UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21515

TS&W / Claymore Tax-Advantaged Balanced Fund

(Exact name of registrant as specified in charter)

2455 Corporate West Drive

Lisle, IL 60532

(Address of principal executive offices) (Zip code)

Nicholas Dalmaso, Chief Legal and Executive Officer

TS&W / Claymore Tax-Advantaged Balanced Fund

2455 Corporate West Drive

Lisle, IL 60532

(Name and address of agent for service)

Registrant’s telephone number, including area code: (630) 505-3700

Date of fiscal year end: December 31

Date of reporting period: June 30, 2005

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Item 1. Reports to Stockholders.

The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

SemiAnnual

Report

June 30, 2005

TS&W/Claymore

TYW

Tax-Advantaged Balanced Fund

Thompson, Siegel & Walmsley, Inc.

Investment Counsel

www.tswclaymore.com

... home port for the LATEST,

most up-to-date INFORMATION about the

TS&W/Claymore Tax-Advantaged Balanced Fund

The shareholder report you are reading right now is just the beginning of the story. Online at tswclaymore.com, you will find:

| • | | Daily, weekly and monthly data on share prices, distributions and more |

| • | | Monthly portfolio overviews and performance analyses |

| • | | Announcements, press releases and special notices |

| • | | Fund and adviser contact information |

Thompson, Siegel & Walmsley, Inc. and Claymore are continually updating and expanding shareholder information services on the Fund’s website, in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more way we are working to keep you better informed about your investment in the Fund.

2 | SemiAnnual Report | June 30, 2005

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund

Dear Shareholder |

We thank you for your investment in TS&W/Claymore Tax-Advantaged Balanced Fund (TYW). We are pleased to submit the TYW semiannual shareholder report for the six-month period ended June 30, 2005.

As you may know, the Fund’s primary investment objective is to provide a high level of total after-tax return, including attractive tax-advantaged income. The Fund focuses its investments on securities that generate income that is either exempt from regular federal income tax or qualifies for federal income taxation at long-term capital gain rates (“tax-advantaged income”), while also offering the potential for capital appreciation through exposure to equity markets. The portfolio is comprised of municipal securities that are not preference items for purposes of the alternative minimum tax, equity and high-yield securities.

The Fund’s Investment Adviser is Claymore Advisors, LLC. Claymore Advisors is also the Investment Manager of the Fund’s municipal bond portfolio and is responsible for managing the Fund’s overall asset allocation. Thompson, Siegel & Walmsley Inc. (TS&W) serves as Investment Sub-Adviser to the Fund and is responsible for the day-to-day portfolio management of the Fund’s equity portfolio and other non-municipal income-producing securities. TS&W was founded in 1969 and provides investment management services to corporations, pension and profit-sharing plans, 401(k) and thrift plans, trusts, estates and other institutions and individuals. As of June 30, 2005,TS&W had approximately $5.7 billion in assets under management.

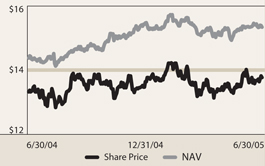

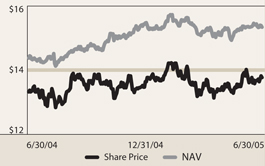

During the six-month period, the Fund generated a total return of 2.14% at net asset value (NAV). This represents a change in NAV from $15.47 at the start of the period to $15.33 on June 30, 2005 plus the reinvestment of the Fund’s quarterly dividends. The Fund’s market price exceeded these returns with a gain of 4.39%, which reflects a market price of $13.75 at the close of the period vs. $13.62 on December 31, 2004 plus the reinvestment of the Fund’s quarterly dividends.

We’d like to encourage shareholders to consider the opportunity to reinvest their dividends from the Fund through the Dividend Reinvestment Plan (DRIP) that is described in detail on page 22 of this report.

If shares should trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the quarterly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at NAV, subject to an IRS limitation that the purchase price can not be more than 5% below the market price per share. The DRIP provides a cost effective means to accumulate additional shares and enjoy the benefits of compounding returns over time.

To learn more about the Fund’s performance over this fiscal period, we encourage you to read the Portfolio Management Commentary section of the report on page 4. You’ll find information on what impacted the performance of the Fund during the fiscal period and the Investment Adviser’s and Sub-Adviser’s views on the overall market environment.

We appreciate your investment and look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at www.tswclaymore.com.

|

| Sincerely, |

|

|

Nicholas Dalmaso Chief Executive Officer,

TS&W/Claymore Tax-Advantaged Balanced Fund |

|

| August 8, 2005 |

SemiAnnual Report | June 30, 2005 | 3

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund

Questions & Answers

TS&W/Claymore Tax-Advantaged Balanced Fund (TYW) is managed jointly by seasoned investment professionals from both Claymore Advisors, LLC and Thompson, Siegel & Walmsley, Inc. The teams employ their specialized experience to different sleeves within the Fund, but work closely with one another to collectively guide the overall operations of TYW.

Vincent R. Giordano

Portfolio Manager, Senior Managing Director,

Claymore Advisors, LLC

Giordano leads Claymore’s municipal fixed-income investment management team and co-manages the Fund’s municipal portfolio. With more than 30 years of investment experience, Giordano joined Claymore in 2003. He holds a degree from Fordham University.

Roberto W. Roffo

Portfolio Manager, Managing Director,

Claymore Advisors, LLC

Roffo co-manages the municipal portfolio. He has more than 12 years of investment management experience focused in the municipal market. Roffo joined Claymore in 2004, and has worked closely with Giordano throughout his career. He holds a Bachelor’s Degree from the University of Massachusetts.

Paul A. Ferwerda, CFA

Portfolio Manager, Senior Vice President-Domestic Equity and Research, Thompson,

Siegel & Walmsley, Inc. (TS&W)

Ferwerda is responsible for the day-to-day management of the Fund’s common stock portfolio. He has been with TS&W for more than 18 years and has 23 years of overall investment experience. Ferwerda has extensive equity research experience within the financial sector and holds an MBA from Duke University.

William M. Bellamy, CFA

Portfolio Manager, Vice President,

Thompson, Siegel & Walmsley, Inc. (TS&W)

Bellamy joined TS&W in 2002. He has more than 16 years of investment industry experience focused on the fixed-income markets. Bellamy is responsible for managing the Fund’s taxable fixed-income securities. He holds an MBA from Duke University.

TS&W/Claymore Tax-Advantaged Balanced Fund is co-managed by Paul A. Ferwerda and William M. Bellamy of Thompson, Siegel & Walmsley, Inc. (TS&W) and Vincent Giordano and Roberto Roffo of Claymore Advisors, LLC. In the following interview, the teams share their thoughts on the market and discuss the factors that influenced performance of the Fund in the semiannual fiscal period ended June 30, 2005.

How did the Fund perform in the six-month period ended June 30, 2005?

We’re very pleased with the Fund’s performance. The Fund generated a total return of 2.14% at net asset value (“NAV”). This represents a change in NAV from $15.47 at the start of the period to $15.33 on June 30, 2005 plus the reinvestment of the Fund’s quarterly dividends. The Fund’s market price exceeded these returns with a gain of 4.39%, which reflects a market price of $13.75 at the close of the period vs. $13.62 on December 31, 2004, plus the reinvestment of the Fund’s quarterly dividends. We’re especially heartened by the rise in market price that occurred during a period when many closed-end funds suffered losses in market value. Of course, we, as managers, cannot control the market price.

For NAV performance comparison purposes, the municipal bond market, as measured by the Lehman Brothers U.S. Municipal Bond Index returned 2.91% for the six-month period ended June 30, 20051. The broad equity market, as measured by the Standard & Poor’s 500 Index (S&P 500), returned -0.81% for that same six-month period.2 The high yield bond market, as measured by the Merrill Lynch High Yield Master II Index, returned 1.14% over the semiannual period.3

The Fund continued to pay an attractive quarterly distribution of $0.234375 per share. The most recent dividend, declared on

August 1, 2005, after the close of this fiscal period will be paid on August 31, 2005 to Fund shareholders of record as of August 15, 2005 with an ex-dividend date of August 11, 2005. This represents a distribution rate of 6.60% based upon the closing market price of $14.20 on July 29, 2005. Given the tax characteristics of the 2004 calendar year, this rate represents a taxable-equivalent distribution rate of 8.83% for a shareholder in the 35% maximum federal income tax bracket. The final determination of the tax characteristics of dividends paid is performed after the end of each calendar year.

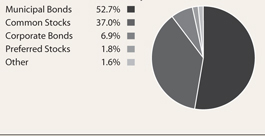

Please tell us about the Fund’s asset allocation.

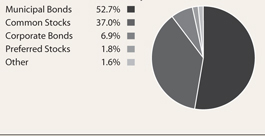

The Fund’s asset allocation remained in a tight range similar to where it was at the Fund’s inception on April, 28, 2004. On June 30, 2005, approximately 54% of the portfolio was invested in municipal securities, which provide, in many cases, income exempt from state and local taxes. About 37% was invested in equity securities which are focused on large-cap dividend-paying stocks. And just about 9% was invested in other taxable income-producing securities, which include high-yield bonds, real estate investment trusts, preferred stocks and other income-producing securities.

This asset allocation has worked well for the Fund and we expect to keep the allocation within a couple percent of this range. We believe this allocation is appropriate for today’s market environment. Of course, we monitor market trends and will adjust the allocation if we think it would be beneficial.

How does the Fund employ leverage?

TYW, like many closed-end funds, utilizes leverage as part of its investment strategy. The purpose of leverage is to fund the purchase of additional securities that provide increased income and potentially greater appreciation potential to shareholders than could be achieved from an unleveraged portfolio. In executing this

4 | SemiAnnual Report | June 30, 2005

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund | Questions & Answers continued

strategy, the Fund issued Auction Market Preferred Shares (“AMPS”). As long as the cost of the AMPS is lower than the yields on our investments, the AMPS should enhance the Fund’s net interest income.

Of course, leverage results in greater NAV volatility and entails more downside risk than an unleveraged portfolio. The use of leverage also makes the Fund more vulnerable to rising interest rates. Approximately 33% of the Fund was leveraged as of June 30, 2005.

Claymore Advisors, LLC manages the Fund’s municipal portfolio. The following questions are related to that portion of the portfolio and are answered by Portfolio Managers Vincent R. Giordano and Roberto W. Roffo.

Will you explain how you select municipal securities for the Fund?

We begin by analyzing broad macroeconomic trends and developments affecting the fixed-income markets. Our team analyzes the economic outlook, market conditions and perceived effects on interest rates and yield curves. From there we incorporate a bottom-up and top-down analysis that helps us construct a portfolio that we believe optimizes tax-exempt income while seeking to avoid undue credit risk and market timing risk. While we monitor interest rates very closely and act quickly to adjust the portfolio to changing market rates, we do not trade the portfolio in search of incremental gains that could be achieved by active trading based on daily changes in rates. Our proprietary, unbiased research helps us identify undervalued sectors that we believe have the potential for ratings upgrades and capital appreciation, however, there is no guarantee that such events will occur.

Which issues or sectors helped the municipal portfolio’s performance and why?

At the Fund’s inception, our analysis indicated that lower-rated health care credits and land-secured housing credits were the most attractive sectors based on yield spreads and potential total return. These sectors remain core areas of the portfolio and both outperformed the overall municipal market during this fiscal period.

Health care credits. The Fund owns a diversified portfolio of municipal health care bonds that represented four of the municipal portfolio’s top-10 holdings and 8.6% of total investments as of June 30, 2005. We initially purchased these securities because of their attractive prices, relatively high yields, and what we believed to be their strong upside potential. Since that time their credit-worthiness has increased substantially and with it their valuations. We continue to hold these securities because they have generated solid income for the portfolio and offer improving risk characteristics.

Land-secured housing credits. These bonds are issued by local municipalities and represent most of the portfolio’s high-yield or non-rated exposure. Many corporate land developers borrow money from local governments to help subsidize the construction of new single- or multi-family housing developments. Bonds from such transactions are called special tax allocation securities. That’s because the bonds are paid off by property taxes assessed on the new homes. At their inception, these securities have higher levels of risk because of the lag time between their issuance and when property taxes are generated. The only collateral for the bonds is the land upon which the homes are being built. We were fortunate enough to purchase issues that have done very well over the last year and in this fiscal period. While externally these credits remain non-rated, our internal ratings analysis suggests to us that their level of credit worthiness has improved as property taxes are now being paid. Like the health care credits, these bonds have generated attractive income and offer improving risk characteristics.

Which issues or sectors hurt performance and why?

We’re pleased to report that there were no fundamental concerns with any of our municipal securities and their related performance. The portfolio’s short-duration bonds, however, muted performance. While we held only a small position in these bonds – about 1.5% of total investments as of June 30 – they hindered performance in a period when longer-duration municipal bonds rallied. Duration is a measure of the interest rate sensitivity of a fixed-income investment or portfolio. Shorter-duration bonds typically underperform longer-duration bonds in a falling interest rate environment, which is what happened with long-term rates in the period. Most of our core holdings – the health care and housing credits we discussed earlier – have longer average durations. However, because of the market’s recent volatility, we believe it is prudent to keep some exposure to shorter-duration bonds to help moderate volatility in the portfolio.

The Fund’s equity portfolio and taxable fixed-income securities are managed by TS&W. The following questions are related to those portions of the portfolio and are answered by Portfolio Managers Paul A. Ferwerda and William M. Bellamy.

Will you provide an overview of the equity and high-yield bond market and discuss how market events impacted the structure of the portfolio?

Equity market overview: As mentioned previously, the broad market as measured by the S&P 500, returned -0.81% in the first half of 2005, with most of the decline taking place early in the year. Large value-style stocks, such as those in which the Fund invests, as measured by the Russell 1000® Value Index, returned 1.77% in the six-month period.4 Some of the disparity in performance of large-value stocks vs. the broad market is due to the relatively strong performance of dividend-paying stocks during the first calendar quarter. As the equity market declined, dividend-paying stocks such as those in which the Fund invests, held up better than the market. That’s because their dividend income can help cushion the impact of declines. The strongest performers this semiannual period were energy stocks that benefited from the high level of commodity prices and, in many cases, from their attractive dividend distributions. In the second calendar quarter the broad market began to rally,

SemiAnnual Report | June 30, 2005 | 5

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund | Questions & Answers continued

led by small-capitalization stocks, while large-cap dividend paying stocks underperformed. Strong gains by value stocks early in the period, however, outweighed any losses incurred in the latter part of the period.

High-yield market overview: High-yield bonds posted positive returns in the six-month period but were weaker than in the previous six-month period. The Merrill Lynch High Yield Master II Index returned 1.14% for the six-months ended June 30, 2005 versus a 9.38% return for the previous six-month period ended December 31, 2004. The relative weakness in the high-yield market was two-fold. First, 2004 was an extremely strong year for high-yield bonds and we saw a good deal of profit taking during the first half of 2005, which resulted in lower security prices. Second, credit ratings agencies downgraded some of auto-mobile giant General Motors’ (GM) most actively-traded bonds to junk status. GM battled for concessions from union employees to cover escalating employee health care and retirement costs as well as higher operational costs due to climbing steel and fuel prices. As a result of these events investors looked for less risky credits and we saw the higher-quality issues within the high yield market perform the best. This was helpful for the Fund as typically we focus our high-yield investments in the highest-quality issues within the sector.

It has been a couple years since U.S. federal tax legislation changed. Are dividend-paying stocks still attractive?

We believe dividend-paying stocks remain attractive. As you may know, the federal tax rate on stock dividends was cut dramatically with the passage of the Jobs and Growth Tax Relief Reconciliation Act of 2003. The federal stock dividend tax rate remains lower than the tax rate on income from taxable bonds, CDs and real estate investment trusts (REITs). As a result of this legislation and due to improving corporate profitability, many companies have increased their distribution rates or declared distributions for the first time. The trend has also appeared in industry sectors – such as technology – in which historically there have been few dividend-paying stocks.

The goal is for the common equity portfolio to generate a dividend yield of about two times that of the S&P 500. During this fiscal period the common stock portfolio yielded approximately 3.5% vs. 1.75% for the S&P 500 as of June 30, 2005. Of course we cannot guarantee this success in the future, but we believe that the pursuit of attractive qualified dividend income will be helped with more companies paying and/or increasing their dividends.

Will you provide a brief overview of your equity and high-yield selection processes?

Thompson, Siegel & Walmsley, Inc.’s investment process is value-driven and team-oriented. On the equity side, we have a proprietary quantitative valuation model that we apply to more than 400 stocks. This directs our review process toward companies that we believe have the highest expected return potential over a multi-year period. Our in-house research analysts are responsible for validating the model inputs for companies under their coverage and monitoring them over the holding period. Buys and sells are discussed at weekly research meetings or more frequently as needed. TS&W’s Fixed-Income team is responsible for overall bond market strategy as well as security selection. In-house analysts are used to support the credit review process.

Which areas of the common equity portfolio most helped performance?

The portfolio’s energy stocks were the clear winners this period. Both an overweight position in the sector relative to the S&P 500 and strong stock performance helped the portfolio. Some of the strongest performers were large integrated oil companies Marathon Oil, British Petroleum, Royal Dutch Shell and French oil company Total. (These issues represented 0.9%, 1.1%, 1.0% and 1.0% of the Fund’s total investments as of June 30.) Not only did these stocks offer attractive dividend yields, they also appreciated in value as commodity prices hovered close to historic highs.

While the portfolio’s financial stocks did not perform strongly as a group, the position in Allstate, a large property and casualty insurance company was the portfolio’s second strongest contributor to overall performance. (Allstate represented 0.8% of the Fund’s total investments as of June 30.) The company benefited from strong pricing in its personal lines of insurance and the successful implementation of new technology. This technology has enabled Allstate to better understand the risk characteristics of its clients and to adjust the pricing of its policies more appropriately, resulting in improved profitability. Allstate has also continued to increase its dividend and we have confidence in company management. Furthermore there have been positive trends in the insurance sector that we believe may continue.

Which areas of the portfolio most disappointed you?

As mentioned previously, the portfolio’s financial stocks, as a sector, held back performance. The financial sector is the largest in the equity portfolio at about 31.2% of equity assets as of June 30, 2005. By comparison, financial stocks represented 32.0% of the Russell 1000® Value Index and 20.2% of the S&P 500 as of June 30, 2005.

The performance in this sector was more of a surprise than a disappointment. There was an unusual shift in interest rates during the first half of 2005. Long-term interest rates declined (good for financial stocks) while short-term interest rates increased (bad for financial stocks). The result was a severe flattening of the yield curve which was primarily responsible for holding back the performance of financial stocks. This occurred despite a strong economy and good loan demand, especially in real estate. Companies in the financial sector, which normally pay above market dividend yields, have also been increasing their dividends faster than the average company.

6 | SemiAnnual Report | June 30, 2005

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund | Questions & Answers continued

The Fund held a large position in financials primarily because of the attractive dividends that these stocks pay. The portfolio is diversified among individual stocks throughout the sector. We also seek to reduce risk by investing in non-U.S. financial stocks, which oftentimes offer more attractive dividend yields and are not subject to the same market risks as U.S. companies.

National City Bank was one of the most disappointing stocks in the financial sector and the overall portfolio during the first half of 2005. (National City represented 1.0% of the Fund’s total investments as of June 30.) National City is an active mortgage originator and rising investor concern over the sustainability of their recent growth rate caused the stock to decline substantially during this period. We would note that over the past year National City’s dividend increased by 9.4% and as of June 30, 2005, it offered an above market dividend yield of 4.10%. National City’s dividend yield on June 30, 2005 was also higher than the 3.91% yield on the 10-year Treasury note. This dividend yield is more attractive than the 10-year bond when factoring in the tax advantage of qualified dividend income versus ordinary income.

Technology stocks, in general, were poor performers in the period. We’re pleased, however, that the technology holdings posted a positive return in such a dismal environment. The portfolio also benefited because it held a significant underweight in technology vs. both the S&P 500 and the Russell 1000® Value Index. Within our portfolio, we were most disappointed by the poor market performance of Microsoft. (Microsoft represented 0.5% of the Fund’s total investments as of June 30.) Microsoft is one of a small group of technology stocks that pay dividends. In late 2004, the company paid out a one-time special dividend, and boosted its regular payout. To date, Microsoft’s dividend policy has not led to a higher stock price.

How did the portfolio’s high-yield securities perform?

High-yield bonds represent the largest position within the 9% allocation to non-qualified dividend income-producing securities. As stated previously, the goal of owning these securities is to generate income that will pay for expenses generated by the Fund. When these securities also appreciate in value, we’re pleased. We focus our investments in the higher-quality segment of the high-yield market, where we believe the relative risks of default are lower. To help further reduce risk, we keep the portfolio diversified across industry sectors and individual securities.

| 1 | The Lehman Brothers U.S. Municipal Bond Index is an unmanaged index of approximately 1,100 investment-grade, tax-exempt bonds. Index returns include the reinvestment of all distributions. It is not possible to invest directly in an index. |

| 2 | The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad economy, representing all major industries. Index returns include the reinvestment of all distributions. It is not possible to invest directly in an index. |

| 3 | The Merrill Lynch High Yield Master II Index is an unmanaged index that measures the performance of nonconvertible, U.S. corporate bonds rated below Baa3 by Moody’s or below BBB by Standard & Poor’s ratings agencies. Index returns include the reinvestment of all distributions. It is not possible to invest directly in an index. |

| 4 | The Russell 1000 Value Index measures the performance of large companies with lower forecasted growth values than the overall market. Index returns include the reinvestment of all distributions. It is not possible to invest directly in an index. |

TYW Risks and Other Considerations

Under normal market conditions, the Fund will invest at least 50%, and may invest up to 60%, of its total assets in municipal securities. Additionally, the Fund will invest at least 40%, and may invest up to 50%, of its total assets in equity securities and other income securities. Under normal market conditions, the Fund will invest at least 25% of its total assets in equity securities. There can be no assurance that the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. Additionally, any capital gains dividends will be subject to capital gains taxes.

The Investment Adviser may, but is not required to, utilize a variety of strategic transactions to seek to protect the value of the Fund’s assets in the municipal securities portfolio against the volatility of interest rate changes and other market movements. There can be no guarantee that hedging strategies will be employed or will be successful. The premium paid for entering into such hedging strategies will result in a reduction in the net asset value of the Fund and a subsequent reduction of income to the Fund. Any income generated from hedging transactions will not be exempt from income taxes.

The Fund may seek to enhance the level of the Fund’s current income through the use of leverage. Certain risks are associated with the leveraging of common stock. Both the net asset value and the market value of shares of common stock may be subject to higher volatility and a decline in value. There is no assurance that the Fund will utilize leverage or, if leverage is utilized, that it will be successful in enhancing the level of the Fund’s current income.

Fund Distribution Risk: In order to make regular quarterly distributions on its common shares, the fund may have to sell a portion of its investment portfolio at a time when independent investment judgment may not dictate such action. In addition, the Fund’s ability to make distributions more frequently than annually from any net realized capital gains by the Fund is subject to the Fund obtaining exemptive relief from the Securities and Exchange Commission, which cannot be assured. To the extent the total quarterly distributions for a year exceed the Fund’s net investment company income and net realized capital gain for that year, the excess will generally constitute a return of the Fund’s capital to its common shareholders. Such return of capital distributions generally are tax-free up to the amount of a common shareholder’s tax basis in the common shares (generally, the amount paid for the common shares). In addition, such excess distributions will decrease the Fund’s total assets and may increase the Fund’s expense ratio.

NOT FDIC-INSURED Ÿ NOT BANK-GUARANTEED Ÿ MAY LOSE VALUE

SemiAnnual Report | June 30, 2005 | 7

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund

Fund Summary | As of June 30, 2005 (unaudited)

| | | | |

Fund Statistics

| | | |

Share Price | | $ | 13.75 | |

Common Share Net Asset Value | | $ | 15.33 | |

Premium/(Discount) to NAV | | | -10.31 | % |

Net Assets Applicable to Common Shares ($000) | | $ | 236,153 | |

Total Returns

| | | | | | |

(Inception 4/28/03)

| | Market

| | | NAV

| |

Six Month – non-annualized | | 4.39 | % | | 2.14 | % |

One Year | | 12.31 | % | | 13.33 | % |

Since Inception – average annual | | -1.64 | % | | 11.66 | % |

| | | |

Top Ten Holdings Municipal Portfolio

| | % of Total

Investments

| |

Sayre Health Care Facilities Authority (PA) 5.875%, 12/1/2031 | | 2.9 | % |

Golden State Tobacco Securitization Corp. (CA) 5.500%, 6/1/2043 | | 2.3 | % |

Richardson Hospital Authority (TX) 6.000%, 12/1/2034 | | 2.1 | % |

Camden County Improvement Authority (NJ) 5.750%, 2/15/2034 | | 1.9 | % |

California Statewide Communities Development Authority Revenue Bentley School (CA) 6.750%, 7/1/2032 | | 1.8 | % |

Missouri Development Finance Board (MO) 5.625%, 12/1/2028 | | 1.8 | % |

Saint Johns County Industrial Development Authority (FL) 5.625%, 8/1/2034 | | 1.7 | % |

Erie County Convention Center Authority (PA) 5.000%, 1/15/2036 | | 1.5 | % |

New Jersey Economic Development Authority Revenue (NJ) 5.750%, 6/15/2034 | | 1.5 | % |

Toledo-Lucas County Port Authority (OH) 5.375%, 12/1/2035 | | 1.5 | % |

| | | |

Top Ten Holdings Equity and Income Portfolio

| | % of Total Investments

| |

| |

Citigroup, Inc. | | 1.3 | % |

BP PLC ADR | | 1.1 | % |

ChevronTexaco Corp. | | 1.1 | % |

Altria Group, Inc. | | 1.1 | % |

Bank of America Corp. | | 1.1 | % |

PPG Industries, Inc. | | 1.1 | % |

GlaxoSmithKline PLC ADR | | 1.0 | % |

Total SA ADR | | 1.0 | % |

Shell Transport & Trading Co. PLC ADR | | 1.0 | % |

National City Corp. | | 1.0 | % |

| | | |

Top Ten Industries

| | % of Total

Investments

| |

| Health Care | | 20.5 | % |

| Banking and Finance | | 11.1 | % |

| Special Tax | | 8.5 | % |

| Higher Education | | 6.6 | % |

| Oil and Gas | | 6.6 | % |

| General Funds | | 5.4 | % |

| Telecommunications | | 3.7 | % |

| Continuing Care Retirement Center | | 2.7 | % |

| Transportation | | 2.3 | % |

| Pharmaceuticals | | 2.0 | % |

Share Price & NAV Performance

Portfolio Concentration by Asset Class*

| * | As a percentage of total investments |

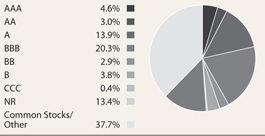

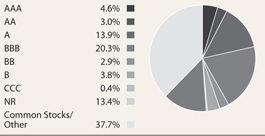

Credit Quality*

| * | Represents higher rating of either S&P or Moody’s as a percentage of long-term investments |

Past performance does not guarantee future results. Portfolio composition, holdings and sectors are subject to change daily.

8 | SemiAnnual Report | June 30, 2005

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund

Portfolio of Investments | June 30, 2005 (unaudited)

| | | | | | | |

Principal

Amount

| | | | Optional Call

Provisions

| | Value

|

| | | Long-Term Municipal Bonds – 79.6% | | | | | |

| | | Arizona – 3.4% | | | | | |

| $3,300,000 | | Maricopa County Industrial Development Authority Health Facilities Revenue, Catholic Health Care West-A,A-, Baa1

5.375%, 7/1/2023 | | 7/1/14 @ 100 | | $ | 3,516,843 |

| 4,500,000 | | Maricopa County Pollution Control Corp., Pollution Control Revenue Reference Public Service Co-A-RMK, BBB, Baa2

5.750%, 11/1/2022 | | 5/1/06 @ 101 | | | 4,602,150 |

| | | | | | |

|

|

| | | | | | | | 8,118,993 |

| | | | | | |

|

|

| | | California – 19.2% | | | | | |

| 3,500,000 | | California State Public Works Board Various University California Projects, Series 2005 D, AA-, Aa2

5.000%, 5/1/2030 | | 5/1/15 @ 100 | | | 3,714,830 |

| 6,000,000 | | California Statewide Communities Development Authority Revenue Bentley School, NR, NR

6.750%, 7/1/2032 | | 7/1/10 @ 103 | | | 6,527,580 |

| 2,250,000 | | California Statewide Communities Development Authority Revenue Sub-Wildwood Elementary School, NR, NR

7.000%, 11/1/2029 | | 11/1/09 @ 102 | | | 2,438,483 |

| | | California Statewide Community Development Authority Eskaton Properties, Inc., ACA Insured, A, NR (a)

| | | | | |

| 2,900,000 | | 4.450%, 5/15/2029 | | — | | | 2,900,000 |

| 250,000 | | 4.500%, 5/15/2029 | | — | | | 250,000 |

| 1,080,000 | | Eastern California Municipal Water District Community Facilities, Special Tax Improvement Area 2-Sheffield/Rancho, NR, NR

5.875%, 9/1/2034 | | 9/1/05 @102 | | | 1,102,302 |

| 7,620,000 | | Golden State Tobacco Securitization Corp., Tobacco Settlement Revenue Enhanced Asset Backed, Series B, A-, A3

5.500%, 6/1/2043 | | 6/1/13 @ 100 | | | 8,378,190 |

| 2,580,000 | | Lincoln Improvement Board Act 1915 Public Finance Authority - Twelve Bridges, NR, NR

6.200%, 9/2/2025 | | 9/2/09 @ 102 | | | 2,742,488 |

| | | Murrieta Valley Unified School District, Special Tax Community Facilities District No. 2000-2, NR, NR | | | | | |

| 1,625,000 | | 6.300%, 9/1/2024 | | 3/1/12 @ 101 | | | 1,790,457 |

| 2,505,000 | | 6.375%, 9/1/2032 | | 3/1/12 @ 101 | | | 2,732,479 |

| 1,000,000 | | Orange County Community Facilities District, Special Tax No. 03-1-Ladera Ranch, Series A, NR, NR 5.625%, 8/15/2034 | | 8/15/12 @ 101 | | | 1,039,220 |

| 1,800,000 | | Palm Springs Community Redevelopment Agency Tax Allocation Reference Merged Production No. 1, Series A, A-, NR

5.500%, 9/1/2034 | | 9/1/14 @ 100 | | | 1,914,840 |

| 4,000,000 | | Palm Springs Financing Authority Lease Revenue Convention Center Expansion Project, 2004 Series A, MBIA Insured, AAA, Aaa

5.500%, 11/1/2035 | | 11/1/14 @ 102 | | | 4,519,360 |

| 1,350,000 | | Poway Unified School District, Special Tax Community Facilities District Number 6-Area-A, NR, NR

6.125%, 9/1/2033 | | 9/1/10 @ 102 | | | 1,428,556 |

| $915,000 | | Poway Community Facilities District Number 10-Area-E, NR, NR

5.750%, 9/1/2032 | | 9/1/08 @ 102 | | $ | 939,430 |

| 820,000 | | Snowline California Joint Unified School District Community Facility Special Tax, No. 2002-1, Series A, NR, NR

5.400%, 9/1/2034 | | 9/1/05 @ 103 | | | 842,009 |

| 1,870,000 | | William S. Hart Joint School Financing Authority CFD’s No’s 90-1, 99-1 & 2000-1 Series 2004, BBB+, NR

5.625%, 9/1/2034 | | 9/1/12 @ 100 | | | 1,979,133 |

| | | | | | |

|

|

| | | | | | | | 45,239,357 |

| | | | | | |

|

|

| | | Colorado – 2.0% | | | | | |

| 1,355,000 | | Denver Health & Hospital Authority Health Care Revenue Series 1998 A, ACA Insured, A, NR

5.375%, 12/1/2028 | | 12/1/08 @ 101 | | | 1,388,292 |

| | | Denver Health & Hospital Authority Health Care Revenue Series 2004 A, BBB, Baa3

| | | | | |

| 1,000,000 | | 6.000%, 12/1/2031 | | 12/1/11 @ 100 | | | 1,064,500 |

| 2,000,000 | | 6.250%, 12/1/2033 | | 12/1/14 @ 100 | | | 2,217,600 |

| | | | | | |

|

|

| | | | | | | | 4,670,392 |

| | | | | | |

|

|

| | | Delaware – 0.2% | | | | | |

| 500,000 | | Delaware Health Facilities Authority Beebe Medical Center Project, Series 2004 A, BBB, Baa1

5.500%, 6/1/2024 | | 6/1/14 @ 100 | | | 533,730 |

| | | | | | |

|

|

| | | Florida – 2.5% | | | | | |

| 5,450,000 | | Saint Johns County Industrial Development Authority First Mortgage Revenue Presbyterian Retirement, Series A, NR, NR

5.625%, 8/1/2034 | | 8/1/14 @ 101 | | | 5,886,926 |

| | | | | | |

|

|

| | | Georgia – 5.7% | | | | | |

| 3,000,000 | | Chatham County Hospital Authority Memorial Health University Medical Center, Series 2004 A, A-, A3

5.500%, 1/1/2034 | | 1/1/14 @ 100 | | | 3,194,760 |

| | | Milledgeville and Baldwin County Development Authority Georgia College & State University Foundation Property III, LLC Student Housing System, BBB, NR | | | | | |

| 2,500,000 | | 5.625%, 9/1/2030 | | 9/1/14 @ 101 | | | 2,663,700 |

| 1,000,000 | | 6.000%, 9/1/2033 | | 9/1/14 @ 101 | | | 1,092,230 |

| | | Richmond County Development Authority Jaguar Student Housing | LLC, Series 2004 A, NR, A3 | | | | | |

| 2,865,000 | | 5.250%, 2/1/2030 | | 2/1/14 @ 100 | | | 2,991,604 |

| 3,350,000 | | 5.250%, 2/1/2035 | | 2/1/14 @ 100 | | | 3,498,539 |

| | | | | | |

|

|

| | | | | | | | 13,440,833 |

| | | | | | |

|

|

| | | Illinois – 0.9% | | | | | |

| 2,000,000 | | Metropolitan Pier and Exposition Authority McCormick Place Expansion Project, Series 2004 A, AA-, A1

5.500%, 6/15/2027 | | 6/15/06 @ 100 | | | 2,019,640 |

| | | | | | |

|

|

| | | Kansas - 1.2% | | | | | |

| 2,500,000 | | Burlington Pollution Control Revenue Kansas Gas and Electric Co. Project, Series 2004 A, MBIA Insured, AAA, Aaa

5.300%, 6/1/2031 | | 6/1/14 @ 100 | | | 2,736,600 |

| | | | | | |

|

|

See notes to financial statements.

SemiAnnual Report | June 30, 2005 | 9

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund | Portfolio of Investments (unaudited) continued

| | | | | | | | |

Principal

Amount

| | | | Optional Call

Provisions

| | Value

|

| | | | Massachusetts – 1.9% | | | | | |

| $ | 930,000 | | Massachusetts Development Finance Agency Revenue Hampshire College, BBB, Baa2

5.625%, 10/1/2024 | | 10/1/14 @ 100 | | $ | 985,995 |

| | | | Massachusetts Development Finance Agency Revenue Evergreen Center, BBB-, NR | | | | | |

| | 1,505,000 | | 5.500%, 1/1/2020 | | 1/1/15 @ 100 | | | 1,576,442 |

| | 1,820,000 | | 5.500%, 1/1/2035 | | 1/1/15 @ 100 | | | 1,856,018 |

| | | | | | | |

|

|

| | | | Michigan – 1.6% | | | | | 4,418,455 |

| | | | | | | |

|

|

| | | | Michigan State Hospital Finance Authority Revenue Reference Presbyterian Village, NR, NR | | | | | |

| | 1,250,000 | | 5.250%, 11/15/2025 | | 5/15/15 @ 100 | | | 1,265,388 |

| | 2,500,000 | | 5.500%, 11/15/2035 | | 5/15/15 @ 100 | | | 2,558,150 |

| | | | | | | |

|

|

| | | | | | | | | 3,823,538 |

| | | | | | | |

|

|

| | | | Minnesota – 1.6% | | | | | |

| | 3,650,000 | | Duluth Economic Development Authority Benedictine Health System, Saint Mary’s Duluth Clinic Health System, Series 2004, A-, NR 5.250%, 2/15/2028 | | 2/15/14 @ 100 | | | 3,841,041 |

| | | | | | | |

|

|

| | | | Missouri – 4.8% | | | | | |

| | 4,690,000 | | Cole County Industrial Development Authority Senior Living Facilities Revenue Lutheran Senior Services Heisinger Project, NR, NR 5.500%, 2/1/2035 | | 2/1/14 @ 100 | | | 4,964,928 |

| | 6,000,000 | | Missouri Development Finance Board Branson Landing Project, Series 2004 A, BBB+, Baa1 5.625%, 12/1/2028 | | 6/1/14 @ 100 | | | 6,427,860 |

| | | | | | | |

|

|

| | | | | | | | | 11,392,788 |

| | | | | | | |

|

|

| | | | New Jersey – 9.4% | | | | | |

| | 6,400,000 | | Camden County Improvement Authority Cooper Health System, Series 2004 A, BBB, Baa3 5.750%, 2/15/2034 | | 8/15/14 @ 100 | | | 6,854,400 |

| | | | New Jersey Economic Development Authority Revenue Cigarette Tax, BBB, Baa2 | | | | | |

| | 1,850,000 | | 5.750%, 6/15/2029 | | 6/15/14 @ 100 | | | 2,001,904 |

| | 1,000,000 | | 5.500%, 6/15/2031 | | 6/15/14 @ 100 | | | 1,058,670 |

| | 5,000,000 | | 5.750%, 6/15/2034 | | 6/15/14 @ 100 | | | 5,380,150 |

| | 2,000,000 | | New Jersey Health Care Facilities Financing Authority Revenue Saint Elizabeth Hospital Obligated Group, BBB-, Baa3 6.000%, 7/1/2020 | | 7/1/07 @ 102 | | | 2,101,700 |

| | 3,000,000 | | New Jersey Educational Facilities Authority Fairleigh Dickinson University, Series 2002 D, NR, NR 6.000%, 7/1/2025 | | 7/1/13 @ 100 | | | 3,243,090 |

| | 1,450,000 | | New Jersey Educational Facilities Authority Stevens Institute of Technology, Series 2004 B, BBB+, Baa2 5.375%, 7/1/2034 | | 7/1/14 @ 100 | | | 1,538,987 |

| | | | | | | |

|

|

| | | | | | | | | 22,178,901 |

| | | | | | | |

|

|

| | | | New York – 1.4% | | | | | |

| | $3,200,000 | | New York State Dormitory Authority School Districts Revenue Bond Financing Prog., Series 2005 C, MBIA Ins., AAA, Aaa 5.000%, 4/1/2035 | | 4/1/15 @ 100 | | $ | 3,416,128 |

| | | | | | | |

|

|

| | | | Ohio – 4.4% | | | | | |

| | 4,560,000 | | Akron Bath Copley Joint Township Hospital District Revenue Hospital Facilities-Summa Health Systems, Series A, RADIAN Insured, NR, Aa3 5.500%, 11/15/2034 | | 11/15/14 @ 100 | | | 4,956,674 |

| | 5,000,000 | | Toledo-Lucas County Port Authority Special Assessment Revenue Crocker Park Public Improvement Project Series 2003, NR, NR 5.375%, 12/1/2035 | | 12/1/13 @ 102 | | | 5,345,900 |

| | | | | | | |

|

|

| | | | | | | | | 10,302,574 |

| | | | | | | |

|

|

| | | | Pennsylvania – 8.3% | | | | | |

| | 5,100,000 | | Erie County Convention Center Authority Convention Center Hotel Revenue, Ser.of 2005, FGIC Ins., AAA, Aaa 5.000%, 1/15/2036 | | 1/15/15 @ 100 | | | 5,426,196 |

| | 3,750,000 | | Pennsylvania Higher Educational Facilities Authority Widener University Series 2003, BBB+, NR 5.375%, 7/15/2029 | | 7/15/13 @ 100 | | | 3,971,850 |

| | 9,530,000 | | Sayre Health Care Facilities Authority Guthrie Health, Series 2002 A, A-, NR 5.875%, 12/1/2031 | | 12/1/11 @ 101 | | | 10,270,100 |

| | | | | | | |

|

|

| | | | | | | | | 19,668,146 |

| | | | | | | |

|

|

| | | | Rhode Island – 3.1% | | | | | |

| | | | Rhode Island State Health & Educational Building Corp. Revenue Hospital Financing Lifespan Obligated Group, BBB+, Baal | | | | | |

| | 3,500,000 | | 6.375%, 8/15/2021 | | 8/15/12 @ 100 | | | 3,930,920 |

| | 3,000,000 | | 6.500%, 8/15/2032 | | 8/15/12 @ 100 | | | 3,358,200 |

| | | | | | | |

|

|

| | | | | | | | | 7,289,120 |

| | | | | | | |

|

|

| | | | South Carolina – 2.9% | | | | | |

| | | | Lexington County Health Services District, Inc. Hospital Revenue Lexington Medical Center, Series 2004, A, A2 | | | | | |

| | 1,430,000 | | 5.500%, 5/1/2032 | | 5/1/14 @ 100 | | | 1,523,551 |

| | 5,000,000 | | 5.500%, 5/1/2037 | | 5/1/14 @ 100 | | | 5,335,350 |

| | | | | | | |

|

|

| | | | | | | | | 6,858,901 |

| | | | | | | |

|

|

| | | | Texas – 3.1% | | | | | |

| | 6,780,000 | | Richardson Hospital Authority Hospital Refinance & Improvement Richardson Regional, BBB, Baa2 6.000%, 12/1/2034 | | 12/1/13 @ 100 | | | 7,346,537 |

| | | | | | | |

|

|

| | | | Wisconsin – 2.0% | | | | | |

| | 3,350,000 | | Wisconsin State Health & Educational Facilities Authority Revenue Aurora Health Care, Series A, BBB+, NR 5.600%, 2/15/2029 | | 2/15/09 @ 101 | | | 3,473,113 |

| | | | Wisconsin State Health & Educational Facilities Authority Revenue Blood Center Southeastern Project, BBB+, NR | | | | | |

| | 500,000 | | 5.500%, 6/1/2024 | | 6/1/14 @ 100 | | | 533,355 |

| | 750,000 | | 5.750%, 6/1/2034 | | 6/1/14 @ 100 | | | 808,448 |

| | | | | | | |

|

|

| | | | | | | | | 4,814,916 |

| | | | | | | |

|

|

| | | | Total Long-Term Municipal Bonds | | | | | |

| | | | (Cost $176,772,617) | | | | $ | 187,997,516 |

| | | | | | | |

|

|

See notes to financial statements.

10 | SemiAnnual Report | June 30, 2005

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund | Portfolio of Investments (unaudited) continued

| | | | | |

Number

of Shares

| | | | Value

|

| | | Common Stocks – 56.0% | | | |

| | | Automotive – 1.0% | | | |

| 60,000 | | DaimlerChrysler AG (Germany) | | $ | 2,430,600 |

| | | | |

|

|

| | | Banking and Finance – 15.4% | | | |

| 20,000 | | Australia and New Zealand Banking Group Ltd. ADR (Australia) | | | 1,654,000 |

| 85,000 | | Bank of America Corp. | | | 3,876,850 |

| 50,000 | | BB&T Corp. | | | 1,998,500 |

| 100,000 | | Citigroup, Inc. | | | 4,623,000 |

| 25,000 | | HSBC Holdings PLC ADR (United Kingdom) | | | 1,991,250 |

| 70,000 | | ING Groep NV ADR (Netherlands) | | | 1,963,500 |

| 61,500 | | Merrill Lynch & Co., Inc. | | | 3,383,115 |

| 100,000 | | National City Corp. | | | 3,412,000 |

| 150,000 | | New York Community Bancorp, Inc. | | | 2,718,000 |

| 40,000 | | PNC Financial Services Group | | | 2,178,400 |

| 100,000 | | U.S. Bancorp | | | 2,920,000 |

| 50,000 | | Wachovia Corp. | | | 2,480,000 |

| 75,000 | | Washington Mutual, Inc. | | | 3,051,750 |

| | | | |

|

|

| | | | | | 36,250,365 |

| | | | |

|

|

| | | Beverages, Food and Tobacco – 2.4% | | | |

| 60,000 | | Altria Group, Inc. | | | 3,879,600 |

| 90,000 | | Sara Lee Corp. | | | 1,782,900 |

| | | | |

|

|

| | | | | | 5,662,500 |

| | | | |

|

|

| | | Building and Building Products – 0.6% | | | |

| 46,500 | | Masco Corp. | | | 1,476,840 |

| | | | |

|

|

| | | Business Equipment and Services – 1.2% | | | |

| 66,500 | | Pitney Bowes, Inc. | | | 2,896,075 |

| | | | |

|

|

| | | Chemicals – 1.6% | | | |

| 59,800 | | PPG Industries, Inc. | | | 3,753,048 |

| | | | |

|

|

| | | Computers – 1.0% | | | |

| 100,000 | | Hewlett-Packard Co. | | | 2,351,000 |

| | | | |

|

|

| | | Computers – Software and Peripherals – 0.8% | | | |

| 75,000 | | Microsoft Corp. | | | 1,863,000 |

| | | | |

|

|

| | | Conglomerates – 1.1% | | | |

| 75,000 | | General Electric Co. | | | 2,598,750 |

| | | | |

|

|

| | | Entertainment – 0.9% | | | |

| 115,000 | | Regal Entertainment Group, Class A | | | 2,171,200 |

| | | | |

|

|

| | | Household and Personal Care Products – 2.3% | | | |

| 47,500 | | Kimberly-Clark Corp. | | | 2,973,025 |

| 106,500 | | Newell Rubbermaid, Inc. | | | 2,538,960 |

| | | | |

|

|

| | | | | | 5,511,985 |

| | | | |

|

|

| | | Insurance – 2.1% | | | |

| 47,500 | | Allstate Corp. (The) | | $ | 2,838,125 |

| 55,000 | | St. Paul Travelers Cos., Inc. (The) | | | 2,174,150 |

| | | | |

|

|

| | | | | | 5,012,275 |

| | | | |

|

|

| | | Iron/Steel – 1.0% | | | |

| 52,500 | | Nucor Corp. | | | 2,395,050 |

| | | | |

|

|

| | | Metals and Mining – 1.2% | | | |

| 30,000 | | Phelps Dodge Corp. | | | 2,775,000 |

| | | | |

|

|

| | | Oil and Gas – 9.1% | | | |

| 65,000 | | BP PLC ADR (United Kingdom) | | | 4,054,700 |

| 70,000 | | ChevronTexaco Corp. | | | 3,914,400 |

| 80,000 | | KeySpan Corp. | | | 3,256,000 |

| 60,000 | | Marathon Oil Corp. | | | 3,202,200 |

| 60,000 | | Shell Transport & Trading Co. PLC ADR (United Kingdom) | | | 3,483,600 |

| 30,000 | | Total SA ADR (France) | | | 3,505,500 |

| | | | |

|

|

| | | | | | 21,416,400 |

| | | | |

|

|

| | | Pharmaceuticals – 3.0% | | | |

| 135,000 | | Bristol-Myers Squibb Co. | | | 3,372,300 |

| 75,000 | | GlaxoSmithKline PLC ADR (United Kingdom) | | | 3,638,250 |

| | | | |

|

|

| | | | | | 7,010,550 |

| | | | |

|

|

| | | Publishing – 1.3% | | | |

| 85,000 | | R.R. Donnelley & Sons Co. | | | 2,933,350 |

| | | | |

|

|

| | | Telecommunications – 5.2% | | | |

| 115,000 | | BCE, Inc. (Canada) | | | 2,723,200 |

| 60,000 | | BellSouth Corp. | | | 1,594,200 |

| 56,300 | | BT Group PLC ADR (United Kingdom) | | | 2,342,080 |

| 115,000 | | SBC Communications, Inc. | | | 2,731,250 |

| 80,000 | | Verizon Communications, Inc. | | | 2,764,000 |

| | | | |

|

|

| | | | | | 12,154,730 |

| | | | |

|

|

| | | Transportation – 0.7% | | | |

| 25,000 | | United Parcel Service, Inc., Class B | | | 1,729,000 |

| | | | |

|

|

| | | Utilities – Gas and Electric – 2.8% | | | |

| 55,000 | | DTE Energy Co. | | | 2,572,350 |

| 75,000 | | NiSource, Inc. | | | 1,854,750 |

| 50,000 | | Progress Energy, Inc. | | | 2,262,000 |

| | | | |

|

|

| | | | | | 6,689,100 |

| | | | |

|

|

| | | Waste Management – 1.3% | | | |

| 110,000 | | Waste Management, Inc. | | | 3,117,400 |

| | | | |

|

|

| | | Total Common Stocks | | | |

| | | (Cost $127,493,238) | | $ | 132,198,218 |

| | | | |

|

|

See notes to financial statements

SemiAnnual Report | June 30, 2005 | 11

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund | Portfolio of Investments (unaudited) continued

| | | | | | | | |

Principal

Amount

| | | | Optional Call

Provisions

| | Value

|

| | | | Corporate Bonds – 10.5% | | | | | |

| | | | Aerospace/Defense – 0.4% | | | | | |

| | $1,000,000 | | DRS Technologies, Inc., B, B2

6.875%, 11/1/2013 | | 11/1/08 @ 103.44 | | $ | 1,035,000 |

| | | | | | | |

|

|

| | | | Automotive – 0.4% | | | | | |

| | 1,000,000 | | Navistar International, BB-, Ba3

7.500%, 6/15/2011 | | 6/15/08 @ 103.75 | | | 1,020,000 |

| | | | | | | |

|

|

| | | | Banking and Finance – 1.4% | | | | | |

| | 1,250,000 | | E*Trade Financial Corp., B+, B1

8.000%, 6/15/2011 | | 6/15/08 @ 104 | | | 1,315,625 |

| | 1,000,000 | | General Motors Acceptance Corp., BB, Baa2

6.875%, 9/15/2011 | | — | | | 923,088 |

| | 1,000,000 | | Presidential Life Corp., B-, B2

7.875%, 2/15/2009 | | — | | | 1,020,000 |

| | | | | | | |

|

|

| | | | | | | | | 3,258,713 |

| | | | | | | |

|

|

| | | | Building and Building Products – 0.4% | | | | | |

| | 1,000,000 | | K Hovnanian Enterprises, BB, Ba1

6.500%, 1/15/2014 | | — | | | 1,007,500 |

| | | | | | | |

|

|

| | | | Coal – 0.4% | | | | | |

| | 1,000,000 | | Massey Energy Co., BB, Ba3

6.625%, 11/15/2010 | | 11/15/07 @ 103.31 | | | 1,030,000 |

| | | | | | | |

|

|

| | | | Entertainment – 1.0% | | | | | |

| | 1,500,000 | | Carmike Cinemas, Inc., CCC+, Caa1

7.500%, 2/15/2014 | | 2/15/09 @ 103.75 | | | 1,359,375 |

| | 900,000 | | Scientific Games Corp., B+, B1 (b)

6.250%, 12/15/2012 | | 12/15/08 @ 103.13 | | | 909,000 |

| | | | | | | |

|

|

| | | | | | | | | 2,268,375 |

| | | | | | | |

|

|

| | | | Food – 0.4% | | | | | |

| | 1,000,000 | | Smithfield Foods, Inc., BB, Ba2

7.000%, 8/1/2011 | | — | | | 1,052,500 |

| | | | | | | |

|

|

| | | | Forest Products & Paper – 0.6% | | | | | |

| | 400,000 | | Boise Cascade LLC, B+, B2 (b)

7.125%, 10/15/2014 | | 10/15/09 @ 103.56 | | | 393,000 |

| | 1,100,000 | | Stone Container Finance (Canada), B, B2

7.375%, 7/15/2014 | | 7/15/09 @ 103 .69 | | | 1,034,000 |

| | | | | | | |

|

|

| | | | | | | | | 1,427,000 |

| | | | | | | |

|

|

| | | | Health and Medical Facilities – 1.1% | | | | | |

| $ | 1,100,000 | | Community Health Systems, Inc., B, B3

6.500%, 12/15/2012 | | 12/15/08 @ 103.25 | | $ | 1,119,250 |

| | 1,325,000 | | Triad Hospitals, Inc., B+, B2

7.000%, 5/15/2012 | | 5/15/08 @ 103.5 | | | 1,381,313 |

| | | | | | | |

|

|

| | | | | | | | | 2,500,563 |

| | | | | | | |

|

|

| | | | Home Furnishings – 0.4% | | | | | |

| | 1,000,000 | | Sealy Mattress Co., B-, B3 8.250%, 6/15/2014 | | 6/15/09 @ 104.13 | | | 1,010,000 |

| | | | | | | |

|

|

| | | | Iron/Steel – 0.4% | | | | | |

| | 1,125,000 | | AK Steel Corp., B+, B1

7.875%, 2/15/2009 | | 8/18/05 @ 102.65 | | | 1,023,750 |

| | | | | | | |

|

|

| | | | Office Equipment & Supplies – 0.4% | | | | | |

| | 1,000,000 | | Xerox Capital Trust I, B-, Ba3

8.000%, 2/1/2027 | | 2/1/07 @ 102.45 | | | 1,035,000 |

| | | | | | | |

|

|

| | | | Oil and Gas – 0.9% | | | | | |

| | 1,000,000 | | Giant Industries, Inc., B-, B3

8.000%, 5/15/2014 | | 5/15/09 @ 104 | | | 1,042,500 |

| | 1,000,000 | | Stone Energy Corp., B+, B2

6.750%, 12/15/2014 | | 12/15/09 @ 103.38 | | | 972,500 |

| | | | | | | |

|

|

| | | | | | | | | 2,015,000 |

| | | | | | | |

|

|

| | | | Real Estate Investment Trusts - Hotels – 0.4% | | | | | |

| | 850,000 | | Host Marriott LP, B+, Ba3 (b)

6.375%, 3/15/2015 | | 3/15/10 @ 103.19 | | | 841,500 |

| | | | | | | |

|

|

| | | | Retail – Apparel and Shoes – 0.9% | | | | | |

| | 1,000,000 | | Foot Locker, Inc., BB+, Ba2

8.500%, 1/15/2022 | | — | | | 1,097,500 |

| | 1,000,000 | | Phillips-Van Heusen Corp., BB+, B1

7.750%, 11/15/2023 | | — | | | 1,045,000 |

| | | | | | | |

|

|

| | | | | | | | | 2,142,500 |

| | | | | | | |

|

|

| | | | Telecommunications – 0.5% | | | | | |

| | 1,000,000 | | Nextel Communications, Inc., BB, Ba3

6.875%, 10/31/2013 | | 10/31/08 @ 103.44 | | | 1,068,750 |

| | | | | | | |

|

|

| | | | Transportation – 0.5% | | | | | |

| | 1,000,000 | | General Maritime Corp. (Marshall Island), B+, B1

10.000%, 3/15/2013 | | 3 /15/08 @ 105 | | | 1,085,000 |

| | | | | | | |

|

|

| | | | Total Corporate Bonds (Cost $24,570,999) | | | | $ | 24,821,151 |

| | | | | | | |

|

|

See notes to financial statements.

12 | SemiAnnual Report | June 30, 2005

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund | Portfolio of Investments (unaudited) continued

| | | | | | | |

Number of Shares

| | | | Value

| |

| | | | Preferred Stocks – 2.7% | | | | |

| | | | Real Estate Investment Trusts – 2.5% | | | | |

| | 20,000 | | Brandywine Realty Trust, Series C, 7.500%, NR, NR | | $ | 501,000 | |

| | 10,000 | | CarrAmerica Realty Corp., Series E, 7.500%, BBB-, Baa3 | | | 258,700 | |

| | 20,000 | | CBL & Associates Properties, Series C, 7.750%, NR, NR | | | 549,000 | |

| | 25,000 | | CBL & Associates Properties, Series D, 7.375%, NR, NR | | | 633,250 | |

| | 9,000 | | Capital Automotive REIT, Series A, 7.500%, BB+, Ba1 | | | 228,600 | |

| | 20,000 | | Developers Diversified Realty, 8.600%, BBB-, Ba1 | | | 529,400 | |

| | 5,461 | | Glenborough Realty Trust, Inc., Series A, 7.750%, NR, Ba3 | | | 139,938 | |

| | 20,000 | | Health Care REIT, Inc., Series D, 7.875%, BB+, Ba1 | | | 513,600 | |

| | 10,000 | | iStar Financial, Inc., Series I, 7.500%, BB, Ba2 | | | 251,200 | |

| | 5,000 | | PS Business Parks, Inc., Series H, 7.000%, BBB-, Ba1 | | | 123,000 | |

| | 20,000 | | Realty Income Corp., Series D, 7.375%, BBB-, Baa3 | | | 524,000 | |

| | 18,500 | | Regency Centers Corp., 7.250%, BBB-, Baa3 | | | 474,525 | |

| | 20,000 | | The Mills Corp., Series G, 7.875%, NR, NR | | | 514,000 | |

| | 25,000 | | Vornado Realty Trust, Series E, 7.000%, BBB-, Baa3 | | | 639,750 | |

| | | | | |

|

|

|

| | | | | | | 5,879,963 | |

| | | | | |

|

|

|

| | | | Pipelines – 0.2% | | | | |

| | 15,000 | | Dominion Consolidated Natural Gas Capital Trust I, 7.800%, BBB-, Baa1 | | | 392,700 | |

| | | | Total Preferred Stocks (Cost $6,082,385) | | | 6,272,663 | |

| | | | | |

|

|

|

| | | | Investment Companies – 0.1% | | | | |

| | 5,000 | | AEW Real Estate Income Fund | | | 94,000 | |

| | 5,000 | | Neuberger Berman Real Estate Income Fund, Inc. | | | 107,500 | |

| | 7,000 | | Scudder RREEF Real Estate Fund II, Inc. | | | 117,600 | |

| | | | | |

|

|

|

| | | | Total Investment Companies (Cost $266,359) | | $ | 319,100 | |

| | | | | |

|

|

|

| | | | Total Long-Term Investments – 148.9% (Cost $335,185,598) | | $ | 351,608,648 | |

| | | | | |

|

|

|

| | |

Principal Amount

| | | | Value

| |

| | | | Short-Term Investments – 2.2% | | | | |

| | | | New York City Municipal Water Finance Authority

Water & Sewer System Revenue,

FGIC Insured, AAA/A-1+, Aaa/VMIG1 (c) | | | | |

| $ | 800,000 | | Series A 2.170%, 6/15/2025 | | $ | 800,000 | |

| | 4,500,000 | | Series C

2.340%, 6/15/2023 | | | 4,500,000 | |

| | | | | |

|

|

|

| | | | Total Short-Term Investments (Cost $5,300,000) | | $ | 5,300,000 | |

| | | | | |

|

|

|

| | | | Total Investments – 151.1% (Cost $340,485,598) | | $ | 356,908,648 | |

| | | | Liabilities in excess of other assets – (0.3%) | | | (755,515 | ) |

| | | | Preferred Shares, at Liquidation Value – (-50.8% of Net Assets Applicable to Common Shares or – 33.6% of Total Investments) | | | (120,000,000 | ) |

| | | | | |

|

|

|

| | | | Net Assets Applicable to Common Shares – 100.0% | | $ | 236,153,133 | |

| | | | | |

|

|

|

| | |

| ACA | | ACA Financial Guaranty Corporation. |

| ADR | | American Depositary Receipt. |

| FGIC | | Financial Guaranty Insurance Company. |

| LLC | | Limited Liability Corporation. |

| LP | | Limited Partnership. |

| MBIA | | MBIA Insurance Corp. |

| PLC | | Public Limited Company. |

| RADIAN | | Radian Asset Assurance, Inc. |

| (a) | Variable rate security. The rate shown is as of June 30, 2005. |

| (b) | Securities are exempt from registration under Rule 144A of the Securities Act of 1933. These securities may only be resold in transactions exempt from registration, normally to qualified institutional buyers. At June 30, 2005, these securities amounted to $2,143,500 or 0.9% of Net Assets Applicable to Common Shares. |

| (c) | Security has a maturity of more than one year, but has variable rate and demand features which qualify it as a short-term security. The rate shown is as of June 30, 2005. |

Ratings shown are per Standard & Poor’s and Moody’s. Securities classified as NR are not rated.

All percentages shown in the Portfolio of Investments are based on Net Assets Applicable to Common Shares unless otherwise noted.

See notes to financial statements.

SemiAnnual Report | June 30, 2005 | 13

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund

Statement of Assets and Liabilities | June 30, 2005 (unaudited)

| | | | |

Assets | | | | |

Investments in securities, at value (cost $340,485,598) | | $ | 356,908,648 | |

Cash | | | 3,805 | |

Receivable for securities sold | | | 4,921,508 | |

Interest receivable | | | 2,878,978 | |

Dividends receivable | | | 392,920 | |

Other assets | | | 23,026 | |

| | |

|

|

|

Total assets | | | 365,128,885 | |

| | |

|

|

|

| |

Liabilities | | | | |

Payable for securities purchased | | | 8,142,541 | |

Unrealized depreciation on swap transactions | | | 413,019 | |

Advisory fee payable | | | 205,170 | |

Dividend payable - preferred shares | | | 140,183 | |

Accrued expenses and other liabilities | | | 74,839 | |

| | |

|

|

|

Total liabilities | | | 8,975,752 | |

| | |

|

|

|

| |

Preferred Shares, at Redemption Value | | | | |

$.01 par value per share; 4,800 Auction Market Preferred Shares authorized, issued and outstanding at $25,000 per share liquidation preference | | | 120,000,000 | |

| | |

|

|

|

| |

Net Assets Applicable to Common Shareholders | | $ | 236,153,133 | |

| | |

|

|

|

| |

Composition of Net Assets Applicable to Common Shareholders | | | | |

Common stock, $.01 par value per share; unlimited number of shares authorized, 15,407,000 shares issued and outstanding | | $ | 154,070 | |

Additional paid-in capital | | | 218,557,393 | |

Net unrealized appreciation on investments and swap transactions | | | 16,010,031 | |

Accumulated net realized gain on investments, options and swap transactions | | | 2,413,995 | |

Accumulated undistributed net investment income | | | (982,356 | ) |

| | |

|

|

|

| |

Net Assets Applicable to Common Shareholders | | $ | 236,153,133 | |

| | |

|

|

|

| |

Net Asset Value Applicable to Common Shareholders (based on 15,407,000 common shares outstanding) | | $ | 15.33 | |

| | |

|

|

|

See notes to financial statements.

14 | SemiAnnual Report | June 30, 2005

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund

Statement of Operations | For the six months ended June 30, 2005 (unaudited)

| | | | | | | |

Investment Income | | | | | | | |

Interest | | $ | 5,998,255 | | | | |

Dividends (net of foreign withholding taxes of $41,321) | | | 2,592,758 | | | | |

| | |

|

| | | | |

Total income | | | | | $ | 8,591,013 | |

| | | | | |

|

|

|

| | |

Expenses | | | | | | | |

Advisory fee | | | 1,235,799 | | | | |

Preferred share maintenance | | | 157,989 | | | | |

Trustees’ fees and expenses | | | 54,559 | | | | |

Administration fee | | | 50,185 | | | | |

Fund accounting | | | 49,923 | | | | |

Professional fees | | | 38,895 | | | | |

Insurance | | | 27,273 | | | | |

Custodian fee | | | 26,588 | | | | |

Transfer agent fee | | | 24,547 | | | | |

Printing expenses | | | 17,152 | | | | |

NYSE listing fee | | | 16,043 | | | | |

Miscellaneous | | | 4,347 | | | | |

| | |

|

| | | | |

Total expenses | | | | | | 1,703,300 | |

| | | | | |

|

|

|

Net investment income | | | | | | 6,887,713 | |

| | | | | |

|

|

|

| | |

Realized and Unrealized Gain (Loss) on Investments and Swap Transactions | | | | | | | |

Net realized gain (loss) on: | | | | | | | |

Investments | | | | | | 3,932,480 | |

Options | | | | | | 73,125 | |

Swaps | | | | | | (1,097,100 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | | | | |

Investments | | | | | | (2,683,026 | ) |

Swaps | | | | | | (413,019 | ) |

| | | | | |

|

|

|

Net realized and unrealized loss on investments, options and swap transactions | | | | | | (187,540 | ) |

| | | | | |

|

|

|

| | |

Distributions to Preferred Shareholders from | | | | | | | |

Net investment income | | | | | | (1,729,086 | ) |

| | | | | |

|

|

|

| | |

Net Increase in Net Assets Applicable to Common Shareholders Resulting from Operations | | | | | $ | 4,971,087 | |

| | | | | |

|

|

|

See notes to financial statements.

SemiAnnual Report | June 30, 2005 | 15

TVW | TS&W/Claymore Tax-Advantaged Balanced Fund

Statement of Changes in Net Assets |

| | | | | | | | |

| | | For the Six

Months Ended

June 30, 2005

(unaudited)

| | | For the Period

April 28, 2004*

through

December 31, 2004

| |

Increase in Net Assets Applicable to Common Shareholders Resulting from Operations | | | | | | | | |

Net investment income | | $ | 6,887,713 | | | $ | 8,022,297 | |

Net realized gain on investments, options and swap transactions | | | 2,908,505 | | | | 895,209 | |

Net change in unrealized appreciation (depreciation) on investments and swap transactions | | | (3,096,045 | ) | | | 19,106,076 | |

| | |

Distributions to Preferred Shareholders from | | | | | | | | |

Net investment income | | | (1,729,086 | ) | | | (1,108,937 | ) |

| | |

|

|

| |

|

|

|

Net increase in net assets applicable to Common Shareholders resulting from operations | | | 4,971,087 | | | | 26,914,645 | |

| | |

|

|

| |

|

|

|

Distributions to Common Shareholders from Net Investment Income | | | (7,222,031 | ) | | | (7,222,031 | ) |

| | |

|

|

| |

|

|

|

Capital Share Transactions | | | | | | | | |

Net proceeds from the issuance of Common Shares | | | — | | | | 220,605,000 | |

Common and preferred shares’ offering expenses charged to paid-in-capital | | | 18,188 | | | | (2,012,000 | ) |

| | |

|

|

| |

|

|

|

Net Increase from Capital Share Transactions | | | 18,188 | | | | 218,593,000 | |

| | |

|

|

| |

|

|

|

Total increase (decrease) in net assets applicable to Common Shareholders | | | (2,232,756 | ) | | | 238,285,614 | |

Net Assets | | | | | | | | |

Beginning of period | | | 238,385,889 | | | | 100,275 | |

| | |

|

|

| |

|

|

|

End of period (including accumulated undistributed net investment income of ($982,356) and

$1,081,048, respectively) | | $ | 236,153,133 | | | $ | 238,385,889 | |

| | |

|

|

| |

|

|

|

| * | Commencement of investment operations. |

See notes to financial statements.

16 | SemiAnnual Report | June 30, 2005

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund

Financial Highlights |

| | | | | | | | |

Per Share Operating Performance for a Common Share Outstanding Throughout the Period

| | For the Six

Months Ended

June 30, 2005 (unaudited)

| | | For the Period

April 28, 2004*

through

December 31, 2004

| |

Net Asset Value, Beginning of Period | | $ | 15.47 | | | $ | 14.33 | (b) |

| | |

Income from Investment Operations | | | | | | | | |

Net investment income(a) | | | 0.45 | | | | 0.52 | |

Net realized and unrealized gain (loss) on investments, options and swap transactions | | | (0.01 | ) | | | 1.29 | |

Distributions to preferred shareholders from net investment income (common share equivalent basis) | | | (0.11 | ) | | | (0.07 | ) |

| | |

|

|

| |

|

|

|

Total from investment operations | | | 0.33 | | | | 1.74 | |

| | |

|

|

| |

|

|

|

| | |

Distributions to Common Shareholders | | | (0.47 | ) | | | (0.47 | ) |

| | |

|

|

| |

|

|

|

Common and Preferred Shares’ Offering Expenses Charged to Paid-In Capital | | | — | (f) | | | (0.13 | ) |

| | |

|

|

| |

|

|

|

Net Asset Value, End of Period | | $ | 15.33 | | | $ | 15.47 | |

| | |

|

|

| |

|

|

|

Market Value, End of period | | $ | 13.75 | | | $ | 13.62 | |

| | |

|

|

| |

|

|

|

Total investment return(c) | | | | | | | | |

Net asset value | | | 2.14 | % | | | 11.42 | % |

Market value | | | 4.39 | % | | | -6.05 | % |

| | |

Ratios and Supplemental Data | | | | | | | | |

Net assets applicable to Common Shareholders, end of period (thousands) | | $ | 236,153 | | | $ | 238,386 | |

Preferred Shares, at liquidation value ($25,000 per share liquidation preference) (thousands) | | $ | 120,000 | | | $ | 120,000 | |

Preferred Shares asset coverage per share | | $ | 74,199 | | | $ | 74,664 | |

| | |

Ratios to Average Net Assets Applicable to Common Shares:(d) | | | | | | | | |

Total expenses | | | 1.46 | % | | | 1.36 | % |

Net investment income, prior to effect of dividends to preferred shares | | | 5.89 | % | | | 5.31 | % |

Net investment income, after effect of dividends to preferred shares | | | 4.41 | % | | | 4.58 | % |

| | |

Ratios to Average Managed Assets:(d)(e) | | | | | | | | |

Total expenses | | | 0.96 | % | | | 0.98 | % |

Net investment income, prior to effect of dividends to preferred shares | | | 3.90 | % | | | 3.83 | % |

Portfolio turnover rate | | | 54 | % | | | 75 | % |

| * | Commencement of investment operations. |

| (a) | Based on average shares outstanding during the period. |

| (b) | Before reimbursement of offering expenses charged to capital. |

| (c) | Total investment return is calculated assuming a purchase of a Common Share at the beginning of the period and a sale on the last day of the period reported either at net asset value (“NAV”) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for NAV returns or the prices obtained under the Fund’s Dividend Reinvestment Plan for market value returns. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized. |

| (e) | Managed assets is equal to net assets applicable to Common Shareholders plus outstanding leverage, such as the liquidation value of preferred shares. |

| (f) | Represents less than $0.01 per share. |

See notes to financial statements

SemiAnnual Report | June 30, 2005 | 17

TYW | TS&W/Claymore Tax-Advantaged Balanced Fund

Notes to Financial Statements | June 30, 2005 (unaudited)

Note 1 – Organization:

TS&W/Claymore Tax-Advantaged Balanced Fund (the “Fund”) was organized as a Delaware statutory trust on February 12, 2004. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940.

Under normal market conditions, the Fund will invest at least 50%, but less than 60% of its total assets in debt securities and other obligations issued by or on behalf of states, territories and possessions of the United States and the District of Columbia and their political subdivisions, agencies and instrumentalities, the interest on which is exempt from regular federal income tax and which is not a preference item for purposes of the alternative minimum tax (the “Municipal Securities Portfolio”) and at least 40%, but less than 50%, of its total assets in common stocks, preferred securities and other income securities (the “Equity and Income Securities Portfolio”).

Note 2 – Significant Accounting Policies:

The preparation of the financial statements in accordance with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

The following is a summary of significant accounting policies consistently followed by the Fund.

(a) Valuation of Investments

Equity securities listed on an exchange and securities traded over the counter are valued at the last reported sale price on the primary exchange on which they are traded. Equity securities traded on an exchange for which there are no transactions on a given day are valued at the last available bid price. Securities traded on the NASDAQ are valued at the NASDAQ Official Closing Price. Preferred stocks are valued at their sales price as of the close of the exchange on which they are traded. Preferred stocks for which the last sales price is not available are valued at the mean of the bid and asked prices. Debt securities are valued at the last available bid price for such securities or, if such prices are not available, at prices for securities of comparable maturity, quality and type. Foreign securities are translated from the local currency into U.S. dollars using the current exchange rate. The Fund’s securities that are primarily traded in foreign markets may be traded in such markets on days that the New York Stock Exchange is closed. As a result, the net asset value of the Fund may be significantly affected on days when holders of Common Shares have no ability to trade the Common Shares on the New York Stock Exchange. For those securities where quotations or prices are not available, valuations are determined in accordance with procedures established in good faith by the Board of Trustees. Short-term securities with remaining maturities of 60 days or less are valued at amortized cost which, when combined with interest earned, approximates market value.

(b) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Dividend income is recorded net of applicable withholding taxes on the ex-dividend date and interest income is recorded on an accrual basis. Discounts or premiums on debt securities purchased are accreted or amortized to interest income over the lives of the respective securities using the effective interest method.

(c) Swaps

A swap is an agreement to exchange the return generated by one instrument for the return generated by another instrument. The Fund may enter into swap agreements to manage its exposure to interest rates or to manage the duration of its portfolio. The swaps are valued at current market value and any unrealized gain or loss is included in the Statement of Operations. Gain or loss is realized on the termination date of the swap and is equal to the difference between the Fund’s basis in the swap and the proceeds of the closing transaction, including any fees. During the period that the swap agreement is open, the Fund may be subject to risk from the potential inability of the counterparty to meet the terms of the agreement. The swaps involve elements of both market and credit risk in excess of the amounts reflected on the Statement of Assets and Liabilities.

(d) Options