1934 Act Registration No. 000-50631

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the Month of November 2004

TOM Online Inc.

(Translation of registrant’s name into English)

8th Floor, Tower W3, Oriental Plaza

No. 1 Dong Chang An Avenue

Beijing, China 100738

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): )

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): )

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):82- .)

EXHIBITS

FORWARD-LOOKING STATEMENTS

The Press Release and the Announcement of TOM Online Inc. (the “Company”), constituting Exhibits 1.1 and 1.2 to this Form 6-K, contain statements that may be viewed as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements are, by their nature, subject to significant risks and uncertainties that may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward-looking statements. Such forward-looking statements include, without limitation, statements that are not historical fact relating to the financial performance and business operations of the Company, the continued growth of the telecommunications industry in China, the development of the regulatory environment, and the Company’s latest product offerings and the Company’s ability to successfully execute its business strategies, including its ability to expand its market share and revenue through acquisitions.

Such forward-looking statements reflect the current views of the Company with respect to future events and are not a guarantee of future performance. Actual results may differ materially from information contained in the forward-looking statements as a result of a number of factors, including, without limitation, any changes in our relationships with telecommunication operators in China, the effect of competition on the demand for and the price of our services, changes in customer demand and usage preference for our products and services, changes in the regulatory policies of the Ministry of Information Industry and other relevant government authorities, any changes in telecommunications and related technology and applications based on such technology, and changes in political, economic, legal and social conditions in China, including the Chinese government’s policies with respect to economic growth, foreign exchange, foreign investment and entry by foreign companies into China’s telecommunications market. Please also see the “Risk Factors” section of the Company’s registration statement on Form F-1 (File No. 333-112800), as filed with the Securities and Exchange Commission.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | | TOM ONLINE INC. |

| | |

| Date: November 19, 2004 | | By: | | /s/ Peter Schloss

|

| | | Name: | | Peter Schloss |

| | | Title: | | Chief Financial Officer |

3

Exhibit 1.1

TOM Online announces deal to buy a 2.5G WAP services provider

(Beijing, November 19, 2004) TOM Online Inc. (Nasdaq: TOMO; HK GEM stock code: 8282), China’s leading wireless internet company, announced today it will acquire the entire issued share capital of Whole Win Investments Ltd, a fast-growing 2.5G services provider, to continue to expand its share in the country’s dynamic wireless internet market.

The only portal that is ranked among the top three by revenues in a wide range of wireless internet products such as WAP (wireless application protocol), IVR (interactive voice response) and MMS (multimedia messaging services), TOM Online has signed an agreement to pay HK$25.35 million for the purchase of Whole Win. The total consideration could be adjusted to up to HK$64.79 million depending on the firm’s profitability in 2004.

Whole Win is a key provider of WAP services in China. Based on Whole Win’s unaudited figures, the company generated revenues of HK$5.83 million from its WAP business in the eight months ended 31 August 2004.

“The purchase of Whole Win, which has been successful in growing its wireless internet services, will further consolidate TOM Online’s position as the leading provider of 2.5G services,” said Wang Lei Lei, Chief Executive Officer and Executive Director of TOM Online.

“The transaction will broaden TOM Online’s range of popular mobile internet products at a time when China’s 2.5G market is showing signs of entering into a new phase of growth,” he added.

About TOM Online

TOM Online Inc. is a leading mobile internet company in China, operating one of the most successful Internet portals in China (www.tom.com) and offering a wide variety of online and mobile services, including wireless internet and online advertising. In the wireless internet arena, TOM Online provides a diverse range of services such as SMS, MMS and WAP, and is the largest player of wireless interactive voice response services (IVR services). As of September 30, 2004, TOM Online is the only portal in China that enjoyed a top three ranking in every wireless internet service segment.

4

TOM Online is a subsidiary of TOM Group Limited (“TOM Group”), one of the leading Chinese language media groups in the Greater China region. TOM Group’s diverse operations span five media sectors: the Internet (through TOM Online Inc.), outdoor (through TOM Outdoor Media Group), publishing, sports and TV & entertainment.

Safe harbor statement

This announcement contains forward-looking statements that are, by their nature, subject to significant risks and uncertainties that may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward-looking statements. Such forward-looking statements include, without limitation, statements relating to management’s estimation with respect to the growth rate of the Company’s total revenues, wireless internet revenues and online advertising revenues, the success of the Company’s latest product offerings and the Company’s ability to successfully execute its business strategies and plans, including its ability to expand its market share and revenue through acquisitions. Such forward-looking statements reflect the current views of the Company with respect to future events and are not a guarantee of future performance. Actual results may differ materially from information contained in the forward-looking statements as a result of a number of factors, including, without limitation, any changes in our relationships with telecommunication operators in China, the effect of competition on the demand for the price of our services, changes in customer demand and usage preference for our products and services, changes in the regulatory policies of the Ministry of Information Industry and other relevant government authorities, any changes in telecommunications and related technology and applications based on such technology, and changes in political, economic, legal and social conditions in China, including the Chinese government’s policies with respect to economic growth, foreign exchange, foreign investment and entry by foreign companies into China’s telecommunications market. Please also see the “Risk Factors” section of the Company’s registration statement on Form F-1 (File No. 333-112800), as filed with the Securities and Exchange Commission in the United States and the “Risk Factors” section of the Company’s prospectus of March 2, 2004 filed with the Company’s Registry in Hong Kong.

Media Contacts:

| | |

TOM Online Rico Ngai | | TOM Online Tan Xiaoqing |

Corporate Communications (International) TOM Online Inc. Tel: +86 (10) 6528-3399 ext 6940 Mobile: +86 139-1189-5354 Email: ricongai@bj.tom.com | | Corporate Communications (Domestic) TOM Online Inc. Tel: +86 (10) 6528-3399 ext 6768 Mobile: +86 135-0123-6009 Email: tanxiaoqing@bj.tom.com |

5

Exhibit 1.2

| | |

| This announcement appears for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for securities. | | 19.59(4) |

| | | 2.19 |

The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this announcement, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

(Stock code: 8282)

SHARE TRANSACTION

Proposed acquisition of the entire issued share capital of Whole Win Investments Limited

The Board is pleased to announce that the Company, through its wholly-owned subsidiary, TOM Online Media, will acquire the Sale Shares (representing the entire issued share capital of Whole Win as at the date of this announcement and as at Completion) at the Consideration (being a sum of RMB27 million (equivalent to approximately HK$25.35 million) (subject to adjustment)). The maximum amount of the Consideration (as adjusted) is RMB69 million (equivalent to approximately HK$64.79 million)).

The Consideration may be adjusted upward or downward in the manner described in the section headed “Payment terms and adjustment of Consideration” below. For upward adjustment of the Consideration, the additional amount of the Consideration will be paid by TOM Online Media in cash and/or satisfied by the issue and allotment of TOM Online Shares at the option of TOM Online Media. For downward adjustment of the Consideration, the excess amount of the Consideration already paid will be refunded by the Vendor to TOM Online Media.

6

If part of the Consideration (as adjusted) is satisfied by the issue and allotment of TOM Online Shares, the Acquisition will constitute a share transaction of the Company under Chapter 19 of the GEM Listing Rules.

THE AGREEMENT

Date

19 November 2004

Parties

| | |

| Purchaser: | | TOM Online Media |

| |

| Vendor: | | Key Result |

| |

| Other parties: | | (1) Mr. Zhang |

| | | (2) Ms. Jia |

Assets to be acquired

The Sale Shares, representing the entire issued share capital of Whole Win as at the date of this announcement and as at Completion.

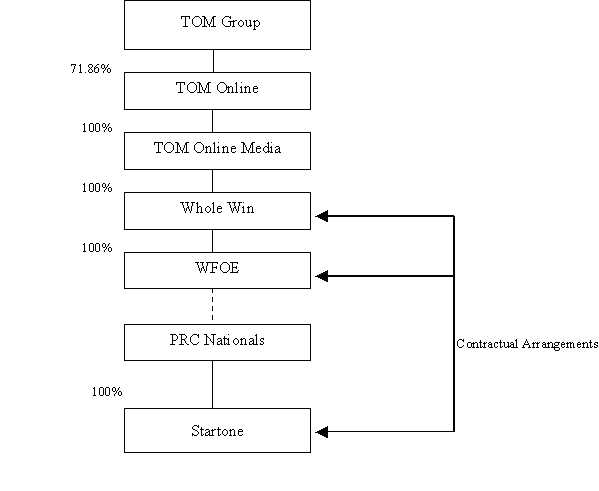

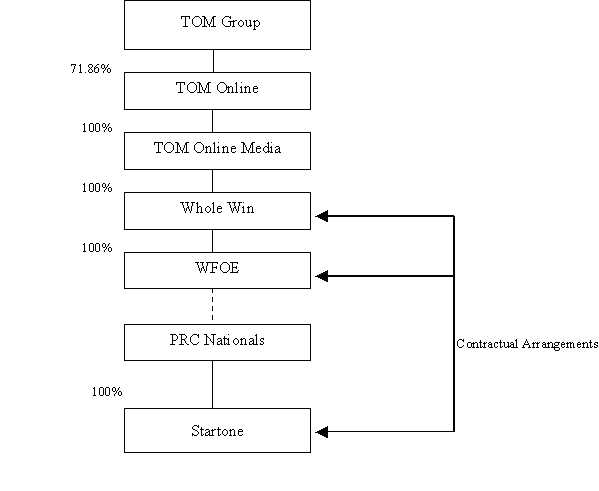

WFOE will become a wholly-owned subsidiary of Whole Win prior to Completion.

Under the Contractual Arrangements (as described in the section headed “Contractual Arrangements” below), Whole Win and WFOE will be able to enjoy the economic interest in Startone. Subject to confirmation by the auditors of the Company, Startone will be accounted for as a wholly-owned subsidiary of the Company.

Transfer of equity interest in Startone

Prior to Completion, Mr. Zhang and Ms. Jia will transfer all of their respective equity interests in Startone to the PRC Nationals at an aggregate consideration of RMB5 million (equivalent to approximately HK$4.69 million), which amount is included in the Consideration.

7

Consideration

The Consideration of RMB27 million (equivalent to approximately HK$25.35 million) is subject to adjustment in the manner described in the section headed “Payment terms and adjustment of Consideration” below. The maximum amount of the Consideration (as adjusted) is RMB69 million (equivalent to approximately HK$64.79 million).

The Consideration was arrived at after arm’s length negotiations between the Vendor and TOM Online Media and being a price acceptable to the Vendor and TOM Online Media with reference to the past, present and future performance and the strategic value of the Whole Win Group (as mentioned in the section headed “Reasons for entering into the Agreement” below).

Payment terms and adjustment of Consideration

The Consideration will be paid and adjusted in the following manner:

| 1. | a sum of RMB18 million (equivalent to approximately HK$16.90 million) will be paid in cash within 15 Business Days after the Completion Date; |

| 2. | a sum of RMB9 million (equivalent to approximately HK$8.45 million) will be paid in cash within 12 months after the Completion Date; and |

| 3. | based on the valuation of the Whole Win Group, the Consideration will be adjusted as follows: |

A = 2004 Net Profit x B

where:

| | | | |

| A = | | Valuation of the Whole Win Group (subject to a cap of RMB60 million (equivalent to approximately HK$56.34 million)) |

| | |

| B = | | (i) | | 5.5 if the 2004 Net Profit is less than or equal to RMB6 million (equivalent to approximately HK$5.63 million); or |

| | |

| | | (ii) | | 6 if the 2004 Net Profit is more than RMB6 million (equivalent to approximately HK$5.63 million) but less than or equal to RMB8 million (equivalent to approximately HK$7.51 million); or |

| | |

| | | (iii) | | 6.5 if the 2004 Net Profit is more than RMB8 million (equivalent to approximately HK$7.51 million). |

| | | | | |

Subject to a cap of RMB60 million (equivalent to approximately HK$56.34 million), if the valuation of the Whole Win Group calculated in accordance with the above formula:

| | (a) | exceeds RMB18 million (equivalent to approximately HK$16.9 million): |

| | (i) | the entire amount of such excess will be paid by TOM Online Media in cash; or |

8

| | (ii) | at the option of TOM Online Media (which will be determined by TOM Online Media on or before 31 December 2004): |

| | (1) | 20% of the amount of such excess will be paid by TOM Online Media in cash; and |

| | (2) | 80% of the amount of such excess will be satisfied by the issue and allotment of TOM Online Shares (credited as fully paid) at an issue price equal to the average closing price per TOM Online Share as quoted on the Stock Exchange for the 30 Trading Days immediately preceding the 2004 Report Date, |

| | | within 15 Business Days after the date on which the auditors of the Whole Win Group deliver the 2004 Audited Accounts to TOM Online Media and Key Result. For illustration purpose, assuming that the valuation of the Whole Win Group is RMB60 million (equivalent to approximately HK$56.34 million) and that TOM Online Media decides to satisfy 80% of the additional amount of Consideration payable by TOM Online Media (being an amount of RMB33,600,000 (equivalent to approximately HK$31.55 million)) by the issue and allotment of TOM Online Shares based on the closing price of HK$1.30 per TOM Online Share as quoted on the Stock Exchange as at the date of the Agreement, approximately 24,268,689 TOM Online Shares (representing approximately 0.62% of the Existing Capital) will be issued and allotted to the Vendor; or |

| | (b) | is less than RMB18 million (equivalent to approximately HK$16.9 million), the amount of such shortfall will be refunded by the Vendor to TOM Online Media within 45 Business Days after the date on which the auditors of the Whole Win Group deliver the 2004 Audited Accounts to TOM Online Media and Key Result. |

All or such part of the Consideration to be paid in cash will be satisfied by the Company’s internal resources. In the event that TOM Online Media decides to satisfy part of the Consideration by the issue and allotment of TOM Online Shares as mentioned above, the Company will apply to the Stock Exchange for the listing of, and permission to deal in, such TOM Online Shares accordingly.

9

Trading restrictions

If part of the Consideration (as adjusted) is satisfied by the issue and allotment of TOM Online Shares:

| 1. | Key Result agrees not to sell, charge or pledge any of the TOM Online Shares issued to it within three months after the date of issue of such TOM Online Shares (“Lock-up Period”); |

| 2. | after the expiry of the Lock-up Period, the aggregate number of TOM Online Shares to be sold on any one Trading Day shall not exceed 5% of the total number of TOM Online Shares issued to it; and |

| 3. | Key Result will enter into a deed of share charge (in a form to be agreed by TOM Online Media) with TOM Online Media, under which Key Result will charge and assign to TOM Online Media during the Lock-up Period all of its interests in the TOM Online Shares issued to it in satisfaction of part of the Consideration. |

| Undertakings | by Mr. Zhang and Ms. Jia |

Mr. Zhang and Ms. Jia have jointly and severally undertaken to TOM Online Media that, save and except where China Mobile and/or the Company change(s) its/their business strategies, Mr. Zhang and Ms. Jia will ensure that, in the year ending 31 December 2005, at least 3 types of WAP products of Startone or the Company will be included in China Mobile’s monthly special new WAP products category. In connection therewith, Mr. Zhang and Ms. Jia will:

| 1. | if the entire amount of the Consideration (as adjusted) is paid in cash, deposit or cause to be deposited in a bank account specified by TOM Online Media a sum of RMB5 million (equivalent to approximately HK$4.69 million) in cash; or |

| 2. | if part of the Consideration (as adjusted) is satisfied by the issue and allotment of TOM Online Shares, place or caused to be placed with a third party escrow agent appointed by TOM Online Media RMB5 million (equivalent to approximately HK$4.69 million) worth of TOM Online Shares and if the aggregate value of all of the TOM Online Shares so allotted and issued to the Vendor is less than RMB5 million (equivalent to approximately HK$4.69 million), the amount of such shortfall will be topped up in cash by Mr. Zhang and Ms. Jia, who will deposit or cause to be deposited such cash amount in a bank account specified by TOM Online Media, |

as security for the due performance by Mr. Zhang and Ms. Jia of the above undertaking (“Security”). If TOM Online Media is satisfied that the above undertaking is duly performed, the Security will be released to Mr. Zhang and Ms. Jia by 31 January 2006.

10

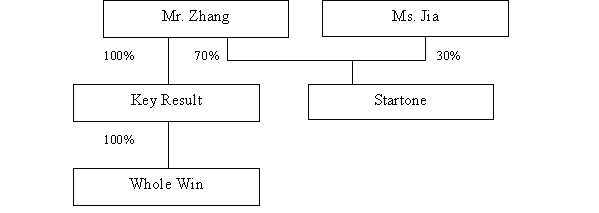

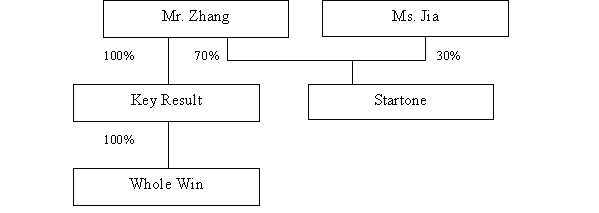

Structure chart of the Whole Win Group as at the date of the Agreement

Structure chart of the Whole Win Group immediately after Completion

11

| Note: | Upon Completion, the PRC Nationals and their associates (which, for this purpose, do not include Startone as, subject to confirmation by the auditors of the Company, it will be accounted for as a wholly-owned subsidiary of the Company) will be deemed to be connected persons of the Company but only for the purposes of transactions between any of them or their associates (excluding Startone) on the one hand and any member of the Company on the other hand, which do not form part of the transactions arising from the Contractual Arrangements to which they are a party. Any such transaction will be deemed to be a connected transaction of the Company and will be subject to the requirements of Chapter 20 of the GEM Listing Rules. |

Conditions precedent

Completion is conditional upon, among other things, the following conditions (“Conditions”) having been fulfilled or waived on or before 30 April 2005 (or such other date as the parties to the Agreement may agree):

| 1. | a legal opinion issued by a PRC legal counsel approved by TOM Online Media opining on the legality of the establishment of the WFOE, the Agreement and the transactions contemplated under the Agreement (including the Contractual Arrangements) having been delivered to TOM Online Media; |

| 2. | an employment contract in such form and substance satisfactory to TOM Online Media having been duly executed between WFOE and each member of the management team and other essential staff members (including Mr. Zhang) of WFOE; |

| 3. | the Contractual Arrangements in such form and substance satisfactory to TOM Online Media having been duly entered into by the relevant parties thereto; |

| 4. | a Beijing Municipal telecommunications value-added services license issued by the relevant local authorities in Beijing, the PRC and a PRC national telecommunications value added services license issued by the Ministry of Information and Industry in the PRC having been obtained by Startone; |

| 5. | TOM Online Media having been satisfied with the result of the due diligence exercise carried out by it on the assets, liabilities, business and prospects of the Whole Win Group; |

| 6. | a legal opinion issued by a BVI legal counsel approved by TOM Online Media opining on the due incorporation and continual existence of Whole Win and ownership of the Sale Shares having been delivered to TOM Online Media; and |

| 7. | approval from NASDAQ for the transactions contemplated under the Agreement having been obtained, if necessary. |

12

Completion

Completion will take place within 10 Business Days after the date on which the last of the Conditions is fulfilled (or waived) (or such other date as the parties to the Agreement may agree) (“Completion Date”).

Contractual Arrangements

As the relevant PRC laws, rules and regulations currently restrict foreign ownership of companies engaged in the provision of telecommunications value-added services (such as Startone), therefore in order to comply with such restrictions, TOM Online Media will not acquire any direct equity interest in Startone but it will designate the PRC Nationals to acquire the entire equity interest in Startone. Prior to Completion, Whole Win, WFOE, Startone, Mr. Zhang and Ms. Jia will enter into the contractual arrangements set out below (“Contractual Arrangements”). Upon Completion, Mr. Zhang and Ms. Jia will be replaced by the PRC Nationals in relation to those Contractual Arrangements to which Mr. Zhang and Ms. Jia are parties.

The Contractual Arrangements are as follows:

| 1. | an exclusive technical and consultancy services agreement to be entered into between WFOE and Startone, under which WFOE will provide certain technical and consultancy services to Startone. Startone will pay WFOE service fees on a monthly basis, which fees will be an amount equal to 65% of the total number of subscribers of the month multiplied by the net average charge per subscriber for that month (after deduction of business tax); |

| 2. | a business operation agreement to be entered into between WFOE, Startone and the shareholders of Startone, under which WFOE will act as a guarantor for any obligations undertaken by Startone and in return for which, Startone will pledge to WFOE their accounts receivable and assets. No consideration is payable under the aforesaid business operation agreements; |

| 3. | an exclusive option agreement to be entered into between Whole Win and each of the shareholders of Startone, pursuant to which the shareholders of Startone will grant an exclusive right to Whole Win to purchase all or part of the shareholders’ equity interest in Startone at an aggregate exercise price of RMB10 million (equivalent to approximately HK$9.39 million). The option is exercisable at the discretion of Whole Win; |

13

| 4. | an equity pledge agreement to be entered into between WFOE and each of the shareholders of Startone, pursuant to which the shareholders of Startone will pledge their respective interests in Startone to WFOE for the performance of Startone’s payment obligations under the aforesaid exclusive technical consultancy services agreement. No consideration is payable under the aforesaid equity pledge agreement; |

| 5. | a transfer agreement of the equity interest in Startone to be entered into between Mr. Zhang, Ms. Jia and the PRC Nationals whereby Mr. Zhang, Ms. Jia will transfer their respective equity interests in Startone to the PRC Nationals at an aggregate consideration of RMB5 million (equivalent to approximately HK$4.69 million); |

| 6. | an irrevocable power of attorney to be entered into between the shareholders of Startone in favour of: (a) Mr. Zhang and Ms. Jia prior to Completion; and (b) the PRC Nationals upon Completion so that Mr. Zhang and Ms. Jia or, as the case may be, the PRC Nationals will have full power and authority to exercise all of the shareholder’s rights with respect to the shareholders’ interest in Startone; and |

| 7. | a loan agreement to be entered into between Whole Win and each of the shareholders of Startone so that loans (the aggregate amount of which will be equal to the amount of the registered capital of Startone (i.e., RMB10 million (equivalent to approximately HK$9.39 million)) will be provided by Whole Win to: (a) Mr. Zhang and Ms. Jia prior to Completion; and (b) the PRC Nationals upon Completion for the exclusive purpose of investment in the registered capital of Startone. |

As a result of the Contractual Arrangements, the TOM Online Group will be able to govern the financial and operating policies of Startone and enjoy all of the economic benefits of the Whole Win Group.

INFORMATION ON THE WHOLE WIN GROUP

Whole Win is a company incorporated on 18 August 2004 in the BVI with limited liability. As at the date hereof, the entire issued shareholdings of Whole Win is owned by Key Result. TOM Online Media will acquire the entire issued share capital of Whole Win upon the terms and subject to the conditions set out in the Agreement. WFOE will become a wholly-owned subsidiary of Whole Win prior to Completion. Under the Contractual Arrangements, Whole Win and WFOE will be able to enjoy the economic interest in Startone. Subject to confirmation by the auditors of the Company, Startone will be accounted for as a wholly-owned subsidiary of the Company. As Whole Win and WFOE have been dormant since their incorporation, no financial information for the past two years is available.

14

The corporate structure of WFOE is as follows:

| | | | |

| 1. | | Company name: | |  (Heng Dong Wei Xin (Beijing) Technology Company Limited) (Heng Dong Wei Xin (Beijing) Technology Company Limited) |

| | |

| 2. | | Registered capital: | | US$150,000 (equivalent to approximately HK$1,170,000) (all of which have been fully paid up) |

| | |

| 3. | | Shareholder: | | Whole Win will become the sole shareholder of WFOE prior to Completion |

| | |

| 4. | | Scope of business: | | Any business activities that are not in breach of the PRC laws, rules and regulations |

Startone is a domestic company established in the PRC in December 2002 by Mr. Zhang and Ms. Jia. As at the date of this announcement, the registered capital of Startone is RMB10 million (equivalent to approximately HK$9.39 million) (all of which have been fully paid up). Startone is primarily engaged in the provision of wireless application protocol (WAP) services since September 2003. As at the date of the Agreement, Startone is held as to 70% by Mr. Zhang and 30% by Ms. Jia, respectively. Prior to Completion, Mr. Zhang and Ms. Jia will transfer their respective equity interests in Startone to the PRC Nationals.

Based on the management accounts of Startone prepared in accordance with US GAAP, the unaudited net revenue of Startone for the year ended 31 December 2003 and the 8 months ended 31 August 2004 were approximately RMB223,000 (equivalent to approximately HK$209,390) and approximately RMB5,831,000 (equivalent to approximately HK$5,475,117), respectively. The unaudited loss both before and after tax of Startone for the year ended 31 December 2003 were approximately RMB884,000 (equivalent to approximately HK$830,047) and the unaudited profit both before and after tax of Startone for the 8 months ended 31 August 2004 were approximately RMB3,613,000 (equivalent to approximately HK$3,392,488). The unaudited net asset of Startone as at 31 August 2004 was approximately RMB12,729,000 (equivalent to approximately HK$11,952,113).

REASONS FOR ENTERING INTO THE AGREEMENT

Startone is a wireless value-added service provider focused on providing WAP services. The acquisition of Startone’s WAP business can strengthen the Company’s WAP business. Furthermore, the addition of Startone’s WAP user base can also enable the Company to cross sell its other WVAS products.

The Acquisition is in line with the statement of business objectives of the Company as disclosed in its prospectus dated 2 March 2004. The Directors believe that the Acquisition will enable the Company to enlarge its market share in the WAP market and increase its revenue arising from the WAP segment.

15

The Directors consider that the Agreement is entered into on normal commercial terms in the ordinary and usual course of business of the Company and that the terms of the Agreement are fair and reasonable and in the interests of the Company so far as the shareholders of the Company are concerned.

SHARE TRANSACTION OF THE COMPANY

If part of the Consideration (as adjusted) is satisfied by the issue and allotment of the TOM Online Shares as mentioned in the section headed “Payment terms and adjustment of Consideration” above, the Acquisition will constitute a share transaction of the Company under Chapter 19 of the GEM Listing Rules.

The aforesaid TOM Online Shares (if any) will be allotted and issued pursuant to the general mandate granted to the Directors by the sole shareholder on 12 February 2004 (which has not been used by the Directors since the date of grant).

GENERAL

The Company is an internet company in the PRC providing value-added multimedia products and services. It delivers its products and services from its Internet portal to its users both through their mobile phones and through its websites. Its primary business activities include wireless value-added services, online advertising and commercial enterprise solutions.

DEFINITIONS

| | |

| “2004 Audited Accounts” | | the audited consolidated balance sheet of Whole Win made up as at 31 December 2004 and the audited consolidated profit and loss account of Whole Win for the year ending 31 December 2004 prepared in accordance with US GAAP |

| |

| “2004 Net Profit” | | the consolidated net profit after tax and extraordinary items of Whole Win as shown in the 2004 Audited Accounts |

| |

| “2004 Report Date” | | the date of the auditors report on the 2004 Audited Accounts |

| |

| “Acquisition” | | the proposed acquisition by TOM Online Media of the entire issued share capital of Whole Win from the Vendor upon the terms and subject to the conditions set out in the Agreement |

| |

| “Agreement” | | a conditional sale and purchase agreement dated 19 November 2004 entered into between TOM Online Media, the Vendor, Mr. Zhang and Ms. Jia in respect of the Acquisition |

16

| | |

| |

| “associates” | | has the same meaning as ascribed to it under the GEM Listing Rules |

| |

| “Board” | | the board of directors of the Company |

| |

| “Business Day” | | a day (excluding Saturday) on which banks are generally open for business in the PRC |

| |

| “BVI” | | the British Virgin Islands |

| |

| “China Mobile” | | China Mobile Communications Corporation and/or certain of its subsidiaries which have business relationships with the Company and/or Startone |

| |

| “Company” | | TOM Online Inc., a company incorporated in the Cayman Islands with limited liability, whose shares are listed on GEM |

| |

| “Completion” | | completion of the Acquisition upon the terms and subject to the conditions set out in the Agreement |

| |

| “Completion Date” | | has the meaning ascribed to it in the section headed “Completion” above |

| |

| “Conditions” | | has the meaning ascribed to it in the section headed “Conditions precedent” above |

| |

| “Consideration” | | the consideration for the Acquisition, being a sum of RMB27 million (equivalent to approximately HK$25.35 million), which is subject to adjustment in the manner described in the section headed “Payment terms and adjustment of Consideration” above |

| |

| “Contractual Arrangements” | | has the meaning ascribed to it in the section headed “Contractual Arrangements” above |

| |

| “Director(s)” | | the director(s) of the Company |

| |

| “Existing Capital” | | 3,896,200,000 TOM Online Shares in issue at as the date of the Agreement |

| |

| “GEM” | | the Growth Enterprise Market of the Stock Exchange |

| |

| “GEM Listing Rules” | | the Rules Governing the Listing of Securities on GEM |

| |

| “HK$” | | Hong Kong dollars, the lawful currency of Hong Kong. For the purposes of this announcement: |

| |

| | | (a) the conversion rate between HK$ and RMB is HK$1º RMB1.065; and |

17

18

| | |

| “Startone” | |  (Startone (Beijing) Information Technology Company Limited), a limited liability company established in Beijing, the PRC and is owned as to 70% by Mr. Zhang and as to 30% by Ms. Jia as at the date of this announcement (Startone (Beijing) Information Technology Company Limited), a limited liability company established in Beijing, the PRC and is owned as to 70% by Mr. Zhang and as to 30% by Ms. Jia as at the date of this announcement |

| |

| “Stock Exchange” | | The Stock Exchange of Hong Kong Limited |

| |

| “TOM Group” | | TOM Group Limited, a company incorporated in the Cayman Islands with limited liability, whose shares are listed on the Main Board of the Stock Exchange |

| |

| “TOM Online Group” | | TOM Online and its subsidiaries |

| |

| “TOM Online Media” | | TOM Online Media Group Limited, a company incorporated in the BVI with limited liability and a wholly-owned subsidiary of the Company |

| |

| “TOM Online Share(s)” | | share(s) of HK$0.01 each in the capital of the Company |

| |

| “Trading Day” | | any one day on which the TOM Online Shares are traded on the Stock Exchange |

| |

| “US” | | the United States of America |

| |

| “US GAAP” | | the generally accepted accounting principles in the US |

| |

| “US$” | | US dollars, the lawful currency of the US |

| |

| “Vendor” or “Key Result” | | Key Result Holdings Limited, a company incorporated in the BVI and wholly-owned by Mr. Zhang, whose principal business is investment holding. Key Result is a third party independent of and not connected with the Company or any of its connected persons (as defined in the GEM Listing Rules) or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company |

| |

| “WAP” | | wireless application protocol |

| |

| “WFOE” | |  (Heng Dong Wei Xin (Beijing) Technology Company Limited), a wholly-foreign owned enterprise established in Beijing, the PRC and will become a wholly-owned subsidiary of Whole Win prior to Completion (Heng Dong Wei Xin (Beijing) Technology Company Limited), a wholly-foreign owned enterprise established in Beijing, the PRC and will become a wholly-owned subsidiary of Whole Win prior to Completion |

19

| | |

| “Whole Win” | | Whole Win Investments Limited, a company incorporated in the BVI with limited liability, whose principal business is investment holding. Whole Win is a third party independent of and not connected with the Company or any of its connected persons (as defined in the GEM Listing Rules) or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company |

| |

| “Whole Win Group” | | Whole Win, WFOE and Startone |

|

| By Order of the Board |

| TOM ONLINE INC. |

| Angela Mak |

|

| Company Secretary |

Hong Kong, 19 November 2004

As at the date thereof, the directors of the Company are:

| | | | |

Executive Directors: Mr. Wang Lei Lei Mr. Xu Zhiming Mr. Peter Schloss Ms. Elaine Feng Mr. Fan Tai Mr. Wu Yun | | Non-executive Directors: Mr. Frank Sixt (Chairman) Mr. Sing Wang (Vice Chairman) Ms. Tommei Tong Alternate Director: Mrs. Susan Chow (Alternate to Mr. Frank Sixt) | | Independent non-executive Directors: Mr. Gordon Kwong Mr. Ma Wei Hua Dr. Lo Ka Shui |

This announcement, for which the Directors collectively and individually accept full responsibility, includes particulars given in compliance with the GEM Listing Rules for the purpose of giving information with regard to the Company. The Directors, having made all reasonable enquiries, confirm that, to the best of their knowledge and belief: (i) the information contained in this announcement is accurate and complete in all material respects and not misleading; (ii) there are no other matters the omission of which would make any statements in this announcement misleading; and (iii) all opinions expressed in this announcement have been arrived at after due and careful consideration and are founded on bases and assumptions that are fair and reasonable.

This announcement will remain on the GEM website at www.hkgem.com on the “Latest Company Announcements” page for at least 7 days from the date of its posting and on the website of the Company atwww.tom.com.

| * | for identification purpose |

20

(Heng Dong Wei Xin (Beijing) Technology Company Limited)

(Heng Dong Wei Xin (Beijing) Technology Company Limited) , who holds 70% of the equity interest in Startone and is the sole legal and beneficial owner of Key Result. Mr. Zhang is the son of Ms. Jia. Mr. Zhang is a third party independent of and not connected with the Company or any of its connected persons (as defined in the GEM Listing Rules) or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company

, who holds 70% of the equity interest in Startone and is the sole legal and beneficial owner of Key Result. Mr. Zhang is the son of Ms. Jia. Mr. Zhang is a third party independent of and not connected with the Company or any of its connected persons (as defined in the GEM Listing Rules) or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company , who holds 30% of the equity interest in Startone. Ms. Jia is the mother of Mr. Zhang. Ms. Jia is a third party independent of and not connected with the Company or any of its connected persons (as defined in the GEM Listing Rules) or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company

, who holds 30% of the equity interest in Startone. Ms. Jia is the mother of Mr. Zhang. Ms. Jia is a third party independent of and not connected with the Company or any of its connected persons (as defined in the GEM Listing Rules) or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company and Mr. Pu Dongwan

and Mr. Pu Dongwan , who have been designated by TOM Online Media to acquire the entire equity interest in Startone from Mr. Zhang and Ms. Jia. Mr. Liu and Mr. Pu are employees of the TOM Online Group and connected persons (as defined in the GEM Listing Rules) of the Company by virtue of their being directors of a subsidiary of the Company prior to Completion

, who have been designated by TOM Online Media to acquire the entire equity interest in Startone from Mr. Zhang and Ms. Jia. Mr. Liu and Mr. Pu are employees of the TOM Online Group and connected persons (as defined in the GEM Listing Rules) of the Company by virtue of their being directors of a subsidiary of the Company prior to Completion (Startone (Beijing) Information Technology Company Limited), a limited liability company established in Beijing, the PRC and is owned as to 70% by Mr. Zhang and as to 30% by Ms. Jia as at the date of this announcement

(Startone (Beijing) Information Technology Company Limited), a limited liability company established in Beijing, the PRC and is owned as to 70% by Mr. Zhang and as to 30% by Ms. Jia as at the date of this announcement (Heng Dong Wei Xin (Beijing) Technology Company Limited), a wholly-foreign owned enterprise established in Beijing, the PRC and will become a wholly-owned subsidiary of Whole Win prior to Completion

(Heng Dong Wei Xin (Beijing) Technology Company Limited), a wholly-foreign owned enterprise established in Beijing, the PRC and will become a wholly-owned subsidiary of Whole Win prior to Completion