As filed with the Securities and Exchange Commission on December 27, 2006

Registration No. ___

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SB-2/A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ASIA BIOTECHNOLOGY GROUP INC.

(Exact name of registrant as specified in its charter)

| Delaware | N/A | N/A |

(State or other jurisdiction of organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Incorporation or Identification Number) |

No. 7, BohaiSanLu, Pingfang Industrial District,

Economic & Technological Development Area, Harbin, Heilongjiang Province, China

Telephone: +86 451 86812888

Fax: +86 451 86813999

(Address and telephone number of principal executive offices)

No. 7, BohaiSanLu, Pingfang Industrial District,

Economic & Technological Development Area, Harbin, Heilongjiang Province, China

(Address of principal place of business or intended principal place of business)

Mr. Xueliang Qiu, CEO

No. 7 BohaiSanLu, Pingfang Industrial District,

Economic & Technological Development Area, Harbin, Heilongjiang Province, China

Telephone: +86 451 86812888

Fax: +86 451 86813999

(Name, address and telephone number of agent for service)

Copies to:

Charles Law

King and Wood LLP

650 Page Mill Road Palo Alto, CA 94304

Tel. (650) 320-4563

Fax: (650) 494-1387

Approximate date of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | | Amount to be registered | | Proposed maximum offering price per unit(1) | | Proposed maximum aggregate offering price(1) | | Amount of registration fee | |

| Common Stock, $.001 par value | | | 23,444,000 Shares | | $ | 1(1 | ) | $ | 23,444,000 | | $ | 2,508.51 (1 | ) |

| Total | | | 23,444,000 Shares | | $ | 1(1 | ) | $ | 23,444,000 | | $ | 2,508.51 (1 | ) |

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457( a) under the Securities Act of 1933. |

EXPLANATORY NOTE

A filing fee of $5,935.93 was paid upon the first filing of this registration statement on May 12, 2006 for 55,476,000 shares of common stock.

The offering price of $1.00 per share for the shares offered hereby has been arbitrarily determined by corporate management. The offering price was not established through any consideration of actual book value, earnings per share, past operating history, recent sales transactions, or any other recognized criteria of value.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES, AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, December 27, 2006

Asia Biotechnology Group, Inc.

23,444,000 Shares

Common Stock

This prospectus is an offering of up to 23,444,000 shares of our common stock by the selling shareholders.

These securities are more fully described in the section of this prospectus titled "Description of Securities".

These securities are being registered to permit public secondary trading of the securities offered by the selling shareholders named in this prospectus. We will not receive any of the proceeds from the sale of the securities by the selling shareholders.

The selling shareholders may, but are not obligated to, offer all or part of their shares of common stock for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. See "Plan of Distribution."

There is currently no public market for our common stock shares. We intend to request our common stock be quoted on the OTC Bulletin Board and trade our securities in the secondary market.

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE OUR SECURITIES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE "RISK FACTORS" BEGINNING AT PAGE 8.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is____, 2006

ASIA BIOTECHNOLOGY GROUP INC.

TABLE OF CONTENTS

| | Page |

| Prospectus Summary | 5 |

| Risk Factors | 8 |

| Use of Proceeds | 31 |

| Market for Common Equity and Related Shareholder Matters | 32 |

| Management’s Discussion and Analysis or Plan of Operation | 32 |

| Business | 49 |

| Management | 67 |

| Director and Executive Compensation | 68 |

| Certain Relationships and Related Transactions | 69 |

| Security Ownership of Certain Beneficial Owners and Management | 70 |

| Selling Security Holders | 71 |

| Description of Securities | 105 |

| Plan of Distribution | 108 |

| Legal Matters | 109 |

| Experts | 109 |

| Changes In and Disagreements With Accountants on Accounting and Financial Disclosure | |

| Where You Can Find Additional Information | |

| Financial Statements | F-1 |

OT, OT logo, OuTi, and OuTi logo are trademarks or logos of Harbin OT Pharmaceutical Co., Ltd., our indirect subsidiary in China ("OT Pharmaceutical"). All other brand names or trademarks appearing in this prospectus are the property of their respective holders.

You should rely only on the information contained in this prospectus in deciding whether to purchase the securities. We have not authorized anyone to provide information different from that contained in this prospectus. The information contained in the prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of securities. Our business, financial condition, results of operations, and prospects may have changed since that date.

The information contained in this prospectus is not complete and is subject to change. The selling shareholders are not permitted to sell securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, nor is it a solicitation of an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS SUMMARY

This summary highlights selected information about Asia Biotechnology Group Inc. (“Asia Biotech” or the “Company”) and the offering that is contained elsewhere in this prospectus. You should read the entire prospectus before making an investment decision, especially the information presented under the heading "Risk Factors" on page 8 and the financial statements and related notes included elsewhere in this prospectus, as well as any other documents to which we refer you. Except as otherwise indicated by context, references in this prospectus to "we," "us," "our" or the "Company" are to the combined business of Asia Biotech, its wholly owned direct subsidiaries, Asia Biotechnology Group Inc. a BVI company ("ABG"), Harbin OT Pharmaceutical Co., Limited, a Samoa company ("OT Samoa"), and its indirect subsidiary in China, OT Pharmaceutical, and in each case do not include the selling shareholders. References to "China" or to the "PRC" are references to the People's Republic of China. This prospectus contains forward-looking statements and information about us. See "Forward-Looking Statements" on page 31.

OUR COMPANY

OVERVIEW

ASIA BIOTECHNOLOGY GROUP INC. (ASIA BIOTECH)

Asia Biotech was formerly named as Echelon Acquisition Corp., which was originally incorporated on July 27, 2004 under the laws of the State of Delaware and fell within the definition of a "blank check" corporation contained in Section (7) (b) (3) of the Securities Act of 1933, as amended. Since our inception we have intended to serve as a vehicle to effect an asset acquisition, merger, and the exchange of capital stock or other business combination with a domestic or foreign business. Prior to the acquisition with ABG and OT Samoa, we had no operations and only minimal liabilities.

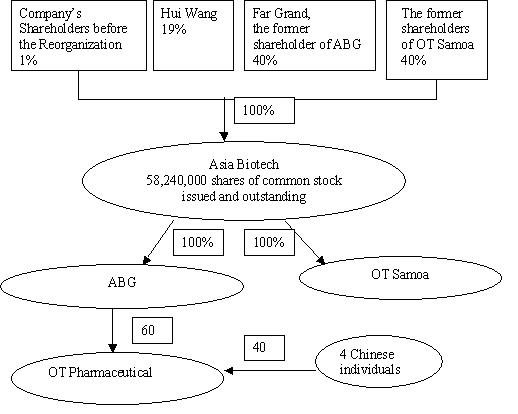

On May 8, 2006, we entered into a triangular Agreement and Plan of Reorganization with the shareholders of ABG and OT Samoa. Pursuant to this agreement, we simultaneously acquired the one single issued and outstanding share of ABG from its sole shareholder in exchange for 23,296,000 shares of our common stock, and all of 20,000,000 issued and outstanding shares of OT Samoa from their shareholders in exchange for other 23,296,000 shares of our common stock. Immediately after the merger, the former shareholder of ABG and former shareholders of OT Samoa respectively own 40 percent of the shares of our common stock (the “Reorganization”). After the Reorganization, all of our business is conducted in China, and all of our management as well as our employees are located in China.

On July 19, 2006, we changed our name from Echelon Acquisition Corp. to Asia Biotechnology Group Inc. to reflect the change of our business scope.

There is currently no public market for our common stock. We intend to have our common stock quoted on the Over-The-Counter Bulletin Board.

Our principal executive office is located at No. 7 BohaiSanLu, Pingfang Industrial District, Economic & Technological Development Area, Harbin, Heilongjiang Province, China.

ASIA BIOTECHNOLOGY GROUP INC., BVI Company (ABG)

ABG is one of the Company’s wholly owned subsidiaries, which was incorporated on March 21, 2005 under the laws of the British Virgin Islands. Prior to the Reorganization, Far Grand Investment Limited, a company organized under the laws of Cayman Islands (“Far Grand”), was the sole shareholder of ABG. Mr. Wensheng Wang, a Chinese citizen, is the sole control person of Far Grand.

On November 3, 2005, ABG acquired 60% of the equity interests in OT Pharmaceutical under the relevant Chinese authorities’ approval.

HARBIN PHARMACEUTICAL CO., LTD., Chinese Company

(OT PHARMACEUTICAL)

On November 3, 2005, OT Pharmaceutical became ABG’s subsidiary. After the Reorganization, OT Pharmaceutical became Asia Biotech’s indirect subsidiary and the only operating entity of the Company.

ABG holds 60% of the equity interests in OT Pharmaceutical, the remaining 40% are held by four Chinese individuals.

OT Pharmaceutical's primary business is designing, manufacturing and marketing gynecological products and is mainly focused on the manufacturing and marketing of feminine suppositories.

HARBIN PHARMACEUTICAL CO., LTD., Samoa Company (OT SAMOA)

OT Samoa is the Company’s other wholly owned subsidiary which was incorporated on April 13, 2005 under the laws of Samoa. The shareholders of OT Samoa before the Reorganization were 1399 Chinese residents.

OT Samoa did not engage in any business other than sub-licensing a kind of gynecological treatment related proprietary technology and cooperating with ABG on the manufacturing of the technology related products.

The chart below illustrates our current corporate structure:

THE OFFERING

| Common stock outstanding prior to the offering | 58,240,000 shares |

| | |

| Common stock to be offered by the selling shareholders | 23,444,000 shares |

| | |

| Common stock to be outstanding after the offering | 58,240,000 shares |

| | |

| Use of Proceeds | We will receive no proceeds from the sale of shares of common stock in this offering. |

RISK FACTORS

This offering involves a high degree of risk. You should carefully consider the risks described below before making a decision to buy our common stock. If any of the following risks actually occurs, our business could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should also refer to the other information in this prospectus, including our financial statements and the related notes. Except for historical information, the information in this prospectus contains "Forward-looking" statements about our expected future business and performance. Our actual operating results and financial performance may prove to be very different from what we have predicted as of the date of this prospectus. The risks described below address all material risks to us and our investors, as currently known to us. Notwithstanding the above, Section 27A of the Securities Act and Section 21E of the Securities Exchange Act expressly state that the safe harbor for forward looking statements does not apply to companies that issue securities that meet the definition of a penny stock, as such, the safe harbor for forward looking statements does not apply to us.

The following risk factors are mainly referring to the business of OT Pharmaceutical.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

WE HAVE A LIMITED OPERATING HISTORY WHICH MAKES EVALUATING OUR BUSINESS DIFFICULT

Our limited operating history may be insufficient for investors to evaluate our business and future prospects. Our indirect subsidiary, OT Pharmaceutical, was established and commenced business in 2001. Even though OT Pharmaceutical has commercialized nine medicines and one sanitary product since inception, it has historically lost money in the last two years and we cannot assure that it will not incur losses in the future. The other subsidiary, OT Samoa, cooperated with ABG on the manufacturing of certain products in the early fiscal year of 2006, but has not yet generated any revenues.

Our ability to generate revenue depends heavily on the successful commercialization and the market acceptance of our products. Nevertheless, we may not be able to validate and market products unless we successfully develop and commercialize our medicines and sanitary products and achieve success. Capital expenditures, marketing efforts and capital investment are significantly required in order to achieve such goals. If we do not successfully develop and commercialize our products, we will be unable to generate any revenue, or the revenue generated may not cover the expenditures. If we fail to generate sufficient revenue, we may be unable to continue our operations, our stock price would likely be lower, and investors may lose their entire investment.

WE EXPERIENCED HISTORICAL FINANCIAL LOSSES DURING THE PAST TWO YEARS

The net loss of OT Pharmaceutical was $545,093 by the end of June 30, 2006. We are unable to predict the extent of any future expenditure and the potential profitability. As all of our total revenues are from the sales of medicines and sanitary products, our ultimate success will depend on whether we are able to successfully market approved products. The historical financial losses and financial condition of the OT Pharmaceutical could make it difficult for us to obtain financing in the future or could reduce the value the market places on our common stock. Moreover, if we are unable to make a profit, the market value of our common stock will likely decline.

WE NEED TO RAISE ADDITIONAL CAPITAL TO FUND OUR OPERATIONS AND WE MAY BE UNABLE TO RAISE SUCH FUNDS

As an early-stage company, we need to raise additional capital for our future operations, especially for the development of new products or product lines, financing of general and administrative expenses, licensing or acquisition of additional technologies, and marketing of new or existing products. It has been estimated that OT Pharmaceutical may need to raise approximately US$100,000 in the research and development of its current 6 product candidates and approximately US$330,000 for the introduction of more production lines. Compared to the capital we need, our cash and cash equivalents at the end of June 30, 2006 was $37,923, which was not enough to meet OT Pharmaceutical’s operational needs and capital requirements. We need to raise additional capital through private placements and/or bank loans from a local bank by mortgaging or pledging OT Pharmaceutical’s assets.

There are no assurances that we will be able to raise the appropriate amount of capital needed for our future operations. In addition, we cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all. Even though our assets were US$1,690,266 as of June 30, 2006, there are no assurances that any Chinese bank will accept our assets as collateral and loan us the necessary funding. Failure to obtain funding when needed may force us to delay, reduce, or eliminate our product development and manufacture programs. The incurrence of indebtedness would also result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations or our ability to pay dividends to our shareholders.

WE RELY ON SUPPLIERS WHO ARE OUTSIDE OUR CONTROL AND ANY DISRUPTION WITH OUR SUPPLIERS COULD DELAY PRODUCT SHIPMENTS AND ADVERSELY AFFECT OUR BUSINESS OPERATIONS AND REVENUES

We rely upon certain suppliers who are outside our control. By the end of 2005, we had developed limited relationships with 21 suppliers for raw materials and 21 suppliers for drug packaging materials, including Shantou Sunda Plastic Factory, Nanning Shangren Plastic bags Co., Ltd., Harbin Gaomei Printing House Ltd., Gongxin Enterprise Ltd., and Jiangsu Qionghua Hi-tech Stock Co., Ltd. We cannot control the timing or resources that they devote to our products. Although we believe that alternative suppliers are available to supply materials, should any of these current suppliers fail to devote sufficient resources and time to our drug manufacture or increase their prices of materials supplied, it could delay product shipments and adversely affect our business operations and profitability. In addition, if the prices of raw materials needed for our products increase, and we cannot pass this price increase on to our end customers, our profit margins and operating results will suffer and we may be unable to produce certain products.

THE FAILURE TO MANAGE GROWTH EFFECTIVELY COULD HAVE AN ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION, AND RESULTS OF OUR OPERATIONS

Our management’s ability to successfully manage the business will be essential to achieving profitability. We may encounter difficulties associated with increasing production scale, including shortages of qualified personnel to operate our equipment, assemble our products or manage manufacturing operations, as well as shortages of key raw materials or components for our products. For effective growth management, we will be required to continue improving our operations, management, and financial systems and control. Our failure to manage growth effectively may lead to operational and financial inefficiencies that will have a negative effect on the Company's profitability.

WE ARE DEPENDENT ON CERTAIN KEY PERSONNEL AND LOSS OF THESE KEY PERSONNEL COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR RESEARCH AND DEVELOPMENT, OPERATIONS AND REVENUES

Our success is, to a certain extent, attributable to the management, sales and marketing, and pharmaceutical factory operational expertise of key personnel. We are highly dependent on our senior management to manage our business and operations and upon our key research and development personnel for the development of new technologies and applications and the enhancement of our existing products. In particular, we are currently highly dependent upon the ability and experience of Mr. Xueliang Qiu, our CEO, President, Secretary and Chairman of the Board of Directors. Mr. Xueliang Qiu entered into an employment contract with OT Pharmaceutical for a term of three years from January 15, 2006 to January 14, 2008. Other senior management personnel of OT Pharmaceutical include senior management personnel include Ms. Meng Yan, Mr. Changfu Gong and Ms. Jieying Lu, who jointly perform key functions in the operation of OT Pharmaceutical. We also rely on our key research personnel such as Haitao Liu, Yuqiao Yang, Zhiming Chen. OT Pharmaceutical has entered into employment agreements with all of these individuals. Ms. Meng Yan will act as OT Pharmaceutical’s Assistant General Manager from January 1, 2006 to December 31, 2008. Mr. Changfu Gong will act as the Assistant General Manager for a term from January 1, 2006 to December 31, 2008. Ms. Jieying Lu will act as the chief engineer from January 1, 2006 to December 31, 2008. Haitao Liu is in charge of the production techniques, Yuqiao Yang is in charge of the toxin tests of candidate products, and Zhiming Chen is mainly in charge of the quality of raw materials.

We compete for qualified personnel with other pharmaceutical companies and research institutions. Intense competition for these personnel could cause our compensation costs to increase significantly, which could have a material adverse effect on our operations results. Our future success and ability to grow our business will depend in part on the continued service of these individuals and our ability to identify, hire and retain additional qualified personnel. If we are unable to attract and retain qualified employees, we may be unable to meet our business and financial goals. There can be no assurance that we will be able to retain these officers and key personnel after the term of their employment contracts expire. The loss of any one of these officers could have a material adverse effect upon our business, financial condition, and results of operations. We must attract, recruit and retain a sizeable workforce of technically competent employees. Our ability to effectively implement our business strategy will depend upon, among other factors, the successful recruitment and retention of additional highly skilled and experienced management and other key personnel. We cannot assure that we will be able to hire or retain such employees.

WE FACE COMPETITION IN THE PHARMACEUTICAL INDUSTRY AND SUCH COMPETITION COULD CAUSE OUR SALES REVENUE TO DECLINE

According to the State Food and Drug Administration of China, or the SFDA, there were approximately 5,071 pharmaceutical manufacturing companies in the PRC as of 30 June 2004, of which approximately 3,237 manufacturers obtained a GMP, or a Good Manufacturing Practice certificate. After GMP certification became a mandatory requirement on July 1, 2004, approximately 1,834 pharmaceutical manufacturers were forced to cease production (Source: Jilin Food and Drug Administration http://www.jlda.gov.cn/hyzx/showhyzx.x?id=789). Only the 3,237 pharmaceutical manufacturers with a GMP certificate were allowed to continue their manufacturing operations. The certificates, permits, and licenses required for pharmaceutical operation in the PRC create a potential barrier for new competitors seeking entrance into the market. Despite these obstacles, we face competitors who will attempt to create, or who are already marketing, products in the PRC that are similar to ours. The market of gynecological disease remedies is a segment with intense competition, where newly developed gynecological drugs for exterior use seem to emerge endlessly. Our subsidiary in China faces direct competition both domestically and internationally across all product lines and price points. The competitors are numerous and include major pharmaceutical companies such as Xian-Janssen Pharmaceutical Ltd., a foreign invested company, whose key gynecological product is Miconazole Nitrate Suppository, and Chengdu Enwei Group, a domestic company, whose major products include Skinpro Lotion.

Although OT Pharmaceutical focuses solely on R&D and manufacture of feminine suppositories, and one of its products, Shenqi Wenyang Suppository, has been labeled as a protected Chinese medicine by the PRC government, there is no assurance that OT Pharmaceutical’s products can successfully compete with other external gynecological products in China. Our competitors may succeed in developing technologies and products that are more advanced than the products we are developing. Many of our competitors have greater financial and other resources; larger varieties of products; more products that have received regulatory approvals; and greater pricing flexibility than we have. OT Pharmaceutical is also competing against their greater manufacturing efficiency and marketing capabilities, areas in which it has limited experience. For example, Skinpro Lotion produced by Chengdu Enwei Group took 17.65% market shares in Beijing, the capital of China, in 2001. Besides, compared to Chengdu Enwei’s more than 400 sales representatives and over 30 offices and agencies around China, OT Pharmaceutical only has 5 sales representatives and 21 sales distributors. Moreover, there can be no assurance that our products will be able to compete in price with those of our competitors. Consequently, we may be unable to offer products similar to, or more desirable than, those offered by our competitors, market our products as effectively as our competitors, or otherwise respond successfully to competitive pressures. As a result, as competition intensifies in the area of gynecological external remedies in China, we may lose customers and our sales may decline. There can be no assurance that our products will be either more effective in their therapeutic abilities and/or be able to compete in price with those of our competitors. Failure to do either of these may result in decreased revenues for our Company.

OUR DEVELOPMENT OF BUSINESS IS IN PART DEPENDENT ON CONTINUALLY DEVELOPING NEW AND ADVANCED PRODUCTS, TECHNOLOGIES, AND PROCESSES; FAILURE TO DO SO MAY CAUSE US TO LOSE OUR COMPETITIVENESS IN THE PHARMACEUTICAL INDUSTRY AND MAY CAUSE OUR REVENUES TO DECLINE

Through our subsidiaries, we have traditionally been committed to developing and manufacturing gynecological diseases treatments. To remain competitive in the pharmaceutical industry, it is important to continually develop new and advanced products, technologies, and processes. Currently, there are 6 product candidates in the development stage, and 3 pending patents under application. There is no assurance that the competitors' new products, technologies, and processes will not render our existing products obsolete or non-competitive. Our competitiveness in the pharmaceutical market therefore relies upon our ability to enhance our current products, introduce new products, and develop and implement new technologies and processes. Although OT Pharmaceutical owns 3 patents, and 3 pending patents in connection with gynecology disease treatments, our failure to technologically evolve and/or develop new or enhanced products may cause us to lose our competitiveness in the pharmaceutical industry and may cause our profits to decline.

THE SALE OF OUR PRODUCTS DEPENDS UPON THE DEGREE OF MARKET ACCEPTANCE AMONG THE MEDICAL COMMUNITY AND CUSTOMERS, AND FAILURE TO ATTAIN MARKET ACCEPTANCE AMONG THE MEDICAL COMMUNITY MAY HAVE AN ADVERSE IMPACT ON OUR OPERATIONS

The sale of our products depends upon the degree of market acceptance among the medical community and end customers. Out of our 9 medicines, these 3 medicines need a prescription from a physician, including Kushenjian Suppository, Shenqi Wenyang Suppository and Fu Ning Suppository. Even if our products are approved by the SFDA, there is no assurance that physicians will recommend our products to patients, or that patients will accept and use them. Furthermore, a product's prevalence and use at hospitals may be contingent upon our relationship with the medical community. The acceptance of our products among the medical community may depend upon several factors, including but not limited to, the product’s acceptance by physicians and patients as a safe and effective treatment, cost effectiveness, potential advantages over alternative treatments, and the prevalence and severity of side effects. Failure to attain market acceptance among the medical community may have an adverse impact on our operations.

WE ENJOY CERTAIN PREFERENTIAL TAX CONCESSIONS AND THE LOSS OF THESE PREFERENTIAL TAX CONCESSIONS WILL CAUSE OUR TAX LIABILITIES TO INCREASE

The income tax rate for domestic companies in the PRC is universally 33%. However, to attract more local enterprises to engage in high technology research and development in China, the PRC government has provided various incentives, such as reducing tax rates, to companies. Since OT Pharmaceutical owns certain technologies, patents and pending patents on the R&D and manufacturing of gynecological remedies, it was recognized as a high technology company by the local government in 2001, and accordingly enjoys preferential tax treatment, in the form of reduced tax rates and tax holidays. OT Pharmaceutical is now entitled to a 15% preferential corporate income tax rate compared to a rate of 33% applicable to most domestic companies, and it enjoyed the preferential policy of “two years of exemption” of corporate income tax from its inception. Moreover, OT Pharmaceutical is entitled to enjoy a 7-year cash refund equals to the building tax and land-use tax it has paid commencing from 2001, at the time the company was incorporated, to 2008.

These tax incentives have been granted by the municipal government of Heilongjiang Province and are subject to annual review by the municipal government. Continuing eligibility for the financial incentives OT Pharmaceutical receives requires that it continues to meet a number of criteria, such as its hi-tech company status, which is subject to the discretion of the municipal government. Moreover, either the central government or the municipal government of Heilongjiang could determine at any time to immediately eliminate or reduce these financial incentives, generally with prospective effect. As a result, in addition to any business or operations related factors we may otherwise experience, OT Pharmaceutical's profits, if they are generated, may decline because OT Pharmaceutical’s tax liabilities may increase if the preferential tax treatments are no longer applicable or available in the future.

WE ARE SUBJECT TO THE PRC'S PRICE CONTROL OF DRUGS WHICH MAY LIMIT OUR PROFITABILITY AND EVEN CAUSE US TO STOP MANUFACTURING CERTAIN PRODUCTS

The State Development and Reform Commission ("SDRC") of the PRC, and the price administration bureaus of the relevant provinces of the PRC in which the pharmaceutical products are manufactured, are responsible for the retail price control over our pharmaceutical products. The SDRC sets the price ceilings for certain pharmaceutical products in the PRC. The maximum prices of such pharmaceutical products are published by the state and provincial DRC from time to time. The upper limit of the prices of medicines subject to price control are set by the pricing authorities to create a reasonable profit margin for pharmaceutical enterprises, after taking into account the type and quality of the products, the production costs, the prices of substitute products, and other related factors. The prices of other medicines that are not subject to price control are determined by the company. Currently, four specifications of our two products, Econazole Nitrate Suppositories 1*3*0.15g, and 1*6*0.15g, Clotrimazole Suppositories 1*3*0.15g and 1*6*0.15g are subject to price control as of the date of this Prospectus. The price ceilings are above our production costs and we have not stopped manufacturing any products in the past due to price control. However, to the extent that we are subject to price control, our revenue, gross profit, gross margin and net income will be affected since the revenue we derive from our sales will be limited and we may face no limitation on our costs. Although our other products have not been subject to such price control as of the date of this Prospectus, there is no assurance that those products will remain unaffected by it. Further, if price controls affect both our revenue and our costs, our ability to be profitable and the extent of our profitability will be effectively subject to the determination of the applicable regulatory authorities in the PRC.

OUR CERTIFICATES, PERMITS, AND LICENSES ARE SUBJECT TO GOVERNMENTAL CONTROL AND RENEWAL; FAILURE TO OBTAIN RENEWAL WILL CAUSE ALL OR PART OF OUR OPERATIONS TO BE TERMINATED

OT Pharmaceutical is subject to various PRC laws and regulations pertaining to the pharmaceutical industry. OT Pharmaceutical has attained certificates, permits, and licenses required for the operation of a pharmaceutical enterprise and the manufacturing of pharmaceutical products in the PRC.

We obtained the Medicine Production Permit in January 2001, and it will be valid until December 31, 2010. If it does not renew the permit after 2010, OT Pharmaceutical will not be able to operate medicine production, which will cause its operations to be terminated. OT Pharmaceutical has obtained a GMP certificate which is effective through February 13, 2008. The pharmaceutical production permit and GMP certificate are valid for a term of five years and must be renewed before their expiration. During the renewal process, OT Pharmaceutical will be re-evaluated by the appropriate governmental authorities and must comply with the then prevailing standards and regulations which may change from time to time. In the event that OT Pharmaceutical is not able to renew the certificates, permits and licenses, all or part of our operations may be terminated. Furthermore, if escalating compliance costs associated with governmental standards and regulations restrict or prohibit any part of our operations, it may adversely affect our operation and profitability.

IF OUR PRODUCTS FAIL TO RECEIVE REGULATORY APPROVAL, WE MAY BE UNABLE TO RECOUP RESEARCH AND DEVELOPMENT EXPENDITURES

In China, a company wishing to enter the pharmaceutical industry must comply with the standards and regulations set forth by the government. In the PRC, the State Food and Drug Administration, or the SFDA is the authority that monitors and supervises the administration of the pharmaceutical industry including pharmaceutical products and medical appliances. Pharmaceutical manufacturing enterprises must obtain a Pharmaceutical Manufacturing Enterprise Permit issued by the relevant pharmaceutical administrative authorities and relevant health departments at the provincial level where the enterprise is located. Furthermore, all pharmaceutical products produced in the PRC, with the exception of Chinese herbal medicines in soluble form, must bear a registered number approved by the appropriate medicine administration authorities in the PRC. Lastly, in accordance with the World Health Organization, the PRC now requires compliance with GMP standards in pharmaceutical production in order to minimize the risks involved in any pharmaceutical production that cannot be eliminated through testing final products. As the regulatory approval process becomes more stringent, it also increases the industry's capital entry barrier.

The regulatory approval procedure for pharmaceuticals can be quite lengthy, costly, and uncertain. Depending upon the discretion of the SFDA, the approval process may be significantly delayed by additional clinical testing and require the expenditure of resources not currently available; in such an event, it may be necessary for us to abandon our application. Even where approval of the product is granted, it may contain significant limitations in the form of narrow indications, warnings, precautions, or contra-indications with respect to conditions of use.

Currently, OT Pharmaceutical has obtained SFDA approvals for 9 kinds of existing medicine products and has obtained the local health supervision authority’s approval for one sanitary product. The 6 candidate products under the R&D are sanitary products and are therefore not subject to the strict regulatory procedure on medicines. However, if OT Pharmaceutical intends to produce new medicines, it must comply with the relevant regulations, and if approval of our product is denied, abandoned, or severely limited in terms of the scope of product use, it may result in the inability to recoup research and development expenditures.

ALL ACTIVE INGREDIENTS OF OUR PRODUCTS ARE GENERIC DRUGS. OTHER COMPANIES MAY MAKE PRODUCTS SIMILAR TO OURS

Currently, OT Pharmaceutical does not need any licenses to produce the existing products. All active ingredients of OT Pharmaceutical’s products are generic drugs compliant with the Chinese Pharmacopoeia and Chinese Drug Standards. All patented ingredients should be subject to patent protection in China, but all active ingredients in OT Pharmaceutical’s products are not patented. However, we are exposed to risks that such generic drugs may be used by other companies for producing products similar to ours. They may capture market share by selling the similar products at low prices, which can reduce the market share held by our company. Although we believe that the complexity of our technologies may decrease the risks, there are no assurances that other companies may not make similar products.

OUR RESEARCH AND DEVELOPMENT MAY NEITHER BE SUCCESSFUL NOR COMPLETED WITHIN THE ANTICIPATED TIMEFRAME, IF EVER

There are six candidate products that are currently under research and development. The research and development of our new and existing products and their subsequent commercialization to some extent plays an important role in our success. The research and development of new products is costly and time consuming, and there are no assurances that our research and development of new products will either be successful or completed within the anticipated timeframe, if ever at all. There are also no assurances that if the product is developed, it will lead to successful commercialization. Currently, all the Company’s research and development is conducted by our key research personnel within OT Pharmaceutical. The Company needs to raise approximately US$ 100,000 for the development of our current 6 product candidates and approximately US$ 330,000 for the introduction of more production lines. Such funding will be derived from the income of OT Pharmaceutical. If the Company can not generate enough revenues in 2006, the funding contributed will have to be decreased. As a result, our research and development will be terminated.

The 6 product candidates are defined as disposable sanitary products under the related PRC regulations and, therefore, are not subject to the strict pharmaceutical related regulations. On May 27, 2004, The Company was granted permission to produce disposable sanitary products by the Ministry of Health of the PRC. The term of the permission is from May 27, 2004 to May 26, 2008.

WE CANNOT GUARANTEE THE PROTECTION OF OUR INTELLECTUAL PROPERTY RIGHTS AND IF INFRINGEMENT OR COUNTERFEITING OF OUR INTELLECTUAL PROPERTY RIGHTS OCCURS, OUR REPUTATION AND BUSINESS MAY BE ADVERSELY AFFECTED

Our success depends on our ability to protect our patents and trademarks. According to the PRC Patent Law, the protection period of patent right for inventions is twenty years, and the protection period of patent rights for utility models is ten years. No time extension is allowed. According to the PRC Trademark Law, a registered trademark is valid for a period of 10 years after approved, and it can be extended for another 10 years upon the application. Currently, OT Pharmaceutical owns 1 utility patent which was granted in 2004, 2 invention patents which were granted in 2006, and has 3 pending invention patents in China. To protect the reputation of our products, OT Pharmaceutical has registered and applied for registration of 21 trademarks or logos in the PRC. All of our products are sold under these trademarks. Please refer to the paragraph headed "Intellectual property rights" in the Business section of this Prospectus on page 35.

Although we believe our existing patents and pending patents (subject to approval of our applications) will provide a competitive advantage, the patent positions of pharmaceutical companies are highly uncertain and involve complex legal and factual questions. We may not be able to develop patentable products or processes, and may not be able to obtain patents from pending applications. Even if patent claims are allowed, the claims may not issue, or in the event of issuance, may not be sufficient to protect our technology. In addition, any patents or patent rights we obtain may be circumvented, challenged or invalidated by our competitors.

Regarding our trademarks, as of the date of this Prospectus, we have not experienced any infringements of such trademarks for sales of pharmaceutical products. However, there is no assurance that there will not be any infringement of our brand name or other registered trademarks or counterfeiting of our products in the future. Should any such infringement or counterfeiting occur, our reputation and business may be adversely affected. We may also incur significant expenses, and expend substantial amounts of time and effort to enforce our intellectual property rights in the future. Such a diversion of our resources may adversely affect our existing business and future expansion plans.

We may need to resort to litigation to enforce or defend our patents or trademarks in China. The experience and capabilities of PRC courts in handling intellectual property litigation varies and outcomes are unpredictable. Further, such litigation may require significant expenditures of cash and management efforts and could harm our business, financial condition and results of operations. An adverse determination in any such litigation will impair our intellectual property rights and may harm our business and reputation.

Due to the different legal systems and varying requirements in different countries, we have not applied for any patents outside China. The process of seeking patent protection can be lengthy and expensive, and we cannot assure you that our patent applications will be successful, or that our existing patent rights will provide us with sufficient protection or commercial advantage. We cannot assure you that our current or potential competitors do not have, and will not develop, products that will compete directly with our products despite our intellectual property rights.

WE MAY SUFFER AS A RESULT OF PRODUCT LIABILITY OR DEFECTIVE PRODUCTS

We may produce medicines which inadvertently have an adverse pharmaceutical effect on the health of individuals, despite proper testing. As existing PRC laws and regulations do not require us to maintain third party liability insurance to cover product liability claims and as the insurance industry in China is still in an early stage of development, business insurance is not readily available in the PRC. OT Pharmaceutical currently does not maintain any liability insurance. If a product liability claim is brought against us, it may, regardless of merit or eventual outcome, result in damage to our reputation, breach of contract with our customers, decreased demand for our products, costly litigation, or product recalls. In addition, since OT Pharmaceutical has to use its revenues to both defend any action and pay any claims that result from a settlement or judgment, it would incur significant expenses. If the nature or amount of any uninsured loss is significant, OT Pharmaceutical may be unable to continue in business. We currently are not aware of any existing or anticipated product liability claims with respect to our products.

BECAUSE A SIGNIFICANT ACCOUNT RECEIVABLE HAS BEEN GENERATED, THE FAILURE OF ITS COLLECTION COULD IMPAIR OUR FINANCIAL CONDITION

Our accounts receivable represents a large percentage of our assets. Our account receivable as of June 30, 2006 was US$424,092, representing approximately 25% of our total assets. This concentration of accounts receivable represents a significant credit risk. The failure of any of the distributors/customers to pay their obligations to us in a timely manner could have a material adverse effect upon our financial condition.

SUCCESSFUL COOPERATION BETWEEN OT SAMOA AND ABG IS UNCERTAIN. THERE CAN BE NO ASSURANCE THAT PRODUCTS WILL BE COMMERCIALIZED

As of January 22, 2006, OT Samoa executed a cooperation agreement with ABG on the manufacturing of certain pharmaceutical product. Products that appear promising in the early phases of development may fail to be commercialized. Moreover, our products may prove to be not accepted in the Chinese market. As a result, there can be no assurance that our products will be successfully commercialized.

RISKS RELATED TO DOING BUSINESS IN CHINA

Our revenues are derived from the operation in China. Accordingly, our business, financial condition, results of operation and prospects are affected significantly by economic, political and legal developments in China.

CHANGES IN CHINA’S ECONOMIC, POLITICAL AND SOCIAL CONDITION COULD ADVERSELY AFFECT OUR FINANCIAL CONDITION AND RESULTS OF OPERATION

We derive all of our revenues from our operations in China. Accordingly, our business, financial condition, results of operations and prospects are affected to a significant degree by economic, political and social conditions in China. The PRC economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall PRC economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by changes in tax regulations applicable to us. The PRC government has implemented certain measures, including a recent interest rate increase, to control the pace of economic growth. These measures may cause decreased economic activity in China, including a slowing or decline in individual hospital spending, which in turn could adversely affect our financial condition and results of operations.

THE PRC LEGAL SYSTEM EMBODIES UNCERTAINTIES THAT COULD LIMIT THE LEGAL PROTECTIONS AVAILABLE TO YOU AND US

The PRC legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which decided legal cases have limited precedential value. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation over the past three decades has significantly increased the protections afforded to various forms of foreign investment in China. However, these laws, regulations, and legal requirements are relatively recent and are evolving rapidly, and their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors.

The practical effect of the PRC's legal system on our business operations in China can be viewed from two separate but intertwined considerations:

First, as a matter of the substantive law, the PRC laws regarding the Sino-foreign Equity Joint Ventures provide significant protection from government interference. In addition, these laws guarantee the full benefit of corporate articles and contracts to Sino-foreign Equity Joint Venture participants. These laws, however, do impose standards concerning corporate formation and governance, which are not qualitatively different from the corporation laws found in the United States. Similarly, PRC accounting laws mandate accounting practices which may not be consistent with the US Generally Accepted Accounting Principles. China accounting laws require that an annual "statutory audit" be performed in accordance with PRC accounting standards and that the books of account of Sino-foreign Equity Joint Venture be maintained in accordance with Chinese accounting laws. Article 78 of the Regulations for the Implementation of the Law of the People’s Republic of China on Chinese-foreign Equity Joint Ventures requires a Sino-foreign Equity Joint Venture to submit certain periodic fiscal reports and statements to designated financial and tax authorities.

Second, while the enforcement of substantive rights may appear less clear than United States procedures, Sino-foreign Equity Joint Ventures are Chinese registered companies that enjoy the same status as other Chinese registered companies in business-to-business dispute resolutions. The Chinese legal infrastructure is significantly different in operation from its United States counterpart, and may present a significant impediment to the operation of Sino-foreign Equity Joint Ventures.

Our PRC operating subsidiary, OT Pharmaceutical, is an equities joint venture enterprise and is subject to laws and regulations applicable to foreign investment in China, as well as laws and regulations applicable to foreign-invested enterprises. These laws and regulations change frequently, and their interpretation and enforcement involve uncertainties. For example, we may have to resort to administrative and court proceedings to enforce the legal protections that we enjoy either by law or contract. However, since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy, than in more developed legal systems. These uncertainties may also impede our ability to enforce the contracts we have entered into. As a result, these uncertainties could materially and adversely affect our business and operations.

AS OUR MAIN OPERATION AND MANAGEMENT ARE OUTSIDE THE UNITED STATES, IT WILL BE DIFFICULT TO ACQUIRE JURISDICTION AND ENFORCE LIABILITIES AGAINST US AND OUR OFFICERS, DIRECTORS AND ASSETS BASED IN CHINA.

Our operating entity, OT Pharmaceutical is governed by PRC laws; all directors and officers reside outside of the United States, and our assets are and will continue to be located outside the United States. As a result, it may be difficult or impossible to effect service of process within the United States upon our directors or officers and our subsidiaries, or enforce against any of them court judgments obtained in United States’ courts, including judgments relating to United States federal securities laws. In addition, there is uncertainty as to whether the courts of the PRC and of other offshore jurisdictions would recognize or enforce judgments of United States’ courts obtained against us predicated upon the civil liability provisions of the securities laws of the United States or any state thereof, or be competent to hear original actions brought in the PRC or other offshore jurisdictions predicated upon the securities laws of the United States or any state thereof. Furthermore, because all of our assets are located in China, it would also be extremely difficult to access those assets to satisfy an award entered against us in a United States court.

As a result of all of the above, public shareholders may have more difficulty in protecting their interests in the face of actions taken by management, members of the board of directors or controlling shareholders than they would as public shareholders of a U.S. company.

RECENT PRC REGULATIONS RELATING TO ACQUISITIONS OF PRC COMPANIES BY FOREIGN ENTITIES MAY LIMIT OUR ABILITY TO ACQUIRE PRC COMPANIES AND ADVERSELY AFFECT THE IMPLEMENTATION OF OUR STRATEGY AS WELL AS OUR BUSINESS AND PROSPECTS

The PRC State Administration of Foreign Exchange, or SAFE, issued a public notice in January 2005 concerning foreign exchange regulations on mergers and acquisitions in China ("January Notice"). The public notice states that if an offshore company controlled by PRC residents intends to acquire a PRC company, such acquisition will be subject to strict examination by the relevant foreign exchange authorities. The public notice also states that the approval of the relevant foreign exchange authorities is required for any sale or transfer of a PRC company's assets or equity interests by the PRC residents to foreign entities, such as us, for the equity interests or assets of the foreign entities.

In April 2005, SAFE issued another public notice (the “April Notice”) further explaining the January notice. In accordance with the April notice, if an acquisition of a PRC company by an offshore company controlled by PRC residents has been confirmed by a Foreign Investment Enterprise Certificate prior to the promulgation of the January notice, the PRC residents must each submit a registration form to the local SAFE branch with respect to their respective ownership interests in the offshore company, and must also file an amendment to such registration if the offshore company experiences material events, such as changes in the share capital, share transfer, mergers and acquisitions, spin-off transactions or use of assets in China to guarantee offshore obligations. The April notice also provides that failure to comply with the registration procedures set forth therein may result in a restriction on the PRC company's ability to distribute profits to its offshore parent company. Pending the promulgation of detailed implementation rules, the relevant government authorities are reluctant to commence processing any registration or application for approval required under the SAFE notices.

In October 2005, SAFE promulgated another notice (“Decree No. 75) which vacates the above January Notice and April Notice. Decree No. 75 requires PRC residents and PRC corporate entities to register with and obtain approvals from relevant PRC government authorities in connection with their direct or indirect offshore investment activities. These regulations apply to our shareholders who are PRC residents in connection with any future offshore acquisitions.

The Decree No. 75 requires registration by March 31, 2006 of direct or indirect investments previously made by PRC residents in offshore companies prior to the implementation of the Decree No. 75 on November 1, 2005. If a PRC shareholder with a direct or indirect stake in an offshore parent company fails to make the required SAFE registration, the PRC subsidiaries of such offshore parent company may be prohibited from making distributions of profit to the offshore parent and from paying the offshore parent proceeds from any reduction in capital, share transfer or liquidation in respect of the PRC subsidiaries. Furthermore, failure to comply with the various SAFE registration requirements described above could result in liability under PRC law for foreign exchange evasion.

As it is uncertain how Decree No. 75 will be interpreted or implemented, we cannot predict how it will affect our business operations or future strategy. For example, we may be subject to a more stringent review and approval process with respect to our foreign exchange activities, such as the remittance of dividends and foreign-currency-denominated borrowings, which may adversely affect our results of operation and financial condition. In addition, if we decide to acquire a PRC company, we cannot assure that the owners of such company, as the case may be, will be able to complete the necessary approval, filings and registrations for the acquisition. This may restrict our ability to implement our acquisition strategy and adversely affect our business and prospects.

On August 8, 2006, six PRC regulatory agencies, including the Chinese Securities Regulatory Commission, or CSRC, promulgated a regulation (the “M&A Regulation”) that became effective on September 8, 2006. This regulation, among other things, has some provisions that purport to require that an offshore special purpose vehicle, or SPV, formed for listing purposes and controlled directly or indirectly by PRC companies or individuals, shall obtain the approval of the CSRC prior to the listing and trading of such SPV’s securities on an overseas stock exchange.

Because the M&A Regulation became effective very recently, it remains uncertain how the M&A Regulation will be interpreted and enforced by Chinese governmental authorities such as the CSRC and the Ministry of Commerce. We cannot predict how the M&A Regulation will affect our business operations or future strategy. If the CSRC requires that we obtain its approval, we may be unable to obtain a waiver of the CSRC approval requirements, if and when procedures are established to obtain such a waiver. Any uncertainties and/or negative publicity regarding this CSRC approval requirement could have a material adverse effect on the trading price of our common stock.

RESTRICTIONS ON CURRENCY EXCHANGE MAY LIMIT OUR ABILITY TO UTILIZE OUR REVENUES EFFECTIVELY

All of our revenues and operating expenses are denominated in Renminbi. The Renminbi is currently convertible under the “current account,” which includes dividends, trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans. Currently, OT Pharmaceutical may purchase foreign exchange for settlement of “current account transactions,” including payment of dividends to us, without the approval of SAFE. However, the relevant PRC governmental authorities may limit or eliminate our ability to purchase foreign currencies in the future. Since all of our future revenues will be denominated in Renminbi, any existing and future restrictions on currency exchange may limit our ability to utilize revenues generated in Renminbi to fund our business activities outside of China that are denominated in foreign currencies. Foreign exchange transactions under the capital account are still subject to limitations and require approvals from, or registration with, SAFE and other relevant PRC governmental authorities. This could affect the ability of OT Pharmaceutical to obtain foreign funding.

FLUCTUATIONS IN EXCHANGE RATE COULD RESULT IN FOREIGN CURRENCY EXCHANGE LOSSES

As all of our cash and cash equivalents are denominated in Renminbi. Fluctuations in exchange rates between US dollars and Renminbi will affect our balance sheet and earnings per share in US dollars. In addition, appreciation or depreciation in the value of the Renminbi relative to the US dollar would affect our financial results reported in US dollar terms without giving effect to any underlying change in our business, financial condition or results of operations. Since July 2005, the Renminbi is no longer pegged solely to the US dollar. Instead, the Renminbi is reported to be pegged against a basket of currencies, determined by the People’s Bank of China, against which it can rise or fall by as much as 0.3% each day. The Renminbi may appreciate or depreciate significantly in value against the US dollar in the long term, depending on the fluctuation of the basket of currencies against which it is currently valued, or it may be permitted to enter into a full float, which may also result in a significant appreciation or depreciation of the Renminbi against the US dollar. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue after this offering which will be exchanged into US dollars, and earnings from and the value of any US dollar-denominated investments we make in the future.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions in an effort to reduce our exposure to foreign currency exchange risk. While we may decide to enter into hedging transactions in the future, the availability and effectiveness of these hedges may be limited and we may not be able to successfully hedge our exposure at all. In addition, our currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert Renminbi into foreign currency.

CHINA HAS DIFFERENT CORPORATE DISCLOSURE, GOVERNANCE AND REGULATORY REQUIREMENTS THAN THOSE IN THE UNITED STATES WHICH MAY MAKE IT MORE DIFFICULT OR COMPLEX TO CONSUMMATE A BUSINESS COMBINATION

Companies in China are subject to accounting, auditing, regulatory and financial standards and requirements that differ, in some cases significantly, from those applicable to public companies in the United States, which may make it more difficult or complex to consummate a business combination. In particular, the assets and profits appearing on the financial statements of a Chinese company may not reflect its financial position or results of operations in the way they would be reflected had such financial statements been prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP). There is substantially less publicly available information about Chinese companies than there is about United States companies. Moreover, companies in China are not subject to the same degree of regulation as are United States companies with respect to such matters as insider trading rules, tender offer regulation, shareholder proxy requirements and the timely disclosure of information.

To meet the requirements of the United States Federal securities laws, which is necessary in order to seek stockholder approval of a business combination, a proposed target business will be required to have certain financial statements which are prepared in accordance with, or which can be converted to GAAP and audited in accordance with U.S. Generally Accepted Auditing Standards (GAAS). GAAP and GAAS compliance may limit the potential number of acquisition targets.

PRC ECONOMIC REFORM POLICIES OR NATIONALIZATION COULD RESULT IN A TOTAL INVESTMENT LOSS IN OUR COMMON STOCK

Since 1979, the Chinese government has reformed its economic policies. Because many reforms are unprecedented or experimental, they are expected to be refined and improved. Other political, economic and social factors, such as political changes, changes in the rates of economic growth, unemployment or inflation, or in the disparities in per capita wealth between regions within China, could lead to further readjustment of the reform measures. This refining and readjustment process may negatively affect our operations.

Although the Chinese government owns the majority of productive assets in China, in the past several years the government has implemented economic reform measures that emphasize decentralization and encourage private economic activity. Because these economic reform measures may be inconsistent or ineffectual, there are no assurances that:

| | · | We will be able to capitalize on economic reforms; |

| | · | The Chinese government will continue its pursuit of economic reform policies; |

| | · | The economic policies, even if pursued, will be successful; |

| | · | Economic policies will not be significantly altered from time to time; and |

| | · | Business operations in China will not become subject to the risk of nationalization. |

Over the last few years, China's economy has registered high growth rates. Recently, there have been indications that rates of inflation have increased. In response, the Chinese government recently has taken measures to curb this excessively expansive economy. These measures have included restrictions on the availability of domestic credit, reducing the purchasing capability of some of its customers. These austere measures alone may not succeed in slowing down the economy's excessive expansion or control inflation, and may result in severe dislocations in the Chinese economy. The Chinese government may adopt additional measures to further combat inflation, including the establishment of freezes or restraints on certain projects or markets. These measures may adversely affect our operations.

There can be no assurance that the reforms to China's economic system will continue or that we will not be adversely affected by changes in China's political, economic, and social conditions and by changes in policies of the Chinese government, such as changes in laws and regulations, measures which may be introduced to control inflation, changes in the rate or method of taxation, imposition of additional restrictions on currency conversion and remittance abroad, and reduction in tariff protection and other import restrictions.

ANY OCCURRENCE OF SERIOUS INFECTIOUS DISEASES, SUCH AS RECURRENCE OF SEVERE ACUTE RESPIRATORY SYNDROME (SARS) CAUSING WIDESPREAD PUBLIC HEALTH PROBLEMS, COULD ADVERSELY AFFECT OUR BUSINESS AND RESULTS OF OPERATIONS

A renewed outbreak of SARS or other widespread public health problems in China, where all of our revenue is derived, and in Heilongjiang, where our operations are headquartered, could have a negative effect on our operations. Our operations may be impacted by a number of public health-related factors, including the following:

| | · | quarantines or closures of our factories or subsidiaries which would severely disrupt its operations; |

| | · | the sickness or death of the key officers and employees; and |

| | · | general slowdown in the Chinese economy. |

Any of the foregoing events or other unforeseen consequences of public health problems could adversely affect our business and results of operations.

WE ARE SUBJECT TO THE ENVIRONMENTAL PROTECTION LAWS OF THE PRC

Our manufacturing process produces by-products such as effluent and noise, which are harmful to the environment. We are subject to multiple laws governing environmental protection as well as standards set by the relevant governmental bodies determining the classification of different wastes and proper disposal. OT Pharmaceutical properly passed the environmental examination on January 10, 2006, but there is no assurance that we will pass the environmental examinations in future.

China is experiencing substantial problems with environmental pollution. Accordingly, it is likely that the national, provincial and local governmental agencies will adopt stricter pollution controls. There can be no assurance that future changes in environmental laws and regulations will not impose costly compliance requirements on us or otherwise subject us to future liabilities. Our business's profitability may be adversely affected if additional or modified environmental control regulations are imposed upon us.

OUR BUSINESS MAY BE ADVERSELY AFFECTED AS A RESULT OF CHINA'S ENTRY INTO THE WORLD TRADE ORGANIZATION ("WTO") BECAUSE THE PREFERENTIAL TAX TREATMENTS AVAILABLE TO US MAY BE DISCONTINUED AND FOREIGN PHARMACEUTICAL MANUFACTURERS MAY COMPETE WITH US IN THE PRC PHARMACEUTIAL INDUSTRY

The PRC became a member of the WTO on December 11th, 2001. The current tax benefits enjoyed by OT Pharmaceutical may be regarded as unfair treatment by other members of the WTO. Accordingly, the preferential tax treatments available to our indirect subsidiary may be discontinued. In such circumstances, our profitability may be adversely affected. In addition, we may face additional competition from foreign pharmaceutical manufacturers if they set up their production facilities in the PRC or form Sino-foreign joint ventures with our competitors in the PRC. In the event that we fail to maintain our competitiveness against these competitors, our profitability may be adversely affected.

RISKS RELATED TO OUR COMMON STOCK

THERE IS NO MARKET FOR OUR COMMON STOCK

We intend to apply for a listing of our common stock on the Over-the-Counter Bulletin Board, but have not yet done so. To be listed on the OTCBB, we will have to comply with the requirement of material information regarding the issuer's finances, business and other information. There can be no assurance that the application for our common stock will be approved, or that if it is approved and listed, there can be no assurance that an active trading market will be maintained. We cannot assure you that our common stock will be included for trading on any stock exchange or through any other quotation system (including, without limitation, the NASDAQ Stock Market).

THE INITIAL OFFERING PRICE HAS BEEN ARBITRARILY SET BY OUR MANAGEMENT AND ACCORDINGLY DOES NOT INDICATE THE ACTUAL VALUE OF OUR BUSINESS

Until such time as our stock is quoted on the OTC Bulletin Board, the selling stockholders will offer the shares of common stock to which this registration statement relates at a price of $1.00 per share. The initial offering price is not based upon earnings or operating history, does not reflect our actual value, and bears no relation to our earnings, book values, net worth or any other recognized criteria of value. Accordingly, the offering price should not be regarded as an indication of any future price of our common stock.

THE NUMBER OF SHARES BEING REGISTERED FOR SALE IS SIGNIFICANT IN RELATION TO OUR TRADING VOLUME

All of the shares registered for sale on behalf of the selling stockholders are “restricted shares”, as defined in Rule 144 under the Securities Act. We have filed this registration statement to register 40% of all issued and outstanding shares of common stock of the company. Such an amount of shares, if sold in the market all at once or at about the same time, could depress the market price during the period the registration statement remains effective and also could affect our ability to raise equity capital. Except for those held by non-affiliates for a period of two years, calculated pursuant to Rule 144, any outstanding shares not sold by the selling stockholders pursuant to this prospectus will remain “restricted shares” in the possession of the stockholders.

THE MARKET PRICE FOR OUR COMMON STOCK MAY BE VOLATILE WHICH COULD RESULT IN A COMPLETE LOSS OF YOUR INVESTMENT

The market price for our common stock is likely to be highly volatile and subject to wide fluctuations in response to factors including the following:

| · | actual or anticipated fluctuations in our quarterly operating results, |

| · | announcements of new products by us or our competitors, |

| · | changes in financial estimates by securities analysts, |

| · | conditions in the pharmaceutical market, |

| · | changes in the economic performance or market valuations of other companies involved in pharmaceutical production, |

| · | announcements by our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments, |

| · | additions or departures of key personnel, or |

In addition, the securities markets have, from time to time, experienced significant price and volume fluctuations that are not related to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

A LARGE PORTION OF OUR COMMON STOCK IS CONTROLLED BY A SMALL NUMBER OF SHAREHOLDERS AND, AS A RESULT, THESE SHAREHOLDERS ARE ABLE TO INFLUENCE THE OUTCOME OF SHAREHOLDER VOTES ON VARIOUS MATTERS

Currently, Far Grand and Mrs. Hui Wang respectively own 40% and 19% of Asia Biotech’s outstanding ordinary shares. As a result, these shareholders are able to influence the outcome of shareholder votes on various matters, including the election of directors and other corporate transactions including business combinations. In addition, the occurrence of sales of a large number of shares of our common stock, or the perception that these sales could occur, may affect our stock price and could impair our ability to obtain capital through an offering of equity securities. Furthermore, the current ratios of ownership of our common stock reduce the public float and liquidity of our common stock, which can in turn affect the market price of our common stock.

WE ARE LIKELY TO REMAIN SUBJECT TO "PENNY STOCK” REGULATIONS AND AS A CONSEQUENCE THERE ARE ADDITIONAL SALES PRACTICE REQUIREMENTS AND ADDITIONAL WARNINGS ISSUED BY THE SEC

As long as the trading price of our common stock is below $5.00 per share, the open-market trading of our common stock will be subject to the "penny stock" rules. The "penny stock" rules impose additional sales practice requirements on broker-dealers who sell securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 together with their spouse). For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of securities and have received the purchaser's written consent to the transaction before the purchase.

Additionally, for any transaction involving a penny stock, unless exempt, the broker-dealer must deliver, before the transaction, a disclosure schedule prescribed by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information on the limited market in penny stocks. These additional burdens imposed on broker-dealers may restrict the ability of broker-dealers to sell the common stock and may affect a shareholder's ability to resell the common stock.

Shareholders should be aware that, according to Securities and Exchange Commission Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (iv) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequential investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market.

COMPLIANCE WITH RECENTLY ENACTED CHANGES IN SECURITIES LAWS AND REGULATIONS COULD COST HUNDREDS OF THOUSANDS OF DOLLARS, REQUIRE ADDITIONAL PERSONNEL AND REQUIRE HUNDREDS OF MAN HOURS OF EFFORT, AND THERE CAN BE NO ASSURANCE THAT WE WILL HAVE THE PERSONNEL, FINANCIAL RESOURCES OR EXPERTISE TO COMPLY WITH THESE REGULATIONS

Efforts to comply with recently enacted changes in securities laws and regulations will increase our costs and require additional management resources, and we still may fail to comply.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, the SEC adopted rules requiring public companies to include a report of management on the company's internal controls over financial reporting in their annual reports on Form 10-KSB. In addition, the public accounting firm auditing the company's financial statements must attest to and report on management's assessment of the effectiveness of the company's internal controls over financial reporting. These requirements are not presently applicable to us. If and when these regulations become applicable to us, and if we are unable to conclude that we have effective internal controls over financial reporting or if our independent auditors are unable to provide us with an unqualified report as to the effectiveness of our internal controls over financial reporting as required by Section 404 of the Sarbanes-Oxley Act of 2002, investors could lose confidence in the reliability of our financial statements, which could result in a decrease in the value of our securities. We have not yet begun a formal process to evaluate our internal controls over financial reporting. Given the status of our efforts, coupled with the fact that guidance from regulatory authorities in the area of internal controls continues to evolve, substantial uncertainty exists regarding our ability to comply by applicable deadlines.

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act (the "Exchange Act"). We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including, among other things:

| | · | general economic and business conditions, both internationally and in the PRC markets, |