Filed Pursuant to Rule 424(b)(3)

Registration No. 333-128870

PROSPECTUS

Harry & David Operations Corp.

Offer to Exchange

All Outstanding Senior Floating Rate Notes due 2012

for

Newly Issued Senior Floating Rate Notes due 2012

and

All Outstanding 9.0% Senior Notes due 2013

for

Newly Issued 9.0% Senior Notes due 2013

The Exchange Offer

| | • | | We will exchange all of the applicable series of outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of newly issued exchange notes which have been registered under the Securities Act. |

| | • | | The exchange offer expires at 5:00 p.m. New York City Time, on December 6, 2005, unless extended. |

| | • | | You may withdraw tenders of outstanding notes at any time prior to the expiration of the exchange offer. |

| | • | | We will not receive any cash proceeds from the exchange offer. |

| | • | | We do not intend to list the exchange notes on any securities exchange or to seek approval through any automated quotation system and no active market for the exchange notes is anticipated. |

The Exchange Notes

| | • | | The terms of each series of exchange notes to be issued are substantially identical to the applicable series of outstanding notes that Harry & David Operations Corp. issued on February 25, 2005, except for transfer restrictions, registration rights and special interest rate provisions relating to the outstanding notes that will not apply to the exchange notes. |

| | • | | Harry & David Operations Corp.’s obligations under the notes are jointly and severally guaranteed by its parent, Harry & David Holdings, Inc., and by all of its existing and future U.S. restricted subsidiaries. |

| | • | | The exchange notes will be Harry & David Operations Corp.’s senior, unsecured obligations, will rank equally with its other senior unsecured obligations and will be effectively subordinated to all of Harry & David Operations Corp.’s secured obligations to the extent of the value of the assets securing indebtedness. |

| | • | | The guarantees will be the guarantors’ senior, unsecured obligations, and will rank equally with their respective other senior unsecured obligations and will be effectively subordinated to all of their respective secured obligations to the extent of the value of the assets securing such indebtedness. |

Each broker-dealer that receives exchange notes for its own account pursuant to the registered exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the expiration date, we will make this prospectus available to any broker-dealer for use in connection with these resales. See “Plan of Distribution.”

Please consider carefully the “Risk Factors” beginning on page 18 of this prospectus before deciding to participate in the exchange offer.

Neither the SEC nor any state securities commission has approved the securities to be distributed in the exchange offer nor have any of these organizations passed upon the accuracy or adequacy of or disapproval of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 5, 2005

TABLE OF CONTENTS

We have not authorized anyone to provide you with information that is different than that contained in this prospectus. This prospectus may only be used where it is legal to make the exchange offer and by a broker-dealer for resales of exchange notes acquired in the exchange offer where it is legal to do so. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

i

MARKET AND INDUSTRY DATA

Market and industry data, U.S. Census data and forecasts used throughout this prospectus are based on the most recently available independent industry and government publications, reports by market research firms or other published independent sources, including: Packaged Facts; Forrester Research; Shop.org; Unity Marketing; the U.S. Census Bureau; Harris Interactive; and the National Association for the Specialty Food Trade. Some of the data, statistical information and forecasts are also based on our good faith estimates, which are derived from our review of internal surveys, as well as other independent sources and publicly available information.

TRADEMARKS

We own or have rights to trademarks or trade names that we use in conjunction with the operation of our business. Our service marks and trademarks used in this prospectus include: Harry and David® and Jackson & Perkins®; Royal Riviera® pears; Fruit-of-the-Month Club®; Tower of Treats®; Moose Munch®; Baskets by YouSM; Royal Chocolates®; J&P® roses; Simplicity® roses; Ronald Reagan® roses; and Princess Diana® roses. Each trademark, trade name or service mark of any other company appearing in this prospectus belongs to its holder. Use or display by us of other parties’ trademarks, trade names or service marks is not intended to and does not imply a relationship with, or endorsement or sponsorship by us of, the trademark, trade name or service mark owner.

ii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in more detail in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding to invest in the exchange notes. You should read this entire prospectus carefully before deciding to invest in the exchange notes.

Unless otherwise indicated, as used in this prospectus, the terms “we,” “our,” and “us” refer to Harry & David Holdings, Inc. and its consolidated subsidiaries. Harry & David Operations Corp., the issuer of the outstanding notes and the exchange notes, is a wholly owned subsidiary of Harry & David Holdings, Inc., which has guaranteed the outstanding notes and will guarantee the exchange notes.

Our fiscal year has historically ended on the last Saturday of March of each year. Our fiscal quarters have historically ended on the last Saturday in each of June, September, December and March and are generally thirteen weeks in length. Effective June 2005, we changed our fiscal year end to the last Saturday of June of each year with corresponding changes to each of our fiscal quarters. In this prospectus, when we refer to fiscal 2005, we are referring to twelve months ended June 25, 2005 and when we refer to any fiscal year prior to fiscal 2005, we are referring to the twelve months ended on the last Saturday of March of that year. In this prospectus, we sometimes refer to the fourth calendar quarter as the “holiday selling season.” In this prospectus, we sometimes compare information from fiscal 2005, which ended in June, to fiscal 2004 and earlier periods, which ended in March. The change in fiscal year end for fiscal 2005 from March 26, 2005 to June 25, 2005 did not result in any material changes to the results of operations for the respective March 2005 and June 2005 fiscal years. As such, we believe that the comparisons for fiscal 2005 to earlier fiscal years are fair and accurate comparisons.

Our Company

We are a leading multi-channel specialty retailer and producer of branded premium gift-quality fruit and gourmet food products and other gifts marketed under the Harry and David® brand, and premium rose plants, horticultural products and gifts, and other premium home and garden décor products marketed under the Jackson & Perkins® brand, based on net sales. Our signature Harry and David® products include our flagship Royal Riviera® pears and our Fruit-of-the-Month Club®, and our signature Jackson & Perkins® products include our award-winning premium hybrid roses, as well as our patented and exclusive roses. Our Harry and David® and Jackson & Perkins® brands, established 71 years and 133 years ago, respectively, are among the most recognized and distinctive brand names in U.S. direct marketing, and, we believe, are synonymous with high quality products and outstanding customer service. In fiscal 2005, we generated net sales of $566.3 million, an increase of 8.4% over the prior fiscal year.

We market our products through multiple channels, including direct mail, the Internet, business-to-business and consumer telemarketing, as well as our Harry and David retail stores and wholesale distribution through select retailers. We grow, manufacture, design or package products that account for the significant majority of our sales annually, which enables us to efficiently manage our costs, quality assurance, manufacturing flexibility, and inventory.

We have been able to expand our marketing channels and grow our net sales virtually every year over the past three decades, including through several economic cycles. We have done so by focusing on the strength and unique positioning of our brands, our strong customer loyalty and our proprietary database of over 47 million customers, gift recipients and inquiries, as described in more detail under “Business—Our Growth Strategy.”

1

Harry and David®

Founded in 1886 as Bear Creek Orchards and launched as a direct marketing brand in 1934, Harry and David today, grows, manufactures, designs, packages and markets our Harry and David® products through multiple channels as follows:

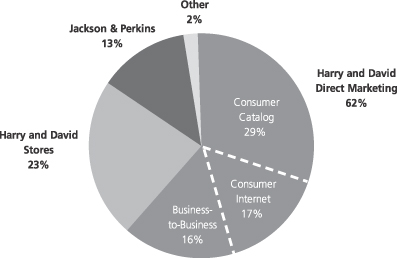

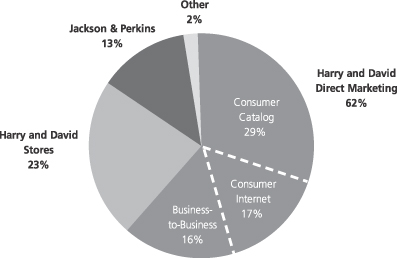

Harry and David Direct Marketing. Direct marketing operations, which accounted for 62% of fiscal 2005 net sales, include our Harry and David catalog, the Internet and our business-to-business and consumer telemarketing channels. Based on our internal evaluations and customer surveys, we believe that our direct marketing efforts have contributed to record annual Harry and David direct marketing sales in fiscal 2005 of $349.6 million, an increase of 11.3% over fiscal 2004, and our highest annual sales growth for the holiday selling season since 2001.

Our catalogs are our primary marketing tool for both existing and new customers and generate the majority of our orders and sales in each of our direct marketing channels. We circulated approximately 94 million Harry and David catalogs in fiscal 2005, an increase of approximately 8% over the prior fiscal year. Our catalog business accounted for 29% of fiscal 2005 net sales.

The Internet, which provides a growing and complementary channel to our catalog business, accounted for nearly 40% of our fiscal 2005 direct marketing orders. Our Internet business accounted for 17% of fiscal 2005 net sales.

Our business-to-business direct marketing channel focuses, which accounted for 16% of fiscal 2005 net sales, on selling our products to businesses and working with our corporate customers to develop effective corporate gift-giving, incentive and consumer promotional programs.

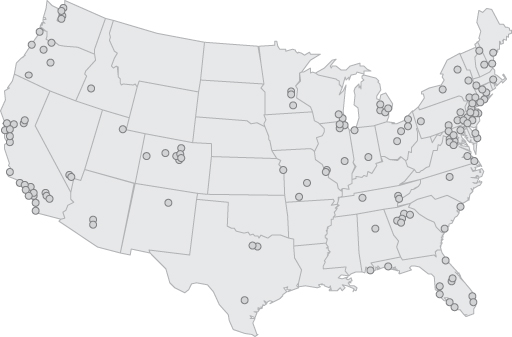

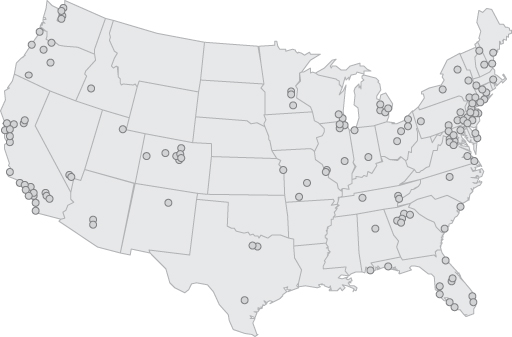

Harry and David Stores. In 1993, we launched the Harry and David stores division and opened our flagship Country Village store near our headquarters in Medford, Oregon in 1994. As of June 25, 2005, in addition to our Country Village store, we operated 83 outlet stores and 52 specialty stores throughout the United States. Our stores serve as a platform for capturing consumer demand for year-round gifts, self-consumption and entertaining needs through an expanded assortment of products beyond our core holiday and seasonal gift selections. We have experienced positive comparable store sales for the last 21 consecutive months, through August 2005. For fiscal 2005, net sales for Harry and David stores, which accounted for 23% of fiscal 2005 net sales, were $130.0 million, an increase of 8.3% compared to fiscal 2004, and a comparable store sales increase of 8.7% compared to fiscal 2004. Comparable store sales are adjusted for the $6.3 million sales generated by stores closed in fiscal 2005.

Harry and David Wholesale. We launched the Harry and David wholesale division in 2001 to further expand our consumer reach. Products sold in the wholesale channel are packaged specifically for this channel and include chocolates and confections and non-fruit gifts. We focus primarily on building relationships with select retailers who are leaders in their respective classes of trade, as described in more detail under “Business—Harry and David®,” and who provide access to a large number of consumers. These relationships provide us with significant opportunities for growth and enable us to utilize our production capabilities during non-peak seasons.

Jackson & Perkins®

Jackson & Perkins was founded in 1872 and we acquired the business in 1966. Jackson & Perkins is the nation’s largest grower and marketer of premium rose plants with nearly 250 registered patents. Jackson & Perkins® products are sold through direct marketing and wholesale distribution channels. For fiscal 2005, net sales for Jackson & Perkins were $75.5 million, which represented 13% of fiscal 2005 net sales.

2

Jackson & Perkins Direct Marketing. Catalogs are the primary marketing tool for Jackson & Perkins, and, in fiscal 2005, Jackson & Perkins circulated approximately 24 million catalogs. The Internet provides a complementary channel to Jackson & Perkins’ catalog operations.

Jackson & Perkins Wholesale. The Jackson & Perkins wholesale business serves customers such as garden centers (both independent members and buying cooperatives), home improvement stores and resellers of our premium rose plants and other horticultural products. Jackson & Perkins wholesale also receives royalty revenue generated by licensing patented roses to other growers for resale. Jackson & Perkins wholesale is the North American master licensee for Suntory, a Japanese breeder of bedding plants and, in that capacity, markets and sublicenses Suntory varieties to bedding plant growers and brokers throughout North America.

Our Competitive Strengths

Well-Positioned Premium Brands with Broad Appeal. The Harry and David® and Jackson & Perkins® premium brands are among the most recognized names in U.S. direct marketing. According to a survey conducted by Harris Interactive, nearly 60% of Americans with income over $75,000, our target market, are aware of the Harry and David® brand.

Loyal Customer Base with Attractive Demographics. We have a loyal customer base with approximately 70% of Harry and David® direct marketing net sales having been generated by repeat purchasers during the last 10 years. Our typical individual customers tend to be affluent, well-educated, discerning and brand-responsive women. Both our individual and corporate customers tend to place larger-than-industry-average orders and have a high propensity to repurchase.

Proprietary and Diverse Product Offerings. We focus on offering distinctive and premium foods, gifts and horticulture products, specializing in “best-in-class” and “hard-to-find” products such as our Royal Riviera® pears (the Comice variety) and our nearly 250 patented varieties of Jackson & Perkins® award-winning hybrid roses. Moreover, each season we introduce new or refreshed products across all channels in order to attract new and repeat customers.

Vertical Integration. We grow, manufacture, design or package products that account for a significant majority of our sales. We believe that our vertical integration allows us to maintain a high degree of control over product quality, generally lowers our product sourcing costs and allows us to optimally adjust the assortment of products we offer and our product inventory levels quickly to respond to changes in customer demand.

High Barriers to Entry. We believe that our vertically integrated operations, proprietary database and substantial and scalable infrastructure combined with the strength of our brands, customer loyalty, signature products, expertise in producing and delivering perishable items and marketing create high barriers to entry, as these attributes would be very costly and time consuming for a competitor to replicate.

Our Growth Strategy

We intend to grow each of our businesses profitably by continuing to execute the following growth strategies:

Promote Our Premium Brands. We intend to increase our investment in our premium brands to promote a consistent brand message and enhance the customer’s experience across all of our channels through further new product development, broader catalog circulation, enhanced packaging and product merchandising and expansion of our Internet presence.

3

Expand Catalog Initiatives. We plan to continue to expand the assortment of products we offer, increase the number of pages in our catalogs and increase the frequency and timeliness of customer mailings. We also plan to increase catalog circulation to prospective gift recipients and consumer and business lists to generate new customers.

Increase Internet Sales. We intend to use the broad appeal and easy access of the Internet to increase our market share of last minute gift giving sales and enhance our brand awareness. We intend to accomplish this by expanding our Internet joint marketing agreements and the frequency and form of our email communications.

Grow Business-to-Business Sales. We intend to promote and grow business-to-business sales by focusing on customized corporate catalogs and websites, increasing our dedicated direct sales force and increasing catalog circulation to business customers and lists.

Capitalize on Proprietary Database. We intend to continue to use information from our proprietary database to target specific existing and potential new customers, customize catalog content pages and product assortments, and identify prospective product line extensions. Additionally, we plan to continue to extrapolate relevant information from our database to drive store traffic and increase cross channel sales.

Increase Store Sales per Square Foot. We intend to increase the sales and productivity of our Harry and David® stores by expanding our store product offerings, enhancing in-store creative merchandising and optimizing our store portfolio. We are also upgrading selected specialty stores to test a new interior design intended to improve store layout and product presentation, increase store traffic and increase the number of browsing customers converted to purchasing customers.

Broaden Reach of Harry and David®Wholesale. We intend to grow our wholesale business by continuing to develop relationships with retailers who are leaders in their respective classes of trade who provide access to a large number of consumers, many of whom are attractive prospective Harry and David customers. We also plan to increase the range of proprietary products sold in this channel.

Increase Jackson & Perkins Profitability. We intend to grow the sales and profitability of Jackson & Perkins by focusing on and investing in brand promotion for Jackson & Perkins’ direct marketing, and expanding its successful gift business. We intend to continue to grow Jackson & Perkins’ wholesale business through enhanced marketing strategies and rose growing practices.

The 2004 Acquisition and Related Financings

We were formed in March 2004 by Wasserstein Partners, LP and certain of its affiliates, or Wasserstein, and Highfields Capital Management and its affiliates, or Highfields, for the purpose of completing the acquisition of Harry & David Operations Corp. On June 17, 2004, we purchased all of the outstanding shares of common stock of Harry & David Operations Corp. (formerly known as Bear Creek Corporation), from Yamanouchi Consumer Inc., or YCI. The aggregate consideration for the acquisition was approximately $252.9 million, including fees and expenses. For more information about the acquisition and how it was financed, see “Management’s Discussion and Analysis of Financial Conditions and Results of Operations—Impact of the 2004 Acquisition and Related Financings.”

4

Recent Developments

We have filed with the Securities and Exchange Commission, or SEC, a registration statement on Form S-1 for a proposed initial public offering of shares of our common stock by us and certain of our stockholders. We will not receive any of the proceeds from the shares of common stock sold by the selling shareholders. We intend to use the net proceeds of the proposed initial public offering to:

| | • | | redeem up to $24.5 million of the floating rate notes and up to $61.3 million of the fixed rate notes, in each case, including accrued and unpaid interest and the applicable premium (which would have aggregated $8.2 million as of September 24, 2005), with the balance of such net proceeds available for general corporate purposes; and |

| | • | | pay to Wasserstein and Highfields a one-time fee relating to the termination of our existing management agreement. The termination fee will be at most $10.0 million based on the expected present value of the fees Wasserstein and Highfields would have received over the life of the management agreement. |

5

The Exchange Offer

Floating Rate Notes | Harry & David Operations Corp. is offering to exchange up to $70,000,000 aggregate principal amount of its Senior Floating Rate Notes due 2012 which have been registered under the Securities Act for an equal principal amount of its outstanding Senior Floating Rate Notes due 2012. The terms of the floating rate exchange notes are identical in all material respects to those of the outstanding floating rate notes, except for transfer restrictions and registration rights relating to the floating rate outstanding notes. |

Fixed Rate Notes | Harry & David Operations Corp. is offering to exchange up to $175,000,000 aggregate principal amount of its 9.0% Senior Notes due 2013 which have been registered under the Securities Act for an equal amount of its outstanding 9.0% Senior Notes due 2013. The terms of the fixed rate exchange notes are identical in all material respects to those of the fixed rate outstanding notes, except for transfer restrictions and registration rights relating to the fixed rate outstanding notes. |

Purpose of the Exchange Offer | The exchange notes are being offered to satisfy our obligations under a registration rights agreement entered into at the time we issued and sold the outstanding notes. |

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, on December 6, 2005, or on a later date and time to which we extend it. |

Failure to Exchange Your Outstanding Notes | If you do not exchange your outstanding notes for exchange notes in the exchange offer, your outstanding notes will continue to be subject to the restrictions on transfer provided in the outstanding notes and the indenture governing the notes. In general, the outstanding notes, unless registered under the Securities Act, may not be offered or sold, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. We do not plan to register the outstanding notes under the Securities Act. |

Procedures for Tendering Outstanding Notes | Each holder of outstanding notes wishing to accept the exchange offer must complete, sign and date the letter of transmittal, or its facsimile, in accordance with its instructions, and mail or otherwise deliver it, or its facsimile, together with the outstanding notes and any other required documentation to the exchange agent at the address in the letter of transmittal. Outstanding notes may be physically delivered, but physical delivery is not required if a confirmation of a book-entry transfer of the outstanding notes to the exchange agent’s account at DTC is delivered in a timely fashion. See “The Exchange Offer—Procedures for Tendering Outstanding Notes.” |

6

Conditions to the Exchange Offer | The exchange offer is not conditioned upon any minimum aggregate principal amount of outstanding notes being tendered for exchange. The exchange offer is subject to certain customary conditions, which may be waived by us. We currently expect that each of the conditions will be satisfied and that no waivers will be necessary. See “The Exchange Offer—Conditions to the Exchange Offer.” |

Withdrawal of Tender | The tender of outstanding notes in the exchange offer may be withdrawn at any time prior to the expiration date. Any outstanding notes not accepted for exchange for any reason will be returned without expense to the tendering holder as promptly as practicable after the expiration or termination of the exchange offer. |

Exchange Agent | Wells Fargo Bank, National Association |

U.S. Federal Income Tax Considerations | Your exchange of an outstanding note for an exchange note will not constitute a taxable exchange. The exchange will not result in taxable income, gain or loss being recognized by you or by us. Immediately after the exchange, you will have the same adjusted basis and holding period in each exchange note received as you had immediately prior to the exchange in the corresponding outstanding note surrendered. See “Important U.S. Federal Income Tax Consequences of the Exchange Offer.” |

7

The Exchange Notes

The following summary describes material terms of the exchange notes, but it is not intended to be complete. For a more detailed description of the exchange notes, see “Description of Floating Rate Notes” and “Description of Fixed Rate Notes.”

The terms of the exchange notes are identical in all material respects to those of the outstanding notes, except for the transfer restrictions and registration rights relating to the outstanding notes that do not apply to the exchange notes.

Issuer | Harry & David Operations Corp. |

Exchange Notes:

Floating Rate Exchange Notes | $70,000,000 aggregate principal amount of Senior Floating Rate Notes due 2012. |

Fixed Rate Exchange Notes | $175,000,000 aggregate principal amount of 9.0% Senior Notes due 2013. |

Interest:

Floating Rate Exchange Notes | The floating rate exchange notes will accrue interest at a floating rate equal to LIBOR (as defined in the indenture) plus 5.0%, and will be reset and payable in arrears quarterly on each March 1, June 1, September 1 and December 1 and will accrue from the last interest payment date on which interest in respect of the outstanding notes surrendered in the exchange offer was paid, or if no interest has been paid on the outstanding notes, from February 25, 2005. |

Fixed Rate Exchange Notes | The fixed rate exchange notes will accrue interest at the rate of 9.0% per year. Interest on the notes will be payable semi-annually in arrears on each March 1 and September 1 and will accrue from the last interest payment date on which interest in respect of the outstanding notes surrender in exchange was paid, or if no interest has been paid on the outstanding notes, from February 25, 2005. |

Maturity Date:

Floating Rate Exchange Notes | March 1, 2012 |

Fixed Rate Exchange Notes | March 1, 2013 |

Optional Redemption:

Floating Rate Exchange Notes | We may redeem the floating rate exchange notes, in whole or in part, at any time before March 1, 2007 at a price equal to 100% of the principal amount thereof, plus the make-whole premium described in this prospectus, plus accrued and unpaid interest to, but excluding, the date of redemption. |

8

| | We may also redeem the floating rate exchange notes, in whole or in part, at any time on or after March 1, 2007 at a redemption price equal to 100% of the principal amount plus a premium declining ratably to par, plus accrued and unpaid interest to, but excluding, the date of redemption. |

| | In addition, prior to March 1, 2007, we may redeem up to 35% of the aggregate principal amount of the floating rate exchange notes with the proceeds of qualified equity offerings at a redemption price equal to 100% of the principal amount, plus LIBOR (as defined in the indenture governing the notes) on the date of the redemption notice, plus 5.0%, plus accrued and unpaid interest to, but excluding, the date of redemption. |

Fixed Rate Notes | We may redeem the fixed rate exchange notes, in whole or part, at any time before March 1, 2009, at a price equal to 100% of the principal amount thereof, plus the make-whole premium described in this offering memorandum, plus accrued and unpaid interest to, but excluding, the date of redemption. |

| | We may also redeem the fixed rate exchange notes, in whole or in part, at any time on or after March 1, 2009 at a redemption price equal to 100% of the principal amount, plus a premium declining ratably to par, plus accrued and unpaid interest to, but excluding, the date of redemption. |

| | In addition, prior to March 1, 2008, we may redeem up to 35% of the aggregate principal amount of the fixed rate exchange notes with the proceeds of qualified equity offerings at a redemption price equal to 109% of the principal amount, plus accrued and unpaid interest to, but excluding, the date of redemption. |

Change of Control | If Harry & David Operations Corp. experiences a change of control, we may be required to offer to purchase the exchange notes at a purchase price equal to 101% of the principal amount, plus accrued and unpaid interest to, but excluding, the date of redemption. We might not be able to pay you the required price for exchange notes you present us at the time of a change of control because our revolving credit facility or other indebtedness may prohibit payment or we might not have enough funds at that time. |

Ranking | The exchange notes will be Harry & David Operations Corp.’s senior unsecured obligations and will rank equal in right of payment to all other secured indebtedness of Harry & David Operations Corp. |

| | The exchange notes will be effectively subordinated to all of Harry & David Operations Corp.’s secured indebtedness, including under our revolving credit facility, to the extent of the value of the assets securing that indebtedness. |

9

| | As of September 24, 2005, we had $63.0 million in borrowings and approximately $4.0 million of letters of credit outstanding under the revolving credit facility and $245.0 million of debt represented by the outstanding notes. As of September 24, 2005, we had an additional $62.0 million available for borrowing under the revolving credit facility. |

Guarantees | The exchange notes will be guaranteed on a senior unsecured basis by Harry & David Holdings, Inc. and by all of Harry & David Operations Corp.’s existing and future domestic restricted subsidiaries. Each guarantee will be a senior unsecured obligation of the applicable guarantor and will rank equal in right of payment with all other senior indebtedness of the guarantor. |

| | The guarantees will be effectively subordinated to all other secured indebtedness of the guarantors, including any obligations of the guarantors under our revolving credit facility, to the extent of the value of the assets securing that indebtedness. |

| | As of September 24, 2005, the parent guarantor and the subsidiary guarantors had no outstanding senior indebtedness, other than in respect of guarantees of the revolving credit facility and the outstanding notes. |

Certain Covenants | The indenture governing the outstanding notes and that will govern the exchange notes contains covenants that limit Harry & David Operations Corp.’s and its restricted subsidiaries’ ability to, among other things: |

| | • | | incur additional indebtedness or issue preferred stock; |

| | • | | pay dividends or make other distributions or repurchase or redeem our stock or subordinated indebtedness; |

| | • | | sell assets and issue capital stock of restricted subsidiaries; |

| | • | | enter into agreements restricting our subsidiaries’ ability to pay dividends; |

| | • | | enter into transactions with affiliates; and |

| | • | | consolidate, merge or sell all or substantially all of Harry & David Operations Corp.’s or its subsidiaries’ assets. |

| | These covenants are subject to important exceptions and qualifications, which are described under the heading “Description of Floating Rate Notes—Certain Covenants” and “Description of Fixed Rate Notes—Certain Covenants” in this prospectus. The indenture does not contain any restrictions on the parent guarantor. |

10

Use of Proceeds | We will not receive any cash proceeds from the issuance of the exchange notes. See “Use of Proceeds.” |

Risk Factors | See “Risk Factors” beginning on page 18 for a discussion of factors you should carefully consider before deciding to participate in the exchange offer. |

Additional Information

Our principal executive offices are located at 2500 South Pacific Highway, Medford, Oregon 97501, and our telephone number is (541) 864-2362. We also maintain a website at www.bco.com.However, the information on our website is not a part of this prospectus and you should rely only on the information contained in this prospectus when making a decision to exchange your outstanding notes.

11

Summary Historical and Pro Forma Consolidated Financial Data

Because the outstanding notes have been guaranteed, and the exchange notes will be guaranteed, by Harry & David Holdings, Inc., the following tables present summary historical and pro forma consolidated financial data for Harry & David Holdings, Inc. and its consolidated subsidiaries, including Harry & David Operations Corp., the issuer of the outstanding notes and exchange notes, and the subsidiary guarantors.

We were formed for the purpose of completing the acquisition of Harry & David Operations Corp. (formerly known as Bear Creek Corporation). Prior to the acquisition, we had substantially no operations. The summary historical consolidated financial data for each of the fiscal years ended March 29, 2003, March 27, 2004 and the period from March 28, 2004 to June 16, 2004 has been derived from, and should be read together with, the audited consolidated financial statements of our predecessor, Harry & David Operations Corp., appearing elsewhere in this prospectus. The summary historical consolidated financial data as of June 26, 2004, June 25, 2005 and for the period from June 17, 2004 to June 26, 2004 and for the twelve months ended June 25, 2005, has been derived from, and should be read together with, the audited consolidated financial statements of Harry & David Holdings, Inc. appearing elsewhere in this prospectus. The summary historical consolidated financial data as of and for the thirteen weeks ended September 25, 2004 and September 24, 2005 has been derived from, and should be read together with, the unaudited condensed consolidated financial statements of Harry & David Holdings, Inc. appearing elsewhere in this prospectus. The summary historical balance sheet information as of March 29, 2003, March 27, 2004 and June 16, 2004 has been derived from the audited consolidated financial statements of our predecessor, Harry & David Operations Corp., which have not been included in this prospectus. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full year or any future period.

The audited consolidated financial statements for fiscal 2003 and fiscal 2004 have been restated to comply with recent SEC guidance on lease accounting. On February 7, 2005, the Office of the Chief Accountant of the SEC issued a letter to the American Institute of Certified Public Accountants, or AICPA, expressing its views regarding certain operating lease-related accounting issues and their application under U.S. generally accepted accounting principles, or GAAP.

The following discussion is only a summary and should be read in conjunction with “Selected Historical Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited and unaudited consolidated financial statements and accompanying notes appearing elsewhere in this prospectus.

The pro forma interest expense for fiscal 2005 and for the 13 weeks ended September 24, 2005 presented below has been prepared to give pro forma effect to the issuance of the outstanding notes in February 2005, the application of the net proceeds of that offering, the proposed initial public offering and the application of the net proceeds of that offering. The pro forma financial data is for informational purposes only and should not be considered indicative of actual results that would have been achieved had the transactions actually been consummated on the dates indicated and do not purport to indicate results as of any future date or for any future period.

12

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Predecessor

| | | Successor

| |

| | | Fiscal Year Ended | | | Period from March 28, 2004 to June 16, 2004

| | | Period from

June 17,

2004 to

June 26, 2004

| | | Fiscal Year Ended

June 25, 2005

| | | Thirteen Weeks Ended

September 25,

2004 (Unaudited)

| | | Thirteen Weeks Ended

September 24,

2005 (Unaudited)

| |

| | | March 29, 2003 (Restated)

| | | March 27, 2004 (Restated)

| | | | | | |

| | | (dollars in thousands, except share and per share data) | | | (dollars in thousands, except share and per share data) | |

Consolidated Operations Statement Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 515,131 | | | $ | 522,162 | | | $ | 61,845 | | | $ | 7,664 | | | $ | 566,266 | | | $ | 53,710 | | | $ | 57,723 | |

Costs and expenses(1): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cost of goods sold | | | 289,049 | | | | 295,706 | | | | 46,152 | | | | 5,382 | | | | 319,776 | | | | 38,189 | | | | 42,756 | |

Selling, general and administrative | | | 205,338 | | | | 211,951 | | | | 41,488 | | | | 4,023 | | | | 218,277 | | | | 37,040 | | | | 39,786 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating income (loss) | | | 20,744 | | | | 14,505 | | | | (25,795 | ) | | | (1,741 | ) | | | 28,213 | | | | (21,519 | ) | | | (24,819 | ) |

| | | | | | | |

Other (Income) Expense: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest income | | | (29 | ) | | | (34 | ) | | | (8 | ) | | | (1 | ) | | | (934 | ) | | | (8 | ) | | | (102 | ) |

Interest expense | | | 654 | | | | 411 | | | | 21 | | | | 565 | | | | 35,351 | | | | 4,966 | | | | 6,453 | |

Loss on investments | | | 1,017 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

Gain on vendor settlement | | | – | | | | (3,735 | ) | | | – | | | | – | | | | – | | | | – | | | | – | |

Other (income) expense | | | 216 | | | | (1,072 | ) | | | – | | | | – | | | | (270 | ) | | | – | | | | – | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income (loss) before provision for income taxes | | | 18,886 | | | | 18,935 | | | | (25,808 | ) | | | (2,305 | ) | | | (5,934 | ) | | | (26,477 | ) | | | (31,170 | ) |

Provision (benefit) for income taxes | | | 8,635 | | | | 8,098 | | | | (10,476 | ) | | | (927 | ) | | | (1,611 | ) | | | (5,771 | ) | | | (13,904 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss)(2) | | $ | 10,251 | | | $ | 10,837 | | | $ | (15,332 | ) | | $ | (1,378 | ) | | $ | (4,323 | ) | | $ | (20,706 | ) | | $ | (17,266 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | |

Net income (loss) per share: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic and diluted | | $ | 10,251 | | | $ | 10,837 | | | $ | (15,332 | ) | | $ | (1.38 | ) | | $ | (4.32 | ) | | $ | (20.71 | ) | | $ | (17.11 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | |

Weighted-average shares used in per share calculations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic and diluted | | | 1,000 | | | | 1,000 | | | | 1,000 | | | | 1,000,000 | | | | 1,000,000 | | | | 1,000,000 | | | | 1,009,454 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | |

Consolidated Balance Sheet Data (at end of period): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 4,515 | | | $ | 3,702 | | | $ | 3,768 | | | $ | 23,629 | | | $ | 24,854 | | | $ | 12,874 | | | $ | 13,708 | |

Working capital(3) | | | 15,047 | | | | 11,630 | | | | 13,195 | | | | 39,692 | | | | 24,992 | | | | 43,456 | | | | 13,431 | |

Total assets | | | 324,108 | | | | 306,988 | | | | 328,299 | | | | 342,318 | | | | 346,812 | | | | 395,932 | | | | 395,327 | |

Total liabilities | | | 143,204 | | | | 115,248 | | | | 118,635 | | | | 259,694 | | | | 367,039 | | | | 334,013 | | | | 431,477 | |

| | | | | | | |

Consolidated Statement of Cash Flow Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in): | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating activities | | $ | 22,988 | | | $ | 29,967 | | | $ | (12,837 | ) | | $ | (1,746 | ) | | $ | 31,647 | | | $ | (58,822 | ) | | $ | (71,163 | ) |

Investing activities | | | (23,696 | ) | | | (15,913 | ) | | | (2,021 | ) | | | (230,367 | ) | | | (14,683 | ) | | | (1,933 | ) | | | (4,070 | ) |

Financing activities | | | 258 | | | | (14,867 | ) | | | 13,996 | | | | 252,902 | | | | (15,739 | ) | | | 50,000 | | | | 64,087 | |

| | | | | | | |

Other Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA(2)(4) | | $ | 36,434 | | | $ | 36,728 | | | $ | (19,741 | ) | | $ | (1,292 | ) | | $ | 44,101 | | | $ | (17,583 | ) | | $ | (19,643 | ) |

Pro forma interest expense(5) | | | | | | | | | | | | | | | | | | | 18,064 | | | | | | | | 4,632 | |

Capital expenditures | | | 23,736 | | | | 15,926 | | | | 2,037 | | | | 247 | | | | 14,683 | | | | 1,938 | | | | 4,078 | |

Depreciation and amortization | | | 16,923 | | | | 17,416 | | | | 6,054 | | | | 449 | | | | 15,618 | | | | 3,936 | | | | 5,176 | |

| | | | | | | |

Financial Ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of earnings to fixed charges(6) | | | 9.2 | x | | | 11.1 | x | | | – | | | | – | | | | 0.9 | x | | | – | | | | – | |

13

| (1) | We paid YCI, our former parent company, a fixed percentage of its total costs for each fiscal year as a cash corporate charge. This charge was intended to compensate YCI for various centralized services that YCI provided to us, such as benefit plan design and administration, income tax planning and compliance, information technology, accounting, treasury operations and auditing, and included an allocation of the depreciation and amortization expense associated with the information technology assets we transferred to YCI at the beginning of fiscal 2003, as described in more detail in footnote (2) below. As part of our acquisition of the common stock of Harry & David Operations Corp., YCI transferred the services and assets and the associated personnel described below back to us as described below in footnote (2). However, due to a disproportionate deconsolidation of YCI resulting from the transfer to Harry & David Operations Corp. of certain personnel who previously performed services for both companies, the transferred amounts exceeded historical cost allocations. As a result, the transfer back to us of the personnel and assets (but excluding the non-cash depreciation and amortization expense associated with the information technology assets, which is discussed separately in footnote (2) below) resulted in an increase of $6.7 million in annual expenses beginning in fiscal 2005 over the amount we paid YCI in fiscal 2004 as a cash corporate charge. These incremental stand-alone costs have been offset in their entirety by annual cost savings resulting primarily from a reduction in force that management implemented beginning in August 2004. |

| | The savings from the reduction in force, as well as other de minimus selling, general and administrative savings and reduced ordinary course banking fees, resulted in total cost savings of $8.5 million in fiscal 2005. The one-time cost associated with achieving these cost savings is estimated to be approximately $7.3 million, primarily representing severance incurred in fiscal 2005 and to be incurred in fiscal 2006. We recorded a liability reserve in our balance sheet in that amount as of the date the acquisition of Harry & David Operations Corp. was consummated (June 17, 2004) as discussed in Note 2 to our audited consolidated financial statements included elsewhere in this prospectus. |

| (2) | In fiscal 2003 and fiscal 2004, net income and EBITDA included, as part of the cash corporate charge described in footnote (1) above, $9.5 million and $9.6 million, respectively, of a depreciation and amortization expense associated with the information technology assets that we transferred to YCI at the beginning of fiscal 2003 and that were transferred back to us in April 2004. Because this expense was charged to us as part of the cash corporate charge, we recorded the expense in selling, general and administrative expense, even though it reflected an allocation of the depreciation and amortization expense recorded at the YCI level on those assets. In fiscal 2005, because those assets were transferred back to us at the beginning of the fiscal year, we recorded the expense as a depreciation and amortization expense and not as a selling, general and administrative expense. Although net income was not impacted because of the different classification of this expense between fiscal 2003 and fiscal 2004, on the one hand, and fiscal 2005, on the other hand, the different classifications did affect the calculation of EBITDA in each period and EBITDA among the periods or in future periods, may not be comparable. |

| | In connection with the acquisition of Harry and David Operations Corp. by us, we made an assessment of our stores and evaluated them for underperformance. As a result of that evaluation, we closed or are in the process of closing 21 underperforming stores in fiscal 2005 and fiscal 2006. Our results for fiscal 2003, 2004, 2005, and for each of the first quarters of fiscal 2005 and 2006, including net income (loss) and EBITDA, include losses of $1.1 million, $1.9 million, $1.1 million, $1.2 million and $0.5 million, respectively, generated by these stores that have now been, or are in the process of being, closed. Because some of these stores were closed at various points during fiscal 2005 and 2006, our results in fiscal 2005 and 2006 may include the results for some of these stores for only a partial year. As a result, fiscal 2005 results may not be comparable to the prior periods. In addition, our historical results may not be indicative of what our future results will be now that these stores have been, or are in the process of being, closed. |

| | In fiscal 2003, net income and EBITDA included: |

| | • | | $9.5 million of depreciation and amortization expenses associated with the information technology assets that we transferred to YCI at the beginning of fiscal 2003, as discussed above; |

| | • | | $1.1 million of losses related to closed stores, as discussed above; |

| | • | | $1.2 million in non-recurring charges, including a $1.0 million charge related to impairments of equity investments in two internet based companies; |

| | • | | $0.3 million related to fixed asset impairment charges related to one store location; and |

| | • | | $0.4 million relating to severance payments that arose due to a reorganization effected when YCI merged certain of our operational units with those of another YCI subsidiary. |

| | Net income and EBITDA in fiscal 2003 did not include compensation expense of $0.5 million that we would have incurred had our current incentive compensation programs been in effect at that time. |

| | In fiscal 2004, net income and EBITDA included: |

| | • | | $9.6 million of depreciation and amortization expenses associated with the information technology assets that we transferred to YCI at the beginning of fiscal 2003 that were transferred back to us in April 2004, as discussed above; |

| | • | | $1.9 million of losses related to closed stores, as discussed above; |

| | • | | $3.3 million relating to fixed asset impairment charges, including $1.9 million related to seven store locations, $1.2 million relating to terminated capital expenditure projects and an impairment charge of $0.2 million related to certain orchards; |

| | • | | $1.1 million in additional inventory reserves resulting from improved inventory turnover reporting as applied to carryover inventory and obsolete product lines; |

14

| | • | | $0.9 million relating to severance payments that arose due to a reorganization effected when YCI merged certain of our operational units with those of another YCI subsidiary; |

| | • | | $1.3 million of FAS 88 pension expense related to a reduction in force, primarily at YCI and its affiliates, which triggered higher pension expense; and |

| | • | | $4.8 million of other income relating to non-recurring charges, including $3.7 million of income related to the settlement of certain litigation and $1.0 million related to life insurance proceeds from the demutualization of a policy. |

| | Net income and EBITDA in fiscal 2004 did not include compensation expense of $1.4 million that we would have incurred had our current incentive compensation programs been in effect at that time. |

| | In fiscal 2005, net loss and EBITDA included: |

| | • | | $1.1 million of losses related to closed stores, as discussed above; |

| | • | | $1.9 million of restructuring charges relating to a reduction in force implemented beginning in August 2004 instead of at the beginning of our prior fiscal year in April 2004; |

| | • | | $2.2 million of one-time consulting fees associated with evaluating the Harry and David® brand strategy and information technology strategy projects and, to a lesser extent, employee executive recruiting charges; |

| | • | | $1.5 million of purchase accounting adjustments reflecting a one-time non-cash charge incurred primarily due to a step-up in store leaseholds and inventory value associated with the purchase accounting in connection with our acquisition of Harry & David Operations Corp. on June 17, 2004; |

| | • | | $0.3 million of other income related to collection of a note receivable written off during fiscal 2002; |

| | • | | $0.9 million related to fixed asset impairment charges from a lower rose crop harvest yield associated with a new growing technique; and |

| | • | | $1.1 million of fees paid to Wasserstein and Highfields under the management agreement. |

| | In the thirteen weeks ended September 25, 2004, net loss and EBITDA included: |

| | • | | $1.2 million of losses related to closed stores, as discussed above; |

| | • | | $0.7 of restructuring charges relating to a reduction in force implemented beginning in August 2004 instead of at the beginning of our prior fiscal year in April 2004; |

| | • | | $0.3 million of one-time consulting fees associated with evaluating the Harry and David® brand strategy and information technology strategy projects and, to a lesser extent, employee executive recruiting charges; |

| | • | | $0.3 million of purchase accounting adjustments reflecting a one-time non-cash charge incurred primarily due to a step-up in store leaseholds and inventory value associated with the purchase accounting in connection with our acquisition of Harry & David Operations Corp. on June 17, 2004: and |

| | • | | $0.3 million of fees paid to Wasserstein and Highfields under the management agreement. |

| | In the thirteen weeks ended September 24, 2005, net loss and EBITDA included: |

| | • | | $0.5 million of losses related to closed stores, as discussed above; |

| | • | | $0.1 million of restructuring charges relating to a reduction in force implemented beginning in August 2004 instead of at the beginning of our prior fiscal year in April 2004; |

| | • | | $0.1 million of one-time consulting fees associated with evaluating the Harry and David® brand strategy and information, technology strategy projects and, to a lesser extent, employee executive recruiting charges; |

| | • | | $0.1 million of rent expense due to a change in accounting treatment; |

| | • | | $0.1 million of charges related to the grant of stock options; |

| | • | | $0.3 million of fees paid to Wasserstein and Highfields under the management agreement; and |

| | • | | $0.5 million of incremental employee executive recruiting and relocation charges. |

| | Because each of the different items of expense and/or income set forth above are not included in each period presented, net income (loss) and EBITDA for fiscal 2003, fiscal 2004 and fiscal 2005, and for the respective first quarters of fiscal 2005 and 2006 may not be comparable, and may not be indicative of future results. |

| (3) | Working capital represents current assets (which includes cash and short-term investments) less current liabilities. |

| (4) | EBITDA is defined as earnings before net interest expense, income taxes, depreciation and amortization and is computed on a consistent method from quarter to quarter and year to year. |

15

| | We use EBITDA, in conjunction with GAAP measures such as cash flows from operating activities, cash flows from investing activities and cash flows from financing activities, to assess our liquidity, financial leverage and ability to service our outstanding debt. For example, certain covenant and compliance ratios under our revolving credit facility and the indenture governing the outstanding notes use EBITDA, as further adjusted for certain items as defined in each agreement. If we are not able to comply with these covenants, we may not be able to borrow additional amounts, incur more debt to finance our ongoing operations and working capital or take other actions. In addition, the lenders could accelerate the outstanding amounts, which could materially and adversely affect our liquidity and financial position. The covenants which use EBITDA and the amounts required for compliance with such covenants are described under the section, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Current Borrowing Arrangements.” |

| | We use EBITDA, in conjunction with the other GAAP measures discussed above, to assess our debt to cash flow leverage, including for planning and forecasting overall expectations and for evaluating actual results against such expectations; to assess our ability to service existing debt and incur new debt; and to measure the rate of capital expenditure and cash outlays from year to year and to assess our ability to fund future capital and non-capital projects. We believe that, like management, debt and equity investors frequently use (and expect to be able to continue to use) EBITDA to compare debt to cash flow leverage among companies. |

| | EBITDA, when used as a liquidity measure, has limitations as an analytical tool. These limitations include: |

| | • | | EBITDA does not reflect our cash expenditures, or future requirements for capital expenditures or contractual commitments; |

| | • | | EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| | • | | EBITDA is not a measure of discretionary cash available to us to pay down debt; |

| | • | | EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; and |

| | • | | other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as comparative measures. |

| | To compensate for these limitations, we analyze EBITDA in conjunction with other GAAP financial measures impacting liquidity and cash flow, including depreciation and amortization, capital spending and net income in terms of the impact on depreciation and amortization, changes in net working capital, other non-operating income and losses that affect cash flow and liquidity, interest expense and taxes. Similarly, you should not consider EBITDA in isolation or as a substitute for these GAAP liquidity measures. |

| | We also use EBITDA, in conjunction with GAAP measures such as operating income and net income, to assess our operating performance and that of each of our businesses and segments. Specifically, we use EBITDA, alongside the GAAP measures mentioned above, to measure profitability and profit margins and to make budgeting decisions relating to historical performance and future expectations of our operating segments and business as a whole, and to make performance comparisons of our company compared to other peer companies. We believe that, like management, debt and equity investors frequently use (and expect to be able to continue to use) EBITDA to assess our operating performance and compare it to that of other peer companies. |

| | Furthermore, we use EBITDA (in conjunction with other GAAP and non-GAAP measures such as operating income, capital expenditures, taxes and changes in working capital) to measure return on capital employed. EBITDA allows us to determine the cash return after taxes, capital spending and changes in working capital generated by the total equity employed in our company. We believe return on capital employed is a useful measure because it indicates the total returns generated by our business, which, when viewed together with profit margin information, allows us to better evaluate profitability and profit margin trends. |

| | As a performance measure, we also use return on capital employed to assist us in making budgeting decisions related to how debt and equity capital is being employed and how it will be employed in the future. Historical measures of return on capital employed, which include the use of EBITDA, are used in estimating and predicting future return on capital trends. Combined with other GAAP financial measures, historical return on capital information helps us make decisions about how to employ capital effectively going forward. |

| | However, because EBITDA does not take into account certain of these non-cash items, which do affect our operations and performance, EBITDA has inherent limitations as an operating measure. These limitations include: |

| | • | | EBITDA does not reflect the cash cost of acquiring assets or the non-cash depreciation and amortization of those assets over time, or the replacement of those assets in the future; |

| | • | | EBITDA does not reflect cash capital expenditures on an historical basis or in the current period, or address future requirements for capital expenditures or contractual commitments; |

| | • | | EBITDA is not a measure of discretionary cash available to us to invest in the growth of our business; |

| | • | | EBITDA does not reflect changes in working capital or cash needed to fund our business; |

| | • | | EBITDA does not reflect our tax expenses or the cash payments we are required to make to fulfill our tax liabilities; and |

| | • | | other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure. |

To compensate for these limitations we analyze EBITDA alongside other GAAP financial measures of operating performance, including, operating income, net income and changes in working capital, in terms of the impact on other non-operating income and losses that affect profitability and return on capital. You should not consider EBITDA in isolation or as a substitute for these GAAP measures of operating performance.

16

The following table reconciles EBITDA to net cash provided by operating activities, which we believe to be the closest GAAP liquidity measure to EBITDA, and net income (loss), which we believe to be the closest GAAP performance measure to EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Predecessor

| | | Successor

| |

| | | Fiscal year ended | | | Period March 28, 2004 to June 16, 2004

| | | Period from June 17, 2004 to June 26, 2004

| | | Fiscal

Year Ended

June 25, 2005

| | | Thirteen

Weeks Ended

September 25,

2004

(Unaudited)

| | | Thirteen

Weeks Ended

September 24,

2005

(Unaudited)

| |

| | | March 29, 2003 (Restated)

| | | March 27, 2004 (Restated)

| | | | | | |

| | | (dollars in thousands) | | | (dollars in thousands) | |

Net cash provided by (used in) operating activities | | $ | 22,988 | | | $ | 29,967 | | | $ | (12,837 | ) | | $ | (1,746 | ) | | $ | 31,647 | | | $ | (58,822 | ) | | $ | (71,163 | ) |

Stock option expense | | | – | | | | – | | | | – | | | | – | | | | 502 | | | | – | | | | 113 | |

Changes in operating assets and liabilities | | | 50 | | | | 68 | | | | (10,879 | ) | | | 6,451 | | | | 469 | | | | (50,735 | ) | | | (46,129 | ) |

Loss on impairment or retirement of PP&E | | | 1,100 | | | | 2,831 | | | | – | | | | – | | | | 192 | | | | 58 | | | | 75 | |

Deferred income taxes | | | (6,353 | ) | | | (1,185 | ) | | | 7,320 | | | | (7,341 | ) | | | 8,242 | | | | 7,479 | | | | (13,715 | ) |

Loss on investments | | | 1,017 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

Deferred financing costs(a) | | | – | | | | – | | | | – | | | | 73 | | | | 10,947 | | | | 786 | | | | 583 | |

Depreciation and amortization | | | 16,923 | | | | 17,416 | | | | 6,054 | | | | 449 | | | | 15,618 | | | | 3,936 | | | | 5,176 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss) | | | 10,251 | | | | 10,837 | | | | (15,332 | ) | | | (1,378 | ) | | | (4,323 | ) | | | (20,706 | ) | | | (17,266 | ) |

Interest expense, net | | | 625 | | | | 377 | | | | 13 | | | | 564 | | | | 34,417 | | | | 4,958 | | | | 6,351 | |

Provision (benefit) for income tax | | | 8,635 | | | | 8,098 | | | | (10,476 | ) | | | (927 | ) | | | (1,611 | ) | | | (5,771 | ) | | | (13,904 | ) |

Depreciation and amortization | | | 16,923 | | | | 17,416 | | | | 6,054 | | | | 449 | | | | 15,618 | | | | 3,936 | | | | 5,176 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

EBITDA | | $ | 36,434 | | | $ | 36,728 | | | $ | (19,741 | ) | | $ | (1,292 | ) | | $ | 44,101 | | | $ | (17,583 | ) | | $ | (19,643 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (5) | Pro forma interest expense has been calculated for fiscal 2005 and for the thirteen weeks ended September 24, 2005, on a pro forma basis after giving effect to the issuance of the outstanding notes in February 2005, the application of the net proceeds of that offering, our proposed initial public offering and the application of the net proceeds from the initial public offering, assuming that each such transaction occurred on June 27, 2004. In calculating pro forma interest expense, we have assumed that we will use a portion of the proceeds of the initial public offering to redeem $24.5 million of the floating rate notes and $61.3 million of the senior notes. We have also assumed that the floating rate notes accrued interest at 8.33% and 8.87%, respectively, during all of fiscal 2005 and during the thirteen weeks ended September 24, 2005, the applicable interest rate as of June 25, 2005 and September 24, 2005. The following table reflects the adjustments made to historical interest expense to arrive at pro forma interest expense: |

| | | | | | |

| | | Fiscal Year

Ended

June 25,

2005

| | | Thirteen

Weeks Ended

September 24,

2005

| |

Interest Expense: | | |

Eliminate historical interest expense | | 32,360 | | | 5,869 | |

Include full-year pro forma interest expense | | (16,159 | ) | | (4,155 | ) |

Eliminate amortization of historical deferred financing fees | | 2,991 | | | 583 | |

Include pro forma full-year amortization of deferred financing fees | | (1,905 | ) | | (477 | ) |

| | |

|

| |

|

|

Pro forma adjustment | | 17,287 | | | 1,821 | |

| | |

|

| |

|

|

| (6) | For the purposes of calculating the ratio of earnings to fixed charges, “earnings” represents income from continuing operations before income taxes, plus fixed charges. “Fixed charges” consist of interest expense, including amortization of debt issuance costs, capitalized interest, and that portion of rental expense considered to be a reasonable approximation of interest. Our earnings for the period from March 28, 2004 to June 16, 2004, the period from June 17, 2004 to June 26, 2004, and the thirteen weeks ended September 25, 2004 and September 24, 2005, is less than one-to-one, which indicates that earnings were insufficient to cover fixed charges. The deficiency for the period from March 28, 2004 to June 16, 2004, the period from June 17, 2004 to June 26, 2004, and the thirteen weeks ended September 25, 2004 and September 24, 2005, was $25.5 million, $1.6 million, $20.3 million and $23.4 million, respectively. On a pro forma basis, after giving effect to the issuance of the outstanding notes and the application of the net proceeds from that issuance, and the intended use of the net proceeds from the initial public offering, as if each transaction had occurred on June 27, 2004, our ratio of earnings to fixed charges would have been 1.5x. |

17

RISK FACTORS

Our business, operations and financial condition are subject to various risks. Some of these risks are described below and you should take these risks into account in making a decision to participate in the exchange offer. This section does not describe all risks associated with us, our industry or our business, and it is intended only as a summary of the material risk factors. If any of the following risks actually occurs, we may not be able to conduct our business as currently planned and our financial condition and operating results could be seriously harmed.

Risks Relating to Our Business

The majority of our sales and net earnings are realized during the holiday selling season from October through December, therefore, if sales during this period are below our expectations, there will be a disproportionate effect on our revenues and expenses.

We experience significantly increased sales activity during the holiday selling season, particularly between the Thanksgiving and Christmas holidays. For example, in fiscal 2005 the Harry and David direct marketing and Harry and David stores segments collectively generated approximately two-thirds of their annual net sales during the holiday selling season. In anticipation of the holiday selling season, we commit to and incur significant advance and incremental expenses. For example, we typically hire a substantial number of seasonal employees to supplement our existing workforce and significantly increase our inventory levels. If sales during this period are below our expectations, there will be a disproportionate effect on our revenues and expenses. Disruption in our operations in preparation for or during the holiday season could result in decreased sales. Such disruptions can result from interruptions or delays in telecommunication systems or the Internet that interfere with our order-taking process, supply chain disruptions caused by an interruption in our information technology systems or at our distribution centers, which could impede the timely and effective delivery of our products and result in cancelled orders, a delay in the circulation of our holiday catalogs, or other problems with our information technology or order-fulfillment operations as discussed below.

If we fail to successfully manage our order fulfillment and distribution operations, merchandise may not be delivered in a timely and effective manner and the reputation of our brands may be damaged, resulting in decreased sales or unanticipated expenses.

In order to deliver high-quality products on a timely, reliable and accurate basis, we must successfully manage our order-taking, fulfillment and distribution operations. Our call centers and websites must be able to handle increased traffic, particularly during peak holiday periods. As is common in our industry, our order-taking operations rely, in part, on third parties who provide telecommunications, data, electrical and other systems. If these third parties experience system failures, interruptions or long response times, degradation of our service may result. If orders are incorrect, incomplete, defective, or not delivered on time, customer retention rates could decline and, in turn, cause our revenues and profitability to decline.

We conduct the majority of our distribution operations through three year-round distribution centers. A serious disruption or slow-down at any of these facilities or to the flow of goods in or out of these centers due to inclement weather, fire, earthquake, telephone service or power outages, inadequate system capacity, labor disputes, union organizing activity, human error, acts of terrorism or any other cause could materially impair our ability to distribute our products to customers in a timely manner or at the anticipated cost. We could incur significantly higher costs and longer lead times associated with distributing our products to our customers during the time that it takes for us to reopen or replace any of our distribution centers or systems, which could reduce our revenues and profits and may harm our relationships with our customers. A significant portion of our products are perishable goods, and any disruption in operations, particularly any failure of our cold storage facilities, could damage a significant portion of our inventory and require us to write off that damaged inventory, thereby increasing our expenses.

18

Extreme weather conditions, crop diseases and pests could reduce both our crop size and quality, and we may be unable to produce or acquire sufficient inventory, resulting in lost sales, increased costs or lost customers.

Our business activities are subject to a variety of agricultural risks. Extreme weather conditions, such as droughts, frosts, hail or other storms, can cause unfavorable growing conditions that may adversely affect the quality and quantity of the pears, peaches and roses grown in our orchards and nurseries. Moreover, all of our irrigation rights are subject to and limited by adequate availability of irrigation water within a particular water shed system. Seasonal circumstances such as lower annual rainfall or snow accumulation may negatively affect the availability of water and consequently, in such a year, we may not receive our full allotment of water. The loss or reduction of the supply of water to any of our orchards or farms as a result of a drought at a particular water shed, could result in our inability to produce sufficient inventory. Furthermore, weather conditions may also affect the availability and ripening of the fruit we use in various programs and promotions, which in turn may shift sales between quarters on a comparable year-to-year basis. Pests and crop diseases can also reduce our crop size and quality. If any of these factors affect a substantial portion of our production facilities in any year, we may be unable to produce sufficient crop inventory, resulting in lost sales, shifts in fruit sales between fiscal quarters, increased costs and/or lost customers.

Our operations and the food and horticultural products that we grow, manufacture and market, including products we source from third parties, are subject to regulation and inspection by the U.S. Department of Agriculture and the U.S. Food and Drug Administration, among other regulatory agencies, and we may incur increased costs to comply with applicable regulations.

We are subject to regulations enforced by, among others, the U.S. Food and Drug Administration and state, local and foreign equivalents, and to inspection by the U.S. Department of Agriculture and other federal, state, local and foreign environmental, health and safety authorities. These agencies enforce statutory standards and regulate matters such as the nature and amounts of pesticides that may be used in growing fruit, the sanitary condition of storage, processing and packing facilities and equipment, documentation of shipments, traceability of food products, the use of various additives, labeling, sales promotion, marketing practices and, in some cases, the fruit that may be shipped to or from a state. Although we believe that our operations and our products, including products we source from third parties, are substantially in compliance with all currently applicable regulations and licensing requirements, we may be required to incur costly changes to operations in the future if regulations change or if new rules are adopted or if it is ultimately determined that we are not in compliance with existing regulations. Applicable federal, state or local regulations may cause us to incur substantial compliance costs or delay the availability of items at one or more of our orchards, nurseries, food production facilities, or storage and distribution centers, which could result in decreased sales. In addition, if violations occur, regulators can impose fines, penalties or other sanctions, and we could be subject to private lawsuits alleging injury and/or property damage. Our products could also become subject to quarantine by regulatory authorities, which would result in significant lost sales.

If we are unable to accurately target the appropriate segment of the consumer market with our catalog mailings and achieve adequate response rates through our catalog mailings, we could experience lower sales, significant markdowns or write-offs of inventory and lower margins.

We have historically relied on revenues generated from customers initially contacted through our catalog mailings. The success of our direct marketing business largely depends on our ability to achieve adequate response rates to our catalog mailings, which have historically fluctuated. Although we track the purchasing history of our customers to extrapolate a customer’s propensity to respond to future catalog circulations, any of the following could cause customers to forgo or defer purchases:

| | • | | the failure by us to offer a mix of products that is attractive to our catalog customers; |

19

| | • | | the size and breadth of our product offering and the timeliness and condition of delivery of our catalog mailings; |

| | • | | the inability to design appealing catalogs; and |

| | • | | the customer’s particular economic circumstances or general economic conditions. |

Store performance may fluctuate and our store sales may decrease in the future.

Our store sales have fluctuated significantly in the past on an annual, quarterly and monthly basis, and we expect that comparable store sales will continue to fluctuate in the future. Various factors affect store sales, including:

| | • | | the general retail sales environment, including local competition and economic conditions, which if negatively impacted by lower discretionary spending among our target market, could cause our store sales to decline; |

| | • | | seasonal changes in our merchandise mix and the timing of release and the success of new merchandise and promotional events, which could adversely affect our sales if we fail to accurately anticipate and respond to merchandise trends and customer demands; |

| | • | | our ability to efficiently source and distribute products, which could be adversely impacted by third-party suppliers’ ability to timely fill our purchase orders and distribute merchandise to our stores; |

| | • | | the success of marketing programs; |

| | • | | our ability to attract and retain a qualified sales staff, particularly during the holiday season, which may be adversely impacted by changes to the local labor markets; and |

| | • | | the number of stores we open, expand, or close in any period, which may fluctuate if stores do not meet, or exceed, sales expectations. |

In addition, adverse weather conditions can reduce customer traffic, thereby affecting comparable store sales.

Some of our agricultural lands receive irrigation water through facilities improved by or owned and operated by the United States government acting through the Department of the Interior’s Bureau of Reclamation, which subjects us and certain holders of our common stock to annual disclosure and filing requirements. Failure to comply with such requirements would subject us to the risk of denial of water, which could adversely affect our pear, peach and plant production and increase our costs, resulting in lower revenues.