Filed by Gas Natural SDG, S.A. pursuant to

Rule 425 of the Securities Act of 1933

Subject Company: Endesa, S.A.

Commission File No.: 333-07654

This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The exchange offer will commence only (1) following approval of a final offer document by the SpanishComisión Nacional del Mercado de Valores (CNMV) and publication thereof and (2) on or after the date on which Gas Natural SDG, S.A. (Gas Natural) files a Registration Statement on Form F-4 with the U.S. Securities and Exchange Commission (SEC) relating to the exchange offer.

Investors in ordinary shares of Endesa, S.A. (Endesa) should not subscribe for any securities referred to herein except on the basis of the final approved and published offer document that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004. Investors and security holders may obtain a free copy of such final offer document (once it is approved and published) at the registered offices of Gas Natural, Endesa, the CNMV or the Spanish Stock Exchanges.

Investors in American Depositary Shares of Endesa and U.S. holders of ordinary shares of Endesa are urged to read the U.S. prospectus and tender offer statement regarding the exchange offer, when it becomes available, because it will contain important information. The U.S. prospectus and tender offer statement will be filed with the SEC as part of its Registration Statement on Form F-4. Investors and security holders may obtain a free copy of the U.S. prospectus and tender offer statement (when available) and other documents filed by Gas Natural with the SEC at the SEC’s website at www.sec.gov. A free copy of the U.S. prospectus and tender offer statement (when available) may also be obtained for free from Gas Natural.

These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements may relate to, among other things:

| | • | | synergies and cost savings; |

| | • | | integration of the businesses; |

| | • | | expected gas and electricity mix and volume increases; |

| | • | | planned asset disposals and capital expenditures; |

| | • | | net debt levels and EBITDA and earnings per share growth; |

2

| | • | | timing and benefits of the offer and the combined company. |

These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding-looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition.

Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions.

These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information.

This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited.

* * *

The following is a communication issued by Gas Natural SDG, S.A. containing additional information regarding the proposed disposal of certain assets to Iberdrola, S.A. in connection with the offer by Gas Natural SDG for 100% of the share capital of Endesa.

Gas Natural-Iberdrola Agreement

The agreement relates to the sale of certain assets or shareholdings, which is subject to certain authorizations

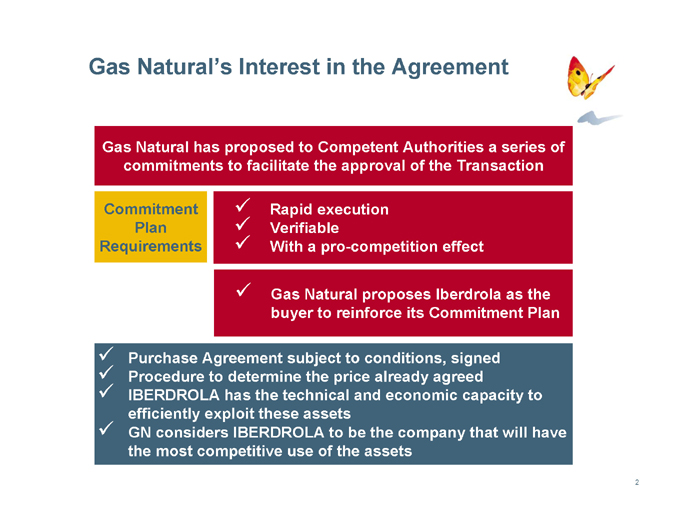

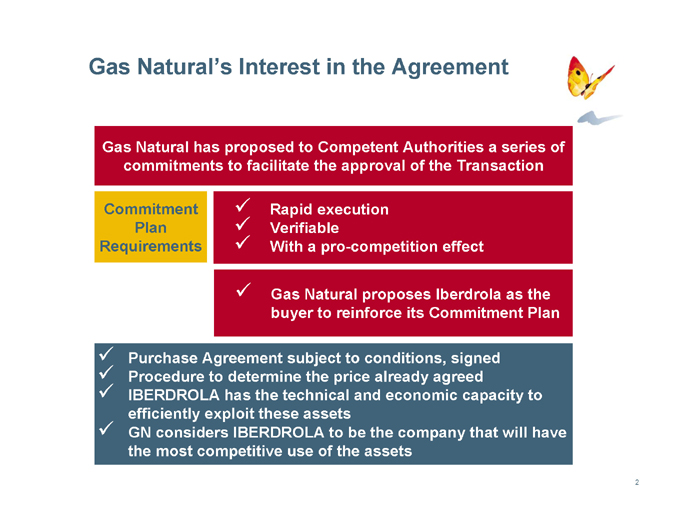

Gas Natural’s Interest in the Agreement

Gas Natural has proposed to Competent Authorities a series of commitments to facilitate the approval of the Transaction

Commitment Plan Requirements

Rapid execution

Verifiable

With a pro-competition effect

Gas Natural proposes Iberdrola as the buyer to reinforce its Commitment Plan

Purchase Agreement subject to conditions, signed

Procedure to determine the price already agreed

IBERDROLA has the technical and economic capacity to efficiently exploit these assets

GN considers IBERDROLA to be the company that will have the most competitive use of the assets

2

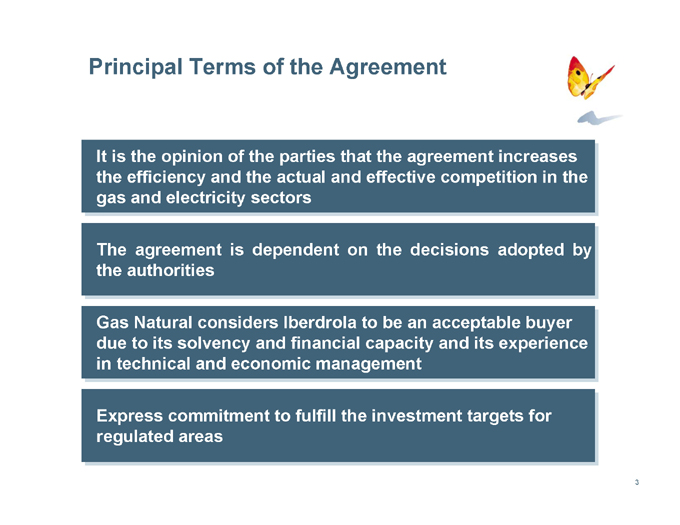

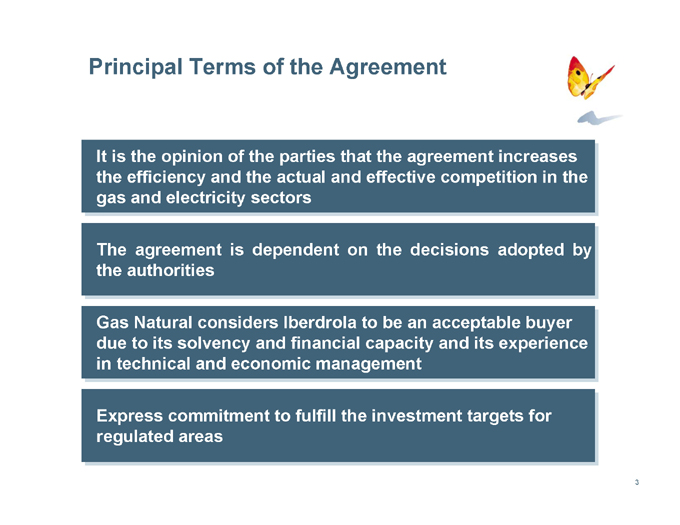

Principal Terms of the Agreement

It is the opinion of the parties that the agreement increases the efficiency and the actual and effective competition in the gas and electricity sectors

The agreement is dependent on the decisions adopted by the authorities

Gas Natural considers Iberdrola to be an acceptable buyer due to its solvency and financial capacity and its experience in technical and economic management

Express commitment to fulfill the investment targets for regulated areas

3

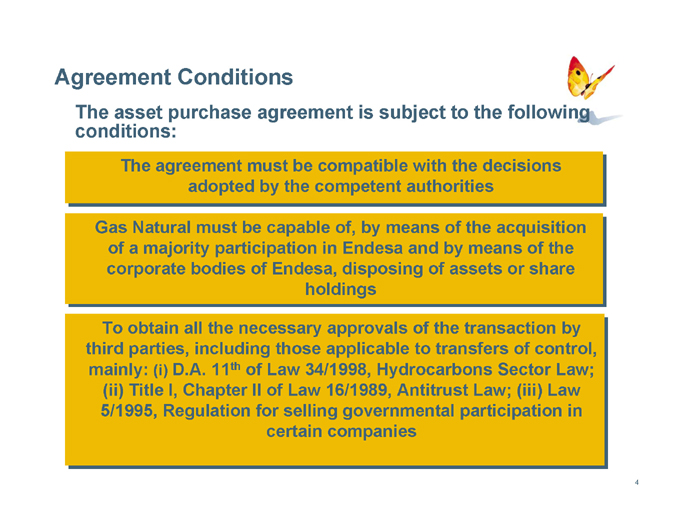

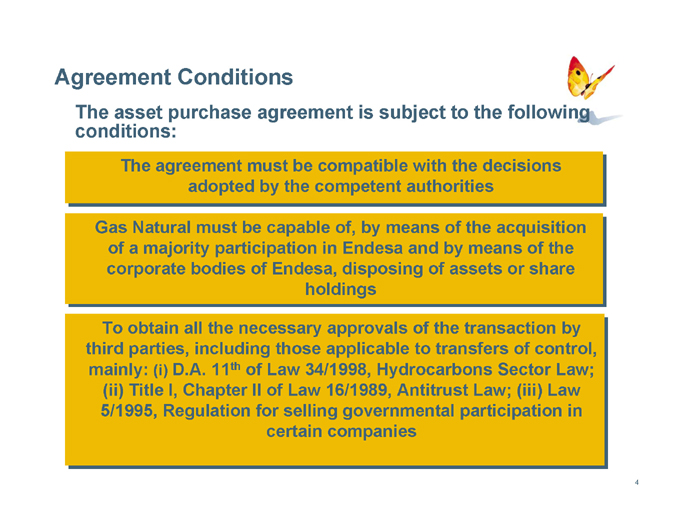

Agreement Conditions

The asset purchase agreement is subject to the following conditions:

The agreement must be compatible with the decisions adopted by the competent authorities

Gas Natural must be capable of, by means of the acquisition of a majority participation in Endesa and by means of the corporate bodies of Endesa, disposing of assets or share holdings

To obtain all the necessary approvals of the transaction by third parties, including those applicable to transfers of control, mainly: (i) D.A. 11th of Law 34/1998, Hydrocarbons Sector Law; (ii) Title I, Chapter II of Law 16/1989, Antitrust Law; (iii) Law 5/1995, Regulation for selling governmental participation in certain companies

4

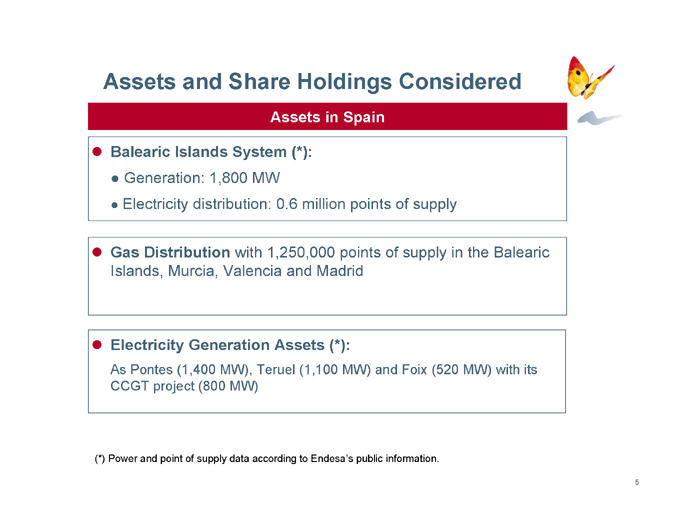

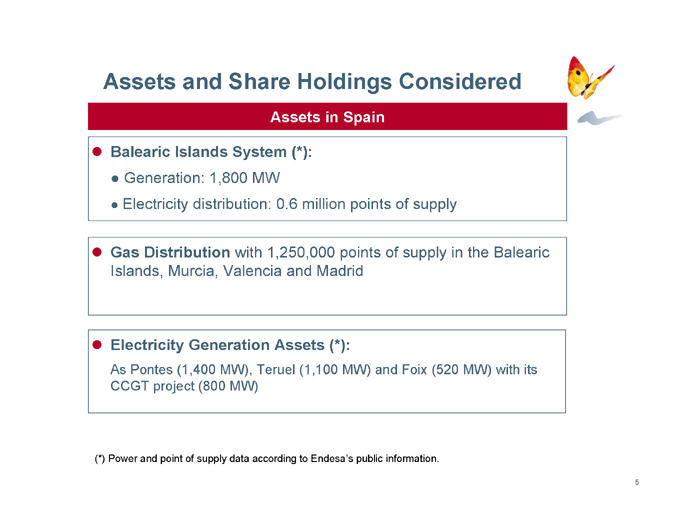

Assets and Share Holdings Considered

Assets in Spain

Balearic Islands System (*):

Generation: 1,800 MW

Electricity distribution: 0.6 million points of supply

Gas Distribution with 1,250,000 points of supply in the Balearic Islands, Murcia, Valencia and Madrid

Electricity Generation Assets (*):

As Pontes (1,400 MW), Teruel (1,100 MW) and Foix (520 MW) with its CCGT project (800 MW)

(*) Power and point of supply data according to Endesa’s public information.

5

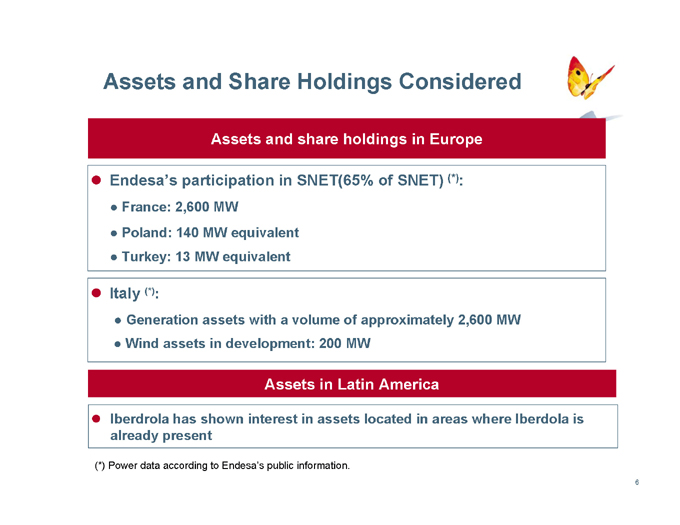

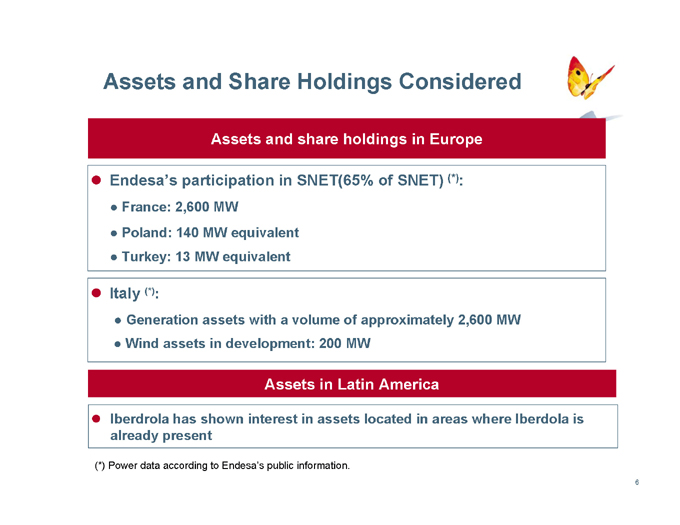

Assets and Share Holdings Considered

Assets and share holdings in Europe

Endesa’s participation in SNET(65% of SNET) (*):

France: 2,600 MW

Poland: 140 MW equivalent

Turkey: 13 MW equivalent

Italy (*):

Generation assets with a volume of approximately 2,600 MW

Wind assets in development: 200 MW

Assets in Latin America

Iberdrola has shown interest in assets located in areas where Iberdola is already present

(*) Power data according to Endesa’s public information.

6

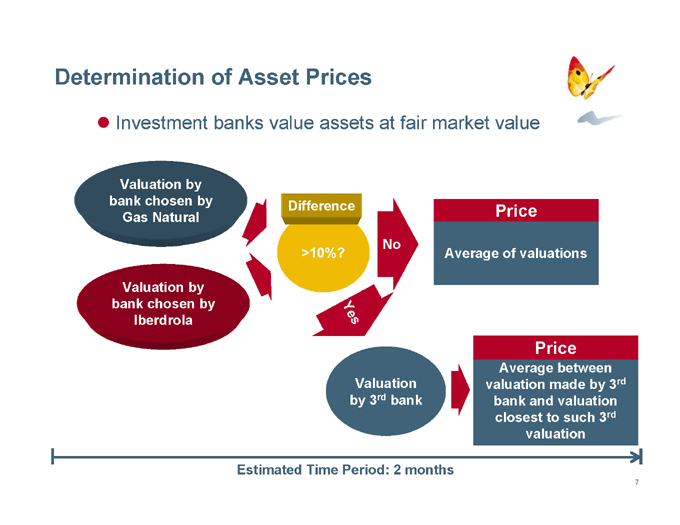

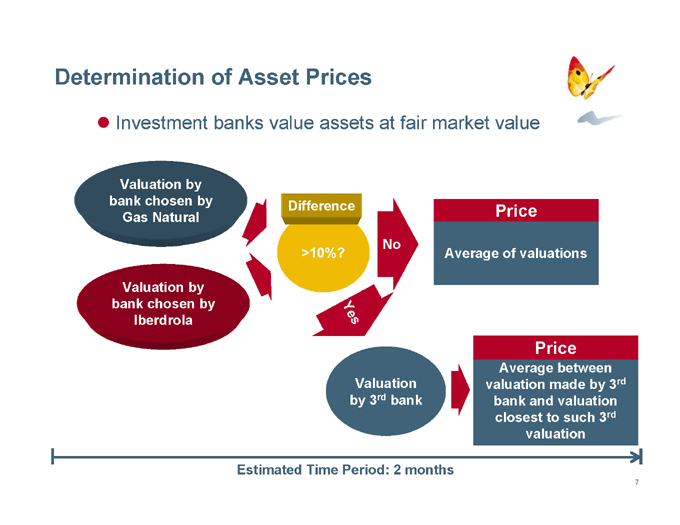

Determination of Asset Prices

Investment banks value assets at fair market value

Valuation by bank chosen by Gas Natural

Price

Average of valuations

Difference

>10%?

No

Yes

Valuation by bank chosen by Iberdrola

Average between valuation made by 3rd bank and valuation closest to such 3rd valuation

Price

Valuation by 3rd bank

Estimated Time Period: 2 months

7

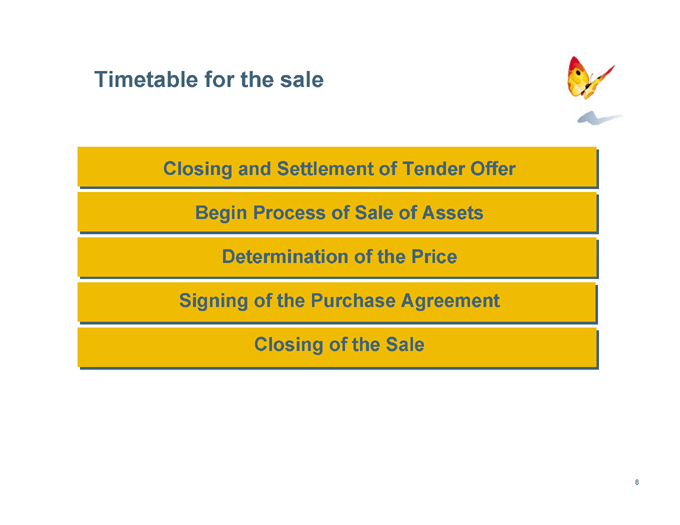

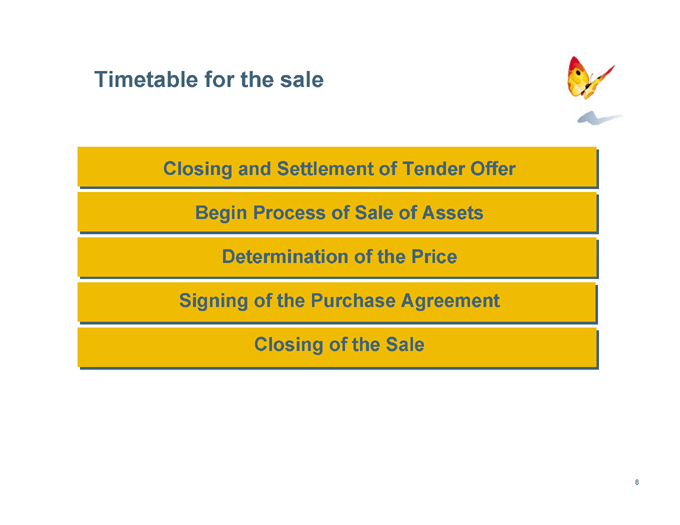

Timetable for the sale

Closing and Settlement of Tender Offer

Begin Process of Sale of Assets

Determination of the Price

Signing of the Purchase Agreement

Closing of the Sale

8