2014 Shareholder Meeting Hines Real Estate Investment Trust, Inc. Sherri Schugart President and CEO

Hines REIT 2014 Shareholder Meeting Commenced capital raising in 2004 and raised $2.5 billion of capital between then and the end of 2009 to invest primarily in high quality office assets in the US Raised and invested significant capital in 2006 and 2007, a period which represented a peak in the last economic cycle and real estate cycle In 2008 and 2009, amidst the global financial crisis, we experienced significant declines in capital raising and significant increases in redemption requests as well as significant declines in the valuations of our assets At the end of 2009, capital raising ceased and we suspended our redemption plan to prudently preserve liquidity and protect the company’s financial position 2 Company History and Overview

Hines REIT 2014 Shareholder Meeting Since 2009, the Company has been focused on the following: – Leasing: Keeping our tenants in occupancy to preserve and maintain operating income and values – Strategic asset sales and acquisitions: Identifying opportunities to sell certain assets to harvest liquidity and reposition the portfolio to be more geographically concentrated for a future portfolio exit – Liquidity: Ensuring we have sufficient funds to meet liquidity needs for operating expenses, leasing capital, and debt refinancings, while still maintaining reasonable levels of distributions to our shareholders We continue to be patient and disciplined in managing our portfolio in order to benefit from the slow but steady economic U.S. office market recovery 3 Company History and Overview

Hines REIT 2014 Shareholder Meeting Portfolio Summary1 Total real estate assets of approximately $2.7B 2 Interests in 36 properties totaling approximately 18.5 million square feet Weighted average occupancy of 87% Current leverage percentage of 48% with weighted average interest rate of 4.0% Distributions at an annualized rate of 4.2% on the estimated per share NAV of $6.40 3 declared through September 2014. This NAV excludes the $1.01 per share special distribution of return of capital in prior years Share Redemption Program reinstated in April 2013 at 85% of NAV and all eligible requests submitted since then have been honored to date 4 1Data as of June 30, 2014. Owned directly or indirectly. 2This represents Hines REIT’s pro-rata share of the appraised values of each investment held directly and indirectly as of September 30, 2013. The estimated value of the property acquired subsequent to December 31, 2013 was based on the net contract purchase price. It does not necessarily reflect the current aggregate value of Hines REIT’s investments. 3The distribution rate is $0.00073973 per share, per day. The annualized rate assumes that the distribution rate is maintained for a 12-month period.

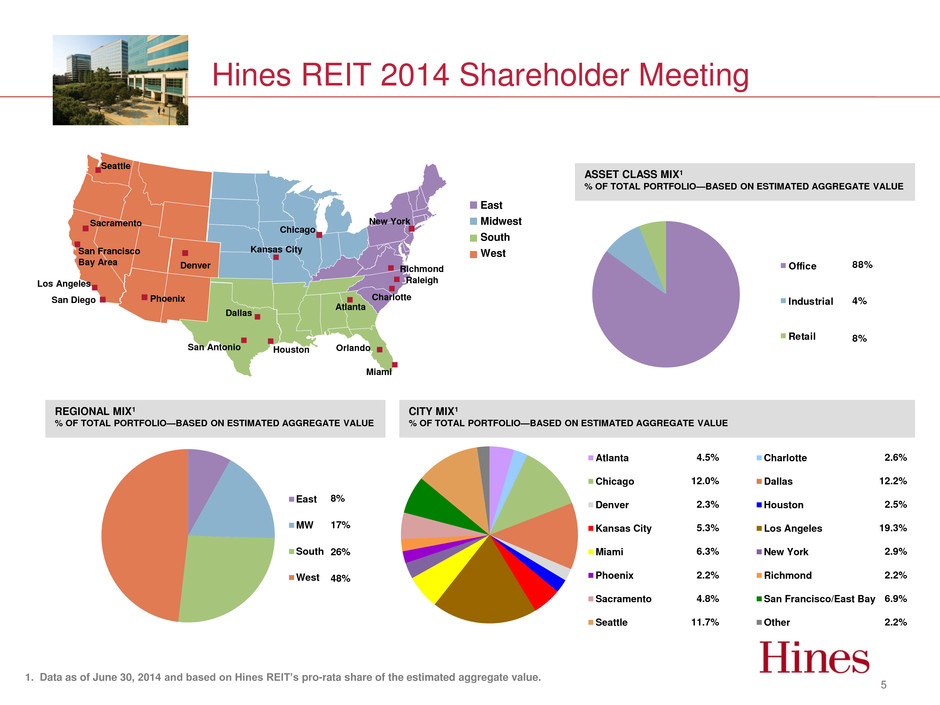

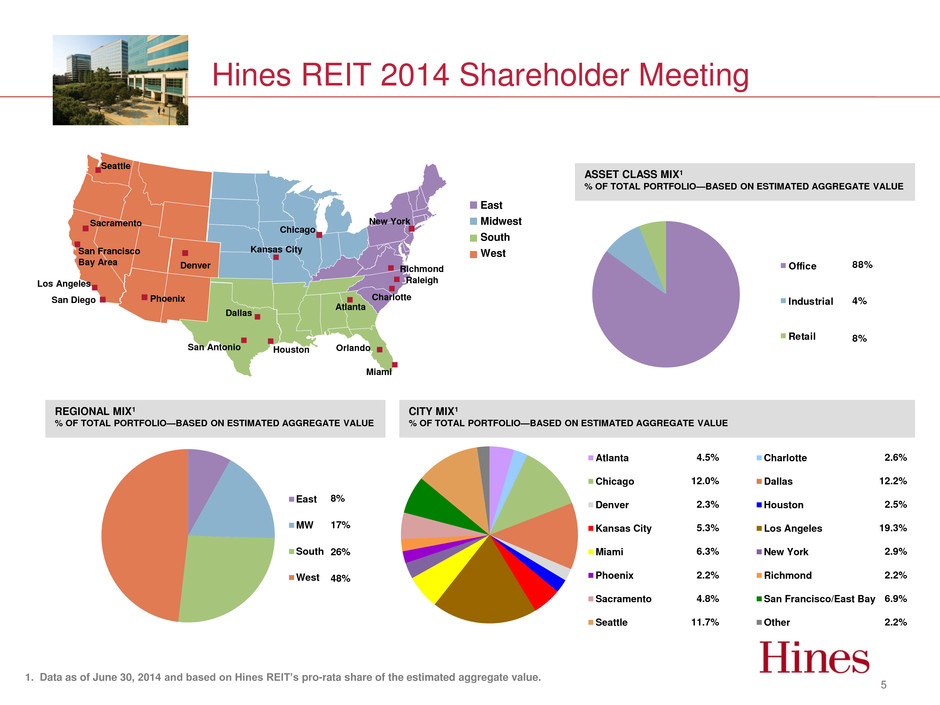

Hines REIT 2014 Shareholder Meeting REGIONAL MIX1 % OF TOTAL PORTFOLIO—BASED ON ESTIMATED AGGREGATE VALUE CITY MIX1 % OF TOTAL PORTFOLIO—BASED ON ESTIMATED AGGREGATE VALUE East Midwest South West San Francisco Bay Area Houston Chicago Seattle Atlanta San Diego Los Angeles New York Dallas Sacramento Miami Richmond Charlotte Phoenix Kansas City San Antonio Orlando Denver ASSET CLASS MIX1 % OF TOTAL PORTFOLIO—BASED ON ESTIMATED AGGREGATE VALUE East MW South West 8% 17% 26% 48% Atlanta Charlotte Chicago Dallas Denver Houston Kansas City Los Angeles Miami New York Phoenix Richmond Sacramento San Francisco/East Bay Seattle Other 4.5% 12.0% 2.3% 5.3% 6.3% 2.2% 4.8% 11.7% 2.6% 12.2% 2.5% 19.3% 2.9% 2.2% 6.9% 2.2% Office Industrial Retail 88% 4% 8% 5 1. Data as of June 30, 2014 and based on Hines REIT’s pro-rata share of the estimated aggregate value. Raleigh

Hines REIT 2014 Shareholder Meeting 6 101 Second Street San Francisco, CA Acquired: Sept. 2004 for $157.0 million Sold: Jan. 2014 for $297.5 million1 The KPMG Building San Francisco, CA Acquired: Sept. 2004 for $148.0 million Sold: May 2014 for $274.0 million1 720 Olive Way Seattle, WA Acquired: Jan. 2006 for $83.7 million Sold: June 2014 for $101.0 million2 Minneapolis Office/Flex Portfolio Minneapolis, MN Acquired: Sept. 2007 for $87.0 million Sold: May 2014 for $75.5 million Airport Corporate Center Miami, FL Acquired: Jan. 2006 for $156.8 million Expected Sale: Oct. 2014 for $132.3 million3 1As a result of its investment in the Core Fund, Hines REIT had a 24% indirect interest in these properties at the time of the sale. 2As a result of its investment in the Core Fund, Hines REIT had a 19% indirect interest in this property at the time of the sale. 3There is no guarantee that this pending transaction will close. Strategic Dispositions

Hines REIT 2014 Shareholder Meeting Strategic Asset Acquisition 7 Howard Hughes Center Los Angeles, CA Acquired: January 15, 2014 for $510.7 million Five, Class-A office buildings with 1.3 million rentable square feet 93 tenants including Pepperdine University, Sony Corporation and Qantas Airways Acquisition helps bolster the portfolio’s inventory of high-quality, core office properties Located in a desirable West Coast gateway city Another step in repositioning the portfolio for a successful future disposition

Hines REIT 2014 Shareholder Meeting Management Focus and Priorities Our near-term priorities consist of: – Leasing existing assets in our portfolio – Managing liquidity & maximizing distributions to shareholders – Strategic asset sales and seeking high-quality reinvestment opportunities for repositioning the portfolio – Evaluating and preparing for potential exit strategies most likely in the 2015-2017 timeframe These priorities are designed to maximize shareholder returns over the long term Alignment of interest – Hines is the largest investor with approximately $140 million of equity and reinvested fees invested in Hines REIT 8

Hines REIT 2014 Shareholder Meeting Important Information About the Estimated Per Share NAV There is no public market for Hines REIT’s common shares, and Hines REIT does not expect one to develop. Hines REIT currently has no plans to list its common shares on a national securities exchange or over-the-counter market, or to include the shares for quotation on any national securities market. Additionally, Hines REIT’s charter contains restrictions on the ownership and transfer of its common shares, and these restrictions may inhibit the ability of Hines REIT’s shareholders to sell their shares. Hines REIT has a share redemption program, but it is limited in terms of the amount of shares that may be redeemed and the current redemption price is $5.45 per share, unless the redemption is requested in connection with the death or disability (as defined in the Internal Revenue Code of 1986, as amended) of a shareholder, in which case the redemption price is $6.40 per share. Hines REIT’s board of directors may further limit, suspend or terminate the share redemption program in its sole discretion. Accordingly, it may be difficult for shareholders to sell their shares promptly or at all. If shareholders are able to sell their shares, they may only be able to sell them at a substantial discount from the price they paid and at a substantial discount from the estimated per share NAV. In addition, this presentation does not account for the expenses that Hines REIT would incur in connection with a liquidation of its assets or the execution of another exit strategy, which likely would cause the amount shareholders would receive in connection with such transaction to be lower than the estimated per share NAV. 9