As filed with the Securities and Exchange Commission on August 13, 2004

File No. 0-50635

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 2

to

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(B) OR 12(G) OF THE

SECURITIES EXCHANGE ACT OF 1934

COLONY RESORTS LVH ACQUISITIONS, LLC

(Exact Name of Registrant as Specified in Its Charter)

| | |

| NEVADA | | 41-2120123 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

1999 AVENUE OF THE STARS, SUITE 1200 LOS ANGELES, CALIFORNIA | | 90067 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 310-282-8820

Copies of correspondence to:

| | |

Mark M. Hedstrom Colony Capital, LLC 1999 Avenue of the Stars Suite 1200 Los Angeles, CA 90067 | | Thomas M. Cerabino, Esq. Willkie Farr & Gallagher LLP 787 Seventh Avenue New York, NY 10019 |

SECURITIES TO BE REGISTERED PURSUANT TO SECTION 12(B) OF THE ACT:

| | |

Title of each class to be so registered

| | Name of each exchange on which each class to be registered

|

| NOT APPLICABLE | | NOT APPLICABLE |

SECURITIES TO BE REGISTERED PURSUANT TO SECTION 12(G) OF THE ACT:

CLASS A MEMBERSHIP UNITS

(Title of class)

TABLE OF CONTENTS

-i-

FORWARD LOOKING STATEMENTS MAY PROVE INACCURATE

CERTAIN STATEMENTS IN THIS REGISTRATION STATEMENT (THE “REGISTRATION STATEMENT”) CONTAIN OR MAY CONTAIN INFORMATION THAT IS FORWARD-LOOKING. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE DESCRIBED IN THE FORWARD-LOOKING STATEMENTS AND WILL BE AFFECTED BY A VARIETY OF RISKS AND FACTORS INCLUDING BUT NOT LIMITED TO THE FOLLOWING: THE INABILITY OF REGULATED ENTITIES AND CERTAIN OFFICERS AND OTHER AFFILIATES OF THE COMPANY (AS DEFINED HEREIN) TO OBTAIN GAMING LICENSES OR PERMITS IN JURISDICTIONS WHERE THE CURRENT OR PLANNED BUSINESS OF THE COMPANY REQUIRES SUCH LICENSES OR PERMITS; THE LIMITATION, CONDITIONING, REVOCATION OR SUSPENSION OF ANY SUCH GAMING LICENSES OR PERMITS; A FINDING OF UNSUITABILITY OR DENIAL BY REGULATORY AUTHORITIES WITH RESPECT TO ANY MANAGERS OR OFFICERS, DIRECTORS OR KEY EMPLOYEES REQUIRED TO BE FOUND SUITABLE; LOSS OR RETIREMENT OF KEY EXECUTIVES; INCREASED COMPETITION IN EXISTING MARKETS OR THE OPENING OF NEW GAMING JURISDICTIONS (INCLUDING IN NATIVE AMERICAN LANDS); A DECLINE IN THE PUBLIC ACCEPTANCE OF GAMING; INCREASES IN OR NEW TAXES OR FEES IMPOSED ON GAMING REVENUES OR GAMING DEVICES; SIGNIFICANT INCREASES IN FUEL OR TRANSPORTATION PRICES; ADVERSE ECONOMIC CONDITIONS IN THE COMPANY’S OR LVH CORPORATION’S (AS DEFINED HEREIN) KEY MARKETS; AND SEVERE OR UNUSUAL WEATHER IN THE COMPANY’S KEY MARKETS. IN ADDITION, THE FINANCING REQUIRED FOR THE ACQUISITION (AS DEFINED HEREIN) SUBSTANTIALLY INCREASED THE LEVERAGE AND OTHER FIXED CHARGE OBLIGATIONS OF THE COMPANY. THE LEVEL OF THE COMPANY’S INDEBTEDNESS AND OTHER FIXED CHARGE OBLIGATIONS COULD HAVE IMPORTANT CONSEQUENCES, INCLUDING BUT NOT LIMITED TO THE FOLLOWING: (1) A SUBSTANTIAL PORTION OF THE COMPANY’S CASH FLOW FROM OPERATIONS WOULD BE DEDICATED TO DEBT SERVICE AND OTHER FIXED CHARGE OBLIGATIONS AND WOULD NOT BE AVAILABLE FOR OTHER PURPOSES; (2) THE COMPANY’S ABILITY TO OBTAIN ADDITIONAL FINANCING IN THE FUTURE FOR WORKING CAPITAL, CAPITAL EXPENDITURES OR ACQUISITIONS MAY BE LIMITED; AND (3) THE COMPANY’S LEVEL OF INDEBTEDNESS COULD LIMIT ITS FLEXIBILITY IN REACTING TO CHANGES IN ITS INDUSTRY AND ECONOMIC CONDITIONS GENERALLY. READERS SHOULD CAREFULLY REVIEW THIS REGISTRATION STATEMENT IN ITS ENTIRETY, INCLUDING BUT NOT LIMITED TO THE COMPANY’S AND LVH CORPORATION’S RESPECTIVE FINANCIAL STATEMENTS AND THE NOTES THERETO.

Colony Resorts LVH Acquisitions, LLC, a Nevada limited liability company (the “Company”), was formed at the direction of Colony Investors VI, L.P., a Delaware limited partnership (“Colony VI”) and an affiliate of Colony Capital, LLC (“Colony Capital”) of Los Angeles, California, under the laws of the State of Nevada on December 18, 2003. Prior to the consummation of the Acquisition (as defined below), the Company conducted no business other than in connection with the Purchase and Sale Agreement (as defined herein), relating to the acquisition of substantially all of the assets and certain liabilities of LVH Corporation, a Nevada corporation (“LVH”). LVH is a wholly-owned subsidiary of Caesars Entertainment Inc., formerly Park Place Entertainment Corporation (“Park Place”). Prior to the consummation of the Acquisition, LVH owned and operated the Las Vegas Hilton, a casino hotel located in Las Vegas, Nevada (the “Hotel”). The Company does not currently have any subsidiaries.

Colony Capital is a private, international investment firm focusing primarily on real estate-related assets and operating companies with a strategic dependence on such assets. Colony VI is its sixth discrete investment fund. Colony Capital is led by Thomas J. Barrack, Jr., Chairman and Chief Executive Officer. Colony Capital has a

2

staff of approximately 105 people, with offices in Los Angeles, New York, Kohala Coast in Hawaii, London, Paris, Rome, Seoul, Shanghai, Singapore, Taipei, and Tokyo.

The Company, LVH and Park Place, entered into a Purchase and Sale Agreement, dated as of December 24, 2003 (the “Purchase and Sale Agreement”). Pursuant to the Purchase and Sale Agreement, subject to the satisfaction or waiver of certain conditions to the obligations of the parties under the Purchase and Sale Agreement, the Company will acquire substantially all of the assets, including the real property on which the hotel is situated and related parcels of land and all buildings, structures and fixtures on such land, all furniture and equipment used in connection with the operation of the Hotel, and all cash held by LVH as of the closing of the transaction, and certain liabilities of LVH (the “Acquisition”), for a purchase price of $280 million, subject to certain adjustments for proration items and a working capital adjustment. Subsequent to the Acquisition, the Company will continue certain of the current business operations of LVH. On June 18, 2004, the Acquisition was consummated.

Following the completion of the Acquisition, the Company does not have an ongoing relationship with LVH or Park Place except for customary, surviving provisions in the Purchase and Sale Agreement. Certain terms of the Purchase and Sale Agreement survive the closing of the Purchase and Sale Agreement, including the representations and warranties of each party which generally survive for a period of 270 days post-closing. In addition, certain covenants including the obligation to keep information confidential survive the closing. The other covenants survive in accordance with their respective terms which are set forth in the Purchase and Sale Agreement, a copy of which is attached as an exhibit to this Registration Statement. The indemnification provisions of the Purchase and Sale Agreement also survive the closing of the Acquisition.

All of the Company’s Class A Units (as defined below) outstanding prior to the closing of the Acquisition were held by Holdings (as defined below). The Class A Units held by Holdings were exchanged for Class B Units (as defined below) immediately prior to and in connection with the closing of the Acquisition.

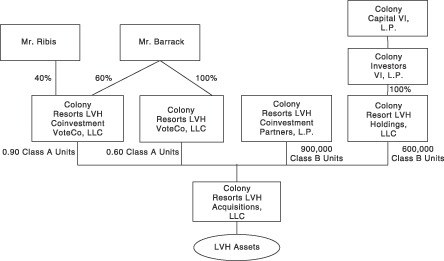

In connection with and immediately prior to the closing of the Acquisition, the Company issued:

| | • | 0.90 Class A Membership Units (“Class A Units”) to Colony Resorts LVH Coinvestment VoteCo, LLC, a Delaware limited liability company (“Coinvestment VoteCo”) for a total purchase price of $90 in cash; |

| | • | 0.60 Class A Units to Colony Resorts LVH VoteCo, LLC, a Delaware limited liability company (“VoteCo”) for a total purchase price of $60 in cash; |

| | • | 900,000 Class B Membership Units (“Class B Units” and together with the Class A Units, the “Membership Units”) to Colony Resorts LVH Co-Investment Partners, L.P., a Delaware limited partnership (“Co-Investment Partners”) for a total purchase price of $90,000,000 in cash; and |

| | • | 600,000 Class B Units to Colony Resorts LVH Holdings, LLC, a Delaware limited liability company and wholly-owned subsidiary of Colony VI (“Holdings”) for an aggregate purchase price of $60,000,000, including the surrender of the Class A Units previously purchased by Holdings. |

The Company raised approximately $150 million from the sale of the Membership Units, collectively, including the prior sale of Class A Units to Holdings.

In addition, the Company granted options to purchase Membership Units to certain of its executive officers and other qualifying parties pursuant to the terms of the Company’s 2004 Incentive Plan and certain employment arrangements between the Company and such executive officers. See “Item 7. Certain Relationships and Related Transactions.”

Immediately prior to and in connection with the closing of the Acquisition, an Amended and Restated Operating Agreement of the Company (the “Operating Agreement”) was entered into by and among the Company, VoteCo, Coinvestment VoteCo, Holdings and Co-Investment Partners. Pursuant to the Operating

3

Agreement, holders of Class A Units are entitled to one vote per unit in all matters to be voted on by voting members of the Company. Holders of Class B Units are not entitled to vote, except as otherwise expressly required by law. Mr. Barrack is the sole member and manager of VoteCo. Mr. Barrack and Mr. Ribis are the members and managers of Coinvestment VoteCo. Any future holders of Membership Units will be required to become a party to the Operating Agreement. For a description of certain material provisions of the Operating Agreement, see “Item 7. Certain Relationships and Related Transactions.”

The Company issued Class A Units and Class B Units in connection with the organizational structure put in place to consummate the Acquisition so that Holdings and Co-Investment Partners were able to acquire substantially all of the assets of LVH without having any voting power or other power to control the affairs or operations of the Company, except as otherwise expressly required by law. If Holdings or Co-Investment Partners had any voting or other power to control the affairs or operations of the Company, each entity and its respective constituent partners would be required to be licensed or found suitable pursuant to the gaming laws and regulations of the State of Nevada (“Nevada Act”) and Clark County liquor and gaming codes. As a result, Messrs. Barrack and Ribis, through VoteCo and Coinvestment VoteCo are be able to govern all matters of the Company that are subject to the vote of members, including the appointment of managers and officers and the amendment of the Company’s Articles of Organization and Operating Agreement.

The Company was required to be approved by the Nevada Gaming Commission (the “Nevada Commission”), upon the recommendation of the State Gaming Control Board (the “Nevada Board” and collectively with the Nevada Commission, the “Gaming Authorities”), as well as by the Clark County Liquor and Gaming Board (comprised of the Clark County Commissioners) (“Clark County”) prior to acquiring substantially all of the assets of LVH through the Acquisition. In connection with such approvals, VoteCo and Coinvestment VoteCo were registered as holding companies and found suitable as members of the Company. Mr. Barrack was licensed as a member and manager of each of VoteCo and Coinvestment VoteCo and found suitable as a controlling member and manager of the Company. Mr. Ribis was licensed as a manager and member of Coinvestment VoteCo and found suitable as a controlling member and manager of the Company.

On June 17, 2004, the Nevada Commission issued an order of registration of the Company (the “Final Order”), the Final Order (1) prohibits Holdings, Co-Investment Partners, VoteCo, Coinvestment VoteCo or their respective affiliates from selling, assigning, transferring, pledging or otherwise disposing of Membership Units or any other security convertible into or exchangeable for Class A Units or Class B Units, without the prior approval of the Nevada Commission and (2) prohibits the Company from declaring cash dividends or distributions on any class of membership unit of the Company beneficially owned in whole or in part by Holdings, Co-Investment Partners, VoteCo, Coinvestment VoteCo or their respective affiliates, without the prior approval of the Nevada Commission. The Final Order sets forth a description of the Company and its affiliates and intermediary companies and the various gaming licenses and approvals obtained by those entities together with certain conditions and limitations pertaining to the licenses and approvals.

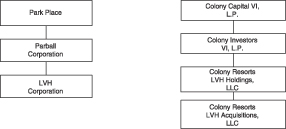

The diagram below shows the ownership of the Company and LVH immediately before the Acquisition and the issuances of the Class A Units and the Class B Units to VoteCo and Coinvestment VoteCo, and Holdings and Co-Investment Partners, respectively, as well as certain affiliations between certain parties.

4

The diagram below shows the ownership of the Company following the closing of the Acquisition as well as certain affiliations between certain parties.

At the time of the closing of the Acquisition, the following transfer restriction agreements were executed: (1) Transfer Restriction Agreement by and among Mr. Barrack, Mr. Ribis, Co-Investment Partners and Coinvestment VoteCo (the “Coinvestment Transfer Restriction Agreement”) and (2) Transfer Restriction Agreement by and among Mr. Barrack, VoteCo and Holdings (the “VoteCo Transfer Restriction Agreement”).

The Company’s Class A Units issued to Coinvestment VoteCo are subject to the Coinvestment Transfer Restriction Agreement, which provides, among other things, that:

| | • | Co-Investment Partners has the right to acquire Class A Units from Coinvestment VoteCo on each occasion that Class B Units held by Co-Investment Partners would be transferred to a proposed purchaser who, in connection with such proposed sale, has obtained all licenses, permits, registrations, authorizations, consents, waivers, orders, findings of suitability or other approvals required to be obtained from, and has made all findings, notices or declarations required to be made with, all gaming authorities under all applicable gaming laws, |

| | • | A specific purchase price, as determined in accordance with the Coinvestment Transfer Restriction Agreement, will be paid to acquire the Class A Units from Coinvestment VoteCo, and |

| | • | Coinvestment VoteCo will not transfer ownership of Class A Units owned by it except pursuant to such option of Co-Investment Partners. |

The Company’s Class A Units issued to VoteCo are subject to the VoteCo Transfer Restriction Agreement, which provides, among other things, that:

| | • | Holdings has the right to acquire Class A Units from VoteCo on each occasion that Class B Units held by Holdings would be transferred to a proposed purchaser who, in connection with such proposed sale, has obtained all licenses, permits, registrations, authorizations, consents, waivers, orders, findings of suitability or other approvals required to be obtained from, and has made all findings, notices or declarations required to be made with, all gaming authorities under all applicable gaming laws, |

| | • | A specific purchase price, as determined in accordance with the VoteCo Transfer Restriction Agreement, will be paid to acquire the Class A Units from VoteCo, and |

| | • | VoteCo will not transfer ownership of Class A Units owned by it except pursuant to such option of Holdings. |

5

The Company financed the Acquisition and paid related fees and expenses with (1) proceeds from the issuance of Class A Units to VoteCo and Coinvestment VoteCo and Class B Units to Holdings and Co-Investment Partners (collectively, the “Equity Financing”), which generated proceeds of approximately $150 million in the aggregate and (2) a term loan in the amount of $200 million from Archon Financial, L.P., an affiliate of Goldman Sachs & Co. (the “Goldman Term Loan” and together with the Equity Financing, the “Acquisition Financing”).

All of the assets to be acquired by the Company in the Acquisition, including the Hotel, secure the Goldman Term Loan.

The Company is filing this Form 10 Registration Statement (the “Registration Statement”) voluntarily. The Company is not required to file this Registration Statement pursuant to the Securities Act of 1933, as amended (the “Securities Act”), or Securities Exchange Act of 1934, as amended (the “Exchange Act”), or the rules and regulations of the Securities and Exchange Commission (the “SEC”) promulgated thereunder.

Upon the effectiveness of this Registration Statement, the Class A Units became registered under Section 12(g) of the Exchange Act. Because such Class A Units are registered under the Exchange Act, the Company is a “publicly traded corporation” under the Nevada Act. Any beneficial owner of the Company’s voting securities or other equity securities may be required to file an application, be investigated, and have such holder’s suitability as a beneficial owner of the Company’s voting securities or other equity securities determined if the Nevada Commission has reason to believe that such ownership would otherwise be inconsistent with the declared policies of the State of Nevada. It is customary practice of Clark County to defer to Nevada Gaming Authorities with respect to the background and suitability investigation of applications of the nature filed by the Company. It is anticipated that the Nevada Commission and Clark County will require only VoteCo and Coinvestment VoteCo and each company’s respective members and managers to be found suitable in connection with the Acquisition. Class B Unit holders will, however, remain subject to the discretionary authority of the Nevada Gaming Authorities and Clark County and may be required to file an application and have their suitability determined or dispose of their indirect investment in the Company. See “—Regulatory Matters—Nevada Gaming Laws and Regulations.”

Following effectiveness of this Registration Statement, the Company is required and will file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any reports, statements or other information filed by the Company at the SEC’s public reference facilities at Room 1024, Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms. The Company’s filings are also available to the public from commercial document retrieval services and at the world wide web site maintained by the SEC at http://www.sec.gov.

LAS VEGAS HILTON

Overview of Las Vegas Hilton

The Las Vegas Hilton Hotel and Casino is located one block east of the Las Vegas Strip (the “Strip”) on approximately fifty-nine acres of land between Paradise Road and Joe W. Brown Drive adjacent to the Las Vegas Convention Center. It has approximately 2,950 hotel rooms, an approximately 74,000 square feet casino with approximately fifty table games and 1,400 slot machines, a race and sports book, twelve restaurants, approximately 4,800 parking spaces, approximately 225,000 square feet of meeting/convention space, a 1,600-seat showroom, a night club, retail outlets, an outdoor pool and a spa and health club.

Property History

Originally developed in 1969, the Hotel was purchased by Hilton in 1971 and has been operated as a Hilton-branded hotel ever since. The Hotel historically catered primarily to the high-end gaming customer segment.

6

Since its opening, the Hotel has undergone numerous substantial expansions and renovations to its hotel and casino space. The original Hotel consisted of a central or “core” hotel tower with a North and East tower attached to it. Over the years, the East tower was expanded to its current size and the North tower was expanded twice to its current size. Expansions have also been made to the casino floor, including the 1997 addition of SpaceQuest – a 22,000 square feet themed-casino area that was developed in coordination with the ‘Star Trek: The Experience’ show, which is managed by Paramount Parks (“Paramount”).

The opening of new luxury upscale mega-resorts on the Strip during the 1990s resulted in increased competition for high-end and premium play gaming business. Due to the Hotel’s off-Strip location and intense competition from newer Strip assets, which offered customers a more updated package of rooms and amenities, the Hotel’s management decided to exit the premium gaming segment in 2000 and focus on the core convention and mid-level casino business.

The Hotel embarked on a strategy to attract convention business and mid-level casino players through the introduction of various marketing programs. Added value packages combining room, show and dinner offers were introduced to attract leisure customers to the Hotel and improve occupancy at the Hotel during non-peak hours. Complimentary and cash back programs were modified to make them more attractive to gaming customers and competitive with the Hotel’s peer group. New retail programs were introduced that gave customers the opportunity to earn tickets for playing their favorite table games and slot machines as well as for restaurant and show purchases, thereby keeping such customers at the Hotel for a longer average period of time. A new membership program was implemented for the locals market, which provided discounts on restaurants and shows, which are key drivers for the locals market.

Capital Improvements

The Hotel has been renovated and expanded over the past ten years. From 1993 to 1995, the Hotel developed three 12,600 square feet to 15,000 square feet Sky Villa Suites, which represented a $41 million investment by the Hotel. In 1994 and 1995, the Hotel built $16 million worth of new casino lounges. From 1995 to 1998, the Hotel invested approximately $62 million to renovate its rooms and suites. During the same time period, the Hotel invested approximately $72 million in connection with the development of ‘Star Trek: The Experience’ show with Paramount and the opening of the SpaceQuest Casino. In addition, the Hotel invested approximately $9 million to construct a covered parking garage. From 1999 to 2002, the Hotel has invested approximately $44 million towards the renovation of the meeting/convention space, the pool area, the health spa and the hotel rooms and corridors.

Business Strategy

The Company’s business strategy includes:

Capital Improvement Program. The Company plans to spend approximately $67 million on capital improvements in the Hotel and casino over the next forty-eight months. Amounts and timing are preliminary but reflect the best information currently available to the Company. The most important elements of this program include reconfiguration of the casino floor to open up more gaming areas, improve access and increase foot traffic through the casino. It is currently anticipated that construction will start within 6 months of the closing of the Acquisition and the spending in the first year is currently anticipated to include approximately $22 million on renovations of the casino and public areas, $1.2 million on slot machines, $5 million on information technology and $3 million on a retail space buildout. It is currently anticipated that $2.8 million will be spent during each of the second and third years following the closing of the Acquisition on slot operations. Finally, it is currently anticipated that approximately $10 million will be spent renovating hotel rooms during each of the second, third and fourth years following the closing of the Acquisition.

These changes will provide incentive for visitors to stay in the casino longer and increase the number of visitors to the Hotel’s food venues. In addition to the new casino design, the Company plans to remodel the bars,

7

restaurants and entertainment venues, which will provide a new entry statement by raising ceiling heights and changing the overall feel of the entrance into the Hotel. The Company also plans to create a new signage program in the Hotel and convention areas.

Focus on Customer Service. The Company continues to emphasize the importance of creating a culture focused on customer service. Each employee will be extensively trained in their respective functional area to respond immediately to customer needs. Customer satisfaction will be a key basis of employee evaluation. The Company believes this will promote an environment in which all employees feel a sense of commitment to customer service and customers feel welcome and happy in the Hotel. The Company plans to implement these training programs shortly after the closing of the Acquisition.

Increase in Convention Business. Although the total Las Vegas convention market has grown steadily, with the number of convention room nights growing at an annual growth rate of 10.6% from 2000 to 2003 (source: the Las Vegas Convention and Visitors Authority), the Hotel has seen only a 1.7% compound annual growth rate in convention room nights from 1999 and 2003 (source: LVH financial statements), even though convention room nights increased 15% in 2003 as compared to 2002. This is especially incongruous because of the Hotel’s proximity to the Las Vegas Convention Center. The Company intends to reposition the Hotel as a convention hotel. In addition, the Company will undertake an initiative to build relationships with both convention organizers and the Las Vegas Convention Center. This initiative will include, but not be limited to, beginning a dialogue with the management of the Las Vegas Convention Center and developing a means of ensuring that convention organizers and the Las Vegas Convention Center have advance notice of room availability, price and certainty of delivery. The Company intends to provide guarantees of room availability and pricing and to target middle-income conventioneers. The Company is already in discussions with the Las Vegas Convention Center to implement these initiatives following the closing of the Acquisition.

Targeted Customer Base. The Company expects to target middle-income customers with more disposable income for gaming and entertainment. The Company plans to reengineer its customer databases to identify and target value-added high margin repeat gaming customers, and to use sophisticated player tracking systems to award cash rebates or promotional allowances, such as complimentary rooms, food, beverage and entertainment to guests based on their level of profitability to the Company.

Invest in State-of-the-Art Slot Machines. The Company is committed to offering its customers the latest themed slot machines and gaming technology. The Company intends to spend approximately $1.2 million to purchase state-of-the-art slot machines within 6 months of the closing of the Acquisition as part of the $67 million capital improvement project which will be funded by proceeds of the Acquisition Financing and income from operations. The Company believes this focus is critical to retaining mid-level slot players who are more knowledgeable and sophisticated than players in other gaming segments.

Property Description

The Hotel

The 30-story Las Vegas Hilton hotel tower has been a Hilton-branded hotel for over thirty years. The Hotel consists of approximately 2,650 standard rooms and 300 suites with the standard rooms ranging from 300 square feet to 500 square feet and suites beginning at 600 square feet. Other services offered to the guests include a business center, 24-hour room service and in-room high-speed data ports.

Immediately prior to and in connection with the closing of the Acquisition, the Company entered into a license agreement (the “License Agreement”), pursuant to which the Company licensed from Hilton Inns, Inc. (“Hilton”) the right to use the mark “Hilton” and became part of Hilton’s reservation system and Hilton’s “HHonors Program™”. The License Agreement commenced on June 18, 2004, the date of the closing of the

8

Acquisition, and expires on December 31, 2008. During the term of the License Agreement, the Company is required to pay Hilton an annual fee of $2,000,000 plus 1% of the Hotel’s gross room revenue to fund national and regional group advertising and sales and business promotion efforts by Hilton.

The Casino

The Hotel features an approximately 74,000 square feet gaming area with approximately 1,400 slot machines and approximately fifty table games. The casino offers customers a variety of gaming options including popular table games such as Blackjack, Baccarat, Craps and Roulette and the latest slot machine games such as Monopoly™, Yahtzee™, Playboy™ and Elvis™ under applicable agreements with the manufacturers of such slot machines.

Race and Sports Book

The race and sports book is located on the east end of the main casino floor and features over 45 screens, including thirty projection television screens, eleven for the sports book and nineteen for the race book. This 10,500 square feet facility has seating for 400 people with eighty in the sports book area. Wagering options include daily lines, parlays, weekly golf and NASCAR betting, marquee boxing matches and grand slam tennis events plus year-round futures. The race book offers no-limit pari-mutuel wagering.

Prior to the closing of the Acquisition, the race and sports book was operated by LVH through a subscriber agreement with The Sports Network. Following the closing of the Acquisition, the race and sports book will be operated by the Company through an agreement with Computerized Bookmaking Systems, Inc.

Restaurants

The Hotel features twelve dining options with seating for approximately 1,800 customers, including the Benihana Village. The Hotel has six fine dining options with approximately 750 seats and six casual dining restaurants with approximately 1,000 seats. All the restaurants are owned or franchised by the Hotel, with the exception of Vegas Subs, which is leased.

Entertainment

Show venues at the Hotel include the 1,600-seat Hilton Theater, the 330-seat Night Club and ‘Star Trek: The Experience’ show. This theater has great historical relevance and has hosted performances by some of the top acts in the music industry including Elvis Presley, who performed at the Hotel from 1969 to 1976. The Night Club is an after hours dance club with a bar, balcony area, dancing and a wide array of DJs and other performances. In addition, there are several separate lounges available to patrons including the Crystal Lounge located just off of the main casino floor, which features live jazz and dance bands. The Hotel also hosts ‘Star Trek: The Experience’, an approximately 65,000 square feet attraction featuring a motion-based simulation ride, interactive video and virtual reality stations, dining and souvenir shops. This attraction was developed in collaboration with Paramount and is managed by Paramount.

Convention/Meeting Areas

The Hotel is located adjacent to the Las Vegas Convention Center, which has approximately 3.2 million square feet of total space, and features approximately 2 million square feet of net exhibit space, and 243,950 square feet of net meeting room space, accommodating 144 meeting rooms with seating capacities from 20 to 12,000.

Additionally, the Hotel itself has approximately 225,000 square feet of total meeting space including the Hilton Center, the Hilton Pavilion and the Hilton Ballroom. The Hilton Center is comprised of the Conrad Room and the Barron Room – each a pillar-free area with a total of 95,000 square feet. Using a partition, two smaller rooms can be created seating up to a total of 8,900 people depending on the seating arrangement. The Hilton

9

Ballroom and Hilton Pavilion, located adjacent to the Hilton Center, offer a combined 78,130 square feet of space for meetings and conferences. Additionally, there are fourteen conference rooms available for meetings, each with moveable partitions, two large Board Rooms and five Salon Suites. Based upon demand for meeting space, some hotel rooms can also be converted to hospitality suites.

Las Vegas Monorail Station

The Hotel is one of only seven existing stations linking the new four-mile monorail running from MGM Grand to Sahara Hotel and Casino. The monorail began operations on July 15, 2004, and is estimated to carry twenty million passengers annually (source: Regional Transportation Commission of Southern Nevada). The Hotel is currently the only property with the station located directly at the front entrance to the property providing more convenient access to the monorail for its customers. Future plans for the monorail include extending it to downtown Las Vegas (Fremont Street), the McCarran Airport as well as to the west side of the Strip.

Other Amenities

Other amenities offered by the Hotel include an outdoor pool and recreation area with individual cabanas, an indoor/outdoor spa, fitness room, six championship tennis courts, three temperature spas, dry and wet sauna, the Cabana Bar and the Cabana Shop. Additionally, the Hotel has a Sports Zone Video Arcade and a retail area.

Las Vegas Market

According to the Nevada Gaming Control Board, during 2003, gaming revenues in Clark County reached $7.8 billion. The number of visitors traveling to Las Vegas was approximately 35.5 million in 2003, representing a compound annual growth rate of 5.0% since 1988’s 17.2 million visitors (Source: Las Vegas Convention & Visitors Authority). Aggregate expenditures by Las Vegas visitors increased at a compound annual growth rate of 8.2% from $10.0 billion in 1988 to $32.8 billion in 2003 (Source: Las Vegas Convention & Visitors Authority). The number of hotel and motel rooms in Las Vegas increased at a compound annual growth rate of 4.8% from 67,391 in 1989 to 130,482 in 2003 (Source: Las Vegas Convention & Visitors Authority).

Las Vegas Market Statistics

The following table sets forth certain statistical information for the Las Vegas market for the years 1999 through 2003.

| | | | | | | | | | | | | | | |

| | | 1999

| | 2000

| | 2001

| | 2002

| | 2003

|

Visitor Volume (in thousands)* | | | 33,809 | | | 35,850 | | | 35,017 | | | 35,072 | | | 35,540 |

Clark County gaming revenues (in millions)** | | $ | 7,209 | | $ | 7,671 | | $ | 7,637 | | $ | 7,631 | | $ | 7,831 |

Hotel/motel rooms* | | | 120,294 | | | 124,270 | | | 126,610 | | | 126,787 | | | 130,482 |

Airport passenger traffic (in thousands)*** | | | 33,669 | | | 36,866 | | | 35,180 | | | 35,009 | | | 36,266 |

Convention attendance (in thousands)* | | | 3,773 | | | 3,853 | | | 5,014 | | | 5,105 | | | 5,658 |

| * | Source: Las Vegas Convention & Visitors Authority |

| ** | Source: Nevada Gaming Control Board |

| *** | Source: McCarran International Airport |

Customer Segmentation

During the 1990s, the Hotel catered primarily to premium play gaming customers. Following management’s decision to exit this segment in 2000, the Hotel focused its marketing efforts primarily on the convention segment, the mid-level casino segment and the leisure and tour and travel segment.

10

While convention and leisure customers come from all areas of the United States, historically, geographically, California provides the largest base of customers to the Hotel accounting for approximately 60% to 65% of total room nights, followed by Arizona with 5% of total room nights and Texas with 4% of total room nights. Accordingly, as a region, California has historically been critical to the Hotel’s success both on the hotel and casino side of the business.

The convention business is the number one market segment for the Hotel. The Hotel’s prominent location next to the Las Vegas Convention Center allows it to effectively target large convention groups, thereby increasing mid-week demand for available room nights. Of the 865,000 annual room nights occupied at the Hotel in 2002, convention groups represented approximately 37% of total room nights sold and over half of the Hotel’s room revenue.

The casino customers accounted for approximately 20% of total room nights. These customers represent the second most important market for the Hotel after the convention business. The Hotel uses a reward program to track casino customers play and provides comps based on historical levels of play.

The leisure customers accounted for approximately 43% of the Hotel’s total room nights sold in 2002. Though leisure customers accounted for a higher share of room nights than the casino customers, the Company regards the casino segment as more valuable because of higher casino play from the casino segment. Leisure customers are attracted to the Hotel due to the property’s Strip-like environment and extensive amenities offered at a more affordable and attractive cost relative to other Strip properties. Within the leisure segment, the Hotel caters to the Free & Independent Traveler leisure segment, Tour & Travel segment and package customers. The Hotel targets the leisure segment through added value packages, promotional discounts, and tour and travel operators. The Tour & Travel segment, which represents 14% of total room nights, is primarily used to increase occupancy during off-peak and low seasons.

The Hotel also attracts some locals play due to its popular race and sports book and the ease of access through the east end of the Hotel. With over 1.6 million people living in Clark County, the locals market represents an attractive customer base for the Hotel. The Hotel recently began targeting this segment through new advertising and marketing programs such as a membership program which provides discounts for shows and restaurants.

Advertising Strategy

Over the past few years, LVH has implemented various advertising strategies to reinforce the Hotel’s image as a mid-level casino product and to attract new customers to the Hotel. The Company expects to substantially maintain the existing advertising strategies after the closing of the Acquisition.

A series of advertising campaigns was introduced to deliver a consistent message about the Hotel to the customers. In addition, a new complimentary policy and cash back programs were put in place and advertised in order to reposition the Hotel as a more gambler friendly property. The entertainment lineup (including the Star Trek Experience) at the Hotel is prominently featured on billboards in order to attract locals and visitors alike.

Most of the advertising for the Hotel and its marketing programs are done through one of the following four mediums; print, radio, outdoor and internet marketing. The internet is increasingly being used to promote the Hotel through advertising on major internet sites and search engine optimization to ensure customer traffic is directed to the Hotel’s website.

Competition

The Hotel located less than one mile east of the Strip, competes with other high-quality Las Vegas resorts and other Las Vegas hotel casinos, including those located on the Strip, on the basis of overall atmosphere, range

11

of amenities, price, location, entertainment offered, theme and size. Currently, there are approximately thirty major gaming properties located on or near the Strip, thirteen additional major gaming properties in the downtown area and additional gaming properties located in other areas of Las Vegas. Many of the competing properties, such as the Rio, Mandalay Bay, Paris, The Venetian, The Mirage, Treasure Island, Caesar’s Palace, Luxor, New York-New York, Bellagio, Aladdin, the Palms and the MGM Grand have themes and attractions which draw a significant number of visitors and directly compete with the Hotel’s operations. Some of these facilities are operated by companies that have more than one operating facility and may have greater name recognition and financial and marketing resources than the Hotel and market to the same target demographic group as the Hotel does. Furthermore, additional hotel casinos, containing a significant number of hotel rooms, are expected to open in Las Vegas within the coming years. There can be no assurance that the Las Vegas market will continue to grow or that hotel casino resorts will continue to be popular. A decline or leveling off of the growth or popularity of such facilities could result in reduced casino and hotel revenues.

To a lesser extent, the Hotel competes with hotel casinos in the Mesquite, Laughlin, Reno and Lake Tahoe areas of Nevada, and in Atlantic City, New Jersey. The Hotel also competes with state-sponsored lotteries, on and off-track wagering, card parlors, riverboat and Native American gaming ventures, and other forms of legalized gaming in the United States, as well as with gaming on cruise ships, internet gaming ventures and international gaming operations. In 1998, California enacted the Tribal Government Gaming and Economic Self-Sufficiency Act (the “Tribal Act”). The Tribal Act provides a mechanism for federally recognized Native American tribes to conduct certain types of gaming on their land. The California electorate approved Proposition 1A on March 7, 2000. Proposition 1A gives all California Indian tribes the right to operate a limited number of certain kinds of gaming machines and other forms of casino wagering on California Indian reservations. Continued proliferation of gaming activities permitted by Proposition 1A may materially reduce casino and hotel revenues in Nevada generally and at the Hotel. The Company is unable, however, to assess the magnitude of the impact on its business.

Employees

As of March 31, 2004, the Hotel had approximately 2,100 active employees. The Hotel currently has approximately 1,700 full-time equivalent employees.

The Company recognizes that the Hotel’s employees are critical to its success and has fostered a productive work culture. Employees are offered competitive salaries and a benefits package that includes medical and dental coverage.

The Company believes that it will have a good working relationship with both its union and non-union work force. Labor unions represent approximately 69% of the work force at the Hotel with labor agreement terms ranging from one year to five years. In connection with the closing of the Acquisition, the Company assumed obligations under existing collective bargaining agreements with certain labor unions.

Zoning, Real Estate and Environmental Issues

The Hotel is located on approximately fifty-nine acres of land designated with H-1 Limited Resort and Apartment District zoning. This H-1 Limited Resort and Apartment District was established to provide for the development of gaming enterprises, compatible commercial, and mixed commercial and residential uses, and to prohibit the development of incompatible uses that are detrimental to gaming enterprises. Permitted uses under H-1 Limited Resort and Apartment District zoning include, but are not limited to, and subject to obtaining necessary special use permits and other land use approvals, hotels, casinos, condominiums and timeshares. The existing facility sits on approximately thirty-five acres. Initial analysis, though incomplete, suggests that some of this acreage could be suitable for future development projects by the Company, third parties or some combination thereof. Although the Company has contemplated preliminary plans for the development of this acreage, there are no definite or binding plans regarding such development. Additionally, the Company has not secured any financing in respect of such contemplated preliminary plans for development.

12

The Hilton Grand Vacations property, located adjacent to the Hotel, has an easement for use of approximately 260 parking spaces (out of approximately 4,800 parking spaces). There is also an easement for the use of the monorail that runs through the Hotel property.

An independent environmental consultant performed a Phase I environmental site assessment in accordance with American Society for Testing and Materials (“ASTM”) standards on the Las Vegas Hilton property in December 2003. This assessment involved visual inspection, interviews with site personnel, review of certain publicly available records, and preparation of a written report. The assessment did not include any testing of soil or groundwater at the property. According to certain historical data integrated into the Phase I report, in 2000 it was discovered that there is a plume of tetrachloroethene in the groundwater and the property was listed as a leaking underground storage tank site. The contamination is believed to originate from an off-site source, but the source has not yet been identified. To date, the Nevada Division of Environmental Protection has not required any additional investigation at the property. The Phase I report states that levels of tetrachloroethene and total petroleum hydrocarbons in the groundwater beneath the property in 2000 exceeded certain limits allowed under a National Pollutant Discharge Elimination System permit. The Phase I report indicates that the allowable levels have been exceeded in the past and a treatment system is needed to ensure compliance with applicable requirements. The Company expects to install a treatment system at a nominal cost. The Phase I report also identified asbestos-containing materials at the Hotel. The Company expects to manage these materials pursuant to an operations and maintenance program.

The Company does not expect that its compliance measures in respect of the groundwater issue or the asbestos issue will have a material effect upon its capital expenditures, earnings or competitive position. The Company believes that the proper filtration system required for the dewatering sump pumps could be installed at a cost of under $10,000. In addition, the Company has allocated $750,000 in its renovation budget to allow for asbestos abatement in common areas which will be affected by the planned renovation. There can be no assurance, however, that the estimated capital and operating costs for the treatment system will not be exceeded or that there will be no claims or other liabilities associated with the foregoing conditions.

Litigation

The Hotel is involved in various legal proceedings relating to its business. While any proceeding or litigation has an element of uncertainty, LVH’s management believes that the final outcome of these matters is not likely to have a material adverse effect upon its results of operations or financial position. The Company is not currently a party to any legal proceedings.

Purchase and Sale Agreement

On December 24, 2003, the Company, LVH and Park Place, entered into the Purchase and Sale Agreement. Pursuant to the Purchase and Sale Agreement, the Company will purchase substantially all of the assets of LVH, including, without limitation, the Hotel and assume certain of LVH’s liabilities. The transactions contemplated pursuant to the Purchase and Sale Agreement were consummated on June 18, 2004. At the closing date of the Acquisition, LVH transferred fee simple title to all real property at the Hotel including, without limitation, buildings, structures, fixtures and improvements located thereon and all rights associated with the land. LVH also assigned certain contracts and agreements related to the business and the Hotel to the Company. In addition, subject to certain conditions, LVH granted a non-exclusive license to the Company to use customer data relating to the Hotel and the business of LVH. Certain property, which is primarily owned by Park Place and used in connection with all of its hotels and casinos, was excluded from the assets transferred to the Company in the Purchase and Sale Agreement. Pursuant to the Purchase and Sale Agreement, the Company offered employment to certain employees of LVH, assumed certain of the collective bargaining agreements with existing labor unions and assumed certain obligations with respect to those employees who accepted offers of employment with the Company.

13

In consideration for the sale of the Hotel, at closing the Company paid the purchase price of $280 million subject to certain adjustments for proration items and a working capital adjustment and assumed approximately $30.7 million in current liabilities as of March 2004, primarily relating to accrued payroll, taxes and benefits, accrued expenses and unpaid gaming tickets, which was offset by the assumption of approximately $26.4 million of current assets.

During the time between the execution date and the closing date (the “Pre-Closing Period”), LVH agreed to conduct the business of the Hotel consistent in all material respects with past practice and to perform all material obligations. LVH also agreed to certain covenants during the Pre-Closing Period including, without limitation, that (a) it would refrain from entering into any contracts which (i) expire after the one year anniversary of the execution date of the Purchase and Sale Agreement or (ii) involve aggregate consideration greater than $100,000, (b) it would not enter into, amend or terminate any material real property lease or (c) it would not enter into, or renew, any employment contracts or arrangements providing for severance with any employees. Subject to certain conditions, LVH agreed to provide the Company and its representatives reasonable access to the Hotel as necessary during the Pre-Closing Period.

Certain terms of the Purchase and Sale Agreement survive the closing of the Acquisition, including the representations and warranties of each party, which generally survive for a period of 270 days post-closing. In addition, certain covenants, including the obligation to keep information confidential survive the closing. The other covenants survive in accordance with their respective terms, which are set forth in the Purchase and Sale Agreement, a copy of which is attached as an exhibit to this Registration Statement. The indemnification provisions of the Purchase and Sale Agreement also survive the closing of the Acquisition.

Regulatory Matters

Nevada Gaming Laws and Regulations.

The ownership and operation of casino gaming facilities in Nevada and the manufacture and distribution of gaming devices and cashless wagering systems for use or play in Nevada or for distribution outside of Nevada are subject to (1) the Nevada Act and (2) various local ordinances and regulations. The gaming operations of the Company are subject to the licensing and regulatory control of the Nevada Gaming Authorities and Clark County.

The laws, regulations and supervisory procedures of the Nevada Gaming Authorities are based upon declarations of public policy which are concerned with, among other things: (1) the prevention of unsavory or unsuitable persons from having a direct or indirect involvement with gaming at any time or in any capacity; (2) the strict regulation of all persons, locations, practices, associations and activities related to the operation of licensed gaming establishments and the manufacture and distribution of gaming devices and cashless wagering systems; (3) the establishment and maintenance of responsible accounting practices and procedures; (4) the maintenance of effective controls over the financial practices of licensees, including the establishment of minimum procedures for internal fiscal affairs and the safeguarding of assets and revenues, providing reliable record keeping and requiring the filing of periodic reports with the Nevada Gaming Authorities; (5) the prevention of cheating and other fraudulent practices; and (6) providing a source of state and local revenues through taxation and licensing fees. Changes in such laws, regulations and procedures could have an adverse effect on the Company’s gaming operations.

The Company, is required to be licensed and VoteCo and Coinvestment VoteCo are required to be registered as holding companies with respect to the Company by the Nevada Gaming Authorities. The Company’s gaming licenses will require the periodic payment of fees and taxes and are not transferable. The Company has applied to be registered by the Nevada Commission as a publicly traded corporation (a “Registered Company”), to be found suitable to acquire the assets of LVH and for approval to hold a gaming license to own and operate the Hotel. Following the effectiveness of this Registration Statement, the Company will be deemed a

14

“publicly traded corporation” under the Nevada Act, even though it is not currently anticipated that the Membership Units or any other class of the Company’s securities will be listed for trading or trade with any frequency. As a Registered Company and gaming licensee, the Company will be required to submit detailed financial and operating reports to the Nevada Commission and Nevada Board and furnish any other information which the Nevada Commission or Nevada Board may require. The Company is expected to continue to qualify as a Registered Company upon the effectiveness of this Registration Statement. No person may become a member or acquire a membership interest in, or receive any percentage of the profits from, the Company without first obtaining all required registrations, licenses, findings of suitability, approvals and permits from the Nevada Gaming Authorities. The Company, VoteCo and Coinvestment VoteCo have made application with the Nevada Gaming Authorities to obtain the various registrations, licenses, findings of suitability, approvals and permits (individually, a “Gaming License” and, collectively, the “Gaming Licenses”) required in order to engage in gaming operations in Nevada.

The Nevada Gaming Authorities may investigate any individual who has a material relationship to, or material involvement with, the Company, VoteCo and Coinvestment VoteCo in order to determine whether such individual is suitable or should be licensed as a business associate of a gaming licensee. Members, transferees of a member’s interest, directors, managers and certain key employees of the Company, VoteCo and Coinvestment VoteCo must file applications with the Nevada Gaming Authorities and may be required to be licensed or found suitable by the Nevada Gaming Authorities. The Nevada Gaming Authorities may deny an application for licensing for any cause which they deem reasonable. A finding of suitability is comparable to licensing, and both require submission of detailed personal and financial information followed by a thorough investigation. The applicant for licensing or a finding of suitability must pay all the costs of the investigation. Changes in licensed positions must be reported to the Nevada Gaming Authorities and in addition to its authority to deny an application for a finding of suitability or licensure, the Nevada Commission has jurisdiction to limit, condition, restrict, revoke or suspend any license, registration, finding of suitability or approval, or to fine any person licensed, registered, found suitable or approved, for any cause which it deems reasonable.

If the Nevada Gaming Authorities were to find an officer, manager or key employee unsuitable for licensing or unsuitable to continue having a relationship with the Company, VoteCo or Coinvestment VoteCo, the companies involved would have to sever all relationships with such person. In addition, the Nevada Commission may require the Company, VoteCo or Coinvestment VoteCo to terminate the employment of any person who refuses to file appropriate applications. Determinations of suitability or of questions pertaining to licensing are not subject to judicial review in Nevada.

The Company, VoteCo and Coinvestment VoteCo will each be required to submit detailed financial and operating reports to the Nevada Gaming Authorities. Substantially all material loans, leases, sales of securities and similar financing transactions by the Company, VoteCo and Coinvestment VoteCo must be reported to, or approved by, the Nevada Commission.

If it were determined that the Nevada Act was violated by the Company, VoteCo or Coinvestment VoteCo, the Gaming Licenses they hold could be limited, conditioned, suspended or revoked, subject to compliance with certain statutory and regulatory procedures. In addition, the Company, VoteCo and Coinvestment VoteCo, and the persons involved, could be subject to substantial fines of up to $250,000 for each separate violation of the Nevada Act at the discretion of the Nevada Commission. Further, a supervisor could be appointed by the Nevada Commission to operate the Company and, under certain circumstances, earnings generated during the supervisor’s appointment could be forfeited to the State of Nevada. Limitation, conditioning or suspension of any gaming license or the appointment of a supervisor could (and revocation of any gaming license would) impact casino revenues and cause the Company to suffer financial loss.

Any beneficial holder of the Company’s voting securities or other equity securities, regardless of the number of units owned, may be required to file an application, be investigated, and have such holder’s suitability as a beneficial holder of the Company’s voting securities or other equity securities determined if the Nevada

15

Commission has reason to believe that such ownership would otherwise be inconsistent with the declared policies of the State of Nevada. The applicant must pay all costs of investigation incurred by the Nevada Gaming Authorities in conducting any such investigation.

The Nevada Act requires any person who individually or in association with others acquires, directly or indirectly, beneficial ownership of more than 5% of the Company’s voting securities to report the acquisition to the Nevada Commission, and such person may be required to be found suitable. The Nevada Act requires that each person who, individually or in association with others, acquires, directly or indirectly, beneficial ownership of more than 10% of the Company’s voting securities apply to the Nevada Commission for a finding of suitability within thirty days after the Chairman of the Nevada Board mails the written notice requiring such filing. Under certain circumstances, an “institutional investor,” as defined in the Nevada Act, which acquires more than 10%, but not more than 15%, of the Company’s voting securities may apply to the Nevada Commission for a waiver of such suitability requirement if such institutional investor holds the voting securities for investment purposes only. An institutional investor shall not be deemed to hold voting securities for investment purposes unless the voting securities were acquired and are held in the ordinary course of business as an institutional investor and not for the purpose of causing, directly or indirectly, the election of a majority of the managers of the Company, any change in the Company’s Articles of Organization, operating agreement, management, policies or operations of the Company, or any of its gaming affiliates, or any other action which the Nevada Commission finds to be inconsistent with holding the Company’s voting securities for investment purposes only. Activities which are not deemed to be inconsistent with holding voting securities for investment purposes only include: (1) voting on all matters voted on by members; (2) making financial and other inquiries of management of the type normally made by securities analysts for informational purposes and not to cause a change in its management, policies or operations; and (3) such other activities as the Nevada Commission may determine to be consistent with such investment intent. If the beneficial holder of voting securities who must be found suitable is a corporation, partnership or trust, it must submit detailed business and financial information, including a list of beneficial owners. The applicant is required to pay all costs of investigation.

Any person who fails or refuses to apply for a finding of suitability or a license within thirty days after being ordered to do so by the Nevada Commission or the Chairman of the Nevada Board, may be found unsuitable. The same restrictions apply to a record owner of equity securities if the record owner, after request, fails to identify the beneficial owner. Any member found unsuitable and who holds, directly or indirectly, any beneficial ownership of the equity securities of a Registered Company beyond such period of time as may be prescribed by the Nevada Commission may be guilty of a criminal offense. The Company is subject to disciplinary action if, after it receives notice that a person is unsuitable to be a member or hold a voting security or other equity security issued by the Company or to have any other relationship with the Company, the Company (1) pays that person any dividend or interest upon voting securities of the Company, (2) allows that person to exercise, directly or indirectly, any voting right conferred through securities held by that person, (3) pays remuneration in any form to that person for services rendered or otherwise, or (4) fails to pursue all lawful efforts to require such unsuitable person to relinquish his voting securities including, if necessary, the immediate purchase of said voting securities for cash at fair market value.

The Nevada Commission may, in its discretion, require the holder of any debt or nonvoting security of a Registered Company, to file applications, be investigated and be found suitable to own the debt or nonvoting security of a Registered Company. If the Nevada Commission determines that a person is unsuitable to own such security, then pursuant to the Nevada Act, the Registered Company can be sanctioned, including by revocation of its approvals, if without the prior approval of the Nevada Commission, the Registered Company: (1) pays to the unsuitable person any dividend, interest, or any distribution whatsoever; (2) recognizes any voting right by such unsuitable person in connection with such securities; (3) pays the unsuitable person remuneration in any form; or (4) makes any payment to the unsuitable person by way of principal, redemption, conversion, exchange, liquidation, or similar transaction.

16

The Company is required to maintain a current ledger in Nevada reflecting the ownership of record of each outstanding equity security issued by the Company which may be examined by the Nevada Gaming Authorities at any time. If any securities are held in trust by an agent or by a nominee, the record holder may be required to disclose the identity of the beneficial owner to the Nevada Gaming Authorities. A failure to make such disclosure may be grounds for finding the record holder unsuitable. The Company is also required to render maximum assistance in determining the identity of the beneficial owner. The Nevada Commission has the power to require the Company’s securities to bear a legend indicating that the securities are subject to the Nevada Act.

The Company may not make a public offering of its securities without the prior approval of the Nevada Commission if the securities or the proceeds therefrom are intended to be used to construct, acquire or finance gaming facilities in Nevada, or to retire or extend obligations incurred for such purposes. On January 7, 2004, the Company made application with the Nevada Board for approval of the registration of its Class A Units described in this Registration Statement to be filed with the Securities and Exchange Commission to register the Company’s Class A Units under the Securities Exchange Act of 1934 and for state and county gaming licenses to own and operate the Hotel. Coinvestment VoteCo and VoteCo have filed applications for approval of the Nevada Gaming Commission and Clark County to acquire control of the Company and for registration as holding companies. In connection with the Company’s, Coinvestment VoteCo’s and VoteCo’s applications, Mr. Barrack has filed applications for approval as a controlling member and manager of the Company and as a manager and member of Coinvestment VoteCo and VoteCo; and Mr. Ribis has filed applications for approval as a controlling member and manager of the Company, and as a manager and member of Coinvestment VoteCo. The applications were on the agenda of the State Gaming Control Board, Clark County and Nevada Gaming Commission on June 14, 2004, June 15, 2004 and June 17, 2004, respectively. On June 17, 2004, the Gaming Licenses were granted.

Changes in control of the Company through merger, consolidation, stock or asset acquisitions, management or consulting agreements, or any act or conduct by a person whereby the person obtains control, may not occur without the prior approval of the Nevada Gaming Commission and Clark County. Entities and persons seeking to acquire control of a Registered Company must satisfy the Nevada Gaming Commission in a variety of stringent standards prior to assuming control of such Registered Company. The Nevada Gaming Commission may also require controlling stockholders, members, partners, officers, directors and other persons having an ownership interest in or a material relationship or involvement with the entity proposing to acquire control to be investigated and licensed as part of the approval process relating to the transaction.

The Nevada legislature has declared that some corporate acquisitions opposed by management, repurchases of voting securities and corporate defense tactics affecting Nevada gaming licensees, and Registered Companies that are affiliated with those operations, may be injurious to stable and productive corporate gaming. The Nevada Commission has established a regulatory scheme to ameliorate the potentially adverse effects of these business practices upon Nevada’s gaming industry and to further Nevada’s policy to: (1) assure the financial stability of corporate gaming operators and their affiliates; (2) preserve the beneficial aspects of conducting business in the corporate form; and (3) promote a neutral environment for the orderly governance of corporate affairs. Approvals are, in certain circumstances, required from the Nevada Commission before the Company can make exceptional repurchases of voting securities above the current market price thereof and before a corporate acquisition opposed by management can be consummated. The Nevada Act also requires prior approval of a plan of recapitalization proposed by the Company’s directors in response to a tender offer made directly to the Registered Company’s members for the purposes of acquiring control of the Registered Company.

License fees and taxes, computed in various ways depending on the type of gaming or activity involved, are payable to the State of Nevada and to the counties and cities in which a Nevada licensee’s respective operations are conducted. Depending upon the particular fee or tax involved, these fees and taxes are payable either monthly, quarterly or annually and are based upon either: (1) a percentage of the gross revenues received; (2) the number of gaming devices operated; or (3) the number of table games operated. An excise tax is imposed on admission to any facility operated by a licensed gaming establishment where live entertainment is provided. The

17

tax rate varies with the size of the facility in which the live entertainment is conducted and where maximum occupancy is less than 7,500, amounts paid for food, refreshments and merchandise purchased at the facility during live entertainment are also subject to taxation. Nevada licensees that hold a license as an operator of a slot machine route, or a manufacturer’s or distributor’s license, also pay certain fees and taxes to the State of Nevada.

Any person who is licensed, required to be licensed, registered, required to be registered, or under common control with such persons (collectively, “Licensees”), and who proposes to become involved or is involved in a gaming venture outside of Nevada (“Foreign Gaming”) is required to deposit with the Nevada Board, and thereafter maintain, a revolving fund in the amount of $10,000 to pay the expenses of investigation of the Nevada Board of their participation in such Foreign Gaming. The revolving fund is subject to increase or decrease in the discretion of the Nevada Commission. Thereafter, Licensees are required to comply with certain reporting requirements imposed by the Nevada Act. A licensee is also subject to disciplinary action by the Nevada Commission if it knowingly violates any laws of the foreign jurisdiction pertaining to the Foreign Gaming operation, fails to conduct the Foreign Gaming operation in accordance with the standards of honesty and integrity required of Nevada gaming operations, engages in activities or enters into associations that are harmful to the State of Nevada or its ability to collect gaming taxes and fees, or employs, contracts with, or associates with, a person in the Foreign Gaming operation who has been denied a license or finding of suitability in Nevada on the ground of personal unsuitability.

Gaming and liquor activities at the Hotel are subject to regulation and licensing by the Clark County Department of Business License. The Company has made application with the Clark County Department of Business License which serves as staff to the Clark County Liquor and Gaming Board (the members of which are the Clark County Commissioners) for all required gaming and liquor licenses in the unincorporated areas of Clark County. The Clark County application and regulatory process, which is detailed in the Clark County Code, is independent from, consistent with, but less extensive than, the application and regulatory process of the Nevada Gaming Authorities. Background and suitability investigations in Clark County are conducted primarily by the Las Vegas Metropolitan Police Department (“LVMPD”). It is the customary practice of Clark County and the LVMPD to defer to the Nevada Gaming Authorities for the background and suitability investigation of applications of the nature filed by the Company, but jurisdiction is retained to conduct any investigation and take any regulatory action deemed appropriate under the circumstances, to the extent allowed under Clark County Code as amended from time to time. Clark County liquor and gaming licenses are revocable and are not transferable.

18

| ITEM 2 | FINANCIAL INFORMATION. |

The Company

Prior to the closing of the Acquisition, the Company conducted no business other than in connection with the Purchase and Sale Agreement and had no material assets or liabilities. See “Item 1. Business—The Company” and the financial statements of the Company as of December 31, 2003 and March 31, 2004 included elsewhere herein.

LVH

SELECTED FINANCIAL DATA

LVH has derived the following historical information from its audited financial statements for 2001 through 2003 and from its unaudited financial statements for 1999 and 2000 and for the three months ended March 31, 2004 and 2003. LVH’s audited financial statements and related notes thereto as of December 31, 2003, 2002 and 2001 and unaudited financial statements as of March 31, 2004 appear elsewhere in this Registration Statement. The unaudited financial statements include all adjustments (which include normal recurring adjustments) necessary for a fair presentation of financial position and results of operations. The information is only a summary and should be read in conjunction with Management’s Discussion and Analysis in this section and the historical financial statements and related notes in Item 13. The results for the three months ended March 31, 2004 are not necessarily indicative of the results that may be expected for the entire year. The selected financial data is not necessarily indicative of the Company’s or LVH’s future results of operations or condition.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended or as of December 31,

| | Three Months Ended

or as of March 31,

|

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| | 2004

| | 2003

|

| | | (dollars in thousands) | | | | |

Results of Operations: | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenue | | $ | 214,011 | | | $ | 215,651 | | | $ | 226,842 | (1) | | $ | 271,904 | (1) | | $ | 357,297 | | $ | 66,921 | | $ | 56,743 |

Depreciation and amortization | | | 18,190 | | | | 16,708 | (2) | | | 31,790 | (2) | | | 22,579 | (2) | | | 40,401 | | | 4,688 | | | 4,461 |

Impairment loss | | | — | | | | — | | | | 124,000 | (3) | | | 55,000 | (3) | | | — | | | — | | | — |

Total operating (loss) income | | | (15,525 | ) | | | (6,429 | ) | | | (145,998 | ) | | | (54,531 | ) | | | 8,100 | | | 6,763 | | | 455 |

Net (loss) income | | | (15,525 | ) | | | (6,417 | ) | | | (145,934 | ) | | | (47,460 | ) | | | 4,779 | | | 6,763 | | | 455 |

Balance Sheet: | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | | 207,211 | | | | 207,256 | | | | 203,712 | (3) | | | 375,441 | (3) | | | 479,417 | | | 190,462 | | | 207,211 |

Total stockholder’s equity | | | 118,712 | | | | 134,237 | | | | 140,654 | | | | 286,588 | | | | 334,048 | | | 125,475 | | | 118,712 |

| (1) | In July 2000, a definitive agreement was signed that would have resulted in the sale of the property, building and equipment of LVH for a base price of $300,000,000. The agreement provided that Park Place would retain receivables relating to high-end casino play and would attempt to service high-end customers at other properties. As anticipated by the agreement, and once it was announced, high-end gaming customers gradually ceased play at the Hotel. During the third and fourth quarters of 2000, revenues began to reflect the loss of the high-end play without incremental lower and mid-level gamblers’ play or increased convention business. Operating income was also negatively impacted as costs associated with the high-end play could not be reduced as quickly because the Hotel continued to provide service to the remaining high-end market pending closing of the sale. Additionally, the held-for-sale status affected the Hotel’s ability to compete for other casino business. |

| (2) | As the Hotel was considered “Held for Sale” effective July 2000, no deprecation and amortization expense was charged from that date through December 31, 2000. Effective January 2001, the Hotel was no longer considered “Held for Sale” and as such, depreciation and amortization expense resumed at that time on the remaining assets after the $55,000,000 second quarter of 2000 non-cash impairment loss (See Note (3) following). Depreciation and amortization decreased once again after the $124,000,000 write-down of fixed assets that occurred in the third quarter of 2001. |

| (3) | In July 2000, a definitive agreement was signed that would have resulted in the sale of the property, building and equipment of LVH for a base price of $300,000,000. As a result, a $55,000,000 non-cash impairment |

19

| | loss was taken in the second quarter of 2000. In January 2001, the purchaser failed to further extend the closing date and did not complete the transaction. Park Place ceased its efforts to sell the Hotel and continued to operate it in the normal course, but with a focus on lower and mid-level gamblers’ play and convention business. During 2001, revenues declined from $73,000,000 in the first quarter to $48,000,000 in the third quarter. Operating income during 2001 was $7,000,000 in the first quarter, a loss of $3,000,000 in the second quarter, and a loss of $14,000,000 in the third quarter. The successive quarters of operating losses coupled with the significant reduction in convention and group visitation into Las Vegas resulting from the events of September 11 necessitated a review of LVH’s assets for impairment. Based on an analysis of expected future cash flows, an impairment existed. LVH engaged an independent appraisal company to assist in the valuation of the Hotel. The fair value was determined using a combination of future cash flow analysis and market/sales comparison analysis of the Hotel resulting in a fair value that was $124,000,000 less than the carrying value of the assets. A $124,000,000 write-down of fixed assets was made in the third quarter of 2001. |

20

UNAUDITED PRO FORMA FINANCIAL DATA

The following unaudited pro forma balance sheet of the Company as of March 31, 2004 and unaudited pro forma statement of operations for the year ended December 31, 2003 and three months ended March 31, 2004, give effect to the Acquisition and the Acquisition Financing as if they occurred, for balance sheet purposes, on March 31, 2004 and, for statement of operations purposes, on January 1, 2003 and 2004. The unaudited pro forma financial statements are not necessarily indicative of the results that would have been reported had such transactions actually occurred on the date specified, nor are they indicative of the Company’s or the Hotel’s future results of operations or financial condition. The unaudited pro forma financial statements are based on and should be read in conjunction with, and are qualified in their entirety by, the historical financial statements and notes thereto of the Company, the historical financial statements and notes thereto of LVH (including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” relating thereto) appearing elsewhere in this Registration Statement.

21

Unaudited Pro Forma Balance Sheet

(As of March 31, 2004)

(In 000’s)

| | | | | | | | | | | | | | | | | | | |

| | | Historical | | | | | | | | | | | | Colony Resorts LVH Acquisitions, LLC | |

| | | Colony Resorts | | | | | | Pro Forma | | | | | | Pro Forma | |

| | | LVH | | | Historical | | | Adjustments | | | | | | as Adjusted | |

| | | Acquisitions, LLC

| | | LVH

| | | (see Note 2)

| | | | | | for Merger

| |

Assets | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | — | | | $ | 8,634 | | | $ | 34,106 | | | 2 | (b) | | $ | 42,740 | |

Accounts receivable, net | | | — | | | | 11,637 | | | | — | | | | | | | 11,637 | |

Inventories | | | — | | | | 2,283 | | | | 379 | | | 2 | (g) | | | 2,662 | |

Prepaid expenses and other current assets | | | — | | | | 5,410 | | | | (1,970 | ) | | 2 | (h)(1) | | | 3,440 | |

| | |

|

|

| |

|

|

| |

|

|

| | | | |

|

|

|

Total current assets | | | — | | | | 27,964 | | | | 32,515 | | | | | | | 60,479 | |

| | |

|