UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21515

TS&W / Claymore Tax-Advantaged Balanced Fund

(Exact name of registrant as specified in charter)

| | |

| 2455 Corporate West Drive, Lisle, IL | | 60532 |

| (Address of principal executive offices) | | (Zip code) |

Nicholas Dalmaso

2455 Corporate West Drive, Lisle, IL 60532

(Name and address of agent for service)

Registrant’s telephone number, including area code: (630) 505-3700

Date of fiscal year end: December 31

Date of reporting period: June 30, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

| Item 1. | Reports to Stockholders. |

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

SemiAnnual Report

June 30, 2007 (Unaudited)

TS&W/ Claymore TYW Tax-Advantaged Balanced Fund

TS&W Thompson, Siegel & Walmsley LLC

INVESTMENT MANAGEMENT

CLAYMORE ®

www.tswclaymore.com

... home port for the LATEST,

most up-to-date INFORMATION about the

TS&W/Claymore Tax-Advantaged Balanced Fund

TYW LISTED NYSE

TS&W/Claymore Tax-Advantaged Balanced Fund

TS&W Thompson, Siegel & Walmsley LLC

INVESTMENT MANAGEMENT

CLAYMORE

There can be no assurance the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value.

NOT FDIC-INSURED . NOT BANK-GUARANTED . MAY LOSE VALUE

The shareholder report you are reading right now is just the beginning of the story. Online at www.tswclaymore.com, you will find:

• Daily, weekly and monthly data on share prices, distributions and more

• Portfolio overviews and performance analyses

• Announcements, press releases and special notices

• Fund and adviser contact information

Thompson, Siegel & Walmsley LLC and Claymore are continually updating and expanding shareholder information services on the Fund’s website, in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more way we are working to keep you better informed about your investment in the Fund.

2 l SemiAnnual Report l June 30, 2007

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund

Dear Shareholderl

We are pleased to submit the semiannual report for the TS&W/Claymore Tax-Advantaged Balanced Fund (the “Fund”) for the six months ended June 30, 2007. As you may know, the Fund’s investment objective is to provide a high level of total after-tax return, including attractive tax-advantaged income. The Fund seeks to achieve its objective by investing in a pool of assets that generate income that is either exempt from regular federal income tax or qualifies for federal income taxation at long-term capital gains rates (“tax-advantaged income”), while also offering the potential for capital appreciation through exposure to the equity markets. The portfolio is comprised primarily of municipal securities, equity securities, preferred securities and high-yield debt securities.

Claymore Advisors, LLC is the Investment Adviser to the Fund, with responsibility for managing the Fund’s overall asset allocation. Two Investment Sub-Advisers are responsible for day-to-day management of the Fund’s investments. Thompson, Siegel & Walmsley LLC manages the Fund’s equity portfolio and other non-municipal income-producing securities. SMC Fixed Income Management, LP is responsible for the Fund’s portfolio of municipal bonds.

All Fund returns cited – whether based on net asset value (“NAV”) or market price – assume the reinvestment of all distributions. For this six-month period, the Fund provided a total return based on market value of -1.60%. This represents a closing market price of $15.06 on June 30, 2007, versus $15.77 on December 31, 2006. On an NAV basis, the Fund generated a total return of 2.68%. This an represents a NAV of $16.81 on June 30, 2007, versus $16.83 on December 31, 2006. The Fund’s market price at June 30, 2007, represented a discount to market value of 10.4%; as of December 31, 2006, the discount was 6.3%.

We believe that the Fund’s market price discount to NAV represents an opportunity as common shares of the Fund continue to be available in the market at prices below the value of the securities in the underlying portfolio. When shares trade at a discount to NAV, the Dividend Reinvestment Plan (“DRIP”) takes advantage of the discount by reinvesting distributions in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at NAV, subject to an IRS limitation that the purchase price cannot be more than 5% below the market price per share. The DRIP provides a cost effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. Shareholders have the opportunity to reinvest their dividends from the Fund through the DRIP, which is described in detail on page 27 of this report.

SemiAnnual Report l June 30, 2007 l 3

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund l Dear Shareholder continued

The Fund paid quarterly dividends of $.234375 per common share during the six months ended June 30, 2007. This represents an annualized distribution rate of 6.23% based on the Fund’s closing price of $15.06 on June 30, 2007. Given the Fund’s tax characteristics for the 2006 calendar year, this rate represents a tax-advantaged distribution rate of 8.16% for an individual shareholder subject to the maximum federal income tax rate of 35%. However, there is no guarantee that this level of distribution or income breakdown will be maintained. The determination of the tax character for the 2007 distributions will be made in January after the end of the Fund’s fiscal year.

To learn more about the Fund’s performance and investment strategy, we encourage you to read the Questions & Answers section of the report, which begins on page 5. You will find information about what impacted the performance of the Fund during the first half of 2007 and the Sub-Advisers’ views on the market environment.

We appreciate your investment and look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at www.tswclaymore.com.

Sincerely,

/s/ Nicholas Dalmaso

Nicholas Dalmaso

TS&W/Claymore Tax-Advantaged Balanced Fund

4 l SemiAnnual Report l June 30, 2007

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund

Questions & Answersl

The portfolio of TS&W/Claymore Tax-Advantaged Balanced Fund (the “Fund”) is managed jointly by Thompson, Siegel & Walmsley LLC (“TS&W”) and SMC Fixed Income Management, LP (“SMC”). The teams employ their specialized experience to different sleeves within the Fund, but work closely with one another to collectively guide the overall operations of the Fund. The individuals named below are responsible for managing the Fund.

Vincent R. Giordano, Portfolio Manager, Managing Member SMC Fixed Income Management, LP.

Mr. Giordano is a Managing Member of SMC. He leads the SMC’s municipal fixed-income investment management team and co-manages the Fund’s municipal securities portfolio. Prior to joining SMC, Mr. Giordano was employed by Claymore Advisors, LLC and Merrill Lynch. He has more than 30 years of investment management experience.

Roberto W. Roffo, Portfolio Manager, Managing Director SMC Fixed Income Management, LP.

Mr. Roffo co-manages the Fund’s municipal portfolio. He has more than 15 years of investment management experience focused on the municipal securities market. Prior to joining SMC, Mr. Roffo was employed by Claymore Advisors, LLC and Merrill Lynch. He has worked closely with Mr. Giordano throughout his career. He holds a Bachelor’s Degree from the University of Massachusetts.

Paul A. Ferwerda, CFA, Portfolio Manager,

Senior Vice President – Domestic Equity and Research Thompson, Siegel & Walmsley LLC

Mr. Ferwerda is responsible for the day-to-day management of the Fund’s common stock portfolio. He has been with TS&W for over 20 years and has more than 25 years of investment management experience. Mr. Ferwerda has extensive equity research experience within the financial sector and holds an MBA from Duke University.

William M. Bellamy, CFA, Portfolio Manager, Vice President Thompson, Siegel & Walmsley LLC

Mr. Bellamy joined TS&W in 2002. He has 20 years of investment industry experience focused on the fixed-income markets. Mr. Bellamy is responsible for managing the Fund’s taxable fixed-income securities. He holds an MBA from Duke University.

In the following interview, TS&W and SMC share their thoughts on the market and discuss the factors that influenced the Fund’s performance for the six months ended June 30, 2007.

Will you remind us of this Fund’s objectives and how you seek to achieve them?

The Fund’s primary investment objective is to provide a high level of total after-tax return, including attractive tax-advantaged income. The Fund seeks to achieve its objective by investing in a pool of assets that generate income that is either exempt from regular federal income tax or qualifies for federal income taxation at long-term capital gains rates (“tax-advantaged income”), while also offering the potential for capital appreciation through exposure to the equity markets. The portfolio is comprised primarily of municipal securities, equity securities, preferred securities and high-yield debt securities.

How did the Fund perform in the first six months of 2007?

All Fund returns cited – whether based on net asset value (“NAV”) or market price – assume the reinvestment of all distributions. For the six months ended June 30, 2007, the Fund provided a total return based on market price of -1.60%. The Fund gained ground on an NAV basis, generating a total return of 2.68% for the six months ended June 30, 2007. Since the Fund is invested in several different asset classes, it is to be expected that returns will be between those achieved by investments in each asset class. Each segment of the Fund performed well, exceeding the returns of the Fund’s benchmarks used to measure market returns of the respective asset classes.

For NAV performance comparison purposes, the municipal bond market, as measured by the Lehman Brothers U.S. Municipal Long Bond Index, returned -0.58% for the six months ended June 30, 2007. The broad equity market, as measured by the Standard & Poor’s 500 Index (“S&P 500”), returned 6.96%, and the high-yield bond market, as measured by the Merrill Lynch High Yield Master II Index, returned 3.05% over the six-month period.

SemiAnnual Report l June 30, 2007 l 5

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund l Questions & Answers continued

The Fund continued to pay a quarterly distribution of $0.234375 per common share. This represents an annualized distribution rate of 6.23% based on the closing market price of $15.06 on June 30, 2007. However there is no guarantee that this level of income will be maintained. Given the Fund’s tax characteristics of the 2006 calendar year, this rate represents a taxable-equivalent distribution rate of 8.16% for a shareholder in the 35% maximum federal income tax bracket. However, there is no guarantee that this level of distribution or income breakdown will be maintained. The determination of the tax character for the 2007 distributions will be made in January after the end of the Fund’s fiscal year.

How are assets allocated among the various asset classes?

The Fund invests at least 50%, and may invest up to 60%, of its total assets in debt securities on which the interest is exempt from regular federal income tax and is not a preference item for purposes of the alternative minimum tax (“municipal securities”). As of June 30, 2007, approximately 52.1% of the Fund’s assets were invested in municipal securities. Of the remaining assets in the Fund’s portfolio as of June 30, 2007, approximately 38.8% were invested in equity securities consisting primarily of large-cap dividend-paying stocks, and approximately 9.1% were invested in other taxable income-producing securities, which include high-yield bonds, preferred stocks, real estate investment trusts and other income producing securities.

From time to time, assets are rebalanced to maintain at least 50% of total assets in municipal securities. Strong growth within the Fund’s common stock portfolio enabled us to reallocate the Fund’s assets in late January and again in May as the equity and taxable income portion of the portfolio appreciated to a level close to the maximum allowable allocation of 50% of assets. Assets within the equity and taxable income portfolio were sold and general obligation municipal securities were purchased with the proceeds.

How does the Fund employ leverage?

TYW, like many closed-end funds, utilizes leverage as part of its investment strategy. The purpose of leverage is to finance the purchase of additional securities that provide the potential for increased income and capital appreciation to common shareholders than could otherwise be achieved from an unleveraged portfolio.

In executing this strategy, the Fund issued Auction Market Preferred Shares (“AMPS”) when the Fund was first brought to market. Over the past year, we have also used a derivative structure known as inverse floaters, which involves leveraging individual municipal bonds in the portfolio, using intermediate-term notes with floating rates. We were able to do this because, unlike the taxable bond market, the yield curve in the municipal market was relatively steep, which means that interest rates on long-term bonds were significantly higher than rates on short-term instruments. This made it possible to use leverage to provide additional income while structuring the portfolio defensively in anticipation of rising interest rates. The additional income received on this leverage contributed to performance. We expect to employ a leverage program as long as it adds value. Of course, leverage results in greater NAV volatility and entails more downside risk than an unleveraged portfolio. The use of leverage also makes the Fund more vulnerable to rising interest rates.

The following questions are related to the municipal securities portfolio and are answered by Portfolio Managers Vincent R. Giordano and Roberto W. Roffo, who have managed the municipal securities portfolio since the Fund’s inception.

Will you provide an overview of the municipal market and the performance of the municipal bond portion of the Fund for the six months ended June 30, 2007?

It has been a challenging period for bond managers. Interest rates on long-term bonds rose 40 to 50 basis points between the beginning of the year and the end of June, and of course that means that bond prices fell, since bond prices and interest rates move in the opposite direction.

6 l SemiAnnual Report l June 30, 2007

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund l Questions & Answers continued

Issuance of municipal bonds was at or near record levels over this period, as issuers sought to take advantage of low interest rates to reduce their cost of debt, fearing that rates might be higher in the near future. New issues were absorbed fairly easily, in large part because option bond programs used by hedge funds created new demand for municipal securities.

The municipal securities portion of the portfolio was positioned well for this environment, with a fairly defensive posture that made it possible to achieve a higher return than the Lehman Brothers Municipal Long Bond Index, which had a negative 0.58% return for the six months ended June 30, 2007.

How do you select municipal securities for the Fund?

We begin by analyzing broad macroeconomic trends and developments affecting the fixed-income markets. Our team analyzes the economic outlook, market conditions and perceived effects on interest rates and yield curves. From there, we incorporate a bottom-up and top-down analysis that helps us construct a portfolio that we believe optimizes federally tax-exempt income while seeking to avoid undue credit risk and market timing risk. While we monitor interest rates very closely and act quickly to adjust the portfolio to changing market rates, we do not trade the portfolio in search of incremental gains that could be achieved by active trading based on daily changes in rates. Our proprietary unbiased research helps us identify undervalued sectors that we believe have the potential for ratings upgrades and capital appreciation; however, there is no guarantee that such events will occur.

Which issues or sectors contributed to the performance of the municipal securities portfolio?

Since the Fund’s inception, it has been positioned with an overweight in investment-grade health care credits. We initially purchased these securities because of their attractive prices, relatively high yields and what we believed to be their strong upside potential. Since that time, their credit-worthiness and valuations have improved significantly. These bonds have performed well over the last three years, and they continued to do so over the last six months. Much of this performance was research-driven, as we anticipated some upgrades and advance refundings. The upgrades and pre-refundings helped contribute to performance, as the credits increased in quality without sacrificing their income. The pre-refundings also resulted in a shortening of the portfolio’s average duration over the reporting period. (Duration is a measure of a bond’s price sensitivity to changes in interest rates, expressed in years. Duration approximates how much a bond’s price will change if interest rates change by a given amount.)

The other major sector of emphasis is land-secured housing credits. These bonds, which are issued by local municipalities, represent most of the portfolio’s high-yield or non-rated exposure. Many corporate land developers borrow money from local governments to help subsidize the construction of new housing developments. Bonds from such transactions are called special tax allocation securities and are paid off by property taxes assessed on the new homes. At their inception, these securities have higher levels of risk because of the time lag between their issuance and when property taxes are collected. The only collateral for the bonds is the land upon which the homes are being built.

We were fortunate enough to purchase issues that have done very well since our investment; however, we have not added to the position in land-secured housing credits since the initial investment. While externally these credits remain non-rated, our internal analysis suggests to us that their level of creditworthiness has improved, as property taxes are now being collected. Like the health care credits, these bonds have generated attractive income and offer improving risk/reward characteristics. Although spreads in this sector widened, reflecting concerns about weakness in the housing market, the additional income from relatively high coupons helped those bonds perform well. Also, since the issues in this portfolio are seasoned bonds, their shorter duration than the market helped performance.

SemiAnnual Report l June 30, 2007 l 7

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund l Questions & Answers continued

Which areas of the municipal securities portfolio hurt performance?

Especially in the second calendar quarter, the highest-rated municipal bonds underperformed the broad market. The Fund was underweight these high-rated low-coupon bonds, but there were some in the portfolio, and they had a negative impact on performance.

What is your outlook for the economy and the municipal market, and what does this mean for the Fund?

We believe that interest rates are at reasonable levels for the current economic environment. We have some concern about how mortgage defaults and weakness on the housing market will affect the overall economy. If the housing slump leads to slower economic growth, we believe that would be positive for bond returns. However, the inflation rate is somewhat higher than we would like to see. On balance, with one potential major positive and one potential major negative effect, we are neutral regarding the direction of the municipal bond market over the next six months.

The Fund’s equity portfolio and taxable fixed-income securities are managed by TS&W. The following questions are related to those portions of the portfolio and are answered by Portfolio Managers Paul A. Ferwerda and William M. Bellamy.

Will you provide an overview of equity and high-yield bond markets during the first half of 2007?

Equity Market

Except for a period of weakness in late February and early March, equity markets were generally strong during the first six months of 2007, despite moderation in economic growth. By the end of May, most indices were at or near their all-time highs; markets were volatile with no pronounced trend in June. Within the equity market, large-cap stocks performed modestly better than small-cap stocks; the mid-cap market performed better than the large-cap or small-cap markets. Growth stocks performed better than value stocks in all size categories.

High-Yield Market

In the first half 2007 returns in the high-yield market moderated from the blistering pace set in 2006, but high-yield bonds still outperformed investment grade bonds. Investors’ willingness to take risk diminished as the year progressed, mainly because of concerns about the sub-prime mortgage market. Therefore, high-yield bonds performed very well in the first quarter, but not quite so well in the second quarter. Hedge fund problems in May and the near collapse of two levered hedge funds in June weighed on the market as the first half ended. In May and June, risk aversion increased, and spreads (the difference between yields on high-yield and investment-grade bonds) widened from the historically tight spreads in 2006.

Before we discuss the specific performance attributes of the portfolios, will you describe how you choose equity and high-yield securities?

TS&W’s investment process is value-driven and team-oriented. On the equity side, we have a proprietary quantitative valuation model that we apply to more than 400 stocks. This directs our review process toward companies that we believe have the highest expected return potential over a multi-year period. Our in-house research analysts are responsible for validating the model inputs for companies under their coverage and monitoring them over the holding period. Buys and sells are discussed at weekly research meetings or more frequently as needed. TS&W’s fixed-income team is responsible for overall bond market strategy as well as security selection. In-house analysts are used to support the credit review process.

Please tell us about the dividend income earned on the Fund’s equity investments.

Our internal goal is for the common equity portfolio to generate a dividend yield of about two times the yield on the S&P 500. We were very pleased with the portfolio’s dividend yield in the first half of 2007, which maintained a significant premium to the yield of the index. The annualized yield on the equity portion of the portfolio was approximately 3.75%, compared with 1.80% for the

8 l SemiAnnual Report l June 30, 2007

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund l Questions & Answers continued

S&P 500. However, there is no guarentee that this level of income will be maintained. The portfolio’s yield was enhanced as many companies in which the Fund was invested increased their regular dividends and some also declared special dividends.

The current environment of strong corporate profitability, together with the 2006 extension of the favorable income tax treatment of dividends on equities, could further support the recent trend of companies initiating dividends and increasing dividends. If that happens, it should help us in our pursuit of a high-yielding equity portfolio. However there is no guarantee that this will occur.

Which areas of the common equity portfolio helped performance?

We are very pleased with the performance of the equity portion of the Fund in the first half of 2007, on an absolute basis as well as relative to the indices we use for comparison. We consider this performance an especially positive accomplishment, considering that three major market trends worked against several defining characteristics that affect the portfolio’s pattern of performance. First, this is a large cap portfolio, and large cap stocks underper-formed mid cap and small cap. Second, the portfolio is oriented to value, and growth stocks outperformed value stocks. And third, we give strong preference to stocks that pay dividends; in the first half of 2007, stocks that do not pay dividends performed better than dividend-paying stocks. Despite those challenges, the equity portion outperformed both the S&P 500, which is generally regarded as an indicator of the broad equity market, and the Russell 1000® Value Index, which consists of large-cap value stocks.

The portfolio was able to achieve this strong performance through a combination of investing in industry and geographic sectors that performed well and good stock selection. Since we believe it is important to maintain good diversity among industry sectors, we were pleased that the top five holdings in terms of contribution to performance came from four different industry sectors, and the top 10 contributors came from six different sectors.

The Fund’s orientation to yield and value means that it will generally have significant exposure to sectors such as energy and utilities, which tend to provide attractive yields. The portfolio’s position in sectors such as information technology and consumer discretionary is generally low because few stocks in these sectors offer attractive dividends. In order to gain exposure to these sectors, we occasionally use perpetual preferred stocks, which qualify for favorable tax treatment, pairing them with low-yielding common stocks that are otherwise attractive. We will consider stocks with below market yields if our research group believes the total return opportunity is worth the risk. When evaluating a potential holding with a relatively low yield, we look for the opportunity for something special, such as a stock buyback, a special dividend or an accelerated increase in the dividend.

Telecommunications

The equity portfolio’s performance was particularly strong in telecommunications, a sector that combines growth with relatively high dividend yields. Among the best performing telecommunications holdings were AT&T, Inc. (1.3% of total net investments), Verizon Communications, Inc. (1.1% of total net investments), Deutsche Telekom (1.1% of total net investments) and AG Nokia Corp. (0.9% of total net investments), which was the best performing stock in the portfolio for the six-month period.

International Markets and ADRs

Although the portfolio’s main equity focus is on securities of U.S. issuers, we may invest in American depositary receipts (“ADRs”) and in other dollar-denominated securities of foreign issuers. We often find that yields are higher in international markets than in the U.S., and during this six-month period, international markets (as measured by the Morgan Stanley EAFE Index) performed better than U.S. markets. In order to identify attractive foreign investments, we work closely with TS&W’s international team. We review attractive opportunities they have identified to see if they pay dividends and have ADRs in which this Fund can invest.

SemiAnnual Report l June 30, 2007 l 9

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund l Questions & Answers continued

During the six-month period ended June 30, 2007, ADRs represented approximately 20% of the equity portfolio. Besides the foreign telecommunications positions mentioned above, other ADRs that performed especially well include Nestle SA (no longer held in portfolio) in the consumer staples sector and several international energy companies.

Energy

After experiencing weakness in the second half of 2006, energy stocks performed well during the first six months of 2007. We continue to overweight energy in the portfolio, not only because of the stocks’ attractive yields, but also because we believe growing worldwide demand will enable these companies to increase earnings. Energy holdings that contributed to performance include Royal Dutch Shell PLC (1.6% of total net investments), BP PLC (1.4% of total net investments) and ConocoPhillips (0.8% of total net investments).

Consumer Sectors

The portfolio has been consistently underweight in the consumer discretionary sector, which includes many retailers and restaurant companies, as well as companies that produce consumer durables such as automobiles. We have adopted this position for the portfolio because few of these stocks have attractive yields and also because we are concerned about consumer spending. The equity portfolio currently has just one position in the consumer discretionary sector, Regal Entertainment Group (0.7% of total net investments), which operates movie theatres throughout the United States, and it performed very well over the last six months. Another positive holding in the consumer basic sector was Molson Coors Brewing Co. (no longer held in portfolio).

Which areas of the common equity portfolio hurt performance?

The financial sector performed poorly in the last six months, largely because of concerns about the impact of sub-prime mortgages. Some of the large banks such as Citigroup, Inc. (1.4% of total net investments) and Bank of America Corp. (1.3% of total net investments) represent a large percentage of market value in this sector, and their stock prices dropped as investors rejected the entire industry; the portfolio’s positions in these stocks detracted from performance. Since both of these stocks were yielding more than 4% at the end of the reporting period, they are providing attractive income, and we believe there is little downside risk at current prices.

We have eliminated several positions with more direct involvement in the mortgage business, such as Genworth Financial, Inc. and MGIC Investment Corp., which were purchased and sold within the six-month period. We added a position in American International Group, Inc., (1.2% of total net investments) a diversified insurance company with excess capital, which we believe bodes well for the possibility of future stock buybacks or dividend increases. This stock has not yet added any value, perhaps because of lingering issues related to former management, but we believe it has good potential.

How did the portfolio’s high-yield bonds, preferred stocks and real estate investment trusts perform?

Over this six-month period, the composition of the taxable non-equity portion of the portfolio has been approximately 66% high-yield bonds and 34% preferred stocks. The Fund’s high-yield portfolio underperformed the major high-yield indices, such as the Merrill Lynch High Yield Master II Index, because this portfolio holds higher quality bonds than the index, and lower quality bonds performed much better than higher quality. However, near the end of the period, our higher-rated high-yield bonds performed quite well, as investors became more risk averse.

In managing the high-yield portion of the portfolio, we place greater focus on income than on total return. Our strategy is to generate a high level of non-QDI income (income that does not qualify for the favorable tax treatment accorded certain dividends) without taking significant credit risk.

10 l SemiAnnual Report l June 30, 2007

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund l Questions & Answers continued

What is your outlook for the equity and high-yield markets in the months ahead?

Our outlook has become more cautious since beginning of the year. Corporate earnings have been above what we consider to be their long-term trend, and we believe some earnings disappointments are likely in the coming quarters. In addition, we believe consumer spending is likely to come under pressure, in part because of weakness in the housing market; accordingly, we have underweighted the consumer discretionary sector. Because we believe the fundamentals are stronger in economies outside the U.S., we are maintaining a significant position in ADRs.

Without earnings support, the stock market is vulnerable; we do not expect the strong returns of the first half — over 6%, as measured by the S&P 500 index — to be replicated in the second half of the year. Actually, a somewhat weaker stock market favors our strategy, because dividends become a more important aspect of returns when stock prices are not moving up so much.

We believe high-yield bonds will continue to perform well because companies’ balance sheets remain quite strong. As we move into the second half of the year, we expect to see substantial new supply from LBO (leveraged buy-out) activity. As these new bonds reach the market, we believe there will be pressure on lower rated credits. Because of economic uncertainty and this expected new supply, we will continue to keep the credit quality of the Fund’s high yield bond portfolio higher than the high yield indices. We have been able to meet our yield targets while maintaining relatively high quality, and we hope to continue to do so.

TYW Risks and Other Considerations

Under normal market conditions, the Fund will invest at least 50%, and may invest up to 60%, of its total assets in municipal securities. Additionally, the Fund will invest at least 40%, and may invest up to 50%, of its total assets in equity securities and other income securities. Under normal market conditions, the Fund will invest at least 25% of its total assets in equity securities. There can be no assurance that the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. Additionally, any capital gains dividends will be subject to capital gains taxes.

The Investment Manager may, but is not required to, utilize a variety of strategic transactions to seek to protect the value of the Fund’s assets in the municipal securities portfolio against the volatility of interest rate changes and other market movements. There can be no guarantee that hedging strategies will be employed or will be successful. The premium paid for entering into such hedging strategies will result in a reduction in the net asset value of the Fund and a subsequent reduction of income to the Fund. Any income generated from hedging transactions will not be exempt from income taxes.

The Fund may seek to enhance the level of the Fund’s current income through the use of leverage. Certain risks are associated with the leveraging of common stock. Both the net asset value and the market value of shares of common stock may be subject to higher volatility and a decline in value. There is no assurance that the Fund will utilize leverage or, if leverage is utilized, that it will be successful in enhancing the level of the Fund’s current income.

There are also specific risks associated with investing in municipal bonds. The secondary market for municipal bonds is less liquid than many other securities markets, which may adversely affect the Fund’s ability to sell its bonds at prices approximating those at which the Fund currently values them. The ability of municipal issuers to make timely payments of interest and principal may be diminished during general economic downturns. In addition, laws enacted in the future by Congress or state legislatures or referenda could extend the time for payment of principal and/or interest. In the event of bankruptcy of an issuer, the Fund could experience delays in collecting principal and interest.

There also risks associated with investing in Auction Market Preferred Shares or AMPS. The AMPS are redeemable, in whole or in part, at the option of the Fund on any dividend payment date for the AMPS, and will be subject to mandatory redemption in certain circumstances. The AMPS will not be listed on an exchange. You may only buy or sell AMPS through an order placed at an auction with or through a broker-dealer that has entered into an agreement with the auction agent and the Fund or in a secondary market maintained by certain broker-dealers. These broker-dealers are not required to maintain this market, and it may not provide you with liquidity.

Fund Distribution Risk: In order to make regular quarterly distributions on its common shares, the fund may have to sell a portion of its investment portfolio at a time when independent investment judgment may not dictate such action. In addition, the Fund’s ability to make distributions more frequently than annually from any net realized capital gains by the Fund is subject to the Fund obtaining exemptive relief from the Securities and Exchange Commission, which cannot be assured. To the extent the total quarterly distributions for a year exceed the Fund’s net investment company income and net realized capital gain for that year, the excess will generally constitute a return of the Fund’s capital to its common shareholders. Such return of capital distributions generally are tax-free up to the amount of a common shareholder’s tax basis in the common shares (generally, the amount paid for the common shares). In addition, such excess distributions will decrease the Fund’s total assets and may increase the Fund’s expense ratio.

It is important to note that closed-end funds often trade at a discount to their market value.

The federal tax advice contained herein was not intended or written to be used, and it cannot be used by any taxpayer, for the purpose of avoiding penalties that may be imposed on the taxpayer; the advice was written to support the promotion or marketing of the matters addressed and taxpayers should seek advice based on the taxpayer’s circumstance from an independent tax advisor.

SemiAnnual Report l June 30, 2007 l 11

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund

Fund SummarylAs of June 30, 2007 (unaudited)

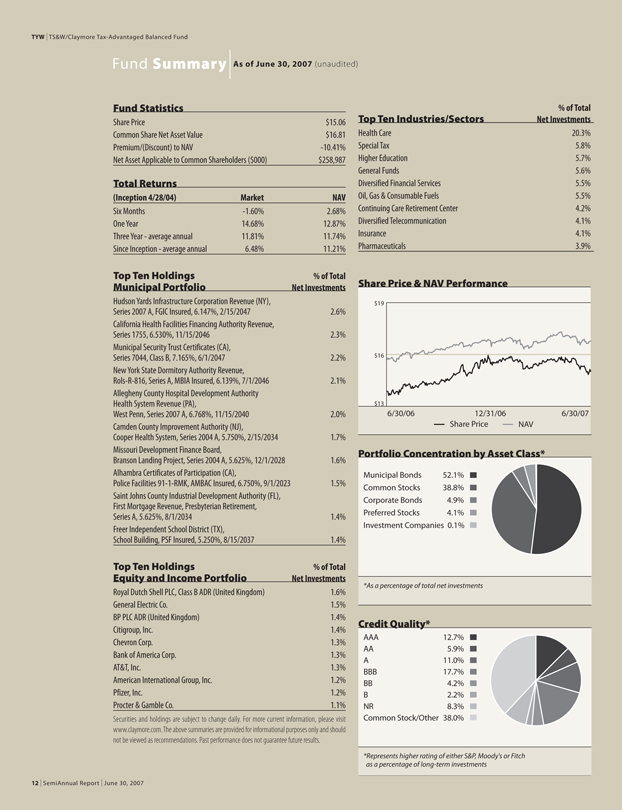

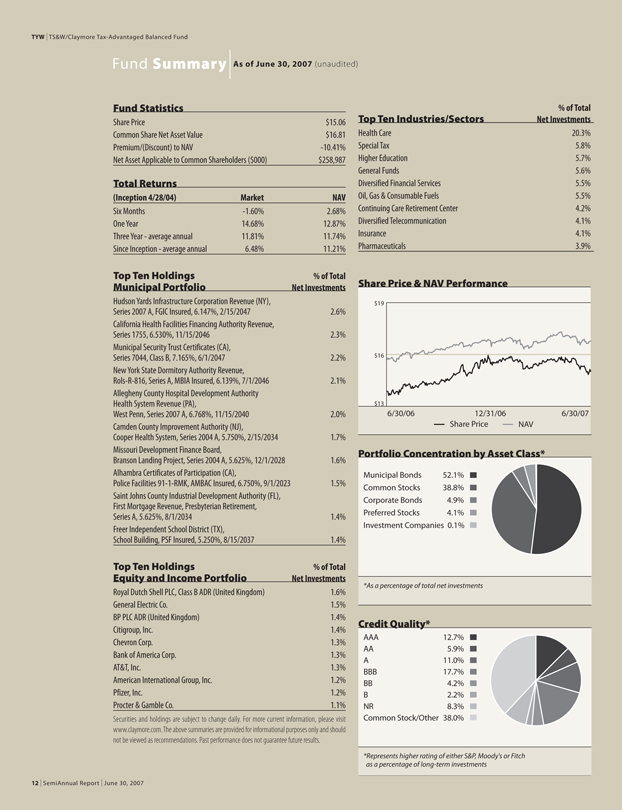

Fund Statistics

Share Price $15.06

Common Share Net Asset Value $16.81

Premium/(Discount) to NAV -10.41%

Net Asset Applicable to Common Shareholders ($000) $258,987

Total Returns

(Inception 4/28/04)

Market NAV

Six Months -1.60% 2.68%

One Year 14.68% 12.87%

Three Year - average annual 11.81% 11.74%

Since Inception - average annual 6.48% 11.21%

Top Ten Holdings % of Total

Municipal Portfolio Net Investments

Hudson Yards Infrastructure Corporation Revenue (NY), Series 2007 A, FGIC Insured, 6.147%, 2/15/2047 2.6%

California Health Facilities Financing Authority Revenue, Series 1755, 6.530%, 11/15/2046 2.3%

Municipal Security Trust Certificates (CA), Series 7044, Class B, 7.165%, 6/1/2047 2.2%

New York State Dormitory Authority Revenue, Rols-R-816, Series A, MBIA Insured, 6.139%, 7/1/2046 2.1%

Allegheny County Hospital Development Authority Health System Revenue (PA), West Penn, Series 2007 A, 6.768%, 11/15/2040 2.0%

Camden County Improvement Authority (NJ), Cooper Health System, Series 2004 A, 5.750%, 2/15/2034 1.7%

Missouri Development Finance Board, Branson Landing Project, Series 2004 A, 5.625%, 12/1/2028 1.6%

Alhambra Certificates of Participation (CA), Police Facilities 91-1-RMK, AMBAC Insured, 6.750%, 9/1/2023 1.5%

Saint Johns County Industrial Development Authority (FL), First Mortgage Revenue, Presbyterian Retirement, Series A, 5.625%, 8/1/2034 1.4%

Freer Independent School District (TX), School Building, PSF Insured, 5.250%, 8/15/2037 1.4%

Top Ten Holdings Equity and Income Portfolio

% of Total Net Investments

Royal Dutch Shell PLC, Class B ADR (United Kingdom) 1.6%

General Electric Co. 1.5%

BP PLC ADR (United Kingdom) 1.4%

Citigroup, Inc. 1.4%

Chevron Corp. 1.3%

Bank of America Corp. 1.3%

AT&T, Inc. 1.3%

American International Group, Inc. 1.2%

Pfizer, Inc. 1.2%

Procter & Gamble Co. 1.1%

Securities and holdings are subject to change daily. For more current information, please visit www.claymore.com. The above summaries are provided for informational purposes only and should not be viewed as recommendations. Past performance does not guarantee future results.

Top Ten Industries/Sectors

% of Total Net Investments

Health Care 20.3%

Special Tax 5.8%

Higher Education 5.7%

General Funds 5.6%

Diversified Financial Services 5.5%

Oil, Gas & Consumable Fuels 5.5%

Continuing Care Retirement Center 4.2%

Diversified Telecommunication 4.1%

Insurance 4.1%

Pharmaceuticals 3.9%

Share Price & NAV Performance

$19 $16 $13 6/30/06 12/31/06 6/30/07 Share Price NAV

Portfolio Concentration by Asset Class*

Municipal Bonds 52.1%

Common Stocks 38.8%

Corporate Bonds 4.9%

Preferred Stocks 4.1%

Investment Companies 0.1%

* As a percentage of total net investments

Credit Quality*

AAA 12.7%

AA 5.9%

A 11.0%

BBB 17.7%

BB 4.2%

B 2.2%

NR 8.3%

Common Stock/Other 38.0%

* Represents higher rating of either S&P, Moody’s or Fitch as a percentage of long-term investments

12 l SemiAnnual Report l June 30, 2007

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund

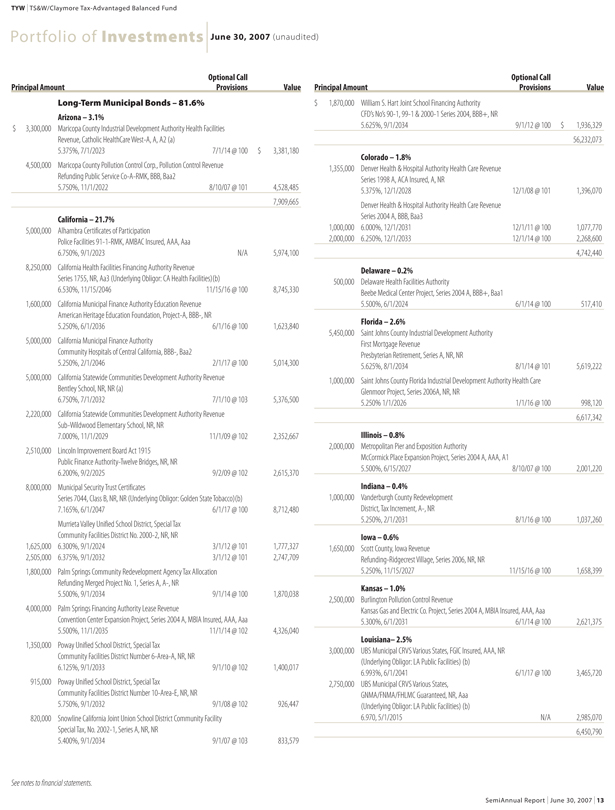

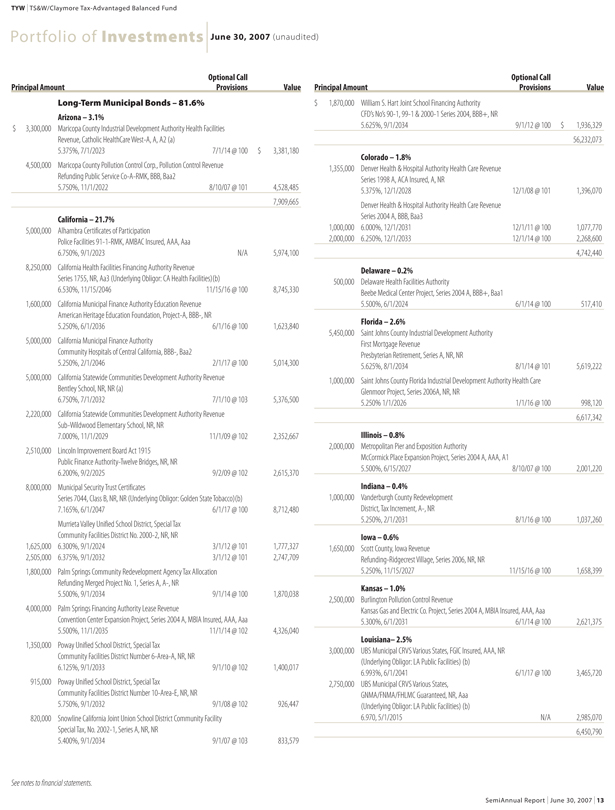

Portfolio of InvestmentslJune 30, 2007 (unaudited)

Principal Amount Optional Call Provisions Value

Long-Term Municipal Bonds – 81.6%

Arizona – 3.1%

$3,300,000

Maricopa County Industrial Development Authority Health Facilities

Revenue, Catholic HealthCare West-A, A, A2 (a)

5.375%, 7/1/2023 7/1/14 @ 100 $3,381,180 4,500,000

Maricopa County Pollution Control Corp., Pollution Control Revenue

Refunding Public Service Co-A-RMK, BBB, Baa2

5.750%, 11/1/2022 8/10/07 @ 101 4,528,485 7,909,665

California – 21.7% 5,000,000

Alhambra Certificates of Participation

Police Facilities 91-1-RMK, AMBAC Insured, AAA, Aaa

6.750%, 9/1/2023 N/A 5,974,100 8,250,000

California Health Facilities Financing Authority Revenue

Series 1755, NR, Aa3 (Underlying Obligor: CA Health Facilities)(b)

6.530%, 11/15/2046 11/15/16 @ 100 8,745,330 1,600,000

California Municipal Finance Authority Education Revenue

American Heritage Education Foundation, Project-A, BBB-, NR

5.250%, 6/1/2036 6/1/16 @ 100 1,623,840 5,000,000

California Municipal Finance Authority

Community Hospitals of Central California, BBB-, Baa2

5.250%, 2/1/2046 2/1/17 @ 100 5,014,300 5,000,000

California Statewide Communities Development Authority Revenue

Bentley School, NR, NR (a)

6.750%, 7/1/2032 7/1/10 @ 103 5,376,500 2,220,000

California Statewide Communities Development Authority Revenue

Sub-Wildwood Elementary School, NR, NR

7.000%, 11/1/2029 11/1/09 @ 102 2,352,667 2,510,000

Lincoln Improvement Board Act 1915

Public Finance Authority-Twelve Bridges, NR, NR

6.200%, 9/2/2025 9/2/09 @ 102 2,615,370 8,000,000

Municipal Security Trust Certificates

Series 7044, Class B, NR, NR (Underlying Obligor: Golden State Tobacco)(b)

7.165%, 6/1/2047 6/1/17 @ 100 8,712,480

Murrieta Valley Unified School District, Special Tax

Community Facilities District No. 2000-2, NR, NR

1,625,000 6.300%, 9/1/2024 3/1/12 @ 101 1,777,327

2,505,000 6.375%, 9/1/2032 3/1/12 @ 101 2,747,709 1,800,000

Palm Springs Community Redevelopment Agency Tax Allocation

Refunding Merged Project No. 1, Series A, A-, NR

5.500%, 9/1/2034 9/1/14 @ 100 1,870,038 4,000,000

Palm Springs Financing Authority Lease Revenue

Convention Center Expansion Project, Series 2004 A, MBIA Insured, AAA, Aaa 5.500%, 11/1/2035 11/1/14 @ 102 4,326,040

1,350,000

Poway Unified School District, Special Tax

Community Facilities District Number 6-Area-A, NR, NR

6.125%, 9/1/2033 9/1/10 @ 102 1,400,017 915,000

Poway Unified School District, Special Tax

Community Facilities District Number 10-Area-E, NR, NR

5.750%, 9/1/2032 9/1/08 @ 102 926,447 820,000

Snowline California Joint Union School District Community Facility

Special Tax, No. 2002-1, Series A, NR, NR

5.400%, 9/1/2034 9/1/07 @ 103 833,579

Principal Amount

Provisions

Optional Call

Value

$1,870,000

William S. Hart Joint School Financing Authority

CFD’s No’s 90-1, 99-1 & 2000-1 Series 2004, BBB+, NR

5.625%, 9/1/2034

9/1/12 @ 100

$1,936,329

56,232,073

Colorado – 1.8%

1,355,000

Denver Health & Hospital Authority Health Care Revenue

Series 1998 A, ACA Insured, A, NR

5.375%, 12/1/2028

12/1/08 @ 101

1,396,070

Denver Health & Hospital Authority Health Care Revenue

Series 2004 A, BBB, Baa3

1,000,000

6.000%, 12/1/2031

12/1/11 @ 100

1,077,770

2,000,000

6.250%, 12/1/2033

12/1/14 @ 100

2,268,600

4,742,440

Delaware – 0.2%

500,000

Delaware Health Facilities Authority

Beebe Medical Center Project, Series 2004 A, BBB+, Baa1

5.500%, 6/1/2024

6/1/14 @ 100

517,410

Florida – 2.6%

5,450,000

Saint Johns County Industrial Development Authority

First Mortgage Revenue

Presbyterian Retirement, Series A, NR, NR

5.625%, 8/1/2034

8/1/14 @ 101

5,619,222

1,000,000

Saint Johns County Florida Industrial Development Authority Health Care

Glenmoor Project, Series 2006A, NR, NR

5.250% 1/1/2026

1/1/16 @ 100

998,120

6,617,342

Illinois – 0.8%

2,000,000

Metropolitan Pier and Exposition Authority

McCormick Place Expansion Project, Series 2004 A, AAA, A1

5.500%, 6/15/2027

8/10/07 @ 100

2,001,220

Indiana – 0.4%

1,000,000

Vanderburgh County Redevelopment

District, Tax Increment, A-, NR

5.250%, 2/1/2031

8/1/16 @ 100

1,037,260

Iowa – 0.6%

1,650,000

Scott County, Iowa Revenue

Refunding-Ridgecrest Village, Series 2006, NR, NR

5.250%, 11/15/2027

11/15/16 @ 100

1,658,399

Kansas – 1.0%

2,500,000

Burlington Pollution Control Revenue

Kansas Gas and Electric Co. Project, Series 2004 A, MBIA Insured, AAA, Aaa

5.300%, 6/1/2031

6/1/14 @ 100

2,621,375

Louisiana– 2.5%

3,000,000

UBS Municipal CRVS Various States, FGIC Insured, AAA, NR

(Underlying Obligor: LA Public Facilities) (b)

6.993%, 6/1/2041

6/1/17 @ 100

3,465,720

2,750,000

UBS Municipal CRVS Various States,

GNMA/FNMA/FHLMC Guaranteed, NR, Aaa

(Underlying Obligor: LA Public Facilities) (b)

6.970, 5/1/2015

N/A

2,985,070

6,450,790

See notes to financial statements.

SemiAnnual Report l June 30, 2007 l 13

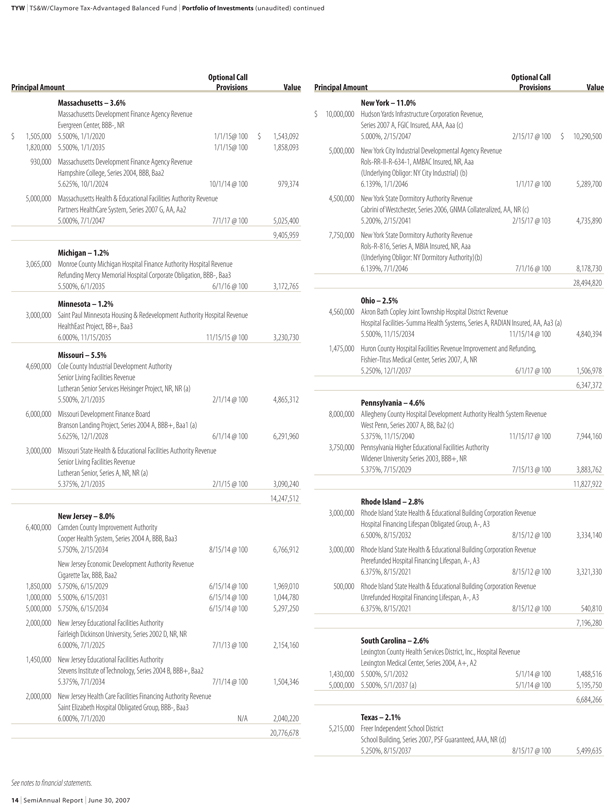

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund l Portfolio of Investments (unaudited) continued

Principal Amount

Optional Call Provisions

Value

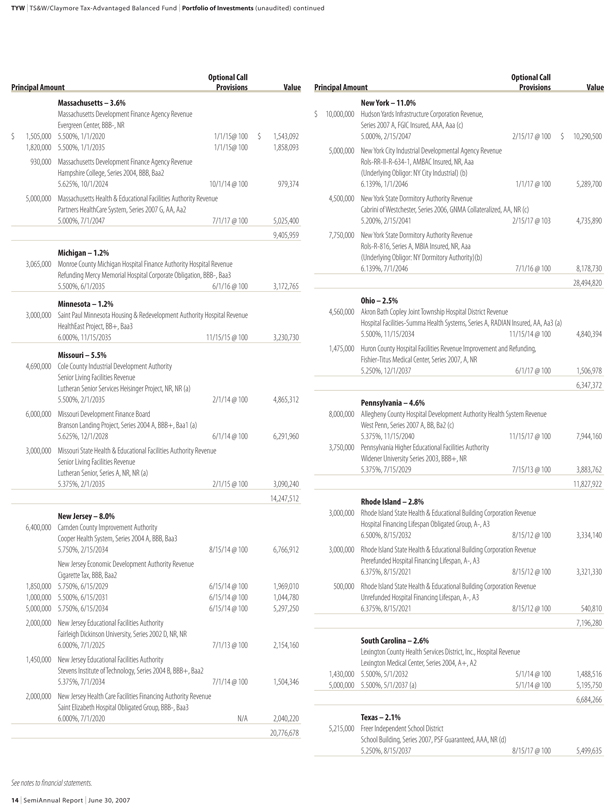

Massachusetts – 3.6%

Massachusetts Development Finance Agency Revenue

Evergreen Center, BBB-, NR

$1,505,000

5.500%, 1/1/2020

1/1/15@ 100

$1,543,092

1,820,000

5.500%, 1/1/2035

1/1/15@ 100

1,858,093

930,000

Massachusetts Development Finance Agency Revenue

Hampshire College, Series 2004, BBB, Baa2

5.625%, 10/1/2024

10/1/14 @ 100

979,374

5,000,000

Massachusetts Health & Educational Facilities Authority Revenue

Partners HealthCare System, Series 2007 G, AA, Aa2

5.000%, 7/1/2047

7/1/17 @ 100

5,025,400

9,405,959

Michigan – 1.2%

3,065,000

Monroe County Michigan Hospital Finance Authority Hospital Revenue

Refunding Mercy Memorial Hospital Corporate Obligation, BBB-, Baa3

5.500%, 6/1/2035

6/1/16 @ 100

3,172,765

Minnesota – 1.2%

3,000,000

Saint Paul Minnesota Housing & Redevelopment Authority Hospital Revenue

HealthEast Project, BB+, Baa3

6.000%, 11/15/2035

11/15/15 @ 100

3,230,730

Missouri – 5.5%

4,690,000

Cole County Industrial Development Authority

Senior Living Facilities Revenue

Lutheran Senior Services Heisinger Project, NR, NR (a)

5.500%, 2/1/2035

2/1/14 @ 100

4,865,312

6,000,000

Missouri Development Finance Board

Branson Landing Project, Series 2004 A, BBB+, Baa1 (a)

5.625%, 12/1/2028

6/1/14 @ 100

6,291,960

3,000,000

Missouri State Health & Educational Facilities Authority Revenue

Senior Living Facilities Revenue

Lutheran Senior, Series A, NR, NR (a)

5.375%, 2/1/2035

2/1/15 @ 100

3,090,240

14,247,512

New Jersey – 8.0%

6,400,000

Camden County Improvement Authority

Cooper Health System, Series 2004 A, BBB, Baa3

5.750%, 2/15/2034

8/15/14 @ 100

6,766,912

New Jersey Economic Development Authority Revenue

Cigarette Tax, BBB, Baa2

1,850,000

5.750%, 6/15/2029

6/15/14 @ 100

1,969,010

1,000,000

5.500%, 6/15/2031

6/15/14 @ 100

1,044,780

5,000,000

5.750%, 6/15/2034

6/15/14 @ 100

5,297,250

2,000,000

New Jersey Educational Facilities Authority

Fairleigh Dickinson University, Series 2002 D, NR, NR

6.000%, 7/1/2025

7/1/13 @ 100

2,154,160

1,450,000

New Jersey Educational Facilities Authority

Stevens Institute of Technology, Series 2004 B, BBB+, Baa2

5.375%, 7/1/2034

7/1/14 @ 100

1,504,346

2,000,000

New Jersey Health Care Facilities Financing Authority Revenue

Saint Elizabeth Hospital Obligated Group, BBB-, Baa3

6.000%, 7/1/2020

N/A

2,040,220

20,776,678

Principal Amount

Provisions

Optional Call

Value

New York – 11.0%

$10,000,000

Hudson Yards Infrastructure Corporation Revenue,

Series 2007 A, FGIC Insured, AAA, Aaa (c)

5.000%, 2/15/2047

2/15/17 @ 100

$10,290,500

5,000,000

New York City Industrial Developmental Agency Revenue

Rols-RR-II-R-634-1, AMBAC Insured, NR, Aaa

(Underlying Obligor: NY City Industrial) (b)

6.139%, 1/1/2046

1/1/17 @ 100

5,289,700

4,500,000

New York State Dormitory Authority Revenue

Cabrini of Westchester, Series 2006, GNMA Collateralized, AA, NR (c)

5.200%, 2/15/2041

2/15/17 @ 103

4,735,890

7,750,000

New York State Dormitory Authority Revenue

Rols-R-816, Series A, MBIA Insured, NR, Aaa

(Underlying Obligor: NY Dormitory Authority)(b)

6.139%, 7/1/2046

7/1/16 @ 100

8,178,730

28,494,820

Ohio – 2.5%

4,560,000

Akron Bath Copley Joint Township Hospital District Revenue

Hospital Facilities-Summa Health Systems, Series A, RADIAN Insured, AA, Aa3 (a)

5.500%, 11/15/2034

11/15/14 @ 100

4,840,394

1,475,000

Huron County Hospital Facilities Revenue Improvement and Refunding,

Fishier-Titus Medical Center, Series 2007, A, NR

5.250%, 12/1/2037

6/1/17 @ 100

1,506,978

6,347,372

Pennsylvania – 4.6%

8,000,000

Allegheny County Hospital Development Authority Health System Revenue

West Penn, Series 2007 A, BB, Ba2 (c)

5.375%, 11/15/2040

11/15/17 @ 100

7,944,160

3,750,000

Pennsylvania Higher Educational Facilities Authority

Widener University Series 2003, BBB+, NR

5.375%, 7/15/2029

7/15/13 @ 100

3,883,762

11,827,922

Rhode Island – 2.8%

3,000,000

Rhode Island State Health & Educational Building Corporation Revenue

Hospital Financing Lifespan Obligated Group, A-, A3

6.500%, 8/15/2032

8/15/12 @ 100

3,334,140

3,000,000

Rhode Island State Health & Educational Building Corporation Revenue

Prerefunded Hospital Financing Lifespan, A-, A3

6.375%, 8/15/2021

8/15/12 @ 100

3,321,330

500,000

Rhode Island State Health & Educational Building Corporation Revenue

Unrefunded Hospital Financing Lifespan, A-, A3

6.375%, 8/15/2021

8/15/12 @ 100

540,810

7,196,280

South Carolina – 2.6%

Lexington County Health Services District, Inc., Hospital Revenue

Lexington Medical Center, Series 2004, A+, A2

1,430,000

5.500%, 5/1/2032

5/1/14 @ 100

1,488,516

5,000,000

5.500%, 5/1/2037 (a)

5/1/14 @ 100

5,195,750

6,684,266

Texas – 2.1%

5,215,000

Freer Independent School District

School Building, Series 2007, PSF Guaranteed, AAA, NR (d)

5.250%, 8/15/2037

8/15/17 @ 100

5,499,635

See notes to financial statements.

14 l SemiAnnual Report l June 30, 2007

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund l Portfolio of Investments (unaudited) continued

Principal Amount

Optional Call Provisions

Value

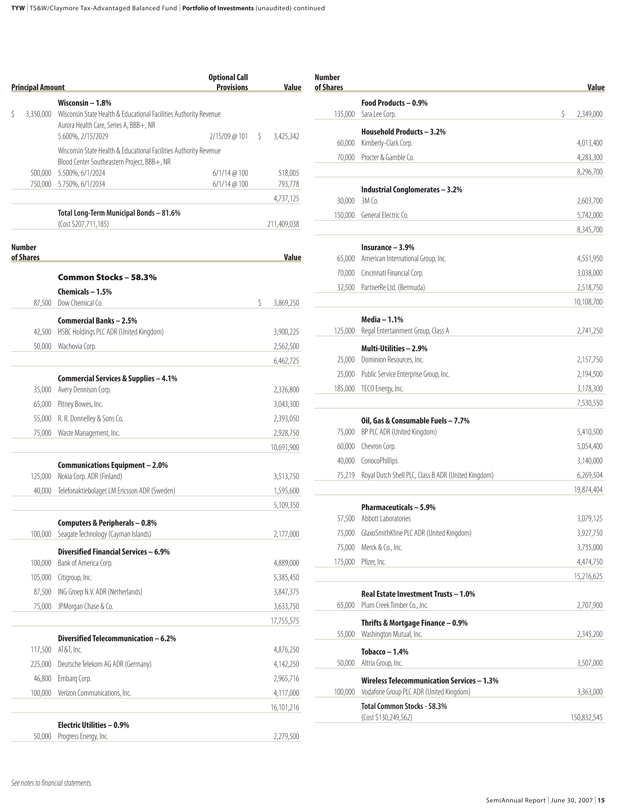

Wisconsin – 1.8%

$3,350,000

Wisconsin State Health & Educational Facilities Authority Revenue

Aurora Health Care, Series A, BBB+, NR

5.600%, 2/15/2029

2/15/09 @ 101

$3,425,342

Wisconsin State Health & Educational Facilities Authority Revenue

Blood Center Southeastern Project, BBB+, NR

500,000

5.500%, 6/1/2024

6/1/14 @ 100

518,005

750,000

5.750%, 6/1/2034

6/1/14 @ 100

793,778

4,737,125

Total Long-Term Municipal Bonds – 81.6% (Cost $207,711,185)

211,409,038

Number of Shares

Value

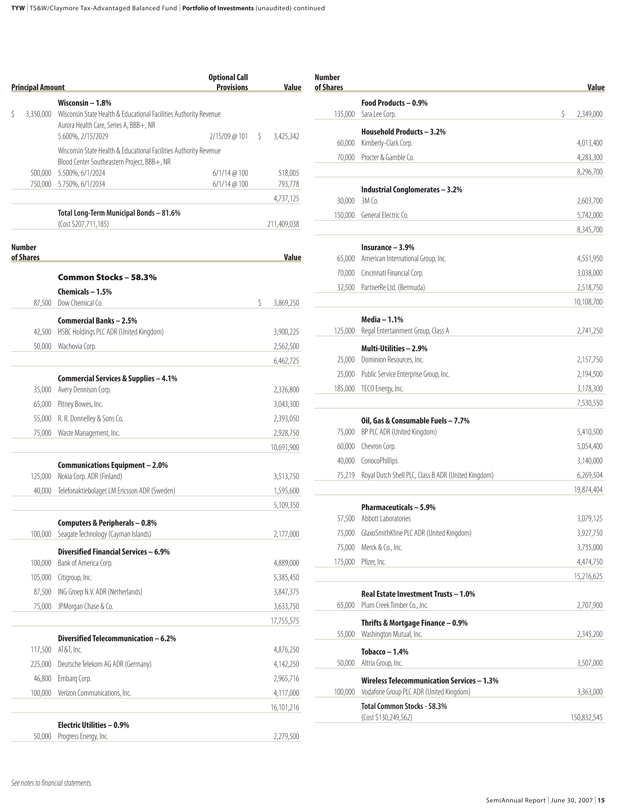

Common Stocks – 58.3%

Chemicals – 1.5%

87,500

Dow Chemical Co.

$3,869,250

Commercial Banks – 2.5%

42,500

HSBC Holdings PLC ADR (United Kingdom)

3,900,225

50,000

Wachovia Corp.

2,562,500

6,462,725

Commercial Services & Supplies – 4.1%

35,000

Avery Dennison Corp.

2,326,800

65,000

Pitney Bowes, Inc.

3,043,300

55,000

R. R. Donnelley & Sons Co.

2,393,050

75,000

Waste Management, Inc.

2,928,750

10,691,900

Communications Equipment – 2.0%

125,000

Nokia Corp. ADR (Finland)

3,513,750

40,000

Telefonaktiebolaget LM Ericsson ADR (Sweden)

1,595,600

5,109,350

Computers & Peripherals – 0.8%

100,000

Seagate Technology (Cayman Islands)

2,177,000

Diversified Financial Services – 6.9%

100,000

Bank of America Corp.

4,889,000

105,000

Citigroup, Inc.

5,385,450

87,500

ING Groep N.V. ADR (Netherlands)

3,847,375

75,000

JPMorgan Chase & Co.

3,633,750

17,755,575

Diversified Telecommunication – 6.2%

117,500

AT&T, Inc.

4,876,250

225,000

Deutsche Telekom AG ADR (Germany)

4,142,250

46,800

Embarq Corp.

2,965,716

100,000

Verizon Communications, Inc.

4,117,000

16,101,216

Electric Utilities – 0.9%

50,000

Progress Energy, Inc.

2,279,500

Number of Shares

Value

Food Products – 0.9%

135,000

Sara Lee Corp.

$2,349,000

Household Products – 3.2%

60,000

Kimberly-Clark Corp.

4,013,400

70,000

Procter & Gamble Co.

4,283,300

8,296,700

Industrial Conglomerates – 3.2%

30,000

3M Co.

2,603,700

150,000

General Electric Co.

5,742,000

8,345,700

Insurance – 3.9%

65,000

American International Group, Inc.

4,551,950

70,000

Cincinnati Financial Corp.

3,038,000

32,500

PartnerRe Ltd. (Bermuda)

2,518,750

10,108,700

Media – 1.1%

125,000

Regal Entertainment Group, Class A

2,741,250

Multi-Utilities – 2.9%

25,000

Dominion Resources, Inc.

2,157,750

25,000

Public Service Enterprise Group, Inc.

2,194,500

185,000

TECO Energy, Inc.

3,178,300

7,530,550

Oil, Gas & Consumable Fuels – 7.7%

75,000

BP PLC ADR (United Kingdom)

5,410,500

60,000

Chevron Corp.

5,054,400

40,000

ConocoPhillips

3,140,000

75,219

Royal Dutch Shell PLC, Class B ADR (United Kingdom)

6,269,504

19,874,404

Pharmaceuticals – 5.9%

57,500

Abbott Laboratories

3,079,125

75,000

GlaxoSmithKline PLC ADR (United Kingdom)

3,927,750

75,000

Merck & Co., Inc.

3,735,000

175,000

Pfizer, Inc.

4,474,750

15,216,625

Real Estate Investment Trusts – 1.0%

65,000

Plum Creek Timber Co., Inc.

2,707,900

Thrifts & Mortgage Finance – 0.9%

55,000

Washington Mutual, Inc.

2,345,200

Tobacco – 1.4%

50,000

Altria Group, Inc.

3,507,000

Wireless Telecommunication Services – 1.3%

100,000

Vodafone Group PLC ADR (United Kingdom)

3,363,000

Total Common Stocks - 58.3%

(Cost $130,249,562)

150,832,545

See notes to financial statements.

SemiAnnual Report l June 30, 2007 l 15

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund l Portfolio of Investments (unaudited) continued

Principal Amount

Optional Call Provisions

Value

Corporate Bonds – 7.2%

Aerospace/Defense – 0.7%

$1,000,000

DRS Technologies, Inc., B, B3

6.875%, 11/1/2013

11/1/08 @ 103.44

$970,000

700,000

L-3 Communications Corp., BB+, Ba3

7.625%, 6/15/2012

8/10/07 @ 103.81

716,625

1,686,625

Apparel – 0.4%

1,000,000

Phillips-Van Heusen Corp., BB, Ba3

7.250%, 2/15/2011

2/15/08 @ 103.63

1,015,000

Auto Manufacturers – 0.4%

1,000,000

Navistar International Corp., NR, NR

7.500%, 6/15/2011

6/15/08 @ 103.75

992,472

Auto Parts & Equipment – 0.2%

500,000

Goodyear Tire & Rubber Co. (The), B, B2

7.857%, 8/15/2011

N/A

510,000

Commercial Banks – 0.1%

100,000

FCB/NC Capital Trust I, BB+, A3

8.050%, 3/1/2028

3/1/08 @ 104.03

104,591

Commercial Services – 0.1%

350,000

Rent-A-Center, Inc., B+, B2

7.500%, 5/1/2010

8/10/07 @ 102.5

355,250

Diversified Financial Services – 0.4%

1,000,000

General Motors Acceptance Corp., BB+, Ba1

6.875%, 9/15/2011

N/A

983,654

Electronics – 0.3%

700,000

IMAX Corp. (Canada), CCC+, Caa2

9.625%, 12/1/2010

12/1/07 @ 104.81

710,500

Food – 0.5%

1,465,000

Dean Foods Co., B+, B1

7.000%, 6/1/2016

N/A

1,399,075

235,000

Smithfield Foods, Inc., BB, Ba3

7.000%, 8/1/2011

N/A

233,825

1,632,900

Forest Products & Paper – 0.1%

400,000

Boise Cascade LLC, B+, B2

7.125%, 10/15/2014

10/15/09 @ 103.56

380,000

Health Care – 0.3%

740,000

DaVita, Inc., B, B2

7.250%, 3/15/2015

3/15/10 @ 103.63

730,750

Home Builders – 0.3%

1,000,000

K. Hovnanian Enterprises, Inc., BB, Ba3

6.500%, 1/15/2014

N/A

885,000

Principal Amount

Optional Call Provisions

Value

Home Furnishings – 0.4%

$1,000,000

Sealy Mattress Co., B, B2

8.250%, 6/15/2014

6/15/09 @ 104.13

$1,025,000

Insurance – 0.6%

500,000

Odyssey Re Holdings Corp., BBB-,Baa3

7.650%, 11/1/2013

N/A

531,998

1,000,000

Presidential Life Corp., B, B2

7.875%, 2/15/2009

N/A

1,000,000

1,531,998

Iron/Steel – 0.3%

374,000

AK Steel Corp., B+, B2

7.875%, 2/15/2009

8/10/07 @ 100.00

373,065

455,000

Allegheny Technologies, Inc., BB-, Ba2

8.375%, 12/15/2011

N/A

480,025

853,090

Office/Business Equipment – 0.4%

1,000,000

Xerox Capital Trust I, BB, Ba1

8.000%, 2/1/2027

8/10/07 @ 102.45

1,026,613

Oil & Gas – 0.6%

500,000

Chesapeake Energy Corp., BB, Ba2

6.500%, 8/15/2017

N/A

473,750

1,000,000

Giant Industries, Inc., NR, NR

8.000%, 5/15/2014

N/A

1,082,300

1,556,050

Retail – 0.5%

500,000

Bon-Ton Stores, Inc. (The), B-, B3

10.250%, 3/15/2014

3/15/10 @ 105.13

506,250

700,000

Dillards, Inc., BB, B1

7.130%, 8/1/2018

N/A

665,841

475,000

Pantry, Inc. (The), B, B3

7.750%, 2/15/2014

2/15/09 @ 103.88

463,125

1,635,216

Semiconductors – 0.1%

345,000

Advanced Micro Devices, Inc., BB-, Ba2

7.750%, 11/1/2012

11/1/08 @ 103.88

325,163

Telecommunications – 0.1%

83,000

American Cellular Corp., CCC, B3

10.000%, 8/1/2011

8/10/07 @ 105.00

86,943

Transportation – 0.4%

850,000

Overseas Shipholding Group, BB+, Ba1

8.750%, 12/1/2013

N/A

924,375

Total Corporate Bonds – 7.2%

(Cost $19,094,808)

18,951,190

See notes to financial statements.

16 l SemiAnnual Report l June 30, 2007

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund l Portfolio of Investments (unaudited) continued

Number of Shares

Value

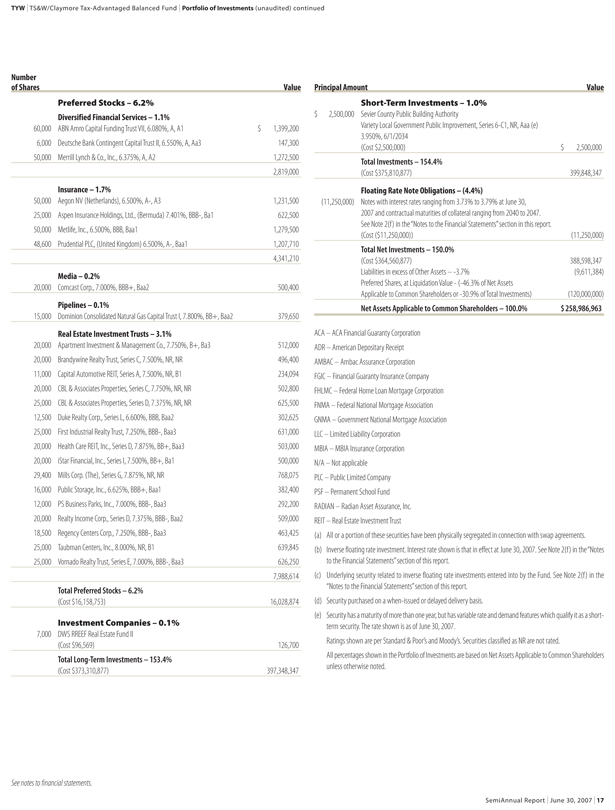

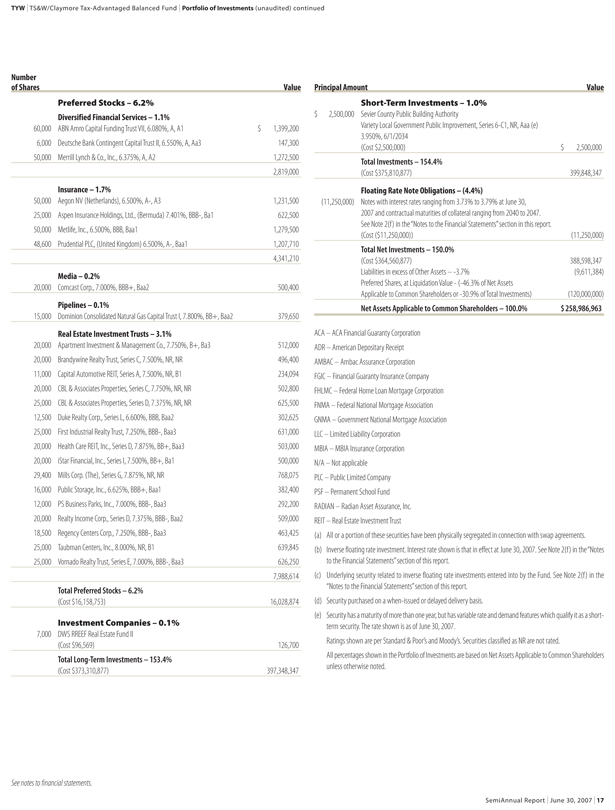

Preferred Stocks – 6.2%

Diversified Financial Services – 1.1%

60,000

ABN Amro Capital Funding Trust VII, 6.080%, A, A1

$1,399,200

6,000

Deutsche Bank Contingent Capital Trust II, 6.550%, A, Aa3

147,300

50,000

Merrill Lynch & Co., Inc., 6.375%, A, A2

1,272,500

2,819,000

Insurance – 1.7%

50,000

Aegon NV (Netherlands), 6.500%, A-, A3

1,231,500

25,000

Aspen Insurance Holdings, Ltd., (Bermuda) 7.401%, BBB-, Ba1

622,500

50,000

Metlife, Inc., 6.500%, BBB, Baa1

1,279,500

48,600

Prudential PLC, (United Kingdom) 6.500%, A-, Baa1

1,207,710

4,341,210

Media – 0.2%

20,000

Comcast Corp., 7.000%, BBB+, Baa2

500,400

Pipelines – 0.1%

15,000

Dominion Consolidated Natural Gas Capital Trust I, 7.800%, BB+, Baa2

379,650

Real Estate Investment Trusts – 3.1%

20,000

Apartment Investment & Management Co., 7.750%, B+, Ba3

512,000

20,000

Brandywine Realty Trust, Series C, 7.500%, NR, NR

496,400

11,000

Capital Automotive REIT, Series A, 7.500%, NR, B1

234,094

20,000

CBL & Associates Properties, Series C, 7.750%, NR, NR

502,800

25,000

CBL & Associates Properties, Series D, 7.375%, NR, NR

625,500

12,500

Duke Realty Corp., Series L, 6.600%, BBB, Baa2

302,625

25,000

First Industrial Realty Trust, 7.250%, BBB-, Baa3

631,000

20,000

Health Care REIT, Inc., Series D, 7.875%, BB+, Baa3

503,000

20,000

iStar Financial, Inc., Series I, 7.500%, BB+, Ba1

500,000

29,400

Mills Corp. (The), Series G, 7.875%, NR, NR

768,075

16,000

Public Storage, Inc., 6.625%, BBB+, Baa1

382,400

12,000

PS Business Parks, Inc., 7.000%, BBB-, Baa3

292,200

20,000

Realty Income Corp., Series D, 7.375%, BBB-, Baa2

509,000

18,500

Regency Centers Corp., 7.250%, BBB-, Baa3

463,425

25,000

Taubman Centers, Inc., 8.000%, NR, B1

639,845

25,000

Vornado Realty Trust, Series E, 7.000%, BBB-, Baa3

626,250

7,988,614

Total Preferred Stocks – 6.2% (Cost $16,158,753)

16,028,874

Investment Companies – 0.1%

7,000

DWS RREEF Real Estate Fund II (Cost $96,569)

126,700

Total Long-Term Investments – 153.4% (Cost $373,310,877)

397,348,347

Principal Amount

Value

Short-Term Investments – 1.0%

$ 2,500,000

Sevier County Public Building Authority

Variety Local Government Public Improvement, Series 6-C1, NR, Aaa (e)

3.950%, 6/1/2034

(Cost $2,500,000)

$2,500,000

Total Investments – 154.4%

(Cost $375,810,877)

399,848,347

Floating Rate Note Obligations – (4.4%)

(11,250,000)

Notes with interest rates ranging from 3.73% to 3.79% at June 30,

2007 and contractual maturities of collateral ranging from 2040 to 2047.

See Note 2(f) in the “Notes to the Financial Statements” section in this report.

(Cost ($11,250,000))

(11,250,000)

Total Net Investments – 150.0%

(Cost $364,560,877)

388,598,347

Liabilities in excess of Other Assets – -3.7%

(9,611,384)

Preferred Shares, at Liquidation Value - (-46.3% of Net Assets

Applicable to Common Shareholders or -30.9% of Total Investments)

(120,000,000)

Net Assets Applicable to Common Shareholders – 100.0%

$258,986,963

ACA – ACA Financial Guaranty Corporation ADR – American Depositary Receipt AMBAC – Ambac Assurance Corporation FGIC – Financial Guaranty Insurance Company FHLMC – Federal Home Loan Mortgage Corporation FNMA – Federal National Mortgage Association GNMA – Government National Mortgage Association LLC – Limited Liability Corporation MBIA – MBIA Insurance Corporation N/A – Not applicable PLC – Public Limited Company PSF – Permanent School Fund RADIAN – Radian Asset Assurance, Inc.

REIT – Real Estate Investment Trust

(a) All or a portion of these securities have been physically segregated in connection with swap agreements.

(b) Inverse floating rate investment. Interest rate shown is that in effect at June 30, 2007. See Note 2(f) in the “Notes to the Financial Statements” section of this report.

(c) Underlying security related to inverse floating rate investments entered into by the Fund. See Note 2(f) in the “Notes to the Financial Statements” section of this report.

(d) Security purchased on a when-issued or delayed delivery basis.

(e) Security has a maturity of more than one year, but has variable rate and demand features which qualify it as a short-term security. The rate shown is as of June 30, 2007.

Ratings shown are per Standard & Poor’s and Moody’s. Securities classified as NR are not rated.

All percentages shown in the Portfolio of Investments are based on Net Assets Applicable to Common Shareholders unless otherwise noted.

See notes to financial statements. SemiAnnual Report l June 30, 2007 l 17

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund

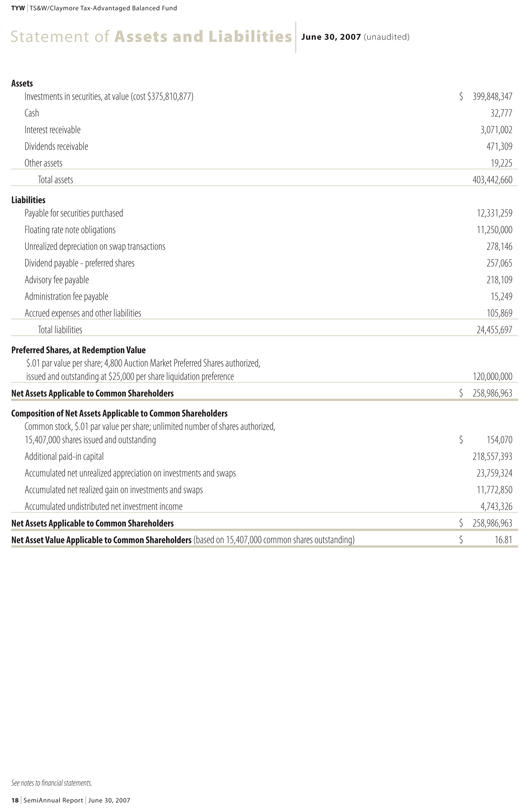

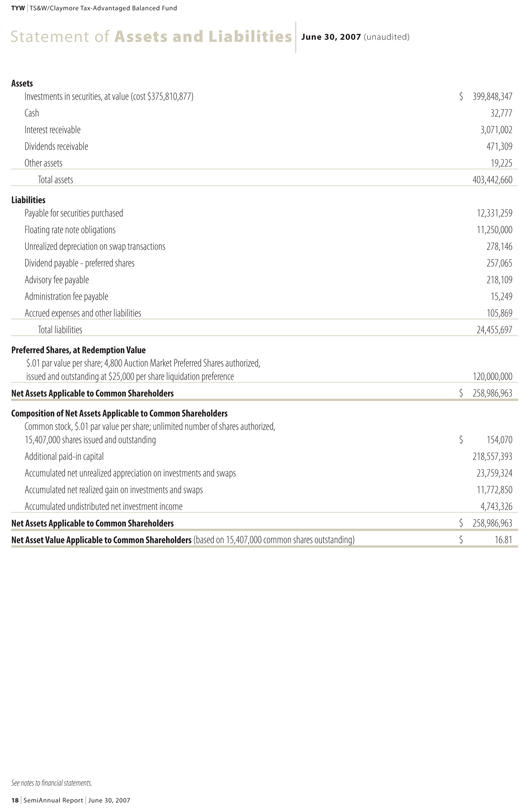

Statement of Assets and LiabilitieslJune 30, 2007 (unaudited)

Assets

Investments in securities, at value (cost $375,810,877) $399,848,347

Cash 32,777

Interest receivable 3,071,002

Dividends receivable 471,309

Other assets 19,225

Total assets 403,442,660

Liabilities

Payable for securities purchased 12,331,259

Floating rate note obligations 11,250,000

Unrealized depreciation on swap transactions 278,146

Dividend payable - preferred shares 257,065

Advisory fee payable 218,109

Administration fee payable 15,249

Accrued expenses and other liabilities 105,869

Total liabilities 24,455,697

Preferred Shares, at Redemption Value

$.01 par value per share; 4,800 Auction Market Preferred Shares authorized, issued and outstanding at $25,000 per share liquidation preference 120,000,000

Net Assets Applicable to Common Shareholders $258,986,963

Composition of Net Assets Applicable to Common Shareholders Common stock, $.01 par value per share; unlimited number of shares authorized, 15,407,000 shares issued and outstanding

$154,070 Additional paid-in capital 218,557,393

Accumulated net unrealized appreciation on investments and swaps 23,759,324

Accumulated net realized gain on investments and swaps 11,772,850

Accumulated undistributed net investment income 4,743,326

Net Assets Applicable to Common Shareholders $258,986,963

Net Asset Value Applicable to Common Shareholders (based on 15,407,000 common shares outstanding) $16.81

See notes to financial statements.

18 l SemiAnnual Report l June 30, 2007

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund

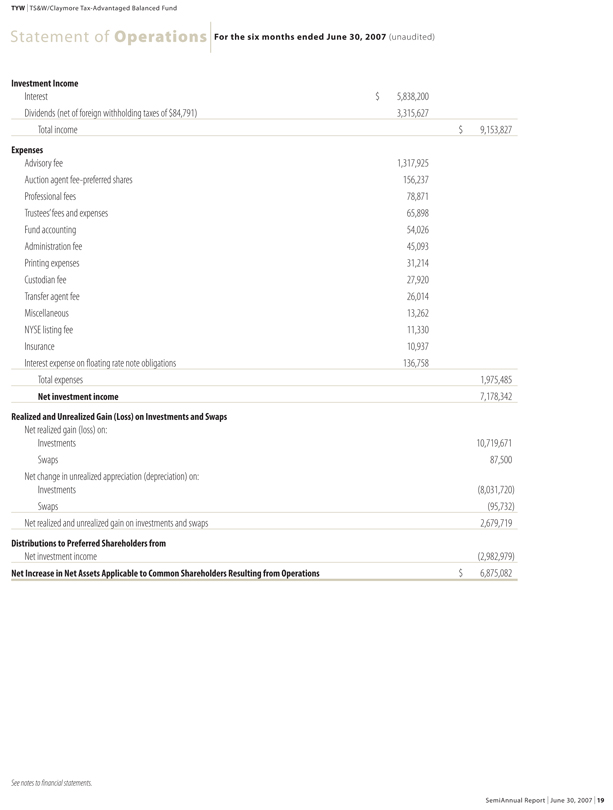

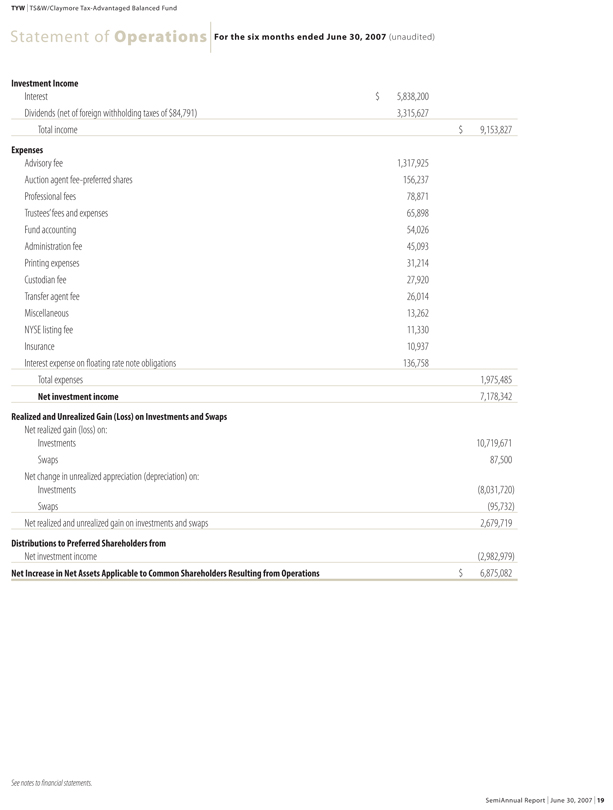

Statement of OperationslFor the six months ended June 30, 2007 (unaudited)

Investment Income

Interest $5,838,200

Dividends (net of foreign withholding taxes of $84,791) 3,315,627

Total income $9,153,827

Expenses

Advisory fee 1,317,925

Auction agent fee-preferred shares 156,237

Professional fees 78,871

Trustees’ fees and expenses 65,898

Fund accounting 54,026

Administration fee 45,093

Printing expenses 31,214

Custodian fee 27,920

Transfer agent fee 26,014

Miscellaneous 13,262

NYSE listing fee 11,330

Insurance 10,937

Interest expense on floating rate note obligations 136,758

Total expenses 1,975,485

Net investment income 7,178,342

Realized and Unrealized Gain (Loss) on Investments and Swaps

Net realized gain (loss) on:

Investments 10,719,671

Swaps 87,500

Net change in unrealized appreciation (depreciation) on:

Investments (8,031,720)

Swaps (95,732)

Net realized and unrealized gain on investments and swaps 2,679,719

Distributions to Preferred Shareholders from

Net investment income (2,982,979)

Net Increase in Net Assets Applicable to Common Shareholders Resulting from Operations $6,875,082

See notes to financial statements.

SemiAnnual Report l June 30, 2007 l 19

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund

Statement of Changes in Net Assets Applicable to Common Shareholders l

For the Six Months Ended June 30, 2007 (unaudited)

For the Year Ended December 31, 2006

Increase in Net Assets Applicable to Common Shareholders Resulting from Operations

Net investment income

$7,178,342

$14,087,404

Net realized gain on investments and swaps

10,807,171

11,312,240

Net change in unrealized appreciation (depreciation) on investments and swaps

(8,127,452)

16,209,364

Distributions to Preferred Shareholders

From and in excess of net investment income

(2,982,979)

(5,648,917)

Net increase in net assets applicable to common shareholders resulting from operations

6,875,082

35,960,091

Distributions to Common Shareholders from and in excess of Net Investment Income

(7,222,031)

(14,444,063)

Total increase (decrease) in net assets applicable to common shareholders

(346,949)

21,516,028

Net Assets

Beginning of period

259,333,912

237,817,884

End of period (including accumulated undistributed net investment income of $4,743,326 and $7,769,994, respectively)

$258,986,963

$259,333,912

See notes to financial statements.

20 l SemiAnnual Report l June 30, 2007

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund

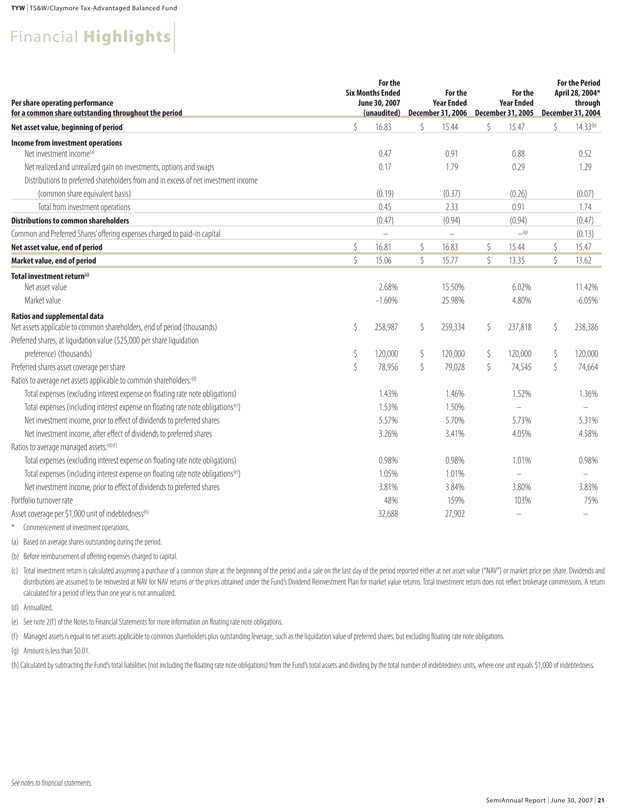

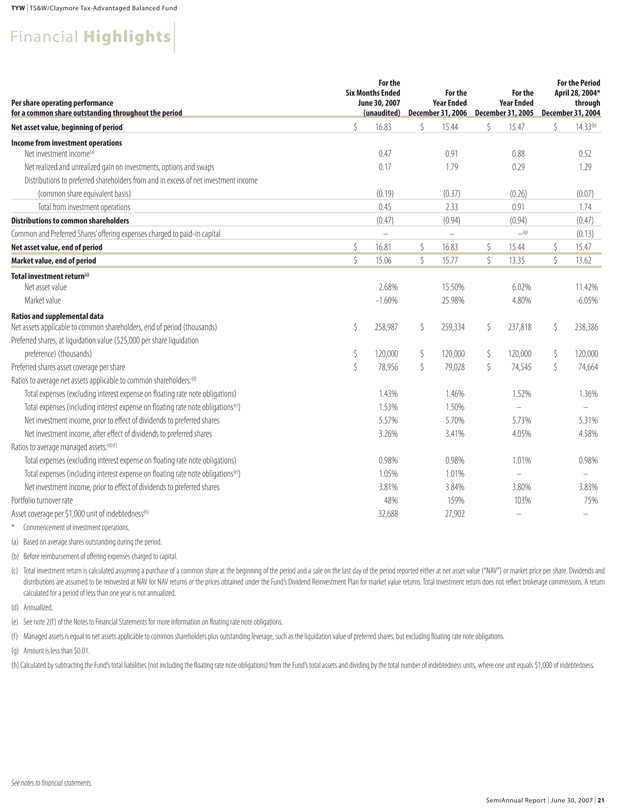

Financial Highlightsl

Per share operating performance for a common share outstanding throughout the period

For the Six Months Ended June 30, 2007 (unaudited)

For the Year Ended December 31, 2006

For the Year Ended December 31, 2005

For the Period April 28, 2004* through December 31, 2004

Net asset value, beginning of period $16.83 $15.44 $15.47 $14.33(b)

Income from investment operations

Net investment income(a) 0.47 0.91 0.88 0.52

Net realized and unrealized gain on investments, options and swaps 0.17 1.79 0.29 1.29

Distributions to preferred shareholders from and in excess of net investment income

(common share equivalent basis) (0.19) (0.37) (0.26) (0.07)

Total from investment operations 0.45 2.33 0.91 1.74

Distributions to common shareholders (0.47) (0.94) (0.94) (0.47)

Common and Preferred Shares’ offering expenses charged to paid-in capital – – –(g) (0.13)

Net asset value, end of period $16.81 $16.83 $15.44 $15.47

Market value, end of period $15.06 $15.77 $13.35 $13.62

Total investment return(c)

Net asset value 2.68% 15.50% 6.02% 11.42%

Market value -1.60% 25.98% 4.80% -6.05%

Ratios and supplemental data

Net assets applicable to common shareholders, end of period (thousands) $258,987 $259,334 $237,818 $238,386

Preferred shares, at liquidation value ($25,000 per share liquidation preference) (thousands) $120,000 $120,000

$120,000 $120,000

Preferred shares asset coverage per share $78,956 $79,028 $74,545 $74,664

Ratios to average net assets applicable to common shareholders:(d)

Total expenses (excluding interest expense on floating rate note obligations) 1.43% 1.46% 1.52% 1.36%

Total expenses (including interest expense on floating rate note obligations(e)) 1.53% 1.50% – –

Net investment income, prior to effect of dividends to preferred shares 5.57% 5.70% 5.73% 5.31%

Net investment income, after effect of dividends to preferred shares 3.26% 3.41% 4.05% 4.58%

Ratios to average managed assets:(d)(f)

Total expenses (excluding interest expense on floating rate note obligations) 0.98% 0.98% 1.01% 0.98%

Total expenses (including interest expense on floating rate note obligations(e)) 1.05% 1.01% – –

Net investment income, prior to effect of dividends to preferred shares 3.81% 3.84% 3.80% 3.83%

Portfolio turnover rate 48% 159% 103% 75%

Asset coverage per $1,000 unit of indebtedness(h) 32,688 27,902 – –

* Commencement of investment operations.

(a) Based on average shares outstanding during the period.

(b) Before reimbursement of offering expenses charged to capital.

(c) Total investment return is calculated assuming a purchase of a common share at the beginning of the period and a sale on the last day of the period reported either at net asset value (“NAV”) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for NAV returns or the prices obtained under the Fund’s Dividend Reinvestment Plan for market value returns. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized.

(d) Annualized.

(e) See note 2(f) of the Notes to Financial Statements for more information on floating rate note obligations.

(f) Managed assets is equal to net assets applicable to common shareholders plus outstanding leverage, such as the liquidation value of preferred shares, but excluding floating rate note obligations.

(g) Amount is less than $0.01.

(h) Calculated by subtracting the Fund’s total liabilities (not including the floating rate note obligations) from the Fund’s total assets and dividing by the total number of indebtedness units, where one unit equals $1,000 of indebtedness.

See notes to financial statements.

SemiAnnual Report l June 30, 2007 l 21

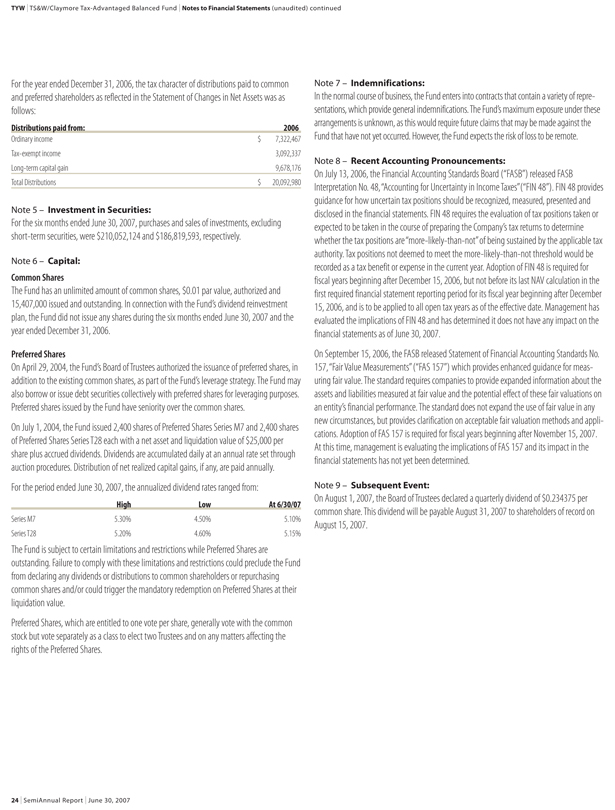

TYW l TS&W/Claymore Tax-Advantaged Balanced Fund

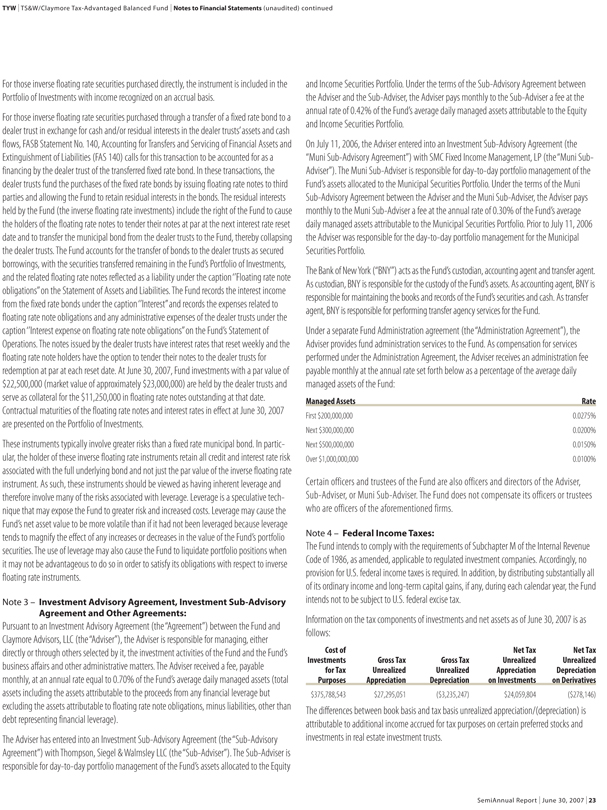

Notes to Financial StatementslJune 30, 2007 (unaudited)

Note 1– Organization:

TS&W/Claymore Tax-Advantaged Balanced Fund (the “Fund”) was organized as a Delaware statutory trust on February 12, 2004. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940.

Under normal market conditions, the Fund will invest at least 50%, but less than 60% of its total assets in debt securities and other obligations issued by or on behalf of states, territories and possessions of the United States and the District of Columbia and their political subdivisions, agencies and instrumentalities, the interest on which is exempt from regular federal income tax and which is not a preference item for purposes of the alternative minimum tax (the “Municipal Securities Portfolio”) and at least 40%, but less than 50%, of its total assets in common stocks, preferred securities and other income securities (the “Equity and Income Securities Portfolio”).

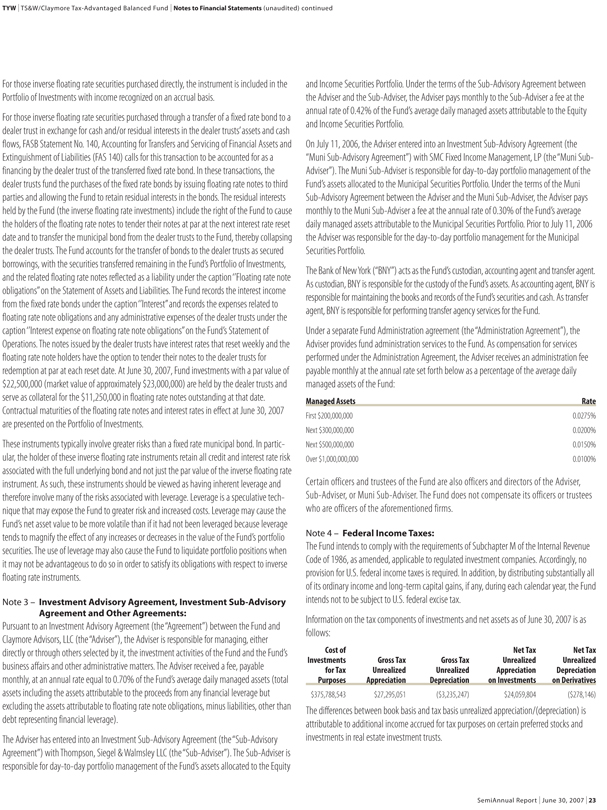

Note 2 – Accounting Policies: