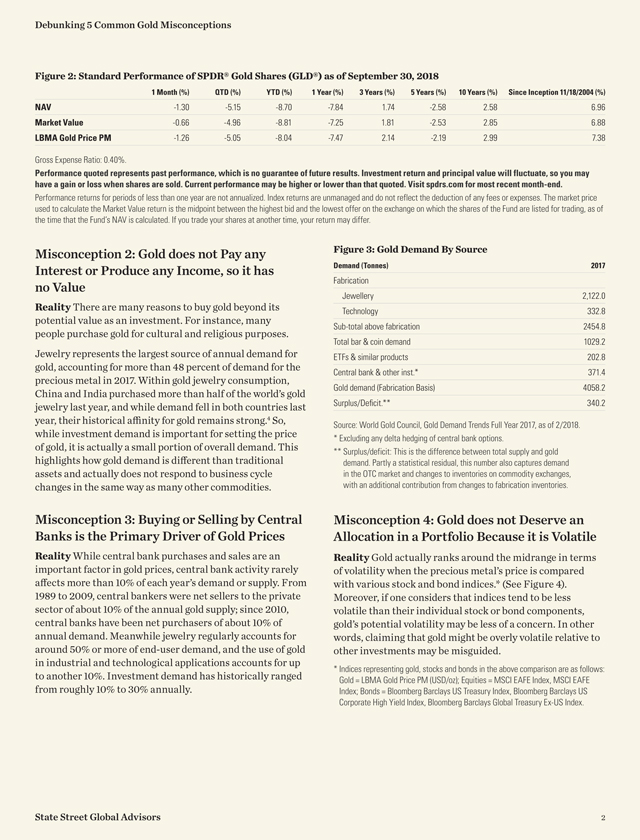

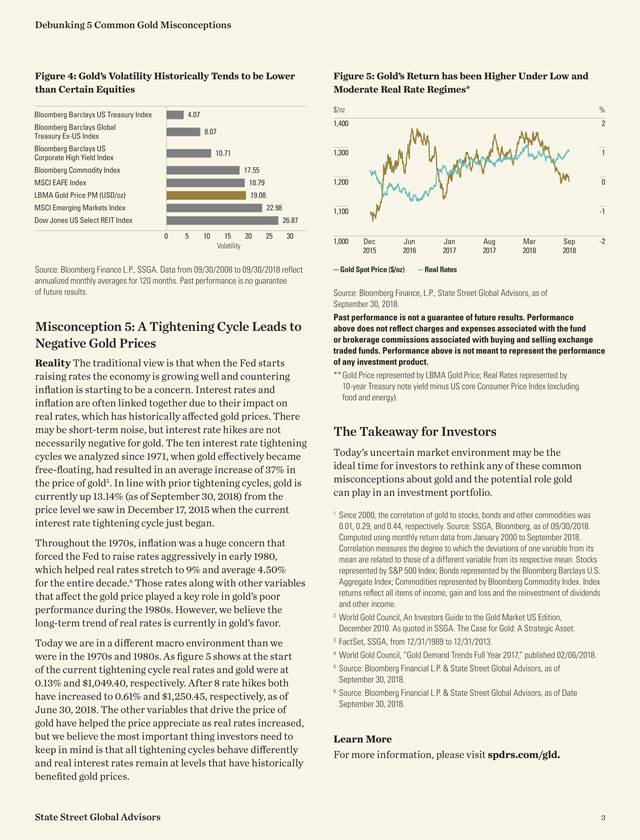

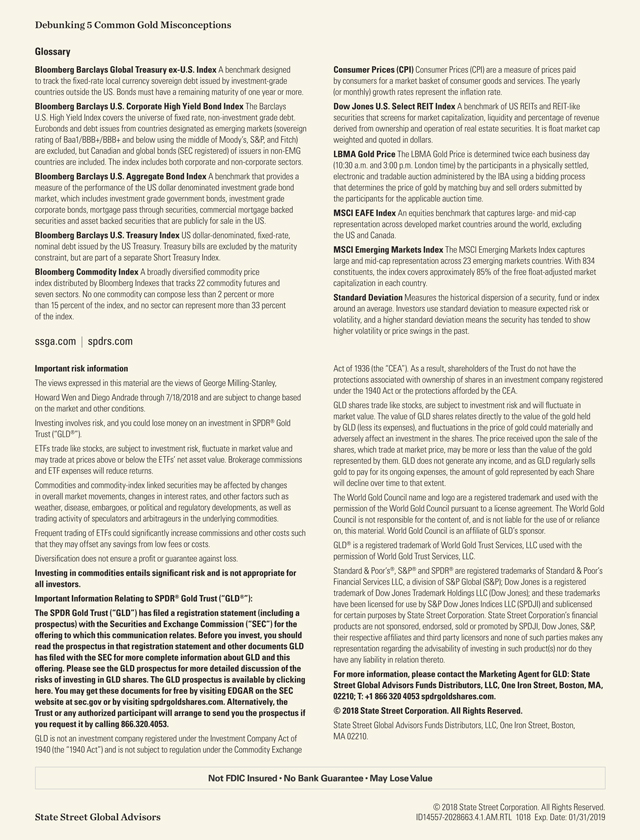

Debunking 5 Common Gold Misconceptions Glossary Bloomberg Barclays Global Treasuryex-U.S. Index A benchmark designed to track the fixed-rate local currency sovereign debt issued by investment-grade countries outside the US. Bonds must have a remaining maturity of one year or more. Bloomberg Barclays U.S. Corporate High Yield Bond Index The Barclays U.S. High Yield Index covers the universe of fixed rate,non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers innon-EMG countries are included. The index includes both corporate andnon-corporate sectors. Bloomberg Barclays U.S. Aggregate Bond Index A benchmark that provides a measure of the performance of the US dollar denominated investment grade bond market, which includes investment grade government bonds, investment grade corporate bonds, mortgage pass through securities, commercial mortgage backed securities and asset backed securities that are publicly for sale in the US. Bloomberg Barclays U.S. Treasury Index US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index. Bloomberg Commodity Index A broadly diversified commodity price index distributed by Bloomberg Indexes that tracks 22 commodity futures and seven sectors. No one commodity can compose less than 2 percent or more than 15 percent of the index, and no sector can represent more than 33 percent of the index. ssga.com | spdrs.com Important risk information The views expressed in this material are the views of George Milling-Stanley, Howard Wen and Diego Andrade through 7/18/2018 and are subject to change based on the market and other conditions. Investing involves risk, and you could lose money on an investment in SPDR® Gold Trust (“GLD®”). ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs’ net asset value. Brokerage commissions and ETF expenses will reduce returns. Commodities and commodity-index linked securities may be affected by changes in overall market movements, changes in interest rates, and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities. Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs. Diversification does not ensure a profit or guarantee against loss. Investing in commodities entails significant risk and is not appropriate for all investors. Important Information Relating to SPDR® Gold Trust (“GLD®”): The SPDR Gold Trust (“GLD”) has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents GLD has filed with the SEC for more complete information about GLD and this offering. Please see the GLD prospectus for more detailed discussion of the risks of investing in GLD shares. The GLD prospectus is available by clicking here. You may get these documents for free by visiting EDGAR on the SEC website at sec.gov or by visiting spdrgoldshares.com. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus if you request it by calling 866.320.4053. GLD is not an investment company registered under the Investment Company Act of 1940 (the “1940 Act”) and is not subject to regulation under the Commodity Exchange Consumer Prices (CPI) Consumer Prices (CPI) are a measure of prices paid by consumers for a market basket of consumer goods and services. The yearly (or monthly) growth rates represent the inflation rate. Dow Jones U.S. Select REIT Index A benchmark of US REITs and REIT-like securities that screens for market capitalization, liquidity and percentage of revenue derived from ownership and operation of real estate securities. It is float market cap weighted and quoted in dollars. LBMA Gold Price The LBMA Gold Price is determined twice each business day (10:30 a.m. and 3:00 p.m. London time) by the participants in a physically settled, electronic and tradable auction administered by the IBA using a bidding process that determines the price of gold by matching buy and sell orders submitted by the participants for the applicable auction time. MSCI EAFE Index An equities benchmark that captures large- andmid-cap representation across developed market countries around the world, excluding the US and Canada. MSCI Emerging Markets Index The MSCI Emerging Markets Index captures large andmid-cap representation across 23 emerging markets countries. With 834 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. Standard Deviation Measures the historical dispersion of a security, fund or index around an average. Investors use standard deviation to measure expected risk or volatility, and a higher standard deviation means the security has tended to show higher volatility or price swings in the past. Act of 1936 (the “CEA”). As a result, shareholders of the Trust do not have the protections associated with ownership of shares in an investment company registered under the 1940 Act or the protections afforded by the CEA. GLD shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of GLD shares relates directly to the value of the gold held by GLD (less its expenses), and fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them. GLD does not generate any income, and as GLD regularly sells gold to pay for its ongoing expenses, the amount of gold represented by each Share will decline over time to that extent. The World Gold Council name and logo are a registered trademark and used with the permission of the World Gold Council pursuant to a license agreement. The World Gold Council is not responsible for the content of, and is not liable for the use of or reliance on, this material. World Gold Council is an affiliate of GLD’s sponsor. GLD® is a registered trademark of World Gold Trust Services, LLC used with the permission of World Gold Trust Services, LLC. Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties makes any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto. For more information, please contact the Marketing Agent for GLD: State Street Global Advisors Funds Distributors, LLC, One Iron Street, Boston, MA, 02210; T: +1 866 320 4053 spdrgoldshares.com. © 2018 State Street Corporation. All Rights Reserved. State Street Global Advisors Funds Distributors, LLC, One Iron Street, Boston, MA 02210. Not FDIC Insured No Bank Gurantee May Lose Value © 2018 State Street Corporation. All Rights Reserved. State Street Global Advisors ID14557-2028663.4.1.AM.RTL 1018 Exp. Date: 01/31/2019