Q2 FY2021 November 2020 Exhibit 99.4

Cautionary Statement and Disclaimer The views expressed here may contain information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness, reasonableness or reliability of this information. Any forward looking information in this presentation including, without limitation, any tables, charts and/or graphs, has been prepared on the basis of a number of assumptions which may prove to be incorrect. This presentation should not be relied upon as a recommendation or forecast by Vedanta Resources plc and Vedanta Limited and any of their subsidiaries. Past performance of Vedanta Resources plc and Vedanta Limited and any of their subsidiaries cannot be relied upon as a guide to future performance. This presentation contains 'forward-looking statements' – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as 'expects,' 'anticipates,' 'intends,' 'plans,' 'believes,' 'seeks,' or 'will.' Forward–looking statements by their nature address matters that are, to different degrees, uncertain. For us, uncertainties arise from the behaviour of financial and metals markets including the London Metal Exchange, fluctuations in interest and or exchange rates and metal prices; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a environmental, climatic, natural, political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different that those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. We caution you that reliance on any forward-looking statement involves risk and uncertainties, and that, although we believe that the assumption on which our forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate and, as a result, the forward-looking statement based on those assumptions could be materially incorrect. This presentation is not intended, and does not, constitute or form part of any offer, invitation or the solicitation of an offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of, any securities in Vedanta Resources plc and Vedanta Limited and any of their subsidiaries or undertakings or any other invitation or inducement to engage in investment activities, nor shall this presentation (or any part of it) nor the fact of its distribution form the basis of, or be relied on in connection with, any contract or investment decision.

Contents Section Presenter Page Q2 FY21 Review & Business Update Sunil Duggal, CEO 4 Financial Update Arun Kumar, CFO 12 Appendix 21

Q2 FY2021 Review & Business Update Sunil Duggal | Chief Executive Officer Q2 FY2021

Key Highlights: Q2 FY2021 Operational Zinc India ever highest ore production of 3.9 Mnt since underground transition highest ever quarterly silver production of 203 tonnes lowest ever quarterly cost of $919/t since underground operations Zinc International Gamsberg highest ever production of 35kt O&G gross production 165 kboepd with $7.0/bbl opex at Rajasthan Aluminium cost of production at $1,288/t with highest ever EBITDA margin of 26% Both of our smelters at Jharsuguda and Balco operate in 1st quartile# of the cost curve for the year 2020 TSPL achieved 81% plant availability Iron Ore Karnataka sales at 1.3 Mnt ESL Steel sales 271kt with margin $94/t Financial Highest quarterly EBITDA of 6,531 crores for >2 years with robust margin* of 36% Attributable PAT (before exceptional items and tax on dividend) of ₹ 1,979 crores, up 75% q-o-q Net Debt at 27,190 crores, flat q-o-q with ND/EBITDA at 1.2x, maintained at low level # as per CRU estimates * Excludes custom smelting at Copper and Zinc India operations

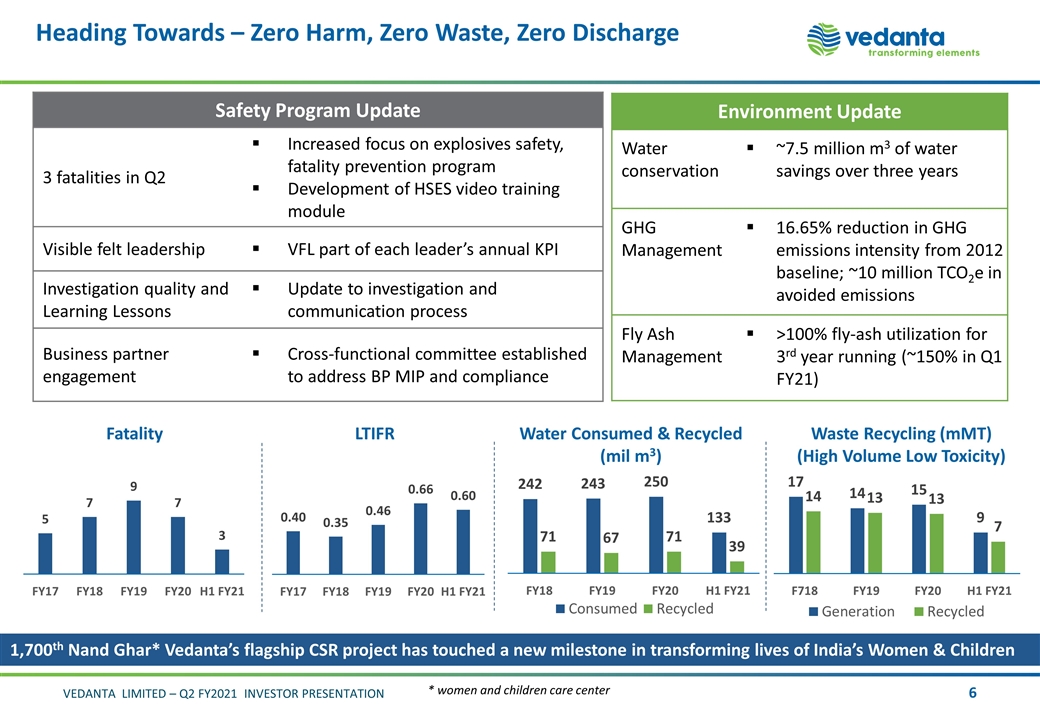

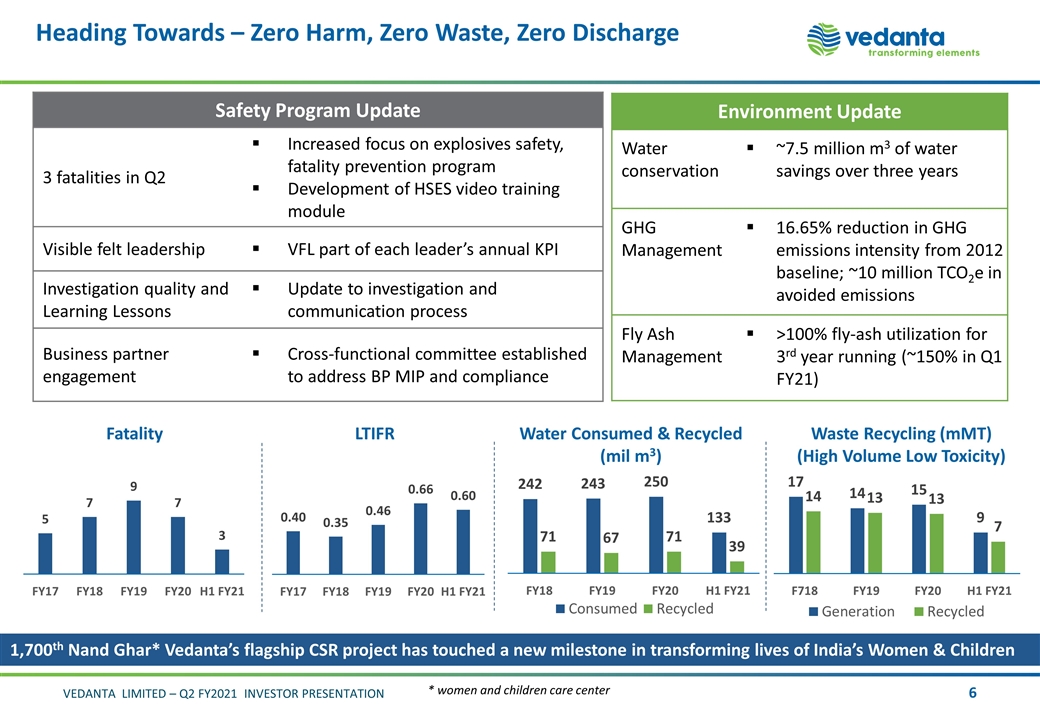

Heading Towards – Zero Harm, Zero Waste, Zero Discharge Environment Update Water conservation ~7.5 million m3 of water savings over three years GHG Management 16.65% reduction in GHG emissions intensity from 2012 baseline; ~10 million TCO2e in avoided emissions Fly Ash Management >100% fly-ash utilization for 3rd year running (~150% in Q1 FY21) Water Consumed & Recycled (mil m3) LTIFR Fatality Waste Recycling (mMT) (High Volume Low Toxicity) Safety Program Update 3 fatalities in Q2 Increased focus on explosives safety, fatality prevention program Development of HSES video training module Visible felt leadership VFL part of each leader’s annual KPI Investigation quality and Learning Lessons Update to investigation and communication process Business partner engagement Cross-functional committee established to address BP MIP and compliance 1,700th Nand Ghar* Vedanta’s flagship CSR project has touched a new milestone in transforming lives of India’s Women & Children * women and children care center

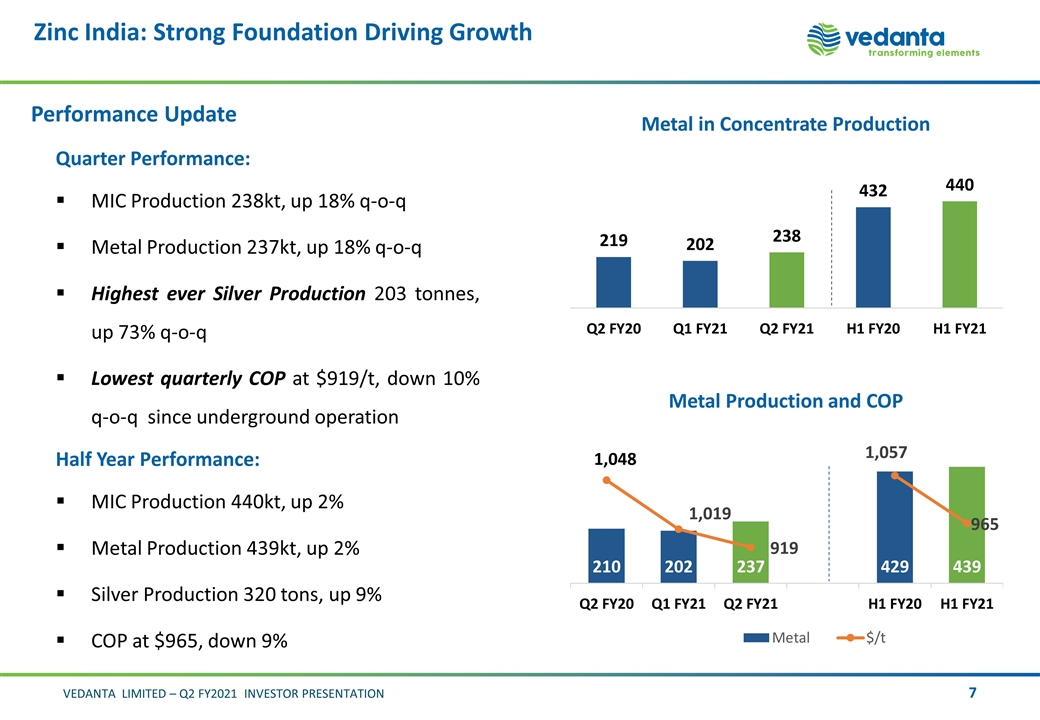

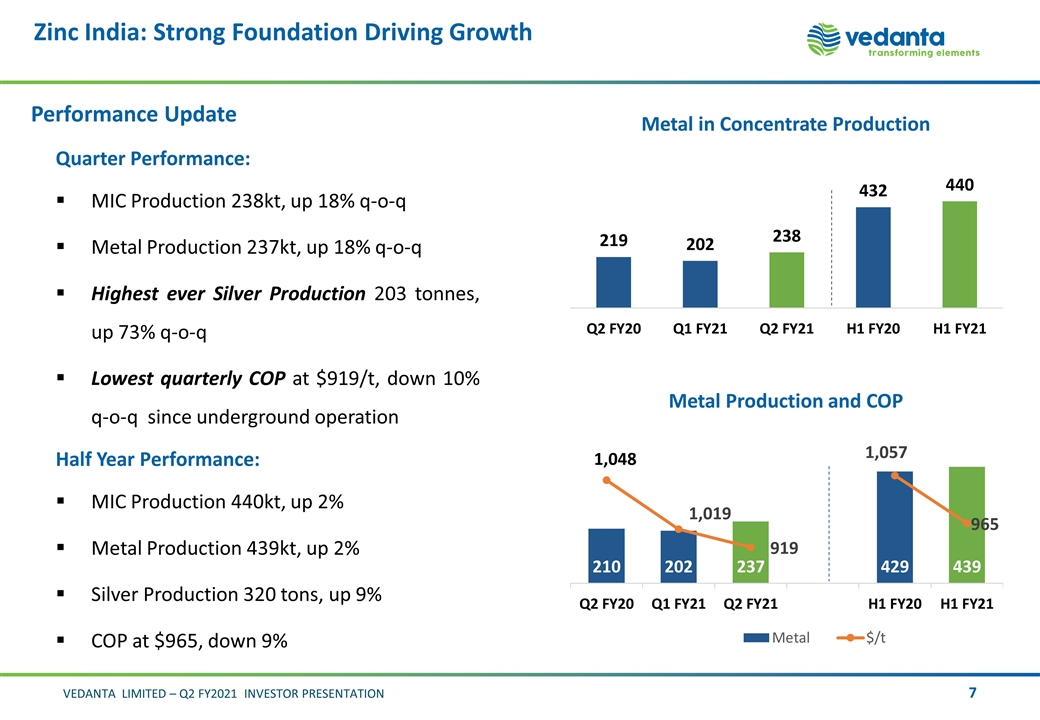

Zinc India: Strong Foundation Driving Growth Metal in Concentrate Production Metal Production and COP Performance Update Quarter Performance: MIC Production 238kt, up 18% q-o-q Metal Production 237kt, up 18% q-o-q Highest ever Silver Production 203 tonnes, up 73% q-o-q Lowest quarterly COP at $919/t, down 10% q-o-q since underground operation Half Year Performance: MIC Production 440kt, up 2% Metal Production 439kt, up 2% Silver Production 320 tons, up 9% COP at $965, down 9%

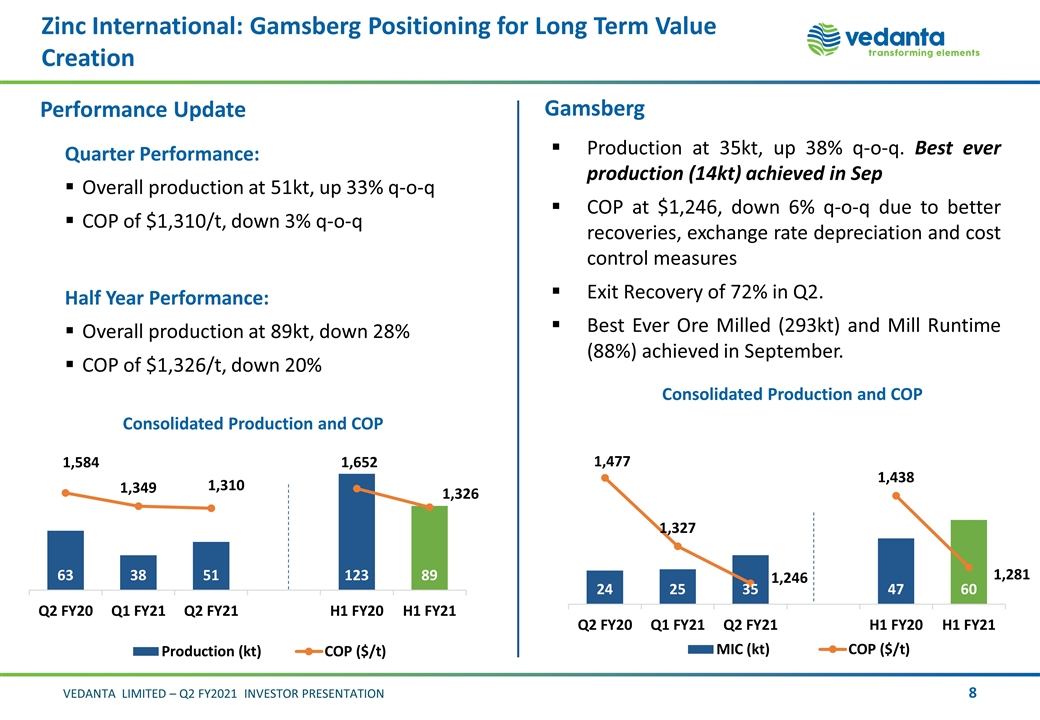

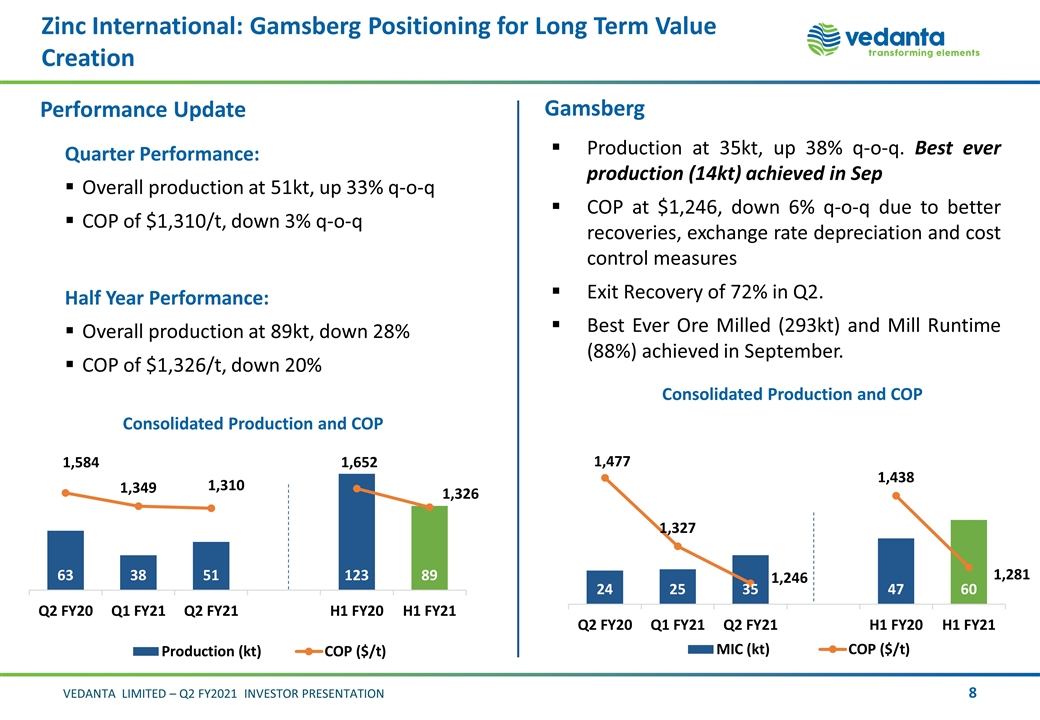

Zinc International: Gamsberg Positioning for Long Term Value Creation Performance Update Quarter Performance: Overall production at 51kt, up 33% q-o-q COP of $1,310/t, down 3% q-o-q Half Year Performance: Overall production at 89kt, down 28% COP of $1,326/t, down 20% Gamsberg Production at 35kt, up 38% q-o-q. Best ever production (14kt) achieved in Sep COP at $1,246, down 6% q-o-q due to better recoveries, exchange rate depreciation and cost control measures Exit Recovery of 72% in Q2. Best Ever Ore Milled (293kt) and Mill Runtime (88%) achieved in September.

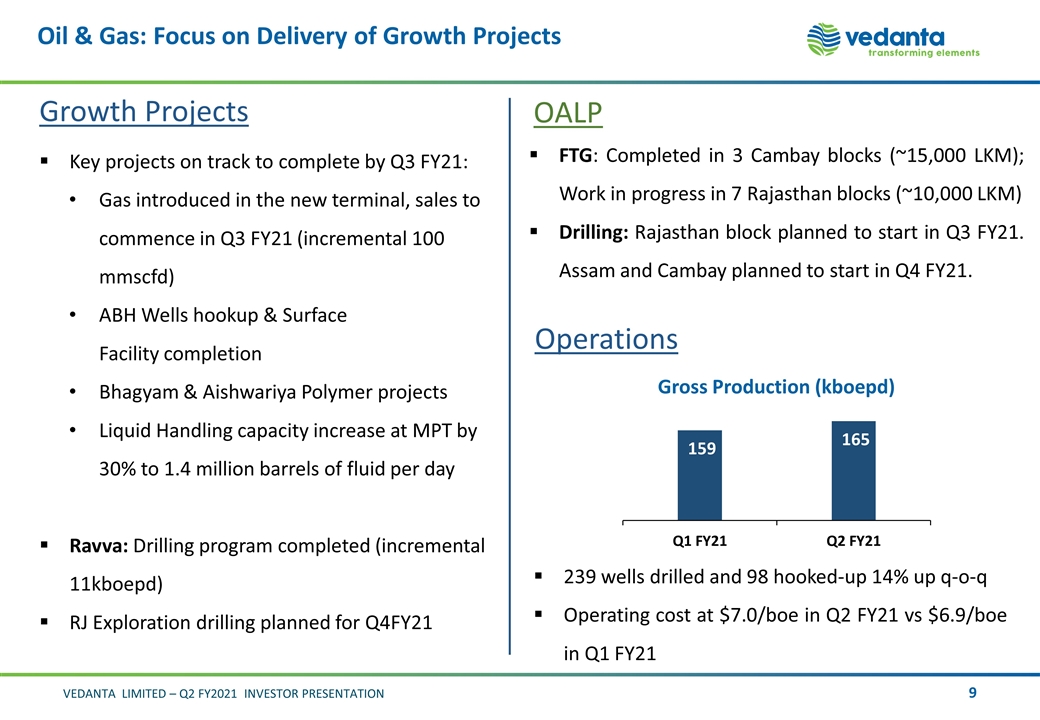

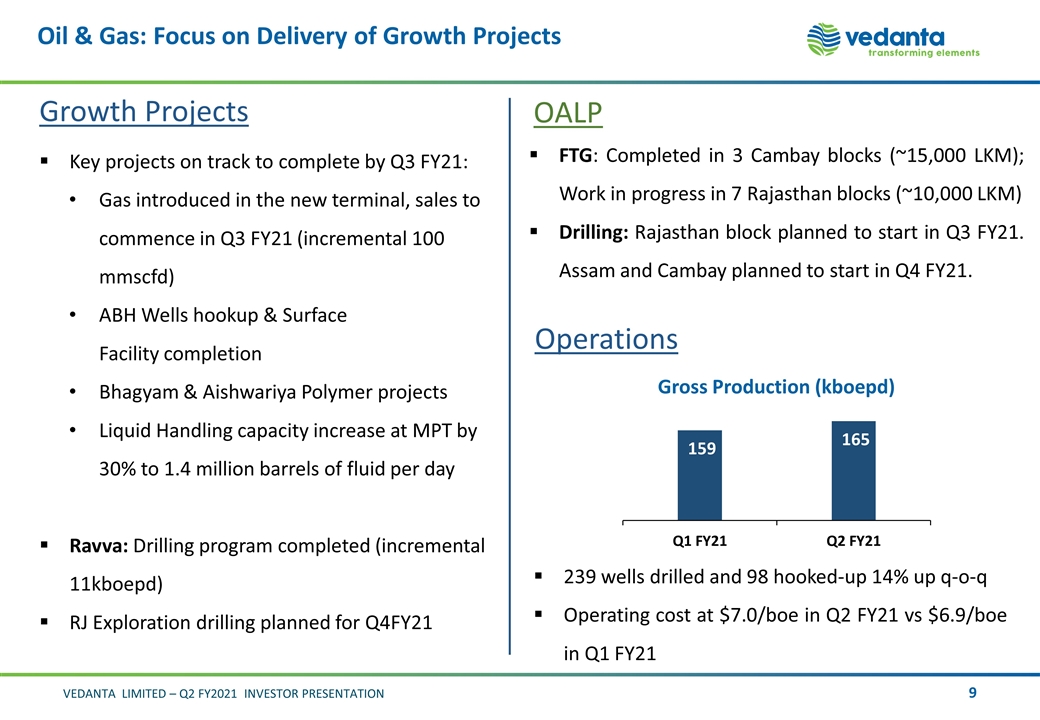

Oil & Gas: Focus on Delivery of Growth Projects Gross Production (kboepd) 239 wells drilled and 98 hooked-up 14% up q-o-q Operating cost at $7.0/boe in Q2 FY21 vs $6.9/boe in Q1 FY21 Key projects on track to complete by Q3 FY21: Gas introduced in the new terminal, sales to commence in Q3 FY21 (incremental 100 mmscfd) ABH Wells hookup & Surface Facility completion Bhagyam & Aishwariya Polymer projects Liquid Handling capacity increase at MPT by 30% to 1.4 million barrels of fluid per day Ravva: Drilling program completed (incremental 11kboepd) RJ Exploration drilling planned for Q4FY21 Growth Projects OALP FTG: Completed in 3 Cambay blocks (~15,000 LKM); Work in progress in 7 Rajasthan blocks (~10,000 LKM) Drilling: Rajasthan block planned to start in Q3 FY21. Assam and Cambay planned to start in Q4 FY21. Operations

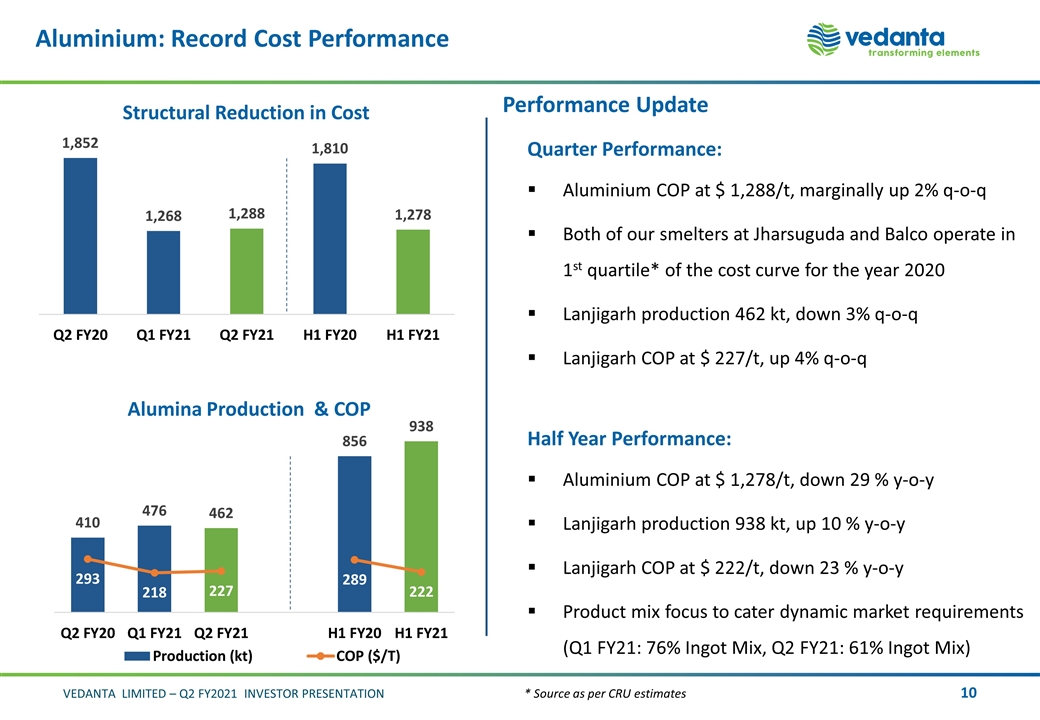

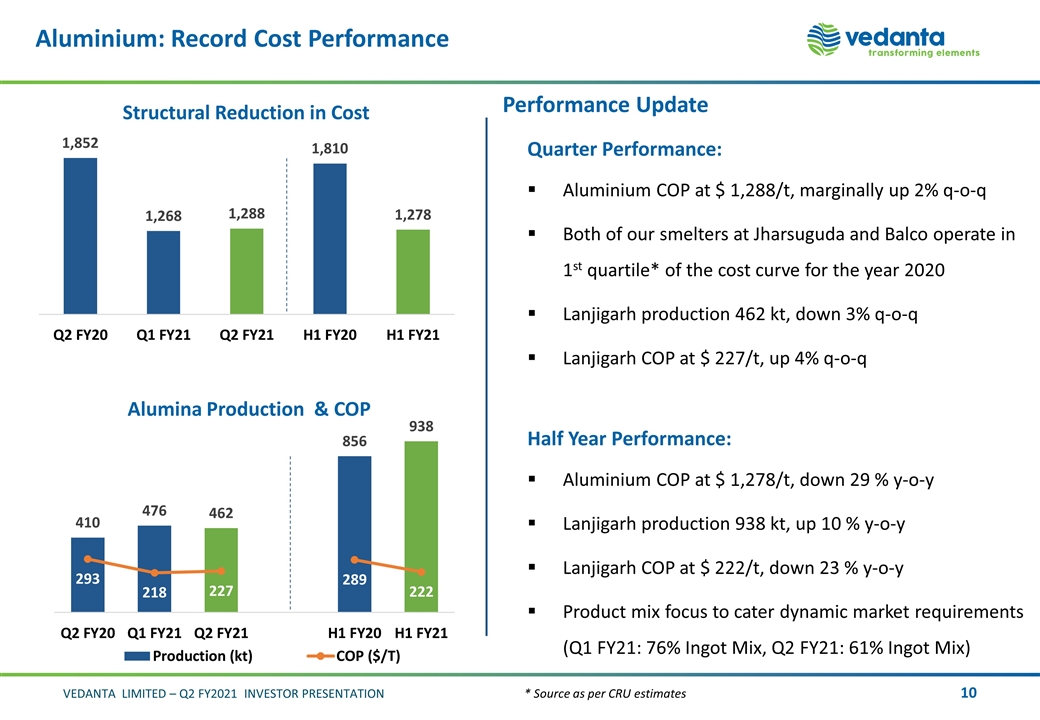

Aluminium: Record Cost Performance Structural Reduction in Cost Alumina Production & COP Performance Update Quarter Performance: Aluminium COP at $ 1,288/t, marginally up 2% q-o-q Both of our smelters at Jharsuguda and Balco operate in 1st quartile* of the cost curve for the year 2020 Lanjigarh production 462 kt, down 3% q-o-q Lanjigarh COP at $ 227/t, up 4% q-o-q Half Year Performance: Aluminium COP at $ 1,278/t, down 29 % y-o-y Lanjigarh production 938 kt, up 10 % y-o-y Lanjigarh COP at $ 222/t, down 23 % y-o-y Product mix focus to cater dynamic market requirements (Q1 FY21: 76% Ingot Mix, Q2 FY21: 61% Ingot Mix) * Source as per CRU estimates

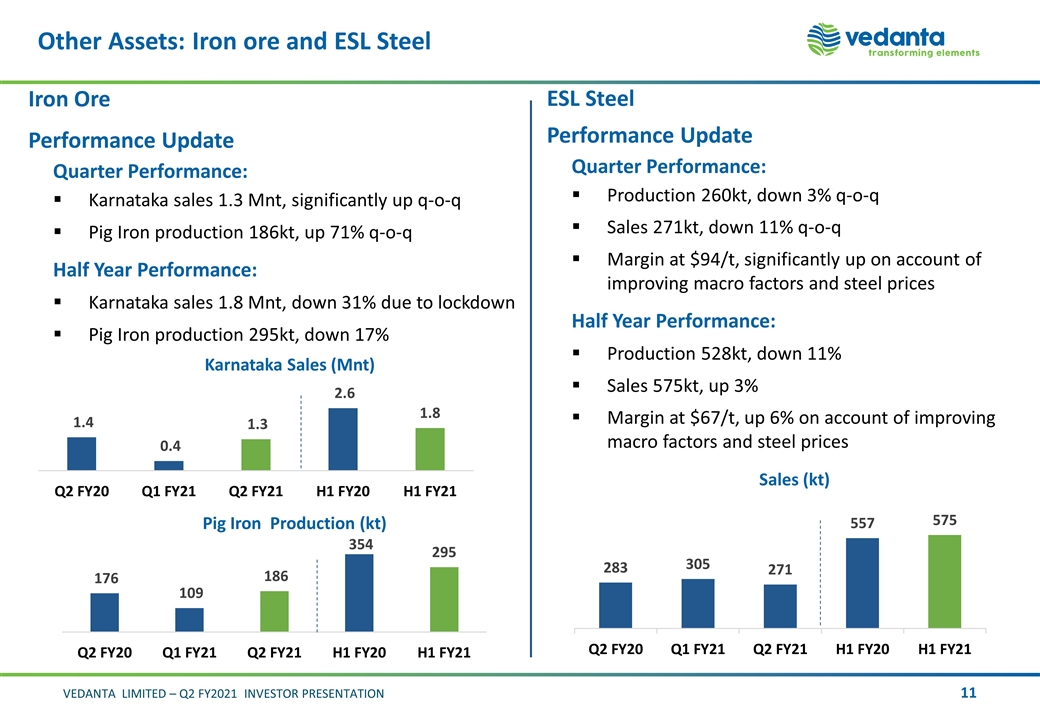

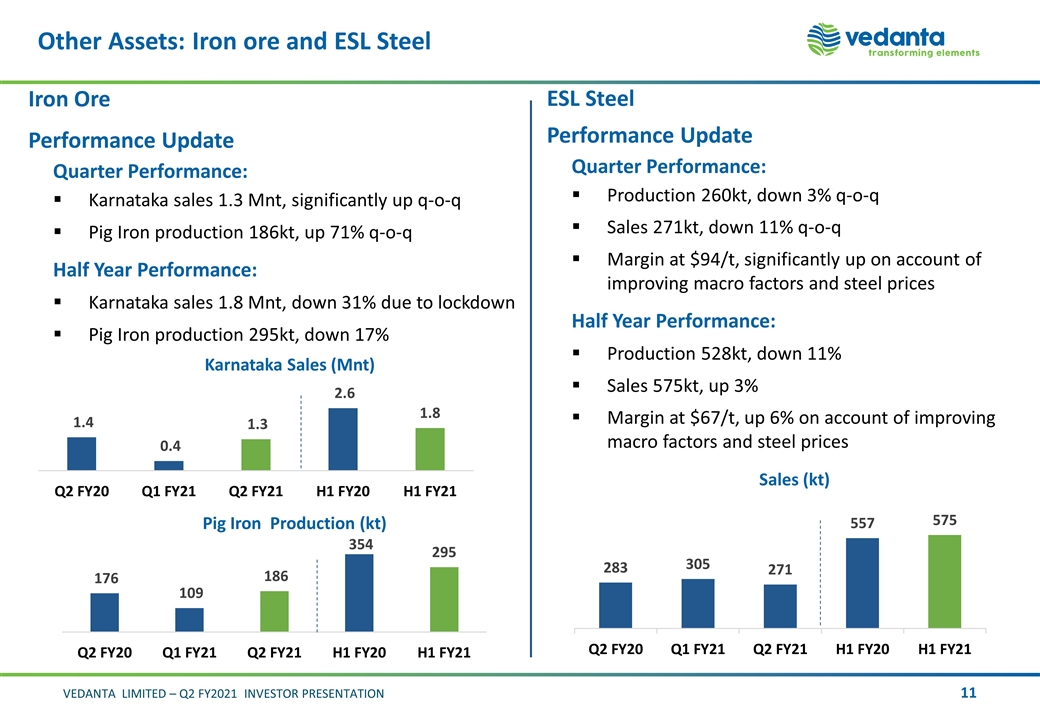

Other Assets: Iron ore and ESL Steel Pig Iron Production (kt) Karnataka Sales (Mnt) Iron Ore Performance Update Quarter Performance: Karnataka sales 1.3 Mnt, significantly up q-o-q Pig Iron production 186kt, up 71% q-o-q Half Year Performance: Karnataka sales 1.8 Mnt, down 31% due to lockdown Pig Iron production 295kt, down 17% ESL Steel Performance Update Quarter Performance: Production 260kt, down 3% q-o-q Sales 271kt, down 11% q-o-q Margin at $94/t, significantly up on account of improving macro factors and steel prices Half Year Performance: Production 528kt, down 11% Sales 575kt, up 3% Margin at $67/t, up 6% on account of improving macro factors and steel prices Sales (kt)

Finance Update Arun Kumar | Chief Financial Officer Q2 FY2021

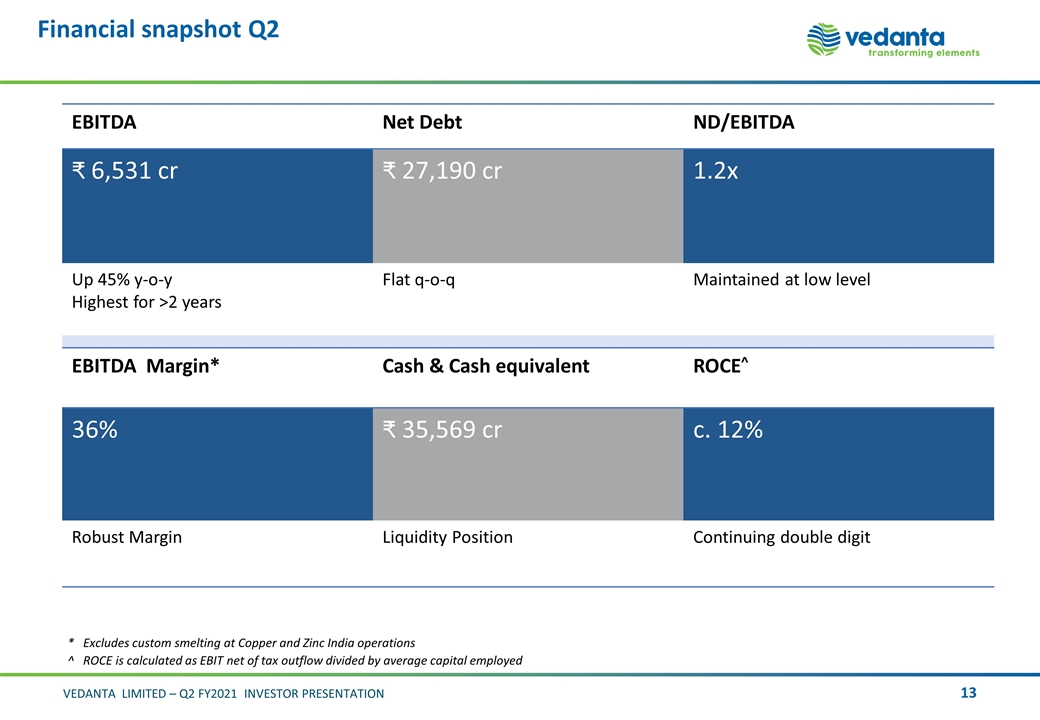

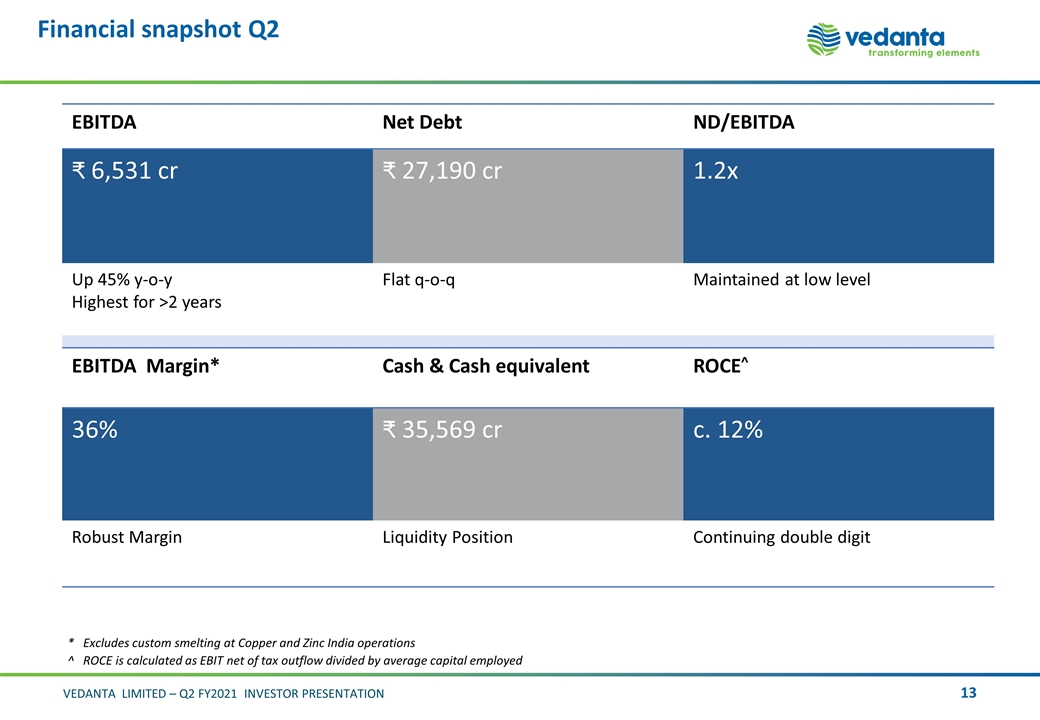

Financial snapshot Q2 EBITDA Net Debt ND/EBITDA 6,531 cr ₹ 27,190 cr 1.2x Up 45% y-o-y Highest for >2 years Flat q-o-q Maintained at low level EBITDA Margin* Cash & Cash equivalent ROCE^ 36% ₹ 35,569 cr c. 12% Robust Margin Liquidity Position Continuing double digit * Excludes custom smelting at Copper and Zinc India operations ^ ROCE is calculated as EBIT net of tax outflow divided by average capital employed

Zinc, Lead & Silver 285 Brent (536) Aluminium (230) (In crore) Market & Regulatory 686 crore Operational 1,192 crore LME / Brent /premiums Input Commodity Inflation Cost & Mktg Currency Adjusted EBITDA Regulatory & Profit Petroleum Q2 FY20 Q2 FY21 EBITDA Bridge (Q2 FY 2020 vs. Q2 FY 2021) Aluminium 720 Steel 191 Cairn 61 IOB 72

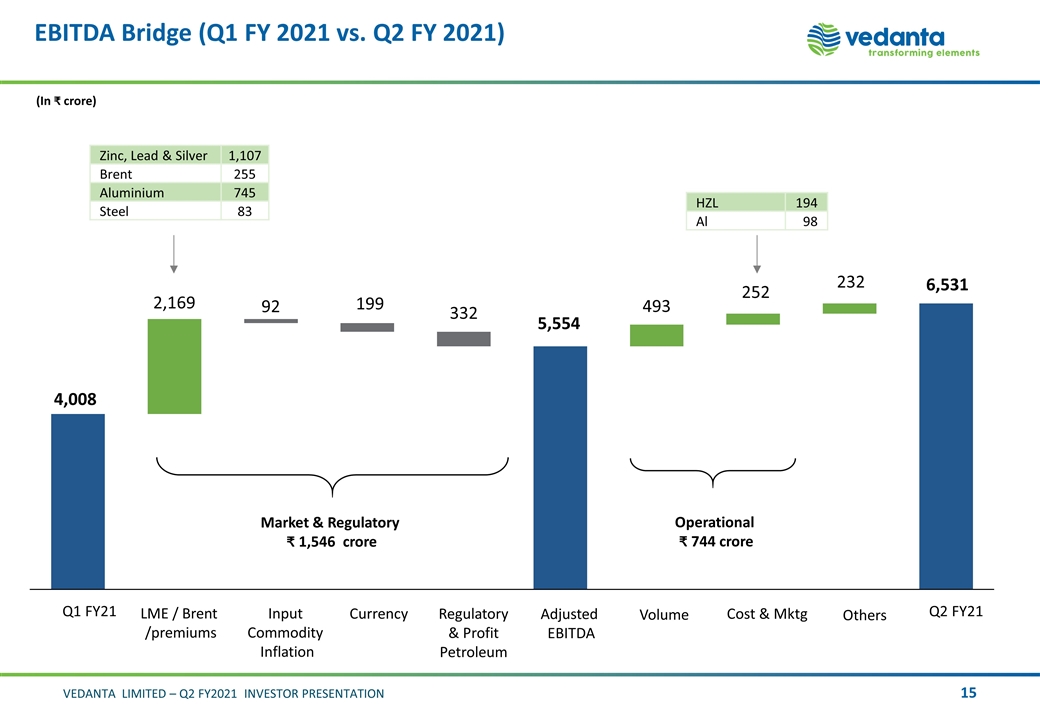

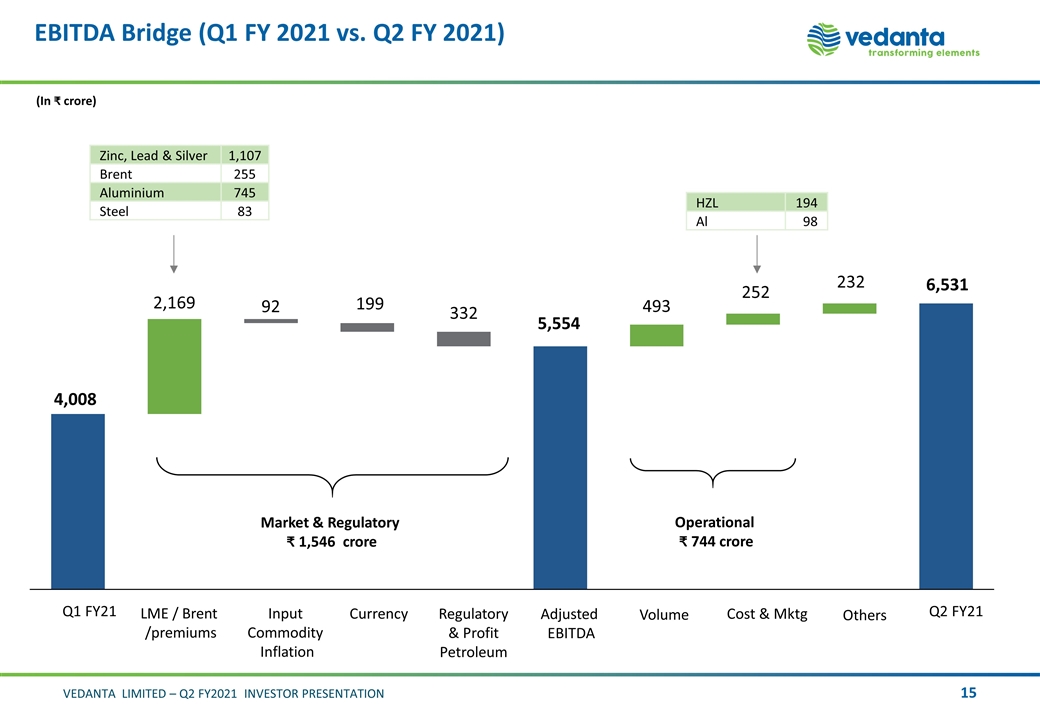

Q1 FY21 LME / Brent /premiums Input Commodity Inflation Cost & Mktg Currency Adjusted EBITDA Regulatory & Profit Petroleum Q2 FY21 EBITDA Bridge (Q1 FY 2021 vs. Q2 FY 2021) Zinc, Lead & Silver 1,107 Brent 255 Aluminium 745 Steel 83 (In crore) HZL 194 Al 98 Market & Regulatory 1,546 crore Operational 744 crore

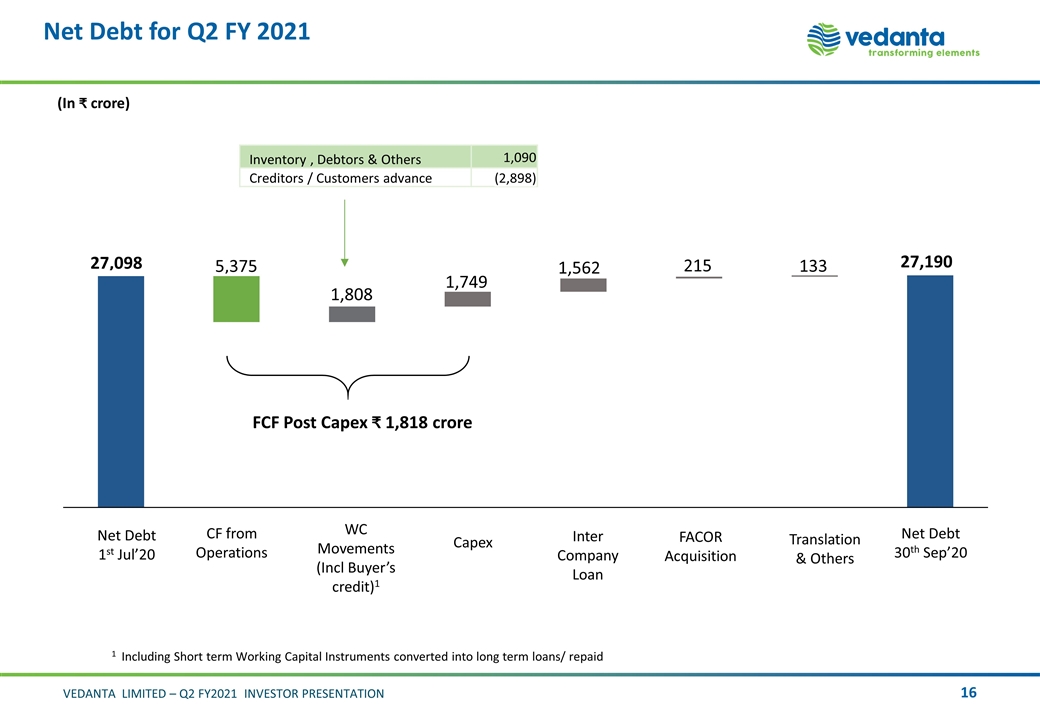

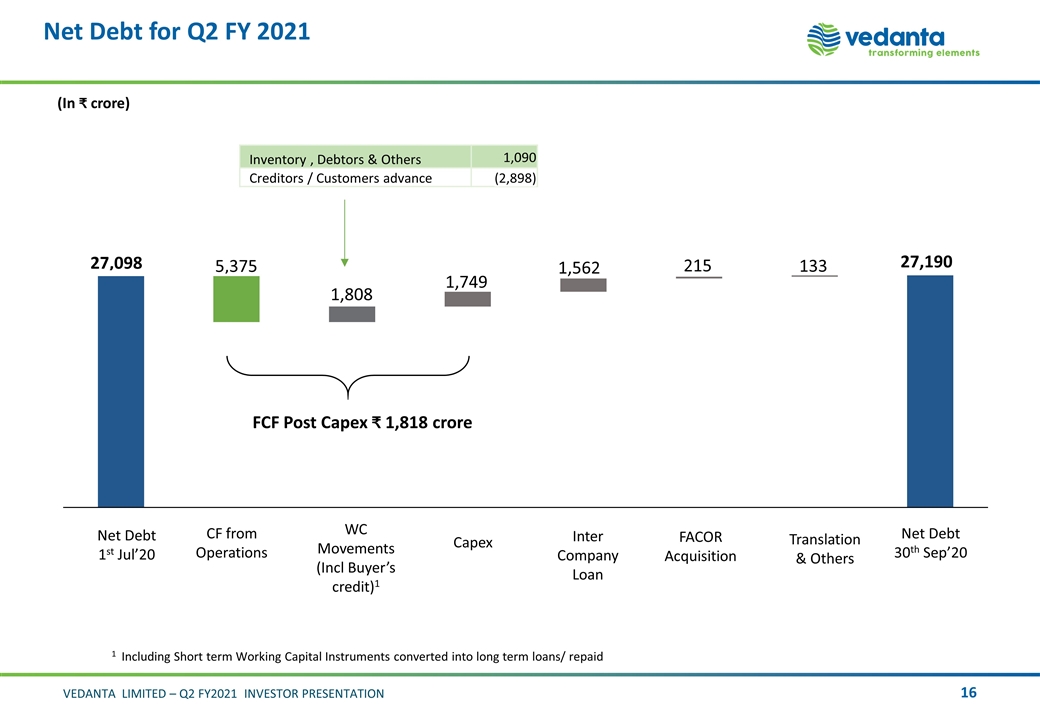

Net Debt for Q2 FY 2021 (In ₹ crore) (Incl Buyer’s credit)1 Inter Company Loan Net Debt 30th Sep’20 Net Debt 1st Jul’20 Inventory , Debtors & Others 1,090 Creditors / Customers advance (2,898) FACOR Acquisition Translation & Others Capex 1 Including Short term Working Capital Instruments converted into long term loans/ repaid

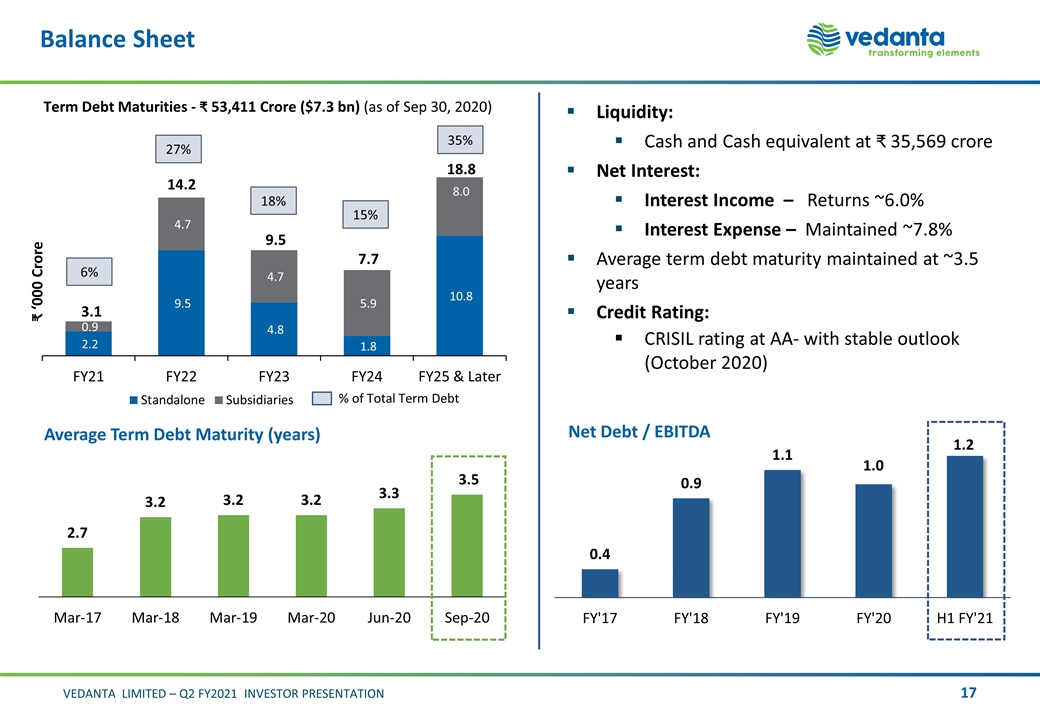

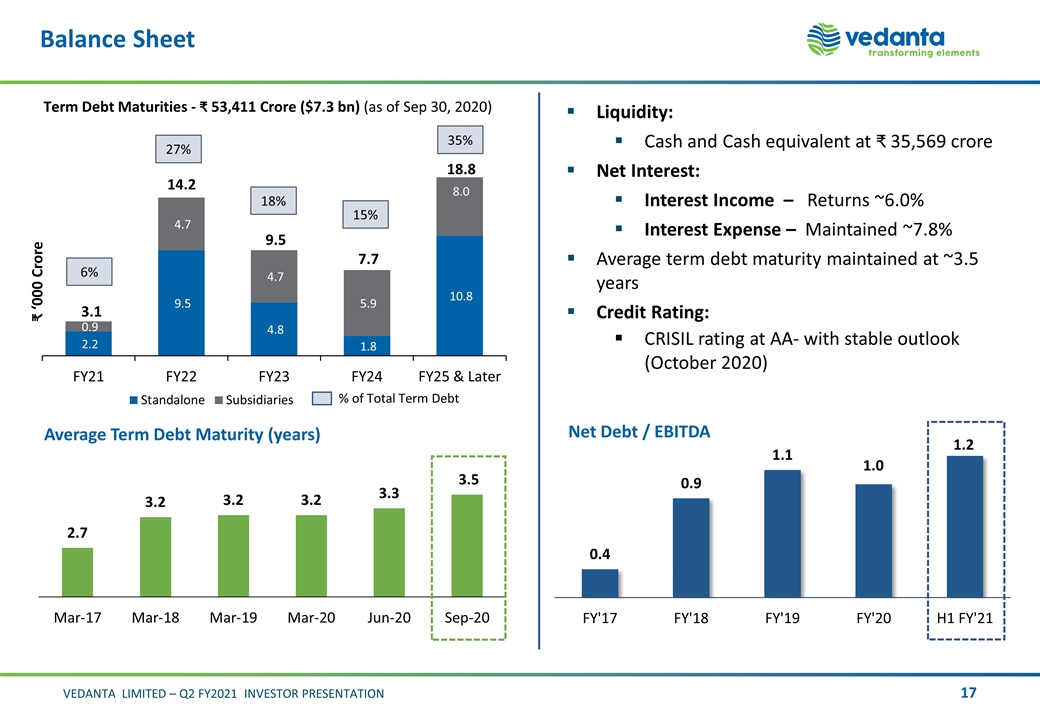

Balance Sheet Net Debt / EBITDA Liquidity: Cash and Cash equivalent at 35,569 crore Net Interest: Interest Income – Returns ~6.0% Interest Expense – Maintained ~7.8% Average term debt maturity maintained at ~3.5 years Credit Rating: CRISIL rating at AA- with stable outlook (October 2020) Average Term Debt Maturity (years) 6% 27% 18% 15% 35%

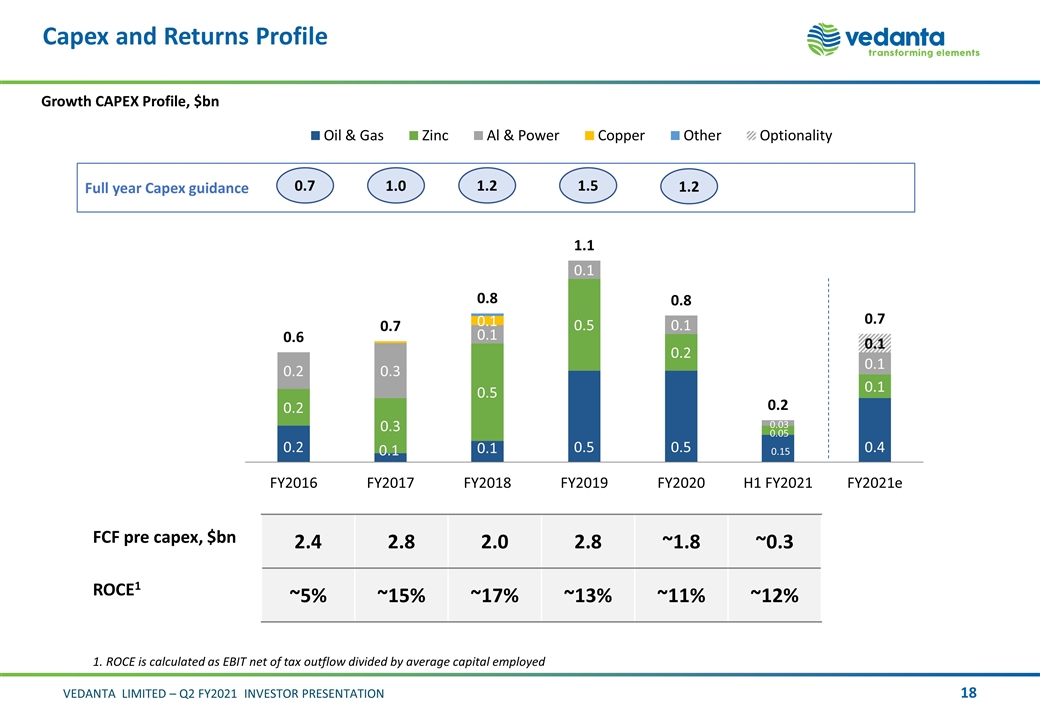

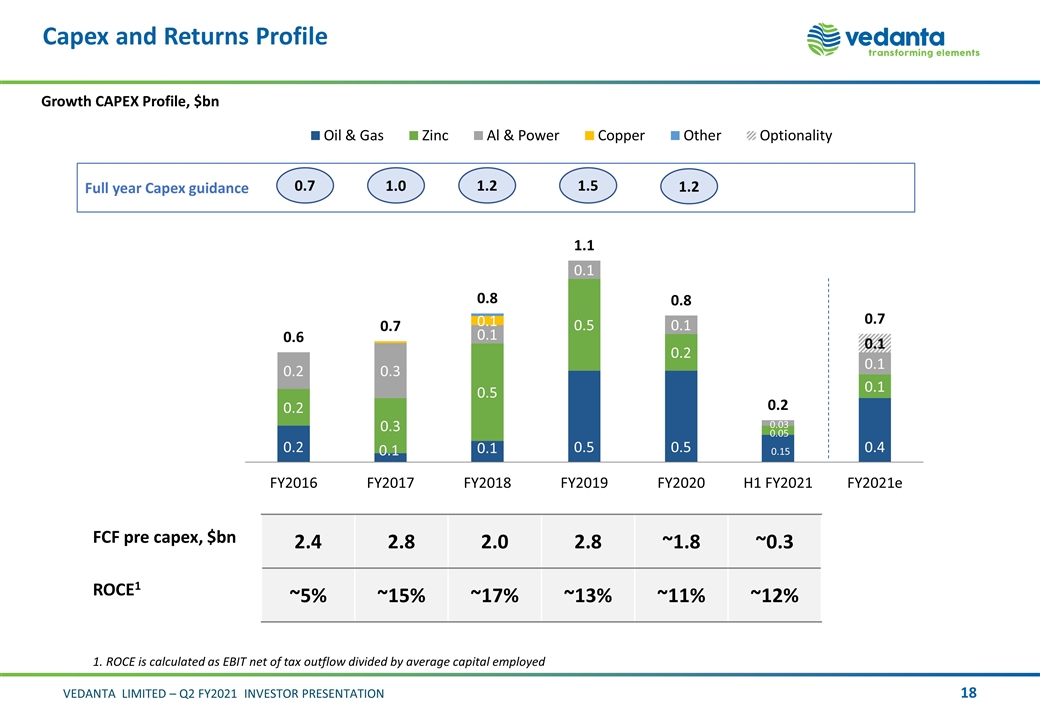

Full year Capex guidance ROCE1 2.4 2.8 2.0 2.8 ~1.8 ~0.3 ~5% ~15% ~17% ~13% ~11% ~12% Capex and Returns Profile Growth CAPEX Profile, $bn 0.7 1.0 1.2 1.5 FCF pre capex, $bn 1. ROCE is calculated as EBIT net of tax outflow divided by average capital employed 1.2

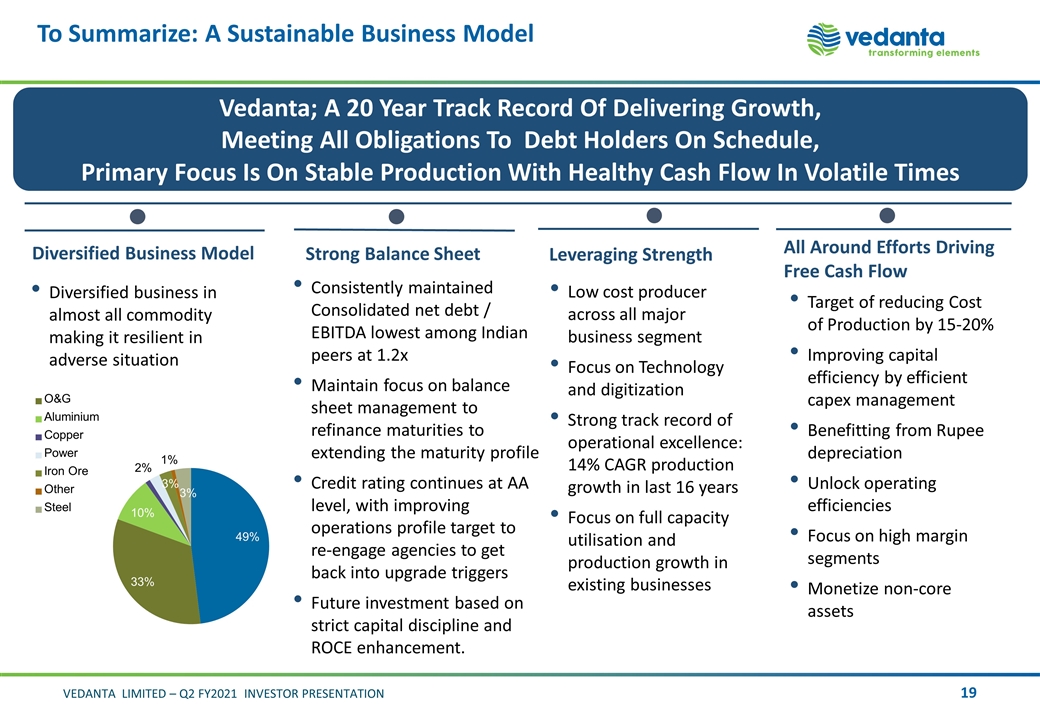

To Summarize: A Sustainable Business Model Vedanta; A 20 Year Track Record Of Delivering Growth, Meeting All Obligations To Debt Holders On Schedule, Primary Focus Is On Stable Production With Healthy Cash Flow In Volatile Times Diversified Business Model Diversified business in almost all commodity making it resilient in adverse situation Leveraging Strength Low cost producer across all major business segment Focus on Technology and digitization Strong track record of operational excellence: 14% CAGR production growth in last 16 years Focus on full capacity utilisation and production growth in existing businesses Strong Balance Sheet Consistently maintained Consolidated net debt / EBITDA lowest among Indian peers at 1.2x Maintain focus on balance sheet management to refinance maturities to extending the maturity profile Credit rating continues at AA level, with improving operations profile target to re-engage agencies to get back into upgrade triggers Future investment based on strict capital discipline and ROCE enhancement. All Around Efforts Driving Free Cash Flow Target of reducing Cost of Production by 15-20% Improving capital efficiency by efficient capex management Benefitting from Rupee depreciation Unlock operating efficiencies Focus on high margin segments Monetize non-core assets

Key Investment Highlights Large Low Cost, Long Life and Diversified Asset Base with an Attractive Commodity Mix 1 Ideally Positioned to Capitalise on Favourable Geographic Presence Operational Excellence and Technology Driving Efficiency and Sustainability 4 Well-Invested Assets Driving Cash Flow Growth 3 Strong Financial Profile 5 Proven Track Record 6 2

Appendix Q2 FY2021

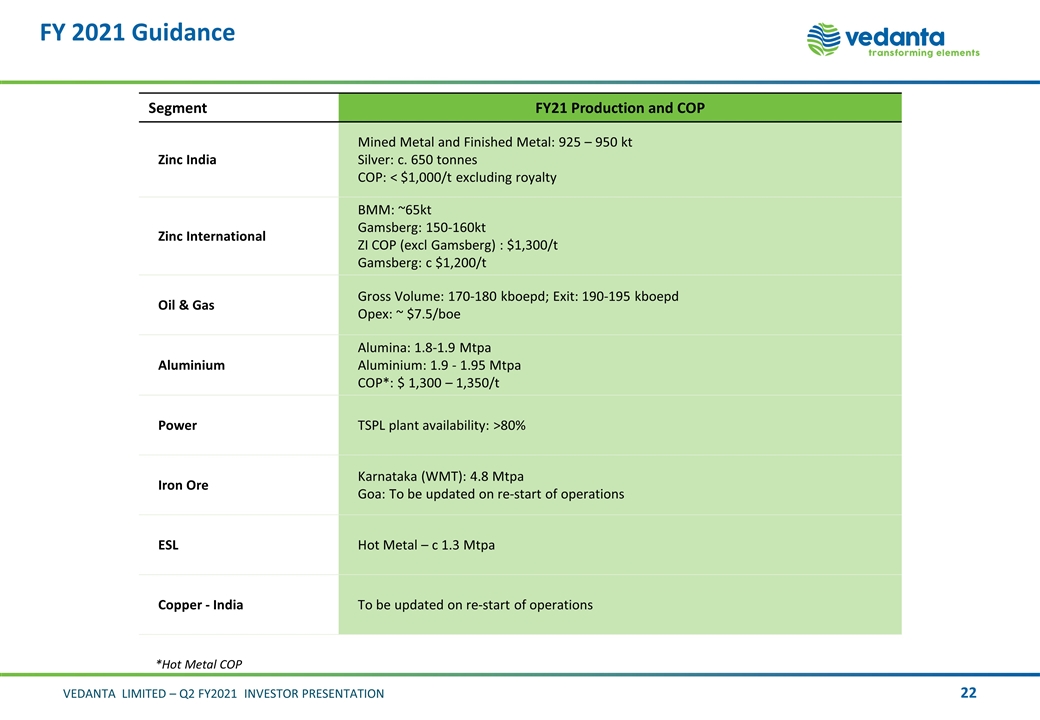

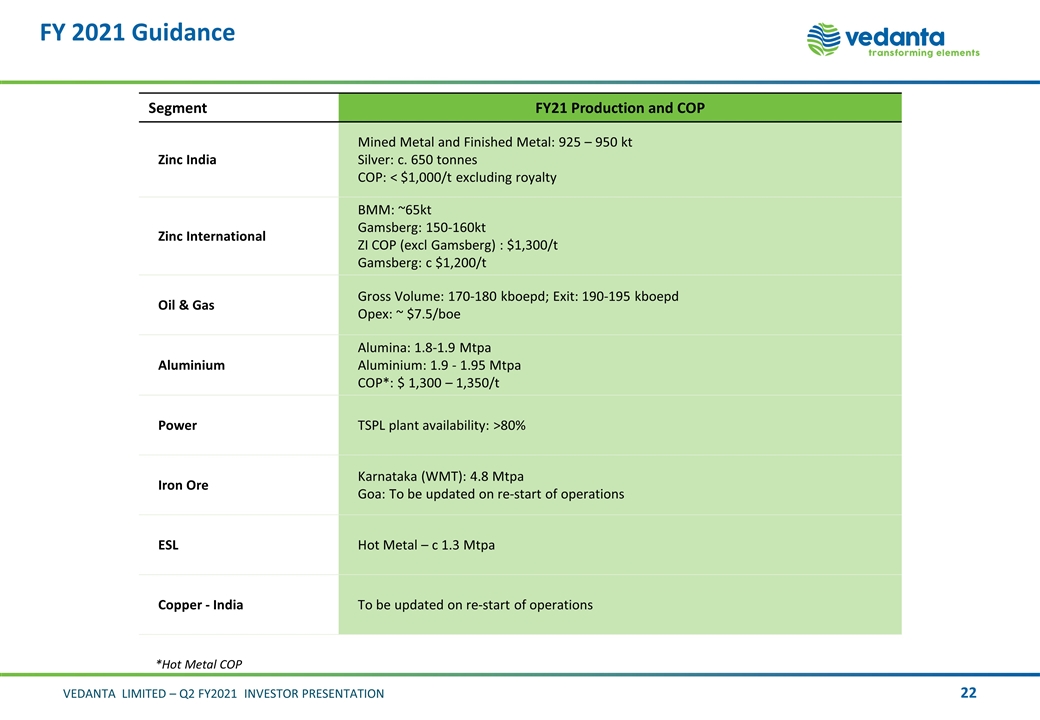

FY 2021 Guidance Segment FY21 Production and COP Zinc India Mined Metal and Finished Metal: 925 – 950 kt Silver: c. 650 tonnes COP: < $1,000/t excluding royalty Zinc International BMM: ~65kt Gamsberg: 150-160kt ZI COP (excl Gamsberg) : $1,300/t Gamsberg: c $1,200/t Oil & Gas Gross Volume: 170-180 kboepd; Exit: 190-195 kboepd Opex: ~ $7.5/boe Aluminium Alumina: 1.8-1.9 Mtpa Aluminium: 1.9 - 1.95 Mtpa COP*: $ 1,300 – 1,350/t Power TSPL plant availability: >80% Iron Ore Karnataka (WMT): 4.8 Mtpa Goa: To be updated on re-start of operations ESL Hot Metal – c 1.3 Mtpa Copper - India To be updated on re-start of operations *Hot Metal COP

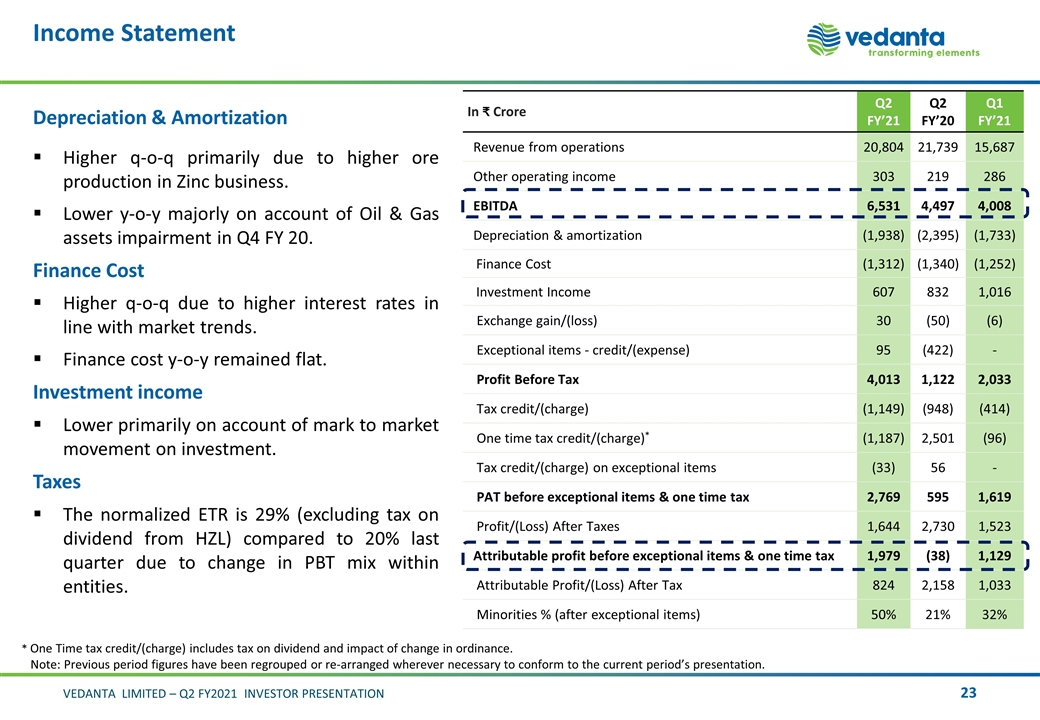

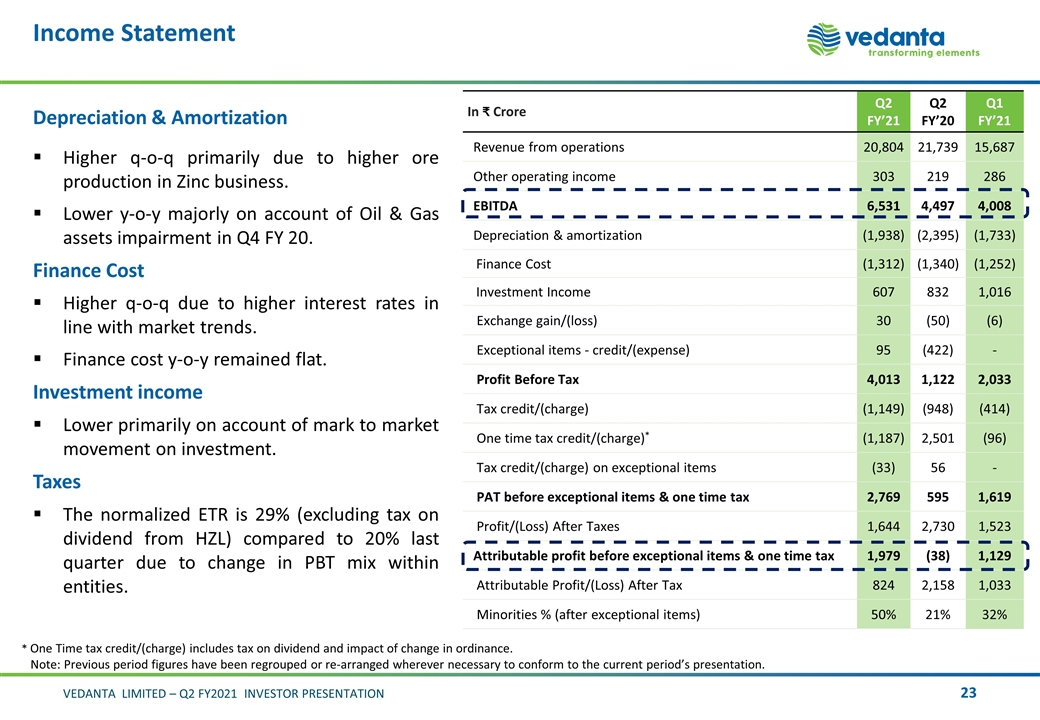

Income Statement In Crore Q2 FY’21 Q2 FY’20 Q1 FY’21 Revenue from operations 20,804 21,739 15,687 Other operating income 303 219 286 EBITDA 6,531 4,497 4,008 Depreciation & amortization (1,938) (2,395) (1,733) Finance Cost (1,312) (1,340) (1,252) Investment Income 607 832 1,016 Exchange gain/(loss) 30 (50) (6) Exceptional items - credit/(expense) 95 (422) - Profit Before Tax 4,013 1,122 2,033 Tax credit/(charge) (1,149) (948) (414) One time tax credit/(charge)* (1,187) 2,501 (96) Tax credit/(charge) on exceptional items (33) 56 - PAT before exceptional items & one time tax 2,769 595 1,619 Profit/(Loss) After Taxes 1,644 2,730 1,523 Attributable profit before exceptional items & one time tax 1,979 (38) 1,129 Attributable Profit/(Loss) After Tax 824 2,158 1,033 Minorities % (after exceptional items) 50% 21% 32% * One Time tax credit/(charge) includes tax on dividend and impact of change in ordinance. Note: Previous period figures have been regrouped or re-arranged wherever necessary to conform to the current period’s presentation. Depreciation & Amortization Higher q-o-q primarily due to higher ore production in Zinc business. Lower y-o-y majorly on account of Oil & Gas assets impairment in Q4 FY 20. Finance Cost Higher q-o-q due to higher interest rates in line with market trends. Finance cost y-o-y remained flat. Investment income Lower primarily on account of mark to market movement on investment. Taxes The normalized ETR is 29% (excluding tax on dividend from HZL) compared to 20% last quarter due to change in PBT mix within entities.

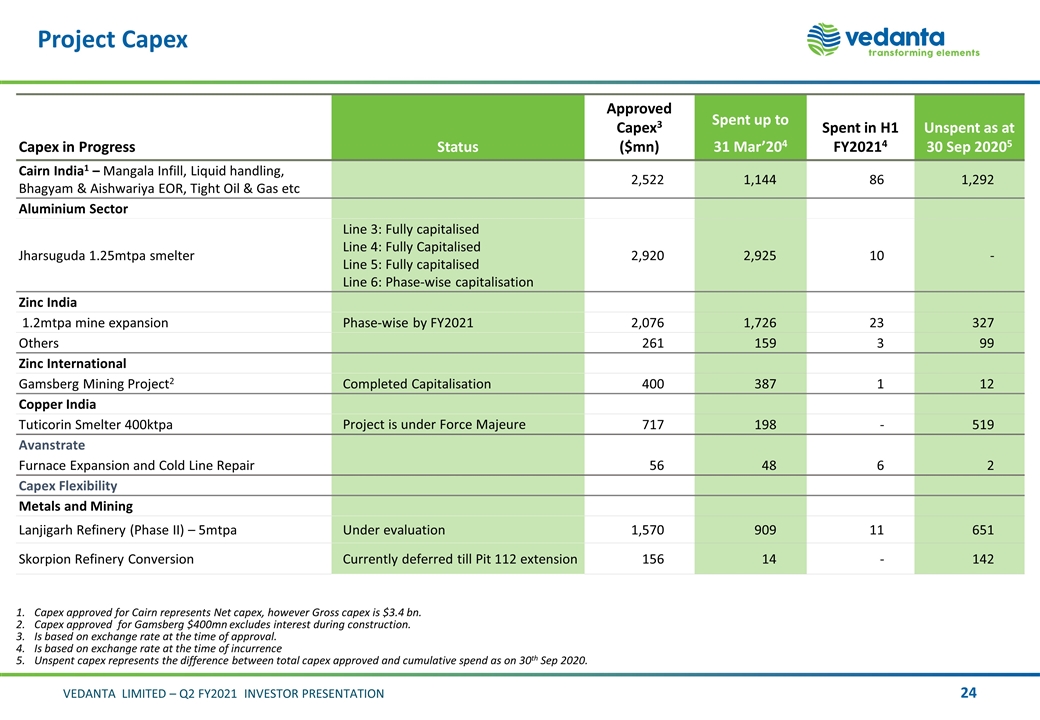

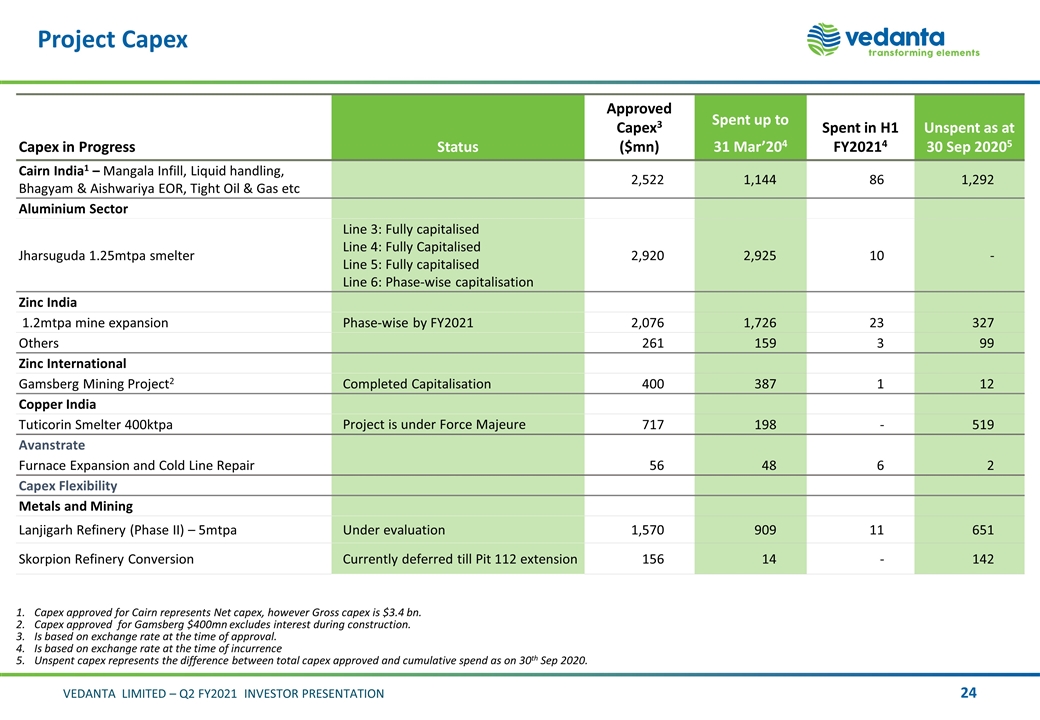

Project Capex Capex in Progress Status Approved Capex3 ($mn) Spent up to 31 Mar’204 Spent in H1 FY20214 Unspent as at 30 Sep 20205 Cairn India1 – Mangala Infill, Liquid handling, Bhagyam & Aishwariya EOR, Tight Oil & Gas etc 2,522 1,144 86 1,292 Aluminium Sector Jharsuguda 1.25mtpa smelter Line 3: Fully capitalised Line 4: Fully Capitalised Line 5: Fully capitalised Line 6: Phase-wise capitalisation 2,920 2,925 10 - Zinc India 1.2mtpa mine expansion Phase-wise by FY2021 2,076 1,726 23 327 Others 261 159 3 99 Zinc International Gamsberg Mining Project2 Completed Capitalisation 400 387 1 12 Copper India Tuticorin Smelter 400ktpa Project is under Force Majeure 717 198 - 519 Avanstrate Furnace Expansion and Cold Line Repair 56 48 6 2 Capex Flexibility Metals and Mining Lanjigarh Refinery (Phase II) – 5mtpa Under evaluation 1,570 909 11 651 Skorpion Refinery Conversion Currently deferred till Pit 112 extension 156 14 - 142 Capex approved for Cairn represents Net capex, however Gross capex is $3.4 bn. Capex approved for Gamsberg $400mn excludes interest during construction. Is based on exchange rate at the time of approval. Is based on exchange rate at the time of incurrence Unspent capex represents the difference between total capex approved and cumulative spend as on 30th Sep 2020.

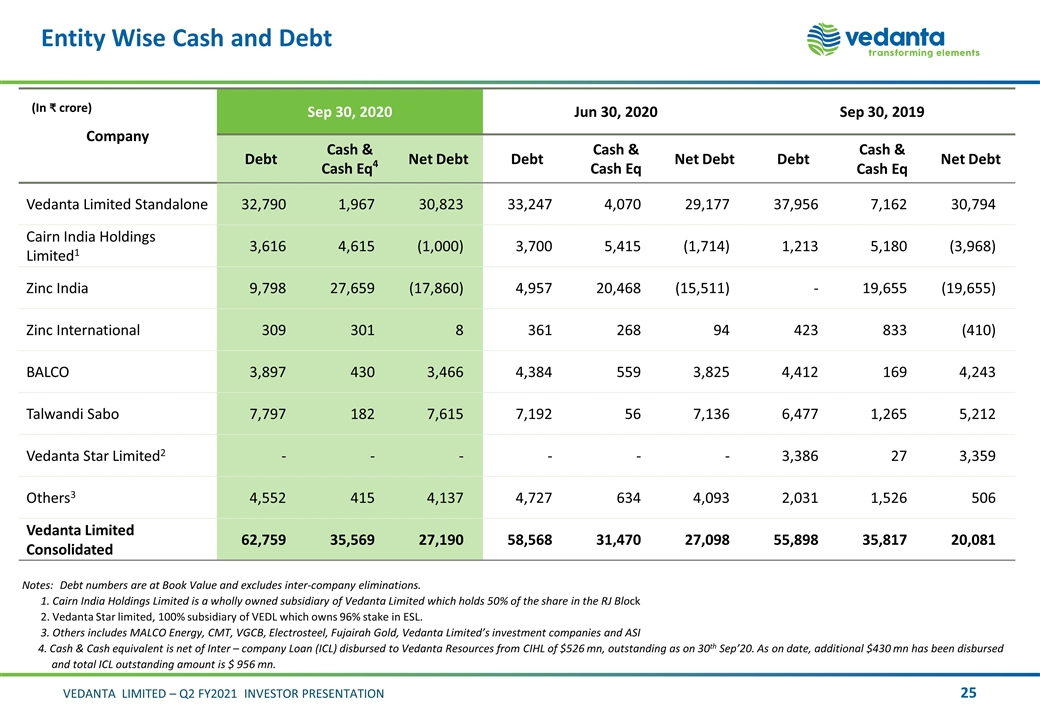

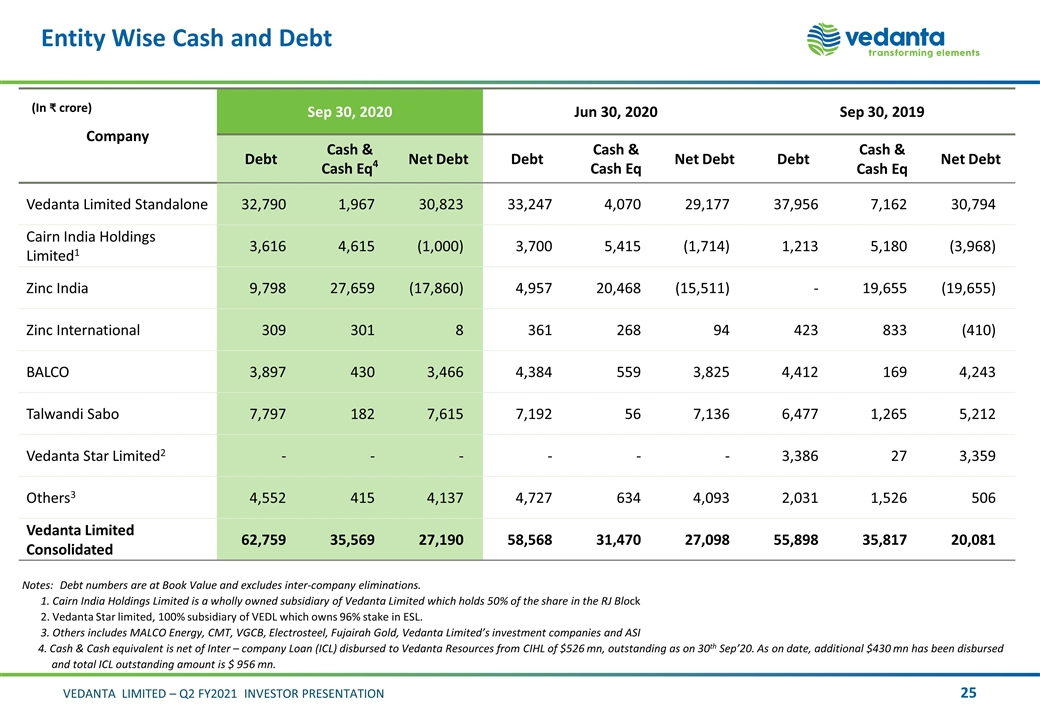

Entity Wise Cash and Debt Company Sep 30, 2020 Jun 30, 2020 Sep 30, 2019 Debt Cash & Cash Eq4 Net Debt Debt Cash & Cash Eq Net Debt Debt Cash & Cash Eq Net Debt Vedanta Limited Standalone 32,790 1,967 30,823 33,247 4,070 29,177 37,956 7,162 30,794 Cairn India Holdings Limited1 3,616 4,615 (1,000) 3,700 5,415 (1,714) 1,213 5,180 (3,968) Zinc India 9,798 27,659 (17,860) 4,957 20,468 (15,511) - 19,655 (19,655) Zinc International 309 301 8 361 268 94 423 833 (410) BALCO 3,897 430 3,466 4,384 559 3,825 4,412 169 4,243 Talwandi Sabo 7,797 182 7,615 7,192 56 7,136 6,477 1,265 5,212 Vedanta Star Limited2 - - - - - - 3,386 27 3,359 Others3 4,552 415 4,137 4,727 634 4,093 2,031 1,526 506 Vedanta Limited Consolidated 62,759 35,569 27,190 58,568 31,470 27,098 55,898 35,817 20,081 Notes:Debt numbers are at Book Value and excludes inter-company eliminations. 1. Cairn India Holdings Limited is a wholly owned subsidiary of Vedanta Limited which holds 50% of the share in the RJ Block 2. Vedanta Star limited, 100% subsidiary of VEDL which owns 96% stake in ESL. 3. Others includes MALCO Energy, CMT, VGCB, Electrosteel, Fujairah Gold, Vedanta Limited’s investment companies and ASI 4. Cash & Cash equivalent is net of Inter – company Loan (ICL) disbursed to Vedanta Resources from CIHL of $526 mn, outstanding as on 30th Sep’20. As on date, additional $430 mn has been disbursed and total ICL outstanding amount is $ 956 mn. (In crore)

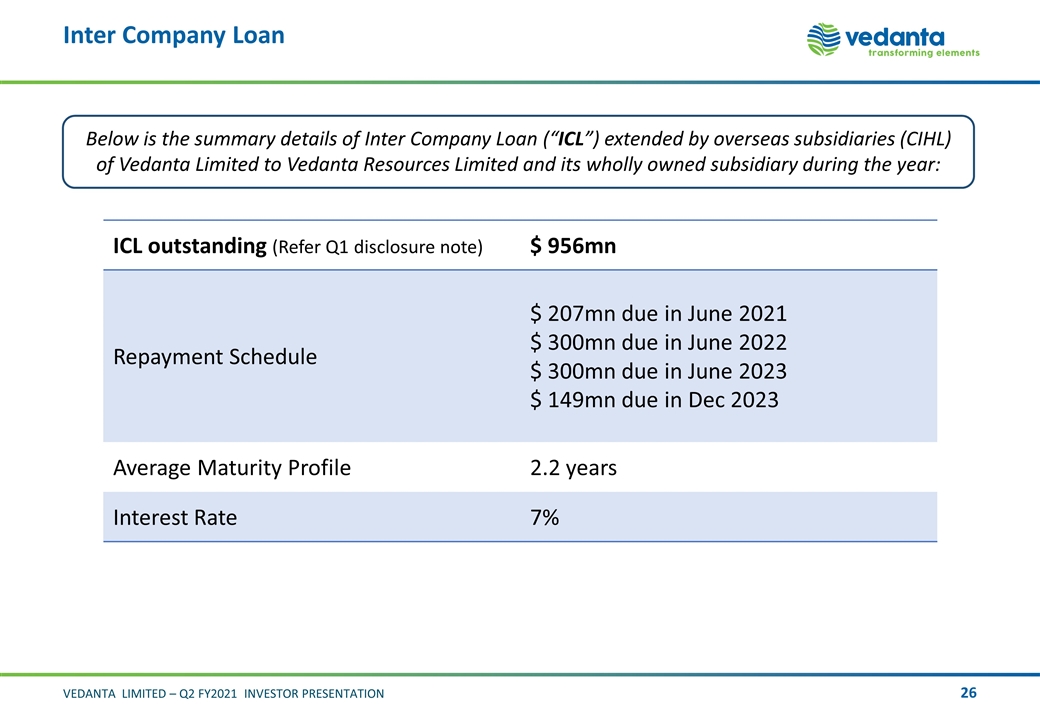

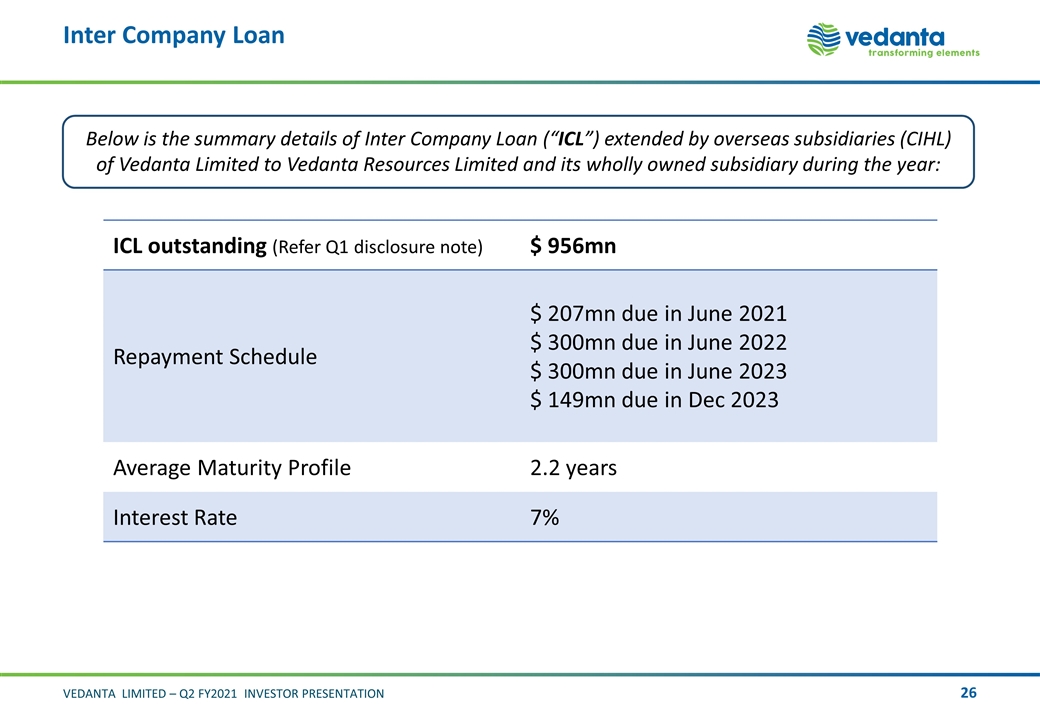

Inter Company Loan Below is the summary details of Inter Company Loan (“ICL”) extended by overseas subsidiaries (CIHL) of Vedanta Limited to Vedanta Resources Limited and its wholly owned subsidiary during the year: ICL outstanding (Refer Q1 disclosure note) $ 956mn Repayment Schedule $ 207mn due in June 2021 $ 300mn due in June 2022 $ 300mn due in June 2023 $ 149mn due in Dec 2023 Average Maturity Profile 2.2 years Interest Rate 7%

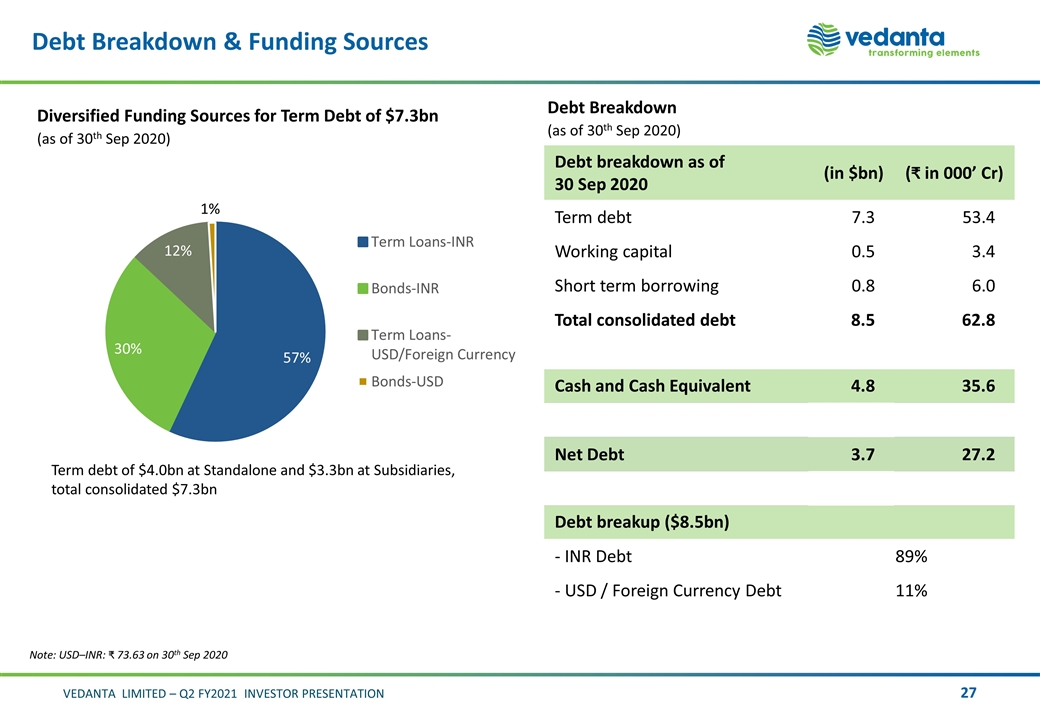

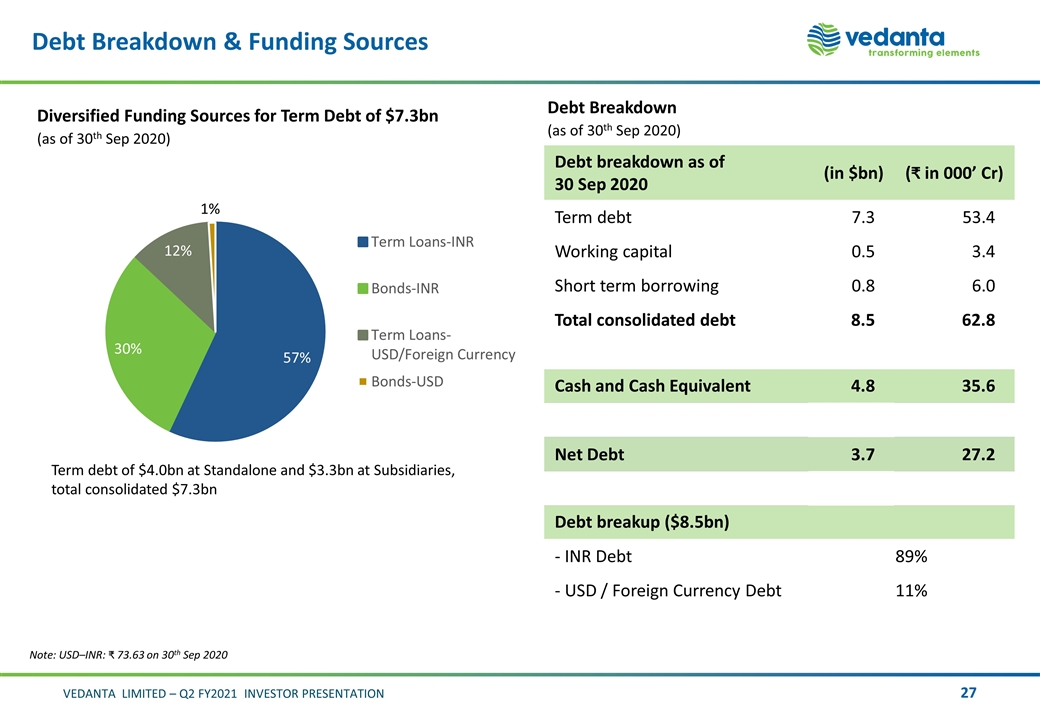

Debt Breakdown & Funding Sources Debt breakdown as of 30 Sep 2020 (in $bn) ( in 000’ Cr) Term debt 7.3 53.4 Working capital 0.5 3.4 Short term borrowing 0.8 6.0 Total consolidated debt 8.5 62.8 Cash and Cash Equivalent 4.8 35.6 Net Debt 3.7 27.2 Debt breakup ($8.5bn) - INR Debt 89% - USD / Foreign Currency Debt 11% Diversified Funding Sources for Term Debt of $7.3bn (as of 30th Sep 2020) Note: USD–INR: 73.63 on 30th Sep 2020 Term debt of $4.0bn at Standalone and $3.3bn at Subsidiaries, total consolidated $7.3bn Debt Breakdown (as of 30th Sep 2020)

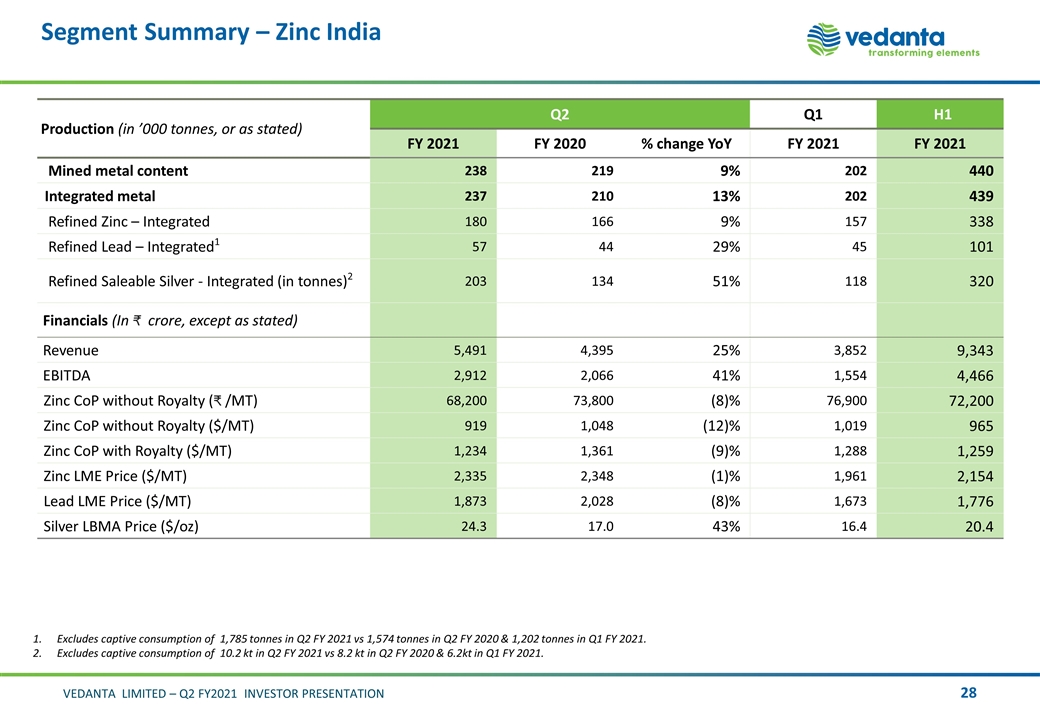

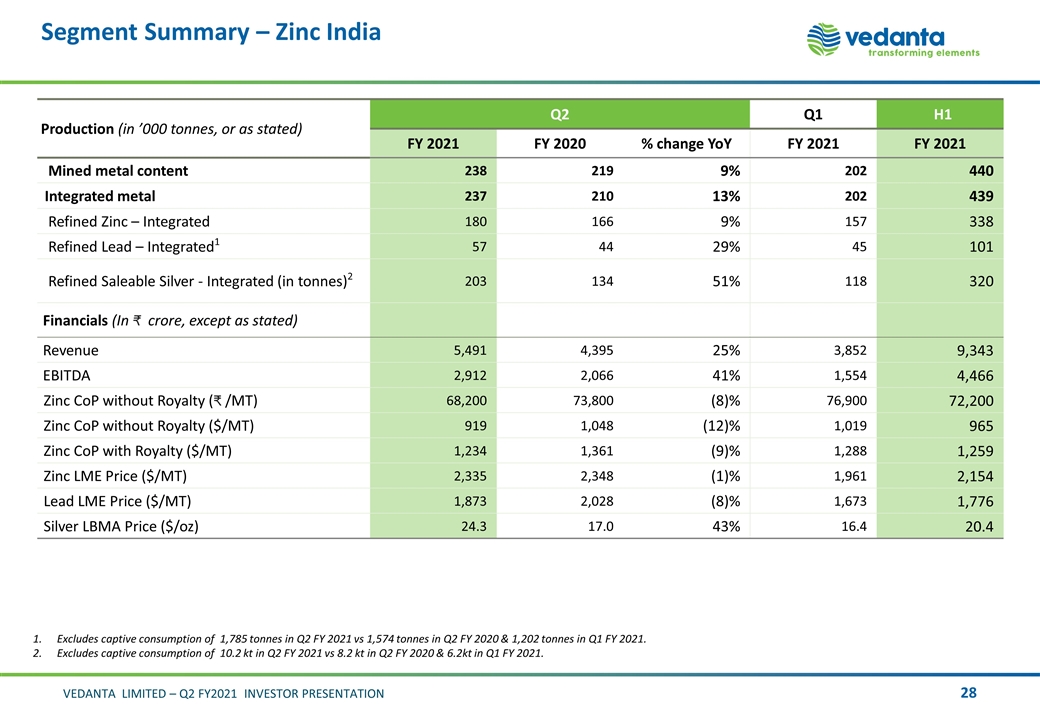

Segment Summary – Zinc India Production (in ’000 tonnes, or as stated) Q2 Q1 H1 FY 2021 FY 2020 % change YoY FY 2021 FY 2021 Mined metal content 238 219 9% 202 440 Integrated metal 237 210 13% 202 439 Refined Zinc – Integrated 180 166 9% 157 338 Refined Lead – Integrated1 57 44 29% 45 101 Refined Saleable Silver - Integrated (in tonnes)2 203 134 51% 118 320 Financials (In crore, except as stated) Revenue 5,491 4,395 25% 3,852 9,343 EBITDA 2,912 2,066 41% 1,554 4,466 Zinc CoP without Royalty ( /MT) 68,200 73,800 (8)% 76,900 72,200 Zinc CoP without Royalty ($/MT) 919 1,048 (12)% 1,019 965 Zinc CoP with Royalty ($/MT) 1,234 1,361 (9)% 1,288 1,259 Zinc LME Price ($/MT) 2,335 2,348 (1)% 1,961 2,154 Lead LME Price ($/MT) 1,873 2,028 (8)% 1,673 1,776 Silver LBMA Price ($/oz) 24.3 17.0 43% 16.4 20.4 Excludes captive consumption of 1,785 tonnes in Q2 FY 2021 vs 1,574 tonnes in Q2 FY 2020 & 1,202 tonnes in Q1 FY 2021. Excludes captive consumption of 10.2 kt in Q2 FY 2021 vs 8.2 kt in Q2 FY 2020 & 6.2kt in Q1 FY 2021.

Segment Summary – Zinc International Production (in’000 tonnes, or as stated) Q2 Q1 H1 FY 2021 FY 2020 % change YoY FY 2021 FY 2021 Refined Zinc – Skorpion 0 23 - 1 1 Mined metal content- BMM 16 16 (5)% 12 28 Mined metal content- Gamsberg 35 24 44% 25 60 Total 51 63 (20)% 38 89 Financials (In Crore, except as stated) Revenue 632 890 (29)% 374 1,006 EBITDA 261 207 26% 66 327 CoP – ($/MT) 1,310 1,584 (17)% 1,349 1,326 Zinc LME Price ($/MT) 2,335 2,348 (1)% 1,961 2,154 Lead LME Price ($/MT) 1,873 2,028 (8)% 1,673 1,776

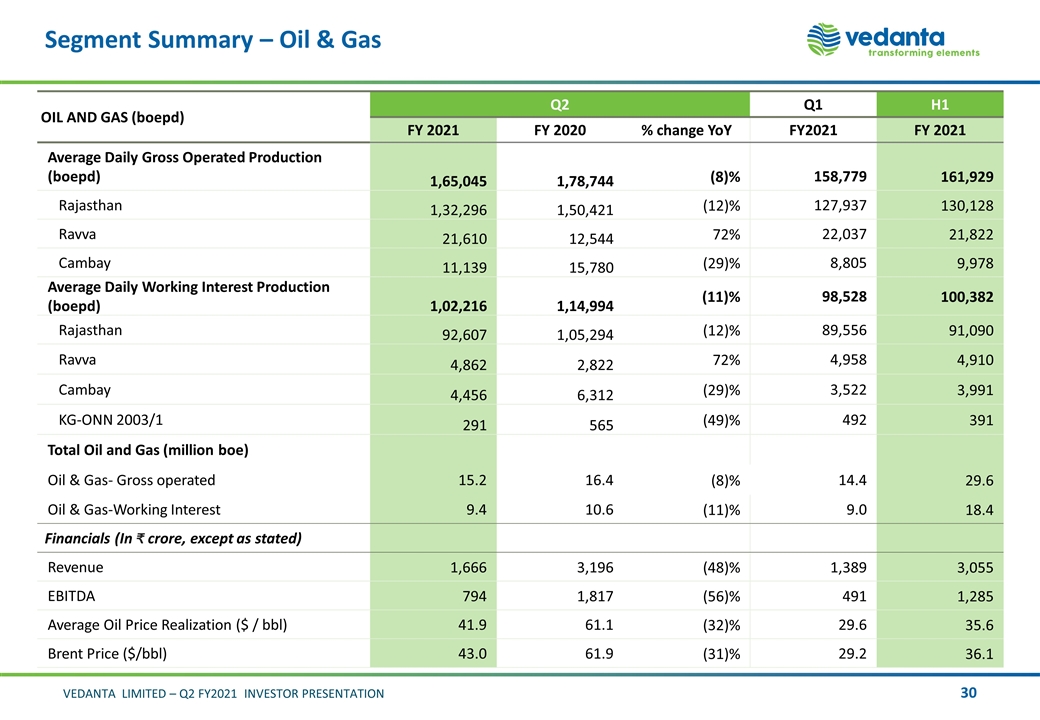

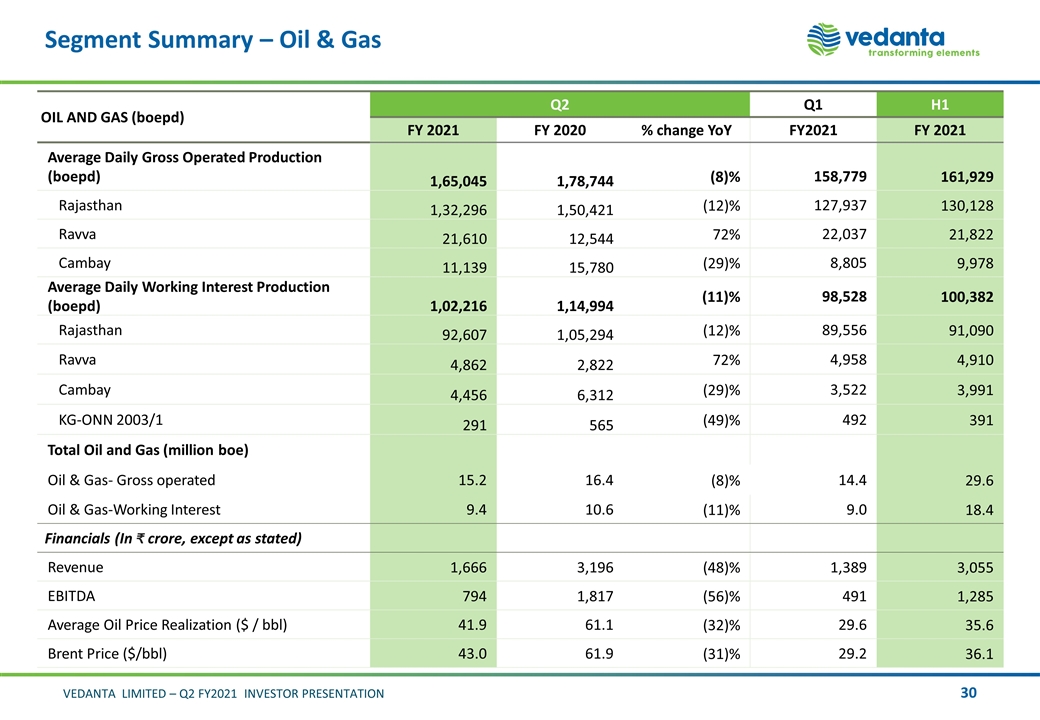

Segment Summary – Oil & Gas OIL AND GAS (boepd) Q2 Q1 H1 FY 2021 FY 2020 % change YoY FY2021 FY 2021 Average Daily Gross Operated Production (boepd) 1,65,045 1,78,744 (8)% 158,779 161,929 Rajasthan 1,32,296 1,50,421 (12)% 127,937 130,128 Ravva 21,610 12,544 72% 22,037 21,822 Cambay 11,139 15,780 (29)% 8,805 9,978 Average Daily Working Interest Production (boepd) 1,02,216 1,14,994 (11)% 98,528 100,382 Rajasthan 92,607 1,05,294 (12)% 89,556 91,090 Ravva 4,862 2,822 72% 4,958 4,910 Cambay 4,456 6,312 (29)% 3,522 3,991 KG-ONN 2003/1 291 565 (49)% 492 391 Total Oil and Gas (million boe) Oil & Gas- Gross operated 15.2 16.4 (8)% 14.4 29.6 Oil & Gas-Working Interest 9.4 10.6 (11)% 9.0 18.4 Financials (In crore, except as stated) Revenue 1,666 3,196 (48)% 1,389 3,055 EBITDA 794 1,817 (56)% 491 1,285 Average Oil Price Realization ($ / bbl) 41.9 61.1 (32)% 29.6 35.6 Brent Price ($/bbl) 43.0 61.9 (31)% 29.2 36.1

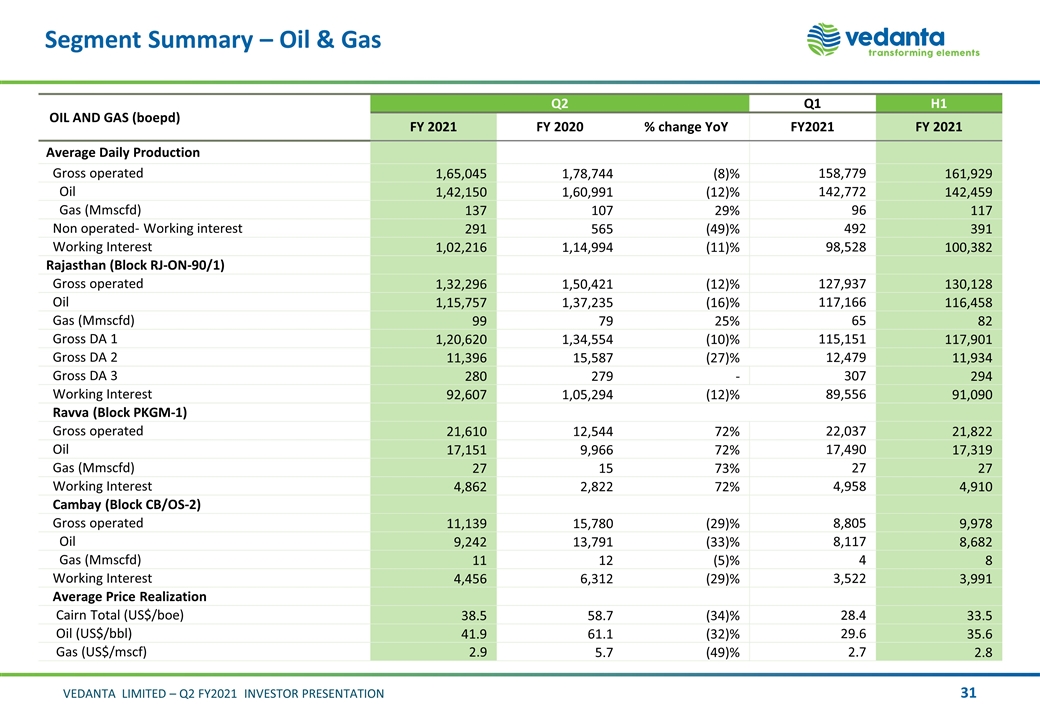

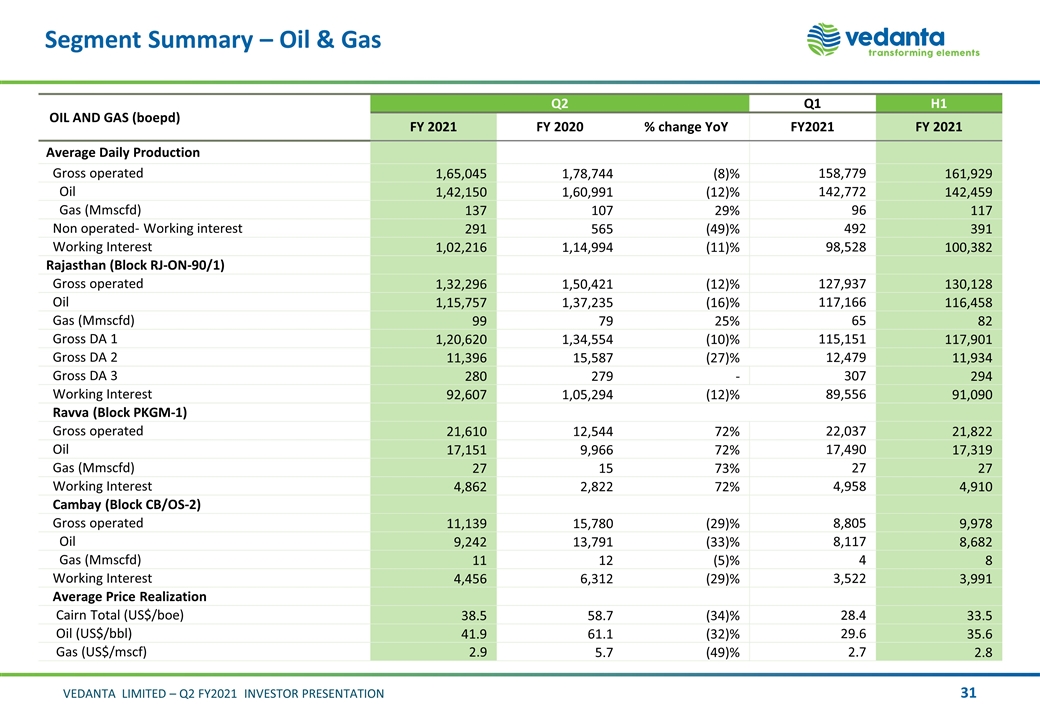

OIL AND GAS (boepd) Q2 Q1 H1 FY 2021 FY 2020 % change YoY FY2021 FY 2021 Average Daily Production Gross operated 1,65,045 1,78,744 (8)% 158,779 161,929 Oil 1,42,150 1,60,991 (12)% 142,772 142,459 Gas (Mmscfd) 137 107 29% 96 117 Non operated- Working interest 291 565 (49)% 492 391 Working Interest 1,02,216 1,14,994 (11)% 98,528 100,382 Rajasthan (Block RJ-ON-90/1) Gross operated 1,32,296 1,50,421 (12)% 127,937 130,128 Oil 1,15,757 1,37,235 (16)% 117,166 116,458 Gas (Mmscfd) 99 79 25% 65 82 Gross DA 1 1,20,620 1,34,554 (10)% 115,151 117,901 Gross DA 2 11,396 15,587 (27)% 12,479 11,934 Gross DA 3 280 279 - 307 294 Working Interest 92,607 1,05,294 (12)% 89,556 91,090 Ravva (Block PKGM-1) Gross operated 21,610 12,544 72% 22,037 21,822 Oil 17,151 9,966 72% 17,490 17,319 Gas (Mmscfd) 27 15 73% 27 27 Working Interest 4,862 2,822 72% 4,958 4,910 Cambay (Block CB/OS-2) Gross operated 11,139 15,780 (29)% 8,805 9,978 Oil 9,242 13,791 (33)% 8,117 8,682 Gas (Mmscfd) 11 12 (5)% 4 8 Working Interest 4,456 6,312 (29)% 3,522 3,991 Average Price Realization Cairn Total (US$/boe) 38.5 58.7 (34)% 28.4 33.5 Oil (US$/bbl) 41.9 61.1 (32)% 29.6 35.6 Gas (US$/mscf) 2.9 5.7 (49)% 2.7 2.8 Segment Summary – Oil & Gas

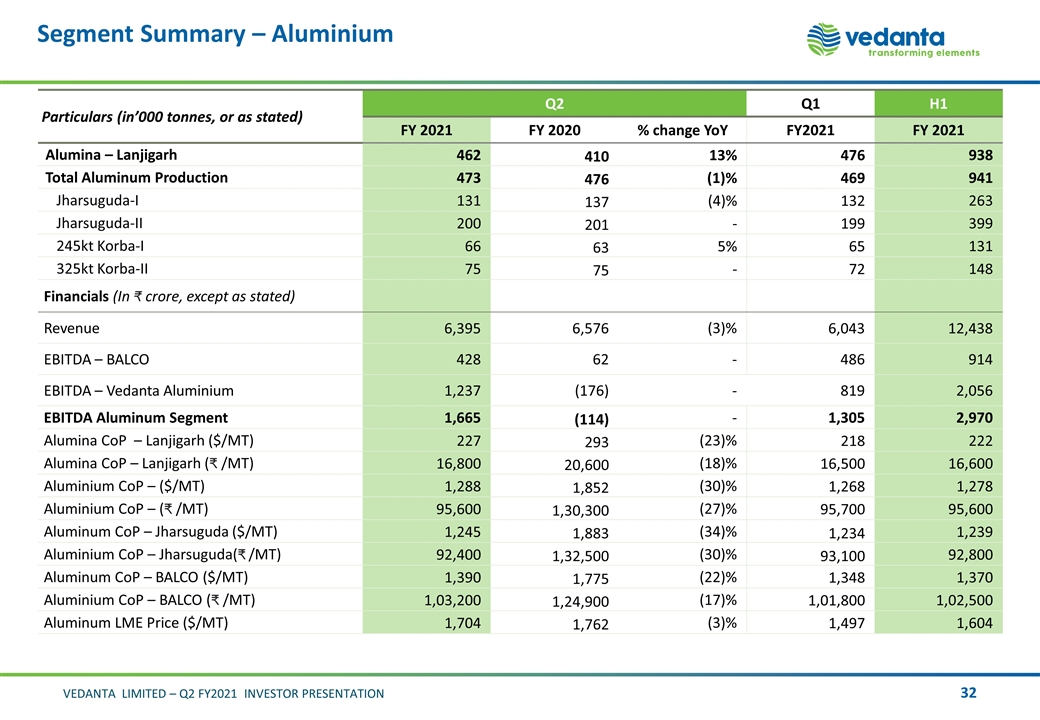

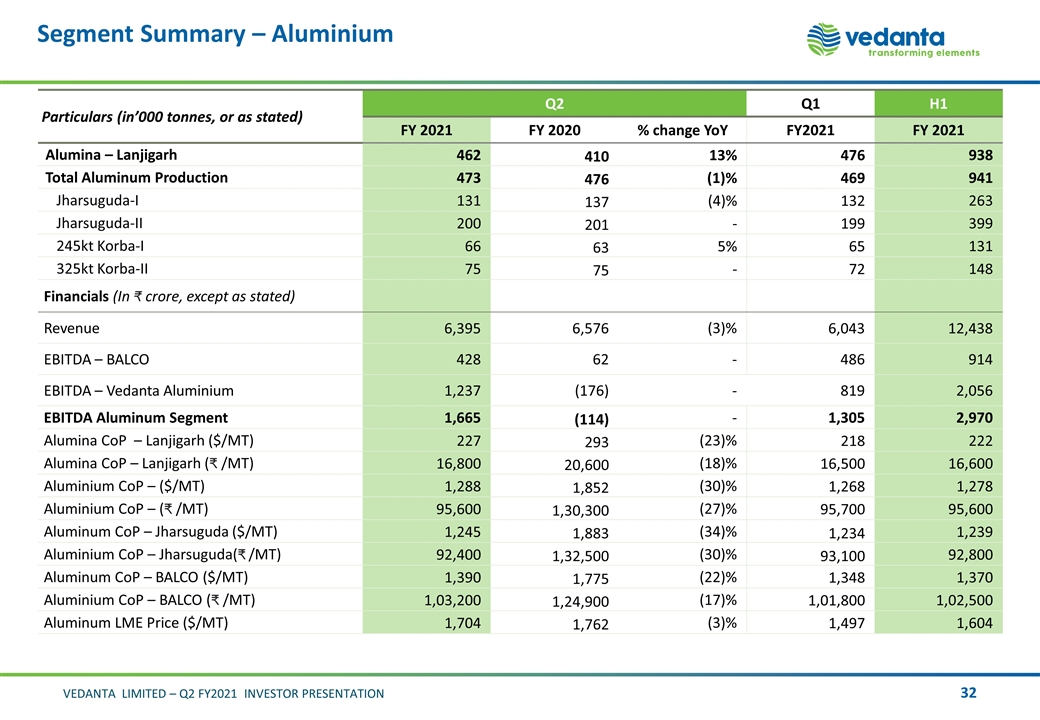

Segment Summary – Aluminium Particulars (in’000 tonnes, or as stated) Q2 Q1 H1 FY 2021 FY 2020 % change YoY FY2021 FY 2021 Alumina – Lanjigarh 462 410 13% 476 938 Total Aluminum Production 473 476 (1)% 469 941 Jharsuguda-I 131 137 (4)% 132 263 Jharsuguda-II 200 201 - 199 399 245kt Korba-I 66 63 5% 65 131 325kt Korba-II 75 75 - 72 148 Financials (In crore, except as stated) Revenue 6,395 6,576 (3)% 6,043 12,438 EBITDA – BALCO 428 62 - 486 914 EBITDA – Vedanta Aluminium 1,237 (176) - 819 2,056 EBITDA Aluminum Segment 1,665 (114) - 1,305 2,970 Alumina CoP – Lanjigarh ($/MT) 227 293 (23)% 218 222 Alumina CoP – Lanjigarh ( /MT) 16,800 20,600 (18)% 16,500 16,600 Aluminium CoP – ($/MT) 1,288 1,852 (30)% 1,268 1,278 Aluminium CoP – ( /MT) 95,600 1,30,300 (27)% 95,700 95,600 Aluminum CoP – Jharsuguda ($/MT) 1,245 1,883 (34)% 1,234 1,239 Aluminium CoP – Jharsuguda( /MT) 92,400 1,32,500 (30)% 93,100 92,800 Aluminum CoP – BALCO ($/MT) 1,390 1,775 (22)% 1,348 1,370 Aluminium CoP – BALCO ( /MT) 1,03,200 1,24,900 (17)% 1,01,800 1,02,500 Aluminum LME Price ($/MT) 1,704 1,762 (3)% 1,497 1,604

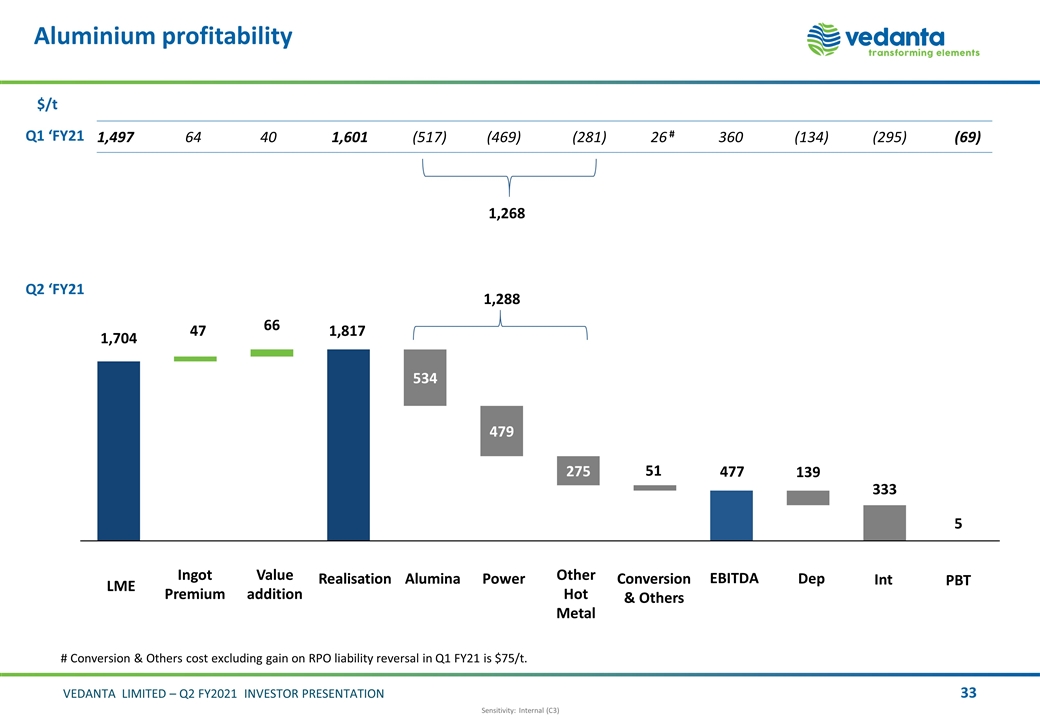

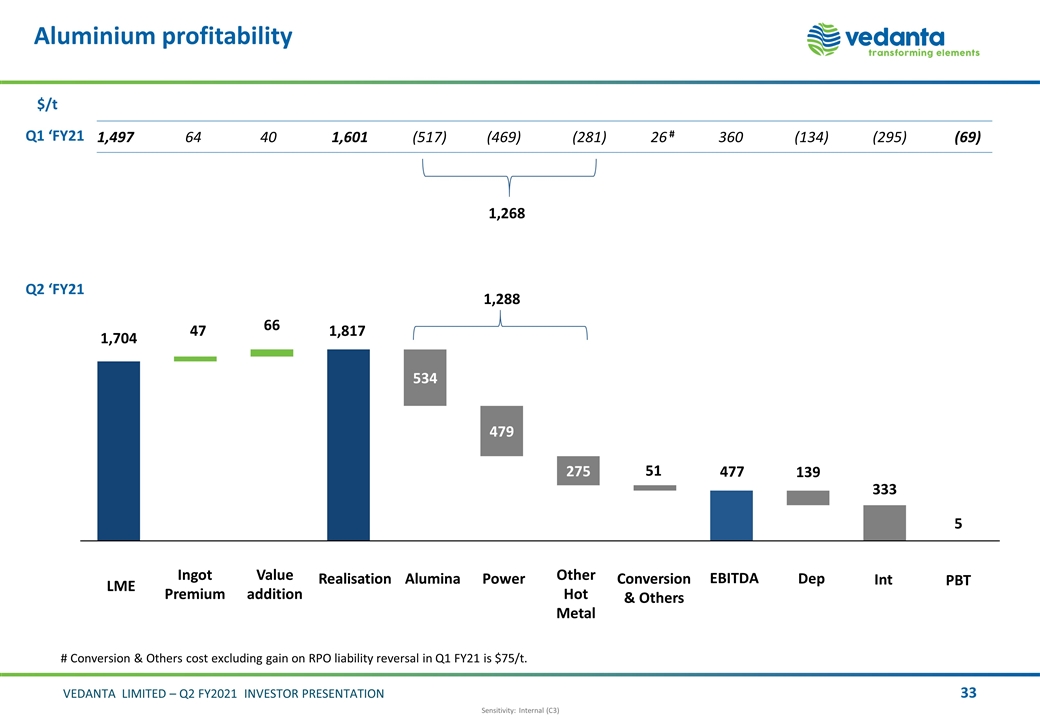

Aluminium profitability Q1 ‘FY21 $/t Q2 ‘FY21 66 47 333 477 5 1,497 64 40 1,601 (517) (469) (281) 26 # 360 (134) (295) (69) 1,268 1,288 # Conversion & Others cost excluding gain on RPO liability reversal in Q1 FY21 is $75/t.

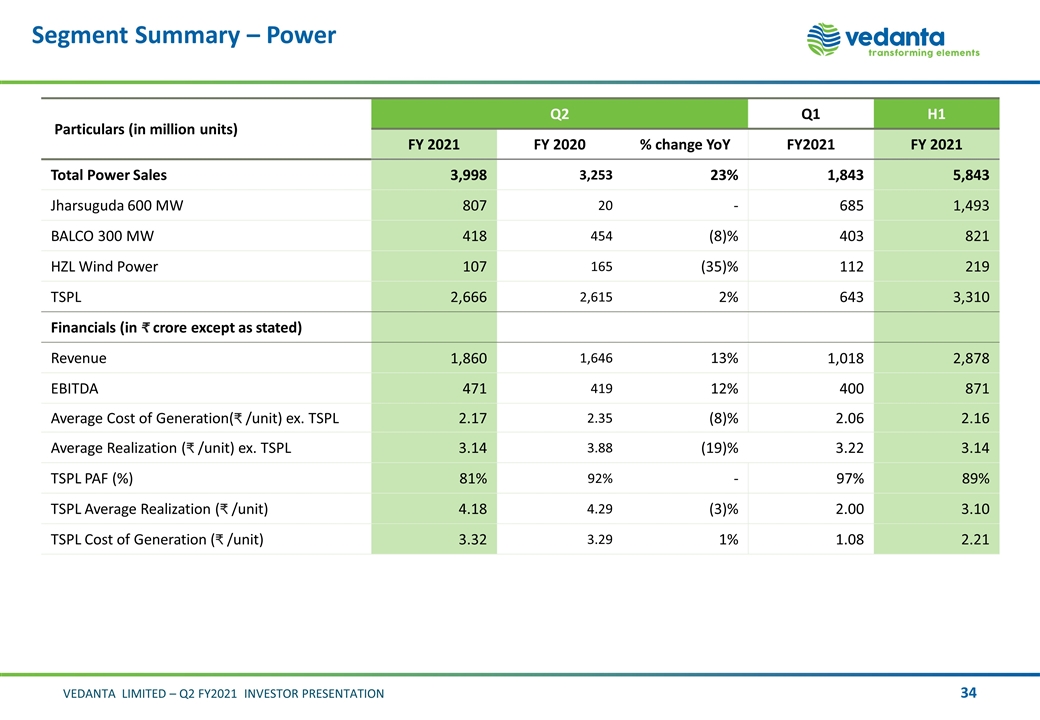

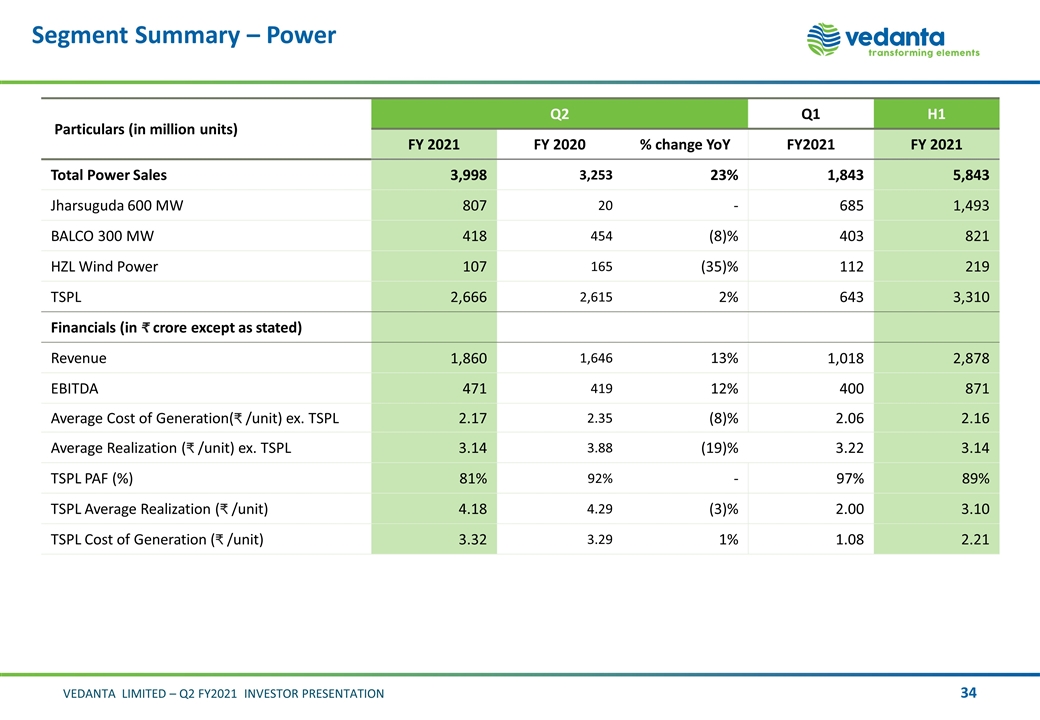

Segment Summary – Power Particulars (in million units) Q2 Q1 H1 FY 2021 FY 2020 % change YoY FY2021 FY 2021 Total Power Sales 3,998 3,253 23% 1,843 5,843 Jharsuguda 600 MW 807 20 - 685 1,493 BALCO 300 MW 418 454 (8)% 403 821 HZL Wind Power 107 165 (35)% 112 219 TSPL 2,666 2,615 2% 643 3,310 Financials (in crore except as stated) Revenue 1,860 1,646 13% 1,018 2,878 EBITDA 471 419 12% 400 871 Average Cost of Generation( /unit) ex. TSPL 2.17 2.35 (8)% 2.06 2.16 Average Realization ( /unit) ex. TSPL 3.14 3.88 (19)% 3.22 3.14 TSPL PAF (%) 81% 92% - 97% 89% TSPL Average Realization ( /unit) 4.18 4.29 (3)% 2.00 3.10 TSPL Cost of Generation ( /unit) 3.32 3.29 1% 1.08 2.21

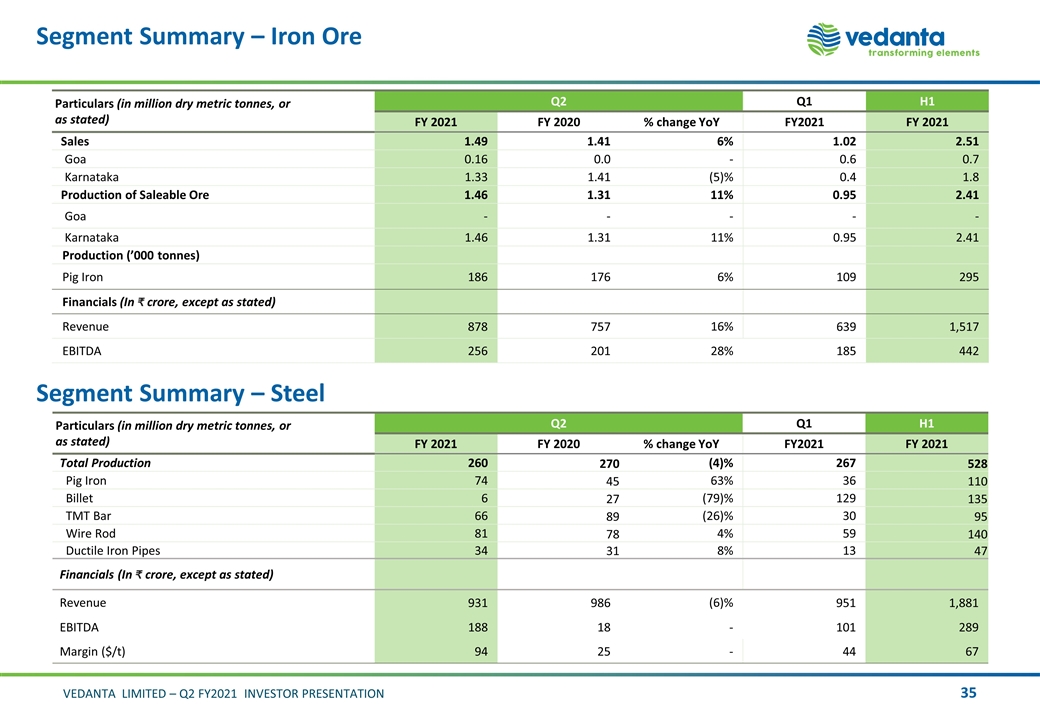

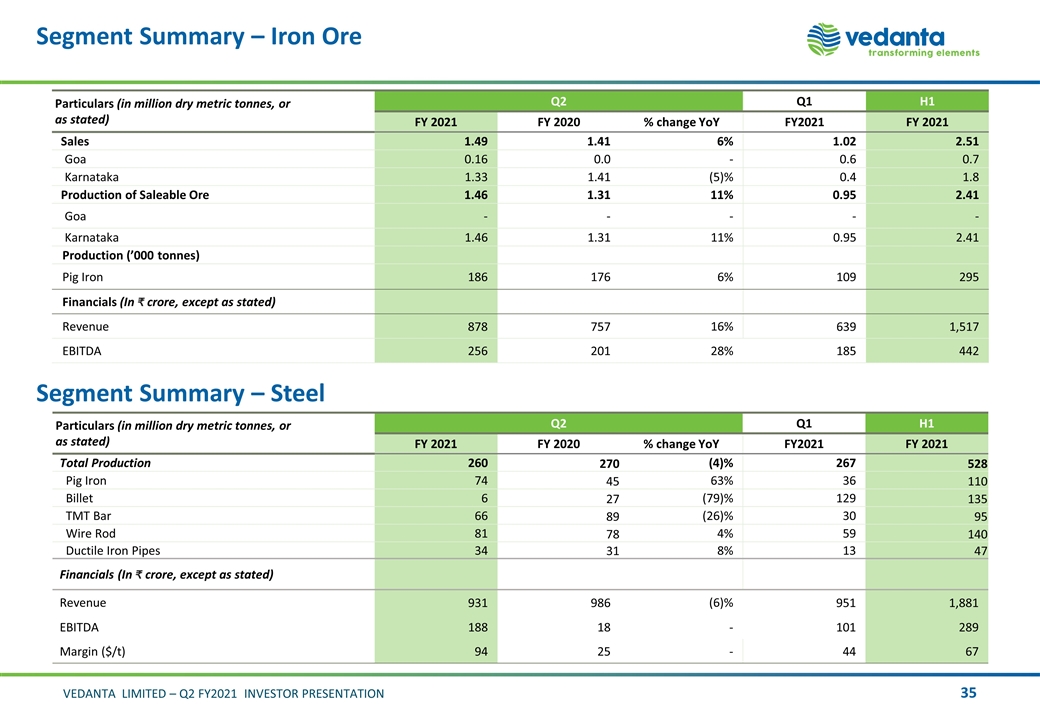

Segment Summary – Iron Ore Particulars (in million dry metric tonnes, or as stated) Q2 Q1 H1 FY 2021 FY 2020 % change YoY FY2021 FY 2021 Sales 1.49 1.41 6% 1.02 2.51 Goa 0.16 0.0 - 0.6 0.7 Karnataka 1.33 1.41 (5)% 0.4 1.8 Production of Saleable Ore 1.46 1.31 11% 0.95 2.41 Goa - - - - - Karnataka 1.46 1.31 11% 0.95 2.41 Production (’000 tonnes) Pig Iron 186 176 6% 109 295 Financials (In crore, except as stated) Revenue 878 757 16% 639 1,517 EBITDA 256 201 28% 185 442 Segment Summary – Steel Particulars (in million dry metric tonnes, or as stated) Q2 Q1 H1 FY 2021 FY 2020 % change YoY FY2021 FY 2021 Total Production 260 270 (4)% 267 528 Pig Iron 74 45 63% 36 110 Billet 6 27 (79)% 129 135 TMT Bar 66 89 (26)% 30 95 Wire Rod 81 78 4% 59 140 Ductile Iron Pipes 34 31 8% 13 47 Financials (In crore, except as stated) Revenue 931 986 (6)% 951 1,881 EBITDA 188 18 - 101 289 Margin ($/t) 94 25 - 44 67

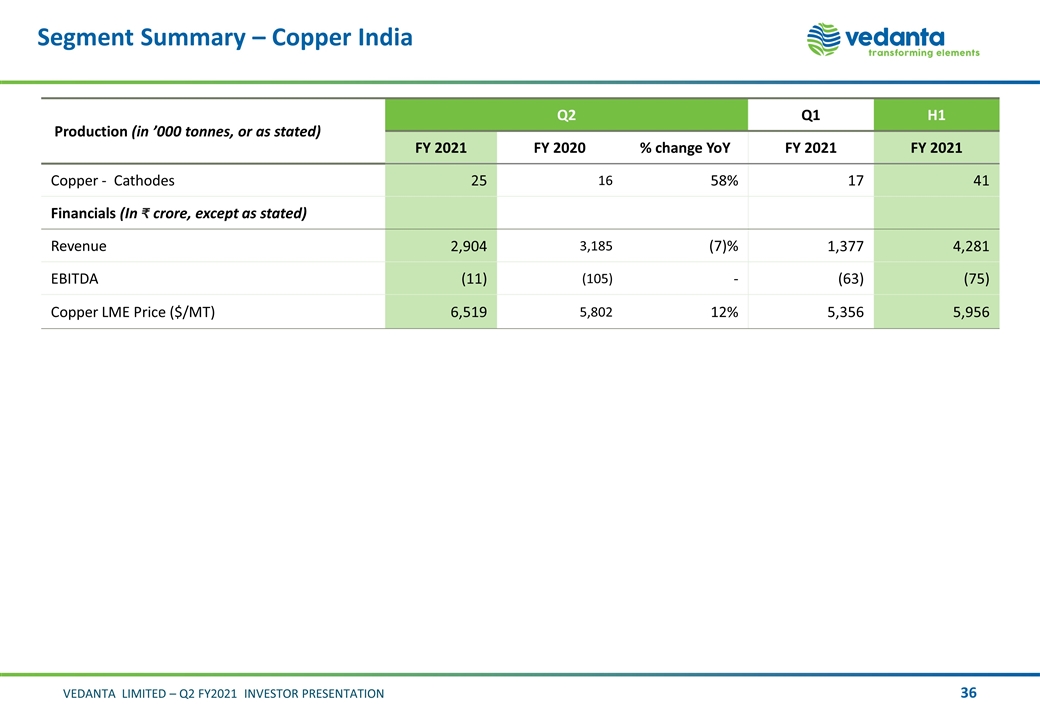

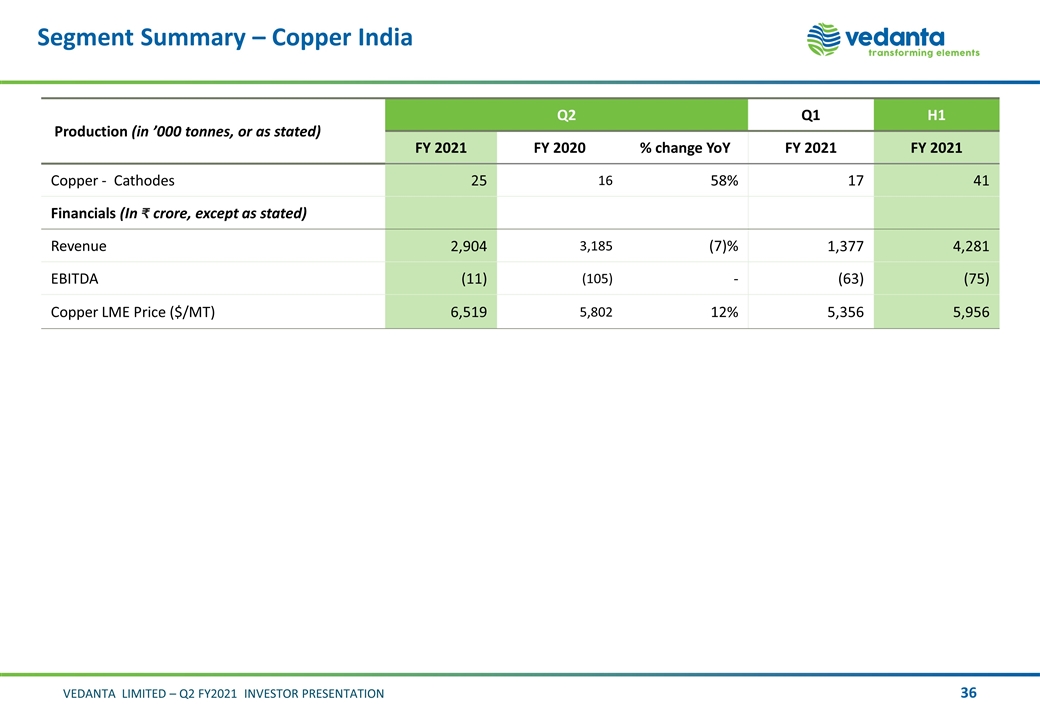

Segment Summary – Copper India Production (in ’000 tonnes, or as stated) Q2 Q1 H1 FY 2021 FY 2020 % change YoY FY 2021 FY 2021 Copper - Cathodes 25 16 58% 17 41 Financials (In crore, except as stated) Revenue 2,904 3,185 (7)% 1,377 4,281 EBITDA (11) (105) - (63) (75) Copper LME Price ($/MT) 6,519 5,802 12% 5,356 5,956

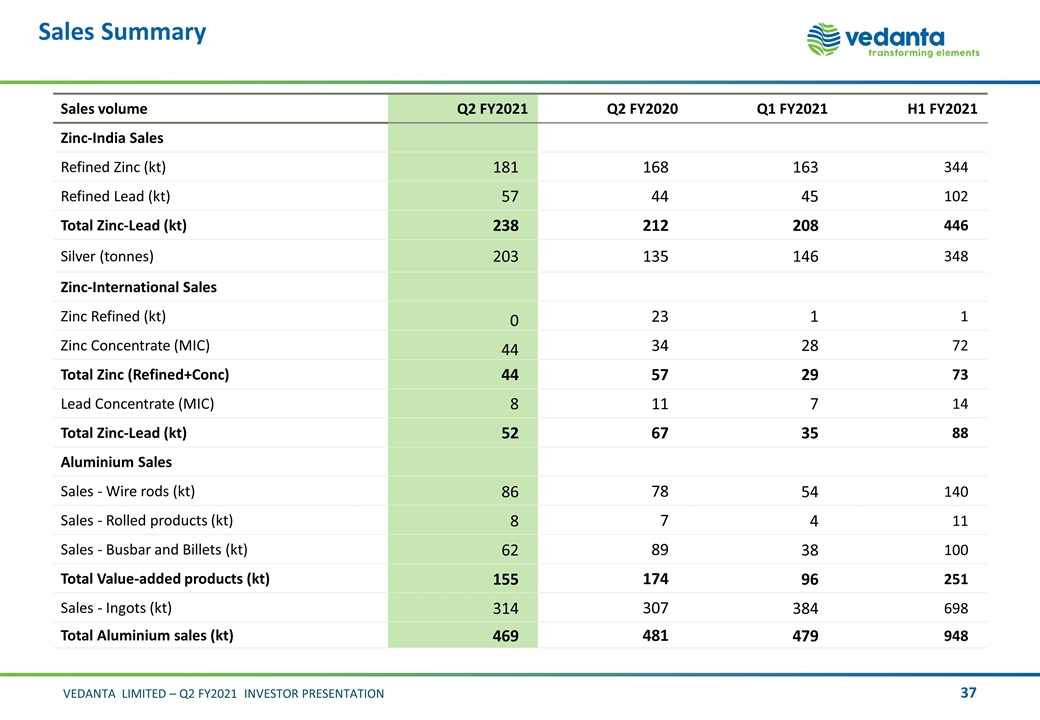

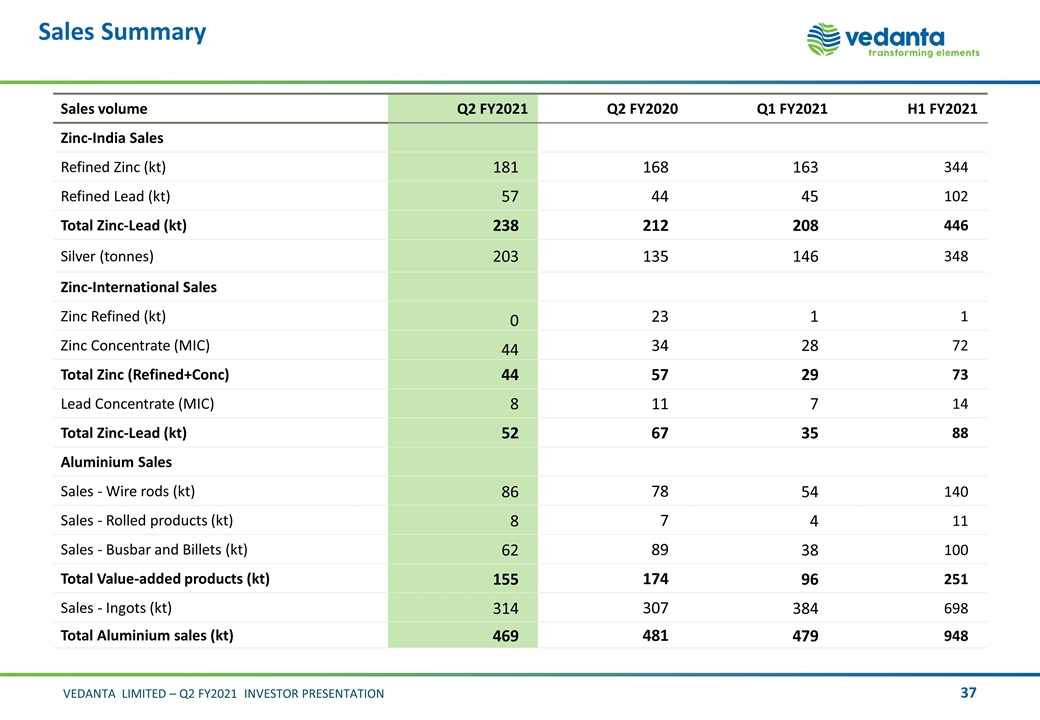

Sales Summary Sales volume Q2 FY2021 Q2 FY2020 Q1 FY2021 H1 FY2021 Zinc-India Sales Refined Zinc (kt) 181 168 163 344 Refined Lead (kt) 57 44 45 102 Total Zinc-Lead (kt) 238 212 208 446 Silver (tonnes) 203 135 146 348 Zinc-International Sales Zinc Refined (kt) 0 23 1 1 Zinc Concentrate (MIC) 44 34 28 72 Total Zinc (Refined+Conc) 44 57 29 73 Lead Concentrate (MIC) 8 11 7 14 Total Zinc-Lead (kt) 52 67 35 88 Aluminium Sales Sales - Wire rods (kt) 86 78 54 140 Sales - Rolled products (kt) 8 7 4 11 Sales - Busbar and Billets (kt) 62 89 38 100 Total Value-added products (kt) 155 174 96 251 Sales - Ingots (kt) 314 307 384 698 Total Aluminium sales (kt) 469 481 479 948

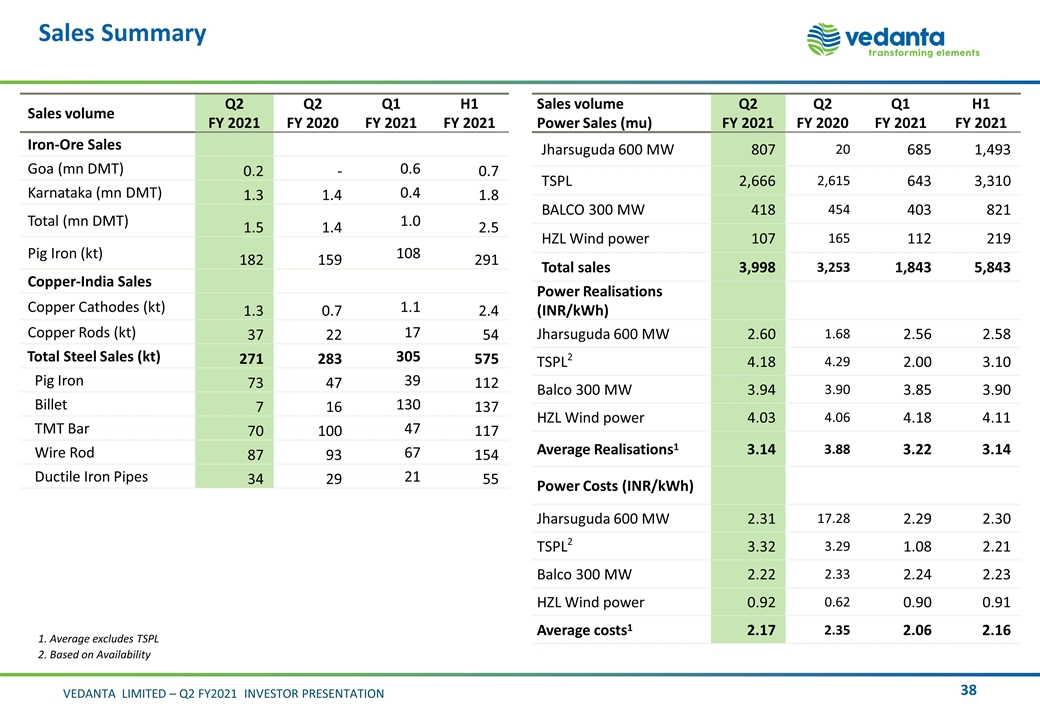

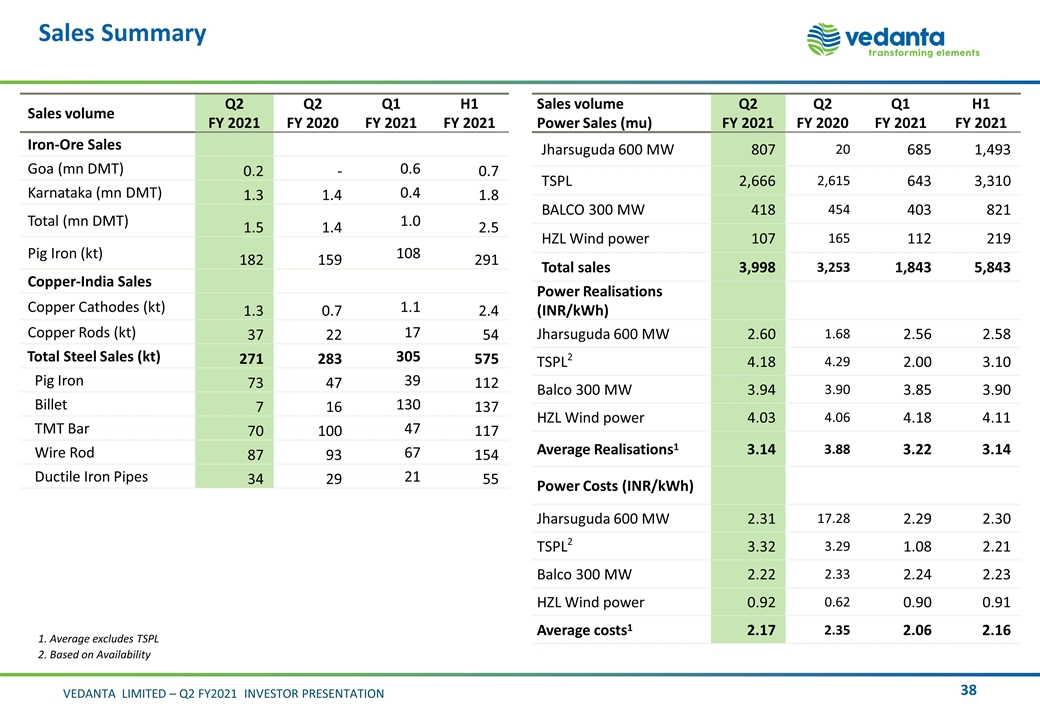

Sales Summary Sales volume Q2 FY 2021 Q2 FY 2020 Q1 FY 2021 H1 FY 2021 Iron-Ore Sales Goa (mn DMT) 0.2 - 0.6 0.7 Karnataka (mn DMT) 1.3 1.4 0.4 1.8 Total (mn DMT) 1.5 1.4 1.0 2.5 Pig Iron (kt) 182 159 108 291 Copper-India Sales Copper Cathodes (kt) 1.3 0.7 1.1 2.4 Copper Rods (kt) 37 22 17 54 Total Steel Sales (kt) 271 283 305 575 Pig Iron 73 47 39 112 Billet 7 16 130 137 TMT Bar 70 100 47 117 Wire Rod 87 93 67 154 Ductile Iron Pipes 34 29 21 55 Sales volume Power Sales (mu) Q2 FY 2021 Q2 FY 2020 Q1 FY 2021 H1 FY 2021 Jharsuguda 600 MW 807 20 685 1,493 TSPL 2,666 2,615 643 3,310 BALCO 300 MW 418 454 403 821 HZL Wind power 107 165 112 219 Total sales 3,998 3,253 1,843 5,843 Power Realisations (INR/kWh) Jharsuguda 600 MW 2.60 1.68 2.56 2.58 TSPL2 4.18 4.29 2.00 3.10 Balco 300 MW 3.94 3.90 3.85 3.90 HZL Wind power 4.03 4.06 4.18 4.11 Average Realisations1 3.14 3.88 3.22 3.14 Power Costs (INR/kWh) Jharsuguda 600 MW 2.31 17.28 2.29 2.30 TSPL2 3.32 3.29 1.08 2.21 Balco 300 MW 2.22 2.33 2.24 2.23 HZL Wind power 0.92 0.62 0.90 0.91 Average costs1 2.17 2.35 2.06 2.16 1. Average excludes TSPL 2. Based on Availability

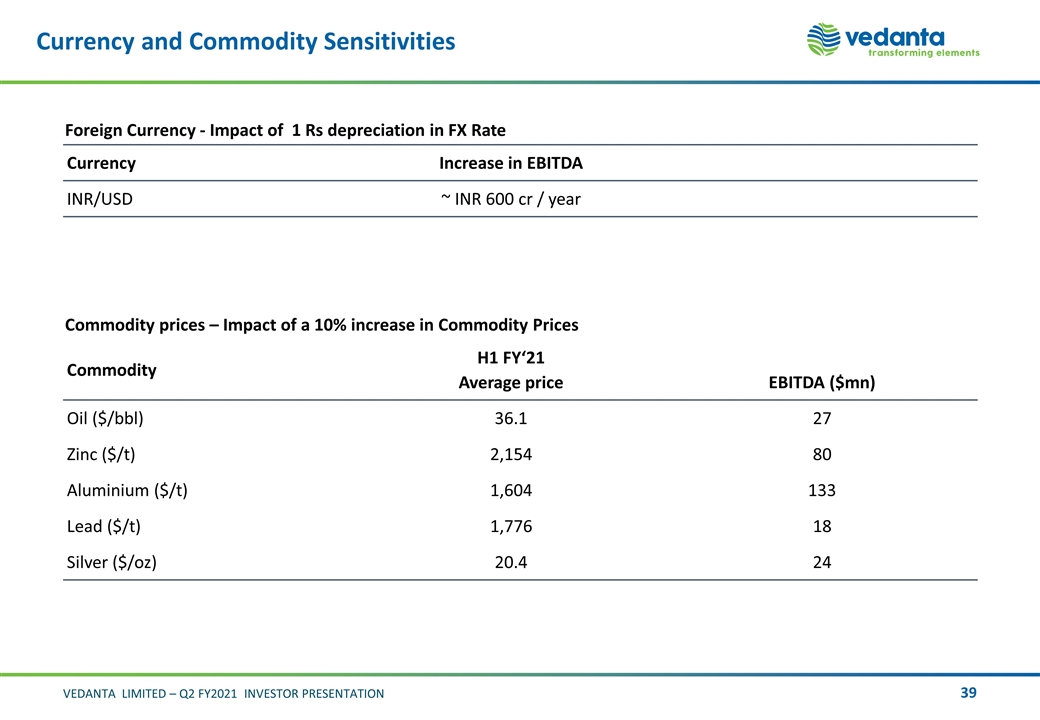

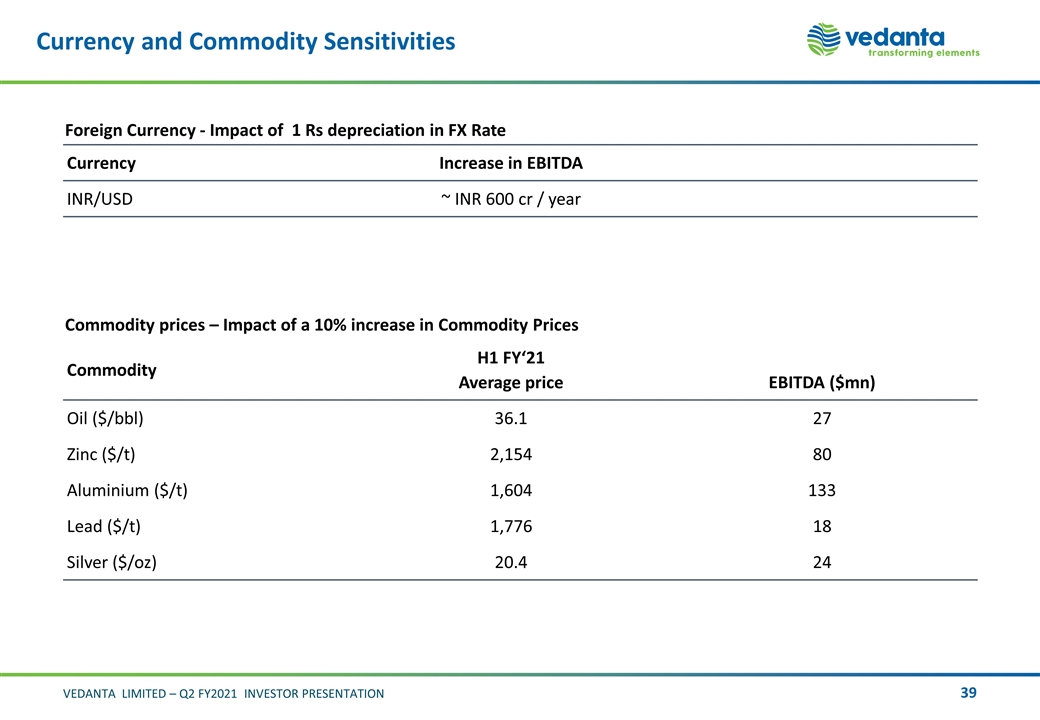

Currency and Commodity Sensitivities Commodity prices – Impact of a 10% increase in Commodity Prices Commodity H1 FY‘21 Average price EBITDA ($mn) Oil ($/bbl) 36.1 27 Zinc ($/t) 2,154 80 Aluminium ($/t) 1,604 133 Lead ($/t) 1,776 18 Silver ($/oz) 20.4 24 Foreign Currency - Impact of 1 Rs depreciation in FX Rate Currency Increase in EBITDA INR/USD ~ INR 600 cr / year

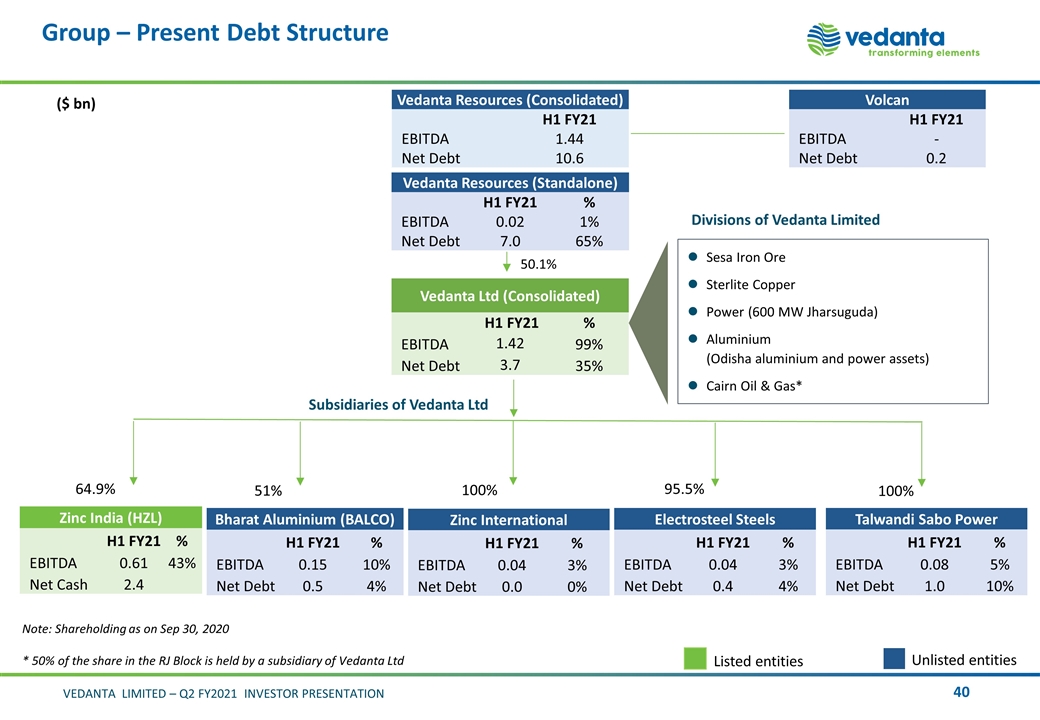

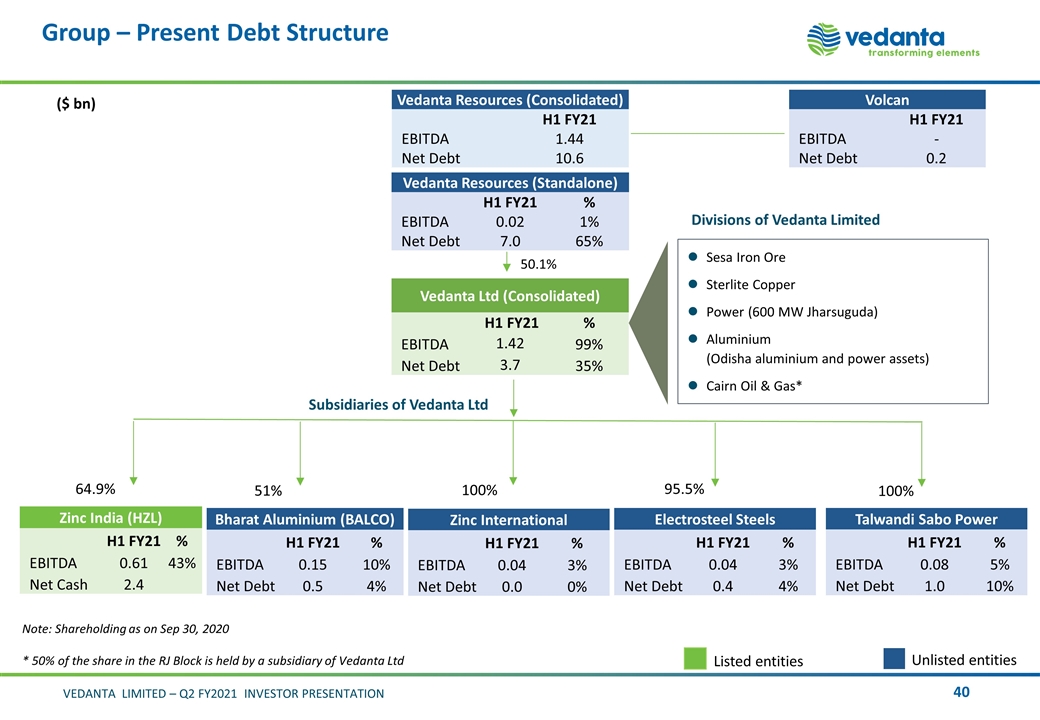

Group – Present Debt Structure 50.1% 64.9% Subsidiaries of Vedanta Ltd Sesa Iron Ore Sterlite Copper Power (600 MW Jharsuguda) Aluminium (Odisha aluminium and power assets) Cairn Oil & Gas* Divisions of Vedanta Limited Unlisted entities Listed entities 95.5% 100% 51% Note: Shareholding as on Sep 30, 2020 * 50% of the share in the RJ Block is held by a subsidiary of Vedanta Ltd 100% Vedanta Resources (Consolidated) H1 FY21 EBITDA 1.44 Net Debt 10.6 Vedanta Resources (Standalone) H1 FY21 % EBITDA 0.02 1% Net Debt 7.0 65% Vedanta Ltd (Consolidated) H1 FY21 % EBITDA 1.42 99% Net Debt 3.7 35% Zinc India (HZL) H1 FY21 % EBITDA 0.61 43% Net Cash 2.4 Bharat Aluminium (BALCO) H1 FY21 % EBITDA 0.15 10% Net Debt 0.5 4% Zinc International H1 FY21 % EBITDA 0.04 3% Net Debt 0.0 0% Electrosteel Steels H1 FY21 % EBITDA 0.04 3% Net Debt 0.4 4% Talwandi Sabo Power H1 FY21 % EBITDA 0.08 5% Net Debt 1.0 10% Volcan H1 FY21 EBITDA - Net Debt 0.2 ($ bn)

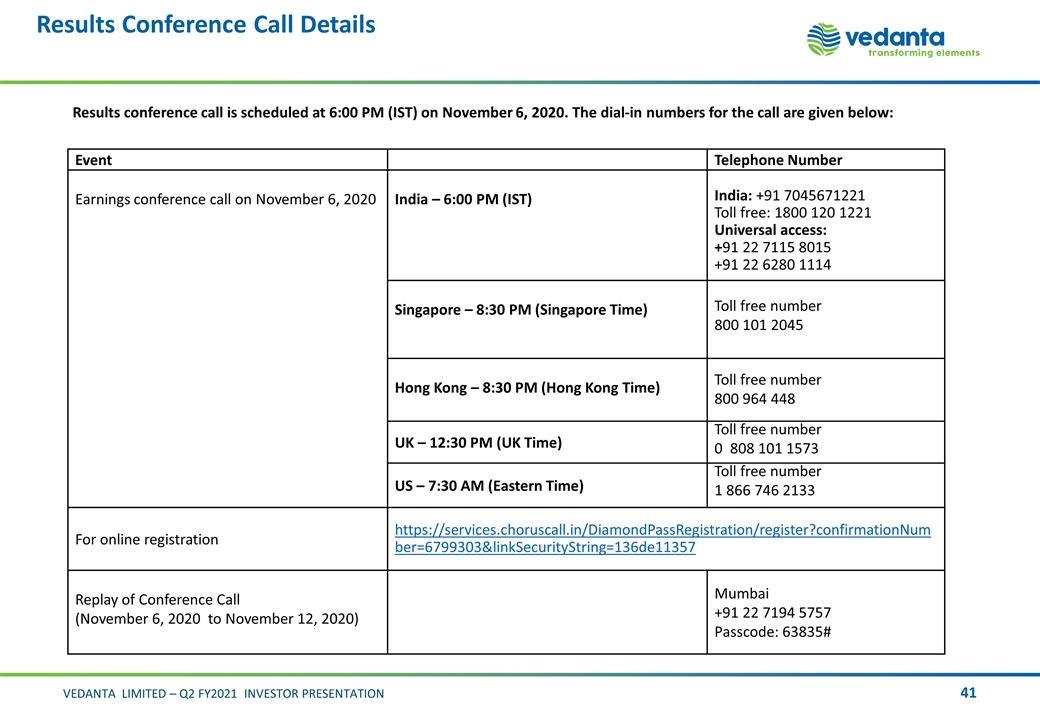

Results Conference Call Details Results conference call is scheduled at 6:00 PM (IST) on November 6, 2020. The dial-in numbers for the call are given below: Event Telephone Number Earnings conference call on November 6, 2020 India – 6:00 PM (IST) India: +91 7045671221 Toll free: 1800 120 1221 Universal access: +91 22 7115 8015 +91 22 6280 1114 Singapore – 8:30 PM (Singapore Time) Toll free number 800 101 2045 Hong Kong – 8:30 PM (Hong Kong Time) Toll free number 800 964 448 UK – 12:30 PM (UK Time) Toll free number 0 808 101 1573 US – 7:30 AM (Eastern Time) Toll free number 1 866 746 2133 For online registration https://services.choruscall.in/DiamondPassRegistration/register?confirmationNumber=6799303&linkSecurityString=136de11357 Replay of Conference Call (November 6, 2020 to November 12, 2020) Mumbai +91 22 7194 5757 Passcode: 63835#