| Table 64: Santo Nino - Manto Descriptive Statistics for Raw, Non-Composited, Metal Data |

| |

Santo Nino - RAW Non - Composited Data-Manto | Ag (gpt) | Au (gpt) | Cu (%) | Pb (%) | Zn (%) | W (ppm) | Mo (ppm) |

| Mean | 7.74 | 0.04 | 0.17 | 0.012 | 0.099 | 193.24 | 64.06 |

| Standard Error | 1.22 | 0.01 | 0.03 | 0.003 | 0.015 | 16.53 | 8.74 |

| Median | 2.3 | 0.02 | 0.02 | 0.000 | 0.015 | 90 | 18 |

| Mode | 0.5 | 0 | 0 | 0.000 | 0.010 | 10 | 1 |

| Standard Deviation | 18.13 | 0.12 | 0.38 | 0.051 | 0.221 | 246.34 | 130.17 |

| Sample Variance | 328.87 | 0.01 | 0.14 | 0.003 | 0.049 | 60,683 | 16,944 |

| Skewness | 5.68 | 10.28 | 4.47 | 7.222 | 3.353 | 1.90 | 4.76 |

| Range | 178.9 | 1.61 | 2.86 | 0.540 | 1.280 | 1190 | 1149 |

| Minimum | 0.1 | 0 | 0 | 0.000 | 0.000 | 10 | 1 |

| Maximum | 179 | 1.61 | 2.86 | 0.540 | 1.280 | 1200 | 1150 |

| Count | 222 | 222 | 222 | 222 | 222 | 222 | 222 |

| 97.5th | 53.63 | 0.18 | 0.91 | 0.120 | 0.894 | 878.00 | 396.13 |

| 99th | 88.06 | 0.45 | 2.08 | 0.240 | 1.131 | 1027.90 | 607.56 |

| Table 65: Santo Nino – Manto 2 metre Composited Descriptive Metal Data |

| |

Santo Nino- 2 m- Composited Data-Manto | Ag (gpt) | Au (gpt) | Cu (%) | Pb (%) | Zn (%) | W (ppm) | Mo (ppm) |

| Mean | 5.41 | 0.03 | 0.10 | 0.009 | 0.068 | 137.83 | 63.13 |

| Standard Error | 0.665 | 0.005 | 0.016 | 0.002 | 0.010 | 12.431 | 7.686 |

| Median | 1.8 | 0.01 | 0.01 | 0.001 | 0.015 | 60 | 19 |

| Mode | 0.1 | 0.01 | 0 | 0.000 | 0.006 | 10 | 5 |

| Standard Deviation | 9.93 | 0.08 | 0.23 | 0.027 | 0.155 | 185.64 | 114.78 |

| Sample Variance | 98.54 | 0.01 | 0.05 | 0.001 | 0.024 | 34,462 | 13,175 |

| Skewness | 3.945 | 7.463 | 5.076 | 4.428 | 4.615 | 2.230 | 3.718 |

| Range | 74.4 | 0.89 | 2.21 | 0.200 | 1.173 | 1010 | 850 |

| Minimum | 0.1 | 0 | 0 | 0.000 | 0.002 | 10 | 1 |

| Maximum | 74.5 | 0.89 | 2.21 | 0.200 | 1.175 | 1020 | 851 |

| Count | 223 | 223 | 223 | 223 | 223 | 223 | 223 |

| 97.5th | 55.78 | 0.456 | 1.136 | 0.157 | 0.929 | 829 | 121.4 |

| 99th | 64.708 | 0.6468 | 1.73 | 0.184 | 1.035 | 978.4 | 127.76 |

| Table 66: Santo Nino – Manto 2 metre Composited >15 AgEQ Descriptive Metal Data |

| |

Santo Nino- 2 m Composited Manto Data; AgEQ >15 gpt | Ag (gpt) | Au (gpt) | Cu (%) | Pb (%) | Zn (%) | W (ppm) | Mo (ppm) |

| Mean | 44.34 | 0.07 | 0.31 | 0.019 | 0.143 | 239.86 | 26.74 |

| Standard Error | 4.72 | 0.02 | 0.04 | 0.005 | 0.029 | 29.54 | 3.96 |

| Median | 33.85 | 0.04 | 0.22 | 0.001 | 0.049 | 150 | 12 |

| Mode | 16 | 0.04 | 0.17 | 0.000 | 0.026 | 20 | 7 |

| Standard Deviation | 38.05 | 0.13 | 0.35 | 0.042 | 0.232 | 238.12 | 31.92 |

| Sample Variance | 1447.94 | 0.02 | 0.12 | 0.002 | 0.054 | 56,702 | 1018.6 |

| Skewness | 3.76 | 4.58 | 3.21 | 2.866 | 2.931 | 1.49 | 1.87 |

| Range | 250.48 | 0.89 | 2.21 | 0.2 | 1.169 | 1010 | 137 |

| Minimum | 15.22 | 0 | 0 | 0 | 0.006 | 10 | 1 |

| Maximum | 265.7 | 0.89 | 2.21 | 0.2 | 1.175 | 1020 | 138 |

| Count | 65 | 65 | 65 | 65 | 65 | 65 | 65 |

| 97.5th | 55.78 | 0.456 | 1.136 | 0.157 | 0.929 | 829 | 121.4 |

| 99th | 64.708 | 0.6468 | 1.73 | 0.184 | 1.035 | 978.4 | 127.76 |

| Table 67: Santo Nino – Manto 2 metre Composited >30 AgEQ Descriptive Metal Data |

| |

Santo Nino- 2 m Composited Manto Data; AgEQ >30 gpt | Ag (gpt) | Au (gpt) | Cu (%) | Pb (%) | Zn (%) | W (ppm) | Mo (ppm) |

| Mean | 19.08 | 0.09 | 0.44 | 0.027 | 0.189 | 299.16 | 30.84 |

| Standard Error | 2.94 | 0.03 | 0.07 | 0.009 | 0.047 | 45.72 | 5.43 |

| Median | 11.6 | 0.04 | 0.34 | 0.001 | 0.059 | 195 | 18 |

| Mode | 4.8 | 0.04 | 0.23 | 0.000 | 0.026 | 75 | 5 |

| Standard Deviation | 17.89 | 0.16 | 0.42 | 0.053 | 0.288 | 278.10 | 33.01 |

| Sample Variance | 320.23 | 0.03 | 0.17 | 0.003 | 0.083 | 77,342 | 1089.8 |

| Skewness | 1.48 | 4.07 | 2.56 | 2.15 | 2.28 | 1.09 | 1.60 |

| Range | 73.1 | 0.88 | 2.21 | 0.200 | 1.169 | 990 | 121 |

| Minimum | 1.4 | 0.01 | 0 | 0.000 | 0.006 | 30 | 1 |

| Maximum | 74.5 | 0.89 | 2.21 | 0.200 | 1.175 | 1020 | 122 |

| Count | 37 | 37 | 37 | 37 | 37 | 37 | 37 |

| 97.5th | 60.73 | 0.55 | 1.54 | 0.178 | 0.979 | 961.50 | 121.10 |

| 99th | 68.99 | 0.75 | 1.94 | 0.191 | 1.097 | 996.60 | 121.64 |

| Table 68: Santo Nino – Manto 2 metre Composited >60 AgEQ Descriptive Metal Data |

| |

Santo Nino- 2m Composited Data-Manto AgEQ >60 gpt | Ag (gpt) | Au (gpt) | Cu (%) | Pb (%) | Zn (%) | W (ppm) | Mo (ppm) |

| Mean | 28.764 | 0.046 | 0.724 | 0.040 | 0.180 | 427.500 | 31.429 |

| Standard Error | 6.267 | 0.008 | 0.146 | 0.019 | 0.065 | 88.058 | 10.814 |

| Median | 26.650 | 0.040 | 0.640 | 0.000 | 0.113 | 367.500 | 15.000 |

| Mode | 6.800 | 0.030 | 0.640 | 0.000 | - | 710.000 | 4.000 |

| Standard Deviation | 23.451 | 0.028 | 0.545 | 0.070 | 0.244 | 329.482 | 40.462 |

| Sample Variance | 549.935 | 0.001 | 0.298 | 0.005 | 0.060 | 108,558 | 1637.19 |

| Skewness | 0.573 | 1.709 | 1.712 | 1.670 | 2.783 | 0.525 | 1.809 |

| Range | 69.700 | 0.100 | 2.160 | 0.200 | 0.946 | 990.00 | 121.00 |

| Minimum | 4.8 | 0.02 | 0.05 | 0 | 0.0114 | 30 | 1 |

| Maximum | 74.5 | 0.12 | 2.21 | 0.2 | 0.957 | 1020 | 122 |

| Count | 14 | 14 | 14 | 14 | 14 | 14 | 14 |

| 97.5th | 69.528 | 0.110 | 1.966 | 0.192 | 0.743 | 998.875 | 121.675 |

| 99th | 72.511 | 0.116 | 2.113 | 0.197 | 0.871 | 1011.550 | 121.870 |

| Table 69: Santo Nino Structure Descriptive Statistics for Raw, Non-Composited, Metal Data |

| |

Santo Nino- RAW Non - Composited Data-Structure | Ag (gpt) | Au (gpt) | Cu (%) | Pb (%) | Zn (%) | W (ppm) | Mo (ppm) |

| Mean | 22.42 | 0.04 | 0.45 | 0.025 | 0.253 | 208.54 | 71.18 |

| Standard Error | 4.00 | 0.00 | 0.11 | 0.009 | 0.069 | 16.04 | 8.50 |

| Median | 3.85 | 0.02 | 0.03 | 0.000 | 0.020 | 130 | 24.5 |

| Mode | 0.3 | 0.01 | 0.01 | 0.000 | 0.010 | 10 | 5 |

| Standard Deviation | 53.38 | 0.06 | 1.43 | 0.116 | 0.914 | 214.03 | 113.37 |

| Sample Variance | 2849.5 | 0.00 | 2.03 | 0.014 | 0.836 | 45,808 | 12,852 |

| Skewness | 3.64 | 3.09 | 4.64 | 6.675 | 5.684 | 1.35 | 3.30 |

| Range | 300.7 | 0.48 | 10.25 | 1.000 | 7.540 | 900 | 699 |

| Minimum | 0.3 | 0 | 0 | 0.000 | 0.000 | 10 | 1 |

| Maximum | 301 | 0.48 | 10.25 | 1.000 | 7.540 | 910 | 700 |

| Count | 178 | 178 | 178 | 178 | 178 | 178 | 178 |

| 97.5th | 221.80 | 0.22 | 6.01 | 0.199 | 2.857 | 747.25 | 365.70 |

| 99th | 279.44 | 0.25 | 7.48 | 0.747 | 5.545 | 852.30 | 644.49 |

| Table 70: Santo Nino Structure Descriptive Statistics for 2 metre Composited, Metal Data |

| |

Santo Nino- 2 m- Composited Data-Structure | Ag (gpt) | Au (gpt) | Cu (%) | Pb %) | Zn (%) | W (ppm) | Mo (ppm) |

| Mean | 12.84 | 0.03 | 0.24 | 0.015 | 0.142 | 169.08 | 69.43 |

| Standard Error | 2.09 | 0.00 | 0.06 | 0.004 | 0.036 | 14.16 | 8.35 |

| Median | 2.9 | 0.01 | 0.03 | 0.000 | 0.020 | 100 | 27 |

| Mode | 0.3 | 0.01 | 0 | 0.000 | 0.007 | 10 | 14 |

| Standard Deviation | 26.99 | 0.04 | 0.73 | 0.056 | 0.462 | 182.41 | 107.58 |

| Sample Variance | 728.51 | 0.00 | 0.53 | 0.003 | 0.213 | 33,273 | 11,573 |

| Skewness | 3.61 | 2.33 | 4.93 | 5.589 | 5.304 | 1.39 | 3.24 |

| Range | 179.6 | 0.24 | 6.06 | 0.397 | 3.115 | 810 | 699 |

| Minimum | 0.2 | 0 | 0 | 0.000 | 0.002 | 10 | 1 |

| Maximum | 179.8 | 0.24 | 6.06 | 0.397 | 3.118 | 820 | 700 |

| Count | 166 | 166 | 166 | 166 | 166 | 166 | 166 |

| 97.5th | 92.63 | 0.15 | 2.51 | 0.178 | 1.412 | 651.75 | 389.75 |

| 99th | 123.15 | 0.20 | 3.21 | 0.344 | 3.046 | 710.50 | 525.35 |

| Table 71: Santo Nino Structure Descriptive Statistics for 2 metre Composited >15 AgEQ Descriptive Metal Data |

| |

Santo Nino- 2 m- Composited Structure Data; AgEQ >15 gpt | Ag (gpt) | Au (gpt) | Cu (%) | Pb %) | Zn (%) | W (ppm) | Mo (ppm) |

| Mean | 34.67 | 0.06 | 0.71 | 0.037 | 0.367 | 254.50 | 47.83 |

| Standard Error | 5.34 | 0.01 | 0.16 | 0.013 | 0.102 | 25.96 | 7.94 |

| Median | 16 | 0.04 | 0.195 | 0.000 | 0.095 | 199.5 | 21.5 |

| Mode | 5.1 | 0.01 | 0.11 | 0.000 | - | 120 | 12 |

| Standard Deviation | 39.22 | 0.06 | 1.15 | 0.095 | 0.746 | 190.74 | 58.36 |

| Sample Variance | 1538.3 | 0.00 | 1.33 | 0.009 | 0.557 | 36,384 | 3405.58 |

| Skewness | 1.89 | 1.59 | 2.68 | 3.003 | 2.989 | 0.99 | 2.02 |

| Range | 177.2 | 0.23 | 6.04 | 0.397 | 3.106 | 800 | 233 |

| Minimum | 2.6 | 0.01 | 0.02 | 0.000 | 0.012 | 20 | 4 |

| Maximum | 179.8 | 0.24 | 6.06 | 0.397 | 3.118 | 820 | 237 |

| Count | 54 | 54 | 54 | 54 | 54 | 54 | 54 |

| 97.5th | 139.725 | 0.21375 | 3.35375 | 0.357 | 3.061 | 690.25 | 223.175 |

| 99th | 167.345 | 0.2347 | 4.7032 | 0.383 | 3.095 | 756.4 | 233.29 |

| Table 72: Santo Nino Structure Descriptive Statistics for 2 metre Composited >30 AgEQ Descriptive Metal Data |

| |

| Santo Nino- 2 m Composited Structure Data; AgEQ >30 gpt | Ag (gpt) | Au (gpt) | Cu (%) | Pb (%) | Zn (%) | W (ppm) | Mo (ppm) |

| Mean | 18.8 | 0.136 | 0.226 | 0.05 | 0.53 | 213.4 | 31.8 |

| Standard Error | 4.22 | 0.05 | 0.04 | 0.02 | 0.16 | 100.03 | 12.11 |

| Median | 14.6 | 0.2 | 0.24 | 0 | 0.1519 | 115 | 30 |

| Mode | - | - | - | 0 | - | - | - |

| Standard Deviation | 9.45 | 0.11 | 0.10 | 0.12 | 0.91 | 223.67 | 27.09 |

| Sample Variance | 89.22 | 0.01 | 0.01 | 0.01 | 0.83 | 50,029 | 733.70 |

| Skewness | 1.76 | -0.57 | -1.23 | 2.20 | 2.25 | 2.09 | 1.18 |

| Range | 23.7 | 0.22 | 0.25 | 0.40 | 3.10 | 533 | 68 |

| Minimum | 11.2 | 0.01 | 0.07 | 0 | 0.0216 | 75 | 7 |

| Maximum | 34.9 | 0.23 | 0.32 | 0.40 | 3.12 | 608 | 75 |

| Count | 5 | 5 | 5 | 33 | 33 | 5 | 5 |

| 97.5th | 31.37 | 0.23 | 0.31 | 0.38 | 3.08 | 718.05 | 227.68 |

| 99th | 33.49 | 0.23 | 0.32 | 0.39 | 3.10 | 737.22 | 254.27 |

| Table 73: Santo Nino Structure Descriptive Statistics for 2 metre Composited >60 AgEQ Descriptive Metal Data |

| |

Santo Nino - 2m Composited Data- Structure AgEQ >60 gpt | Ag (gpt) | Au (gpt) | Cu (%) | Pb (%) | Zn (%) | W (ppm) | Mo (ppm) |

| Mean | 71.495 | 0.082 | 1.606 | 0.065 | 0.816 | 297.550 | 36.550 |

| Standard Error | 9.697 | 0.011 | 0.341 | 0.029 | 0.241 | 37.010 | 8.168 |

| Median | 61.250 | 0.075 | 1.410 | 0.000 | 0.278 | 273.500 | 20.500 |

| Mode | - | 0.040 | - | 0.000 | - | - | 9.000 |

| Standard Deviation | 43.366 | 0.051 | 1.525 | 0.129 | 1.079 | 165.514 | 36.530 |

| Sample Variance | 1880.6 | 0.003 | 2.326 | 0.017 | 1.165 | 27,395 | 1334.5 |

| Skewness | 0.976 | 1.347 | 1.333 | 1.845 | 1.509 | 0.583 | 1.154 |

| Range | 164 | 0.22 | 6.04 | 0.3965 | 3.0834 | 585 | 117 |

| Minimum | 15.8 | 0.01 | 0.02 | 0 | 0.0342 | 85 | 4 |

| Maximum | 179.8 | 0.23 | 6.06 | 0.3965 | 3.1176 | 670 | 121 |

| Count | 20 | 20 | 20 | 20 | 20 | 20 | 20 |

| 97.5th | 168.638 | 0.192 | 4.844 | 0.365 | 3.098 | 603.500 | 109.125 |

| 99th | 175.335 | 0.215 | 5.574 | 0.384 | 3.110 | 643.400 | 116.250 |

| Table 74: Santo Nino Contact Skarn Descriptive Statistics for Raw, Non-Composited Descriptive Metal Data |

| |

Santo Nino - RAW Non - Composited Data- Contact Skarn | Ag (gpt) | Au (gpt) | Cu (%) | Pb (%) | Zn (%) | W (ppm) | Mo (ppm) |

| Mean | 2.697 | 0.017 | 0.027 | 0.007 | 0.055 | 152.099 | 57.481 |

| Standard Error | 0.499 | 0.004 | 0.006 | 0.003 | 0.013 | 17.071 | 6.091 |

| Median | 0.7 | 0 | 0.01 | 0.0005 | 0.01 | 70 | 31 |

| Mode | 0.2 | 0 | 0 | 0 | 0.01 | 10 | 3 |

| Standard Deviation | 6.72 | 0.05 | 0.08 | 0.04 | 0.17 | 229.67 | 81.95 |

| Sample Variance | 45.112 | 0.003 | 0.007 | 0.002 | 0.030 | 52,749 | 6716.05 |

| Skewness | 5.250 | 5.905 | 5.726 | 10.903 | 5.943 | 3.912 | 3.255 |

| Range | 56.300 | 0.440 | 0.690 | 0.500 | 1.480 | 1870.0 | 559.00 |

| Minimum | 0.1 | 0 | 0 | 0 | 0 | 10 | 1 |

| Maximum | 56.4 | 0.44 | 0.69 | 0.5 | 1.48 | 1880 | 560 |

| Count | 181 | 181 | 181 | 181 | 181 | 181 | 181 |

| 97.5th | 20.15 | 0.145 | 0.2 | 0.04 | 0.4405 | 695 | 258 |

| 99th | 35.44 | 0.3 | 0.476 | 0.098 | 1.004 | 1024 | 370.4 |

| Table 75: Santo Nino Contact Skarn Descriptive Statistics for 2 metre Composited Descriptive Metal Data |

| |

Santo Nino - 2 m Composited Contact Skarn Data | Ag (gpt) | Au (gpt) | Cu (%) | Pb (%) | Zn (%) | W (ppm) | Mo (ppm) |

| Mean | 2.00 | 0.01 | 0.02 | 0.005 | 0.050 | 122.49 | 53.33 |

| Standard Error | 0.28 | 0.00 | 0.00 | 0.002 | 0.011 | 11.35 | 4.99 |

| Median | 0.6 | 0.01 | 0.01 | 0.001 | 0.008 | 63 | 28 |

| Mode | 0.2 | 0 | 0 | 0.000 | 0.003 | 10 | 3 |

| Standard Deviation | 3.99 | 0.03 | 0.04 | 0.028 | 0.162 | 162.90 | 71.66 |

| Sample Variance | 15.91 | 0.00 | 0.00 | 0.001 | 0.026 | 26,538 | 5134.85 |

| Skewness | 4.46 | 4.74 | 4.76 | 12.544 | 6.769 | 2.59 | 2.89 |

| Range | 34.8 | 0.23 | 0.32 | 0.385 | 1.478 | 1025 | 539 |

| Minimum | 0.1 | 0 | 0 | 0.000 | 0.002 | 10 | 1 |

| Maximum | 34.9 | 0.23 | 0.32 | 0.385 | 1.480 | 1035 | 540 |

| Count | 206 | 206 | 206 | 206 | 206 | 206 | 206 |

| 97.5th | 14.10 | 0.08 | 0.12 | 0.033 | 0.439 | 573.75 | 243.25 |

| 99th | 17.25 | 0.21 | 0.24 | 0.040 | 0.643 | 759.50 | 314.05 |

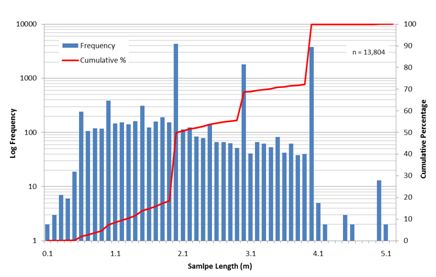

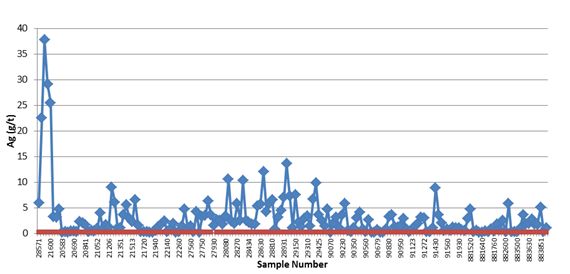

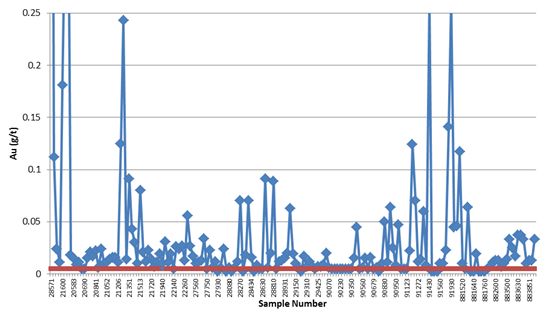

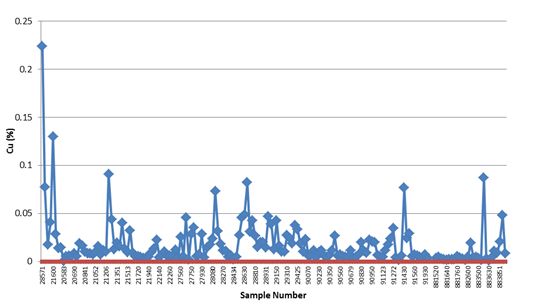

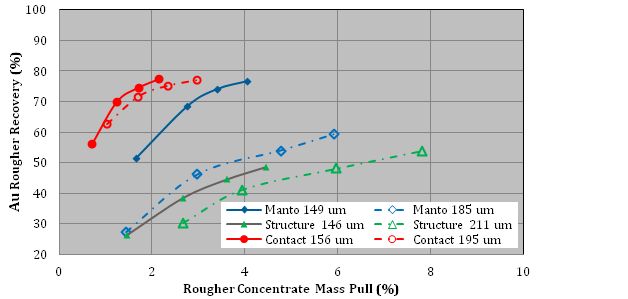

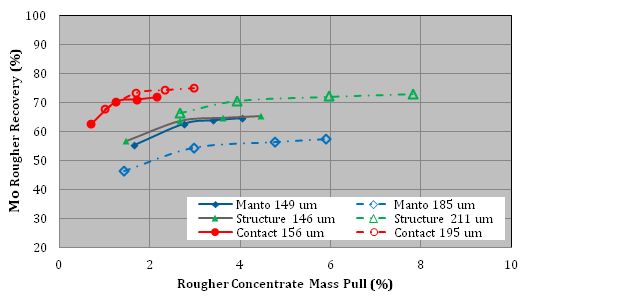

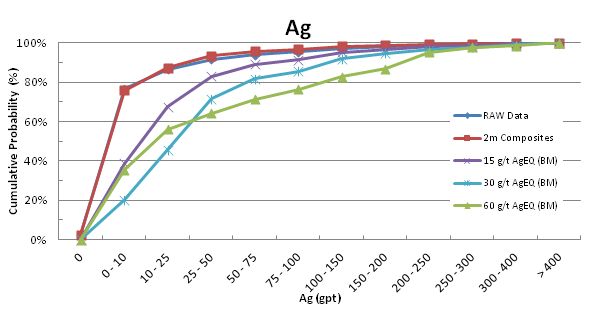

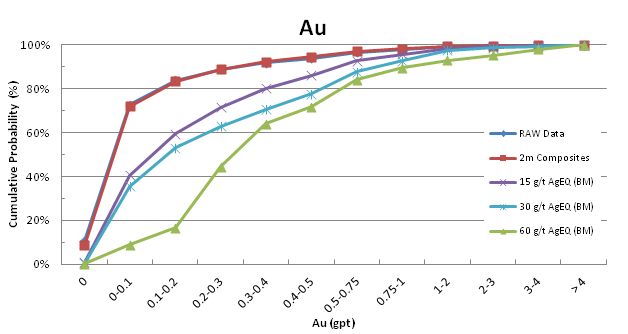

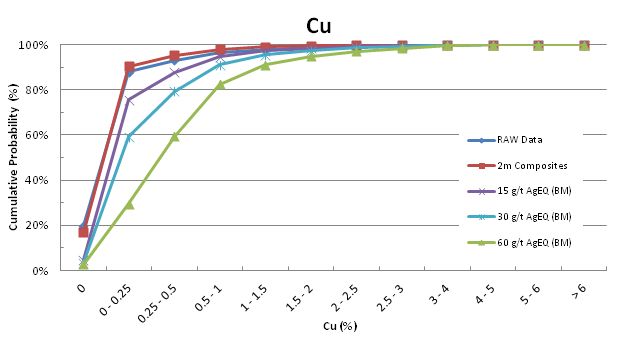

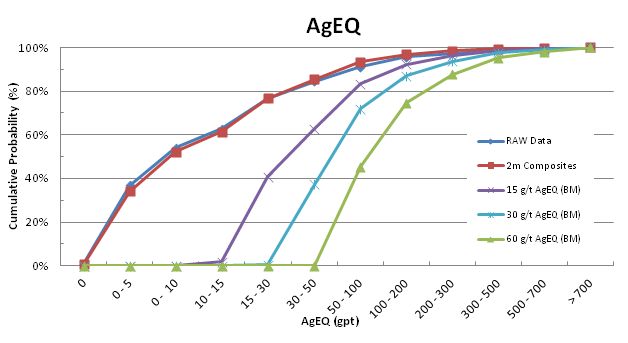

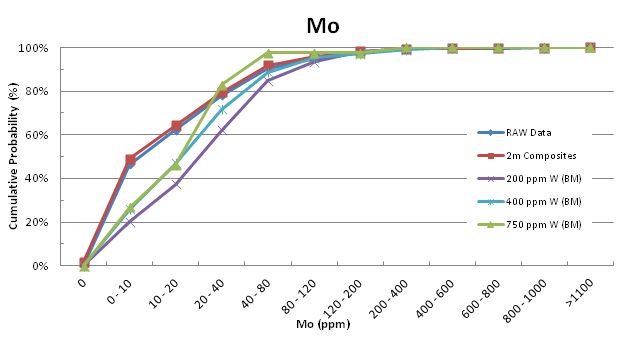

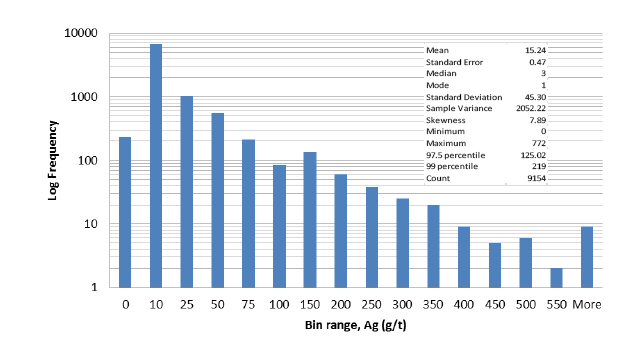

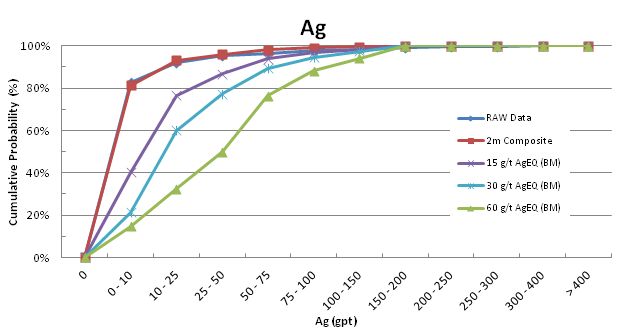

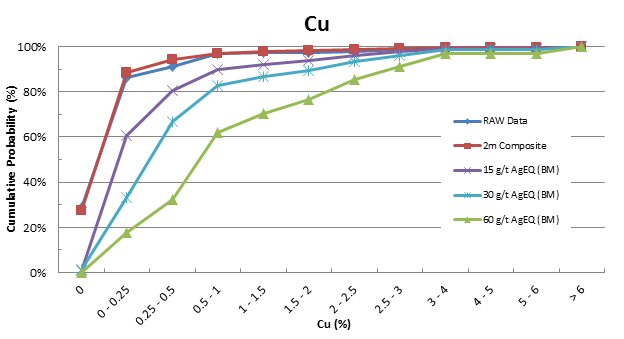

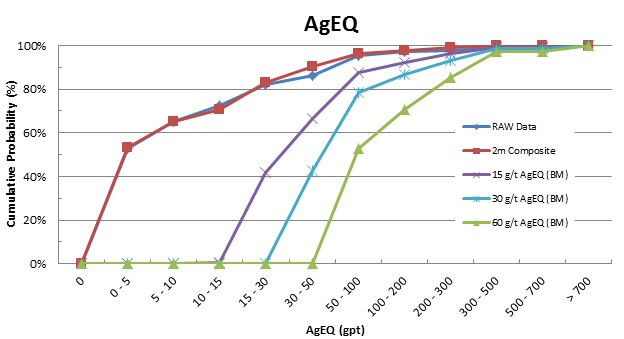

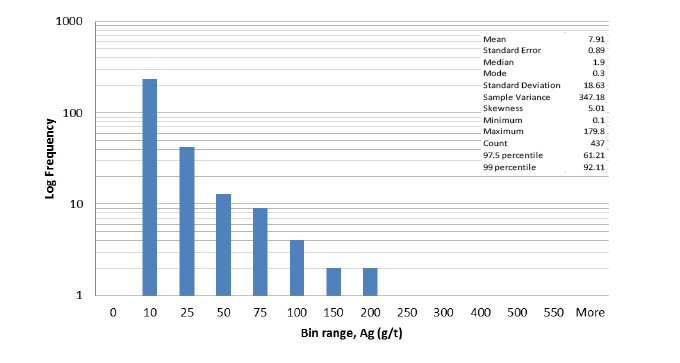

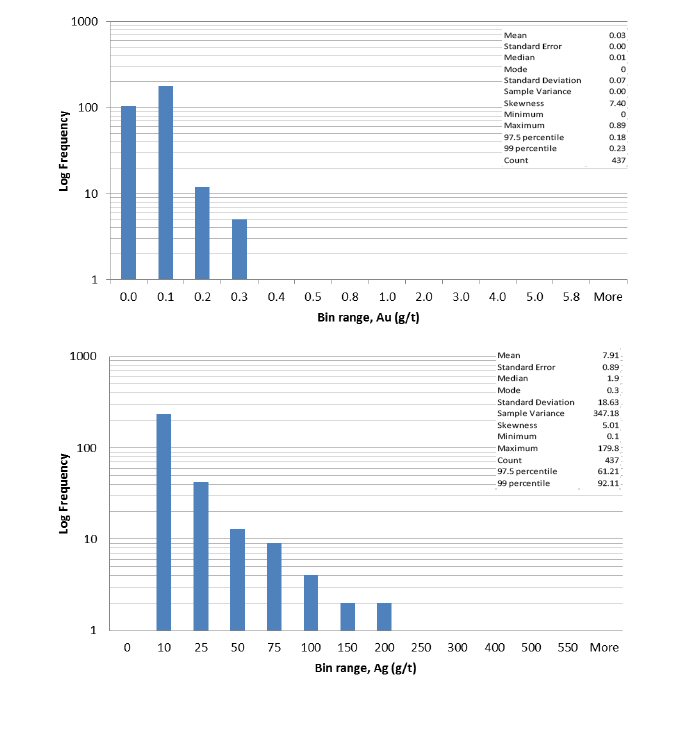

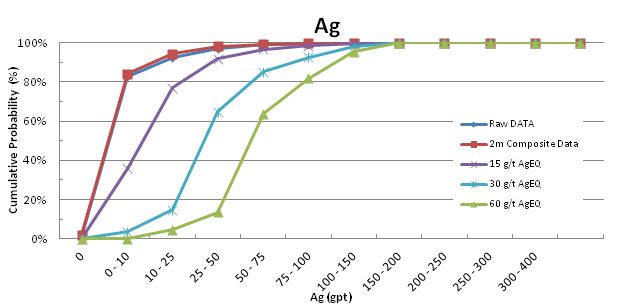

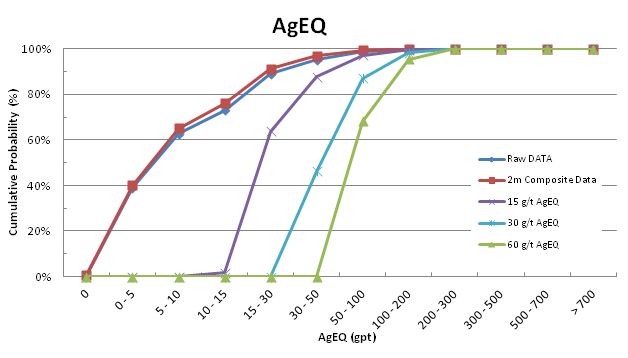

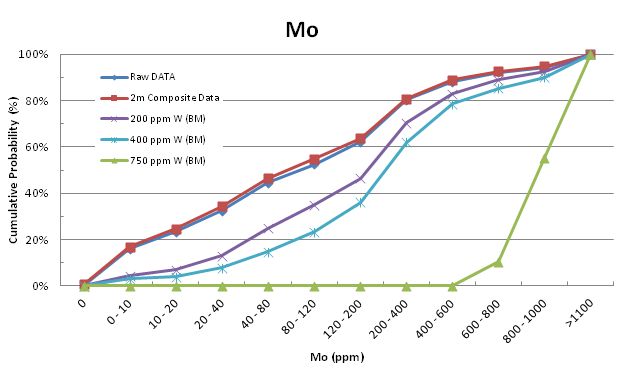

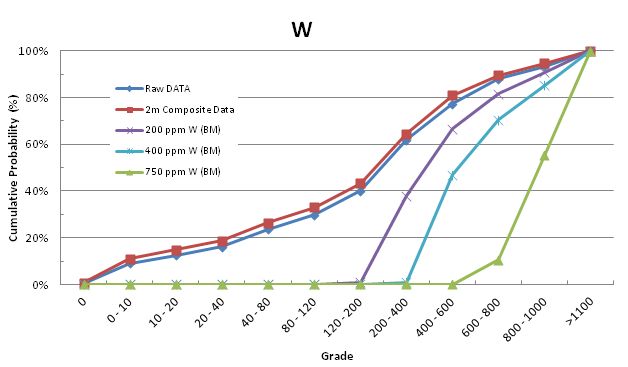

Tetra Tech feels that the reduction and interpolation of data values into the Santo Nino block model is well constrained and representative of the raw assay values. Cumulative probability plots shown in Figure 49 show an increase in grade control and elimination of lower grade dilution with successive data constraint.

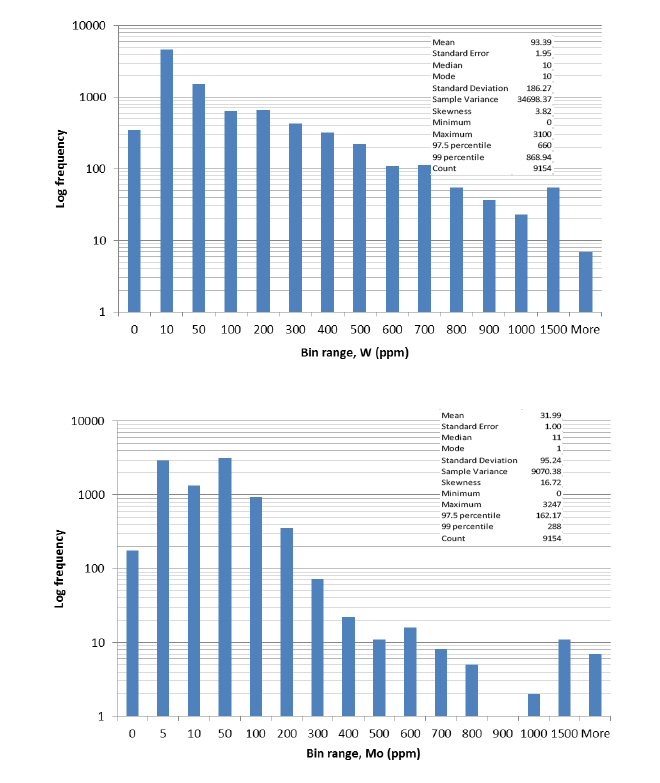

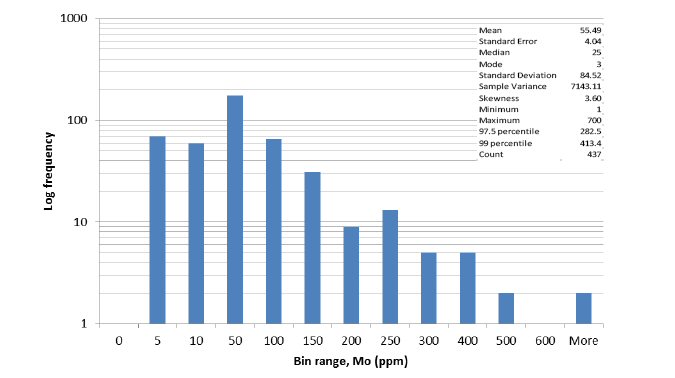

Figure 49: Santo Nino cumulative probability plots for silver, gold, copper, AgEQ, molybdenum and tungsten

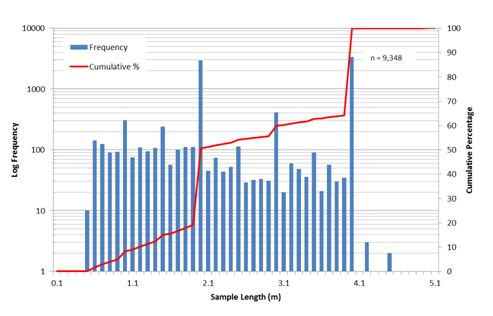

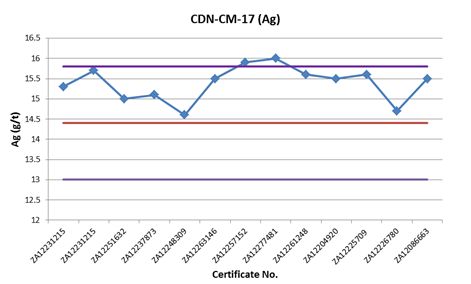

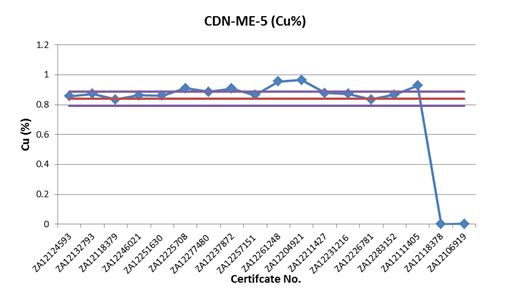

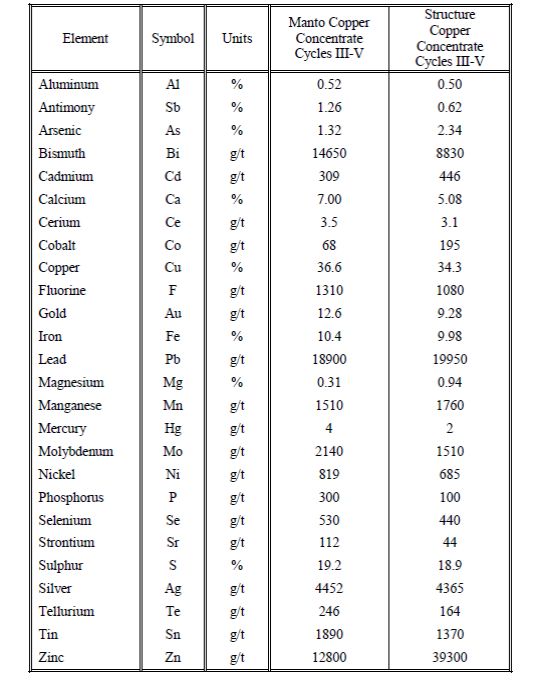

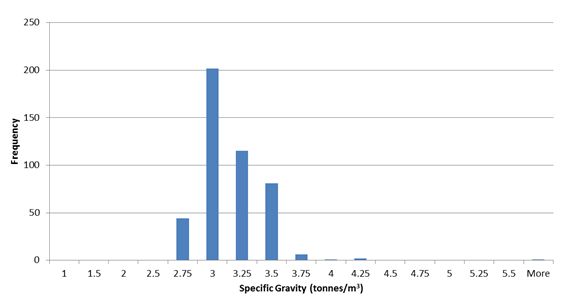

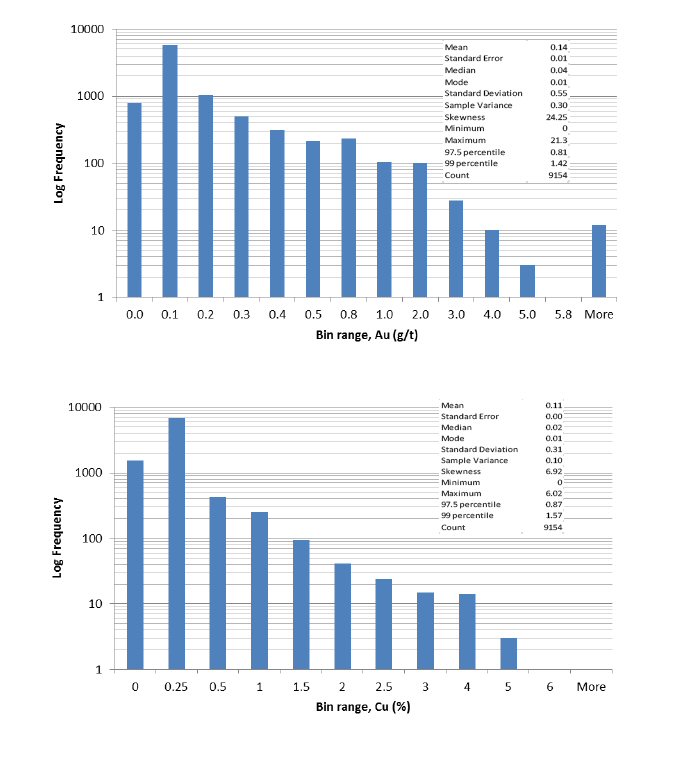

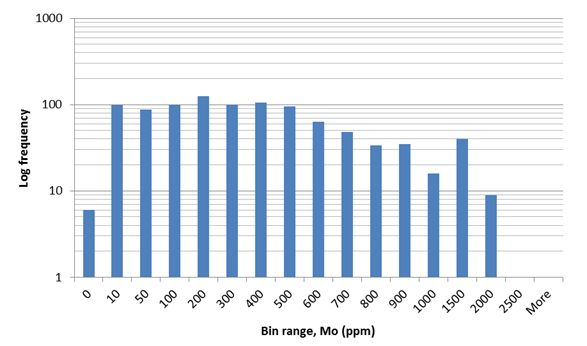

14.3.3.1 Santo Nino High Grade Capping

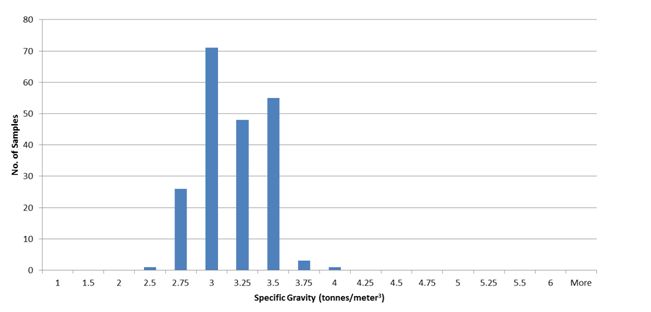

Inspection of 2 metre composite grade distributions (Figure 50) in Santo Nino mineralized solids for silver, copper, gold, tungsten and molybdenum indicated that the data populations were positively skewed and may include multiple internal grade populations. Histogram distributions for each metal were used for visual determination of anomalous values and for the basis of high grade metal caps. High grade caps were applied to the 2 metre composites during interpolation of the block model using values of 550 gpt for silver, 6% for copper and 5.8 gpt for gold. No grade cap was applied to molybdenum or tungsten data as distributions appear to be continuous and where outliers were noted, visual inspection confirmed that these samples occurred adjacent to other high grade samples in drill core records and are thereby not felt to be anomalous.

Figure 50: Santo Nino histogram for distributions of 2 metre composite data

14.3.4 Coloradito Geostatistics

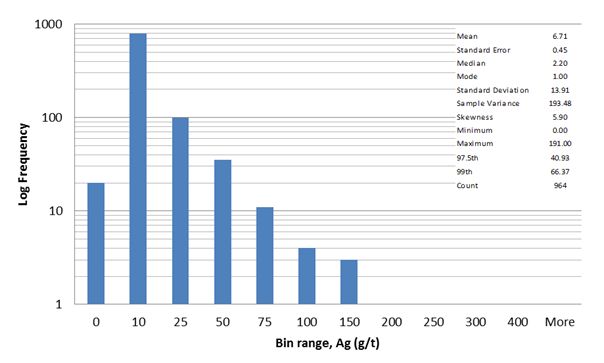

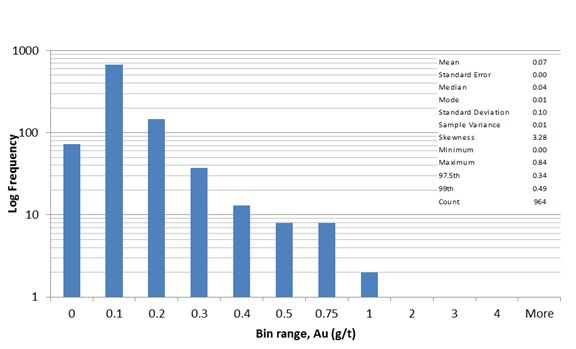

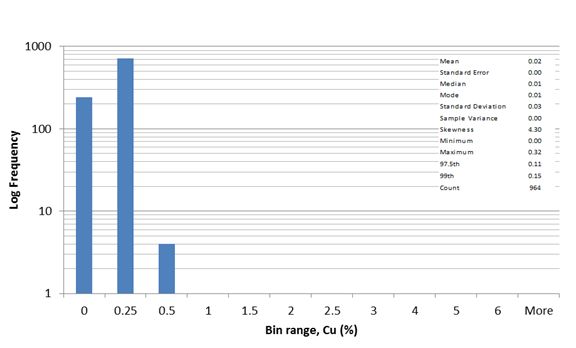

Coloradito used 2,784 recent and historically verified raw samples within two solids of contact skarn designation, one large primary solid and a second smaller solid constrained by 200 ppm W. These were used in the development of the geological and resource estimation model. Raw samples within the contact skarn were composited to 2 metre weighted averages, with the data ‘reduction’ resulting in 964 normalized composite samples. Minor Ag, Au & Cu mineralization was also located in the primary and secondary solids. Descriptive statistics for the raw and 2 metre composite samples contained within contact skarn, along with the resulting >15 gpt, 30 gpt and >60 gpt AgEQ cutoff and 200 ppm and 400 ppm W cutoffs, are listed in Table 76 to Table 82.

| Table 76: Coloradito Contact Skarn - Descriptive Statistics for Raw, Non-Composited, Metal Data |

| |

Coloradito - RAW Data Contact Skarn | Ag (gpt) | Au (gpt) | Cu (%) | Mo (ppm) | W (ppm) |

| Mean | 7.85 | 0.08 | 0.03 | 274.91 | 390.82 |

| Standard Error | 0.33 | 0.00 | 0.00 | 9.24 | 7.57 |

| Median | 2.4 | 0.04 | 0.01 | 105.5 | 300 |

| Mode | 1 | 0.01 | 0.01 | 4 | 10 |

| Standard Deviation | 17.55 | 0.12 | 0.04 | 487.74 | 399.32 |

| Sample Variance | 307.94 | 0.02 | 0.00 | 237,890 | 159,460 |

| Skewness | 6.18 | 4.78 | 4.00 | 5.20 | 2.33 |

| Minimum | 0 | 0 | 0 | 0 | 0 |

| Maximum | 230 | 1.43 | 0.41 | 6520 | 3970 |

| Count | 2784 | 2784 | 2784 | 2784 | 2784 |

| 97.5th | 58 | 0.39 | 0.17 | 1570 | 1360.2 |

| 99th | 83 | 0.5651 | 0.2217 | 2240 | 1816.8 |

| Table 77: Coloradito Contact Skarn – 2 metre Composited Descriptive Metal Data |

| |

Coloradito - 2 metre- Composited Data | Ag (gpt) | Au (gpt) | Cu (%) | Mo (ppm) | W (ppm) |

| Mean | 6.71 | 0.07 | 0.02 | 254.08 | 352.60 |

| Standard Error | 0.45 | 0.00 | 0.00 | 13.67 | 11.34 |

| Median | 2.20 | 0.04 | 0.01 | 94.00 | 260 |

| Mode | 1.00 | 0.01 | 0.01 | 4.00 | 10 |

| Standard Deviation | 13.91 | 0.10 | 0.03 | 424.41 | 352.07 |

| Sample Variance | 193.48 | 0.01 | 0.00 | 180,126 | 123,951 |

| Skewness | 5.90 | 3.28 | 4.30 | 4.22 | 1.84 |

| Minimum | 0.00 | 0.00 | 0.00 | 0.00 | 0 |

| Maximum | 191.00 | 0.84 | 0.32 | 4710.00 | 3060 |

| Count | 964 | 964 | 964 | 964 | 964 |

| 97.5th | 40.93 | 0.34 | 0.11 | 1470.13 | 1272.00 |

| 99th | 66.37 | 0.49 | 0.15 | 2048.10 | 1512.36 |

| Table 78: Coloradito Contact Skarn – Composited >15 AgEQ Descriptive Metal Data |

| |

Coloradito - 2 metre- Composited Contact Skarn Data; >15 gpt AgEQ | Ag (gpt) | Au (gpt) | Cu (%) | Mo (ppm) | W (ppm) |

| Mean | 20.4 | 0.2 | 0.0 | 469.2 | 531.6 |

| Standard Error | 1.5 | 0.0 | 0.0 | 43.8 | 25.1 |

| Median | 13.2 | 0.13 | 0.02 | 238.5 | 478 |

| Mode | 13.10 | 0.06 | 0.01 | 4 | 40 |

| Standard Deviation | 23.2 | 0.1 | 0.1 | 670.6 | 383.5 |

| Sample Variance | 536.1 | 0.0 | 0.0 | 449,751 | 147,071 |

| Skewness | 3.4 | 1.9 | 2.7 | 3.0 | 1.2 |

| Minimum | 0.8 | 0.01 | 0 | 1 | 10 |

| Maximum | 191 | 0.84 | 0.32 | 4710 | 2430 |

| Count | 234 | 234 | 234 | 234 | 234 |

| 97.5th | 94.01 | 0.54275 | 0.21525 | 2165.75 | 1394.68 |

| Table 79: Coloradito Contact Skarn - >30 AgEQ Descriptive Metal Data |

| |

Coloradito – 2 metre- Composited Contact Skarn Data; >30 gpt AgEQ | Ag (gpt) | Au (gpt) | Cu (%) | Mo (ppm) | W (ppm) |

| Mean | 37.69 | 0.23 | 0.05 | 559.14 | 503.05 |

| Standard Error | 3.21 | 0.02 | 0.01 | 81.50 | 40.63 |

| Median | 29.75 | 0.175 | 0.03 | 242 | 481.5 |

| Mode | 60 | 0.05 | 0.02 | 20 | 30 |

| Standard Deviation | 30.08 | 0.19 | 0.07 | 764.56 | 381.13 |

| Sample Variance | 904.74 | 0.04 | 0.00 | 584,551 | 145,259 |

| Skewness | 2.32 | 1.50 | 2.65 | 2.46 | 1.63 |

| Minimum | 1.3 | 0.03 | 0 | 2 | 10 |

| Maximum | 191 | 0.84 | 0.32 | 3670 | 2430 |

| 97.5th | 103.40 | 0.72 | 0.27 | 3271.25 | 1125.00 |

| 99th | 141.15 | 0.81 | 0.31 | 3574.30 | 1442.55 |

| Table 80: Coloradito Contact Skarn - >60 AgEQ Descriptive Metal Data |

| |

Coloradito - 2m- Composited Data-60 gpt AgEQ | Ag (gpt) | Au (gpt) | Cu (%) | Mo (ppm) | W (ppm) |

| Mean | 7.75 | 2.57 | 0.005 | 31 | 10 |

| Standard Error | 2.25 | 0.79 | 0.005 | 3 | 0 |

| Median | 7.75 | 2.57 | 0.005 | 31 | 10 |

| Mode | - | - | - | - | 10 |

| Standard Deviation | 3.18 | 1.12 | 0.01 | 4.24 | 0 |

| Sample Variance | 10.13 | 1.25 | 0.00 | 18.00 | 0 |

| Skewness | - | - | - | - | - |

| Minimum | 5.5 | 1.78 | 0 | 28 | 10 |

| Maximum | 10 | 3.36 | 0.01 | 34 | 10 |

| Count | 2 | 2 | 2 | 2 | 2 |

| 97.5th | 9.888 | 3.321 | 0.010 | 33.850 | 10.000 |

| 99th | 9.955 | 3.344 | 0.010 | 33.940 | 10.000 |

| Table 81: Coloradito Contact Skarn - >200 ppm W Descriptive Metal Data |

| |

Coloradito - 2 metre Composited Data >200 ppm W | Mo (ppm) | W (ppm) |

| Mean | 360.85 | 562.46 |

| Standard Error | 18.98 | 14.17 |

| Median | 226.50 | 471.50 |

| Mode | 13 | 240 |

| Standard Deviation | 445.87 | 332.86 |

| Sample Variance | 198,799 | 110,799 |

| Skewness | 3.33 | 2.16 |

| Minimum | 2 | 200 |

| Maximum | 4710 | 3060 |

| Count | 552 | 552 |

| 97.5th | 0.07225 | 288.45 |

| 99th | 0.1298 | 390.98 |

| Table 82: Coloradito Contact Skarn - >200 ppm W Descriptive Metal Data |

| |

Coloradito - 2 metre- Composited Data >400 ppm W | Mo (ppm) | W (ppm) |

| Mean | 432.47 | 720.16 |

| Standard Error | 25.64 | 17.68 |

| Median | 289 | 625 |

| Mode | 829 | 420 |

| Standard Deviation | 476.88 | 328.92 |

| Sample Variance | 227,413 | 108,188 |

| Skewness | 3.33 | 2.39 |

| Minimum | 2 | 400 |

| Maximum | 4710 | 3060 |

| Count | 346 | 346 |

| 97.5th | 1541.25 | 1662.75 |

| 99th | 1758.65 | 2074.25 |

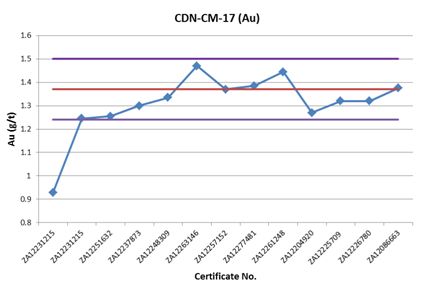

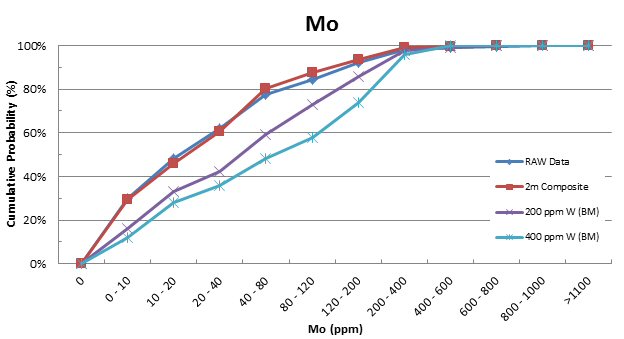

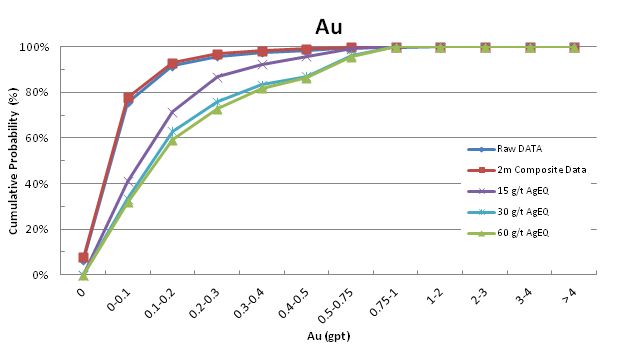

Tetra Tech feels that the reduction and interpolation of data values into the Coloradito block model is well constrained and representative of the raw assay values. Cumulative probability plots shown in

Figure 51 show an increase in grade control and elimination of lower grade dilution with successive data constraint.

Figure 51: Coloradito cumulative probability plots for silver, gold, copper, AgEQ, Molybdenum and Tungsten.

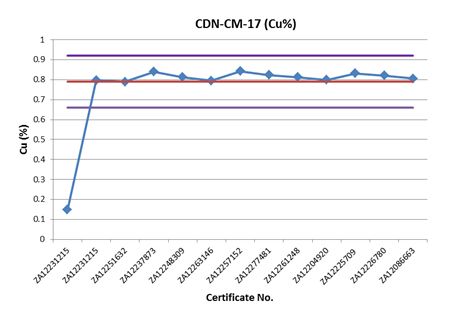

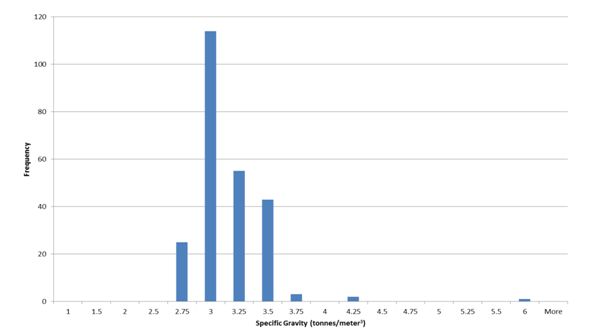

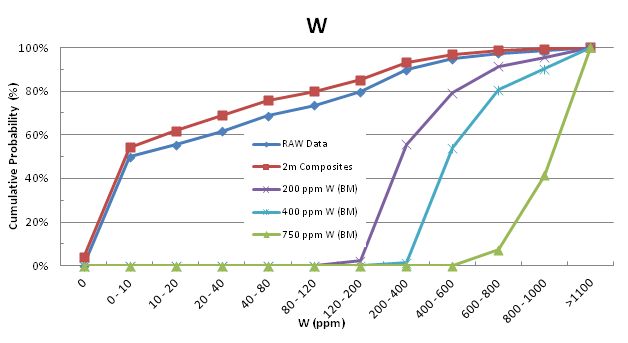

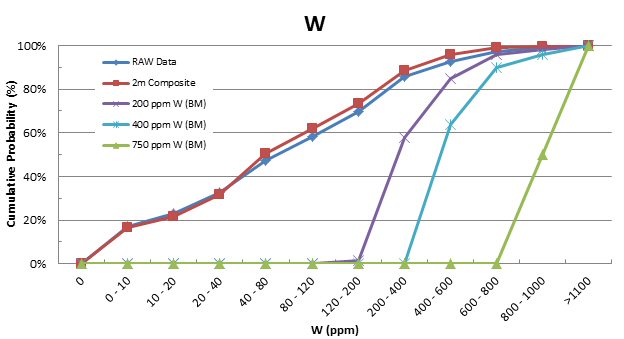

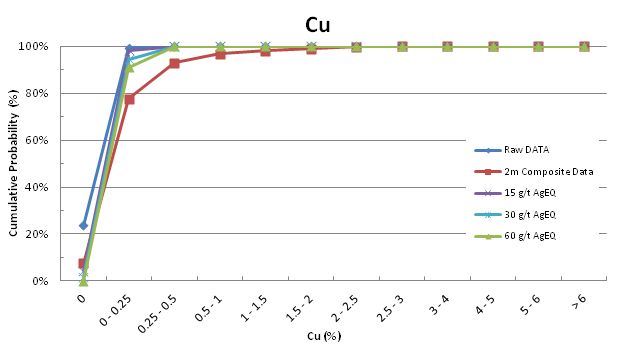

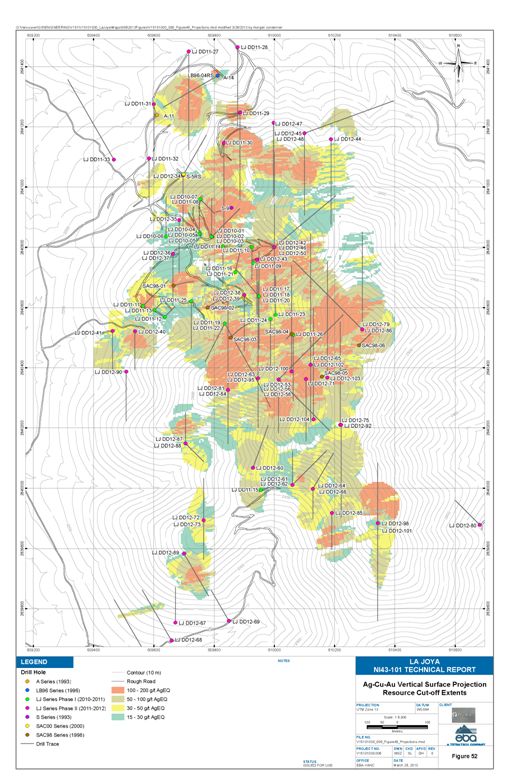

14.3.4.1 Coloradito High Grade Capping

Inspection of 2 metre composite (Figure 52) grade distributions of the Coloradito for tungsten, molybdenum, silver, copper and gold indicated that the data populations were positively skewed and may include multiple internal grade populations. Histogram distributions for each metal were used for visual determination of anomalous values and as the basis of high grade metal caps. High grade caps were applied to the 2 metre composites during interpolation of the block model using values of 550 gpt for silver, 6% for copper and 5.8 gpt for gold. No high grade caps were applied to the composite dataset as distributions appear to be continuous and where outliers were noted, visual inspection confirmed that these samples occurred adjacent to other high grade samples in drill core records and are thereby not felt to be anomalous.

Figure 52: Coloradito histogram distributions of 2 metre composite data

14.3.5 Interpolation and Modelling Parameters

Based on the low sample density available within each mineralized solid, Tetra Tech determined that variography analysis was not effective in determination of orientation and anisotropy values of elliptical search parameters. Instead, the orientations of the search ellipses were aligned corresponding to the geological interpretation. Anisotropy and search axis ranges listed in Table 83 were based on iterative interpolation and field observations.

14.3.5.1 Main Mineralized Trend

The resource is based on verified information from historical and recent (Phase I and II) SilverCrest sources. Raw assay data was composited to 2 metre and interpolated into a block model using 5 m x 5 m x 5 m block size using inverse distance squared (ID2) methodology. A series of distinct search ellipses were defined for each mineralized domains based on geological field observation, geostatistical analysis and iterative interpolation. High grade ranges are based on +2SD from the mean values of each reporting metal for this specific model.Error! Reference source not found.Table 83 lists the anisotropic search ellipses for silver, copper and gold mineralization within the stratabound mantos. High grade range limiting ellipses, where manto grades exceeded 150 gpt Ag, 1 gpt Au, or 1 % Cu, are shown in parentheses. High grade ranges limits the lateral influence of high grades associated with proximal skarn near the SCSV corridors.

| Table 83: Model Search Parameters |

| | Mineralization Type | Orientation | Major Axis Range | Semi-major Axis Range | Minor Axis Range | Min - Max Composites | Reporting Composites |

| MMT | Manto | 110,5,0 (Z,Y,Z) | 75 (40*) | 75 (40*) | 35 (20*) | 2 to 12 | 3 |

| SCSV | 10,90,-90 (Z,Y,Z) | 80 (30*) | 80 (30*) | 20 (15*) | 2 to 12 | 3 |

| Contact Skarn | 0,-15,0 (Z,Y,Z) | 150 | 150 | 75 | 2 to 12 | 5 |

| Contact Skarn | 240,-10,0 (Z,Y,Z) | 200 | 200 | 100 | 2 to 12 | 5 |

| Contact Skarn | 0,0,0 (Z,Y,Z) | 200 | 200 | 100 | 2 to 12 | 5 |

| HT | 10,-90,90 (Z,Y,Z) | 70 | 70 | 35 | 2 to 12 | 3 |

| Santo Nino | Manto | 55,10,55 (Z,Y,Z) | 75 (40**) | 75 (40**) | 30 (20**) | 2 to 12 | 3 |

| SCSV | 10, 90,-90 (Z,Y,Z) | 80 (30**) | 80 (30**) | 20 (15**) | 2 to 12 | 3 |

| Contact Skarn | 50,12, 0 (Z,Y,Z) | 150 | 150 | 75 | 2 to 12 | 5 |

| HT | 30,90,-90 (Z,Y,Z) | 100 | 100 | 40 | 2 to 12 | 3 |

| Coloradito | Manto | 250,25,250 (Z,Y,Z) | 90 | 75 | 50 | 2 to 20 | 6 |

| Contact Skarn A | 250,25,145 (Z,Y,Z) | 125 | 125 | 60 | 2 to 20 | 6 |

| Contact Skarn B | 18, 80, 60 (Z,Y,Z) | 60 | 50 | 20 | 2 to 20 | 6 |

*MMT high grade threshold (150 gpt Ag, 1 gpt Au and 1% Cu) limiting search ellipse ranges

**Santo Nino high grade threshold (92 gpt Ag, 0.21 gpt Au and 2.39% Cu) limiting search ellipse ranges

Silver, copper, gold, lead, zinc, tungsten and molybdenum grades were interpolated into blocks contained within the interpreted SCSV corridors Table 83 list search ellipse orientation and ranges. High grade range limiting ellipses, where manto grades exceeded 150 gpt Ag, 1 gpt Au, or 1 % Cu, are shown in parentheses. Mineralization contained within these solids demonstrated continuity and is considered to be the most recent mineralization event. Grades within the SCSV solids were interpolated into the block model to overprint all other forms of mineralization.

Tungsten and molybdenum mineralization has been recognized as continuous within the intrusive draping contact skarn. Table 83 list the three search ellipses orientations and ranges relating to the three individual solids segregated from the contact skarn to aid interpolation.

For volume and grade calculations in the mineralized and overprinting manto and structure (SCSV) intercepts, a series of HT solids were created. The HT solids constrained grade interpolation bleed into the adjoining manto and SCSV zones. The HT zones interpolated silver, copper, silver, lead, zinc, tungsten and molybdenum with the search ellipse and ranges listed in Table 83.

Table 84 provides a summary of average reporting composite data by solid. Average reporting composite distances indicate that sample density may be low. Infill drilling is recommended in order to increase sample density and improve geostatistical characterization of the individual mineralized trends.

Table 84: Average Reporting Composite Data for Block Model by Mineralized Solid Type for the MMT |

| Solid Type | Average Distance to Nearest Reporting Composite (m) | Average Number of Reporting Composites | Average Number of Reporting Drill holes |

| Manto | 53 | 7 | 2 |

| SCSV | 60 | 7 | 2 |

| Contact Skarn | 108 | 9 | 3 |

| HT | 40 | 7 | 2 |

The resource is based on verified historical and recent (Phase II) SilverCrest drilling. Raw assay data was composited to 2 metre and interpolated into a block model using 5 m x 5 m x 5 m block size model using inverse distance squared (ID2) methodology. A series of distinct search ellipses were defined for each of spatially associated mineralized domain, based on geological field observation, geostatistical analysis and iterative interpolation. High grade ranges are based on +2SD from the mean values of each reporting metal for this specific model.Error! Reference source not found. Table 83 lists the anisotropic search ellipses for silver, copper and gold mineralization within the stratabound mantos. High grade range limiting search ellipses, where manto grades exceeded 92 gpt Ag, 0.21 gpt Au, or 2.39%, are shown in parentheses. High grade ranges limits the lateral influence of high grades associated with proximal skarn near the SCSV corridors.

Silver, copper, gold, lead, zinc, tungsten and molybdenum grades were interpolated into blocks contained within the interpreted SCSV corridors using an anisotropic ellipse with orientation and ranges listed in Table 83. High grade range limiting ellipses, where manto grades exceeded 92 gpt Ag, 0.21 gpt Au, or 2.39% Cu, are shown in parentheses. Mineralization contained within these solids has demonstrated continuity and is considered to be the most recent mineralization event. Grades within the SCSV solids were interpolated into the block model to overprint all other forms of mineralization. Tungsten and molybdenum mineralization has been recognized to be continuous within the contact skarn. Grades were interpolated into blocks contained within the interpreted contact skarn using an anisotropic ellipse (Table 83).

The HT solids restricted grade interpolation into the adjoining manto and SCSV corridors. These zones interpolated silver, copper, silver, lead, zinc, tungsten and molybdenum. Table 83 list the search ellipse orientation and range parameters.

Table 85 provides a summary of the average reporting composite data by solid. Average distances indicate that sample density may be moderate. Infill drilling is recommended to increase sample density with the aim to improve geostatistical characterization of the individual mineralized trends.

| Table 85: Main Mineralized Trend – Manto 2 metre Composited >30 AgEQ Descriptive Metal Data |

| Solid Type | Average Distance to Nearest Reporting Composite (m) | Average Number of Reporting Composites | Average Number of Reporting Drill holes |

| Manto | 15 | 6 | 2 |

| SCSV | 24 | 7 | 53 |

| Contact Skarn | 2 | 8 | 91 |

| HT | 12 | 10 | 50 |

The resource is based on verified and resampled historical and recent Phase II SilverCrest drilling. Raw assay data was composited to 2 metre and interpolated into a block model using 5 m x 5 m x 5 m block size model using inverse distance squared (ID2) methodology. A series of distinct search ellipses were defined for each of spatially associated mineralized domain, based on geological field observation, geostatistical analysis and iterative interpolation. Tungsten and molybdenum mineralization is of primary interest at Coloradito and occur in two grade solids. Both are constrained by tungsten grades with a >200 ppm cut off. Table 83 lists search ellipse orientation and ranges.

Table 86 lists the average data of blocks within the >200 ppm W tungsten contact skarn grade solid. Average distances indicate that sample density may be low for contact skarn A. Infill drilling is recommended to increase sample density with the aim to improve geostatistical characterization of the individual mineralized trends.

| Table 86: Average Reporting Composite Data for Block Model by Mineralized Solid Type for Coloradito |

| Solid Type | Average Distance to Nearest Reporting Composite (m) | Average Number of Reporting Composites | Average Number of Reporting Drill holes |

| Contact Skarn A | 71 | 11 | 2 |

| Contact Skarn B | 30 | 5 | 2 |

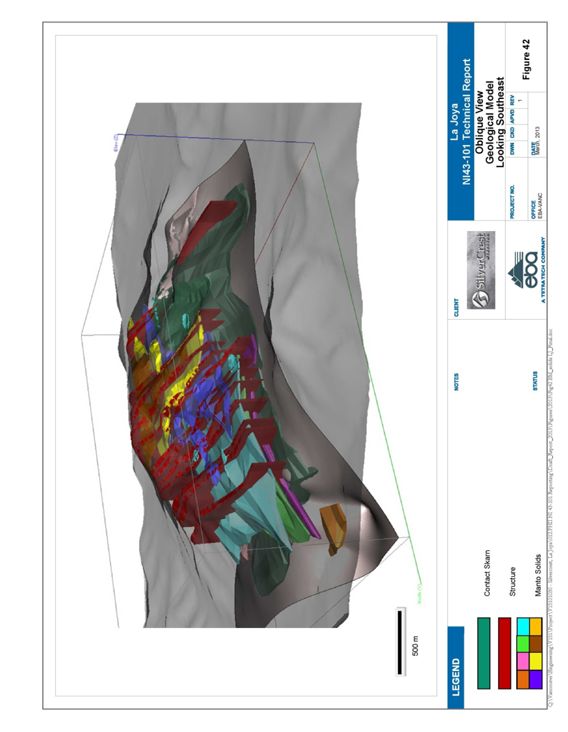

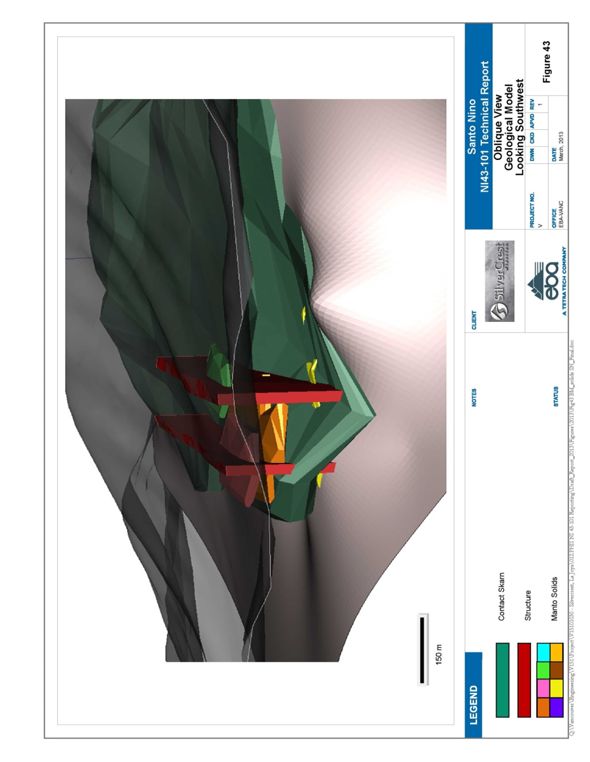

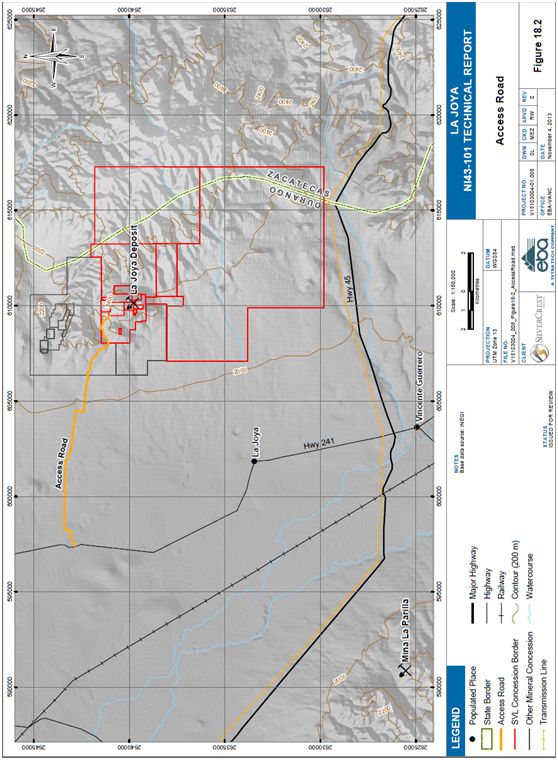

The current Mineral Resources were previously estimated for the MMT , Santo Nino and Coloradito deposits and disclosed in the previous Technical Report titled “Updated Resource Estimate for the La Joya Property, Durango, Mexico, NI 43-101 Technical Report, Effective Date: December 16, 2012, Released Date: March 27, 2013” which is available on SEDAR. The estimates in this report remain current and are described in the following section.

Silver, copper, gold, tungsten and molybdenum hosted in Manto and Structure mineralization at the MMT and Santo Nino deposits have been reported as Inferred Mineral Resources at a 30 gpt AgEQ6 cut-off in Table 87 below. Block model sensitivities using 15 gpt AgEQ6 and 60 gpt AgEQ6 cut-offs have been included in the table. Grade contours for MMT of the 15, 30, 50, 100 and 200 gpt AgEQ6 are plotted in Figure 53.

Tungsten and molybdenum hosted in Contact Zone mineralization at the MMT, Santo Nino and Coloradito deposits have been reported as Inferred Mineral Resources at a 0.050% WO3 cut-off in Table 88, below. Block model sensitivities using 0.025% WO3 and 0.095% WO3 cut-offs have been included in the table. Tetra Tech classified the resources as Inferred using 30gpt AgEQ and 0.05% WO3 (tungsten trioxide) as appropriate reporting cut-offs. The materials containing the Ag-Cu-Au mineralization estimate are reported independently from the the mineralized material containing the W mineralization. These estimates represent discrete, non-overlapping, units of rock, however in reality the boundary between the mineraliztion is gradational and not abrupt.

| Table 87: Inferred Ag-Cu-Au Resource Estimation for MMT and, Santo Nino Deposits, Effective Date Dec. 16, 2012 |

| Zone | Category7 | AgEQ Cut off (gpt) 6 | Rounded Tonnes | SG | Ag (gpt) | Au (gpt) | Cu (%) | Contained Ag (oz) | Contained Au (oz) | Contained Cu (lbs) | Contained AgEQ (oz)6 |

MMT 8 (Ag, Au, Cu) | Inferred | 15 | 120,570,000 | 3.00 | 23.7 | 0.18 | 0.18 | 91,855,000 | 708,000 | 466,474,000 | 185,757,000 |

| 30 | 67,618,000 | 3.00 | 34.6 | 0.24 | 0.25 | 75,367,000 | 519,000 | 377,392,000 | 148,671,000 |

| 60 | 26,109,000 | 3.00 | 58.5 | 0.3 | 0.42 | 49,129,000 | 256,000 | 240,114,000 | 92,035,000 |

Santo Nino 8 (Ag, Au, Cu) | Inferred | 15 | 6,169,000 | 3.00 | 20.3 | 0.04 | 0.49 | 4,039,000 | 8,000 | 66,775,000 | 12,826,000 |

| 30 | 3,586,000 | 3.00 | 29.1 | 0.05 | 0.75 | 3,363,000 | 5,000 | 59,384,000 | 11,079,000 |

| 60 | 1,818,000 | 3.00 | 43.0 | 0.05 | 1.2 | 2,517,000 | 3,000 | 48,269,000 | 872,000 |

| TOTAL | Inferred | 15 | 126,739,000 | | 23.5 | 0.17 | 0.20 | 95,894,000 | 716,000 | 533,249,000 | 198,583,000 |

| 30 | 71,204,000 | | 34.4 | 0.23 | 0.28 | 78,730,000 | 524,000 | 436,776,000 | 159,750,000 |

| 60 | 27,927,000 | | 57.5 | 0.28 | 0.47 | 51,646,000 | 259,000 | 288,383,000 | 92,907,000 |

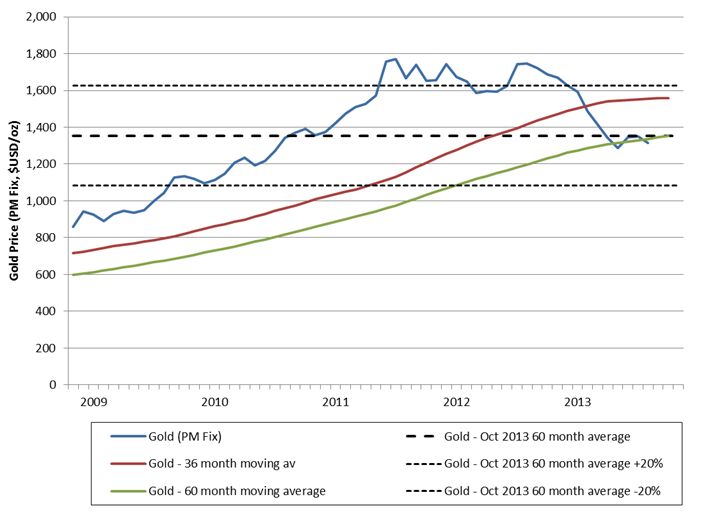

| 6 | Silver equivalency includes silver, gold and copper and excludes lead, zinc, molybdenum and tungsten values. Ag:Au is 50:1, Ag:Cu is 86:1, based on 5 year historic metal price trends of US$24/oz silver, US$1200/oz gold, US$3/lb copper. 100% metallurgical recovery is assumed. |

| 7 | Classified by Tetra Tech, A Tetra Tech Company and conforms to NI 43-101 and CIM definitions for resources. All numbers are rounded. Inferred Resources have been estimated from geological evidence and limited sampling and must be treated with a lower level of confidence than Measured and Indicated Resources. The reported mineral resource for each zone is based on the 30 gpt AgEQ cut-off and is highlighted in light blue. |

| 8 | Mineralization boundaries used in the interpretation of the geological model and resource estimate are based on a cut-off of 15 gpt AgEQ using the metal price ratios described above. Manto and Structure Resource blocks, and their associated volumes, are exclusive of Contact Zone blocks. |

| Table 88: Inferred W-Mo- Resource Estimation for MMT, Santo Nino and Coloradito Deposits, Effective Date Dec. 16, 2012 |

| Zone | Category9 | WO3 Cut off (%) | Rounded Tonnes | SG | Mo (%) | WO3 (%) | Contained WO3 (lbs) | Contained Mo (lbs) |

MMT Contact Zone 10 (W, Mo, Ag, Au, Cu) | Inferred | 0.025 | 60,508,000 | 3 | 0.0035 | 0.053 | 70,526,000 | 4,232,000 |

| 0.050 | 25,136,000 | 3 | 0.0039 | 0.075 | 41,438,000 | 1,942,000 |

| 0.095 | 4,395,000 | 3 | 0.0023 | 0.109 | 10,587,000 | 205,000 |

Santo Nino Contact Zone 10 (W, Mo, Ag, Au, Cu) | Inferred | 0.025 | 5,220,000 | 3 | 0.0077 | 0.04 | 4,591,000 | 806,000 |

| 0.050 | 950,000 | 3 | 0.0132 | 0.07 | 1,456,000 | 250,000 |

| 0.095 | 750 | 3 | 0.0115 | 0.101 | 2,000 | 172 |

Coloradito Contact Zone 10 (W, Mo, Ag, Au, Cu) | Inferred | 0.025 | 31,907,000 | 3 | 0.0283 | 0.062 | 43,302,000 | 18,045,000 |

| 0.050 | 18,486,000 | 3 | 0.0322 | 0.079 | 32,252,000 | 11,921,000 |

| 0.095 | 4,159,000 | 3 | 0.0335 | 0.112 | 10,282,000 | 2,784,000 |

| TOTAL | Inferred | 0.025 | 97,635,000 | | 0.0118 | 0.055 | 118,419,000 | 23,083,000 |

| 0.05 | 44,573,000 | | 0.0158 | 0.076 | 75,147,000 | 14,113,000 |

| 0.095 | 4,159,184 | | 0.0175 | 0.111 | 20,871,000 | 2,989,000 |

| 9 | Classified by Tetra Tech and conforms to NI 43-101 and CIM definitions for resources. All numbers are rounded. Inferred Resources have been estimated from geological evidence and limited sampling and must be treated with a lower level of confidence than Measured and Indicated Resources. The reported mineral resource for each zone is based on the 0.050% WO3 cut-off and is highlighted in light blue |

| 10 | Mineralization boundaries used in the interpretation of the geological model and resource estimate are based on a cut-off of 15 gpt AgEQ using the metal price ratios described above. Contact Zone Resource blocks, and their associated volumes, are exclusive of Manto and Structure blocks. |

Figure 53: Resource contours of 15, 30, 50, 100 and 200 gpt AgEQ cut-offs for MMT

14.4.1 Mineral Resource Classification

Mineral Resources have been classified by James Barr, P.Geo, an independent Qualified Person, based on the CIM Definition Standards for Mineral Resources and Mineral Reserves. The category for which the resources have been assigned is based on the confidence in geological information available relating to the mineral deposit, the quantity and quality of data available on the deposit, the level of detail of the technical and economic information which has been generated for the deposit and the interpretation of the data and information.

All Mineral Resources for the La Joya Deposit, as presented in the above discussion, are classified as Inferred Mineral Resources. Drilling, surface sampling and mapping information from exploration on the property to date is sufficient to allow a reasonable geological interpretation and assumption of grade continuity. Drill spacing remains wide and the associated level of confidence in the ranges of mineralized zones remains low. The geological understanding of the property is considered to remain in the developing stages for the project and will require further ongoing detailed knowledge on the distribution of mineralization to improve overall confidence of the deposit. In particular, detailed logging and study of the SCSV and intercepting manto mineralization, manto and mineralization variability and the relationships between other controls on mineralization including distribution along axial planes to D3 deformation and the extent of lateral manto and SCSV development would be beneficial to future resource estimation.

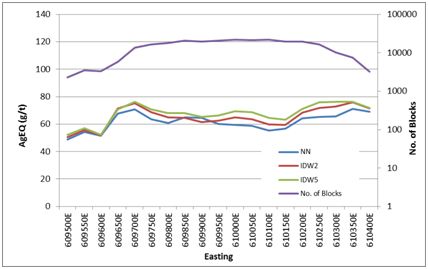

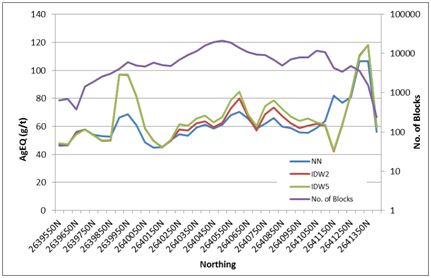

Visual estimated block grade were compared to drill hole grades along sections for Santo Nino, Coloradito and the MMT with statistical method also used for the latter. Nearest Neighbor (NN) and Inverse Distance Weighted method (IDW5) grade models were run for AgEQ (gpt) along 50m wide corridors in both the easterly and northerly directions throughout the MMT. The results from each section of each direction were plotted (Figure 54 and Figure 55) to check for potential global biases in the inverse distance grade models (IDW2) using grade summaries for the 30 gpt AgEQ attribute..

Figure 54: Comparison of >30 gpt AgEQ from NN, IDW2 and IDW5 methods of easting corridor through the La Joya MMT model.

Figure 55: Comparison of >30 gpt AgEQ from NN, IDW2 and IDW5 methods of northing corridors through the La Joya MMT model.

Figure 54 shows good correlation and increasing offset with less influence. Figure 55 shows a general correlation between the different interpolation methods with decreased grades of the NN method with samples receiving identical weighting compared to the IDW2 and IDW5 method where samples closer to the sample point have a higher weighting increasing grades with the increased power. Overall the repeatability of the NN and IDW5 model display acceptable levels and the original model is valid and unbiased. The number of reporting blocks per sections over AgEQ 30 gpt are also plotted.

15.0 MINERAL RESERVE ESTIMATES

A Mineral Reserve has not been estimated for the Project as part of this PEA study.

A Mineral Reserve is the economically mineable part of a Measured or Indicated Mineral Resource.

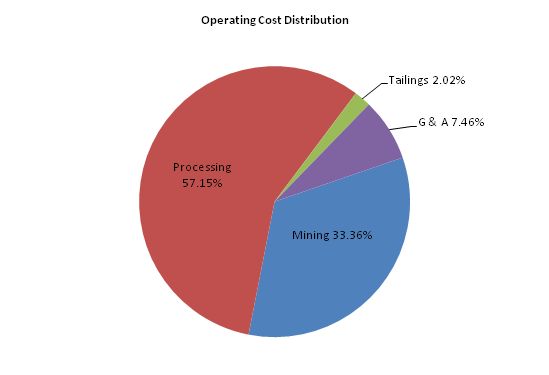

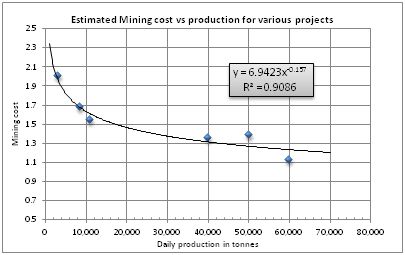

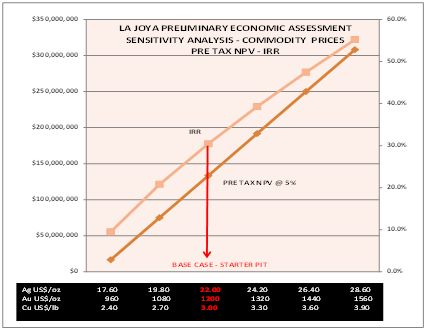

Tetra Tech was retained by SilverCrest to prepare a PEA study for the MMT deposit from the La Joya project based on a 5,000 tpd mill capacity and an estimated mine life ranging from 8 to 10 years.

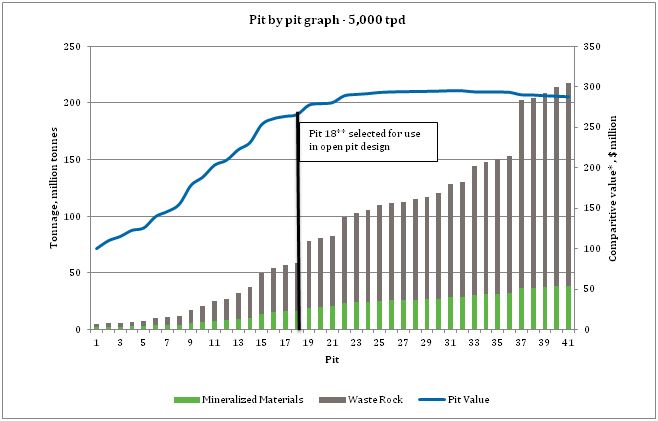

On the basis of the Inferred Mineral Resources presented in Section 14, initial open pit conceptualization of the mining methods and mine plan has been undertaken for the PEA. Preliminary economic, geotechnical and metallurgical and additional non-economic criteria such as mine life have been applied to the Inferrred mineral rsource block model to create a series of Lerch-Grossman nested pit shells using Geovia WhittleTM software. The input parameters used to generate the nested pit shells are shown in Table 89.

Additional objectives to minimize the capital cost requirements and to design an open pit with an 8 to 10 year mine life were considered in the selection of the pit shell to be used for further designs. The selected pit is therefore only a portion of what may be considered economically extractable under selected costs-recoveries and commodities assumptions.

Since the pit shell selection includes criteria other than pure economic, the pit shells used in the PEA for the final pit design do not constrain the Inferred Mineral Resources economically. Tetra Tech has not assessed Inferred mineralization contained in pits larger than pit 41 as shown in Figure 56 for potential economic extraction. Additionally Tetra Tech has not assessed potential for underground mining of any resources that may currently fall outside of the pit shells created for the PEA. The selected pit and the subsequent open pit design are therefore characterised as a “Starter Pit”.

Pit 18 as shown in Figure 56 was selected for further designs and production scheduling. The selected pit will provide guidance to subsequent drilling to increase confidence within the target mining areas defined by the preliminary mine design done for the PEA.

Table 89: La Joya Pit Optimization Parameters

| La Joya Pit Optimization Parameters |

| Items | Units | Proposed Parameters |

| | | | ($US) | Value |

| Discount Rate | | % | | 8 |

| Production Rate | Plant feed | tpd | | 5,000 |

| | Mt/year | | 1.8 |

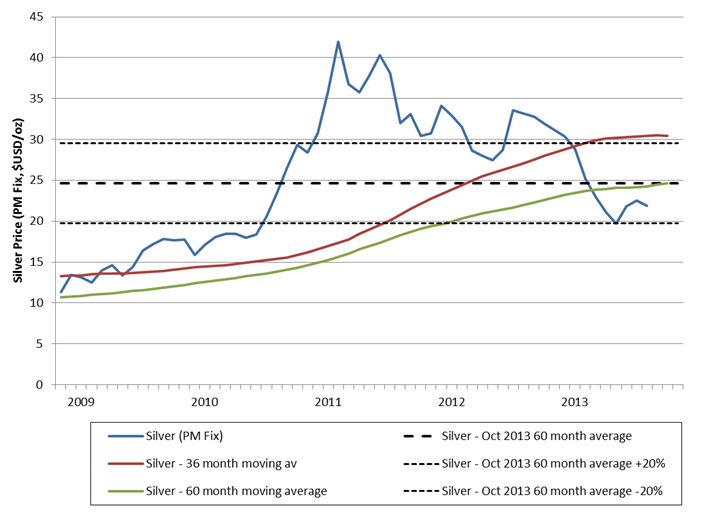

| Metal Market Price | Gold | $US/oz. | $1,200.00 | |

| Copper | $US/lb. | $3.00 |

| Silver | $US/oz. | $22.00 |

| Royalty | | % of NSR | | 2% |

| | Structure | Manto |

Metal Recovery1 | Copper | % | | 84.1 | 86.2 |

| Gold | % | | 49.8 | 64.6 |

| Silver | % | | 82.6 | 83.2 |

Operating Costs2 | Mining (Ore & Waste) | $US/t mined | $1.77 | |

| Process | $US/t mined | $14.63 |

| Tailing | $US/t mined | $0.60 |

| G&A | $US/t mined | $1.81 |

| Block Model | Block dimensions | m | | 5 x 5 x 5 |

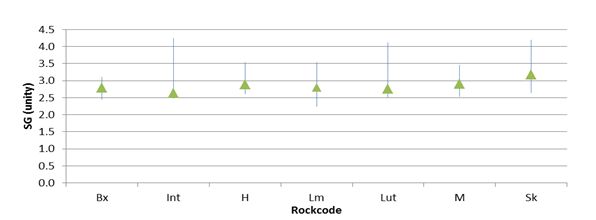

| Density | Ore | t/m3 | | 3 |

| Waste | t/m3 | | 2.8 |

| Mining Dilution | | % | | 5 |

| Mining Recovery | | % | | 95 |

Pit Slope Angles3 | | degrees | | 48 |

| | 1 – Metal recoveries are based on test work as described in section 13 |

| | 2 – Operating costs are based on conceptual understanding of the mining operation factored comparison to similar mines. The costs provided here have not been used to assess the economic value of the property as discussed in section 21 and 22 |

| | 3 – Overall pit slope angle of 48 degrees was recommended by the geotechnical team of EBA, A Tetra Tech Company |

| | 4 – Mining (Ore & Waste) cost per tonne mined reflected in table 91 above does not represent the actual contract mining cost used in the economic analysis. |

Note that no additional costs were considered for increased depth in the pit optimisation. However, for the final costing, the costs were adjusted based on haul distances and will thus reflect lower costs for the initial years and higher costs at the end of the planned life of mine, when haul distances increase.

Figure 56: Pit by pit graph for the 5,000 tpd case (result of pit optimization process)

| | * Pit value shown here is not representative of the actual net present value of the pit, but is purely for comparison purposes |

The 41 pit shells shown in Figure 56 were generated using the optimization parameters listed in Table 89 and by varying the price factor from 0.3 to 1.1 at 0.02 intervals. The selection of pit 18 was undertaken to fall in line with SilverCrest’s scenario for mine life of roughly 8-10 years at 5,000 tpd mill capacity. Pit 18 corresponds to a price factor of 0.64, gold price of $768/oz, copper price of $1.92/lb and silver price of $14.08/oz. The selected pit was then subjected to mine design parameters as shown in Table 90 which resulted in the final pit as shown in Figure 59: 3D Starter Pit Design with Dump and Infrastructure (Figure 59). The ultimate pit was subsequently scheduled which resulted in the final PEA mining schedule, which includes the stockpiling of ore to achieve a better head grade scenario.

16.2 Geotechnical Considerations for open pit design

Analyses of the pit slope angles at PEA level performed by the geotechnical team of Tetra Tech were based on geotechnical information collected in seventy-seven exploration diamond holes drilled in 2011 and 2012 (LJ-11-27 through LJ11-33 drilled in 2011 and LJ12-34 through LJ-12-105 drilled in 2012). The length of the holes ranged in general between 250 and 600 m. The geotechnical parameters were measured by SilverCrest field mine geologists. It should be noted that Tetra Tech had provided training to the site geologist on methods of geotechnical logging rock core. Geotechnical logs for rock mass characterization were made available to Tetra Tech in raw spreadsheets. Core photographs were also made available. Neither oriented core data nor geotechnical laboratory test were part of the investigation.

The geotechnical data recorded consists of percent total of recovery, rock hardness (strength index property), weathering, rock quality designation (RQD), the number of natural and mechanical fractures, as well as characterization and orientation of structural discontinuities. The descriptions follow those set out in the International Society for Rock Mechanics (ISRM) guide to rock characterization. Parameters for characterization of joints and discontinuities were collected based on two widely used empirical rock classification systems. The Norwegian Geotechnical Institute NGI Q-System was used to assess joint roughness (Jr), joint alteration (Ja) and joint number (Jn). The Bieniawski’s rock mass rating (RMR76) was used to assess the overall condition of the joints, by assessing individual parameters such as separation, roughness, infilling, and joint weathering.

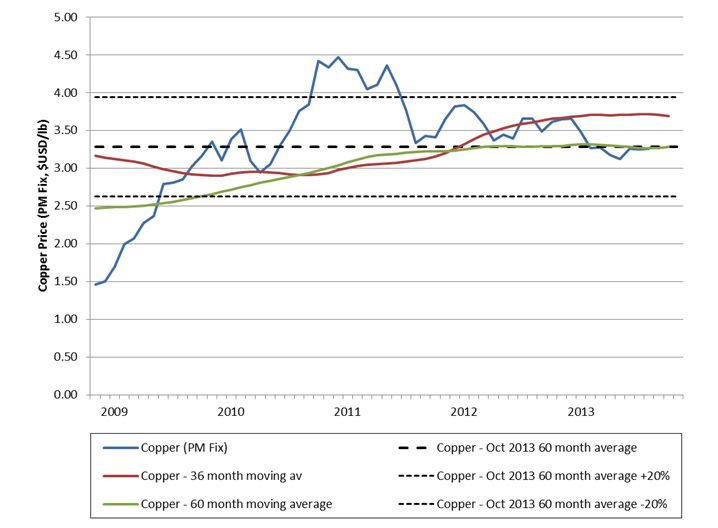

Tetra Tech processed the geotechnical data and calculated the RQD, RMR and Q values for each of the runs of the above referred drill holes. From the available data, it was determined that the rock mass geotechnical conditions tend to be homogeneous. According to the RMR, the quality of the rock mass of the main rock types (limestone, skarn, hornfels) was determined to be good to very good rock (RMR76 rating varying between 70-90), and good according to RQD system (RQD rating varying between 75-90).

As stated above, the rock mass quality according to the Bieniawski’s rock mass rating system, indicates that the RMR76 throughout the country rock and ore is generally over 70, and therefore, the structure of the rock is likely to be the main controlling factor governing the stability of the pit walls at bench, inter-ramp and overall scales. However, no structural information is available (rock fabric and major structures) at this PEA level which allowed to assess the pit slope angles. Therefore, at the PEA level a conservative pit slope angle of 48 degrees is recommended (Table 89). To achieve steep angles in competent rock as for the rock in this proposed open pit carefully controlled blasting are of paramount importance. Further project stages (Pre-Feasibility or Feasibility stages) should implement geotechnical programs (mapping and subsurface investigations) such that structural conditions data of the rock mass is obtained with the purpose of pit slope design.

16.3 Open Pit Design (Starter Pit)

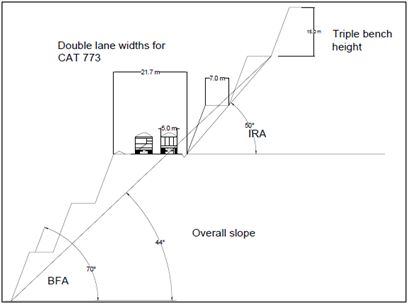

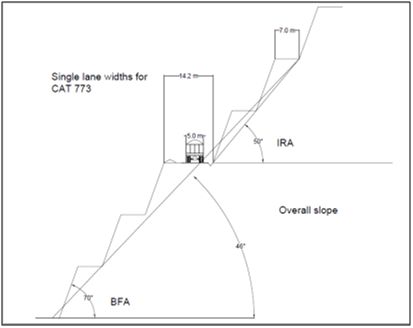

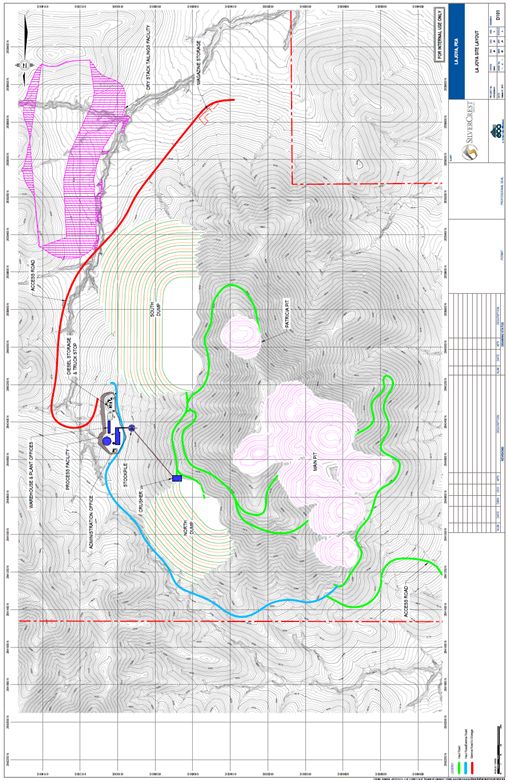

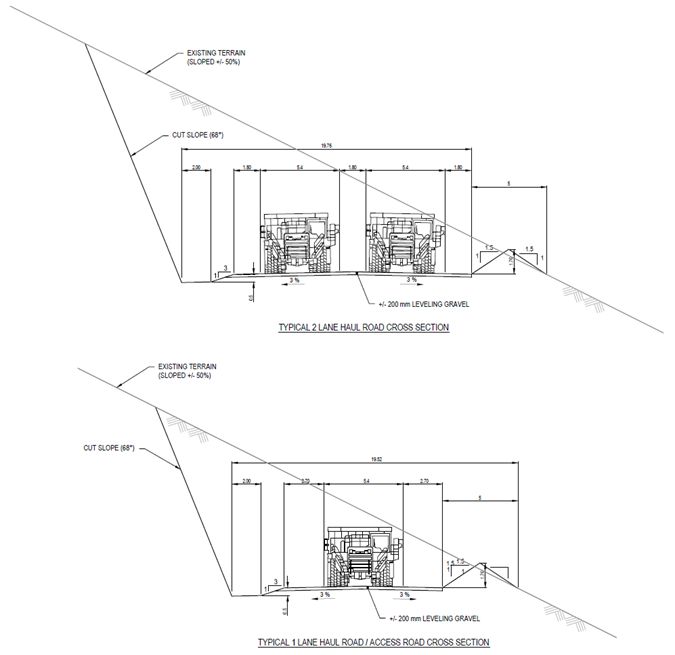

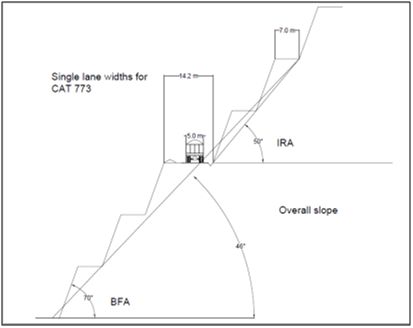

The selected pit shell (Pit 18) was then imported into Dassault Systemes Geovia GEMS™ (GEMS) and was used as a reference to design the Starter Pit. The bench face angle, inter-ramp angle, overall pit slope angle recommended by the geotechnical studies, as well as road widths and ramp gradient requirements were all incorporated into the design. Single lane haul roads have been considered for final pit layouts with double lane haul roads for the longer term haul roads between the open pit, waste dumps, and crusher. The values for each of these parameters are listed in Table 90. The approach was to create a pit including ramps and switchbacks as closely aligned with the selected pit shell as possible, while keeping the design within the stated open pit design parameters.

Table 90: La Joya Open Pit Design Parameters

| Open pit slope |

| Overall pit slope | Maximum 50 °, dependent on haul roads |

| Inter ramp angle max | 50° |

| Bench face angle | 68° |

| Berm width minimum | 7 m |

| Minimum mining width | 30 m |

| Bench height | 15 m (triple benching) |

| Haul roads |

| Double lane * | 21.7 m |

| Single lane * | 14.2 m |

| In pit haul road grades | 8%-10% max |

| Design parameter - waste dumps bottom up |

| Bench face angle | 34° |

| Overall slope when benched | 1:2.5 (22°) |

| Bench width | 10 m |

| Lift heights for bottom up construction | 10 m |

| Design parameter – waste dumps top down |

| Overall slope angle** | 1:1.8 (30°) |

| | * The haul roads widths are based on a truck design width of 5 m applicable to a CAT 773E and Komatsu HD 605 |

| | ** Lifts will be considered in design to achieve overall slope angle |

Figure 57 and Figure 58 show conceptual profile views of both a double lane and single lane haul road.

Figure 57: Shows a conceptual profile view of the pit slopes with double lane haul road

Figure 58: Shows a conceptual profile view of the pit slopes with single lane haul road

Various haul roads were considered from pit entry/exit points over the life of mine to the waste rock storage locations (waste dumps) and the selected primary crusher location. Where possible the length of these roads were minimized by cutting through the mining area and providing access around the Cerro Sacrificio ridge east of the open pit to the selected waste rock management areas. The average haul distance from the pit to the crusher over the life of mine is 4,250 m. The haul roads within the open pit were placed on the western side of the pit as far as possible, so that the high walls on the eastern side could better match the optimized pit shell. Figure 59 shows a 3D view of the open pit design for the Starter Pit and Figure 63 shows a plan view of the open pit in relation to other infrastructure planned for the property. The two separate pits namely the Main pit and Patricia pit may be a consequence of drill spacing and further infill drilling may allow for geological continuity that spans the area between the two pits, an area which currently does not support any economical mining.

Figure 59: 3D Starter Pit Design with Dump and Infrastructure

The open pit created for the PEA as shown in Figure 54 and Figure 63, is estimated to contain 15.5 Mt of mill feed with an overall stripping ratio of 2.9 tonnes of waste per tonne of mill feed. The total rock in the pit was estimated to be 61 Mt.

The preliminary pit design has two separate entities, namely the Main pit and isolated Patricia pit located roughly 200 m to the south. The Patricia pit is mined out in the initial 5 years of the mine life concurrently with the Main pit.

The pits have been scheduled using Geovia WhittleTM software. The scheduling parameters used to create the mining schedule are:

| 1. | 1.8 M tonnes processed per year from open pit or reclaiming stockpile. |

| 2. | 360 days of operations per year. |

| 3. | Target of 8 to 10 year mine life. |

| 4. | NSR cut-off of $17.9 /tonne. |

| 5. | Stockpiling to buffer mill feed capacity. |

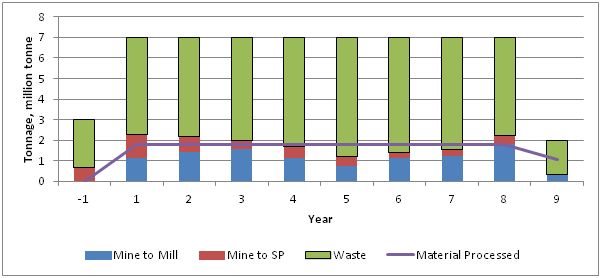

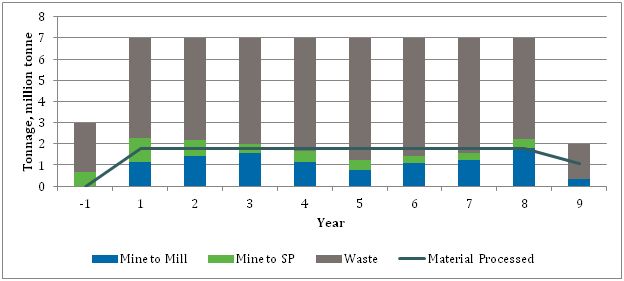

The preliminary mining schedule, shown in Table 91 and Figure 60, provides the estimated breakdown of the mill feed and waste rock throughout the proposed 9 years of La Joya’s mine life. This schedule is based on maintaining consistent total mining tonnage, with stockpiling used to maintain the mill feed at 1.8 Mt per year and maximizing head grades in the earlier years of the project life.

The schedule, shown in Appendix C, differentiates the grades and tonnages associated with the two different rock types as well as the split between material placed on stockpile and material transported from the pit directly to the processing plant for each year. Figure 60 shows the scheduled tonnages of waste, material processed, and mined material split between material moved directly to the mill and material stockpiled.

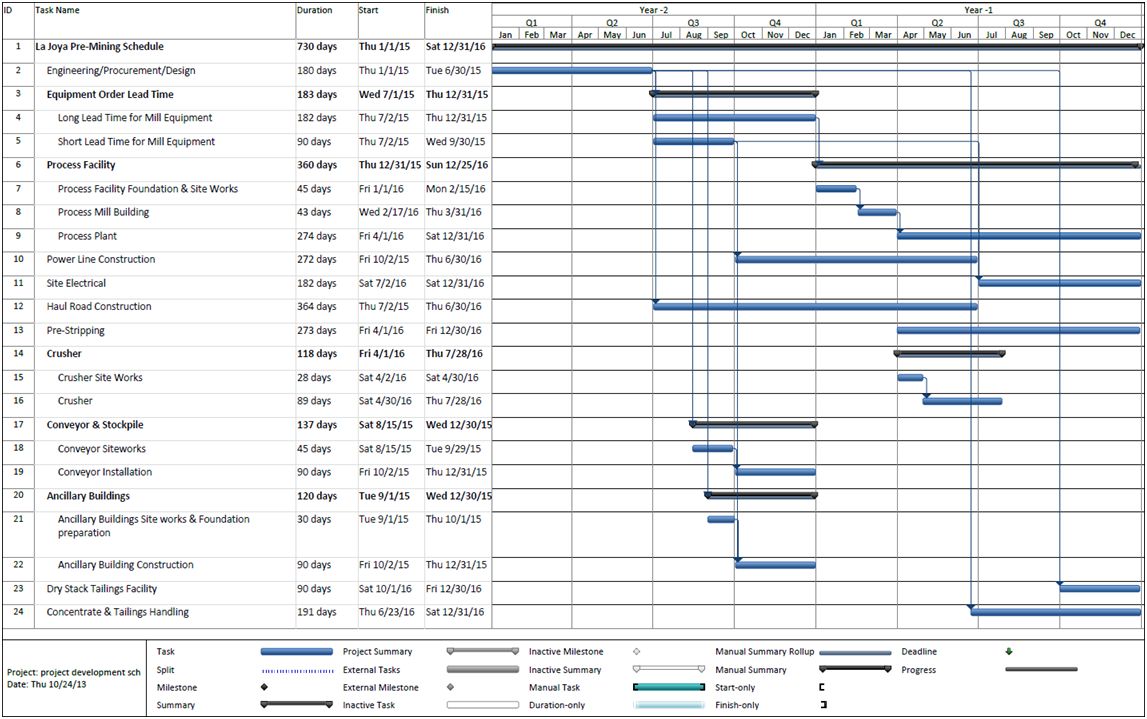

For the PEA, a mining plan was considered which allowed for a pre-production construction period with pre-stripping initiated in advance of commercial production. Pre-stripping will commence in Year -1 and will include the mining of both waste and 650Kt of mineralised material which will be stockpiled until the processing plant is completed towards the end of the construction Year -1. Processing from the stockpile as well as directly from the open pit will then begin in Year 1, where 1.8 Mt per annum will be processed.

Figure 60: Annual tonnages

Table 91: Project Schedule Summary

| Year | Mine to Mill | Mine to SP* | SP to Mill | Total mineralized material mined | Total tonnes processed | Mill feed grade | Waste | Strip ratio | Total tonnes mined |

| | | | | | | AG | AU | CU | AG EQ** | | | |

| | t | t | t | t | t | gpt | gpt | % | gpt | t | | t |

| -1 | 0 | 666,441*** | 0 | 666,441*** | | | | | | 2,333,559 | | 3,000,000 |

| 1 | 1,133,604 | 1,119,763 | 666,396 | 2,253,367 | 1,800,000 | 71 | 0.25 | 0.57 | 132 | 4,746,632 | 2.6 | 7,000,000 |

| 2 | 1,411,747 | 774,387 | 388,253 | 2,186,134 | 1,800,000 | 65 | 0.30 | 0.40 | 114 | 4,813,865 | 2.7 | 7,000,000 |

| 3 | 1,547,449 | 419,833 | 252,551 | 1,967,282 | 1,800,000 | 61 | 0.19 | 0.37 | 102 | 5,032,718 | 2.8 | 7,000,000 |

| 4 | 1,147,466 | 523,698 | 652,534 | 1,671,164 | 1,800,000 | 46 | 0.20 | 0.32 | 84 | 5,328,836 | 3.0 | 7,000,000 |

| 5 | 743,761 | 480,777 | 1,056,239 | 1,224,538 | 1,800,000 | 31 | 0.15 | 0.21 | 56 | 5,775,462 | 3.2 | 7,000,000 |

| 6 | 1,109,843 | 308,084 | 690,157 | 1,417,927 | 1,800,000 | 36 | 0.14 | 0.23 | 63 | 5,582,072 | 3.1 | 7,000,000 |

| 7 | 1,245,819 | 297,612 | 554,181 | 1,543,431 | 1,800,000 | 39 | 0.19 | 0.23 | 69 | 5,456,569 | 3.0 | 7,000,000 |

| 8 | 1,800,000 | 431,933 | 0 | 2,231,933 | 1,800,000 | 65 | 0.18 | 0.40 | 109 | 4,768,068 | 2.7 | 7,000,000 |

| 9 | 317,455 | 0 | 762,219 | 317,455 | 1,079,674 | 27 | 0.11 | 0.19 | 49 | 1,662,584 | 1.5 | 1,980,000 |

| | | | | | | | | | | | | |

| Total | 10,457,144 | 5,022,528 | 5,022,530 | 15,479,672 | 15,479,674 | 50 | 0.19 | 0.33 | 88 | 45,500,365 | 2.94 | 60,980,000 |

*SP means stockpile

**Head Grade means combined grade to the mill from all sources

**Silver equivalency includes silver, gold and copper and excludes lead, zinc, molybdenum and tungsten values. Ag:Au is 50:1, Ag:Cu is 86:1, based on 5 year historic metal price trends of US$22/oz silver, US$1200/oz gold, US$3/lb copper.

*** No grade is reflected for the material mined in year -1, as the material is not fed into the mill during that year. Please refer to appendix C for the grade of mined, stockpiled and mill feed material.

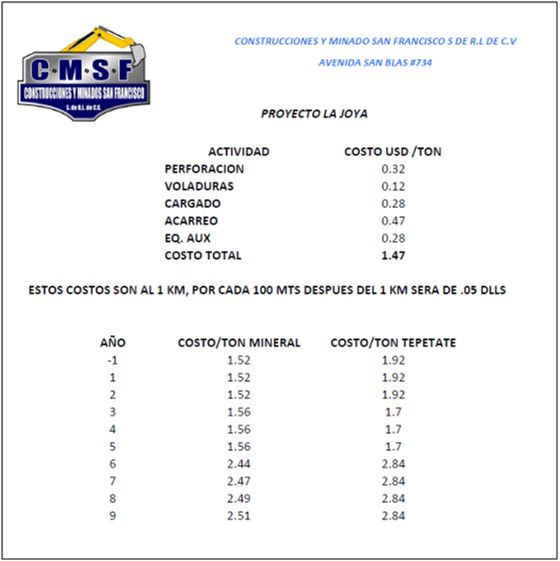

Tetra Tech has considered the use of a mining contractor for the La Joya project for the purpose of the PEA. A quote was obtained from a mining contractor from Mexico by the name of Construcciones Y Minado San Francisco S De R.L De C.V (CMSF). Conceptualization of the proposed mining method has been undertaken for the PEA. Tetra Tech has considered conventional benched open pit mining. The mined rock will require drill and blast prior to loading onto haul trucks as part of the mining process.

For the preliminary pit design, bench heights of 5 m for mineralized material and 5 m for waste have been used. Triple benching has been considered for waste benches. Triple benching allows for three benches to be stacked on top of on another without a berm in between, this is conventional practice in open pit mining to enable steeper pit walls. The estimated powder factor used in the design was 0.3 kg/m3 of rock (Schnelder 1999). Two drilling rigs are proposed to be used, with a smaller machine for mineralized material such as a crawler mounted drilling rig capable of drilling up to 150 mm holes, with a larger machine for drilling waste rock capable of drilling up to 180 mm holes.

The blasting for mineralized material and waste could be undertaken daily or in larger blasts providing material for a longer duration. During drilling, blast hole samples will be taken for analysis to enable a decision on whether rock is considered mineralized above a cut-off grade or waste rock. A similar practice is undertaken at SilverCrest’s operating mine, Santa Elena.

The loading of blasted material within the pits will be completed with a combination of hydraulic shovel or excavator and a large wheeled front end loader. The hydraulic shovel or excavator is operable in poorly prepared areas or narrow mining areas but cannot be moved quickly between loading sites, whereas the wheeled loader requires a relatively competent working surface and a larger working area but can move quickly between multiple sites for loading of trucks.

Hauling has been considered using 60 tonne mining haul trucks, for which current commercial models typically have an operating width of 5 m. The trucks will transport blasted material to either the waste dumps, stockpile or directly to the crusher as required. Single lane haul roads have been considered for final pit layouts with double lane haul roads for the longer term haul roads between the open pit, waste dumps and crusher. A minimum of a 30 m mining width has been applied to the final pit design for the PEA.

The schedule includes placement of mineralized material, mined from the open pit into a low grade stockpile, with higher grade material supplied directly to the process facility.

Mining equipment will be allocated for the re-handling of the stockpile from the existing fleet. Any mineralized material mined in excess of the annual mill feed capacity of 1.8 Mtpa will be deposited at the stockpile location. Tetra Tech has investigated sites for the location of the stockpile, and due to the terrain and the PEA site layout, Tetra Tech have considered a system of progressive placement of the stockpile on top of the north waste dump, as the waste dump is enlarged. The stockpiled material will form a lift off the north waste dump, with the waste dump forming a stable platform for stockpile formation.

This stockpiled material will be loaded and handled by a wheeled loader and loaded back onto haul trucks to be transported to the crusher site.

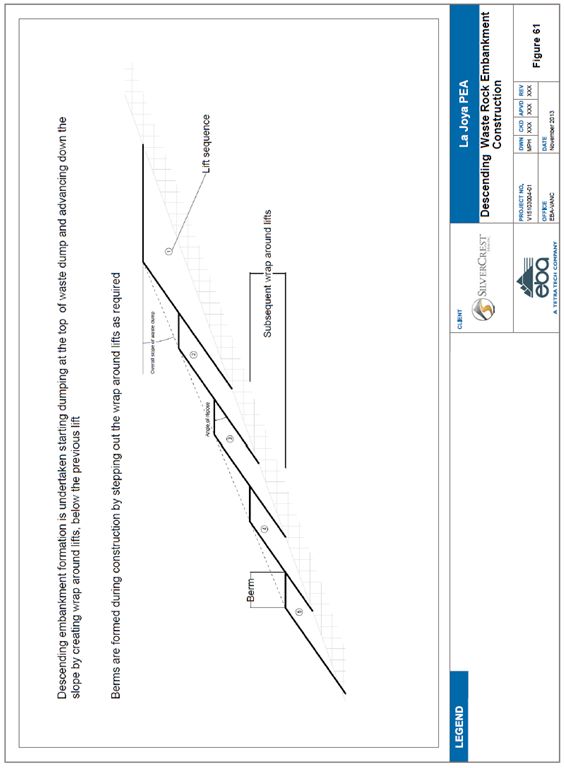

16.5.4 Waste Rock Storage

Tetra Tech investigated optimal waste dump locations within the mining concession for La Joya and ultimately considered two sites. A smaller area to the northeast side of the ridge focuses on depositing the non-mineralized material from the northern side of the Main pit and the larger site to the southeast of the Patricia pit. This would serve not only the Patricia pit, but the remaining waste from the Main pit too. The volume of the two waste dump sites is 8.5 Mt for the North Dump, and 36.4 Mt for the South Dump with a total capacity of 45 Mt.

To fit into the topography Tetra Tech has proposed side hill dumps. However stability analysis and waste dump slope design has not been completed. The construction of the waste dump will be undertaken using descending methods, involving the advancement of the waste dump from the top of the slope, progressing down the slope through adding subsequent wrap around lifts at a lower elevation, successively around the toe of each previous lift. The latter approach will provide for long term enhanced stability where the dump slopes can be adjusted to be less than the natural angle of repose. A schematic of this approach is shown in Figure 61. Figure 59 and Figure 63 show the proposed waste dump locations and design.

Figure 61: Descending Waste Rock Embankment Construction

Tetra Tech has considered contract mining for the La Joya project. This was undertaken by conducting a trade-off study of contractor versus in house mining. The trade-off included consideration of inhouse mining equipment purchase and costs as opposed to contractor costs. Tetra Tech has selected an equipment fleet based on the configuration of the open pit mining, haul roads and the processing plant.

Tetra Tech has reviewed the mining quote provided by Construcciones Y Minado San Francisco S De R.L De C.V. (CMSF) in Mexico, by doing an evaluation of the cost of operation of the required mining machinery. The quote has been found to be 20% greater than the estimate by Tetra Tech which is in line with expectations for contract mining in Mexico.

Tetra Tech estimated cycle times for the haul trucks using manufacturer specifications for the trucks and the associated loader/shovel. Data such as number of passes required to fill the truck in conjunction with time taken per pass were incorporated into the cycle time study.

Runge Limited Xeras© (2011) software was used to obtain equipment operating costs, which were compared to the costs provided by CMSF in Mexico. This software aided in estimating manning requirements for each individual equipment, which in turn provided more accurate total operating costs. Xeras also provided estimates for number of trucks, loaders, and shovels required to mine 5,000 tpd based on the man hours available per annum.

Mechanical availability was considered and assumptions were made as to total working hours available from the equipment. These included both scheduled and unscheduled downtime as well as operating efficiency to account for unforeseen events applicable to open pit mining scenarios. Shift changes, meal breaks, fueling/lubing time, and blasting stoppages were all factored into the XERAS model when sizing the equipment fleet.

The estimated equipment requirements are shown in Table 92.

Table 92: Mining Equipment

| Equipment | Key Productivity input | Hourly capacity | LOM Hours | LOM units required |

| Drill rig ore | 25 m/ hr. | 486 tonnes/ hr. | 31,000 | 2 |

| Drill rig waste | 25 m/ hr. | 1503 tonnes/hr. | 29,000 | 1 |

| 60 t haul trucks | 58 to 60 tonnes per load | 121 to 409 tonnes per hour depending on use | 352,000 | 12 |

| Waste loader | 220 secs per 60 t load | 890 Tonnes/hr. | 27,000 | 2 |

| Ore shovel | 195 secs per 60 t load | 910 Tonnes/hr. | 17,000 | 1 |

| Service and stockpile loader | 60 Secs per bucket plus 1500 hours per year | 332 tonnes/hr. | 51,000 | 2 |

| Bull dozer | 52 cycles per hour | 563 BCMs per hour | 74,000 | 3 |

| Grader | 20% of truck hours | 17,000 | 1 |

| Fuel truck | 1500 hours per year | 14,000 | 1 |

| Maintenance truck | 1500 hours per year | 13,500 | 1 |

| Water truck | 8% of truck hours | 18,000 | 1 |

| Welding truck | 1500 hours per year | | 13,500 | 1 |

| Lighting plant | 9 Hours per day | | 28,800 | 2 |

| Light vehicles | 5,181 hours per year | | 51,000 | 5 |

Tetra Tech has considered contractor mining for the La Joya property; however, estimates of the labour force required for mining have been undertaken. The conceptual staffing for the mining operation is shown in Table 93. Management and technical services staff such as geology and mining engineering are included in G & A.

Table 93: Mining Operation workforce

| Labour type | Year -1 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | Year 9 | Maximum Life of Mine |

| Blasting crews | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 |

| 7 Day operators | 28 | 58 | 56 | 53 | 54 | 56 | 81 | 80 | 79 | 35 | 81 |

| Total operators | 32 | 62 | 60 | 57 | 58 | 60 | 85 | 84 | 83 | 39 | 85 |

| Maintenance | 11 | 26 | 25 | 23 | 24 | 24 | 34 | 33 | 34 | 13 | 34 |

| Pit management and Supervision | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 |

| Total mining workforce per year | 47 | 92 | 89 | 84 | 86 | 88 | 123 | 121 | 121 | 56 | 123 |

The impact on the local hydrogeological regime in the vicinity of the pit excavation area has not been thoroughly assessed. Due to the arid climate of the area in which the La Joya project occurs, the presence of significant quantities of ground water is not expected. The hill side nature of the mining operation also allows for easy drainage of the mining area duringmine life. Once pits are formed completely below the ground surface, pumping to dewater the pits is likely to become necessary but currently this is not expected to be onerous.

16.5.8 Qualified person statement

Tetra Tech has estimated the mining methodology and mining equipment requirements and finds that the open pit nature of the operation will be comparable to many other operations and therefore no significant issues are foreseen. In addition, it is acknowledged that SilverCrest operates a mine in Mexico, which includes an open pit with contractor mining. A similar model thus applied to the La Joya property is expected to be reasonable. The precise details of the mining machinery are likely to vary from what Tetra Tech has proposed without significantly impacting the potential operations or mining costs.

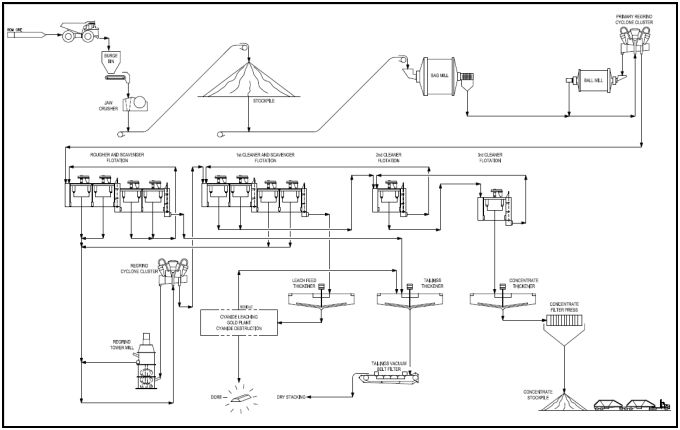

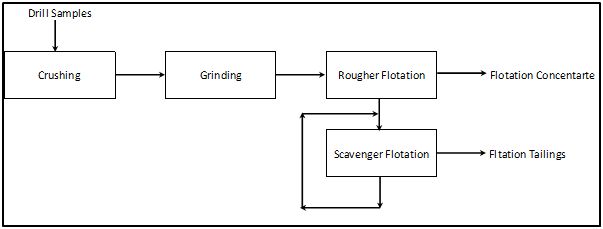

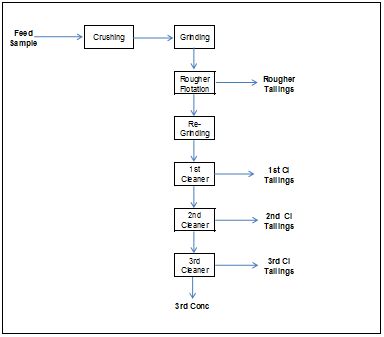

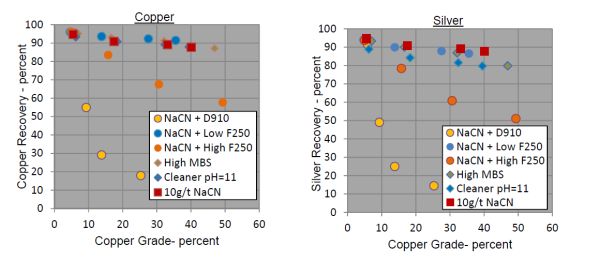

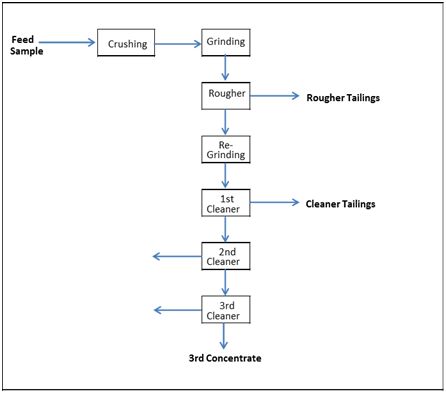

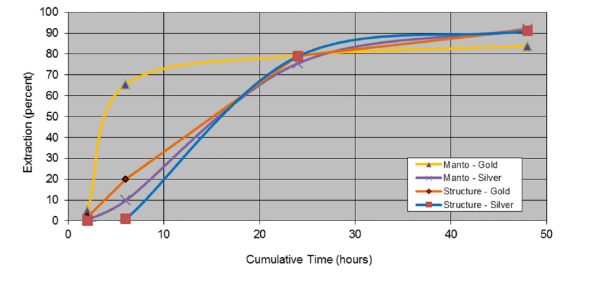

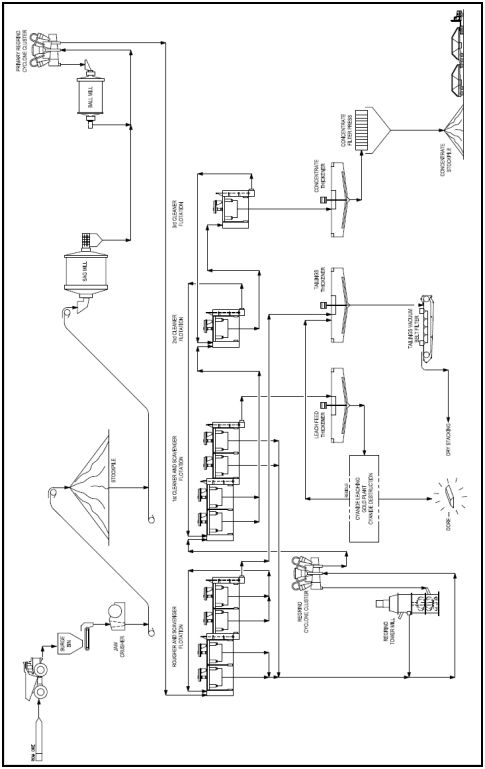

Tetra Tech Wardrop designed a 5,000 tonne/d mill to process ROM ore from the MMT mineralisation at the La Joya property. Two products will be produced: one is copper concentrate with silver and gold components; the other is silver doré bars (with gold) recovered from the first cleaner scavenger tailings. The process design is mainly based on currently available test results as summarised in Section 13.0 and industry experience. This section will describe the major design parameters and unit process. The complete process design criteria are included in Appendix D, with detailed process flow sheets and general site and plant layouts are available in Appendix D.

ROM ore will be trucked and fed to a jaw crusher at the mine site. The crushed ore will be conveyed to a coarse ore stockpile at the plant site to compensate for the throughput imbalance between mining and processing. The crushed ore will then be reclaimed and conveyed to the grinding circuit of a conventional SAB milling arrangement. The particle size of the ground ore will be reduced to a P80 of 150 µm from a F80 of 150 mm.

Product from the primary grinding circuits will feed copper-gold/silver bulk rougher flotation cells. The floated copper rougher concentrate will be reground to a particle size of P80 of 20 µm in the high-efficiency tower milling process. The rougher tailings will be thickened, filtered and then directed to the dray stacking area.

The reground rougher concentrate will be further upgraded in a cleaner flotation circuit with three stages of copper cleaner flotation and one cleaner scavenger stage, producing the final bulk copper-gold/silver concentrate. The copper-gold concentrate will be dewatered in thickening and filtration processes and then stored on the plant site.

The first cleaner scavenger tailings will be thickened and pumped to a gold leaching plant to recover silver and gold components. The plant will be composed of leach feed thickening, cyanide leaching, zinc precipitation (Merrill Crowe process), and cyanide destruction stages. The treated leaching residues will join the rougher tailings in the same thickening process as part of the final tailings.

Figure 62 shows a simplified process diagram for the designed processing facilities.

Figure 62: Simplified Process Diagram

17.3 Process Design Criteria

The processing facility has been designed to accept a blended ROM ore of half Manto and half Structure at a nominal rate 5,000 tpd. The facility will operate 24 hours per day, 360 days per year. Operation availability for the process plant will be 92%, and for the primary crushing circuit, 75%. The major process design criteria are shown in Table 94.

Table 94: Major Processing Design Criteria

| Description | Units | Values |

| Operating Schedule | | |

| Annual Operating Days | d/a | 360 |

| Shift per day | | 2 |

| Hours per shift | | 12 |

| Plant Throughput | | |

| Annual Rate | t/a | 1,800,000 |

| Daily Rate | tpd | 5,000 |

| Hourly Rate - Crushing Plant | t/h | 278 |

- Grinding/Flotation/Gold Leaching Plant | t/h | 226 |

| Feed Properties | | |

| ROM Ore Rock Type | | 50%Manto, 50% Structure |

| Coarse Ore Work Index, Mia | kWh/t | 17.6 |

| SAG Mill Specific Energy Requirement | kWh/t | 9.1 |

| Bond Ball Mill Working Index, BWI | kWh/t | 14.8 |

| Abrasion Index | g | 0.12 |

| Head Grades - Copper | %, Cu | 0.41 |

- Silver | gpt | 58 |

- Gold | gpt | 0.2 |

| Product Quality | | |

| Copper Concentrate | %, Cu | 35 |

| | gpt, Ag | 4,380 |

| | gpt, Au | 11.5 |

| Silver/Gold Dore | %, Ag | >99% |

One jaw crusher will perform primary crushing on the ROM ore. Haul trucks will deliver ROM ore from the open pit to one surge bin which will be equipped with one apron feeder to feed the primary jaw crusher. The top feed ore size to the crushers is approximately 1,000 mm, which will be reduced to a particle size of P80 of 150mm. The product from the primary crushers, the coarse ore, will be discharged onto dedicated ore transfer conveyors. These conveyors will deliver the coarse ore to the coarse ore stockpile. Dust collectors and sumps will be located in the facility to remove dust and runoff water. The crushing plant availability of 75% is considered with current plant design practice and industry experience.

The primary crushing circuit comprises the following major equipment:

| § | one 950 mm x 1,250 mm jaw crusher, driven by a 160 kW motor; |

| § | one 1.2 m wide discharge conveyors driven by a 12 kW motor, and one 1.2 m wide coarse ore stockpile feed conveyor driven by a 52 kW motor; and |

| § | one 7.5 kW apron feeder. |

17.4.2 Coarse Material Storage

The coarse ore will be sent to a 3,000 t live capacity ore transfer stockpile via the coarse ore transfer conveyors. The ore then will be reclaimed by three 1.2 m wide x 9.0 m long apron feeders (including one standby) to the SAG mill.

17.4.3 Comminution Circuit

Grinding will be conducted in a SAB circuit with an average throughput of 5,000 tpd. The main equipment includes:

| § | one 6.7 m diameter x 3.2 m long SAG Mill, driven by a 2,100 kW motor; |

| § | one 4.3 m diameter x 7.2 m long ball mill, driven by a 2,100 kW motor; and, |

| § | pumps and classification hydro cyclones. |

The crushed ore will be fed to the SAG Mill feed chute along with process water, making a slurry with 65% solid content. One automatic ball charging systems will deliver grinding media to SAG mill feed chute. Discharge from the SAG mill will be sent through a trommel screen and a SAG mill screen. Undersize from the screens will be sent to the cyclone feed pump box. Oversize from the SAG mill screen will be conveyed back to the SAG mill.

Slurry from the hydrocyclone pump box is pumped to the hydrocyclone cluster. Process water is added to the cyclone feed pump box as required. The hydrocyclone underflow will gravity-flow to the ball mill feed chute with solids content of 75%, while the overflow will flow to the bulk rougher flotation bank with solids content of 30% by gravity. The hydrocyclone clusters will have a cut size of P80 of 150 µm, and the circulation load to the ball mill circuits will be 300%. One automatic ball charging systems will deliver grinding media to each ball milling feed system.

17.4.4 Copper-Gold/Silver Flotation

17.4.4.1 Bulk rougher/Scavenger Flotation

The hydrocyclone overflow of the grinding circuit will feed one rougher flotation bank that will be consisted of four 70 m3 flotation cells. The flotation reagents will include potassium amyl xanthate (PAX) and methyl isobutyl carbinol (MIBC). The bulk copper-gold/silver bulk rougher concentrate will be sent to a tower mills for regrinding. The flotation tailings will be sent to the rougher scavenger flotation stage, with scavenger concentrate pumped back to rougher flotation, and scavenger tailings pumped a dewatering circuit prior to being dry-stacked on the site.

17.4.4.2 Bulk Concentrate Regrinding

The copper-gold/silver bulk concentrate will be reground to a particle size of P80 of 20 µm, together with the 1st cleaner scavenger tailings. The regrinding process will be conducted in a regrind tower mill closed with a hydrocyclone cluster. The overflow from the hydrocyclone cluster will gravity-flow to the cleaner flotation circuit, while the underflow of the hydrocyclones will flow to the regrinding mill feed distributor. The major equipment in the regrind circuit are:

| § | one tower mill, driven by a 265 kW motor; |

| § | pumps and classification hydrocyclones. |

Reagent cyanide and lime will be added in the regrind cyclone feed pump box to depress the arsenopyrite associated with Manto and Structure mineralisation.

17.4.4.3 Cleaner Flotation

The hydrocyclone overflow will be cleaned in three cleaner flotation stages. In the first stage of cleaner flotation, a bank of five 5 m3 tank cells will be used. The 1st cleaner concentrate is fed to a single 2nd/3rdcleaner flotation circuit. The 1st cleaner tailings will pass to a scavenger stage. The 1st cleaner scavenger concentrate will be sent back to regrind circuit by slurry pumps; the scavenger tailings will be discharged and sent to leaching circuit. For the 2nd and 3rd cleaner stages, the same size cell of 5 m3 will be used with two for the 2nd cleaner stage and one for the 3rd cleaner flotation. The tailings from the 2nd and 3rd cleaner flotation stages will be returned to the head of the preceding cleaner flotation circuit. The final concentrate will be sent to a dewatering circuit.

The same reagents used in the rougher flotation circuit will be used in the cleaner circuit.

17.4.4.4 Copper Concentrate Dewatering

The final copper-gold/silver concentrate will be thickened to 55% solids by weight in a 4.5 m diameter high-rate thickener. The thickener overflow will return to various circuits for use as process water. The thickener underflow will be directed to a thickened concentrate stock tank. The concentrate will then be pumped and filtered to contain about 8 to 9% moisture.

The key equipment used in the concentrate dewatering processes will include:

| § | one 4.5 m diameter high-rate thickener; |

| § | one 30 m2 filter press; and |

17.4.5 Cyanidation Leaching/Gold Plant/Cyanide Destruction

The 1st cleaner scavenger tailings will be further processed in a Cyanidation leaching process to recover silver and gold components. The separation will employ the feed thickening, cyanidation leaching, zinc precipitation (Merrill Crowe process), and cyanide destruction stages.

The circuit will include the following key equipment:

| § | one 10 m diameter high rate thickener; |

| § | one cyanidation leaching circuit; |

| § | one zinc precipitation plant; and |

| § | one cyanidation destruction circuit. |

The first cleaner scavenger tailings will be thickened prior to the cyanidation leaching. The thickener underflow will be pumped to leaching tanks.

The discharge from cyanidation will be pumped to a Merrill-Crowe zinc precipitation plant for recovery of silver and gold from cyanide solutions. The plant is typically composed of a solid and liquid separation such as a CCD circuit, a de-aeration stage of the pregnant solution typically in a packed tower under vacuum, and zinc precipitation followed by a filtration. The predicated silver and gold will be sent to the on-site electro winning and fire refining to produce silver/gold dore.

The leaching residues will be discharged in the form of the CCD thickener underflow and treated by using Inco sulfur dioxide /air process. The equipment used will include one high pre-aeration agitation tank, SO2 oxidation tanks and a wet alkaline scrubbing system. The treated residues will join the rougher flotation tailings in the tailings dewatering area.

Typical reagents will be added including cyanide, lime, lead nitrate, zinc dust, filter aid, sodium metabisulphite (SMBS) and anti-scalant.

17.4.6 Tailings Management

The tailings will be generated in the recovery processes of valued metals, namely the rougher flotation tailings, and the treated cyanidation residues. The tailings streams will be combined and dewatered to a dry stacking level. The circuit will include the following key equipment:

| § | one 45 m diameter high rate thickener; |

| § | two 90 m2 vacuum belt filters packages; and |

The combine tailings will be directed to one 45 m diameter high rate thickeners, where the tailings will be thickened to 60% solids. The thickener overflow will be pumped to the process water tank, and the underflow will be pumped and filtered in two vacuum belter filters each with a filtration area of 90 m2. The filtered tailings will be trucked to a dedicated area for dry stacking storage. Tetra Tech WEI recommends a trade-off study comparing the conventional tailings pond storage.

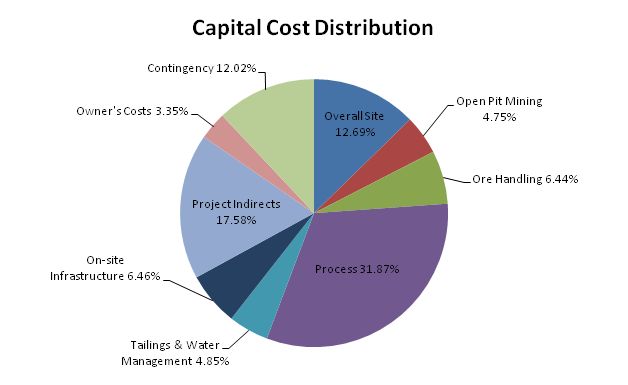

All the reagents will be prepared in a bermed containment area in a separate reagent preparation and storage facility. The reagent storage tanks will be equipped with level indicators and instrumentation to ensure that spills do not occur during operation. Appropriate ventilation and fire and safety protection will be provided at the facility.