UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21503

The FBR Funds

———————————–

(Exact name of registrant as specified in charter)

1001 Nineteenth Street North

Arlington, VA 22209

————————————————

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: 703.469.1040

William Ginivan

General Counsel

Friedman, Billings, Ramsey Group, Inc.

Potomac Tower

1001 Nineteenth Street North

Arlington, VA 22209

—————————————————————————

(Name and address of agent for service)

Date of fiscal year end: October 31, 2007

Date of reporting period: April 30, 2007

ITEM 1. REPORT TO SHAREHOLDERS

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17CRF 270.30e-1).

THE FBR FUNDS

FBR Pegasus FundTM

FBR Pegasus Mid Cap FundTM

FBR Pegasus Small Cap FundTM

FBR Large Cap Financial Fund

FBR Large Cap Technology Fund

FBR Small Cap Fund

FBR Small Cap Financial Fund

FBR Small Cap Technology Fund

FBR Gas Utility Index Fund

FBR Fund for Government Investors

Semi-Annual Report

April 30, 2007

[THIS PAGE INTENTIONALLY LEFT BLANK]

The FBR Funds

Semi-Annual Letter to Shareholders

Dear Shareholder,

Market returns were favorable for the first half of our fiscal year ended April 30, 2007. The S&P and Dow Jones indexes were up 8.60% and 8.13% respectively. These favorable returns were due to numerous positives including, stable interest rates, stable employment, moderate inflation and continued economic growth both in the U.S. and around the world. The primary off-set to these positives was the slowing housing market and related troubles in the subprime loan market. Overall, the positives have created a favorable environment for earnings growth and the stocks have generally followed.

For The FBR Funds in particular, we had a number of noteworthy events take place in the last six months. First, the three original FBR Funds celebrated their ten-year anniversary in January. Five of the ten funds we offer, now have over a decade of performance history. Second, we reopened the FBR Small Cap Fund (FBRVX) to all investors after being closed for over two years. We have seen significant inflows to that Fund and appreciate the confidence you have placed in us to manage this money. Finally, on February 28th, we formally launched our two newest additions to our product line-up, the Pegasus Small Cap (FBRYX) and Pegasus Mid Cap Funds (FBRMX). Due to their relatively short operating life, the manager’s discussion of performance and outlook for these Funds is not included in this report, but will be available in our annual shareholder report.

The two new Funds complete our diversified suite of equity fund solutions. We now offer investors the ability to construct a well-rounded equity portfolio anchored by FBR Funds that provide exposure to the large-, mid- and small-cap segments. We also continue to offer our sector focused funds to allow targeted growth opportunities, further diversifying and enhancing the overall return characteristics of your portfolio.

All of The FBR Funds, regardless of capitalization and industry sector, are about respecting your money. Our goal is to achieve attractive returns that are balanced, focused on the long-term and ever mindful of the downside risks associated with equity investing. If you would like more timely updates,fbrfunds.com provides daily prices, monthly performance data, and other important fund information.

All of us at The FBR Funds want to thank you for your continued support, and we look forward to serving your investment needs in the years ahead. As always, we welcome your questions and comments. You can reach us via e-mail at funds@fbr.com or toll free at 888.200.4710.

Sincerely,

David Ellison

President and Trustee

The FBR Funds

2

The FBR Funds

FBR Pegasus FundTM

Management Overview

Co-Portfolio Managers: Robert C. Barringer, CFA and Ryan Kelley, CFA

How did the Fund perform?

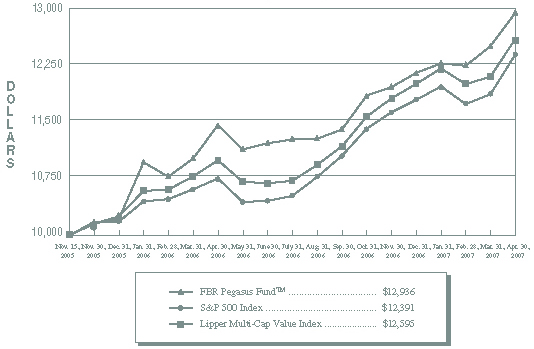

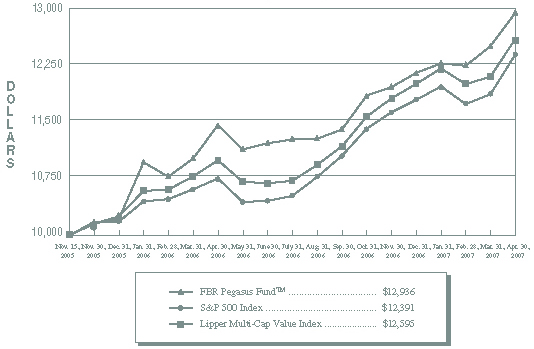

For the six months ended April 30, 2007, the Pegasus Fund appreciated 9.19%. During the same time period, the S&P 500 Index and the Lipper Multi-Cap Value Index returned 8.60% and 9.58%, respectively.

What factors contributed to the Fund’s performance?

The Fund benefited from our positions in railroads, iron and steel companies, electric utilities, and oil and gas operations, among other segments. In particular, three of the top ten positive contributors to the Fund’s performance over the past six months were our investments in large-cap railroad companies. Given our disciplined investment process, we continue to favor companies characterized by financial strength, attractive valuations and proven records of consistent growth.

What is the outlook for the Fund?

We continue to believe that the outlook for the Fund is positive. Our balanced approach to portfolio management, and our ability to underweight or overweight economic sectors based on the fundamental qualities of the companies, allows us to manage the portfolio for the long-term. Additionally, we find individual opportunities to invest in higher margin, strong growth companies, while adhering to our focus on valuation, low debt, and growing shareholders’ equity.

Currently, we continue to be invested in three segments of the market that have been largely in favor: large-cap companies (the Dow Jones Industrial Average continues to reach record levels), companies tied to hard assets (such as materials and mining companies), and utilities (which is this year’s best performing sector of the S&P 500 Index as of April 30, 2007). We continue to invest in companies which we believe show promise in the latter part of 2007. In particular, the Fund is invested in higher margin technology servicing companies as well as certain financial institutions, such as investment banks and asset managers, which are poised to benefit from continued strength in the capital markets. Overall, we are confident in our investment process and in the Fund’s position as we head in to the second half of 2007.

|

The opinions expressed in this commentary reflect those of the Portfolio Manager(s) as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change. |

3

The FBR Funds

FBR Pegasus FundTM

Comparison of Changes in Value of $10,000 Investment in

Fund Shares(1)(2) vs. Various Indices(1)(3)

(unaudited)

| |

| Total Returns—For the Periods Ended April 30, 2007(4) |

| | | | | | Annualized | |

| | | | | | Since | |

| | | One Year | | Inception(5) | |

| | |

| |

| |

| FBR Pegasus FundTM(1)(2) | | 12.91 | % | | 19.34 | % | |

| S&P 500 Index(1)(3) | | 15.24 | % | | 15.84 | % | |

| Lipper Multi-Cap Value Index(1)(3) | | 14.57 | % | | 17.14 | % | |

| |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the indices are unmanaged, do not incur expenses and are not available for investment. The performance of the indices includes reinvested dividends, and does not reflect sales charges or expenses, except for the Lipper Multi-Cap Value Index which reflects fund expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | S&P 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to represent the broad domestic economy through changes in aggregate market value of 500 stocks representing all major industries. The Lipper Multi-Cap Value Index is an equally weighted index of the largest thirty funds within the multi-cap value fund classification as defined by Lipper Inc. The index is rebalanced quarterly. Lipper Analytical Services, Inc., is a nationally recognized organization that reports on mutual fund total return performance and calculates fund rankings. Each Lipper Average is based on a universe of funds with similar investment objectives. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period November 15, 2005 (commencement of investment operations) through April 30, 2007. |

4

The FBR Funds

FBR Pegasus FundTM

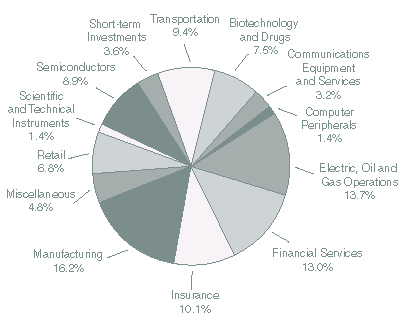

Portfolio Summary

April 30, 2007

(unaudited)

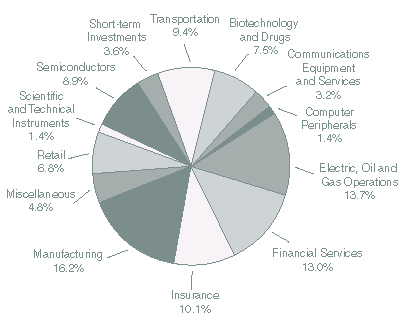

The following chart provides a visual breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

5

The FBR Funds

FBR Pegasus FundTM

Portfolio of Investments

April 30, 2007

(unaudited)

|

| | | | | | VALUE | |

| | SHARES | | | | (NOTE 2) | |

|

| | | | COMMON STOCKS — 98.9% | | | | |

| | | | Banks - Regional — 4.6% | | | | |

| | 1,925 | | Allied Irish Banks PLC ADR | | $ | 116,828 | |

| | 2,081 | | Bank of Montreal | | | 130,437 | |

| | 1,110 | | Comerica, Inc. | | | 68,720 | |

| | 1,600 | | Commerce Bancorp, Inc. | | | 53,504 | |

| | 600 | | UnionBanCal Corp. | | | 36,888 | |

| | 4,000 | | Wells Fargo & Co. | | | 143,560 | |

| | | | | |

| |

| | | | | | | 549,937 | |

| | | | | |

| |

| | | | Biotechnology and Drugs — 7.7% | | | | |

| | 2,900 | | AstraZeneca PLC ADR | | | 157,499 | |

| | 900 | | Barr Pharmaceuticals, Inc.* | | | 43,524 | |

| | 3,450 | | Eli Lilly and Co. | | | 203,999 | |

| | 4,350 | | Novartis AG ADR | | | 252,692 | |

| | 2,700 | | Novo Nordisk A/S ADR | | | 265,706 | |

| | | | | |

| |

| | | | | | | 923,420 | |

| | | | | |

| |

| | | | Business Services — 2.7% | | | | |

| | 4,100 | | Accenture Ltd., Class A | | | 160,310 | |

| | 2,500 | | Moody’s Corp. | | | 165,300 | |

| | | | | |

| |

| | | | | | | 325,610 | |

| | | | | |

| |

| | | | Capital Goods - Miscellaneous — 1.2% | | | | |

| | 1,500 | | Cummins, Inc. | | | 138,240 | |

| | | | | |

| |

| | | | Communications Services — 1.9% | | | | |

| | 3,400 | | America Movil S.A.B. de C.V., Series L ADR | | | 178,602 | |

| | 1,800 | | Nippon Telegraph and Telephone Corp. ADR | | | 44,802 | |

| | | | | |

| |

| | | | | | | 223,404 | |

| | | | | |

| |

| | | | Computer Peripherals — 1.5% | | | | |

| | 6,500 | | Cisco Systems, Inc.* | | | 173,810 | |

| | | | | |

| |

| | | | Conglomerates — 2.4% | | | | |

| | 3,500 | | 3M Co. | | | 289,695 | |

| | | | | |

| |

| | | | Consumer Financial Services — 1.4% | | | | |

| | 2,800 | | American Express Co. | | | 169,876 | |

| | | | | |

| |

6

The FBR Funds

FBR Pegasus FundTM

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | VALUE | |

| | SHARES | | | | (NOTE 2) | |

|

| | | | Electric Utilities — 5.0% | | | | |

| | 2,476 | | Edison International | | $ | 129,619 | |

| | 1,912 | | International Power PLC ADR | | | 168,791 | |

| | 3,700 | | Mirant Corp.* | | | 166,019 | |

| | 2,675 | | PG&E Corp. | | | 135,355 | |

| | | | | |

| |

| | | | | | | 599,784 | |

| | | | | |

| |

| | | | Food Processing — 5.3% | | | | |

| | 7,525 | | Archer Daniels Midland Co. | | | 291,218 | |

| | 1,375 | | Bunge Ltd. | | | 104,170 | |

| | 4,000 | | Wm. Wrigley Jr. Co. | | | 235,520 | |

| | | | | |

| |

| | | | | | | 630,908 | |

| | | | | |

| |

| | | | Insurance - Life — 2.5% | | | | |

| | 1,997 | | Prudential Financial, Inc. | | | 189,715 | |

| | 2,350 | | Sun Life Financial, Inc. | | | 111,273 | |

| | | | | |

| |

| | | | | | | 300,988 | |

| | | | | |

| |

| | | | Insurance - Property and Casualty — 7.8% | | | | |

| | 68 | | Berkshire Hathaway, Inc., Class B* | | | 246,705 | |

| | 2,695 | | Loews Corp. | | | 127,527 | |

| | 845 | | Safeco Corp. | | | 56,395 | |

| | 2,600 | | The Allstate Corp. | | | 162,032 | |

| | 1,319 | | The Hartford Financial Services Group, Inc. | | | 133,483 | |

| | 3,004 | | The Travelers Companies, Inc. | | | 162,516 | |

| | 1,500 | | W.R. Berkley Corp. | | | 48,735 | |

| | | | | |

| |

| | | | | | | 937,393 | |

| | | | | |

| |

| | | | Investment Services — 6.5% | | | | |

| | 1,025 | | Ameriprise Financial, Inc. | | | 60,957 | |

| | 3,151 | | Morgan Stanley | | | 264,715 | |

| | 1,900 | | NYSE Euronext, Inc.* | | | 160,227 | |

| | 3,400 | | T. Rowe Price Group, Inc. | | | 168,912 | |

| | 753 | | The Bear Stearns Companies, Inc. | | | 117,242 | |

| | | | | |

| |

| | | | | | | 772,053 | |

| | | | | |

| |

| | | | Iron and Steel — 1.8% | | | | |

| | 3,188 | | Arcelor Mittal, Class A NYS | | | 170,303 | |

| | 430 | | United States Steel Corp. | | | 43,662 | |

| | | | | |

| |

| | | | | | | 213,965 | |

| | | | | |

| |

7

The FBR Funds

FBR Pegasus FundTM

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Metal Mining — 7.0% | | | | |

| | 3,413 | | BHP Billiton PLC ADR | | $ | 155,223 | |

| | 4,100 | | Companhia Vale Do Rio Doce ADR | | | 166,501 | |

| | 2,300 | | Freeport-McMoRan Copper & Gold, Inc. | | | 154,468 | |

| | 653 | | Rio Tinto PLC ADR | | | 159,332 | |

| | 2,700 | | Teck Cominco Ltd., Class B | | | 205,281 | |

| | | | | |

| |

| | | | | | | 840,805 | |

| | | | | |

| |

| | | | Oil and Gas Operations — 8.1% | | | | |

| | 677 | | Apache Corp. | | | 49,083 | |

| | 1,250 | | Canadian Natural Resources Ltd. | | | 74,513 | |

| | 1,725 | | Chevron Corp. | | | 134,187 | |

| | 1,700 | | ConocoPhillips | | | 117,894 | |

| | 900 | | Devon Energy Corp. | | | 65,583 | |

| | 1,275 | | Newfield Exploration Co.* | | | 55,781 | |

| | 950 | | Noble Energy, Inc. | | | 55,870 | |

| | 1,985 | | Occidental Petroleum Corp. | | | 100,640 | |

| | 650 | | Questar Corp. | | | 63,135 | |

| | 1,848 | | Royal Dutch Shell PLC, Class A ADR | | | 128,158 | |

| | 1,992 | | Sempra Energy | | | 126,451 | |

| | | | | |

| |

| | | | | | | 971,295 | |

| | | | | |

| |

| | | | Oil Well Services and Equipment — 1.0% | | | | |

| | 1,025 | | ENSCO International, Inc. | | | 57,789 | |

| | 675 | | Noble Corp. | | | 56,842 | |

| | | | | |

| |

| | | | | | | 114,631 | |

| | | | | |

| |

| | | | Railroads — 9.7% | | | | |

| | 3,825 | | Burlington Northern Santa Fe Corp. | | | 334,840 | |

| | 5,522 | | CSX Corp. | | | 238,385 | |

| | 4,639 | | Norfolk Southern Corp. | | | 246,980 | |

| | 2,888 | | Union Pacific Corp. | | | 329,954 | |

| | | | | |

| |

| | | | | | | 1,150,159 | |

| | | | | |

| |

| | | | Retail - Apparel — 1.7% | | | | |

| | 11,500 | | The Gap, Inc. | | | 206,425 | |

| | | | | |

| |

| | | | Retail - Department and Discount — 2.3% | | | | |

| | 4,600 | | Target Corp. | | | 273,102 | |

| | | | | |

| |

8

The FBR Funds

FBR Pegasus FundTM

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Retail - Drugs — 2.1% | | | | |

| | 5,825 | | Walgreen Co. | | $ | 255,718 | |

| | | | | |

| |

| | | | Retail - Grocery — 0.8% | | | | |

| | 2,150 | | Whole Foods Market, Inc. | | | 100,599 | |

| | | | | |

| |

| | | | Savings and Loans – Savings Banks — 0.9% | | | | |

| | 2,425 | | Washington Mutual, Inc. | | | 101,802 | |

| | | | | |

| |

| | | | Schools — 1.0% | | | | |

| | 2,600 | | Apollo Group, Inc., Class A* | | | 122,980 | |

| | | | | |

| |

| | | | Scientific and Technical Instruments — 1.4% | | | | |

| | 2,900 | | Garmin Ltd. | | | 168,751 | |

| | | | | |

| |

| | | | Semiconductors — 9.2% | | | | |

| | 12,600 | | Intel Corp. | | | 270,900 | |

| | 2,885 | | Kyocera Corp. ADR | | | 281,288 | |

| | 26,200 | | Micron Technology, Inc.* | | | 300,514 | |

| | 12,350 | | STMicroelectronics N.V. NYS | | | 240,331 | |

| | | | | |

| |

| | | | | | | 1,093,033 | |

| | | | | |

| |

| | | | Software and Programming — 1.4% | | | | |

| | 9,100 | | Oracle Corp.* | | | 171,080 | |

| | | | | |

| |

| | | | Total Common Stocks (Cost $11,057,043) | | | 11,819,463 | |

| | | | | |

| |

9

The FBR Funds

FBR Pegasus FundTM

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | | VALUE | |

| | PAR | | | | | (NOTE 2) | |

|

| | | | REPURCHASE AGREEMENT — 3.7% | | | | |

| | $443,000 | | With Mizuho Securities, Inc. dated 4/30/07 at 5.06% to be repurchased at $443,062 on 5/1/07, collateralized by U.S. Treasury Bill, 4.81% due 8/23/07, value $54,280, U.S. Treasury Bond, 7.5% due 11/15/16, value $158,280, U.S. Treasury Notes, interest rates ranging from 5.625% to 6.5%, maturities ranging from 5/15/08 to 2/15/10, value $177,433 & $62,417 (Cost $443,000) | | $ | 443,000 | |

| | | | | |

| |

| | | | Total Investments — 102.6% (Cost $11,500,043) | | | 12,262,463 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — (2.6%) | | | (313,556 | ) |

| | | | | |

| |

| | | | Net Assets — 100.0% | | $ | 11,948,907 | |

| | | | | |

| |

|

| * | | Non-income producing security |

| ADR | | American Depositary Receipts |

| NYS | | New York Shares |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

10

The FBR Funds

FBR Pegasus Mid Cap FundTM

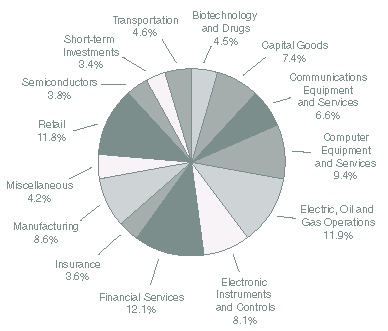

Portfolio Summary

April 30, 2007

(unaudited)

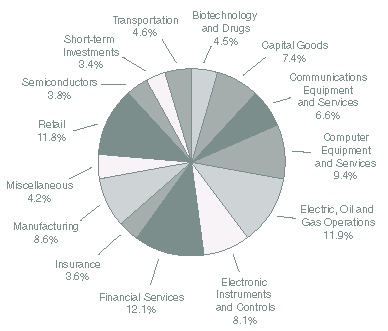

The following chart provides a visual breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

11

The FBR Funds

FBR Pegasus Mid Cap FundTM

Portfolio of Investments

April 30, 2007

(unaudited)

|

| | | | | | VALUE | |

| | SHARES | | | | (NOTE 2) | |

|

| | | | COMMON STOCKS — 97.1% | | | | |

| | | | Airlines — 1.1% | | | | |

| | 675 | | Air France-KLM ADR | | $ | 34,351 | |

| | | | | |

| |

| | | | Apparel/Accessories — 1.5% | | | | |

| | 575 | | VF Corp. | | | 50,491 | |

| | | | | |

| |

| | | | Auto and Truck Parts — 2.5% | | | | |

| | 1,050 | | Magna International, Inc., Class A | | | 83,108 | |

| | | | | |

| |

| | | | Banks - Regional — 1.3% | | | | |

| | 500 | | Comerica, Inc. | | | 30,955 | |

| | 250 | | Marshall & Ilsley Corp. | | | 12,005 | |

| | | | | |

| |

| | | | | | | 42,960 | |

| | | | | |

| |

| | | | Biotechnology and Drugs — 4.5% | | | | |

| | 2,040 | | Barr Pharmaceuticals, Inc.* | | | 98,654 | |

| | 825 | | Techne Corp.* | | | 48,650 | |

| | | | | |

| |

| | | | | | | 147,304 | |

| | | | | |

| |

| | | | Capital Goods - Miscellaneous — 7.5% | | | | |

| | 700 | | Cummins, Inc. | | | 64,512 | |

| | 2,400 | | Graco, Inc. | | | 94,799 | |

| | 775 | | Lincoln Electric Holdings, Inc. | | | 49,391 | |

| | 400 | | W.W. Grainger, Inc. | | | 33,048 | |

| | | | | |

| |

| | | | | | | 241,750 | |

| | | | | |

| |

| | | | Chemical Manufacturing — 2.1% | | | | |

| | 2,900 | | Methanex Corp. | | | 69,542 | |

| | | | | |

| |

| | | | Computer Hardware — 2.5% | | | | |

| | 2,000 | | Ingram Micro, Inc., Class A* | | | 39,240 | |

| | 1,200 | | Tech Data Corp.* | | | 42,648 | |

| | | | | |

| |

| | | | | | | 81,888 | |

| | | | | |

| |

| | | | Computer Networks — 2.9% | | | | |

| | 4,000 | | Jack Henry & Associates, Inc. | | | 95,000 | |

| | | | | |

| |

| | | | Computer Services — 1.1% | | | | |

| | 1,200 | | NeuStar, Inc., Class A* | | | 34,512 | |

| | | | | |

| |

12

The FBR Funds

FBR Pegasus Mid Cap FundTM

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | VALUE | |

| | SHARES | | | | (NOTE 2) | |

|

| | | | Computer Storage Devices — 2.9% | | | | |

| | 3,850 | | Micron Technology, Inc.* | | $ | 44,160 | |

| | 1,150 | | SanDisk Corp.* | | | 49,967 | |

| | | | | |

| |

| | | | | | | 94,127 | |

| | | | | |

| |

| | | | Consumer Financial Services — 1.2% | | | | |

| | 1,050 | | The First Marblehead Corp. | | | 38,063 | |

| | | | | |

| |

| | | | Electric Utilities — 2.7% | | | | |

| | 1,100 | | SCANA Corp. | | | 47,883 | |

| | 1,475 | | Westar Energy, Inc. | | | 40,150 | |

| | | | | |

| |

| | | | | | | 88,033 | |

| | | | | |

| |

| | | | Electronic Instruments and Controls — 2.1% | | | | |

| | 350 | | TDK Corp. ADR | | | 30,275 | |

| | 2,200 | | Vishay Intertechnology, Inc.* | | | 36,630 | |

| | | | | |

| |

| | | | | | | 66,905 | |

| | | | | |

| |

| | | | Fabricated Products - Miscellaneous — 1.6% | | | | |

| | 1,300 | | Fastenal Co. | | | 53,456 | |

| | | | | |

| |

| | | | Food Processing — 2.6% | | | | |

| | 1,125 | | Bunge Ltd. | | | 85,230 | |

| | | | | |

| |

| | | | Healthcare Facilities — 1.1% | | | | |

| | 575 | | Universal Health Services, Inc., Class B | | | 34,914 | |

| | | | | |

| |

| | | | Insurance – Accident and Health — 1.3% | | | | |

| | 1,700 | | Unum Group | | | 42,296 | |

| | | | | |

| |

| | | | Insurance - Life — 2.3% | | | | |

| | 4,250 | | Conseco, Inc.* | | | 75,183 | |

| | | | | |

| |

| | | | Investment Services — 4.5% | | | | |

| | 1,975 | | Eaton Vance Corp. | | | 75,484 | |

| | 1,450 | | T. Rowe Price Group, Inc. | | | 72,036 | |

| | | | | |

| |

| | | | | | | 147,520 | |

| | | | | |

| |

| | | | Iron and Steel — 0.9% | | | | |

| | 195 | | IPSCO, Inc. | | | 28,831 | |

| | | | | |

| |

13

The FBR Funds

FBR Pegasus Mid Cap FundTM

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | VALUE | |

| | SHARES | | | | (NOTE 2) | |

|

| | | | Medical Equipment and Supplies — 6.2% | | | | |

| | 1,675 | | Kinetic Concepts, Inc.* | | $ | 83,749 | |

| | 1,250 | | Mentor Corp. | | | 48,638 | |

| | 1,625 | | Varian Medical Systems, Inc.* | | | 68,591 | |

| | | | | |

| |

| | | | | | | 200,978 | |

| | | | | |

| |

| | | | Metal Mining — 3.0% | | | | |

| | 1,475 | | Freeport-McMoRan Copper & Gold, Inc., Class B | | | 99,061 | |

| | | | | |

| |

| | | | Natural Gas Utilities — 1.7% | | | | |

| | 1,100 | | Nicor, Inc. | | | 56,364 | |

| | | | | |

| |

| | | | Oil and Gas - Integrated — 1.3% | | | | |

| | 3,100 | | Canetic Resources Trust | | | 41,540 | |

| | | | | |

| |

| | | | Oil and Gas Operations — 6.3% | | | | |

| | 2,000 | | Chesapeake Energy Corp. | | | 67,500 | |

| | 950 | | Forest Oil Corp.* | | | 33,478 | |

| | 725 | | Pogo Producing Co. | | | 34,989 | |

| | 700 | | Questar Corp. | | | 67,991 | |

| | | | | |

| |

| | | | | | | 203,958 | |

| | | | | |

| |

| | | | Paper and Related Products — 1.0% | | | | |

| | 1,850 | | Stora Enso Oyj ADR | | | 33,818 | |

| | | | | |

| |

| | | | Printing and Publishing — 2.3% | | | | |

| | 2,150 | | NAVTEQ Corp.* | | | 76,024 | |

| | | | | |

| |

| | | | Recreational Products — 1.5% | | | | |

| | 1,750 | | Mattel, Inc. | | | 49,525 | |

| | | | | |

| |

| | | | Retail - Apparel — 3.3% | | | | |

| | 720 | | Abercrombie & Fitch Co., Class A | | | 58,795 | |

| | 2,000 | | Foot Locker, Inc. | | | 47,580 | |

| | | | | |

| |

| | | | | | | 106,375 | |

| | | | | |

| |

| | | | Retail - Department and Discount — 1.3% | | | | |

| | 1,200 | | Dillard’s, Inc., Class A | | | 41,556 | |

| | | | | |

| |

14

The FBR Funds

FBR Pegasus Mid Cap FundTM

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | VALUE | |

| | SHARES | | | | (NOTE 2) | |

|

| | | | Retail - Specialty — 4.4% | | | | |

| | 1,175 | | Bed Bath & Beyond, Inc.* | | $ | 47,870 | |

| | 1,400 | | BJ’s Wholesale Club, Inc.* | | | 48,342 | |

| | 1,675 | | Copart, Inc.* | | | 48,541 | |

| | | | | |

| |

| | | | | | | 144,753 | |

| | | | | |

| |

| | | | Retail - Technology — 1.4% | | | | |

| | 2,700 | | Circuit City Stores, Inc. | | | 47,115 | |

| | | | | |

| |

| | | | Savings and Loans – Savings Banks — 5.0% | | | | |

| | 800 | | Capitol Federal Financial | | | 30,896 | |

| | 3,600 | | Hudson City Bancorp, Inc. | | | 47,952 | |

| | 2,500 | | TFS Financial Corp.* | | | 29,300 | |

| | 2,325 | | Washington Federal, Inc. | | | 55,126 | |

| | | | | |

| |

| | | | | | | 163,274 | |

| | | | | |

| |

| | | | Semiconductors — 3.8% | | | | |

| | 1,150 | | International Rectifier Corp.* | | | 40,572 | |

| | 4,725 | | QLogic Corp.* | | | 84,483 | |

| | | | | |

| |

| | | | | | | 125,055 | |

| | | | | |

| |

| | | | Software and Programming — 3.3% | | | | |

| | 3,250 | | THQ, Inc.* | | | 108,452 | |

| | | | | |

| |

| | | | Water Transportation — 1.1% | | | | |

| | 500 | | Overseas Shipholding Group, Inc. | | | 35,400 | |

| | | | | |

| |

| | | | Total Common Stocks (Cost $3,031,230) | | | 3,168,712 | |

| | | | | |

| |

15

The FBR Funds

FBR Pegasus Mid Cap FundTM

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | VALUE | |

| | PAR | | | | (NOTE 2) | |

|

| | | | REPURCHASE AGREEMENT — 3.4% | | | | |

| $ | 110,000 | | With Mizuho Securities, Inc. dated 4/30/07 at 5.06% to be repurchased at $110,015 on 5/1/07, collateralized by U.S. Treasury Bill, 4.81% due 8/23/07, value $13,478, U.S. Treasury Bond, 7.5% due 11/15/16, value $39,302, U.S. Treasury Notes, interest rates ranging from 5.625% to 6.5%, maturities ranging from 5/15/08 to 2/15/10, value $44,058 & $15,499 (Cost $110,000) | | $ | 110,000 | |

| | | | | |

| |

| | | | Total Investments — 100.5% (Cost $3,141,230) | | | 3,278,712 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — (0.5%) | | | (17,001 | ) |

| | | | | |

| |

| | | | Net Assets — 100.0% | | $ | 3,261,711 | |

| | | | | |

| |

|

| * | | Non-income producing |

| ADR | | American Depositary Receipts |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

16

The FBR Funds

FBR Pegasus Small Cap FundTM

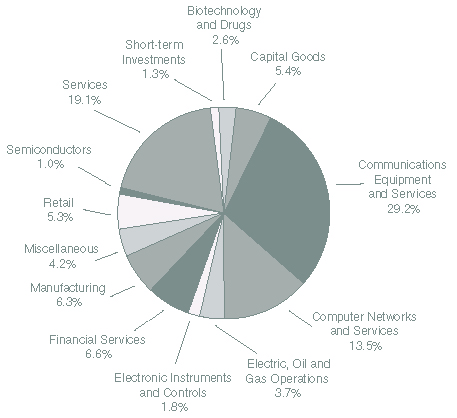

Portfolio Summary

April 30, 2007

(unaudited)

The following chart provides a visual breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

17

The FBR Funds

FBR Pegasus Small Cap FundTM

Portfolio of Investments

April 30, 2007

(unaudited)

|

| | | | | VALUE | |

| SHARES | | | | (NOTE 2) | |

|

| | | COMMON STOCKS — 99.7% | | | | |

| | | Advertising — 1.2% | | | | |

| 1,500 | | ValueClick, Inc.* | | $ | 42,900 | |

| | | | |

| |

| | | Aerospace and Defense — 3.0% | | | | |

| 2,600 | | FLIR Systems, Inc.* | | | 105,274 | |

| | | | |

| |

| | | Beverages — 1.3% | | | | |

| 2,900 | | National Beverage Corp.* | | | 45,124 | |

| | | | |

| |

| | | Biotechnology and Drugs — 2.6% | | | | |

| 700 | | IDEXX Laboratories, Inc.* | | | 63,119 | |

| 1,000 | | Meridian Bioscience, Inc. | | | 29,730 | |

| | | | |

| |

| | | | | | 92,849 | |

| | | | |

| |

| | | Business Services — 6.5% | | | | |

| 1,300 | | Global Payments, Inc. | | | 49,374 | |

| 700 | | Portfolio Recovery Associates, Inc.* | | | 38,955 | |

| 2,600 | | Rollins, Inc. | | | 59,982 | |

| 1,800 | | TNS, Inc.* | | | 21,852 | |

| 1,300 | | Watson Wyatt Worldwide, Inc., Class A | | | 61,269 | |

| | | | |

| |

| | | | | | 231,432 | |

| | | | |

| |

| | | Capital Goods - Miscellaneous — 2.5% | | | | |

| 2,250 | | Graco, Inc. | | | 88,875 | |

| | | | |

| |

| | | Casinos and Gaming — 1.0% | | | | |

| 1,300 | | Monarch Casino & Resort, Inc.* | | | 34,671 | |

| | | | |

| |

| | | Coal — 2.4% | | | | |

| 2,900 | | Alpha Natural Resources, Inc.* | | | 50,373 | |

| 6,000 | | International Coal Group, Inc.* | | | 33,540 | |

| | | | |

| |

| | | | | | 83,913 | |

| | | | |

| |

| | | Communications Services — 1.8% | | | | |

| 2,200 | | j2 Global Communications, Inc.* | | | 63,272 | |

| | | | |

| |

18

The FBR Funds

FBR Pegasus Small Cap FundTM

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | VALUE | |

| SHARES | | | | (NOTE 2) | |

|

| | | Computer Networks — 4.6% | | | | |

| 2,800 | | Convergys Corp.* | | $ | 70,728 | |

| 3,800 | | Jack Henry & Associates, Inc. | | | 90,250 | |

| | | | |

| |

| | | | | | 160,978 | |

| | | | |

| |

| | | Computer Services — 9.1% | | | | |

| 1,500 | | FactSet Research Systems, Inc. | | | 92,265 | |

| 1,250 | | Interactive Data Corp. | | | 35,788 | |

| 1,200 | | Morningstar, Inc.* | | | 62,484 | |

| 6,800 | | The Trizetto Group, Inc.* | | | 132,464 | |

| | | | |

| |

| | | | | | 323,001 | |

| | | | |

| |

| | | Construction – Supplies and Fixtures — 1.8% | | | | |

| 900 | | Chaparral Steel Co. | | | 63,450 | |

| | | | |

| |

| | | Electronic Instruments and Controls — 1.3% | | | | |

| 1,600 | | Raven Industries, Inc. | | | 46,224 | |

| | | | |

| |

| | | Healthcare Facilities — 1.9% | | | | |

| 1,700 | | VCA Antech, Inc.* | | | 67,031 | |

| | | | |

| |

| | | Investment Services — 4.4% | | | | |

| 1,025 | | International Securities Exchange Holdings, Inc. | | | 68,357 | |

| 1,600 | | Penson Worldwide, Inc.* | | | 42,912 | |

| 1,900 | | Waddell & Reed Financial, Inc., Class A | | | 46,018 | |

| | | | |

| |

| | | | | | 157,287 | |

| | | | |

| |

| | | Medical Equipment and Supplies — 0.5% | | | | |

| 500 | | Immucor, Inc.* | | | 16,315 | |

| | | | |

| |

| | | Metal Mining — 2.2% | | | | |

| 1,100 | | Cleveland-Cliffs, Inc. | | | 76,219 | |

| | | | |

| |

| | | Oil and Gas Operations — 3.7% | | | | |

| 1,650 | | Alon USA Energy, Inc. | | | 61,710 | |

| 875 | | Penn Virginia Corp. | | | 70,044 | |

| | | | |

| |

| | | | | | 131,754 | |

| | | | |

| |

| | | Personal Services — 1.8% | | | | |

| 1,900 | | Ambassadors Group, Inc. | | | 63,688 | |

| | | | |

| |

19

The FBR Funds

FBR Pegasus Small Cap FundTM

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | VALUE | |

| SHARES | | | | (NOTE 2) | |

|

| | | Real Estate Operations — 4.6% | | | | |

| 2,100 | | Hospitality Properties Trust | | $ | 95,613 | |

| 2,000 | | National Health Investors, Inc. | | | 67,840 | |

| | | | |

| |

| | | | | | 163,453 | |

| | | | |

| |

| | | Retail - Specialty — 5.4% | | | | |

| 1,000 | | Big Lots, Inc.* | | | 32,200 | |

| 1,000 | | Copart, Inc.* | | | 28,980 | |

| 1,125 | | Dick’s Sporting Goods, Inc.* | | | 63,101 | |

| 900 | | O’Reilly Automotive, Inc.* | | | 32,040 | |

| 1,800 | | The Pep Boys - Manny, Moe & Jack | | | 33,570 | |

| | | | |

| |

| | | | | | 189,891 | |

| | | | |

| |

| | | Savings and Loans – Savings Banks — 2.2% | | | | |

| 700 | | Downey Financial Corp. | | | 46,865 | |

| 1,300 | | Washington Federal, Inc. | | | 30,823 | |

| | | | |

| |

| | | | | | 77,688 | |

| | | | |

| |

| | | Schools — 6.3% | | | | |

| 1,575 | | Capella Education Co.* | | | 55,046 | |

| 750 | | ITT Educational Services, Inc.* | | | 72,908 | |

| 775 | | Strayer Education, Inc. | | | 96,363 | |

| | | | |

| |

| | | | | | 224,317 | |

| | | | |

| |

| | | Semiconductors — 1.0% | | | | |

| 1,500 | | Cypress Semiconductor Corp.* | | | 34,230 | |

| | | | |

| |

| | | Software and Programming — 26.6% | | | | |

| 2,000 | | Aladdin Knowledge Systems Ltd.* | | | 41,880 | |

| 800 | | Business Objects S.A. ADR* | | | 30,008 | |

| 800 | | Cognos, Inc.* | | | 34,488 | |

| 1,600 | | DealerTrack Holdings, Inc.* | | | 52,800 | |

| 1,200 | | MICROS Systems, Inc.* | | | 65,760 | |

| 800 | | MicroStrategy, Inc., Class A* | | | 91,008 | |

| 3,000 | | Parametric Technology Corp.* | | | 53,310 | |

| 800 | | Quality Systems, Inc. | | | 32,376 | |

| 3,100 | | SPSS, Inc.* | | | 113,646 | |

| 2,900 | | Sybase, Inc.* | | | 70,151 | |

| 3,675 | | THQ, Inc.* | | | 122,635 | |

20

The FBR Funds

FBR Pegasus Small Cap FundTM

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | VALUE | |

| SHARES | | | | (NOTE 2) | |

|

| | | Software and Programming — 26.6% (continued) | | | | |

| 13,300 | | TIBCO Software, Inc.* | | $ | 121,296 | |

| 3,500 | | Transaction Systems Architects, Inc.* | | | 111,055 | |

| | | | |

| |

| | | | | | 940,413 | |

| | | | |

| |

| | | Total Common Stocks (Cost $3,361,093) | | | 3,524,249 | |

| | | | |

| |

| PAR | | | | | | |

| | | | | | |

| | | REPURCHASE AGREEMENT — 1.3% | | | | |

| $46,000 | | With Mizuho Securities, Inc. dated 4/30/07 at 5.06% to be repurchased at $46,006 on 5/1/07, collateralized by U.S. Treasury Bill, 4.81% due 8/23/07, value $5,636, U.S. Treasury Bond, 7.5% due 11/15/16, value $16,435, U.S. Treasury Notes, interest rates ranging from 5.625% to 6.5%, maturities ranging from 5/15/08 to 2/15/10, value $18,424 & $6,481 (Cost $46,000) | | | 46,000 | |

| | | | |

| |

| | | Total Investments — 101.0% (Cost $3,407,093) | | | 3,570,249 | |

| | | | | | | |

| | | Liabilities Less Other Assets — (1.0%) | | | (33,757 | ) |

| | | | |

| |

| | | Net Assets — 100.0% | | $ | 3,536,492 | |

| | | | |

| |

|

| * | | Non-income producing security |

| ADR | | American Depositary Receipts |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

21

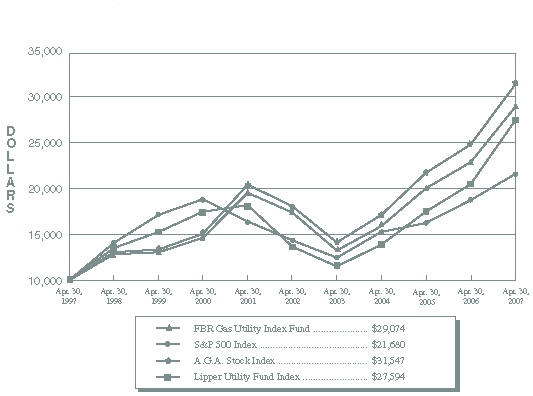

| The FBR Funds |

|

| FBR Large Cap Financial Fund |

| Management Overview |

Portfolio Manager: David Ellison

How did the Fund perform?

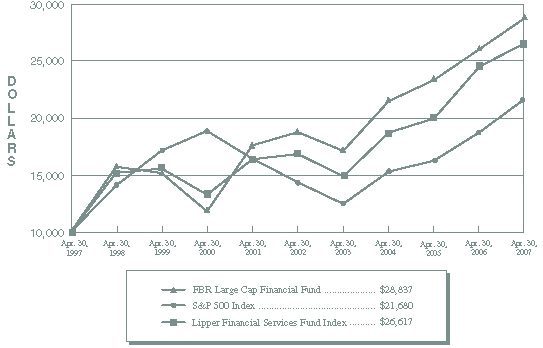

For the six month period ended April 30, 2007, the FBR Large Cap Financial Fund appreciated 6.12%. This compares to the Lipper Financial Services Fund Index and the S&P 500 Index, which returned 5.02% and 8.60% for the same period, respectively.

What factors contributed to the Fund’s performance?

The Fund out paced the Lipper Financial Services Index and lagged the broader market for the reporting period. The Fund’s out performance relative to its peers can be attributed to several factors. Our investments in high quality companies within the insurance and brokerage related sectors performed well during the period. Our lack of investments in the securities of companies primarily engaged in subprime lending practices also benefited shareholders. Finally, large-cap banks and thrifts, in general, performed better than similar mid-cap and small-cap securities during the period as investors favored business models with more diverse streams of revenue and the ability to participate in capital markets related activities. From a historical perspective, and more importantly over the last year, the Fund maintained its conservative investment philosophy and generally avoided the companies directly impacted by the negative effects of the flat yield curve and aggressive lending strategies.

The S&P 500 Index out performed the Fund and the Lipper Financial Services Index during the reporting period. This was due, in large part, to the non-financial services oriented sectors in the economy which were not as negatively impacted by the short-term interest rate increases and recent concerns and related costs associated with delinquencies and foreclosures in the housing market.

What is the outlook for the Fund and the financial services sector?

The financial services industry is fighting an uphill battle on a number of fronts, which is making it difficult to grow earnings and depressing market valuations. These battles include 1) the duration of the flat yield curve, which has lowered profits on lending margins, 2) sluggish loan growth, as the housing market has slowed, 3) pricing pressures from non-traditional lending institutions competing for market share, and 4) the developing increases in delinquency and foreclosure costs across the residential housing market.

The solution to these negative EPS (earnings per share) drivers is time. The lending markets are now making adjustments. We have seen evidence of credit tightening and renewed attention to funding reliability. We have also seen a modest regulatory response to the credit issues. I would expect to see a better fundamental environment for financial companies going forward as the industry corrects past lending and liability mistakes.

While all sub-segments of the financial services industry have not been equally impacted, it is generally in the most difficult times that real opportunities arise. I view the past six to twelve months as a period where problems developed. I view the next six to twelve months

22

| The FBR Funds |

|

| FBR Large Cap Financial Fund |

| Management Overview (continued) |

as a period where these problems will be identified and corrected. I view the period beyond that as having the potential for recovery in fundamentals which the stocks in this industry should follow.

The opinions expressed in this commentary reflect those of the Portfolio Manager(s) as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

23

| The FBR Funds |

|

| FBR Large Cap Financial Fund |

| |

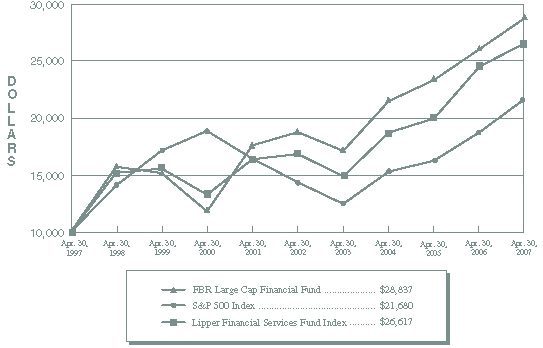

| Comparison of Changes in Value of $10,000 Investment in |

| Fund Shares(1)(2) vs. Various Indices(1)(3) |

| (unaudited) |

| | | | | | | | | | | | | |

| Total Returns—For the Periods Ended April 30, 2007(4) |

| | | | | | | | Annualized | | | | Annualized | |

| | | | One Year | | | | Five Year | | | | Ten Year | |

| | | |

| | | |

| | | |

| |

| FBR Large Cap Financial Fund(1)(2) | | | 10.29% | | | | 8.92% | | | | 11.17% | |

| S&P 500 Index(1)(3) | | | 15.24% | | | | 8.53% | | | | 8.04% | |

| Lipper Financial Services Fund Index(1)(3) | | | 8.13% | | | | 9.53% | | | | 10.29% | |

| | | | | | | | | | | | | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the indices are unmanaged, do not incur expenses and are not available for investment. The performance of the indices includes reinvested dividends, and does not reflect sales charges or expenses, except for the Lipper Financial Services Fund Index which reflects fund expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | S&P 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to represent the broad domestic economy through changes in aggregate market value of 500 stocks representing all major industries. The Lipper Financial Services Fund Index is an equally weighted index of the largest thirty funds within the financial services fund classification as defined by Lipper Inc. The index is rebalanced quarterly. Lipper Analytical Services, Inc., is a nationally recognized organization that reports on mutual fund total return performance and calculates fund rankings. Each Lipper Average is based on a universe of funds with similar investment objectives. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

24

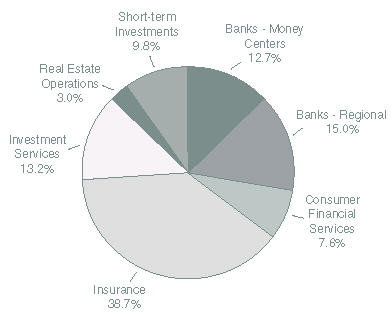

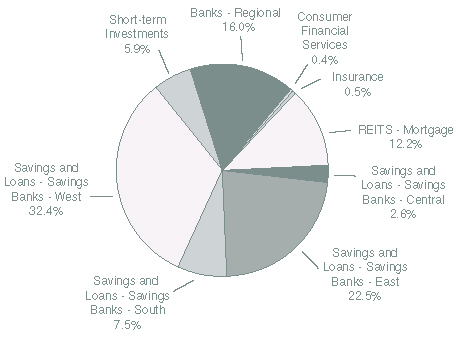

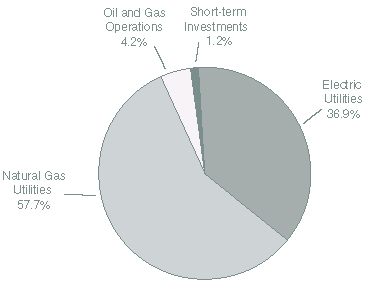

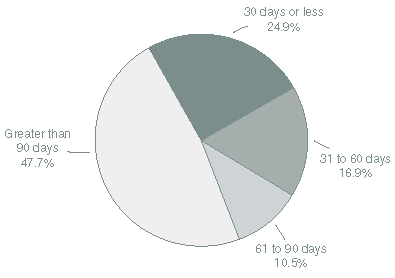

The FBR Funds

FBR Large Cap Financial Fund

Portfolio Summary

April 30, 2007

(unaudited)

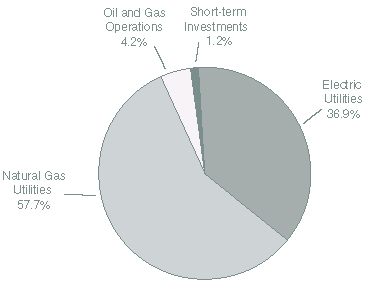

The following chart provides a visual breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

25

The FBR Funds

FBR Large Cap Financial Fund

Portfolio of Investments

April 30, 2007

(unaudited)

|

| | | | | VALUE | |

| SHARES | | | | (NOTE 2) | |

|

| | | COMMON STOCKS — 93.4% | | | | |

| | | Banks - Money Centers — 13.2% | | | | |

| 17,000 | | Bank of America Corp. | | $ | 865,300 | |

| 16,500 | | Citigroup, Inc. | | | 884,730 | |

| 15,000 | | JP Morgan Chase & Co. | | | 781,500 | |

| 6,000 | | The Bank of New York Company, Inc. | | | 242,880 | |

| 8,000 | | U.S. BanCorp. | | | 274,800 | |

| 6,000 | | Wachovia Corp. | | | 333,240 | |

| | | | |

| |

| | | | | | 3,382,450 | |

| | | | |

| |

| | | Banks - Regional — 15.5% | | | | |

| 8,000 | | Capital One Financial Corp. | | | 594,080 | |

| 13,500 | | Comerica, Inc. | | | 835,785 | |

| 21,500 | | KeyCorp. | | | 767,120 | |

| 6,000 | | SunTrust Banks, Inc. | | | 506,520 | |

| 9,000 | | The PNC Financial Services Group, Inc. | | | 666,900 | |

| 7,500 | | Zions BanCorp. | | | 613,500 | |

| | | | |

| |

| | | | | | 3,983,905 | |

| | | | |

| |

| | | Consumer Financial Services — 7.9% | | | | |

| 8,000 | | CIT Group, Inc. | | | 477,200 | |

| 12,000 | | Fannie Mae (Federal National Mortgage) | | | 707,040 | |

| 13,000 | | Freddie Mac (Federal Home Loan) | | | 842,140 | |

| | | | |

| |

| | | | | | 2,026,380 | |

| | | | |

| |

| | | Insurance - Accident and Health — 3.4% | | | | |

| 35,000 | | Unum Group | | | 870,800 | |

| | | | |

| |

| | | Insurance - Life — 12.9% | | | | |

| 19,000 | | Genworth Financial, Inc., Class A | | | 693,310 | |

| 5,000 | | Lincoln National Corp. | | | 355,750 | |

| 13,500 | | MetLife, Inc. | | | 886,950 | |

| 11,000 | | Principal Financial Group, Inc. | | | 698,390 | |

| 7,000 | | Prudential Financial, Inc. | | | 665,000 | |

| | | | |

| |

| | | | | | 3,299,400 | |

| | | | |

| |

| | | Insurance - Property and Casualty — 23.7% | | | | |

| 10,000 | | ACE Ltd. | | | 594,600 | |

| 9,500 | | American International Group, Inc. | | | 664,145 | |

| 17,500 | | CNA Financial Corp.* | | | 816,725 | |

26

The FBR Funds

FBR Large Cap Financial Fund

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | VALUE |

| SHARES | | | | | (NOTE 2) |

|

| | | Insurance - Property and Casualty — 23.7% (continued) | | | | |

| 13,000 | | Loews Corp. | | $ | 615,160 | |

| 7,000 | | MGIC Investment Corp. | | | 431,270 | |

| 9,000 | | Safeco Corp. | | | 600,660 | |

| 13,000 | | The Chubb Corp. | | | 699,790 | |

| 6,000 | | The Hartford Financial Services Group, Inc. | | | 607,200 | |

| 7,000 | | The PMI Group, Inc. | | | 339,290 | |

| 13,000 | | The Travelers Companies, Inc. | | | 703,300 | |

| | | | |

| |

| | | | | | 6,072,140 | |

| | | | |

| |

| | | Investment Services — 13.7% | | | | |

| 14,000 | | Ameriprise Financial, Inc. | | | 832,580 | |

| 8,000 | | Fortress Investment Group, LLC, Class A | | | 232,080 | |

| 7,000 | | Lehman Brothers Holdings, Inc. | | | 526,960 | |

| 6,000 | | Mellon Financial Corp. | | | 257,580 | |

| 6,000 | | Merrill Lynch & Company, Inc. | | | 541,380 | |

| 4,500 | | Morgan Stanley | | | 378,045 | |

| 2,000 | | The Bear Stearns Companies, Inc. | | | 311,400 | |

| 2,000 | | The Goldman Sachs Group, Inc. | | | 437,220 | |

| | | | |

| |

| | | | | | 3,517,245 | |

| | | | |

| |

| | | Real Estate Operations — 3.1% | | | | |

| 50,000 | | Annaly Capital Management, Inc. | | | 795,500 | |

| | | | |

| |

| | | Total Common Stocks (Cost $21,077,376) | | | 23,947,820 | |

| | | | |

| |

| PAR | | | | | | |

| | | | | | |

| | | REPURCHASE AGREEMENT — 10.2% | | | | |

| $2,612,000 | | With Mizuho Securities, Inc. dated 4/30/07 at 5.06% to be repurchased at $2,612,367 on 5/1/07, collateralized by U.S. Treasury Bill, 4.81% due 8/23/07, value $320,044, U.S. Treasury Bond, 7.5% due 11/15/16, value $933,245, U.S. Treasury Notes, interest rates ranging from 5.625% to 6.5%, maturities ranging from 5/15/08 to 2/15/10, value $1,046,176 & $368,019 (Cost $2,612,000) | | | 2,612,000 | |

| | | | |

| |

| | | Total Investments — 103.6% (Cost $23,689,376) | | | 26,559,820 | |

| | | | | | | |

| | | Liabilities Less Other Assets — (3.6%) | | | (926,820 | ) |

| | | | |

| |

| | | Net Assets — 100.0% | | $ | 25,633,000 | |

| | | | |

| |

|

| * | Non-income producing security |

The accompanying notes are an integral part of the financial statements.

27

| The FBR Funds |

|

| FBR Large Cap Technology Fund |

| Management Overview |

Portfolio Managers: David Ellison and Winsor Aylesworth

How did the Fund perform?

For the six month period ended April 30, 2007, the FBR Large Cap Technology Fund appreciated 5.85%. This compares to the S&P 500 Index, the Lipper Science & Technology Fund Index and the NASDAQ Composite Index which returned 8.60%, 8.28% and 7.10% for the same period respectively.

What factors contributed to the Fund’s performance?

For the first time in a long time the Fund under performed against its various benchmarks and peers. The Fund’s positions in the semiconductor industry, our largest exposure to an individual sector, detracted from overall performance. Short-term oversupply issues led to a very competitive pricing environment. This resulted in some disappointing earnings and revised expectations for the future growth by certain companies. Because of this, the stock prices remained flat or retracted during the reporting period.

As disappointing as these short-term results may be to shareholders, we should take comfort that the Fund’s investment philosophy of only investing in established large-cap technology companies with minimal debt and a history of growing book value continues to allow us to keep focused on the long-term and take advantage of any “price correction” periods.

What is the outlook for the Fund and the technology sector?

The technology sector continues to be driven by the consumer’s desire for the newest and greatest “gadget”. To that end, we await the delivery of the new Apple iPhone and wonder whether they will be as successful in the wireless handset market as they were with the introduction of the iPod. The release of Microsoft Windows Vista has been met by mixed reviews but, due to Microsoft’s dominance in the PC market, it can not be ignored.

On a larger scale, the world is talking more and more about certain issues that should continue to drive technological growth and innovation. The current main topic is global warming. Technology solutions will be sought to allow for energy efficient alternatives to any product that currently relies on fossil fuels and could be deemed to be polluting. “Green” technology is a powerful trend that will be with us for a long-time. We continue to believe that the large-cap technology companies best-suited to benefit from these trends have a capital structure that will allow them to invest in research and development or have a track record of profitably integrating acquisitions to drive their growth. Companies that exhibit these types of characteristics form the mantra for your Fund’s investment philosophy.

28

| The FBR Funds |

|

| FBR Large Cap Technology Fund |

| Management Overview (continued) |

As fellow shareholders, we remain confident that our investment process has positioned the Fund for continued growth as we head into the back half of our fiscal year.

The opinions expressed in this commentary reflect those of the Portfolio Manager(s) as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

29

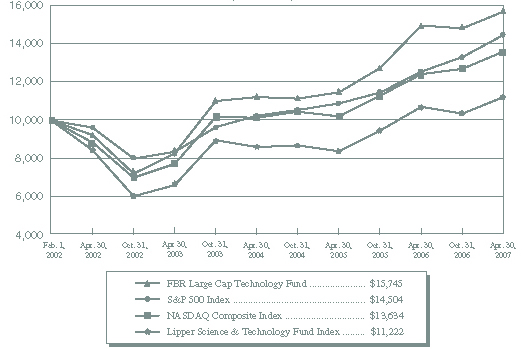

| The FBR Funds |

|

| FBR Large Cap Technology Fund |

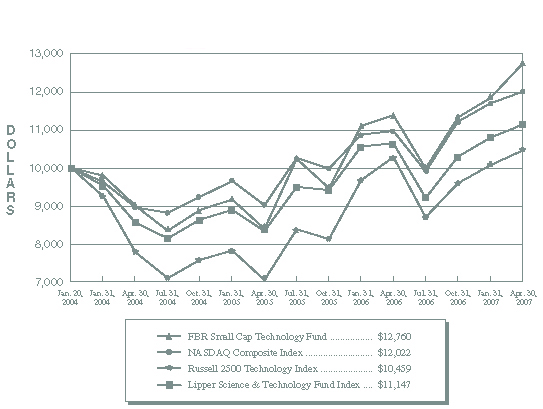

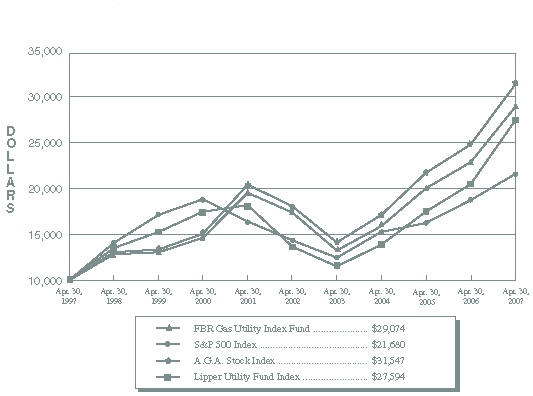

Comparison of Changes in Value of $10,000 Investment in

Fund Shares(1)(2) vs. Various Indices(1)(3)

(unaudited)

| |

| Total Returns—For the Periods Ended April 30, 2007(4) |

| | | | | | | | | Annualized | |

| | | | | | Annualized | | Since | |

| | | One Year | | Five Year | | Inception(5) | |

| | |

| |

| |

| |

| FBR Large Cap Technology Fund(1)(2) | | 4.80 | % | | 11.27 | % | | 9.05 | % | |

| S&P 500 Index(1)(3) | | 15.24 | % | | 8.53 | % | | 7.34 | % | |

| NASDAQ Composite Index(1)(3) | | 9.49 | % | | 9.05 | % | | 6.09 | % | |

| Lipper Science & Technology Fund Index(1)(3) | | 4.65 | % | | 5.89 | % | | 2.22 | % | |

| |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the indices are unmanaged, do not incur expenses and are not available for investment. The performance of the indices includes reinvested dividends, and does not reflect sales charges or expenses, except for the Lipper Science & Technology Fund Index which reflects fund expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | S&P 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to represent the broad domestic economy through changes in aggregate market value of 500 stocks representing all major industries. The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ National Market and Small Cap stocks. The Lipper Technology & Science Fund Index is an equally weighted index of the largest thirty funds within the science and technology fund classification as defined by Lipper Inc. The index is rebalanced quarterly. Lipper Analytical Services, Inc., is a nationally recognized organization that reports on mutual fund total return performance and calculates fund rankings. Each Lipper Average is based on a universe of funds with similar investment objectives. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period February 1, 2002 (commencement of investment operations) through April 30, 2007. |

30

The FBR Funds

FBR Large Cap Technology Fund

Portfolio Summary

April 30, 2007

(unaudited)

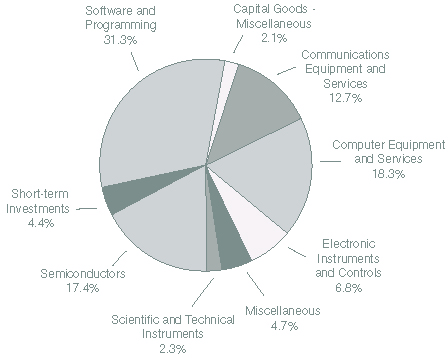

The following chart provides a visual breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

31

The FBR Funds

FBR Large Cap Technology Fund

Portfolio of Investments

April 30, 2007

(unaudited)

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | COMMON STOCKS — 89.3% | | | | |

| | | | Aerospace and Defense — 0.2% | | | | |

| | 650 | | Precision Castparts Corp. | | $ | 67,672 | |

| | | | | |

| |

| | | | Audio and Video Equipment — 7.0% | | | | |

| | 70,100 | | Matsushita Electric Industrial Company Ltd. ADR | | | 1,362,043 | |

| | 22,900 | | Sony Corp. ADR | | | 1,219,654 | |

| | | | | |

| |

| | | | | | | 2,581,697 | |

| | | | | |

| |

| | | | Auto and Truck Parts — 1.1% | | | | |

| | 4,200 | | Autoliv, Inc. | | | 244,230 | |

| | 2,200 | | BorgWarner, Inc. | | | 171,402 | |

| | | | | |

| |

| | | | | | | 415,632 | |

| | | | | |

| |

| | | | Biotechnology and Drugs — 8.1% | | | | |

| | 6,100 | | AstraZeneca PLC ADR | | | 331,291 | |

| | 1,500 | | Barr Pharmaceuticals, Inc.* | | | 72,540 | |

| | 1,000 | | Biovail Corp. | | | 24,390 | |

| | 9,400 | | Eli Lilly and Co. | | | 555,822 | |

| | 2,000 | | Endo Pharmaceuticals Holdings, Inc.* | | | 61,880 | |

| | 2,000 | | King Pharmaceuticals, Inc.* | | | 40,900 | |

| | 3,000 | | Mylan Laboratories, Inc. | | | 65,790 | |

| | 13,005 | | Novartis AG ADR | | | 755,460 | |

| | 2,500 | | Novo Nordisk A/S ADR | | | 246,025 | |

| | 14,600 | | Pfizer, Inc. | | | 386,316 | |

| | 3,000 | | Watson Pharmaceuticals, Inc.* | | | 81,900 | |

| | 6,800 | | Wyeth | | | 377,400 | |

| | | | | |

| |

| | | | | | | 2,999,714 | |

| | | | | |

| |

| | | | Business Services — 0.4% | | | | |

| | 4,500 | | Hewitt Associates, Inc., Class A* | | | 133,875 | |

| | | | | |

| |

| | | | Capital Goods - Miscellaneous — 5.0% | | | | |

| | 5,700 | | Cummins, Inc. | | | 525,312 | |

| | 17,300 | | Hitachi Ltd. ADR | | | 1,313,762 | |

| | | | | |

| |

| | | | | | | 1,839,074 | |

| | | | | |

| |

| | | | Communications Equipment — 11.3% | | | | |

| | 22,100 | | Alcatel-Lucent ADR | | | 292,825 | |

| | 20,300 | | Avaya, Inc.* | | | 262,276 | |

32

The FBR Funds

FBR Large Cap Technology Fund

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Communications Equipment — 11.3% (continued) | | | | |

| | 19,300 | | Corning, Inc.* | | $ | 457,796 | |

| | 1,300 | | F5 Networks, Inc.* | | | 99,814 | |

| | 29,367 | | LM Ericsson Telephone Co. ADR | | | 1,120,938 | |

| | 28,500 | | Motorola, Inc. | | | 493,905 | |

| | 44,400 | | Nokia Corp. ADR | | | 1,121,100 | |

| | 31,200 | | Tellabs, Inc.* | | | 331,344 | |

| | | | | |

| |

| | | | | | | 4,179,998 | |

| | | | | |

| |

| | | | Communications Services — 1.2% | | | | |

| | 4,100 | | Telephone and Data Systems, Inc. | | | 233,495 | |

| | 2,800 | | United States Cellular Corp.* | | | 203,000 | |

| | | | | |

| |

| | | | | | | 436,495 | |

| | | | | |

| |

| | | | Computer Hardware — 5.3% | | | | |

| | 9,500 | | Apple Computer, Inc.* | | | 948,100 | |

| | 9,000 | | Ingram Micro, Inc., Class A* | | | 176,580 | |

| | 162,000 | | Sun Microsystems, Inc.* | | | 845,640 | |

| | | | | |

| |

| | | | | | | 1,970,320 | |

| | | | | |

| |

| | | | Computer Networks — 1.7% | | | | |

| | 2,900 | | Cerner Corp.* | | | 154,396 | |

| | 4,100 | | Convergys Corp.* | | | 103,566 | |

| | 6,382 | | Dassault Systemes S.A. ADR | | | 379,091 | |

| | | | | |

| |

| | | | | | | 637,053 | |

| | | | | |

| |

| | | | Computer Peripherals — 5.3% | | | | |

| | 24,975 | | Canon, Inc. ADR | | | 1,403,595 | |

| | 5,400 | | Lexmark International, Inc., Class A* | | | 294,300 | |

| | 10,500 | | Logitech International S.A.* | | | 282,555 | |

| | | | | |

| |

| | | | | | | 1,980,450 | |

| | | | | |

| |

| | | | Computer Services — 2.7% | | | | |

| | 20,000 | | Electronic Data Systems Corp. | | | 584,800 | |

| | 600 | | Google, Inc., Class A* | | | 282,828 | |

| | 3,900 | | Total System Services, Inc. | | | 121,134 | |

| | | | | |

| |

| | | | | | | 988,762 | |

| | | | | |

| |

| | | | Computer Storage Devices — 0.7% | | | | |

| | 4,900 | | Computer Sciences Corp.* | | | 272,146 | |

| | | | | |

| |

33

The FBR Funds

FBR Large Cap Technology Fund

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Conglomerates — 5.8% | | | | |

| | 15,500 | | ABB Ltd. ADR | | $ | 309,380 | |

| | 27,500 | | Koninklijke Philips Electronics N.V. NYS | | | 1,128,600 | |

| | 21,800 | | Tyco International Ltd. | | | 711,334 | |

| | | | | |

| |

| | | | | | | 2,149,314 | |

| | | | | |

| |

| | | | Electronic Instruments and Controls — 4.8% | | | | |

| | 6,600 | | Arrow Electronics, Inc.* | | | 260,832 | |

| | 8,500 | | Avnet, Inc.* | | | 347,650 | |

| | 23,600 | | Molex, Inc. | | | 705,168 | |

| | 5,425 | | TDK Corp. ADR | | | 469,263 | |

| | | | | |

| |

| | | | | | | 1,782,913 | |

| | | | | |

| |

| | | | IT Consulting and Other Services — 0.2% | | | | |

| | 1,000 | | Cognizant Technology Solutions Corp., Class A* | | | 89,400 | |

| | | | | |

| |

| | | | Medical Equipment and Supplies — 1.7% | | | | |

| | 3,300 | | Respironics, Inc.* | | | 134,508 | |

| | 5,900 | | Stryker Corp. | | | 383,146 | |

| | 2,500 | | Varian Medical Systems, Inc.* | | | 105,525 | |

| | | | | |

| |

| | | | | | | 623,179 | |

| | | | | |

| |

| | | | Office Equipment — 2.3% | | | | |

| | 45,300 | | Xerox Corp.* | | | 838,050 | |

| | | | | |

| |

| | | | Personal and Household Products — 1.7% | | | | |

| | 10,600 | | McKesson Corp. | | | 623,598 | |

| | | | | |

| |

| | | | Photography — 2.7% | | | | |

| | 24,434 | | FUJIFILM Holdings Corp. ADR | | | 999,106 | |

| | | | | |

| |

| | | | Printing and Publishing — 0.2% | | | | |

| | 2,500 | | NAVTEQ Corp.* | | | 88,400 | |

| | | | | |

| |

| | | | Scientific and Technical Instruments — 1.4% | | | | |

| | 7,000 | | Applera Corp. - Applied Biosystems Group | | | 218,680 | |

| | 2,000 | | Hillenbrand Industries, Inc. | | | 122,300 | |

| | 4,500 | | Pall Corp. | | | 188,775 | |

| | | | | |

| |

| | | | | | | 529,755 | |

| | | | | |

| |

34

The FBR Funds

FBR Large Cap Technology Fund

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Semiconductors — 16.4% | | | | |

| | 9,000 | | ASML Holding N.V. NYS* | | $ | 245,250 | |

| | 8,400 | | Broadcom Corp., Class A* | | | 273,420 | |

| | 9,800 | | Flextronics International Ltd.* | | | 109,270 | |

| | 59,600 | | Infineon Technologies AG ADR* | | | 925,588 | |

| | 2,475 | | KLA-Tencor Corp. | | | 137,486 | |

| | 6,150 | | Kyocera Corp. ADR | | | 599,625 | |

| | 4,803 | | Lam Research Corp.* | | | 258,305 | |

| | 31,200 | | LSI Logic Corp.* | | | 265,200 | |

| | 11,300 | | Marvell Technology Group Ltd.* | | | 182,269 | |

| | 11,100 | | Maxim Integrated Products, Inc. | | | 352,092 | |

| | 6,200 | | Microchip Technology, Inc. | | | 250,108 | |

| | 65,650 | | Micron Technology, Inc.* | | | 753,006 | |

| | 6,800 | | Novellus Systems, Inc.* | | | 220,116 | |

| | 5,650 | | NVIDIA Corp.* | | | 185,829 | |

| | 16,600 | | Qimonda AG ADR* | | | 244,020 | |

| | 51,100 | | STMicroelectronics N.V. NYS | | | 994,406 | |

| | 8,304 | | Taiwan Semiconductor Manufacturing Company Ltd. ADR | | | 87,524 | |

| | | | | |

| |

| | | | | | | 6,083,514 | |

| | | | | |

| |

| | | | Software and Programming — 2.1% | | | | |

| | 14,000 | | BEA Systems, Inc.* | | | 165,060 | |

| | 4,500 | | Cognos, Inc.* | | | 193,995 | |

| | 10,000 | | Compuware Corp.* | | | 98,700 | |

| | 7,500 | | KONAMI Corp. ADR | | | 202,500 | |

| | 4,100 | | Trend Micro, Inc. ADR | | | 128,002 | |

| | | | | |

| |

| | | | | | | 788,257 | |

| | | | | |

| |

| | | | Total Common Stocks (Cost $31,430,126) | | | 33,098,374 | |

| | | | | |

| |

35

The FBR Funds

FBR Large Cap Technology Fund

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | | VALUE | |

| | PAR | | | | | (NOTE 2) | |

|

| | | | REPURCHASE AGREEMENT — 9.5% | | | | |

| $ | 3,505,000 | | With Mizuho Securities, Inc. dated 4/30/07 at 5.06% to be repurchased at $3,505,493 on 5/1/07, collateralized by U.S. Treasury Bill, 4.81% due 8/23/07, value $429,461, U.S. Treasury Bond, 7.5% due 11/15/16, value $1,252,307, U.S. Treasury Notes, interest rates ranging from 5.625% to 6.5%, maturities ranging from 5/15/08 to 2/15/10, value $1,403,846 & $493,839 (Cost $3,505,000) | | $ | 3,505,000 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Investments — 98.8% (Cost $34,935,126) | | | 36,603,374 | |

| | | | | | | | |

| | | | Other Assets Less Liabilities — 1.2% | | | 458,113 | |

| | | | | |

| |

| | | | Net Assets — 100.0% | | $ | 37,061,487 | |

| | | | | |

| |

| * | | Non-income producing security |

| ADR | | American Depositary Receipts |

| NYS | | New York Shares |

The accompanying notes are an integral part of the financial statements.

36

| The FBR Funds |

|

| FBR Small Cap Fund |

| Management Review |

Investment Sub Adviser: Akre Capital Management, LLC

Portfolio Manager: Charles T. Akre, Jr.

At the end of our 2006 fiscal year we wrote to you, our fellow shareholders, about our ten-year record, and more importantly the thought process which we believe is responsible for our better than average results. You also know by now, the Trustees of the Fund authorized it’s reopening at the first of this calendar year. Since that time the Fund has had net inflows in excess of five hundred and fifty million dollars. We at Akre Capital Management (the Fund’s Sub Adviser) have been surprised and flattered by this huge inflow of capital, and take very seriously our mandate to invest it well.

It will come as no surprise to you that our ability to put all this money to work quickly is limited at times by the overall level of valuations in the small cap arena. We will put the new funds to work as appropriate opportunities arise, using our long held and well recounted principles of investing. Please refer to the 2006 annual letter for an in-depth review of these principles; our view is unchanged as we write this semi-annual letter to you.

While the Fund is up around five percent through the middle of May, it nevertheless is behind the broader market. We would not be surprised to see the Fund’s performance “lag” should the market continue its upward momentum. Conversely, the Fund may do relatively better should we encounter a declining market, as our cash “gives us an anchor” and provides us with the where-with-all to take advantage of opportunities which might appear. We truly don’t know which outcome is more likely, so as you now expect from us, we just continue to search for outstanding businesses to own in our portfolio.

We have been busy during the last few months with annual meetings, annual reports, and other company visits. This is what we love to do, working this treasure hunt for the exceptional companies. It is likely that we will request that the Trustees consider closing the fund to new investors in the not distant future, so that those of us who have been long-term shareholders are not overly burdened by the new capital.

The opinions expressed in this commentary reflect those of the Portfolio Manager(s) as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

37

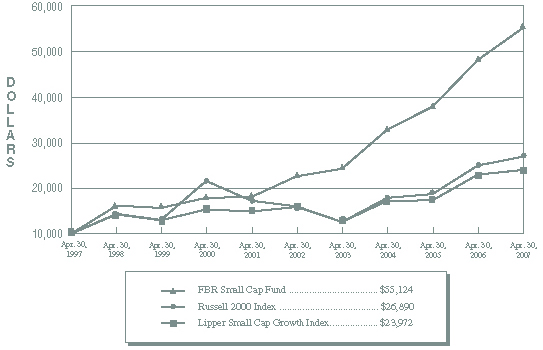

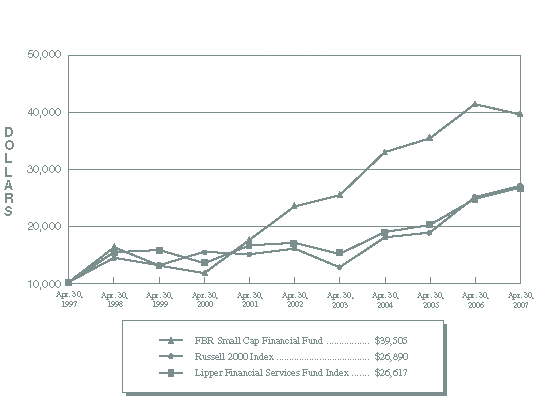

| The FBR Funds |

|

| FBR Small Cap Fund |

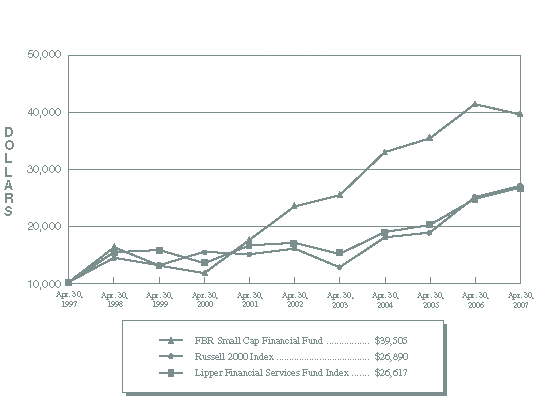

Comparison of Changes in Value of $10,000 Investment in

Fund Shares(1)(2) vs. Various Indices(1)(3)

(unaudited)

| |

| Total Returns—For the Periods Ended April 30, 2007(4) |

| | | | | | | Annualized | | Annualized | |

| | | | One Year | | Five Year | | Ten Year | |

| | | |

| |

| |

| |

| FBR Small Cap Fund(1)(2) | | | 14.65 | % | | 19.53 | % | | 18.61 | % | |

| Russell 2000 Index(1)(3) | | | 7.83 | % | | 11.14 | % | | 10.40 | % | |

| Lipper Small Cap Growth Index(1)(3) | | | 4.55 | % | | 8.45 | % | | 9.14 | % | |

| |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the indices are unmanaged, do not incur expenses and are not available for investment. The performance of the indices includes reinvested dividends, and does not reflect sales charges or expenses, except for the Lipper Small Cap Growth Index which reflects fund expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | Russell 2000 Index is comprised of the smallest of the 2000 companies of the Russell 3000 Index, representing approximately 8% of the Russell 3000’s total market-capitalization. The Lipper Small Cap Growth Index is an equally weighted index of the largest thirty funds within the small-cap fund classification as defined by Lipper Inc. The index is rebalanced quarterly. Lipper Analytical Services, Inc., is a nationally recognized organization that reports on mutual fund total return performance and calculates fund rankings. Each Lipper Average is based on a universe of funds with similar investment objectives. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

38

The FBR Funds

FBR Small Cap Fund

Portfolio Summary

April 30, 2007

(unaudited)

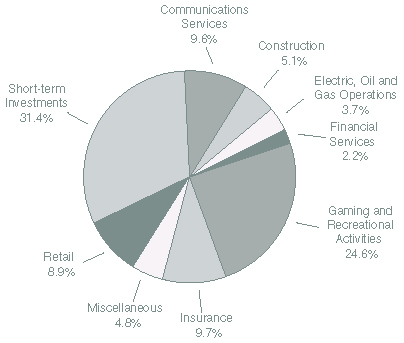

The following chart provides a visual breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

39

The FBR Funds

FBR Small Cap Fund

Portfolio of Investments

April 30, 2007

(unaudited)

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | COMMON STOCKS — 68.1% | | | | |

| | | | Banks - Regional — 0.1% | | | | |

| | 50,000 | | Bank of Florida Corp.* | | $ | 925,000 | |

| | | | | |

| |

| | | | Biotechnology and Drugs — 0.3% | | | | |

| | 228,100 | | Bradley Pharmaceuticals, Inc.* | | | 4,477,603 | |

| | | | | |

| |

| | | | Business Services — 0.3% | | | | |

| | 183,200 | | Iron Mountain, Inc.* | | | 5,147,920 | |

| | | | | |

| |

| | | | Casinos and Gaming — 20.6% | | | | |

| | 1,600,000 | | Bally Technologies, Inc.* | | | 37,440,000 | |

| | 20,000 | | International Game Technology | | | 762,800 | |

| | 555,943 | | Isle of Capri Casinos, Inc.* | | | 13,587,247 | |

| | 992,000 | | Monarch Casino & Resort, Inc.* † | | | 26,456,640 | |

| | 4,100,000 | | Penn National Gaming, Inc.* | | | 198,193,999 | |

| | 1,621,407 | | Pinnacle Entertainment, Inc.* | | | 45,529,109 | |

| | 157,500 | | Shuffle Master, Inc.* | | | 2,682,225 | |

| | 234,861 | | Station Casinos, Inc. | | | 20,432,907 | |

| | | | | |

| |

| | | | | | | 345,084,927 | |

| | | | | |

| |

| | | | Communications Services — 9.3% | | | | |

| | 4,107,256 | | American Tower Corp., Class A* | | | 156,075,728 | |

| | | | | |

| |

| | | | Construction - Supplies and Fixtures — 3.2% | | | | |

| | 730,850 | | American Woodmark Corp. | | | 25,221,634 | |

| | 902,300 | | Simpson Manufacturing Company, Inc. | | | 29,026,991 | |

| | | | | |

| |

| | | | | | | 54,248,625 | |

| | | | | |

| |

| | | | Construction Services — 1.8% | | | | |

| | 566,666 | | D.R. Horton, Inc. | | | 12,568,652 | |

| | 600,000 | | Toll Brothers, Inc.* | | | 17,868,000 | |

| | | | | |

| |

| | | | | | | 30,436,652 | |

| | | | | |

| |

| | | | Consumer Financial Services — 2.1% | | | | |

| | 1,350,000 | | AmeriCredit Corp.* | | | 34,060,500 | |

| | 28,200 | | White River Capital, Inc.* | | | 673,980 | |

| | | | | |

| |

| | | | | | | 34,734,480 | |

| | | | | |

| |

40

The FBR Funds

FBR Small Cap Fund

Portfolio of Investments (continued)

April 30, 2007

(unaudited)

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Electric Utilities — 1.3% | | | | |

| | 1,000,000 | | The AES Corp.* | | $ | 21,990,000 | |

| | | | | |

| |

| | | | Electronic Instruments and Controls — 0.8% | | | | |

| | 200,000 | | WESCO International, Inc.* | | | 12,634,000 | |

| | | | | |

| |

| | | | Insurance - Miscellaneous — 1.1% | | | | |

| | 50,000 | | Brown & Brown, Inc. | | | 1,287,500 | |

| | 393,500 | | Hilb Rogal and Hobbs Co. | | | 17,097,575 | |

| | | | | |

| |

| | | | | | | 18,385,075 | |

| | | | | |

| |

| | | | Insurance - Property and Casualty — 8.3% | | | | |

| | 80 | | Berkshire Hathaway, Inc., Class B* | | | 290,240 | |

| | 1,385,600 | | Flagstone Reinsurance Holdings Ltd.* | | | 18,567,040 | |

| | 61,000 | | Investors Title Co. | | | 2,924,340 | |

| | 255,400 | | Markel Corp.* | | | 117,205,614 | |

| | | | | |

| |

| | | | | | | 138,987,234 | |

| | | | | |

| |

| | | | Office Equipment — 1.9% | | | | |

| | 1,085,400 | | Global Imaging Systems, Inc.* | | | 31,357,206 | |

| | | | | |

| |

| | | | Oil and Gas Operations — 2.4% | | | | |

| | 397,890 | | MarkWest Hydrocarbon, Inc. | | | 23,809,738 | |

| | 211,800 | | Penn Virginia Corp. | | | 16,954,590 | |

| | | | | |

| |

| | | | | | | 40,764,328 | |

| | | | | |

| |

| | | | Real Estate Operations — 0.4% | | | | |

| | 500,225 | | Affordable Residential Communities, Inc.* | | | 5,867,639 | |

| | | | | |

| |

| | | | Recreational Activities — 0.4% | | | | |

| | 603,800 | | Dover Motorsports, Inc. | | | 3,387,318 | |

| | 60,000 | | International Speedway Corp., Class A | | | 2,964,000 | |

| | 19,000 | | International Speedway Corp., Class B | | | 940,500 | |

| | | | | |