QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on February 11, 2005

Registration No. 333-

Securities and Exchange Commission

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

COFFEYVILLE RESOURCES, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | | 2911 | | 22-2269010 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

10 East Cambridge Circle Drive

Kansas City, Kansas 66103

(913) 982-0500

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Philip L. Rinaldi

Coffeyville Resources, Inc.

10 East Cambridge Circle Drive

Kansas City, Kansas 66103

(913) 982-0500

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

With a copy to:

Bruce S. Mendelsohn

Akin, Gump, Strauss, Hauer & Feld, L.L.P.

Robert S. Strauss Building

1333 New Hampshire Avenue

Washington, D.C. 20036

Telephone: (202) 887-4000 | | Peter M. Labonski

Latham & Watkins LLP

885 Third Avenue

New York, NY 10022

Telephone: (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable on or after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

|

Title of Shares to be Registered

| | Amount to be Registered(1)

| | Proposed Maximum Aggregate Offering Price(2)

| | Amount of Registration Fee

|

|---|

|

| Common Stock, $0.01 par value | | | | $300,000,000 | | $35,310 |

|

- (1)

- Includes shares which the underwriters have the option to purchase solely to cover over-allotments, if any.

- (2)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED FEBRUARY 11, 2005.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Shares

Coffeyville Resources, Inc.

Common Stock

Prior to this offering there has been no public market for our common stock. The initial public offering price of the common stock is expected to be between $ and $ per share. We intend to apply to list our common stock on under the symbol " ."

We are selling shares of common stock in this offering and Coffeyville Group Holdings, LLC is selling shares of common stock in this offering. We will not receive any proceeds from the sale of shares by Coffeyville Group Holdings, LLC.

The underwriters have an option to purchase a maximum of additional shares from Coffeyville Group Holdings, LLC to cover over-allotments.

Investing in our common stock involves risks. See "Risk Factors" on page 11.

| | Public

Price to

| | Underwriting

Discounts and

Commissions

| | Proceeds to

Coffeyville Resources, Inc.

| | Proceeds to

Coffeyville Group

Holdings, LLC

|

|---|

| Per Share | | $ | | $ | | $ | | $ |

| Total | | $ | | $ | | $ | | $ |

Delivery of the shares of common stock will be made on or about , 2005.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Credit Suisse First Boston | | Jefferies & Company, Inc. |

The date of this prospectus is , 2005.

|

|

|

TABLE OF CONTENTS

| | Page

|

|---|

| PROSPECTUS SUMMARY | | 1 |

| RISK FACTORS | | 11 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | | 26 |

| USE OF PROCEEDS | | 27 |

| DIVIDEND POLICY | | 27 |

| CAPITALIZATION | | 28 |

| DILUTION | | 29 |

| UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | | 30 |

| SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA | | 35 |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 39 |

| INDUSTRY OVERVIEW | | 63 |

|

|

|

| BUSINESS | | 76 |

| MANAGEMENT | | 102 |

| PRINCIPAL AND SELLING STOCKHOLDERS | | 108 |

RELATED PARTY TRANSACTIONS |

|

110 |

| DESCRIPTION OF OUR SENIOR SECURED CREDIT FACILITY | | 111 |

| DESCRIPTION OF CAPITAL STOCK | | 113 |

| SHARES ELIGIBLE FOR FUTURE SALE | | 115 |

| UNDERWRITING | | 116 |

| NOTICE TO CANADIAN RESIDENTS | | 120 |

| LEGAL MATTERS | | 121 |

| EXPERTS | | 121 |

| WHERE YOU CAN FIND MORE INFORMATION | | 122 |

| GLOSSARY OF SELECTED TERMS | | 123 |

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | | F-1 |

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document. We will amend or supplement this document as required by law.

Dealer Prospectus Delivery Obligation

Until , 2005, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

i

PROSPECTUS SUMMARY

This summary highlights information about Coffeyville Resources, Inc. and the offering contained elsewhere in this prospectus. It is not complete and may not contain all the information that may be important to you. You should carefully read the entire prospectus, including the "Risk Factors" and our financial statements and notes to those statements contained elsewhere in this prospectus, before making an investment decision. In this prospectus, all references to "Coffeyville," "the Company," "we," "us," and "our" refer to Coffeyville Resources, Inc., unless the context otherwise requires or where otherwise indicated. You should also see the "Glossary of Selected Terms" beginning on page 123 for definitions of some of the terms we use to describe our business and industry.

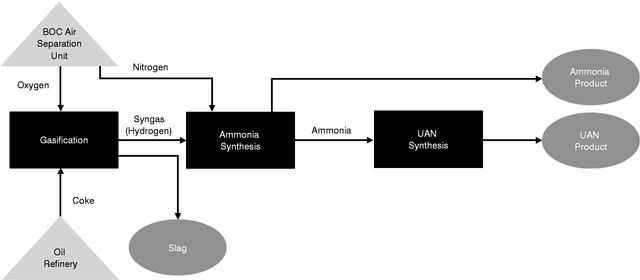

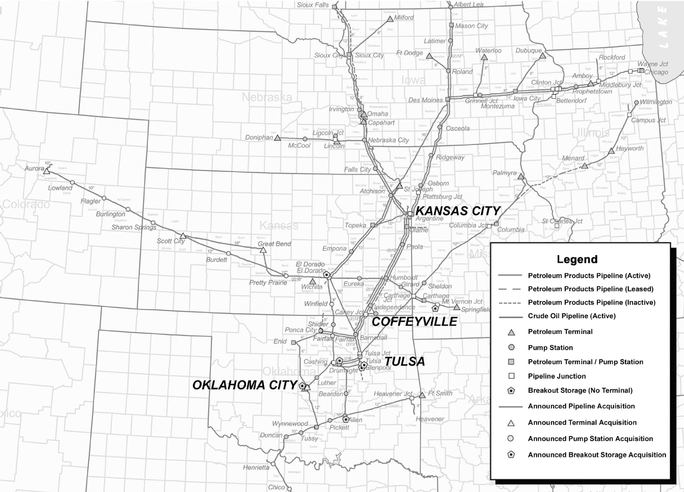

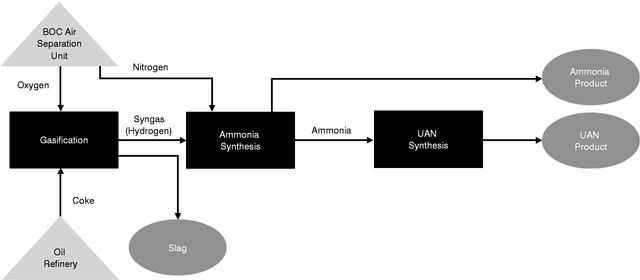

Our Company

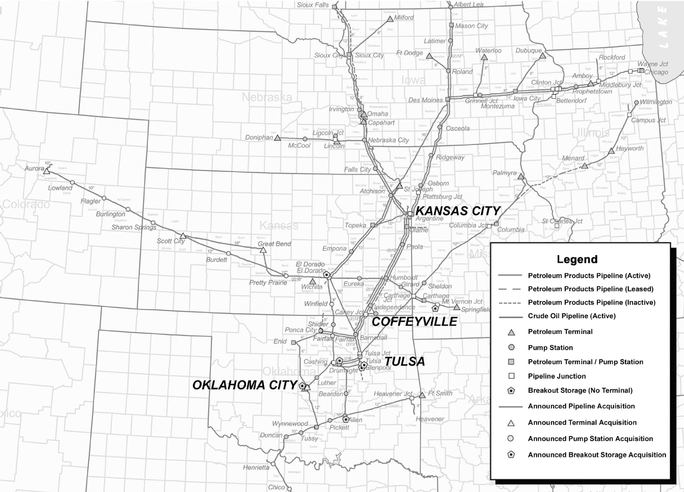

We are one of the largest independent high complexity petroleum refiners and marketers in the mid-continental U.S. and the lowest cost producer and marketer of upgraded nitrogen fertilizer products in North America. Our operations are organized into two business segments: petroleum and nitrogen fertilizer. Our petroleum business includes a complex oil refinery in Coffeyville, Kansas, a crude oil gathering system throughout Kansas and Northern Oklahoma, and storage and terminalling facilities for asphalt and refined fuels in Phillipsburg, Kansas. Our refinery operates in close proximity to our primary customer base and benefits from favorable crude oil supply and product distribution logistics. Our nitrogen fertilizer business in Coffeyville, Kansas, includes a petroleum coke gasification plant that produces high purity hydrogen that is converted to ammonia at our ammonia plant and upgraded to urea ammonium nitrate (UAN) at our UAN plant. We operate the only nitrogen fertilizer plant in North America utilizing a coke gasification process to generate hydrogen feedstock that is further converted to ammonia for the production of nitrogen fertilizers. This currently provides us with a significant competitive advantage due to the high prevailing and volatile natural gas prices. On a pro forma basis, we generated revenue of $1.3 billion during 2003 and $1.2 billion during the nine months ended September 30, 2004, increases of 42% and 31%, respectively, compared to the corresponding prior periods. On a pro forma basis for the same periods, net income was $21.8 million and $51.0 million, respectively, and our earnings before net interest, taxes, depreciation and amortization (EBITDA), was $43.4 million and $86.3 million, respectively.

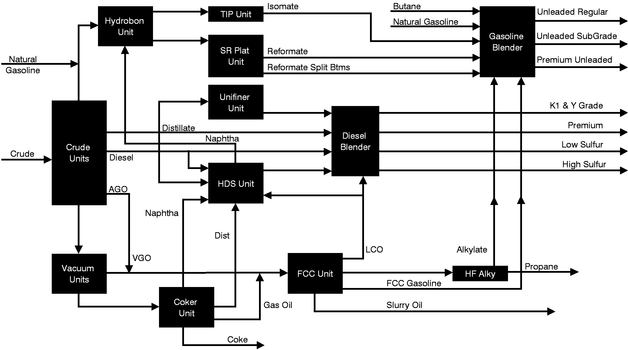

Petroleum Business

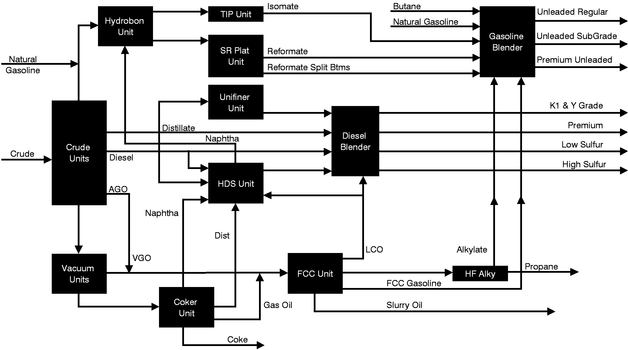

We operate one of the seven fuels refineries located in the mid-continental U.S. We produce at a throughput of 100,000 barrels per day (bpd), which accounts for approximately 15% of those fuels refineries' production. Our cracking/coking refinery has a modified Solomon complexity of approximately 8.8 and Nelson complexity of approximately 9.7, making ours one of the most complex refineries in our region. Our refinery's high level of complexity allows us to process heavier, less expensive, crude oil compared to competitors with less complex facilities, and still produce a high percentage of high-value, clean transportation fuels such as gasoline and diesel. The current excess availability of heavy crude oil in world markets provides us a significant cost advantage over our less complex peers. During the nine months ended September 30, 2004, our heavy and medium sour crude processing capacity was approximately 40% to 50% of our throughput, and high-value products represented approximately a 94% product yield on a crude oil basis.

We primarily target a diverse customer base in the Midwestern states where regional demand for petroleum products has exceeded regional refining production. As a result of our geographic location, we do not incur the high cost of transporting refined products to customers in the Midwest compared to refiners located outside the Midwest. Consequently, we estimate our region's refining margins have exceeded Gulf Coast refining margins by approximately $1.93 per barrel on average for the last four years. All of our non-gathered crude is purchased through a credit intermediation agreement, which mitigates crude pricing risks and allows us to reduce our inventory position. We also derive additional

1

revenue by leasing storage and charging for terminalling services at Phillipsburg, Kansas, on a throughput basis to third parties in need of asphalt and refined fuels.

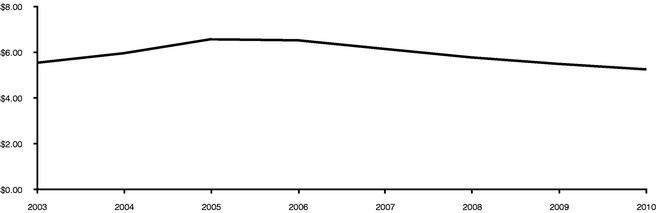

Nitrogen Fertilizer Business

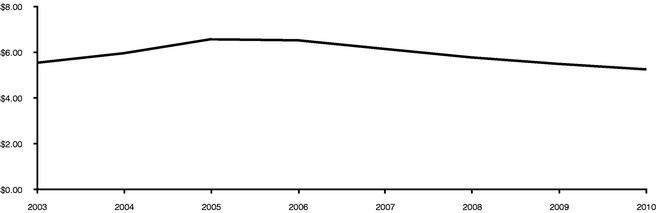

We operate the only nitrogen fertilizer plant in North America utilizing a coke gasification process to generate hydrogen feedstock that is further converted to ammonia for the production of nitrogen fertilizers. By using petroleum coke rather than natural gas as a raw material, we currently have a significant cost advantage over other North American natural gas based fertilizer producers. In addition, we benefit economically from high prevailing natural gas prices because fertilizer prices tend to rise with natural gas prices. We estimate that our cost advantage over natural gas based fertilizer producers is realized when natural gas prices are in the range of $1.50 to $2.50 per million Btu and above. This level is generally low by historical industry prices and our cost advantage is more pronounced at current natural gas prices, which have generally fluctuated between $5.00 and $8.00 per million Btu since the end of 2003.

We obtain approximately 80% of the petroleum coke we use at our nitrogen fertilizer plant from our adjacent refinery. The use of coke as a raw material in our fertilizer plant also provides a superior value to our refinery's coke, which would otherwise be sold at significantly lower economic value, as is the current practice in the industry. Any coke not obtained from our oil refinery is readily available and purchased on the open market. Our plant produces approximately 370,000 tons per annum of ammonia. We upgrade approximately two-thirds of our ammonia into approximately 638,000 tons per annum of high value UAN, bringing salable tonnage to approximately 755,000 tons per annum of finished product. As the largest single train UAN production facility in North America, our UAN production represents 5.6% of U.S. demand. Our nitrogen products are delivered by trucks and our own fleet of rail cars to retailers and distributors in the mid-continental agricultural and industrial markets and to certain locations served by the Union Pacific (UP) railroad. Our nitrogen fertilizer customers are located in close proximity to us, enabling us to avoid intermediate, transfer, storage, barge freight, or pipeline freight charges. As a result, we believe we enjoy a freight advantage over U.S. Gulf Coast ammonia importers of approximately $65 per ton and over U.S. Gulf Coast UAN importers of approximately $37 per ton. Such cost differentials represent a significant portion of the market price of these commodities. For example, since the end of 2003, ammonia prices have fluctuated between $268 and $329 per ton, and UAN prices have fluctuated between $156 and $195 per ton.

Market Trends

We have identified several key factors we believe lead to a favorable outlook for the refining and nitrogen fertilizer industries for the next several years.

For the refining industry, these factors include:

- •

- The supply and demand fundamentals of the domestic refining industry have improved since the 1990s, and are expected to continue as the demand for refined products continues to exceed increases in refining capacity in the U.S.

- •

- Continued excess availability of lower cost sour and heavy sour crude oil is expected to continue to provide a cost advantage to complex refiners with the ability to process these crude oils.

- •

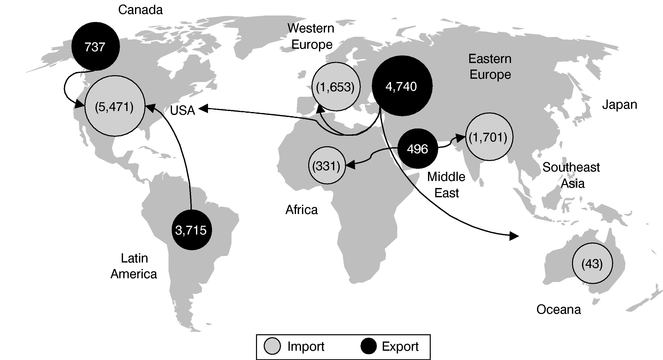

- Increasing reliance on imports to satisfy refined products demand, especially gasoline, and lower ability to deliver refined products due in part to varying product specifications from state to state will favor regional refiners with transportation cost advantages.

- •

- More products based on new and evolving fuel specifications, including ultra-low sulfur content, reduced vapor pressure, and the addition of oxygenates such as ethanol, will require refiners to blend and process these boutique fuels and exert pressure on product availability.

2

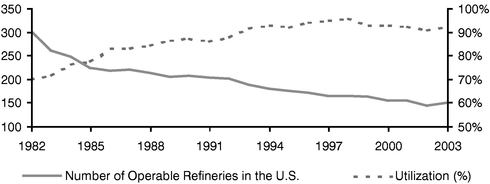

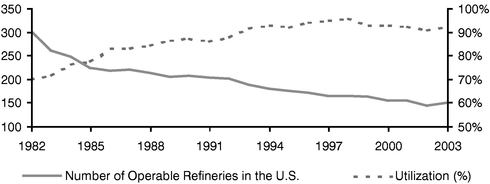

- •

- High capital costs, excess capacity, and environmental regulatory requirements have limited the construction of new refineries in the U.S. over the past thirty to forty years. No new major refinery has been built in the U.S. since 1976. More than 150 small and unsophisticated refineries, however, have been shut down in recent years.

For the nitrogen fertilizer industry, these factors include:

- •

- Persistently high natural gas prices, a deficit in natural gas supply and increased demand for natural gas in North America as an environmentally friendly fuel are expected to result in reduced production of natural gas based nitrogen fertilizer products in the U.S. Imports of nitrogen fertilizer product will only partially address this shortfall due to the lack of surplus of natural gas and a shortage of fertilizer transportation infrastructure, such as terminals, pipelines, barges and railcars. These factors will help maintain high nitrogen fertilizer prices in the central Midwestern U.S., or the U.S. farm belt, the largest market for nitrogen fertilizer products in the U.S.

- •

- The combined impact of a growing world population, improving diets, and low grain inventories will drive grain prices and productions worldwide and consequently drive high nitrogen and nitrogen-based fertilizer prices in order to stimulate increased grain production.

- •

- Continued high prices of petroleum and natural gas will result in a cost preferential position for coke gasification technology.

Competitive Strengths

Strong Oil Refining Industry Fundamentals

We believe attractive demand and supply dynamics for refined products favor us because of our ability to receive and process crude efficiently, produce high-value products, and transport our refined products cost-effectively to our customers. Throughout the U.S., expected annual increases in demand continue to exceed estimated increases in refining capacity. There has also been a shortage of refined products as evidenced by inventories of refined products, especially gasoline, below their historical averages. These nationwide trends are more pronounced in our marketing region, where demand for refined products has exceeded refining production by approximately 38% since 1997.

Strong Nitrogen Fertilizer Industry Fundamentals

The combined impact of growing world population and low grain inventories results in rising grain prices and strong projections for acres of corn and wheat planted in North America, which we believe will drive the demand for nitrogen fertilizer. Consequently, we expect high nitrogen fertilizer prices to prevail in North America for the foreseeable future. This projection is further supported by strong natural gas prices, a deficit in North American ammonia and UAN production and a shortage of infrastructure, such as pipelines, barges, and railcars that are needed to transport imported products into the mid-continent market where nitrogen fertilizer is primarily consumed. The total UAN capacity of our nitrogen fertilizer business is well suited to reach into premium agricultural markets in Kansas, Missouri, Nebraska, Iowa, Illinois and Texas.

Regional Focus and Strategic Location

As one of the seven fuels refineries located in the Midwest, we are located in close proximity to our customers and we benefit from favorable crude oil supply and product distribution logistics, including access to pipelines. As a result, we do not incur high transportation costs. We believe our low transportation costs enable us to capture higher margins than similar refineries outside the Midwest. We have ready and economical access to international crudes available in the U.S. Gulf Coast through the Seaway pipeline, which currently has excess capacity available, and potentially in Canada through a

3

proposed future pipeline connection. In addition, our favorable plant location relative to end users of ammonia and UAN, as well as high product demand relative to production volume allow us to target freight-advantaged destinations in the U.S. farm belt.

Efficient, Modern Asset Base

Since 1994, approximately $188 million has been invested to modernize our oil refinery to make it one of the most advanced in our region and to meet environmental regulations. Similarly, between 1999 and 2002, approximately $370 million was invested to create our coke gasification facility. Our nitrogen fertilizer plant's gasification process uses less than 1% of natural gas used by natural gas based nitrogen fertilizer plants and emits significantly less pollutants during normal operations compared to other nitrogen fertilizer facilities.

Low Input and Operational Costs

Our refinery is capable of processing a broad array of crude oils from both foreign and domestic sources, with approximately 40% to 50% of its feedstock comprised of heavy and medium sour crude. As a result, we believe we are well positioned to benefit from the increasing share of global crude oil production represented by heavy sour crude oil, which tends to be less expensive than lighter, sweeter types of crudes and contributes to higher margins. In addition, we estimate that our fertilizer plant, which has lower feedstock costs and capital requirements than natural gas based fertilizer plants, retains its competitive advantage at natural gas prices in the range of $1.50 to $2.50 per million Btu and above. This price level is generally low by historical industry standards and our cost advantage is more pronounced at current natural gas prices, which have generally fluctuated between $5.00 and $8.00 per million Btu since the end of 2003.

Experienced Management Team

We have a highly experienced management team, each with an average of over 23 years of industry experience. Our management compensation is directly tied to achieving certain performance objectives. Under the leadership of our chief executive officer, Philip L. Rinaldi, we have made significant operational improvements, which have reduced operating costs and increased stockholder value.

Our Business Strategy

Our goal is to continue to be a premier independent refiner and marketer of high-value, clean transportation fuels and producer of ammonia and UAN. We believe that this offering will strengthen our ability to execute the following strategic objectives:

- •

- We intend to continue to take advantage of favorable supply and demand dynamics in the Midwest by capitalizing on our position as one of the largest refiners in the mid-continental U.S. and growing organically.

- •

- We intend to improve our competitive position in our refining and fertilizer operations by selectively investing in high-return projects that enhance our operating efficiency and expand our capacity while rigorously controlling costs.

- •

- We intend to increase our sales and supply capabilities of boutique fuels, UAN, and other high-value products, while finding cheaper sources of raw materials, such as crude oil from Canada.

- •

- We intend to maximize our location and transportation cost advantages and continue to focus on being a reliable, low-cost supplier of our products to our existing customers and identify new commercial customers.

4

- •

- We intend to continue to devote significant time and resources toward improving the reliability, safety and environmental performance of our operations and build on our status as a premier employer in Southeastern Kansas, serving as a beneficial economic presence in our communities and with our employees.

Our History

Prior to March 3, 2004, our assets were operated as a small component of Farmland Industries, Inc. (Farmland), an agricultural cooperative. Farmland filed for bankruptcy protection on May 31, 2002. Coffeyville Resources, LLC, a subsidiary of Coffeyville Group Holdings, LLC, won the bankruptcy court auction for Farmland's petroleum business and a nitrogen fertilizer plant and completed the purchase of these assets on March 3, 2004. Throughout this prospectus we refer to this purchase as the Transaction. Prior to consummation of the Transaction, we expended significant time and money preparing for our proposed post-closing implementation of several key strategic initiatives that we believed would significantly enhance our competitive position and improve our financial and operational performance following the Transaction. Specifically, the following initiatives were implemented:

- •

- We contracted to construct a crude pipeline which would enable us to control our crude oil supply chain from Cushing, Oklahoma, a major mid-continental hub, to Coffeyville, at a favorable economic cost to us.

- •

- We negotiated new collective bargaining agreements with the existing unions which would enable us to improve the overall work force and reward our employees for increasing productivity and diversifying their skills.

- •

- We negotiated new agreements with respect to potential environmental liabilities with the United States Environmental Protection Agency (EPA) and the Kansas Department of Health and Environment (KDHE) and significant insurance coverage for certain historical and potential future liabilities.

- •

- We negotiated a long-term electric supply agreement with the City of Coffeyville.

- •

- We renegotiated a number of key supplier contracts on favorable terms.

- •

- We identified a new management team, consisting of experienced non-Farmland industry managers as well as certain key Farmland employees.

Following the consummation of the Transaction, we significantly improved our coke gasifiers' performance and optimized operations at our nitrogen fertilizer plant, enabling us to be one of the top performers in our industry. We have also reduced operating costs at our refinery.

Our Structure

All information in this prospectus assumes that prior to this offering, Coffeyville Group Holdings, LLC will contribute the stock of its subsidiaries to us and we will issue 74,852,941 shares of common stock to Coffeyville Group Holdings, LLC. Prior to the contribution of stock by Coffeyville Group Holdings, LLC and our issuance of common stock to Coffeyville Group Holdings, LLC, we anticipate that we will seek a waiver from the lenders under our senior secured credit facility permitting this transaction. See "Description of Our Senior Secured Credit Facility."

5

The Offering

| Issuer | | Coffeyville Resources, Inc. |

Common stock offered by us |

|

shares. |

Common stock offered by Coffeyville Group Holdings, LLC. |

|

shares ( shares if the underwriters' over-allotment option is fully exercised). |

Common stock outstanding after the offering |

|

shares. |

Use of proceeds |

|

We estimate that the net proceeds to us in this offering, after deducting underwriters' discounts and commissions of $ million, will be $ million. We plan to use a portion of these net proceeds for discretionary and non-discretionary capital expenditures. We intend to use any remaining net proceeds for general corporate purposes, which may include repayment of indebtedness under our senior secured credit facility. We will not receive any proceeds from the sale of shares by Coffeyville Group Holdings, LLC, including any proceeds from the purchase by the underwriters of up to shares from Coffeyville Group Holdings, LLC to cover over-allotments. |

Proposed symbol |

|

" ." |

Risk Factors: |

|

See "Risk Factors" beginning on page 11 of this prospectus for a discussion of factors that you should carefully consider before deciding to invest in shares of our common stock. |

Unless we specifically state otherwise, the information in this prospectus does not take into account the sale of up to shares of common stock, which the underwriters have the option to purchase from Coffeyville Group Holdings, LLC to cover over-allotments.

Coffeyville Resources, Inc., was incorporated in Delaware in January 2005. Our principal executive offices are located at 10 East Cambridge Circle Drive, Kansas City, Kansas 66103, and our telephone number is (913) 982-0500. Our website address is www.coffeyvillegroup.com. Information contained on our website is not a part of this prospectus.

Pegasus Partners II, L.P., which is referred to in this prospectus as Pegasus, was the principal investor in the transaction that created Coffeyville Group Holdings, LLC. Pegasus Capital Advisors, L.P. is the manager of Pegasus.

6

Summary Consolidated Financial Information

The summary consolidated financial information presented below under the caption Statement of Operations Data for the years ended December 31, 2001, 2002 and 2003 and for the 62 day period ended March 2, 2004 and the summary consolidated financial information presented below under the caption Balance Sheet Data as of December 31, 2002 and 2003 and as of March 2, 2004 have been derived from our financial statements included elsewhere in this prospectus, which financial statements have been audited by KPMG LLP, independent registered public accounting firm. The summary consolidated balance sheet data as of December 31, 2001, is derived from our audited consolidated financial statements that are not included in this prospectus. The summary consolidated statement of operations data for the nine months ended September 30, 2003 and for the 212 day period ended September 30, 2004 and the summary balance sheet data as of September 30, 2004 are derived from unaudited financial statements included elsewhere in this prospectus that have been prepared on the same basis as the audited financial statements and, in the opinion of management, contain all adjustments, consisting only of normal recurring adjustments, necessary for the fair presentation of our operating results for these periods and our financial condition as of that date.

The summary unaudited pro forma condensed consolidated statement of operations data, other financial data and key operating statistics set forth below give pro forma effect to the acquisition of the assets of the former Farmland Petroleum Division and one facility within Farmland's eight-plant Nitrogen Fertilizer Manufacturing and Marketing Division (which we refer to collectively as the Predecessor) in the manner described under "Unaudited Pro Forma Condensed Consolidated Statements of Operations" as if it occurred on January 1, 2004. We refer to our acquisition of the Predecessor as the Transaction. The summary unaudited pro forma information does not purport to represent what our results of operations would have been if the Transaction had occurred as of the date indicated or what these results will be for future periods.

During the Predecessor periods, Farmland allocated certain general corporate expenses and interest expense to the Predecessor. The allocation of these costs is not necessarily indicative of the costs that would have been incurred if the Predecessor had operated as a stand-alone entity. As a result of certain adjustments made in connection with the Transaction, the results of operations for the 212 days ended September 30, 2004 are not comparable to prior periods. Further, the results for any interim periods are not necessarily indicative of the results that may be expected for the full year, and the historical results are not necessarily indicative of the results to be expected in future periods.

We calculate earnings per share for the Successor on a pro forma basis, based on an assumed number of shares outstanding at the time of the public offering with respect to the existing shares. All information in this prospectus assumes that prior to this offering, Coffeyville Group Holdings, LLC will contribute the stock of its subsidiaries to Coffeyville Resources, Inc. and that Coffeyville Resources, Inc. will issue 74,852,941 shares of common stock to Coffeyville Group Holdings, LLC. No effect has been given to any incremental shares that might be issued in the public offering.

We have omitted per share data for the Predecessor because, under Farmland's cooperative structure, earnings of the Predecessor were distributed as patronage dividends to members and associate members based on the level of business conducted with the Predecessor as opposed to a common shareholder's proportionate share of underlying equity in the Predecessor.

The Predecessor was not a separate legal entity, and its operating results were included with the operating results of Farmland and its subsidiaries in filing consolidated federal and state income tax returns. As a cooperative, Farmland was subject to income taxes on all income not distributed to patrons as qualifying patronage refunds and Farmland did not allocate income taxes to its divisions. As a result, the Predecessor periods do not reflect any provision for income taxes.

7

The historical data presented below has been derived from financial statements that have been prepared using U.S. generally accepted accounting principles and pro forma data has been derived from the Unaudited Pro Forma Condensed Consolidated Statements of Operations included elsewhere in this prospectus. This data should be read in conjunction with the financial statements and the notes to the financial statements and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this prospectus.

| | Predecessor

| | Successor

| | Pro Forma

|

|---|

| | Year Ended December 31,

| | Nine Months

Ended

September 30,

2003

| | 62 Days

Ended

March 2,

2004

| | 212 Days

Ended

September 30,

2004

| | Nine Months

Ended

September 30,

2004

|

|---|

| | 2001

| | 2002

| | 2003

|

|---|

| |

| |

| |

| | (unaudited)

| |

| | (unaudited)

| | (unaudited)

|

|---|

| | (in millions, except as otherwise indicated)

| |

|

|---|

| Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | |

| Net sales | | $ | 1,630.2 | | $ | 887.5 | | $ | 1,262.2 | | $ | 937.2 | | $ | 261.1 | | $ | 970.6 | | $ | 1,231.6 |

| Gross profit (loss) | | | 6.8 | | | (58.5 | ) | | 63.9 | | | 44.8 | | | 15.9 | | | 90.1 | | | 106.0 |

| Selling, general and administrative expenses | | | 24.8 | | | 16.4 | | | 23.6 | | | 18.3 | | | 4.6 | | | 9.1 | | | 13.7 |

| Impairment, (earnings) losses in joint venture, and other charges(1) | | | 2.8 | | | 375.1 | | | 10.9 | | | 9.6 | | | — | | | — | | | — |

| | |

| |

| |

| |

| |

| |

| |

|

| Operating income (loss) | | $ | (20.8 | ) | $ | (449.9 | ) | $ | 29.4 | | $ | 16.9 | | $ | 11.2 | | $ | 81.1 | | $ | 92.3 |

| Other (income) expense and (gain) loss on sale in joint ventures(2) | | | (19.6 | ) | | 4.1 | | | 0.2 | | | 0.2 | | | — | | | 8.0 | | | 8.0 |

| Interest expense | | | 18.3 | | | 11.7 | | | 1.3 | | | 1.3 | | | — | | | 6.4 | | | 7.2 |

| | |

| |

| |

| |

| |

| |

| |

|

| Income (loss) before taxes | | $ | (19.4 | ) | $ | (465.7 | ) | $ | 27.9 | | $ | 15.3 | | $ | 11.2 | | $ | 66.6 | | $ | 77.1 |

| Income tax (benefit) provision | | | — | | | — | | | — | | | — | | | — | | | 26.8 | | | 31.0 |

| | |

| |

| |

| |

| |

| |

| |

|

| Net income (loss) | | $ | (19.4 | ) | $ | (465.7 | ) | $ | 27.9 | | $ | 15.3 | | $ | 11.2 | | $ | 39.8 | | $ | 46.1 |

Pro forma earnings per share,

basic and diluted | | | | | | | | | | | | | | | | | $ | 0.53 | | $ | 0.62 |

Pro forma weighted average shares,

basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

74.7 |

|

|

74.7 |

Other Financial Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization | | $ | 19.1 | | $ | 30.8 | | $ | 3.3 | | $ | 2.7 | | $ | 0.4 | | $ | 1.6 | | $ | 2.0 |

| EBITDA(3) | | | 18.0 | | | (423.2 | ) | | 32.5 | | | 19.3 | | | 11.6 | | | 74.6 | | | 86.3 |

| Adjusted EBITDA(4) | | | 18.7 | | | (47.8 | ) | | 42.1 | | | 28.9 | | | 11.6 | | | 81.8 | | | 93.5 |

| Capital expenditures for property, plant and equipment | | | 8.2 | | | 272.4 | | | 0.8 | | | 0.8 | | | — | | | 10.5 | | | 10.5 |

8

| | Predecessor

| | Successor

|

|---|

| |

| |

| |

| | Nine Months

Ended

September 30,

2003

(unaudited)

| |

| | 212 Days

Ended

September 30,

2004

(unaudited)

|

|---|

| | Year Ended December 31,

| | 62 Days

Ended

March 2,

2004

|

|---|

| | 2001

| | 2002

| | 2003

|

|---|

| | (in millions, except as otherwise indicated)

|

|---|

| Balance Sheet Data: | | | | | | | | | | | | | | | | | |

| Cash, cash equivalents and short-term investments | | $ | — | | $ | — | | $ | — | | | | $ | — | | $ | 13.0 |

| Working capital(5) | | | 71.2 | | | 122.2 | | | 150.5 | | | | | 103.6 | | | 101.4 |

| Total assets | | | 300.3 | | | 172.3 | | | 199.0 | | | | | 158.9 | | | 220.1 |

| Total debt, including current portion | | | — | | | — | | | — | | | | | — | | | 150.5 |

| Divisional/stockholders' equity | | | 241.4 | | | 49.8 | | | 58.2 | | | | | 16.2 | | | 3.7 |

Key Operating Statistics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Production (barrels per day) | | | 94,758 | | | 84,343 | | | 95,701 | | 96,018 | | | 106,645 | | | 101,510 |

| Crude oil throughput (barrels per day) | | | 84,605 | | | 74,446 | | | 85,501 | | 85,713 | | | 92,596 | | | 91,030 |

Nitrogen Fertilizer Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Production Volume: | | | | | | | | | | | | | | | | | |

| | Ammonia (tons in thousands) | | | 198.5 | | | 265.1 | | | 335.7 | | 244.4 | | | 56.4 | | | 176.6 |

| | UAN (tons in thousands) | | | 286.2 | | | 434.6 | | | 510.6 | | 363.8 | | | 93.4 | | | 384.7 |

- (1)

- Includes the following:

- •

- During the year ended December 31, 2001, we recognized expenses of $2.8 million for our interest in Country Energy, LLC.

- •

- During the year ended December 31, 2002, we recorded a $375.1 million asset impairment related to the write-down of the refinery and nitrogen fertilizer plant to fair market value.

- •

- During the year ended December 31, 2003, we recorded a charge of $9.6 million related to the asset impairment of the refinery and nitrogen fertilizer plant based on the expected sales price of the assets in the Transaction. In addition we recorded a charge of $1.3 million for rejection of existing contracts.

- (2)

- Includes a gain on sale of joint venture interest of $18.0 million that was recorded in 2001 for the disposition of our share in Country Energy, LLC. During the 212 days ended September 30, 2004, we recognized a loss of $7.2 million on early extinguishment of debt.

- (3)

- EBITDA represents earnings before interest, taxes, depreciation and amortization. Management believes that EBITDA is a useful adjunct to net income and other measurements under GAAP because it is a meaningful measure for evaluating our performance in a given period compared to prior periods and compared to other companies in our industry as interest, taxes, depreciation and amortization can vary significantly across periods and between companies due in part to differences in accounting policies, tax strategies, levels of indebtedness, capital purchasing practices and interest rates. EBITDA also assists management in evaluating operating performance. EBITDA, with adjustments specified in our credit agreement, is also the basis for calculating our financial debt covenants under our credit facility. Accordingly, management believes that EBITDA is an accepted indicator of our ability to incur and service debt obligations. EBITDA has distinct limitations as compared to GAAP information, such as net income, income from continuing operations or operating income. By excluding interest and income taxes for example, it may not be apparent that both represent a reduction in cash available to us. Likewise, depreciation and amortization, while non-cash items, represent generally the decreases in value of assets that produce revenue for us. EBITDA should not be substituted as an alternative to net income or income from operations which are measures of performance in accordance with U.S. GAAP. We believe it assists the investing community in evaluating the performance of our company. Our computation of EBITDA may not be comparable to other similarly titled measures

9

computed by other companies because all companies do not calculate EBITDA in the same fashion. The following is a reconciliation of EBITDA to net income:

| | Predecessor

| | Successor

| | Pro Forma

|

|---|

| | Year Ended December 31,

| | Nine Months

Ended

September 30,

2003

| | 62 Days

Ended

March 2,

2004

| | 212 Days

Ended

September 30,

2004

| | Nine Months Ended September 30, 2004

|

|---|

| | 2001

| | 2002

| | 2003

|

|---|

| |

| |

| |

| | (unaudited)

| |

| | (unaudited)

| | (unaudited)

|

|---|

| | (in millions)

|

|---|

| EBITDA | | $ | 18.0 | | $ | (423.2 | ) | $ | 32.5 | | $ | 19.3 | | $ | 11.6 | | $ | 74.6 | | $ | 86.3 |

| Less: | | | | | | | | | | | | | | | | | | | | | |

| | Income tax (benefit) provision for taxes | | | — | | | — | | | — | | | — | | | — | | | 26.8 | | | 31.0 |

| | Interest expense | | | 18.3 | | | 11.7 | | | 1.3 | | | 1.3 | | | — | | | 6.4 | | | 7.2 |

| | Depreciation and amortization | | | 19.1 | | | 30.8 | | | 3.3 | | | 2.7 | | | 0.4 | | | 1.6 | | | 2.0 |

| | |

| |

| |

| |

| |

| |

| |

|

| Net income (loss) | | $ | (19.4 | ) | $ | (465.7 | ) | $ | 27.9 | | $ | 15.3 | | $ | 11.2 | | $ | 39.8 | | $ | 46.1 |

- (4)

- For the periods presented, Adjusted EBITDA represents EBITDA plus or minus the items described below. We believe additional adjustments to EBITDA for these special charges provides a meaningful comparison of period-to-period results. We present Adjusted EBITDA as a further supplemental measure of our performance and ability to service debt. We prepare adjusted EBITDA by adjusting EBITDA to eliminate the impact of a number of items we do not consider indicative of our ongoing operating performance. As an analytical tool, Adjusted EBITDA is subject to all of the limitations applicable to EBITDA. In addition, in evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

| | Predecessor

| | Successor

| | Pro Forma

|

|---|

| | Year Ended December 31,

| | Nine Months

Ended

September 30,

2003

| | 62 Days

Ended

March 2,

2004

| | 212 Days

Ended

September 30,

2004

| | Nine Months Ended September 30, 2004

|

|---|

| | 2001

| | 2002

| | 2003

|

|---|

| |

| |

| |

| | (unaudited)

| |

| | (unaudited)

| | (unaudited)

|

|---|

| | (in millions)

|

|---|

| Adjusted EBITDA | | $ | 18.7 | | $ | (47.8 | ) | $ | 42.1 | | $ | 28.9 | | $ | 11.6 | | $ | 81.8 | | $ | 93.5 |

| Less: | | | | | | | | | | | | | | | | | | | | | |

| | Impairment of property, plant and equipment(a) | | | — | | | 375.1 | | | 9.6 | | | 9.6 | | | — | | | — | | | — |

| | Fertilizer lease payments(b) | | | 18.7 | | | 0.3 | | | — | | | — | | | — | | | — | | | — |

| | Gain on sale of joint venture interest(c) | | | (18.0 | ) | | — | | | — | | | — | | | — | | | — | | | — |

| | Loss on extinguishment of debt(d) | | | — | | | — | | | — | | | — | | | — | | | 7.2 | | | 7.2 |

| | |

| |

| |

| |

| |

| |

| |

|

| EBITDA | | $ | 18.0 | | $ | (423.2 | ) | $ | 32.5 | | $ | 19.3 | | $ | 11.6 | | $ | 74.6 | | $ | 86.3 |

- (a)

- During the year ended December 31, 2002, we recorded a $375.1 million asset impairment related to the write-down of our refinery and nitrogen fertilizer plant to fair market value. During the year ended December 31, 2003, we recorded an additional charge of $9.6 million related to the asset impairment of our refinery and nitrogen fertilizer plant based on the expected sale price of the assets in the Transaction.

- (b)

- Reflects the impact of an operating lease structure utilized by Farmland to finance the nitrogen fertilizer plant. The cost of this plant under the operating lease was $263.0 million and the rental payments were $18.7 million and $0.3 million for the periods ended December 31, 2001 and 2002, respectively. In February 2002, Farmland refinanced the operating lease into a secured loan structure, which effectively terminated the lease and all of Farmland's obligations under the lease.

- (c)

- Reflects the gain on sale of $18.0 million, which was recorded for the disposition of the Predecessor's share in Country Energy, LLC.

- (d)

- Represents the write-off of $7.2 million of deferred financing costs in connection with the refinancing of our senior secured credit facility on May 10, 2004.

- (5)

- Excludes liabilities subject to compromise of $105.2 million as of December 31, 2002 and 2003 and September 30, 2003, and $99.1 million as of March 2, 2004.

10

RISK FACTORS

You should carefully consider each of the following risks and all of the information set forth in this prospectus before deciding to invest in our common stock. If any of the following risks and uncertainties develops into actual events, our business, financial condition or results of operations could be materially adversely affected. In that case, the price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Petroleum Business

Volatile margins in the refining industry may negatively affect our future results of operations and decrease our cash flow.

Our petroleum business' financial results are primarily affected by the relationship, or margin, between refined product prices and the prices for crude oil and other feedstocks. Although an increase or decrease in the price for crude oil generally results in a similar increase or decrease in prices for refined products, there is normally a time lag in the realization of the similar increase or decrease in prices for refined products. The effect of changes in crude oil prices on our results of operations therefore depends in part on how quickly and how fully refined product prices adjust to reflect these changes. A substantial or prolonged increase in crude oil prices without a corresponding increase in refined product prices, a substantial or prolonged decrease in refined product prices without a corresponding decrease in crude oil prices, or a substantial or prolonged decrease in demand for refined products could have a significant negative effect on our earnings and cash flows.

Our cost to acquire our feedstocks and the price at which we can ultimately sell refined products depend upon a variety of factors beyond our control. Future volatility may negatively affect our results of operations, since the margin between refined product prices and feedstock prices may decrease below the amount needed for us to generate net cash flow sufficient for our needs.

Specific factors that may affect both our petroleum business' and the refining industry's margins include:

- •

- accidents, interruptions in transportation, inclement weather or other events that cause unscheduled shutdowns or otherwise adversely affect our refinery, machinery, pipelines or equipment, or those of our suppliers or customers;

- •

- changes in the cost and availability to us of transportation for feedstocks and refined products;

- •

- failure to successfully implement our planned capital projects or to realize the benefits expected from those projects;

- •

- changes in fuel specifications required by environmental and other laws, particularly with respect to oxygenates and sulfur content;

- •

- new laws, changes in existing laws and regulations, new interpretations of existing laws and regulations, increased government enforcement of existing or new laws and regulations;

- •

- reduction in availability to our refinery of crude oil obtained from our gathering system at a discount to the corresponding benchmark market price;

- •

- reduction in our ability to sell petroleum coke to our adjacent nitrogen fertilizer plant;

- •

- increases in the cost of our credit intermediation agreement for obtaining our non-gathered crude oil;

- •

- rulings, judgments or settlements in litigation or other legal matters, including unexpected environmental remediation or compliance costs at our facilities in excess of any reserves, and claims of product liability, property damage, or personal injury; and

- •

- changes in the aggregate refinery capacity in our industry to convert heavy sour crude oil into refined products.

11

Other factors that may affect our refining margins, as well as the margins in the refining industry in general, include:

- •

- domestic and worldwide refinery overcapacity or undercapacity;

- •

- extent of product demand growth in foreign economies;

- •

- aggregate demand for crude oil and refined products, which is influenced by factors such as weather patterns, including seasonal fluctuations, and demand for specific products such as jet fuel, which may be influenced by acts of God, nature, power outages, and acts of terrorism;

- •

- domestic and foreign supplies of crude oil and other feedstocks and domestic supply of refined products, including from imports;

- •

- price fluctuations between the time we enter into domestic crude oil purchase commitments and the time we actually process the crude oil into refined products (approximately one month);

- •

- the ability of the members of the Organization of Petroleum Exporting Countries (OPEC) to maintain oil price and production controls;

- •

- political conditions in oil producing regions, including the Middle East, Africa and Latin America;

- •

- refining industry utilization rates;

- •

- pricing and other actions taken by competitors that impact the market;

- •

- price, availability, and acceptance of alternative fuels;

- •

- adoption of or modifications to federal, state or foreign environmental, taxation, and other laws and regulations;

- •

- increased market adoption of alternative and/or hybrid fuel powered vehicles;

- •

- price fluctuations in natural gas, as our refineries purchase and consume significant amounts of natural gas to fuel their operations; and

- •

- general economic conditions.

Disruption of our ability to obtain crude oil could adversely affect our liquidity and results of operations.

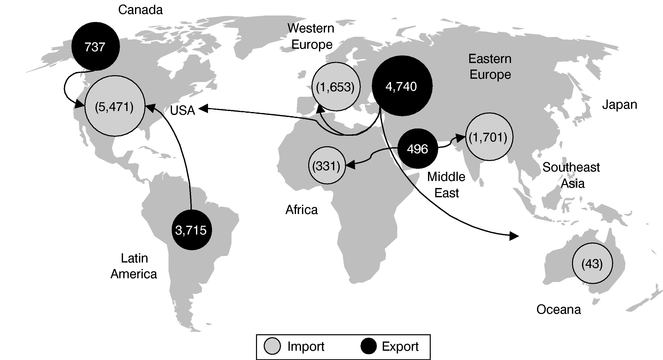

We obtain the majority of our feedstock through a crude oil credit intermediation agreement which minimizes the amount of in transit inventory and mitigates crude pricing risks by ensuring pricing takes place extremely close to the time when the crude is refined and the yielded products are sold. In the event this agreement is terminated or is not renewed prior to expiration we may be unable to obtain similar services from another party at the same or better terms as our existing agreement. Further, if we were required to obtain our feedstock without the benefit of an intermediation, our exposure to crude pricing risks may increase, even despite any hedging activity in which we may engage, and our liquidity would be negatively impacted due to the increased inventory. Our refinery requires approximately 80,000 bpd of crude oil in addition to the light sweet crude oil we gather locally in Kansas and Northern Oklahoma. We obtain a significant amount of our non-gathered crude oil, approximately 40% to 60% in any given month, from Latin America and South America. If these supplies become unavailable to us, we may be required to seek supplies from the Middle East, West Africa and the North Sea. We are subject to the political, geographic, and economic risks attendant to doing business with suppliers located in those regions. In the event that one or more of our traditional suppliers becomes unavailable to us, we believe we would be able to find alternative sources of supply. However, we cannot assure you that this would be the case, or that such a situation would continue. If we are unable to obtain adequate crude oil volumes, or are only able to obtain such volumes at unfavorable prices, our results of operations could be materially adversely affected.

12

Our profitability is linked to the light/heavy crude oil price spread, which increased significantly in 2004. A decrease in the spread would negatively impact our profitability.

Our profitability is linked to the price spread between light and heavy crude oil. We prefer to refine heavier crude oils because they have historically provided wider refining margins than light crude. Accordingly, any tightening of the light/heavy spread will reduce our profitability. During 2004 relatively high demand for lighter sweet crude due to increasing demand for more highly refined fuels resulted in an attractive light/heavy crude oil price spread. However, crude oil prices may not remain at current levels and the light/heavy spread may decline again, which could adversely affect our profitability, particularly if there is a worldwide softening of product demand that lessens the need for marginal sweet crude refining.

Our refinery faces operating hazards and interruptions and the limits on insurance coverage could expose us to potentially significant liability costs to the extent such hazards or interruptions are not fully covered.

Our operations are subject to significant operating hazards and interruptions and our profitability may be negatively impacted if our refinery experienced a major accident or fire, is damaged by severe weather or other natural disaster, or is otherwise forced to curtail its operations or shut down. If a major crude oil pipeline becomes inoperative, crude oil would have to be supplied to our refinery through an alternative pipeline or from additional tank trucks, which could increase our costs and hurt our business and profitability. Similarly, if a major refined fuels pipeline becomes inoperative, refined fuels would have to be kept in inventory or supplied to our customers through an alternative pipeline or from additional tank trucks from the refinery, which could hurt our business and profitability. In addition, a major accident, fire or other event could damage our refinery or the environment or result in injuries or loss of life. If our refinery experiences a major accident or fire or other event or an interruption in supply or operations, our business could be materially adversely affected if the damage or liability exceeds the amounts of business interruption, property, terrorism and other insurance that we maintain against these risks. We maintain significant insurance, capped at $300 million, which we believe meets or exceeds levels standard for our industry; however, in the event of a business interruption we would not be entitled to recover our loses until such interruption exceeds 45 days in the aggregate. We are fully exposed to losses in excess of this cap and that occur in the 45 days of our deductible period.

Our refinery consists of many processing units, a number of which have been in operation for a long time. One or more of the units may require additional unscheduled down time for unanticipated maintenance or repairs that is more frequent than our scheduled turnaround for each unit every one to five years, or our planned turnarounds may last longer than anticipated. Scheduled and unscheduled maintenance could reduce our revenues during the period of time that our units are not operating.

Our petroleum business' financial results are seasonal and generally lower in the first and fourth quarters of the year.

Demand for gasoline products is generally higher during the summer months than during the winter months due to seasonal increases in highway traffic and road construction work. As a result, our results of operations for the first and fourth calendar quarters are generally lower than for those for the second and third quarters. Diesel demand has historically been more stable in our market because our proximity to rail lines creates year-round demand for diesel and because of our proximity to agricultural operations, which employ diesel powered farming equipment most months of the year. However, reduced agricultural work during the winter months somewhat depresses demand for diesel in the winter months.

Further, in addition to the overall seasonality of our business, unseasonably cool weather in the summer months and/or unseasonably warm weather in the winter months in the markets in which we sell our petroleum products could have the effect of reducing demand for gasoline and diesel which could result in lower prices and reduce operating margins.

13

Competitors who produce their own supply of feedstocks, have extensive retail outlets, make alternative fuels or have greater financial resources than we do may have a competitive advantage over us.

The refining industry is highly competitive with respect to both feedstock supply and refined product markets. We compete with numerous other companies for available supplies of crude oil and other feedstocks and for outlets for our refined products. We are not engaged in the petroleum exploration and production business and therefore do not produce any of our crude oil feedstocks. We do not have a retail business and therefore are dependent upon others for outlets for our refined products. We do not have any long-term arrangements for much of our output. Many of our competitors in the U.S. as a whole, and one of our regional competitors, obtain a significant portion of their feedstocks from company-owned production and have extensive retail outlets. Competitors that have their own production or extensive retail outlets with brand-name recognition are at times able to offset losses from refining operations with profits from producing or retailing operations, and may be better positioned to withstand periods of depressed refining margins or feedstock shortages. A number of our competitors also have materially greater financial and other resources than us. These competitors have a greater ability to bear the economic risks inherent in all phases of the refining industry. In addition, we compete with other industries that provide alternative means to satisfy the energy and fuel requirements of our industrial, commercial and individual consumers. If we are unable to compete effectively with these competitors, both within and outside of our industry, our financial condition and results of operations, as well as our business prospects, could be materially adversely affected.

Governmental regulations and policies affect the prices and demand for our petroleum products and will require us to make substantial capital expenditures in the future.

The United States Environmental Protection Agency (EPA) has promulgated regulations under the federal Clean Air Act that establish stringent low sulfur content specifications for our petroleum products, including the Tier II gasoline standards, as well as regulations with respect to on- and off-road diesel fuel, which are designed to reduce air emissions from the use of these products. The on-road diesel regulations will require a 97% reduction in the sulfur content of diesel fuel sold for highway use by 2006. In addition, the EPA in May 2004 finalized regulations to reduce sulfur in off-road diesel fuel by 2010. We are currently conducting engineering activities for the installation of equipment and controls, as necessary, to meet the diesel fuel requirements and have begun identifying technologies to comply with the gasoline standards. Depending on the compliance strategy we adopt to comply with the off-road diesel rules, the estimate of our capital expenditures required to comply with the on- and off-road diesel standards will range between $75 to $85 million over the next two years. Based on our preliminary estimates, we believe that compliance with the Tier II gasoline standards will require us to spend approximately $35 million between 2008 and 2010. See "Business—Environmental Matters—The Clean Air Act—Fuel Regulations."

The refinery is also subject to the National Emissions Standards for Hazardous Air Pollutants for Petroleum Refineries: Catalytic Cracking Units, Catalytic Reforming Units, and Sulfur Recovery Units (MACT II). The refinery must comply with the MACT II standards by April 11, 2005. We believe that the refinery will be able to comply with the MACT II standards without installing additional controls. If the refinery cannot comply with the MACT II standards utilizing existing controls, the refinery would be required to install additional controls, which could require a significant capital expenditure.

There have been numerous recently promulgated National Emission Standards for Hazardous Air Pollutants (NESHAP or MACT), including, but not limited to, the Organic Liquid Distribution MACT, the Miscellaneous Organic NESHAP, Gasoline Distribution Facilities MACT, Reciprocating Internal Combustion Engines MACT, Asphalt Processing MACT, and the Commercial and Institutional Boilers and Process Heaters standards. Some or all of these MACT standards may require the installation of controls or changes to our operations in order to comply. If we are required to install controls or change our operations, the costs could be significant. These new requirements, other requirements of

14

the federal Clean Air Act, or other presently existing or future environmental laws and regulations could cause us to expend substantial amounts to permit our refinery to produce products that meet applicable requirements and could have an adverse impact on our operations, financial condition or cash flows for any given period.

In addition, in March 2004, we entered into a Consent Decree with EPA and KDHE to address certain allegations of Clean Air Act violations by Farmland at the oil refinery in order to reduce environmental risks and liabilities going forward, including sulfur dioxide emissions. Pursuant to the Consent Decree, in the short-term, we will increase sulfur dioxide—reducing catalyst additives to the fluid catalytic cracking unit at the facility to reduce emissions of sulfur dioxide. We will install controls to minimize sulfur dioxide emissions in the long-term. In addition, we will undertake an investigation to verify the facility's compliance with the Benzene Waste Oil NESHAP. Depending upon the results of that investigation, we may need to install additional controls on the facility's wastewater treatment system. In addition, pursuant to the Consent Decree, we assumed certain cleanup obligations at the refinery. There are other permitting, monitoring, recordkeeping and reporting requirements associated with the Consent Decree. The overall costs of complying with the Consent Decree over the next six years are expected to be approximately $20 to $30 million.

Changes in our credit profile may have a material adverse effect on our liquidity.

Changes in our credit profile may affect the way crude oil suppliers view our ability to make payments and induce them to shorten the payment terms of their invoices. Given the large dollar and volumetric size of our feedstock purchases a change in payment terms may have a material adverse effect on our liquidity and our ability to make payments.

We have additional capital needs for which our internally generated cash flows may not be adequate; we may have insufficient liquidity to meet those needs.

We have substantial short term and long term capital needs, including for capital expenditures we will make to comply with Tier II gasoline standards, on-road diesel regulations, off-road diesel regulations and the Consent Decree. Our short-term working capital needs are primarily crude oil purchase requirements, which fluctuate with the pricing and sourcing of crude oil. Although historically our internally generated cash flows and availability under our senior secured credit facility have been sufficient to meet our needs, we cannot assure you that this will continue to be the case. We also have significant long-term needs for cash. We estimate that mandatory capital and turnaround expenditures, excluding the non-recurring capital expenditures required to comply with Tier II gasoline standards, on-road diesel regulations and off-road diesel regulations described above. Most of these expenditures will occur during the next two years. While we expect that internally generated cash flows, available borrowings under our senior secured credit facility and any net proceeds from the sale of shares by us in this offering will be sufficient to support such capital expenditures, we cannot assure you that this will continue to be the case or that we will be able to find alternative means to support capital expenditures.

Risks Related to Our Nitrogen Fertilizer Business

Because our nitrogen fertilizer plant has high fixed costs, the ability of our nitrogen fertilizer business to maintain profitability will depend on natural gas prices remaining above a certain level.

Our nitrogen fertilizer plant has high fixed costs. As a result, downtime or low productivity due to reduced demand, weather interruptions, equipment failures, low prevailing prices for our products or other causes can result in significant operating losses. Unlike our competitors, whose primary costs are related to the purchase of natural gas and whose fixed costs are minimal, we have high fixed costs not dependent on the price of natural gas. A decline in natural gas prices has the effect of reducing the base price for our products without a corresponding reduction in our costs. Any decline in the price of our fertilizer products for whatever reason would have a negative impact on our results of operations.

15

Our nitrogen fertilizer business is cyclical, which exposes us to potentially significant fluctuations in our financial condition and results of operations.

A significant portion of our nitrogen fertilizer product sales consist of sales of commodity products that are used in agriculture, which is primarily a commodity industry. Accordingly, in the normal course of business, we are exposed to fluctuations in supply and demand, which historically have had and could in the future have significant effects on prices across all of our nitrogen fertilizer products and, in turn, our nitrogen fertilizer business' results of operations and financial condition. The prices of nitrogen fertilizer products depend on a number of factors, including general economic conditions, cyclical trends in end-user markets, supply and demand imbalances, and weather conditions, which have a greater relevance because of the seasonal nature of fertilizer application. Changes in supply result from capacity additions or reductions and from changes in inventory levels. Demand for fertilizer products is dependent, in part, on demand for crop nutrients by the global agricultural industry. Periods of high demand, high capacity utilization, and increasing operating margins have tended to result in new plant investment and increased production until supply exceeds demand, followed by periods of declining prices and declining capacity utilization until the cycle is repeated.

Adverse weather conditions during peak fertilizer application periods may have a negative effect upon our results of operations and financial condition.

Sales of our fertilizer products to agricultural customers are seasonal in nature. As a result, our nitrogen fertilizer business generates greater net sales and operating income in the spring. However, quarterly results may vary significantly from one year to the next due primarily to weather-related shifts in planting schedules and purchase patterns, as well as the relationship between natural gas and nitrogen fertilizer product prices. We derive a majority of our nitrogen fertilizer business from the Great Plains and Midwest states. Accordingly, an adverse weather pattern affecting agriculture in these regions could have a negative effect on fertilizer demand, which could, in turn, result in a decline in our net sales, lower margins and otherwise negatively affect our financial condition and results of operations.

If China begins to export urea on a large scale, the global market for fertilizer could be destabilized which could negatively affect our margins, financial condition, and results of operations.

Given the rapid expansion of Chinese urea production and the possibility that other nitrogen-based fertilizers may meet an increasing share of Chinese domestic demand, China may begin to export large volumes of urea, thereby putting downward pressure on the price of urea and UAN. Because we convert a significant portion of our ammonia production to UAN, and because UAN currently generates higher margins than ammonia, this could negatively affect our results of operations, margins and financial condition.

Our margins and results of operations may be adversely affected by the supply and price levels of petroleum coke and other essential raw materials.

Petroleum coke is a key raw material used in the manufacture of our nitrogen fertilizer products. Our profitability is directly affected by the price and availability of petroleum coke obtained from our oil refinery and purchased from third parties. If we are unable to obtain the majority of the coke we need from our adjacent oil refinery we will be required to purchase coke on the open market, increasingly subjecting us to fluctuations in the price of petroleum coke on the open market. Increases in the price of petroleum coke increase our costs and can decrease our margins. We have no way of predicting to what extent petroleum coke prices will rise in the future. In addition, the air separation plant that provides oxygen, nitrogen, and compressed dry air to our nitrogen fertilizer plant's gasifier has experienced numerous short term (one to five minute) interruptions that adversely impacted gasifier operations.

16

We cannot assure you that we will be able to maintain an adequate supply of petroleum coke and other essential raw materials or that this supply will not be delayed or interrupted, resulting in production delays or in cost increases if alternative sources of supply prove to be more expensive or difficult to obtain. If our cost of raw materials were to increase, or if we were to experience an extended interruption in the supply of raw materials to our production facilities, we could lose sale opportunities, damage our relationships with or lose customers, suffer lower margins, and experience other negative effects to our business, results of operations and financial condition. In addition, if natural gas prices in the U.S. were to decline to a level that prompts those U.S. producers who have permanently or temporarily closed production facilities to resume fertilizer production, this would likely contribute to a global supply/demand imbalance that could negatively affect our margins, results of operations and financial condition.

Ammonia can be very volatile. Accidents involving ammonia could cause severe damage to property and/or injury to the environment and human health.

We manufacture, process, store, handle, distribute and transport ammonia, which is very volatile. Accidents, releases or mishandling involving ammonia could cause severe damage or injury to property, the environment and human health, as well as a possible disruption of supplies and markets. Such an event could result in civil lawsuits and regulatory enforcement proceedings, both of which could lead to significant liabilities. Any damage to persons, equipment or property or other disruption of our ability to produce or distribute our products could result in a significant decrease in operating revenues and significant additional cost to replace or repair and insure our assets, which could negatively affect our operating results and financial condition. In addition, we may incur significant losses or costs relating to the operation of railcars used for the purpose of carrying various products, including ammonia. Due to the dangerous and potentially destructive nature of the cargo, in particular ammonia, on board the railcars, a railcar accident may result in uncontrolled or catastrophic circumstances, including fires, explosions, accidents and severe pollution. Such circumstances may result in severe damage and/or injury to property, the environment and human health. Litigation from any such event may result in our being named as a defendant in lawsuits asserting claims for large amounts of damages. In the event of pollution, we may be subject to strict liability.

Prior to our acquisition of the fertilizer plant and continuing into our ownership, the facility experienced an equipment failure that resulted in air releases of ammonia into the environment. We replaced the equipment in August 2004 and have reported the excess emissions of ammonia to EPA and KDHE as part of an air permitting audit of the facility. The new equipment continues to experience operational difficulties. See "—The results of an air permitting compliance audit may reveal the need for additional controls." We cannot assure you that additional equipment or repairs will not be required or that government enforcement or third-party claims will not result from the excess ammonia emissions and ongoing operational difficulties continuing to be experienced at the fertilizer plant.

Governmental regulations and policies affect the prices and demand for our fertilizer products and could require us to make substantial capital expenditures in the future.

We manufacture, process, store, handle, distribute and transport fertilizer products, including ammonia, that are subject to federal, state and local laws and regulations. Presently existing or future environmental laws and regulations, particularly requirements of the federal Clean Air Act and Clean Water Act, could cause us to expend substantial amounts to comply. In addition, future environmental laws and regulations, or new interpretations of existing laws or regulations, could limit our ability to market and sell our products to end users. We cannot assure you that any such future environmental laws or governmental regulations will not have a significant impact on the results of our operations.

17

The results of an air permitting compliance audit may reveal the need for additional controls.

When we acquired the fertilizer plant, we agreed to undertake a voluntary federal and state air permitting compliance audit. EPA and KDHE agreed not to seek civil penalties if we disclosed and corrected any discovered noncompliance in accordance with their policies. The audit has been completed and we are in the process of correcting noncompliance that was discovered. No penalties are expected to be imposed for the violations that were self-disclosed and corrected, but we have not reached a final resolution with the agencies. We cannot be certain that additional controls will not have to be installed in order to return the fertilizer plant to compliance. We also cannot be certain that each and every instance of noncompliance has been detected by the audit or will be covered by the agencies' audit policies so that no liability would result from the audit.

Our nitrogen fertilizer operations are dependent on a few third-party suppliers. Failure by key third-party suppliers of elemental oxygen, nitrogen and electricity to perform in accordance with their contractual obligations may have a negative effect upon our results of operations and financial condition.

Our operations depend in large part on the performance of third-party suppliers, including The BOC Group, for the supply of oxygen and nitrogen, and the City of Coffeyville for the supply of electricity. Should either of those two suppliers fail to perform in accordance with the existing contractual arrangements, our gasification operation would be forced to a halt. Any shutdown of our operations would have a negative effect upon our results of operations and financial condition.

Risks Related to Our Entire Business

Our operations involve environmental risks that may require us to make substantial capital expenditures to remain in compliance or that could give rise to material liabilities.

Our results of operations may be affected by increased costs resulting from compliance with the extensive federal, state and local environmental laws to which our facilities are subject and from contamination of our facilities as a result of accidental spills, discharges or other releases of petroleum or hazardous substances.