UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21503

The FBR Funds

(Exact name of registrant as specified in charter)

| | |

| 4922 Fairmont Avenue Bethesda, MD 20814 |

| (Address of principal executive offices) (Zip code) |

FBR Mutual Fund Services, 4922 Fairmont Avenue Bethesda, MD 20814

(Name and address of agent for service)

Registrant’s telephone number, including area code: (301) 657-1500

Date of fiscal year end: October 31, 2004

Date of reporting period: October 31, 2004

| ITEM 1. | REPORT TO SHAREHOLDERS |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17CRF 270.30e-1).

FRIEDMAN BILLINGS RAMSEY

THE FBR FUNDS

FBR Large Cap Financial Fund

FBR Small Cap Financial Fund

FBR Small Cap Fund

FBR Large Cap Technology Fund

FBR Small Cap Technology Fund

FBR Gas Utility Index Fund

FBR Fund for Government Investors

FBR Maryland Tax-Free Portfolio

FBR Virginia Tax-Free Portfolio

Annual Report

October 31, 2004

The FBR Funds

Letter to Shareholders

Dear Shareholder,

Fiscal 2004 was another active year for The FBR Funds. We launched the Small Cap Technology Fund (FBRCX) in January and hired Robert Barringer to manage that fund. Robert has 16 years of experience in the investment business and is a valuable addition to our portfolio management team. We have implemented polices and procedures under the Sarbanes-Oxley Act and adopted a fund compliance program as required under new SEC rules. We continue to improve and expand our marketing efforts. We have worked to reduce the Fund’s administrative costs and you should see the benefits reflected in lower administrative fees in the coming year. Finally, record inflows combined with solid investment performance allowed the Funds to surpass $2 billion in assets under management in late October. All of us at The FBR Funds want to thank you for your continued support and trust in our efforts to bring you quality mutual fund products.

At The FBR Funds, we believe that quality mutual fund products begin and end with a consistent investment approach. Our equity funds strive to give you diversified exposure to segments of the market that offer long-term potential for growth. We look for companies that believe in what we believe - that durable equity returns are driven by consistent profitability. Consistent profits begin with conservative accounting, an aversion to debt, a low cost operating structure, an uncomplicated business plan, and an overall philosophy of building for the long-term. Our fixed income funds follow a conservative strategy consistent with owning the highest quality government and municipal securities. Preservation of capital is the main objective of our fixed income funds.

The FBR Funds are in sum about respecting your money. We understand the capital markets are not always favorable and strive to preserve capital during these turbulent periods. We believe that losing less money in difficult markets is more important than making the most in rising ones. We believe you want a return on your money and the return of your money. Our goal is to give your money the best chance of achieving returns that are balanced, mindful of the downside and sustainable over the long run.

What follows is a discussion about each of our Fund’s performance during the year and the outlook going forward. Thanks again for your support.

|

Sincerely, |

|

|

David Ellison |

President and Trustee |

The FBR Funds |

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. This and other important information about The FBR Funds can be found in the prospectus. To obtain a free prospectus, please call 888.888.0025 or visit www.fbrfunds.com. Please read the prospectus carefully before investing.

The FBR Funds are distributed by FBR Investment Services, Inc., member NASD/SIPC

2

The FBR Funds

Standardized Annual Returns

As of September 30, 2004

| | | | | | | | | | | | | | |

| | | | | Average Annual Returns

| |

| | | Inception

Date

| | One

Year

| | | Five

Years

| | | Ten

Years

| | | Since

Inception

| |

| | | | | |

Money Market Fund | | | | | | | | | | | | | | |

FBR Fund for Government Investors (FUSXX)1 | | Feb-75 | | 0.43 | % | | 2.26 | % | | 3.36 | % | | n/a | |

| | | | | |

Fixed Income Funds | | | | | | | | | | | | | | |

FBR Maryland Tax-Free Portfolio (RSXLX)2, 5 | | Sep-83 | | 3.01 | % | | 5.40 | % | | 5.49 | % | | 6.47 | % |

FBR Virginia Tax-Free Portfolio (RSXIX)2, 5 | | Sep-83 | | 2.81 | % | | 5.81 | % | | 5.62 | % | | 6.36 | % |

| | | | | |

Equity Funds | | | | | | | | | | | | | | |

FBR Large Cap Financial Fund (FBRFX)3, 5 | | Jan-97 | | 18.36 | % | | 12.02 | % | | n/a | | | 12.13 | % |

FBR Small Cap Financial Fund (FBRSX)3, 4, 5 | | Jan-97 | | 21.51 | % | | 23.10 | % | | n/a | | | 18.84 | % |

FBR Small Cap Fund (FBRVX)4, 5 | | Jan-97 | | 22.44 | % | | 18.50 | % | | n/a | | | 17.10 | % |

FBR Large Cap Technology Fund (FBRTX)5, 6 | | Feb-02 | | 4.22 | % | | n/a | | | n/a | | | 2.25 | % |

FBR Small Cap Technology Fund (FBRCX)4, 5, 6 | | Jan-04 | | n/a | | | n/a | | | n/a | | | n/a | |

FBR Gas Utility Index Fund (GASFX)7 | | May-89 | | 18.82 | % | | 5.62 | % | | 10.20 | % | | 8.86 | % |

TOTAL RETURNS REPRESENT PAST PERFORMANCE WHICH IS NO GUARANTEE OF FUTURE RESULTS.

The current performance may be lower or higher than performance data quoted.

To obtain performance data current to the most recent month-end please call 888.888.0025.

| 1 | Investments in money market funds are not guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the NAV (Net Asset Value) at $1.00 per share, it is possible to lose money by investing in the Fund. |

| 2 | Some income earned in the Fixed Income Funds may be subject to the Federal Alternative Minimum Tax. Income earned by non-Maryland or non-Virginian residents will be subject to applicable state and local taxes. |

| 3 | Fund investments are focused in the financial services industry, which may be adversely affected by regulatory or other market conditions, such as rising interest rates. |

| 4 | Investing in a small-cap fund involves the risks of investing in small-cap companies, which generally involve greater risk than investing in larger, more established companies. |

| 5 | The non-diversified nature of the fund may subject investors to greater volatility than other diversified funds. |

| 6 | Fund investments are focused in the technology sector, which may be affected by developments in the technology industry and its related businesses. In addition, the Fund may be subject to risks posed by use of derivative instruments. The value of the FBR Technology Funds’ shares may fluctuate more than shares of funds investing in a broader range of industries. |

| 7 | The Fund is subject to risks associated with the natural gas industry which is sensitive to interest rates, weather and competition risks. |

Investors are asked to consider the investment objectives, risks, charges and expenses carefully before investing. For more complete information about The FBR Funds, including fees and expenses, and a copy of a free prospectus please call 888.888.0025 or visit us at www.fbrfunds.com. Please read the prospectus carefully before you invest or send money.

The FBR Funds are distributed by FBR Investment Services, Inc., member NASD/SPIC.

3

The FBR Funds

FBR Large Cap Financial Fund

Management Overview

Portfolio Manager: David Ellison

Over the recent fiscal year, how did the Fund perform?

For the one-year period ended October 31, 2004, the FBR Large Cap Financial Fund appreciated 9.76%. This compares to the S&P 500 Composite Index and the Lipper Financial Services Fund Index which returned 9.42% and 9.92% for the same period, respectively.

What factors contributed to the Fund’s performance?

The fear of rising interest rates in early 2004 had a significant impact on the Fund’s performance this past year. Even with this fear, the Fund was able to perform in line with the relevant indices. We have historically used fundamental valuation metrics and overall business risk assessments as keys to stock selection, a process which served shareholders well this year as the more highly valued and interest rate sensitive financial stocks fared worse than the Fund and relevant indexes.

What is the outlook for the Fund and the financial services sector?

Fundamental business conditions for the financial services industry have been favorable over the last couple years. Interest rates have fluctuated within a narrow range. Credit conditions have been improving. Commercial and residential loan growth has been slow but positive. Capital market activities have continued to show signs of improvement from depressed levels last year. Capital expenditures by companies have continued to improve customer service efforts and reduce operating costs. Mergers and acquisitions have created modest benefits to operating leverage. Regulatory control continues to be focused while not hampering industry competitiveness. I expect these favorable fundamental trends will continue in 2005 and expect the stocks to follow these trends.

The risks to these favorable trends are numerous but all hinge on two concerns — interest rates and overall economic activity. If interest rates were to rise too quickly, operating margins could be negatively impacted. A slowdown in economic activity could lead to unfavorable credit conditions. Also, historical valuations have crept up to the high end of the range which present downside risk should the fundamental trends deteriorate.

We will continue to concentrate the funds holdings in financial stocks that follow low-risk business strategies and trade at below average valuations. This strategy has the intended effect of reducing the potential downside risks over the long-term.

4

The FBR Funds

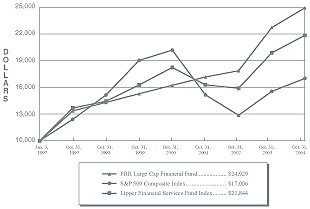

FBR Large Cap Financial Fund

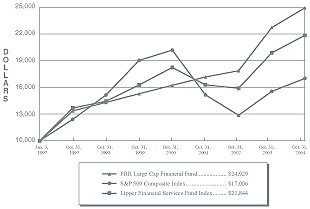

Comparison of Change in Value of $10,000 Investment in

Fund Shares(1)(2) vs. Various Indices(1)(3)

Total Returns—For the Periods Ended October 31, 2004(4)

| | | | | | | | | |

| | | One

Year

| | | Annualized

Five Year

| | | Annualized

Since

Inception(5)

| |

FBR Large Cap Financial Fund(1)(2) | | 9.76 | % | | 10.28 | % | | 12.38 | % |

S&P 500 Composite Index(1)(3) | | 9.42 | % | | (2.22 | %) | | 7.01 | % |

Lipper Financial Services Fund Index(1)(3) | | 9.92 | % | | 6.07 | % | | 10.49 | % |

TOTAL RETURNS REPRESENT PAST PERFORMANCE, WHICH IS NO GUARANTEE OF FUTURE RESULTS.

Investment return and principal value will fluctuate so that investors’ shares, when redeemed, may be

worth more or less than their original cost. Returns shown assume reinvestment of distributions.

The current performance may be lower or higher than the performance data quoted.

| (1) | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the indices are unmanaged, do not incur sales charges or expenses and are not available for investment. |

| (2) | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | S&P 500 Composite Index is a capitalization-weighted index of 500 stocks. The index is designed to represent the broad domestic economy through changes in aggregate market value of 500 stocks representing all major industries. Lipper Analytical Services, Inc., is a nationally recognized organization that reports on mutual fund total return performance and calculates fund rankings. Peer averages are based on universes of funds with the same investment objective. Peer group averages include reinvested dividends and capital gains, if any, and exclude sales charges. |

| (4) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | For the period January 3, 1997 (commencement of investment operations) through October 31, 2004. Certain purchases made by shareholders within this period would have been subject to an initial maximum sales charge of up to 5.50%. As a result, total returns for such shareholders would have been lower. |

5

The FBR Funds

FBR Large Cap Financial Fund

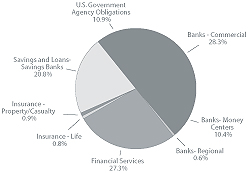

Portfolio Summary

October 31, 2004

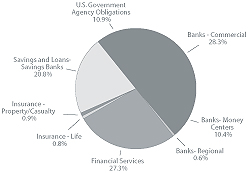

The following chart provides a visual breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

6

The FBR Funds

FBR Large Cap Financial Fund

Portfolio of Investments

October 31, 2004

| | | | | |

SHARES

| | | | VALUE (NOTE 2)

|

| | | COMMON STOCKS — 89.2% | | | |

| | | Banks - Commercial — 28.3% | | | |

| 29,000 | | Comerica, Inc. | | $ | 1,783,790 |

| 24,000 | | Hibernia Corp. | | | 696,000 |

| 44,000 | | KeyCorp. | | | 1,477,960 |

| 27,000 | | North Fork Bancorporation, Inc. | | | 1,190,700 |

| 27,500 | | SunTrust Banks, Inc. | | | 1,935,450 |

| 25,000 | | UnionBanCal Corp. | | | 1,518,750 |

| | | | |

|

|

| | | | | | 8,602,650 |

| | | | |

|

|

| | | Banks - Money Centers — 10.5% | | | |

| 35,000 | | Bank of America Corp. | | | 1,567,650 |

| 24,000 | | Citigroup, Inc. | | | 1,064,880 |

| 11,000 | | Wachovia Corp. | | | 541,310 |

| | | | |

|

|

| | | | | | 3,173,840 |

| | | | |

|

|

| | | Banks - Regional — 0.6% | | | |

| 5,000 | | Banknorth Group, Inc. | | | 176,350 |

| | | | |

|

|

| | | Financial Services — 27.3% | | | |

| 20,000 | | Capital One Financial Corp. | | | 1,475,200 |

| 44,000 | | CIT Group, Inc. | | | 1,777,600 |

| 12,000 | | Countrywide Financial Corp. | | | 383,160 |

| 15,500 | | Fannie Mae (Federal National Mortgage) | | | 1,087,325 |

| 16,000 | | Freddie Mac (Federal Home Loan) | | | 1,065,600 |

| 15,000 | | JP Morgan Chase & Co. | | | 579,000 |

| 23,000 | | MBNA Corp. | | | 589,490 |

| 11,000 | | Merrill Lynch & Co. | | | 593,340 |

| 11,000 | | Morgan Stanley | | | 561,990 |

| 2,000 | | The Goldman Sachs Group, Inc. | | | 196,760 |

| | | | |

|

|

| | | | | | 8,309,465 |

| | | | |

|

|

| | | Insurance - Life — 0.8% | | | |

| 15,000 | | Conseco, Inc.* | | | 251,400 |

| | | | |

|

|

| | | Insurance - Property/Casualty — 0.9% | | | |

| 7,000 | | PMI Group, Inc. | | | 271,740 |

| | | | |

|

|

| | | Savings and Loans - Savings Banks — 20.8% | | | |

| 60,000 | | Astoria Financial Corp. | | | 2,345,400 |

| 19,000 | | Golden West Financial Corp. | | | 2,221,480 |

| 59,000 | | Sovereign Bancorp, Inc. | | | 1,277,350 |

| 11,000 | | Washington Mutual, Inc. | | | 425,810 |

| 1,000 | | Webster Financial Corp. | | | 47,800 |

| | | | |

|

|

| | | | | | 6,317,840 |

| | | | |

|

|

| | | Total Common Stocks (Amortized Cost $20,481,972) | | | 27,103,285 |

| | | | |

|

|

7

The FBR Funds

FBR Large Cap Financial Fund

Portfolio of Investments (continued)

October 31, 2004

| | | | | | |

PAR

| | | | VALUE (NOTE 2)

| |

| | | U.S. GOVERNMENT AND AGENCY OBLIGATIONS — 10.9% | | | | |

| $3,298,000 | | Federal Home Loan Bank Discount Note, 1.69%**, due 11/01/04

(Amortized Cost $3,298,000) | | $ | 3,298,000 | |

| | | | |

|

|

|

| | | Total Investments — 100.1%

(Amortized Cost $23,779,972) | | | 30,401,285 | |

| | | Liabilities Less Other Assets — (0.1%) | | | ( 17,148 | ) |

| | | | |

|

|

|

| | | Net Assets — 100.0% | | $ | 30,384,137 | |

| | | | |

|

|

|

| * | Non-income producing security. |

| ** | This issue shows the rate of discount at time of purchase. |

The accompanying notes are an integral part of the financial statements.

8

The FBR Funds

FBR Small Cap Financial Fund

Management Overview

Portfolio Manager: David Ellison

Over the recent fiscal year, how did the Fund perform?

For the one-year period ended October 31, 2004, the FBR Small Cap Financial Fund appreciated 14.29%. This compares to the Russell 2000 Index and the Lipper Financial Services Fund Index which returned 11.73% and 9.92% for the same period, respectively.

What factors contributed to the Fund’s performance?

In 2004, the pervasive fear of a sharp spike in short-term rates caused significant investor outflows around mid-year, but had little impact on fund performance. The Fund outperformed the relevant indices as investors’ fears about rising rates were overblown and the companies held in the Fund’s portfolio continued to generally outperform market expectations. Historically, we have focused on fundamental valuation metrics and overall business risk assessments as keys to stock selection. This process served shareholders well over the year as the more highly valued and interest rate sensitive small cap financial stocks fared worse than the Fund and relevant indexes.

What is the outlook for the Fund and the financial services sector?

Fundamental business conditions for the small cap financial services industry have been favorable over the last two years. Interest rates have fluctuated within a narrow range. Credit conditions have been improving. Loan growth has been slow but positive. Capital expenditures have continued to expand customer service and reduce operating costs. Consolidation has created benefits to operating leverage and internal efficiencies. Regulatory control continues to be tough while not reducing industry competitiveness. I expect these favorable fundamental trends will continue in 2005 and expect the stocks to follow these trends.

The risks to these favorable trends are numerous but the two major concerns are interest rates and overall economic activity. Also, historical valuations have crept up to the high side of the range, which presents downside risk if fundamental trends should deteriorate.

We will continue to concentrate the Fund’s holdings in financial stocks that follow low-risk business strategies and trade at below average valuations. This strategy has the intended effect of reducing the potential downside risk over the long-term.

9

The FBR Funds

FBR Small Cap Financial Fund

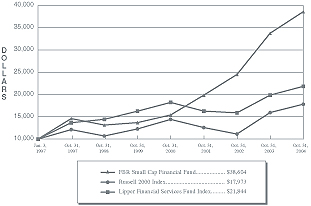

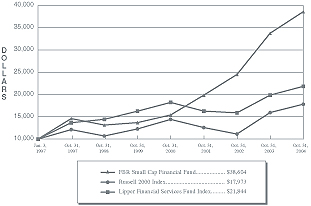

Comparison of Change in Value of $10,000 Investment in

Fund Shares(1)(2) vs. Various Indices(1)(3)

Total Returns—For the Periods Ended October 31, 2004(4)

| | | | | | | | | |

| | | One Year

| | | Annualized

Five Year

| | | Annualized

Since

Inception(5)

| |

FBR Small Cap Financial Fund(1)(2) | | 14.29 | % | | 23.02 | % | | 18.84 | % |

Russell 2000 Index(1)(3) | | 11.73 | % | | 7.74 | % | | 7.78 | % |

Lipper Financial Services Fund Index(1)(3) | | 9.92 | % | | 6.07 | % | | 10.49 | % |

TOTAL RETURNS REPRESENT PAST PERFORMANCE, WHICH IS NO GUARANTEE OF FUTURE RESULTS.

Investment return and principal value will fluctuate so that investors’ shares, when redeemed, may be

worth more or less than their original cost. Returns shown assume reinvestment of distributions.

The current performance may be lower or higher than the performance data quoted.

| (1) | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the indices are unmanaged, do not incur sales charges or expenses and are not available for investment. |

| (2) | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | Russell 2000 Index is comprised of the smallest of the 2000 companies of the Russell 3000 Index, representing approximately 11% of the Russell 3000’s total market-capitalization. Lipper Analytical Services, Inc., is a nationally recognized organization that reports on mutual fund total return performance and calculates fund rankings. Peer averages are based on universes of funds with the same investment objective. Peer group averages include reinvested dividends and capital gains, if any, and exclude sales charges. |

| (4) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | For the period January 3, 1997 (commencement of investment operations) through October 31, 2004. Certain purchases made by shareholders within this period would have been subject to an initial maximum sales charge of up to 5.50%. As a result, total returns for such shareholders would have been lower. |

10

The FBR Funds

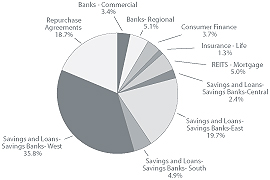

FBR Small Cap Financial Fund

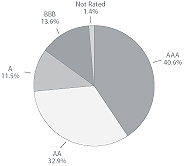

Portfolio Summary

October 31, 2004

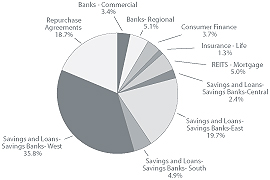

The following chart provides a visual breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

11

The FBR Funds

FBR Small Cap Financial Fund

Portfolio of Investments

October 31, 2004

| | | | | |

SHARES

| | | | VALUE

(NOTE 2)

|

| | | COMMON STOCKS — 81.3% | | | |

| | | Banks - Commercial — 3.4% | | | |

| 470,000 | | Provident Financial Services, Inc. | | $ | 8,460,000 |

| 402,645 | | Taylor Capital Group, Inc. | | | 11,817,631 |

| | | | |

|

|

| | | | | | 20,277,631 |

| | | | |

|

|

| | | Banks - Regional — 5.1% | | | |

| 937,895 | | Bank Mutual Corp. | | | 11,517,350 |

| 69,012 | | Cheviot Financial Corp. | | | 769,484 |

| 88,800 | | City Holding Co. | | | 3,076,920 |

| 166,150 | | Hanmi Financial Corp. | | | 5,047,637 |

| 622,769 | | NewAlliance Bancshares, Inc. | | | 8,644,034 |

| 115,118 | | Partners Trust Financial Group, Inc. | | | 1,171,901 |

| | | | |

|

|

| | | | | | 30,227,326 |

| | | | |

|

|

| | | Consumer Finance — 3.7% | | | |

| 311,000 | | AmeriCredit Corp.* | | | 6,033,400 |

| 421,322 | | ASTA Funding, Inc. | | | 7,615,395 |

| 423,000 | | Saxon Capital, Inc.* | | | 8,121,600 |

| | | | | | 21,770,395 |

| | | Insurance - Life — 1.3% | | | |

| 35,000 | | Ceres Group, Inc.* | | | 189,000 |

| 99,000 | | StanCorp Financial Group, Inc. | | | 7,462,620 |

| | | | |

|

|

| | | | | | 7,651,620 |

| | | | |

|

|

| | | REITs - Mortgage — 5.0% | | | |

| 275,000 | | Annaly Mortgage Management, Inc. | | | 4,944,500 |

| 50,000 | | Anthracite Capital, Inc. | | | 579,000 |

| 313,000 | | Anworth Mortgage Asset Corp. | | | 3,201,990 |

| 325,500 | | Government Properties Trust, Inc. | | | 3,264,765 |

| 185,000 | | Luminent Mortgage Capital, Inc. | | | 2,127,500 |

| 373,000 | | MFA Mortgage Investments, Inc. | | | 3,148,120 |

| 27,000 | | Redwood Trust, Inc. | | | 1,624,320 |

| 375,000 | | Thornburg Mortgage, Inc. | | | 10,713,750 |

| | | | |

|

|

| | | | | | 29,603,945 |

| | | | |

|

|

| | | Savings and Loans - Savings Banks - Central — 2.4% | | | |

| 219,500 | | Capitol Federal Financial | | | 7,458,609 |

| 49,174 | | First Place Financial Corp. | | | 971,187 |

| 116,369 | | HMN Financial, Inc. | | | 3,461,978 |

| 98,000 | | TierOne Corp. | | | 2,183,440 |

| | | | |

|

|

| | | | | | 14,075,214 |

| | | | |

|

|

12

The FBR Funds

FBR Small Cap Financial Fund

Portfolio of Investments (continued)

October 31, 2004

| | | | | | |

SHARES

| | | | VALUE

(NOTE 2)

| |

| | | Savings and Loans - Savings Banks - East — 19.7% | | | | |

| 278,497 | | Bancorp Rhode Island, Inc. | | $ | 10,652,510 | † |

| 535,054 | | Brookline Bancorp, Inc. | | | 8,287,986 | |

| 333,497 | | Dime Community Bancshares, Inc. | | | 5,355,962 | |

| 49,961 | | Flushing Financial Corp. | | | 962,748 | |

| 107,600 | | Hingham Institution for Savings | | | 4,478,850 | † |

| 803,000 | | Hudson City Bancorp, Inc. | | | 29,341,621 | |

| 287,000 | | Independence Community Bank Corp. | | | 10,799,810 | |

| 130,956 | | MASSBANK Corp. | | | 4,910,850 | |

| 264,020 | | New York Community Bancorp, Inc. | | | 4,847,407 | |

| 28,518 | | Pamrapo Bancorp, Inc. | | | 641,655 | |

| 241,311 | | Parkvale Financial Corp. | | | 6,459,895 | |

| 35,950 | | PennFed Financial Services, Inc. | | | 1,165,499 | |

| 266,000 | | Sovereign Bancorp, Inc. | | | 5,758,900 | |

| 90,523 | | TF Financial Corp. | | | 2,650,513 | |

| 334,291 | | Waypoint Financial Corp. | | | 9,179,631 | |

| 356,662 | | Yardville National Bancorp | | | 11,834,046 | |

| | | | |

|

|

|

| | | | | | 117,327,883 | |

| | | | |

|

|

|

| | | Savings and Loans - Savings Banks - South — 4.9% | | | | |

| 569,833 | | BankUnited Financial Corp., Class A* | | | 16,952,532 | |

| 26,800 | | FFLC Bancorp, Inc. | | | 813,916 | |

| 620,100 | | Franklin Bank Corp.* | | | 10,231,650 | |

| 49,600 | | Greenville First Bancshares, Inc.* | | | 992,000 | |

| | | | |

|

|

|

| | | | | | 28,990,098 | |

| | | | |

|

|

|

| | | Savings and Loans - Savings Banks - West — 35.8% | | | | |

| 421,376 | | Banner Corp. | | | 12,599,142 | |

| 1,181,116 | | Commercial Capital Bancorp, Inc. | | | 26,492,432 | |

| 419,300 | | Downey Financial Corp. | | | 23,170,518 | |

| 108,243 | | First PacTrust Bancorp, Inc. | | | 3,012,403 | |

| 717,100 | | FirstFed Financial Corp.* | | | 36,858,940 | |

| 354,822 | | ITLA Capital Corp.* | | | 17,180,836 | † |

| 255,550 | | Pacific Premier Bancorp, Inc.* | | | 3,002,713 | |

| 457,800 | | PFF Bancorp, Inc. | | | 18,060,210 | |

| 675,000 | | Sterling Financial Corp.* | | | 25,359,750 | |

| 1,128,600 | | Washington Federal, Inc. | | | 28,801,872 | |

| 472,900 | | Westcorp | | | 18,878,168 | |

| | | | |

|

|

|

| | | | | | 213,416,984 | |

| | | | |

|

|

|

| | | Total Common Stocks (Amortized Cost $354,428,750) | | | 483,341,096 | |

| | | | |

|

|

|

13

The FBR Funds

FBR Small Cap Financial Fund

Portfolio of Investments (continued)

October 31, 2004

| | | | | |

PAR

| | | | VALUE

(NOTE 2)

|

| | | REPURCHASE AGREEMENTS — 18.7% | | | |

| $111,064,000 | | With Mizuho Securities, Inc. dated 10/29/04 at 1.75% to be repurchased at $111,080,197 on 11/01/04, collateralized by U.S. Treasury Notes, 1.875% due 1/31/06, value $65,108,964; U.S. Treasury Bonds, 8.75% due 8/15/20, value $48,367,295 (Amortized Cost $ 111,064,000) | | $ | 111,064,000 |

| | | | |

|

|

| | | Total Investments — 100.0%

(Amortized Cost $465,492,750) | | | 594,405,096 |

| | | Other Assets Less Liabilities — 0.0% | | | 220,208 |

| | | | |

|

|

| | | Net Assets — 100.0% | | $ | 594,625,304 |

| | | | |

|

|

| * | Non-income producing security |

| † | Affiliated issuer as defined in the Investment Company Act of 1940 (ownership of at least 5% of the outstanding voting securities of an issuer) |

The accompanying notes are an integral part of the financial statements.

14

The FBR Funds

FBR Small Cap Fund

Management Overview

Portfolio Manager: Charles T. Akre, Jr.

Over the recent fiscal year, how did the Fund perform?

For the one-year period ended October 31, 2004 the FBR Small Cap Fund appreciated 19.46%. This compares to the Russell 2000 Index and the Lipper Small Cap Growth Fund Index which returned 11.73% and 1.95% for the same period, respectively.

What factors contributed to the Fund’s performance?

During the course of the year, we were able to maintain, and in some cases grow, the capital committed to our four largest holdings. Each of the four continued to solidify their leadership positions in their respective industries: property casualty insurance; wireless telecommunications infrastructure; gaming; and specialty retailing. Each of the four had solid years building intrinsic value on a per share basis, our key metric for evaluating and monitoring securities. We have owned shares in these companies for seven, seven, five and two years, respectively. We maintained or increased our allocations during the year because we felt that they remained undervalued, superbly managed and possessed excellent prospects to continue to compound their intrinsic values at high rates.

We also enjoyed success with several holdings in industry groupings new to the Fund. We successfully added shares in energy pipeline operators, discount retailers and in the homebuilding industry. As you would expect, we added to individual holdings in these select industries cautiously over the year as market pullbacks gave us buying opportunities. We approached each of these purchases in the same bottom-up oriented, company specific process we have followed for years. Our aim is never to own an industry or to rotate amongst industries chasing trends, but instead, to make selective additions to the portfolio in superior businesses when the opportunities arise.

What is the outlook for the Fund and the small cap sector?

As we have said in the past, we offer no opinion on the direction of the market or for small cap stocks. We do affirm to you that we will continue to be diligent in searching out a small number of outstanding businesses to own in our portfolio. We remain totally committed to our goal of compounding your capital at an above average rate, while incurring a level of risk compatible with that goal.

As may be evident from the sector breakdown of assets found in the annual report, the Fund does not own a wide cross section of small cap stocks. The Fund owns fewer securities, but with real commitment. As such, the outlook for the Fund is a function of its basket of holdings rather than the market in general. We remain enthusiastic about the individual company prospects within the Fund’s portfolio and continue to work hard to find new places to commit capital. That said, market prices are higher today for many of our businesses and our valuation discipline means that we are typically more active in periods of declining prices and less active during periods of rising prices.

15

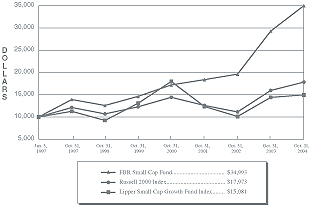

The FBR Funds

FBR Small Cap Fund

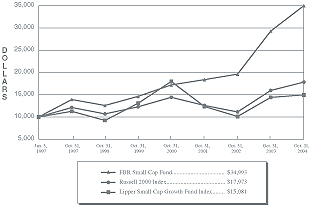

Comparison of Change in Value of $10,000 Investment in

Fund Shares(1)(2) vs. Various Indices(1)(3)

Total Returns—For the Periods Ended October 31, 2004(4)

| | | | | | | | | |

| | | One Year

| | | Annualized

Five Year

| | | Annualized

Since

Inception(5)

| |

FBR Small Cap Fund(1)(2) | | 19.46 | % | | 19.06 | % | | 17.36 | % |

Russell 2000 Index(1)(3) | | 11.73 | % | | 7.74 | % | | 7.78 | % |

Lipper Small Cap Growth Fund Index(1)(3) | | 1.95 | % | | 2.34 | % | | 5.39 | % |

TOTAL RETURNS REPRESENT PAST PERFORMANCE, WHICH IS NO GUARANTEE OF FUTURE RESULTS.

Investment return and principal value will fluctuate so that investors’ shares, when redeemed, may be

worth more or less than their original cost. Returns shown assume reinvestment of distributions.

The current performance may be lower or higher than the performance data quoted.

| (1) | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the indices are unmanaged, do not incur sales charges or expenses and are not available for investment. |

| (2) | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | Russell 2000 Index is comprised of the smallest of the 2000 companies of the Russell 3000 Index, representing approximately 11% of the Russell 3000’s total market-capitalization. Lipper Analytical Services, Inc., is a nationally recognized organization that reports on mutual fund total return performance and calculates fund rankings. Peer averages are based on universes of funds with the same investment objective. Peer group averages include reinvested dividends and capital gains, if any, and exclude sales charges. |

| (4) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | For the period January 3, 1997 (commencement of investment operations) through October 31, 2004. Certain purchases made by shareholders within this period would have been subject to an initial maximum sales charge of up to 5.50%. As a result, total returns for such sharesholders would have been lower. |

16

The FBR Funds

FBR Small Cap Fund

Portfolio Summary

October 31, 2004

The following chart provides a visual breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

17

The FBR Funds

FBR Small Cap Fund

Portfolio of Investments

October 31, 2004

| | | | | |

SHARES

| | | | VALUE (NOTE 2)

|

| | | COMMON STOCKS — 72.4% | | | |

| | | Beverages — 1.1% | | | |

| 170,800 | | Coca-Cola Bottling Co. | | $ | 9,027,634 |

| | | | |

|

|

| | |

| | | Biotechnology and Drugs — 1.1% | | | |

| 542,000 | | Bradley Pharmaceuticals, Inc.* | | | 8,975,520 |

| | | | |

|

|

| | |

| | | Capital Goods-Miscellaneous — 1.7% | | | |

| 200,000 | | Briggs & Stratton Corp. | | | 14,362,000 |

| | | | |

|

|

| | |

| | | Casinos and Gaming — 12.0% | | | |

| 1,595,324 | | Alliance Gaming Corp.* | | | 14,756,747 |

| 27,500 | | Florida Gaming Corp.* | | | 404,250 |

| 20,000 | | International Game Technology | | | 660,800 |

| 515,500 | | Monarch Casino & Resort, Inc.* | | | 14,397,915 |

| 1,105,584 | | Penn National Gaming, Inc.* | | | 45,914,904 |

| 369,450 | | Pinnacle Entertainment, Inc.* | | | 5,430,915 |

| 105,000 | | Shuffle Master, Inc.* | | | 4,419,450 |

| 250,000 | | Station Casinos, Inc. | | | 12,737,500 |

| | | | |

|

|

| | | | | | 98,722,481 |

| | | | |

|

|

| | |

| | | Communication Services — 6.9% | | | |

| 3,100,000 | | American Tower Corp., Class A* | | | 53,289,000 |

| 10,700 | | Outdoor Channel Holdings, Inc.* | | | 147,339 |

| 74,650 | | SpectraSite, Inc.* | | | 3,829,545 |

| | | | |

|

|

| | | | | | 57,265,884 |

| | | | |

|

|

| | |

| | | Computer Peripherals — 0.3% | | | |

| 118,500 | | Metrologic Instruments, Inc.* | | | 2,210,025 |

| | | | |

|

|

| | |

| | | Construction Services — 4.0% | | | |

| 425,000 | | D.R. Horton, Inc. | | | 12,750,000 |

| 90,000 | | Hovnanian Enterprises, Inc., Class A* | | | 3,378,600 |

| 60,000 | | Standard Pacific Corp. | | | 3,369,000 |

| 300,000 | | Toll Brothers, Inc.* | | | 13,905,000 |

| | | | |

|

|

| | | | | | 33,402,600 |

| | | | |

|

|

| | |

| | | Construction-Supplies and Fixtures — 1.5% | | | |

| 143,000 | | American Woodmark Corp. | | | 5,316,740 |

| 107,471 | | Simpson Manufacturing Company, Inc. | | | 6,908,236 |

| | | | |

|

|

| | | | | | 12,224,976 |

| | | | |

|

|

18

The FBR Funds

FBR Small Cap Fund

Portfolio of Investments (continued)

October 31, 2004

| | | | | |

SHARES

| | | | VALUE

(NOTE 2)

|

| | | Consumer Financial Services — 2.1% | | | |

| 873,000 | | AmeriCredit Corp.* | | $ | 16,936,200 |

| | | | |

|

|

| | |

| | | Electric Utilities — 1.7% | | | |

| 1,316,400 | | The AES Corp.* | | | 14,348,760 |

| | | | |

|

|

| | |

| | | Insurance-Life — N.M. | | | |

| 3,007 | | Independence Holding Co. | | | 57,103 |

| | | | |

|

|

| | |

| | | Insurance-Miscellaneous — 1.6% | | | |

| 25,000 | | Brown & Brown, Inc. | | | 1,044,000 |

| 393,500 | | Hilb, Rogal, and Hobbs Co. | | | 12,473,950 |

| | | | |

|

|

| | | | | | 13,517,950 |

| | | | |

|

|

| | |

| | | Insurance-Mortgage Insurance — 0.2% | | | |

| 30,000 | | Triad Guaranty, Inc.* | | | 1,635,300 |

| | | | |

|

|

| | |

| | | Insurance-Property and Casualty — 16.7% | | | |

| 523,000 | | Allmerica Financial Corp.* | | | 15,742,300 |

| 80 | | Berkshire Hathaway, Inc., Class B* | | | 224,320 |

| 33,000 | | Fairfax Financial Holdings Ltd. | | | 4,853,970 |

| 255,400 | | Markel Corp.* | | | 81,217,199 |

| 275,000 | | PartnerRe Ltd. | | | 15,991,250 |

| 500,000 | | Platinum Underwriters Holdings Ltd. | | | 14,625,000 |

| 300,000 | | PMA Capital Corp., Class A* | | | 2,460,000 |

| 75,000 | | ProAssurance Corp.* | | | 2,676,750 |

| | | | |

|

|

| | | | | | 137,790,789 |

| | | | |

|

|

| | |

| | | Insurance-Title Insurance — 0.2% | | | |

| 61,000 | | Investors Title Co. | | | 2,019,100 |

| | | | |

|

|

| | |

| | | Motion Pictures — 0.6% | | | |

| 220,800 | | AMC Entertainment, Inc.* | | | 4,241,568 |

| 40,000 | | Regal Entertainment Group | | | 796,400 |

| | | | |

|

|

| | | | | | 5,037,968 |

| | | | |

|

|

| | | Office Equipment — 2.3% | | | |

| 542,700 | | Global Imaging Systems, Inc.* | | | 19,103,040 |

| | | | |

|

|

| | |

| | | Oil and Gas Operations — 3.1% | | | |

| 400,600 | | Kaneb Services LLC | | | 12,578,840 |

| 326,290 | | MarkWest Hydrocarbon, Inc. | | | 5,253,269 |

| 211,800 | | Penn Virginia Corp. | | | 7,624,800 |

| | | | |

|

|

| | | | | | 25,456,909 |

| | | | |

|

|

19

The FBR Funds

FBR Small Cap Fund

Portfolio of Investments (continued)

October 31, 2004

| | | | | |

SHARES/

PAR

| | | | VALUE

(NOTE 2)

|

| | | Personal Services — 0.2% | | | |

| 200,000 | | Service Corporation International* | | $ | 1,322,000 |

| | | | |

|

|

| | |

| | | Recreational Activities — 0.8% | | | |

| 603,800 | | Dover Motorsports, Inc. | | | 2,868,050 |

| 60,000 | | International Speedway Corp., Class A | | | 2,822,400 |

| 19,000 | | International Speedway Corp., Class B | | | 883,500 |

| | | | |

|

|

| | | | | | 6,573,950 |

| | | | |

|

|

| | |

| | | Regional Banks — 0.1% | | | |

| 14,000 | | Corus Bankshares, Inc. | | | 644,140 |

| | | | |

|

|

| | |

| | | Restaurants — 0.8% | | | |

| 586,100 | | Krispy Kreme Doughnuts, Inc.* | | | 6,212,660 |

| | | | |

|

|

| | |

| | | Retail - Apparel — 1.6% | | | |

| 412,500 | | Aeropostale, Inc.* | | | 13,014,375 |

| | | | |

|

|

| | |

| | | Retail - Specialty — 11.5% | | | |

| 1,700,000 | | 99 Cents Only Stores* | | | 26,197,000 |

| 150,000 | | Advance Auto Parts, Inc.* | | | 5,868,000 |

| 1,500,000 | | CarMax, Inc.* | | | 39,510,000 |

| 800,000 | | Dollar Tree Stores, Inc.* | | | 23,120,000 |

| | | | |

|

|

| | | | | | 94,695,000 |

| | | | |

|

|

| | |

| | | Software and Programming — 0.1% | | | |

| 16,000 | | MICROS Systems, Inc.* | | | 945,920 |

| | | | |

|

|

| | |

| | | Transportation Services — 0.2% | | | |

| 90,000 | | Dynamex, Inc.* | | | 1,863,000 |

| | | | |

|

|

| | | Total Common Stocks (Amortized Cost $449,934,674) | | | 597,365,284 |

| | | | |

|

|

| | |

| | | MASTER LIMITED PARTNERSHIPS — N.M. Casinos — N.M. | | | |

| 61,650 | | Equus Gaming Company L.P.* (Amortized Cost $110,489) | | | 67,815 |

| | | | |

|

|

20

The FBR Funds

FBR Small Cap Fund

Portfolio of Investments (continued)

October 31, 2004

| | | | | | | | | | |

PAR

| | | | RATE

| | | MATURITY

| | VALUE

(NOTE 2)

|

| | | U.S. GOVERNMENT AGENCY OBLIGATION — 2.4% | | | | | | | | |

| $20,000,000 | | Student Loan Marketing Association | | | | | | | | |

| | | (Amortized Cost $20,114,104) | | 2.25 | % | | 12/15/32 | | | 19,876,800 |

| | | | | | | | | |

|

|

| | | | |

| | | SHORT-TERM INVESTMENTS — 25.0% | | | | | | | | |

| | | Commercial Paper — 15.2% | | | | | | | | |

| 15,000,000 | | Ford Motor Credit Co. | | 1.89 | ** | | 11/24/04 | | | 14,981,888 |

| 15,000,000 | | Ford Motor Credit Co. | | 1.89 | ** | | 12/9/04 | | | 14,970,075 |

| 16,000,000 | | General Electric Capital Corp. | | 1.96 | ** | | 1/5/05 | | | 15,943,378 |

| 25,000,000 | | Lockhart Funding LLC | | 1.93 | ** | | 12/2/04 | | | 24,958,451 |

| 15,000,000 | | Lockhart Funding LLC | | 1.93 | ** | | 12/8/04 | | | 14,970,246 |

| 8,500,000 | | National Grid Transco PLC | | 1.845 | ** | | 12/14/04 | | | 8,481,268 |

| 20,000,000 | | Prudential Funding LLC | | 1.82 | ** | | 12/16/04 | | | 19,954,500 |

| 11,571,000 | | Sunbelt Funding Corp. | | 1.82 | ** | | 12/8/04 | | | 11,549,356 |

| | | | | | | | | |

|

|

| | | Total Commercial Paper (Amortized Cost $125,809,162) | | | | | | | | 125,809,162 |

| | | | | | | | | |

|

|

| | | | |

| | | U.S. Government Agency Obligation — 3.0% | | | | | | | | |

| 24,850,000 | | Federal National Mortgage Association, Discount Note (Amortized Cost $24,850,000) | | 1.78 | ** | | 11/1/04 | | | 24,850,000 |

| | | | | | | | | |

|

|

| | | | |

| | | Repurchase Agreements — 6.8% | | | | | | | | |

| 56,074,000 | | With Mizuho Securities, Inc. dated 10/29/04 at 1.75 % to be repurchased at $56,082,177 on 11/01/04, collateralized by U.S. Treasury Notes, 1.875% due 1/31/06, value $32,872,218; U.S. Treasury Bonds, 8.75% due 8/15/20, value $24,419,683 (Amortized Cost $56,074,000) | | | 56,074,000 |

| | | | | | | | | |

|

|

| | | Total Short-Term Investments (Amortized Cost $206,733,162) | | | | | | 206,733,162 |

| | | | | | | | | |

|

|

| | | Total Investments — 99.8% | | | | | | |

| | | (Amortized Cost $676,892,429) | | | | | | 824,043,061 |

| | | Other Assets Less Liabilities — 0.2% | | | | | | 1,453,825 |

| | | | | | | | | |

|

|

| | | Net Assets — 100.0% | | | | | $ | 825,496,886 |

| | | | | | | | | |

|

|

| * | Non-income producing security |

| † | Affiliated issuer as defined in the Investment Company Act of 1940 (ownership of at least 5% of the outstanding voting securities of an issuer) |

| ** | This issue shows the rate of discount at time of purchase. |

N.M. Not Meaningful

The accompanying notes are an integral part of the financial statements.

21

The FBR Funds

FBR Large Cap Technology Fund

Management Overview

Portfolio Manager: Winsor Aylesworth

Over the recent fiscal year, how did the fund perform?

For the one-year period ended October 31, 2004 the FBR Large Cap Technology Fund appreciated 1.17%. This compares to the S&P 500 Composite Index, the NASDAQ Comp Index and the Lipper Science & Technology Fund Index which returned 9.42%, 2.68% and -3.08% for the same period, respectively.

What factors contributed to the Fund’s performance?

Historically, the technology sector has tended to track the nation’s economy. Companies spend more on technology as the economy improves and cut back as the economy slows. The first half of the 12-month period, characterized by broad based economic growth, ran into a soft patch in the second half due to decelerating economic indicators, the expectation and realization of rising rates and sharply increasing commodity prices. Investors tended to stay on the sidelines as such high profile events as the Olympics, the political conventions and our national election played out. As all these internationally visible events reached successful conclusions, and corporate executives and investors became more optimistic about the prospects for growth, investors and companies appeared ready to get back to business.

Our overall strategy of investing in large cap technology companies with earnings and minimal debt, that are selling at reasonable valuations is an inherently conservative approach that served the Fund well during this period.

What is the outlook for the Fund and the technology sector?

As one of the major “pillars” of the economy, the technology sector will always be linked to the overall growth of the global economy. As a society, we are perpetually looking for new ways and the latest gadgets that allow us to do what we want any time and any place. This all bodes well for technology. Currently, consumer items such as flat panel displays, digital cameras, mp3 players, and entertainment convergence are all examples of segments that will continue to fuel growth for the sector. Corporately, our desire for smaller, faster, and lighter will feed the demand for new technological breakthroughs. The changing demographic of the population will continue to drive advances in healthcare technology and biotechnology. Even the war on terrorism will create opportunities for technology over the long term.

The FBR Large Cap Technology Fund offers investors exposure to the technology industry by owning a wide range of fundamentally sound companies with attractive and sustainable profit margins. These market leaders should continue to participate in the inherent growth of the sector and most importantly, weather any market downturn as well as, if not better than the industry averages.

22

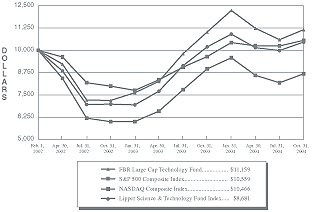

The FBR Funds

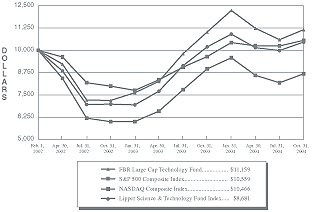

FBR Large Cap Technology Fund

Comparison of Change in Value of $10,000 Investment in

Fund Shares(1)(2) vs. Various Indices(1)(3)

Total Returns—For the Periods Ended October 31, 2004(4)

| | | | | | |

| | | One Year

| | | Annualized

Since

Inception(5)

| |

FBR Large Cap Technology Fund(1)(2) | | 1.17 | % | | 4.08 | % |

S&P 500 Composite Index(1)(3) | | 9.42 | % | | 1.99 | % |

NASDAQ Composite Index(1)(3) | | 2.68 | % | | 1.67 | % |

Lipper Science & Technology Fund Index(1)(3) | | (3.08 | %) | | (5.01 | %) |

TOTAL RETURNS REPRESENT PAST PERFORMANCE, WHICH IS NO GUARANTEE OF FUTURE RESULTS.

Investment return and principal value will fluctuate so that investors’ shares, when redeemed, may be

worth more or less than their original cost. Returns shown assume reinvestment of distributions.

The current performance may be lower or higher than the performance data quoted.

| (1) | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the indices are unmanaged, do not incur sales charges or expenses and are not available for investment. |

| (2) | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | S&P500 Composite Index is a capitalization-weighted index of 500 stocks. The index is designed to represent the broad domestic economy through changes in aggregate market value of 500 stocks representing all major industries. The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ National Market and Small Cap stocks. Lipper Analytical Services, Inc., is a national recognized organization that reports on mutual fund total return performance and calculates fund rankings. Peer averages are based on a universe of funds with the same investment objective. Peer group averages include reinvested dividends and capital gains, if any, and exclude sales charges. |

| (4) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | For the period February 1, 2002 (commencement of investment operations) through October 31, 2004. |

23

The FBR Funds

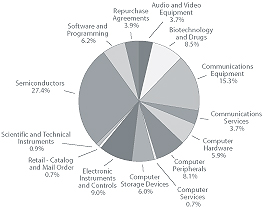

FBR Large Cap Technology Fund

Portfolio Summary

October 31, 2004

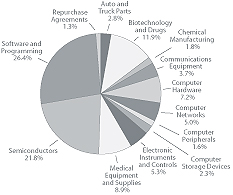

The following chart provides a visual breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

24

The FBR Funds

FBR Large Cap Technology Fund

Portfolio of Investments

October 31, 2004

| | | | | |

SHARES

| | | | VALUE

(NOTE 2)

|

| | | COMMON STOCKS — 96.2% | | | |

| | | Audio and Video Equipment — 3.7% | | | |

| 7,075 | | Sony Corp. ADR | | $ | 246,564 |

| | | | |

|

|

| | | Biotechnology and Drugs — 8.5% | | | |

| 1,100 | | AmerisourceBergen Corp. | | | 60,544 |

| 1,150 | | Barr Pharmaceuticals, Inc.* | | | 43,298 |

| 4,550 | | Cardinal Health, Inc. | | | 212,712 |

| 2,700 | | MedImmune, Inc.* | | | 76,734 |

| 4,000 | | Mylan Laboratories, Inc. | | | 68,880 |

| 6,425 | | Serono S.A. ADR | | | 98,688 |

| | | | |

|

|

| | | | | | 560,856 |

| | | | |

|

|

| | | Communications Equipment — 15.3% | | | |

| 4,800 | | Cisco Systems, Inc.* | | | 92,208 |

| 2,050 | | Comverse Technology, Inc.* | | | 42,312 |

| 14,500 | | Corning, Inc.* | | | 166,024 |

| 15,200 | | Motorola, Inc. | | | 262,352 |

| 18,525 | | Nokia Oyj ADR | | | 285,655 |

| 1,300 | | Qualcomm, Inc. | | | 54,353 |

| 2,100 | | Scientific-Atlanta, Inc. | | | 57,519 |

| 6,250 | | Tellabs, Inc.* | | | 50,000 |

| | | | |

|

|

| | | | | | 1,010,423 |

| | | | |

|

|

| | | Communications Services — 3.7% | | | |

| 9,675 | | SBC Communications, Inc. | | | 244,391 |

| | | | |

|

|

| | | Computer Hardware — 5.9% | | | |

| 3,400 | | Apple Computer, Inc.* | | | 178,602 |

| 755 | | International Business Machines Corp. | | | 67,761 |

| 30,900 | | Sun Microsystems, Inc.* | | | 139,977 |

| | | | |

|

|

| | | | | | 386,340 |

| | | | |

|

|

| | | Computer Peripherals — 8.1% | | | |

| 5,600 | | Canon, Inc. ADR | | | 277,200 |

| 13,900 | | Hewlett-Packard Co. | | | 259,374 |

| | | | |

|

|

| | | | | | 536,574 |

| | | | |

|

|

| | | Computer Services — 0.7% | | | |

| 850 | | NCR Corp.* | | | 47,898 |

| | | | |

|

|

| | | Computer Storage Devices — 6.0% | | | |

| 20,875 | | EMC Corp.* | | | 268,662 |

| 3,275 | | SanDisk Corp.* | | | 68,349 |

| 4,800 | | Seagate Technology | | | 60,672 |

| | | | |

|

|

| | | | | | 397,683 |

| | | | |

|

|

25

The FBR Funds

FBR Large Cap Technology Fund

Portfolio of Investments (continued)

October 31, 2004

| | | | | |

SHARES

| | | | VALUE

(NOTE 2)

|

| | | Electronic Instruments and Controls — 9.0% | | | |

| 5,115 | | Agilent Technologies, Inc.* | | $ | 128,181 |

| 2,225 | | American Power Conversion Corp. | | | 42,898 |

| 8,700 | | AU Optronics Corp. ADR | | | 91,350 |

| 3,150 | | Jabil Circuit, Inc.* | | | 76,577 |

| 4,900 | | LG.Philips LCD Company, Ltd. ADR* | | | 66,395 |

| 3,200 | | Molex, Inc. | | | 94,624 |

| 1,400 | | TDK Corp. ADR | | | 97,075 |

| | | | |

|

|

| | | | | | 597,100 |

| | | | |

|

|

| | | Retail - Catalog and Mail Order — 0.7% | | | |

| 750 | | CDW Corp. | | | 46,523 |

| | | | |

|

|

| | |

| | | Scientific and Technical Instruments — 0.9% | | | |

| 2,950 | | Applera Corp. - Applied Biosystems Group | | | 56,286 |

| | | | |

|

|

| | |

| | | Semiconductors — 27.5% | | | |

| 16,200 | | Applied Materials, Inc.* | | | 260,820 |

| 2,900 | | Freescale Semiconductor, Inc. Class A* | | | 45,066 |

| 8,700 | | Infineon Technologies AG ADR* | | | 95,091 |

| 12,000 | | Intel Corp. | | | 267,119 |

| 2,000 | | KLA-Tencor Corp.* | | | 91,060 |

| 1,800 | | Kyocera Corp. ADR | | | 129,780 |

| 9,050 | | Micron Technology, Inc.* | | | 110,229 |

| 4,100 | | National Semiconductor Corp. | | | 68,470 |

| 2,950 | | Novellus Systems, Inc.* | | | 76,435 |

| 3,150 | | NVIDIA Corp.* | | | 45,581 |

| 9,600 | | STMicroelectronics N.V | | | 177,696 |

| 11,950 | | Texas Instruments, Inc. | | | 292,177 |

| 5,025 | | Xilinx, Inc. | | | 153,765 |

| | | | |

|

|

| | | | | | 1,813,289 |

| | | | |

|

|

| | | Software and Programming — 6.2% | | | |

| 2,800 | | Check Point Software Technologies Ltd.* | | | 63,339 |

| 1,650 | | Electronic Arts, Inc.* | | | 74,118 |

| 4,725 | | Microsoft Corp. | | | 132,253 |

| 2,200 | | PeopleSoft, Inc.* | | | 45,694 |

| 6,600 | | Siebel Systems, Inc.* | | | 62,700 |

| 1,850 | | Synopsys, Inc.* | | | 30,045 |

| | | | |

|

|

| | | | | | 408,149 |

| | | | |

|

|

| | |

| | | Total Common Stocks (Amortized Cost $6,086,462) | | | 6,352,076 |

| | | | |

|

|

26

The FBR Funds

FBR Large Cap Technology Fund

Portfolio of Investments (continued)

October 31, 2004

| | | | | | |

PAR

| | | | VALUE

(NOTE 2)

| |

| | | REPURCHASE AGREEMENTS — 3.9% | | | | |

| $259,000 | | With Mizuho Securities, Inc. dated 10/29/04 at 1.75% to be repurchased at $259,038 on 11/01/04, collateralized by U.S. Treasury Notes, 1.875% due 1/31/06, value $151,833; U.S. Treasury Bonds, 8.75% due 8/15/20, value $112,792 (Amortized Cost $259,000) | | $ | 259,000 | |

| | | | |

|

|

|

| | | Total Investments— 100.1%

(Amortized Cost $6,345,462) | | | 6,611,076 | |

| | | Liabilities Less Other Assets — (0.1%) | | | (3,340 | ) |

| | | | |

|

|

|

| | | Net Assets — 100.0% . | | $ | 6,607,736 | |

| | | | |

|

|

|

| * | Non-income producing security ADR American Depository Receipts |

The accompanying notes are an integral part of the financial statements.

27

The FBR Funds

FBR Small Cap Technology Fund

Management Overview

Portfolio Manager: Robert C. Barringer, CFA

Over the recent fiscal year, how did the fund perform?

The FBR Small Cap Technology Fund commenced operations on January 20, 2004. Since inception through the end of the fiscal year (October 31, 2004), the Fund returned -11.20% while the NASDAQ Composite Index and the Lipper Science & Technology Fund Index returned -7.72% and -9.44%, respectively.

What factors contributed to the Fund’s performance?

There has been a lot of uncertainty about the strength and duration of the technology spending recovery since its bottoming in late 2001, both from the standpoint of the companies and the investment community. The Fund’s performance was impacted by the continued uncertainty surrounding the corporate spending environment and its attendant effects on companies’ earnings visibility and financial performance. This uncertainty or lack of visibility, as it has been called, has been caused by such issues as the elections and the war in Iraq, which impacted consumer and corporate confidence. In addition, the semiconductor industry faced an excess inventory issue from the beginning of the year, resulting in poor operating and stock performance. Lastly, size played a role as small cap companies were more negatively impacted by these factors.

What is the outlook for the Fund and the technology sector?

The outlook for the technology sector remains bright as technology is integrated into larger parts of our economy and everyday lives. Broadband and wireless penetration are continuing to grow, enabling greater communication and productivity in our business and personal lives. The Fund positions itself in the stocks of companies that should take advantage of these and other major technology trends, companies with differentiated strategies, and solid balance sheets.

I was named portfolio manager of the FBR Small Cap Technology Fund this past August and I am very excited to create and maintain a portfolio of future leaders in technology. There is progress being made on numerous fronts in technology, including communications, energy, medical devices and biotechnology. These and other areas should provide fertile ground for investment opportunities into the future.

28

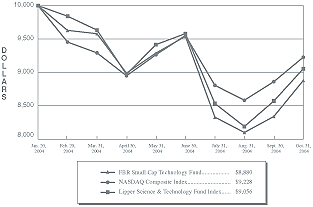

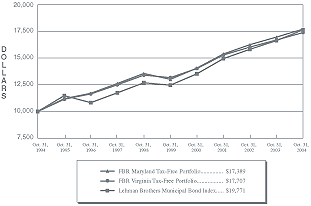

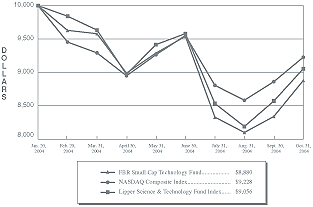

The FBR Funds

FBR Small Cap Technology Fund

Comparison of Change in Value of $10,000 Investment in

Fund Shares(1)(2) vs. Various Indices(1)(3)

Total Returns—For the Period Ended October 31, 2004(4)

| | | |

| | | Since

Inception(5)

| |

FBR Small Cap Technology Fund (1)(2) | | (11.20 | %) |

NASDAQ Composite Index (1)(3) | | (7.72 | %) |

Lipper Science & Technology Fund Index (1)(3) | | (9.44 | %) |

TOTAL RETURNS REPRESENT PAST PERFORMANCE, WHICH IS NO GUARANTEE OF FUTURE RESULTS.

Investment return and principal value will fluctuate so that investors’ shares, when redeemed, may be

worth more or less than their original cost. Returns shown assume reinvestment of distributions.

The current performance may be lower or higher than the performance data quoted.

| (1) | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the indices are unmanaged, do not incur sales charges or expenses and are not available for investment. |

| (2) | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total return shown includes fee waivers and expense reimbursements, if any; total return would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ National Market and Small Cap stocks. Lipper Analytical Services, Inc., is a national recognized organization that reports on mutual fund total return performance and calculates fund rankings. Peer averages are based on a universe of funds with the same investment objective. Peer group averages include reinvested dividends and capital gains, if any, and exclude sales charges. |

| (4) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | For the period January 20, 2004 (commencement of investment operations) through October 31, 2004. |

29

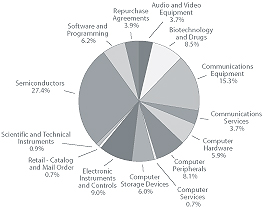

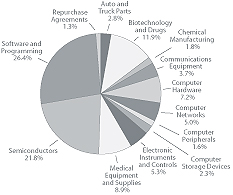

The FBR Funds

FBR Small Cap Technology Fund

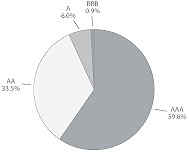

Portfolio Summary

October 31, 2004

The following chart provides a visual breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

30

The FBR Funds

FBR Small Cap Technology Fund

Portfolio of Investments

October 31, 2004

| | | | | |

SHARES

| | | | VALUE

(NOTE 2)

|

| | | COMMON STOCKS — 97.3% | | | |

| | | Auto and Truck Parts — 2.8% | | | |

1,200 | | Gentex Corp. | | $ | 39,612 |

| | | | |

|

|

| | | Biotechnology and Drugs — 11.8% | | | |

2,200 | | Abaxis, Inc.* | | | 28,435 |

2,000 | | Angiotech Pharmaceuticals, Inc.* | | | 36,559 |

1,700 | | Dendreon Corp.* | | | 17,578 |

950 | | Eon Labs, Inc.* | | | 23,380 |

600 | | Martek Biosciences Corp.* | | | 28,234 |

900 | | Par Pharmaceutical Companies, Inc.* | | | 35,505 |

| | | | |

|

|

| | | | | | 169,691 |

| | | | |

|

|

| | | Chemical Manufacturing — 1.8% | | | |

725 | | Cabot Microelectronics Corp.* | | | 26,122 |

| | | | |

|

|

| | | Communications Equipment — 3.6% | | | |

2,000 | | Foundry Networks, Inc.* | | | 24,260 |

1,350 | | Polycom, Inc.* | | | 27,878 |

| | | | |

|

|

| | | | | | 52,138 |

| | | | |

|

|

| | | Computer Hardware — 7.1% | | | |

12,300 | | Cray, Inc.* | | | 41,144 |

1,225 | | Ingram Micro, Inc., Class A* | | | 21,131 |

700 | | Park Electrochemical Corp. | | | 14,707 |

625 | | Tech Data Corp.* | | | 25,244 |

| | | | |

|

|

| | | | | | 102,226 |

| | | | |

|

|

| | | Computer Networks — 4.9% | | | |

1,675 | | Intergraph Corp.* | | | 41,766 |

4,100 | | Novell, Inc.* | | | 29,479 |

| | | | |

|

|

| | | | | | 71,245 |

| | | | |

|

|

| | | Computer Peripherals — 1.6% | | | |

1,250 | | Metrologic Instruments, Inc.* | | | 23,313 |

| | | | |

|

|

| | | Computer Storage Devices — 2.3% | | | |

1,200 | | Storage Technology Corp.* | | | 32,424 |

| | | | |

|

|

| | | Electronic Instruments and Controls — 5.2% | | | |

975 | | Benchmark Electronics, Inc.* | | | 33,120 |

2,675 | | Power-One, Inc.* | | | 18,779 |

1,400 | | Technitrol, Inc.* | | | 22,848 |

| | | | |

|

|

| | | | | | 74,747 |

| | | | |

|

|

31

The FBR Funds

FBR Small Cap Technology Fund

Portfolio of Investments (continued)

October 31, 2004

| | | | | |

SHARES

| | | | VALUE

(NOTE 2)

|

| | | Medical Equipment and Supplies — 8.8% | | | |

| 600 | | Atrion Corp. | | $ | 27,496 |

| 1,700 | | Kensey Nash Corp.* | | | 48,619 |

| 1,450 | | Wright Medical Group, Inc.* | | | 37,454 |

| 400 | | ZOLL Medical Corp.* | | | 12,800 |

| | | | |

|

|

| | | | | | 126,369 |

| | | | |

|

|

| | | Semiconductors — 21.4% | | | |

| 1,850 | | Actel Corp.* | | | 28,065 |

| 3,390 | | Cirrus Logic, Inc.* | | | 17,120 |

| 900 | | Coherent, Inc.* | | | 21,717 |

| 3,800 | | ESS Technology, Inc.* | | | 24,852 |

| 1,800 | | Exar Corp.* | | | 27,036 |

| 1,150 | | Genesis Microchip, Inc.* | | | 16,296 |

| 4,200 | | Integrated Silicon Solution, Inc.* | | | 31,541 |

| 2,900 | | MEMC Electronic Materials, Inc.* | | | 27,260 |

| 2,500 | | Mykrolis Corp.* | | | 26,275 |

| 950 | | Power Integrations, Inc.* | | | 20,330 |

| 1,400 | | Semtech Corp.* | | | 29,232 |

| 1,150 | | Standard Microsystems Corp.* | | | 25,323 |

| 400 | | Varian Semiconductor Equipment Associates, Inc.* | | | 13,844 |

| | | | |

|

|

| | | | | | 308,891 |

| | | | |

|

|

| | | Software and Programming — 26.0% | | | |

| 3,112 | | Activision, Inc.* | | | 45,061 |

| 1,950 | | Ascential Software Corp.* | | | 27,476 |

| 3,850 | | Compuware Corp.* | | | 22,292 |

| 1,500 | | FileNet Corp.* | | | 41,744 |

| 4,550 | | Informatica Corp.* | | | 35,536 |

| 1,500 | | Internet Security Systems, Inc.* | | | 32,640 |

| 1,225 | | Manhattan Associates, Inc.* | | | 25,198 |

| 3,400 | | NetIQ Corp.* | | | 43,111 |

| 2,350 | | Sybase, Inc.* | | | 37,201 |

| 815 | | Take-Two Interactive Software, Inc.* | | | 26,862 |

| 1,200 | | THQ, Inc.* | | | 22,680 |

| 1,500 | | TIBCO Software, Inc.* | | | 14,580 |

| | | | |

|

|

| | | | | | 374,381 |

| | | | |

|

|

| | | Total Common Stocks (Amortized Cost $1,403,262) | | | 1,401,159 |

| | | | |

|

|

32

The FBR Funds

FBR Small Cap Technology Fund

Portfolio of Investments (continued)

October 31, 2004

| | | | | |

PAR

| | | | VALUE

(NOTE 2)

|

| | | REPURCHASE AGREEMENTS — 1.3% | | | |

| $19,000 | | With Mizuho Securities, Inc. dated 10/29/04 at 1.75% to be repurchased at $19,003 on 11/01/04, collateralized by U.S. Treasury Notes, 1.875% due 1/31/06, value $11,138; U.S. Treasury Bonds, 8.75% due 8/15/20, value $8,274 (Amortized Cost $19,000) | | $ | 19,000 |

| | | | |

|

|

| | | Total Investments — 98.6%

(Amortized Cost $1,422,262) | | $ | 1,420,159 |

| | | Other Assets Less Liabilities — 1.4% | | | 19,952 |

| | | | |

|

|

| | | Net Assets — 100.0% | | $ | 1,440,111 |

| | | | |

|

|

| * | Non-income producing security |

The accompanying notes are an integral part of the financial statements.

33

The FBR Funds

FBR Gas Utility Index Fund

Management Overview

Portfolio Manager: Winsor Aylesworth

Over the recent fiscal year, how did the fund perform?

For the one-year period ended October 31, 2004 the FBR Gas Utility Index Fund appreciated 20.63%. This compares to the AGA Stock Index, the Dow Jones Utility Index and the Lipper Utility Index which returned 21.59%, 28.68% and 22.97% for the same period, respectively.

What factors contributed to the Fund’s performance?

Three major factors impacted the Fund’s performance during the fiscal year, the continued post “Enron” balance sheet restructuring issues; the broad economic recovery; and the overall weather patterns and trends.

The overriding “Back to Basics” philosophy adopted by the utility industry in the aftermath of the “Enron” debacle has begun to pay dividends to investors. Companies sold non-core assets, reduced debt and focused efforts on electricity generation and gas distribution within their respective markets. As a result, many of the Fund’s holdings have either resumed or increased their dividend payout which in turn has increased overall investor interest in the industry.

The utility business is driven by a straight forward supply and demand dynamic. When demand is up, the companies sell more energy, increase revenues and usually profits. A decrease in overall energy demand generally indicates an oversupply of generating capacity. As a result, revenues and subsequent profits tend to fall. Over the course of the fiscal year, the continued economic recovery and overall stronger job environment drove demand for energy which helped off-set the mild weather experienced in the Midwest and Northeast.

What is the outlook for the Fund and the utility sector?

We have made some exciting changes which should bode well for the Fund and its investors.

First, we changed the name of the Fund to the FBR Gas Utility Index Fund. The ticker symbol remains GASFX and the underlying investment methodology is unchanged. We feel the new name better reflects the Fund’s investment objectives and will help prevent the notion that the Fund’s performance is directly correlated to the price of the underlying commodity.

Second, the Fund now includes some foreign based utility holdings. Since the demise of Enron and others, many domestic companies have been divesting non-core assets. This has provided international companies with opportunities to acquire valuable natural gas distribution assets throughout North America. Recently, several of these international companies have acquired significant U.S. based natural gas assets and have become members of the American Gas Association. As a result, in late October, these companies were added to the AGA stock Index and the Fund.

Finally, barring any terrorism and major geopolitical issues, we feel the economy is poised to continue its recovery in 2005. This should fuel the overall demand for energy which is a positive for the Fund’s holdings. We also expect the portfolio companies to continue to strengthen their balance sheets and where possible, increase their dividends. Unfortunately we can’t predict the weather, but baring any major variances in seasonal temperatures we remain moderately positive on the long-term fundamental trends of the natural gas industry.

34

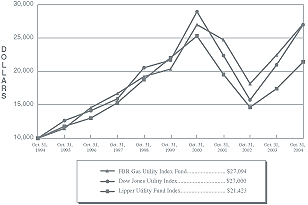

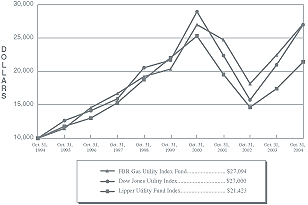

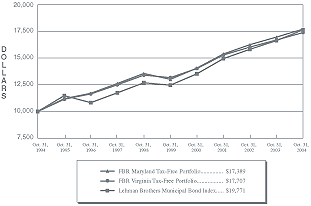

The FBR Funds

FBR Gas Utility Index Fund

Comparison of Change in Value of $10,000 Investment in

Fund Shares(1)(2) vs. Index(1)(3)

Total Returns—For the Years Ended October 31, 2004(4)(5)

| | | | | | | | | |

| | | One

Year

| | | Annualized

Five Year

| | | Annualized

Ten Year

| |

FBR Gas Utility Index Fund (1)(2) | | 20.63 | % | | 5.89 | % | | 10.48 | % |

Dow Jones Utility Index(1)(3) | | 28.68 | % | | 4.47 | % | | 10.42 | % |

Lipper Utility Fund Index(1)(3) | | 22.97 | % | | (0.57 | %) | | 7.92 | % |

TOTAL RETURNS REPRESENT PAST PERFORMANCE, WHICH IS NO GUARANTEE OF FUTURE RESULTS.

Investment return and principal value will fluctuate so that investors’ shares, when redeemed, may be

worth more or less than their original cost. Returns shown assume reinvestment of distributions.

The current performance may be lower or higher than the performance data quoted.

| (1) | The graph assumes a hypothetical investment of $10,000. The Fund’s performance assumes reinvestment of all dividends and distributions and reflects all Fund expenses. The indices are unmanaged and do not incur charges or expenses and are not available for investment. |

| .(2) | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | Dow Jones Utility Index is a price weighted average of 15 utility companies listed on the New York Stock Exchange and involved in the production of electrical energy. Lipper Analytical Services, Inc., is a nationally recognized organization that reports on mutual fund total return performance and calculates fund rankings. Peer averages are based on universes of funds with the same investment objective. Peer group averages include reinvested dividends and capital gains, if any, and exclude sales charges. |

| (4) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | In 2003, the Fund changed its fiscal year-end from March to October. |

35

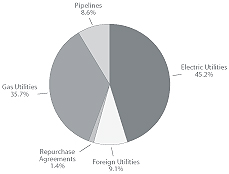

The FBR Funds

FBR Gas Utility Index Fund

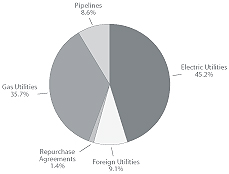

Portfolio Summary

October 31, 2004

The following chart provides a visual breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

36

The FBR Funds

FBR Gas Utility Index Fund

Portfolio of Investments

October 31, 2004

| | | | | | | | |

SHARES

| | | | VALUE

(NOTE 2)

| | PERCENT OF

NET ASSETS

| |

| | | COMMON STOCKS — 99.52% | | | | | | |

| 452,000 | | Duke Energy Corp. | | $ | 11,087,559 | | 5.03 | % |

| 340,175 | | PG&E Corp.* | | | 10,899,206 | | 4.94 | |

| 267,850 | | KeySpan Corp. | | | 10,700,607 | | 4.85 | |

| 124,200 | | E.ON AG - ADR | | | 10,128,509 | | 4.59 | |

| 142,850 | | Dominion Resources, Inc. | | | 9,188,111 | | 4.17 | |

| 423,950 | | NiSource, Inc. | | | 9,093,727 | | 4.12 | |

| 174,100 | | Enbridge, Inc. | | | 7,557,680 | | 3.43 | |

| 169,200 | | National Grid Transco PLC ADR | | | 7,461,719 | | 3.38 | |

| 735,850 | | El Paso Corp. | | | 6,578,499 | | 2.98 | |

| 141,350 | | Public Service Enterprise Group, Inc. | | | 6,020,097 | | 2.73 | |

| 124,400 | | Questar Corp. | | | 5,971,200 | | 2.71 | |

| 242,683 | | Southern Union Co.* | | | 5,331,746 | | 2.42 | |

| 165,000 | | AGL Resources, Inc. | | | 5,148,000 | | 2.33 | |

| 112,700 | | Piedmont Natural Gas Companies, Inc. | | | 5,131,231 | | 2.32 | |

| 409,900 | | The Williams Companies, Inc. | | | 5,127,849 | | 2.32 | |

| 115,275 | | Consolidated Edison, Inc. | | | 5,008,699 | | 2.27 | |

| 180,750 | | Atmos Energy Corp. | | | 4,665,158 | | 2.12 | |

| 123,650 | | Nicor, Inc. | | | 4,639,348 | | 2.10 | |

| 164,400 | | ONEOK, Inc. | | | 4,409,208 | | 2.00 | |

| 148,400 | | National Fuel Gas Co. | | | 4,158,168 | | 1.89 | |

| 96,550 | | Peoples Energy Corp. | | | 4,130,409 | | 1.87 | |

| 101,050 | | Exelon Corp. | | | 4,003,601 | | 1.82 | |

| 140,300 | | WGL Holdings, Inc. | | | 3,991,535 | | 1.81 | |

| 71,350 | | Equitable Resources, Inc. | | | 3,945,655 | | 1.78 | |

| 142,600 | | Energy East Corp. | | | 3,593,520 | | 1.63 | |

| 322,800 | | CenterPoint Energy, Inc. | | | 3,392,628 | | 1.54 | |

| 128,825 | | Vectren Corp. | | | 3,332,703 | | 1.51 | |

| 76,775 | | DTE Energy Co. | | | 3,279,060 | | 1.49 | |

| 53,400 | | TXU Corp. | | | 3,269,148 | | 1.48 | |

| 74,850 | | Cinergy Corp. | | | 2,958,072 | | 1.34 | |

| 70,050 | | New Jersey Resources Corp. | | | 2,879,756 | | 1.31 | |

| 52,025 | | Energen Corp. | | | 2,797,905 | | 1.27 | |

| 86,750 | | Northwest Natural Gas Co. | | | 2,749,975 | | 1.25 | |

| 109,250 | | Southwest Gas Corp. | | | 2,668,978 | | 1.21 | |

| 116,100 | | TransCanada Corp. | | | 2,627,343 | | 1.19 | |

| 77,800 | | American Electric Power Company, Inc. | | | 2,561,954 | | 1.16 | |

| 131,550 | | Xcel Energy, Inc. | | | 2,249,505 | | 1.02 | |

| 86,100 | | Puget Energy, Inc. | | | 2,002,686 | | 0.90 | |

| 61,350 | | The Laclede Group, Inc. | | | 1,849,703 | | 0.84 | |

37

The FBR Funds

FBR Gas Utility Index Fund

Portfolio of Investments (continued)

October 31, 2004

| | | | | | | | |

SHARES

| | | | VALUE

(NOTE 2)

| | PERCENT OF

NET ASSETS

| |

| 69,700 | | MDU Resources Group, Inc. | | $ | 1,787,805 | | 0.81 | % |

| 36,880 | | South Jersey Industries, Inc. | | | 1,740,736 | | 0.79 | |

| 40,975 | | Constellation Energy Group, Inc. | | | 1,664,405 | | 0.75 | |

| 42,575 | | UGI Corp. | | | 1,644,672 | | 0.74 | |

| 48,350 | | Wisconsin Energy Corp. | | | 1,578,144 | | 0.72 | |

| 29,375 | | Ameren Corp. | | | 1,410,000 | | 0.64 | |

| 123,000 | | CMS Energy Corp.* | | | 1,151,280 | | 0.52 | |

| 22,925 | | Southwestern Energy Co.* | | | 1,053,175 | | 0.48 | |

| 19,925 | | NSTAR | | | 985,690 | | 0.45 | |

| 34,000 | | Alliant Energy Corp. | | | 896,920 | | 0.41 | |

| 39,875 | | Northeast Utilities | | | 770,784 | | 0.35 | |

| 232,300 | | Aquila, Inc.* | | | 736,391 | | 0.33 | |

| 29,925 | | PNM Resources, Inc. | | | 696,654 | | 0.32 | |

| 24,486 | | EnergySouth, Inc. | | | 662,836 | | 0.30 | |