Filed by Gas Natural SDG, S.A. pursuant to

Rule 425 of the Securities Act of 1933

Subject Company: Endesa, S.A.

Commission File No.: 333-07654

This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The exchange offer will commence only (1) following approval of a final offer document by the SpanishComisión Nacional del Mercado de Valores (CNMV) and publication thereof and (2) on or after the date on which Gas Natural SDG, S.A. (Gas Natural) files a Registration Statement on Form F-4 with the U.S. Securities and Exchange Commission (SEC) relating to the exchange offer.

Investors in ordinary shares of Endesa, S.A. (Endesa) should not subscribe for any securities referred to herein except on the basis of the final approved and published offer document that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004. Investors and security holders may obtain a free copy of such final offer document (once it is approved and published) at the registered offices of Gas Natural, Endesa, the CNMV or the Spanish Stock Exchanges.

Investors in American Depositary Shares of Endesa and U.S. holders of ordinary shares of Endesa are urged to read the U.S. prospectus and tender offer statement regarding the exchange offer, when it becomes available, because it will contain important information. The U.S. prospectus and tender offer statement will be filed with the SEC as part of its Registration Statement on Form F-4. Investors and security holders may obtain a free copy of the U.S. prospectus and tender offer statement (when available) and other documents filed by Gas Natural with the SEC at the SEC’s website at www.sec.gov. A free copy of the U.S. prospectus and tender offer statement (when available) may also be obtained for free from Gas Natural.

These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements may relate to, among other things:

| | • | | synergies and cost savings; |

| | • | | integration of the businesses; |

| | • | | expected gas and electricity mix and volume increases; |

| | • | | planned asset disposals and capital expenditures; |

| | • | | net debt levels and EBITDA and earnings per share growth; |

| | • | | timing and benefits of the offer and the combined company. |

These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding-looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition.

Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions.

These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information.

This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited.

* * *

The following is a press release issued by Gas Natural SDG, S.A. in connection with the offer by Gas Natural SDG for 100% of the share capital of Endesa.

| | |

| | GAS NATURAL CONSIDERS ENDESA’S NEW OBJECTIVES TO BE UNREALISTIC AND LACKING RIGOUR AND CREDIBILITY THE TRACK RECORD SHOWN BY ENDESA’S CURRENT EXECUTIVE TEAM DOES NOT PREDICT A BETTER PROJECT OR HIGHER VALUE THAN THE €18.56 PER SHARE PRIOR TO THE TENDER OFFER The Gas Natural Group considers that the presentation made by Endesa last Monday, 3 October put forward a series of “new” financial measures with the aim of increasing the dividend for shareholders and the executive management team remuneration, which were prepared in response to the tender offer, and that these merit little credibility because of their manifest lack of rigour. Furthermore, some of the arguments used make it clear that the Endesa management team does not seem to have understood the message that the resulting group would not longer be an electricity company, but would become an integrated gas and power group, in line with the recent worldwide trend towards a convergence between gas and power. Endesa’s presentation contains a series of inaccurate and contrived statements which are deliberately confusing. At this time, Gas Natural is preparing a detailed response to the statements made by Endesa, which will be presented to the markets next week, and reserves the right to start the legal actions it may deem appropriate. However, out of respect for the shareholders, executives and employees of Endesa, the regulatory bodies and the financial markets, and their right to receive accurate and true information, Gas Natural feels obliged to clarify and define certain questions without delay. As has always been the company’s policy, these declarations are based on the indisputable reality of past history and reasonable estimates for the future

|

| |

| 1. | GAS NATURAL’S OFFER IS EQUIVALENT IN TERMS OF DIVIDEND PER SHARE FOR THE ENDESA SHAREHOLDER TO THAT RECENTLY AMENDED BY THE ENDESA EXECUTIVE TEAM |

The new plan announced by Endesa on Monday implies a total dividend payout of €7 billion against the 2005-2009 financial results. Of this amount, €5 billion will be the dividend on ordinary activities and €2 billion will consist of extraordinary dividends.

The €5 billion of ordinary dividends are the result of an estimated 12% compounded annual growth in the dividend up to 2009, which would not be linked to the financial performance posted by the company – as stated by Endesa’s Chief Executive Officer –, and could seriously jeopardise the investments in regulated activities required to improve the supply of electricity and the quality of service, ultimately hurting the consumer.

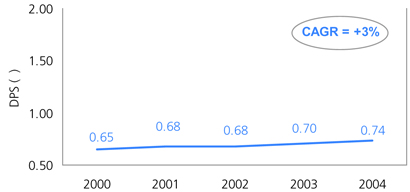

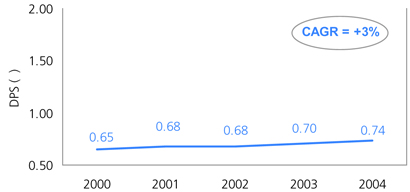

Moreover, this forecast dividend growth does not stand up to an analysis of Endesa’s track record, which shows a compounded annual dividend growth rate of 3% per annum between 2000 and 2004. However, with respect to the new group, based on the higher growth, diversification and the expected synergies, Gas Natural foresees in that same period (assuming that the cash payment for the tender offer is reinvested in Gas Natural shares) that the Endesa shareholder will receive a dividend equivalent to that recently announced by the Endesa management team, of around €5 billion, while at the same time the new group preserves the planned investments and reduces debt.

|

Endesa’s Dividend per Share (DPS) Historical Evolution |

|

| Source: 2004 Endesa Annual Report |

In relation to the €1 billion of extraordinary dividend resulting from the sale of Auna, Gas Natural would like to refer to the statement made by the Endesa Chief Financial Officer to the effect that the current Endesa share price already includes the value of the dividend.

Endesa also announced additional dividends amounting to nearly €1 billion, related to capital gains on the possible sale of other non-strategic assets. The greater part of these capital gains (€750 million) is linked to the future reclassification of land belonging to Endesa, which is of an uncertain and possibly speculative nature. In any case, Gas Natural also commits to pass on to the shareholders of the New Group the capital gains on sales of non-energy assets over the same period.

2. THE REPEATED INABILITY BY THE ENDESA MANAGEMENT TEAM TO MEET OBJECTIVES CASTS DOUBTS OVER THEIR NEW COMMITMENTS

2.1 The new financial projections lack credibility

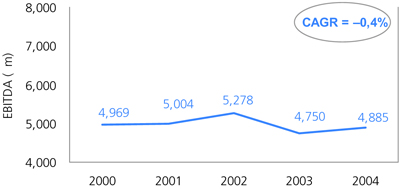

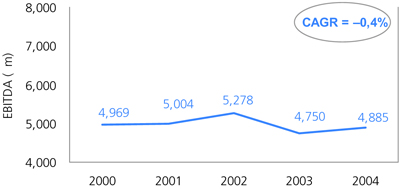

The EBITDA projections put forward by the Endesa management team for 2009 are based on an overall business growth that is much higher than in the past and than that forecast by the market. In the period 2000-2004, the EBITDA for Endesa dropped by 0.4% per annum, in comparison to a 10-11% per annum growth now estimated by Endesa for the period 2004-2009. These optimistic forecasts are surprising, as they are 30% higher than the market consensus.

|

Endesa’s EBITDA Historical Evolution |

|

| Source: 2004 Endesa Annual Report |

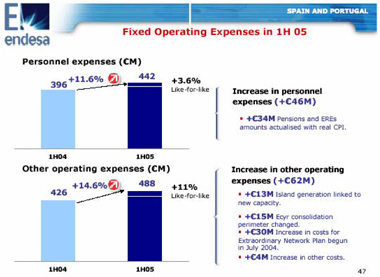

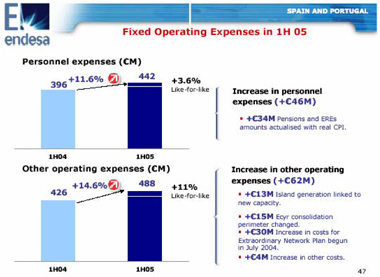

Endesa’s projected EBITDA growth is based to a large extent on improvements in fixed costs and contribution margins, that should reach €525 million by 2009. This cost reduction is not only difficult to believe, but also has failed to materialise in the first-half results published by Endesa, in which fixed personnel costs and other fixed operating expenses increased in Spain and Portugal by 11.6% and 14.6% respectively. If the cost cutting programme was introduced at the beginning of the year, as Endesa claimed on Monday, it does not seem to have been very successful so far.

|

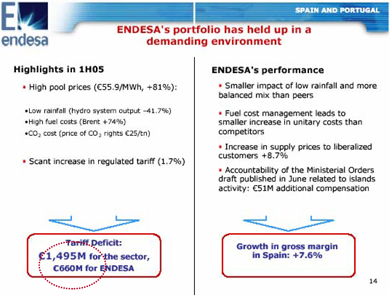

Presentation of Endesa 1st Half Results 2005 (27 July 2005) |

|

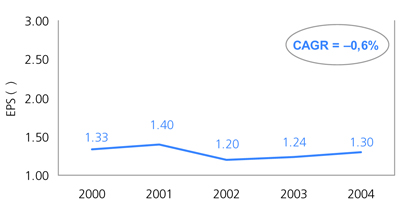

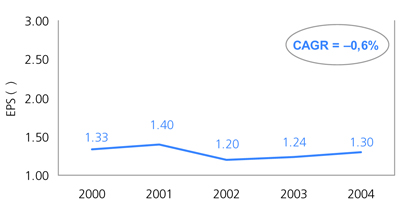

In the period 2000-2004, Endesa’s earnings per share (EPS) showed a negative CAGR of -0.6%, versus the 12% positive CAGR announced by the Endesa team for 2004-2009.

|

Endesa’s Earnings per Share (EPS) Historical Evolution |

|

| Source: 2004 Endesa Annual Report |

2.2 Continuous disorientation with respect to key regulatory aspects

In the last few months, the current management team at Endesa has radically changed its public position with respect to key regulatory issues, which have a large impact upon the company, consumers and the viability of the Spanish electricity sector.

Gas Natural considers that the combined proposals made by Endesa with respect to CTCs, the tariff deficit and the “cap” in tariff growth could destroy value for Endesa’s current shareholders.

CTCs

In Monday’s presentation, Endesa’s management team announced its intention to renounce the right to receive payment for CTCs.

As of 31 December 2004, in the financial statements formulated by Endesa’s Board of Directors, audited by Deloitte and approved at the last General Shareholders Meeting, the balance of outstanding CTC payments was 2,535 million euros, of which 1,440 million euros were recorded as assets on the balance sheet. Furthermore, as shown on page 22 of Endesa’s 2004 financial statements:“The Company’s directors consider that the costs of transition to competition constitute an irrevocable right of the Company, and will take all the necessary steps to ensure that the maximum amount assigned is recovered in full”.

This opinion with respect to CTCs was once again reinforced by Endesa in its analyst presentation of 8 July 2005, in which Endesa’s vision to develop the Spanish wholesale market included “pricing mechanisms without distortions, with clear and predictable rules (legitimate recovery of stranded costs –CTC– without interfering the market operation)” proposing “a specific element in the tariff to allow the recovery of 80% of initial CTC, while correcting current imbalances between agents in the degree of recovery.”

TARIFFS

Additionally, regarding its view on increasing the tariff to permit the recovery of CTCs, in its analyst presentation just three months ago, Endesa pointed out the convenience of a “move towards an additive and sufficient tariff, without ‘de facto’ caps in wholesale prices, which truly covers the competitive costs of the system (and)... the need of frequent tariff revisions (e.g., every 3 months).” This is, once again, inconsistent with the 3% annual tariff increase through 2009 that was proposed at the October 3 presentation.

TARIFF DEFICIT

Equally, Endesa’s management team cast doubts over the recognition and amount of the tariff deficit, being once again inconsistent with its previous position. As can be observed below, in Endesa’s first half results presentation this year, the company recorded a profit of 660 million euros from the tariff deficit, whereas now the scenario that is being contemplated by Endesa considers a situation where hydroelectric and nuclear energy will not receive a retribution higher than €36/MWh, which Endesa estimates will have a negative impact of around €200 million on its earnings.

Endesa 1st Half 2005 Results Presentation (27 July 2005)

2.3 Lack of rigour in statements about Gas Natural’s offer

Endesa’s statements with respect to the principal aspects of Gas Natural’s offer are plagued by declarations which are either inexact, contrived or deliberately confusing. Good examples of this are statements such as “Giving away assets to main competitor” or “pre-agreed asset disposals at very low multiples.” Both statements make one think that Endesa’s management team prefers to disregard the regulatory filings with respect to the agreement between Gas Natural and Iberdrola, filed with the CNMV (Spanish market regulator) by each company on the 6th and 16th of September, which explain in detail the mechanism for determining the future selling price of the assets, to be set by prestigious investment banks based on “fair market value” principles. Regarding these statements, Gas Natural reserves the right to take the legal actions it deems appropriate.

At the same time, with respect to comparisons between Gas Natural’s tender offer and other transactions, such as ACS’s recent acquisition of a stake in Unión Fenosa, and according to the information filed by ACS with the CNMV, the 2006 EV/EBITDA multiple for Unión Fenosa was 9.4x, while for Gas Natural it was 9.3x. Endesa omitted this information at its presentation.

2.4 Lack of transparency

Endesa’s October 3 presentation reflects a sudden commitment to transparency with respect to some of the assumptions on which its new financial plan is based. This new philosophy of transparency responds solely to the tender offer presented by Gas Natural, in an attempt to substantiate a plan that is falsely optimistic, in light of past results obtained by Endesa’s management team, and of the market consensus estimates for the coming years.

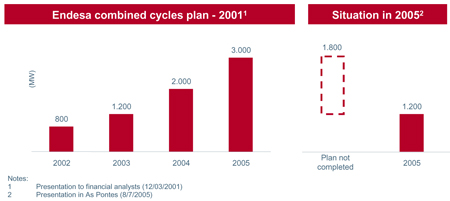

2.5 Changing and inconsistent strategic plan

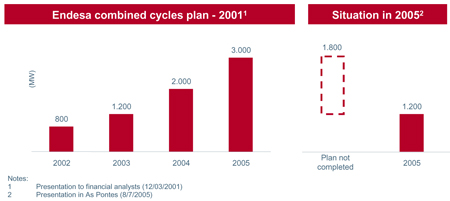

In the last few years, Endesa’s strategic plan has suffered numerous revisions, with contradictory objectives, such as those with respect to renewable energy, the construction of combined cycle plants, the consideration of telecommunications as a strategic pillar, or the investment effort in Latin America. This lack of strategic definition has been reflected in the company’s erratic financial performance and in its stock price evolution.

With reference to its main business, Endesa’s position in the Spanish generation market is conditioned by delays in constructing its combined cycle plants, and its slowness to invest in renewable energy.

2.6 The new financial commitment by Senior Management does not defend shareholders’ interests

Endesa’s Chief Executive Officer presented a new remuneration package for the 2005-2009 period, linking all variable compensation to the company’s share price performance.

Surprisingly, and in contrast to normal practice in these type of compensation systems, the share price from which one has the right to receive this variable incentive, which can represent up to 70% of Senior Management’s fixed compensation, is almost 20% below the stock price at the time the plan was presented.

Only in the event that Endesa’s shareholders lose €4 billion in stock market value would its Board and Senior Management cease to receive their variable compensation.

3. ENDESA’S APPEAL TO BRUSSELS DEMONSTRATES ITS LACK OF RESPECT AND CONFIDENCE IN SPAIN’S REGULATORY AND ANTI-TRUST BODIES

Endesa’s repeated steps to try to convince the authorities in Brussels to examine the anti-trust aspects of the tender offer presented by Gas Natural demonstrate a lack of confidence on the part of Endesa in the technical capacity of Spain’s regulatory and anti-trust bodies.

To justify its claims that the tender offer launched by Gas Natural falls under the competency and dimension of the European Union, Endesa claims that the financial statements that should be considered are not the accounts prepared according to Spanish legislation, as audited and approved at the Annual General Shareholders Meeting, but rather a version in which specific changes have been introduced to meet Endesa’s own interpretation of International Financial Reporting Standards (IFRS) and the EU norms.

Additionally, as a listed company on the New York Stock Exchange, Endesa annually presents its audited consolidated financial statements in accordance with US Generally Accepted Accounting Principles (US GAAP). In the official, certified copy of its annual financial statements which Endesa presented to the Securities Exchange Commission (SEC) on 30 June, the company’s net sales for 2004 barely showed any variation between those calculated under Spanish accounting standard and those under US GAAP.

According to the aforementioned document that was delivered and filed with the SEC only three months ago, Endesa’s net sales according to Spanish accounting standards were €17,642 million while under US GAAP they amounted to €17,718 million euros, curiously slightly higher, rather than lower, than the Spanish GAAP figures.

The only difference between these financial statements lies in the accounting treatment with respect to amounts relating to newly contracted customers, which represented €76 million more under US GAAP.

Bearing in mind that the treatment of a company’s revenues according to the American system (SAB 104) is very similar to the treatment under International Financial Reporting Standards (IFRS 18), it is hard to understand Endesa’s management team interpretation that the company’s revenues should suffer such a drastic change in adapting the 2004 accounts (audited according to Spanish accounting standards) to the IFRS system. All the questions raised by Endesa as adjustments under the IFRS method should also have already been raised with respect to US GAAP, if the criteria now recommended were those really applicable.

However, it should be noted that, even with these IFRS adjustments according to Endesa’s interpretation, Endesa would still not be able to justify the EU dimension of the operation under the two-thirds rule. As a result, to the aforementioned adjustments Endesa has added a further opportunistic interpretation whereby it also tries to change additional specific accounting concepts, which were previously booked differently, in order to avoid compliance with the two-thirds rule.

Endesa needs more than 30 such accounting adjustments to reduce the proportion of its Spanish revenues to 64%. In these adjustments there are considerable errors, inconsistencies in criteria and partial interpretations, of which Gas Natural has already duly informed the relevant authorities, while the Spanish Anti-trust Authorities continue analyzing the operation.

Madrid, 5 October 2005