Exhibit 99.3

LAKE SHORE GOLD CORP.

MANAGEMENT’S DISCUSSION & ANALYSIS

Three and nine months ended September 30, 2014 and 2013

TABLE OF CONTENTS

GENERAL | 1 |

| |

HIGHLIGHTS | 3 |

| |

OUTLOOK | 5 |

| |

CONSOLIDATED FINANCIAL INFORMATION | 5 |

| |

KEY PERFORMANCE INDICATORS | 6 |

| |

REVIEW OF OPERATIONS | 9 |

| |

SUMMARY OF QUARTERLY RESULTS | 17 |

| |

FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES | 17 |

| |

OUTSTANDING SHARE CAPITAL | 19 |

| |

NON-GAAP MEASURES | 19 |

| |

ACCOUNTING POLICIES, STANDARDS AND JUDGMENTS | 21 |

| |

OFF BALANCE SHEET ARRANGEMENTS AND TRANSACTIONS WITH RELATED PARTIES | 26 |

| |

RISKS AND CONTROLS | 26 |

| |

FORWARD-LOOKING STATEMENTS | 28 |

| |

ADDITIONAL INFORMATION | 30 |

GENERAL

This Management’s Discussion and Analysis, or MD&A, is intended to assist the reader in the understanding and assessment of the trends and significant changes in the results of operations and financial condition of Lake Shore Gold Corp. (the “Company” or “Lake Shore Gold”). This MD&A should be read in conjunction with the unaudited condensed consolidated interim financial statements of the Company, including the notes thereto, for the three and nine months ended September 30, 2014 and 2013 (the “financial statements”), which are prepared in accordance with International Financial Reporting Standards (“IFRS”) for interim financial statements, as issued by the International Accounting Standards Board, and the annual MD&A for the year ended December 31, 2013. This MD&A has taken into account information available up to and including October 29, 2014. All dollar amounts are in Canadian dollars unless otherwise stated.

This MD&A contains forward-looking statements. For example, statements in the “Outlook” section of this MD&A are forward looking, and any statements elsewhere with respect to the cost or timeline of planned or expected development, production, or exploration are all forward-looking statements. As well, statements about future mining or milling capacity, future growth, future financial position, the adequacy of the Company’s cash resources or the need for future financing are also forward-looking statements. All forward-looking statements, including forward-looking statements not specifically identified in this paragraph, are made subject to the cautionary language at the end of this document, and readers are directed to refer to that cautionary language when reading any forward-looking statements.

1

Overview

Lake Shore Gold is a gold producing company with two operating mines, a central milling facility and a large portfolio of growth projects and exploration properties, all located in the Timmins Gold Camp of Northern Ontario.

The Company’s Timmins West Complex is located 18 kilometres west of the City of Timmins and hosts the Timmins West Mine, an underground mining operation that produced 107,100 ounces of gold in 2013 and 111,000 ounces in the first nine months of 2014. Production at Timmins West Mine comes from two deposits, Timmins Deposit and Thunder Creek Deposit, both of which are open for expansion. Additional growth opportunities at Timmins West Complex include the 144 exploration area (“144”) and the Gold River Trend Deposit. 144 is a four kilometre trend to the southwest of the Thunder Creek Deposit. The recent intersection of wide, high-grade gold mineralization at 144 within 770 metres of Thunder Creek illustrates the potential for additional gold deposits along the Thunder Creek-144 Trend. The Gold River Trend Deposit is located 3 kilometres south of Timmins West Mine and currently hosts over a million ounces of resources with considerable growth potential.

On the east side of the City of Timmins, the Bell Creek Complex hosts the Company’s milling facility as well as the Bell Creek Mine. The Bell Creek Mine is an underground mine that produced 27,500 ounces in 2013 and 31,500 ounces in the first nine months of 2014. Significant potential exists to add reserves and extend the life of the Bell Creek Mine operation given that the majority of resources are located below current mining operations, in the Labine Deep Zone. The Bell Creek Complex also hosts two additional deposits, Vogel and Marlhill, as well as other exploration targets.

The Company’s central mill, located at the Bell Creek Complex, is a conventional gold milling circuit, which processes ore from both the Timmins West and Bell Creek mines. Following completion of an expansion in the third quarter of 2013, throughput at the mill has consistently averaged well over 3,000 tonnes per day with average recoveries consistently exceeding 95%.

A third gold complex, the Fenn-Gib Deposit, is located approximately 60 kilometres east of Bell Creek. Fenn-Gib is an advanced stage exploration project, which hosts a large, near-surface deposit with excellent potential for further growth.

Lake Shore Gold is a reporting issuer in all Provinces in Canada (excluding the Territories), and a foreign private issuer in the United States. The Company’s common shares trade on the Toronto Stock Exchange and NYSE MKT under the symbol LSG.

Strategy

Lake Shore Gold’s strategy for increasing shareholder value is focused on effectively managing its current business operations, advancing its wholly owned projects and drilling to realize its significant exploration potential. Through effective operational management, the Company is meeting and exceeding its key performance targets and is positioned as a low-cost producer in its industry. Low-cost production is a key driver of free cash flow, which in turn allows the Company to build financial strength, repay debt and invest to replace reserves and extend mine life. The Company is advancing a number of key growth projects through drilling, engineering and metallurgical work, including Bell Creek Deep, Gold River and Fenn-Gib, and is also drilling to realize the potential of exploration targets, such as 144.

2

HIGHLIGHTS

Operating and financial results for the third quarter and first nine months of 2014 included strong production growth, significant improvement in cash operating and all-in sustaining costs and a rapid increase in cash and bullion. The Company also reported exploration progress at the Bell Creek Mine during the third quarter of 2014 and, subsequent to the end of the quarter, reported encouraging drill results at both Timmins Deposit and 144.

Third Quarter 2014 (“Q3/14”) and Nine-Month 2014 (“9M/14”) Operating Highlights

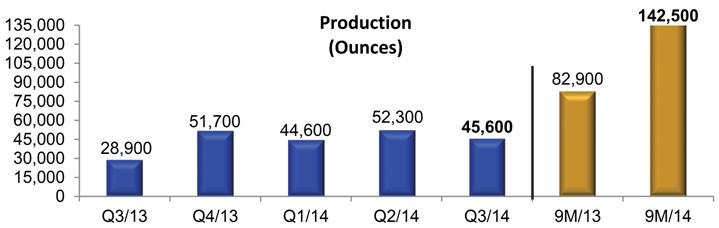

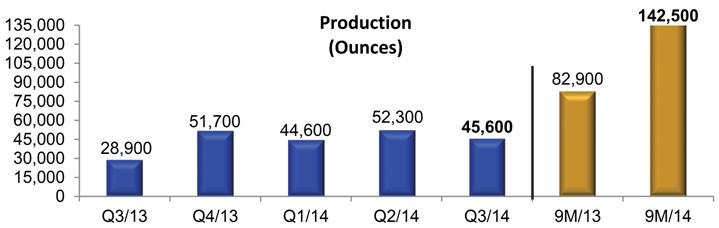

· Gold production of 45,600 ounces in Q3/14 and record production of 142,500 ounces in 9M/14

· Gold poured of 44,900 ounces in Q3/14 and 144,100 ounces in 9M/14

· Mill throughput of 320,800 tonnes (3,490 tonnes per day) in Q3/14 and 914,400 tonnes (3,350 tonnes per day) in 9M/14

· Average grade of 4.6 grams per tonne in Q3/14 and 5.0 grams per tonne in 9M/14

· Exploration results in Q3/14 included intersecting high-grade mineralization below current mining at the Bell Creek Mine, highlighting the potential to add reserves and increase mine life

· Subsequent to the end of Q3/14, the Company announced drill results at 144, which confirmed the presence of a high-grade zone approximately 770 metres southwest of Thunder Creek, as well as results showing the presence of high-grade mineralization in both the north and south limbs of the S2 Fold Nose at Timmins Deposit.

Q3/14 and 9M/14 Financial Highlights

· Gold sales of 45,500 ounces in Q3/14 and record gold sales of 142,000 ounces in 9M/14

· Total revenues of $63.5 million in Q3/14 and record revenues of $200.1 million in 9M/14

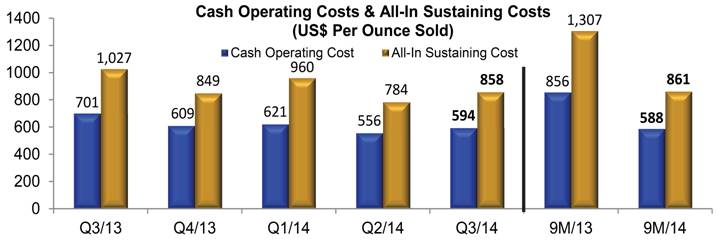

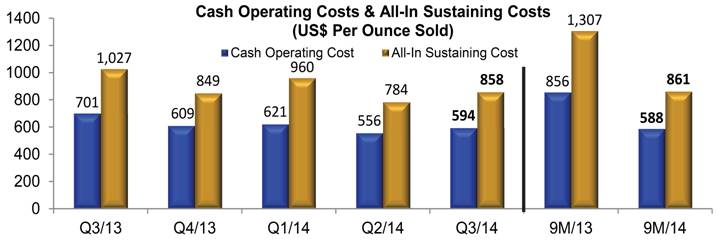

· Cash operating cost per ounce sold(1) of US$594 in Q3/14 and US$588 in 9M/14, based on cash operating costs(1) of $29.5 million (production costs of $29.6 million) and $91.3 million (production costs of $91.6 million), respectively

· All-in sustaining cost per ounce sold(2) of US$858 in Q3/14 and US$861 in 9M/14

· Total capital investment of $15.2 million in Q3/14 and $39.4 million in 9M/14, including exploration spending of $2.1 million in Q3/14 and $3.5 million in 9M/14

· Total debt repayments of approximately $21.1 million in 9M/14, including $10.0 million prepayment on standby line of credit on June 4, 2014

· Cash and bullion at September 30, 2014 of $67.3 million versus $34.0 million at December 31, 2013

· Net earnings of $7.9 million ($0.02 per common share) in Q3/14 and $25.7 million ($0.06 per common share) in 9M/14.

This MD&A contains measures that are not prepared in accordance with Generally Accepted Accounting Principles (“GAAP”). Each of the following is a Non-GAAP measure: cash operating costs and cash operating cost per ounce sold, all-in sustaining costs and all-in sustaining cost per ounce sold, cash earnings from mine operations(3), and adjusted net earnings (loss)(4). The

3

Company believes these Non-GAAP measures provide useful information that can be used to evaluate the Company’s performance and ability to generate cash flows. These measures do not have standardized definitions and should not be relied upon in isolation or as a substitute for measures prepared in accordance with GAAP. A reconciliation of these measures to amounts included in the Consolidated Statements of Comprehensive Income (Loss) for the three and nine month periods ended September 30, 2014 and 2013 begins on page 19 of this MD&A.

(1) Cash operating costs and cash operating cost per ounce are Non-GAAP measures. In the gold mining industry, cash operating costs and cash operating costs per ounce are common performance measures but do not have any standardized meaning. Cash operating costs are derived from amounts included in the Consolidated Statements of Comprehensive Income (Loss) and include mine site operating costs such as mining, processing and administration as well as royalty expenses, but exclude depreciation, depletion and share-based payment expenses and reclamation costs. Cash operating costs per ounce are based on ounces sold and are calculated by dividing cash operating costs by commercial gold ounces sold; US$ cash operating costs per ounce sold are derived from the cash operating costs per ounce sold translated using the average Bank of Canada C$/US$ exchange rate. The Company discloses cash operating costs and cash operating costs per ounce as it believes the measures provide valuable assistance to investors and analysts in evaluating the Company’s operational performance and ability to generate cash flow. The most directly comparable measure prepared in accordance with GAAP is total production costs. A reconciliation of cash operating costs and cash operating cost per ounce to total production costs for the three and nine months ended September 30, 2014 and 2013 is set out on page 19 of this MD&A.

(2) All-in sustaining costs and all-in sustaining cost per ounce are Non-GAAP measures. These measures are intended to assist readers in evaluating the total costs of producing gold from current operations. While there are no standardized meanings across the industry for these measures, the Company’s definitions conform to the all-in sustaining costs definition as set out by the World Gold Council in its guidance note dated June 27, 2013. The Company defines all-in sustaining costs as the sum of production costs, sustaining capital (capital required to maintain current operations at existing levels), corporate general and administrative expenses, in-mine exploration expenses and reclamation cost accretion related to current operations. All-in sustaining costs exclude growth capital, reclamation cost accretion not related to current operations, interest expense, debt repayment and taxes. The costs included in the calculation of all-in sustaining costs are divided by commercial gold ounces sold to obtain the all-in sustaining cost per ounce; US$ all-in sustaining cost per ounce sold is translated using the average Bank of Canada C$/US$ exchange rate. The most directly comparable measure prepared in accordance with GAAP is total production costs. A reconciliation of all-in sustaining costs and all-in sustaining cost per ounce to total production costs for the three and nine months ended September 30, 2014 and 2013 is set out on page 20 of this MD&A.

(3) Cash earnings from mine operations is a Non-GAAP measure and does not have any standardized meaning. The Company discloses cash earnings from mine operations as it believes this measure provides valuable assistance to investors and analysts in evaluating the Company’s ability to finance its ongoing business and capital activities. The most directly comparable measure prepared in accordance with GAAP is earnings from mine operations. Cash earnings from mine operations represent the earnings from mine operations prior to deducting non-cash expenses, and is calculated by adding depletion, depreciation and share based payments in production costs to earnings from mine operations”. A reconciliation of cash earnings from mine operations to earnings from mine operations for the three and nine months ended September 30, 2014 and 2013 is set out on page 20 of this MD&A.

(4) Adjusted net earnings (loss) excludes impairment charges, other income/losses (which includes gains/losses and other costs incurred for acquisition and disposal of mining interests, unrealized and non—cash realized gains/losses on financial instruments) as well as significant non-cash non-recurring items. The Company also excludes the net (earnings) losses from the Company’s investments in associates as well as write down/off of investments in associates. The Company excludes these items from net earnings (losses) to provide a measure which allows the Company and investors to evaluate the operating results of the core operations of the Company and its ability to generate operating cash flows to fund working capital requirements, future capital expenditures and service outstanding debt. A reconciliation of adjusted net earnings (loss) to net earnings(loss) for the three and nine months ended September 30, 2014 and 2013 is set out on page 21 of this MD&A.

4

OUTLOOK

After the first nine months of 2014, the Company is on track to produce at least 180,000 ounces in 2014 and to beat its full-year 2014 guidance for both cash operating costs and all-in sustaining costs. Effectively managing unit costs is a priority as the Company continues to focus on building its financial strength. After repaying $21.1 million of debt in 9M/14, the Company is targeting total debt repayments of $25.0 million for the full year, including monthly payments on the Company’s gold loan in the fourth quarter of 2014.

In addition to generating strong operating results, continued exploration will remain an important focus during the final quarter of 2014. Drilling activity during the quarter is increasing as the Company builds on recent exploration results at Timmins Deposit, 144 and Bell Creek. Additional mine development is also planned for the fourth quarter of 2014 in support of reserve replacement, underground exploration and execution of the 2015 mine plan.

The Company’s full-year 2014 guidance includes:

· Gold production of 160,000 — 180,000 ounces;

· Cash operating cost per ounce sold of US$675 to US$775;

· All-in sustaining cost per ounce sold between US$950 and US$1,050;

· Total production costs of $128.0 million; and,

· Total principal debt repayments of $25.0 million.

CONSOLIDATED FINANCIAL INFORMATION(1)

| | Three months ended | | Nine months ended | |

(in $’000, except the per share amounts) | | Sept. 30,

2014 | | Sept. 30,

2013 | | Sept. 30,

2014 | | Sept. 30,

2013 | |

Revenue | | $ | 63,514 | | $ | 44,301 | | $ | 200,064 | | $ | 126,833 | |

Production costs | | $ | 29,554 | | $ | 23,428 | | $ | 91,625 | | $ | 75,539 | |

Earnings from mine operations | | $ | 16,144 | | $ | 7,554 | | $ | 52,825 | | $ | 13,211 | |

Earnings (loss) from continuing operations | | $ | 7,889 | | $ | (1,718 | ) | $ | 25,716 | | $ | (3,474 | ) |

Net earnings (loss) | | $ | 7,889 | | $ | (1,718 | ) | $ | 25,716 | | $ | (7,776 | ) |

| | | | | | | | | |

Basic net income (loss) per share from continuing operations | | $ | 0.02 | | $ | 0.00 | | $ | 0.06 | | $ | (0.01 | ) |

Basic net income (loss) per share | | $ | 0.02 | | $ | 0.00 | | $ | 0.06 | | $ | (0.02 | ) |

Cash flows from continuing operating activities | | $ | 28,368 | | $ | 11,365 | | $ | 90,122 | | $ | 32,535 | |

5

KEY PERFORMANCE INDICATORS(1)

| | Three months ended | | Nine months ended | |

| | Sept. 30,

2014 | | Sept. 30,

2013 | | Sept. 30,

2014 | | Sept. 20,

2013 | |

Tonnes milled | | 320,800 | | 202,300 | | 914,400 | | 630,900 | |

Grade | | 4.6 | | 4.7 | | 5.0 | | 4.3 | |

Average mill recoveries | | 96.7 | % | 95.2 | % | 96.6 | % | 95.5 | % |

Ounces produced | | 45,600 | | 28,900 | | 142,500 | | 82,900 | |

Ounces poured | | 44,900 | | 25,900 | | 144,100 | | 78,200 | |

Ounces sold | | 45,500 | | 32,300 | | 142,000 | | 86,000 | |

Average price (US$/oz) | | $ | 1,284 | | $ | 1,324 | | $ | 1,289 | | $ | 1,444 | |

Average price ($/oz) | | $ | 1,397 | | $ | 1,372 | | $ | 1,410 | | $ | 1,476 | |

Cash operating costs (US$/oz) | | $ | 594 | | $ | 701 | | $ | 588 | | $ | 856 | |

Cash operating costs ($/oz) | | $ | 647 | | $ | 726 | | $ | 643 | | $ | 875 | |

All - in sustaining costs (US$/oz) | | $ | 858 | | $ | 1,027 | | $ | 861 | | $ | 1,307 | |

All - in sustaining costs ($/oz) | | $ | 935 | | $ | 1,065 | | $ | 942 | | $ | 1,336 | |

Cash earnings from mine operations ($000s) | | $ | 34,059 | | $ | 20,846 | | $ | 108,734 | | $ | 51,572 | |

Adjusted net earnings (loss) ($000s) | | $ | 7,935 | | $ | 997 | | $ | 26,679 | | $ | (5,903 | ) |

Adjusted net earnings (loss) per share ($/share) | | $ | 0.02 | | $ | 0.00 | | $ | 0.06 | | $ | (0.01 | ) |

(1) The Company’s Consolidated Financial Information includes measures prepared in accordance with GAAP. The Company’s Key Performance Indicators include a number of Non-GAAP measures, including cash operating costs, all-in sustaining costs, cash earnings from mine operations as well as adjusted net earnings (loss) and adjusted net earnings (loss) per share, which the Company believes provide useful information that can be used to evaluate the Company’s performance. These Non-GAAP measures do not have standardized definitions and should not be relied upon in isolation or as a substitute for the measures prepared in accordance with GAAP. A reconciliation of these measures to amounts included in the Consolidated Statements of Comprehensive Income (Loss) is set out beginning on page 19 of this MD&A.

An overriding financial objective for the Company is to generate cash flow. Achieving this objective is critical for funding the Company’s operations, reducing debt and providing the financial strength to invest in future production growth. Other key performance indicators include the business inputs that drive cash flow generation, specifically, gold production, gold poured and gold sales, as well as unit costs which, along with the gold price, determine the Company’s margins. Also important to the Company’s cash position is its ability to manage its capital investment as well as its debt levels. Another indicator of the Company’s ability to generate cash flow is cash earnings from mine operations, which along with earnings from mine operations and net earnings are the Company’s primary earnings measures.

Strong Production in Q3/14, record production for 9M/14

Production in Q3/14 was 45,600 ounces of gold, an increase of 58% from the 28,900 ounces produced in the third quarter of 2013 (“Q3/13”). Production levels in the current year’s third quarter reflected 59% growth in average mill throughput compared to Q3/13, to 3,490 tonnes per day. The Company completed an expansion of its milling facility in the third quarter of 2013, and since that time both its mill and mining operations have consistently produced at rates exceeding 3,000 tonnes per day. The average grade in Q3/14 was 4.6 grams per tonne, similar to the 4.7 grams per tonne reported in the same quarter a year earlier. Gold poured during Q3/14 totaled 44,900 ounces, a 73% increase from 25,900 ounces poured in Q3/13.

The Company achieved record production in the first nine months of the year, with a total of 142,500 ounces produced. Production in 9M/14 was 72% higher than the 82,900 ounces produced in the first nine months of 2013 (“9M/13”). Mill throughput in 9M/14 averaged 3,350

6

tonnes per day, an increase of 45% from the 2,310 tonnes per day achieved in 9M/13. Higher volumes resulted from the completion of the Company’s mill expansion in last year’s third quarter as well as increased production levels from the Company’s Timmins West and Bell Creek mines. The average grade in 9M/14 was 5.0 grams per tonne compared to 4.3 grams per tonne in 9M/13 due mainly to mine sequencing. Gold poured during 9M/14 totaled 144,100 ounces, an increase of 84% from 78,200 ounces in 9M/13.

Increased Gold Sales Drive Revenues Higher

Gold sales in Q3/14 totaled 45,500 ounces, a 41% increase from the 32,300 ounces sold in Q3/13, reflecting higher production levels. The average Canadian dollar selling price of gold in Q3/14 was $1,397 per ounce, 2% higher than the average Canadian dollar gold price of $1,372 per ounce in Q3/13. The strong growth in sale volumes and slight increase in the average price resulted in a 43% increase in revenues to $63.5 million in Q3/14 versus $44.3 million in Q3/13. The increase in the average gold price in Q3/14 reflected a weaker Canadian dollar (US$1:C$1.09 in Q3/14 versus US$1:C$0.97 in Q3/13), which more than offset the impact of a 3% reduction in the average US$ gold price from US$1,324 per ounce in Q3/13 to US$1,284 per ounce in Q3/14.

Gold sales in 9M/14 were a record 142,000 ounces, a 65% increase from the 86,000 ounces sold in 9M/13. Total revenues in 9M/14 were also a record at $200.1 million, an increase of 58% from 9M/13, with the impact of strong volume growth more than offsetting an 4% reduction in the average gold price, to $1,410 (US$1,289) per ounce from $1,476 (US$1,444) per ounce in 9M/13.

Lower Unit Operating Costs Lead to Significant Margin Improvement

Total production costs in Q3/14 totaled $29.6 million, an increase from $23.4 million in Q3/13 due primarily to significantly higher production volumes. On a unit cost basis, cash operating cost per ounce sold of US$594 improved by US$107 or 15% from US$701 in Q3/13. All-in sustaining costs averaged US$858 per ounce sold in Q3/14, a 16% improvement from US$1,027 per ounce sold in Q3/13 and US$426 per ounce less than the average selling price for the quarter of US$1,284.

Total production costs in 9M/14 totaled $91.6 million, an increase from $75.5 million in 9M/13 reflecting higher production volumes. On a unit cost basis, cash operating cost per ounce sold totaled US$588 in 9M/14, a 31% improvement from US$856 in 9M/13 and well below the Company’s target range for full-year 2014 of between US$675 and US$775. All-in sustaining cost per ounce sold averaged US$861, a 34% improvement from US$1,307 in 9M/13 and US$428 per ounce less than the average selling price of US$1,289 per ounce during 9M/14. The US$861 per

7

ounce sold of all-in sustaining costs in 9M/14 was 9% better than the low end of the Company’s 2014 target range of US$950 to US$1,050.

Capital Expenditures in Line with Expectations

During Q3/14, the Company invested a total of $15.2 million in its mining interests compared to $14.2 million invested in Q3/13. The increase reflects higher exploration spending as the Company resumed its drilling program in the second half of 2014.

Capital investment in 9M/14 totaled $39.4 million, representing 49% of the $80.2 million invested in 9M/13.

$21.1 Million of Debt Repayments in 9M/14

Debt repayments in Q3/14 totaled $3.7 million, all related to the principal portion of monthly payments during Q3/14 on the Company’s gold loan.

Total debt repayments in the first nine months of 2014 were $21.1 million, including $10.0 million related to a prepayment on the Company’s standby line of credit during the second quarter. The prepayment was made without penalty and reduced the outstanding balance on the standby line of credit to $20.0 million. Excluding the $10.0 million prepayment, debt repayments in 9M/14 were $11.1 million, which related to principal repayments on the Company’s gold loan.

Cash and Bullion of $67.3 Million at September 30, 2014

Cash and bullion at September 30, 2014 totaled $67.3 million, including $62.2 million of cash and cash equivalents and $5.1 million of bullion valued at market prices (bullion represents gold poured in doré that has not yet been included in revenue and for which cash has not yet been received). The $67.3 million of cash and bullion at September 30, 2014 was $13.9 million or 26% higher than cash and bullion at June 30, 2014 and almost double the $34.0 million of cash and bullion at December 31, 2013. The increase in cash and bullion was after debt repayments of $21.1 million, including the $10.0 million prepayment on the Company’s standby line of credit. The increase in cash and bullion in 9M/14 mainly results from internally generated cash flow, with the only exception being $5.0 million from a flow-through financing completed on May 22, 2014.

Cash flow from operating activities, before movements in working capital, totaled $27.6 million in Q3/14 compared to $14.2 million for the same period in 2013 ($28.4 million and $12.5 million, respectively, for Q3/14 and Q3/13 after movements in working capital). Investing activities

8

represented a use of cash totaling $14.0 million in Q3/14 reflecting capital expenditures during the quarter. Financing activities accounted for $5.3 million of cash used during Q3/14 of which $3.9 million related to payments (principal and interest) on the Company’s gold loan and $1.6 million of payments for finance leases.

Strong Growth in Both Cash Earnings and Earnings from Mine Operations

The Company generated cash earnings from mine operations in Q3/14 of $34.1 million, 64% higher than the $20.8 million reported in Q3/13. The significant increase in cash earnings from mine operations mainly reflected the 43% increase in revenues from gold sales and the impact of lower unit cash operating costs and improved margins. These same factors also largely accounted for a $57.2 million increase in cash earnings from mine operations in 9M/14, to $108.7 million, compared to $51.6 million in 9M/13.

Earnings from mine operations, which include cash earnings as well as the impact of depreciation and depletion expense and share based payments increased to $16.1 million in Q3/14 from $7.6 million in Q3/13. For the first nine months of 2014, earnings from mine operations totaled $52.8 million, compared to $13.2 million in 9M/13. The impact of higher cash earnings and reduced depreciation and depletion expense per ounce sold accounted for the increases in earnings from mine operations in Q3/14 and 9M/14 compared to the same periods in 2013.

Company Reports Net Earnings of $7.9 Million in Q3/14, $25.7 Million in 9M/14

The Company reported net earnings of $7.9 million or $0.02 per common share in Q3/14 compared to a net loss of $1.7 million or $0.00 per common share in Q3/13.

Net earnings in 9M/14 totaled $25.7 million or $0.06 per common share, which compared to a net loss of $7.8 million or $0.02 per common share in 9M/13. The net loss in 9M/13 included a $4.3 million loss from discontinued activities relating to the sale of the Company’s Mexico subsidiary.

The higher net earnings for Q3/14 and 9M/14 compared to same periods in previous years resulted mainly from higher gold sales and lower unit costs in 2014.

Adjusted Net Earnings of $7.9 Million in Q3/14 and $26.7 Million in 9M/14

Starting in the first quarter of 2014, the Company began reporting adjusted net earnings (see the Non-GAAP Measures section on page 21 of this MD&A for a full definition). Adjusted net earnings in Q3/14 totaled $7.9 million compared to adjusted net earnings of $1.0 million recorded in Q3/13. Adjusted net earnings in 9M/14 totaled $26.7 million versus adjusted net losses of $5.9 million in 9M/13.

REVIEW OF OPERATIONS

Processing

The Company’s central mill, located at the Bell Creek Complex, is a conventional gold mill circuit, involving crushing and grinding, gravity and leaching, followed by carbon-in-leach and carbon-in-pulp processes for gold recovery. The milling facility is located approximately 20 kilometres east of the City of Timmins. The mill, which processes ore from both the Timmins West and Bell Creek mines, has consistently achieved metallurgical recoveries exceeding 95%. In Q3/13, the second phase of an expansion was completed which increased the mill’s processing rate from approximately 2,500 tonnes per day to over 3,000 tonnes per day.

9

In Q3/14, a total of 320,800 tonnes (approximately 3,490 tonnes per day) of ore was processed at the Bell Creek Mill, an increase of 59% from Q3/13 reflecting higher capacity levels following completion of the Company’s mill expansion in Q3/13, as well as the impact of downtime during mill commissioning during Q3/13. A total of 45,600 ounces were recovered in Q3/14 at an average grade of 4.6 grams per tonne with recoveries averaging 96.7%. These results compare to 202,300 tonnes (approximately 2,200 tonnes per day) at an average grade of 4.7 grams per tonne and recoveries of 95.2% for 28,900 recovered ounces in Q3/13. The Company poured 44,900 ounces of gold in Q3/14, a 73% increase from the 25,900 ounces poured in Q3/13.

During 9M/14, the Company processed 914,400 tonnes (approximately 3,350 tonnes per day) of ore at an average grade of 5.0 grams per tonne and average recoveries of 96.6% for a total of 142,500 recovered ounces. 9M/14 production compared to 630,900 tonnes (approximately 2,310 tonnes per day) at an average grade of 4.3 grams per tonne and recoveries of 95.5% for 82,900 ounces recovered for the same period in 2013.

Timmins West Mine

The Timmins West Mine is an underground mine located approximately 18 kilometres west of Timmins, Ontario at the junction of highways 101 and 144. The current mine represents the combination, on January 1, 2012, of the Timmins Deposit and the adjacent Thunder Creek Deposit into a single fully integrated mining operation. The Company produces ore at Timmins West Mine using a 710 metre, 5.5 metre diameter shaft, with a 6,000 tonne per day total hoisting capacity. The ore is accessed using mobile equipment via internal ramps both from surface and the main shaft. Primary mining methods include longitudinal and transverse longhole mining. Broken ore is removed from the stopes using remote controlled Load-Haul-Dump Loaders (“LHDs”), loaded onto trucks and hauled to the main shaft rockbreaker station prior to skipping to surface.

A total of 35,000 ounces of gold was produced at Timmins West Mine in Q3/14 from processing 254,800 tonnes at an average grade of 4.4 grams per tonne. Production for the quarter was 55% higher than the 22,600 ounces (148,400 tonnes at an average grade of 4.9 grams per tonne) produced in Q3/13, with the increase due to greater throughput. Production during Q3/14 came largely from stopes in the Rusk and Porphyry zones between the 625 and 660 levels at Thunder Creek and in the Ultramafic (‘UM”) zone between the 730 and 850 levels at Timmins Deposit.

For the first nine months of 2014, a total of 111,000 ounces of gold was produced at Timmins West Mine from processing 719,400 tonnes at an average grade of 4.9 grams per tonne. 9M/14 production was almost 69% higher than the 65,500 ounces produced during 9M/13 (487,700 tonnes at an average grade of 4.3 grams per tonne). Higher throughput, process improvements and the favourable impact of mine sequencing on average grades mainly accounted for the increase in production compared to 9M/13.

During Q3/14, the Company invested $8.1 million at the Timmins West Mine ($23.2 million in 9M/14), mainly related to investments in mine development and equipment and including $0.9 million for in-mine, definition drilling and $1.0 million for exploration drilling and development in support of exploration. The Company completed 1,225 metres of capital development in Q3/14, mainly focused on continued ramp development and level development in both Timmins Mine and Thunder Creek. During the quarter, the ramp at Timmins Deposit was extended to below the 910 Level. The ramp at Thunder Creek was driven upward from the 555 Level to the 520 Level. In

10

addition to all other associated infrastructure development, a portion of the capital development included an exploration drift on the 910 level at Timmins Deposit.

A total of 15,945 metres of in-mine, definition drilling was completed in Q3/14. Drilling during the quarter was focused on the Ultramafic and Footwall zones between the 850 and 1,120 levels at the Timmins Deposit. At Thunder Creek, drilling was continued from the 765 Level testing between the 765 and the 890 levels.

Drilling also continued on an exploration program initiated in January 2014 focused on targets outside the Mine’s existing resources. The program includes approximately 20,000 metres of drilling, and 167 metres of development focused on exploring high-potential areas along strike and down dip of current zones at the Timmins Deposit as well as areas along the sediment/ultramafic contact between the Timmins Deposit and Thunder Creek. Progress during Q3/14 included continuation of drilling from a new exploration drift developed on the east side of the 790 level to test a potential new fold nose structure east of the Timmins Deposit. Additional exploration holes were initiated targeting the downplunge projection of the Main Zone mineralization just west of the Ramp from the 790m Level drill drift. Drilling was also started from the 710mL and continued on the 765 Level at Thunder Creek with the programs aimed at extending the Porphyry Zone mineralization below the 780 Level and to the west and exploration up to 350 metres west of the Thunder Creek Deposit testing the volcanic-sediment contact. A total of 9,140 metres of exploration drilling was completed at Timmins West Mine during Q3/14 (16,159 metres in 9M/14).

Subsequent to the end of Q3/14, the Company announced that it had intersected high-grade mineralization in both the north and south limbs of the S2 Fold Nose at Timmins Deposit. Key intercepts in the north limb included 12.32 grams per tonne over 9.3 metres (including 27.70 grams per tonne over 3.3 metres), 5.57 grams per tonne over 11.6 metres and 11.72 grams per tonne over 9.7 metres. Results from the south limb included 12.85 grams per tonne over 5.4 metres and 23.7 metres over 5.0 metres. The S2 Fold nose in a high-potential exploration target with similar characteristics to the main fold nose structure at Timmins Deposit. Entering the fourth quarter, additional drilling was planned for the purpose of establishing continuity of the zones in both limbs.

Bell Creek Mine

The Bell Creek Mine is an underground mine located approximately 20 kilometres northeast of Timmins, Ontario. Ore at Bell Creek is trucked to surface using a five metre wide by five metre high ramp. Longitudinal longhole stoping is the primary mining method. Broken ore is removed from the stope using remote controlled LHDs, and trucked to surface.

During Q3/14, 10,600 ounces of gold was produced from Bell Creek Mine (66,000 tonnes at an average grade of 5.2 grams per tonne), which compared to production of 6,300 ounces (54,000 tonnes at an average grade of 3.9 grams per tonne) in Q3/13. Production in Q3/14 was primarily in the North A, Hanging Wall and North B3 zones between the 300 Level and 745 Level. Increased tonnage in Q3/14 compared to the same quarter in 2013 reflected an increase in the mining rate given a widening of the orebody at depth. The 33% improvement in average grade resulted from mine sequencing and process improvements.

Production in 9M/14 totaled 31,500 ounces of gold (195,000 tonnes at an average grade of 5.3 grams per tonne), an 81% increase from 17,400 ounces (143,200 tonnes at an average grade of

11

4.0 grams per tonne) produced in 9M/13. Higher throughput levels and increased average grades accounted for the strong growth compared to 9M/13.

In Q3/14, the Company invested $3.5 million ($10.2 million in 9M/14) at the Bell Creek Mine mainly for mine development, equipment and exploration drilling. The Company completed 552 metres of capital development during Q3/14, primarily related to ramp development from the 760 Level to the 775 Level, lateral level development from the 120 Level to the 760 Level, as well as escapeway and ventilation raise development. In addition, development for an exploration drift (for drilling at depth) on the 610 Level was completed during the quarter. A total of 1,271 metres of in-mine definition drilling was completed at the Bell Creek Mine during Q3/14 (10,903 metres in 9M/14) in support of ongoing mining operations.

Exploration drilling programs, totaling 22,000 metres ($2.1 million), are being completed at Bell Creek during 2014. In January 2014, a 4,000 metre exploration program was initiated targeting high-potential areas near existing resources. To the end of Q3/14, 3,831 metres of drilling had been completed testing the Bell Creek vein structures between the 775 Level (the bottom of the existing reserve) and 925 Level.

In July, the Company approved an additional program for 18,000 metres of drilling and 54 metres of development for drill drift platforms. The program is being completed as part of a program to infill and expand resources and increase reserves. The key focus of the program is on the area below the 775 level, which is the current lower limit for reserves, and the 1050 level. The drilling is being completed as part of a pre-feasibility study to evaluate deepening the mine, including re-activation of the Bell Creek shaft and extension of the existing ramp to depth. The study is planned for completion in early 2015. As of the end of Q3/14 12,291 metres of drilling from the total program have been completed.

On September 25, 2014, the Company announced the results of 65 holes (13,900 metres) of drilling, including the identification of new zones of high-grade mineralization in untested gaps between the 775 and 925 levels and the confirmation of high-grade mineralization extending to depth below the 925 Level. The results highlighted the significant potential that exists at Bell Creek to increase grades, grow the resource base and expand reserves and mine life through greater resource conversion.

144

During Q3/14, the Company commenced a new $1.6 million, 10,000 metre, drill program at the 144, located directly southwest of Thunder Creek, and completed 1,749 metres in the program. On October 6, 2014, the Company announced that the first hole (HWY-14-48) from the program had intersected 5.37 grams per tonne over 46.0 metres, including 21.87 grams per tonne over 6.0 metres and 12.54 grams per tonne over 4.4 metres. The intersections confirm the presence of wide, high-grade gold mineralization within 770 metres of Thunder Creek. The Company plans to complete the program during the fourth quarter of 2014.

FINANCIAL REVIEW

The table that follows highlights the results of operations for the three and nine months ended September 30, 2014 and 2013:

12

| | Three months ended September 30, | | Nine months ended September 30, | |

(in $’000, except the per share amounts) | | 2014 | | 2013 | | 2014 | | 2013 | |

Revenue | | $ | 63,514 | | $ | 44,301 | | $ | 200,064 | | $ | 126,833 | |

Cash operating costs | | (29,455 | ) | (23,455 | ) | (91,330 | ) | (75,261 | ) |

Cash earnings from operations | | 34,059 | | 20,846 | | 108,734 | | 51,572 | |

Depreciation and depletion | | (17,816 | ) | (13,319 | ) | (55,614 | ) | (38,083 | ) |

Share based payments in production costs | | (99 | ) | 27 | | (295 | ) | (278 | ) |

Earnings from mine operations | | 16,144 | | 7,554 | | 52,825 | | 13,211 | |

Expenses* | | | | | | | | | |

General and administrative | | (2,506 | ) | (2,364 | ) | (8,587 | ) | (7,316 | ) |

Exploration | | (404 | ) | (239 | ) | (851 | ) | (1,013 | ) |

Share-based payments in expenses | | (775 | ) | (459 | ) | (2,380 | ) | (1,395 | ) |

| | 12,459 | | 4,492 | | 41,007 | | 3,487 | |

Other income (loss), net | | 126 | | (1,685 | ) | (409 | ) | 6,963 | |

Share of loss of investments in associates | | (172 | ) | (411 | ) | (554 | ) | (962 | ) |

Write down of investment in associates | | — | | (619 | ) | — | | (3,572 | ) |

Earnings before finance items | | 12,413 | | 1,777 | | 40,044 | | 5,916 | |

Finance expense, net | | (4,524 | ) | (3,495 | ) | (14,328 | ) | (9,390 | ) |

Earnings (loss) before taxes | | 7,889 | | (1,718 | ) | 25,716 | | (3,474 | ) |

Loss from discontinued operations | | — | | — | | — | | (4,302 | ) |

Net earnings (loss) | | $ | 7,889 | | $ | (1,718 | ) | 25,716 | | $ | (7,776 | ) |

Basic and diluted income (loss) per share | | | | | | | | | |

Income (loss) per share from continuing operations | | $ | 0.02 | | $ | 0.00 | | $ | 0.06 | | $ | (0.01 | ) |

Income (loss) per share | | $ | 0.02 | | $ | 0.00 | | $ | 0.06 | | $ | (0.02 | ) |

*General and administrative and exploration expenses differ from the balances on the consolidated statements of comprehensive income (loss) by the share based payments in expenses of $775 and $2,381 respectively for the three and nine months ended September 30, 2014 ($459 and $1,395, respectively, for the same periods in 2013).

Summary

Cash earnings from mine operations of $34.1 million in the third quarter of 2014 were $13.2 million or 63% higher than the same period in 2013 due to higher gold sales and lower unit operating costs. The average realized gold price in the third quarter of 2014 was $1,397 per ounce, 2% higher than in the same period in 2013.

The Company reported net earnings of $7.9 million, or $0.02 per common share, in the third quarter of 2014 compared to a net loss of $1.7 million in the same period of 2013, reflecting higher gold sales and revenues, improved unit costs as well as lower depletion and depreciation per ounce compared to last year’s third quarter.

Cash earnings from mine operations of $108.7 million in the first nine months of 2014 were $57.2 million, or more than double than in the same period in 2013 due to higher gold sales and lower unit operating costs which more than offset the impact of a 4% reduction in the average realized Canadian gold price.

The Company reported net earnings of $25.7 million, or $0.06 per common share, in the first nine months of 2014 compared to a net loss of $7.8 million in the same period of 2013. The net loss in the first nine months of 2013 includes the impact of a loss from discontinued operations of $4.3 million (refer below). Excluding the loss from discontinued operations, the Company’s net loss in the first nine months of 2013 was $3.5 million. Higher gold sales, improved unit costs as well as lower depletion and depreciation costs per ounce more than offset the impact of a reduction in the

13

average gold price in accounting for the improved earnings performance compared to last year’s third quarter.

Discontinued operations

On January 30, 2013 the Company and Revolution Resources Corp., subsequently renamed IDM Mining Ltd. (“IDM”) entered into an agreement for the sale of the Company’s Mexico subsidiary (which held 100% of the Company’s Mexico property portfolio) to IDM for shares of IDM and other consideration.

The transaction closed on May 8, 2013 (“closing date”) at which time the Company received 20 million common shares of IDM. For the three and nine months ended September 30, 2013, the Company recorded a loss of $Nil and $4.3 million, respectively, on the discontinued operations.

At the closing date the Company’s interest in IDM increased to 22.5% (from approximately 7% before the transaction) and IDM became an associate of Lake Shore Gold. As such, from May 8, 2013 to June 13, 2014 (refer to discussion on “Other income (loss), net” further down on this MDA), the Company accounted for its interest in IDM under the equity method of accounting.

Prior to the closing date, the Company’s investment in IDM was considered available for sale and marked to market at each period end with changes in value accumulated in other comprehensive income (loss) as part of investment revaluation reserve. The Company recorded a loss of $1.7 million on the transaction (deemed disposition of the available for sale investment in IDM).

Revenue

| | Three months ended September 30, | | Nine months ended September 30, | |

| | 2014 | | 2013 | | 2014 | | 2013 | |

Revenues | | | | | | | | | |

Gold sales (ounces) | | 45,500 | | 32,300 | | 142,000 | | 86,000 | |

Realized gold price ($/ounce) | | $ | 1,397 | | $ | 1,372 | | $ | 1,410 | | $ | 1,476 | |

Revenues ($’000) | | $ | 63,514 | | $ | 44,301 | | $ | 200,064 | | $ | 126,833 | |

Revenues for the three months ended September 30, 2014 are 43% higher than in the same period in 2013, reflecting higher gold sales and an increase in the average realized gold price. Revenues for the nine months ended September 30, 2014 are 58% higher than in the same period in 2013 reflecting higher gold sales, which more than offset a lower average realized gold price.

Cash operating costs

Cash operating costs in the third quarter of 2014 totaled $29.5 million, which represented US$594 per ounce sold compared to cash operating costs of $23.5 million or US$701 per ounce in the third quarter of 2013. Cash operating costs in the first nine months of 2014 totaled $91.3 million, which represented US$588 per ounce sold compared to cash operating costs of $75.3 million or US$856 per ounce in the first nine months of 2013.

The higher cash operating costs in the third quarter and first nine months of 2014 compared to the same periods in 2013 reflected increased production volumes. Lower per unit costs in the third quarter and first nine months of 2014 compared to the same periods in 2013 reflect increased grades for the nine months of 2014, the benefit of completed infrastructure, as well as

14

the impact of a number of cost control measures introduced since the end of the first quarter of 2013 in response to lower gold prices.

Depreciation and depletion

Depreciation and depletion in the third quarter and first nine months of 2014 of $17.8 million and $55.6 million, respectively, increased by $4.5 million and $17.5 million from the same periods in 2013, reflecting increased production volumes and sales. On a per ounce sold basis, depletion and depreciation were $392 for both the third quarter and first nine months of 2014, or 5% and 12% lower, respectively, than the same periods in 2013.

The reduction in per unit depletion and depreciation costs from 2013 was mainly due to the lower carrying value of mining interests in 2014 after the impairment charge recorded at the end of 2013.

Share-based payments in production costs

Share-based payments in production costs of $0.1 million and $0.3 million in the third quarter and first nine months of 2014 were comparable to the same periods in 2013.

Other income (loss) and expenses

General and administrative expenses (net of share based payment expense discussed below) for the three and nine months ended September 30, 2014 of $2.5 million and $8.6 million, respectively, increased by $0.1 million and $1.3 million, from the same periods in 2013. The increase is due to expenditures for management restructuring and timing of certain accruals.

Exploration expenses (net of share based payment expense discussed below) of $0.4 million for the three months ended September 30, 2014 are $0.2 million higher than in the same periods in 2013 as the Company started drilling on the 144 in the third quarter of 2014. Exploration expenses of $0.9 million for the nine months ended September 30, 2014 are $0.2 million lower than in the same period in 2013 reflecting lower levels of green field exploration drilling during the first six months of 2014 compared to the same period in 2013.

Share based payments in expenses for the three and nine months ended September 30, 2014 were $0.8 million and $2.4 million, respectively, or $0.3 million and $1.0 million higher than in the same periods in 2013 mainly due to a larger number of performance share units and deferred share units vesting in 2014 as well as a higher market price for the Company’s common shares at September 30, 2014 compared to September 30, 2013.

Other income (loss), net, for the three and nine months ended September 30, 2014 and 2013 is as follows (in $’000s):

15

| | Three months ended September 30, | | Nine months ended September 30, | |

| | 2014 | | 2013 | | 2014 | | 2013 | |

Unrealized and realized gain on embedded derivatives | | $ | 1,985 | | $ | (2,175 | ) | $ | 3,774 | | $ | 8,416 | |

Unrealized and realized foreign exchange (loss) gain, net | | (1,960 | ) | 490 | | (4,358 | ) | 66 | |

Gain on deemed disposition of investments in associates | | — | | — | | 1,038 | | — | |

Write down of unamortized transaction costs on loan prepayment | | — | | — | | (964 | ) | — | |

Amortization of deferred premium on flow through shares | | 101 | | — | | 101 | | — | |

Loss on deemed disposition of available for sale investment | | — | | — | | — | | (1,681 | ) |

Gain on disposal of mining interest | | — | | — | | — | | 200 | |

Unrealized loss on warrants | | — | | — | | — | | (38 | ) |

Other income (loss), net | | $ | 126 | | $ | (1,685 | ) | $ | (409 | ) | $ | 6,963 | |

The unrealized and realized gain on embedded derivatives of $2.0 million and $3.8 million, respectively for the three and nine months ended September 30, 2014 (unrealized and realized loss of $2.2 million and gain of $8.4 million for the same periods in 2013) represents the gain (loss) from the mark to market of the embedded derivatives on the Sprott gold loan as a result of movements in gold prices. The change in the realized and unrealized gain reflects decreased gold prices from 2013 as well as fewer payments remaining on the Sprott gold loan at September 30, 2014 compared to September 30, 2013.

Unrealized and realized foreign exchange loss of $2.0 million and $4.4 million, respectively for the three and nine months ended September 30, 2014 ($0.5 million and $0.1 million gain for the same periods in 2013) includes unrealized losses from the mark to market of the embedded derivative on the Sprott Gold Loan and reflects movements in the C$/US$ exchange rate during the periods.

On June 13, 2014 the Company’s interest in IDM was diluted to 11.6% (from 22.5%) reflecting Lake Shore Gold’s decision not to participate in a financing by IDM. Effective June 13, 2014 (the “change date”), the investment in IDM was transferred to available for sale investments since IDM is no longer considered an associate of the Company. The Company recorded a gain of $1.0 million on the change date, representing the difference between the Company’s carrying value of the investment in IDM and the market value of the available for sale investment in IDM on June 13, 2014.

On June 4, 2014, the Company repaid $10.0 million of its standby line of credit with Sprott and wrote down $1.0 million from unamortized transaction costs.

Loss on deemed disposition of available for sale investment is discussed above under “Discontinued Operations” and relates to the transaction with IDM which closed in May 8, 2013.

Gain on disposal of mining interest represents the gain from the sale of a non-core exploration property for $0.2 million in the third quarter of 2013.

Share of loss of investments in associates of $0.2 million and $0.6 million, respectively for the three and nine months ended September 30, 2014 decreased by $0.2 million and $0.4 million compared to the same periods in 2013 and represents the Company’s proportionate share of the losses relating to its equity investments for the periods.

16

Write down of investments in associates in 2013 of $3.6 million reflects the write down of certain investments in associates to their fair value, as the decline in value was considered significant or prolonged.

Finance expense, net, for the three and nine months ended September 30, 2014 of $4.5 million and $14.3 million, respectively, is $1.1 million and $4.9 million higher than in the same periods in 2013, primarily due to the capitalizing of a portion of the borrowing costs in 2013 ($1.8 million and $6.2 million capitalized, respectively, for the three and nine months ended September 30, 2013). There were no borrowing costs capitalized on mining interests in 2014 since the Bell Creek Mill expansion was finalized in the third quarter of 2013.

SUMMARY OF QUARTERLY RESULTS

The following selected financial data has been prepared in accordance with IFRS and should be read in conjunction with the Company’s interim consolidated financial statements ($000’s, other than “per share” amounts):

Fiscal quarter ended | | September 30, 2014 | | June 30, 2014 | | March 31, 2014 | | December 31, 2013 | |

Revenue | | $ | 63,514 | | $ | 75,091 | | $ | 61,459 | | $ | 65,814 | |

Earnings (loss) from mine operations | | $ | 16,144 | | $ | 22,284 | | $ | 14,397 | | $ | (213,260 | ) |

Finance expense, net | | $ | (4,524 | ) | $ | (4,865 | ) | $ | (4,939 | ) | $ | (5,286 | ) |

Net earnings (loss) | | $ | 7,889 | | $ | 13,133 | | $ | 4,695 | | $ | (225,693 | ) |

Net income (loss) per share* basic and diluted | | $ | 0.02 | | $ | 0.03 | | $ | 0.01 | | $ | (0.54 | ) |

| | | | | | | | | |

Fiscal quarter ended | | September 30, 2013 | | June 30, 2013 | | March 31, 2013 | | December 31, 2012 | |

Revenue | | $ | 44,301 | | $ | 39,675 | | $ | 42,857 | | $ | 33,976 | |

Earnings (loss) from mine operations | | $ | 7,554 | | $ | 1,797 | | $ | 3,860 | | $ | (227,694 | ) |

Finance (expense) income, net | | $ | (3,495 | ) | $ | (2,794 | ) | $ | (3,101 | ) | $ | (2,778 | ) |

Net loss | | $ | (1,718 | ) | $ | (5,446 | ) | $ | (612 | ) | $ | (302,226 | ) |

Loss from discontinued operations | | $ | — | | $ | (4,302 | ) | $ | — | | $ | (71,500 | ) |

Net loss per share* - basic and diluted | | | | | | | | | |

From continuing and discontinued operations | | $ | (0.00 | ) | $ | (0.01 | ) | $ | (0.00 | ) | $ | (0.73 | ) |

From discontinued operations | | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.17 | ) |

* Net income (loss) per share is calculated based on the weighted average number of shares outstanding for the quarter

The loss from mine operations in the fourth quarters of 2013 and 2012 includes impairment charges related to the Timmins West Mine cash generating unit of $225.0 million and $231.0 million, respectively. Excluding the impairment charges, earnings from mine operations in the fourth quarters of 2013 and 2012 totaled $11.7 million and $3.3 million, respectively. Absent the impairment charges, the increase in earnings from mine operations in the fourth quarter of 2013 compared to the previous quarter is due to higher gold sales and lower production costs, partially offset by lower gold price realized.

FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES

As at September 30, 2014 the Company’s cash and bullion was $67.3 million, an increase of $33.3 million from December 31, 2013. In the third quarter and first nine months of 2014, the Company generated cash from operating activities of $28.4 million and $90.1 million, respectively, which compares to $12.5 million and $36.4 million, respectively, for the same periods in 2013. The increases in both periods largely reflected higher cash earnings from mine operations, resulting from greater sales volumes and lower unit costs.

17

Receivables and prepaids at September 30, 2014 of $3.0 million are $0.6 million lower than balances at December 31, 2013 ($3.6 million), with the decrease mainly due to lower HST receivable. Accounts payable and accrued liabilities of $23.3 million at September 30, 2014 are higher than the balance at December 31, 2013 ($21.6 million) primarily due to the timing of payments.

Net cash used in investing activities of $41.0 million for the nine months ended September 30, 2014 is $46.5 million lower than in the same period in 2013. The reduction in expenditures reflected the completion of the Company’s mill expansion during the third quarter of 2013 and reduced requirements for mine development in 2014 compared to the prior year.

On May 13, 2014, the Company raised gross proceeds of $5.0 million through the issuance of 5,300,000 flow-through common shares under a private placement at $0.95 per flow-through share. The Company has until December 31, 2015 to spend the flow-through funds raised on eligible Canadian exploration expenditures (“CEE”). To September 31, 2014, the Company has spent $0.7 million on CEE.

On June 14, 2012, the Company signed a financing agreement with Sprott Resource Lending Partnership (“Sprott”) for a credit facility totaling up to $70.0 million, secured by the material assets of the Company. The Facility involves two components, a $35.0 million gold loan and a standby line of credit for an additional $35.0 million. The transaction closed on July 16, 2012, at which time the Company received $35.0 million for the gold loan. The standby line of $35.0 million was drawn down on February 1, 2013.

On December 12, 2013, the Company entered into a modification agreement (the “Modification Agreement”) with Sprott whereby the Company agreed to repay the balance of the standby line through 18 equal monthly payments starting on June 30, 2015 with the final payment due on November 30, 2016. Previously, the standby line was due in full on January 1, 2015. The Company repaid $5.0 million of the standby line in December 2013 and $10.0 million in June 2014.

The gold loan is being repaid through 29 monthly cash payments, which started January 31, 2013, based on 947 ounces of gold each month multiplied by the Bloomberg gold closing price on the date prior to payment. The Company paid $3.9 million in the third quarter of 2014 related to the gold loan of which $3.7 million was in respect of principal repayments. To September 30, 2014, the Company had made payments totaling $25.6 million related to the gold loan (principal and interest), with eight monthly payments remaining as of that date. The final payment on the gold loan will be made on May 30, 2015.

The Sprott debt facility has certain financial covenants discussed in note 19 of the consolidated financial statements of the Company for the years ended December 31, 2013 and 2012, which must be maintained on an ongoing basis. The Company was in compliance with all debt covenants throughout the nine months ended September 30, 2014 and the year ended December 31, 2013.

Based on current cash and cash equivalents and anticipated cash flows from operations, the Company expects to have adequate funding to finance its operating and investment plans and meet all contractual obligations over the next 12 months.

18

OUTSTANDING SHARE CAPITAL

As at October 29, 2014 there were 422,523,224 common shares issued and outstanding and the following options:

Number of Options Outstanding | | Exercise Price Range | |

10,812,566 | | $0.37-$0.99 | |

1,971,000 | | $1.00-$1.99 | |

30,000 | | $2.00-$2.99 | |

6,081,000 | | $3.00-$3.99 | |

1,791,000 | | $4.00-$4.13 | |

20,685,566 | | | |

NON-GAAP MEASURES

The Company has included in this MD&A certain Non-GAAP (Generally Accepted Accounting Principles) performance measures as detailed below. In the gold mining industry, these are common performance measures but do not have any standardized meaning, and are considered Non-GAAP measures. The Company believes that, in addition to conventional measures prepared in accordance with GAAP, certain investors use such Non-GAAP measures to evaluate the Company’s performance and ability to generate cash flow. Accordingly, they are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

Cash Operating Costs and Cash Operating Cost Per Gold Ounce

Cash operating costs and cash operating cost per ounce are Non-GAAP measures. In the gold mining industry, cash operating costs and cash operating cost per ounce are common performance measures but do not have any standardized meaning.

Cash operating costs are derived from amounts included in the Consolidated Statements of Comprehensive Income (Loss) and include mine site operating costs such as mining, processing and administration as well as royalty expenses, but exclude depreciation, depletion and share-based payment expenses and reclamation costs. Cash operating cost per ounce is based on ounces sold and is calculated by dividing cash operating costs by commercial gold ounces sold; US$ cash operating cost per ounce sold is derived from the cash operating costs per ounce sold translated using the average Bank of Canada C$/US$ exchange rate.

The Company discloses cash operating costs and cash operating cost per ounce as it believes the measures provide valuable assistance to investors and analysts in evaluating the Company’s operational performance and ability to generate cash flow. The most directly comparable measure prepared in accordance with GAAP is total production costs. Cash operating costs and cash operating cost per ounce of gold sold should not be considered in isolation or as a substitute for measures prepared in accordance with GAAP.

Cash operating costs are reconciled to the amounts included in the Consolidated Statements of Comprehensive Income (Loss) as follows (all dollar amounts, other than per ounce, in 000’s):

19

| | Three months ended September 30, | | Nine months ended September 30, | |

| | 2014 | | 2013 | | 2014 | | 2013 | |

Production costs ($’000) | | $ | 29,554 | | $ | 23,428 | | $ | 91,625 | | $ | 75,539 | |

Less share based payments ($’000) | | (99 | ) | 27 | | (295 | ) | (278 | ) |

Cash operating costs ($’000) | | $ | 29,455 | | $ | 23,455 | | $ | 91,330 | | $ | 75,261 | |

Gold sales (ounces) | | 45,500 | | 32,300 | | 142,000 | | 86,000 | |

Cash operating cost per ounce of gold ($/ounce) | | $ | 647 | | $ | 726 | | $ | 643 | | $ | 875 | |

Cash operating cost per ounce of gold (US$/ounce) | | $ | 594 | | $ | 701 | | $ | 588 | | $ | 856 | |

Cash Earnings from Mine Operations

Cash earnings from mine operations is a Non-GAAP measure and does not have any standardized meaning. The Company discloses cash earnings from mine operations as it believes this measure provides valuable assistance to investors and analysts in evaluating the Company’s ability to finance its ongoing business and capital activities. The most directly comparable measure prepared in accordance with GAAP is earnings from mine operations. Cash earnings from mine operations represent the earnings from mine operations prior to deducting non-cash expenses, and is calculated by adding depletion, depreciation and share based payments in production costs to earnings from mine operations.

Cash earnings from mine operations for the three and nine months ended September 30, 2014 and 2013 are shown below (in 000’s):

| | Three months ended September 30, | | Nine months ended September 30, | |

| | 2014 | | 2013 | | 2014 | | 2013 | |

Earnings from mine operations | | $ | 16,144 | | $ | 7,554 | | $ | 52,825 | | $ | 13,211 | |

Depletion and depreciation | | 17,816 | | 13,319 | | 55,614 | | 38,083 | |

Share based payments in production costs | | 99 | | (27 | ) | 295 | | 278 | |

Cash earnings from mine operations | | $ | 34,059 | | $ | 20,846 | | $ | 108,734 | | $ | 51,572 | |

All-In Sustaining Costs and All-In Sustaining Cost Per Ounce of Gold

All-in sustaining costs and all-in sustaining cost per ounce are Non-GAAP measures. These measures are intended to assist readers in evaluating the total costs of producing gold from current operations. While there is no standardized meaning across the industry for this measure, the Company’s definition conforms to the definition of all-in sustaining costs as set out by the World Gold Council in its guidance note dated June 27, 2013. The Company defines all-in sustaining costs as the sum of production costs, sustaining capital (capital required to maintain current operations at existing levels), corporate general and administrative expenses, in-mine exploration expenses and reclamation cost accretion related to current operations. All-in sustaining costs exclude growth capital, reclamation cost accretion not related to current operations, interest expense, debt repayment and taxes. The costs included in the calculation of all-in sustaining costs are divided by commercial gold ounces sold; US$ all-in sustaining costs per ounce sold are translated using the average Bank of Canada C$/US$ exchange rate.

All-in sustaining costs and all-in sustaining cost per ounce are reconciled to the amounts included in the Consolidated Statements of Comprehensive Income (Loss) as follows (all dollar amounts, other than per ounce, in 000’s):

20

| | Three months ended September 30, | | Nine months ended September 30, | |

| | 2014 | | 2013 | | 2014 | | 2013 | |

Production costs | | $ | 29,554 | | $ | 23,428 | | $ | 91,625 | | $ | 75,539 | |

General and administrative | | 3,281 | | 2,823 | | 10,967 | | 8,711 | |

Rehabilitation - accretion and amortization (operating sites) | | 96 | | 51 | | 132 | | 146 | |

In-mine definition drilling | | 979 | | 1,261 | | 3,269 | | 3,564 | |

Mine development expenditures | | 6,559 | | 6,276 | | 22,201 | | 24,917 | |

Sustaining capital expenditures | | 2,055 | | 548 | | 5,616 | | 2,030 | |

All-in sustaining costs | | $ | 42,524 | | $ | 34,387 | | $ | 133,810 | | $ | 114,907 | |

Gold sales (ounces) | | 45,500 | | 32,300 | | 142,000 | | 86,000 | |

All-in sustaining cost per ounce of gold ($/ounce) | | $ | 935 | | $ | 1,065 | | $ | 942 | | $ | 1,336 | |

All-in sustaining cost per ounce of gold (US$/ounce) | | $ | 858 | | $ | 1,027 | | $ | 861 | | $ | 1,307 | |

Adjusted Net Earnings

Adjusted net earnings excludes impairment charges, other income/losses (which includes gain/losses and other costs incurred for acquisition and disposal of mining interests, unrealized and non—cash realized gain/losses on financial instruments) as well as significant non-cash non-recurring items. The Company also excludes the net (earnings) losses from the Company’s investments in associates as well as write down/off of investments in associates. The Company excludes these items from net earnings (losses) to provide a measure which allows the Company and investors to evaluate the operating results of the core operations of the Company and its ability to generate operating cash flows to fund working capital requirements, future capital expenditures and service outstanding debt.

Adjusted net earnings are reconciled to the amounts included in the Consolidated Statements of Comprehensive Income (Loss) as follows (all dollar amounts, other than per share, in 000’s):

| | Three months ended September 30, | | Nine months ended September 30, | |

| | 2014 | | 2013 | | 2014 | | 2013 | |

Earnings (loss) from continuing operations | | $ | 7,889 | | $ | (1,718 | ) | $ | 25,716 | | $ | (3,474 | ) |

Share of loss of investments in associates | | 172 | | 411 | | 554 | | 962 | |

Write down of investments in associates | | — | | 619 | | — | | 3,572 | |

Other loss (income) | | (126 | ) | 1,685 | | 409 | | (6,963 | ) |

Adjusted net earnings (loss) | | $ | 7,935 | | $ | 997 | | $ | 26,679 | | $ | (5,903 | ) |

Weighted average number of shares outstanding (‘000) | | 422,342 | | 416,620 | | 419,367 | | 416,507 | |

Adjusted net earnings (loss) per share | | $ | 0.02 | | $ | 0.00 | | $ | 0.06 | | $ | (0.01 | ) |

ACCOUNTING POLICIES, STANDARDS AND JUDGMENTS

Changes in Accounting Policies

The Company has adopted the following new standards, along with any consequential amendments, effective January 1, 2014. These changes were made in accordance with the applicable transitional provisions.

IAS 32, Financial instruments: presentation

IAS 32, Financial instruments: presentation (“IAS 32”) was amended by the IASB in December 2011. The amendment clarifies that an entity has a legally enforceable right to offset financial assets and financial liabilities if that right is not contingent on a future event and it is enforceable both in the normal course of business and in the event of default, insolvency or bankruptcy of the entity and all counterparties. The amendment to IAS 32 is effective for annual periods beginning

21

on or after January 1, 2014. The amendment to the standard did not have any impact on the Company’s condensed consolidated interim financial statements.

IAS 36, Impairment of assets

IAS 36, Impairment of assets (“IAS 36”), was amended by the IASB in May 2013. The amendments require the disclosure of the recoverable amount of impaired assets when an impairment loss has been recognised or reversed during the period and additional disclosures about the measurement of the recoverable amount of impaired assets when the recoverable amount is based on fair value less costs of disposal, including the discount rate when a present value technique is used to measure the recoverable amount. The amendments to IAS 36 are effective for annual periods beginning on or after January 1, 2014. The amendments to the standard did not have any impact on the Company’s condensed consolidated interim financial statements.

IAS 39, Financial instruments: recognition and measurement

IAS 39, Financial instruments: recognition and measurement (“IAS 39”), was amended by the IASB in June 2013. The amendments clarify that novation of a hedging derivative to a clearing counterparty as a consequence of laws or regulations or the introduction of laws or regulations does not terminate hedge accounting. The amendments to IAS 39 are effective for annual periods beginning on or after January 1, 2014. The amendments to the standard did not have any impact on the Company’s condensed consolidated interim financial statements.

IFRIC 21, Levies

IFRIC 21, Levies (“IFRIC 21”) was issued in May 2013 and is an interpretation of IAS 37, Provisions, Contingent Liabilities and Contingent Assets. The interpretation clarifies the obligating event that gives rise to a liability to pay a levy. IFRIC 21 is effective for periods beginning on or after January 1, 2014. IFRIC 21 did not have a significant impact on the Company’s condensed consolidated interim financial statements.

Amendments to IFRS 2, Share-based Payments

In the second quarter of 2014, the IASB issued Amendments to IFRS 2, Share-based Payments. The amendments change the definitions of “vesting condition” and “market condition” in the Standard, and add definitions for “performance condition” and “service condition”. They also clarify that any failure to complete a specified service period, even due to the termination of an employee’s employment or a voluntary departure, would result in a failure to satisfy a service condition. This would result in the reversal, in the current period, of compensation expense previously recorded reflecting the fact that the employee failed to complete a specified service condition. These amendments are effective for transactions with a grant date on or after July 1, 2014. These amendments had no impact on the Company’s condensed consolidated financial statements.

Amendments to IFRS 3, Business Combinations (contingent consideration)

In the second quarter of 2014, the IASB issued Amendments to IFRS 3, Business Combinations. The amendments clarify the guidance in respect of the initial classification requirements and subsequent measurement of contingent consideration. This will result in the need to measure the contingent consideration at fair value at each reporting date, irrespective of whether it is a financial instrument or a non-financial asset or liability. Changes in fair value will need to be

22

recognized in profit and loss. These amendments are effective for transactions with acquisition dates on or after July 1, 2014. These amendments had no impact on the Company’s condensed consolidated financial statements.

Accounting Standards Issued but Not Yet Effective

IFRS 15, Revenue from Contracts and Customers

IFRS 15, Revenue from Contracts and Customers (“IFRS 15”) was issued by the IASB on May 28, 2014, and will replace IAS 18, Revenue, IAS 11, Construction Contracts, and related interpretations on revenue. IFRS 15 sets out the requirements for recognizing revenue that apply to all contracts with customers, except for contracts that are within the scope of the Standards on leases, insurance contracts and financial instruments. IFRS 15 uses a control based approach to recognize revenue which is a change from the risk and reward approach under the current standard. Companies can elect to use either a full or modified retrospective approach when adopting this standard and it is effective for annual periods beginning on or after January 1, 2017. The Company is currently evaluating the impact of IFRS 15 on its consolidated financial statements.

IFRS 9, Financial Instruments

IFRS 9, Financial Instruments (“IFRS 9”) was issued by the IASB on July 24, 2014, and will replace IAS 39, Financial Instruments: Recognition and Measurement. IFRS 9 uses a single approach to determine whether a financial asset is measured at amortized cost or fair value, replacing multiple rules in IAS 39. The approach in IFRS 9 is based on how an entity manages its financial instruments in the context of its business model and the contractual cash flow characteristics of the financial assets. Two measurement categories continue to exist to account for financial liabilities in IFRS 9; fair value through profit or loss (“FVTPL”) and amortized cost. Financial liabilities held-for-trading are measured at FVTPL, and all other financial liabilities are measured at amortized cost unless the fair value option is applied. The treatment of embedded derivatives under the new standard is consistent with IAS 39 and is applied to financial liabilities and non-derivative host contracts not within the scope of this standard. The effective date for this standard is for annual periods beginning on or after January 1, 2018. The Company is currently evaluating the impact of IFRS 9 on its consolidated financial statements.

Amendments to IAS 16, Property, Plant and Equipment, and IAS 38, Intangible Assets: Clarification of Acceptable Methods of Depreciation and Amortization

On May 12, 2014, the IASB issued Amendments to IAS 16, Property, Plant and Equipment, and IAS 38, Intangible Assets. In issuing the amendments, the IASB has clarified that the use of revenue-based methods to calculate the depreciation of a tangible asset is not appropriate because revenue generated by an activity that includes the use of a tangible asset generally reflects factors other than the consumption of the economic benefits embodied in the asset. The IASB has also clarified that revenue is generally presumed to be an inappropriate basis for measuring the consumption of the economic benefits embodied in an intangible asset. This presumption for an intangible asset, however, can be rebutted in certain limited circumstances. The standard is to be applied prospectively for fiscal years beginning on or after January 1, 2016, with early application permitted. The Company is currently evaluating the impact of these amendments on its consolidated financial statements.

Critical Accounting Judgments and Key Sources of Estimation Uncertainty

23

In the application of the Company’s accounting policies, which are described in note 3 to the consolidated financial statements for the years ended December 31, 2013 and 2012 (the “Annual Consolidated Financial Statements”), management is required to make judgments, estimates and assumptions about the carrying amount and classification of assets and liabilities that are not readily apparent from other sources. The estimates and associated assumptions are based on historical experience and other factors that are considered to be relevant. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimate is revised if the revisions affect only that period, or in the period of the revision and future periods, if the revision affects both current and future periods.

The following are the critical judgments and areas involving estimates, that management has made in the process of applying the Company’s accounting policies, and that have the most significant effect on the amount recognized in the consolidated financial statements.

Critical Judgments in Applying Accounting Policies

Commercial production - Operating levels intended by management

Prior to reaching operating levels intended by management, costs incurred are capitalized as part of costs of related mining properties and proceeds from sales are offset against costs capitalized. Depletion of capitalized costs for mining properties begins when operating levels intended by management have been reached. Management considers several factors in determining when a mining property has reached the operating levels intended by management.

Determination of functional currency