Exhibit 99.2

May 12, 2022

Fellow Shareholders:

On behalf of the Board of Directors and management of Fortuna Silver Mines Inc., I write in connection with the 2022 annual general meeting of shareholders. The meeting will be held in the Cheakamus Room, Fairmont Waterfront Hotel, 900 Canada Place, Vancouver, BC on Monday, June 27, 2022 at 10:00 a.m. (Vancouver time).

The accompanying Management Information Circular contains important information regarding recording your votes, the directors nominated for election, our corporate governance practices, and how we compensate our executives and directors.

We encourage you to exercise your vote, either in person at the meeting, or by providing your proxy vote, either in paper form, by telephone or online.

We look forward to seeing you at the meeting.

Sincerely,

Jorge Ganoza Durant

President and Chief Executive Officer

NOTIFICATION OF NOTICE AND ACCESS TO SHAREHOLDERS

AND

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual General Meeting (the “Meeting”) of the shareholders of Fortuna Silver Mines Inc. (the “Company”) will be held in the Cheakamus Room, Fairmont Waterfront Hotel, 900 Canada Place, Vancouver, British Columbia on Monday, June 27, 2022 at the hour of 10:00 a.m. (local time), where shareholders will be asked:

| (a) | To receive the financial statements of the Company for the fiscal year ended December 31, 2021, together with the report of the auditors thereon; |

| (b) | To appoint auditors and to authorize the directors of the Company (the “Directors”) to fix their remuneration (for further information, please see the section entitled “Particulars of Matters to be Acted Upon – Appointment and Remuneration of Auditors” in the Circular) as defined below; |

| (c) | To determine the number of Directors at seven (for further information, please see the section entitled “Particulars of Matters to be Acted Upon – Election of Directors” in the Circular); and |

| (d) | To elect Directors (for further information, please see the section entitled “Particulars of Matters to be Acted Upon – Election of Directors” in the Circular). |

Shareholders are also hereby notified that the Company is using the notice-and-access provisions (“Notice-and-Access”) contained in National Instrument 54-101 for the delivery to its shareholders of the proxy materials for the Meeting (the “Meeting Materials”), which include the Management Information Circular for the Meeting (the “Circular”). Under Notice- and-Access, instead of receiving paper copies of the Meeting Materials, shareholders receive this notice to advise them how to either obtain the Meeting Materials electronically or request a paper copy of the Meeting Materials.

Those shareholders with existing instructions on their account to receive paper materials will receive paper copies of the Meeting Materials with this Notice.

Accessing Meeting Materials Online

The Meeting Materials are available on the Company’s SEDAR profile located at www.sedar.com and are also available on the Company’s website at: https://fortunasilver.com/investors/shareholder-meeting-materials/. The Meeting Materials will remain on the Company’s website for one year following the date of this notice. Shareholders are reminded to access and review all of the information contained in the Circular and other Meeting Materials before voting.

Requesting Printed Meeting Materials

Registered shareholders may request a paper copy of the Meeting Materials by telephone at any time prior to the Meeting by calling toll-free at 1-866-962-0498 (or, for holders outside of North America, 1-514-982-8716) and entering the control number located on the proxy and following the instructions provided. A paper copy will be sent to you within three business days of receiving your request. To receive the Meeting Materials prior to the proxy cut-off for the Meeting, you should make your request by Monday, June 13, 2022.

| MANAGEMENT INFORMATION CIRCULAR | Page | i |

Beneficial shareholders may request a paper copy by going on-line at www.proxyvote.com or by calling toll-free at 1-877- 907-7643 and entering the control number located on the voting instruction form and following the instructions provided. If you do not have a control number, please call toll-free at 1-855-887-2243. A paper copy will be sent to you within three business days of receiving your request. To receive the Meeting Materials prior to the proxy cut-off for the Meeting, you should make your request by Monday, June 13, 2022.

For paper copy requests made on or after the date of the Meeting, all shareholders may call toll-free at 1-877-907-7643 (if you have a control number) or 1-855-887-2243 (if you do not have a control number) and a paper copy will be sent to you within 10 calendar days of receiving your request.

Shareholders may obtain a printed copy of the Meeting Materials at no cost until the date that is one year following the date of this notice by calling Broadridge toll free at 1-877-907-7643.

Voting of Proxies

Registered Shareholders

Registered shareholders will still receive a proxy form enabling them to vote at the Meeting. Such proxy will not be valid unless a completed, dated and signed form of proxy is received by Computershare Trust Company, 100 University Avenue, 8th Floor, Toronto, ON M5J 2Y1, no less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the Meeting or any adjournment thereof, or, at the discretion of the Chairman, is delivered to the Chairman of the Meeting prior to commencement of the Meeting or any adjournment thereof.

Non-Registered Shareholders

Shareholders who hold common shares of the Company beneficially (“Non-Registered Holders”), but registered in the name of intermediaries, such as brokers, investment firms, clearing houses and similar entities (“Intermediaries”) may receive certain other materials from their Intermediary, such as a voting instruction form to vote their shares. If you are a Non- Registered Holder of the Company and receive these materials through your broker or through another Intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or by the other Intermediary.

Voting Methods |  |  |

|

| Internet | Telephone or Fax | Mail |

Registered Shareholders Shares are held in own name and represented by a physical certificate or DRS Advice | Vote online at

www.investorvote.com | Telephone: 1-866-732-8683 Fax: 1-866-249-7775 | Return the form of proxy in the enclosed envelope. |

Beneficial Shareholders Shares held with a broker, bank or other Intermediary. | Vote online at

www.proxyvote.com

| Call or fax to the number(s) listed on your voting instruction form. | Return the voting instruction form in the enclosed envelope. |

Questions

If you have any questions about Notice-and-Access and the information contained in this notice, you may obtain further information by calling Broadridge toll free at 1-855-887-2244.

| DATED the 12th day of May, 2022. | |

| | President and Chief Executive Officer |

| MANAGEMENT INFORMATION CIRCULAR | Page | ii |

MANAGEMENT INFORMATION CIRCULAR

TABLE OF CONTENTS

| PROXIES | 1 |

| Notice-and-Access Process | 1 |

| Solicitation and Deposit of Proxies | 1 |

| Non-Registered Holders | 2 |

| Voting of Proxies | 2 |

| Revocation of Proxies | 3 |

| VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF | 3 |

| PARTICULARS OF MATTERS TO BE ACTED UPON | 3 |

| Appointment and Remuneration of Auditors | 3 |

| Election of Directors | 4 |

| OTHER INFORMATION | 9 |

| Audit Committee Disclosure | 9 |

| Normal Course Issuer Bid | 9 |

| Summary of Incentive Plans | 9 |

| Interest of Certain Persons in Matters To Be Acted Upon | 10 |

| Interest of Informed Persons in Material Transactions | 10 |

| Additional Information | 10 |

| Schedule A | Statement of Executive Compensation |

| Schedule B | Corporate Governance |

| MANAGEMENT INFORMATION CIRCULAR | |

MANAGEMENT INFORMATION CIRCULAR

As at May 12, 2022

(Monetary amounts expressed in US dollars, unless otherwise indicated)

This Management Information Circular (“Circular”) is furnished in connection with the solicitation of proxies by and on behalf of the management of Fortuna Silver Mines Inc. (the “Company” or “Fortuna”) for use at the Annual General Meeting of the holders of common shares (“Common Shares”) of the Company to be held on Monday, June 27, 2022 (the “Meeting”) and any adjournment thereof, at the time and place and for the purposes set forth in the notice of the Meeting (the “Notice of the Meeting”).

In this Circular, references to “Non-Registered Holders” means shareholders who do not hold Common Shares in their own name and “Intermediaries” refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Non-Registered Holders.

PROXIES

Notice-and-Access Process

The Company has elected to use the notice-and-access provisions (“Notice-and-Access”) of National Instrument 54-101 for distribution of this Circular, form of proxy (“Proxy”) and other meeting materials (the “Meeting Materials”) to registered shareholders and Non-Registered Holders of the Company.

Under Notice-and-Access, rather than the Company mailing paper copies of the Meeting Materials to shareholders, the Meeting Materials can be accessed online on the Company’s SEDAR profile at www.sedar.com or on the Company’s website at: https://fortunasilver.com/investors/shareholder-meeting-materials/. The Company has adopted this alternative means of delivery for the Meeting Materials in order to reduce paper use and the printing and mailing costs.

Shareholders will receive a “notice package” (the “Notice-and-Access Notification”) by prepaid mail, with details regarding the Meeting date, location and purpose, and information on how to access the Meeting Materials online or request a paper copy.

Shareholders will not receive a paper copy of the Meeting Materials unless they contact Broadridge at the applicable toll free number as set out in the Notice of the Meeting. Provided the request is made prior to the Meeting, Broadridge will mail the requested materials within three business days. Requests for paper copies of the Meeting Materials should be made by June 13, 2022 in order to receive the Meeting Materials in time to vote before the Meeting.

Shareholders with questions about Notice-and-Access may contact Broadridge toll-free at 1-855-887-2244.

Solicitation and Deposit of Proxies

While it is expected that the solicitation will be primarily by Notice-and-Access and mail, Proxies may be solicited personally or by telephone by the directors and regular employees of the Company. All costs of solicitation will be borne by the Company. We have arranged for Intermediaries to forward the Notice-and-Access Notification to Non-Registered Holders of Common Shares held as of record by those Intermediaries and we may reimburse the Intermediaries for their reasonable fees and disbursements in that regard.

The individuals named in the Proxy are directors of the Company, senior management and the Corporate Secretary of the Company. A shareholder wishing to appoint some other person (who need not be a shareholder) to represent him or her at the Meeting has the right to do so, either by inserting such person’s name in the blank space provided in the Proxy and striking out the two printed names or by completing another form of proxy. The Proxy will not be valid unless the completed, dated and signed form of proxy is received by Computershare Trust Company, 100 University Avenue, 8th Floor, Ontario M5J 2Y1, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the Meeting or any adjournment thereof, or, at the discretion of the Chairman, is delivered to the Chairman of the Meeting prior to commencement of the Meeting or any adjournment thereof.

| MANAGEMENT INFORMATION CIRCULAR | Page | 1 |

Non-Registered Holders

Only registered holders of Common Shares or the persons they appoint as their proxyholders are permitted to vote at the Meeting. In many cases, however, Common Shares beneficially owned by a Non-Registered Holder are registered either:

| (a) | in the name of an Intermediary that the Non-Registered Holder deals with in respect of the shares. Intermediaries include banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans, or |

| (b) | in the name of a clearing agency, such as The Canadian Depository for Securities Limited (CDS), of which the Intermediary is a participant. |

There are two kinds of Non-Registered Holders – those who have not objected to their Intermediary disclosing certain ownership information about themselves to the Company, referred to as “Non-Objecting Beneficial Owners”, and those who have objected to their Intermediary disclosing ownership information about themselves to the Company, referred to as “Objecting Beneficial Owners” (“OBOs”).

In accordance with the requirements of NI 54-101, the Company will distribute the Notice-and-Access Notification to Intermediaries and clearing agencies for onward distribution to all Non-Registered Holders. Intermediaries are required to forward the Notice-and-Access Notification to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive Meeting Materials. Intermediaries often use service companies to forward the Meeting Materials to Non-Registered Holders. The Company intends to pay for the delivery to OBOs, by Intermediaries, of any proxy-related materials and Form 54-101F7 – Request for Voting Instructions made by Intermediary for the Meeting.

Generally, Non-Registered Holders who have not waived the right to receive Meeting Materials will be sent a voting instruction form which must be completed, signed and returned by the Non-Registered Holder in accordance with the Intermediary’s directions on the voting instruction form. In some cases, such Non-Registered Holders will instead be given a Proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature) which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. This form of proxy does not need to be signed by the Non-Registered Holder, but, to be used at the Meeting, needs to be properly completed and deposited with Computershare Trust Company as described under “Solicitation and Deposit of Proxies” above.

The purpose of these procedures is to permit Non-Registered Holders to direct the voting of the Common Shares that they beneficially own. Should a Non-Registered Holder wish to attend and vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should strike out the names of the persons named in the Proxy and insert the Non-Registered Holder’s (or such other person’s) name in the blank space provided or, in the case of a voting instruction form, follow the corresponding instructions on the form.

Non-Registered Holders should carefully follow the instructions of their Intermediaries and their service companies, including instructions regarding when and where the voting instruction form or Proxy form is to be delivered.

Voting of Proxies

Common Shares represented by any properly executed Proxy will be voted or withheld from voting on any ballot that may be called for in accordance with the instructions given by the shareholder. In the absence of such direction, such Common Shares will be voted in favour of the matters set forth herein.

The Proxy, when properly completed and delivered and not revoked, confers discretionary authority upon the person appointed proxy thereunder to vote with respect to amendments or variations of matters identified in the Notice of the Meeting, and with respect to other matters which may properly come before the Meeting. In the event that amendments or variations to matters identified in the Notice of the Meeting are properly brought before the Meeting or any further or other business is properly brought before the Meeting, it is the intention of the persons designated in the Proxy to vote in accordance with their best judgment on such matters or business. As at the date hereof, the management of the Company knows of no such amendment, variation or other matter that may come before the Meeting.

| MANAGEMENT INFORMATION CIRCULAR | Page | 2 |

Revocation of Proxies

A shareholder who has given a Proxy may revoke it by an instrument in writing executed by the shareholder or by his or her attorney authorized in writing or, where the shareholder is a corporation, by a duly authorized officer or attorney of the corporation, and delivered either to the registered office of the Company, 200 Burrard Street, Suite 650, Vancouver, British Columbia, V6C 3L6, at any time up to and including the last business day preceding the day of the Meeting, or if adjourned, any reconvening thereof, or to the Chairman of the Meeting on the day of the Meeting or, if adjourned, any reconvening thereof or in any other manner provided by law. A revocation of a Proxy does not affect any matter on which a vote has been taken prior to the revocation.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

As at the record date of May 9, 2022 (the “Record Date”), the Company had issued and outstanding 292,176,418 fully paid and non-assessable Common Shares, each share carrying the right to one vote. The Company has no other classes of voting securities.

Holders of Common Shares as at the Record Date who either personally attend the Meeting or who have completed and delivered a Proxy or VIF in the manner and subject to the provisions described above shall be entitled to vote or to have their Common Shares voted at the Meeting.

To the knowledge of the directors and officers of the Company, as at the Record Date, no person or company directly or indirectly beneficially owns or exercises control or direction over Common Shares carrying more than 10% of the voting rights attached to all outstanding Common Shares of the Company, other than:

| Name | | No. of Common Shares | | | % of Outstanding Common Shares | |

| Van Eck Associates Corporation | | | 30,690,608 | | | | 10.50 | % |

PARTICULARS OF MATTERS TO BE ACTED UPON

To the knowledge of the Board of directors of the Company (the “Board”), the only matters to be brought before the Meeting are those matters set forth in the Notice of the Meeting, as more particularly described as follows:

Appointment and Remuneration of Auditors

Effective July 13, 2017, KPMG LLP, Chartered Professional Accountants, were appointed as auditors of the Company. The management of the Company will recommend to the Meeting to appoint KPMG LLP as auditors of the Company for the ensuing year, and to authorize the directors to fix their remuneration.

Recommendation: Management of the Company recommends that Shareholders VOTE FOR the appointment of KPMG LLP as Fortuna's auditors and authorizing the directors to fix their remuneration.

Proxies: Unless otherwise instructed, Proxies in favour of the management designees will VOTE FOR the appointment of KPMG LLP as Fortuna's auditors and authorizing the directors to fix their remuneration.

| MANAGEMENT INFORMATION CIRCULAR | Page | 3 |

Election of Directors

The Board presently consists of seven directors. Shareholders will be asked at the Meeting to determine the number of directors at seven, and to elect seven directors. The term of office for all the current directors will expire on the date of the Meeting. The persons named below (the “Director Nominees”) will be presented for election at the Meeting as management’s nominees and the persons named in the Proxy intend to vote for the election of these nominees. Management does not contemplate that any of these nominees will be unable to serve as a director. Each director elected will hold office until the next annual general meeting of the Company or until his or her successor is elected or appointed, unless his or her office is earlier vacated in accordance with the Articles of the Company, or with the provisions of the British Columbia Business Corporations Act.

Recommendation: Management of the Company recommends that Shareholders VOTE FOR the election of each of the Director Nominees.

Proxies: Unless otherwise instructed, Proxies in favour of the management designees will VOTE FOR the ordinary resolution for the election of the seven Director Nominees

Information regarding the Director Nominees is set out below:

JORGE GANOZA DURANT - Director, President and Chief Executive Officer Jorge Ganoza Durant is a geological engineer with over 25 years of experience in mineral exploration, mining and business development throughout Latin America. He is a graduate from the New Mexico Institute of Mining and Technology. He is a fourth generation miner from a Peruvian family that has owned and operated underground gold, silver and polymetallic mines in Peru and Panama. Before co-founding Fortuna in 2004, Jorge was involved in business development at senior levels for several private and public Canadian junior mining companies working in Central and South America.

|

Residence: Age: | Lima, Peru 52 | Principal Occupation: President and CEO of the Company | | Areas of Expertise: Strategy and Leadership Operations and Exploration Corporate Governance Metals and Mining

Health and Safety, Environment and Sustainability Finance Human Resources Financial Literacy International Business Spanish Language |

| | | | |

| Independent: | No | Equity Ownership: | |

| Director since: | December 2, 2004 | Shares: | 1,988,131 |

| 2021 vote results: | 98.4% in favour | Options: | 450,987 |

| | | PSUs/RSUs (share-settled): | 782,383 |

| | | | |

| 2021 Meeting Attendance: | Mr. Ganoza meets the Company’s minimum equity ownership requirements. As at May 12, 2022, the value of Mr. Ganoza’s common shares, not including options, PSUs and RSUs, was $5,427,598. |

| Board: | 12 of 12 |

| Overall: | 100% |

| Other Public Boards: | |

| | |

| Nil | | | | | |

| | | | | | |

| MANAGEMENT INFORMATION CIRCULAR | Page | 4 |

DAVID LAING - Director; Chair of the Board; Chair of Sustainability Committee; Member of Compensation Committee. David Laing is a mining engineer with over 35 years of experience in the industry. He was the COO of Equinox Gold Corp. and predecessors (mining) from August 2016 to November 2018, and was the COO of Luna Gold from August 2016 until it merged with JDL Gold in March 2017 to form Trek Mining. Before joining Luna Gold, David was the COO of True Gold, which developed the Karma gold mine in Burkina Faso and was acquired by Endeavour Mining in April 2016. Prior to joining True Gold, David was COO and EVP of Quintana Resources Capital, a base metals streaming company. David was also one of the original executives of Endeavour Mining, a gold producer in West Africa. Prior to these recent roles, David held senior positions in mining investment banking at Standard Bank in New York, technical consulting at MRDI in California, the Refugio project at Bema Gold Corp., and various roles at Billiton with operations in Peru, South Africa, and northern Chile. | |

Residence: Age: | BC, Canada 66 | Principal Occupation: Mining Engineer; Independent Mining Consultant | | Areas of Expertise: Strategy and Leadership Operations and Exploration Corporate Governance Metals and Mining Health and Safety, Environment and Sustainability Finance Human Resources Financial Literacy International Business Spanish Language | |

| | | | | |

| Independent: | Yes | Equity Ownership: | | |

| Director since: | September 26, 2016 | Shares: | 74,150 | |

| 2021 vote results: | 94.8% in favour | DSUs (cash-settled): | 120,215 | |

| | | | | |

| 2021 Meeting Attendance: | Mr. Laing meets the Company’s minimum equity ownership requirements. As at May 12, 2022, the value of Mr. Laing’s securities was $530,616. | |

| Board: | 12 of 12 | |

| Committees: | 9 of 9 | |

| Independent Directors: | 12 of 12 | | |

| Overall: | 100% | | |

| | | | |

Other Public Boards: Arizona Sonoran Copper Company Inc. (TSX) Blackrock Silver Corp. (TSX Venture Exchange; FSE; OTC) Lavras Gold Corp. (TSX Venture Exchange) Northern Dynasty Minerals Ltd. (TSX; NYSE American) | |

| | | |

| | | | | | | |

MARIO SZOTLENDER - Director and Member of Sustainability Committee Mario Szotlender is a co-founder of Fortuna Silver Mines Inc. He holds a degree in international relations and is fluent in several languages. He has successfully directed Latin American affairs for numerous private and public companies over the past 20 years, specializing in developing new business opportunities and establishing relations within the investment community. He has been involved in various mineral exploration and development joint ventures (precious metals and diamonds) in Central and South America, including heading several mineral operations in Venezuela, such as Las Cristinas in the 1980s. He was President of Mena Resources Inc. until it was purchased by Rusoro Mining Ltd., of which he was also President. | |

Residence: Age: | Caracas,

Venezuela 60 | Principal Occupation: Independent Consultant and Director of public resource companies | | Areas of Expertise: Strategy and Leadership Operations and Exploration Corporate Governance Metals and Mining Health and Safety, Environment and Sustainability Finance Human Resources Financial Literacy International Business Spanish Language | |

| | | | | |

| Independent: | No | Equity Ownership: | | |

| Director since: | June 16, 2008 | Shares: | 171,700 | |

| 2021 vote results: | 97.9% in favour | DSUs (cash-settled): | 296,083 | |

| | | | | |

| 2021 Meeting Attendance: | Mr. Szotlender meets the Company’s minimum equity ownership requirements. As at May 12, 2022, the value of Mr. Szotlender’s securities was $1,277,048. | |

| Board: | 12 of 12 | |

| Committees: | 5 of 5 | |

| Overall: | 100% | | |

| | | | |

Other Public Boards: Atico Mining Corp. (TSX Venture Exchange)

Endeavour Silver Corp. (TSX and NYSE)

Radius Gold Inc. (TSX Venture Exchange) | |

| | | |

| | | | | | | |

| MANAGEMENT INFORMATION CIRCULAR | Page | 5 |

DAVID FARRELL - Director; Chair of CG&N and Compensation Committees; Member of Audit Committee David Farrell is a Corporate Director, with over 25 years of corporate and mining experience, and has negotiated, structured and closed more than $25 billion worth of M&A and structured financing transactions for natural resource companies. Previously, he was President of Davisa Consulting, a private consulting firm working with global mining companies. Prior to founding Davisa, he was Managing Director of Mergers & Acquisitions at Endeavour Financial, working in Vancouver and London. Prior to Endeavour Financial, David was a lawyer at Stikeman Elliott, working in Vancouver, Budapest and London. Mr. Farrell graduated from the University of British Columbia with a B.Comm. (Honours, Finance) and an LL.B. and has earned his ICD.D designation from the UofT Rotman School of Management and the Institute of Corporate Directors. | |

Residence: Age: | BC, Canada 53 | Principal Occupation: Corporate Director; President of Davisa Consulting (private consulting) | | Areas of Expertise: Strategy and Leadership Corporate Governance Metals and Mining Finance Human Resources Financial Literacy International Business | |

| | | | | |

| Independent: | Yes | Equity Ownership: | | |

| Director since: | July 15, 2013 | Shares: | 15,000 | |

| 2021 vote results: | 92.8% in favour | DSUs (cash-settled): | 269,471 | |

| | | | | |

| 2021 Meeting Attendance: | Mr. Farrell meets the Company’s minimum equity ownership requirements. As at May 12, 2022, the value of Mr. Farrell’s securities was $776,606. | |

| Board: | 12 of 12 | |

| Committees: | 9 of 9 | |

| Independent Directors: | 12 of 12 | | |

| Overall: | 100% | | |

| | | | |

Other Public Boards: Elevation Gold Mining Corporation (TSX Venture Exchange)

Hillcrest Energy Technologies Ltd. (CSE) Luminex Resources Corp. (TSX Venture Exchange) | |

| | | |

| | | | | | | |

ALFREDO SILLAU - Director; Member of Audit, Compensation and CG&N Committees Alfredo Sillau is a graduate of Harvard Business School and is Managing Partner, CEO and Director of Faro Capital, an investment management firm that manages private equity and real estate funds. Previously, Alfredo headed the business development in Peru for Compass Group, a regional investment management firm, until late 2011. As CEO of Compass, Alfredo actively took part in the structuring, promoting and management of investment funds with approximately $500 million in assets under management. | |

Residence: Age: | Lima, Peru 55 | Principal Occupation: Managing Partner, CEO and Director of Faro Capital (investment management) | | Areas of Expertise: Strategy and Leadership Corporate Governance Metals and Mining Finance Human Resources Financial Literacy International Business Spanish Language | |

| | | | | |

| Independent: | Yes | Equity Ownership: | | |

| Director since: | November 29, 2016 | Shares: | 36,502 | |

| 2021 vote results: | 98.8% in favour | DSUs (cash-settled): | 104,728 | |

| | | | | |

| 2021 Meeting Attendance: | Mr. Sillau meets the Company’s minimum equity ownership requirements. As at May 12, 2022, the value of Mr. Sillau’s securities was $385,558. | |

| Board: | 12 of 12 | |

| Committees: | 11 of 11 | |

| Independent Directors: | 12 of 12 | | |

| Overall: | 100% | | |

| | | | |

Other Public Boards: Nil | |

| | | |

| | | | | | | |

| MANAGEMENT INFORMATION CIRCULAR | Page | 6 |

KYLIE DICKSON - Director; Chair of Audit Committee; Member of CG&N Committee Kylie Dickson is a Canadian CPA, CA with more than 14 years’ experience working with publicly traded resource companies. She received her Bachelor of Business Administration degree in Accounting from Simon Fraser University. Until March 2020, she was Vice- President, Business Development of Equinox Gold Corp. and previously held the position of Chief Financial Officer of several mineral exploration and mining companies. Prior to her work with public companies, Ms. Dickson was an audit manager in the mining group of a major audit firm. | |

Residence: Age: | BC, Canada 42 | Principal Occupation: Corporate Director of public resource companies | | Areas of Expertise: Strategy and Leadership Operations and Exploration Corporate Governance Metals and Mining Finance Human Resources Financial Literacy International Business | |

| | | | | |

| Independent: | Yes | Equity Ownership: | | |

| Director since: | August 16, 2017 | Shares: | 3,500 | |

| 2021 vote results: | 98.0% in favour | DSUs (cash-settled): | 96,163 | |

| | | | | |

| Meeting Attendance: | Ms. Dickson meets the Company’s minimum equity ownership requirements. As at May 12, 2022, the value of Ms. Dickson’s securities was $272,080. | |

| Board: | 12 of 12 | |

| Committees: | 6 of 6 | |

| Independent Directors: | 12 of 12 | | |

| Overall: | 100% | | |

| | | | |

Other Public Boards: Hillcrest Energy Technologies Ltd. (CSE) Star Royalties Inc. (TSX Venture Exchange) | |

| | | |

| | | | | | | |

KATE HARCOURT - Director; Member of Sustainability Committee Kate Harcourt is a sustainability professional with over 30 years of experience, principally in the mining industry. She has worked with a number of mining companies and as a consultant for International Finance Corp. She received a BSc Hons, Environmental Science, from Sheffield University and a MSc Environmental Technology, from Imperial College, London, and is a Chartered Environmentalist (CEnv) and a Member of the Institution of Environmental Scientists. | |

Residence: Age: | Wales, UK 58 | Principal Occupation: Independent Environmental and Social Advisor | | Areas of Expertise: Strategy and Leadership Corporate Governance Metals and Mining Health and Safety, Environment and Sustainability Finance Human Resources Financial Literacy International Business | |

| | | | | |

| Independent: | Yes | Equity Ownership: | | |

| Director since: | July 2, 2021 | Shares: | Nil | |

| 2021 vote results: | N/A | DSUs (cash-settled): | 24,955 | |

| | | | | |

| 2021 Meeting Attendance: | The deadline for Ms. Harcourt to meet the Company’s minimum equity ownership requirements is July 2, 2026. As at May 12, 2022, the value of Ms. Harcourt’s securities was $68,127. | |

| Board: | 5 of 5 | |

| Committees: | 2 of 2 | |

| Independent Directors: | 5 of 5 | | |

| Overall: | 100% | | |

| | | | |

Other Public Boards: Condor Gold plc (TSX; AIM-LSE) Orezone Gold Corporation (TSX) | |

| | | |

| | | | | | | |

Due to a review by the United States Securities and Exchange Commission (the “SEC”) of the Company’s use of inferred resources for the calculation of depletion expense in its audited financial statements contained in the Annual Report on Form 40-F for the year ended December 31, 2015, the Company was delayed in filing its annual audited financial statements and related MD&A for the years ended December 31, 2016 and 2015, and its annual information form for the year ended December 31, 2016 (collectively, the “Annual Financial Documents”). In connection with the delayed filing of the Annual Financial Documents, the Company applied for and received on April 3, 2017 a management cease trade order (“MCTO”) from the British Columbia Securities Commission and other Canadian provincial securities regulatory authorities. The MCTO prohibited certain executive officers of the Company from trading in securities of the Company until the Company completed the required filing of the Annual Financial Documents and is current on all filing obligations.

| MANAGEMENT INFORMATION CIRCULAR | Page | 7 |

On May 1, 2017, the Company reported that the SEC had verbally communicated it will accept the Company’s use of inferred resources for the calculation of depletion expense, provided that the Company includes additional disclosure regarding these calculations. Accordingly, the Company proceeded to finalize the Annual Financial Documents and filed them on May 15, 2017. The SEC formally concluded its review on May 17, 2017.

Due to the delay in finalizing the Annual Financial Documents, the Company was delayed in filing its interim financial statements and related MD&A for the three months ended March 31, 2017 and 2016 (together, the “Interim Financial Documents”). The Company filed the Interim Financial Documents on May 24, 2017, and the MCTO was revoked by the British Columbia Securities Commission on May 25, 2017.

Advance Notice Policy

Pursuant to the Advance Notice Policy of the Company which was ratified by the shareholders in 2018, any additional director nominations by a shareholder of the Company must be received by the Company by May 26, 2022 and must be in compliance with the Advance Notice Policy. The Company will provide details of any such additional director nominations through a public announcement.

A copy of the Advance Notice Policy is available for viewing on the Company’s website and on SEDAR at www.sedar.com.

Majority Voting Policy

The Board has adopted a Majority Voting Policy for the election of directors in uncontested elections. Under this policy, if a nominee receives a greater number of votes withheld from his or her election than votes for such election, the director shall immediately tender his or her resignation to the Chairman of the Board. The Corporate Governance and Nominating Committee will consider the resignation and recommend to the Board whether or not to accept it. Any director who tenders his or her resignation may not participate in the deliberations of either the Committee or the Board. In its deliberations, the Committee will consider the following: the effect such resignation may have on the Company’s ability to comply with any applicable corporate or securities laws or any applicable governance rules and policies; whether such resignation would result in a violation of a contractual provision by the Company; the stated reasons, if any, why certain shareholders cast “withheld” votes for the director, the qualifications of the director, whether the director’s resignation from the Board would be in the best interests of the Company; whether the director is a key member of an established, active special committee which has a defined term or mandate (such as a strategic review) and accepting the resignation of such director would jeopardize the achievement of the special committee’s mandate; and any other exceptional factors that the Committee considers relevant.

The Board will review the recommendation of the Corporate Governance and Nominating Committee and determine whether to accept or reject the resignation. Within 90 days after the applicable shareholder meeting, the Company will file its decision with the Toronto Stock Exchange (“TSX”) and issue a news release disclosing the Board’s decision (and, if applicable, the reasons for rejecting the resignation). If the Board accepts any tendered resignation in accordance with the Majority Voting Policy, then the Board may proceed to either fill the vacancy through the appointment of a new director, or not to fill the vacancy and instead decrease the size of the Board.

A copy of the Majority Voting Policy is available for viewing on the Company’s website.

Executive Compensation & Corporate Governance

See Schedule “A” to this Circular for information regarding the Company's compensation strategy, its executive compensation philosophy and the objectives of the Company’s compensation structures. For additional information on the Director Nominees and the Company’s corporate governance practices, see Schedule “B” to this Circular.

| MANAGEMENT INFORMATION CIRCULAR | Page | 8 |

OTHER INFORMATION

Audit Committee Disclosure

Pursuant to the provisions of National Instrument 52-110 – Audit Committees, the Company’s Annual Information Form dated March 30, 2022 (the “AIF”) includes under the heading “Audit Committee” a description of the Company’s Audit Committee and related matters. A copy of the Audit Committee charter setting out the Committee’s mandate and responsibilities is attached as a schedule to the AIF. The AIF is available for viewing at www.sedar.com.

Normal Course Issuer Bid

In March 2022, the Board approved a share repurchase program pursuant to a normal course issuer bid (the “NCIB”). On April 28, 2022, the Company announced the acceptance by the TSX of the Company’s NCIB to purchase up to five percent of its outstanding Common Shares. Under the NCIB, purchases of Common Shares may be made through the facilities of the TSX, the NYSE and/or alternative Canadian trading systems, commencing on May 2, 2022 and expiring on the earlier of May 1, 2023 and the date on which the Company has acquired the maximum number of Common Shares allowable under the NCIB or the date on which the Company otherwise decides not to make any further repurchases under the NCIB. The Company’s securityholders may obtain a copy of the notice of the normal course issuer bid, without charge, by contacting the Corporate Secretary of the Company by email at: info@fortunasilver.com.

Summary of Incentive Plans

The following table sets out information regarding compensation plans under which equity securities of the Company are authorized for issuance, as at December 31, 2021:

| EQUITY COMPENSATION PLAN |

| Plan Category | | (a)

No. of Securities to be

Issued Upon Exercise of

Outstanding Options,

Warrants and Rights | | | (b)

Weighted Average Exercise

Price of Outstanding

Options, Warrants and

Rights (CAD$) | | | (c)

No. of Securities Remaining

Available for Future Issuance under

Equity Compensation Plans

(excluding Securities Reflected in

column (a)) | |

| | | | | | | | | | |

| Equity Compensation Plans Approved by Shareholders1: |

| Options | | | | 1,122,033 | | | $ | 5.88 | | | | 2,092,236 | |

| Share Units | | | | 2,150,709 | | | $ | 5.98 | | | | 5,692,066 | |

| Equity Compensation Plans Not Approved by Shareholders: |

| | | | N/A | | | | N/A | | | | N/A | |

| Total: | | | 3,272,742 | | | | N/A | | | | 7,784,302 | |

Notes:

| 1. | In connection with Fortuna’s acquisition of Roxgold Inc. (“Roxgold”) on July 2, 2021 by way of a court-approved plan of arrangement, Fortuna issued certain replacement options (“Legacy Options”) and assumed certain share units (“Legacy Share Units”) which continue to be governed by the terms of the stock option plan of Roxgold dated March 5, 2020 (as amended) and the restricted share unit plan of Roxgold dated December 18, 2012 (as amended). The Company does not intend to make any subsequent grants of securities under the foregoing plans. |

As at December 31, 2021, an aggregate of 127,350 Legacy Options (which entitle the holder to purchase up to 127,350 common shares of Fortuna) and 1,131,893 Legacy Share Units (which entitle the holder on settlement to an aggregate of up to 1,131,893 common shares of Fortuna or their cash equivalent, as the election of Fortuna) were outstanding. The Legacy Options and Legacy Share Units are not included in the total securities referred to in the Equity Compensation table above.

| MANAGEMENT INFORMATION CIRCULAR | Page | 9 |

Interest of Certain Persons in Matters To Be Acted Upon

Other than as disclosed elsewhere in this Circular, none of the directors or executive officers of the Company, no proposed nominee for election as a director of the Company, none of the persons who have been directors or executive officers of the Company since the commencement of the Company’s last completed financial year and no associate or affiliate of any of the foregoing persons has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting.

Interest of Informed Persons in Material Transactions

Other than as disclosed in this Circular, no insider, proposed nominee for election as a director, or any associate or affiliate of the foregoing, had any material interest, direct or indirect, in any transaction or proposed transaction since the commencement of the Company’s last completed financial year which has materially affected or would materially affect the Company or its subsidiaries.

Additional Information

Additional information relating to the Company is available for viewing at www.sedar.com. Financial information is provided in the Company’s financial statements and accompanying management’s discussion and analysis for the fiscal year ended December 31, 2021, and its annual information form dated March 30, 2022. Copies of these documents may be obtained by contacting the Company, attention Corporate Secretary, at 200 Burrard Street, Suite 650, Vancouver, BC V6C 3L6 (Tel: 604-484-4085; Fax: 604-484-4029).

| | President and Chief Executive Officer |

| MANAGEMENT INFORMATION CIRCULAR | Page | 10 |

SCHEDULE "A"

Statement of Executive Compensation

Table of Contents

| Introduction | A-1 |

| Overview | A-1 |

| Acquisition of Roxgold – July 2021 | A-1 |

| Effect of COVID-19 on our Operations in 2021 | A-2 |

| 2021 Business Performance | A-2 |

| Pay for Performance Alignment | A-3 |

| Executive Compensation Philosophy | A-3 |

| Non-IFRS Financial Measures | A-4 |

| Compensation Governance | A-4 |

| Objectives of Compensation | A-4 |

| Share Ownership Policy | A-5 |

| Reduction in CEO Change of Control Termination Severance | A-5 |

| Role of the Compensation Committee | A-5 |

| Role of the Chief Executive Officer | A-6 |

| Role of Independent Third Party Compensation Advisors | A-6 |

| Elements of Executive Compensation | A-7 |

| Peer Comparator Companies - Benchmarking | A-7 |

| Risk Assessment | A-8 |

| Vesting Philosophy | A-9 |

| Incentive Compensation Clawback Policy | A-9 |

| Anti-Hedging Policy | A-10 |

| NEO Compensation | A-10 |

| Base Salary | A-10 |

| Annual Performance-Based Cash Incentives | A-11 |

| Medium- and Long-Term Incentives | A-20 |

| Performance Graphs | A-32 |

| NEO Profiles | A-34 |

| Summary Compensation Table | A-37 |

| Incentive Plan Awards to NEOs | A-39 |

| Management Contracts / Termination and Change of Control Benefits | A-39 |

| Director Compensation | A-41 |

| Deferred Share Unit Plan | A-41 |

| Retainer Fees | A-42 |

| Director Compensation Table | A-43 |

| Option-Based and Share-Based Awards to the Directors | A-44 |

Introduction

At Fortuna, we believe executive compensation is key to helping us achieve our strategic goals and retain our success- proven team, and we design and oversee our compensation strategy with these goals in mind. Our compensation structures are built on the following pillars:

| 1. | Pay for Performance. Our executives’ pay is highly geared to their achievement of pre-defined performance metrics, using individual short-term performance scorecards and long-term performance share units. In 2021, 88% of our CEO’s (as defined below) compensation was performance-based or at-risk pay. |

| 2. | Attraction and Retention of Quality People. Our strength is our people. We operate in a highly competitive global environment and structure our compensation to balance prudent fiscal management and attractive, long-term incentives to bring the best people to work for you, our shareholders. |

| 3. | Shareholder Alignment. A fundamental tenet of our executive compensation is to establish the right mix of fixed short- term, and at-risk long-term compensation in order to encourage management to focus on long-term shareholder value. We structure our compensation to promote and provide the incentive for growth and long-term management of our business through all aspects of the cyclical commodity price cycle. |

| 4. | Listen to our Stakeholders: Effective January 1, 2022, we reduced our CEO’s change-of-control severance from 3x annual base salary and annual target bonus, to 2x annual base salary and annual target bonus. |

What We Do

| | ü We pay for performance | ü We have an anti-hedging policy |

| | ü We report details of our Pay for Performance metrics (see pages A-10 to A-18) | ü We have a trading blackout and insider-trading policy |

| | ü We require minimum share ownership levels for executives and directors | ü We promote retention with equity awards that vest over three years |

| | ü We have a double trigger for cash severance upon a change of control | ü We engage independent compensation consultants |

| | ü Our compensation plans mitigate undue risk taking | ü We promote retention and performance with equity awards that are based on performance |

| | ü We have an incentive compensation clawback policy | ü We work to provide comprehensive compensation disclosure to strengthen shareholder communication and engagement |

| | | |

| | What We Don’t Do |

| | |

| | x We do not reprice underwater stock options | x We do not guarantee incentive compensation |

| | x We do not grant stock options to non- executive directors | x We do not provide tax gross-ups for perquisites |

Overview

Set out below is a brief summary of our Company’s performance in 2021, our alignment when it comes to pay for performance, and our executive compensation philosophy. All values in this Statement of Executive Compensation are in US$ unless otherwise noted.

Acquisition of Roxgold – July 2021

On July 2, 2021, the Company completed the acquisition (the “Roxgold Acquisition”) of Roxgold Inc. (“Roxgold”) which was transformational for the Company. The Acquisition created a global premier growth-oriented intermediate gold and silver producer. The Company has expanded its reach from Peru, Mexico and Argentina to West Africa, and has increased its ability to generate shared value through the acquisition. In addition to its mines and exploration projects in Latin America, the Company now owns and operates the Yaramoko gold mine in Burkina Faso, and is developing the Séguéla gold project in Côte d’Ivoire on which it announced a decision in September 2021 to start construction on an open pit gold mine, which will be the Company’s fifth mine.

| MANAGEMENT INFORMATION CIRCULAR | Statement of Executive Compensation | Page | A- 1 |

Effect of COVID-19 on our Operations in 2021

During 2021, while there were no Government mandated suspensions of operations related to COVID-19 at any of our operations in Latin America or West Africa, operations in Latin America were affected by new variants of COVID-19 and more waves of COVID-19 during the year, which resulted in reduced workforces and quarantine periods for those affected. In spite of these constraints, we were able to manage our operations without any suspensions. The Company has been able to continue operations in West Africa largely unaffected since the outbreak of COVID-19. However, the pandemic continued to cause difficulties and hardship in the regions where we operate, and we continued to provide support to our communities where possible.

Health protocols remain in place at each mine site for control, isolation and quarantine, as necessary, and these continue to be reviewed and adjusted accordingly based on the circumstances at each location. The Company’s focus is the health and safety of the workforces and on measures to prevent and manage the transmission of COVID-19 amongst the workforce and the communities in which it operates. A key focus in 2021 was on vaccination. We carried out awareness campaigns to promote vaccination by our employees. In 2021, in our operations in Latin America, 97% of our total workforce received at least one dose of a COVID-19 vaccine, and 100% of our workers in Peru, 85% of our workers in Mexico and 88% of our workers in Argentina were fully vaccinated. In Burkina Faso, at least 92% of our workers were fully vaccinated in 2021. Each of the Company’s mine sites is, at the date of this Information Circular, operating with a regular workforce.

2021 Business Performance

As a result of the Acquisition, on July 19, 2021, the Company updated its production guidance for 2021 to reflect:

| ● | Gold production at the Yaramoko Mine in Burkina Faso for the second half of 2021 of 62,000 to 66,000 ounces of gold, which represented 30 to 32 percent of the updated guidance. |

| ● | Due to direct and indirect COVID-19 related disruptions experienced in Argentina, we reduced our gold production guidance range for Lindero by 31 percent to 36 percent to 90,000 ounces to 110,000 ounces of gold. |

| ● | Gold production of four to five thousand ounces was added to the updated production guidance to take into account the higher-grade zone related to the intersection of the Animas NE and Nancy veins at the Caylloma mine in Peru. |

The 2021 financial year saw a year of strong financial results based on record production from the Company’s four operating mines in Argentina, Burkina Faso, Mexico and Peru. The Company produced 207,192 ounces of gold (274 percent increase over 2020), 7,498,701 ounces of silver (five percent increase over 2020), 32,989,973 pounds of lead (11 percent increase over 2020) and 47,549,301 pounds of zinc (four percent increase 2020), all within the updated production guidance range for 2021. Production results for each mine in 2021 compared to 2020 are as follows:

| ● | San Jose Mine: the Company produced 6,425,029 ounces of silver, an increase over 2020 of 4 percent, and 39,406 ounces of gold, an increase over 2020 of 4 percent. |

| ● | Lindero Mine: the Company produced 104,161 ounces of gold, comprised of 99,313 ounces in doré, 730 ounces of gold contained in precipitate/sludge and 4,118 ounces of gold-in-carbon (GIC) inventory, an increase of 675 percent over the 13,435 ounces produced in 2020. |

| ● | Yaramoko Mine: from July 2, 2021, the Company produced 57,538 ounces of gold. |

| ● | Caylloma Mine: the Company produced 1,073,62 ounces of silver, an increase over 2020 of 11 percent. Base metal production at the Caylloma Mine in 2021 totaled 33.0 million pounds of lead, an increase of 11 percent over 2020, and 47.5 million pounds of zinc, an increase of 4 percent over 2020. |

| MANAGEMENT INFORMATION CIRCULAR | Statement of Executive Compensation | Page | A- 2 |

Based on production results and cost execution, consolidated sales for 2021 increased 115% to $599.9 million compared to $279.0 million for in 2020. Net income was $59.4 million, a 100% increase from the $21.6 million reported in 2020.

On September 29, 2021, the Company announced the decision to proceed with the construction of an open pit mine at the Séguéla Project in Côte d’Ivoire with long lead items procured and development teams established on the ground. The updated Séguéla Project budgeted total capital investment is $173.5 million. The anticipated construction schedule is approximately 20 months, with ramp-up to design capacity expected in the third quarter of 2023. Construction is currently on schedule and within budget.

In 2021, the Company’s health and safety performance among its employees and contractors is highlighted by zero fatalities from work-related injuries or illnesses and zero cases of work-related illnesses. For the year ended December 31, 2021, the LTI frequency rate (“LTIFR”) was 1.57 lost time injuries per million hours worked, which is lower than the performance targeted for 2021 at 1.50. The total recordable injury frequency rate (“TRIFR”), which includes the LTIs and MTIs in 2021 was 3.36 total recordable injuries per million hours worked, which is an important improvement from 2020 (TRIFR at 5.99). The improvements in workplace safety achieved in 2021 were overshadowed in January 2022, when the Company reported a fatality at the Lindero Mine. No other personnel were injured in the incident. Management conducted an in-depth analysis of the accident and has taken targeted actions to mitigate risks identified in the associated report.

In November 2021, the Company entered into a fourth amended and restated credit agreement (the “2021 Credit Facility”) with a syndicate of banks led by BNP Paribas, and including the Bank of Nova Scotia, Bank of Montreal and Société Générale which converted the Company’s non-revolving and revolving facility into a revolving credit facility and increased the amount of the facility from $120 million to $200 million, subject to certain terms and conditions. The 2021 Credit Facility has a term of four years and steps down to $150 million after three years.

Pay for Performance Alignment

A significant portion of executive pay is provided in the form of equity compensation. This pay-for-performance alignment with shareholder interests is strengthened by a performance share unit plan (the “Share Unit Plan”). The Compensation Committee notes that total compensation for the NEOs (as defined below), as disclosed in the Summary Compensation Table on page A-37, includes the grant date value of option and share based compensation. As such, the total compensation disclosure does not reflect the fluctuations in value realizable by executives, which ultimately aligns our executive compensation with shareholder experience. For example, the grant date value of RSUs awarded to the CEO, Jorge Ganoza Durant, in 2021 was $3,969,626; however, due to the vesting restrictions imposed, the value of these awards at December 31, 2021 was $Nil as no portion of the awards had vested by that date. The Compensation Committee believes that deferment of some components of compensation through the application of time-vesting and performance vesting schedules supports retention of executives and long-term alignment with shareholder value.

Executive Compensation Philosophy

Fortuna’s success is built on our people. In addition to investing in high quality tangible assets, Fortuna also invests in market leading human and intellectual capital. Our compensation philosophy is designed to attract and retain highly qualified and motivated executives who are dedicated to the long-term success of the Company and to the creation and protection of shareholder value. Our goal is to focus and motivate employees to achieve higher levels of performance and to appropriately reward those employees for their results. We believe that shareholders should also be rewarded by the efforts of our team, as evidenced by Fortuna’s strong balance sheet and growth in silver and gold production – with low costs - over the past five years.

We believe our pay-for-performance compensation structure aligns our executives with the long-term interests of shareholders. Based on results achieved by both the individual and the Company, our executive compensation structure is strongly performance-based. Our program with a significant proportion of executive compensation at risk, in the form of performance-based short-term cash incentives, as well as long-term share price contingent stock options, RSUs and PSUs, illustrates our strong focus on pay-for-performance.

| MANAGEMENT INFORMATION CIRCULAR | Statement of Executive Compensation | Page | A- 3 |

Fortuna’s executive compensation program and practices are described in detail below. The Compensation Committee believes that Fortuna’s compensation governance provides transparent and effective support for the attainment of Fortuna’s key business objectives, alignment with its shareholders’ interests and the creation of long-term value for all stakeholders.

Non-IFRS Financial Measures

This Statement of Executive Compensation refers to certain non-International Reporting Financial Standards (“IFRS”) measures that are used by Fortuna to analyze and evaluate the performance of Fortuna's business and are widely reported in the mining industry as benchmarks for performance. These measures include “cash cost”, “free cash flow" (“FCF”), "all- in sustaining cash cost" (“AISC”) and "return on assets" (“ROA”). The Company believes that certain investors use these non-IFRS financial measures to evaluate the Company’s performance. However, the measures do not have a standardized meaning and may differ from measures used by other companies with similar descriptions. Accordingly, they should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

For additional information regarding these non-IFRS measures, including reconciliations to the closest comparable IFRS measures, see "Non-GAAP Financial Measures" in the Company's management's discussion and analysis for the year ended December 31, 2021, which is available under the Company's SEDAR profile at www.sedar.com and is incorporated by reference in this Statement of Executive Compensation.

Compensation Governance

Objectives of Compensation

Fortuna operates a complex business in a highly competitive market for experienced executives. We compete with both public and private, and often larger, mining companies across the Americas and the world for experienced management capable of delivering superior value. Fortuna’s people make the difference in distinguishing its performance relative to its peers. The Company’s compensation program is therefore designed to be competitive with its peers to ensure that they can attract, motivate and retain the highly-qualified individuals with the skills and experience necessary to execute the Company’s growth-oriented strategic plan and create sustainable value for Fortuna’s shareholders.

The primary objectives of Fortuna’s executive compensation program are to attract, motivate and retain top-quality, experienced executives who will deliver long-term superior value. Noting that ours is a commodity-based business, Fortuna’s share price is heavily influenced by the price of silver and gold. Fortuna therefore balances its compensation program with rewards for the attainment of operational measures and risk management that are within executives’ ability to influence. Essential to our core business objectives are the following elements:

| ● | To recruit and retain high calibre, appropriately qualified executive officers by offering overall base salary compensation competitive with that offered for comparable positions among a peer group of similarly situated mineral resource companies, while strongly aligning total compensation with performance. For example, executive compensation is structured so that the “at risk” component represents a significant portion of each executive’s total compensation. Our goal is to offer superior opportunities to achieve personal and career goals in a growth-focused team with corresponding pay for performance. |

| ● | To motivate executives to achieve important corporate and individual performance objectives that may be influenced by the executive and reward them when such objectives are met or exceeded. |

| ● | To align the interests of executive officers with shareholders’ interests by providing incentives that balance short- and long-term business goals, reflect value created for shareholders, and support the retention of key executives. This element is delivered primarily through a cash-based short-term incentive plan and a long-term incentive plan consisting of share units granted to vest with performance and over time. While the bonus plan rewards executives on attainment of annual objectives/milestones, typically, our executives see the majority of their compensation in the form of long-term equity tied to long-term value creation. Previous equity grants are taken into account when the granting of new share units or other equity awards is contemplated. |

| ● | To ensure that total compensation paid takes into account the Company’s overall financial position. |

| MANAGEMENT INFORMATION CIRCULAR | Statement of Executive Compensation | Page | A- 4 |

Share Ownership Policy

The Company’s Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”), Chief Operating Officers, Senior Vice- Presidents and directors are required to achieve and maintain minimum shareholding thresholds. As at December 31, 2021, all NEOs have met their minimum shareholding targets.

Reduction in CEO Change of Control Termination Severance

In response to comments received from proxy advisory companies, and to better align with the practices of our peers, the Board approved, on the recommendation of the Compensation Committee, that effective January 1, 2022, the change of control severance payable to Jorge Ganoza, the Company’s President and CEO, be reduced from 3x annual base salary and annual target bonus, to 2x annual base salary and annual target bonus.

Role of the Compensation Committee

The Compensation Committee is responsible for reviewing matters pertaining to the Company’s compensation philosophy, programs and policies, including director and executive compensation and grants, and making recommendations to the Company’s Board of Directors (“Board”) for approval. In particular, the Compensation Committee’s duties include making recommendations to the Board regarding: the goals and objectives of the CEO and CFO, and evaluating the CEO’s and CFO’s performance in light thereof; CEO, CFO and director compensation; bonus plans for executives; equity-based plans; and approving the Company’s annual Statement of Executive Compensation.

The Compensation Committee meets at least twice annually and is comprised of three directors, all of whom (including the chair) are independent within the meaning of section 1.4 of National Instrument 52-110 – Audit Committees. David Farrell is independent, was appointed chair on March 12, 2015 and has served on the Compensation Committee since May 9, 2014. David Laing is independent and has served on the Compensation Committee since December 21, 2016, and Alfredo Sillau is also independent and has served on the Committee since May 1, 2018. In March 2021, the provisions of the Charter of the Compensation Committee relating to composition were strengthened to provide that no member of the Committee shall have served as the CEO of the Company or of an affiliate, within the past five years, or as the CFO of the Company or of an affiliate, within the past three years.

The Compensation Committee members have the necessary experience to enable them to make decisions on the suitability of the Company’s compensation policies or practices. Messrs. Farrell and Laing have in the past served, or currently serve, on compensation committees of other public resource or mining companies. The Board is satisfied that the composition of the Compensation Committee ensures an objective process for determining compensation.

In support of the fulfilment of their role, the Compensation Committee may, from time to time, engage and receive input from external independent advisors skilled in executive compensation matters, with knowledge of the mining industry. As for 2019 and 2020, in 2021 the Committee engaged Global Governance Advisors (“GGA”), an independent executive compensation and governance advisory firm with significant experience advising mining company boards. For certain compensation matters pertaining to executive officers other than the CEO and CFO, the Compensation Committee fulfils its responsibility in consultation with the CEO. The Compensation Committee reviews recommendations made by the CEO and has discretion to modify any of the recommendations before making its independent recommendations to the Board.

When considering the appropriate compensation to be paid to executive officers, the Compensation Committee considers a number of factors including:

| ● | Recruiting and retaining executives critical to the success of Fortuna and the enhancement of shareholder value; |

| MANAGEMENT INFORMATION CIRCULAR | Statement of Executive Compensation | Page | A- 5 |

| ● | Providing fair and competitive compensation that provides pay for performance; |

| ● | Aligning the interests of management and shareholders by including measures of shareholder value among key performance metrics for executive compensation awards and compensation elements that emphasize contingent at-risk and equity-linked compensation; |

| ● | Rewarding performance that supports long-term sustainable value, both on an individual basis and at an overall company level; and |

| ● | Available financial resources and the economic outlook affecting Fortuna’s business. |

In 2021, the Compensation Committee engaged GGA to conduct a review of the competitiveness of the compensation levels for the senior executives and non-employee directors compensation against our primary peer group and supplemental benchmarks from GGA’s database. Based on GGA’s reports and on the recommendation of the Compensation Committee, the Board approved an increase of 3% in the base salaries of the NEOs (except that the base salary of the Senior Vice- President, Technical Services was increased by 23% in line with benchmark sources), no change to the short term incentive program targets (except that the short-term incentive of the Senior Vice-President, Technical Services was increased from 45 percent to 50 percent of base salary in line with benchmark sources), and a shift in the weighting of long term incentive program components with more emphasis being placed on performance contingent awards.

The complete terms of the Compensation Committee Charter are available on Fortuna’s website on the “Our Governance” page.

Role of the Chief Executive Officer

The CEO plays a role in executive compensation decisions by making recommendations to:

| ● | the Board regarding the Company’s annual objectives that provide the structure for the assessment of compensable corporate performance and alignment of individual annual objectives of other executive officers and employees; and |

| ● | the Compensation Committee regarding CEO and CFO base salary adjustments, target annual performance-based cash incentives awards and actual pay-outs, and long-term incentive awards in the form of stock options and grants under the Share Unit Plan. |

Role of Independent Third Party Compensation Advisors

In early 2020, the Compensation Committee engaged GGA to provide a report (the “2020 GGA Report”) regarding a review of the Company’s Share Unit Plan design and cost, and non-executive director equity award trends. In early 2021, the Compensation Committee engaged GGA to prepare reports (the “2021 GGA Reports” and together with the 2020 GGA Report, the “GGA Reports”) of the competitiveness of the compensation levels for the senior executives and non-employee directors compensation against the primary peer group and supplemental benchmarks from GGA’s database. The 2021 GGA Reports were expanded in scope to include a broader number of executives and senior-executives than in previous years.

The Committee and the Board considered the advice contained in the GGA Reports when determining the Company’s executive compensation program for 2020 and 2021.

| MANAGEMENT INFORMATION CIRCULAR | Statement of Executive Compensation | Page | A- 6 |

For the financial years ended December 31, 2020 and 2021, the Company paid independent compensation advisors the following amounts:

| | | 2020 | | | 2021 | |

| Executive and Director Compensation-Related Fees - GGA | | CAD $ | 15,736 | | | CAD $ | 53,973 | |

| All Other Fees | | | Nil | | | | Nil | |

| Total | | CAD $ | 15,736 | | | CAD $ | 53,973 | |

Elements of Executive Compensation

As discussed above, Fortuna’s compensation program has been comprised of three main elements: base salary, an annual performance-based cash incentive award, and grants of equity-based long-term incentive compensation in the form of performance share units (“PSUs”), restricted share units (“RSUs”) and stock options.

Due to the COVID-19 pandemic and the government mandated restrictions on the business of the Company and the resulting withdrawal of the Company’s 2020 operating guidance in April 2020, the base salaries of the Company’s executives for 2020 remained unchanged from 2019, and no PSUs were granted to executives. RSUs were granted in 2020, one-half of which were cash settled and the balance were share-settled. In 2021, the Company granted cash-settled RSUs and share- settled PSUs to its senior executives in order to align executive compensation with shareholder interests. The specific design, rationale, determination of amounts, and related information regarding each of these components are outlined below.

Element of Compensation | | Description | | Relationship to Corporate Objectives | | Element “At- Risk” or “Fixed” |

| Base Salary | | Base salaries are the only fixed pay element and are set based on the position and the individual executive’s growth-to-competence in the role. They are also used as the base to determine the value of other elements of compensation (i.e. multiple of base salary). | | Competitive base salaries enable the Company to attract and retain highly qualified executives and provide essential stability in times of market volatility. | | Fixed |

| | | | | | | |

| Annual Performance- Based Cash Incentives | | Annual performance-based cash incentives are a variable element of compensation designed to reward executive officers for achievement of annual milestones consistent with the long term strategic plan and split between corporate and individual performance metrics. Target percentages are fixed each year by the Board. | | Short-term milestone goals typically represent a balanced portfolio of metrics with a one-year horizon. They are structured to balance elements that are within the control of management (for example: production, safety and development milestones) with external factors (financial metrics which fluctuate with metal prices, and TSR which is influenced by short-term market sentiment). | | At-Risk |

| | | | | | | |

| Long-Term Equity Incentives | | RSUs, PSUs and stock options are a variable element of compensation intended to reward executives for success in achieving sustained shareholder value reflected in stock price. As these grants vest over time, they are also important for executive retention. | | Long-term incentives encourage executives to focus on consistent value creation over the longer term (3 years in the case of RSUs and PSUs and up to 5 years for stock options). Equity grants strongly align the interests of executives with long-term interests of shareholders since the received value is dependent on absolute future share performance. | | At-Risk |

Peer Comparator Companies - Benchmarking

Fundamental to Fortuna’s compensation philosophy is to provide competitive compensation in support of the attraction and retention of high calibre executives. Accordingly, the Compensation Committee relies on input from independent compensation advisors from time to time and other outside information, including the insight of Board members.

| MANAGEMENT INFORMATION CIRCULAR | Statement of Executive Compensation | Page | A- 7 |

Our goal is to design and implement compensation packages that are fair and reasonable, based in large part on benchmarking against similar companies, but offering significant incentive for above-average performance. The ultimate test of this process is our ability to attract and retain high-performance executives over the long term.

In determining an appropriate group of comparator mining companies for consideration in determining the Company’s compensation levels, the Compensation Committee reviewed its comparator mining companies in light of the growth of the Company (principally through the construction of the Lindero Mine) and receipt of the GGA Reports. GGA recommended the following criteria in creating our peer group:

| ● | companies of similar scope to Fortuna’s metrics including Lindero, primarily from a market capitalization perspective, but also considering other factors such as revenue, production levels, and total assets; |

| ● | companies primarily mining for silver or other precious metals; |

| ● | companies who are operational and produce revenue; |

| ● | companies with a similar business strategy and scope of operations to Fortuna; and |

| ● | publicly traded companies on major Canadian and U.S. exchanges. |

Based on these factors and in discussion with GGA, it was determined that the following companies were suitable peer comparators for consideration in determining senior executive compensation for 2021:

| Alamos Gold Inc. | Equinox Gold Corp. | Pretium Resources Inc. |

| Argonaut Gold Corp. | First Majestic Silver Corp. | SSR Mining Inc. |

| Centerra Gold Inc. | Hecla Mining Company | Torex Gold Resources Inc. |

| Coeur Mining Inc. | Lundin Gold Inc. | Wesdome Gold Mines Ltd. |

| Dundee Precious Metals Inc. | New Gold Inc. | |

| Eldorado Gold Corporation | OceanaGold Corp. | |

For 2022, as a result of the Acquisition, our peer group has been updated and expanded by GGA and we have replaced Argonaut Gold Corp., Pretium Resources Inc. and Torex Gold Resources Inc. with B2 Gold Corp., Hudbay Minerals Inc., IAMGOLD Corp., Pan American Silver Corp. and Yamana Gold Inc.

Our compensation decisions are guided by experience and professional judgment, with due consideration of our benchmark data, but including assessment of a complex range of factors including the experience, tenure, and unique leadership characteristics of our executives. Our benchmarking process is a guideline to making the right decision in specific cases, not a pre-determination of compensation decisions.

Risk Assessment

The Compensation Committee considers the risk implications associated with Fortuna’s compensation policies and practices on an on-going basis and as part of its annual compensation review. There are no identified risks arising from the Company’s compensation policies and practices that are reasonably likely to have a material adverse effect on the Company. The executive compensation program seeks to encourage actions and behaviours directed towards increasing long-term value while modifying and limiting incentives that promote inappropriate risk-taking.

The Compensation Committee’s risk assessment and management is based on the underlying philosophy that guides the Committee in the design of the key elements of compensation as follows:

| ● | provide total compensation that is competitive to attract, retain and motivate high calibre executives in a mining employment marketplace with a shortage of world-class executive talent; |

| ● | balance the mix or relative value of the key elements of compensation (salary, annual performance-based cash incentives, long-term incentives), providing sufficient stable income at a competitive level so as to discourage inappropriate risk taking while also providing an important portion of total compensation that is variable and “at- risk” for executives; |

| MANAGEMENT INFORMATION CIRCULAR | Statement of Executive Compensation | Page | A- 8 |

| ● | strengthen and maintain the link between pay and performance, both Company and individual performance, and ensure the objectives against which performance is measured can be fairly assessed and do not encourage inappropriate risk taking; and |

| ● | defer a significant portion of “at-risk” compensation to keep executives focused on continuous long-term, sustainable performance. |

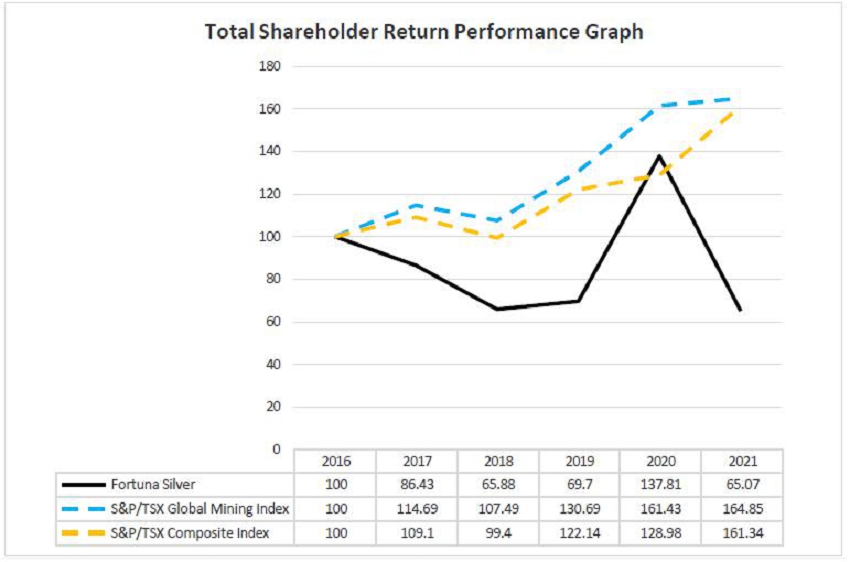

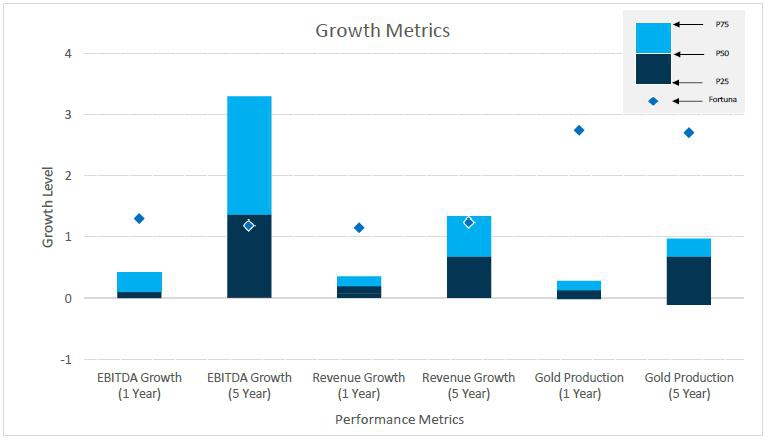

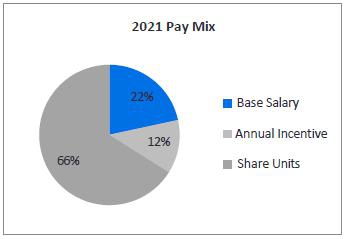

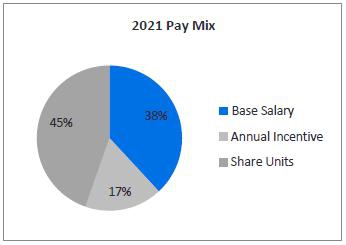

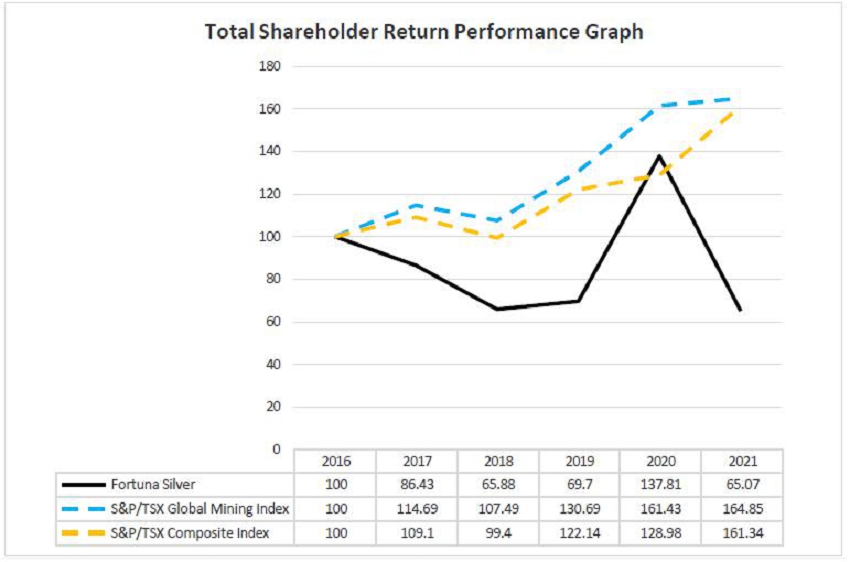

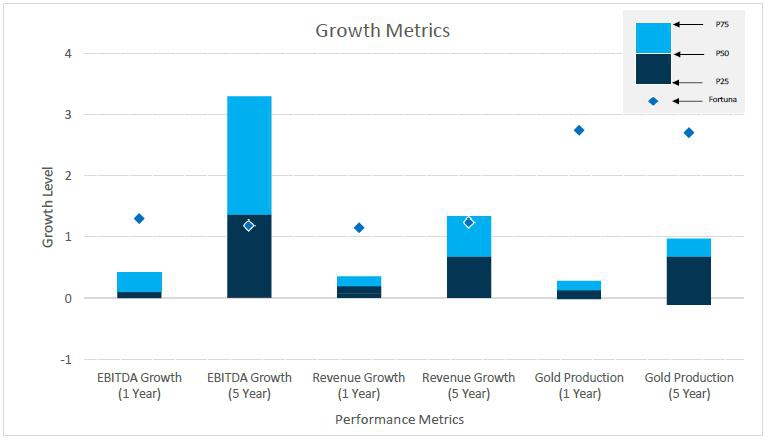

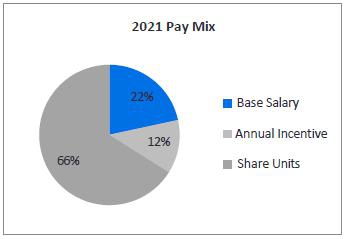

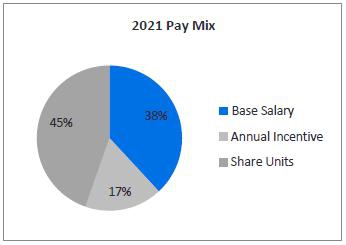

Some specific controls that are in place to mitigate certain risks are as follows: