The estimated fair values of the Company’s financial instruments are as follows as of March 31, 2006 and December 31, 2005:

The Company determined the estimated fair value amounts by using available market information and commonly accepted valuation methodologies. However, considerable judgment is required in interpreting market data to develop the estimates of fair value. Accordingly, the estimates presented herein are not necessarily indicative of the amounts that the Company or holders of the instruments could realize in a current market exchange. The use of different assumptions and estimation methodologies may have a material effect on the estimated fair values.

On each subsequent anniversary date: $20,000 and $20,000 worth of Common Stock.

In addition, the Company is required to spend the following amounts on exploration and maintenance of the property as follows:

The Company may purchase this property for $1,000,000, subject to a 3% net smelter returns royalty on production from the property. The purchase option must be exercised prior to the commencement of production from the property. The Company has the right to terminate this agreement on 60 days notice to the lessor.

PIEDMONT MINING COMPANY, INC

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

11. | Commitments – continued |

Bullion Mountain Project – Effective November 11, 2005, the Company entered into a ten year mining lease with option to purchase. Upon signing the final agreement in 2006, the Company will be required to pay the property owner $7,300. Payments required on each anniversary date are as follows:

| 2006: | $ 5,000 |

| 2007: | $10,000 |

| 2008 and thereafter: | $15,000 |

In addition, the Company is required to spend the following amounts on exploration and maintenance of the property:

| By November 11, 2006: $ 20,000 |

| By November 11, 2007: $ 50,000 |

The Company has the option to purchase this property at any time for $500,000, which must be exercised before production can commence. All lease, work requirement and property maintenance payments made up to this point would be deducted from this price. Also, upon exercise of the purchase option, the Company would be required to pay a 3% net smelter returns royalty on production from the property. The Company has the right to terminate this agreement at any time by giving 60 days prior written notice.

Dome-Hi-Ho Project – On April 26, 2005, the Company entered into a five year exploration agreement with an option to enter into a joint venture agreement. The agreement requires the Company to complete $180,000 in drilling and exploration expenditures by March 1, 2006. The Company may then terminate the agreement upon 60 days written notice to the owner. It must elect by April 13, 2006, to exercise the underlying option on 20 of the claims by paying $200,000. Subsequent annual exploration and development requirements will be:

By March 1, 2007: $180,000

By March 1, 2008: $400,000

By March 1, 2009: $500,000

By March 1, 2010: $540,000

In addition, the Company will be required to pay the property owner the following amounts:

By March 1, 2006: $ 10,000

By March 1, 2007: $ 10,000

By March 1, 2008: $ 10,000

By March 1, 2009: $ 10,000

Upon performance of the above requirements, the Company will be granted a 51% interest in the property. In addition, the Company is obligated to pay the underlying claims maintenance and property holding costs as well as annual rental payments under a preexisting lease agreement with a third party. The term of this lease is twenty years, beginning July 21, 2003. The Company will therefore be required to pay the following lease amounts:

PIEDMONT MINING COMPANY, INC

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

11. Commitments – continued

After the 2007 anniversary date, the annual rental amount will be increased based on the Consumer Price Index. Also, the Company would be required to pay royalties based on a graduated scale, ranging from 3.0% to 4.0% should production occur on the property.

Trinity Silver Project - The Company entered into this agreement in September 2005. In order to earn an initial 25% interest in the property, the Company must spend a total of $1,000,000 on or for the benefit of the property prior to September 2008. $75,000 of this must be spent within the first year of the agreement and not less than $125,000 during the second year. In order to earn an additional 26% interest in the property, the Company must spend an additional $1,000,000 prior to September 2010. This would bring the Company’s total interest to 51%. In order to earn an additional 9% interest in the property (for a total of 60%), the Company must spend an additional $2,000,000 prior to September 2013. The Company may terminate this agreement at any time upon 30 days written notice, whereupon the Company would have no further obligations or liabilities under this agreement except for certain fees.

Pasco Canyon Project – On February 14, 2006, the Company entered into a five year exploration agreement with an option to enter into a joint venture agreement with the property owner. The agreement required a one-time payment of $10,000 to the property owner. In addition, the agreement requires the Company to complete $1,000,000 in exploration and development costs over a five year period as follows:

| Year 1 | $ 50,000 |

| Year 2 | $100,000 |

| Year 3 | $200,000 |

| Year 4 | $200,000 |

| Year 5 | $450,000 |

Upon completion of the required expenditures the Company will have acquired a 60% undivided interest in the property. Furthermore, a formal join venture agreement will be entered into by the Company and the owner of the property recognizes the Company as the operator of the joint venture. The Company has the right to terminate this agreement at any time, subsequent to the first year’s expenditure requirement of $50,000, by giving 30 days prior written notice.

12. Restatement of Consolidated Financial Statements – As a result of analyses performed after the reviewed financial statements were issued, errors in various balance sheet and income statement accounts were discovered, affecting 2005 and 2006. As a result, general and administrative and geological and geophysical expenses were understated for the quarter ended March 31, 2006 and general and administrative expenses overstated for the quarter ended March 31, 2005. As of March 31, 2006, prepaid expenses and deficit accumulated during exploration stage were each understated and exploration projects were overstated. As of December 31, 2005, prepaid expenses and other liabilities were understated, respectively, and exploration projects and deficit accumulated during exploration stage were overstated. The effect of the restatement on results of operations and financial position are as follows:

PIEDMONT MINING COMPANY, INC

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

12. Restatement of Consolidated Financial Statements - continued

| | | |

| | As Previously | | As |

| | Reported | Correction | Restated |

| | | | |

As of December 31, 2005: | | | |

Prepaid expenses and other | | $ 3,913 | $ 16,646 | $ 20,559 |

Exploration projects | | $234,139 | (158,639) | 75,500 |

Other liabilities | - | 9,809 | 9,809 |

Deficit accumulated during exploration stage | (857,181) | 138,743 | (1,008,983) |

| | | | |

As of March 31, 2006: | | | | |

Prepaid expenses and other | | 9,462 | 3,143 | 12,605 |

Exploration projects | | $268,049 | (167,549) | 100,500 |

Deficit accumulated during exploration stage | (930,251) | (164,407) | (1,094,658) |

| | | |

For the quarter ended March 31, 2005: | | | | |

General and administrative | 20,800 | (1,270) | 19,530 |

Geological and geophysical costs | | - | 3,471 | 3,471 |

Net loss | | (56,402) | (2,200) | (58,602) |

Loss per share - basic | | (0.001) | (0.001) | (0.002) |

Loss per share - diluted | | (0.001) | - | (0.001) |

| | | | |

For the quarter ended March 31, 2006: | | | | |

General and administrative | | 15,298 | 3,694 | 18,992 |

Geological and geophysical | | 11,595 | 8,907 | 20,502 |

Net loss | | (73,070) | (12,605) | (85,675) |

Loss per share - basic | | (0.002) | - | (0.002) |

Loss per share - diluted | | (0.002) | - | (0.002) |

| | | |

On the consolidated statements of cash flows: | | | | |

| | | | |

For the quarter ended March 31, 2005: | | | | |

Net loss | $ (56,402) | $ (2,200) | $ (58,602) |

Changes in prepaid expenses and other | | (5,209) | 12,832 | 7,623 |

Changes in accounts payable and

accrued expenses | | (7,324) | 10,127 | 2,803 |

Changes in other liabilities | | - | (7,842) | (7,842) |

Payments made on exploration projects | | (7,471) | 3,471 | (4,000) |

Cash and cash equivalents at end of period | | (254) | 16,388 | 16,134 |

| | | | |

For the quarter ended March 31, 2006: | | | | |

Net loss | | $ (73,070) | $ (12,605) | $ (85,675) |

Changes in prepaid expenses and other | | (5,549) | 13,503 | 7,954 |

Changes in other liabilities | | - | (9,809) | (9,809) |

Payments made on exploration projects | | (33,910) | 8,910 | (25,000) |

| | | |

PIEDMONT MINING COMPANY, INC

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| • | On May 31, 2006, the compensation committee voted to award stock options to various parties. 1,000,000 will be awarded to the President, 100,000 to the Vice President, and 50,000 to a consultant. |

| • | During April and May, 2006, the Company sold 7,378,333 shares of common stock for $1,106,750. Accompanying these shares were 3,689,167 warrants to purchase common stock. These warrants have varying exercise prices and expiration dates. No expiration date is later than May 2008. In addition, the Company issued 737,833 warrants and paid $50,400 as commission to the agent who brokered some of the stock sales. |

| • | On April 21, 2006, 43,478 shares were issued in payment on an exploration project. |

| • | The Dome-Hi-Ho Project was amended on April 3, 2006: In April 2006, the underlying option to purchase the 20 unpatented HiHo claims was amended and extended for an additional 3 years. Instead of making the required payment of $200,000 to exercise the option by April 13, 2006, the underlying optionee was paid $10,000 in April, 2006. In order to maintain this option in good standing, the optionee must be paid an additional $10,000 by April 13, 2007 and then an additional $20,000 by April 13, 2008. These payments are creditable against the option exercise price of $200,000. This amendment also grants the underlying optionee a 1% net smelter return royalty on the 24 Dome claims. Upon the acquisition of the 100% interest described above, the Company will grant to the optionee a 2% net smelter returns royalty on the property, of which one of the 2 percentage points could be repurchased for $1,000,000, subject to adjustment for the consumer price index. |

| • | Drilling commenced at the Trinity project in April 2006. |

PRATT-THOMAS,GUMB&CO.,P.A.

CERTIFIEDPUBLICACCOUNTANTS

ANDBUSINESSADVISORS

P.O. BOX973(525 EASTBAYSTREET, SUITE 100

CHARLESTON,SOUTHCAROLINA29402

(843) 722-6443

(843) 723-2647 FAX

E-MAIL:cpa@p-tg.com

www.prattthomasgumb.com

| BARRY D. GUMB | | MEMBERS |

| HAROLD R. PRATT-THOMAS, JR. | | AMERICAN INSTITUTE OF CPAS |

| LYNNE LORING KERRISON | | THE AICPA ALLIANCE OF CPA FIRMS |

| ROY STRICKLAND | | S.C. ASSOCIATION OF CPAS |

| PATRICIA B. WILSON | | |

| RUDOLPH S. THOMAS | | |

INDEPENDENT AUDITORS’ REPORT

To the Stockholders

Piedmont Mining Company, Inc.

New York, NY

We have audited the accompanying consolidated balance sheets of Piedmont Mining Company, Inc. (an exploration stage corporation) and subsidiaries, as of December 31, 2005 and 2004, and the related consolidated statements of loss, stockholders’ deficit, and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Piedmont Mining Company, Inc., and subsidiaries as of December 31, 2005 and 2004, and the results of their operations and their cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 12 to the financial statements, certain errors resulting in the misstatement of previously reported amounts as of and for the years ended December 31, 2004 and 2005 were discovered subsequent to the issuance of our reports on those consolidated financial statements dated April 12, 2006, June 23, 2006, and August 9, 2006. Accordingly, the accompanying 2004 and 2005 consolidated financial statements have been restated to correct the error.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company has no revenue or cash flow from operations and its liabilities exceed its assets. These conditions raise substantial doubt about its ability to continue as a going concern. Management’s plans regarding those matters also are described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/PRATT-THOMAS, GUMB & CO., P.A.

April 12, 2006, except for the fourth

paragraph above, as to which

the date is September 1, 2006

F-39

PIEDMONT MINING COMPANY, INC. (An Exploration Stage Company) CONSOLIDATED BALANCE SHEETS DECEMBER 31, 2005 AND 2004 |

| December 31, |

| 2005 | 2004 |

| As Restated | As Restated |

ASSETS |

Current Assets | | |

Cash and cash equivalents | $ 400 | $ 1,041 |

Prepaid expenses and other | 20,559 | 20,913 |

| | |

Total Current Assets | 20,959 | 21,954 |

Long Lived Assets, net | 1,667 | 2,667 |

Other Assets | | |

Exploration projects | 75,500 | - |

| | |

Total Other Assets | 75,500 | - |

| | |

Total Assets | $ 98,126 | $ 24,621 |

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

Current Liabilities | | |

Accounts payable | $ 2,281 | $ 278 |

Bank overdraft | 8,247 | - |

Accrued expenses | 43,839 | 18,768 |

Accrued expenses – due to officers | 264,234 | 156,735 |

Other liabilities | 9,809 | 9,567 |

Due to directors | 123,940 | - |

Convertible notes | 27,000 | 243,145 |

| | |

Total Current Liabilities | 479,350 | 428,493 |

Stockholders’ Equity (Deficit) |

Common stock, no par value; 100,000,000 shares | | |

authorized; 43,958,041 shares issued and | | |

outstanding at December 31, 2005; 37,152,646 | | |

shares issued and outstanding at December 31, 2004 | 12,820,971 | 12,335,434 |

Contributed capital | 371,075 | 371,075 |

Accumulated deficit | (12,564,287) | (12,564,287) |

Deficit accumulated during exploration stage | (1,008,983) | (546,094) |

| | |

Total Stockholders’ Equity (Deficit) | (381,224) | (403,872) |

Total Liabilities and Stockholders’ Equity (Deficit) | $ 98,126 | $ 24,621 |

See auditor’s report and notes to the financial statements. |

| | | | | |

F-40

PIEDMONT MINING COMPANY, INC. (An Exploration Stage Company) CONSOLIDATED STATEMENTS OF LOSS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004 AND THE PERIOD JANUARY 1, 2002 TO DECEMBER 31, 2005 |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | Years ended December 31, | | |

| | 2005

As Restated | | 2004

As Restated | | Exploration

Stage Period

January 1, 2002

through

December 31, 2005

As Restated |

| | | | | | |

Operating expenses | | | | | | |

General and administrative | | $ 82,304 | | $ 34,470 | | $ 270,407 |

Compensation, professional, legal and accounting | | 116,262 | | 74,225 | | 242,758 |

Depreciation expense | | 1,000 | | 15,979 | | 142,137 |

Research and development | | 28,222 | | 28,993 | | 59,116 |

Exploration, geological and geophysical costs | | 214,057 | | - | | 214,057 |

| | | | | | |

Loss from operations | | (441,845) | | (153,667) | | (928,475) |

| | | | | | |

Other income (expense) | | | | | | |

Interest income | | 22 | | 10 | | 32 |

Interest expense | | (21,066) | | (8,782) | | (33,950) |

Gain on sale of historic gold bar and mineral rights | | - | | - | | 46,410 |

Loss on legal and note receivable settlements | | - | | - | | (93,000) |

| | | | | | |

Total other income (expense), net | | (21,044) | | (8,772) | | (80,508) |

| | | | | | |

Net Loss | | $ (462,889) | | $ (162,439) | | $ (1,008,983) |

| | | | | | |

Earnings (loss) per share | | | | | | |

Basic | | $ (0.012) | | $ (0.004) | | |

| | | | | | |

Diluted | | $ (0.012) | | $ (0.004) | | |

| | | | | | | |

See auditor’s report and notes to the financial statements.

F-41

| PIEDMONT MINING COMPANY, INC. (An Exploration Stage Company) CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004 |

| | | | | | | | | | | | | |

| | | | | | | | | | Deficit

Accumulated

During

Exploration

Stage

As Restated | | | |

| | Common Stock | | | | Accumulated Deficit | | | |

| | No. of Shares | | $ | | Contributed Capital | | | Total

Shareholders

Deficit

As Restated | |

| | | | | | | | | | | | | |

Balance, December 31, 2003 | | 37,152,646 | | $ 12,335,434 | | $ 371,075 | | $ (12,564,287) | | $ (381,754) | | $ (239,532) | |

Prior period adjustment | | - | | - | | - | | - | | (1,901) | | (1,901) | |

Balance, December 31, 2003, as restated | | 37,152,646 | | 12,335,434 | | 371,075 | | (12,564,287) | | (383,655) | | (241,433) | |

Net loss | | - | | - | | - | | - | | (162,439) | | (162,439) | |

Balance, December 31, 2004 | | 37,152,646 | | 12,335,434 | | 371,075 | | (12,564,287) | | (546,094) | | (403,872) | |

Stock issued upon conversion of debt | | 4,063,403 | | 316,037 | | - | | - | | - | | 316,037 | |

Sales of stock | | 2,441,992 | | 145,000 | | - | | - | | - | | 145,000 | |

Payments in stock on exploration projects | 300,000 | | 24,500 | | - | | - | | - | | 24,500 | |

Net loss | | - | | - | | - | | - | | (462,889) | | (462,889) | |

Balance, December 31, 2005 | | 43,958,041 | | $ 12,820,971 | | $ 371,075 | | $ (12,564,287) | | $ (1,008,983) | | $ (381,224) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

See auditor’s report and notes to the financial statements.

| PIEDMONT MINING COMPANY, INC. |

| (An Exploration Stage Company) |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004 |

| AND THE PERIOD JANUARY 1, 2002 TO DECEMBER 31, 2005 |

| | | | | Exploration | |

| | | | | Stage Period | |

| | | | �� | January 1, 2002 | |

| | | | | through | |

| 2005

As Restated | | 2004

As Restated | | December 31, 2005

As Restated | |

Cash Flows from Operating Activities: | | | | | | |

Net loss | $ (462,889) | | $ (162,439) | | $ (1,008,983) | |

Adjustments to reconcile net loss | | | | | | |

to net cash used in operating activities: | | | | | | |

Gain on sale of mineral rights | - | | - | | (40,000) | |

Loss on settlement of note receivable | - | | - | | 19,000 | |

Depreciation | 1,000 | | 15,979 | | 142,137 | |

Changes due to (increase) decrease in operating assets: | | | | | | |

Prepaid expenses and other | 354 | | (17,964) | | (17,610) | |

Changes due to increase (decrease) in operating liabilities: | | | | | | |

Accounts payable and accrued expenses | 159,465 | | (4,186) | | 270,898 | |

Bank overdraft | 8,247 | | - | | 8,247 | |

Other liabilities | 242 | | 9,567 | | 9,809 | |

Net cash used in operating activities | (293,581) | | (159,043) | | (616,502) | |

Cash Flows from Investing Activities: | | | | | | |

Purchase of long lived assets | - | | (3,000) | | (3,000) | |

Proceeds from note receivable | - | | - | | 57,125 | |

Proceeds from sale of mineral rights | - | | - | | 40,000 | |

Payments made on mineral rights | (51,000) | | - | | (51,000) | |

Net cash provided by (used in) investing activities | (51,000) | | (3,000) | | 43,125 | |

Cash Flows from Financing Activities: | | | | | | |

Sales of stock | 145,000 | | - | | 145,000 | |

Proceeds from convertible notes | 75,000 | | 158,145 | | 318,145 | |

Proceeds from revolving note - due to officer | | | | | | |

and advances from directors | 123,940 | | - | | 157,309 | |

Payments on revolving note - due to officer | | | | | | |

and advances from directors | - | | (13,004) | | (47,374) | |

Net cash provided by financing activities | 343,940 | | 145,141 | | 573,080 | |

Net decrease in cash and cash equivalents | (641) | | (16,902) | | (297) | |

Cash and cash equivalents at beginning of year | 1,041 | | 17,943 | | 697 | |

Cash and cash equivalents at end of year | $ 400 | | $ 1,041 | | $ 400 | |

| | | | | | | |

See auditor’s report and notes to the financial statements.

F-43

PIEDMONT MINING COMPANY, INC.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. | Nature of Business and Significant Accounting Policies |

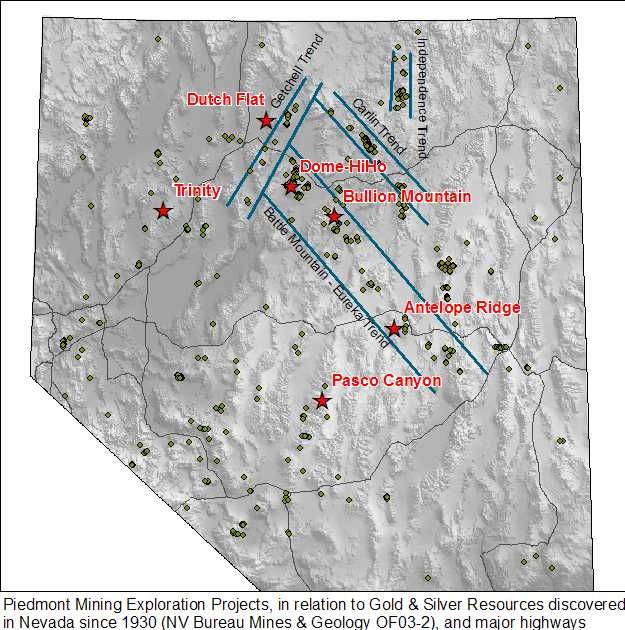

| a. | Nature of Business – Piedmont Mining Company, Inc. (the Company) was incorporated in 1983 under the laws of North Carolina and is an exploration stage company engaged in the exploration for gold and silver. |

| b. | Basis of Presentation - The accompanying consolidated financial statements have been prepared inaccordance with accounting principles generally accepted in the United States of America. |

| c. | Basis of Consolidation - The accompanying consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries, NetColony, LLC and Piedmont Gold Company, Inc. Neither subsidiary has material operations, tangible assts or liabilities. All significant intercompany accounts and transactions, if any, have been eliminated in consolidation. |

| d. | Use of Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts and disclosures, such as the allowance for doubtful accounts and various accruals. Accordingly, actual results could differ from those estimates. |

| e. | Long Lived Assets – Long lived assets are comprised of websites. They are recorded at cost and depreciated using the straight-line basis over 3 years. Depreciation expense for the years ended December 31, 2005 and 2004 was $1,000 and $15,979, respectively. |

| f. | Cash and Cash Equivalents - For purposes of the statement of cash flows, the Company considers all holdings of highly liquid investments with original maturities of three months or less and investments in money market funds to be cash equivalents. |

| g. | Research and Development Costs and Exploration Projects – Pursuant toEmerging Issues Task Force(EITF) 04-02, mineral rights are capitalized at cost. This includes lease payments under exploration agreements. The projects are assessed for write-off when facts and circumstances indicate their carrying values exceed their recoverable values, such as failure to discover mineable ore. If a mineable ore body is found, these costs will be amortized when production begins using a units-of-production method. These costs are recorded to exploration projects on the consolidated balance sheets. Other exploration, geological costs and research and development costs are expensed as incurred. |

| h. | Net Loss Per Share – In accordance with Statement of Financial Accounting Standard (SFAS) No. 128,Earnings Per Share, and SEC Staff Accounting Bulletin No. 98, basic earnings/loss per common share (EPS) is computed by dividing net loss for the period by the weighted average number of common shares outstanding during the period. Under SFAS 128, diluted earnings/loss per share is computed by dividing the net loss for the period, with interest expense added back, by the weighted average number of common and common equivalent shares, such as stock options and warrants, outstanding during the period. |

Net loss used in determining basic EPS was $(462,889) in 2005 and $(162,439) in 2004. The weighted average number of shares of common stock used in determining basic EPS was 39.11 million in 2005 and 37.15 million in 2004.

Net loss used in determining diluted EPS was $(462,889) in 2005 and $(153,657) in 2004. The weighted average number of shares of common stock used in determining diluted EPS was 39.29 million in 2005 and 39.05 million in 2004.

F-44

PIEDMONT MINING COMPANY, INC.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. | Nature of Business and Significant Accounting Policies - continued |

| i. | Income Taxes –The Company provides for incomes taxes under SFAS 109, “Accounting for Income Taxes,” which requires the recognition of deferred tax liabilities and assets for the expected future tax consequences of temporary differences between the carrying amounts and the tax bases of assets and liabilities using the enacted income tax rate expected to apply to taxable income in the periods in which the deferred tax liability or asset is expected to be settled or realized. SFAS 109 requires that a valuation allowance be established if necessary, to reduce the deferred tax assets to the amount that management believes is more likely than not to be realized. A valuation allowance related to a deferred tax asset is recorded when it is more likely than not that some portion or all of the deferred tax asset will not be realized. The provision for federal income taxes differs from that computed by applying federal statutory rates to income before federal income tax expense mainly due to expenses that are not deductible and income that is not taxable for federal income taxes, including permanent differences such as non-deductible meals and entertainment. |

| j. | Stock Options – The Company follows Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees” (APB 25), and related interpretations in accounting for stock options issued to employees and directors. Under APB 25, when the exercise price of stock options equals or is less than the fair market value of the underlying stock of the date of grant, no compensation expense is recognized. For options issued to service providers, the Company follows SFAS No. 123,Accounting for Stock-Based Compensation, which requires recording the options at the fair value of the service provided. |

2. | Going Concern–The Company has had no revenues or cash flow from operations in the recent past and has liabilities exceeding its assets. This is because the Company is an exploration stage company, exploring mineral properties but not yet generating any revenue from those properties. These factors create an uncertainty as to how the Company will fund its operations and maintain sufficient cash flow to operate as a going concern. |

In response to these adverse conditions, management is continuing to look for financing from various sources, including private placements from investors and institutions. Management believes these efforts will contribute toward funding the Company’s activities until revenue can be earned from the properties or a sale can be consummated. The Company’s ability to meet its cash requirements in the next year is dependent upon obtaining this financing and satisfying certain obligations, such as compensating its officers and consultants through non-cash means including the issuance of stock options. If this is not achieved, the Company may be unable to obtain sufficient cash flow to fund its operations and obligations, and therefore, may be unable to continue as a going concern.

The accompanying consolidated financial statements have been prepared on a going concern basis, and accordingly, do not include any adjustments relating to the recoverability and classification of recorded asset amounts nor do they include adjustments to the amounts and classification of liabilities that might be necessary should the Company be unable to continue in existence or be required to sell its assets.

3. | Exploration Stage Company - As discussed in Note 1, the Company was formed in 1983. However, significant changes to the Company’s business and operations occurred from 1983 through 2002. The Company is currently in an exploration stage, which is characterized by significant expenditures for the examination and development of exploration opportunities. The Company’s focus for the foreseeable future will continue to be on exploration of various existing mineral properties and exploration of new properties. |

F-45

PIEDMONT MINING COMPANY, INC.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

4. | Convertible Promissory Notes – During 2003, the Company issued $85,000 of convertible promissory notes bearing interest at 5% per annum and maturing at various dates. During 2004, the Company issued an additional $158,145 of convertible promissory notes bearing interest at 5% per annum. During 2005, the Company issued $75,000 of convertible promissory notes, also bearing interest at 5% per annum. During 2005, most of these notes and the related accrued interest of $24,892 were converted into 4,063,403 shares of common stock. Conversion prices varied per agreement. One $27,000 convertible note remained unconverted at December 31, 2005 and was repaid in February 2006. |

Two of the converted notes were with related parties. One of the Company’s directors held a note totaling $15,000 which converted into 170,156 shares. Also, this director is the chief operating officer of a company which held a note totaling $40,000 that converted into 656,298 shares.

5. | Related Party Transactions - The unpaid portion of the $60,000 annual compensation of the Company’s President is included in accrued liabilities in the accompanying consolidated balance sheets. |

From time to time, the Company’s officers and directors advance monies to the Company under an unwritten arrangement accruing 5% interest annually. The unpaid interest related to these advances at December 31, 2005 and 2004 was $1,405 and $0, respectively.

Various other related party transactions are disclosed in other notes.

6. | Income Taxes – Income taxes are paid only to the United States government and applicable stategovernments. The federal and state income tax expense (benefit) consists of the following: |

| | | 2005 | | 2004 |

Current: | | | | |

| Federal | | $ - | | $ - |

| State | | - | | - |

| Total current | - | | - |

| | | | | |

Deferred: | | | | |

| Federal | | (161,948) | | (56,614) |

| State | | (32,393) | | (11,323) |

| Total deferred | (194,341) | | (67,937) |

| | | | | |

Less valuation allowance | 194,341 | | 67,937 |

| | | | | |

Income tax expense | $ - | | $ - |

F-46

PIEDMONT MINING COMPANY, INC.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

6. | Income Taxes – continued - |

A reconciliation of the provision (benefit) for income taxes with amounts determined by applying the statutory U.S. federal income tax rate to income before income taxes is as follows:

| | Year ended December 31, |

| | 2005 | | 2004 |

| | | | |

Net loss before taxes | | $ (462,889) | | $ (162,439) |

Statutory rate | | 42% | | 42% |

Total computed tax expense (benefit) | (194,413) | | (68,224) |

(Decrease) increase in taxes resulting from: | | | |

Temporary differences | 72 | | 287 |

Increase in valuation allowance | 194,341 | | 67,937 |

| | | |

Income tax expense from continuing operations | $ - | | $ - |

| | | | |

Effective income tax rate | | 0% | | 0% |

The deferred tax assets result from net operating loss carry-forwards. These assets will therefore reverse either upon their utilization against taxable income or upon their statutory expiration. Federal net operating loss carry-forwards of $12,311,059 and $11,853,064 remained at December 31, 2005 and 2004, respectively, and expire as follows:

Expiration | | Net Operating Loss |

| | |

2009 | | $ 2,126,000 |

2010 | | 1,695,000 |

2011 | | 2,958,000 |

2012 | | 1,300,000 |

2017 | | 778,000 |

2018 | | 573,000 |

2019 | | 336,000 |

2020 | | 1,368,000 |

2021 | | 202,000 |

2022 | | 179,000 |

2023 | | 171,545 |

2024 | | 161,755 |

2025 | | 462,759 |

| | |

| | $ 12,311,059 |

The Company’s deferred tax asset as December 31, 2005 and 2004 was $5,170,645 and $4,978,287, respectively. These were fully offset by valuation allowances, resulting in a net deferred tax asset of $0 for each year.

F-47

PIEDMONT MINING COMPANY, INC.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

7. | Supplemental Cash Flow Information and Non-Cash Investing and Financing Activities – The Company paid no cash for income taxes or interest for the years ended December 31, 2005 or 2004. As discussed in footnote 4, the Company converted $316,037 in notes payable and accrued interest into 4,063,403 shares of common stock during 2005. Also, the Company issued 300,000 shares of common stock valued at $24,500 for payment of exploration properties during 2005. |

8. | Stock Based Compensation and Other Equity Transactions – The Company has an informal stock compensation plan. Awards under the plan are decided on a case-by-case basis by the Company’s Compensation Committee and then by the Board of Directors. In accordance with APB 25, the Company did not record stock based compensation to its employees and directors for the years ended December 31, 2005 and 2004. Had compensation cost been recorded based on the fair value at grant date, the effect on net loss would have been immaterial. In making this determination, the Company estimated the fair market value of the options issued during the year ended December 31, 2005, using the Black-Scholes option pricing model with the following assumptions: |

Risk-free interest rate | 2.54% |

Volatility factor | | 17.00% |

Contractual life of options, in years | 5 to 7 |

| | |

No options were granted during the year ended December 31, 2004. Of those granted during the year ended December 31, 2005, 400,000 of the 2,925,000 vested immediately while the remainder will vest in thirds beginning on the grant date and continuing for the two succeeding anniversary dates thereafter. The terms of these awards range from five to seven years. Total shares able to be purchased, as they vest, is 2,925,000. The fair value of these options was immaterial at the grant date. Below is a summary of the stock option activity for the years ended December 31, 2005 and 2004:

| | Number of | |

| | Shares | Weighted |

| | Subject to | Average |

| | Options | Exercise Price |

| | | |

Outstanding, January 1, 2004 | | 500,000 | $ 0.300 |

Outstanding, December 31, 2004 | 500,000 | $ 0.300 |

Granted, February 3, 2005 | | 2,925,000 | $ 0.226 |

| | |

Outstanding, December 31, 2005 | 3,425,000 | $ 0.236 |

The following table summarizes information and terms of the options outstanding and exercisable:

As of December 31, 2004:

Options Outstanding | | Options Exercisable |

| | | | | | |

| | Weighted | | | | |

| | Average Remaining | Weighted | | | Weighted |

| Number | Contractual | Average | | Number | Average |

Exercise Price | of Shares | Life (in years) | Exercise Price | | of Shares | Exercise Price |

| | | | | | |

$0.30 | 500,000 | 0.38 | $ 0.300 | | 500,000 | $ 0.300 |

F-48

PIEDMONT MINING COMPANY, INC.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

8. | Stock Based Compensation and Other Equity Transactions – continued |

As of December 31, 2005:

Options Outstanding | | Options Exercisable |

| | | | | | |

| | | | | | |

Range of

Exercise Prices | Number

of Shares | Weighted

Average Remaining

Contractual

Life (in years) | Weighted

Average

Exercise Price | | Number

of Shares | Weighted

Average

Exercise Price |

| | | | | | |

$0.20 - $0.30 | 3,425,000 | 4.42 | $ 0.236 | | 1,741,667 | $ 0.243 |

Warrants - During the year ended December 31, 2005, the Company issued warrants granting the holders the right to purchase 3,098,290 shares of common stock. These warrants were issued with the common stock sold during the year ended December 31, 2005. The Company estimates the total fair market value of these warrants to be $4,300 at the date of grant, using the same methods and assumptions employed above in valuing the stock options. No other warrants were outstanding at December 31, 2005. None were issued during the year ended December 31, 2004. The exercise prices on these warrants range from $.08 to $.13 per share. The warrants are exercisable immediately upon issuance and the expiration dates range between one year and two years after issuance.

Common Stock – The holders of the Company’s common stock are entitled to one vote for each share held of record on all matters submitted to a vote of shareholders. Holders of common stock are entitled to receive ratably such dividends, if any, as may be declared by the Board of Directors out of funds legally available.

The Company did not declare or pay any cash dividends during the past two years. The Company has no present plan for the payment of any dividends.

9. | Long Lived Assets – Long lived assets are comprised of the following at December 31, 2005 and 2004: |

| | 2005 | | 2004 |

| | | | | |

Websites | | | $ 190,738 | | $ 190,738 |

Accumulated depreciation | | | (189,071) | | (188,071) |

| | | | | |

Total long lived assets | | | $ 1,667 | | $ 2,667 |

| | | | | |

10. | Disclosure About Fair Value of Financial Instruments by a Nonfinancial Entity – |

Accounts payable and accrued expenses - The carrying value of accounts payable and accrued expenses approximates fair value due to the short-term nature of the obligations.

Due to directors - The carrying value of due to directors approximates fair value due to the short term nature of the obligations.

F-49

PIEDMONT MINING COMPANY, INC.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

10. | Disclosure About Fair Value of Financial Instruments by a Nonfinancial Entity –continued |

Convertible notes - The carrying amounts approximate fair value based on current market rates for notes with similar maturities and terms.

The estimated fair values of the Company’s financial instruments are as follows as of December 31, 2005 and 2004:

| | 2005 | | 2004 |

| | | | | | | |

| | | Carrying | Fair | | Carrying | Fair |

| | | Amount | Value | | Amount | Value |

| | | | | | | |

Cash and cash equivalents | | $ 400 | $ 400 | | $ 1,041 | $ 1,041 |

Accounts payable and bank overdraft | 10,528 | 10,528 | | 278 | 278 |

Accrued expenses | | | 43,839 | 43,839 | | 18,768 | 18,768 |

Accrued expenses - due to officers | 264,234 | 264,234 | | 156,735 | 156,735 |

Other liabilities | | | 9,809 | 9,809 | | 9,567 | 9,567 |

Due to directors | | | 123,940 | 123,940 | | - | - |

Convertible notes | | | 27,000 | 27,000 | | 243,145 | 243,145 |

| | | | | | | |

The Company determined the estimated fair value amounts by using available market information and commonly accepted valuation methodologies. However, considerable judgment is required in interpreting market data to develop the estimates of fair value. Accordingly, the estimates presented herein are not necessarily indicative of the amounts that the Company or holders of the instruments could realize in a current market exchange. The use of different assumptions and estimation methodologies may have a material effect on the estimated fair values.

11. | Commitments – The Company entered into various property agreements during 2005. These include: |

Antelope Ridge Project – On April 26, 2005, the Company entered into a ten year mining lease with an option to purchase this property. The Company must pay annual lease and option payments as follows:

By April 26, 2006: $10,000 plus $10,000 worth of Common Stock

By April 26, 2007: $15,000 plus $15,000 worth of Common Stock

On each subsequent anniversary date: $20,000 and $20,000 worth of Common Stock.

In addition, the Company is required to spend the following amounts on exploration and maintenanceof the property as follows:

By April 26, 2006: $ 20,000

By April 26, 2007: $100,000

By April 26, 2008: $100,000

The Company may purchase this property for $1,000,000, subject to a 3% net smelter returns royalty on production from the property. The purchase option must be exercised prior to the commencement of production from the property. The Company has the right to terminate this agreement on 60 days notice to the lessor.

F-50

PIEDMONT MINING COMPANY, INC.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

11. | Commitments – continued |

Bullion Mountain Project – Effective November 11, 2005, the Company entered into a ten year mining lease with option to purchase. Upon signing the final agreement in 2006, the Company will be required to pay the property owner $7,300. Payments required on each anniversary date are as follows:

| 2006: | $ 5,000 |

| 2007: | $10,000 |

| 2008 and thereafter: | $15,000 |

In addition, the Company is required to spend the following amounts on exploration and maintenanceof the property:

| By November 11, 2006: $ 20,000 |

| By November 11, 2007: $ 50,000 |

The Company has the option to purchase this property at any time for $500,000, which must be exercised before production can commence. All lease, work requirement and property maintenance payments made up to this point would be deducted from this price. Also, upon exercise of the purchase option, the Company would be required to pay a 3% net smelter returns royalty on production from the property. The Company has the right to terminate this agreement at any time by giving 60 days prior written notice.

Dome-Hi-Ho Project – On April 26, 2005, the Company entered into a five year exploration agreement with an option to enter into a joint venture agreement. The agreement requires the Company to complete $180,000 in drilling and exploration expenditures by March 1, 2006. The Company may then terminate the agreement upon 60 days written notice to the owner. It must elect by April 13, 2006, to exercise the underlying option on 20 of the claims by paying $200,000. Subsequent annual exploration and development requirements will be:

By March 1, 2007: $180,000

By March 1, 2008: $400,000

By March 1, 2009: $500,000

By March 1, 2010: $540,000

In addition, the Company will be required to pay the property owner the following amounts:

By March 1, 2006: $ 10,000

By March 1, 2007: $ 10,000

By March 1, 2008: $ 10,000

By March 1, 2009: $ 10,000

Upon performance of the above requirements, the Company will be granted a 51% interest in the property. In addition, the Company is obligated to pay the underlying claims maintenance and property holding costs as well as annual rental payments under a preexisting lease agreement with a third party. The term of this lease is twenty years, beginning July 21, 2003. The Company will therefore be required to pay the following lease amounts:

F-51

PIEDMONT MINING COMPANY, INC.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

11. | Commitments – continued |

After the 2007 anniversary date, the annual rental amount will be increased based on the Consumer Price Index. Also, the Company would be required to pay royalties based on a graduated scale, ranging from 3.0% to 4.0% should production occur on the property.

Trinity Silver Project - The Company entered into this agreement in September 2005. In order to earn an initial 25% interest in the property, the Company must spend a total of $1,000,000 on or for the benefit of the property prior to September 2008. $75,000 of this must be spent within the first year of the agreement and not less than $125,000 during the second year. In order to earn an additional 26% interest in the property, the Company must spend an additional $1,000,000 prior to September 2010. This would bring the Company’s total interest to 51%. In order to earn an additional 9% interest in the property (for a total of 60%), the Company must spend an additional $2,000,000 prior to September 2013. The Company may terminate this agreement at any time upon 30 days written notice, whereupon the Company would have no further obligations or liabilities under this agreement except for certain fees.

12. | Restatement of Consolidated Financial Statements – As a result of analyses performed after the audited financial statements were issued, errors in prepaid expenses, accrued liabilities, other liabilities and exploration costs were discovered, affecting 2004 and 2005. As a result, insurance expense was overstated for the year ended December 31, 2004 and accrued expenses were overstated and prepaid expenses and other liabilities were understated at December 31, 2004. The errors also caused an understatement of prepaid expenses, other liabilities, and beginning retained earnings and an overstatement of accrued expenses at December 31, 2005. The errors also caused an overstatement of exploration projects as of December 31, 2005, and an understatement of geological and geophysical costs for the year ended December 31, 2005. The financial statements have been restated to reflect these adjustments. The effect of the restatement on results of operations and financial position as of and for the year ended December 31, 2004 and 2005 are as follows: |

F-52

PIEDMONT MINING COMPANY, INC.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

12. | Restatement of Consolidated Financial Statements – Continued |

| | | |

| | As Previously | | As |

| | Reported | Correction | Restated |

| | | | |

As of and for the year ended December 31, 2004: | | | |

General and administrative | | $ 53,034 | $ (18,564) | $ 34,470 |

Net loss | | (181,003) | 18,564 | (162,439) |

Loss per share - basic | | (0.005) | 0.001 | (0.004) |

Loss per share - diluted | | (0.004) | - | (0.004) |

| | | | |

Prepaid expenses and other | | 3,238 | 17,675 | 20,913 |

Accrued expenses | | 29,224 | (10,456) | 18,768 |

Other liabilities | - | 9,567 | 9,567 |

Deficit accumulated during exploration stage | (564,658) | 18,564 | (546,094) |

| | | | |

As of and for the year ended December 31, 2005: | | | |

General and administrative | | $ 83,636 | $ (1,332) | $ 82,304 |

Geological and geophysical costs | | 55,418 | 158,639 | 214,057 |

Net loss | | (305,582) | (157,307) | (462,889) |

Loss per share - basic | | (0.008) | (0.004) | (0.012) |

Loss per share - diluted | | (0.008) | (0.004) | (0.012) |

| | | | |

Prepaid expenses and other | | 2,000 | 18,559 | 20,559 |

Exploration projects | | 234,139 | (158,639) | 75,500 |

Accrued expenses | | 54,985 | (11,146) | 43,839 |

Other liabilities | - | 9,809 | 9,809 |

Deficit accumulated during exploration stage | (870,240) | (138,743) | (1,008,983) |

| | | | |

On the consolidated statements of cash flows: | | | |

| | | | |

For the year ended December 31, 2004: | | | |

Net loss | | $ (181,003) | $ 18,564 | $ (162,439) |

Changes in prepaid expenses and other | | (289) | (17,675) | (17,964) |

Changes in accounts payable and

accrued expenses | | 6,270 | (10,456) | (4,186) |

Changes in other liabilities | | - | 9,567 | 9,567 |

| | | | |

For the year ended December 31, 2005: | | | |

Net loss | | $ (305,582) | $ (157,307) | $ (462,889) |

Changes in prepaid expenses and other | | 1,238 | (884) | 354 |

Changes in accounts payable and

accrued expenses | | 160,155 | (690) | 159,465 |

Changes in other liabilities | | - | 242 | 242 |

Payments made on exploration projects | | (209,639) | 158,639 | (51,000) |

| | | | |

PIEDMONT MINING COMPANY, INC.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| • | On February 8, 2006, the Company issued five year options to its President and Vice President of Exploration, allowing them to purchase 500,000 and 700,000 shares, respectively, of common stock at $.23 per share. |

| • | As discussed in Note 4, one convertible note remained unconverted at December 31, 2005. This note was repaid in full, during February 2006. |

| • | During February, March, and April of 2006, the Company sold 8,259,999 shares of common stock for $1,194,750. Accompanying these shares were 5,243,333 warrants to purchase common stock. These warrants have varying exercise prices and expiration dates. No expiration date is later than April 2008. In addition, the Company issued 603,333 warrants and paid $50,400 as commission to the agent who brokered some of the April stock sales. |

| • | Pasco Canyon Gold Project – The Company entered into an exploration and option agreement on February 14, 2006. Upon signing of the agreement, the Company paid the property owner $10,000. The Company will be required to spend the following amounts on work and exploration of the property: |

| 2006: | $ 50,000 |

| 2007: | $100,000 | |

| 2008: | $200,000 | |

| 2009: | $200,000 | |

| 2010: | $450,000 | |

Upon completion of the work expenditure requirements above, the Company will have earned a 60% interest in the property, subject to a 1% net smelter returns royalty on any production from the property. The Company may terminate this agreement upon 30 days written notice to the owner, except that the 2006 work expenditure requirement must be fulfilled before termination can occur.