FORM 6-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of March 2005

Commission File Number 001-32412

| GLENCAIRN GOLD CORPORATION |

| (Translation of registrant’s name into English) |

500 – 6 Adelaide St. East

Toronto, ON M5C 1H6 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| | Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders. |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| | Note:Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR. |

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b) 82 —

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | GLENCAIRN GOLD CORPORATION |

| Date: March 9, 2005 | By: “Lorna MacGillivray”

Lorna MacGillivray

Corporate Secretary and General Counsel |

TECHNICAL REPORT ON

LIMON MINE, NICARAGUA

- --------------------------------------------------------------------------------

PREPARED FOR

GLENCAIRN GOLD CORPORATION

NI 43-101 Report

Author:

Hrayr Agnerian M.Sc. (Applied), P. Geo.

Jason J. Cox, P.Eng

February 24, 2005

ROSCOE POSTLE ASSOCIATES INC

Toronto, Ontario.

Vancouver, B.C.

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

TABLE OF CONTENTS

PAGE

1 SUMMARY ........................................................1-1

Executive Summary ..............................................1-1

Technical Summary ..............................................1-9

2 INTRODUCTION AND TERMS OF REFERENCE ............................2-1

3 DISCLAIMER .....................................................3-1

4 PROPERTY DESCRIPTION AND LOCATION ..............................4-1

5 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE

AND PHYSIOGRAPHY ...............................................5-1

6 HISTORY ........................................................6-1

7 GEOLOGICAL SETTING .............................................7-1

Regional Geology ...............................................7-1

Local Geology ..................................................7-1

8 DEPOSIT TYPES ..................................................8-1

9 MINERALIZATION .................................................9-1

10 EXPLORATION ...................................................10-1

11 DRILLING ......................................................11-1

12 SAMPLING METHOD AND APPROACH ..................................12-1

13 SAMPLE PREPARATION, ANALYSES AND SECURITY .....................13-1

14 DATA VERIFICATION .............................................14-1

15 ADJACENT PROPERTIES ...........................................15-1

16 MINERAL PROCESSING AND METALLURGICAL TESTING ..................16-1

17 MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES ................17-1

Mineral Resources .............................................17-1

Mineral Reserve Estimation Procedures .........................17-6

18 OTHER RELEVANT DATA AND INFORMATION ...........................18-1

Mine Operations ...............................................18-1

Life of Mine Plan ............................................18-12

Environmental Considerations .................................18-13

Capital And Operating Cost Estimates .........................18-16

Economic Analysis ............................................18-19

19 CONCLUSIONS ...................................................19-1

i

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

20 RECOMMENDATIONS ...............................................20-1

21 SOURCES OF INFORMATION ........................................21-1

22 SIGNATURE PAGE ................................................22-1

23 CERTIFICATE OF QUALIFICATIONS .................................23-1

24 APPENDIX ......................................................24-1

Check Assay Results: Limon Laboratory v.s. ACME

Laboratories, Diamond Drill Holes From Pozo 1 & 2,

Santa Pancha Deposit ..........................................24-1

LIST OF TABLES

Table 1-1 Mineral Reserves and Mineral Resources ................1-2

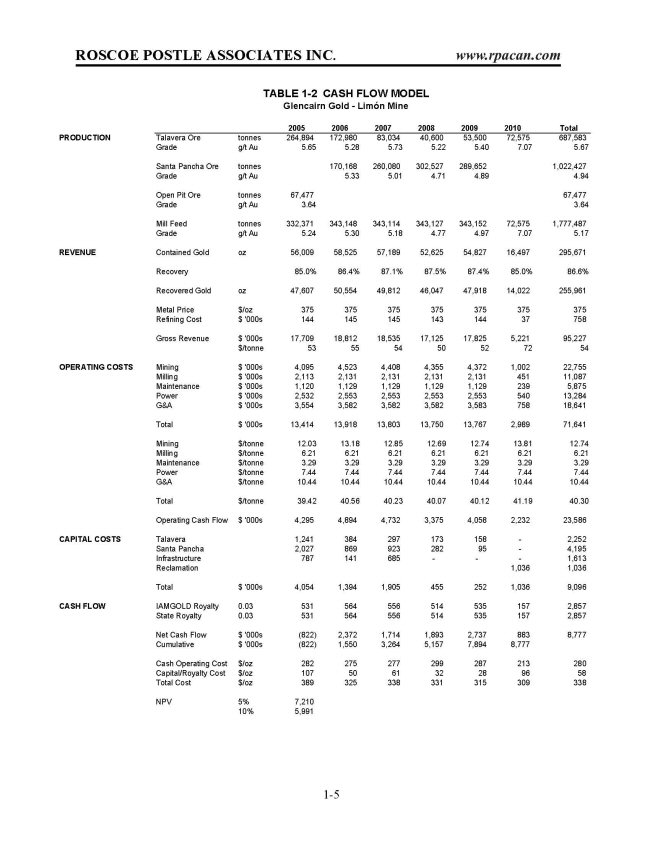

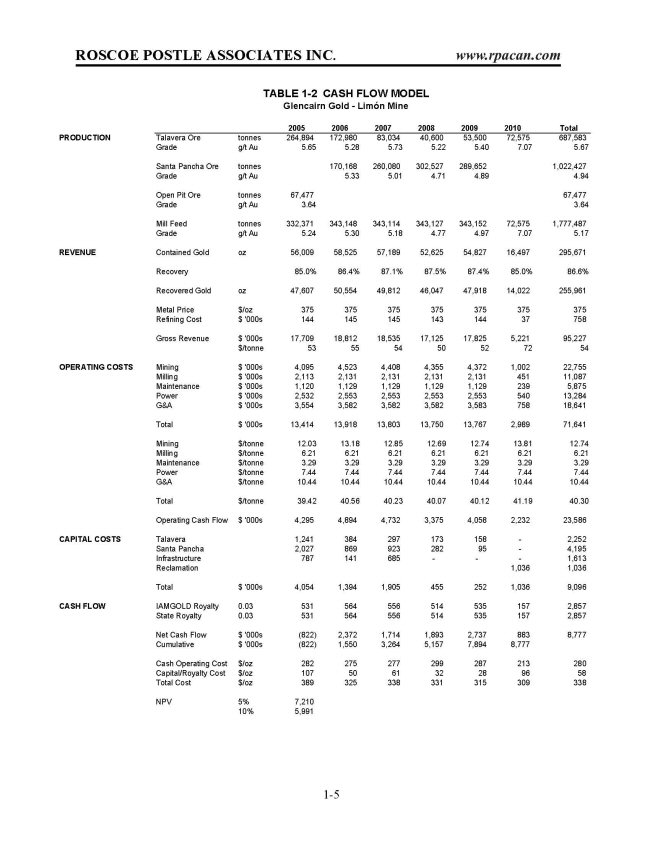

Table 1-2 Cash Flow Model .......................................1-5

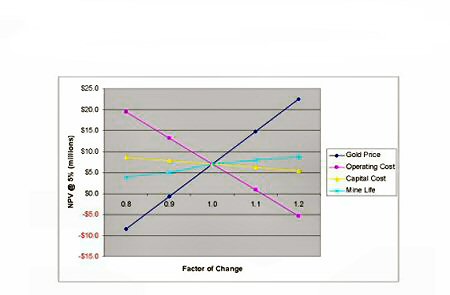

Table 1-3 Sensitivity Data ......................................1-6

Table 1-4 Production History ...................................1-18

Table 1-5 Limon Life of Mine Plan ..............................1-19

Table 4-1 Mineral Concessions List ..............................4-3

Table 6-1 Historical Production and Exploration on Other

Concessions ...........................................6-4

Table 11-1 Statistics of 2004 Exploration Work ..................11-1

Table 14-1 RPA Independent Sampling Results .....................14-2

Table 17-1 Mineral Reserves and Mineral Resources ...............17-2

Table 17-2 Mineral Resources at 3.0 g/t Au Cut-Off Grade ........17-3

Table 17-3 Reserve Replacement .................................17-10

Table 17-4 2004 Resource to Reserve Conversion .................17-11

Table 17-5 Pozo 1 & 2 Probable Mineral Reserves ................17-12

Table 17-6 Santa Pancha Mineral Resources ......................17-13

Table 18-1 Historical Mine Production ...........................18-1

Table 18-2 2004 Mine Production Details .........................18-2

Table 18-3 Limon Mine, Life of Mine Plan .......................18-12

Table 18-4 LOMP Capital Costs ..................................18-17

Table 18-5 LOMP Unit Operating Costs ...........................18-18

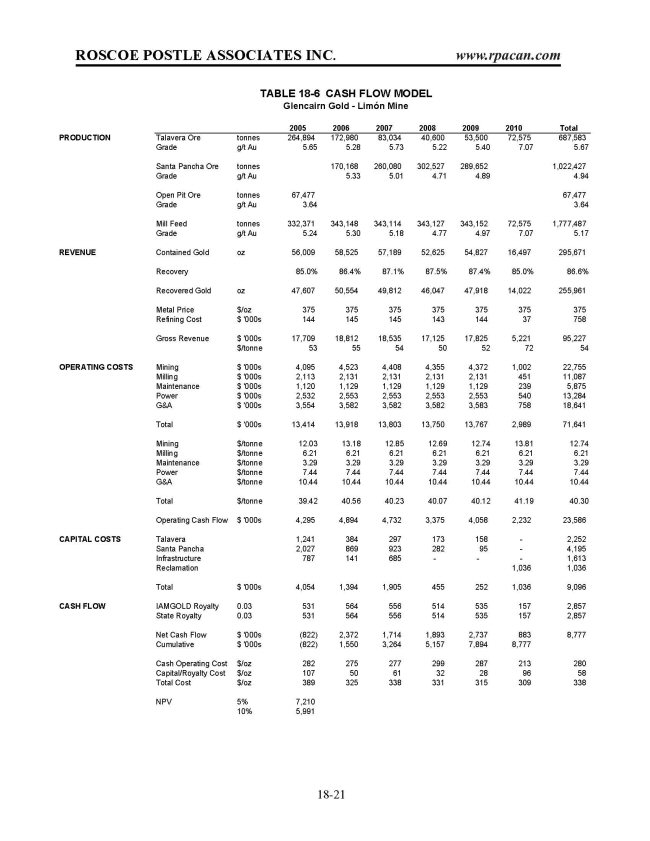

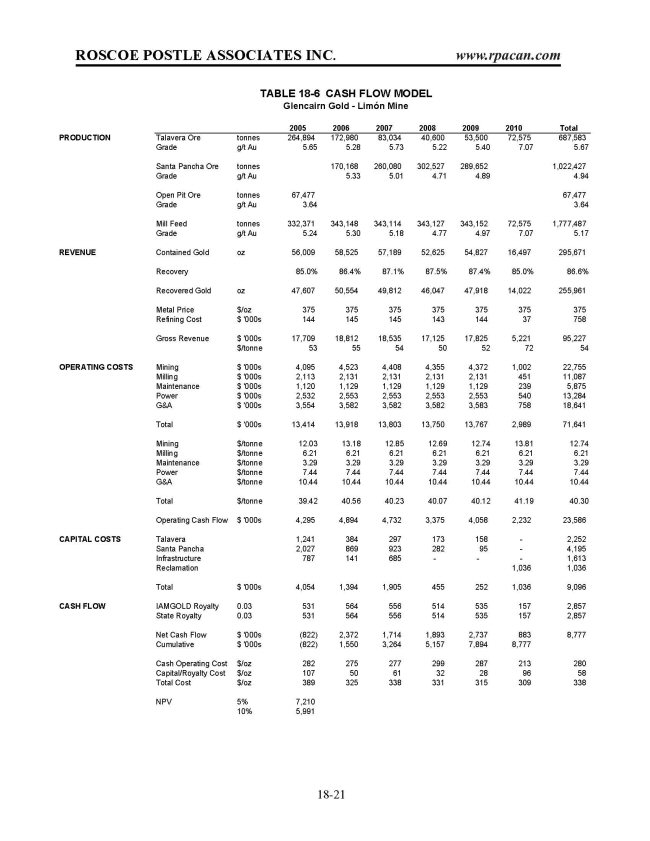

Table 18-6 Limon Mine, Cash Flow Model .........................18-21

Table 18-7 Sensitivity Data ....................................18-22

ii

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

LIST OF FIGURES

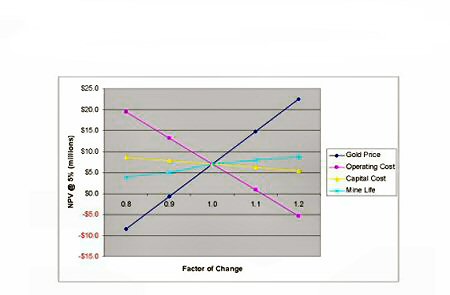

Figure 1-1 Cash Flow Sensitivity Graph 1-7

Figure 4-1 Limon Property, Location Map 4-4

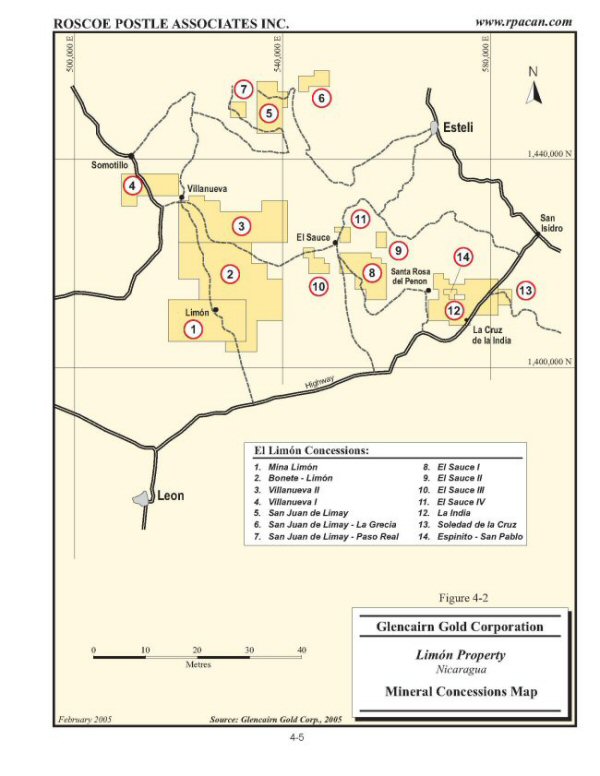

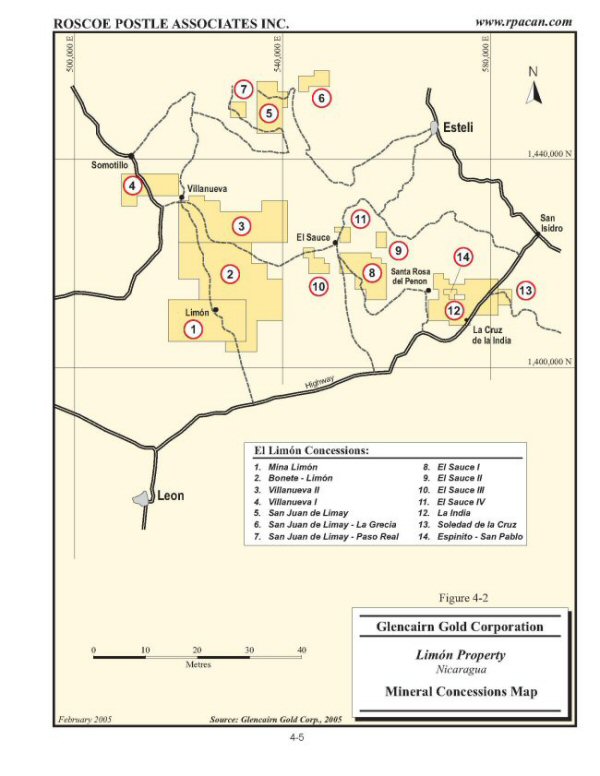

Figure 4-2 Limon Property, Mineral Concessions Map 4-5

Figure 4-3 Surface Rights, Mina El Limon Concession 4-7

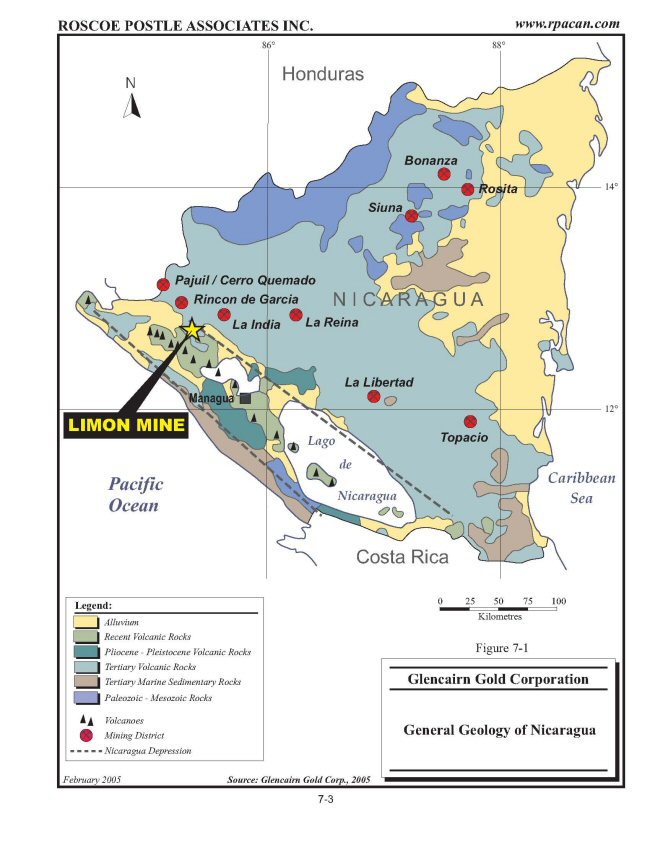

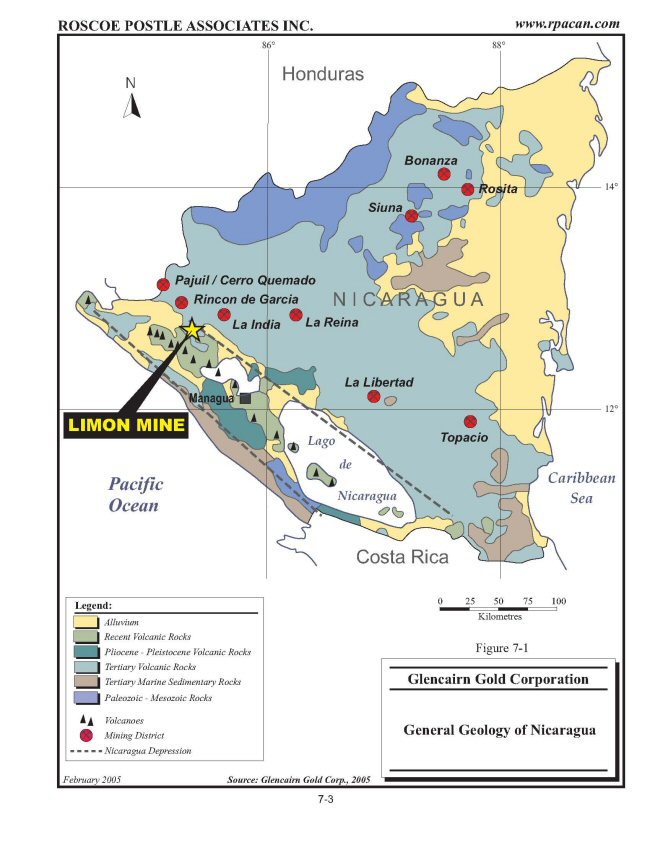

Figure 7-1 General Geology of Nicaragua 7-3

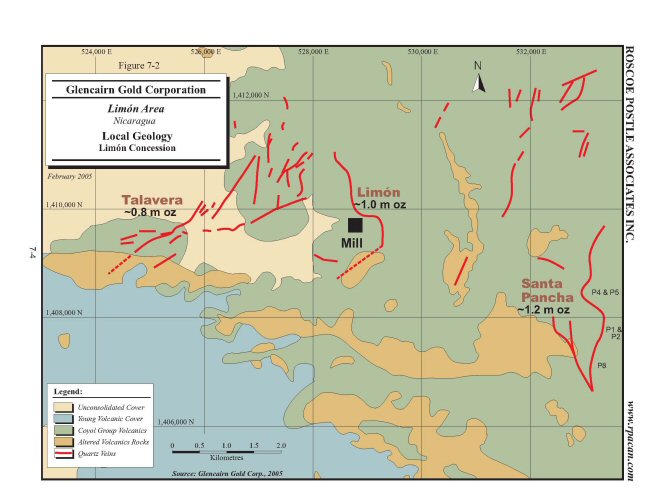

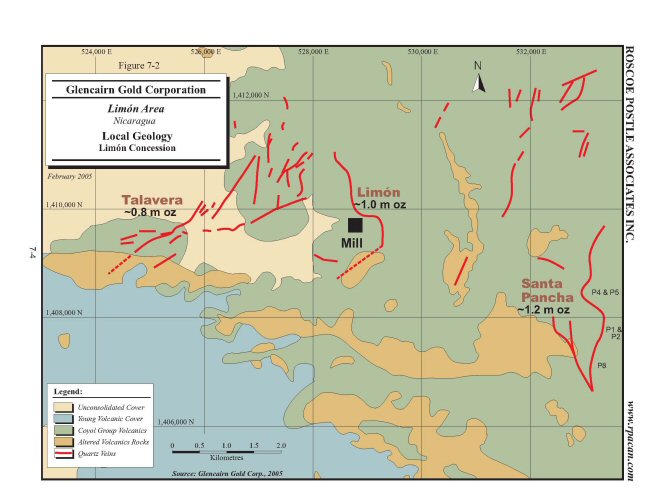

Figure 7-2 Limon Area, Local Geology 7-4

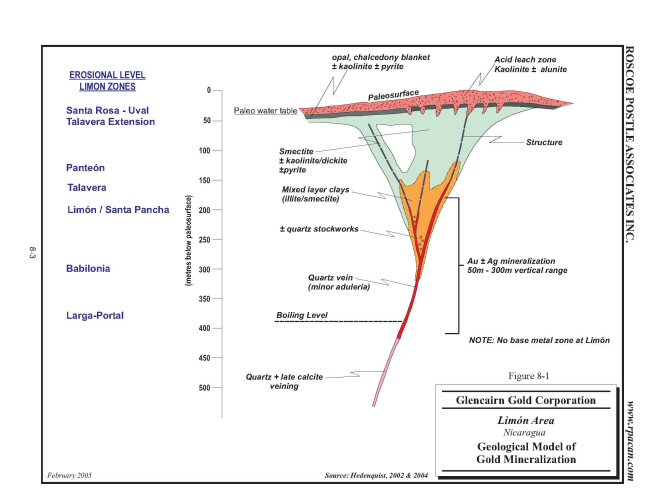

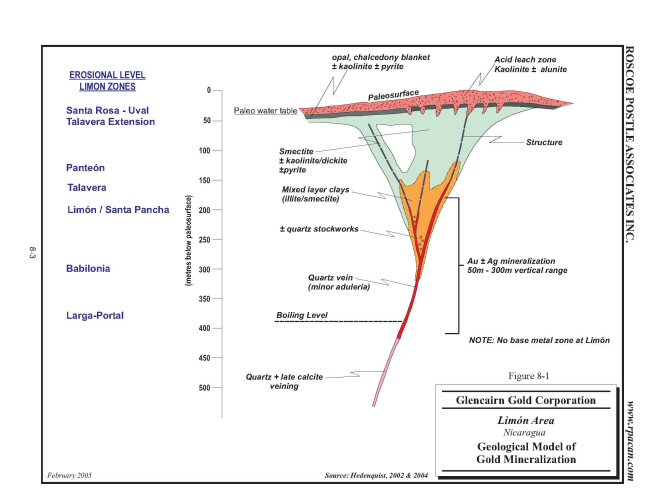

Figure 8-1 Limon Area, Geological Model of Gold Mineralization 8-3

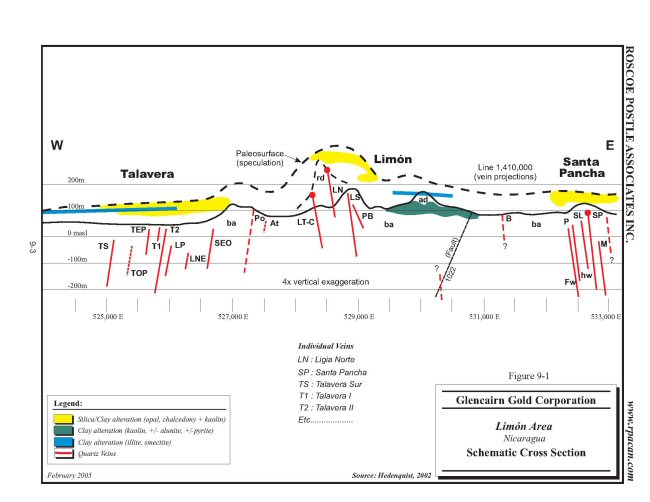

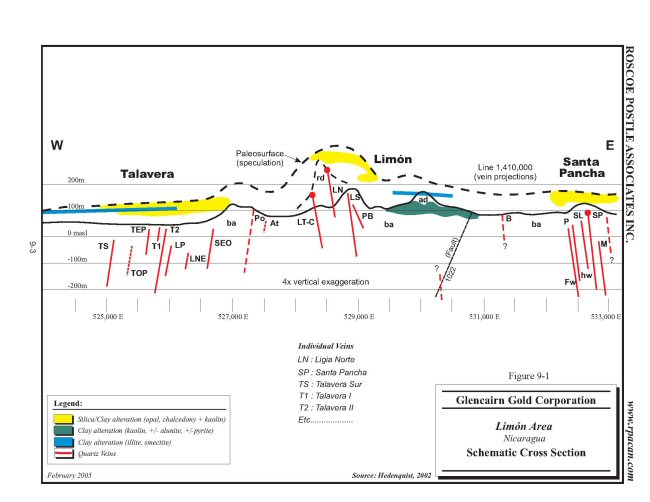

Figure 9-1 Limon Area, Schematic cross Section 9-3

Figure 9-2 Santa Pancha Vein System, Local Geology 9-4

Figure 10-1 Limon Concession, Exploration Targets 10-6

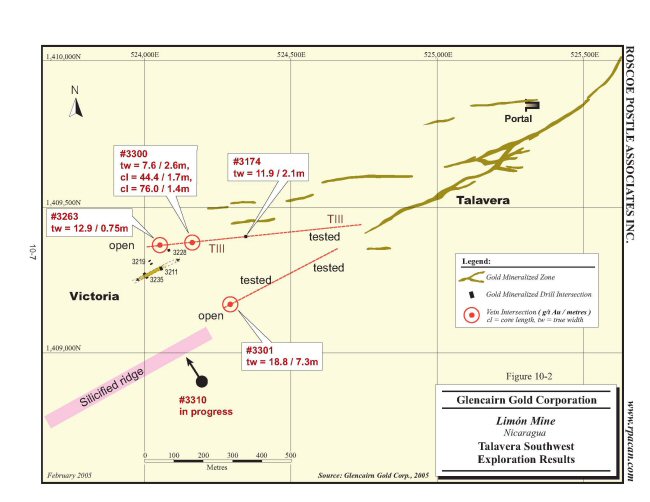

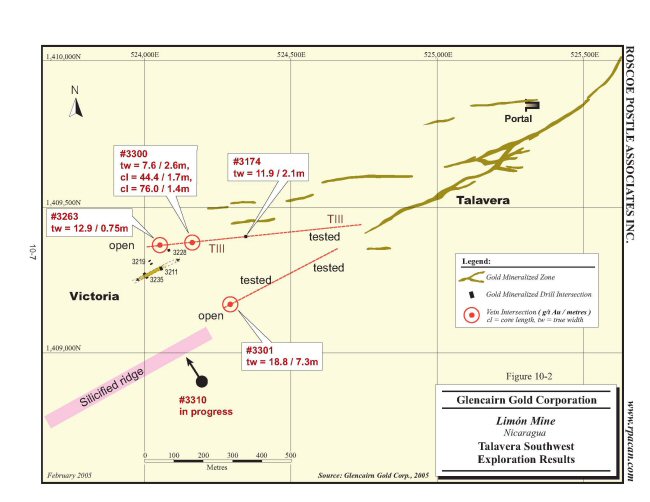

Figure 10-2 Talavera Southwest Exploration Results 10-7

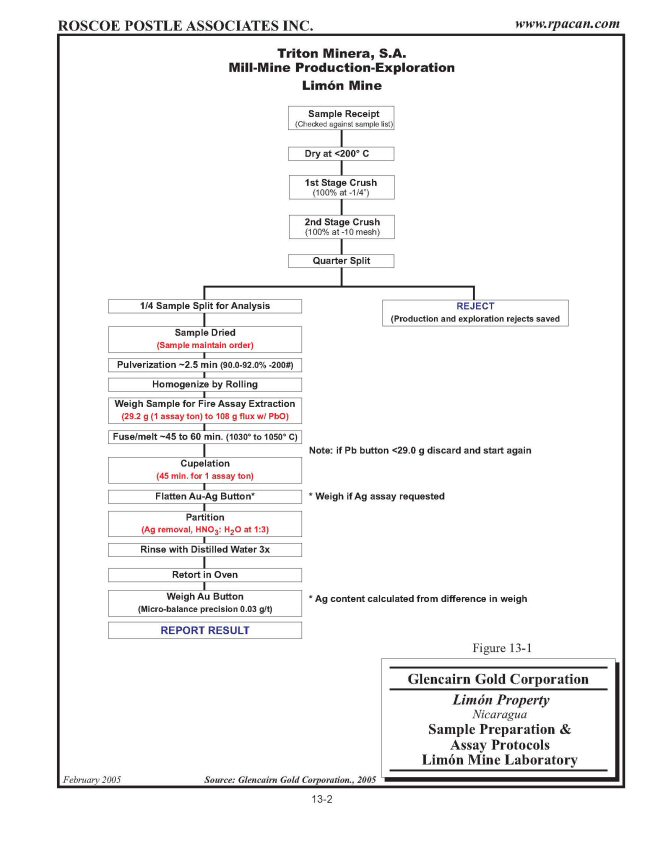

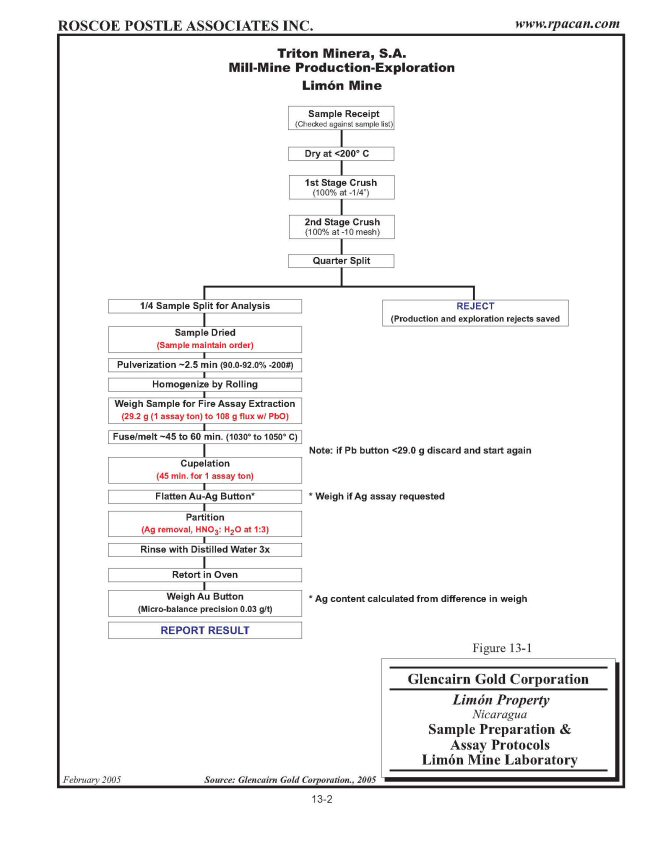

Figure 13-1 Sample Preparation and Assay Protocols,

Limon Mine Laboratory 13-2

Figure 13-2 Check Assay Results, Santa Pancha Deposit 13-6

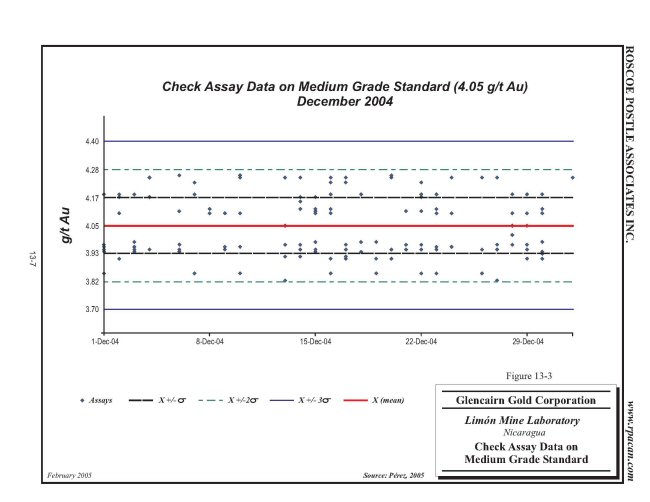

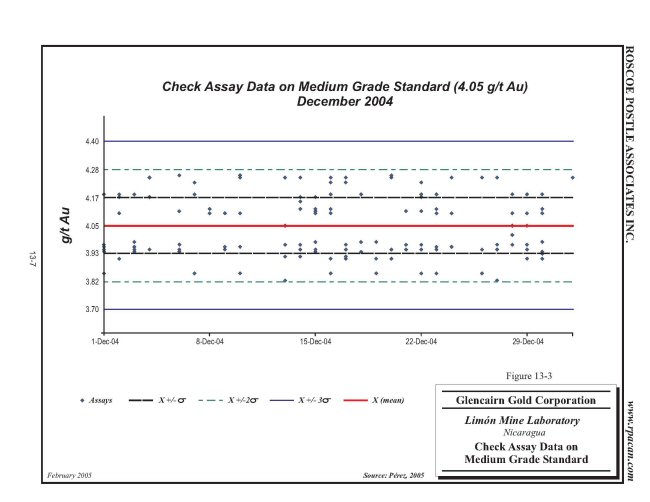

Figure 13-3 Check Assay Data on Medium Grade Standard 13-7

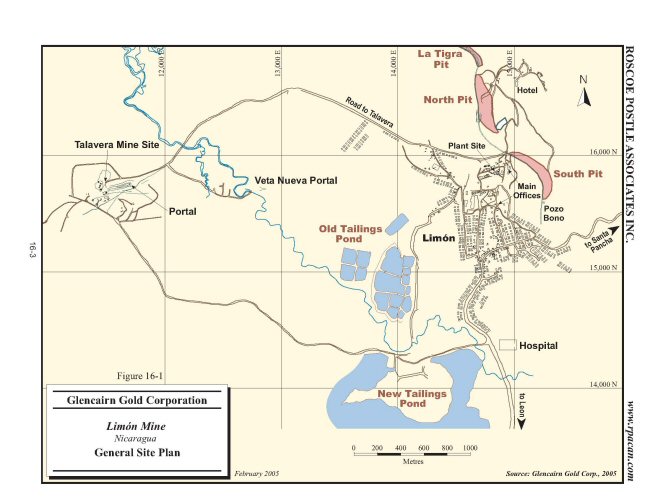

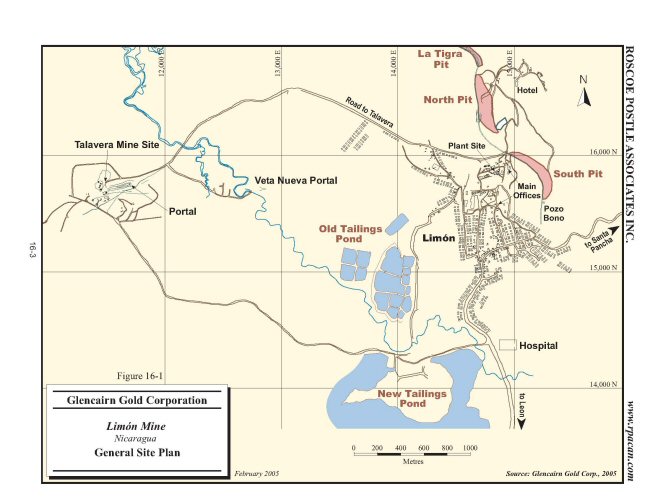

Figure 16-1 Limon Mine, General Site Plan 16-3

Figure 16-2 Limon Mine, Mill Area Site Plan 16-4

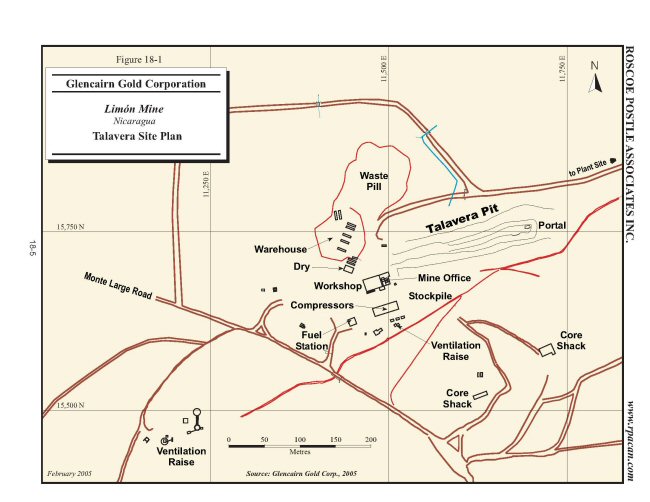

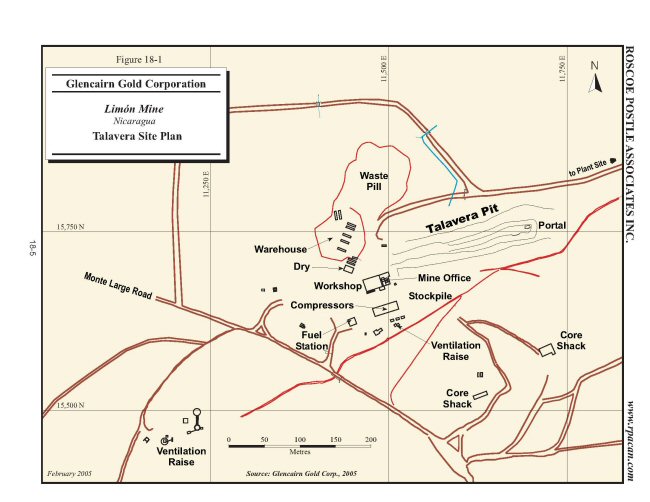

Figure 18-1 Limon Mine, Talavera Site Plan 18-5

Figure 18-2 Talavera Mine Schematic 18-6

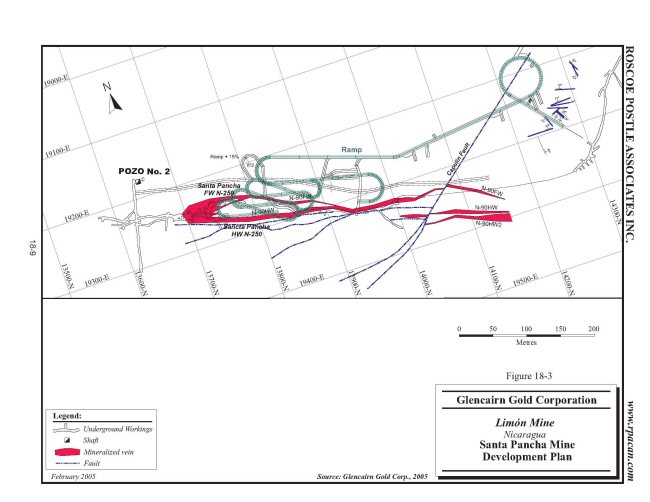

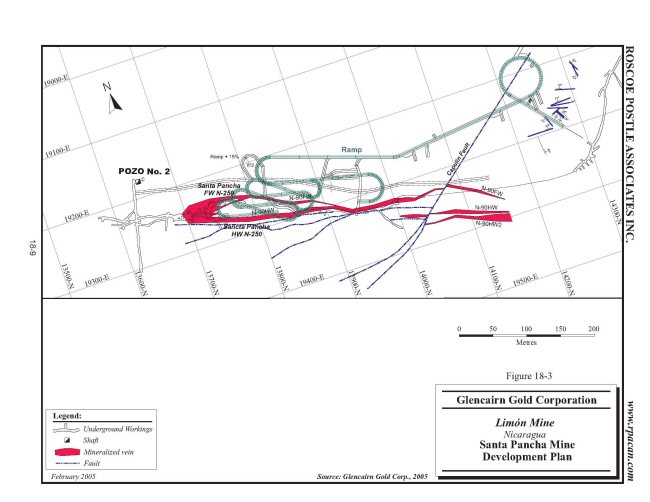

Figure 18-3 Santa Pancha Mine Development Plan 18-9

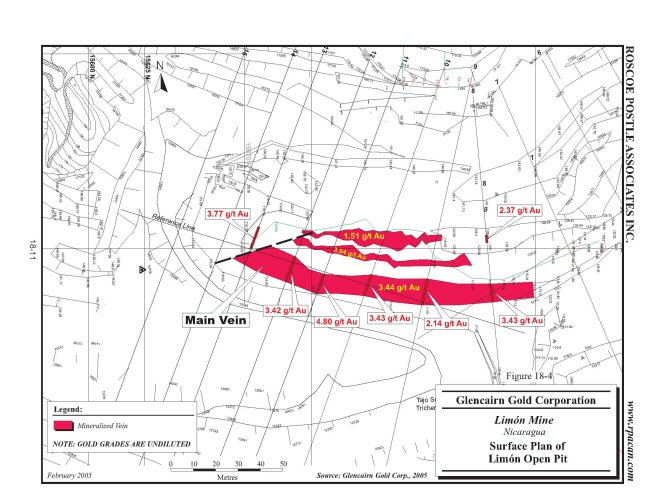

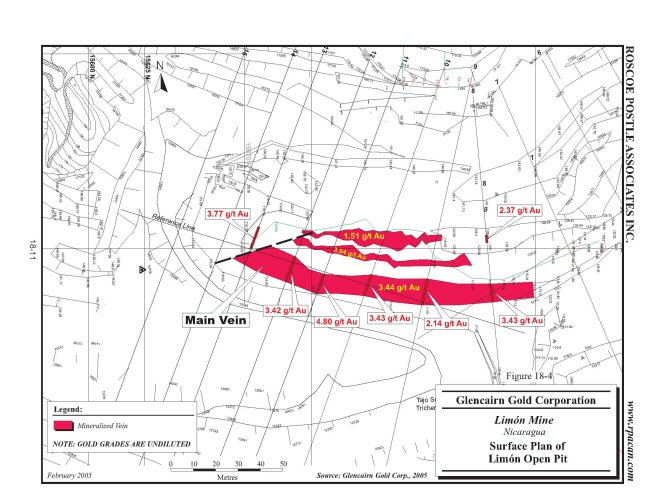

Figure 18-4 Surface Plan of Limon Open Pit 18-11

Figure 18-5 Cash Flow Sensitivity Graph 18-23

LIST OF APPENDIX FIGURES

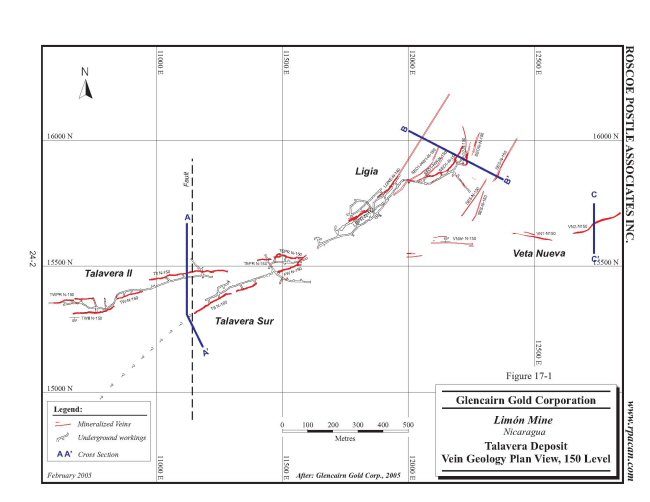

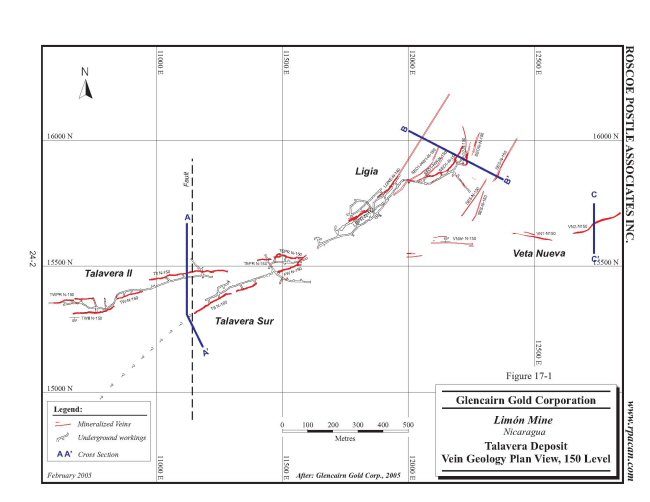

Figure 17-1 Talavera Deposit, Vein Geology Plan View, 150 Level .........24-2

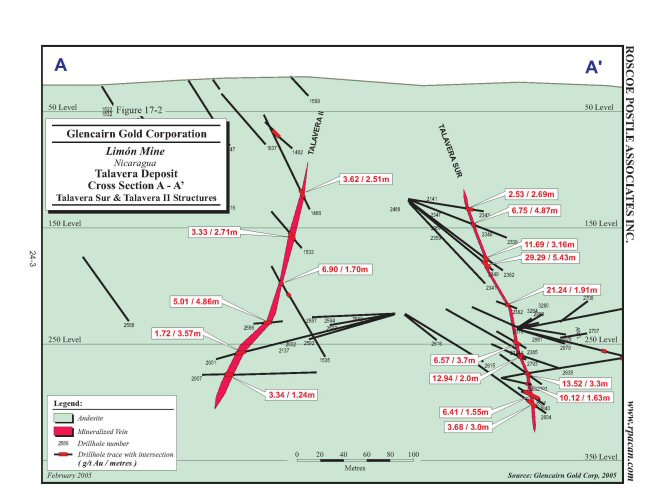

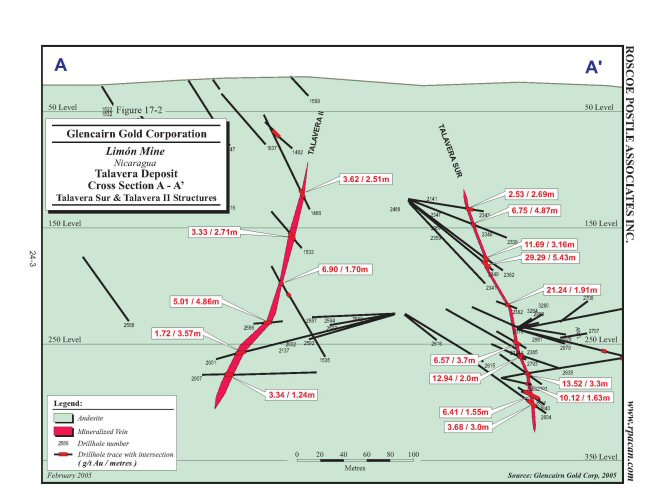

Figure 17-2 Talavera II & Talavera Sur, Cross Section A-A' ..............24-3

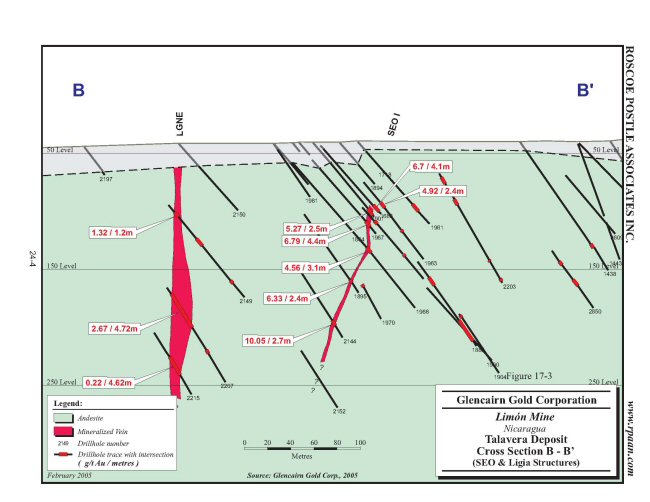

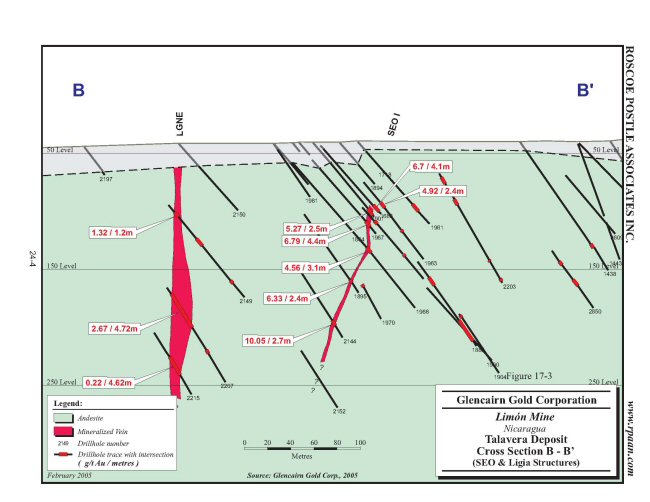

Figure 17-3 Talavera Deposit, SEO & Ligia Structures,

Cross Section B-B' ..........................................24-4

Figure 17-4 Talavera Deposit, Veta Nueva Vein, Cross

Section C-C' ................................................24-5

Figure 17-5 Talavera Main Vein (East Half),

Vertical Longitudinal Section ...............................24-6

Figure 17-6 Talavera Main Vein (West Half), Vertical

Longitudinal Section Long Section ...........................24-7

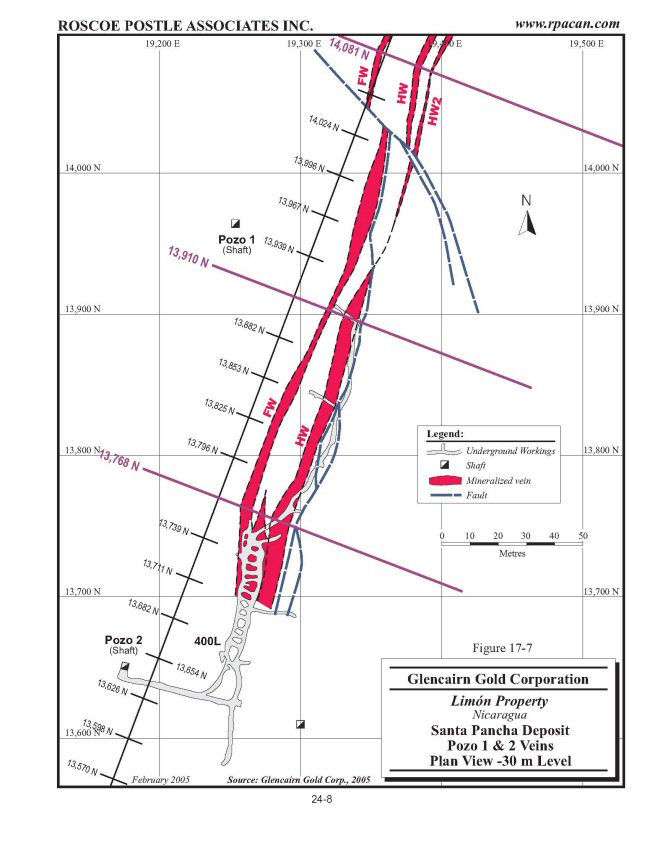

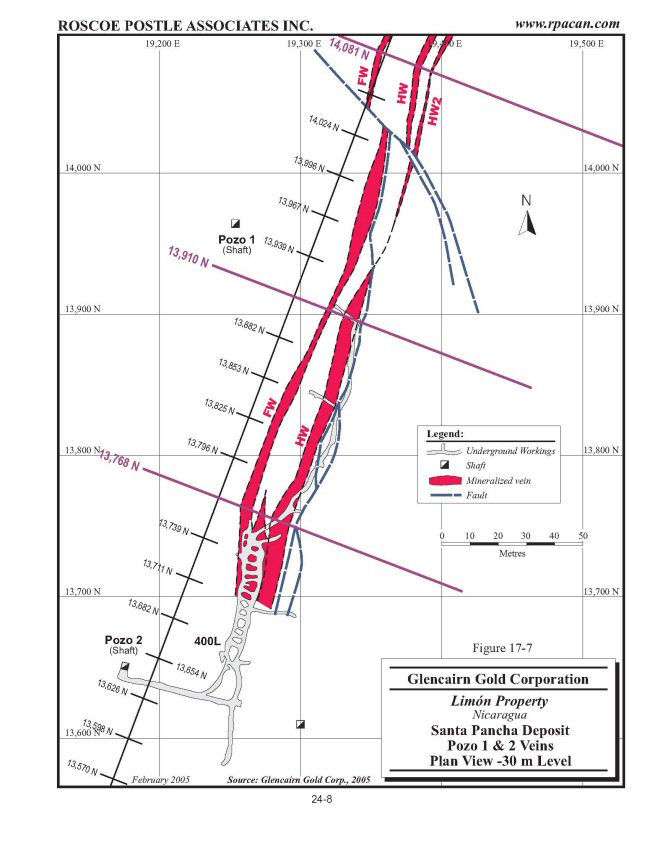

Figure 17-7 Santa Pancha Deposit, Pozo 1 & 2 Veins, Plan

View -30 m Level ............................................24-8

Figure 17-8 Santa Pancha Deposit, Pozo 1 & 2 Veins, Vertical

Cross Section 13,768 N ......................................24-9

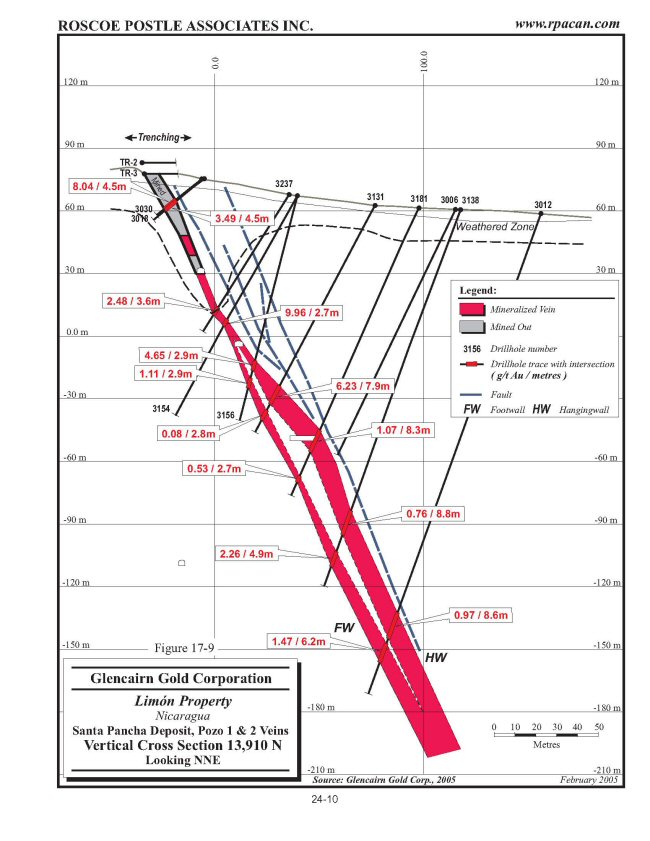

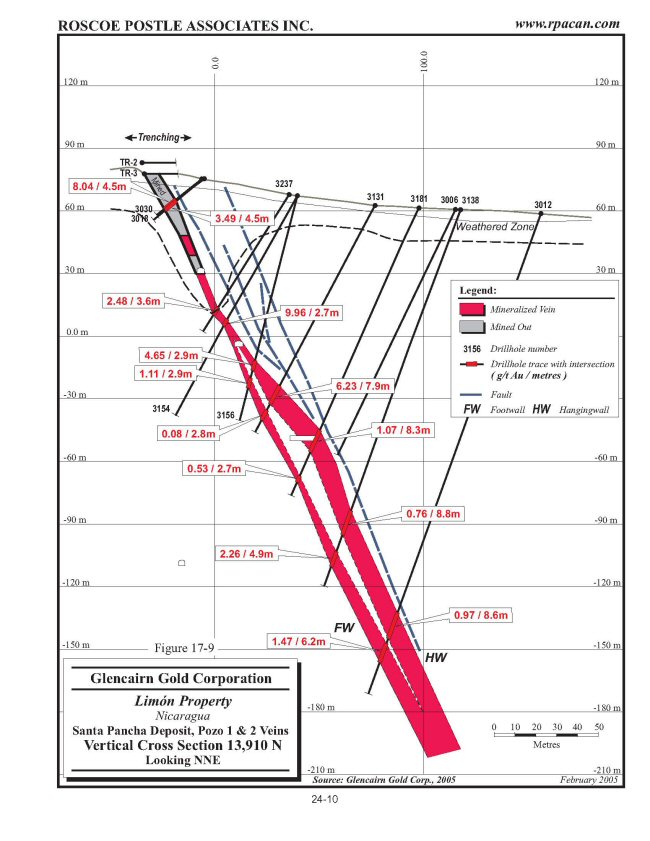

Figure 17-9 Santa Pancha Deposit, Pozo 1 & 2 Veins, Vertical

Cross Section 13,910 N .....................................24-10

Figure 17-10 Santa Pancha Deposit, Pozo 1 & 2 Veins,

Vertical Cross Section 14,081 N ............................24-11

iii

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

Figure 17-11 Santa Pancha Deposit, Pozo 1 & 2 Veins (Hangingwall),

Vertical Longitudinal Section .............................24-12

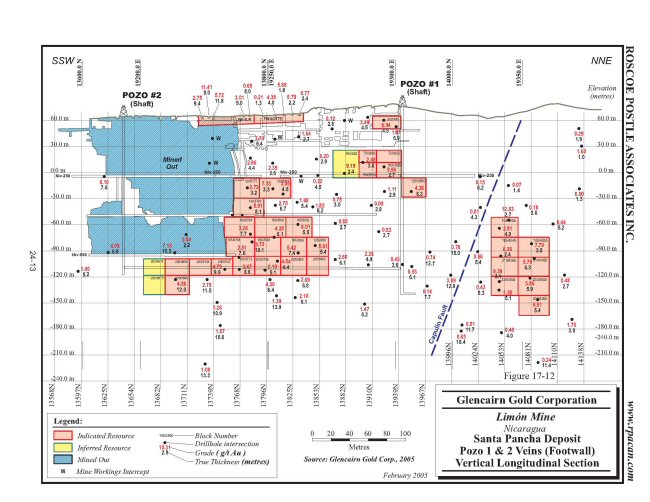

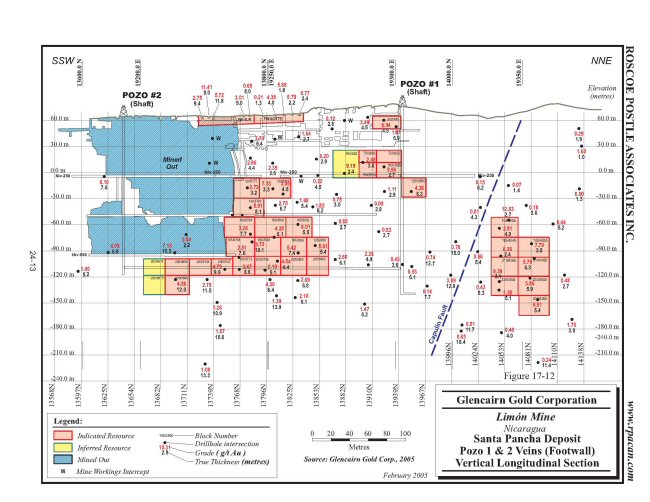

Figure 17-12 Santa Pancha Deposit, Pozo 1 & 2 Veins (Footwall),

Vertical Longitudinal Section .............................24-13

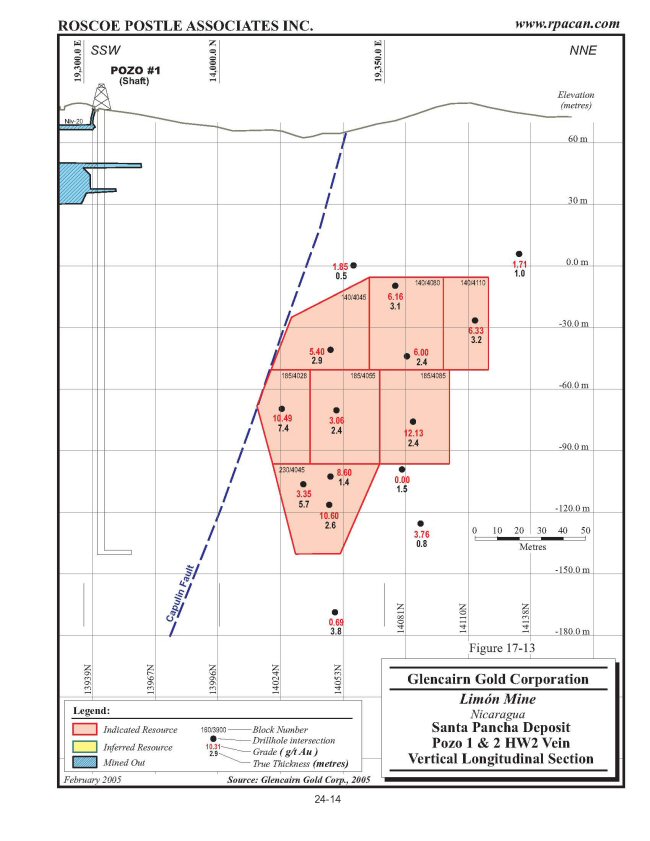

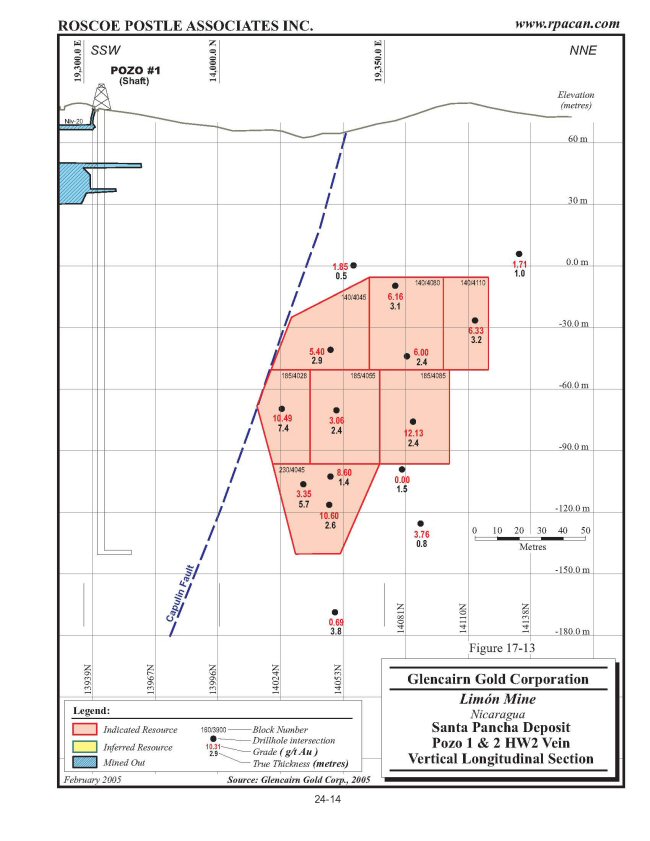

Figure 17-13 Santa Pancha Deposit, Pozo 1 & 2 HW2 Vein Vertical

Longitudinal Section ......................................24-14

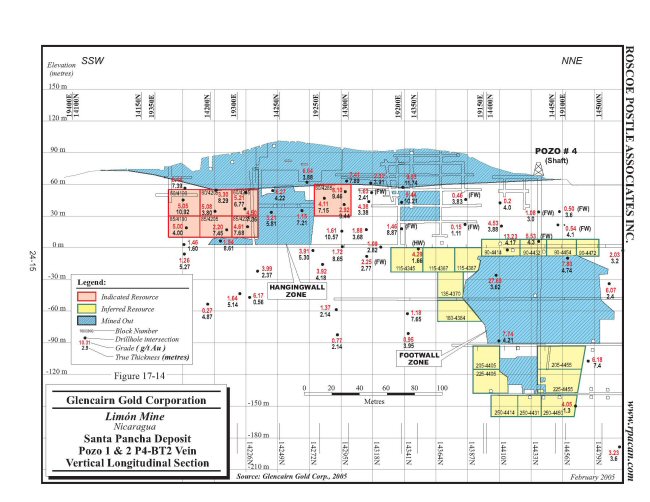

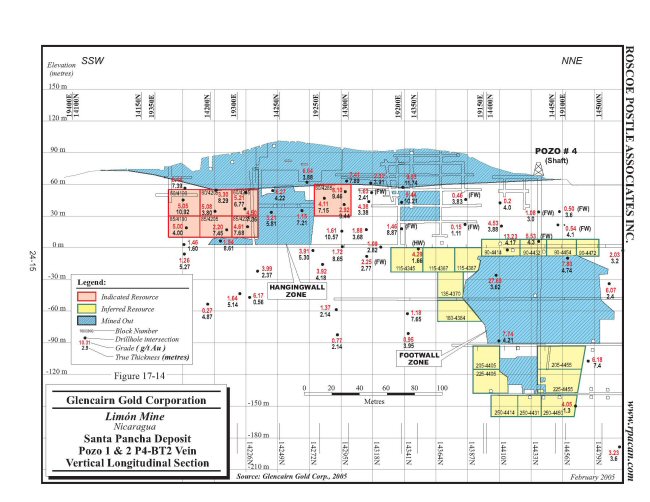

Figure 17-14 Santa Pancha Deposit, Pozo 1 & 2 P4-BT2 Vein

Vertical Longitudinal Section .............................24-15

Figure 17-15 Santa Pancha Deposit, Pozo 4 & 5 Veins (Footwall),

Composite Plan View at Various Levels ....................24-16

Figure 17-16 Santa Pancha Deposit, Pozo 4 & 5 Veins, Vertical

Cross Section 14,583 N ....................................24-17

Figure 17-17 Santa Pancha Deposit, Pozo 4 & 5 Veins, Vertical

Cross Section 14,849 N ....................................24-18

iv

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

1 SUMMARY

EXECUTIVE SUMMARY

Roscoe Postle Associates Inc. (RPA) was retained by Mr. Michael B. Gareau,

Vice-President, Exploration of Glencairn Gold Corporation (Glencairn), to

prepare an independent Technical Report on the Limon gold mine in northern

Nicaragua. The purpose of this report is to provide our independent assessment

of the Mineral Resources and Mineral Reserves of the Talavera and Santa Pancha

deposits and review the Company's Mine Plan. The Technical Report is required to

be conformable to NI 43-101 Standards of Disclosure for Mineral Projects. RPA

visited the property from November 2 to 4, 2004, and from January 18 to 20,

2005.

Glencairn is a reporting issuer listed at the Toronto Stock Exchange (TSX).

The company, through its 95% interest in Triton Minera S.A. (TMSA), owns and

operates the Mina El Limon mineral concession and 13 exploration-stage mineral

concessions, including the past producing La India concession; all of which are

located in northwestern Nicaragua. TMSA, through its 40% interest in Inversiones

La India, S.A., holds a 40% interest in the Espinito-San Pablo mineral

concession enclosed by the La India concession.

This report discusses only the 12,000 ha Mina El Limon mineral concession,

including the Talavera underground mine, the Santa Pancha deposit, and some

small open pits. Table 1-1 below summarizes Glencairn's estimate of the Mineral

Reserves and Mineral Resources at the Mina El Limon concession, as of December

31, 2004:

1-1

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

TABLE 1-1 MINERAL RESERVES AND MINERAL RESOURCES

Glencairn Gold - Limon Mine

Mineral Reserves

Deposit Category Tonnes Grade (g/t Contained

(Au) Ounces Au

- ---------------------------------------------------------------------------------

Talavera Proven 177,600 5.88 33,600

Probable 510,000 5.60 91,780

Santa Pancha Probable 1,064,000 4.94 169,050

Subtotal Proven 177,600 5.88 33,600

Subtotal Probable 1,574,000 5.15 260,830

- ---------------------------------------------------------------------------------

Total Underground Proven & Probable 1,751,600 5.23 294,430

Limon Vein Open Pit Probable 35,200 2.71 3,070

Additional Mineral Resources

Talavera Measured 20,500 6.30 4,100

Indicated 109,300 6.22 21,900

Limon Vein Open Pit Indicated 40,600 3.26 4,300

Santa Pancha Indicated 32,400 8.52 8,900

Subtotal Measured 20,500 6.30 4,100

Subtotal Indicated 182,300 5.97 35,100

- --------------------------------------------------------------------------------

Total Measured & Indicated 202,800 6.00 39,200

Talavera Inferred 339,000 7.29 79,500

Santa Pancha Inferred 616,800 6.76 134,100

- --------------------------------------------------------------------------------

Total Inferred 955,800 6.95 213,600

Source: Glencairn, 2005

Notes:

1. CIM definitions were followed for reserves & resources.

2. Mineral Reserves are estimated at a cutoff grade of 4.02 g/t Au for

Talavera, 3.82 g/t Au for Santa Pancha, and 1.8 g/t Au for the Limon open

pit. Additional Mineral Resources are estimated at a cutoff grade of 4.50

g/t Au for underground, and 1.8 g/t Au for the Limon open pit.

3. Mineral Reserves & Mineral Resources are estimated using an average

long-term gold price of US$375 per ounce.

4. A minimum vein width of 2.4 m was used, and a minimum mining width of 3.0

m.

5. Ore density is 2.60 t/m3.

1-2

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

RPA has audited the Glencairn reserve and resource estimates, and in our

opinion they are in keeping with industry practices and standards. RPA is of the

opinion that the Glencairn resource and reserve estimates at the higher cut-off

grades (4.02 g/t Au for Talavera and 3.82 g/t Au for Santa Pancha) are in

accordance with the Mineral Resource/Reserve Classification as recommended by

the CIM Committee on Mineral Resources and Mineral Reserves, as required by

NI-43-101.

ECONOMIC ANALYSIS

Glencairn has prepared a Life of Mine Plan (LOMP) that schedules production

of the Mineral Reserves (as of January 1, 2005). The mine life is forecast to be

approximately five years, ending in the 1st quarter of 2010. RPA's projection of

the pre-tax cash flow is shown in Table 1-2, expressed in US dollars (US$). The

key input parameters are:

o Production of 1,100 tonnes per day (based on 304 days per annum).

o Reserve and Resource Base: Mineral Reserves of 1.78 million tonnes at

an average grade of 5.2 g/t Au, and Measured and Indicated Mineral

Resources of 203,000 tonnes at an average grade of 6.0 g/t Au. The

Mineral Resources are additional to the Mineral Reserves.

o Total production: 1.78 million tonnes @ 5.2 g/t Au

o Annual gold production: 48,000 ounces, average.

o Metallurgical recovery of 86.6%

o Gold price of $375 per ounce.

o Silver revenue assumed to be not material

o Revenue is recognized at the time of production.

o Operating costs: $40 per tonne milled

o Capital costs: $9.1 million.

1-3

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

GLOBAL MARKETS

The principal commodities at the Limon mine are freely traded, at prices

that are widely known, so that prospects for sale of any production are

virtually assured. RPA used a gold price of US$375 per ounce for the Base Case.

The Nicaraguan currency (Cordoba) has shown a steady decline against the US

dollar over the past few years, as follows:

o February 2003 - 1 US dollar = 14.79 Cordobas

o February 2004 - 1 US dollar = 15.54 Cordobas

o February 2005 - 1 US dollar = 16.22 Cordobas

For costs originally estimated in Cordobas (for example, labour), Glencairn

applies an inflation factor of 6% per annum before converting to US dollars.

CASH FLOW ANALYSIS

The undiscounted pre-tax cash flow totals $8.8 million. The unit operating

cost is $280 per ounce of gold. Capital expenditures are estimated to total $36

per ounce, and royalties are forecast to total $22 per ounce, over the remaining

mine life. The total cost of production, including operating, capital and

royalties, is estimated to be $338 per ounce. All costs and revenue are

expressed in US dollars (US$) unless otherwise noted.

Glencairn's physical and cost data underlying RPA's cash flow model are

consistent with operations during the past several years. In view of recent gold

prices ranging from $400 per ounce to $440 per ounce, the Limon Mine is expected

to generate a positive cash flow for the period detailed in the Life of Mine

Plan.

1-4

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

SENSITIVITY ANALYSIS

Variations to the LOMP base case NPV calculated at a 5% interest rate are

detailed in Table 1-3, and graphed in Figure 1-1. The cash flow is most

sensitive to gold price, followed by operating cost. Downside possibilities

related to Santa Pancha hangingwall stability (increased costs and dilution)

have a lesser impact than the previously mentioned factors.

TABLE 1-3 SENSITIVITY DATA

Glencairn Gold - Limon Mine

Parameter Variables Units -20% -10% Base +10% +20%

- --------------------------------------------------------------------------------

Gold Price $/oz 300 338 375 413 450

Operating Cost $/tonne 32.35 36.40 40.13 44.49 48.53

Capital Cost $millions 7.3 8.2 9.1 10.0 10.9

Mine Life Mt 1.42 1.60 1.78 1.96 2.13

NPV Units -20% -10% Base +10% +20%

- --------------------------------------------------------------------------------

Gold Price $millions (8.5) (0.8) 7.0 14.8 22.5

Operating Cost $millions 19.4 13.2 7.0 0.8 (5.4)

Capital Cost $millions 8.6 7.8 7.0 6.2 5.4

Mine Life $millions 3.9 5.0 7.0 8.0 8.7

1-6

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

FIGURE 1-1 CASH FLOW SENSITIVITY GRAPH

CONCLUSIONS

Based on our review, RPA concludes that:

o The procedures used in assaying, and Mineral Reserve and Mineral

Resource estimation, are in keeping with industry standards, and are

appropriate for the deposit and mining methods.

o The resource and reserve blocks might be better outlined by using the

Contour Method of estimating Mineral Resources, in order to better

represent grade distribution.

o RPA concurs with Glencairn's Life of Mine Plan (LOMP) for five years

commencing January 1, 2005, and believes that the production targets

are achievable. Annual production should average 48,000 ounces per

year over the remaining five years of reserves.

o Maintaining stability of the hangingwall will be crucial to

successfully mining the Santa Pancha deposit

o The LOMP cash flow is most sensitive to gold price and operating cost.

o Glencairn has identified a number of promising exploration targets. In

RPA's view, continued follow up drilling and surface exploration are

warranted.

1-7

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

o There is good potential for the discovery of additional gold veins

with similar mineralization as at Talavera

o Some of the RPA check assay values are slightly higher than the Limon

laboratory results. The differences are considered to be due to the

variability in gold between the two halves of the core, and are not

cause for concern, in RPA's view.

RECOMMENDATIONS

RPA recommends that:

o Ongoing exploration efforts continue, with the goal of extending the

mine life by conversion of resources to reserves, and by delineating

extensions to existing veins in the immediate mine area.

o Ongoing exploration efforts continue to test the Santa Rosa-Uval

target and other target areas by drilling

o Glencairn continue with detailed mine planning for the Santa Pancha

deposit, including options for varying amounts of hangingwall

exposure, and evaluation of the impact on operating costs.

o Minimum mining width be investigated by measurement of existing stopes

at Talavera, and that the results be incorporated into Mineral Reserve

estimation procedures.

o A contingency be applied to Santa Pancha capital requirements. .

o A geomechanics expert be consulted when development provides access to

the Santa Pancha hangingwall.

1-8

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

TECHNICAL SUMMARY

PROPERTY STATUS

Glencairn holds interests in 14 mineral concessions in northwestern

Nicaragua. The Mineral Concessions are located approximately 100 km (straight

line) northwest of Managua, the capital of Nicaragua. Production from the Limon

Mine is subject to the following royalties:

o A 3% net smelter royalty (NSR) to IAMGOLD Corporation (IAMGOLD), on

the mineral production from the Limon Mine and any other production

revenue in the future, obtained from the Limon Mine Concession and the

other mineral concessions, including La India, that were formerly part

of the original El Limon-La India exploration concession. The IAMGOLD

royalty does not apply to the Espinito-San Pablo and the Soledad de la

Cruz concessions.

o A royalty equal to 5% of the net profit of Triton Mining (USA) LLC

(Triton USA) is due to Internacional de Comercial S.A. (IDC). Triton

USA is a subsidiary of Glencairn which holds a 47.5% interest in the

Limon Mine.

o A 3% NSR on gold production, payable to the Government of Nicaragua.

The Talavera and Santa Pancha gold deposits are located within the 12,000

ha Mina El Limon mineral concession that has a term of 25 years, expiring in

2027. The property straddles the boundary of the municipalities of Larreynaga

and Telica of the Department of Leon and the municipalities of Chinandega and

Villa Nueva of the Department of Chinandega.

TMSA is the direct owner of the surface rights that underlie all of its

current mining, milling, tailings and related facilities and infrastructure at

the Limon Mine. When necessary, access agreements are negotiated and signed with

the individual surface owners for other areas within the concession not owned by

the Company. RPA understands that permits required for current mining and

milling operations, and for exploration activities are in place. Glencairn

reports that an Environmental Impact Study for mining of the Santa Pancha

deposit has been submitted and approved, and an operating permit was issued on

January 31, 2005.

1-9

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

The original purchase of the mineral concessions was made by Minera de

Occidente S.A., (subsequently renamed TMSA). TMSA is owned 47.5% by Triton

Mining Corporation (Triton), 47.5% by Triton USA, and 5% by Inversiones Mineras

S.A. (IMISA), a holding company representing the unionized mine workers of

Nicaragua. Glencairn's 95% interest in the concessions is from its 100%

ownership of Triton and Triton USA acquired as a result of a merger with Black

Hawk Mining Inc. in October 2003.

TMSA is not responsible for any type of environmental damage caused prior

to the time at which it took possession of the Limon Mine in 1994, but is

required to implement the necessary changes to reduce any existing environmental

problems. According to the existing Central Bank regulations, TMSA may freely

export and sell the gold produced and the proceeds may be repatriated without

restriction.

LOCATION AND ACCESS

The Mina El Limon mineral concession is situated along the eastern margin

of the Nicaragua Depression. The property lies within the relatively flat

lowlands of the depression itself, but contains hills with moderate relief.

Access to the Limon mine area is by paved road (approximately 125 km from

Managua) and approximately 15 km by all-season gravel road to the Village of El

Limon. The total road distance from Managua is 140 km. The Talavera underground

mine is situated approximately 4 km west of the Village of El Limon, and the

Santa Pancha deposit is situated approximately 5 km east of that village. Both

areas are accessible by gravel roads from the Limon mine site.

The climate in northwestern Nicaragua is tropical with a hot, wet season

from May through November and hotter, dry season from December through to April.

The mean annual temperature is 27(degree) C with an average annual precipitation

of two metres. The Limon Mine operates year round and is not normally affected

by the typical seasonal climatic variations.

1-10

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

Electrical power for the Limon Mine operations is obtained from the

Nicaraguan national grid system with backup generators at the mine site. Water,

both industrial and potable, is drawn from local sources.

The three villages of Limon, Santa Pancha and Minvah, all located within

the mine concession, have a population of approximately 10,000 people including

many of the mine employees. Transportation to the Limon Mine is by private

vehicles and public and company buses.

The Mina El Limon mineral concession is in an area of low to moderate

relief that offers flat areas for mine infrastructure. Elevations of the mine

property range from 40 m to 300 m above mean sea level. The area is covered with

sparse vegetation consisting predominantly of grasslands and scrub brush with

widely spaced trees.

HISTORY

Historic mining and prospecting activities in the Limon district of

northwestern Nicaragua, which hosts the Limon and other gold deposits, date back

to the late 1850s. Modern mining and exploration started in 1918. Mine

production was intermittent from the 1850s to 1941, and the exact amount of gold

production is unknown for this period. Since 1941, continuous production over 63

years has amounted to more than 2.8 million ounces of gold and an unrecorded

quantity of silver (as a by-product) has been produced. Much of this production

was when the mine was under the control of Noranda Mines. Production rates in

this period started at 200 tons per day and increased to 345 tons per day.

Within the Limon Mine concession gold production has come from three

sources. These are:

o Limon vein system,

o Santa Pancha-Panteon vein system, and

o Talavera vein system.

1-11

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

Minor production has also come from three other sources, namely;

Atravesada: (within Limon concession, with production of approximately 11,000 oz

Au); Rincon de Garcia (approximately 23,800 oz Au) and; Mina de Agua

(approximately 46,600 oz Au). The latter are situated some 20 km north of the

Limon Mine.

GEOLOGICAL SETTING AND MINERALIZATION

The geomorphology of Nicaragua consists of three major terranes. A

northwest striking graben, 30 km to 40 km wide, parallels the Pacific coastline

along the western margin of the country. This graben hosts up to 16 active or

recently active volcanoes and is the site of thick Quaternary to Recent volcanic

deposits. To the southwest, between the graben and the Pacific coast, a 10 km to

20 km wide belt of Tertiary, Mesozoic and Palaeozoic rocks are preserved. To the

northeast of the graben; the Tertiary, Mesozoic and Palaeozoic "basement" is

overlain by a major unit of Tertiary volcanic rocks, the Coyol

(Miocene-Pliocene) and Matagalpa (Oligocene-Miocene) Groups. The Coyol Group

hosts the known vein gold deposits in Nicaragua, including those at El Limon and

La India.

The Limon Mine is located along the eastern edge of the Nicaragua graben

within an area of low hills that contrast with the level plain of the graben

floor. Approximately 50% of the area in the general vicinity of the mine is

covered by a thin layer of Quaternary to Recent deposits of volcanic ash and

alluvium. The Mina El Limon mineral concession is underlain predominantly by

volcanic strata that are correlated with the Miocene-Pliocene Coyol Group that

is present over extensive areas of western Nicaragua.

Coyol Group rocks, exposed on the Mina El Limon mineral concession, range

from intermediate to felsic volcanic and volcaniclastic rocks that are cut by

minor intermediate to felsic hypabyssal intrusive bodies. From lowest to highest

in stratigraphic section, these rocks are as follows:

o Interstratified, massive porphyry flows and coarse volcaniclastic

rocks of intermediate composition

o Intermediate to felsic flows, domes and minor tuffs and epiclastic

rocks.

1-12

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

o Weakly stratified, intermediate to felsic tuffs and epiclastic rocks

o Massive to flow-banded, intermediate porphyritic flows.

The above units appear to be conformable and generally strike east to

northeast and dip gently south with local variability common.

Deformation is dominated by normal faulting with little evidence for

significant internal deformation of intervening fault blocks. The faults

commonly trend northeast with moderate to steep dips to the northwest as well as

southeast. A second group of faults strikes north to west-northwest, dipping

steeply to the east and/or to northeast. Apparent displacements on these faults

are tens to several hundreds of metres.

Gold mineralization in the Limon district is typical of low-sulphidation,

quartz-adularia, epithermal systems. These deposits were formed at relatively

shallow depth, typically from just below the surface to a little over one

kilometre deep, from reduced, neutral-pH hydrothermal fluids with temperatures

of (less than) 150o C to 300o C. The volcano-plutonic arc of western Nicaragua

is a common tectonic setting for these deposits. From bottom to top, the

hydrothermal alteration and the associated gold and/or sulphide mineralization

along the mineralized structures is described, as follows:

o Barren to low-grade ((less than) 1 g/t Au) structurally (fault)

controlled and constrained quartz vein, and/or hydrothermal breccias

and quartz stockworks, often with late-stage coarse-grained calcite

veining. No base metal zone is evident at Limon. Wall rock alteration

is normally minimal.

o Ore grade gold mineralization hosted in quartz veins and multi-phased

quartz breccia veins (+/- adularia, +/- pyrite less than 1%). Wall

rock alteration is absent to restricted at depth, but increasing in

width and extent near the tops of veins, in part dependent on wall

rock permeability.

o Clay alteration of variable extent and intensity, depending on wall

rock permeability and fracturing, occurs in a broader zone at the tops

and above the mineralized veins. The clay zone is zoned outward and

upward from higher temperature mixed layer clay minerals

(smectites/illite or smectites/chlorite) to lower temperature

smectites that is often accompanied by dickite or kaolinite, and

disseminated to microvein pyrite up to several percent.

1-13

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

Occasional silicified horizons controlled by permeable lithologies

have been observed in this zone at Limon.

o A discontinuous to continuous, laterally extensive "blanket" of low

temperature quartz (opal and/or chalcedony) conforms to and occurs at

the interface as well as below the paleo-water table (below the vadose

zone). The quartz often includes fine-grained disseminated pyrite.

Clay alteration, principally kaolinite, is more common above the veins

and decreases in content, or is absent, laterally away from the veins.

o A near-surface zone of clay mineral alteration (kaolinite with or

without alunite and devoid of pyrite and other sulphide minerals) is

developed from acid-leaching (steam-heated alteration) in the vadose

zone above the paleo-water table. To date, no evidence of sinter

deposits has been observed at Limon.

Erosion over most of the Limon Property has removed tens to hundreds of

metres of the upper parts of the epithermal system. In the southern portion of

the property the epithermal system at Limon has been preserved from erosion to

the level of, and in places just above, the paleo-water table. Weathering has

imprinted supergene alteration on top of the described model.

The veins at Limon are quartz dominant with lesser and variable quantities

of calcite, and minor adularia. Pyrite is the predominant sulphide, but with an

average content of less than one percent. Trace amounts of chalcopyrite,

sphalerite, arsenopyrite, altaite, gold tellurides and native gold are also

reported to occur. Gold is present in both the banded quartz and silicified

breccias that form the veins. Gold is very fine grained and relatively uniformly

distributed throughout the higher grade parts of the veins; only once has

visible gold ever been reported on the Mina El Limon mineral concession.

The productive vein systems are approximately one to two kilometres long,

with vein widths from less than one metre up to 25 m. Individual ore-shoots

within the veins range from 60 m to 450 m long horizontally, and from 40 m to

290 m vertically. Strike orientations vary from north-northwest through

northeast to east-west, and dips are from 40o to near vertical. All economic

gold mineralization discovered and mined to date lies within 400 m of surface.

The productive and prospective elevations within the vein systems vary across

the district. Post-mineral faults locally disrupt and offset the veins.

1-14

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

EXPLORATION

Prior to 1995, prospecting was the prominent exploration tool in the Limon

area. Consequently, all but one exploration discovery of economic gold

mineralization was made from trenching and drilling of outcropping quartz veins.

Since there is no significant amount of sulphides or intense clay alteration

directly associated with the gold mineralization, there is no geophysical

response to the mineralized zones. RPA understands that a number of conventional

geophysical techniques (IP, EM, and magnetometer) have been applied in the past,

with little success.

Since 1996, exploration work at Limon has been directed at the discovery of

hidden, subparallel veins close to existing gold mineralization. In particular:

o Subparallel veins and extensions of known veins in the Talavera area

o Extensions of previously mined veins at the Limon and Santa Pancha

open pits.

Presently, Glencairn is carrying on an exploration program which consists

primarily of diamond drilling. The exploration targets are low sulphidation

epithermal quartz veins with gold mineralization, and the focus is on

exploration and resource definition around Talavera, at the south end of the

Limon vein, and on finding the source for auriferous quartz boulders at Santa

Rosa-Uval. Additional early exploration drilling has been ongoing to test a

number of the exploration targets within the Limon concession. In total, some

38,300 m of diamond drilling was completed in 2004.

Exploration drilling in 2004 at Santa Pancha outlined significant Mineral

Reserves. This included five areas, as follows:

o Pozo 1 & 2 Area: Drilling to the north of the old stope identified

some 919,200 tonnes at an average grade of 5.06 g/t Au. Glencairn is

of the opinion that this area "may not have been mined because it is

below the old cut-off grade of 10 g/t Au. There are no indications of

this resource in the old records." .

o Pozo 4: A certain amount of Inferred Mineral Resources were upgraded

to 133,100 tonnes of Probable Mineral Reserves at an average grade of

4.05 g/t Au.

1-15

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

o Pozo 5: No new drilling was conducted. The resource blocks were

re-evaluated; tonnage increased and average grade was reduced from

6.10 g/t Au to 4.51 g/t Au, for a net 10% reduction in ounces of gold.

o Pozo 8: Some 142,200 tonnes of Inferred Mineral Resources at an

average grade of 7.45 g/t Au were outlined by diamond drilling.

o Aparejo: Situated some five kilometres east of the Limon mill, old

trench data over a narrow vein have been used to generate small

reserve and resource blocks with higher average grades than at

Talavera. Glencairn plans to use this material and blend it with

production from Talavera to improve mill recovery.

Extensive areas of high-level argillic and silica alteration, along with

the presence of unexplained, high-grade, auriferous quartz boulders in the

southern portion of the Limon mineral concession indicates exploration potential

for hidden vein mineralization.

MINERAL RESERVES AND MINERAL RESOURCES

RPA carried out an audit of the Mineral Reserves and Mineral Resources at

Limon, and performed a number of checks to verify the various procedures and

numerical calculations used in earlier estimates. The RPA review of the

procedures and methodology of the Talavera and Santa Pancha Mineral Resource and

Mineral Reserve estimates comprised the following:

o Geological interpretation of the veins on sections and plans

o Database verification including sampling and assaying protocols.

o Drill core logging of six representative holes in the hangingwall (HW)

and footwall (FW) zones of the Santa Pancha deposit.

o Independent sampling of two holes (from the HW and FW) of the Santa

Pancha deposit and on an underground level of the Talavera deposit.

o Visit to the areas of the Santa Pancha mineral resources and

underground openings of the Talavera Mine

o Resource estimation procedures and methodology, including cutting of

high assays, minimum vein thickness, projection of drill hole and

underground assay data on vertical longitudinal sections with resource

block outlines, and spreadsheet for calculation and summary of

resource blocks.

1-16

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

o Classification of Mineral Reserves and Mineral Resources

o Preliminary mine plan, cost estimate and cut-off grades.

o Check estimate of some zones using the Contour Method.

With few exceptions, RPA found that values and compilations of gold grades

were accurately recorded and calculated as provided on sections and plans. RPA

is of the opinion that the Glencairn resource and reserve estimates are in

accordance with the Mineral Resource/Reserve Classification as recommended by

the CIM Committee on Mineral Resources/Reserves.

INDEPENDENT SAMPLING BY RPA

RPA collected a total of nine (9) samples, four from underground workings

of the Talavera Vein and five samples of split core from diamond drill holes

which have tested the Santa Pancha deposit, and sent them to SGS Laboratories in

Don Mills, Ontario, for independent assays for gold.

The RPA samples confirm the presence of gold and silver values at

essentially the same order of magnitude as the Limon laboratory assays. The

differences are considered to be due to the variability in gold between the two

halves of the core, and are not cause for concern, in RPA's view.

MINING AND MILLING OPERATIONS

The mining methods used at Talavera are longitudinal open stoping for the

primary stopes and sub-level retreat for pillar recovery. Stopes are backfilled

with unconsolidated development waste. Development of most mining areas is from

the top down; sill pillars are left at regular intervals between longhole

blocks.

The Santa Pancha deposit will be mined using cut and fill methods, with

unconsolidated waste fill coming from mine development and nearby open pit

operations. Development began in January 2005, with the first round taken to

establish a portal.

1-17

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

Mine planning is at a preliminary stage. Glencairn intends to develop detailed

stope layouts, ventilation plans, and rock stability testing.

Mining operations are fully mechanized. The mine equipment is adequate to

support the current 1,150 tonnes per day operation.

The Limon mill is a nominal 1,000 tonnes per day CIP gold recovery plant.

It has demonstrated a capacity of 1,200 tonnes per day. The production records

for the past four years, as well as the forecast for the next six years are

summarized in Tables 1-4 and 1-5:

TABLE 1-4 PRODUCTION HISTORY

Glencairn Gold - Limon Mine

Units 2001 2002 2003 2004

- -----------------------------------------------------------------------

Mill feed (`000 t) 349 315 284 341

Head Grade (g/t Au) 7.0 6.2 5.7 5.1

Recovery (%) 86.3 86.8 88.1 84.6

Gold Recovered (oz) 70,351 55,388 45,851 46,135

Source: Glencairn, 2005.

1-18

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

TABLE 1-5 LIMON LIFE OF MINE PLAN

Glencairn Gold - Limon Mine

Units 2005 2006 2007 2008 2009 2010 Total

- --------------------------------------------------------------------------------------

Talavera (`000 t) 265 173 83 41 54 73 688

Grade 5.7 5.3 5.7 5.2 5.4 7.1 5.7

Santa Pancha ('000 t) 170 260 302 290 1,022

Grade 5.3 5.0 4.7 4.9 4.9

Open Pit ('000 t) 67 67

Grade (g/t Au) 3.6 3.6

Mill ('000 t) 332 343 343 343 343 73 1,777

Grade (g/t Au) 5.2 5.3 5.2 4.8 5.0 7.1 6.2

Recovery (%) 85.0 86.4 87.1 87.5 87.4 85.0 86.6

Gold (oz) 47,600 50,500 49,800 46,000 47,900 14,000 256,000

Source: Glencairn, 2005.

Glencairn reports that it conducts Limon operations in compliance with all

applicable environmental requirements and further reports that it has not

received any noncompliance orders from regulators.

EXPLORATION POTENTIAL

The Limon Mine is a gold producer and on-going exploration by Glencairn

continues to extend known zones of gold mineralization along strike of the

Talavera Oeste Principal Vein, near the western extension of the Talavera Main

Vein. Recent drilling and prospecting around the Limon mine area has discovered

new target areas within zones of hydrothermal alteration. The most prominent of

these are:

o West of Talavera: The primary target is the extension of the Talavera

Sur structure. A significant intersection of 18.8 g/t Au over 7.3 m

(true width) in

1-19

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

quartz vein is reported from Drill Hole 3301. This is along the

projected southwest extension of the Talavera Sur structure.

Underground holes previously drilled to test the extension of the

Talavera Sur target resulted in encountering the new Talavera III

(TIII) Vein. Recent drilling included Hole 3300, which intersected two

adjacent zones of 4.3 g/t Au over 2.3 m (true width) and 7.6 g/t Au

over 2.7 m (true width). These intersections are interpreted to

represent the HW and FW segments of the TIII vein, adjacent to the

Victoria Vein.

o Victoria Area: Glencairn reports high-grade intersections of 15.8 g/t

Au over 36.0 m, at a depth of approximately 300 m below the surface,

in Drill Hole 3235, and 7.7 g/t Au over 15.8 m in Drill Hole 3211.

Both drill holes are situated along the flank of hydrothermal

alteration along a ridge, some 5 km west of the Limon mill. Glencairn

is investigating the significance of this intersection in terms of

using it as a guide for over-all exploration in the area.

o Santa Rosa-Uval Target: Sampling of mineralized boulders has also

detected a gold- and clay-mineral anomalous zone in an area 1.5 km to

3 km southwest of the Limon mill. Glencairn considers this to be a

prominent target area because of:

o The presence of shallow/high level clay and silica alteration,

which may indicate the presence of hidden veins.

o The presence of up to 100 auriferous quartz boulders, with

maximum value of 13 g/t Au in grab samples.

o Anomalous values ranging from 0.1 g/t Au to 0.5 g/t Au and up to

8 g/t Ag in selective sampling of scattered quartz microveins in

outcrops

o East of SEO: Drilling in this area near the main Talavera Vein

suggests that the structure remains open to the northeast.

o Pozo Bono Extension: Two holes have tested this area with one hole

intersecting 10.15 g/t Au over 1.0 m. Follow-up drilling is planned.

o Babilonia Sur: Diamond drilling in the past had intersected a wide

zone of low-grade gold, of 0.56 g/t Au over 15.6 m, with intervening

higher grades. Follow-up drilling did not replicate earlier results.

Compilation of historical drill data indicates that the initial

follow-up drilling was poorly placed to test this target; hence, it

remains a valid exploration target for the future. Glencairn also

reports that this wide intersection is likely in a hole drilled down

dip of the vein.

1-20

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

2 INTRODUCTION AND TERMS OF REFERENCE

In a proposal dated December 10 2004, Roscoe Postle Associates Inc. (RPA)

was retained by Mr. Michael B. Gareau, Vice-President, Exploration of Glencairn

Gold Corporation (Glencairn), to prepare an independent Technical Report on the

Limon gold mine in northern Nicaragua. The purpose of this report is to provide

our independent assessment of the Mineral Resources and Mineral Reserves of the

Talavera and Santa Pancha deposits, and to review Glencairn's Life of Mine Plan.

The Technical Report is required to be conformable to NI 43-101 Standards of

Disclosure for Mineral Projects. RPA visited the property from November 2 to 4,

2004, and January 18 to 20, 2005.

Glencairn is a reporting issuer listed at the Toronto Stock Exchange (TSX).

The company, through its 95% interest in Triton Minera S.A. (TMSA), owns and

operates the Mina El Limon -within the Limon mineral concession - and holds 13

exploration-stage mineral concessions located in northwestern Nicaragua. TMSA,

through its 40% interest in Inversiones La India, S.A., holds a 40% interest in

the Espinito-San Pablo mineral concession enclosed by the La India concession.

TMSA's 14 mineral concessions have 25-year terms, expiring in 2027. The

concessions, which cover a total area of approximately 81,380 ha, comprise:

o A producing gold mine - Limon Mine, which includes the Talavera

underground mine, the Santa Pancha project, some small open pits, an

1,100 tpd mill, a tailings impoundment area, and related

infrastructure. The Limon mine property consists of the 12,000 ha Mina

El Limon mineral concession.

o The formerly producing La India Mine and concessions. These consist of

three concessions, located some 40 km east of the Mina El Limon

mineral concession.

o A number of other exploration concessions at early stages of

exploration. These consist of ten mineral concessions and are located

to the north of the Limon Mine as well as between El Limon and La

India districts.

2-1

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

This report discusses only the Mina El Limon mineral concession and its

contained Mineral Reserves and Mineral Resources. The concession hosts numerous

lowsulphidation quartz-adularia veins with gold and silver mineralization. The

veins vary in thickness from less than one metre to five metres, extend more

than one kilometre along strike, and may extend up to 300 metres at depth.

Information for this Technical Report, supplied by Glencairn, was collected

during two site visits by RPA to the Limon mine. Technical documents and other

sources of information are listed at the end of this report. Dr. William E.

Roscoe, P.Eng., Consulting Geologist and Principal of RPA, visited the Limon

Mine from November 2 to 4, 2004. He toured the Santa Pancha area and reviewed

procedures and methodology related to the mineral resource estimate. The second

RPA site visit is described below.

The Qualified Persons for the Technical Report and their involvement are:

o Hrayr Agnerian, M.Sc (Applied), P.Geo., Consulting Geologist with RPA,

visited the Limon Mine from January 18 to 21, 2005 , including the

underground operations at the Talavera deposit and the surface

exposures of the Santa Pancha deposit. Mr. Agnerian is responsible for

the property status, geological, exploration, and mineral resource and

reserve parts of the Technical Report.

o Jason Cox, P.Eng, Senior Mining Engineer with RPA, also visited the

Limon Mine from January 18 to 21, 2005, including the underground

operations at the Talavera deposit and the surface exposures of the

Santa Pancha deposit. Mr. Cox is responsible for the mining,

processing, environmental, and economic analysis sections of the

Technical Report.

This report is prepared in accordance with the requirements of National

Instrument 43-101 (NI 43-101) of the Ontario Securities Commission (OSC) and the

Canadian Securities Administrators (CSA).

In preparation of this report, the authors reviewed technical documents and

reports on the Limon Mine supplied by Glencairn. Messrs. Agnerian and Cox also

held discussions with Glencairn staff and other professionals knowledgeable on

the project including:

2-2

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

o Michael Gareau, P.Geo., Vice President Exploration, Glencairn

o James Watt, P.Eng., Mine Manager, TMSA

o Kenneth T.J. Atkin, Chief Geologist, TMSA

o Pablo Venturo, Chief Engineer, TMSA

o Isidro Aguirre Salgado, Exploration Geologist, Santa Pancha Project,

TMSA

o Manuel Osorio Vega, Mine Geologist, TMSA

o Armando Tercero, Exploration Manager, TMSA

o Aquiles Quintana, Computer Technician, TMSA

o Bayardo Padilla Perez, Laboratory Manager, TMSA

For this report, RPA has carried out some independent sampling of an

underground opening along the Talavera Vein, and two diamond drill holes (cut

core) from the Santa Pancha deposit area. RPA sent these samples for independent

assays at a Canadian laboratory. RPA has not searched title to the property, and

has relied on technical data contained in reports of past exploration, mining

and development work and title documents supplied by Glencairn.

The key technical documents reviewed by RPA for this report are:

o The report entitled "Technical Report on the Nicaragua Properties of

Black Hawk Mining Inc." by RPA, dated August 12, 2003.

o The report entitled "Technical Report of the Santa Pancha Resource

Estimate for the Limon Mineral Concession of Nicaragua" by Michael B.

Gareau of Glencairn, dated November 24, 2004.

o Glencairn's estimate of the Limon Mineral Reserves and Mineral

Resources reported as of December 31, 2004, and the Life of Mine Plan.

2-3

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

3 DISCLAIMER

This report has been prepared by RPA for Glencairn Gold Corporation

(Glencairn). The information, conclusions, opinions, and estimates contained

herein are based on:

o Information available to RPA at the time of preparation of this

report,

o Assumptions, conditions, and qualifications as set forth in this

report, and,

o Data, reports, and other information supplied by Glencairn and its

subsidiary, Triton Minera S.A. (TMSA).

For technical information on the Talavera and Santa Pancha deposits, RPA

has relied on some reports by Glencairn and TMSA, as well as by other

consultants. RPA has not verified the technical information in these reports,

but has formed its opinions on the geological continuity of the mineralized

zones at Talavera and Santa Pancha, primarily on the basis of this technical

information. RPA has visited the Talavera and Santa Pancha deposits and has

taken independent samples.

While it is believed that the information contained herein is reliable

under the conditions and subject to the limitations set forth herein, this

report is based in part on information not within the control of RPA and RPA

does not guarantee the validity or accuracy of conclusions or recommendations

based upon that information that is outside the area of technical expertise of

RPA. While RPA has taken all reasonable care in producing this report, it may

still contain inaccuracies, omissions, or typographical errors.

3-1

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

4 PROPERTY DESCRIPTION AND LOCATION

The Limon Mine is located approximately 100 km northwest of Managua, the

capital of Nicaragua. The mine is adjacent to several small villages. Glencairn

holds interests in 14 mineral concessions in the area, covering a total of

approximately 81,380 ha (Table 41 and Figures 4-1 and 4-2).

LAND TENURE

The original purchase of the concessions was made by Minera de Occidente

S.A., subsequently renamed Triton Minera S. A. (TMSA). TMSA is owned by Triton

Mining Corporation (47.5%) and Triton Mining (USA) LLC (47.5%), both

subsidiaries of Glencairn (acquired as a result of a merger with Black Hawk

Mining Inc., in October 2003), and by Inversiones Mineras S. A. (5%), a holding

company representing the unionized mine workers of Nicaragua. Production from

the Limon Mine is subject to the following royalties:

o A 3% net smelter royalty (NSR) to IAMGOLD Corporation (IAMGOLD), on

the mineral production from the Limon Mine and any other production

revenue in the future, obtained from the Limon Mine Concession and the

other mineral concessions, including La India, that were formerly part

of the original El Limon-La India exploration concession. The royalty

was acquired by Repadre Capital Corporation (Repadre) in 1994, and

transferred to IAMGOLD upon their 2003 merger with Repadre. The

IAMGOLD royalty does not apply to the Espinito-San Pablo and the

Soledad de la Cruz concessions.

o A royalty equal to 5% of the net profit of Triton Mining (USA) LLC

(Triton USA) is due to Internacional de Comercial S.A. (IDC). Triton

USA is a subsidiary of Glencairn which holds a 47.5% interest in the

Limon Mine.

o A 3% NSR on gold production, payable to the Government of Nicaragua.

MINERAL CONCESSIONS

From 1994 until the beginning of 2002, the Limon Mine property and the

other properties were held as exploitation concessions under the previous mining

code. The Nicaraguan government enacted a new mining code and regulations

(Mining Code) in

4-1

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

2001. All holdings under the new Mining Code are classified as mineral

concessions. TMSA applied for and was granted, under the Mining Code, the

conversion of the old exploitation concessions to new mineral concessions in

January 2002. The new concessions, except for the Mina El Limon concession, were

configured somewhat differently than the old concessions and some of the

exploration area was reduced. The reconfigured concessions are shown in Table

4-1 and Figure 4-2.

Under the new 2001 Mining Code and regulations, the new mineral concessions

have a term of 25 years. Each concession is subject to an agreement (Acuerdo

Ministerial) issued by the government of Nicaragua. Administration of the

concessions is more flexible with the new Mining Code that allows for

amalgamation, division, and reduction of the concessions. Mineral concessions

are subject annually to surface taxes payable as two advanced instalments in

January and July of each year, starting from the granting dates in 2002, and

adjusted for any reductions in concession area. The tax rates are as follows:

o Year 1: $0.25 per hectare

o Year 2: $0.75 per hectare

o Years 3 and 4: $1.50 per hectare

o Years 5 and 6: $3.00 per hectare

o Years 7 and 8: $4.00 per hectare

o Years 9 and 10: $8.00 per hectare

o Years 11 to 25: $12.00 per hectare

Under the Mining Code, all mineral concessions include the rights to

explore, develop, mine, extract, export, and sell the mineral commodities found

and produced from the concession. TMSA is required to submit annual reports of

its activities and production statistics to the government, as well as quarterly

reports on its exploration activities. RPA understands that TMSA is in

compliance with all tax payments and report filings (Gareau, 2004).

4-2

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

TABLE 4-1 MINERAL CONCESSIONS LIST

Glencairn Gold - Limon Mine

Certified and

Applicable Ministerial Effective Area TMSA

Concession Name Agreement Tax Date (ha) Equity(%) Tax Year

- --------------------------------------------------------------------------------------

Mina El Limon 185-RN-MC/2002 & 16-Apr-02 12,000 100 3

196-RN-MC/202

Espinito - San Pablo 186-RN-MC/2002 & 16-Apr-02 350 40 3

196-RN-MC/202

Soledad de la Cruz 288-RN-MC/2003 16-Jan-02 780 100 4

San Juan de Limay 290-RN-MC/2003 16-Jan-02 5,100 100 4

San Juan de Limay

La Grecia 291-RN-MC/2003 16-Jan-02 1,700 100 4

San Juan de Limay

Paso Real 292-RN-MC/2003 16-Jan-02 900 100 4

La India 293-RN-MC/2003 16-Jan-02 9,330 100 4

Sauce 1 294-RN-MC/2003 16-Jan-02 5,800 100 4

Sauce 2 295-RN-MC/2003 16-Jan-02 600 100 4

Sauce 3 296-RN-MC/2003 16-Jan-02 1,500 100 4

Sauce 4 297-RN-MC/2003 16-Jan-02 700 100 4

Villanueva 1 298-RN-MC/2003 16-Jan-02 5,220 100 4

Villanueva 2 299-RN-MC/2003 16-Jan-02 15,500 100 4

Bonete Limon 300-RN-MC/2003 16-Jan-02 21,900 100 4

- --------------------------------------------------------------------------------------

TOTAL 81,380

4-3

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

MINA EL LIMON MINERAL CONCESSION

The Talavera and Santa Pancha gold deposits are located within the 12,000

ha Mina El Limon mineral concession that has a term of 25 years, expiring in

2027 (Table 4-1 and Figure 4-3). The property straddles the boundary of the

municipalities of Larreynaga and Telica of the Department of Leon and the

municipalities of Chinandega and Villa Nueva of the Department of Chinandega

(Gareau, 2004).

TMSA owns, or controls through lease arrangements, the surface rights

needed for current mining, milling, tailings and related facilities, and

infrastructure at the Limon Mine (Figure 4-3). When necessary, access agreements

are negotiated and signed with the individual surface owners for other areas

within the concession not owned by the Company. RPA understands that all of the

permits required for mining and milling operations, and for exploration

activities are in place (Gareau, 2004).

TMSA is not responsible for any type of environmental damage caused prior

to the time at which it took possession of the Limon Mine in 1994, but is

required to implement the necessary changes to reduce any existing environmental

problems. According to the existing Central Bank regulations, TMSA may freely

export and sell the gold produced and the proceeds may be repatriated without

restriction (Gareau, 2004).

4-6

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

5 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY

Access to the Limon Mine area is by paved road (approximately 125 km from

Managua) and approximately 15 km by all-season gravel road to the Village of El

Limon. The total road distance from Managua is 140 km. The Talavera underground

mine is situated approximately four kilometres west of the Village of El Limon,

and the Santa Pancha deposit is situated approximately five kilometres east of

the village. Both areas are accessible by gravel roads from the Limon Mine site.

The climate in northwestern Nicaragua is tropical with a hot, wet season

from May through November and hotter, dry season from December through April.

The mean annual temperature is 27(degree) C with an average annual precipitation

of two metres. The Limon Mine operates year round and is not normally affected

by the typical seasonal climatic variations.

Nicaragua in general has a moderately developed infrastructure of

communications, roads, airports, and seaports and there is a fairly high

literacy rate among the population with an ample supply of skilled and unskilled

labour (Gareau, 2004).

The city of Leon, the second largest city in Nicaragua, is situated some 45

km southwest of the Limon Mine, and the city of Esteli is situated approximately

100 km (by road) northeast from the mine. Both of them are agro-industrial

cities. Numerous towns and villages are located throughout the area and are used

as a local base for exploration activities on the various concessions.

Infrastructure support and availability of trained miners proximal to the

various concessions is limited, except in the areas immediately adjacent to the

Limon mining operations.

The mineral concessions are situated along the eastern margin of the

Nicaragua Depression. The westernmost holdings, including the Limon mining

district, lie within

5-1

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

the relatively flat lowlands of the depression itself and the eastern holdings,

including the La India gold district, are located in the moderate to steep

relief of the mountainous Nicaraguan Highlands (Gareau, 2004).

Electrical power for the Limon operations is obtained from the national

grid system with backup generators at the mine site. Water, both industrial and

potable, is drawn from local sources.

The three villages of Limon, Santa Pancha and Minvah, all located within

the mine concession, have a population of approximately 10,000 people including

many of the mine employees. Transportation to the Limon Mine is by private

vehicles and public and company buses.

The Mina El Limon mineral concession is in an area of low to moderate

relief that offers flat areas for mine infrastructure. Elevations of the mine

property range from 40 m to 300 m above mean sea level. Outcrops are not common

in the area but do occur along road cuts. Overburden thickness ranges from one

metre to three metres with an average thickness of approximately 1.5 m.

Overburden consists of unconsolidated conglomerate with pebbles and boulders of

volcanic rocks in a matrix of sand and minor clay. A layer of recent volcanic

ash may also comprise part of the overburden.

The area is covered with sparse vegetation consisting predominantly of

grasslands and scrub brush with widely spaced trees. The land around the Limon

Mine is used for agriculture. The villages in the area use the land to raise

cattle, but it is not used to grow crops. Wildlife in the area includes various

species of insects, lizards, snakes, armadillos, birds, and small mammals.

5-2

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

6 HISTORY

LIMON MINE AREA

Historic mining and prospecting activities in the Limon district of

northwestern Nicaragua, which hosts the Limon Mine and other gold deposits, date

back to the late 1850s. Modern mining and exploration started in 1918 and, since

then, approximately 2.8 million ounces of gold and an unrecorded quantity of

silver (as a by-product) have been produced from the mine concession area. The

present mining operations have been essentially continuous since start-up in

1941.

From 1941 to 1979, just over 2.0 million ounces were recovered from 4.1

million tonnes of ore while the Limon Mine was under the control of Noranda

Mines. Production rates in this period started at 200 tons per day and increased

to 345 tons per day. The following is a brief account of mining and exploration

in the area:

o In 1979 the Sandinistas nationalized the Limon Mine. Production under

national control was reported as 280,000 oz Au from an estimated 1.9

million tonnes of ore. The Limon Mine remained under national control

until privatization in March 1994, when Triton acquired control.

Triton increased production to 1,000 tonnes per day in 1995.

o In May 1998 Triton was acquired by Black Hawk Mining Inc. (Black

Hawk), in a share-for-share exchange resulting in Black Hawk's 95%

interest in the Limon Mine. Production from March 1994 to the end of

2002 totals 455,000 ounces of gold from 2.6 million tonnes of ore.

o In October 2003, Black Hawk merged with Glencairn, in a

share-for-share exchange. Production for 2003 and 2004 totaled 92,000

ounces of gold from 625,000 tonnes of ore.

Mine production has come from three areas on the Mina El Limon mineral

concession:

o The Limon vein located adjacent to the mill in the central part of the

concession

o The Santa Pancha-Panteon vein system located 5 km to the east of the

Limon mill

o The Talavera mine located 3.5 km west of the Limon mill

6-1

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

Currently, mining is active in the Talavera area where several veins are

being mined underground via decline with truck haulage to the mill. The mining

and processing operations are described in more detail in later sections of this

report.

The Limon gold district has a long history of exploration by the various

operators, including the completion of approximately 370,000 m of diamond

drilling in more than 3,300 drill holes to date. The most recent drilling is

described in the Exploration section.

OTHER MINERAL CONCESSIONS

The only records of commercial production within the 13 other concessions

in the Limon area are from mining operations at the La India Mine, Mina de Agua

and Rincon de Garcia. The latter two ran as an extension of Noranda's Limon

operations. The ore from these mines was trucked 22 km south for processing in

the Limon mill. This area was initially identified in the 1860s, and

rediscovered in 1967. At La India, some 575,000 ounces of gold were produced

from 1938 to 1955 (Gareau, 2004).

Gold production by guirisero (artisanal miners) has been carried out for

decades in various areas throughout northwestern Nicaragua.

Noranda conducted gold exploration over various parts of the present

concessions during the 1960s and 1970s that included mapping, prospecting,

geochemistry, and locally, trenching and drilling. In the 1980s, the Nicaraguan

Government undertook site-specific exploration activity, such as the work at La

India, Mina de Agua and Rincon de Garcia, through Corporacion Nicaraguense de

Minas (INMINE), with the assistance of Soviet technical advisors.

Triton was active from 1994 through to 1997, and, more recently, Newmont

Mining Corporation (Newmont) from 2000 to 2002, under a letter of intent with

Black Hawk. Newmont's program was focussed primarily on bulk mineable gold

targets that included a combination of reconnaissance work and prospect specific

geophysics and drilling

6-2

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

within the Bonete Concession, adjacent to and northeast of the Limon Concession.

The drilling did not find a source for the widespread gold-bearing quartz

boulders identified at Bonete.

Table 6-1 provides a summary of the most noteworthy historical mining and

exploration activities associated with the current concessions outside of the

Limon and La India districts.

6-3

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

TABLE 6-1 HISTORICAL PRODUCTION AND EXPLORATION ON OTHER CONCESSIONS

Glencairn Gold - Limon Mine

Year Company Locale Concession Comments

- -----------------------------------------------------------------------------------------------

Commercial mining:

1976-1988 Noranda Rincon de Garcia Villanueva 2 300,000 t @ 11.0 g/t Au

1972-1976 Noranda Mina de Agua Villanueva 2 105,000 t @ 14.7 g/t Au

575,000 oz Au production,

1938-1355 Noranda La India La India from 1.7 million tons @0.39

oz/ton Au

1870s Mina de Agua Villanueva 2 Limited production

Guiriseros Activity:

1970-2003 Guiriseros Cerro Quemado Villanueva 1 Surface and underground

1920s Guiriseros La Grecia San Juan de Underground workings

Limay-La Grecia

Recent Guiriseros Various San Juan de Limay Various surface workings

Exploration Activity:

2000-2002 Newmont Bonete Bonete-Limon Sampling, pits, geophysics,

drilling

2000-2002 Newmont Regional All Stream and rock sampling,

prospecting

1996-1997 Triton Rincon de Garcia Villanueva 2 Geochemistry, trenching

Mina de Agua

1996-1997 TVX La India La India Trenching, drilling &

underground sampling

1994-1995 Triton Cerro Colorado San Juan de Limay Trench sampling

1994-1997 Triton Regional Various Stream and rock sampling,

prospecting

1994-1995 Triton Cerro Quemado Villanueva 1 Mapping, geochemistry,

trenching

Mapping, geochemistry,

1983-1991 INMINE La India La India geophysics, trenching &

drilling

1982-1986 INMINE Mina de Agua Villanueva 2 Mapping, geochemistry,

geophysics, drilling

1970s Noranda Cerro Quemado Villanueva 1 Drilling

1960-70s Noranda Regional Various Geochemistry, prospecting

Source: Glencairn, 2005.

6-4

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------

7 GEOLOGICAL SETTING

REGIONAL GEOLOGY

The geomorphology of Nicaragua consists of three major terranes. A

northwest striking graben, 30 km to 40 km wide, parallels the Pacific coastline

along the western margin of the country and is known as the Nicaragua Depression

(Figure 7-1). This graben hosts up to 16 active or recently active volcanoes and

is the site of thick Quaternary to Recent volcanic deposits. To the southwest,

between the graben and the Pacific coast, a 10 km to 20 km wide belt of

Tertiary, Mesozoic and Palaeozoic rocks are preserved. To the northeast of the

graben, Tertiary, Mesozoic and Palaeozoic "basement" is overlain by a major unit

of Tertiary volcanic rocks, the Coyol (Miocene-Pliocene) and Matagalpa

(Oligocene-Miocene) Groups. The Coyol Group hosts the known vein gold deposits

in Nicaragua, including those at El Limon and La India (Gareau, 2004).

LOCAL GEOLOGY

The Limon Mine is located along the eastern edge of the Nicaragua

Depression within an area of low hills that contrast with the level plain of the

graben floor. Approximately 50% of the area in the general vicinity of the mine

is covered by a thin layer of Quaternary to Recent deposits of volcanic ash and

alluvium. The Mina El Limon mineral concession is underlain predominantly by

volcanic strata that are correlated with the Miocene-Pliocene Coyol Group that

is present over extensive areas of western Nicaragua (Gareau, 2004).

Coyol Group rocks exposed on the Mina El Limon mineral concession range

from intermediate to felsic volcanic and volcaniclastic rocks that are cut by

minor intermediate to felsic hypabyssal intrusive bodies. Several generations of

mapping in Limon district have roughly divided the Coyol Group rocks into local

units that, from lowest to highest in stratigraphic succession, are as follows:

o Interstratified, massive porphyry flows and coarse volcaniclastic

rocks of intermediate composition

7-1

ROSCOE POSTLE ASSOCIATES INC. www.rpacan.com

- --------------------------------------------------------------------------------