Debunking 5 Common Gold Misconceptions

1 Source: Bloomberg Financial L.P. and State Street Global Advisors, date as of Glossary

December 31, 2018. Bloomberg Barclays Global Treasuryex-U.S. Index A benchmark designed

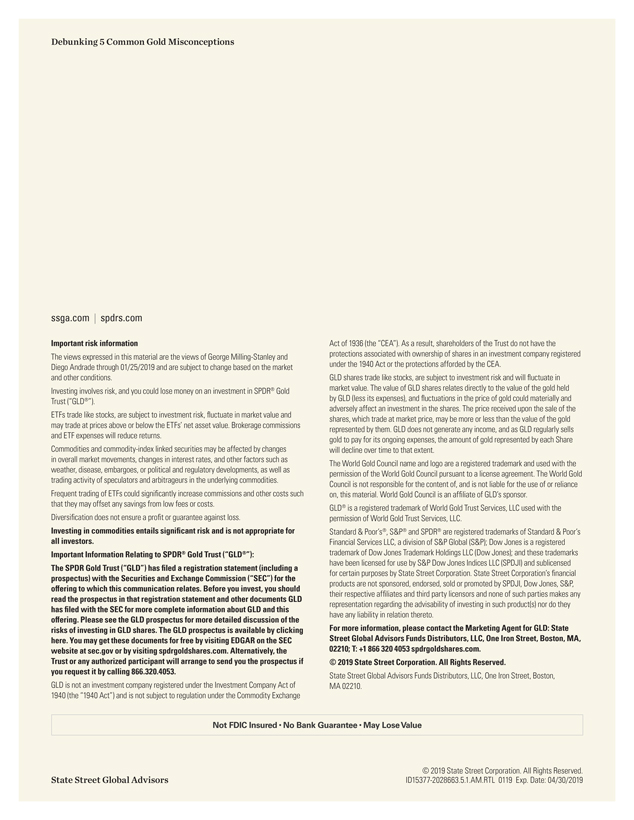

2 Since 2000, the correlation of gold to stocks, bonds and other commodities was to track the fixed-rate local currency sovereign debt issued by investment-grade

-0.01, 0.29, and 0.43, respectively. Source: Bloomberg Financial L.P. & State Street countries outside the US. Bonds must have a remaining maturity of one year or more. Global Advisors, date as of 12/31/2018. Computed using monthly return data from

Bloomberg Barclays U.S. Corporate High Yield Bond Index The Barclays

January 2000 to December 2018. Correlation measures the degree to which the

U.S. High Yield Index covers the universe of fixed rate,non-investment grade debt. deviations of one variable from its mean are related to those of a different variable Eurobonds and debt issues from countries designated as emerging markets (sovereign from its respective mean. Stocks represented by S&P 500 Index; Bonds represented rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) by the Bloomberg Barclays U.S. Aggregate Index; Commodities represented by are excluded, but Canadian and global bonds (SEC registered) of issuers innon-EMG

Bloomberg Commodity Index. Index returns reflect all items of income, gain and loss countries are included. The index includes both corporate andnon-corporate sectors. and the reinvestment of dividends and other income. Bloomberg Barclays U.S. Aggregate Bond Index A benchmark that provides a

3 Bloomberg Finance L.P. & State Street Global Advisors; S&P 500 monthly measure of the performance of the US dollar denominated investment grade bond correlation is from 8/31/1971 to 12/31/2018 and Bloomberg Barclays U.S. market, which includes investment grade government bonds, investment grade Aggregate Bond Index monthly correlation is from 3/31/1976 to 12/31/2018. corporate bonds, mortgage pass through securities, commercial mortgage backed

4 Source: Bloomberg Finance L.P., State Street Global Advisors, as of December 31, securities and asset backed securities that are publicly for sale in the US. 2018. Notes:Dot-Com Meltdown: 2/29/2000–3/30/2001 LBMA Gold Price PM

(USD/oz) returned-12.2%, MSCI AC World TR returned-20.6% and Bloomberg Bloomberg Barclays U.S. Treasury Index US dollar-denominated, fixed-rate, Barclays US Aggregated Bond Index TR returned 14.0% ; September 11 Terrorist nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity Attacks: 8/31/2001–9/28/2001 LBMA Gold Price PM (USD/oz) returned 7.4%, constraint, but are part of a separate Short Treasury Index.

MSCI AC World TR returned-9.1% and Bloomberg Barclays US Aggregated Bond Bloomberg Commodity Index A broadly diversified commodity price Index TR returned 1.2%; 2002 Recession: 2/28/2002–8/30/2002 LBMA Gold Price index distributed by Bloomberg Indexes that tracks 22 commodity futures and PM (USD/oz) returned 5.4%, MSCI AC World TR returned-12.2% and Bloomberg seven sectors. No one commodity can compose less than 2 percent or more

Barclays US Aggregated Bond Index TR returned 4.9%; Global Financial Crisis: than 15 percent of the index, and no sector can represent more than 33 percent

11/30/2007–3/31/2009 LBMA Gold Price PM (USD/oz) returned 17.0%, MSCI AC of the index.

World TR returned-48.6% and Bloomberg Barclays US Aggregated Bond Index TR Consumer Prices (CPI) Consumer Prices (CPI) are a measure of prices paid returned 5.7%; Sovereign Debt Crisis I: 4/30/2010–8/31/2010 LBMA Gold Price by consumers for a market basket of consumer goods and services. The yearly PM (USD/oz) returned 5.7%, MSCI AC World TR returned-8.3% and Bloomberg (or monthly) growth rates represent the inflation rate.

Barclays US Aggregated Bond Index TR returned 4.8%; Sovereign Debt Crisis II:

Dow Jones U.S. Select REIT Index A benchmark of US REITs and REIT-like 2/28/2011–10/31/2011 LBMA Gold Price PM (USD/oz) returned 22.0%, MSCI securities that screens for market capitalization, liquidity and percentage of revenue AC World TR returned-8.1% and Bloomberg Barclays US Aggregated Bond Index derived from ownership and operation of real estate securities. It is float market cap

TR returned 6.4%; Brexit: 6/22/2016–6/27/2016 LBMA Gold Price PM (USD/ weighted and quoted in dollars. oz) returned 4.7%, MSCI AC World TR returned-5.6% and Bloomberg Barclays

US Aggregated Bond Index TR returned 0.91%. Past performance is not a LBMA Gold Price The LBMA Gold Price is determined twice each business day guarantee of future results. Performance above does not reflect charges (10:30 a.m. and 3:00 p.m. London time) by the participants in a physically settled, and expenses associated with the fund or brokerage commissions electronic and tradable auction administered by the IBA using a bidding process associated with buying and selling exchange traded funds. Performance that determines the price of gold by matching buy and sell orders submitted by above is not meant to represent the performance of any investment the participants for the applicable auction time. product. Performance data above derived from total return indices. MSCI EAFE Index An equities benchmark that captures large- andmid-cap

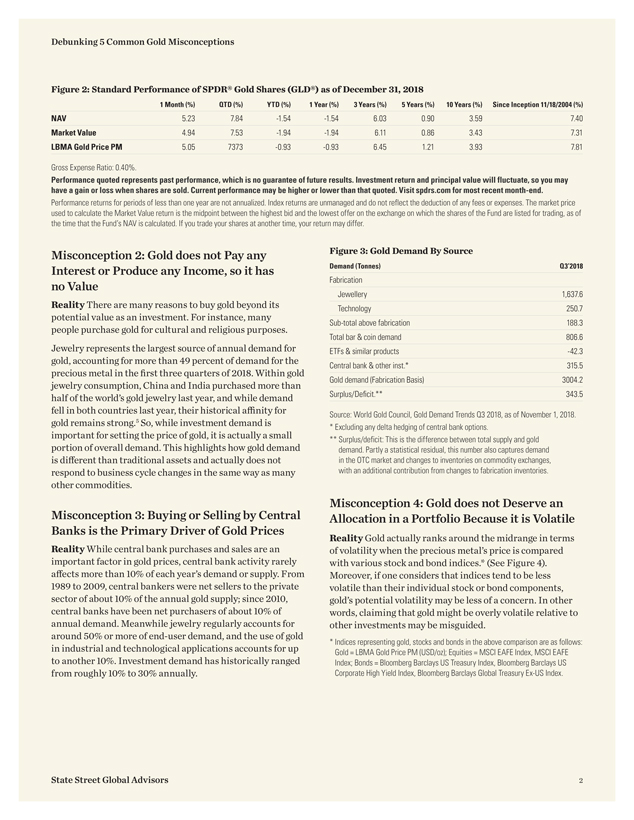

5 World Gold Council, “Gold Demand Trends Full Year 2017,” published 02/06/2018. representation across developed market countries around the world, excluding

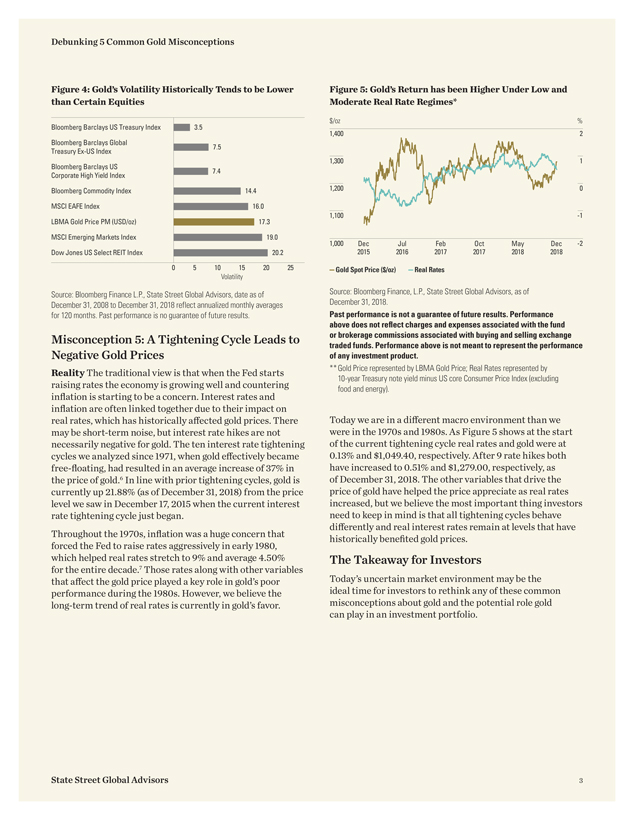

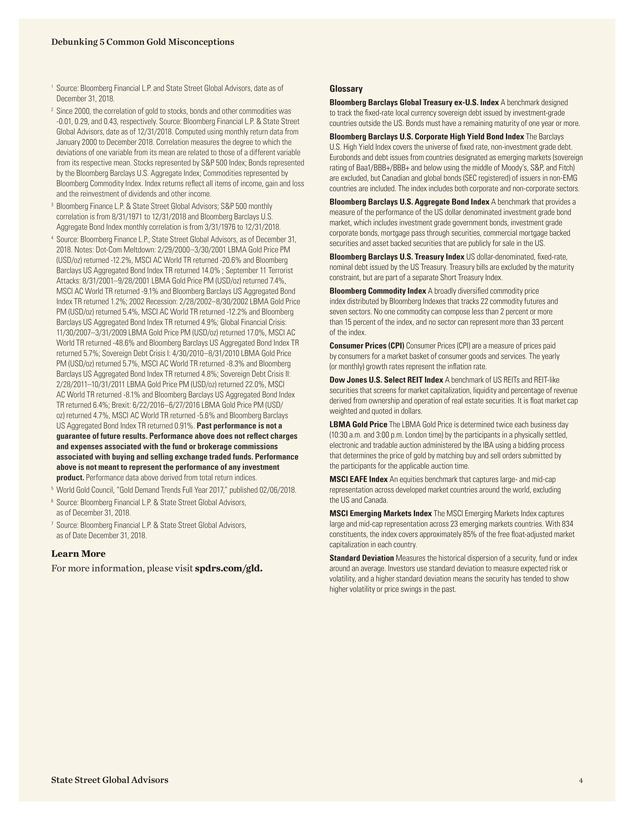

6 Source: Bloomberg Financial L.P. & State Street Global Advisors, the US and Canada. as of December 31, 2018. MSCI Emerging Markets Index The MSCI Emerging Markets Index captures

7 Source: Bloomberg Financial L.P. & State Street Global Advisors, large andmid-cap representation across 23 emerging markets countries. With 834 as of Date December 31, 2018. constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Learn More Standard Deviation Measures the historical dispersion of a security, fund or index For more information, please visit spdrs.com/gld. around an average. Investors use standard deviation to measure expected risk or volatility, and a higher standard deviation means the security has tended to show higher volatility or price swings in the past.

State Street Global Advisors 4