Exhibit 99.2

| Supplemental Financial Information

February 12, 2019 |

| | |

|

|

| |

|

|

| |

|

|

|

|

|

Supplemental Financial Information For the quarter and year ended December 31, 2018 February 12, 2019 |

|

| Supplemental Financial Information

February 12, 2019 |

Table of Contents

| | | | | | | | |

CORPORATE PROFILE, FINANCIAL DISCLOSURES, AND SAFE HARBOR | 3 |

About Sunstone | 4 |

Forward-Looking Statement | 5 |

Non-GAAP Financial Measures | 6 |

CORPORATE FINANCIAL INFORMATION | 9 |

Condensed Consolidated Balance Sheets Q4 2018 – Q4 2017 | 10 |

Consolidated Statements of Operations Q4 and FY 2018/2017 | 12 |

Reconciliation of Net Income to EBITDAre and Adjusted EBITDAre, Excluding Noncontrolling Interest Q4 and FY 2018/2017 | 13 |

Reconciliation of Net Income to FFO and Adjusted FFO Attributable to Common Stockholders Q4 and FY 2018/2017 | 14 |

Pro Forma Consolidated Statements of Operations Q1 2018 – Q4 2018, FY 2018/2017 | 15 |

Pro Forma Reconciliation of Net Income to EBITDAre and Adjusted EBITDAre, Excluding Noncontrolling Interest Q4 2018 | 16 |

Pro Forma Reconciliation of Net Income to FFO and Adjusted FFO Attributable to Common Stockholders Q4 2018 | 17 |

Pro Forma Reconciliation of Net Income to EBITDAre, Adjusted EBITDAre, Excluding Noncontrolling Interest, FFO and Adjusted FFO Attributable to Common Stockholders Q4 2018 Footnotes | 18 |

Pro Forma Reconciliation of Net Income to EBITDAre and Adjusted EBITDAre, Excluding Noncontrolling Interest FY 2018 | 19 |

Pro Forma Reconciliation of Net Income to FFO and Adjusted FFO Attributable to Common Stockholders FY 2018 | 20 |

Pro Forma Reconciliation of Net Income to EBITDAre, Adjusted EBITDAre, Excluding Noncontrolling Interest, FFO and Adjusted FFO Attributable to Common Stockholders FY 2018 Footnotes | 21 |

Pro Forma Reconciliation of Net Income to EBITDAre and Adjusted EBITDAre, Excluding Noncontrolling Interest FY 2017 | 22 |

Pro Forma Reconciliation of Net Income to FFO and Adjusted FFO Attributable to Common Stockholders FY 2017 | 23 |

Pro Forma Reconciliation of Net Income to EBITDAre, Adjusted EBITDAre, Excluding Noncontrolling Interest, FFO and Adjusted FFO Attributable to Common Stockholders FY 2017 Footnotes | 24 |

EARNINGS GUIDANCE | 25 |

Earnings Guidance for Q1 and FY 2019 | 26 |

| Supplemental Financial Information

February 12, 2019 |

| |

| Supplemental Financial Information

February 12, 2019 |

CORPORATE PROFILE, FINANCIAL DISCLOSURES,

AND SAFE HARBOR

| | | | | | | | |

CORPORATE PROFILE, FINANCIAL DISCLOSURES, AND SAFE HARBOR | | Page 3 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

About Sunstone

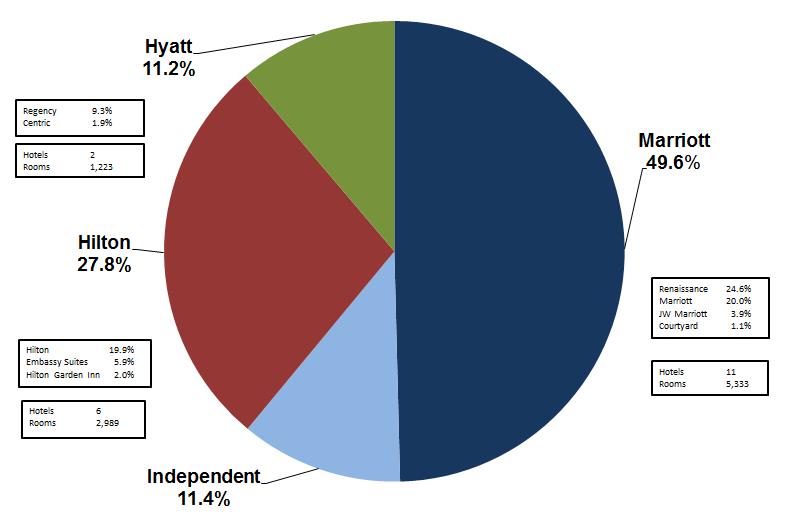

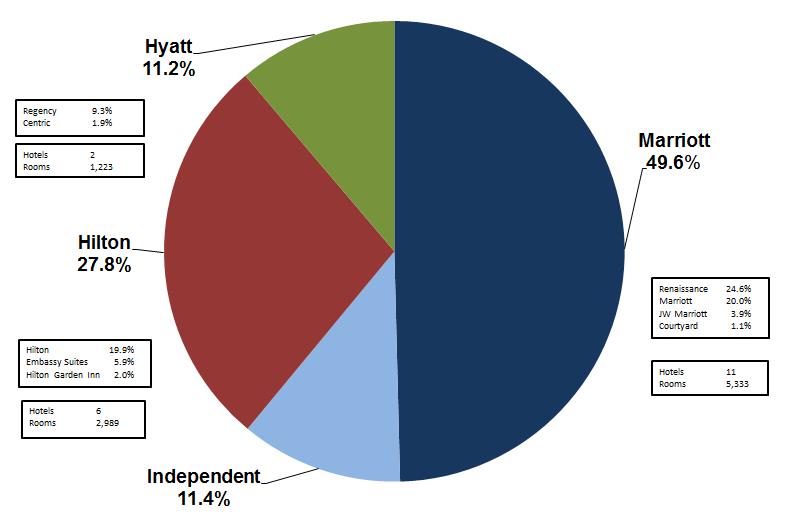

Sunstone Hotel Investors, Inc. (NYSE: SHO) is a lodging real estate investment trust (“REIT”) that as of February 12, 2019 has interests in 21 hotels comprised of 10,780 rooms. Sunstone’s primary business is to acquire, own, asset manage and renovate hotels considered to be Long-Term Relevant Real Estate®, the majority of which are operated under nationally recognized brands, such as Marriott, Hilton and Hyatt.

Sunstone’s mission is to create meaningful value for our stockholders by producing superior long-term returns through the ownership of Long-Term Relevant Real Estate® in the hospitality sector. Our values include transparency, trust, ethical conduct, honest communication and discipline. As demand for lodging generally fluctuates with the overall economy, we seek to own hotels that will maintain a high appeal with travelers over long periods of time and will generate economic earnings materially in excess of recurring capital requirements. Our strategy is to maximize stockholder value through focused asset management and disciplined capital recycling, which is likely to include selective acquisitions and dispositions, while maintaining balance sheet flexibility and strength. Our goal is to maintain appropriate leverage and financial flexibility to position the Company to create value throughout all phases of the operating and financial cycles.

Corporate Headquarters

200 Spectrum Center Drive, 21st Floor

Irvine, CA 92618

(949) 330-4000

Company Contacts

John Arabia

President and Chief Executive Officer

(949) 382-3008

Bryan Giglia

Executive Vice President and Chief Financial Officer

(949) 382-3036

Aaron Reyes

Vice President, Corporate Finance

(949) 382-3018

| | | | | | | | |

CORPORATE PROFILE, FINANCIAL DISCLOSURES, AND SAFE HARBOR | | Page 4 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Forward-Looking Statement

This presentation contains forward-looking statements within the meaning of federal securities laws and regulations. These forward-looking statements are identified by their use of terms and phrases such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will” and other similar terms and phrases, including opinions, references to assumptions and forecasts of future results. Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially from those anticipated at the time the forward-looking statements are made. These risks include, but are not limited to: volatility in the debt or equity markets affecting our ability to acquire or sell hotel assets; international, national and local economic and business conditions, including the likelihood of a U.S. recession, government shutdown, changes in the European Union or global economic slowdown, as well as any type of flu or disease-related pandemic, affecting the lodging and travel industry; the ability to maintain sufficient liquidity and our access to capital markets; terrorist attacks or civil unrest, which would affect occupancy rates at our hotels and the demand for hotel products and services; operating risks associated with the hotel business; risks associated with the level of our indebtedness and our ability to meet covenants in our debt and equity agreements; relationships with property managers and franchisors; our ability to maintain our properties in a first-class manner, including meeting capital expenditure requirements; our ability to compete effectively in areas such as access, location, quality of accommodations and room rate structures; changes in travel patterns, taxes and government regulations, which influence or determine wages, prices, construction procedures and costs; our ability to identify, successfully compete for and complete acquisitions; the performance of hotels after they are acquired; necessary capital expenditures and our ability to fund them and complete them with minimum disruption; our ability to continue to satisfy complex rules in order for us to qualify as a REIT for federal income tax purposes; severe weather events or other natural disasters; risks impacting our ability to pay anticipated future dividends; and other risks and uncertainties associated with our business described in the Company’s filings with the Securities and Exchange Commission. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be attained or that any deviation will not be material. All forward-looking information in this presentation is as of February 12, 2019, and the Company undertakes no obligation to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations.

This presentation contains unaudited information, and should be read together with the consolidated financial statements and notes thereto included in our most recent reports on Form 10-K and Form 10-Q. Copies of these reports are available on our website at www.sunstonehotels.com and through the SEC’s Electronic Data Gathering Analysis and Retrieval System (“EDGAR”) at www.sec.gov.

| | | | | | | | |

CORPORATE PROFILE, FINANCIAL DISCLOSURES, AND SAFE HARBOR | | Page 5 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Non-GAAP Financial Measures

We present the following non-GAAP financial measures that we believe are useful to investors as key supplemental measures of our operating performance: earnings before interest expense, taxes, depreciation and amortization for real estate, or EBITDAre; Adjusted EBITDAre, excluding noncontrolling interest (as defined below); funds from operations attributable to common stockholders, or FFO attributable to common stockholders; Adjusted FFO attributable to common stockholders (as defined below); hotel Adjusted EBITDAre; and hotel Adjusted EBITDAre margin. These measures should not be considered in isolation or as a substitute for measures of performance in accordance with GAAP. In addition, our calculation of these measures may not be comparable to other companies that do not define such terms exactly the same as the Company. These non-GAAP measures are used in addition to and in conjunction with results presented in accordance with GAAP. They should not be considered as alternatives to operating profit, cash flow from operations, or any other operating performance measure prescribed by GAAP. These non-GAAP financial measures reflect additional ways of viewing our operations that we believe, when viewed with our GAAP results and the reconciliations to the corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting our business than could be obtained absent this disclosure. We strongly encourage investors to review our financial information in its entirety and not to rely on a single financial measure.

We present EBITDAre in accordance with guidelines established by the National Association of Real Estate Investment Trusts (“NAREIT”), as defined in its September 2017 white paper “Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate.” We believe EBITDAre is a useful performance measure to help investors evaluate and compare the results of our operations from period to period in comparison to our peers. NAREIT defines EBITDAre as net income (calculated in accordance with GAAP) plus interest expense, income tax expense, depreciation and amortization, gains or losses on the disposition of depreciated property (including gains or losses on change in control), impairment write-downs of depreciated property and of investments in unconsolidated affiliates caused by a decrease in the value of depreciated property in the affiliate, and adjustments to reflect the entity’s share of EBITDAre of unconsolidated affiliates.

We make additional adjustments to EBITDAre when evaluating our performance because we believe that the exclusion of certain additional items described below provides useful information to investors regarding our operating performance, and that the presentation of Adjusted EBITDAre, excluding noncontrolling interest, when combined with the primary GAAP presentation of net income, is beneficial to an investor’s complete understanding of our operating performance. In addition, we use both EBITDAre and Adjusted EBITDAre, excluding noncontrolling interest as measures in determining the value of hotel acquisitions and dispositions. Our presentation of Adjusted EBITDAre, excluding noncontrolling interest results in a similar metric as our previous disclosure of Adjusted EBITDA.

We believe that the presentation of FFO attributable to common stockholders provides useful information to investors regarding our operating performance because it is a measure of our operations without regard to specified noncash items such as real estate depreciation and amortization, amortization of lease intangibles, any real estate impairment loss and any gain or loss on sale of real estate assets, all of which are based on historical cost accounting and may be of lesser significance in evaluating our current performance. Our presentation of FFO attributable to common stockholders conforms to NAREIT’s definition of “FFO applicable to common shares.” Our presentation may not be comparable to FFO reported by other REITs that do not define the terms in accordance with the current NAREIT definition, or that interpret the current NAREIT definition differently that we do.

| | | | | | | | |

CORPORATE PROFILE, FINANCIAL DISCLOSURES, AND SAFE HARBOR | | Page 6 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

We also present Adjusted FFO attributable to common stockholders when evaluating our operating performance because we believe that the exclusion of certain additional items described below provides useful supplemental information to investors regarding our ongoing operating performance, and may facilitate comparisons of operating performance between periods and our peer companies.

We adjust EBITDAre and FFO attributable to common stockholders for the following items, which may occur in any period, and refer to these measures as either Adjusted EBITDAre, excluding noncontrolling interest or Adjusted FFO attributable to common stockholders:

| · | | Amortization of favorable and unfavorable contracts: we exclude the noncash amortization of the favorable management contract asset recorded in conjunction with our acquisition of the Hilton Garden Inn Chicago Downtown/Magnificent Mile, along with the favorable and unfavorable tenant lease contracts, as applicable, recorded in conjunction with our acquisitions of the Boston Park Plaza, the Hilton Garden Inn Chicago Downtown/Magnificent Mile, the Hilton New Orleans St. Charles, the Hyatt Regency San Francisco and the Wailea Beach Resort. We exclude the noncash amortization of favorable and unfavorable contracts because it is based on historical cost accounting and is of lesser significance in evaluating our actual performance for the current period. |

| · | | Noncash ground rent: we exclude the noncash expense incurred from straight-lining our ground lease obligations as this expense does not reflect the actual rent amounts due to the respective lessors in the current period and is of lesser significance in evaluating our actual performance for the current period. |

| · | | Gains or losses from debt transactions: we exclude the effect of finance charges and premiums associated with the extinguishment of debt, including the acceleration of deferred financing costs from the original issuance of the debt being redeemed or retired because, like interest expense, their removal helps investors evaluate and compare the results of our operations from period to period by removing the impact of our capital structure. |

| · | | Acquisition costs: under GAAP, costs associated with completed acquisitions that meet the definition of a business are expensed in the year incurred. We exclude the effect of these costs because we believe they are not reflective of the ongoing performance of the Company or our hotels. |

| · | | Cumulative effect of a change in accounting principle: from time to time, the FASB promulgates new accounting standards that require the consolidated statement of operations to reflect the cumulative effect of a change in accounting principle. We exclude these one-time adjustments, which include the accounting impact from prior periods, because they do not reflect our actual performance for that period. |

| · | | Other adjustments: we exclude other adjustments that we believe are outside the ordinary course of business because we do not believe these costs reflect our actual performance for the period and/or the ongoing operations of our hotels. Such items may include: lawsuit settlement costs; prior year property tax assessments or credits; the write-off of development costs associated with abandoned projects; property-level restructuring, severance and management transition costs; lease terminations; and property insurance proceeds or uninsured losses. |

| | | | | | | | |

CORPORATE PROFILE, FINANCIAL DISCLOSURES, AND SAFE HARBOR | | Page 7 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

In addition, to derive Adjusted EBITDAre, excluding noncontrolling interest we exclude the noncontrolling partner’s pro rata share of the net income (loss) allocated to the Hilton San Diego Bayfront partnership, as well as the noncontrolling partner’s pro rata share of any EBITDAre and Adjusted EBITDAre components. We also exclude the noncash expense incurred with the amortization of deferred stock compensation as this expense is based on historical stock prices at the date of grant to our corporate employees and does not reflect the underlying performance of our hotels. Additionally, we include an adjustment for the cash ground lease expenses recorded on the ground lease at the Courtyard by Marriott Los Angeles and the building lease at the Hyatt Centric Chicago Magnificent Mile. We determined that both of these leases are capital leases, and, therefore, we include a portion of the capital lease payments each month in interest expense. We include an adjustment for ground lease expense on capital leases in order to more accurately reflect the actual rent due to both hotels’ lessors in the current period, as well as the operating performance of both hotels. We also exclude the effect of gains and losses on the disposition of undepreciable assets because we believe that including them in Adjusted EBITDAre, excluding noncontrolling interest is not consistent with reflecting the ongoing performance of our assets.

To derive Adjusted FFO attributable to common stockholders, we also exclude the noncash interest on our derivatives and capital lease obligations, the noncontrolling partner’s pro rata share of any FFO adjustments related to our consolidated Hilton San Diego Bayfront partnership, as well as changes to deferred tax assets or valuation allowances, and income tax benefits or provisions associated with the application of net operating loss carryforwards, uncertain tax positions or with the sale of assets other than real estate investments. We believe that these items are not reflective of our ongoing finance costs.

In presenting hotel Adjusted EBITDAre and hotel Adjusted EBITDAre margins, miscellaneous non-hotel items have been excluded. We believe the calculation of hotel Adjusted EBITDAre results in a more accurate presentation of the hotel Adjusted EBITDAre margins for our hotels, and that these non-GAAP financial measures are useful to investors in evaluating our property-level operating performance.

Reconciliations of net income to EBITDAre and Adjusted EBITDAre, excluding noncontrolling interest are set forth on page 13 of this supplemental package. Reconciliations of net income to FFO attributable to common stockholders and Adjusted FFO attributable to common stockholders are set forth on page 14 of this supplemental package.

Our 21 Hotel Comparable Portfolio is comprised of all hotels we owned as of December 31, 2018, and includes both our results and the prior owner’s results for the Oceans Edge Resort & Marina acquired in July 2017. We obtained prior ownership information from the Oceans Edge Resort & Marina’s previous owner during the due diligence period before acquiring the hotel. We performed a limited review of the information as part of our analysis of the acquisition. We caution you not to place undue reliance on the prior ownership information. We believe that providing comparable hotel data is useful to us and to investors in evaluating our operating performance because this measure helps us and investors evaluate and compare the results of our operations from period to period by removing the fluctuations caused by any acquisitions or dispositions, as well as by those hotels that we classify as held for sale, those hotels that are undergoing a material renovation or repositioning and those hotels whose room counts have materially changed during either the current or prior year. We strongly encourage investors to review our financial information in its entirety and not to rely on a single financial measure.

| | | | | | | | |

CORPORATE PROFILE, FINANCIAL DISCLOSURES, AND SAFE HARBOR | | Page 8 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

CORPORATE FINANCIAL INFORMATION

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 9 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Condensed Consolidated Balance Sheets

Q4 2018 – Q4 2017

| | | | | | | | | | | | | | | | |

(In thousands) | | December 31, 2018 (1) | | September 30, 2018 (2) | | June 30, 2018 (3) | | March 31, 2018 (4) | | December 31, 2017 (5) | |

Assets | | | | | | | | | | | | | |

Investment in hotel properties: | | | | | | | | | | | | | | | | |

Land | | $ | 611,993 | | $ | 615,641 | | $ | 604,866 | | $ | 605,054 | | $ | 605,054 | |

Buildings & improvements | | | 2,983,308 | | | 3,013,659 | | | 3,039,104 | | | 3,067,473 | | | 3,049,569 | |

Furniture, fixtures, & equipment | | | 486,441 | | | 489,153 | | | 488,042 | | | 496,492 | | | 484,749 | |

Other | | | 117,543 | | | 132,813 | | | 117,962 | | | 115,365 | | | 103,631 | |

| | | 4,199,285 | | | 4,251,266 | | | 4,249,974 | | | 4,284,384 | | | 4,243,003 | |

Less accumulated depreciation & amortization | | | (1,168,287) | | | (1,177,644) | | | (1,160,793) | | | (1,173,497) | | | (1,136,937) | |

| | | 3,030,998 | | | 3,073,622 | | | 3,089,181 | | | 3,110,887 | | | 3,106,066 | |

| | | | | | | | | | | | | | | | |

Other noncurrent assets, net | | | 33,361 | | | 35,019 | | | 35,102 | | | 33,016 | | | 23,622 | |

| | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | | 809,316 | | | 650,691 | | | 544,900 | | | 467,050 | | | 488,002 | |

Restricted cash | | | 53,053 | | | 68,794 | | | 74,989 | | | 79,336 | | | 71,309 | |

Other current assets, net | | | 46,105 | | | 57,175 | | | 59,052 | | | 62,496 | | | 46,006 | |

Assets held for sale, net | | | — | | | 33,312 | | | 42,389 | | | — | | | 122,807 | |

Total assets | | $ | 3,972,833 | | $ | 3,918,613 | | $ | 3,845,613 | | $ | 3,752,785 | | $ | 3,857,812 | |

*Footnotes on following page.

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 10 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Condensed Consolidated Balance Sheets

Q4 2018– Q4 2017 (cont.)

| | | | | | | | | | | | | | | | | |

(In thousands) | | December 31, 2018 (1) | | September 30, 2018 (2) | | June 30, 2018 (3) | | March 31, 2018 (4) | | December 31, 2017 (5) | |

Liabilities | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | |

Current portion of notes payable, net | | $ | 5,838 | | $ | 5,913 | | $ | 5,653 | | $ | 5,569 | | $ | 5,477 | |

Other current liabilities | | | 226,887 | | | 118,050 | | | 118,553 | | | 110,685 | | | 236,893 | |

Liabilities of assets held for sale | | | — | | | 3,459 | | | 4,061 | | | — | | | 189 | |

Total current liabilities | | | 232,725 | | | 127,422 | | | 128,267 | | | 116,254 | | | 242,559 | |

| | | | | | | | | | | | | | | | |

Notes payable, less current portion, net | | | 971,225 | | | 972,814 | | | 974,309 | | | 975,779 | | | 977,282 | |

Capital lease obligations, less current portion | | | 27,009 | | | 26,956 | | | 26,904 | | | 26,854 | | | 26,804 | |

Other liabilities | | | 30,703 | | | 30,981 | | | 30,802 | | | 31,041 | | | 28,989 | |

Total liabilities | | | 1,261,662 | | | 1,158,173 | | | 1,160,282 | | | 1,149,928 | | | 1,275,634 | |

| | | | | | | | | | | | | | | | |

Equity | | | | | | | | | | | | | | | | |

Stockholders' equity: | | | | | | | | | | | | | | | | |

6.95% Series E cumulative redeemable preferred stock | | | 115,000 | | | 115,000 | | | 115,000 | | | 115,000 | | | 115,000 | |

| | | | | | | | | | | | | | | | |

6.45% Series F cumulative redeemable preferred stock | | | 75,000 | | | 75,000 | | | 75,000 | | | 75,000 | | | 75,000 | |

| | | | | | | | | | | | | | | | | |

Common stock, $0.01 par value, 500,000,000 shares authorized | | | 2,282 | | | 2,282 | | | 2,283 | | | 2,256 | | | 2,253 | |

| | | | | | | | | | | | | | | | |

Additional paid in capital | | | 2,728,684 | | | 2,726,523 | | | 2,724,379 | | | 2,677,099 | | | 2,679,221 | |

Retained earnings | | | 1,182,722 | | | 1,106,391 | | | 1,017,181 | | | 968,293 | | | 932,277 | |

Cumulative dividends and distributions | | | (1,440,202) | | | (1,313,741) | | | (1,299,121) | | | (1,284,501) | | | (1,270,013) | |

Total stockholders' equity | | | 2,663,486 | | | 2,711,455 | | | 2,634,722 | | | 2,553,147 | | | 2,533,738 | |

Noncontrolling interest in consolidated joint venture | | | 47,685 | | | 48,985 | | | 50,609 | | | 49,710 | | | 48,440 | |

Total equity | | | 2,711,171 | | | 2,760,440 | | | 2,685,331 | | | 2,602,857 | | | 2,582,178 | |

Total liabilities and equity | | $ | 3,972,833 | | $ | 3,918,613 | | $ | 3,845,613 | | $ | 3,752,785 | | $ | 3,857,812 | |

| (1) | | As presented on Form 10-K to be filed in February 2019. |

| (2) | | As presented on Form 10-Q filed on November 6, 2018. |

| (3) | | As presented on Form 10-Q filed on August 1, 2018. |

| (4) | | As presented on Form 10-Q filed on May 8, 2018. |

| (5) | | As presented on Form 10-K filed on February 14, 2018. |

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 11 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Consolidated Statements of Operations

Q4 and FY 2018/2017

| | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

(In thousands, except per share data) | | 2018 | | 2017 | | 2018 | | 2017 |

Revenues | | | | | | | | | | | | |

Room | | $ | 191,132 | | $ | 199,532 | | $ | 799,369 | | $ | 829,320 |

Food and beverage | | | 67,199 | | | 73,990 | | | 284,668 | | | 296,933 |

Other operating | | | 22,521 | | | 16,668 | | | 75,016 | | | 67,385 |

Total revenues | | | 280,852 | | | 290,190 | | | 1,159,053 | | | 1,193,638 |

Operating expenses | | | | | | | | | | | | |

Room | | | 50,281 | | | 53,019 | | | 210,204 | | | 213,301 |

Food and beverage | | | 46,187 | | | 50,457 | | | 193,486 | | | 201,225 |

Other operating | | | 4,681 | | | 4,272 | | | 17,169 | | | 16,392 |

Advertising and promotion | | | 13,708 | | | 13,762 | | | 55,523 | | | 58,572 |

Repairs and maintenance | | | 10,627 | | | 11,653 | | | 43,111 | | | 46,298 |

Utilities | | | 6,791 | | | 7,575 | | | 29,324 | | | 30,419 |

Franchise costs | | | 8,442 | | | 9,314 | | | 35,423 | | | 36,681 |

Property tax, ground lease and insurance | | | 18,756 | | | 20,239 | | | 82,414 | | | 83,716 |

Other property-level expenses | | | 31,414 | | | 33,510 | | | 132,419 | | | 138,525 |

Corporate overhead | | | 8,191 | | | 7,232 | | | 30,247 | | | 28,817 |

Depreciation and amortization | | | 36,268 | | | 38,583 | | | 146,449 | | | 158,634 |

Impairment loss | | | — | | | 5,626 | | | 1,394 | | | 40,053 |

Total operating expenses | | | 235,346 | | | 255,242 | | | 977,163 | | | 1,052,633 |

| | | | | | | | | | | | |

Gain on sale of assets | | | 48,174 | | | — | | | 116,961 | | | 45,474 |

Operating income | | | 93,680 | | | 34,948 | | | 298,851 | | | 186,479 |

Interest and other income | | | 3,451 | | | 1,743 | | | 10,500 | | | 4,340 |

Interest expense | | | (16,081) | | | (10,425) | | | (47,690) | | | (51,766) |

Loss on extinguishment of debt | | | (835) | | | (820) | | | (835) | | | (824) |

Income before income taxes and discontinued operations | | | 80,215 | | | 25,446 | | | 260,826 | | | 138,229 |

Income tax (provision) benefit, net | | | (2,459) | | | (4,766) | | | (1,767) | | | 7,775 |

Income from continuing operations | | | 77,756 | | | 20,680 | | | 259,059 | | | 146,004 |

Income from discontinued operations | | | — | | | — | | | — | | | 7,000 |

Net income | | | 77,756 | | | 20,680 | | | 259,059 | | | 153,004 |

Income from consolidated joint venture attributable to noncontrolling interest | | | (1,425) | | | (1,284) | | | (8,614) | | | (7,628) |

Preferred stock dividends | | | (3,208) | | | (3,208) | | | (12,830) | | | (12,830) |

Income attributable to common stockholders | | $ | 73,123 | | $ | 16,188 | | $ | 237,615 | | $ | 132,546 |

| | | | | | | | | | | | |

Basic and diluted per share amounts: | | | | | | | | | | | | |

Income from continuing operations attributable to common stockholders | | $ | 0.32 | | $ | 0.07 | | $ | 1.05 | | $ | 0.56 |

Income from discontinued operations | | | — | | | — | | | — | | | 0.03 |

Basic and diluted income attributable to common stockholders per common share | | $ | 0.32 | | $ | 0.07 | | $ | 1.05 | | $ | 0.59 |

| | | | | | | | | | | | |

Basic and diluted weighted average common shares outstanding | | | 227,068 | | | 224,147 | | | 225,924 | | | 221,898 |

| | | | | | | | | | | | |

Distributions declared per common share | | $ | 0.54 | | $ | 0.58 | | $ | 0.69 | | $ | 0.73 |

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 12 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Reconciliation of Net Income to EBITDAre and Adjusted EBITDAre, Excluding Noncontrolling Interest

Q4 and FY 2018/2017

| | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

(In thousands) | | | 2018 | | | 2017 | | | 2018 | | | 2017 |

Net income | | $ | 77,756 | | $ | 20,680 | | $ | 259,059 | | $ | 153,004 |

Operations held for investment: | | | | | | | | | | | | |

Depreciation and amortization | | | 36,268 | | | 38,583 | | | 146,449 | | | 158,634 |

Amortization of lease intangibles | | | 65 | | | 62 | | | 93 | | | 251 |

Interest expense | | | 16,081 | | | 10,425 | | | 47,690 | | | 51,766 |

Income tax provision (benefit), net | | | 2,459 | | | 4,766 | | | 1,767 | | | (7,775) |

Gain on sale of assets, net | | | (48,176) | | | (11) | | | (116,916) | | | (45,747) |

Impairment loss | | | — | | | 5,626 | | | 1,394 | | | 40,053 |

EBITDAre | | | 84,453 | | | 80,131 | | | 339,536 | | | 350,186 |

| | | | | | | | | | | | |

Operations held for investment: | | | | | | | | | | | | |

Amortization of deferred stock compensation | | | 2,069 | | | 1,854 | | | 9,007 | | | 8,042 |

Amortization of favorable and unfavorable contracts, net | | | (5) | | | 3 | | | (2) | | | 218 |

Noncash ground rent | | | (287) | | | (281) | | | (1,147) | | | (1,122) |

Capital lease obligation interest - cash ground rent | | | (593) | | | (590) | | | (2,361) | | | (1,867) |

Loss on extinguishment of debt | | | 835 | | | 820 | | | 835 | | | 824 |

Hurricane-related uninsured losses (insurance proceeds), net | | | — | | | 41 | | | (990) | | | 1,690 |

Closing costs - completed acquisition | | | — | | | — | | | — | | | 729 |

Prior year property tax adjustments, net | | | (320) | | | (251) | | | (203) | | | (800) |

Property-level restructuring, severance and management transition costs | | | 29 | | | — | | | 29 | | | — |

Noncontrolling interest: | | | | | | | | | | | | |

Income from consolidated joint venture attributable to noncontrolling interest | | | (1,425) | | | (1,284) | | | (8,614) | | | (7,628) |

Depreciation and amortization | | | (641) | | | (620) | | | (2,556) | | | (2,767) |

Interest expense | | | (545) | | | (482) | | | (1,982) | | | (1,950) |

Noncash ground rent | | | 73 | | | 73 | | | 290 | | | 290 |

Loss on extinguishment of debt | | | — | | | (205) | | | — | | | (205) |

Discontinued operations: | | | | | | | | | | | | |

Gain on sale of assets | | | — | | | — | | | — | | | (7,000) |

| | | (810) | | | (922) | | | (7,694) | | | (11,546) |

Adjusted EBITDAre, excluding noncontrolling interest | | $ | 83,643 | | $ | 79,209 | | $ | 331,842 | | $ | 338,640 |

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 13 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Reconciliation of Net Income to FFO and Adjusted FFO Attributable to Common Stockholders

Q4 and FY 2018/2017

| | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

(In thousands, except per share data) | | | 2018 | | | 2017 | | | 2018 | | | 2017 |

Net income | | $ | 77,756 | | $ | 20,680 | | $ | 259,059 | | $ | 153,004 |

Preferred stock dividends | | | (3,208) | | | (3,208) | | | (12,830) | | | (12,830) |

Operations held for investment: | | | | | | | | | | | | |

Real estate depreciation and amortization | | | 36,020 | | | 38,486 | | | 145,827 | | | 158,177 |

Amortization of lease intangibles | | | 65 | | | 62 | | | 93 | | | 251 |

Gain on sale of assets, net | | | (48,176) | | | (11) | | | (116,916) | | | (45,747) |

Impairment loss | | | — | | | 5,626 | | | 1,394 | | | 40,053 |

Noncontrolling interest: | | | | | | | | | | | | |

Income from consolidated joint venture attributable to noncontrolling interest | | | (1,425) | | | (1,284) | | | (8,614) | | | (7,628) |

Real estate depreciation and amortization | | | (641) | | | (620) | | | (2,556) | | | (2,767) |

Discontinued operations: | | | | | | | | | | | | |

Gain on sale of assets | | | — | | | — | | | — | | | (7,000) |

FFO attributable to common stockholders | | | 60,391 | | | 59,731 | | | 265,457 | | | 275,513 |

| | | | | | | | | | | | |

Operations held for investment: | | | | | | | | | | | | |

Amortization of favorable and unfavorable contracts, net | | | (5) | | | 3 | | | (2) | | | 218 |

Noncash ground rent | | | (287) | | | (281) | | | (1,147) | | | (1,122) |

Noncash interest on derivatives and capital lease obligations, net | | | 3,805 | | | (1,777) | | | (1,190) | | | 3,106 |

Loss on extinguishment of debt | | | 835 | | | 820 | | | 835 | | | 824 |

Hurricane-related uninsured losses (insurance proceeds), net | | | — | | | 41 | | | (990) | | | 1,690 |

Closing costs - completed acquisition | | | — | | | — | | | — | | | 729 |

Prior year property tax adjustments, net | | | (320) | | | (251) | | | (203) | | | (800) |

Property-level restructuring, severance and management transition costs | | | 29 | | | — | | | 29 | | | — |

Noncash income tax provision (benefit), net | | | 2,232 | | | 4,393 | | | 1,132 | | | (9,235) |

Noncontrolling interest: | | | | | | | | | | | | |

Noncash ground rent | | | 73 | | | 73 | | | 290 | | | 290 |

Noncash interest on derivative, net | | | — | | | (25) | | | (1) | | | (30) |

Loss on extinguishment of debt | | | — | | | (205) | | | — | | | (205) |

| | | 6,362 | | | 2,791 | | | (1,247) | | | (4,535) |

Adjusted FFO attributable to common stockholders | | $ | 66,753 | | $ | 62,522 | | $ | 264,210 | | $ | 270,978 |

FFO attributable to common stockholders per diluted share | | $ | 0.27 | | $ | 0.27 | | $ | 1.17 | | $ | 1.24 |

Adjusted FFO attributable to common stockholders per diluted share | | $ | 0.29 | | $ | 0.28 | | $ | 1.17 | | $ | 1.22 |

| | | | | | | | | | | | |

Basic weighted average shares outstanding | | | 227,068 | | | 224,147 | | | 225,924 | | | 221,898 |

Shares associated with unvested restricted stock awards | | | 474 | | | 566 | | | 377 | | | 391 |

Diluted weighted average shares outstanding | | | 227,542 | | | 224,713 | | | 226,301 | | | 222,289 |

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 14 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Pro Forma Consolidated Statements of Operations

Q1 2018 – Q4 2018, FY 2018/2017

| | | | | | | | | | | | | | | | | | | |

| Year Ended (1) | | Three Months Ended (1) | | Year Ended (1) | |

(Unaudited and in thousands) | | December 31, | | | December 31, | | | September 30, | | | June 30, | | | March 31, | | | December 31, | |

| | 2018 | | | 2018 | | | 2018 | | | 2018 | | | 2018 | | | 2017 | |

Revenues | | | | | | | | | | | | | | | | | | | |

Room | $ | 754,093 | | $ | 186,414 | | $ | 198,568 | | $ | 204,295 | | $ | 164,816 | | $ | 733,555 | |

Food and beverage | | 266,086 | | | 65,672 | | | 60,987 | | | 72,136 | | | 67,291 | | | 253,757 | |

Other operating | | 71,809 | | | 22,265 | | | 17,313 | | | 16,502 | | | 15,729 | | | 60,612 | |

Total revenues | | 1,091,988 | | | 274,351 | | | 276,868 | | | 292,933 | | | 247,836 | | | 1,047,924 | |

| | | | | | | | | | | | | | | | | | |

Operating Expenses | | | | | | | | | | | | | | | | | | |

Room | | 198,179 | | | 49,264 | | | 51,210 | | | 50,756 | | | 46,949 | | | 188,508 | |

Food and beverage | | 180,458 | | | 45,200 | | | 43,805 | | | 46,088 | | | 45,365 | | | 171,434 | |

Other expenses | | 367,104 | | | 91,897 | | | 91,887 | | | 93,846 | | | 89,474 | | | 354,730 | |

Corporate overhead | | 30,247 | | | 8,191 | | | 7,360 | | | 7,594 | | | 7,102 | | | 28,817 | |

Depreciation and amortization | | 140,712 | | | 35,836 | | | 35,018 | | | 35,269 | | | 34,589 | | | 140,941 | |

Total operating expenses | | 916,700 | | | 230,388 | | | 229,280 | | | 233,553 | | | 223,479 | | | 884,430 | |

| | | | | | | | | | | | | | | | | | |

Operating Income | | 175,288 | | | 43,963 | | | 47,588 | | | 59,380 | | | 24,357 | | | 163,494 | |

| | | | | | | | | | | | | | | | | | |

Interest and other income | | 10,500 | | | 3,451 | | | 2,592 | | | 2,966 | | | 1,491 | | | 4,340 | |

Interest expense | | (47,690) | | | (16,081) | | | (11,549) | | | (11,184) | | | (8,876) | | | (51,766) | |

Loss on extinguishment of debt | | (835) | | | (835) | | | — | | | — | | | — | | | (824) | |

Income before income taxes and discontinued operations | | 137,263 | | | 30,498 | | | 38,631 | | | 51,162 | | | 16,972 | | | 115,244 | |

Income tax (provision) benefit, net | | (1,767) | | | (2,459) | | | (673) | | | (2,375) | | | 3,740 | | | 7,775 | |

Income from continuing operations | | 135,496 | | | 28,039 | | | 37,958 | | | 48,787 | | | 20,712 | | | 123,019 | |

Income from discontinued operations | | — | | | — | | | — | | | — | | | — | | | 7,000 | |

Net Income | $ | 135,496 | | $ | 28,039 | | $ | 37,958 | | $ | 48,787 | | $ | 20,712 | | $ | 130,019 | |

| | | | | | | | | | | | | | | | | | | |

Adjusted EBITDAre, excluding noncontrolling interest (2) | $ | 318,268 | | $ | 81,668 | | $ | 83,077 | | $ | 95,293 | | $ | 58,230 | | $ | 302,539 | |

| (1) | | Includes the Company's ownership results and prior ownership results for the 21 Hotel Comparable Portfolio, along with the reduction of rental expense due to the acquisitions of previously leased building space and land at the Renaissance Washington DC and JW Marriott New Orleans, respectively. Excludes the Company's ownership results for the Marriott Tysons Corner due to its sale in December 2018, the Hilton North Houston and Marriott Houston (together the “Houston hotels”) due to their sales in October 2018, the Hyatt Regency Newport Beach due to its sale in July 2018, and the Marriott Philadelphia and Marriott Quincy due to their sales in January 2018, along with the Marriott Park City and Fairmont Newport Beach due to their sales in June 2017 and February 2017, respectively. |

| (2) | | Adjusted EBITDAre, excluding noncontrolling interest reconciliations for the three months ended December 31, 2018 and for the years ended December 31, 2018 and 2017 can be found on pages 16, 19 and 22, respectively, in this supplemental package. |

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 15 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Pro Forma Reconciliation of Net Income to EBITDAre and Adjusted EBITDAre, Excluding Noncontrolling Interest

Q4 2018

| | | | | | | | |

| Three Months Ended December 31, 2018 |

| | | | Disposition: | | Disposition: | | |

| | | | | | Marriott | | |

(In thousands) | | Actual (1) | | Houston Hotels (2) | | Tysons Corner (3) | | Pro Forma (4) |

| | | | | | | | |

Net income | $ | 77,756 | $ | (322) | $ | (49,395) | $ | 28,039 |

Operations held for investment: | | | | | | | | |

Depreciation and amortization | | 36,268 | | — | | (432) | | 35,836 |

Amortization of lease intangibles | | 65 | | — | | — | | 65 |

Interest expense | | 16,081 | | — | | — | | 16,081 |

Income tax provision | | 2,459 | | — | | — | | 2,459 |

Gain on sale of assets, net | | (48,176) | | 336 | | 47,838 | | (2) |

EBITDAre | | 84,453 | | 14 | | (1,989) | | 82,478 |

| | | | | | | | |

Operations held for investment: | | | | | | | | |

Amortization of deferred stock compensation | | 2,069 | | — | | — | | 2,069 |

Amortization of favorable and unfavorable contracts, net | | (5) | | — | | — | | (5) |

Noncash ground rent | | (287) | | — | | — | | (287) |

Capital lease obligation interest - cash ground rent | | (593) | | — | | — | | (593) |

Loss on extinguishment of debt | | 835 | | — | | — | | 835 |

Prior year property tax adjustments, net | | (320) | | — | | — | | (320) |

Property-level restructuring, severance and management transition costs | | 29 | | — | | — | | 29 |

Noncontrolling interest: | | | | | | | | |

Income from consolidated joint venture attributable to noncontrolling interest | | (1,425) | | — | | — | | (1,425) |

Depreciation and amortization | | (641) | | — | | — | | (641) |

Interest expense | | (545) | | — | | — | | (545) |

Noncash ground rent | | 73 | | — | | — | | 73 |

| | (810) | | — | | — | | (810) |

| | | | | | | | |

Adjusted EBITDAre, excluding noncontrolling interest | $ | 83,643 | $ | 14 | $ | (1,989) | $ | 81,668 |

*Footnotes on page 18

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 16 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Pro Forma Reconciliation of Net Income to FFO and Adjusted FFO Attributable to Common Stockholders

Q4 2018

| | | | | | | | |

| Three Months Ended December 31, 2018 |

| | | | Disposition: | | Disposition: | | |

| | | | | | Marriott | | |

(In thousands, except per share amounts) | | Actual (1) | | Houston Hotels (2) | | Tysons Corner (3) | | Pro Forma (4) |

| | | | | | | | |

Net income | $ | 77,756 | $ | (322) | $ | (49,395) | $ | 28,039 |

Preferred stock dividends | | (3,208) | | — | | — | | (3,208) |

Operations held for investment: | | | | | | | | |

Real estate depreciation and amortization | | 36,020 | | — | | (432) | | 35,588 |

Amortization of lease intangibles | | 65 | | — | | — | | 65 |

Gain on sale of assets, net | | (48,176) | | 336 | | 47,838 | | (2) |

Noncontrolling interest: | | | | | | | | |

Income from consolidated joint venture attributable to noncontrolling interest | | (1,425) | | — | | — | | (1,425) |

Real estate depreciation and amortization | | (641) | | — | | — | | (641) |

FFO attributable to common stockholders | | 60,391 | | 14 | | (1,989) | | 58,416 |

| | | | | | | | |

Operations held for investment: | | | | | | | | |

Amortization of favorable and unfavorable contracts, net | | (5) | | — | | — | | (5) |

Noncash ground rent | | (287) | | — | | — | | (287) |

Noncash interest on derivatives and capital lease obligations, net | | 3,805 | | — | | — | | 3,805 |

Loss on extinguishment of debt | | 835 | | — | | — | | 835 |

Prior year property tax adjustments, net | | (320) | | — | | — | | (320) |

Property-level restructuring, severance and management transition costs | | 29 | | — | | — | | 29 |

Noncash income tax provision | | 2,232 | | — | | — | | 2,232 |

Noncontrolling interest: | | | | | | | | |

Noncash ground rent | | 73 | | — | | — | | 73 |

| | 6,362 | | — | | — | | 6,362 |

| | | | | | | | |

Adjusted FFO attributable to common stockholders | $ | 66,753 | $ | 14 | $ | (1,989) | $ | 64,778 |

| | | | | | | | |

FFO attributable to common stockholders per diluted share | $ | 0.27 | | | | | $ | 0.26 |

| | | | | | | | |

Adjusted FFO attributable to common stockholders per diluted share | $ | 0.29 | | | | | $ | 0.28 |

| | | | | | | | |

Basic weighted average shares outstanding | | 227,068 | | | | | | 227,068 |

Shares associated with unvested restricted stock awards | | 474 | | | | | | 474 |

Diluted weighted average shares outstanding | | 227,542 | | | | | | 227,542 |

*Footnotes on page 18

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 17 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Pro Forma Reconciliation of Net Income to EBITDAre, Adjusted EBITDAre, Excluding Noncontrolling Interest,

FFO and Adjusted FFO Attributable to Common Stockholders

Q4 2018 Footnotes

| (1) | | Actual represents the Company's ownership results for all 21 hotels owned by the Company as of December 31, 2018, as well as results for the Houston hotels prior to their disposition in October 2018, and the Marriott Tysons Corner prior to its disposition in December 2018. |

| (2) | | Disposition: Houston Hotels represents the Company's ownership results for the hotels, sold in October 2018. |

| (3) | | Disposition: Marriott Tysons Corner represents the Company’s ownership results for the hotel, sold in December 2018. |

| (4) | | Pro Forma represents the Company’s ownership results for the 21 Hotel Comparable Portfolio. |

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 18 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Pro Forma Reconciliation of Net Income to EBITDAre and Adjusted EBITDAre, Excluding Noncontrolling Interest

FY 2018

| | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2018 |

| | | | Disposition: | | Disposition: | | Disposition: | | Disposition: | | Acquisition: | | Acquisition: | | Issuance: | | |

| | | | Marriott Philadelphia | | | | | | | | | | JW Marriott | | | | |

(In thousands) | | Actual (1) | | & Marriott Quincy (2) | | Hyatt Regency Newport Beach (3) | | Houston Hotels (4) | | Marriott Tysons Corner (5) | | Renaissance DC Space Rights (6) | | New Orleans Land (7) | | Common Stock (8) | | Pro Forma (9) |

| | | | | | | | | | | | | | | | | | |

Net income | $ | 259,059 | $ | (14,716) | $ | (56,447) | $ | 332 | $ | (53,446) | $ | 546 | $ | 168 | $ | — | $ | 135,496 |

Operations held for investment: | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | 146,449 | | — | | (1,773) | | (1,522) | | (2,442) | | — | | — | | — | | 140,712 |

Amortization of lease intangibles | | 93 | | — | | — | | — | | — | | — | | 163 | | — | | 256 |

Interest expense | | 47,690 | | — | | — | | — | | — | | — | | — | | — | | 47,690 |

Income tax provision, net | | 1,767 | | — | | — | | — | | — | | — | | — | | — | | 1,767 |

Gain on sale of assets, net | | (116,916) | | 15,659 | | 53,128 | | 336 | | 47,838 | | — | | — | | — | | 45 |

Impairment loss | | 1,394 | | — | | — | | (1,394) | | — | | — | | — | | — | | — |

EBITDAre | | 339,536 | | 943 | | (5,092) | | (2,248) | | (8,050) | | 546 | | 331 | | — | | 325,966 |

| | | | | | | | | | | | | | | | | | |

Operations held for investment: | | | | | | | | | | | | | | | | | | |

Amortization of deferred stock compensation | | 9,007 | | — | | — | | — | | — | | — | | — | | — | | 9,007 |

Amortization of favorable and unfavorable contracts, net | | (2) | | — | | — | | — | | — | | — | | — | | — | | (2) |

Noncash ground rent | | (1,147) | | — | | — | | — | | — | | — | | — | | — | | (1,147) |

Capital lease obligation interest - cash ground rent | | (2,361) | | — | | — | | — | | — | | — | | — | | — | | (2,361) |

Loss on extinguishment of debt | | 835 | | — | | — | | — | | — | | — | | — | | — | | 835 |

Hurricane-related insurance proceeds net of uninsured losses | | (990) | | — | | — | | (4) | | — | | — | | — | | — | | (994) |

Prior year property tax adjustments, net | | (203) | | — | | — | | — | | — | | — | | — | | — | | (203) |

Property-level restructuring, severance and management transition costs | | 29 | | — | | — | | — | | — | | — | | — | | — | | 29 |

Noncontrolling interest: | | | | | | | | | | | | | | | | | | |

Income from consolidated joint venture attributable to noncontrolling interest | | (8,614) | | — | | — | | — | | — | | — | | — | | — | | (8,614) |

Depreciation and amortization | | (2,556) | | — | | — | | — | | — | | — | | — | | — | | (2,556) |

Interest expense | | (1,982) | | — | | — | | — | | — | | — | | — | | — | | (1,982) |

Noncash ground rent | | 290 | | — | | — | | — | | — | | — | | — | | — | | 290 |

| | (7,694) | | — | | — | | (4) | | — | | — | | — | | — | | (7,698) |

| | | | | | | | | | | | | | | | | | |

Adjusted EBITDAre, excluding noncontrolling interest | $ | 331,842 | $ | 943 | $ | (5,092) | $ | (2,252) | $ | (8,050) | $ | 546 | $ | 331 | $ | — | $ | 318,268 |

*Footnotes on page 21

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 19 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Pro Forma Reconciliation of Net Income to FFO and Adjusted FFO Attributable to Common Stockholders

FY 2018

| | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2018 |

| | | | Disposition: | | Disposition: | | Disposition: | | Disposition: | | Acquisition: | | Acquisition: | | Issuance: | | |

| | | | Marriott Philadelphia | | | | | | | | | | JW Marriott | | | | |

(In thousands, except per share amounts) | | Actual (1) | | & Marriott Quincy (2) | | Hyatt Regency Newport Beach (3) | | Houston Hotels (4) | | Marriott Tysons Corner (5) | | Renaissance DC Space Rights (6) | | New Orleans Land (7) | | Common Stock (8) | | Pro Forma (9) |

| | | | | | | | | | | | | | | | | | |

Net income | $ | 259,059 | $ | (14,716) | $ | (56,447) | $ | 332 | $ | (53,446) | $ | 546 | $ | 168 | $ | — | $ | 135,496 |

Preferred stock dividends | | (12,830) | | — | | — | | — | | — | | — | | — | | — | | (12,830) |

Operations held for investment: | | | | | | | | | | | | | | | | | | |

Real estate depreciation and amortization | | 145,827 | | — | | (1,773) | | (1,522) | | (2,442) | | — | | — | | — | | 140,090 |

Amortization of lease intangibles | | 93 | | — | | — | | — | | — | | — | | 163 | | — | | 256 |

Gain on sale of assets, net | | (116,916) | | 15,659 | | 53,128 | | 336 | | 47,838 | | — | | — | | — | | 45 |

Impairment loss | | 1,394 | | — | | — | | (1,394) | | — | | — | | — | | — | | — |

Noncontrolling interest: | | | | | | | | | | | | | | | | | | |

Income from consolidated joint venture attributable to noncontrolling interest | | (8,614) | | — | | — | | — | | — | | — | | — | | — | | (8,614) |

Real estate depreciation and amortization | | (2,556) | | — | | — | | — | | — | | — | | — | | — | | (2,556) |

FFO attributable to common stockholders | | 265,457 | | 943 | | (5,092) | | (2,248) | | (8,050) | | 546 | | 331 | | — | | 251,887 |

| | | | | | | | | | | | | | | | | | |

Operations held for investment: | | | | | | | | | | | | | | | | | | |

Amortization of favorable and unfavorable contracts, net | | (2) | | — | | — | | — | | — | | — | | — | | — | | (2) |

Noncash ground rent | | (1,147) | | — | | — | | — | | — | | — | | — | | — | | (1,147) |

Noncash interest on derivatives and capital lease obligations, net | | (1,190) | | — | | — | | — | | — | | — | | — | | — | | (1,190) |

Loss on extinguishment of debt | | 835 | | — | | — | | — | | — | | — | | — | | — | | 835 |

Hurricane-related insurance proceeds net of uninsured losses | | (990) | | — | | — | | (4) | | — | | — | | — | | — | | (994) |

Prior year property tax adjustments, net | | (203) | | — | | — | | — | | — | | — | | — | | — | | (203) |

Property-level restructuring, severance and management transition costs | | 29 | | — | | — | | — | | — | | — | | — | | — | | 29 |

Noncash income tax provision, net | | 1,132 | | — | | — | | — | | — | | — | | — | | — | | 1,132 |

Noncontrolling interest: | | | | | | | | | | | | | | | | | | |

Noncash ground rent | | 290 | | — | | — | | — | | — | | — | | — | | — | | 290 |

Noncash interest on derivative, net | | (1) | | — | | — | | — | | — | | — | | — | | — | | (1) |

| | (1,247) | | — | | — | | — | | — | | — | | — | | — | | (1,251) |

| | | | | | | | | | | | | | | | | | |

Adjusted FFO attributable to common stockholders | $ | 264,210 | $ | 943 | $ | (5,092) | $ | (2,252) | $ | (8,050) | $ | 546 | $ | 331 | $ | — | $ | 250,636 |

| | | | | | | | | | | | | | | | | | |

FFO attributable to common stockholders per diluted share | $ | 1.17 | | | | | | | | | | | | | | | $ | 1.11 |

| | | | | | | | | | | | | | | | | | |

Adjusted FFO attributable to common stockholders per diluted share | $ | 1.17 | | | | | | | | | | | | | | | $ | 1.10 |

| | | | | | | | | | | | | | | | | | |

Basic weighted average shares outstanding | | 225,924 | | | | | | | | | | | | | | 1,092 | | 227,016 |

Shares associated with unvested restricted stock awards | | 377 | | | | | | | | | | | | | | — | | 377 |

Diluted weighted average shares outstanding | | 226,301 | | | | | | | | | | | | | | 1,092 | | 227,393 |

*Footnotes on page 21

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 20 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Pro Forma Reconciliation of Net Income to EBITDAre, Adjusted EBITDAre, Excluding Noncontrolling Interest,

FFO and Adjusted FFO Attributable to Common Stockholders

FY 2018 Footnotes

| (1) | | Actual represents the Company's ownership results for all 21 hotels owned by the Company as of December 31, 2018, as well as results prior to their dispositions for the Marriott Philadelphia and Marriott Quincy in January 2018, Hyatt Regency Newport Beach in July 2018, the Houston hotels in October 2018, and the Marriott Tysons Corner in December 2018. |

| (2) | | Disposition: Marriott Philadelphia & Marriott Quincy represents the Company's ownership results for the hotels, sold in January 2018. |

| (3) | | Disposition: Hyatt Regency Newport Beach represents the Company's ownership results for the hotel, sold in July 2018. |

| (4) | | Disposition: Houston Hotels represents the Company's ownership results for the hotels, sold in October 2018. |

| (5) | | Disposition: Marriott Tysons Corner represents the Company's ownership results for the hotel, sold in December 2018. |

| (6) | | Acquisition: Renaissance DC Space Rights represents the reduction in lease space rental expense payable to a third party due to the Company's acquisition of the exclusive perpetual rights to use certain portions of the building in May 2018. |

| (7) | | Acquisition: JW Marriott New Orleans Land represents the reduction in ground lease expense payable to a third party due to the Company's acquisition of the land underlying the hotel in July 2018. |

| (8) | | Issuance: Common Stock represents the 2,590,854 shares issued in connection with the Company's ATM program in the second quarter of 2018. |

| (9) | | Pro Forma represents the Company's ownership results for the 21 Hotel Comparable Portfolio, as well as the common stock issuance in 2018 and the reduction of rental expense due to the acquisitions of previously leased building space and land in May 2018 and July 2018, respectively. |

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 21 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Pro Forma Reconciliation of Net Income to EBITDAre and Adjusted EBITDAre, Excluding Noncontrolling Interest

FY 2017

| | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2017 |

| | | Disposition: | Disposition: | Disposition: | Disposition: | Disposition: | Disposition: | Acquisition: | Acquisition: | Acquisition: | Issuance: | | |

| | | | | Marriott Philadelphia | | | | Oceans Edge | | JW Marriott | | | |

(In thousands) | Actual (1) | Fairmont Newport Beach (2) | Marriott Park City (3) | & Marriott Quincy (4) | Hyatt Regency Newport Beach (5) | Houston Hotels (6) | Marriott Tysons Corner (7) | Resort & Marina (8) | Renaissance DC Space Rights (9) | New Orleans Land (10) | Common Stock (11) | Pro Forma (12) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income | $ | 153,004 | $ | (45,304) | $ | (2,636) | $ | (6,385) | $ | (6,604) | $ | 39,372 | $ | (4,733) | $ | 1,393 | $ | 1,291 | $ | 621 | $ | — | $ | 130,019 |

Operations held for investment: | | | | | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | 158,634 | | — | | (699) | | (7,195) | | (3,576) | | (4,692) | | (2,994) | | 1,463 | | — | | — | | — | | 140,941 |

Amortization of lease intangibles | | 251 | | — | | — | | — | | — | | — | | — | | — | | — | | 4 | | — | | 255 |

Interest expense | | 51,766 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 51,766 |

Income tax benefit, net | | (7,775) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (7,775) |

Gain on sale of assets, net | | (45,747) | | 44,285 | | 1,189 | | — | | — | | — | | — | | — | | — | | — | | — | | (273) |

Impairment loss | | 40,053 | | — | | — | | — | | — | | (40,053) | | — | | — | | — | | — | | — | | — |

EBITDAre | | 350,186 | | (1,019) | | (2,146) | | (13,580) | | (10,180) | | (5,373) | | (7,727) | | 2,856 | | 1,291 | | 625 | | — | | 314,933 |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations held for investment: | | | | | | | | | | | | | | | | | | | | | | | | |

Amortization of deferred stock compensation | | 8,042 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 8,042 |

Amortization of favorable and unfavorable contracts, net | | 218 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 218 |

Noncash ground rent | | (1,122) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (1,122) |

Capital lease obligation interest - cash ground rent | | (1,867) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (1,867) |

Loss on extinguishment of debt | | 824 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 824 |

Hurricane-related uninsured losses | | 1,690 | | — | | — | | — | | — | | (848) | | — | | — | | — | | — | | — | | 842 |

Closing costs - completed acquisition | | 729 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 729 |

Prior year property tax adjustments, net | | (800) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (800) |

Noncontrolling interest: | | | | | | | | | | | | | | | | | | | | | | | | |

Income from consolidated joint venture attributable to noncontrolling interest | | (7,628) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (7,628) |

Depreciation and amortization | | (2,767) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (2,767) |

Interest expense | | (1,950) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (1,950) |

Noncash ground rent | | 290 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 290 |

Loss on extinguishment of debt | | (205) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (205) |

Discontinued operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Gain on sale of assets | | (7,000) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (7,000) |

| | (11,546) | | — | | — | | — | | — | | (848) | | — | | — | | — | | — | | — | | (12,394) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDAre, excluding noncontrolling interest | $ | 338,640 | $ | (1,019) | $ | (2,146) | $ | (13,580) | $ | (10,180) | $ | (6,221) | $ | (7,727) | $ | 2,856 | $ | 1,291 | $ | 625 | $ | — | $ | 302,539 |

*Footnotes on page 24

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 22 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Pro Forma Reconciliation of Net Income to FFO and Adjusted FFO Attributable to Common Stockholders

FY 2017

| | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2017 |

| | | Disposition: | Disposition: | Disposition: | Disposition: | Disposition: | Disposition: | Acquisition: | Acquisition: | Acquisition: | Issuance: | | |

| | | Fairmont | Marriott | Marriott Philadelphia & | Hyatt Regency | Houston | Marriott | Oceans Edge Resort & | Renaissance DC | JW Marriott New Orleans | Common | Pro |

(In thousands, except per share amounts) | Actual (1) | Newport Beach (2) | Park City (3) | Marriott Quincy (4) | Newport Beach (5) | Hotels (6) | Tysons Corner (7) | Marina (8) | Space Rights (9) | Land (10) | Stock (11) | Forma (12) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income | $ | 153,004 | $ | (45,304) | $ | (2,636) | $ | (6,385) | $ | (6,604) | $ | 39,372 | $ | (4,733) | $ | 1,393 | $ | 1,291 | $ | 621 | $ | — | $ | 130,019 |

Preferred stock dividends | | (12,830) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (12,830) |

Operations held for investment: | | | | | | | | | | | | | | | | | | | | | | | | |

Real estate depreciation and amortization | | 158,177 | | — | | (699) | | (7,195) | | (3,576) | | (4,692) | | (2,994) | | 1,463 | | — | | — | | — | | 140,484 |

Amortization of lease intangibles | | 251 | | — | | — | | — | | — | | — | | — | | — | | — | | 4 | | — | | 255 |

Gain on sale of assets, net | | (45,747) | | 44,285 | | 1,189 | | — | | — | | — | | — | | — | | — | | — | | — | | (273) |

Impairment loss | | 40,053 | | — | | — | | — | | — | | (40,053) | | — | | — | | — | | — | | — | | — |

Noncontrolling interest: | | | | | | | | | | | | | | | | | | | | | | | | |

Income from consolidated joint venture attributable to noncontrolling interest | | (7,628) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (7,628) |

Real estate depreciation and amortization | | (2,767) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (2,767) |

Discontinued operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Gain on sale of assets | | (7,000) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (7,000) |

FFO attributable to common stockholders | | 275,513 | | (1,019) | | (2,146) | | (13,580) | | (10,180) | | (5,373) | | (7,727) | | 2,856 | | 1,291 | | 625 | | — | | 240,260 |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations held for investment: | | | | | | | | | | | | | | | | | | | | | | | | |

Amortization of favorable and unfavorable contracts, net | | 218 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 218 |

Noncash ground rent | | (1,122) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (1,122) |

Noncash interest on derivatives and capital lease obligations, net | | 3,106 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 3,106 |

Loss on extinguishment of debt | | 824 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 824 |

Hurricane-related uninsured losses | | 1,690 | | — | | — | | — | | — | | (848) | | — | | — | | — | | — | | — | | 842 |

Closing costs - completed acquisition | | 729 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 729 |

Prior year property tax adjustments, net | | (800) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (800) |

Noncash income tax benefit, net | | (9,235) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (9,235) |

Noncontrolling interest: | | | | | | | | | | | | | | | | | | | | | | | | |

Noncash ground rent | | 290 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 290 |

Noncash interest on derivative, net | | (30) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (30) |

Loss on extinguishment of debt | | (205) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | (205) |

| | (4,535) | | — | | — | | — | | — | | (848) | | — | | — | | — | | — | | — | | (5,383) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted FFO attributable to common stockholders | $ | 270,978 | $ | (1,019) | $ | (2,146) | $ | (13,580) | $ | (10,180) | $ | (6,221) | $ | (7,727) | $ | 2,856 | $ | 1,291 | $ | 625 | $ | — | $ | 234,877 |

| | | | | | | | | | | | | | | | | | | | | | | | |

FFO attributable to common stockholders per diluted share | $ | 1.24 | | | | | | | | | | | | | | | | | | | | | $ | 1.06 |

| | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted FFO attributable to common stockholders per diluted share | $ | 1.22 | | | | | | | | | | | | | | | | | | | | | $ | 1.03 |

| | | | | | | | | | | | | | | | | | | | | | | | |

Basic weighted average shares outstanding | | 221,898 | | | | | | | | | | | | | | | | | | | | 4,793 | | 226,691 |

Shares associated with unvested restricted stock awards | | 391 | | | | | | | | | | | | | | | | | | | | — | | 391 |

Diluted weighted average shares outstanding | | 222,289 | | | | | | | | | | | | | | | | | | | | 4,793 | | 227,082 |

*Footnotes on page 24

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 23 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Pro Forma Reconciliation of Net Income to EBITDAre, Adjusted EBITDAre, Excluding Noncontrolling Interest,

FFO and Adjusted FFO Attributable to Common Stockholders

FY 2017 Footnotes

| (1) | | Actual represents the Company's ownership results for all 27 hotels owned by the Company as of December 31, 2017, as well as results for the Fairmont Newport Beach and the Marriott Park City prior to their dispositions in February 2017 and June 2017, respectively. |

| (2) | | Disposition: Fairmont Newport Beach represents the Company's ownership results for the hotel, sold in February 2017. |

| (3) | | Disposition: Marriott Park City represents the Company's ownership results for the hotel, sold in June 2017. |

| (4) | | Disposition: Marriott Philadelphia & Marriott Quincy represents the Company's ownership results for the hotels, sold in January 2018. |

| (5) | | Disposition: Hyatt Regency Newport Beach represents the Company's ownership results for the hotel, sold in July 2018. |

| (6) | | Disposition: Houston Hotels represents the Company's ownership results for the hotels, sold in October 2018. |

| (7) | | Disposition: Marriott Tysons Corner represents the Company's ownership results for the hotel, sold in December 2018. |

| (8) | | Acquisition: Oceans Edge Resort & Marina represents prior ownership results for the hotel acquired in July 2017, adjusted for the Company's pro forma depreciation expense. |

| (9) | | Acquisition: Renaissance DC Space Rights represents the reduction in lease space rental expense payable to a third party due to the Company's acquisition of the exclusive perpetual rights to use certain portions of the building in May 2018. |

| (10) | | Acquisition: JW Marriott New Orleans Land represents the reduction in ground lease expense payable to a third party due to the Company's acquisition of the land underlying the hotel in July 2018. |

| (11) | | Issuance: Common Stock represents the 4,685,023 shares, the 191,832 shares and the 2,590,854 shares issued in connection with the Company's ATM program in the second quarter of 2017, July 2017 and second quarter of 2018, respectively. The 191,832 shares were sold at the end of June 2017, but due to customary settlement periods, the shares were not delivered until July 2017. |

| (12) | | Pro Forma represents the Company's ownership results and prior ownership results for the 21 Hotel Comparable Portfolio, as well as the common stock issuances in 2017 and 2018, along with the reduction of rental expense due to the acquisitions of previously leased building space and land in May 2018 and July 2018, respectively. |

| | | | | | | | |

CORPORATE FINANCIAL INFORMATION | | Page 24 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

EARNINGS GUIDANCE

| | | | | | | | |

EARNINGS GUIDANCE | | Page 25 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Earnings Guidance for Q1 and FY 2019

The Company’s achievement of the anticipated results is subject to risks and uncertainties, including those disclosed in the Company’s filings with the Securities and Exchange Commission. The Company’s guidance does not take into account the impact of any unanticipated developments in its business, changes in its operating environment, or any unannounced hotel acquisitions, dispositions, re-brandings, management changes, transition costs, noncash impairment expense, changes in deferred tax assets or valuation allowances, severance costs associated with restructuring hotel services, uninsured property losses, early lease termination costs, prior year property tax assessments or credits, debt repurchases/repayments, or unannounced financings during 2019.

The Company’s 2019 guidance does not include any residual impact from the recent government shutdown or any additional impact from any future government shutdowns, which could likely have a prolonged negative impact on its business.

For the first quarter of 2019, the Company expects:

| |

Metric | Quarter Ended March 31, 2019 Guidance (1) |

Net Income ($ millions) | $10 to $14 |

21 Hotel Comparable Portfolio RevPAR Growth | + 2.5% to + 4.5% |

Adjusted EBITDAre, excluding noncontrolling interest ($ millions) | $59 to $62 |

Adjusted FFO Attributable to Common Stockholders ($ millions) | $42 to $45 |

Adjusted FFO Attributable to Common Stockholders per Diluted Share | $0.18 to $0.20 |

Diluted Weighted Average Shares Outstanding | 227,700,000 |

For the full year of 2019, the Company expects:

| |

Metric | Full Year 2019

Guidance (1) |

Net Income ($ millions) | $109 to $134 |

21 Hotel Comparable Portfolio RevPAR Growth | 0.0% to + 3.0% |

Adjusted EBITDAre, excluding noncontrolling interest ($ millions) | $300 to $324 |

Adjusted FFO Attributable to Common Stockholders ($ millions) | $229 to $254 |

Adjusted FFO Attributable to Common Stockholders per Diluted Share | $1.01 to $1.11 |

Diluted Weighted Average Shares Outstanding | 228,000,000 |

| (1) | | See page 28 for detailed reconciliations of Net Income to non-GAAP financial measures. |

| | | | | | | | |

EARNINGS GUIDANCE | | Page 26 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Earnings Guidance for Q1 and FY 2019 (cont.)

First quarter and full year 2019 guidance are based in part on the following assumptions:

| · | | Full year revenue displacement of $4.0 million to $5.0 million, related to planned 2019 capital investment projects. |

| · | | Full year Adjusted EBITDAre, excluding noncontrolling interest displacement of approximately $3.0 million to $4.0 million, related to planned 2019 capital investment projects. |

| · | | Full year 21 Hotel Comparable Portfolio Adjusted EBITDAre Margin is expected to decline 25 basis points to 75 basis points. |

| · | | Full year corporate overhead expense (excluding deferred stock amortization) of approximately $23 million. |

| · | | Full year amortization of deferred stock compensation expense of approximately $9 million. |

| · | | Full year interest expense of approximately $51 million, including approximately $3 million in amortization of deferred financing costs and approximately $3 million of capital lease obligation interest. Full year interest expense does not include any noncash gain or loss on derivatives. |

| · | | Full year total preferred dividends of $13 million, which includes the Series E and Series F cumulative redeemable preferred stock. |

| | | | | | | | |

EARNINGS GUIDANCE | | Page 27 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

Reconciliation of Net Income to Adjusted EBITDAre, Excluding Noncontrolling Interest and

Adjusted FFO Attributable to Common Stockholders

Q1 and FY 2019

Reconciliation of Net Income to Adjusted EBITDAre, Excluding Noncontrolling Interest

| | | | | | | | | | | | |

| | | Quarter Ended | | | Year Ended |

| | | March 31, 2019 | | | December 31, 2019 |

(In thousands, except per share data) | | | Low | | | High | | | Low | | | High |

| | | | | | | | | | | | |

Net income | | $ | 10,200 | | $ | 13,800 | | $ | 109,000 | | $ | 134,200 |

Depreciation and amortization | | | 36,200 | | | 36,000 | | | 144,800 | | | 144,200 |

Amortization of lease intangibles | | | 100 | | | 100 | | | 300 | | | 300 |

Interest expense | | | 12,900 | | | 12,700 | | | 51,200 | | | 50,800 |

Income tax provision | | | 300 | | | 300 | | | 1,300 | | | 1,300 |

Noncontrolling interest | | | (1,900) | | | (2,100) | | | (12,300) | | | (12,500) |

Amortization of deferred stock compensation | | | 2,100 | | | 2,100 | | | 9,300 | | | 9,300 |

Noncash ground rent | | | (300) | | | (300) | | | (1,200) | | | (1,200) |

Capital lease obligation interest - cash ground rent | | | (600) | | | (600) | | | (2,400) | | | (2,400) |

Adjusted EBITDAre, excluding noncontrolling interest | | $ | 59,000 | | $ | 62,000 | | $ | 300,000 | | $ | 324,000 |

Reconciliation of Net Income to Adjusted FFO Attributable to Common Stockholders

| | | | | | | | | | | | |

Net income | | $ | 10,200 | | $ | 13,800 | | $ | 109,000 | | $ | 134,200 |

Preferred stock dividends | | | (3,200) | | | (3,200) | | | (12,800) | | | (12,800) |

Real estate depreciation and amortization | | | 36,000 | | | 35,800 | | | 143,800 | | | 143,200 |

Amortization of lease intangibles | | | 100 | | | 100 | | | 300 | | | 300 |

Noncontrolling interest | | | (1,300) | | | (1,500) | | | (10,100) | | | (10,300) |

Noncash ground rent | | | (300) | | | (300) | | | (1,200) | | | (1,200) |

Noncash interest on capital lease obligations | | | 100 | | | 100 | | | 200 | | | 200 |

Adjusted FFO attributable to common stockholders | | $ | 41,600 | | $ | 44,800 | | $ | 229,200 | | $ | 253,600 |

| | | | | | | | | | | | |

Adjusted FFO attributable to common stockholders per diluted share | | $ | 0.18 | | $ | 0.20 | | $ | 1.01 | | $ | 1.11 |

| | | | | | | | | | | | |

Diluted weighted average shares outstanding | | | 227,700 | | | 227,700 | | | 228,000 | | | 228,000 |

| | | | | | | | |

EARNINGS GUIDANCE | | Page 28 |

| | |

|

|

| |

|

|

|

|

|

| |

| Supplemental Financial Information

February 12, 2019 |

CAPITALIZATION

| |

| Supplemental Financial Information

February 12, 2019 |

Comparative Capitalization

Q4 2018 – Q4 2017

| | | | | | | | | | | | | | | | |

| | | December 31, | | | September 30, | | | June 30, | | | March 31, | | | December 31, | |

(In thousands, except per share data) | | | 2018 | | | 2018 | | | 2018 | | | 2018 | | | 2017 | |

| | | | | | | | | | | | | | | | |

Common Share Price & Dividends | | | | | | | | | | | | | | | | |

At the end of the quarter | | $ | 13.01 | | $ | 16.36 | | $ | 16.62 | | $ | 15.22 | | $ | 16.53 | |

High during quarter ended | | $ | 16.13 | | $ | 16.98 | | $ | 17.52 | | $ | 17.26 | | $ | 17.44 | |