Filed by Gas Natural SDG, S.A. pursuant to

Rule 425 of the Securities Act of 1933

Subject Company: Endesa, S.A.

Commission File No.: 333-07654

This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The exchange offer will commence only (1) following approval of a final offer document by the SpanishComisión Nacional del Mercado de Valores (CNMV) and publication thereof and (2) on or after the date on which Gas Natural SDG, S.A. (Gas Natural) files a Registration Statement on Form F-4 with the U.S. Securities and Exchange Commission (SEC) relating to the exchange offer.

Investors in ordinary shares of Endesa, S.A. (Endesa) should not subscribe for any securities referred to herein except on the basis of the final approved and published offer document that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004. Investors and security holders may obtain a free copy of such final offer document (once it is approved and published) at the registered offices of Gas Natural, Endesa, the CNMV or the Spanish Stock Exchanges.

Investors in American Depositary Shares of Endesa and U.S. holders of ordinary shares of Endesa are urged to read the U.S. prospectus and tender offer statement regarding the exchange offer, when it becomes available, because it will contain important information. The U.S. prospectus and tender offer statement will be filed with the SEC as part of its Registration Statement on Form F-4. Investors and security holders may obtain a free copy of the U.S. prospectus and tender offer statement (when available) and other documents filed by Gas Natural with the SEC at the SEC’s website at www.sec.gov. A free copy of the U.S. prospectus and tender offer statement (when available) may also be obtained for free from Gas Natural.

These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements relate to, among other things:

| | • | | synergies and cost savings; |

| | • | | integration of the businesses; |

| | • | | expected gas and electricity mix and volume increases; |

| | • | | planned asset disposals and capital expenditures; |

| | • | | net debt levels and EBITDA and earnings per share growth; |

| | • | | timing and benefits of the offer and the combined company. |

These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding-looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition.

Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions.

These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information.

This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited.

* * *

The following is an Investor Presentation by Gas Natural SDG, S.A. to its investors and investors in Endesa, S.A. relating to the offer by Gas Natural SDG for 100% of the share capital of Endesa.

Creating a leading, fully integrated global energy company

September 2005

gasNatural

Disclaimer and Important Legal Information

This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The exchange offer will be made only (1) following approval of a final offer document by the Spanish Comisión Nacional del Mercado de Valores (CNMV) and publication thereof and (2) on or after the date on which Gas Natural SDG, S.A. files a Registration Statement on Form F-4 with the U.S. Securities and Exchange Commission (SEC) relating to the exchange offer.

Investors in ordinary shares of Endesa, S.A. should not subscribe for any securities referred to herein except on the basis of the final approved and published offer document that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004. Investors and security holders may obtain a free copy of such final offer document (once it is approved and published) at the registered offices of Gas Natural, Endesa, the CNMV or the Spanish Stock Exchanges.

Investors in American Depositary Shares of Endesa and U.S. holders of ordinary shares of Endesa are urged to read the U.S. prospectus and tender offer statement regarding the exchange offer, when it becomes available, because it will contain important information. The U.S. prospectus and tender offer statement will be filed with the SEC as part of its Registration Statement on Form F-4. Investors and security holders may obtain a free copy of the U.S. prospectus and tender offer statement (when available) and other documents filed by Gas Natural with the SEC at the SEC’s website at www.sec.gov. A free copy of the U.S. prospectus and tender offer statement (when available) may also be obtained for free from Gas Natural.

These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements relate to, among other things: management strategies; synergies and cost savings; integration of the businesses; market position; expected gas and electricity mix and volume increases; planned asset disposals and capital expenditures; net debt levels and EBITDA and earnings per share growth; dividend policy; and timing and benefits of the offer and the combined company.

These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition.

Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions. These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information.

This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited.

2

Agenda

Transaction overview

Transaction benefits

Combined company position

Financial overview

Conclusions

3

Creating a leading, fully integrated global energy company

Transaction overview

Transaction benefits

Combined company position

Financial overview

Conclusions

A transforming transaction to accelerate profitable growth

Global leading integrated gas and power company with strong energy management capabilities

Complementary, high-quality asset positions in fast growing markets

Client-focused multinational leader with over 30 million customer accounts

5

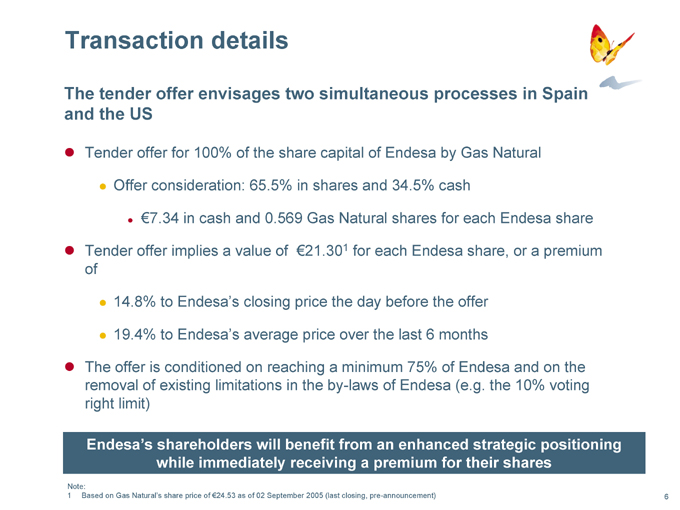

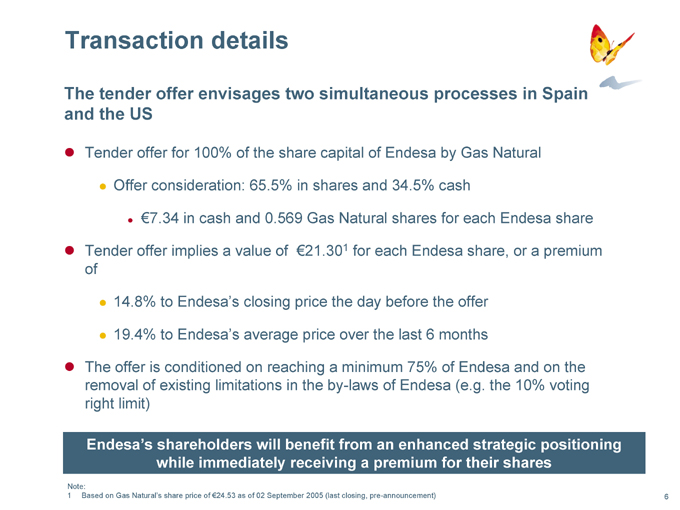

Transaction details

The tender offer envisages two simultaneous processes in Spain and the US

Tender offer for 100% of the share capital of Endesa by Gas Natural

Offer consideration: 65.5% in shares and 34.5% cash

€7.34 in cash and 0.569 Gas Natural shares for each Endesa share

Tender offer implies a value of €21.301 for each Endesa share, or a premium of

14.8% to Endesa’s closing price the day before the offer

19.4% to Endesa’s average price over the last 6 months

The offer is conditioned on reaching a minimum 75% of Endesa and on the removal of existing limitations in the by-laws of Endesa (e.g. the 10% voting right limit)

Endesa’s shareholders will benefit from an enhanced strategic positioning while immediately receiving a premium for their shares

Note:

1 Based on Gas Natural’s share price of €24.53 as of 02 September 2005 (last closing, pre-announcement)

6

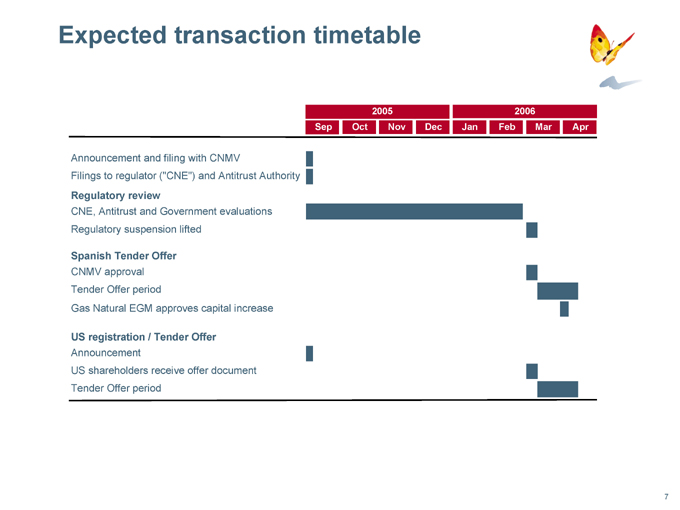

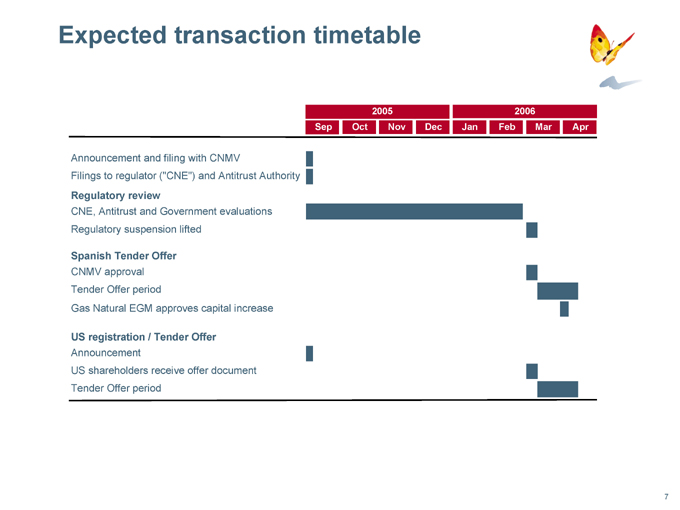

Expected transaction timetable

2005 2006

Sep Oct Nov Dec Jan Feb Mar Apr

Announcement and filing with CNMV Filings to regulator (“CNE”) and Antitrust Authority

Regulatory review

CNE, Antitrust and Government evaluations Regulatory suspension lifted

Spanish Tender Offer

CNMV approval Tender Offer period

Gas Natural EGM approves capital increase

US registration / Tender Offer

Announcement

US shareholders receive offer document Tender Offer period

7

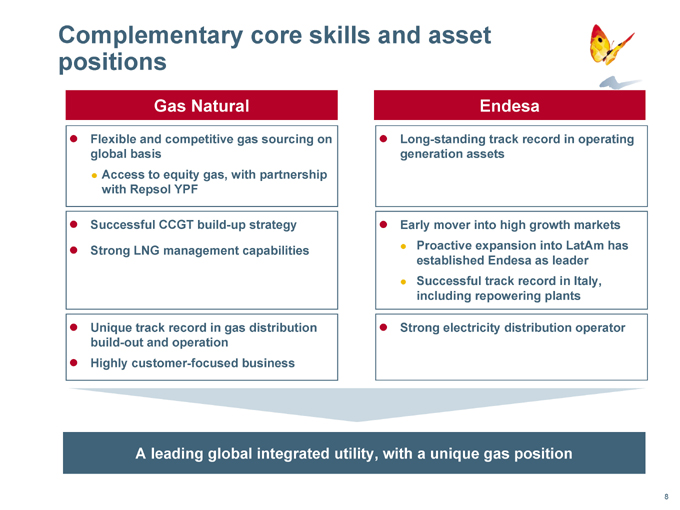

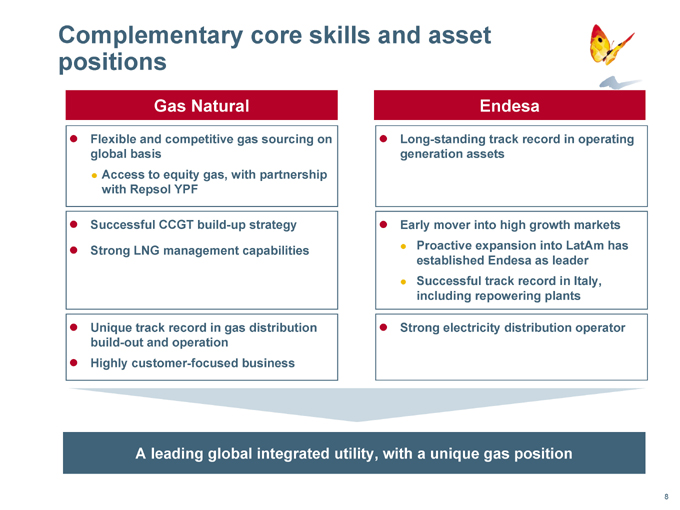

Complementary core skills and asset positions

Gas Natural

Flexible and competitive gas sourcing on global basis

Access to equity gas, with partnership with Repsol YPF

Successful CCGT build-up strategy

Strong LNG management capabilities

Unique track record in gas distribution build-out and operation Highly customer-focused business

Endesa

Long-standing track record in operating generation assets

Early mover into high growth markets

Proactive expansion into LatAm has established Endesa as leader Successful track record in Italy, including repowering plants

Strong electricity distribution operator

A leading global integrated utility, with a unique gas position

8

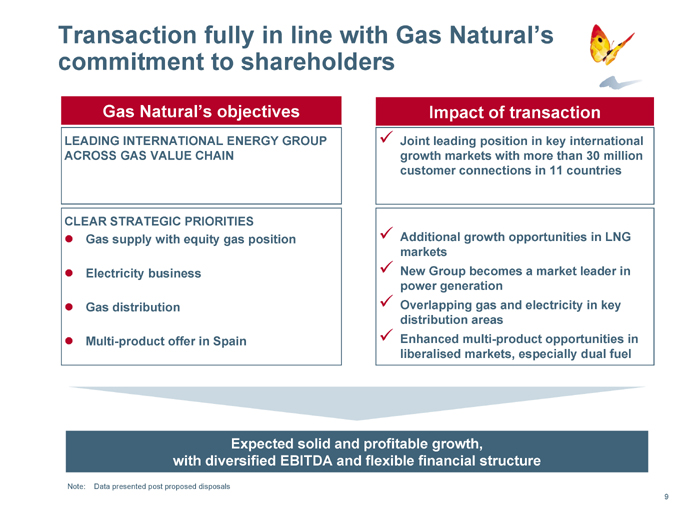

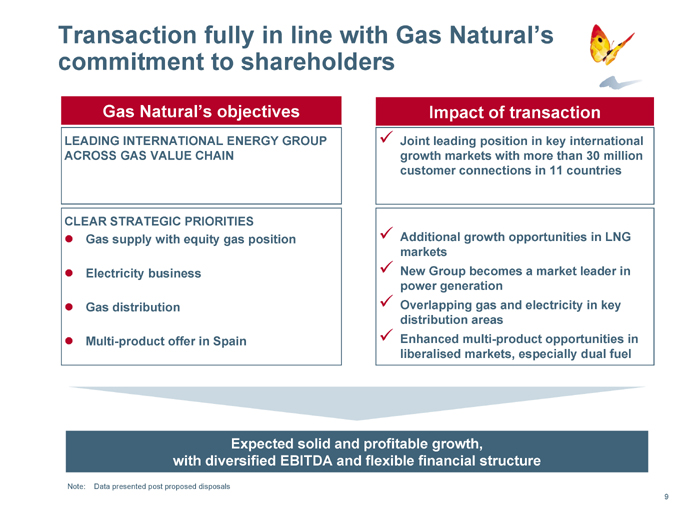

Transaction fully in line with Gas Natural’s commitment to shareholders

Gas Natural’s objectives

LEADING INTERNATIONAL ENERGY GROUP ACROSS GAS VALUE CHAIN

CLEAR STRATEGIC PRIORITIES

Gas supply with equity gas position Electricity business Gas distribution Multi-product offer in Spain

Impact of transaction

Joint leading position in key international growth markets with more than 30 million customer connections in 11 countries

Additional growth opportunities in LNG markets New Group becomes a market leader in power generation Overlapping gas and electricity in key distribution areas Enhanced multi-product opportunities in liberalised markets, especially dual fuel

Expected solid and profitable growth, with diversified EBITDA and flexible financial structure

Note: Data presented post proposed disposals

9

Creating a leading, fully integrated global energy company

Transaction overview

Transaction benefits

Combined company position

Financial overview

Conclusions

10

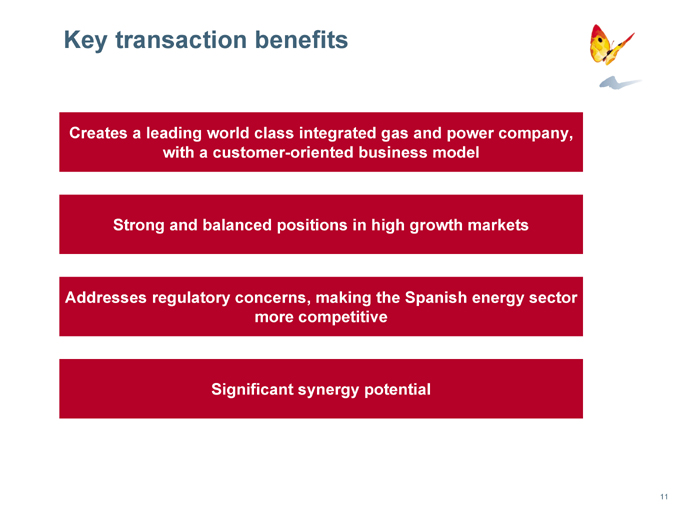

Key transaction benefits

Creates a leading world class integrated gas and power company, with a customer-oriented business model

Strong and balanced positions in high growth markets

Addresses regulatory concerns, making the Spanish energy sector more competitive

Significant synergy potential

11

A global leader in the energy sector

Combined market positions

No.1

Electricity and gas in Spain1

No.1

Electricity and gas in LatAm

No.3

Global LNG supply

No.3

Global customer connections2

Global utilities – ranking by customer connections2

(m)

40 30 20 10 0

33.5

Enel

32.9

E.ON

31.2

New Group

31.0

RWE

27.7

Tokyo Electric

15.2

GDF

Note:

1 By customers, post proposed disposals

2 Post proposed disposals; listed companies only, presented on consolidated basis; includes only gas and electricity customers; Source: Company estimates

12

An integrated, customer-oriented business model

Upstream

Complementarity

Integration of positions in upstream/midstream with generation, and distribution/supply Improve quality of service

Midstream

Pipelines Fleet

Power generation and gas supply

Distribution

Wholesale

/ Energy

Management

Complementarity

Trading and risk management skills Physical backing in fuels, production and wholesale

Retail

GLOBAL CUSTOMER BASE

13

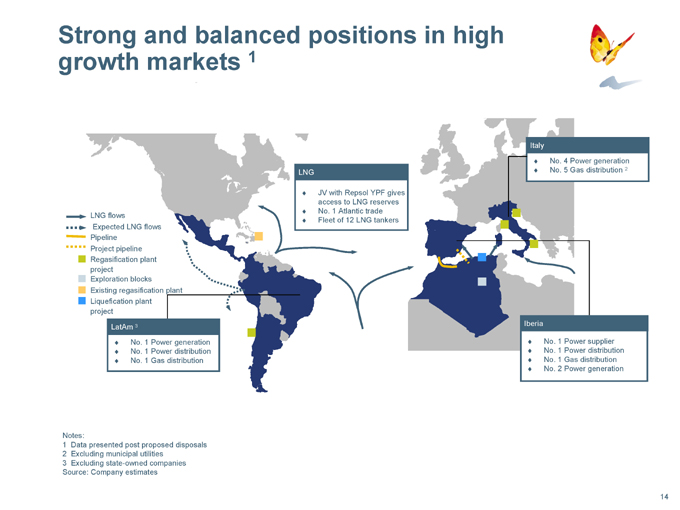

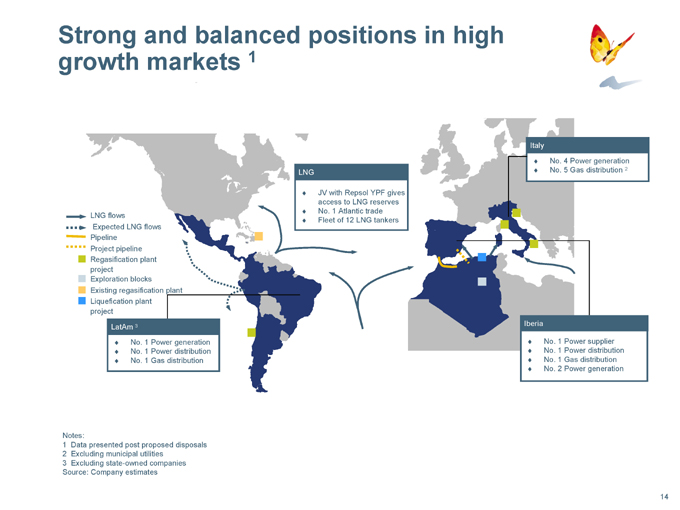

Strong and balanced positions in high growth markets 1

LNG flows

Expected LNG flows Pipeline Project pipeline Regasification plant project Exploration blocks Existing regasification plant Liquefication plant project

LNG

JV with Repsol YPF gives access to LNG reserves No. 1 Atlantic trade Fleet of 12 LNG tankers

Italy

No. 4 Power generation No. 5 Gas distribution 2

LatAm 3

No. 1 Power generation No. 1 Power distribution No. 1 Gas distribution

Iberia

No. 1 Power supplier No. 1 Power distribution No. 1 Gas distribution No. 2 Power generation

Notes:

1 Data presented post proposed disposals

2 Excluding municipal utilities

3 Excluding state-owned companies Source: Company estimates

14

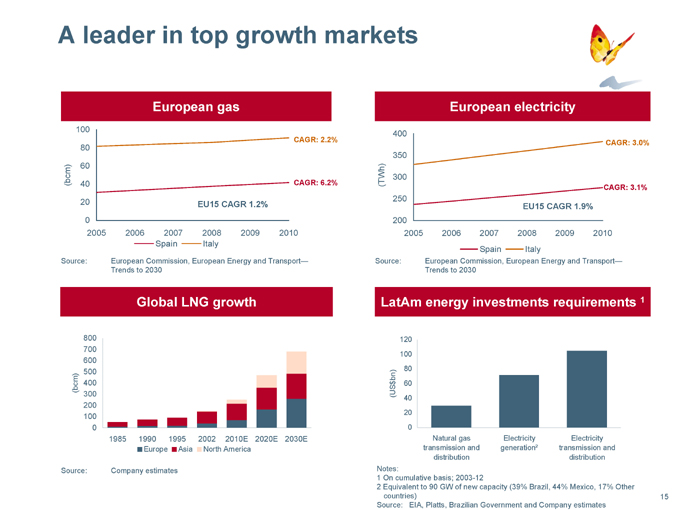

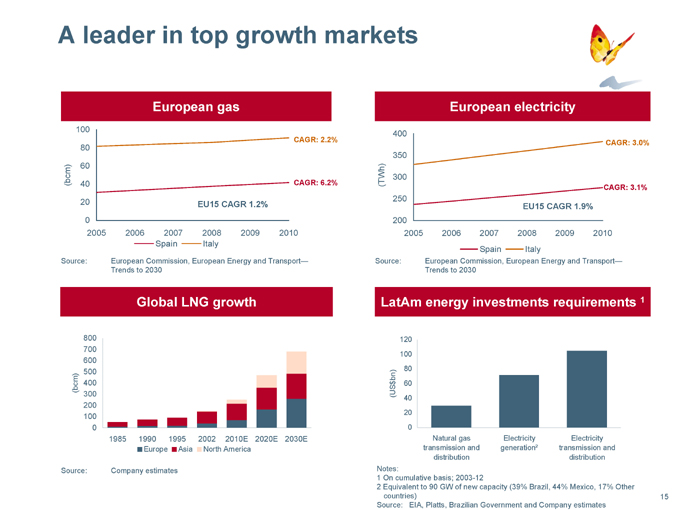

A leader in top growth markets

European gas

(bcm)

100 80 60 40 20 0

CAGR: 2.2%

CAGR: 6.2%

EU15 CAGR 1.2%

2005 2006 2007 2008 2009 2010

Spain

Italy

Source: European Commission, European Energy and Transport—Trends to 2030

European electricity

(TWh)

400 350 300 250 200

CAGR: 3.0%

CAGR: 3.1%

EU15 CAGR 1.9%

2005 2006 2007 2008 2009 2010

Spain

Italy

Source: European Commission, European Energy and Transport—Trends to 2030

Global LNG growth

(bcm)

800 700 600 500 400 300 200 100 0

1985 1990 1995 2002 2010E 2020E 2030E

Europe

Asia

North America

Source: Company estimates

LatAm energy investments requirements 1

(US$bn)

120 100 80 60 40 20 0

Natural gas transmission and distribution

Electricity generation²

Electricity transmission and distribution

Notes:

1 On cumulative basis; 2003-12

2 Equivalent to 90 GW of new capacity (39% Brazil, 44% Mexico, 17% Other countries) Source: EIA, Platts, Brazilian Government and Company estimates

15

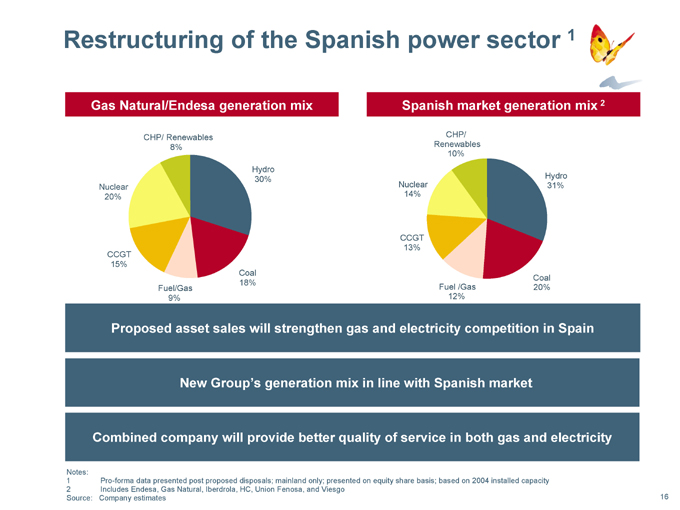

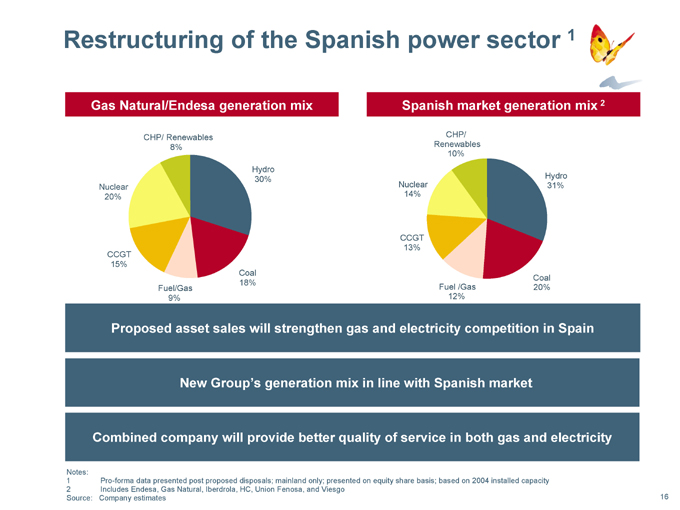

Restructuring of the Spanish power sector 1

Gas Natural/Endesa generation mix

CHP/ Renewables 8%

Nuclear 20%

CCGT 15%

Fuel/Gas 9%

Coal 18%

Hydro 30%

Spanish market generation mix 2

CHP/ Renewables 10%

Nuclear 14%

CCGT 13%

Fuel /Gas 12%

Coal 20%

Hydro 31%

Proposed asset sales will strengthen gas and electricity competition in Spain

New Group’s generation mix in line with Spanish market

Combined company will provide better quality of service in both gas and electricity

Notes:

1 Pro-forma data presented post proposed disposals; mainland only; presented on equity share basis; based on 2004 installed capacity

2 Includes Endesa, Gas Natural, Iberdrola, HC, Union Fenosa, and Viesgo Source: Company estimates

16

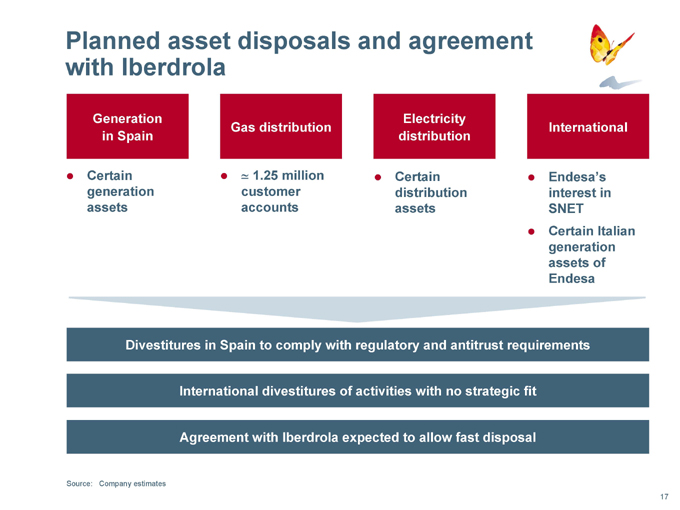

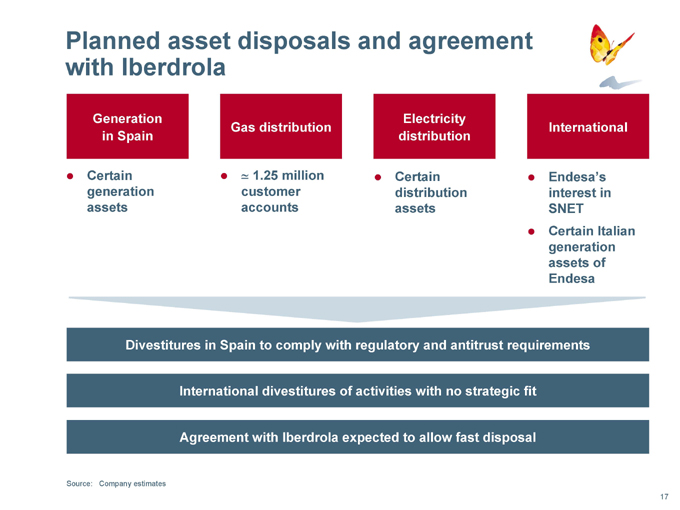

Planned asset disposals and agreement with Iberdrola

Generation in Spain

Certain generation assets

Gas distribution

= 1.25 million customer accounts

Electricity distribution

Certain distribution assets

International

Endesa’s interest in SNET Certain Italian assets of Endesa

Divestitures in Spain to comply with regulatory and antitrust requirements

International divestitures of activities with no strategic fit

Agreement with Iberdrola expected to allow fast disposal

Source: Company estimates

17

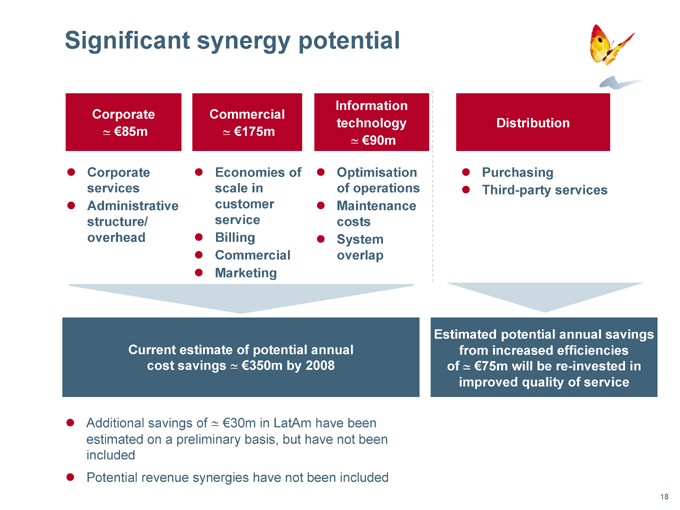

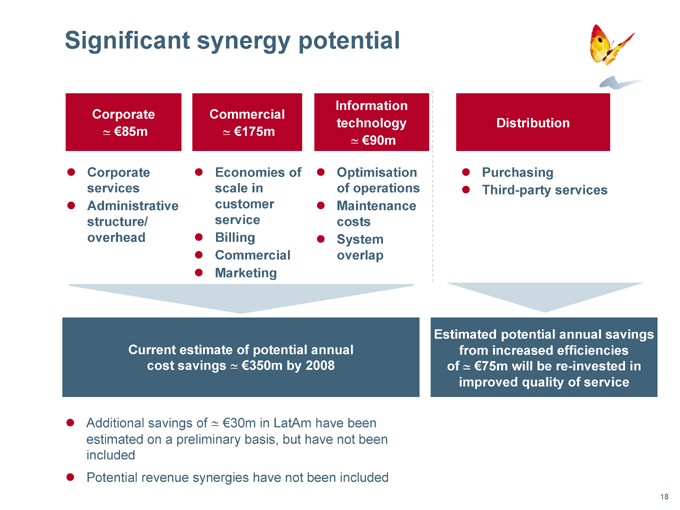

Significant synergy potential

Corporate

€85m

Corporate services Administrative structure/ overhead

Commercial

€175m

Economies of scale in customer service Billing Commercial Marketing

Information technology

€90m

Optimisation of operations Maintenance costs System overlap

Distribution

Purchasing

Third-party services

Current estimate of potential annual cost savings = €350m by 2008

Estimated potential annual savings from increased efficiencies of = €75m will be re-invested in improved quality of service

Additional savings of €30m in LatAm have been estimated on a preliminary basis, but have not been included Potential revenue synergies have not been included

18

Creating a leading, fully integrated global energy company

Transaction overview

Transaction benefits

Combined company position

Financial overview

Conclusions

19

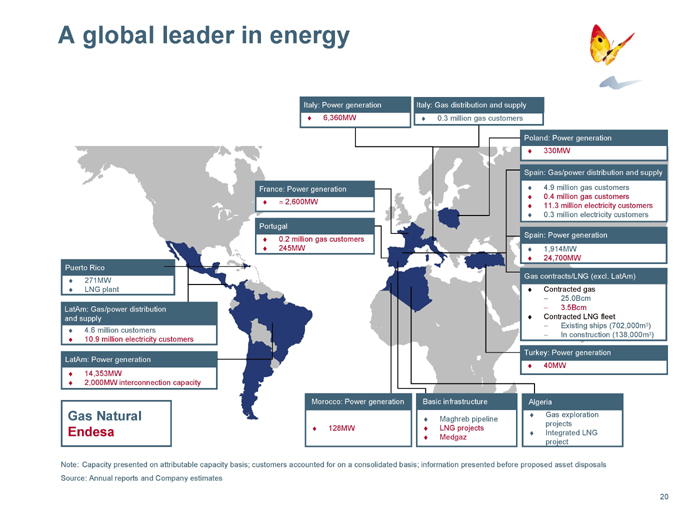

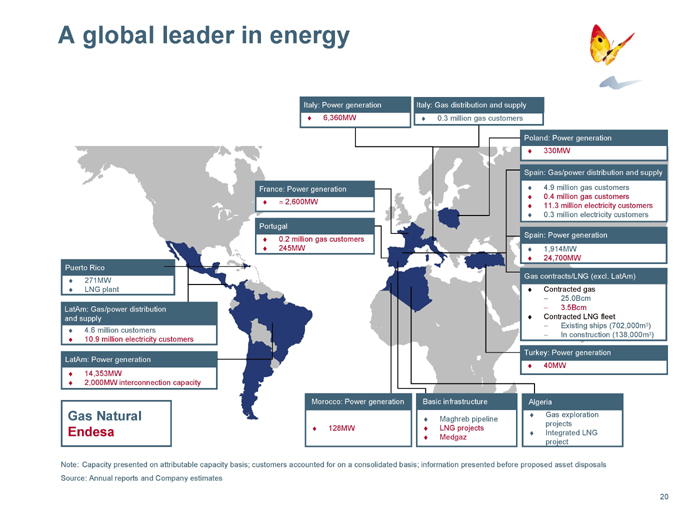

A global leader in energy

Italy: Power generation

= 3,800MW

Italy: Gas distribution and supply

Poland: Power generation

330 MW

Turkey: Power generation

40 MW

0.3 million gas customers

Portugal

0.2 million gas customers 245MW

Puerto Rico

271MW LNG plant

LatAm: Gas/power distribution and supply

4.6 million customers

10.9 million electricity customers

LatAm: Power generation

14,353MW

2,000MW interconnection capacity

Gas Natural Endesa

Spain: Gas/power distribution and supply

= 3.7 million gas customers

= 0.4 million gas customers

= 10.8 million electricity customers 0.3 million electricity customers

Spain: Power generation

1,914MW

= 20,100MW

Gas contracts/LNG (excl. LatAm)

Contracted gas

25.0Bcm 3.5Bcm

Contracted LNG fleet

Existing ships (702,000m3) In construction (138,000m3)

Morocco: Power generation

128MW

Basic infrastructure

Maghreb pipeline Medgaz

Algeria

Gas exploration projects Integrated LNG project

Note: Capacity presented on attributable capacity basis; customers accounted for on a consolidated basis; information presented before proposed asset disposals Source: Annual reports and Company estimates

20

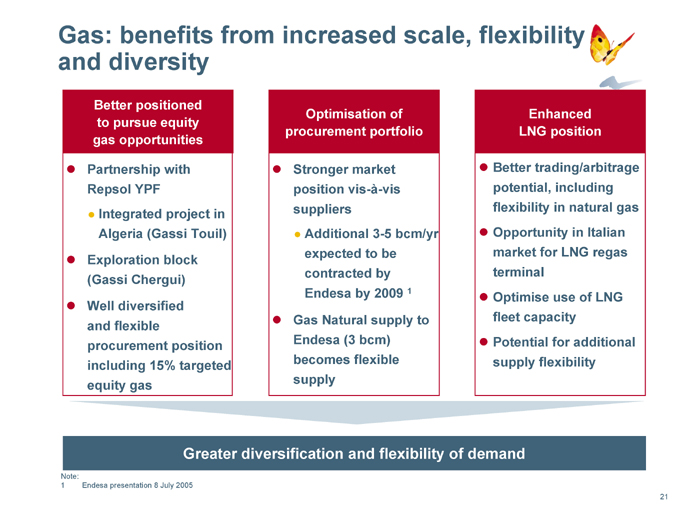

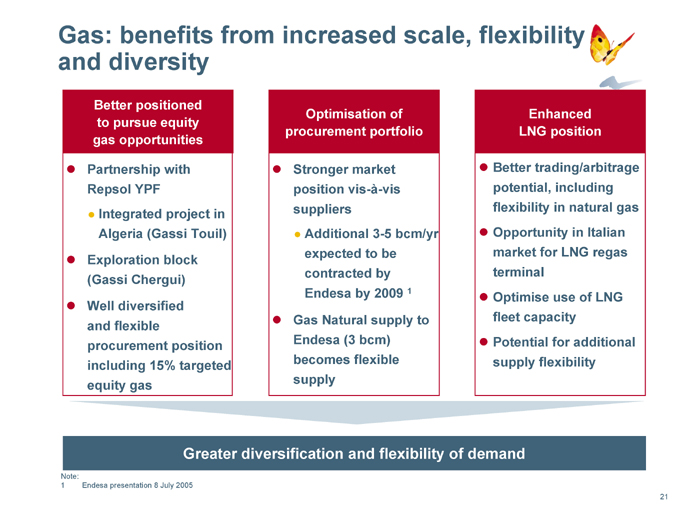

Gas: benefits from increased scale, flexibility and diversity

Better positioned to pursue equity gas opportunities

Partnership with Repsol YPF

Integrated project in Algeria (Gassi Touil)

Exploration block (Gassi Chergui) Well diversified and flexible procurement position including 15% targeted equity gas

Optimisation of procurement portfolio

Stronger market position vis-à-vis suppliers Gas

Additional 3-5 bcm/yr expected to be contracted by Endesa by 2009 1

Gas Natural supply to Endesa (3 bcm) becomes flexible supply

Enhanced LNG position

Better trading/arbitrage potential, including flexibility in natural gas Opportunity in Italian market for LNG regas terminal Optimise use of LNG fleet capacity Potential for additional supply flexibility

Greater diversification and flexibility of demand

Note:

1 Endesa presentation 8 July 2005

21

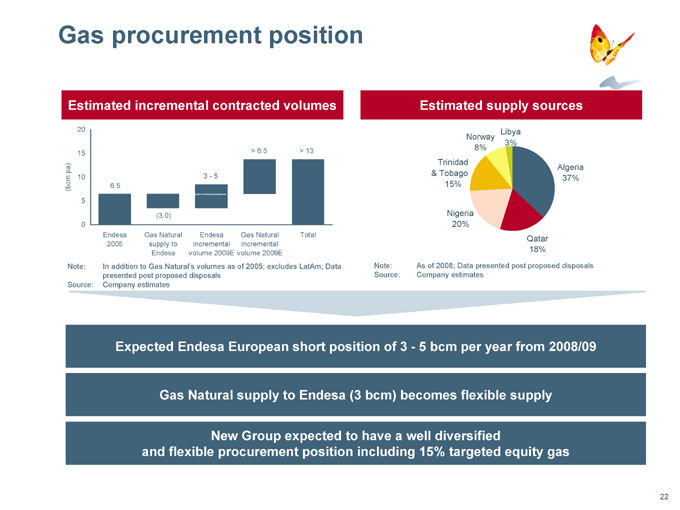

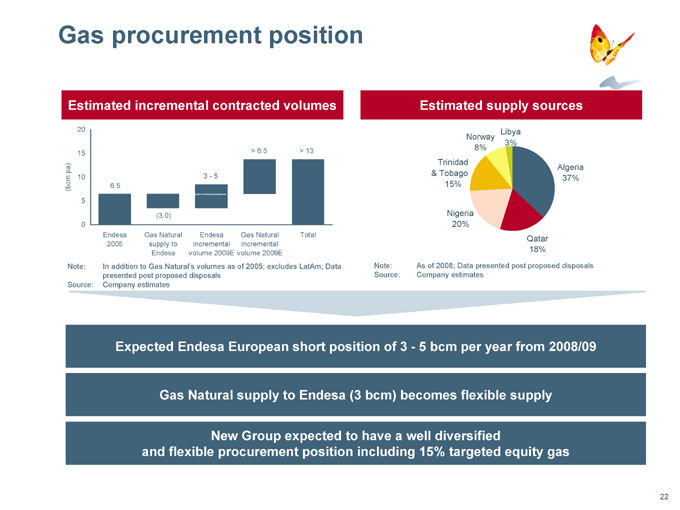

Gas procurement position

Estimated incremental contracted volumes

(bcm pa)

20 15 10 5 0

6.5

(3.0)

3—5

> 6.5

> 13

Endesa 2005

Gas Natural supply to Endesa

Endesa incremental volume 2009E

Gas Natural incremental volume 2009E

Total

Note: In addition to Gas Natural’s volumes as of 2005; excludes LatAm; Data presented post proposed disposals Source: Company estimates

Estimated supply sources

Norway 8%

Libya 3%

Trinidad & Tobago 15%

Nigeria 20%

Algeria 37%

Qatar 18%

Note: As of 2008; Data presented post proposed disposals Source: Company estimates

Expected Endesa European short position of 3—5 bcm per year from 2008/09

Gas Natural supply to Endesa (3 bcm) becomes flexible supply

New Group expected to have a well diversified and flexible procurement position including 15% targeted equity gas

22

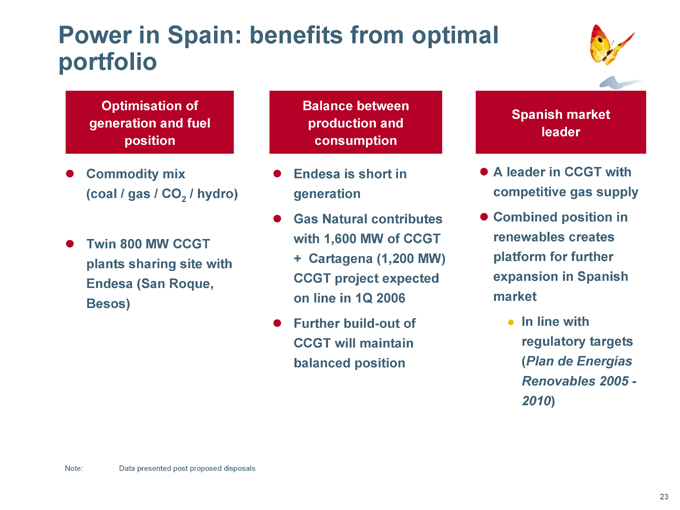

Power in Spain: benefits from optimal portfolio

Optimisation of generation and fuel position

Commodity mix

(coal / gas / CO2 / hydro)

Twin 800 MW CCGT plants sharing site with Endesa (San Roque, Besos)

Balance between production and consumption

Endesa is short in generation

Gas

Gas Natural contributes with 1,600 MW of CCGT

+ Cartagena (1,200 MW) CCGT project expected on line in 1Q 2006 Further build-out of CCGT will maintain balanced position

Spanish market leader

A leader in CCGT with competitive gas supply Combined position in renewables creates platform for further expansion in Spanish market

In line with regulatory targets (Plan de Energías Renovables 2005 -2010)

Note: Data presented post proposed disposals

23

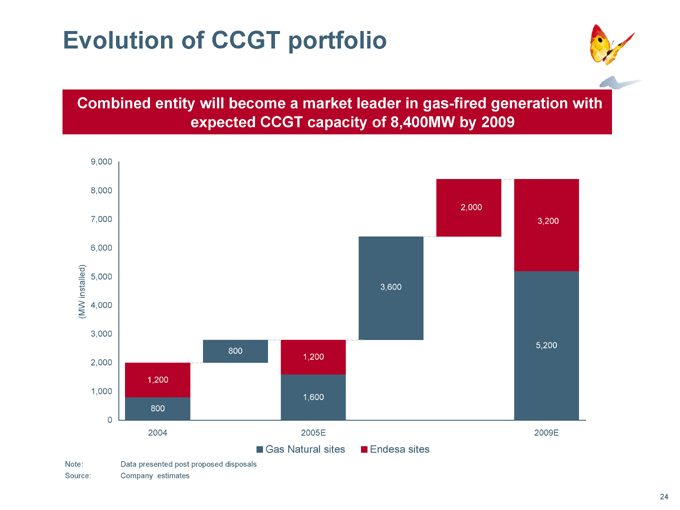

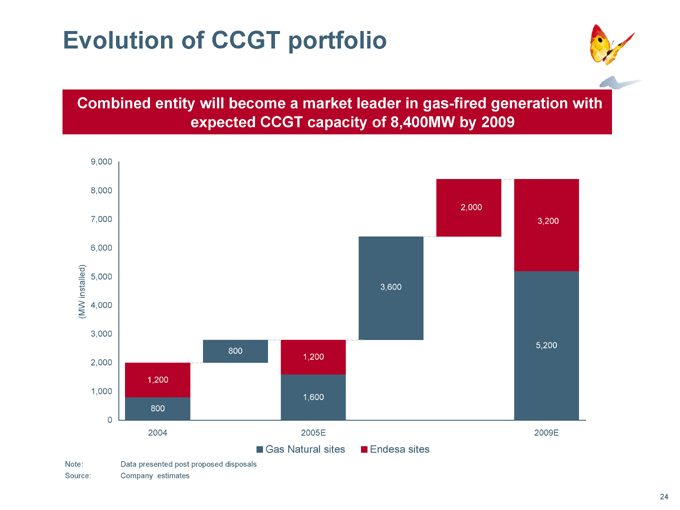

Evolution of CCGT portfolio

Combined entity will become a market leader in gas-fired generation with expected CCGT capacity of 8,400MW by 2009

(MW installed)

9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0

1,200

800

800

1,200

1,600

3,600

2,000

3,200

5,200

2004 2005E 2009E

Gas Natural sites

Endesa sites

Note: Data presented post proposed disposals Source: Company estimates

24

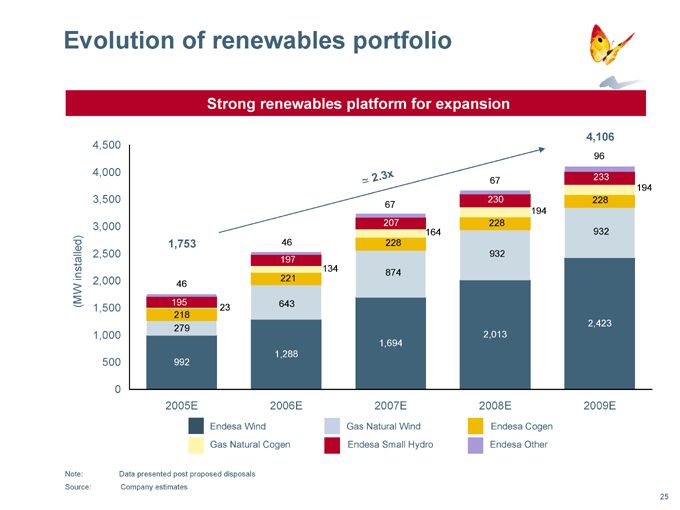

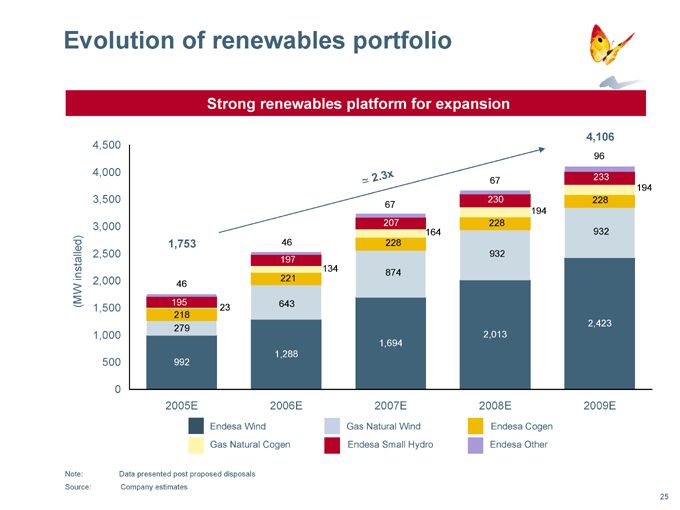

Evolution of renewables portfolio

Strong renewables platform for expansion

(MW installed)

4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0

= 2 .3x

1,753

46 195 218 279

992

23

46 197 221

643

1,288

134

67 207

228

874

1,694

164

67 230

228

932

2,013

194

4,106

96 233 228

932

2,423

194

2005E 2006E 2007E 2008E 2009E

Endesa Wind Gas Natural Cogen

Gas Natural Wind Endesa Small Hydro

Endesa Cogen Endesa Other

Note: Data presented post proposed disposals Source: Company estimates

25

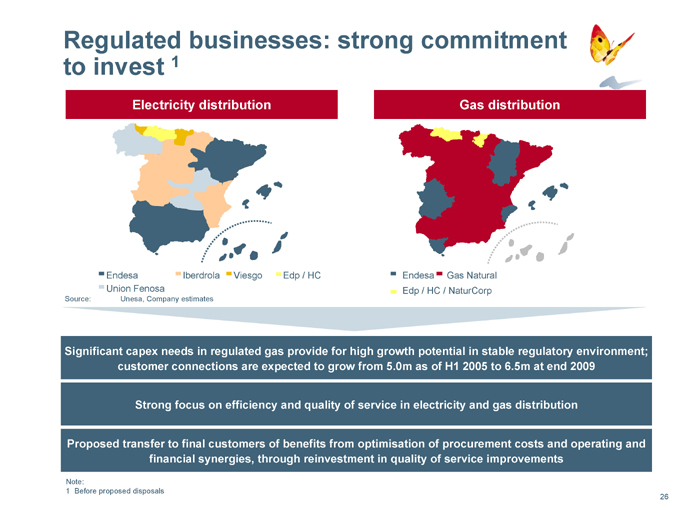

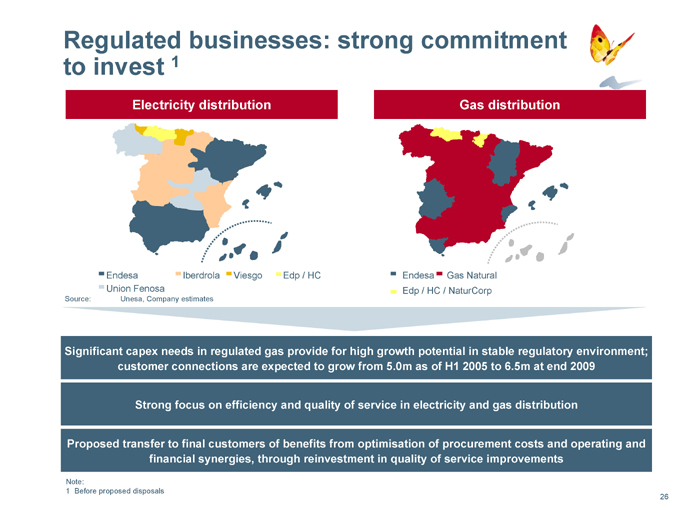

Regulated businesses: strong commitment to invest 1

Electricity distribution

Endesa Union Fenosa

Iberdrola

Viesgo

Edp / HC

Source: Unesa, Company estimates

Gas distribution

Endesa

Gas Natural

Edp / HC / NaturCorp

Significant capex needs in regulated gas provide for high growth potential in stable regulatory environment; customer connections are expected to grow from 5.0m as of H1 2005 to 6.5m at end 2009

Strong focus on efficiency and quality of service in electricity and gas distribution

Proposed transfer to final customers of benefits from optimisation of procurement costs and operating and financial synergies, through reinvestment in quality of service improvements

Note:

1 Before proposed disposals

26

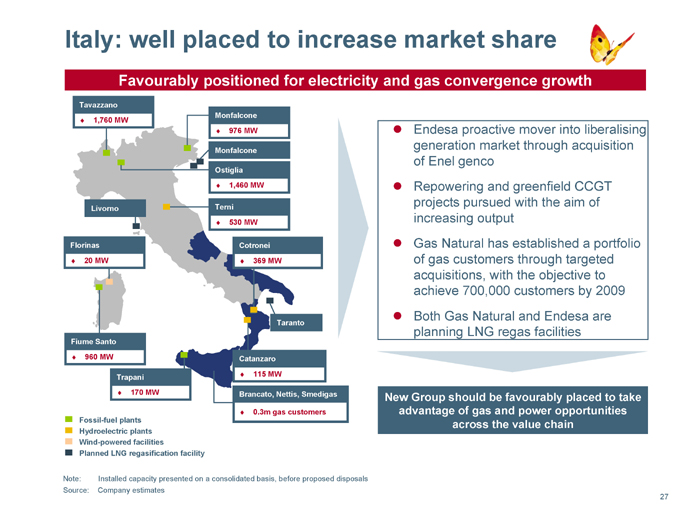

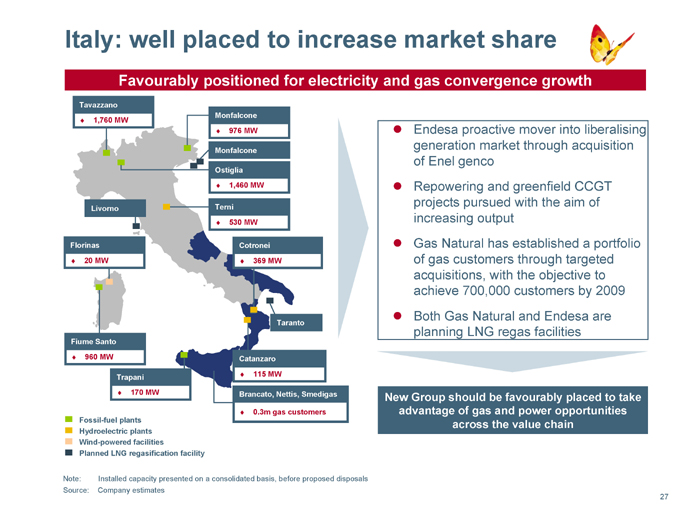

Italy: well placed to increase market share

Favourably positioned for electricity and gas convergence growth

Tavazzano

1,760 MW

Monfalcone

976 MW

Monfalcone

Ostiglia

1,460 MW

Terni

530 MW

Livorno

Florinas

20 MW

Cotronei

369 MW

Fiume Santo

960 MW

Taranto

Catanzaro

115 MW

Trapani

170 MW

Brancato, Nettis, Smedigas

0.3m gas customers

Fossil-fuel plants Hydroelectric plants Wind-powered facilities

Planned LNG regasification facility

Note: Installed capacity presented on a consolidated basis, before proposed disposals Source: Company estimates

Endesa proactive mover into liberalising generation market through acquisition of Enel genco Repowering and greenfield CCGT projects pursued with the aim of increasing output Gas Natural has established a portfolio of gas customers through targeted acquisitions, with the objective to achieve 700,000 customers by 2009 Both Gas Natural and Endesa are planning LNG regas facilities

New Group should be favourably placed to take advantage of gas and power opportunities across the value chain

27

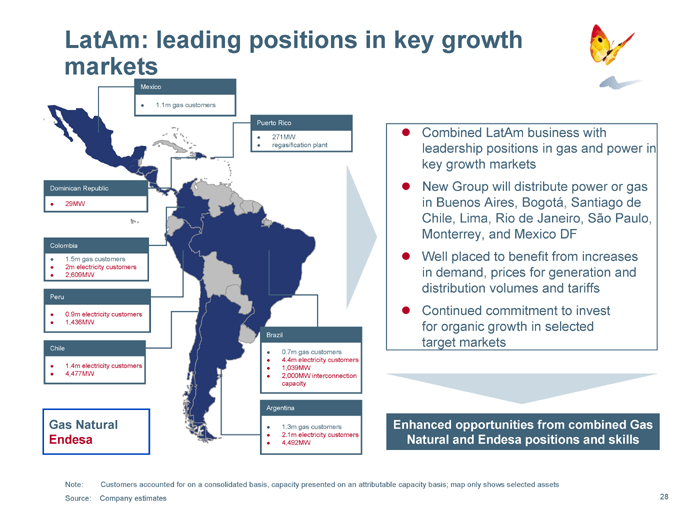

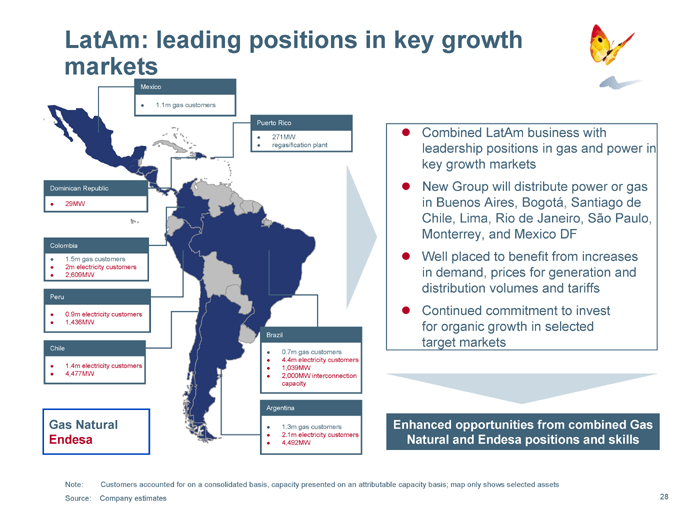

LatAm: leading positions in key growth markets

Mexico

1.1m gas customers

Puerto Rico

271MW regasification plant

Dominican Republic

29MW

Colombia

1.5m gas customers 2m electricity customers 2,609MW

Peru

0.9m electricity customers 1,436MW

Chile

1.4m electricity customers 4,477MW

Gas Natural Endesa

Brazil

0.7m gas customers 4.4m electricity customers 1,039MW

2,000MW interconnection capacity

Argentina

1.3m gas customers 2.1m electricity customers 4,492MW

Combined LatAm business with leadership positions in gas and power in key growth markets New Group will distribute power or gas in Buenos Aires, Bogotá, Santiago de Chile, Lima, Rio de Janeiro, São Paulo, Monterrey, and Mexico DF

Well placed to benefit from increases in demand, prices for generation and distribution volumes and tariffs Continued commitment to invest for organic growth in selected target markets

Enhanced opportunities from combined Gas Natural and Endesa positions and skills

Note: Customers accounted for on a consolidated basis, capacity presented on an attributable capacity basis; map only shows selected assets Source: Company estimates

28

Creating a leading, fully integrated global energy company

Transaction overview

Transaction benefits

Combined company position

Financial overview

Conclusions

29

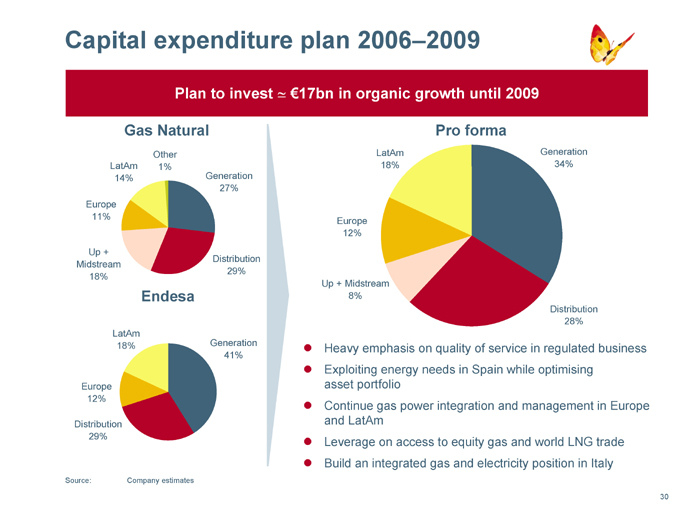

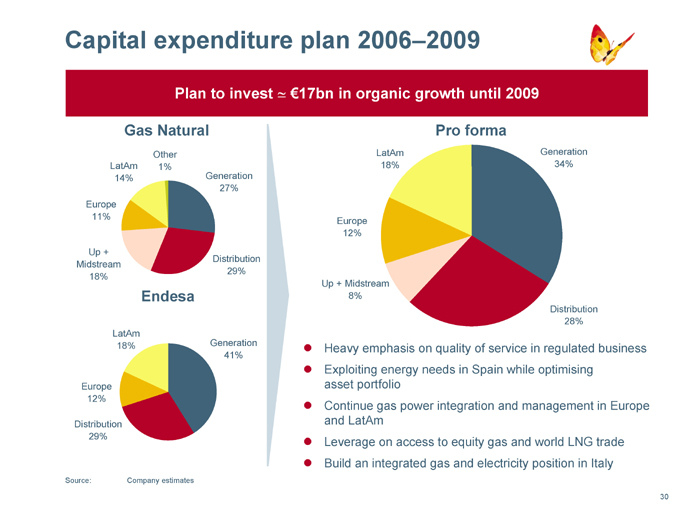

Capital expenditure plan 2006–2009

Plan to invest = €17bn in organic growth until 2009

Gas Natural

Other 1%

LatAm 14%

Europe 11%

Up + Midstream 18%

Generation 27%

Distribution 29%

Pro forma

LatAm 18%

Europe 12%

Up + Midstream 8%

Generation 34%

Distribution 28%

Endesa

LatAm 18%

Europe 12%

Distribution 29%

Generation 41%

Source:

Company estimates

Heavy emphasis on quality of service in regulated business

Exploiting energy needs in Spain while optimising asset portfolio

Continue gas power integration and management in Europe and LatAm

Leverage on access to equity gas and world LNG trade

Build an integrated gas and electricity position in Italy

30

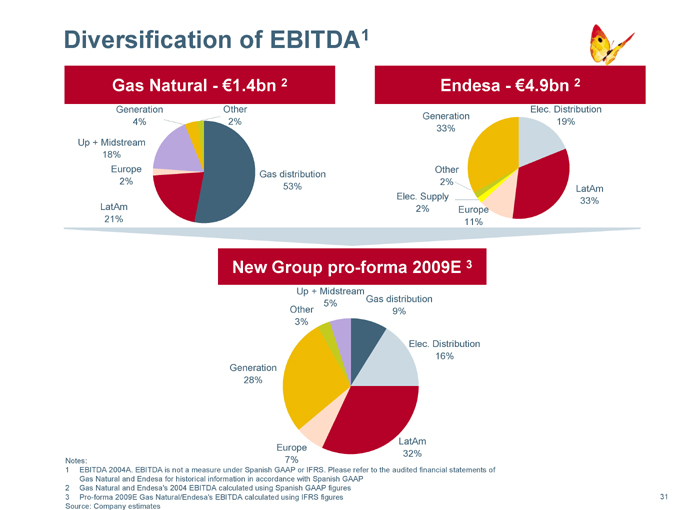

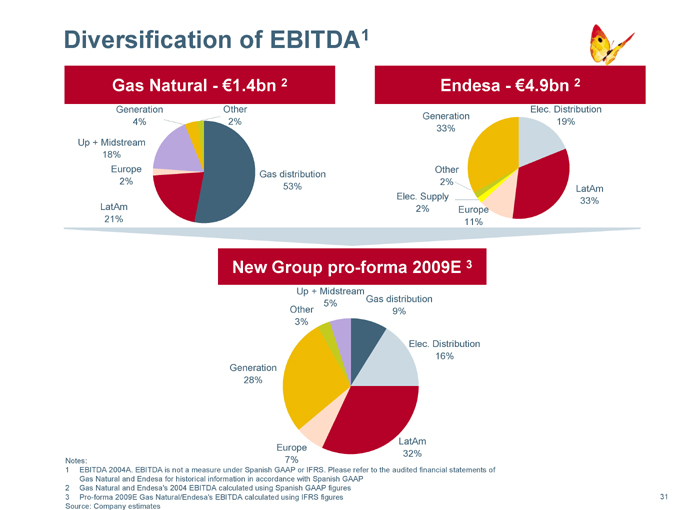

Diversification of EBITDA1

Gas Natural—€1.4bn 2

Generation 4%

Up + Midstream 18% Europe 2%

LatAm 21%

Other 2%

Gas distribution 53%

Endesa—€4.9bn 2

Generation 33%

Elec. Distribution 19%

LatAm 33%

Europe 11%

Elec. Supply 2%

Other 2%

New Group pro-forma 2009E 3

Up + Midstream 5% Other 3%

Gas distribution 9%

Elec. Distribution 16%

Generation 28%

Europe 7%

LatAm 32%

Notes:

1 EBITDA 2004A. EBITDA is not a measure under Spanish GAAP or IFRS. Please refer to the audited financial statements of Gas Natural and Endesa for historical information in accordance with Spanish GAAP

2 Gas Natural and Endesa’s 2004 EBITDA calculated using Spanish GAAP figures

3 Pro-forma 2009E Gas Natural/Endesa’s EBITDA calculated using IFRS figures Source: Company estimates

31

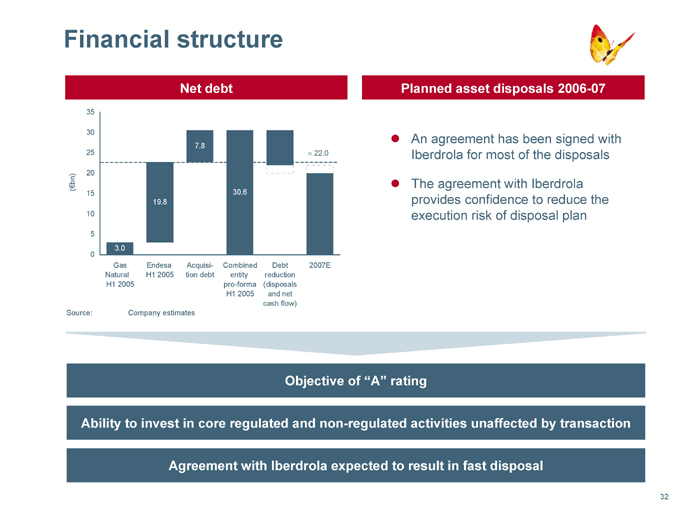

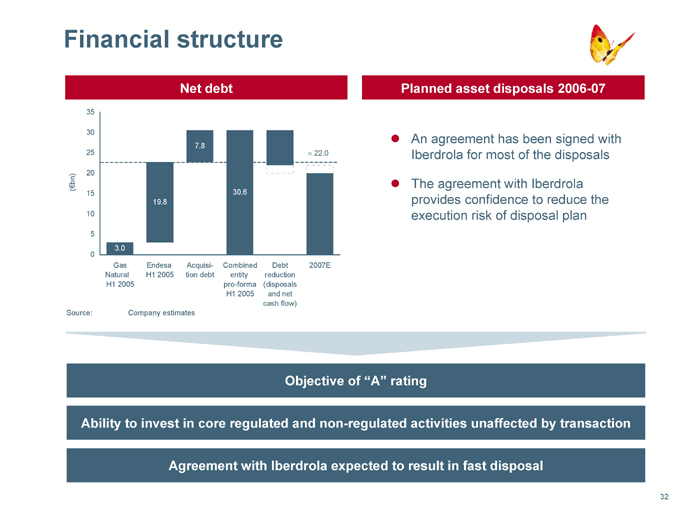

Financial structure

Net debt

(€bn)

35

30

25

20

15

10

5

0

3.0

19.8

7.8

30.6

= 22.0

Gas Natural H1 2005

Endesa H1 2005

Acquisition debt

Combined entity pro-forma H1 2005

Debt reduction (disposals and net cash flow)

2007E

Source: Company estimates

Planned asset disposals 2006-07

An agreement has been signed with Iberdrola for most of the disposals

The agreement with Iberdrola provides confidence to reduce the execution risk of disposal plan

Objective of “A” rating

Ability to invest in core regulated and non-regulated activities unaffected by transaction

Agreement with Iberdrola expected to result in fast disposal

32

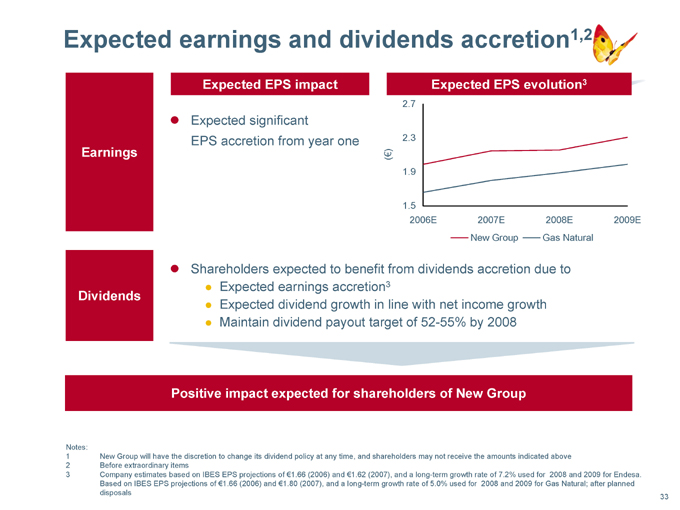

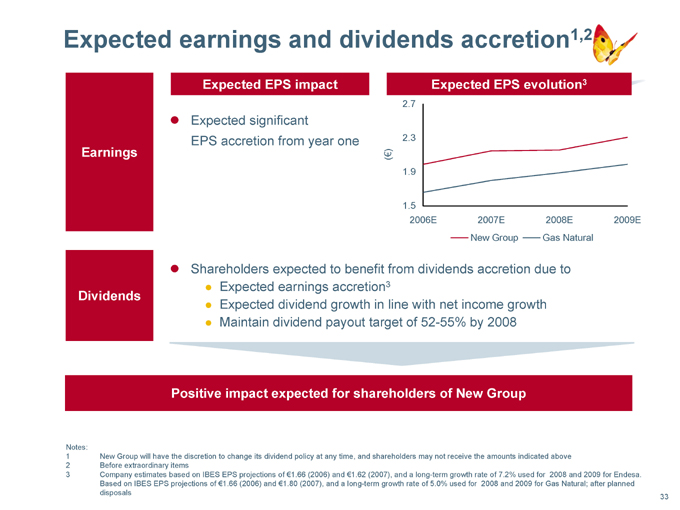

Expected earnings and dividends accretion1,2

Earnings

Dividends

Expected EPS impact

Expected significant

EPS accretion from year one

Shareholders expected to benefit from dividends accretion due to

Expected earnings accretion3

Expected dividend growth in line with net income growth Maintain dividend payout target of 52-55% by 2008

Expected EPS evolution3

(€)

2.7 2.3 1.9 1.5

2006E 2007E 2008E 2009E

New Group Gas Natural

Positive impact expected for shareholders of New Group

Notes:

1 New Group will have the discretion to change its dividend policy at any time, and shareholders may not receive the amounts indicated above

2 Before extraordinary items

3 Company estimates based on IBES EPS projections of €1.66 (2006) and €1.62 (2007), and a long-term growth rate of 7.2% used for 2008 and 2009 for Endesa. Based on IBES EPS projections of €1.66 (2006) and €1.80 (2007), and a long-term growth rate of 5.0% used for 2008 and 2009 for Gas Natural; after planned disposals

33

Creating a leading, fully integrated global energy company

Transaction overview

Transaction benefits

Combined company position

Financial overview

Conclusions

34

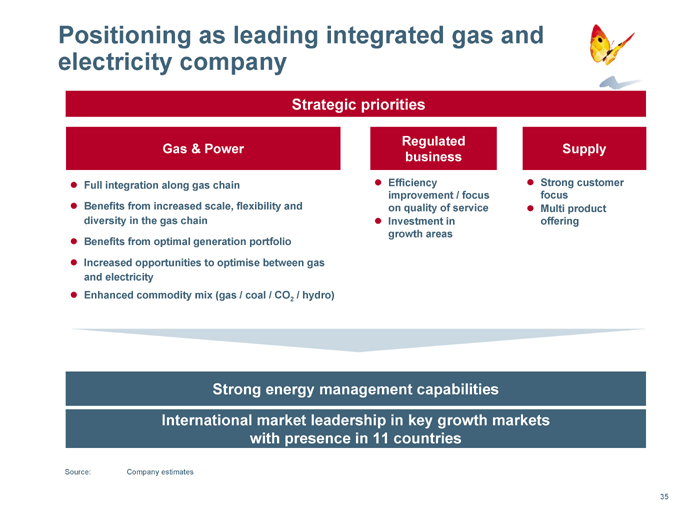

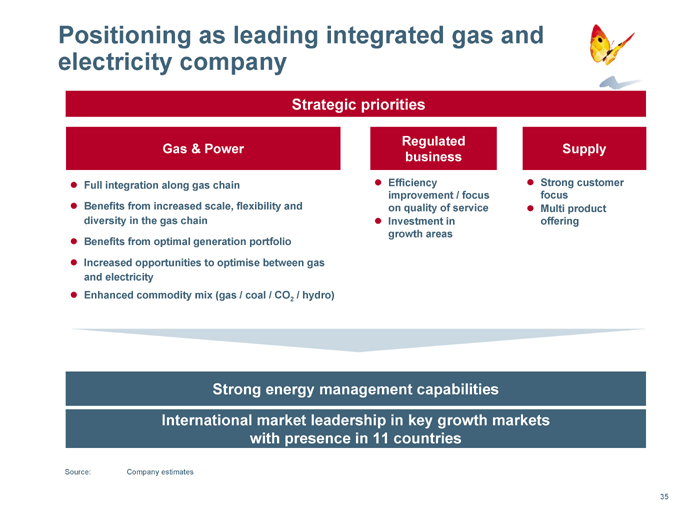

Positioning as leading integrated gas and electricity company

Strategic priorities

Gas & Power

Full integration along gas chain

Benefits from increased scale, flexibility and diversity in the gas chain Benefits from optimal generation portfolio Increased opportunities to optimise between gas and electricity

Enhanced commodity mix (gas / coal / CO2 / hydro)

Regulated business

Efficiency improvement / focus on quality of service Investment in growth areas

Supply

Strong customer focus Multi product offering

Strong energy management capabilities

International market leadership in key growth markets with presence in 11 countries

Source: Company estimates

35

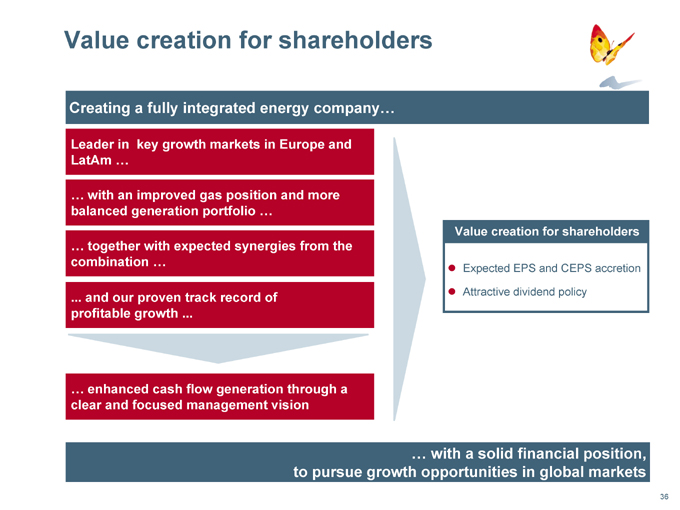

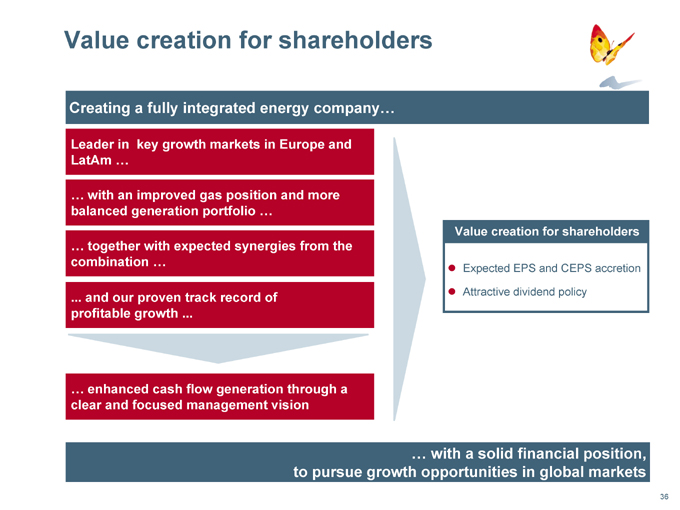

Value creation for shareholders

Creating a fully integrated energy company…

Leader in key growth markets in Europe and LatAm …

… with an improved gas position and more balanced generation portfolio …

… together with expected synergies from the combination …

... and our proven track record of profitable growth

… enhanced cash flow generation through a clear and focused management vision

Value creation for shareholders

Expected EPS and CEPS accretion

Attractive dividend policy

… with a solid financial position, to pursue growth opportunities in global markets

36