UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21128

Legg Mason Partners Variable Equity Trust

(Exact name of registrant as specified in charter)

55 Water Street, New York, NY 10041

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: December 31

Date of reporting period: December 31, 2010

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

December 31, 2010

Annual Repor t

Legg Mason

Investment Counsel

Variable

Social

Awareness

Portfolio

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

| | |

| II | | Legg Mason Investment Counsel Variable Social Awareness Portfolio |

Portfolio objective

The Portfolio seeks capital appreciation and retention of net investment income.

Dear Shareholder,

We are pleased to provide the annual report of Legg Mason Investment Counsel Variable Social Awareness Portfolio for the twelve-month reporting period ended December 31, 2010. Please read on for a detailed look at prevailing economic and market conditions during the Portfolio’s reporting period and to learn how those conditions have affected Portfolio performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com/individualinvestors. Here you can gain immediate access to market and investment information, including:

| Ÿ | | Market insights and commentaries from our portfolio managers and |

| Ÿ | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

February 9, 2011

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio | | | III | |

Investment commentary

Economic review

Despite continued headwinds from high unemployment and issues in the housing market, the U.S. economy continued to expand over the twelve months ended December 31, 2010. Toward the end of the reporting period, fears regarding moderating economic growth were replaced with optimism for a strengthening economy in 2011. With investor sentiment improving, U.S. equities moved sharply higher in the fourth quarter, while rising interest rates negatively impacted some sectors of the fixed-income market. All told, during 2010, investors who took on additional risk in their portfolios were generally rewarded.

In September 2010, the National Bureau of Economic Research (“NBER”), the organization charged with determining when recessions start and end, announced that the recession that began in December 2007 had concluded in June 2009. However, the NBER said, “In determining that a trough occurred in June 2009, the committee did not conclude that economic conditions since that month have been favorable or that the economy has returned to operating at normal capacity.” The NBER’s point is well-taken given continued areas of weakness in the U.S. economy.

Although the U.S. Department of Commerce continued to report positive U.S. gross domestic product (“GDP”)i growth, the expansion has moderated since peaking at 5.0% in the fourth quarter of 2009. A slower drawdown in business inventories and renewed consumer spending were contributing factors spurring the economy’s solid growth at the end of 2009. However, the economy grew at a more modest pace in 2010. According to the Commerce Department, GDP growth was 3.7%, 1.7% and 2.6% during the first, second and third quarters of 2010, respectively. The initial estimate for fourth quarter GDP was a 3.2% expansion.

Turning to the job market, while the unemployment rate moved lower in December 2010, it remained elevated throughout the reporting period. While 384,000 new jobs were created during the fourth quarter and the unemployment rate fell from 9.8% in November to 9.4% in December 2010, there continued to be some disturbing trends in the labor market. The unemployment rate has now exceeded 9.0% for twenty consecutive months, the longest period since the government began tracking this data in 1949. In addition, the U.S. Department of Labor reported in December that a total of 14.5 million Americans looking for work have yet to find a job, and 44% of these individuals have been out of work for more than six months.

There was mixed news in the housing market during the period. According to the National Association of Realtors (“NAR”), existing-home sales increased 7.0% and 8.0% in March and April, respectively, after sales had fallen for the period from December 2009 through February 2010. The rebound was largely attributed to people rushing to take advantage of the government’s $8,000 tax credit for first-time home buyers that expired at the end of April. However, with the end of the tax credit, existing-home sales then declined from May through July. Sales then generally rose from August through the end of the year. In total, existing-home sales volume in 2010 was 4.9 million, the lowest amount since 1997. Looking at home prices, the NAR reported that the median existing-home price for all housing types rose a tepid 0.3% in 2010. The inventory of unsold homes was an 8.1 month supply in December at the current sales level, versus a 9.5 month supply in November.

The manufacturing sector was one area of the economy that remained relatively strong during 2010. Based on the Institute for Supply Management’s PMIii, the manufacturing sector has grown seventeen

| | |

| IV | | Legg Mason Investment Counsel Variable Social Awareness Portfolio |

Investment commentary (cont’d)

consecutive months since it began expanding in August 2009. After reaching a six-year peak of 60.4 in April 2010 (a reading below 50 indicates a contraction, whereas a reading above 50 indicates an expansion), PMI data indicated somewhat more modest growth through the remainder of the year. However, in December, the manufacturing sector expanded at its fastest pace in seven months, with a reading of 57.0 versus 56.6 in November.

Financial market overview

The financial markets experienced several periods of volatility during the reporting period that tested the resolve of novice and experienced investors alike. During most of the first four months of the reporting period, the financial markets were largely characterized by healthy investor risk appetite and solid results by stocks and lower-quality bonds. The market then experienced sharp sell-offs in late April and in May, and again beginning in mid-November. During those periods, investors tended to favor the relative safety of U.S. Treasury securities. However, these setbacks proved to be only temporary and, in each case, risk aversion was replaced with solid demand for riskier assets.

Due to signs that certain areas of the economy were moderating in the second half of the reporting period, the Federal Reserve Board (“Fed”)iii took further actions to spur the economy. At its August 10th meeting, the Fed announced an ongoing program that calls for using the proceeds from expiring agency debt and agency mortgage-backed securities to purchase longer-dated Treasury securities.

In addition, the Fed remained cautious throughout the reporting period given pockets of weakness in the economy. At its meeting in September 2010, the Fed said, “The Committee will continue to monitor the economic outlook and financial developments and is prepared to provide

additional accommodation if needed to support the economic recovery. . . .” This led to speculation that the Fed may again move to purchase large amounts of agency and Treasury securities in an attempt to avoid a double-dip recession and ward off deflation.

The Fed then took additional action in early November. Citing that “the pace of recovery in output and employment continues to be slow,” the Fed announced another round of quantitative easing to help stimulate the economy, entailing the purchase of $600 billion of long-term U.S. Treasury securities by the end of the second quarter of 2011. This, coupled with the Fed’s previously announced program to use the proceeds of expiring securities to purchase Treasuries, means it could buy a total of $850 billion to $900 billion of Treasury securities by the end of June 2011. At its final meeting of the year in December, the Fed said it “will regularly review the pace of its securities purchases and the overall size of the asset-purchase program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability.”

Equity market review

U.S. stock prices, as measured by the S&P 500 Indexiv (the “Index”), moved higher during the twelve months ended December 31, 2010. The reporting period got off to a solid start, with the Index moving higher during three of the first four months covered by this report. The market’s ascent was the result of a number of factors, including optimism regarding the economy, better-than-expected corporate profits and increased investor risk appetite. However, robust investor appetite was replaced with heightened risk aversion in May and June. This was due to the escalating sovereign debt crisis in Europe, uncertainties regarding new financial reforms in the U.S. and some worse-than-expected economic data.

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio | | | V | |

After reaching a nineteen-month high on April 23, 2010, the market, as measured by the Index, fell into “correction territory” in May and plunged more than 10%. Despite continued disappointing economic data, strong second quarter corporate profits helped the market to rally in July. The market then declined again in August, given some disappointing economic data. With the Fed indicating the possibility of another round of quantitative easing, stock prices then moved sharply higher in September and October. After posting solid results in early November, the market weakened later in the month as financial troubles in Ireland resulted in a re-emergence of the European sovereign debt crisis. However, investor sentiment was buoyed in December by a two-year extension of the Bush-era tax cuts and the Index gained 6.68% during the month. This represented its strongest month of December since 1991. All told, the Index returned 15.06% over the twelve months ended December 31, 2010.

Fixed-income market review

Continuing the trend that began in the second quarter of 2009, nearly every spread sector (non-Treasury) outperformed equal-durationv Treasuries during most of the first four months of the reporting period. Over that time, investor confidence was high given encouraging economic data, continued low interest rates, benign inflation and rebounding corporate profits. Robust investor appetite was then replaced with heightened risk aversion toward the end of April and during the month of May. This was due to the escalating sovereign debt crisis in Europe, uncertainties regarding new financial reforms in the U.S. and some worse-than-expected economic data. Most spread sectors then produced positive absolute returns in June and July, as investor demand for these securities again increased. There was another bout of risk aversion in August, given fears that the economy may slip back into a recession.

However, due to expectations for additional quantitative easing, most spread sectors rallied in September and October. The spread sectors started to weaken again toward the middle of November as the European sovereign debt crisis again took center stage. While several spread sectors regained their footing in December, others remained weak given ongoing uncertainties in Europe and concerns regarding economic growth in China and its potential impact on the global economy.

Both short- and long-term Treasury yields fluctuated but, overall, moved lower during the twelve months ended December 31, 2010. When the period began, two- and ten-year Treasury yields were 1.14% and 3.85%, respectively. On April 5, 2010, two- and ten-year Treasury yields peaked at 1.18% and 4.01%, respectively. Subsequent to hitting their highs for the period, yields largely declined during much of the next six months, with two-year Treasuries hitting their low for the year of 0.33% on November 4, 2010. Ten-year Treasuries reached their 2010 trough of 2.41% in early October. Yields then moved sharply higher given expectations for stronger growth in 2011 and the potential for rising inflation. When the period ended on December 31, 2010, two-year Treasury yields were 0.61% and ten-year Treasury yields were 3.30%. For the twelve months ended December 31, 2010, the Barclays Capital U.S. Aggregate Indexvi returned 6.54%.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and

Chief Executive Officer

January 28, 2011

| | |

| VI | | Legg Mason Investment Counsel Variable Social Awareness Portfolio |

Investment commentary (cont’d)

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance

reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| | |

i Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. ii The Institute for Supply Management's PMI is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the manufacturing sector. iii The Federal Reserve Board ("Fed") is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. | | iv The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. v Duration is the measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows. vi The Barclays Capital U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report | | | 1 | |

Portfolio overview

Q. What is the Portfolio’s investment strategy?

A. The Portfolio seeks capital appreciation and retention of net investment income.

The Portfolio invests primarily in common stocks and other equity securities of U.S. companies that we believe are undervalued and have above-average potential for growth. Our rigorous stock selection is based upon proprietary fundamental analysis combined with a top-down approach to portfolio construction. We seek to invest in a broad range of companies, without regard to market capitalization, that exhibit superior characteristics including solid long-term earnings growth, high sustainable profitability, quality management, sound capital structure, strong cash flow and reasonable valuation.

The Portfolio targets a 30% investment (normally between 25% and 35%) in fixed-income securities, primarily investment grade, which may be of any maturity. Our fixed-income strategy utilizes fundamental analysis and an assessment of relative value within the context of current market conditions, expected interest rate movements, changes in the shape of the yield curvei, and fluctuations in sector spreads. We employ a disciplined approach, constantly assessing market conditions in order to identify market anomalies. The Portfolio also may invest up to 25% (and generally invest less than 15%) in foreign securities, including those of issuers in emerging market countries.

For all securities in the Portfolio, we utilize our proprietary social research to determine whether, relative to other companies in their industry, selected companies make a positive contribution to society through their products and services and through the way they conduct business. Specifically, we focus on companies that:

| Ÿ | | Have fair and reasonable employment practices |

| Ÿ | | Contribute to the general well-being of the citizens of their host communities and countries and have respect for human rights |

| Ÿ | | Utilize strategies to minimize the negative impact of business activities on the environment |

| Ÿ | | Do not manufacture nuclear weapons or other weapons of mass destruction or derive more than 5% of their revenue from the production of non-nuclear weaponry |

| Ÿ | | Do not derive more than 5% of their revenue from the production or sale of tobacco products |

Q. What were the overall market conditions during the Portfolio’s reporting period?

A. After the strong results posted in the third quarter of 2010, by both stocks and bonds, the subsequent three months saw a divergence of fortunes. U.S. stocks, as measured by the S&P 500 Indexii, continued their strong advance, gaining 11.29% and 10.76% in the third and fourth quarters, respectively. In contrast, bonds declined during the final three months of the year as the Barclays Capital U.S. Aggregate Indexiii lost 1.30%. For both stocks and bonds, December proved to be an important month as a good bit of either the gain or loss was recorded then. On an annual basis, both of the major asset classes produced strong results with the S&P 500 Index returning 15.06% and the Barclays Capital U.S. Aggregate Index returning 6.54%.

For the first three quarters of 2010, asset returns were driven by macro concerns and an embracing or fleeing by investors from the risks stemming from these issues. For the most part, when risks appeared to be manageable, stocks did well and when the risks increased to a certain point, stocks sold off. Of particular concern was the growing crisis surrounding the potential

| | |

| 2 | | Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report |

Portfolio overview (cont’d)

default by Greece on its government bonds and then, later, fears that the U.S. economy would slip into another recession. In contrast, bonds generally did well in either case as money continued to flow into bond mutual funds. Toward the end of the third quarter, the feeling among equity investors again switched and they were willing to embrace risk. Supporting this attitude was Federal Reserve Board (“Fed”)iv Chairman Bernanke who announced that the central bank was considering another round of buying a significant amount of assets. The goal of such a program would be to stave off any deflationary tendencies in the economy by hopefully fostering a bit of inflation. Possibly of equal importance would be an increase in investor outlook, which would translate into higher stock prices and then more consumption via the wealth effect.

Many economists do not have much hope that this new round of quantitative easing will actually have an effect on the economy. Nevertheless, stock prices began to rise after the idea was broached by Chairman Bernanke. Further support came from the growing perception, which became a reality, that the Republican Party would make significant gains in the mid-term elections. Subsequently, good news came from an upward revision for third quarter U.S. gross domestic product (“GDP”)v. The final piece of the puzzle arrived when the lame duck session of Congress, with the Republican Party leading the charge and President Obama agreeing, was able to craft a compromise extension of the soon-to-sunset Bush-era tax cuts. We had thought that such an agreement was highly unlikely as we could not see how the two sides could find the complementary legislation needed to pay for the extensions. However, in the end, the pay-as-you-go rules were ignored to keep the economy from being hit with a huge fiscal tightening. (We do note that the tax-cut extensions and the payroll tax holiday will increase the deficit and, thus, will

become an issue in the not-so-distant future as Washington is forced to deal with our ballooning national debt.)

Q. How did we respond to these changing market conditions?

A. The equity portion of the portfolio was actively managed during the time period. Actions taken included:

| Ÿ | | Increased exposure to stocks in the Consumer Discretionary and Materials sector. As the economic and market recovery continued, we believed that these sectors would outperform. We also increased exposure to stocks in the Industrials sector during the second and third quarters of the year and took profits in the sector during the fourth quarter. |

| Ÿ | | Reduced exposure to companies in the Health Care sector. During the second quarter of the year, we took profits in the Information Technology (“IT”) sector. |

The fixed-income portion of the portfolio was also actively managed during the time period. Actions taken included:

| Ÿ | | Remained overweighted in the corporate sector as improving (although slowly) economic growth was a positive for credit fundamentals over the year. |

| Ÿ | | Increased exposure to commercial mortgage-backed securities (“CMBS”) as the increased yield offset much of the price declines due to higher U.S. Treasury yields. Limited new issuance should keep demand high as high-quality alternatives offer lower yields. |

| Ÿ | | Remained underweighted in the U.S. Government & Agency Obligations sector which offers little relative value. We anticipate that U.S. Treasury securities will be pressured in the near term as accommodative monetary and fiscal policies produce favorable financial conditions. |

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report | | | 3 | |

Performance review

For the twelve months ended December 31, 2010, Legg Mason Investment Counsel Variable Social Awareness Portfolio1 returned 12.15%. The Portfolio’s unmanaged benchmarks, the S&P 500 Index and the Barclays Capital U.S. Aggregate Index, returned 15.06% and 6.54%, respectively, over the same time frame. The Blended S&P 500 Index (70%) and Barclays Capital U.S. Aggregate Index (30%)vi returned 12.92% for the same period. The Lipper Variable Mixed-Asset Target Allocation Growth Funds Category Average2 returned 13.14% over the same time frame.

| | | | | | | | |

| Performance Snapshot as of December 31, 2010 | |

| (unaudited) | | 6 months | | | 12 months | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio1 | | | 17.24 | % | | | 12.15 | % |

| S&P 500 Index | | | 23.27 | % | | | 15.06 | % |

| Barclays Capital U.S. Aggregate Index | | | 1.15 | % | | | 6.54 | % |

| Blended S&P 500 Index (70%) and Barclays Capital U.S. Aggregate Index (30%) | | | 16.42 | % | | | 12.92 | % |

| Lipper Variable Mixed-Asset Target Allocation Growth Funds Category Average2 | | | 18.35 | % | | | 13.14 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost.

Portfolio returns assume the reinvestment of all distributions, including returns of capital, if any,

at net asset value and the deduction of all Portfolio expenses. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Performance figures reflect compensating balance arrangements, expense reimbursements and/or fee waivers, without which the performance would have been lower.

Total Annual Operating Expenses (unaudited)

As of the Portfolio’s most current prospectus dated April 30, 2010, the gross total operating expense ratio for the Portfolio was 0.91%.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Portfolio expense ratios are more likely to increase when markets are volatile.

Q. What were the leading contributors to performance?

A. In the equity portion of the Portfolio, our stock selection in the IT, Energy, Materials and Utilities sectors contributed to relative performance during the period. In terms of sector positioning, our overweighting in the Telecommunication Services sector and underweighting in the Financials sector also enhanced results. On an individual stock basis, the largest contributors to performance were National-Oilwell Varco Inc., FMC Technologies Inc., Rovi Corp., NetApp Inc. and Apple Inc.

In the fixed-income portion of the Portfolio, our overweighted allocation to the corporate sector, particularly the Financials segment, added value. Also, the addition of CMBS to the Portfolio added to relative performance for the year.

| 1 | The Portfolio is an underlying investment option of various variable annuity and variable life insurance products. The Portfolio’s performance returns do not reflect the deduction of expenses imposed in connection with investing in variable annuity or variable life insurance contracts, such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the performance of the Portfolio. Past performance is no guarantee of future results. |

| 2 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the period ended December 31, 2010, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 251 funds for the six-month period and among the 245 funds for the twelve-month period in the Portfolio’s Lipper category. |

| | |

| 4 | | Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report |

Portfolio overview (cont’d)

Q. What were the leading detractors from performance?

A. In the equity portion of the Portfolio, our stock selection in the Industrials and Consumer Staples sectors detracted from relative results. In terms of sector positioning, our overweighting in the Utilities and Health Care sectors also detracted from performance. On an individual stock basis, the largest detractors from performance were BP PLC (ADR), Gilead Sciences Inc., Bank of America Corp., Marvell Technology Group Ltd. and Alere Inc.

In the fixed-income portion of the Portfolio, our underweight to U.S. Treasury securities in the spring and our average durationvii (which was less than that of the Barclays Capital U.S. Aggregate Index) hurt performance. However, the significant increase in yields during November and December reversed both of these impacts.

Thank you for your investment in Legg Mason Investment Counsel Variable Social Awareness Portfolio. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Portfolio’s investment goals.

Sincerely,

Ronald T. Bates

Portfolio Manager (Equity Portion)

Legg Mason Investment Counsel, LLC

David K. Kafes,

CFA Portfolio Manager (Fixed-Income Portion)

Legg Mason Investment Counsel, LLC

January 18, 2011

RISKS: Stock prices are subject to market fluctuations and fixed-income securities are subject to credit and market risks. As interest rates rise, bond prices fall, reducing the value of the Portfolio’s share price. Also, because the Portfolio uses a social awareness criterion, there may be a smaller universe of investments. The Portfolio may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Portfolio performance. Please see the Portfolio’s prospectus for a more complete discussion of these and other risks, and the Portfolio’s investment strategies.

Portfolio holdings and breakdowns are as of December 31, 2010 and are subject to change and may not be representative of the portfolio managers’ current or future investments. The Portfolio’s top ten holdings (as a percentage of net assets) as of this date were: National-Oilwell Varco Inc. (2.7%), Target Corp. (2.6%), Express Scripts Inc. (2.6%), Procter & Gamble Co. (2.4%), Apache Corp. (2.4%), PepsiCo Inc. (2.2%), Hess Corp. (2.2%), Celgene Corp. (2.0%), General Mills Inc. (2.0%) and Apple Inc. (1.9%). Please refer to pages 10 through 17 for a list and percentage breakdown of the Portfolio’s holdings.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is

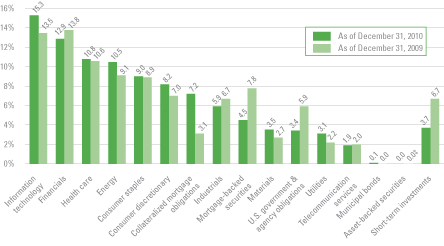

not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Portfolio’s top five sector holdings (as a percentage of net assets) as of December 31, 2010 were: Information Technology (15.3%), Financials (12.9%), Health Care (10.8%), Energy (10.5%) and Consumer Staples (9.0%). The Portfolio’s composition is subject to change at any time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report | | | 5 | |

| | |

i The yield curve is the graphical depiction of the relationship between the yield on bonds of the same credit quality but different maturities. ii The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. iii The Barclays Capital U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. iv The Federal Reserve Board ("Fed") is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. | | v Gross domestic product ("GDP") is the market value of all final goods and services produced within a country in a given period of time. vi The Blended S&P 500 Index (70%) and Barclays Capital U.S. Aggregate Index (30%) has been prepared by the managers. It consists of 70% of the performance of the S&P 500 Index and 30% of the Barclays Capital U.S. Aggregate Index. vii Duration is the measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows. |

| | |

| 6 | | Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report |

Portfolio at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Portfolio’s investments as of December 31, 2010 and December 31, 2009. The Portfolio is actively managed. As a result, the composition of the Portfolio’s investments is subject to change at any time. |

| ‡ | Represents less than 0.1%. |

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report | | | 7 | |

Portfolio expenses (unaudited)

Example

As a shareholder of the Portfolio, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on July 1, 2010 and held for the six months ended December 31, 2010.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

Hypothetical example for

comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare the 5.00% hypothetical example relating to the Portfolio with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Based on actual total return1 | | | | | Based on hypothetical total return1 | |

Actual

Total

Return2 | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period3 | | | | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period3 | |

| 17.24% | | $ | 1,000.00 | | | $ | 1,172.40 | | | | 1.00 | % | | $ | 5.48 | | | | | | 5.00 | % | | $1,000.00 | | $ | 1,020.16 | | | | 1.00 | % | | $ | 5.09 | |

| 1 | For the six months ended December 31, 2010. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Total return does not reflect expenses associated with separate accounts such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the total return. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of compensating balance arrangements, fee waivers and/or expense reimbursements) are equal to the Portfolio’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| | |

| 8 | | Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report |

Portfolio performance (unaudited)

| | | | |

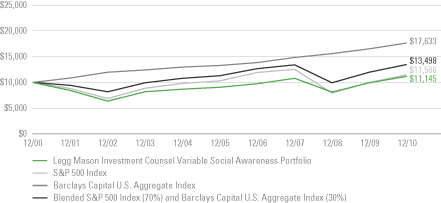

| Average annual total returns1 | | | |

| Twelve Months Ended 12/31/10 | | | 12.15 | % |

| Five Years Ended 12/31/10 | | | 4.24 | |

| Ten Years Ended 12/31/10 | | | 1.09 | |

| | | | |

| Cumulative total return1 | | | |

| 12/31/00 through 12/31/10 | | | 11.45 | % |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect expenses associated with separate accounts such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the total returns. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. |

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report | | | 9 | |

Historical performance

Value of $10,000 invested in

Legg Mason Investment Counsel Variable Social Awareness Portfolio vs. S&P 500 Index, Barclays Capital U.S. Aggregate Index and Blended S&P 500 Index (70%) and Barclays Capital U.S. Aggregate Index (30%)† — December 2000 - December 2010

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect expenses associated with separate accounts such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the total returns. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $10,000 invested in Legg Mason Investment Counsel Variable Social Awareness Portfolio on December 31, 2000, assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through December 31, 2010. The hypothetical illustration also assumes a $10,000 investment in the S&P 500 Index, the Barclays Capital U.S. Aggregate Index and the Blended S&P 500 Index (70%) and Barclays Capital U.S. Aggregate Index (30%). The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. The Barclays Capital U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. The Blended S&P 500 Index (70%) and Barclays Capital U.S. Aggregate Index (30%) has been prepared by the managers. It consists of 70% of the performance of the S&P 500 Index and 30% of the Barclays Capital U.S. Aggregate Index. The Indices are unmanaged and are not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index. |

| | |

| 10 | | Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report |

Schedule of investments

December 31, 2010

Legg Mason Investment Counsel Variable Social Awareness Portfolio

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Common Stocks — 70.8% | | | | | | | | | | | | | | | | |

| Consumer Discretionary — 7.9% | | | | | | | | | | | | | | | | |

Hotels, Restaurants & Leisure —1.4% | | | | | | | | | | | | | | | | |

Yum! Brands Inc. | | | | | | | | | | | 17,660 | | | $ | 866,223 | |

Multiline Retail — 2.7% | | | | | | | | | | | | | | | | |

Target Corp. | | | | | | | | | | | 26,740 | | | | 1,607,876 | |

Specialty Retail — 1.1% | | | | | | | | | | | | | | | | |

Lowe’s Cos. Inc. | | | | | | | | | | | 27,570 | | | | 691,456 | |

Textiles, Apparel & Luxury Goods — 2.7% | | | | | | | | | | | | | | | | |

Coach Inc. | | | | | | | | | | | 13,140 | | | | 726,773 | |

V.F. Corp. | | | | | | | | | | | 10,530 | | | | 907,476 | |

Total Textiles, Apparel & Luxury Goods | | | | | | | | | | | | | | | 1,634,249 | |

Total Consumer Discretionary | | | | | | | | | | | | | | | 4,799,804 | |

| Consumer Staples — 8.4% | | | | | | | | | | | | | | | | |

Beverages — 2.2% | | | | | | | | | | | | | | | | |

PepsiCo Inc. | | | | | | | | | | | 20,310 | | | | 1,326,852 | |

Food & Staples Retailing — 1.2% | | | | | | | | | | | | | | | | |

CVS Caremark Corp. | | | | | | | | | | | 21,280 | | | | 739,906 | |

Food Products — 2.6% | | | | | | | | | | | | | | | | |

Darling International Inc. | | | | | | | | | | | 29,040 | | | | 385,651 | * |

General Mills Inc. | | | | | | | | | | | 33,480 | | | | 1,191,553 | |

Total Food Products | | | | | | | | | | | | | | | 1,577,204 | |

Household Products — 2.4% | | | | | | | | | | | | | | | | |

Procter & Gamble Co. | | | | | | | | | | | 23,037 | | | | 1,481,970 | |

Total Consumer Staples | | | | | | | | | | | | | | | 5,125,932 | |

| Energy — 9.9% | | | | | | | | | | | | | | | | |

Energy Equipment & Services — 5.3% | | | | | | | | | | | | | | | | |

FMC Technologies Inc. | | | | | | | | | | | 12,365 | | | | 1,099,372 | * |

National-Oilwell Varco Inc. | | | | | | | | | | | 24,399 | | | | 1,640,833 | |

Tetra Technology Inc. | | | | | | | | | | | 19,430 | | | | 486,916 | * |

Total Energy Equipment & Services | | | | | | | | | | | | | | | 3,227,121 | |

Oil, Gas & Consumable Fuels — 4.6% | | | | | | | | | | | | | | | | |

Apache Corp. | | | | | | | | | | | 12,200 | | | | 1,454,606 | |

Hess Corp. | | | | | | | | | | | 17,195 | | | | 1,316,105 | |

Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 2,770,711 | |

Total Energy | | | | | | | | | | | | | | | 5,997,832 | |

See Notes to Financial Statements.

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report | | | 11 | |

Legg Mason Investment Counsel Variable Social Awareness Portfolio

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Financials — 7.4% | | | | | | | | | | | | | | | | |

Capital Markets — 4.1% | | | | | | | | | | | | | | | | |

Affiliated Managers Group Inc. | | | | | | | | | | | 4,990 | | | $ | 495,108 | * |

Charles Schwab Corp. | | | | | | | | | | | 58,240 | | | | 996,486 | |

State Street Corp. | | | | | | | | | | | 21,240 | | | | 984,262 | |

Total Capital Markets | | | | | | | | | | | | | | | 2,475,856 | |

Consumer Finance — 1.5% | | | | | | | | | | | | | | | | |

American Express Co. | | | | | | | | | | | 21,105 | | | | 905,827 | |

Insurance — 1.8% | | | | | | | | | | | | | | | | |

Arch Capital Group Ltd. | | | | | | | | | | | 12,805 | | | | 1,127,480 | * |

Total Financials | | | | | | | | | | | | | | | 4,509,163 | |

| Health Care — 8.8% | | | | | | | | | | | | | | | | |

Biotechnology — 3.7% | | | | | | | | | | | | | | | | |

Celgene Corp. | | | | | | | | | | | 20,420 | | | | 1,207,639 | * |

Gilead Sciences Inc. | | | | | | | | | | | 29,665 | | | | 1,075,060 | * |

Total Biotechnology | | | | | | | | | | | | | | | 2,282,699 | |

Health Care Equipment & Supplies — 2.5% | | | | | | | | | | | | | | | | |

Alere Inc. | | | | | | | | | | | 15,050 | | | | 550,830 | * |

Covidien PLC | | | | | | | | | | | 20,970 | | | | 957,490 | |

Total Health Care Equipment & Supplies | | | | | | | | | | | | | | | 1,508,320 | |

Health Care Providers & Services — 2.6% | | | | | | | | | | | | | | | | |

Express Scripts Inc. | | | | | | | | | | | 29,300 | | | | 1,583,665 | * |

Total Health Care | | | | | | | | | | | | | | | 5,374,684 | |

| Industrials — 5.9% | | | | | | | | | | | | | | | | |

Building Products — 1.0% | | | | | | | | | | | | | | | | |

Masco Corp. | | | | | | | | | | | 48,470 | | | | 613,630 | |

Commercial Services & Supplies — 1.3% | | | | | | | | | | | | | | | | |

Republic Services Inc. | | | | | | | | | | | 26,235 | | | | 783,377 | |

Construction & Engineering — 1.4% | | | | | | | | | | | | | | | | |

Quanta Services Inc. | | | | | | | | | | | 42,780 | | | | 852,177 | * |

Electrical Equipment — 1.3% | | | | | | | | | | | | | | | | |

Emerson Electric Co. | | | | | | | | | | | 14,280 | | | | 816,388 | |

Machinery — 0.9% | | | | | | | | | | | | | | | | |

Deere & Co. | | | | | | | | | | | 6,340 | | | | 526,537 | |

Total Industrials | | | | | | | | | | | | | | | 3,592,109 | |

| Information Technology — 14.4% | | | | | | | | | | | | | | | | |

Communications Equipment — 0.9% | | | | | | | | | | | | | | | | |

Cisco Systems Inc. | | | | | | | | | | | 28,135 | | | | 569,171 | * |

See Notes to Financial Statements.

| | |

| 12 | | Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report |

Schedule of investments (cont’d)

December 31, 2010

Legg Mason Investment Counsel Variable Social Awareness Portfolio

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Computers & Peripherals — 3.2% | | | | | | | | | | | | | | | | |

Apple Inc. | | | | | | | | | | | 3,560 | | | $ | 1,148,314 | * |

NetApp Inc. | | | | | | | | | | | 15,015 | | | | 825,224 | * |

Total Computers & Peripherals | | | | | | | | | | | | | | | 1,973,538 | |

Electronic Equipment, Instruments & Components — 0.8% | | | | | | | | | | | | | | | | |

Corning Inc. | | | | | | | | | | | 24,010 | | | | 463,873 | |

Internet Software & Services — 2.5% | | | | | | | | | | | | | | | | |

eBay Inc. | | | | | | | | | | | 25,425 | | | | 707,578 | * |

Google Inc., Class A Shares | | | | | | | | | | | 1,405 | | | | 834,528 | * |

Total Internet Software & Services | | | | | | | | | | | | | | | 1,542,106 | |

IT Services — 1.6% | | | | | | | | | | | | | | | | |

Accenture PLC, Class A Shares | | | | | | | | | | | 19,760 | | | | 958,162 | |

Semiconductors & Semiconductor Equipment — 2.8% | | | | | | | | | | | | | | | | |

Broadcom Corp., Class A Shares | | | | | | | | | | | 21,070 | | | | 917,598 | |

Marvell Technology Group Ltd. | | | | | | | | | | | 41,810 | | | | 775,576 | * |

Total Semiconductors & Semiconductor Equipment | | | | | | | | | | | | | | | 1,693,174 | |

Software — 2.6% | | | | | | | | | | | | | | | | |

Amdocs Ltd. | | | | | | | | | | | 18,176 | | | | 499,295 | * |

Rovi Corp. | | | | | | | | | | | 17,405 | | | | 1,079,284 | * |

Total Software | | | | | | | | | | | | | | | 1,578,579 | |

Total Information Technology | | | | | | | | | | | | | | | 8,778,603 | |

| Materials — 3.1% | | | | | | | | | | | | | | | | |

Chemicals — 1.9% | | | | | | | | | | | | | | | | |

Air Products & Chemicals Inc. | | | | | | | | | | | 5,410 | | | | 492,040 | |

Potash Corp. of Saskatchewan Inc. | | | | | | | | | | | 4,200 | | | | 650,286 | |

Total Chemicals | | | | | | | | | | | | | | | 1,142,326 | |

Construction Materials — 0.4% | | | | | | | | | | | | | | | | |

Martin Marietta Materials Inc. | | | | | | | | | | | 2,500 | | | | 230,600 | |

Metals & Mining — 0.8% | | | | | | | | | | | | | | | | |

Cliffs Natural Resources Inc. | | | | | | | | | | | 6,840 | | | | 533,588 | |

Total Materials | | | | | | | | | | | | | | | 1,906,514 | |

| Telecommunication Services — 1.9% | | | | | | | | | | | | | | | | |

Wireless Telecommunication Services — 1.9% | | | | | | | | | | | | | | | | |

America Movil SAB de CV, Series L Shares, ADR | | | | | | | | | | | 9,895 | | | | 567,379 | |

American Tower Corp., Class A Shares | | | | | | | | | | | 10,930 | | | | 564,425 | * |

Total Telecommunication Services | | | | | | | | | | | | | | | 1,131,804 | |

| Utilities — 3.1% | | | | | | | | | | | | | | | | |

Electric Utilities — 1.6% | | | | | | | | | | | | | | | | |

Northeast Utilities | | | | | | | | | | | 30,500 | | | | 972,340 | |

See Notes to Financial Statements.

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report | | | 13 | |

Legg Mason Investment Counsel Variable Social Awareness Portfolio

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Water Utilities — 1.5% | | | | | | | | | | | | | | | | |

American Water Works Co. Inc. | | | | | | | | | | | 36,400 | | | $ | 920,556 | |

Total Utilities | | | | | | | | | | | | | | | 1,892,896 | |

Total Common Stocks (Cost — $30,958,471) | | | | | | | | | | | | | | | 43,109,341 | |

| | | Rate | | | Maturity

Date | | | Face

Amount | | | | |

| Asset-Backed Securities — 0.0% | | | | | | | | | | | | | | | | |

Honda Auto Receivables Owner Trust, 2008-1 A3 (Cost — $13,572) | | | 4.470 | % | | | 1/18/12 | | | $ | 13,400 | | | | 13,439 | |

| Collateralized Mortgage Obligations — 7.2% | | | | | | | | | |

Banc of America Commercial Mortgage Inc.,

2005-1 A4 | | | 5.060 | % | | | 11/10/42 | | | | 287,000 | | | | 301,034 | (a) |

Banc of America Commercial Mortgage Inc.,

2006-2 A1 | | | 5.611 | % | | | 5/10/45 | | | | 29,274 | | | | 29,405 | |

Banc of America Commercial Mortgage Inc.,

2007-2 A1 | | | 5.421 | % | | | 4/10/49 | | | | 32,813 | | | | 33,527 | |

Bear Stearns Commercial Mortgage Securities,

2003-T12 A3 | | | 4.240 | % | | | 8/13/39 | | | | 100,805 | | | | 102,403 | (a) |

Bear Stearns Commercial Mortgage Securities,

2005-T20 A2 | | | 5.127 | % | | | 10/12/42 | | | | 183,365 | | | | 185,260 | (a) |

Commercial Mortgage Pass-Through Certificates,

2004-LB3A A2 | | | 4.713 | % | | | 7/10/37 | | | | 33,040 | | | | 33,169 | |

Credit Suisse First Boston Mortgage Securities Corp., 2001-CF2 A4 | | | 6.505 | % | | | 2/15/34 | | | | 17,051 | | | | 17,043 | |

Federal Home Loan Bank (FHLB), 00-0606 Y | | | 5.270 | % | | | 12/28/12 | | | | 434,710 | | | | 460,639 | |

Federal Home Loan Mortgage Corp. (FHLMC), 2837 ED | | | 5.000 | % | | | 8/15/19 | | | | 44,274 | | | | 46,833 | |

First Union National Bank Commercial Mortgage,

2002-C1 A2 | | | 6.141 | % | | | 2/12/34 | | | | 126,393 | | | | 131,054 | |

GMAC Commercial Mortgage Securities Inc.,

2004-C2 A2 | | | 4.760 | % | | | 8/10/38 | | | | 259,932 | | | | 262,511 | |

Government National Mortgage Association (GNMA),

2009-22 AG | | | 4.000 | % | | | 10/16/32 | | | | 476,436 | | | | 501,875 | |

Government National Mortgage Association (GNMA),

2009-46 G | | | 4.500 | % | | | 9/20/34 | | | | 515,151 | | | | 545,440 | |

Government National Mortgage Association (GNMA),

2009-93 PB | | | 3.000 | % | | | 12/16/38 | | | | 540,166 | | | | 555,673 | |

Government National Mortgage Association (GNMA),

2010-56 BA | | | 4.500 | % | | | 2/20/36 | | | | 506,862 | | | | 537,128 | |

JPMorgan Chase Commercial Mortgage Securities Corp., 2004-C1 A2 | | | 4.302 | % | | | 1/15/38 | | | | 109,622 | | | | 111,720 | |

JPMorgan Chase Commercial Mortgage Securities Corp., 2005-CB11 ASB | | | 5.201 | % | | | 8/12/37 | | | | 141,324 | | | | 148,092 | (a) |

LB-UBS Commercial Mortgage Trust, 2005-C2 A3 | | | 4.912 | % | | | 4/15/30 | | | | 184,000 | | | | 184,942 | |

See Notes to Financial Statements.

| | |

| 14 | | Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report |

Schedule of investments (cont’d)

December 31, 2010

Legg Mason Investment Counsel Variable Social Awareness Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Collateralized Mortgage Obligations — continued | | | | | | | | | |

Morgan Stanley Dean Witter Capital I Inc.,

2001-TOP3 A4 | | | 6.390 | % | | | 7/15/33 | | | $ | 97,200 | | | $ | 98,619 | |

TIAA Seasoned Commercial Mortgage Trust,

2007-C4 A1 | | | 5.646 | % | | | 8/15/39 | | | | 95,796 | | | | 97,571 | (a) |

Total Collateralized Mortgage Obligations (Cost — $4,342,733) | | | | 4,383,938 | |

| Corporate Bonds & Notes — 10.2% | | | | | | | | | | | | | | | | |

| Consumer Discretionary — 0.3% | | | | | | | | | | | | | | | | |

Media — 0.3% | | | | | | | | | | | | | | | | |

Comcast Corp., Senior Notes | | | 5.650 | % | | | 6/15/35 | | | | 200,000 | | | | 194,926 | |

| Consumer Staples — 0.6% | | | | | | | | | | | | | | | | |

Beverages — 0.6% | | | | | | | | | | | | | | | | |

Anheuser-Busch InBev Worldwide Inc., Senior Notes | | | 2.500 | % | | | 3/26/13 | | | | 95,000 | | | | 97,266 | |

PepsiCo Inc., Senior Notes | | | 5.000 | % | | | 6/1/18 | | | | 245,000 | | | | 270,877 | |

Total Consumer Staples | | | | | | | | | | | | | | | 368,143 | |

| Energy — 0.6% | | | | | | | | | | | | | | | | |

Oil, Gas & Consumable Fuels — 0.6% | | | | | | | | | | | | | | | | |

Apache Corp., Senior Notes | | | 5.250 | % | | | 4/15/13 | | | | 275,000 | | | | 299,386 | |

Statoil ASA, Senior Notes | | | 3.125 | % | | | 8/17/17 | | | | 70,000 | | | | 69,420 | |

Total Energy | | | | | | | | | | | | | | | 368,806 | |

| Financials — 5.5% | | | | | | | | | | | | | | | | |

Capital Markets — 0.7% | | | | | | | | | | | | | | | | |

BlackRock Inc., Senior Notes | | | 3.500 | % | | | 12/10/14 | | | | 160,000 | | | | 166,075 | |

Goldman Sachs Group Inc., Senior Notes | | | 5.700 | % | | | 9/1/12 | | | | 243,000 | | | | 259,471 | |

Total Capital Markets | | | | | | | | | | | | | | | 425,546 | |

Commercial Banks — 1.3% | | | | | | | | | | | | | | | | |

Bank of Nova Scotia, Senior Notes | | | 2.250 | % | | | 1/22/13 | | | | 35,000 | | | | 35,655 | |

Bank of Nova Scotia, Senior Notes | | | 2.375 | % | | | 12/17/13 | | | | 110,000 | | | | 113,411 | |

Bank of Nova Scotia, Senior Notes | | | 2.050 | % | | | 10/7/15 | | | | 100,000 | | | | 97,658 | |

Barclays Bank PLC, Senior Notes | | | 5.000 | % | | | 9/22/16 | | | | 170,000 | | | | 180,118 | |

Rabobank Nederland NV, Senior Notes | | | 2.125 | % | | | 10/13/15 | | | | 170,000 | | | | 164,593 | |

Westpac Banking Corp., Senior Notes | | | 4.200 | % | | | 2/27/15 | | | | 175,000 | | | | 183,846 | |

Total Commercial Banks | | | | | | | | | | | | | | | 775,281 | |

Consumer Finance — 1.9% | | | | | | | | | | | | | | | | |

HSBC Finance Corp., Notes | | | 6.375 | % | | | 10/15/11 | | | | 325,000 | | | | 338,880 | |

SLM Corp., Medium-Term Notes, Senior Notes | | | 5.000 | % | | | 10/1/13 | | | | 800,000 | | | | 802,577 | |

Total Consumer Finance | | | | | | | | | | | | | | | 1,141,457 | |

See Notes to Financial Statements.

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report | | | 15 | |

Legg Mason Investment Counsel Variable Social Awareness Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Diversified Financial Services — 1.2% | | | | | | | | | | | | | | | | |

Bank of America Corp., Senior Notes | | | 5.625 | % | | | 10/14/16 | | | $ | 250,000 | | | $ | 259,519 | |

IBM International Group Capital LLC, Senior Notes | | | 5.050 | % | | | 10/22/12 | | | | 225,000 | | | | 241,983 | |

National Rural Utilities Cooperative Finance Corp., Medium-Term Notes | | | 8.000 | % | | | 3/1/32 | | | | 200,000 | | | | 253,897 | |

Total Diversified Financial Services | | | | | | | | | | | | | | | 755,399 | |

Insurance — 0.3% | | | | | | | | | | | | | | | | |

Genworth Financial Inc., Senior Notes | | | 6.500 | % | | | 6/15/34 | | | | 200,000 | | | | 183,415 | |

Real Estate Investment Trusts (REITs) — 0.1% | | | | | | | | | | | | | | | | |

Simon Property Group LP, Senior Notes | | | 4.200 | % | | | 2/1/15 | | | | 40,000 | | | | 41,864 | |

Total Financials | | | | | | | | | | | | | | | 3,322,962 | |

| Health Care — 2.0% | | | | | | | | | | | | | | | | |

Health Care Equipment & Supplies — 0.2% | | | | | | | | | | | | | | | | |

Medtronic Inc., Senior Notes | | | 3.000 | % | | | 3/15/15 | | | | 70,000 | | | | 71,904 | |

Stryker Corp., Senior Notes | | | 3.000 | % | | | 1/15/15 | | | | 65,000 | | | | 66,475 | |

Total Health Care Equipment & Supplies | | | | | | | | | | | | | | | 138,379 | |

Pharmaceuticals — 1.8% | | | | | | | | | | | | | | | | |

Abbott Laboratories, Senior Notes | | | 5.600 | % | | | 11/30/17 | | | | 225,000 | | | | 257,618 | |

AstraZeneca PLC, Senior Notes | | | 5.400 | % | | | 9/15/12 | | | | 275,000 | | | | 296,667 | |

Merck & Co. Inc., Senior Notes | | | 4.000 | % | | | 6/30/15 | | | | 130,000 | | | | 139,621 | |

Novartis Capital Corp., Senior Notes | | | 4.125 | % | | | 2/10/14 | | | | 185,000 | | | | 197,575 | |

Wyeth, Notes | | | 5.500 | % | | | 2/15/16 | | | | 165,000 | | | | 186,870 | |

Total Pharmaceuticals | | | | | | | | | | | | | | | 1,078,351 | |

Total Health Care | | | | | | | | | | | | | | | 1,216,730 | |

| Information Technology — 0.9% | | | | | | | | | | | | | | | | |

Computers & Peripherals — 0.3% | | | | | | | | | | | | | | | | |

Hewlett-Packard Co., Senior Notes | | | 4.250 | % | | | 2/24/12 | | | | 160,000 | | | | 166,318 | |

Internet Software & Services — 0.2% | | | | | | | | | | | | | | | | |

eBay Inc., Senior Notes | | | 1.625 | % | | | 10/15/15 | | | | 125,000 | | | | 120,077 | |

Software — 0.4% | | | | | | | | | | | | | | | | |

Microsoft Corp., Senior Notes | | | 2.950 | % | | | 6/1/14 | | | | 80,000 | | | | 83,346 | |

Microsoft Corp., Senior Notes | | | 1.625 | % | | | 9/25/15 | | | | 160,000 | | | | 156,212 | |

Total Software | | | | | | | | | | | | | | | 239,558 | |

Total Information Technology | | | | | | | | | | | | | | | 525,953 | |

| Materials — 0.3% | | | | | | | | | | | | | | | | |

Chemicals — 0.3% | | | | | | | | | | | | | | | | |

Potash Corp. of Saskatchewan Inc., Senior Notes | | | 5.875 | % | | | 12/1/36 | | | | 200,000 | | | | 207,572 | |

Total Corporate Bonds & Notes (Cost — $5,955,576) | | | | | | | | | | | | | | | 6,205,092 | |

See Notes to Financial Statements.

| | |

| 16 | | Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report |

Schedule of investments (cont’d)

December 31, 2010

Legg Mason Investment Counsel Variable Social Awareness Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Mortgage-Backed Securities — 4.5% | | | | | | | | | | | | | | | | |

FHLMC — 1.8% | | | | | | | | | | | | | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) | | | 6.000 | % | | | 9/1/37 | | | $ | 232,945 | | | $ | 253,202 | |

Federal Home Loan Mortgage Corp. (FHLMC), Gold | | | 5.000 | % | | | 7/1/35-6/1/36 | | | | 749,014 | | | | 788,722 | |

Federal Home Loan Mortgage Corp. (FHLMC), Gold | | | 7.500 | % | | | 8/1/36 | | | | 12,790 | | | | 14,574 | |

Total FHLMC | | | | | | | | | | | | | | | 1,056,498 | |

FNMA — 2.7% | | | | | | | | | | | | | | | | |

Federal National Mortgage Association (FNMA) | | | 5.000 | % | | | 5/1/18 | | | | 206,716 | | | | 221,121 | |

Federal National Mortgage Association (FNMA) | | | 6.000 | % | | | 6/1/22-9/1/37 | | | | 382,600 | | | | 416,437 | |

Federal National Mortgage Association (FNMA) | | | 5.500 | % | | | 1/1/24-6/1/36 | | | | 810,053 | | | | 869,665 | |

Federal National Mortgage Association (FNMA) | | | 6.500 | % | | | 2/1/37 | | | | 132,602 | | | | 147,878 | |

Total FNMA | | | | | | | | | | | | | | | 1,655,101 | |

Total Mortgage-Backed Securities (Cost — $2,479,595) | | | | | | | | | | | | 2,711,599 | |

| Municipal Bonds — 0.1% | | | | | | | | | | | | | | | | |

Maryland — 0.1% | | | | | | | | | | | | | | | | |

Baltimore, MD, Revenue, Parking System Facilities | | | 2.904 | % | | | 7/1/13 | | | | 40,000 | | | | 39,709 | |

Baltimore, MD, Revenue, Parking System Facilities | | | 3.387 | % | | | 7/1/14 | | | | 40,000 | | | | 39,452 | |

Total Municipal Bonds (Cost — $79,980) | | | | | | | | | | | | | | | 79,161 | |

| U.S. Government & Agency Obligations — 3.4% | | | | | | | | | | | | | | | | |

U.S. Government Agencies — 1.0% | | | | | | | | | | | | | | | | |

Federal Home Loan Mortgage Corp. (FHLMC), Notes | | | 4.500 | % | | | 2/25/20 | | | | 157,000 | | | | 157,878 | |

Federal National Mortgage Association (FNMA), Bonds | | | 6.625 | % | | | 11/15/30 | | | | 365,000 | | | | 461,932 | |

Total U.S. Government Agencies | | | | | | | | | | | | | | | 619,810 | |

U.S. Government Obligations — 2.4% | | | | | | | | | | | | | | | | |

U.S. Treasury Bonds | | | 3.500 | % | | | 2/15/39 | | | | 466,000 | | | | 401,634 | |

U.S. Treasury Bonds | | | 4.375 | % | | | 11/15/39 | | | | 620,000 | | | | 623,391 | |

U.S. Treasury Notes | | | 2.250 | % | | | 11/30/17 | | | | 73,000 | | | | 70,998 | |

U.S. Treasury Notes | | | 3.625 | % | | | 2/15/20 | | | | 71,000 | | | | 73,696 | |

U.S. Treasury Notes | | | 2.625 | % | | | 8/15/20 | | | | 303,000 | | | | 287,305 | |

Total U.S. Government Obligations | | | | | | | | | | | | | | | 1,457,024 | |

Total U.S. Government & Agency Obligations (Cost — $2,068,628) | | | | | | | | 2,076,834 | |

Total Investments before Short-Term Investments (Cost — $45,898,555) | | | | | | | | 58,579,404 | |

See Notes to Financial Statements.

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report | | | 17 | |

Legg Mason Investment Counsel Variable Social Awareness Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Short-Term Investments — 3.8% | | | | | | | | | | | | | | | | |

Repurchase Agreements — 3.8% | | | | | | | | | | | | | | | | |

Goldman Sachs & Co., repurchase agreement dated 12/31/10; Proceeds at maturity — $2,273,226; (Fully collateralized by U.S. government agency obligations, 0.180% due 11/9/11; Market value — $2,323,927) (Cost — $2,273,201) | | | 0.130 | % | | | 1/3/11 | | | $ | 2,273,201 | | | $ | 2,273,201 | |

Total Investments — 100.0% (Cost — $48,171,756#) | | | | | | | | | | | | | | | 60,852,605 | |

Other Assets in Excess of Liabilities — 0.0% | | | | | | | | | | | | | | | 12,845 | |

Total Net Assets — 100.0% | | | | | | | | | | | | | | $ | 60,865,450 | |

| * | Non-income producing security. |

| (a) | Variable rate security. Interest rate disclosed is that which is in effect at December 31, 2010. |

| # | Aggregate cost for federal income tax purposes is $48,445,180. |

| | |

Abbreviation used in this schedule: |

| ADR | | — American Depositary Receipt |

See Notes to Financial Statements.

| | |

| 18 | | Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report |

Statement of assets and liabilities

December 31, 2010

| | | | |

| |

| Assets: | | | | |

Investments, at value (Cost — $48,171,756) | | $ | 60,852,605 | |

Dividends and interest receivable | | | 131,562 | |

Receivable for Portfolio shares sold | | | 6,345 | |

Prepaid expenses | | | 1,366 | |

Total Assets | | | 60,991,878 | |

| |

| Liabilities: | | | | |

Investment management fee payable | | | 44,284 | |

Trustees’ fees payable | | | 257 | |

Payable for Portfolio shares repurchased | | | 44 | |

Accrued expenses | | | 81,843 | |

Total Liabilities | | | 126,428 | |

| Total Net Assets | | $ | 60,865,450 | |

| |

| Net Assets: | | | | |

Par value (Note 5) | | $ | 25 | |

Paid-in capital in excess of par value | | | 58,006,102 | |

Overdistributed net investment income | | | (70,505) | |

Accumulated net realized loss on investments | | | (9,751,021) | |

Net unrealized appreciation on investments | | | 12,680,849 | |

| Total Net Assets | | $ | 60,865,450 | |

| |

| Shares Outstanding | | | 2,494,879 | |

| |

| Net Asset Value | | | $24.40 | |

See Notes to Financial Statements.

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report | | | 19 | |

Statement of operations

For the Year Ended December 31, 2010

| | | | |

| |

| Investment Income: | | | | |

Interest | | $ | 716,264 | |

Dividends | | | 574,125 | |

Less: Foreign taxes withheld | | | (252) | |

Total Investment Income | | | 1,290,137 | |

| |

| Expenses: | | | | |

Investment management fee (Note 2) | | | 423,814 | |

Shareholder reports | | | 70,380 | |

Legal fees | | | 60,972 | |

Audit and tax | | | 25,889 | |

Transfer agent fees | | | 6,639 | |

Trustees’ fees | | | 5,347 | |

Insurance | | | 2,518 | |

Custody fees | | | 1,040 | |

Miscellaneous expenses | | | 622 | |

Total Expenses | | | 597,221 | |

Less: Fee waivers and/or expense reimbursements (Note 2) | | | (5,772) | |

Compensating balance arrangements (Note 1) | | | (188) | |

Net Expenses | | | 591,261 | |

| Net Investment Income | | | 698,876 | |

| |

| Realized and Unrealized Gain on Investments (Notes 1 and 3): | | | | |

Net Realized Gain From Investment Transactions | | | 655,566 | |

Change in Net Unrealized Appreciation (Depreciation) From Investments | | | 5,485,899 | |

| Net Gain on Investments | | | 6,141,465 | |

| Increase in Net Assets From Operations | | $ | 6,840,341 | |

See Notes to Financial Statements.

| | |

| 20 | | Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report |

Statements of changes in net assets

| | | | | | | | | | | | |

For the Year Ended December 31, 2010, the Period Ended

December 31, 2009 and the Year Ended October 31, 2009 | | 2010 | | | 2009† | | | 2009 | |

| | | |

| Operations: | | | | | | | | | | | | |

Net investment income | | $ | 698,876 | | | $ | 173,411 | | | $ | 1,059,830 | |

Net realized gain (loss) | | | 655,566 | | | | (28,980) | | | | (4,090,202) | |

Change in net unrealized appreciation (depreciation) | | | 5,485,899 | | | | 3,500,952 | | | | 10,455,173 | |

Increase in Net Assets From Operations | | | 6,840,341 | | | | 3,645,383 | | | | 7,424,801 | |

| | | |

| Distributions to Shareholders from (Note 1): | | | | | | | | | | | | |

Net investment income | | | (785,004) | | | | (875,003) | | | | (1,400,001) | �� |

Decrease in Net Assets from Distributions to Shareholders | | | (785,004) | | | | (875,003) | | | | (1,400,001) | |

| | | |

| Portfolio Share Transactions (Note 5): | | | | | | | | | | | | |

Net proceeds from sale of shares | | | 378,638 | | | | 236,172 | | | | 438,050 | |

Reinvestment of distributions | | | 785,004 | | | | 875,003 | | | | 1,400,001 | |

Cost of shares repurchased | | | (10,347,880) | | | | (996,925) | | | | (7,815,129) | |

Increase (Decrease) in Net Assets From Portfolio Share Transactions | | | (9,184,238) | | | | 114,250 | | | | (5,977,078) | |

Increase (Decrease) in Net Assets | | | (3,128,901) | | | | 2,884,630 | | | | 47,722 | |

| | | |

| Net Assets: | | | | | | | | | | | | |

Beginning of year | | | 63,994,351 | | | | 61,109,721 | | | | 61,061,999 | |

End of year* | | $ | 60,865,450 | | | $ | 63,994,351 | | | $ | 61,109,721 | |

* Includes undistributed (overdistributed) net investment income of: | | | $(70,505) | | | | $(98,845) | | | | $600,130 | |

| † | For the period November 1, 2009 through December 31, 2009. |

See Notes to Financial Statements.

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report | | | 21 | |

Financial highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| For a share of beneficial interest outstanding throughout each year ended December 31, unless otherwise noted: | |

| | | 2010† | | | 20091 | | | 20092 | | | 20082 | | | 20072 | | | 20062,3 | |

| | | | | | |

| Net asset value, beginning of year | | | $22.04 | | | | $21.08 | | | | $18.92 | | | | $30.39 | | | | $26.45 | | | | $24.58 | |

| | | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.26 | | | | 0.06 | | | | 0.36 | | | | 0.42 | | | | 0.32 | | | | 0.15 | |

Net realized and unrealized gain (loss) | | | 2.42 | | | | 1.20 | | | | 2.24 | | | | (6.86) | | | | 3.76 | | | | 1.90 | |

Total income (loss) from operations | | | 2.68 | | | | 1.26 | | | | 2.60 | | | | (6.44) | | | | 4.08 | | | | 2.05 | |

| | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.32) | | | | (0.30) | | | | (0.44) | | | | (0.40) | | | | (0.14) | | | | (0.18) | |

Net realized gains | | | — | | | | — | | | | — | | | | (4.63) | | | | — | | | | — | |

Total distributions | | | (0.32) | | | | (0.30) | | | | (0.44) | | | | (5.03) | | | | (0.14) | | | | (0.18) | |

| | | | | | |

| Net asset value, end of year | | | $24.40 | | | | $22.04 | | | | $21.08 | | | | $18.92 | | | | $30.39 | | | | $26.45 | |

Total return, based on NAV4 | | | 12.15 | %5 | | | 6.00 | %5 | | | 14.17 | % | | | (25.22) | % | | | 15.48 | % | | | 8.36 | % |

| | | | | | |

| Net assets, end of year (000s) | | | $60,865 | | | | $63,994 | | | | $61,110 | | | | $61,062 | | | | $92,103 | | | | $87,831 | |

| | | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.97 | % | | | 1.29 | %6 | | | 0.88 | % | | | 1.03 | % | | | 0.84 | %7 | | | 0.80 | % |

Net expenses8,9 | | | 0.96 | 10 | | | 0.99 | 6,10 | | | 0.88 | | | | 0.93 | 10 | | | 0.82 | 7,10 | | | 0.79 | 10 |

Net investment income | | | 1.14 | | | | 1.64 | 6 | | | 1.86 | | | | 1.62 | | | | 1.13 | | | | 0.56 | |

| | | | | | |

| Portfolio turnover rate | | | 30 | % | | | 4 | % | | | 30 | % | | | 42 | % | | | 122 | % | | | 13 | % |

| † | Per share amounts have been calculated using the average shares method. |

| 1 | For the period November 1, 2009 through December 31, 2009. |

| 2 | For the year ended October 31. |

| 3 | Represents a share of capital stock outstanding prior to April 30, 2007. |

| 4 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Total returns do not reflect expenses associated with separate accounts such as administrative fees, account charges and surrender charges which, if reflected, would reduce the total return for all periods shown. Past performance is no guarantee of future results. Total returns for period of less than one year are not annualized. |

| 5 | The total return includes gains from settlement of security litigations. Without these gains, the total return would have been 12.01% and 5.95% for the year ended December 31, 2010 and the period ended December 31, 2009, respectively. |

| 7 | Included in the expense ratios are certain non-recurring restructuring (and reorganization, if applicable) fees that were incurred by the Portfolio during the period. Without these fees, the gross and net expense ratios would have been 0.83% and 0.81%, respectively. |

| 8 | As a result of an expense limitation arrangement, the ratio of expenses, other than brokerage, interest, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of the Portfolio did not exceed 1.00%. This expense limitation arrangement cannot be terminated prior to December 31, 2012 without the Board of Trustees’ consent. Prior to April 30, 2007, the expense limitation was 1.25%. |

| 9 | The impact of compensating balance arrangements, if any, was less than 0.01%. |

| 10 | Reflects fee waivers and/or expense reimbursements. |

See Notes to Financial Statements.

| | |

| 22 | | Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report |

Notes to financial statements

1. Organization and significant accounting policies

Legg Mason Investment Counsel Variable Social Awareness Portfolio (the “Portfolio”) is a separate diversified investment series of Legg Mason Partners Variable Equity Trust (the “Trust”). The Trust, a Maryland statutory trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

Shares of the Portfolio may only be purchased or redeemed through variable annuity contracts and variable life insurance policies offered by the separate accounts of participating insurance companies or through eligible pension or other qualified plans.

The following are significant accounting policies consistently followed by the Portfolio and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. Debt securities are valued at the mean between the last quoted bid and asked prices provided by an independent pricing service that are based on transactions in debt obligations, quotations from bond dealers, market transactions in comparable securities and various other relationships between securities. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Portfolio calculates its net asset value, the Portfolio values these securities as determined in accordance with procedures approved by the Portfolio’s Board of Trustees. Short-term obligations with maturities of 60 days or less are valued at amortized cost, which approximates fair value.

The Portfolio has adopted Financial Accounting Standards Board Codification Topic 820 (“ASC Topic 820”). ASC Topic 820 establishes a single definition of fair value, creates a three-tier hierarchy as a framework for measuring fair value based on inputs used to value the Portfolio’s investments, and requires additional disclosure about fair value. The hierarchy of inputs is summarized below.

| Ÿ | | Level 1 — quoted prices in active markets for identical investments |

| Ÿ | | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| Ÿ | | Level 3 — significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

| | | | |

| Legg Mason Investment Counsel Variable Social Awareness Portfolio 2010 Annual Report | | | 23 | |

The Portfolio uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

The following is a summary of the inputs used in valuing the Portfolio’s assets carried at fair value:

| | | | | | | | | | | | | | | | |

| ASSETS | |

| Description | | Quoted Prices

(Level 1) | | | Other Significant

Observable Inputs

(Level 2) | | | Significant

Unobservable

Inputs

(Level 3) | | | Total | |

| Long-term investments†: | | | | | | | | | | | | | | | | |

Common stocks | | $ | 43,109,341 | | | | — | | | | — | | | $ | 43,109,341 | |

Asset-backed securities | | | — | | | $ | 13,439 | | | | — | | | | 13,439 | |

Collateralized mortgage obligations | | | — | | | | 4,383,938 | | | | — | | | | 4,383,938 | |