and processing costs based on actual historical operating costs. |

| · | All figures are rounded to reflect the relative accuracy of the estimates. Totals may not represent the sum of the parts due to rounding. |

| · | Mineral resources are not mineral reserves and do not have demonstrated economic viability. |

| · | L62 mineral reserves and mineral resources are included in the Seabee totals. |

Amisk Gold Project

At the Amisk Gold Project, Claude’s independent National Instrument 43-101 compliant resource calculation outlines an Indicated Resource of 921,000 ounces of 0.95 grams of Au Eq per tonne and an Inferred Resource of 645,000 ounces at 0.70 grams of Au Eq per tonne.

| Table 8: Amisk Gold Project Consolidated Mineral Resource Statement* | |

| | | Quantity | | | Grade (g/tonne) | | | Contained Ounces (000’s) | |

| Resource Class | | (000’s tonnes) | | | Au | | | Ag | | | Au Eq | | | Au | | | Ag | | | Au Eq | |

| | | | | | | | | | | | | | | | | | | | | | |

| Indicated | | | 30,150 | | | | 0.85 | | | | 6.17 | | | | 0.95 | | | | 827 | | | | 5,978 | | | | 921 | |

| Inferred | | | 28,653 | | | | 0.64 | | | | 4.01 | | | | 0.70 | | | | 589 | | | | 3,692 | | | | 645 | |

* Reported at a cut-off of 0.40 grams of gold equivalent (Au Eq) per tonne using a price of U.S. $1,100 per ounce of gold and U.S. $16 per ounce of silver inside a conceptual pit shell optimized using metallurgical and process recovery of 87 percent, overall ore mining and processing costs of U.S. $15 per tonne and overall pit slope of 50 degrees. All figures are rounded to reflect the relative accuracy of the estimates. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 16 |

An updated NI 43-101 resource statement, inclusive of all drilling completed to the end of 2011, is anticipated to be completed in conjunction with the Company’s Preliminary Economic Assessment for the Amisk Gold Project.

Madsen Exploration Project

During 2010, SRK finalized an independent National Instrument 43-101 mineral resource evaluation for the Madsen Mine. This mineral resource evaluation was based on historical exploration and mining data, Phase I underground drilling results up to September 27, 2009 and geological and resource modeling. The resource evaluation was undertaken on the four separate zones, Austin, South Austin, McVeigh and 8 Zone that comprise the Madsen Gold Mine. The National Instrument 43-101 Technical Report was filed on January 20, 2010.

| Table 9: Consolidated Mineral Resource Statement(1) for the Madsen Mine, Ontario |

Resource

Class | | Zone | | | | | Tonnes | | | Grade

(g/tonne) | | | Grade

(oz/ton) | | | Contained

Gold (oz) |

| | | | | | | | | | | | | | | |

| Indicated | | Austin | | | | | | | 1,677,000 | | | | 7.92 | | | | 0.23 | | | 427,000 |

| | | South Austin | | | | | | | 850,000 | | | | 9.32 | | | | 0.27 | | | 254,000 |

| | | McVeigh | | | | | | | 374,000 | | | | 9.59 | | | | 0.28 | | | 115,000 |

| | | 8 Zone | | | | | | | 335,000 | | | | 12.21 | | | | 0.36 | | | 132,000 |

| | | | | | | Total | | | | 3,236,000 | | | | 8.93 | | | | 0.26 | | | 928,000 |

| Inferred | | Austin | | | | | | | 108,000 | | | | 6.30 | | | | 0.18 | | | 22,000 |

| | | South Austin | | | | | | | 259,000 | | | | 8.45 | | | | 0.25 | | | 70,000 |

| | | McVeigh | | | | | | | 104,000 | | | | 6.11 | | | | 0.18 | | | 20,000 |

| | | 8 Zone | | | | | | | 317,000 | | | | 18.14 | | | | 0.53 | | | 185,000 |

| | | | | | | Total | | | | 788,000 | | | | 11.74 | | | | 0.34 | | | 297,000 |

| Note:mineral resources are not mineral reserves and do not have demonstrated economic viability. All figures have been rounded to reflect the relative accuracy of the estimates. Reported at a cut-off grade of 5.0 g/t gold based on U.S. $1,000 per troy ounce of gold and gold metallurgical recoveries of 94 percent. |

Financial Results of Operations

Highlights

| Table 10: Highlights of Financial Results of Operations | |

| | | Three months ended | | | Nine months ended | |

| | | Sept 30 | | | Sept 30 | | | Sept 30 | | | Sept 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| | | | | | | | | | | | | |

| Revenue | | $ | 23,422 | | | $ | 18,203 | | | $ | 59,565 | | | $ | 49,764 | |

| Divided by ounces sold | | | 14,088 | | | | 10,898 | | | | 35,941 | | | | 32,777 | |

| Average Realized Price per Ounce (CDN$) | | $ | 1,663 | | | $ | 1,670 | | | $ | 1,657 | | | $ | 1,518 | |

| | | | | | | | | | | | | | | | | |

| Production costs | | $ | 12,955 | | | $ | 9,488 | | | $ | 38,070 | | | $ | 27,143 | |

| Divided by ounces sold | | | 14,088 | | | | 10,898 | | | | 35,941 | | | | 32,777 | |

| Total cash costs per ounce (CDN$) | | $ | 920 | | | $ | 871 | | | $ | 1,059 | | | $ | 828 | |

| | | | | | | | | | | | | | | | | |

| Net Cash Margin per Ounce Sold (CDN$) | | $ | 743 | | | $ | 799 | | | $ | 598 | | | $ | 690 | |

| | | | | | | | | | | | | | | | | |

| Depreciation and depletion | | $ | 4,172 | | | $ | 2,895 | | | $ | 11,324 | | | $ | 7,463 | |

| Gross profit | | $ | 6,295 | | | $ | 5,820 | | | $ | 10,171 | | | $ | 15,158 | |

| Net profit | | $ | 2,958 | | | $ | 2,643 | | | $ | 3,146 | | | $ | 9,656 | |

| Earnings per share (basic and diluted) | | $ | 0.02 | | | $ | 0.02 | | | $ | 0.02 | | | $ | 0.06 | |

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 17 |

The increase in production costs, partially offset by increased ounces sold, has negatively impacted net cash margin per ounce sold period over period and year over year. The Company intends to improve profitability of the Seabee Gold Operation through a combination of improved grade control, cost controls and developing the production profile at lower cost satellite ore bodies, including Santoy 8 and eventually the Santoy Gap deposit. Also, in addition to external consultants being engaged to provide feedback and recommendations on improving operational efficiencies reducing unit operating costs, the Company anticipates that the continued contribution of the Santoy 8 Project (including the Santoy Gap deposit), contribution of ore from the L62 Zone and completion of the shaft extension will be positive catalysts in improving production and lowering overall unit operating costs at the Seabee Gold Operation.

| |  |

| Figure 9: Average Gold Price Realized (CDN$) | | Figure 10: Cash Cost and Margin Realized (CDN$) |

| Per Ounce Sold | | Per Ounce Sold |

Net Profit

For the three months ended September 30, 2012, the Company recorded net profit of $3.0 million, or $0.02 per share. This compares to a net profit of $2.6 million, or $0.02 per share, for the three months ended September 30, 2011. Year to date, the Company recorded net profit of $3.1 million, or $0.02 per share (YTD 2011 - $9.7 million, or $0.06 per share).

Revenue

Gold revenue from the Company’s Seabee Gold Operation for the three months ended September 30, 2012 increased 29 percent to $23.4 million from $18.2 million reported for the three months ended September 30, 2011. With consistent Canadian dollar gold prices realized period over period (Q3 2012 - $1,663 (U.S. $1,671); Q3 2011 - $1,670 (U.S. $1,704)), this increase in gold revenue was attributable to a 29 percent improvement in gold sales volume (Q3 2012 – 14,088 ounces; Q3 2011 – 10,898 ounces).

Year to date, gold revenue increased 20 percent to $59.6 million from the $49.8 million reported in the first nine months of 2011. This increase was attributable to a nine percent improvement in Canadian dollar gold prices realized: YTD 2012 - $1,657 (U.S. $1,654); YTD 2011 - $1,518 (U.S. $1,553) and a 10 percent increase in gold sales volume (YTD 2012 – 35,941 ounces; YTD 2011 – 32,777 ounces) period over period.

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 18 |

Production Costs

For the three months ended September 30, 2012, mine production costs of $13.0 million (Q3 2011 - $9.5 million) were 37 percent higher period over period. Year to date, mine production costs were $38.1 million (YTD 2011 - $27.1 million), an increase of 41 percent. These increases were primarily attributable to increased personnel, wage increases and increases in mining and maintenance costs.

Total Canadian dollar cash cost per ounce of gold(2) for the third quarter of 2012 increased six percent to CDN $920 (U.S. $924) per ounce from the third quarter of 2011 (Q3 2011: CDN $871 (U.S. $888)), primarily as a result of the higher operating costs period over period. Year to date, total cash cost per ounce of CDN $1,059 (U.S. $1,057) per ounce were 28 percent higher than the cash cost per ounce of CDN $828 (U.S. $847) reported during the first nine months of 2011.

Depreciation and Depletion

For the three months ended September 30, 2012, depreciation and depletion was $4.2 million (Q3 2011 - $2.9 million), up 45 percent period over period. Year to date, depreciation and depletion was $11.3 million, a 51 percent increase over the $7.5 million reported for the first nine months of 2011. For the quarter and year to date, these results are attributable to an increase in tonnes throughput and an increase in the Seabee Operation’s asset base.

General and Administrative Expense

General and administrative expense in the three months ended September 30, 2012 increased to $1.7 million, up 42 percent from the $1.2 million reported for the third quarter of 2011. For the first nine months of 2012, general and administrative costs of $6.1 million were 42 percent higher than the $4.3 million reported for the nine months ended September 30, 2011. The variances noted below primarily relate to increases in personnel, stock-based compensation and professional fees.

| Table 11: Corporate General and Administrative Expense | |

| | | Three months ended | | | Nine months ended | |

| | | Sept 30 | | | Sept 30 | | | Sept 30 | | | Sept 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| | | | | | | | | | | | | |

| Direct administration | | $ | 1,261 | | | $ | 937 | | | $ | 4,241 | | | $ | 3,074 | |

| Stock-based compensation | | | 359 | | | | 276 | | | | 1,654 | | | | 1,201 | |

| Deferred share units | | | 43 | | | | - | | | | 236 | | | | - | |

| Total General and Administrative | | $ | 1,663 | | | $ | 1,213 | | | $ | 6,131 | | | $ | 4,275 | |

Finance Expense

Finance expense includes interest expense, accretion expense and derivative gains or losses (if any). For the three months ended September 30, 2012, finance expense was $0.4 million, down 82 percent from the $2.2 million reported for the third quarter of 2011. Year to date, finance expense was $1.1 million, down 59 percent from the $2.7 million reported from the comparative period of 2011. The decreases were attributable to the Company settling certain out-of-the-money derivative instruments during the third quarter of 2011.

Finance and Other Income

Finance and other income consists of interest income, production royalties pursuant to the Red Mile transactions and other income. For the three months and nine months ended September 30, 2012, finance and other income was relatively unchanged from the comparative periods of 2011.

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 19 |

Deferred Income Tax Expense

Deferred income tax expense for the three months ended September 30, 2012 was $1.3 million and year to date, Deferred income tax expense was $1.7 million (YTD Q3 2011 - $nil). These increases are attributable to increased profitability of the Company in Q3 2012 compared to Q2 2012. The Company did not have any expense or recovery in the comparable periods of 2011 as there was no deferred tax asset or liability recorded.

Liquidity and Financial Resources

The Company monitors its spending plans, repayment obligations and cash resources on a continuous basis with the objective of ensuring that there is sufficient capital within the Company to meet business requirements, after taking into account cash flows from operations and the Company’s holdings of cash and cash equivalents and short-term investments. The Company’s typical cash requirement over the first and second quarters of each year is significant because of the Seabee Gold Operation’s winter ice road resupply, which includes restocking diesel, propane and other large consumables as well as the continued investment in maintenance and growth capital relating to the mining fleet and mine infrastructure.

The Company had cash and cash equivalents of $0.06 million at September 30, 2012 (December 31, 2011 - $2.5 million of cash and cash equivalents and short-term investments of $33.2 million).

At September 30, 2012, the Company had a working capital deficiency of $(3.4) million (December 31, 2011 - surplus of $42.4 million). Included in the working capital calculation at September 30, 2012 are demand loans and outstanding debentures totaling $6.1 million and $9.6 million, respectively. Demand loans have been classified as current liabilities due to their demand feature. As the debenture is due in less than one year, its balance has been classified as a current liability.

| Table 12: Working Capital and Current Ratio | |

| | | September 30 | | | December 31 | | | Percent | |

| | | 2012 | | | 2011 | | | Change | |

| | | | | | | | | | |

| Current assets | | $ | 22,744 | | | $ | 52,004 | | | | (56 | ) |

| Current liabilities | | $ | 26,113 | | | $ | 9,606 | | | | 172 | |

| Working capital | | $ | (3,369 | ) | | $ | 42,398 | | | | (108 | ) |

| Current ratio | | | 0.9 | | | | 5.4 | | | | (83 | ) |

Investing

Mineral property expenditures during the nine months ended September 30, 2012 were $52.3 million, a $14.8 million increase from the comparable period in 2011. Year to date, expenditures were comprised of Seabee Mine and Shaft development of $17.7 million, exploration costs (focusing on the Santoy Gap, Seabee North, Amisk and Madsen exploration projects) of $16.9 million and property, plant and equipment additions of $17.7 million. Property, plant and equipment additions include mining equipment, camp infrastructure and tailings management facility expansion. The Company utilized its cash on hand and short-term investments to fund these additions.

Financing

Financing activities during the first nine months of 2012 included the issuance of 338,676 common shares (Q3 2011 – 235,614) pursuant to the Company’s Employee Share Purchase Plan and 75,402 common shares (Q3 2011 – 168,667) pursuant to the Company’s Stock Option Plan.

During the first nine months of 2012, the Company repaid $3.7 million of its demand loans and capital leases outstanding. The proceeds and repayments of demand loans relate to production equipment at the Seabee Gold Operation.

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 20 |

Capital Structure

The Company’s objective when managing capital is to safeguard its ability to continue as a going concern so that it can continue to provide adequate returns to shareholders and benefits to other stakeholders. The Company manages the capital structure and makes adjustments to it in light of changes in economic conditions and the risk characteristics of the underlying assets. In order to maintain or adjust the capital structure, the Company may issue new shares, sell assets or incur debt. The Company is not subject to externally imposed capital requirements.

The Company utilizes a combination of short-term and long-term debt and equity to finance its operations and exploration.

The Capital structure of the Company is as follows:

| Table 13: Schedule of Capital Structure of the Company | |

| Capital Structure | | | | | | | | September 30 | | | December 31 | |

| | | Interest | | | | Maturity | | | 2012 | | | 2011 | |

| | | | | | | | | | | | | |

| Demand loan | | | 4.575 | % | | | Nov/2012 | | | $ | 163 | | | $ | 896 | |

| Demand loans | | | Prime + 1.50 | % | | | Jan-Apr/2015 | | | | 5,918 | | | | - | |

| Debenture | | | 12.00 | % | | | May/2013 | | | | 9,608 | | | | 9,452 | |

| Total debt | | | | | | | | | | $ | 15,689 | | | $ | 10,348 | |

| | | | | | | | | | | | | | | | | |

| Shareholders’ equity | | | | | | | | | | | 188,872 | | | | 172,895 | |

| | | | | | | | | | | | | | | | | |

| Debt to equity | | | | | | | | | | | 8.31 | % | | | 5.99 | % |

Financial and Other Instruments

In the normal course of its operations, the Company is exposed to gold price, foreign exchange, interest rate, liquidity, equity price and counterparty risks. The overall financial risk management program focuses on preservation of capital and protecting current and future Company assets and cash flows by reducing exposure to risks posed by the uncertainties and volatilities of financial markets.

The Company may use derivative financial instruments to hedge some of its exposure to fluctuations in gold prices and foreign exchange rates. The Company does not acquire, hold or issue derivatives for trading purposes. The Company’s management of financial risks is aimed at ensuring that net cash flows are sufficient to meet all its financial commitments as and when they fall due and to maintain the capacity to fund its forecast project development and exploration strategies.

The value of the Company’s mineral resources is related to the price of gold and the outlook for this mineral. Gold and precious metal prices historically have fluctuated widely and are affected by numerous factors outside of the Company’s control, including, but not limited to, industrial and retail demand, central bank lending, forward sales by producers and speculators, levels of worldwide production, short-term changes in supply and demand because of speculative hedging activities and certain other factors related specifically to gold. The profitability of the Company’s operations is highly correlated to the market price of gold. If the gold price declines below the cost of production at the Company’s operations, for a prolonged period of time, it may not be economically feasible to continue production.

The Company’s revenues from the production and sale of gold are denominated in U.S. dollars. However, the Company’s operating expenses are primarily incurred in Canadian dollars and its liabilities are primarily denominated in Canadian dollars. The results of the Company’s operations are subject to currency risks. The operating results and financial position of the Company are reported in Canadian dollars in the Company’s consolidated financial statements.

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 21 |

The Company did not have any derivative instruments outstanding at September 30, 2012 or September 30, 2011.

The Company’s main interest rate risk arises from interest earning cash deposits that expose the Company to interest rate risk. No hedging programs were implemented by the Company to manage interest rate risk during 2012.

The Company’s liquidity position is managed to ensure sufficient liquid funds are available to meet its financial obligations in a timely manner. The Company manages liquidity risk by continuously monitoring forecast and actual cash flows and ensuring that the Company has the ability to access required funding.

The Company is exposed to equity securities price risk arising from investments classified on the balance sheet as available-for-sale. Investments in equity securities are approved by the Board on a case-by-case basis. All of the Company’s available-for-sale equity investments are in junior resource companies listed on the TSX Venture Exchange.

The Company is exposed to counterparty risk which is the risk that a counterparty will not complete its obligations under a financial instrument resulting in a financial loss for the Company. The Company does not generally obtain collateral or other security to support financial instruments subject to credit risk; however, the Company only deals with credit worthy counterparties. Accounts receivable comprise institutions purchasing gold under normal settlement terms of two working days. Counterparty risk under derivative financial instruments is to reputable institutions. All significant cash balances are on deposit with high-rated banking institutions. The carrying amount of financial assets recorded in the financial statements represents the Company’s maximum exposure to credit risk without taking account of the value of any collateral or other security obtained.

Contractual Obligations

At September 30, 2012, with the exception of the increase in the Company’s demand loans, there were no significant changes to the Company’s contractual obligations from those reported in the Management’s Discussion and Analysis for the year ended December 31, 2011.

Statements of Financial Position

| Table 14: Select Statement of Financial Position Data | |

| | | September 30 | | | December 31 | | | Percent | |

| | | 2012 | | | 2011 | | | Change | |

| | | | | | | | | | |

| Total assets | | $ | 229,549 | | | $ | 207,887 | | | | 10 | |

| Non-current liabilities | | $ | 14,564 | | | $ | 25,386 | | | | (43 | ) |

The Company’s total assets were $229.5 million at September 30, 2012, compared to $207.9 million at December 31, 2011. The $21.6 million net increase was comprised primarily of increases of: $8.4 million in Inventories, attributable to the Company’s annual winter road resupply at the Seabee Gold Operation; and $54.2 million in Mineral properties attributable to Seabee Mine development and Shaft extension, exploration costs (focusing on the Santoy Gap, Seabee North, Amisk and Madsen exploration projects) and additions to property, plant and equipment. These increases were offset by decreases of: $35.6 million in cash and cash equivalents and short term investments, attributable to the Company’s annual winter road resupply and investment in exploration and Seabee capital projects; $2.2 million in account receivable, attributable to the timing of gold sales and receipt of funds; $1.0 million in Deferred income tax asset attributable to a change in the Company’s deferred tax base; and $2.3 million in Investments due to the disposition of certain of the Company’s available for sale securities and a decrease in the market value of the remainder these securities.

Total liabilities were $40.7 million at September 30, 2012, up $5.7 million from December 31, 2011. This result was attributable to a $2.1 million increase in accounts payable and accrued liabilities, attributable to the timing and payment of expenditures relating to consumables at the Seabee Gold Operation; a net increase of $3.7 million in the Company’s current and non-current loans and borrowings attributable to demand loans obtained to fund a portion of the capital equipment resupply at the Seabee Gold Operation; and an increase of 0.6 million in Deferred tax liability attributable to a change in the Company’s deferred tax base.

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 22 |

Shareholders’ equity increased by $16.0 million to $188.9 million at September 30, 2012, from $172.9 million at December 31, 2011. This variance is attributable to an increase in Share capital of $12.7 million due to the issuance of Company stock pursuant to the acquisition of St. Eugene, an increase of $1.3 million to contributed surplus, a $3.1 million decrease to Accumulated deficit; and a $1.1 million decrease to Accumulated other comprehensive income (loss).

Comprehensive income consists of net income, together with certain other economic gains and losses that are collectively referred to as “other comprehensive income (loss)” or “OCI” and are excluded from the income statement. During the period ended September 30, 2012, other comprehensive income decreased to a loss of $0.5 million (December 31, 2011 – comprehensive income of $0.6 million) due to the Company’s disposition of certain available-for-sale securities.

Key Sensitivities

Earnings from Claude’s gold operation are sensitive to fluctuations in both commodity and currency prices. The key factors and their approximate effect on earnings, earnings per share and cash flow, based on assumptions comparable to first quarter 2012 actuals, are as follows:

Gold

For a U.S. $10 movement in gold price per ounce, earnings and cash flow will have a corresponding movement of CDN $0.5 million, or $0.00 per share. For a $0.01 movement in the US$/CDN$ exchange rate, earnings and cash flow will have a corresponding movement of $0.8 million, or $0.00 per share.

Selected Quarterly Financial Data

| Table 15: Summary of select financial and operating data for the Company’s last eight quarters | |

| | | Sept 30 | | | June 30 | | | Mar 31 | | | Dec 31 | | | Sept 30 | | | Jun 30 | | | Mar 31 | | | Dec 31 | |

| | | 2012 | | | 2012 | | | 2012 | | | 2011 | | | 2011 | | | 2011 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Tonnes milled(c) | | | 66,173 | | | | 72,808 | | | | 66,556 | | | | 74,456 | | | | 66,722 | | | | 65,502 | | | | 50,501 | | | | 57,155 | |

| Grade processed (grams per tonne) | | | 7.34 | | | | 5.45 | | | | 4.74 | | | | 4.97 | | | | 5.51 | | | | 6.26 | | | | 6.20 | | | | 7.54 | |

| Ounces produced(c) | | | 15,100 | | | | 12,200 | | | | 9,600 | | | | 11,300 | | | | 11,300 | | | | 12,600 | | | | 9,500 | | | | 13,200 | |

| Ounces sold(b) | | | 14,100 | | | | 12,300 | | | | 9,500 | | | | 11,900 | | | | 10,900 | | | | 12,400 | | | | 9,500 | | | | 10,800 | |

| Gold sales ($ millions) | | | 23.4 | | | | 20.1 | | | | 16.1 | | | | 19.9 | | | | 18.2 | | | | 18.2 | | | | 13.3 | | | | 14.9 | |

| Net profit (loss) ($ millions) | | | 3.0 | | | | 0.7 | | | | (0.5 | ) | | | (0.2 | ) | | | 2.6 | | | | 5.2 | | | | 1.8 | | | | 4.1 | |

| Net profit (loss) per share(a) | | | 0.02 | | | | 0.00 | | | | (0.00 | ) | | | 0.00 | | | | 0.02 | | | | 0.03 | | | | 0.01 | | | | 0.03 | |

| Average realized gold price (CDN$ per ounce) | | | 1,663 | | | | 1,633 | | | | 1,681 | | | | 1,678 | | | | 1,670 | | | | 1,469 | | | | 1,408 | | | | 1,378 | |

| Average realized gold price (US$ per ounce) | | | 1,671 | | | | 1,616 | | | | 1,679 | | | | 1,641 | | | | 1,704 | | | | 1,518 | | | | 1,428 | | | | 1,361 | |

| Cash cost per ounce(d) (CDN$ per ounce) | | | 920 | | | | 1,082 | | | | 1,236 | | | | 1,130 | | | | 871 | | | | 717 | | | | 924 | | | | 597 | |

| Cash cost per ounce(d) (US$ per ounce) | | | 924 | | | | 1,071 | | | | 1,234 | | | | 1,105 | | | | 888 | | | | 741 | | | | 938 | | | | 589 | |

| Cash flow from operations before net changes in non-cash operating working capital ($ millions)(d) | | | 8.6 | | | | 5.3 | | | | 2.6 | | | | 7.2 | | | | 5.7 | | | | 8.3 | | | | 3.6 | | | | 7.7 | |

| Cash flow from operations per share | | | 0.05 | | | | 0.03 | | | | 0.02 | | | | 0.04 | | | | 0.03 | | | | 0.05 | | | | 0.03 | | | | 0.06 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted average shares outstanding (basic) | | | 173,746 | | | | 173,741 | | | | 170,481 | | | | 164,351 | | | | 163,911 | | | | 155,275 | | | | 140,361 | | | | 136,081 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CDN$/US$ Exchange | | | 0.9949 | | | | 1.0101 | | | | 1.0012 | | | | 1.0230 | | | | 0.9804 | | | | 0.9676 | | | | 0.9861 | | | | 1.0128 | |

| (a) | Basic and diluted, calculated based on the number of shares issued and outstanding during the quarter. |

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 23 |

| (b) | Statistics in 2010 exclude ounces sold from the Santoy 8 Project, which was not yet in commercial production. |

| (c) | Statistics in 2010 include ounces produced and tonnes milled from the Santoy 8 Project, which was not yet in commercial production. |

| (d) | Denotes a non-IFRS performance measure. For an explanation of non-IFRS performance measures, refer to the “Non-IFRS Performance Measures” section of this MD&A. |

The financial results for the last eight quarters reflect the following general trends: improved average realized gold price (which has improved gold revenue and net profit (loss)); lower grade attributable to more feedstock from the Santoy 8 ore body; and increasing cash cost per ounce.

Accounting Estimates

Certain of the Company’s accounting policies require that Management make decisions with respect to the formulation of estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. For a discussion of those estimates, please refer to the Company’s Management’s Discussion and Analysis for the year ended December 31, 2011, available atwww.sedar.com.

Future Accounting Pronouncements

Certain new accounting standards and interpretations have been published that are not mandatory for the September 30, 2012 reporting period:

| · | IFRS 9,Financial Instruments: effective for accounting periods commencing on or after January 1, 2015. The Company does not expect the adoption of this standard to have a material impact on its consolidated financial statements. |

| · | IFRS 10,Consolidated Financial Statements,was issued by the IASB in May 2011 and is effective for annual periods beginning on or after January 1, 2013 with early adoption permitted. The Company does not expect the adoption of this standard to have a material impact on its financial statements. |

| · | IFRS 11,Joint Arrangements, was issued by the IASB in May 2011 and is effective for annual periods beginning on or after January 1, 2013 with early adoption permitted. The extent of the impact of adoption of IFRS 11 has not yet been determined by the Company. |

| · | IFRS 12,Disclosure of Interests in Other Entities, was issued by the IASB in May 2011 and is effective for the Company beginning on January 1, 2013. It is expected that IFRS 12 will increase the current level of disclosure related to the Company’s interests in other entities upon adoption. |

| · | In May 2011, the IASB published IFRS 13,Fair Value Measurement, which is effective prospectively for annual periods beginning on or after January 1, 2013. The extent of the impact of adoption of IFRS 13 has not yet been determined. |

| · | In June 2011, the IASB issued IAS 1, Presentation of Items of OCI:Amendments to IAS 1 Presentation of Financial Statements. The amendments stipulate the presentation of net profit and OCI and also require the Company to group items within OCI based on whether the items may be subsequently reclassified to profit or loss. Amendments to IAS 1 are effective for annual periods beginning on or after July 1, 2012. The Company does not expect the adoption of the amendments to this standard to have a material impact on its financial statements. |

| · | In May 2011, the IASB issued amendments to IAS 28,Investments in Associates and Joint Ventures, which are effective for annual periods beginning on or after January 1, 2013 with early adoption permitted. The Company does not expect the amendments to IAS 28 to have a material impact on the financial statements. |

| · | In December 2011, the IASB publishedOffsetting Financial Assets and Financial Liabilities and issued new disclosure requirements in IFRS 7,Financial Instruments: Disclosures. The amendments to IAS 32 clarify that if an entity currently has a legally enforceable right to set-off if that right is not contingent on a future event, and enforceable both in the normal course of business and in the event of default, insolvency or bankruptcy of the entity and all counterparties. The amendments to IAS 32 also clarify when a settlement mechanism provides for net settlement or gross settlement that is equivalent to net settlement. The amendments to IFRS 7 contain new disclosure requirements for financial assets and liabilities that are offset in the statement of financial position, or subject to master netting arrangements or similar arrangements. The effective date for the amendments to IAS 32 is annual periods beginning on or after January 1, 2014. The effective date for the amendments to IFRS 7 is annual periods beginning on or after January 1, 2013. These amendments are to be applied retrospectively. The Company does not expect the amendments to have a material impact on the financial statements. |

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 24 |

Business Risks

Risks and uncertainties related to economic and industry factors are described in detail in the Company’s Annual Information Form (available atwww.sedar.com) and remain substantially unchanged.

Outstanding Share Data

The authorized share capital of the Company consists of an unlimited number of common shares and two classes of unlimited preferred shares issuable in series. At September 30, 2012, there were 173,745,564 common shares outstanding. This compares to 164,630,231 common shares outstanding at December 31, 2011.

During the first nine months of 2012, the Company issued 414,078 common shares pursuant to the Company’s Employee Share Purchase Plan and the Company’s Stock Option plan. An additional 8,701,255 shares were issued as consideration for Claude’s acquisition of St. Eugene(please see Claude news release “Claude Resources Inc. Completes Acquisition of St. Eugene Mining Corporation Limited” dated February 2, 2012). At November 7, 2012, there were 173,745,564 common shares of the Company issued and outstanding.

Outstanding Stock Options and Warrants

At September 30, 2012, there were 6.8 million director, officer and key employee stock options outstanding with exercise prices ranging from $0.50 to $2.38 per share. This compares to 5.5 million director, officer and key employee stock options outstanding at December 31, 2011 with similar prices.

| Table 16: Schedule of Outstanding Stock Options and Weighted Average Exercise Price | |

| | | September 30, 2012 | | | December 31, 2011 | |

| | | Number | | | Weighted

Average

Exercise Price | | | Number | | | Weighted

Average

Exercise Price | |

| | | | | | | | | | | | | |

| Beginning of period | | | 5,484,250 | | | $ | 1.57 | | | | 3,916,737 | | | $ | 1.15 | |

| Options granted | | | 1,721,290 | | | | 1.08 | | | | 2,478,768 | | | | 2.06 | |

| Options exercised | | | (75,402 | ) | | | 0.78 | | | | (648,667 | ) | | | 0.75 | |

| Options forfeited | | | (281,611 | ) | | | 1.82 | | | | (241,876 | ) | | | 1.86 | |

| Options expired | | | (30,000 | ) | | | 1.71 | | | | (20,712 | ) | | | 1.04 | |

| End of period | | | 6,818,527 | | | | 1.45 | | | | 5,484,250 | | | $ | 1.57 | |

| Q3 2012 Management’s Discussion and Analysis | |

| (in thousands of CDN dollars, except as otherwise noted) | Page 25 |

For options outstanding at September 30, 2012, the range of exercise prices, the number vested, the weighted average exercise price and the weighted average remaining contractual life are as follows: