The FBR Funds

Notes to Financial Statements (unaudited)

1. Organization

The FBR Funds (the “Trust”) is registered under the Investment Company Act of 1940, as amended, (“1940 Act”) as an open-end management investment company. The Trust was organized as a business trust under the laws of the State of Delaware on September 29, 2003. The Trust currently consists of nine series which represent interests in one of the following investment portfolios:FBR Large Cap Financial Fund (“Large Cap Financial Fund”), FBR Small Cap Financial Fund (“Small Cap Financial Fund”), FBR Small Cap Fund (“Small Cap Fund”), FBR Large Cap Technology Fund (“Large Cap Technology Fund”), FBR Small Cap Technology Fund (“Small Cap Technology Fund”), FBR Gas Utility Index Fund (“Gas Utility Index Fund”), FBR Fund for Government Investors (“Money Market Fund”), FBR Maryland Tax-Free Portfolio (“Maryland Tax-Free Portfolio”) and FBR Virginia Tax-Free Portfolio (“Virginia Tax-Free Portfolio”), (each a “Fund” and collectively, the “Funds”). The Trust is authorized to issue an unlimited number of shares of beneficial interest with no par value which may be issued in more than one class or series. Each Fund offers one class of shares, which is offered as no-load shares.

On February 27, 2004, the Funds were reorganized as separate series of the Trust. Prior to February 27, 2004, the Large Cap Financial Fund, Small Cap Financial Fund, Small Cap Fund, Large Cap Technology Fund and Small Cap Technology Fund were separate series of the FBR Family of Funds. The Gas Utility Index Fund and Money Market Fund were each in their own respective company and trust, respectively. The Maryland Tax-Free Portfolio and Virginia Tax-Free Portfolio were separate series of the FBR Fund for Tax-Free Investors, Inc.

The Large Cap Financial Fund, a non-diversified fund, intends to invest at least 80% of its total assets in securities of large capitalization (“large-cap”) companies principally engaged in the business of financial services. The investment objective of the Fund is capital appreciation.

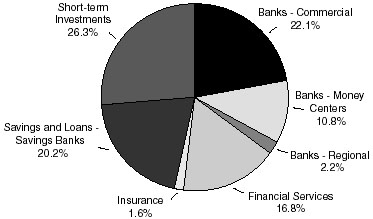

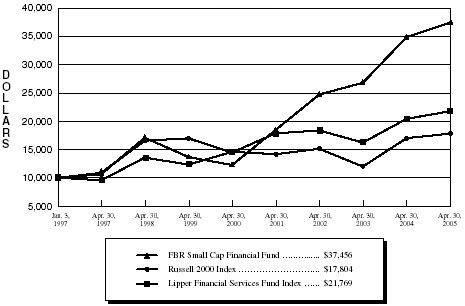

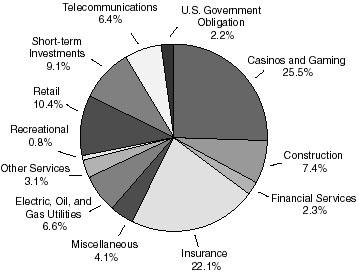

The Small Cap Financial Fund, a non-diversified fund, intends to invest at least 80% of its total assets in securities of small capitalization (“small-cap”) companies principally engaged in the business of providing financial services to consumers and industry. The investment objective of the Fund is capital appreciation.

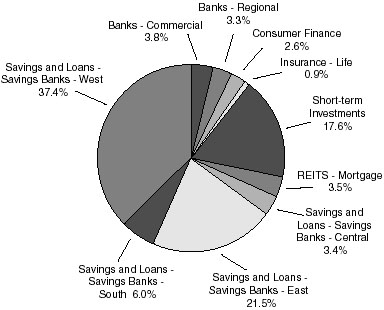

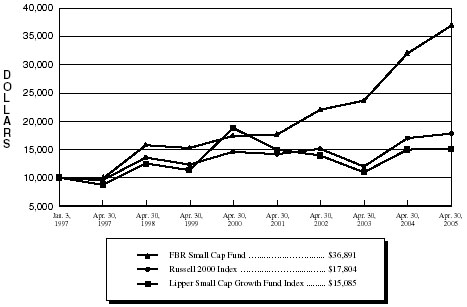

The Small Cap Fund, a non-diversified fund, intends to invest at least 80% of its total assets in securities of small-cap companies. The investment objective of the Fund is capital appreciation.

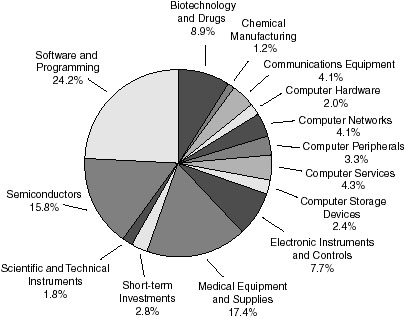

The Large Cap Technology Fund, a non-diversified fund, intends to invest at least 80% of its total assets in securities of large-cap companies that are principally engaged in the research, design, development, manufacturing or distributing products or services in the technology industry. The investment objective of the Fund is long-term capital appreciation.

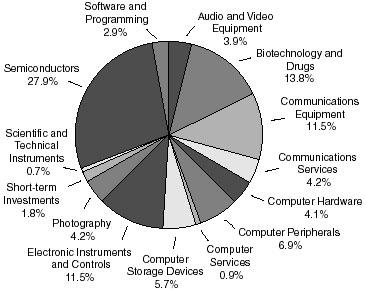

The Small Cap Technology Fund, a non-diversified fund, intends to invest at least 80% of its total assets in securities of small-cap companies that are principally engaged in the

78

The FBR Funds

Notes to Financial Statements (continued)

research, design, development, manufacturing or distributing products or services in the technology industry. The investment objective of the Fund is long-term capital appreciation.

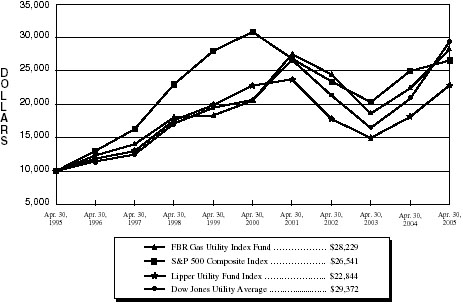

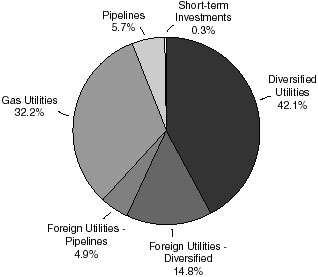

The Gas Utility Index Fund, a diversified fund, intends to invest at least 85% of its net assets in the common stock of companies that have natural gas distribution and transmission operations. The investment objective of the Fund is income and capital appreciation.

The Money Market Fund, a diversified fund, intends to invest at least 95% of its total assets in fixed-rate and floating-rate short-term instruments issued or guaranteed by the U.S. Government, its agencies or instrumentalities and in repurchase agreements secured by such instruments. The investment objective of the Fund is current income consistent with liquidity and preservation of capital.

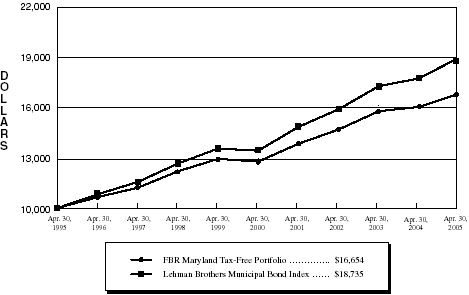

The Maryland Tax-Free Portfolio, a non-diversified fund, intends to invest at least 80% of its assets in securities issued by the State of Maryland, its political subdivisions, agencies and instrumentalities exempt from federal and Maryland state income tax, including the Federal Alternative Minimum Tax (“AMT”). The investment objective of the Fund is to provide investors with income derived from investments exempt from federal and Maryland state and local income taxes, including AMT.

The Virginia Tax-Free Portfolio, a non-diversified fund, intends to invest at least 80% of its assets in securities issued by the Commonwealth of Virginia, its political subdivisions, agencies and instrumentalities exempt from federal and Virginia state income tax, including AMT. The investment objective of the Fund is to provide investors with income derived from investments exempt from federal and Virginia state and local income taxes, including AMT.

2. Significant Accounting Policies

The following is a summary of the Funds’ significant accounting policies:

Portfolio Valuation — The net asset value per share (“NAV”) of each Fund is determined as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m., Eastern Time) on each business day that the exchange is open for trading. Each Fund’s securities are valued at the last sale price on the securities exchange or national securities market on which such securities are primarily traded. Securities that are quoted by NASDAQ are valued at the NASDAQ Official Closing Price. Securities not listed on an exchange or national securities market, or securities in which there were no transactions, are valued at the average of the most recent bid and ask prices, except in the case of open short positions where the ask price is used for valuation purposes. The bid price is used when no ask price is available. The securities of the Maryland Tax-Free Portfolio and Virginia Tax-Free Portfolio are valued on the basis of the mid-point of quoted bid and ask prices when market quotations are available. Short-term investments are carried at amortized cost, which approximates market value. Restricted securities, as well as securities or other assets for which market quotations are not readily available, or are not valued by a pricing service approved by the Funds’ Board of Trustees (the “Board”), are valued at fair value in good faith by, or at the direction of, the Board.

79

The FBR Funds

Notes to Financial Statements (continued)

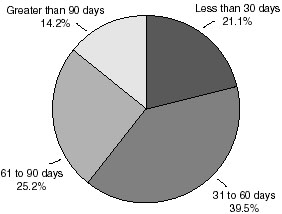

Share Valuation — The NAV of each Fund is calculated by dividing the sum of the value of the securities held by each Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding of each Fund, rounded to the nearest cent. Each Fund’s shares will not be priced on the days on which the NYSE is closed for trading. The offering and redemption price per share of each Fund is equal to each Fund’s net asset value per share. The Funds, except for the Money Market Fund, charge a 1% redemption fee on shares redeemed within 90 days of purchase. These fees are deducted from the redemption proceeds otherwise payable to the shareholder. The Funds will retain the fee charged as paid-in capital and such fees become part of that Fund’s daily NAV calculation.

Investment Income — Dividend income is recorded on the ex-dividend date. Interest income, which includes the amortization of premium and accretion of discount, if any, is recorded on an accrual basis.

Distributions to Shareholders — Each Fund, except the Gas Utility Index Fund, Money Market Fund, Maryland Tax-Free Portfolio and Virginia Tax-Free Portfolio, declares and pays any dividends from its net investment income, if any, annually. The Gas Utility Index Fund declares and pays any such dividend quarterly. The Money Market Fund, Maryland Tax-Free Portfolio and Virginia Tax-Free Portfolio each declare dividends each day the Funds are open for business and pay monthly. Distributions from net realized capital gains, if any, will be distributed at least annually for each Fund. Income and capital gain distributions are determined in accordance with U.S. federal income tax regulations.

Security Transactions — Security transactions are accounted for on the trade date. Securities sold are determined on a specific identification basis.

Estimates — The preparation of financial statements in accordance with U.S. generally accepted accounting principles requires management to make estimates and assumptions that may affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Options — Each Fund, except the Gas Utility Index Fund, Money Market Fund, Maryland Tax-Free Portfolio and Virginia Tax-Free Portfolio, may buy and sell call and put options to hedge against changes in net asset value or to attempt to realize a greater current return. The risk associated with purchasing an option is that a Fund pays a premium whether or not the option is exercised. Additionally, a Fund bears the risk of loss of premium and change in market value should the counterparty not perform under the contract. Put and call options purchased are accounted for in the same manner as portfolio securities. The cost of securities acquired through the exercise of call options is increased by the premiums paid. The proceeds from securities sold through the exercise of put options are decreased by the premiums paid. When a Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current market value of the option written. Premiums received from writing options which expire unexercised are recorded by a Fund on the expiration date as realized gains from options transactions.

80

The FBR Funds

Notes to Financial Statements (continued)

The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying securities in determining whether a Fund has a realized gain or loss. If a put option is exercised, the premium reduces the cost basis of the securities purchased by a Fund. Each Fund’s use of written options involves, to varying degrees, elements of market risk in excess of the amount recognized in the Statement of Assets and Liabilities. The contract or notional amounts reflect the extent of a Fund’s involvement in these financial instruments. In writing an option, a Fund bears the market risk of an unfavorable change in the price of the security underlying the written option. Exercise of an option written by a Fund could result in a Fund selling or buying a security at a price different from the current market value. A Fund’s activities in written options are conducted through regulated exchanges which do not result in counterparty credit risks. The Funds had no outstanding options at April 30, 2005.

Repurchase Agreements — The Large Cap Financial Fund, Small Cap Financial Fund, Small Cap Fund, Large Cap Technology Fund, Small Cap Technology Fund and Gas Utility Index Fund (collectively the “Equity Funds”) have agreed to purchase securities from financial institutions subject to the seller’s agreement to repurchase them at an agreed-upon time and price (“repurchase agreement”). The financial institutions with whom each Fund enters into repurchase agreements are banks and broker/dealers which the Adviser considers creditworthy pursuant to criteria approved by the Trust’s Board of Trustees. The seller under a repurchase agreement will be required to maintain the value of the securities as collateral, subject to the agreement at not less than the repurchase price plus accrued interest. The Adviser marks to market daily the value of the collateral, and, if necessary, requires the seller to maintain additional securities, to ensure that the value is not less than the repurchase price. Default by or bankruptcy of the seller would, however, expose each Fund to possible loss because of adverse market action or delays in connection with the disposition of the underlying securities.

Securities Lending — With respect to the Equity Funds and the Money Market Fund, each may lend its portfolio securities to broker-dealers, banks or institutional borrowers of securities. Loans of securities are required at all times to be secured by collateral equal to at least 100% of the market value of the securities on loan. However, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral may be subject to legal proceedings. In the event that the borrower fails to return securities, and cash collateral being maintained by the borrower is insufficient to cover the value of loaned securities and provided such collateral insufficiency is not the result of investment losses, the lending agent has agreed to pay the amount of the shortfall to the Funds. The Funds had no securities on loan to brokers at April 30, 2005.

Line of Credit — The Trust has a line of credit (“Credit Agreement”) with Custodial Trust Company (“CTC”) for temporary or emergency purposes. Under the Credit Agreement, CTC provides a line of credit in an amount up to the maximum amount permitted under the 1940 Act and each Fund’s prospectus. Pursuant to the Credit Agreement, each participating Fund is liable only for principal and interest payments related to borrowings

81

The FBR Funds

Notes to Financial Statements (continued)

made by that Fund. Borrowings under the Credit Agreement bear interest at 100 basis points (100 basis points = 1%) over the Fed Funds Rate, except for the Gas Utility Index Fund, the Money Market Fund, Maryland Tax-Free Portfolio and Virginia Tax-Free Portfolio, which bear interest at 100 basis points over the LIBOR. The Funds had no borrowings outstanding at April 30, 2005.

3. Transactions with Affiliates

Investment Adviser— FBR Fund Advisers, Inc. (“Fund Advisers”) serves as investment adviser to the Equity Funds. For its advisory services, Fund Advisers receives a monthly fee at an annual rate of 0.90% of the average daily net assets of the Large Cap Financial Fund, Small Cap Financial Fund, Small Cap Fund, Large Cap Technology Fund and Small Cap Technology Fund and at an annual rate of 0.40% of the average daily net assets of the Gas Utility Index Fund. Fund Advisers has contractually agreed to limit each Fund’s total operating expenses to 1.95% of each Fund’s average daily net assets, except for the Gas Utility Index Fund which Fund Advisers has contractually agreed to limit total operating expenses to 0.85% of average daily net assets. Fund Advisershas agreed to maintain these limitations with regard to each Fund through November 1, 2005.

Fund Advisers has retained Akre Capital Management, LLC (“ACM”) as investment sub-adviser to the Small Cap Fund. In this capacity, subject to the supervision of Fund Advisers and the Board, ACM directs the investments of the Small Cap Fund’s assets, continually conducts investment research and supervision for the Small Cap Fund, and is responsible for the purchase and sale of the Small Cap Fund’s investments. For these services, Fund Advisers (and not the Fund) pays ACM a fee out of the Adviser’s advisory fee.

Money Management Advisers, Inc. (“MMA”) serves as the investment adviser to the Money Market Fund, Maryland Tax-Free Portfolio and Virginia Tax-Free Portfolio. MMA is a wholly-owned subsidiary of FBR National Trust Company (“FBR National”), the Funds’ administrator, custodian, fund accounting and transfer agent. MMA has contractually agreed to limit each Fund’s total operating expenses to 1.00% of each Fund’s average daily net assets. MMA has agreed to maintain these limitations with regard to each Fund through November 1, 2005. Under the terms of an agreement with MMA, the Funds pay a management fee at an annual rate based on each Fund’s average daily net assets as follows:

|

| Money Market Fund | | 0.50% of the first $500 million;

0.45% of the next $250 million;

0.40% of the next $250 million;

0.35% of the net assets over $1 billion. | | |

|

| Maryland Tax-Free Portfolio and Virginia Tax-Free Portfolio | | 0.375% | | |

|

Effective April 1, 2003, MMA contractually agreed to waive advisory fees in the amount of 0.10% of the average daily net assets of the Money Market Fund.

82

The FBR Funds

Notes to Financial Statements (continued)

MMA has retained Asset Management, Inc. (“AMI”) as investment sub-adviser to the Maryland Tax-Free Portfolio and Virginia Tax-Free Portfolio. In this capacity, subject to the supervision of the Adviser and the Board, AMI directs the investments of the Maryland Tax-Free Portfolio and Virginia Tax-Free Portfolio’s assets, continually conducts investment research and supervision for the Funds, and is responsible for the purchase and sale of the Funds’ investments. For these services, MMA (and not the Fund) pays AMI a fee out of the MMA advisory fee.

The Sub-Advisory Agreement between MMA, and AMI, by its terms, and in accordance with certain provisions of the 1940 Act, was terminated upon the assignment of the contract to the Estate of Arthur Adler Jr. as a result of the death of Mr. Arthur Adler Jr., President and controlling owner of AMI, which effected a change in control of AMI. MMA and AMI have entered into an Interim Sub-Advisory Agreement. Under this Interim Sub-Advisory Agreement, amounts payable to AMI for sub-advisory services to the Fixed Income Funds are held in escrow in an interest-bearing escrow account with the Funds’ custodian or another bank. The escrow agent will release the money in this escrow account to AMI after a majority of the Funds’ outstanding voting securities has approved a new sub-advisory agreement between MMA and AMI or has approved other action with respect to the escrowed fees. A meeting of shareholders of each of the Fixed Income Funds will be held in the near future in order to consider a new sub-advisory agreement for the Funds and to take action with respect to the escrowed fees.

Under the Interim Agreement, AMI has continued to provide the Fixed Income Funds with the same level of investment advisory services.

Plan of Distribution — The Trust, on behalf of each Fund, except the Gas Utility Index Fund and Money Market Fund, has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. Under the Plan, each Fund may pay FBR Investment Services, Inc. (the “Distributor”) a fee at an annual rate of up to 0.25% of each Fund’s average daily net assets. Fees paid to the Distributor under the Plan are payable without regard to actual expenses incurred. The Maryland Tax-Free Portfolio and Virginia Tax-Free Portfolio adopted the Plan on March 1, 2004. The Distributor has voluntarily agreed to waive a portion of the distribution fees payable by the Small Cap Fund in an amount attributable to marketing expenses for the Fund until such time as the Fund is reopened to new investors.

Administrator, Transfer Agent and Custodian — FBR National (the “Administrator”) provides administrative, transfer agency and custodial services to the Funds and pays the operating expenses (not including extraordinary legal fees, marketing costs, outside of routine shareholder communications and interest costs) of the Funds. For these services,

83

The FBR Funds

Notes to Financial Statements (continued)

| the Administrator receives a fee at an annual rate based on each Fund’s average daily net assets as follows: |

| |

|

| Large Cap Financial Fund | | | | Greater of 1% or $125,000 on assets less than |

| Small Cap Financial Fund | | | | or equal to $20 million; |

| Small Cap Fund | | | | $200,000 plus 0.167% on assets greater than |

| Large Cap Technology Fund | | | | $20 million, but less than or equal to $50 million; |

| Small Cap Technology Fund | | | | $250,000 plus 0.10% on assets greater than |

| Gas Utility Index Fund | | | | $50 million, but less than or equal to |

| | | | | $100 million; |

| | | | | 0.30% on assets greater than $100 million, |

| | | | | but less than or equal to $500 million; |

| | | | | $1,500,000 plus 0.25% on assets greater than |

| | | | | $500 million, but less than or equal to |

| | | | | $1 billion; |

| | | | | $2,750,000 plus 0.225% on assets greater than |

| | | | | $1 billion |

|

| Money Market Fund | | | | $80,000 on assets less than or equal to $20 million; |

| | | | | 0.40% on assets greater than $20 million, but |

| | | | | less than or equal to $100 million; |

| | | | | 0.35% on assets greater than $100 million |

|

| Maryland Tax-Free Portfolio | | | | $60,000 on assets less than or equal to $20 million; |

| Virginia Tax-Free Portfolio | | | | 0.30% on assets greater than $20 million, but |

| | | | | less than or equal to $100 million; |

| | | | | 0.25% on assets greater than $100 million |

|

Brokerage Commissions — For the six months ended April 30, 2005, the following brokerage commissions from portfolio transactions executed on behalf of the Funds were paid to Friedman, Billings, Ramsey and Co., Inc., an affiliate of the Adviser, Distributor and Administrator, by the Large Cap Financial Fund and Small Cap Financial Fund, $250 and $37,479, respectively.

4. Investment Transactions

For the six months ended April 30, 2005, purchases and sales of investment securities (excluding short-term securities and U.S. government obligations) for each Fund were as follows:

| | | | Purchases | | | | Sales | |

| | | |

| | | |

| |

| Large Cap Financial Fund | | | $ | 3,226,423 | | | | $ | 8,743,912 | |

| Small Cap Financial Fund | | | | 52,048,485 | | | | | 86,837,882 | |

| Small Cap Fund | | | | 202,735,243 | | | | | 41,900,372 | |

| Large Cap Technology Fund | | | | 2,882,160 | | | | | 2,809,952 | |

| Small Cap Technology Fund | | | | 1,638,253 | | | | | 1,544,350 | |

| Gas Utility Index Fund | | | | 38,929,113 | | | | | 28,912,316 | |

| Maryland Tax-Free Portfolio | | | | 268,243 | | | | | 1,273,825 | |

| Virginia Tax-Free Portfolio | | | | 2,289,506 | | | | | 3,486,725 | |

84

The FBR Funds

Notes to Financial Statements (continued)

5. Federal Income Taxes

It is each Fund’s policy to comply with the special provisions of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. As provided therein, in any fiscal year in which a Fund so qualifies and distributes at least 90% of its taxable net income, the Fund (but not the shareholders) will be relieved of federal income tax on the income distributed. Accordingly, no provision for income taxes has been made.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also each Fund’s intention to declare and pay as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98% of its net realized capital gains (earned during the twelve months ending October 31) plus undistributed amounts from prior years.

The tax character of distributions paid for each Fund’s tax year was as follows:

| | | | Ordinary Income | | | | | Long-Term Capital Gains | |

| | | |

| | | | |

| |

| | | | Dollar | | | | | Per Share | | | | | Dollar | | | | Per Share | |

| | | | Amount | | | | | Amount | | | | | Amount | | | | Amount | |

| | | |

| | | | |

| | | | |

| | | |

| |

| Large Cap Financial Fund | | | | | | | | | | | | | | | | | | | | | | |

For the Year Ended October 31, 2004 | | | $ | 110,335 | | | | | $ | 0.067980 | | | | | $ | 131,440 | | | | $ | 0.080984 | |

For the Year Ended October 31, 2003 | | | $ | 127,702 | | | | | $ | 0.086100 | | | | | $ | — | | | | $ | — | |

| Small Cap Financial Fund | | | | | | | | | | | | | | | | | | | | | | |

For the Year Ended October 31, 2004 | | | $ | 2,277,539 | | | | | $ | 0.126548 | | | | | $ | 10,628,776 | | | | $ | 0.600311 | |

For the Year Ended October 31, 2003 | | | $ | 1,897,619 | | | | | $ | 0.130900 | | | | | $ | 8,819,518 | | | | $ | 0.639300 | |

| Small Cap Fund | | | | | | | | | | | | | | | | | | | | | | |

For the Year Ended October 31, 2004 | | | $ | — | | | | | $ | — | | | | | $ | 298,169 | | | | $ | 0.027788 | |

For the Year Ended October 31, 2003 | | | $ | — | | | | | $ | — | | | | | $ | — | | | | $ | — | |

| Large Cap Technology Fund | | | | | | | | | | | | | | | | | | | | | | |

For the Year Ended October 31, 2004 | | | $ | 107,767 | | | | | $ | 0.181082 | | | | | $ | 9,239 | | | | $ | 0.015524 | |

For the Year Ended October 31, 2003 | | | $ | — | | | | | $ | — | | | | | $ | — | | | | $ | — | |

| Small Cap Technology Fund | | | | | | | | | | | | | | | | | | | | | | |

For the Period Ended October 31, 2004 | | | $ | — | | | | | $ | — | | | | | $ | — | | | | $ | — | |

| Gas Utility Index Fund | | | | | | | | | | | | | | | | | | | | | | |

For the Year Ended October 31, 2004 | | | $ | 5,900,540 | | | | | $ | 0.387304 | | | | | $ | — | | | | $ | — | |

For the Period Ended October 31, 2003 | | | $ | 2,692,622 | | | | | $ | 0.183900 | | | | | $ | — | | | | $ | — | |

| Fund for Government Investors | | | | | | | | | | | | | | | | | | | | | | |

For the Period Ended October 31, 2004 | | | $ | 1,341,712 | | | | | $ | 0.0042 | | | | | $ | — | | | | $ | — | |

For the Year Ended December 31, 2003 | | | $ | 1,872,046 | | | | | $ | 0.0042 | | | | | $ | — | | | | $ | — | |

| Maryland Tax-Free Portfolio | | | | | | | | | | | | | | | | | | | | | | |

For the Period Ended October 31, 2004 | | | $ | 1,342,056 | | | | | $ | 0.3706 | | | | | $ | — | | | | $ | — | |

For the Year Ended December 31, 2003 | | | $ | 1,739,943 | | | | | $ | 0.4615 | | | | | $ | 88,273 | | | | $ | 0.0234 | |

| Virginia Tax-Free Portfolio | | | | | | | | | | | | | | | | | | | | | | |

For the Period Ended October 31, 2004 | | | $ | 906,314 | | | | | $ | 0.3524 | | | | | $ | — | | | | $ | — | |

For the Year Ended December 31, 2003 | | | $ | 1,263,276 | | | | | $ | 0.4416 | | | | | $ | 31,055 | | | | $ | 0.0114 | |

85

The FBR Funds

Notes to Financial Statements (continued)

The following information is computed on a tax basis for each item:

| | | As of October 31, 2004 |

| | |

|

| | | Large Cap

Financial Fund | | Small Cap

Financial Fund | | Small Cap

Fund | | Large Cap

Technology Fund |

| | |

| |

| |

| |

|

| Cost of investment securities | | | $ | 24,200,668 | | | | $ | 465,974,391 | | | | $ | 676,892,429 | | | | $ | 6,528,688 | |

| | | |

| | | |

| | | |

| | | |

| |

| Gross unrealized appreciation | | | | 6,392,541 | | | | | 138,726,193 | | | | | 160,751,354 | | | | | 566,392 | |

| Gross unrealized depreciation | | | | (191,924 | ) | | | | (10,295,488 | ) | | | | (13,600,722 | ) | | | | (484,004 | ) |

| | | |

| | | |

| | | |

| | | |

| |

| Net unrealized appreciation | | | | 6,200,617 | | | | | 128,430,705 | | | | | 147,150,632 | | | | | 82,388 | |

| Undistributed ordinary income | | | | 1,118,794 | | | | | 3,077,536 | | | | | 8,078,532 | | | | | 456,981 | |

| Undistributed long-term capital gains | | | | 2,502,845 | | | | | 72,800,644 | | | | | 5,377,069 | | | | | 507,449 | |

| | | |

| | | |

| | | |

| | | |

| |

| Accumulated earnings | | | $ | 9,822,256 | | | | $ | 204,308,885 | | | | $ | 160,606,233 | | | | $ | 1,046,818 | |

| | | |

| | | |

| | | |

| | | |

| |

| | | As of October 31, 2004 |

| | |

|

| | | Small Cap | | Gas Utility |

| | | Technology Fund | | Index Fund |

| | |

| |

|

| Cost of investment securities | | | $ | 1,466,033 | | | | $ | 151,115,459 | |

| | | |

| | | |

| |

| Gross unrealized appreciation | | | | 84,720 | | | | | 82,444,956 | |

| Gross unrealized depreciation | | | | (130,594 | ) | | | | (11,030,411 | ) |

| | | |

| | | |

| |

| Net unrealized appreciation (depreciation) | | | | (45,874 | ) | | | | 71,414,545 | |

| Undistributed ordinary income | | | | — | | | | | 328,592 | |

| Capital loss carryforward | | | | (90,658 | )* | | | | (23,504,319 | )** |

| | | |

| | | |

| |

| Accumulated earnings (deficit) | | | $ | (136,532 | ) | | | $ | 48,238,818 | |

| | | |

| | | |

| |

| * | | Expires October 31, 2012 |

| ** | | $21,943,018 expires October 31, 2011 and $1,561,301 expires October 31, 2012. |

| | | As of October 31, 2004 |

| | |

|

| | | Fund for | | Maryland | | Virginia |

| | | Government | | Tax-Free | | Tax-Free |

| | | Investors | | Portfolio | | Portfolio |

| | |

| |

| |

|

| Cost of investment securities | | | $ | 271,750,207 | | | | $ | 36,230,475 | | | | $ | 24,838,443 | |

| | | |

| | | |

| | | |

| |

| Gross unrealized appreciation | | | | — | | | | | 2,358,415 | | | | | 1,943,799 | |

| Gross unrealized depreciation | | | | — | | | | | (8,855 | ) | | | | (517 | ) |

| | | |

| | | |

| | | |

| |

| Net unrealized appreciation | | | | — | | | | | 2,349,560 | | | | | 1,943,282 | |

| Undistributed ordinary income | | | | — | | | | | — | | | | | 5,091 | |

| Undistributed long-term capital gains | | | | — | | | | | 72,652 | | | | | 372,715 | |

| Capital loss carryforward | | | | (188,960 | )*** | | | | — | | | | | — | |

| | | |

| | | |

| | | |

| |

| Accumulated earnings (deficit) | | | $ | (188,960 | ) | | | $ | 2,422,212 | | | | $ | 2,321,088 | |

| | | |

| | | |

| | | |

| |

| *** | | $23,854 expires October 31, 2011 and $165,106 expires October 31, 2012. |

The difference between the cost of investment securities and financial statement cost for the Funds is due to certain timing differences in the recognition of capital losses under income tax regulations and generally accepted accounting principles.

86

The FBR Funds

Notes to Financial Statements (continued)

The capital loss carryforwards may be utilized in the current and future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

As of April 30, 2005, the Federal Tax cost of securities and the resulting net unrealized appreciation (depreciation) are as follows:

| | | | | | | | Gross | | Gross | | Net Unrealized |

| | | Federal | | Unrealized | | Unrealized | | Appreciation |

| | | Tax Cost | | Appreciation | | Depreciation | | (Depreciation) |

| | |

| |

| |

| |

|

| Large Cap Financial Fund | | | $ | 25,165,384 | | | | $ | 4,210,438 | | | | $ | (472,096 | ) | | | $ | 3,738,342 | |

| Small Cap Financial Fund | | | | 438,052,851 | | | | | 100,392,743 | | | | | (17,075,767 | ) | | | | 83,316,976 | |

| Small Cap Fund | | | | 717,415,041 | | | | | 225,869,660 | | | | | (37,010,959 | ) | | | | 188,858,701 | |

| Large Cap Technology Fund | | | | 6,839,087 | | | | | 484,310 | | | | | (556,809 | ) | | | | (72,499 | ) |

| Small Cap Technology Fund | | | | 1,611,458 | | | | | 40,230 | | | | | (207,210 | ) | | | | (166,980 | ) |

| Gas Utility Index Fund | | | | 164,469,558 | | | | | 96,778,145 | | | | | (10,328,850 | ) | | | | 86,449,295 | |

| Maryland Tax-Free Portfolio | | | | 35,140,085 | | | | | 2,089,241 | | | | | (1,659 | ) | | | | 2,087,582 | |

| Virginia Tax-Free Portfolio | | | | 23,913,550 | | | | | 1,498,511 | | | | | (2,804 | ) | | | | 1,495,707 | |

6. Investments in Affiliates

Affiliated issuers, as defined by the 1940 Act, are those in which a Fund’s holdings represent 5% or more of the outstanding voting securities of the issuer. A summary of each Fund’s investments in affiliates, if any, for the six months ended April 30, 2005, is noted below:

| | | SHARE ACTIVITY | | |

| | |

| | |

| | | Balance | | | | | | Balance | | Realized | | | | Value | | Acquisition |

| Affiliate | | 10/31/04 | | Purchases | | Sales | | 4/30/05 | | Gain | | Dividends | | 4/30/05 | | Cost |

|

| FBR Small Cap Financial Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bancorp Rhode Island, Inc | | | 278,497 | | | | — | | | | 40,084 | | | | 238,413 | | | | 769,282 | | | | 82,409 | | | | 8,666,313 | | | | 5,093,124 | |

Hingham Institution for Savings | | | 107,600 | | | | — | | | | 5,692 | | | | 101,908 | | | | 117,553 | | | | 61,458 | | | | 4,400,387 | | | | 2,154,822 | |

ITLA Capital Corp. | | | 354,822 | | | | 6,704 | | | | 12,825 | | | | 348,701 | | | | 437,196 | �� | | | — | | | | 16,005,376 | | | | 9,666,843 | |

| FBR Small Cap Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Monarch Casino & Resort, Inc. | | | 515,500 | | | | 515,500 | | | | — | | | | 1,031,000 | | | | — | | | | — | | | | 18,558,000 | | | | 4,755,717 | |

7. Commitments and Contingencies

In the normal course of business, the Funds enter into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote.

87

The FBR Funds

Important Supplemental Information

April 30, 2005

(unaudited)

Proxy Voting Guidelines

FBR Fund Advisers, Inc. and Money Management Advisers, Inc. (together, the “Advisers”) are responsible for exercising the voting rights associated with the securities purchased and held by the Funds. A description of the policies and procedures the Advisers use in fulfilling this responsibility is included in the Funds’ Statement of Additional Information and is available without charge, upon request, by calling 888.888.0025. The policies and procedures are also available on the Securities and Exchange Commission’s website at http://www.sec.gov. Information on how the Funds voted proxies relating to portfolio securities during the most recent 12 month period ended June 30 is available without charge, upon request, by calling 888.888.0025 and is also available on the SEC’s website at http://www.sec.gov.

Portfolio Holdings

The Funds file their complete schedule of holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is available on the SEC’s website, beginning with the July 31, 2004 report, at http://www.sec.gov. You may review and make copies at the SEC’s Public Reference Room in Washington, D.C. You may also obtain copies after paying a duplicating fee by writing the SEC’s Public Reference Section, Washington, D.C. 20549-0102 or by electronic request to publicinfo@sec.gov. A copy of the quarterly holdings report is available, without charge, upon request, by calling 888.888.0025.

Approval of the Investment Advisory Agreements

In accordance with the 1940 Act, the Board of Trustees is required, on an annual basis, to consider the continuation of the Investment Advisory Agreements with the Advisers and Sub Advisers (collectively, the “Advisory Agreements”) at an in-person meeting of the Board called for such purpose. The relevant provisions of the 1940 Act specifically provide that it is the duty of the Board to request and evaluate such information as the Board determines is necessary to allow them to properly consider the continuation of the AdvisoryAgreements, and it is the duty of the Advisers to furnish the Trustees with such information that is responsive to the Board’srequest.

In approving the renewal of the Advisory Agreements at their October 20, 2004 Board of Trustees meeting, the Board, including the Independent Trustees, reviewed significant information and relevant data provided by the Advisers in response to written questions from the Independent Trustees and held extended discussions with independent legal counsel to the Independent Trustees concerning the same. Written materials included information concerning the organization of each of the investment advisers and sub-advisers to the Funds, a description of the advisory services provided to the Funds, performance information for appropriate periods for the Funds, the current contractual advisory fee schedule for each Fund, and comparative fee and expense information of the Funds’ respective peer groups.

88

The FBR Funds

Important Supplemental Information (continued)

April 30, 2005

(unaudited)

At the request of the Board, representatives of Fund management reviewed information regarding each Fund individually in connection with the Board’s consideration of the continuation of the current Advisory Agreements in order to permit the Board to conduct a meaningful analysis of the material factors regarding the proposed continuation of the fees charged with respect to each Fund.

FBR Fund Advisers, Inc. (“Fund Advisers”), adviser for the Equity Funds, first reviewed the types of funds itmanages, noting that five of the six are actively managed equity funds and one is an index fund. Fund Advisers informed the Board that it does not receive compensation for advising any other similar accounts, such as hedge funds, pension funds or private accounts. It was noted that the investment management fees of the actively managed funds are intended to be more consistent with those charged by other specialty type funds rather than those charged by general equity funds. It was explained to the Board members that these investment advisory fees are not presently subject to any asset based breakpoints, but that the Adviser has in place with respect to each of the actively managed funds an expense limitation of 1.95% of each fund’s average daily net assets. Fund Advisers then discussed with the Board the fact that the investment advisory fee structure for the one index fund is different from the one utilized for each of the five actively managed funds, also noting that it therefore had a different arrangement with respect to its expense limitation agreement. Each portfolio manager followed up with an investment management overview of their respective Fund.

Money Management Advisers, Inc. (“MMA”), adviser for the Money Market and Fixed Income Funds, then reviewed the types of funds they manage and provided an investment overview. MMA explained that the two state tax-free funds are sub-advised by Asset Management, Inc. (“AMI”). MMA also reviewed the terms and conditions of the expense limitation agreements applicable to each Fund. MMA also discussed the assets level in each Fund explaining the trends due to the low interest rate environment. It was noted that the Fixed Income Funds had adopted distribution plans earlier in the year and that MMA had decreased their advisory fees, but had not changed its service level. MMA noted that the sub-advisory agreement with AMI terminated on August 26, 2004 due to the sudden death of Arthur A. Adler Jr., AMI’s President and controlling owner. The Trustees were informed that Mr. Adler’s estate had not been settled and that beneficial ownership of Mr. Adler’s controlling interest in AMI had not been resolved. The Trustees were informed that for this reason, AMI was unable to obtain approval by shareholders of an interim sub-advisory agreement within the time required by applicable law. The Trustees considered various alternatives, including retaining a new sub-adviser. The Trustees concluded that given AMI’s ongoing familiarity with each Fund’s current investment portfolios and investment strategies, AMI’s significant experience in managing Maryland and Virginia tax-exempt investments, and that day-to-day management of the Funds was in the hands of the same portfolio manager, that it was in the best interests of the Funds and their shareholders to ask AMI to continue to provide investment advisory services to the two Funds.

89

The FBR Funds

Important Supplemental Information (continued)

April 30, 2005

(unaudited)

The Board directed that all subadvisory fees payable to AMI be held in escrow pending a resolution of the estate matters and approval by shareholders of the sub-advisory agreements, to be obtained as soon as practicable.

The Board then reviewed information and materials for each Fund, noting their fees, expenses and performance results, and then compared such information to comparable funds and to each Fund’s relevant benchmark indexes. The Board members evaluated the level of fees in light of the services provided, and took note of the strong investment performance for the Funds and the applicable Morningstar rankings with respect to funds that had an operating history of three years or more.

The Board then reviewed the various services provided to the Funds by the Advisers and a summary of recent initiatives taken or to be taken in the near future; and a profitability analysis per Fund for the eight month period ended August 31, 2004 for Fund Advisers, MMA, FBR National Trust Company, and FBR Investment Services, Inc., the Funds’ distributor (“FBRIS”), (collectively, the “FBR Entities”). Also discussed were the marketing initiatives undertaken by the FBR Entities and the use of Rule 12b-1 fees to support these services. Management also responded to questions from the Board concerning the compensation structure in place for the Funds’ portfolio managers.

The Board also took into consideration issues they review regularly at the quarterly meetings such as (1) the nature and amount of affiliated brokerage transactions in accordance with the Funds’ Rule 17e-1 reporting requirements; and (2) the use of soft dollars. It was agreed that the amount of trading done by the Fund through FBR was reasonable, especially in light of the fact that FBR is active in the markets for many financial services stocks, thus making it reasonable for the Funds to utilize FBR for some of their portfolio brokerage transactions. It was noted that effective January 1, 2004, the Adviser had discontinued the practice of directing equity securities trades to brokers who provide research and services to the Adviser to assist it in managing the Equity Funds, thereby increasing the Adviser’s costs of providing services. It was also noted that Akre Capital Management LLC (“ACM”), sub-adviser to the Small Cap Fund, continued the practice of directing equity securities to broker-dealers who provide research and services, subject to the Board’s review.

Following such discussions and questions raised by the Independent Trustees, the Board members determined that they had received sufficient information relating to the Funds in order to consider the approval of the Advisory Agreements. In reaching their conclusion with respect to the continuation of the Advisory Agreements and the level of fees paid under the Agreements, the Trustees did not identify any one single factor as being controlling, rather, the Board took note of a combination of factors that had influenced their decision making process. They noted the level and quality of investment advisory services provided by the Advisers to each of the Funds, and they found that these services continued to benefit the shareholders of the Funds and also reflected Fund management’s

90

The FBR Funds

Important Supplemental Information (continued)

April 30, 2005

(unaudited)

overall commitment to the continued growth and development of the Funds. Based upon their review and consideration of these factors and other matters deemed relevant by the Board in reaching an informed business judgment, a majority of the Board of Trustees, including a majority of the Independent Trustees, concluded that the terms of the Advisory Agreements are fair and reasonable and the Board voted to renew the Advisory Agreements for an additional one-year period.

91

[THIS PAGE INTENTIONALLY LEFT BLANK]

[THIS PAGE INTENTIONALLY LEFT BLANK]

[THIS PAGE INTENTIONALLY LEFT BLANK]

[THIS PAGE INTENTIONALLY LEFT BLANK]

THE FBR FUNDS

888.888.0025

funds@fbr.com

www.fbrfunds.com

Investment Advisers

FBR FUND ADVISERS, INC.

1001 NINETEENTH STREET NORTH

ARLINGTON, VIRGINIA 22209

MONEY MANAGEMENT ADVISERS, INC.

4922 FAIRMONT AVENUE

BETHESDA, MARYLAND 20814

Distributor

FBR INVESTMENT SERVICES, INC.

4922 FAIRMONT AVENUE

BETHESDA, MARYLAND 20814

Administrator, Custodian and Transfer Agent

FBR NATIONAL TRUST COMPANY

4922 FAIRMONT AVENUE

BETHESDA, MARYLAND 20814

Sub-Transfer Agent

INTEGRATED FUND SERVICES, INC.

P.O. BOX 5354

CINCINNATI, OHIO 45201

Independent Public Accountants

TAIT, WELLER, AND BAKER

1818 MARKET STREET

PHILADELPHIA, PENNSYLVANIA 19103

This report is not authorized

for distribution to prospective

investors unless it is preceded or

accompanied by a current prospectus.

ITEM 2. CODE OF ETHICS.

Not applicable for semi-annual reports.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable for semi-annual reports.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable for semi-annual reports.

ITEMS 5. AUDIT COMMITTEE OF LISTED REGISTRANTS

Not applicable.

ITEM 6. SCHEDULE OF INVESTMENTS

Contained in Item 1.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

The Board of Trustees has not adopted procedures by which shareholders may recommend nominees to the Board.

ITEM 11. CONTROLS AND PROCEDURES.

| (a) | | Based upon their evaluation of the Registrant’s disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-CSR, the Registrant’s PFO and PEO have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the Registrant in this Form N-CSR has been recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms. |

| (b) | | There were no changes in the Registrant’s internal controls over financial reporting as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a-3(d)) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

ITEM 12. EXHIBITS.

File the exhibits listed below as part of this Form. Letter or number the exhibits in the sequence indicated.

| (a) | | (1) Not applicable. | |

| | | (2) A separate certification for each principal executive officer and principal financial officer of the Registrant as required by Rule 30a-2(a) under the Act (17 CFR 270.30a-2): Attached herewith. | |

| (b) | | (1) The certifications required by Rule 30a-2(b) of the Investment Company Act of 1940 and Section 906 of the Sarbanes-Oxley Act of 2002: Attached herewith. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The FBR Funds

——————————————————————

| By (Signature and Title)* | | /s/ Susan L. Silva | | June 27, 2005 |

| | |

|

| | | Susan L. Silva | | Date |

| | | Treasurer | | |

| | | The FBR Funds | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title) | | /s/ David H. Ellison | | June 27, 2005 |

| | |

|

| | | David H. Ellison | | Date |

| | | President | | |

| | | The FBR Funds | | |

| | | (Principal Executive Officer) | | |

| By (Signature and Title) | | /s/ Susan L. Silva | | June 27, 2005 |

| | |

|

| | | Susan L. Silva | | Date |

| | | Treasurer | | |

| | | The FBR Funds | | |

| | | (Principal Financial Officer and Accounting Officer) | |