Q3 FY2021 January 2021 Exhibit 99.4

Cautionary Statement and Disclaimer The views expressed here may contain information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness, reasonableness or reliability of this information. Any forward looking information in this presentation including, without limitation, any tables, charts and/or graphs, has been prepared on the basis of a number of assumptions which may prove to be incorrect. This presentation should not be relied upon as a recommendation or forecast by Vedanta Resources plc and Vedanta Limited and any of their subsidiaries. Past performance of Vedanta Resources plc and Vedanta Limited and any of their subsidiaries cannot be relied upon as a guide to future performance. This presentation contains 'forward-looking statements' – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as 'expects,' 'anticipates,' 'intends,' 'plans,' 'believes,' 'seeks,' or 'will.' Forward–looking statements by their nature address matters that are, to different degrees, uncertain. For us, uncertainties arise from the behaviour of financial and metals markets including the London Metal Exchange, fluctuations in interest and or exchange rates and metal prices; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a environmental, climatic, natural, political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different that those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. We caution you that reliance on any forward-looking statement involves risk and uncertainties, and that, although we believe that the assumption on which our forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate and, as a result, the forward-looking statement based on those assumptions could be materially incorrect. This presentation is not intended, and does not, constitute or form part of any offer, invitation or the solicitation of an offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of, any securities in Vedanta Resources plc and Vedanta Limited and any of their subsidiaries or undertakings or any other invitation or inducement to engage in investment activities, nor shall this presentation (or any part of it) nor the fact of its distribution form the basis of, or be relied on in connection with, any contract or investment decision.

Contents Section Presenter Page Q3 FY21 Review & Business Update Sunil Duggal, CEO 4 Financial Update Arun Kumar, CFO 18 Appendix 25

Q3 FY2021 Review & Business Update Sunil Duggal | Chief Executive Officer Q3 FY2021

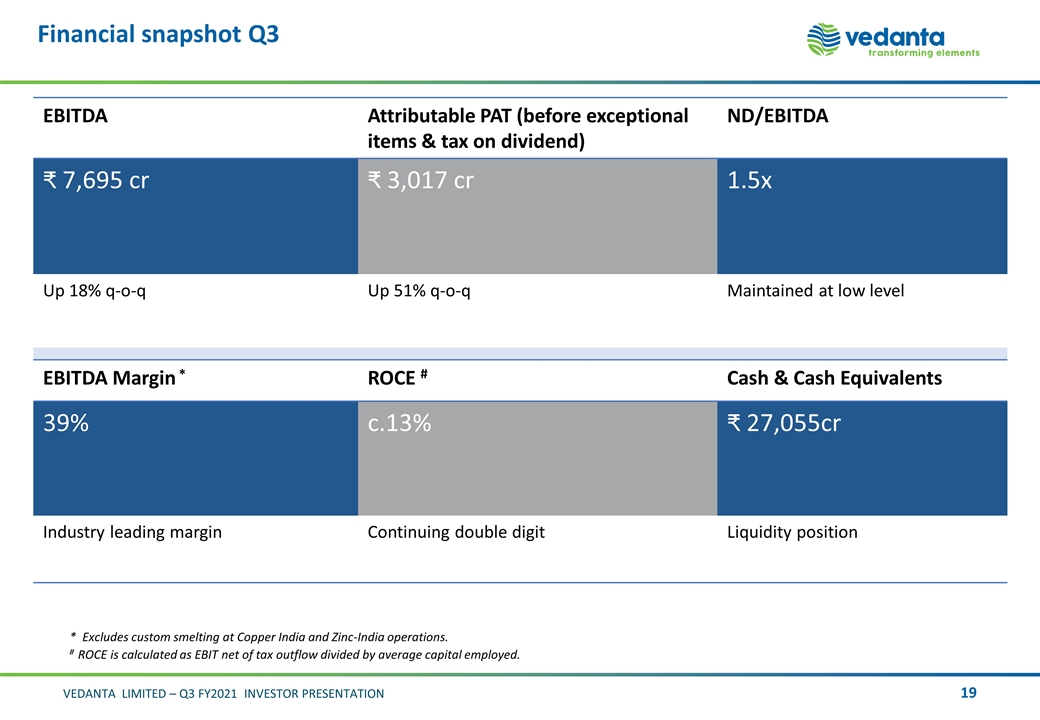

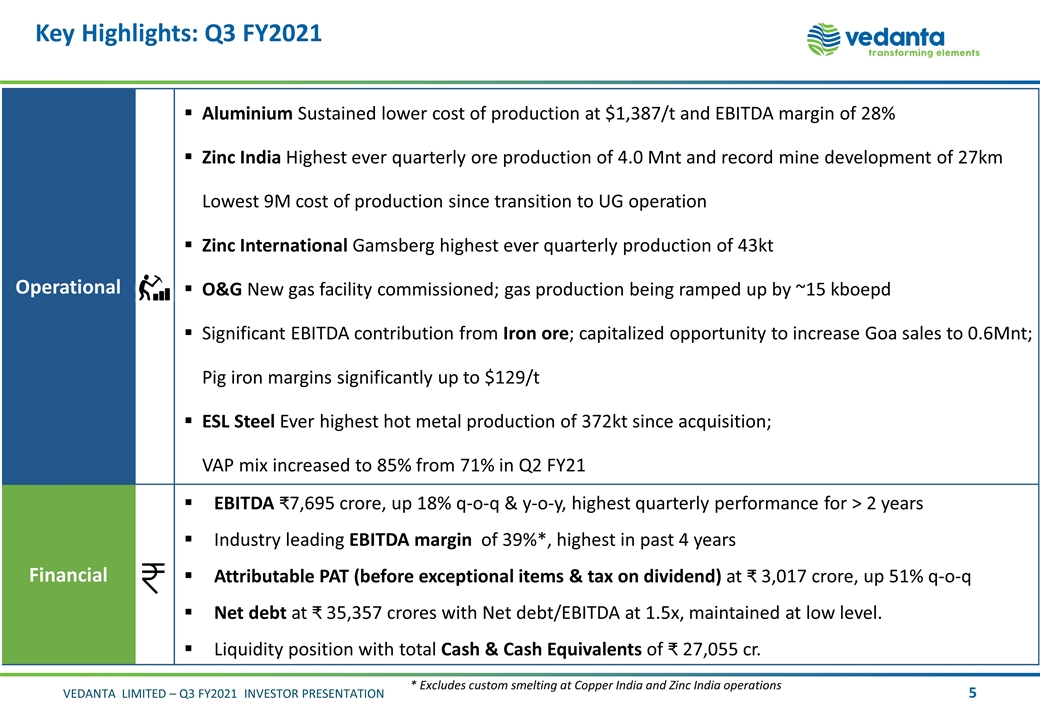

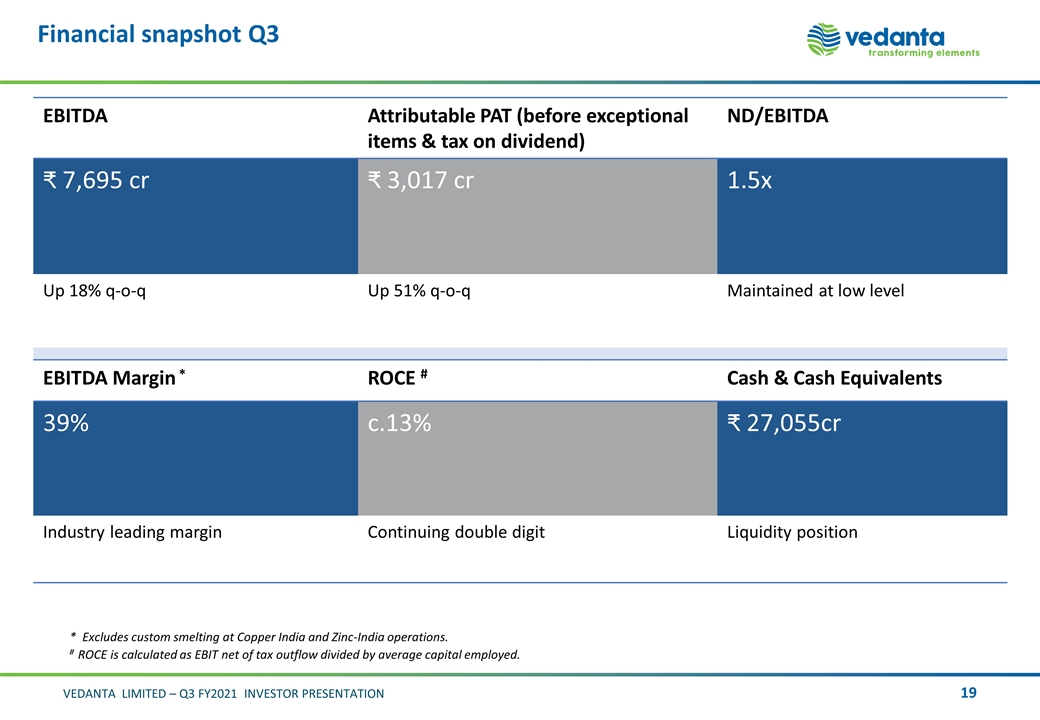

Key Highlights: Q3 FY2021 Operational Aluminium Sustained lower cost of production at $1,387/t and EBITDA margin of 28% Zinc India Highest ever quarterly ore production of 4.0 Mnt and record mine development of 27km Lowest 9M cost of production since transition to UG operation Zinc International Gamsberg highest ever quarterly production of 43kt O&G New gas facility commissioned; gas production being ramped up by ~15 kboepd Significant EBITDA contribution from Iron ore; capitalized opportunity to increase Goa sales to 0.6Mnt; Pig iron margins significantly up to $129/t ESL Steel Ever highest hot metal production of 372kt since acquisition; VAP mix increased to 85% from 71% in Q2 FY21 Financial EBITDA ₹7,695 crore, up 18% q-o-q & y-o-y, highest quarterly performance for > 2 years Industry leading EBITDA margin of 39%*, highest in past 4 years Attributable PAT (before exceptional items & tax on dividend) at ₹ 3,017 crore, up 51% q-o-q Net debt at ₹ 35,357 crores with Net debt/EBITDA at 1.5x, maintained at low level. Liquidity position with total Cash & Cash Equivalents of 27,055 cr. * Excludes custom smelting at Copper India and Zinc India operations

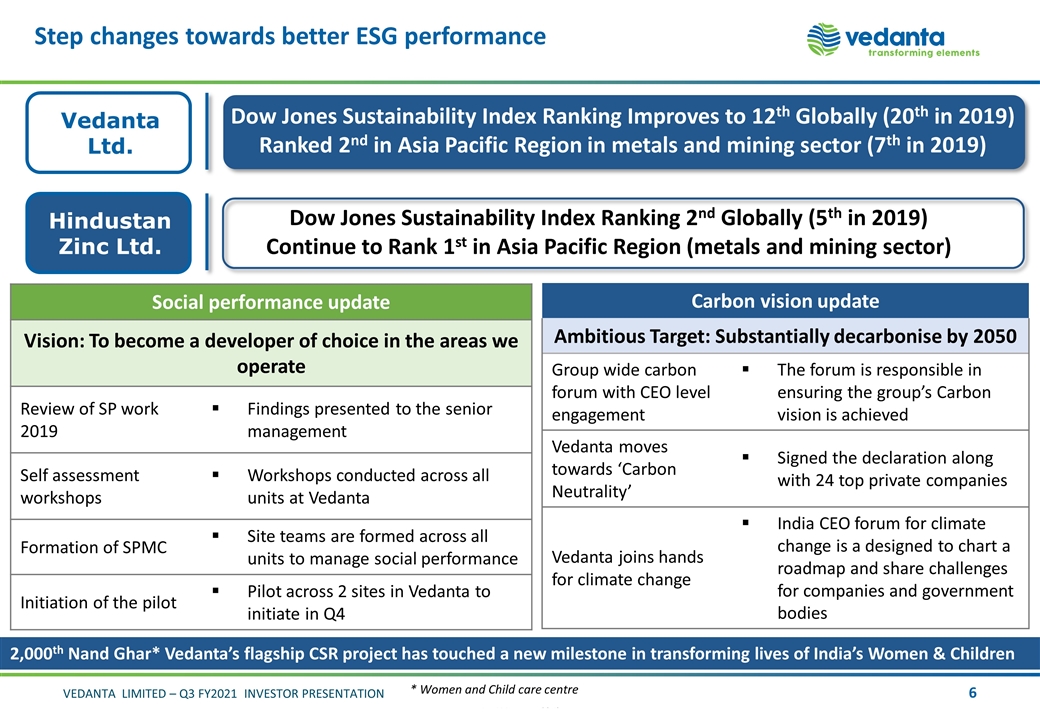

Step changes towards better ESG performance Carbon vision update Ambitious Target: Substantially decarbonise by 2050 Group wide carbon forum with CEO level engagement The forum is responsible in ensuring the group’s Carbon vision is achieved Vedanta moves towards ‘Carbon Neutrality’ Signed the declaration along with 24 top private companies Vedanta joins hands for climate change India CEO forum for climate change is a designed to chart a roadmap and share challenges for companies and government bodies Social performance update Vision: To become a developer of choice in the areas we operate Review of SP work 2019 Findings presented to the senior management Self assessment workshops Workshops conducted across all units at Vedanta Formation of SPMC Site teams are formed across all units to manage social performance Initiation of the pilot Pilot across 2 sites in Vedanta to initiate in Q4 Vedanta Ltd. Dow Jones Sustainability Index Ranking Improves to 12th Globally (20th in 2019) Ranked 2nd in Asia Pacific Region in metals and mining sector (7th in 2019) Hindustan Zinc Ltd. Dow Jones Sustainability Index Ranking 2nd Globally (5th in 2019) Continue to Rank 1st in Asia Pacific Region (metals and mining sector) * Women and Child care centre 2,000th Nand Ghar* Vedanta’s flagship CSR project has touched a new milestone in transforming lives of India’s Women & Children

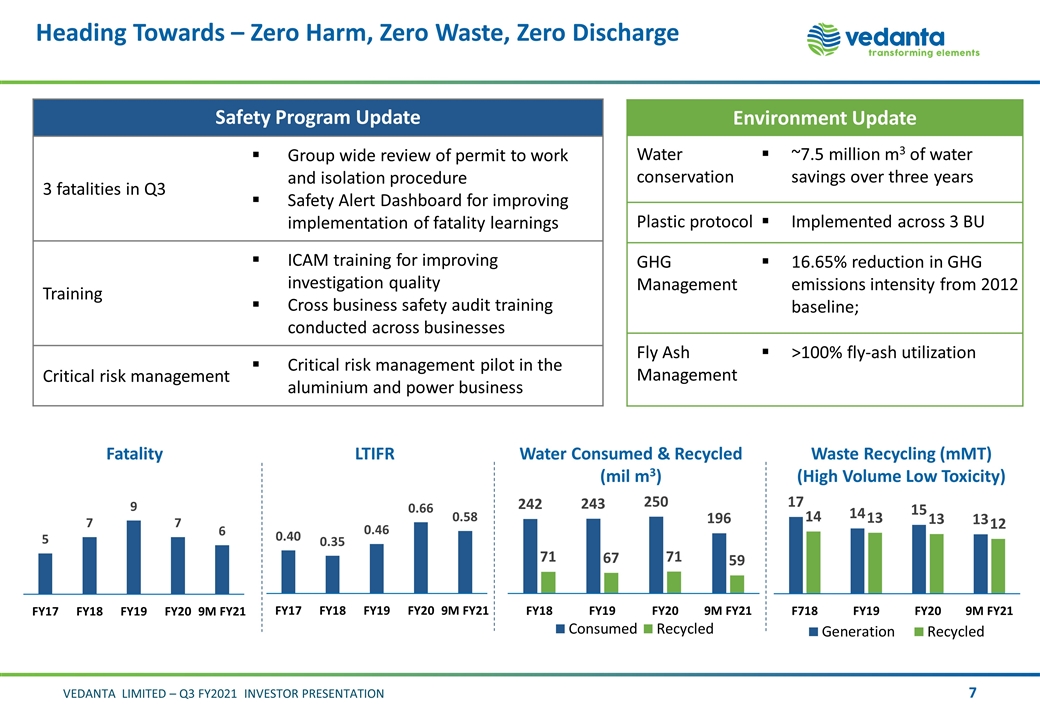

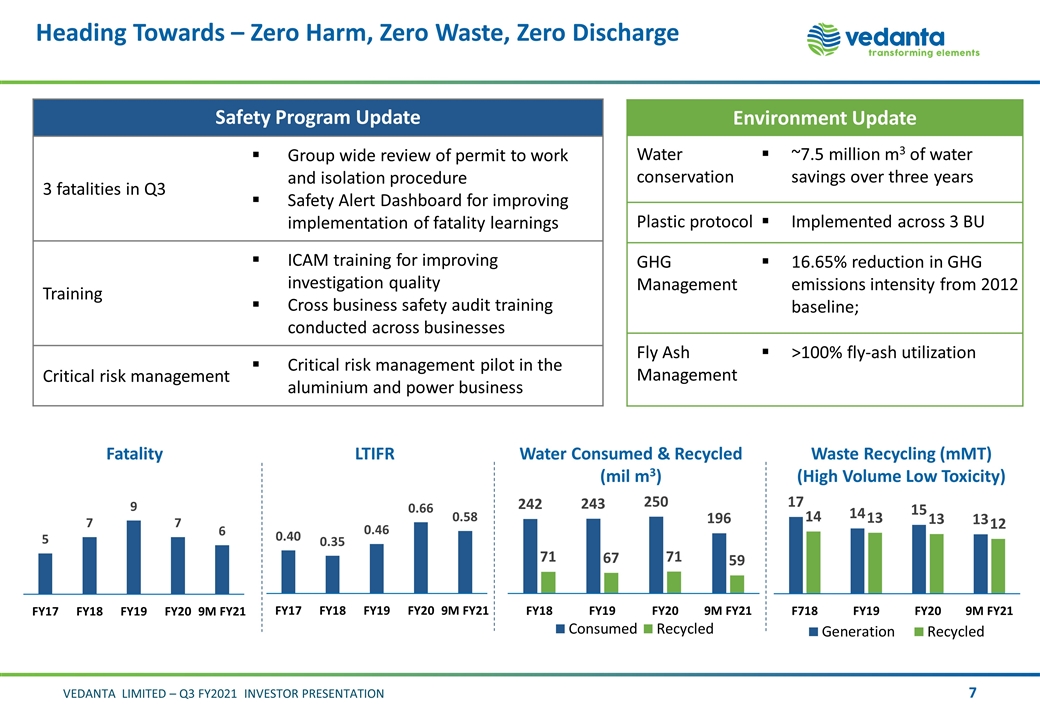

Heading Towards – Zero Harm, Zero Waste, Zero Discharge Environment Update Water conservation ~7.5 million m3 of water savings over three years Plastic protocol Implemented across 3 BU GHG Management 16.65% reduction in GHG emissions intensity from 2012 baseline; Fly Ash Management >100% fly-ash utilization Water Consumed & Recycled (mil m3) LTIFR Fatality Waste Recycling (mMT) (High Volume Low Toxicity) Safety Program Update 3 fatalities in Q3 Group wide review of permit to work and isolation procedure Safety Alert Dashboard for improving implementation of fatality learnings Training ICAM training for improving investigation quality Cross business safety audit training conducted across businesses Critical risk management Critical risk management pilot in the aluminium and power business

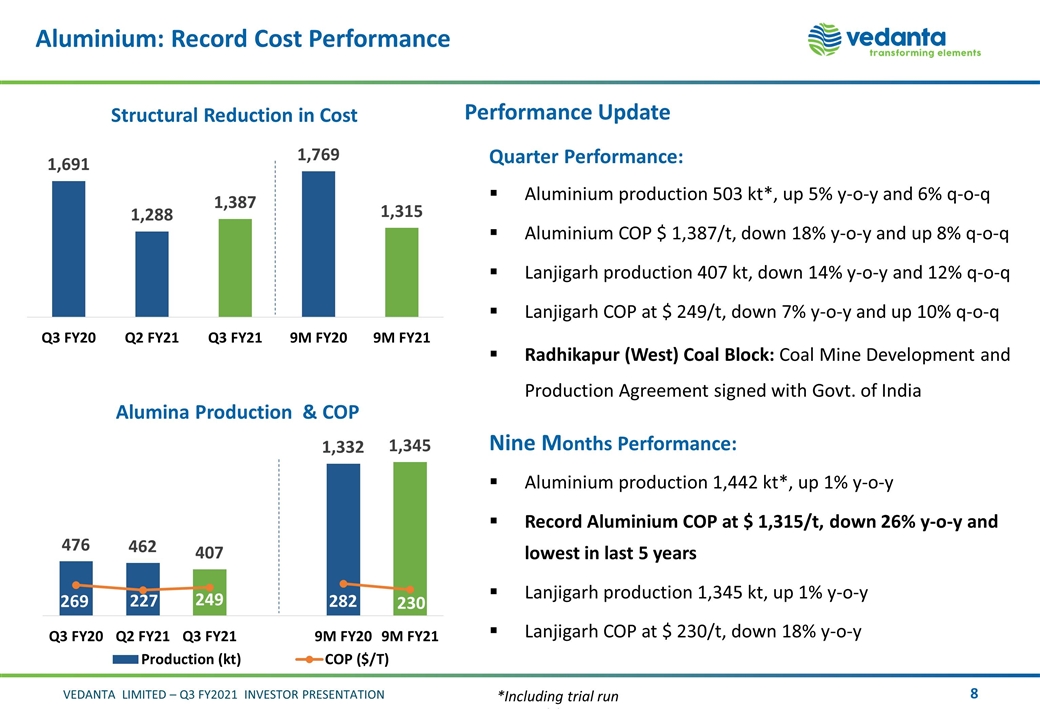

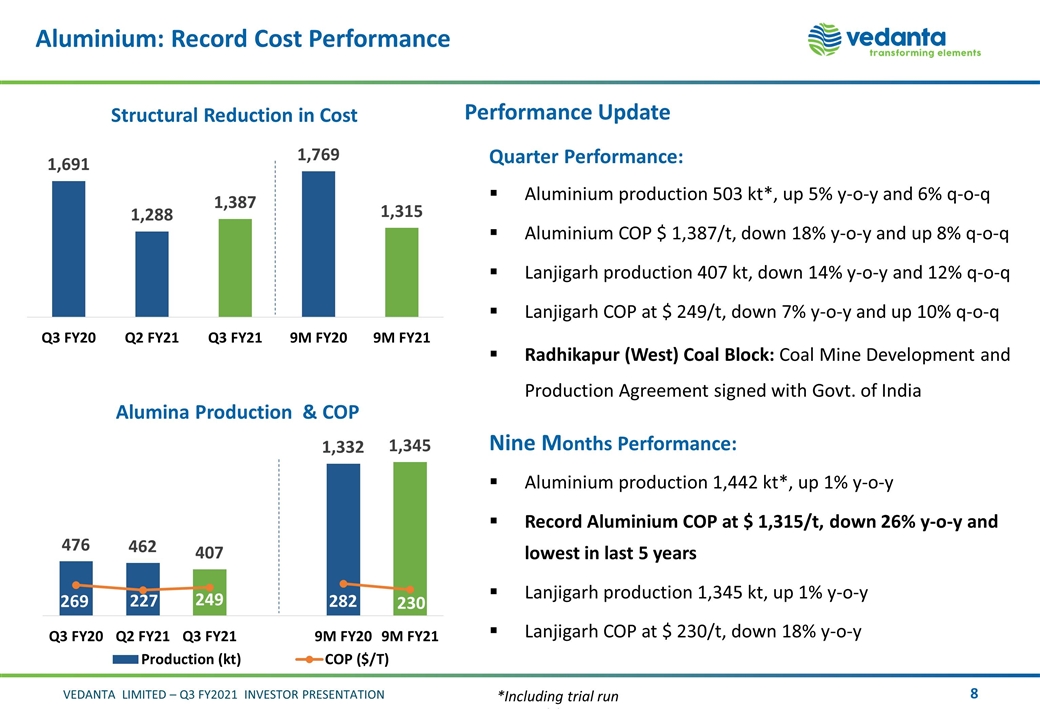

Aluminium: Record Cost Performance Structural Reduction in Cost Alumina Production & COP Performance Update Quarter Performance: Aluminium production 503 kt*, up 5% y-o-y and 6% q-o-q Aluminium COP $ 1,387/t, down 18% y-o-y and up 8% q-o-q Lanjigarh production 407 kt, down 14% y-o-y and 12% q-o-q Lanjigarh COP at $ 249/t, down 7% y-o-y and up 10% q-o-q Radhikapur (West) Coal Block: Coal Mine Development and Production Agreement signed with Govt. of India Nine Months Performance: Aluminium production 1,442 kt*, up 1% y-o-y Record Aluminium COP at $ 1,315/t, down 26% y-o-y and lowest in last 5 years Lanjigarh production 1,345 kt, up 1% y-o-y Lanjigarh COP at $ 230/t, down 18% y-o-y *Including trial run

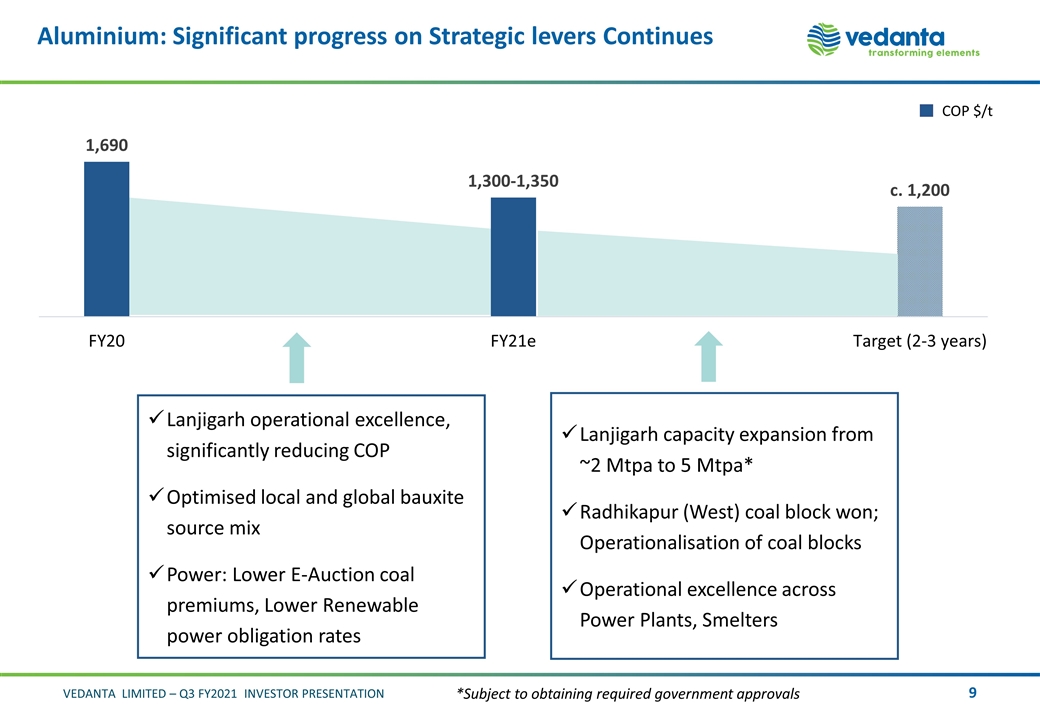

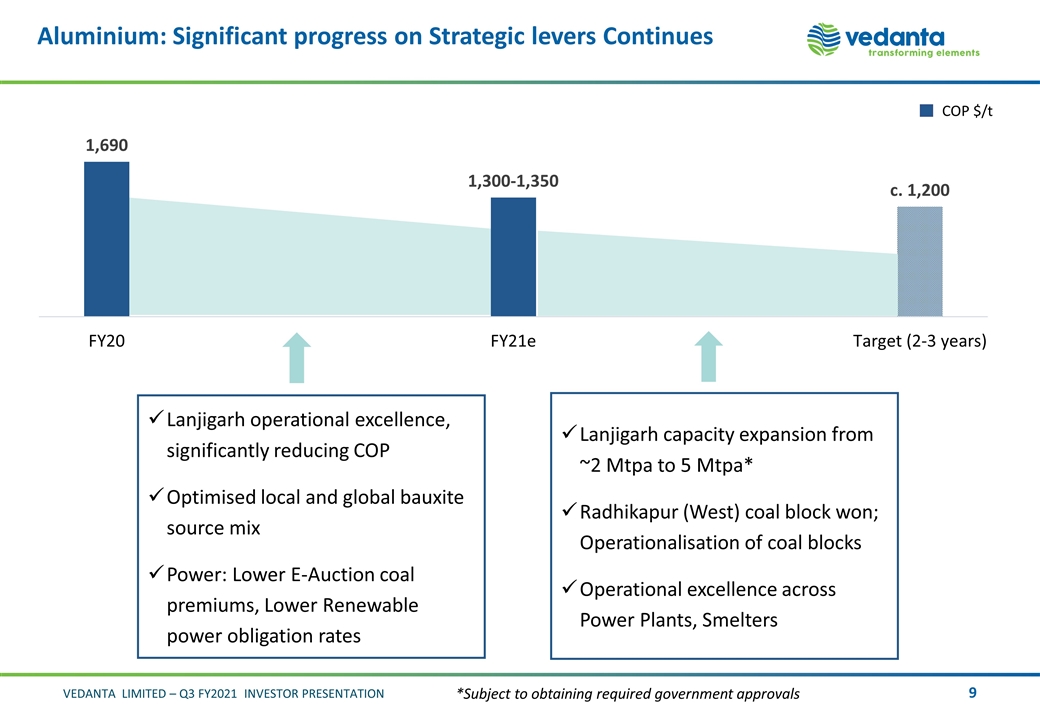

Aluminium: Significant progress on Strategic levers Continues Lanjigarh operational excellence, significantly reducing COP Optimised local and global bauxite source mix Power: Lower E-Auction coal premiums, Lower Renewable power obligation rates Lanjigarh capacity expansion from ~2 Mtpa to 5 Mtpa* Radhikapur (West) coal block won; Operationalisation of coal blocks Operational excellence across Power Plants, Smelters COP $/t *Subject to obtaining required government approvals

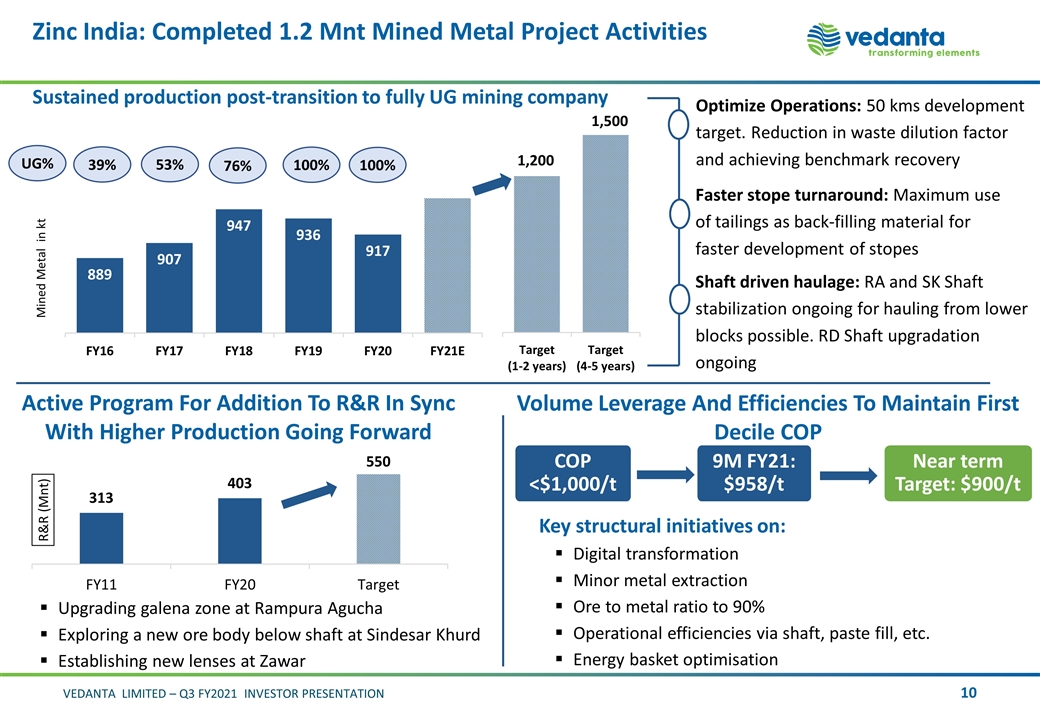

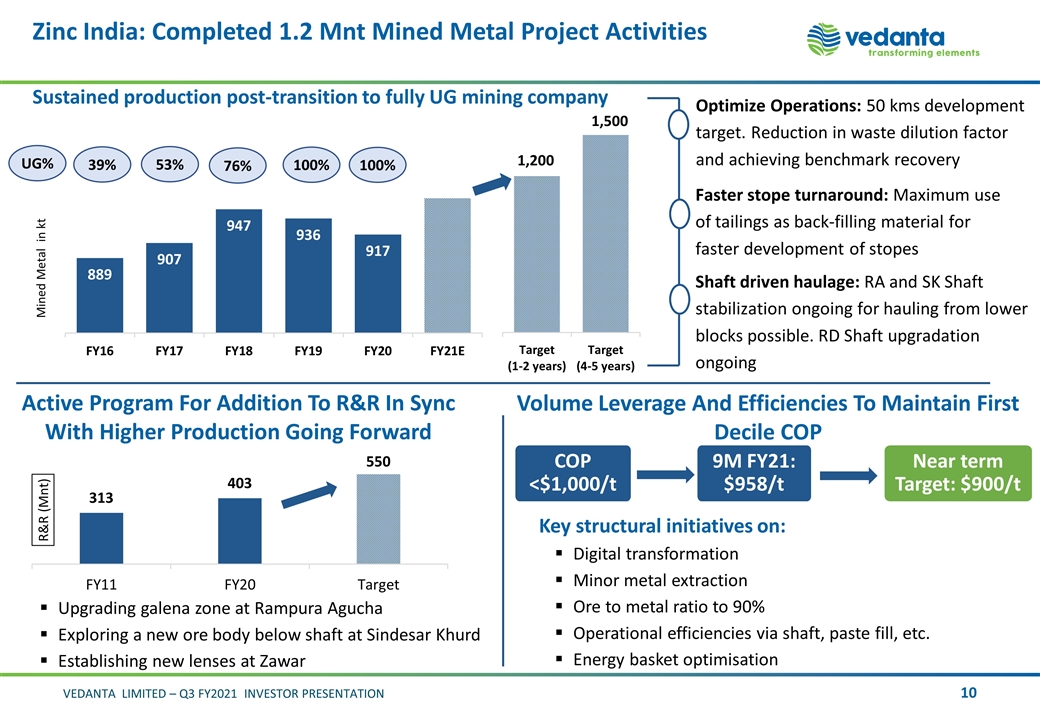

Zinc India: Completed 1.2 Mnt Mined Metal Project Activities Sustained production post-transition to fully UG mining company Optimize Operations: 50 kms development target. Reduction in waste dilution factor and achieving benchmark recovery Faster stope turnaround: Maximum use of tailings as back-filling material for faster development of stopes Shaft driven haulage: RA and SK Shaft stabilization ongoing for hauling from lower blocks possible. RD Shaft upgradation ongoing Active Program For Addition To R&R In Sync With Higher Production Going Forward Upgrading galena zone at Rampura Agucha Exploring a new ore body below shaft at Sindesar Khurd Establishing new lenses at Zawar 9M FY21: $958/t Near term Target: $900/t Key structural initiatives on: Digital transformation Minor metal extraction Ore to metal ratio to 90% Operational efficiencies via shaft, paste fill, etc. Energy basket optimisation Volume Leverage And Efficiencies To Maintain First Decile COP COP <$1,000/t 39% 53% UG%

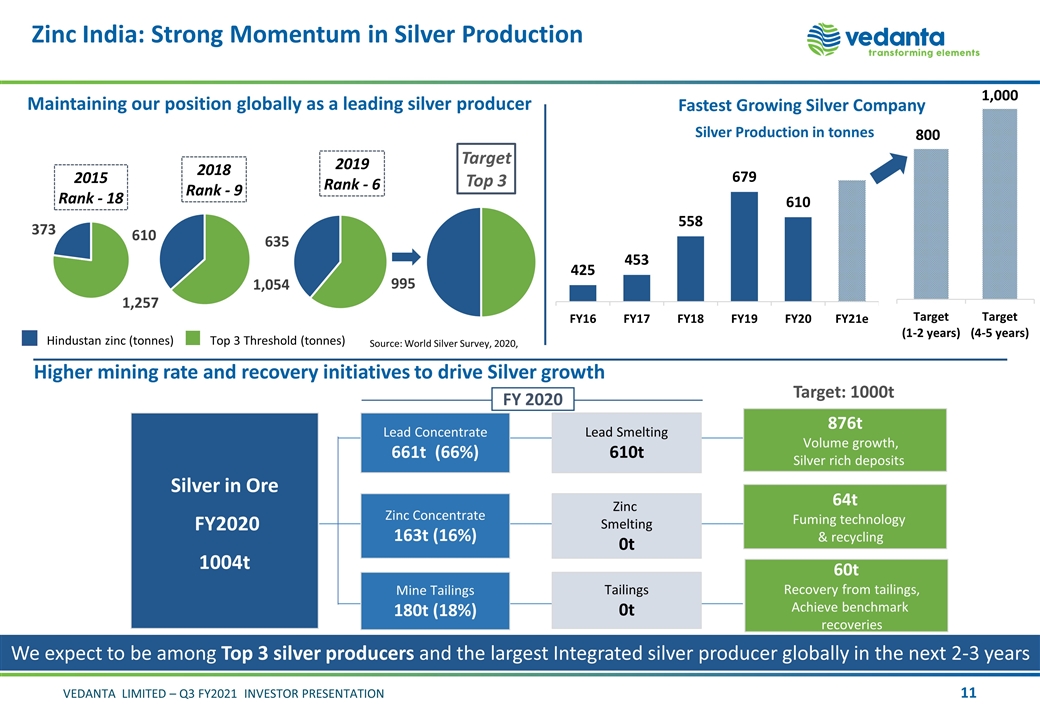

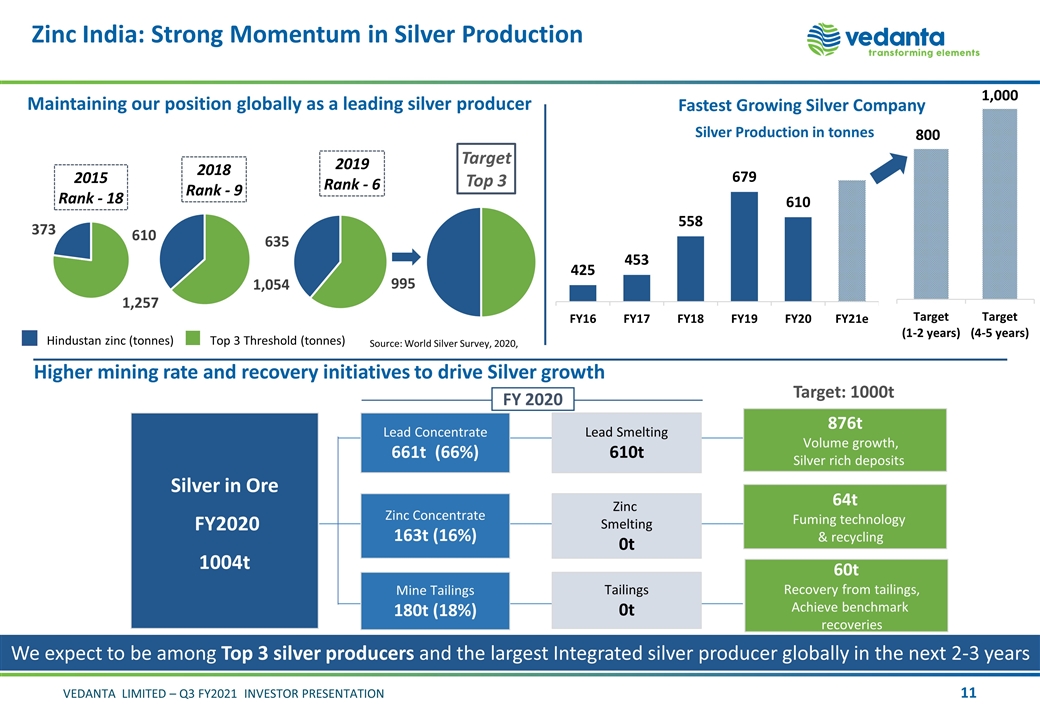

We expect to be among Top 3 silver producers and the largest Integrated silver producer globally in the next 2-3 years Higher mining rate and recovery initiatives to drive Silver growth Zinc India: Strong Momentum in Silver Production Maintaining our position globally as a leading silver producer Hindustan zinc (tonnes) Top 3 Threshold (tonnes) Fastest Growing Silver Company Source: World Silver Survey, 2020, Silver in Ore FY2020 1004t Target: 1000t Lead Concentrate 661t (66%) 876t Volume growth, Silver rich deposits Mine Tailings 180t (18%) 60t Recovery from tailings, Achieve benchmark recoveries 64t Fuming technology & recycling Lead Smelting 610t Tailings 0t Zinc Smelting 0t Zinc Concentrate 163t (16%) FY 2020

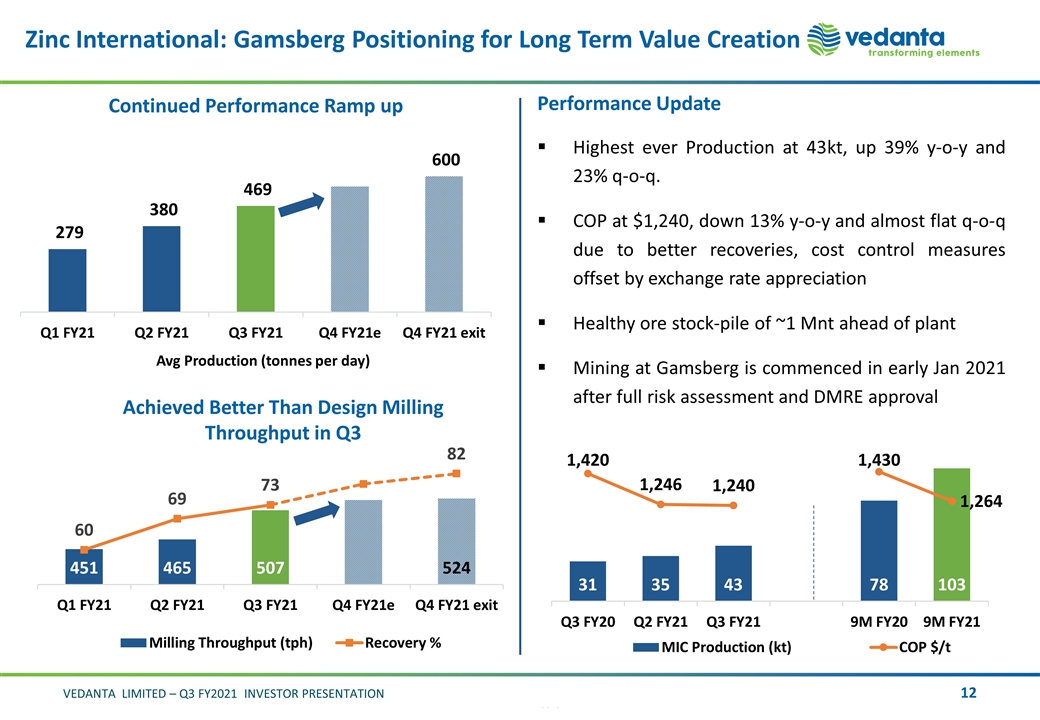

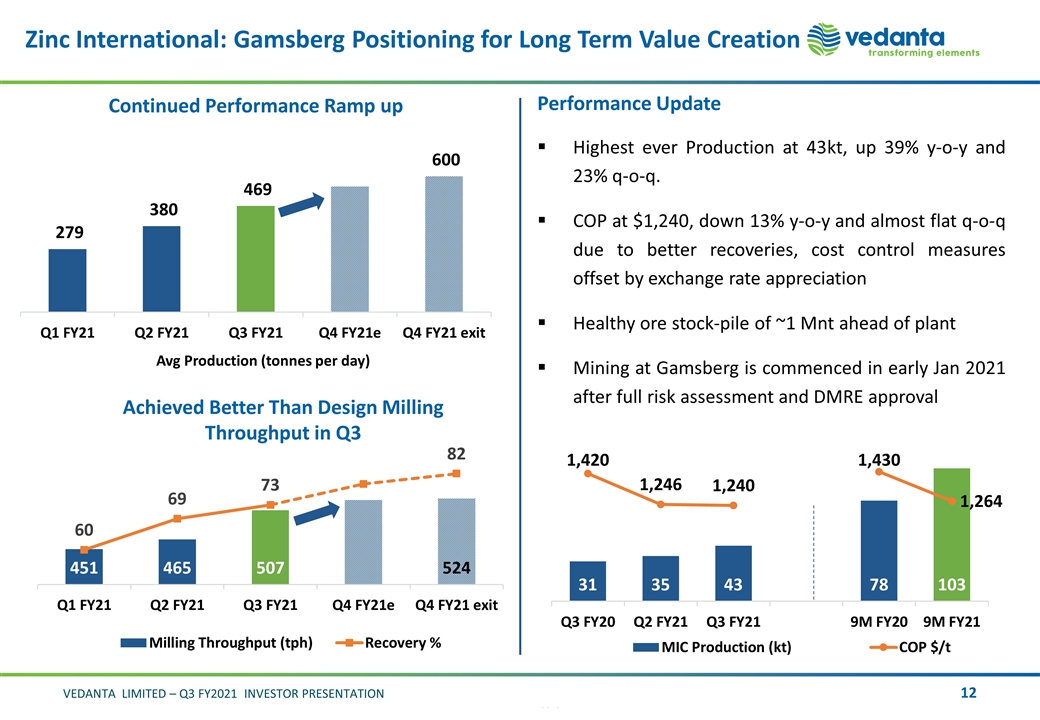

Performance Update Highest ever Production at 43kt, up 39% y-o-y and 23% q-o-q. COP at $1,240, down 13% y-o-y and almost flat q-o-q due to better recoveries, cost control measures offset by exchange rate appreciation Healthy ore stock-pile of ~1 Mnt ahead of plant Mining at Gamsberg is commenced in early Jan 2021 after full risk assessment and DMRE approval Zinc International: Gamsberg Positioning for Long Term Value Creation Continued Performance Ramp up Achieved Better Than Design Milling Throughput in Q3

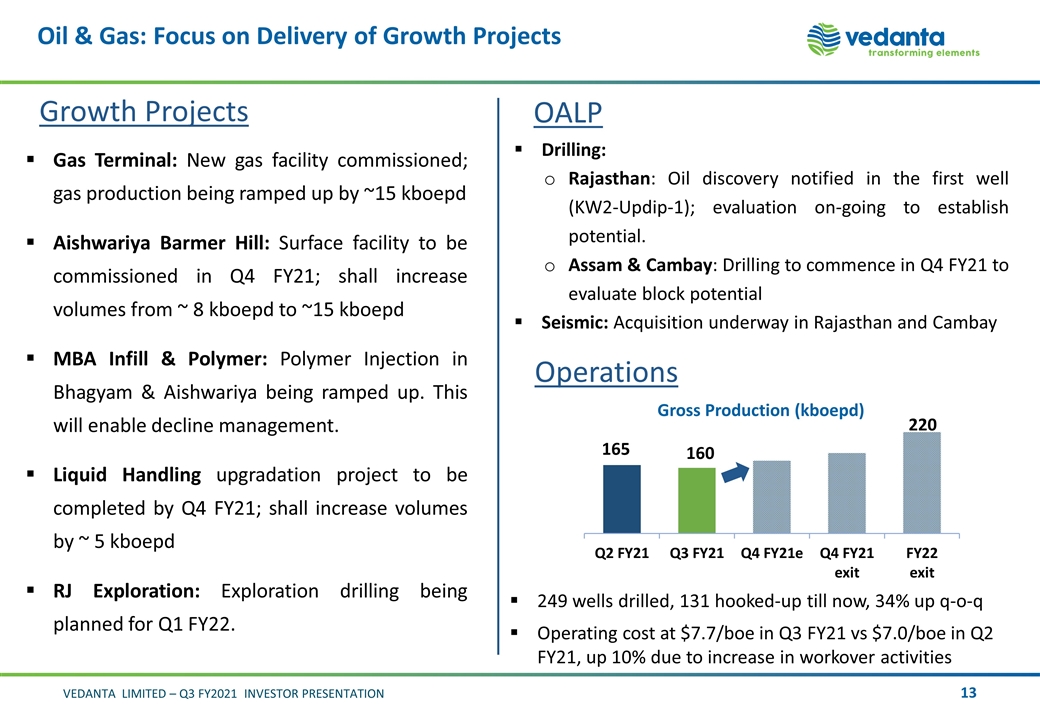

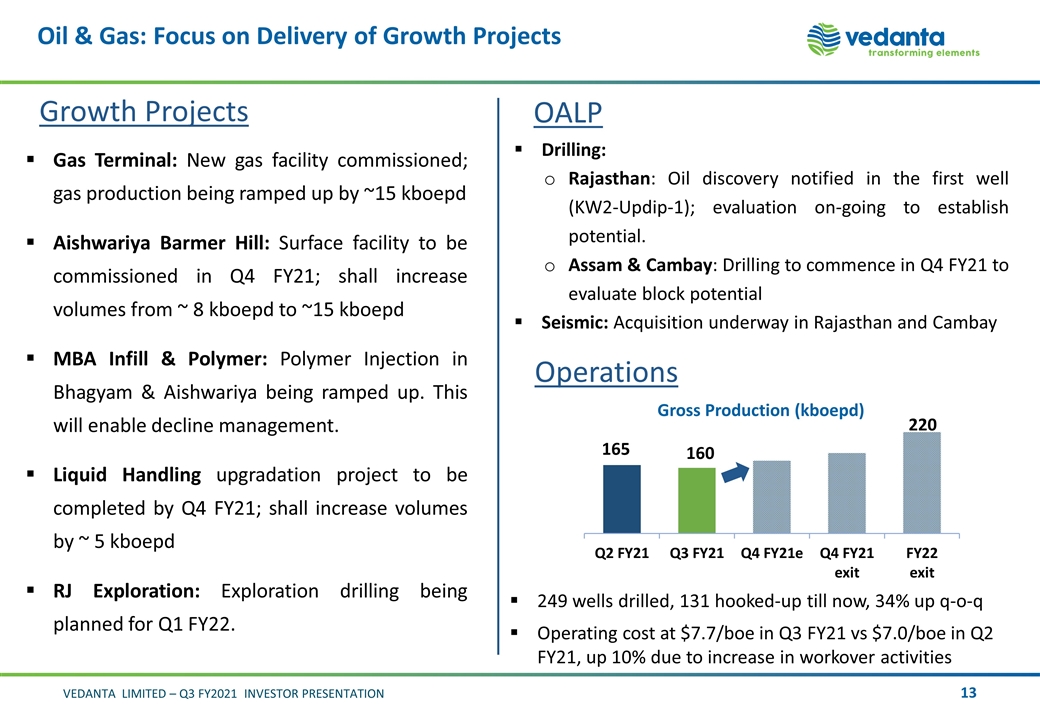

Oil & Gas: Focus on Delivery of Growth Projects Gross Production (kboepd) 249 wells drilled, 131 hooked-up till now, 34% up q-o-q Operating cost at $7.7/boe in Q3 FY21 vs $7.0/boe in Q2 FY21, up 10% due to increase in workover activities Gas Terminal: New gas facility commissioned; gas production being ramped up by ~15 kboepd Aishwariya Barmer Hill: Surface facility to be commissioned in Q4 FY21; shall increase volumes from ~ 8 kboepd to ~15 kboepd MBA Infill & Polymer: Polymer Injection in Bhagyam & Aishwariya being ramped up. This will enable decline management. Liquid Handling upgradation project to be completed by Q4 FY21; shall increase volumes by ~ 5 kboepd RJ Exploration: Exploration drilling being planned for Q1 FY22. Growth Projects OALP Drilling: Rajasthan: Oil discovery notified in the first well (KW2-Updip-1); evaluation on-going to establish potential. Assam & Cambay: Drilling to commence in Q4 FY21 to evaluate block potential Seismic: Acquisition underway in Rajasthan and Cambay Operations

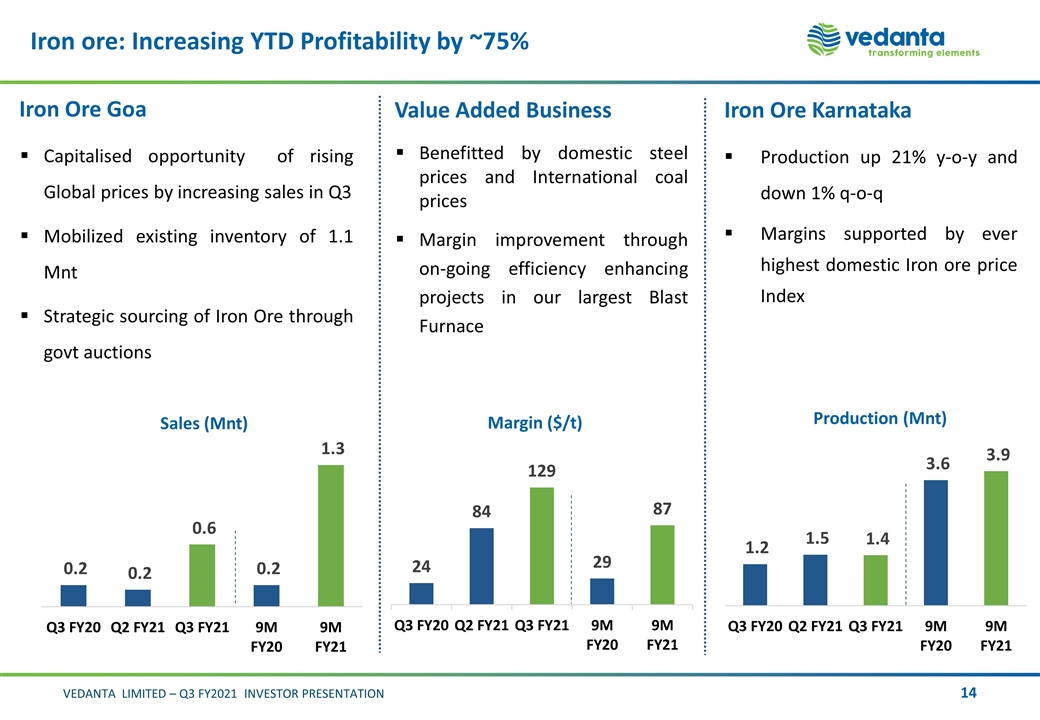

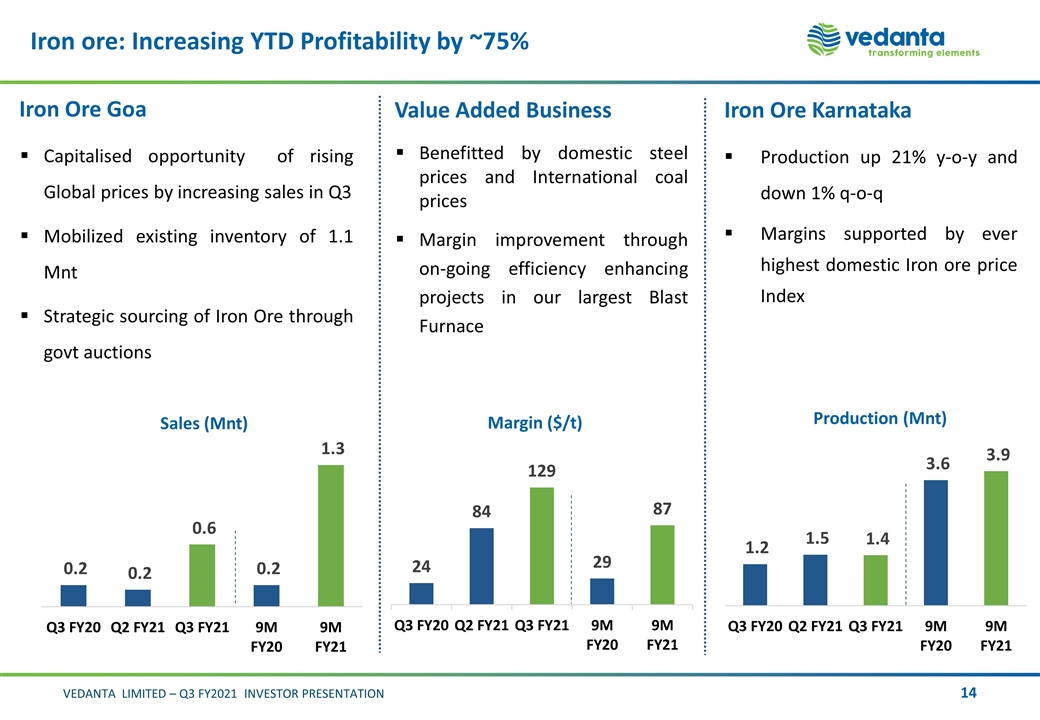

Iron ore: Increasing YTD Profitability by ~75% Iron Ore Goa Capitalised opportunity of rising Global prices by increasing sales in Q3 Mobilized existing inventory of 1.1 Mnt Strategic sourcing of Iron Ore through govt auctions Iron Ore Karnataka Production up 21% y-o-y and down 1% q-o-q Margins supported by ever highest domestic Iron ore price Index Value Added Business Benefitted by domestic steel prices and International coal prices Margin improvement through on-going efficiency enhancing projects in our largest Blast Furnace Sales (Mnt) Production (Mnt) Margin ($/t)

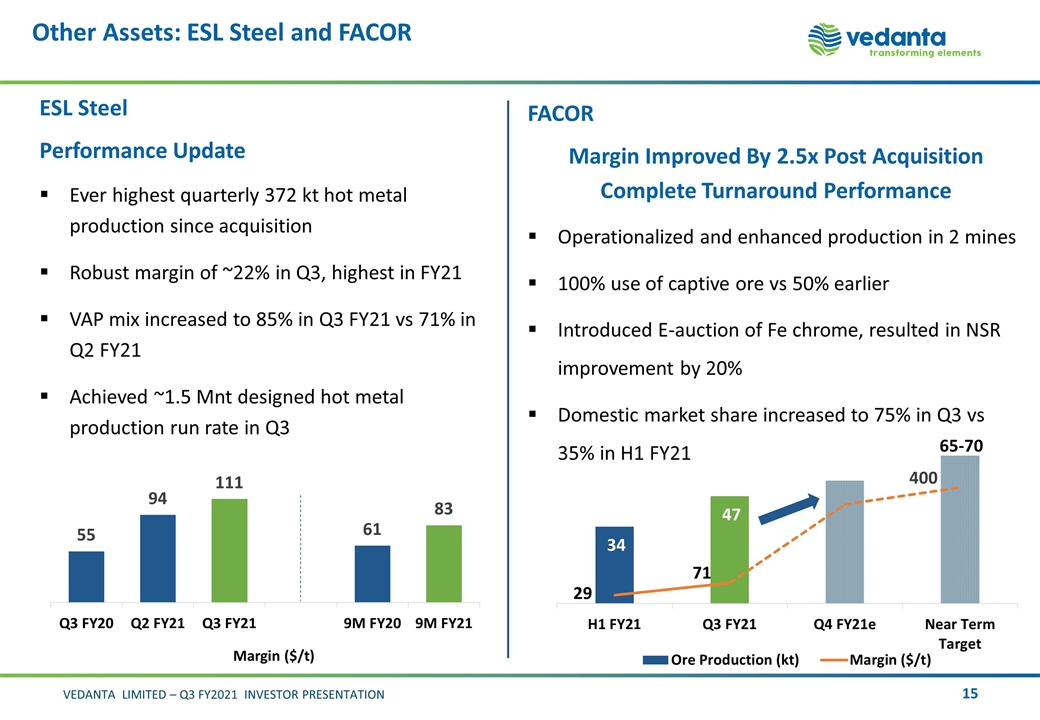

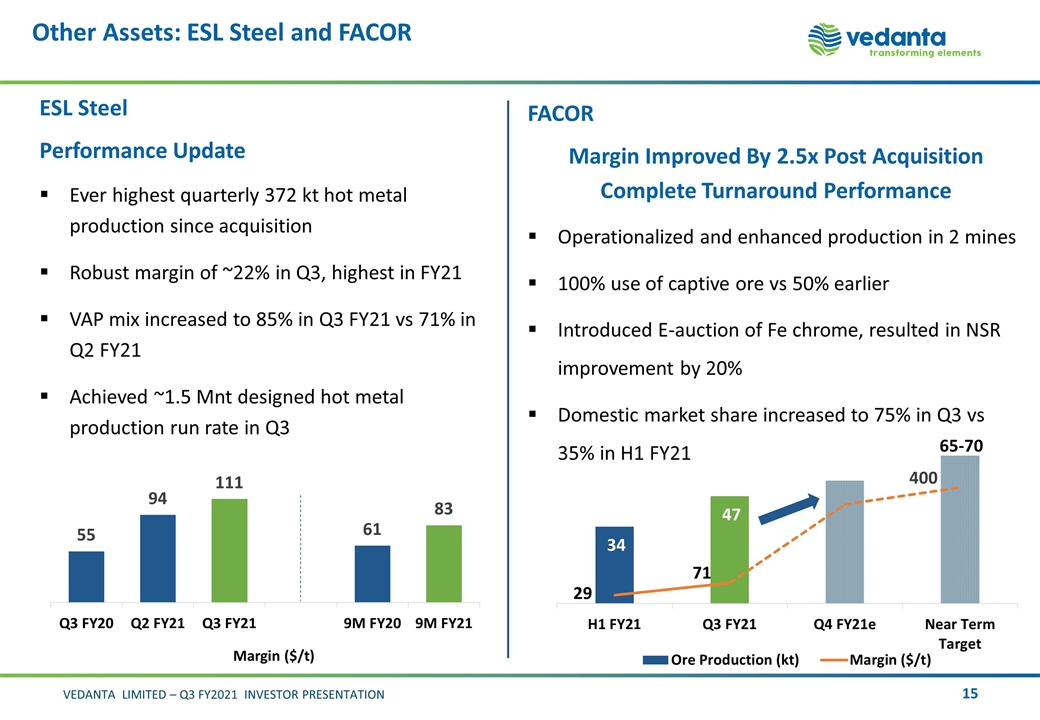

Other Assets: ESL Steel and FACOR ESL Steel Performance Update Ever highest quarterly 372 kt hot metal production since acquisition Robust margin of ~22% in Q3, highest in FY21 VAP mix increased to 85% in Q3 FY21 vs 71% in Q2 FY21 Achieved ~1.5 Mnt designed hot metal production run rate in Q3 FACOR Margin Improved By 2.5x Post Acquisition Complete Turnaround Performance Operationalized and enhanced production in 2 mines 100% use of captive ore vs 50% earlier Introduced E-auction of Fe chrome, resulted in NSR improvement by 20% Domestic market share increased to 75% in Q3 vs 35% in H1 FY21

Creating Value: New Business Model – Integrated Procurement & Marketing Single face for selling of key commodities Consolidated buying for majority spends across businesses – Economies of scale, value buying Focus on digitalization & Strategic Buying through touch less processes, automation & best-in-class partners Move to E-Commerce sales for connecting with SME and MSME Optimizing working capital by leveraging group synergies Increasing cross-sell opportunities & new product development & market growth Vision For Unlocking Potential Savings of $1.0 bn Through Our Integrated Procurement And Marketing

Project Pratham: Digital First Digital Transformation, R&D and Innovation driving business value Smart Manufacturing and Advance Process Control driving volume increments and asset optimization Unified HSE and HR Platform enabling harmonization and effectiveness of group processes Project Disha: Integrated Data and Decision Platform enabling analytics-led decisions and monetizing wealth of group-wide data Digital Logistics Control Towers and Quality Automation enabling visibility, transparency and delivering cost impact Vedanta Spark: Global Startup Platform and Innovation Cafes innovation culture and mindset change, strengthening group wide digital capabilities

Finance Update Arun Kumar | Chief Financial Officer Q3 FY2021

Financial snapshot Q3 EBITDA Attributable PAT (before exceptional items & tax on dividend) ND/EBITDA ₹ 7,695 cr 3,017 cr 1.5x Up 18% q-o-q Up 51% q-o-q Maintained at low level EBITDA Margin * ROCE # Cash & Cash Equivalents 39% c.13% 27,055cr Industry leading margin Continuing double digit Liquidity position * Excludes custom smelting at Copper India and Zinc-India operations. # ROCE is calculated as EBIT net of tax outflow divided by average capital employed.

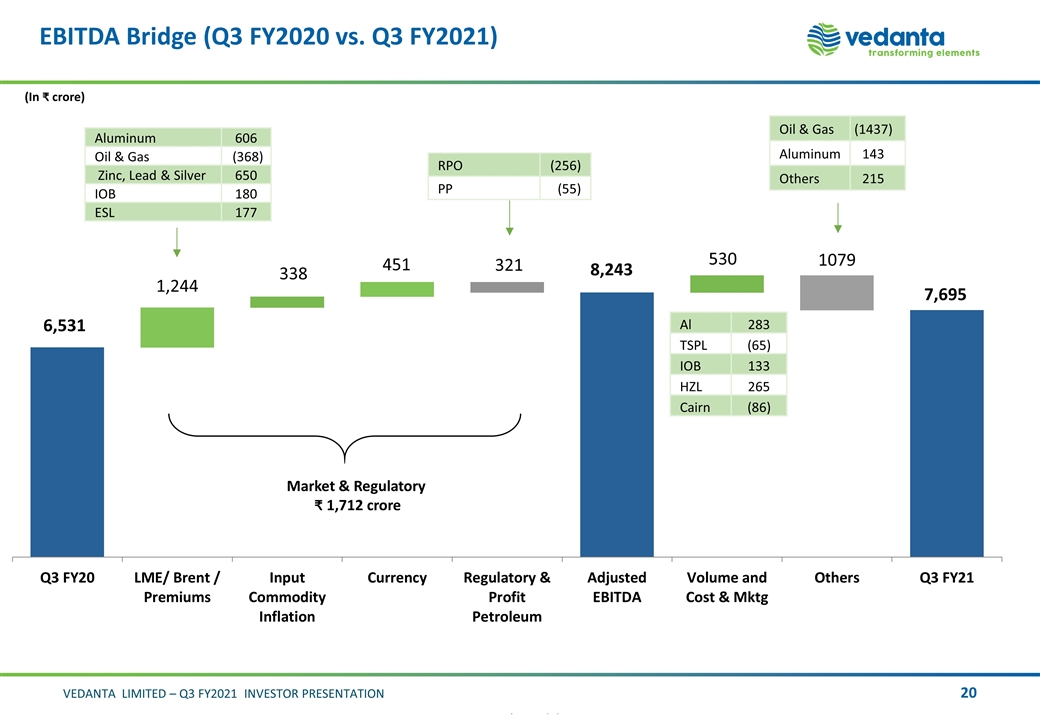

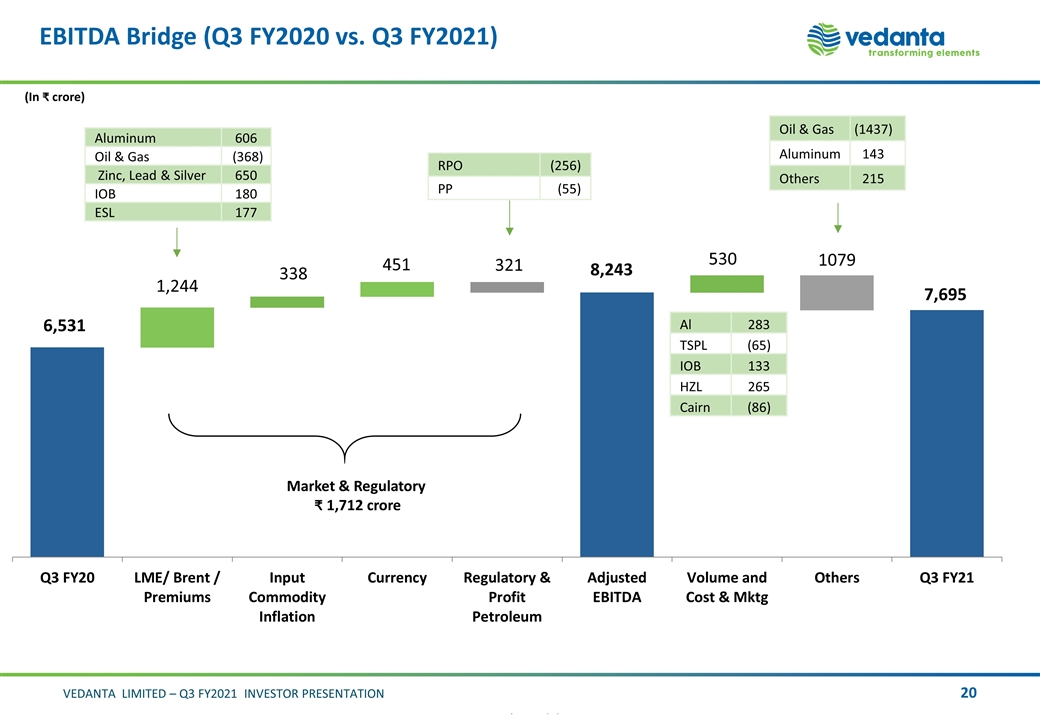

EBITDA Bridge (Q3 FY2020 vs. Q3 FY2021) (In crore) Market & Regulatory 1,712 crore Aluminum 606 Oil & Gas (368) Zinc, Lead & Silver 650 IOB 180 ESL 177 RPO (256) PP (55) Oil & Gas (1437) Aluminum 143 Others 215 Al 283 TSPL (65) IOB 133 HZL 265 Cairn (86)

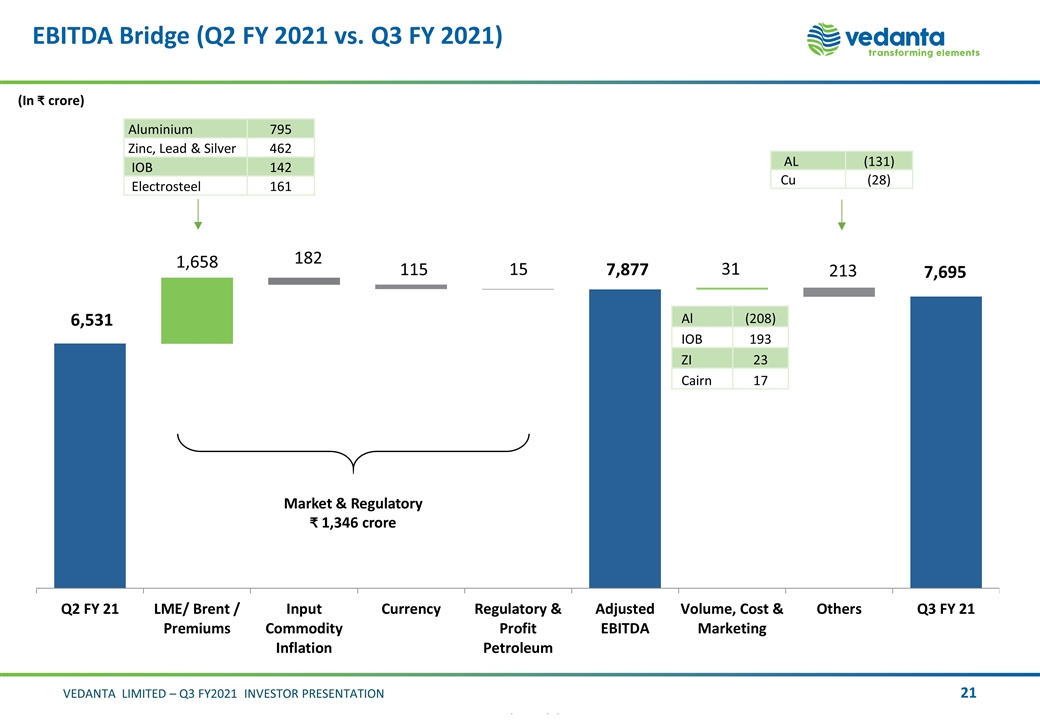

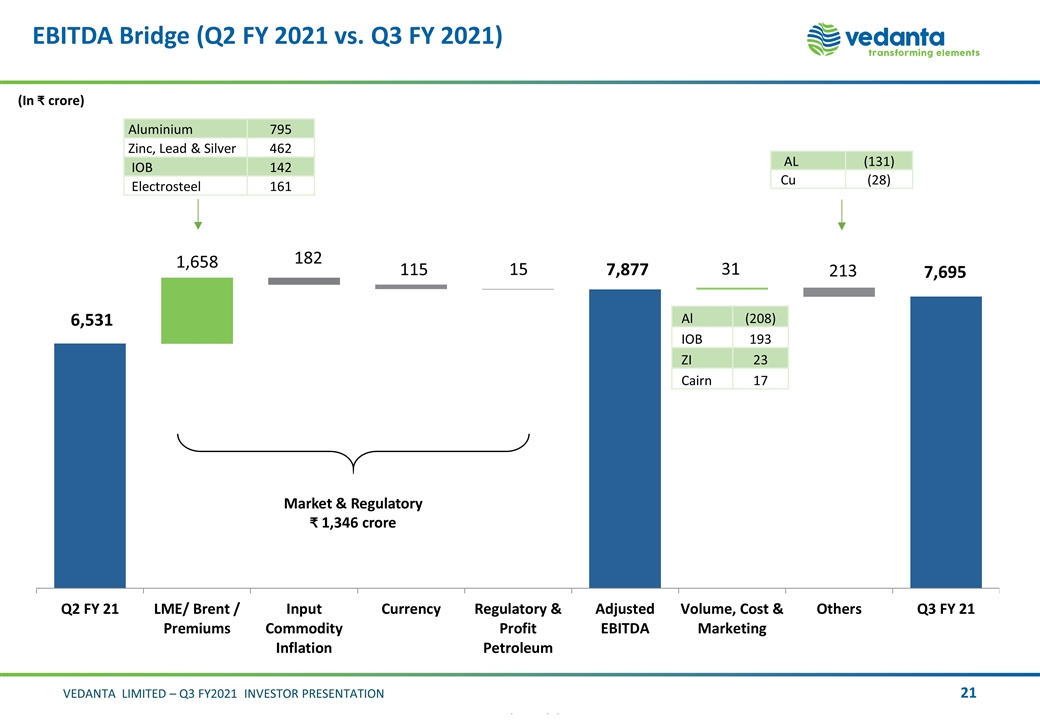

EBITDA Bridge (Q2 FY 2021 vs. Q3 FY 2021) (In crore) Market & Regulatory 1,346 crore Aluminium 795 Zinc, Lead & Silver 462 IOB 142 Electrosteel 161 Al (208) IOB 193 ZI 23 Cairn 17 AL (131) Cu (28) 15 7,877 182 115

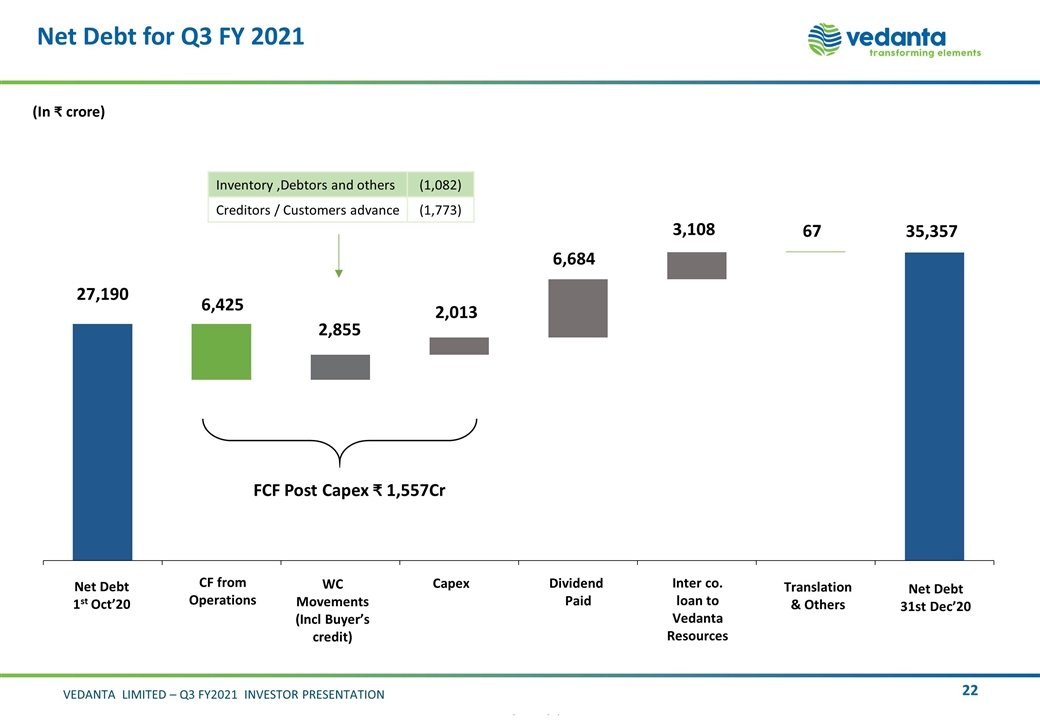

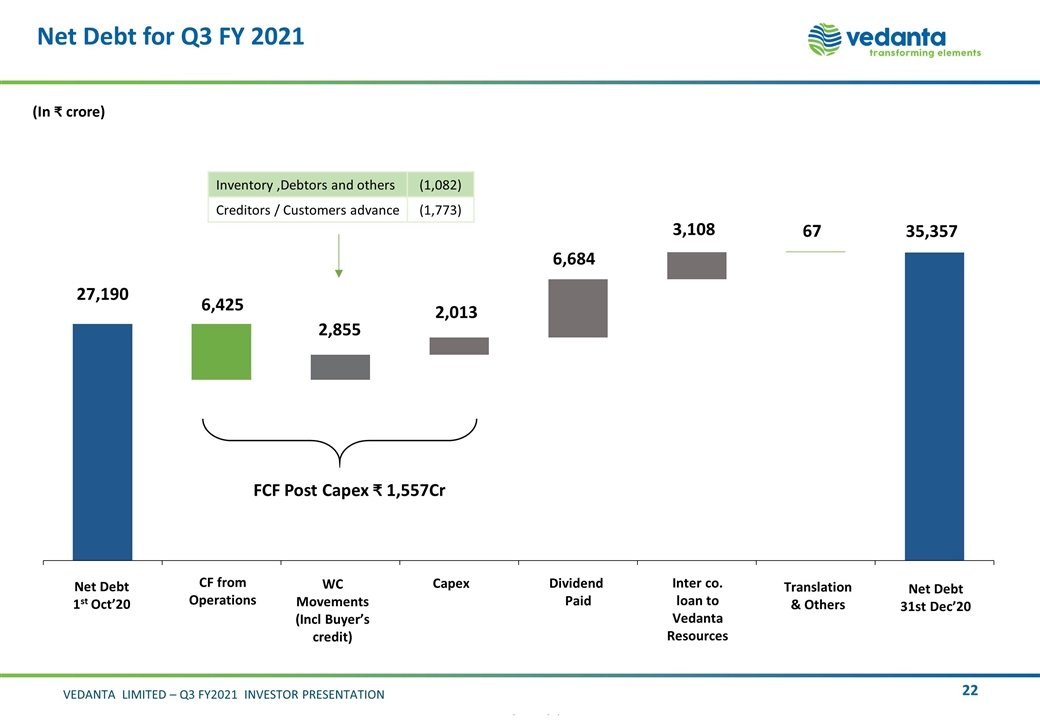

Net Debt for Q3 FY 2021 (In ₹ crore) (Incl Buyer’s credit) Capex Dividend Paid Net Debt 31st Dec’20 Net Debt 1st Oct’20 Inventory ,Debtors and others (1,082) Creditors / Customers advance (1,773) Inter co. loan to Vedanta Resources Translation & Others

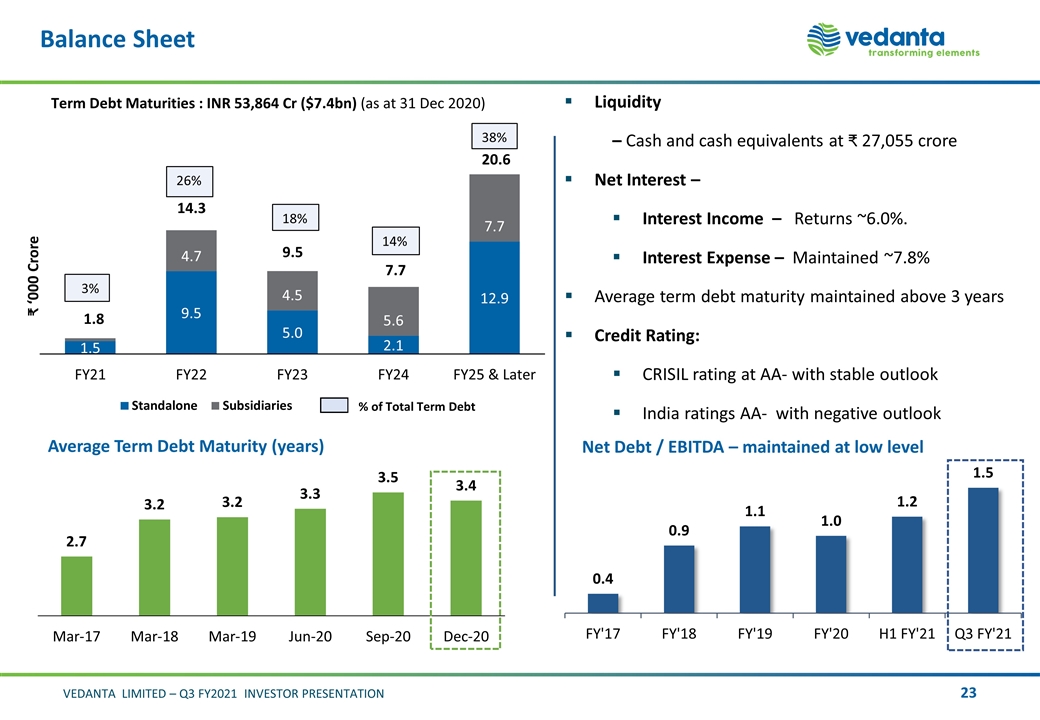

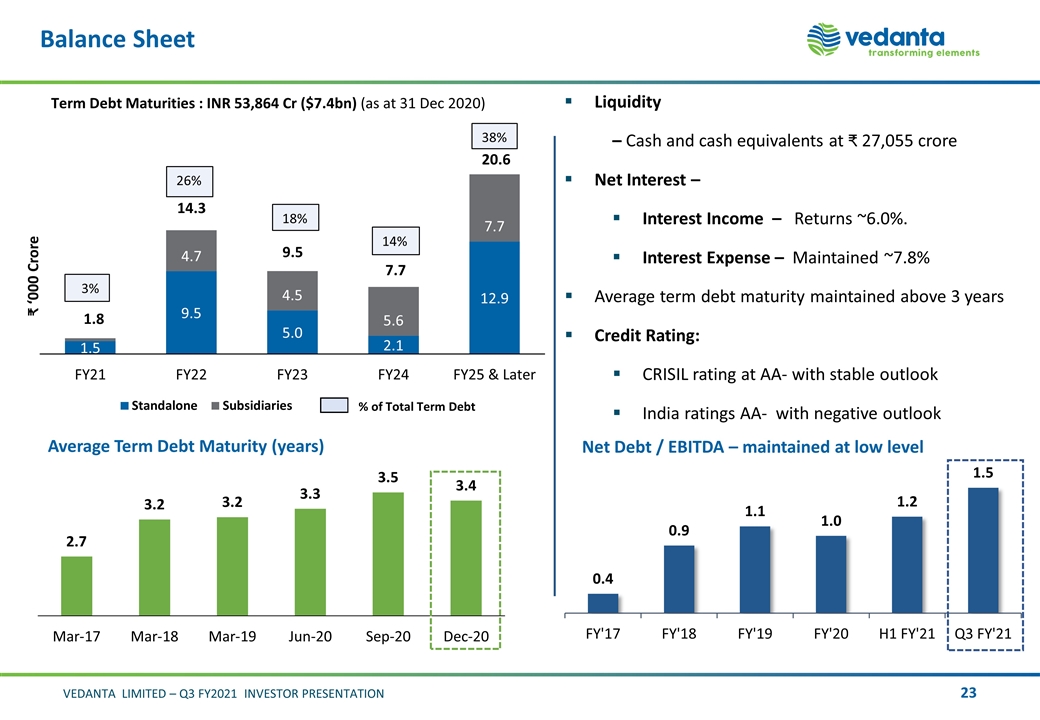

Balance Sheet Net Debt / EBITDA – maintained at low level Liquidity – Cash and cash equivalents at 27,055 crore Net Interest – Interest Income – Returns ~6.0%. Interest Expense – Maintained ~7.8% Average term debt maturity maintained above 3 years Credit Rating: CRISIL rating at AA- with stable outlook India ratings AA- with negative outlook Average Term Debt Maturity (years) % of Total Term Debt

Strategy to Enhance Long Term Value Continue Focus on World Class ESG Performance Augment Our Reserves & Resources Base Delivering on Growth Opportunities Optimise Capital Allocation & Maintain Strong Balance Sheet Operational Excellence and Cost Leadership

Appendix Q3 FY2021

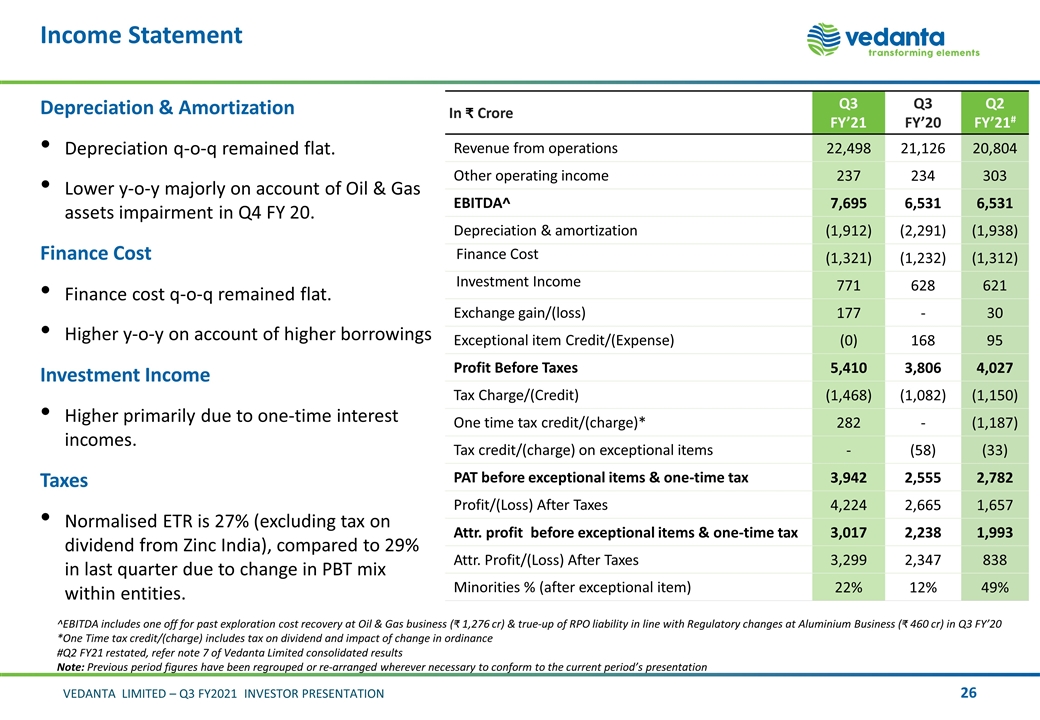

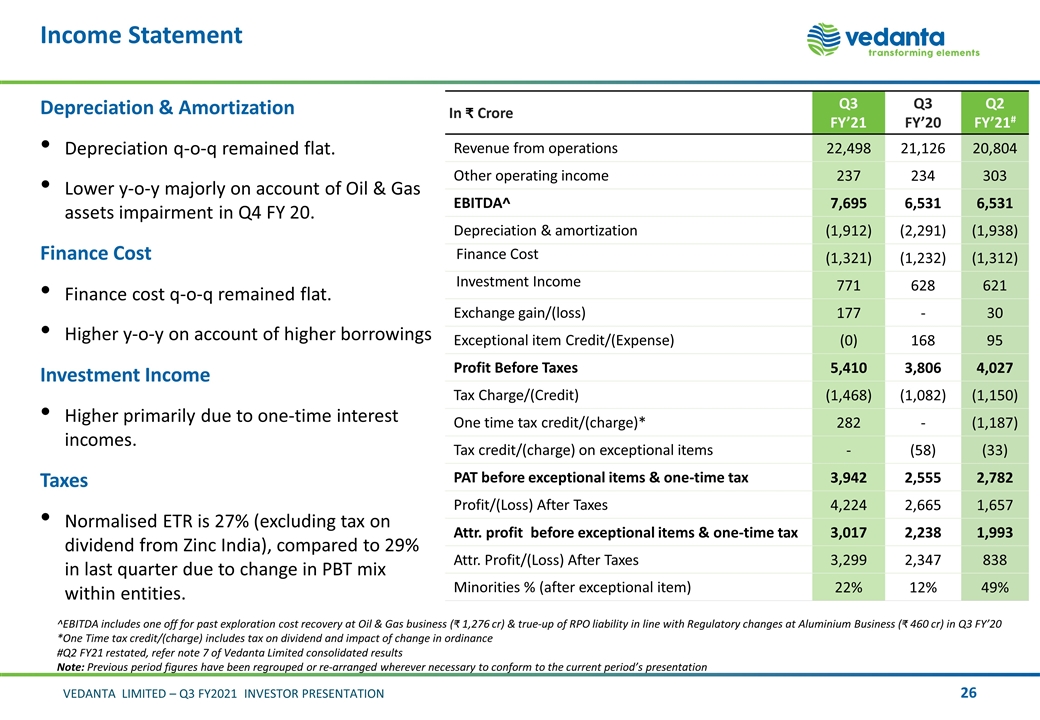

In Crore Q3 FY’21 Q3 FY’20 Q2 FY’21# Revenue from operations 22,498 21,126 20,804 Other operating income 237 234 303 EBITDA^ 7,695 6,531 6,531 Depreciation & amortization (1,912) (2,291) (1,938) Finance Cost (1,321) (1,232) (1,312) Investment Income 771 628 621 Exchange gain/(loss) 177 - 30 Exceptional item Credit/(Expense) (0) 168 95 Profit Before Taxes 5,410 3,806 4,027 Tax Charge/(Credit) (1,468) (1,082) (1,150) One time tax credit/(charge)* 282 - (1,187) Tax credit/(charge) on exceptional items - (58) (33) PAT before exceptional items & one-time tax 3,942 2,555 2,782 Profit/(Loss) After Taxes 4,224 2,665 1,657 Attr. profit before exceptional items & one-time tax 3,017 2,238 1,993 Attr. Profit/(Loss) After Taxes 3,299 2,347 838 Minorities % (after exceptional item) 22% 12% 49% Income Statement Depreciation & Amortization Depreciation q-o-q remained flat. Lower y-o-y majorly on account of Oil & Gas assets impairment in Q4 FY 20. Finance Cost Finance cost q-o-q remained flat. Higher y-o-y on account of higher borrowings Investment Income Higher primarily due to one-time interest incomes. Taxes Normalised ETR is 27% (excluding tax on dividend from Zinc India), compared to 29% in last quarter due to change in PBT mix within entities. ^EBITDA includes one off for past exploration cost recovery at Oil & Gas business (₹ 1,276 cr) & true-up of RPO liability in line with Regulatory changes at Aluminium Business (₹ 460 cr) in Q3 FY’20 *One Time tax credit/(charge) includes tax on dividend and impact of change in ordinance #Q2 FY21 restated, refer note 7 of Vedanta Limited consolidated results Note: Previous period figures have been regrouped or re-arranged wherever necessary to conform to the current period’s presentation

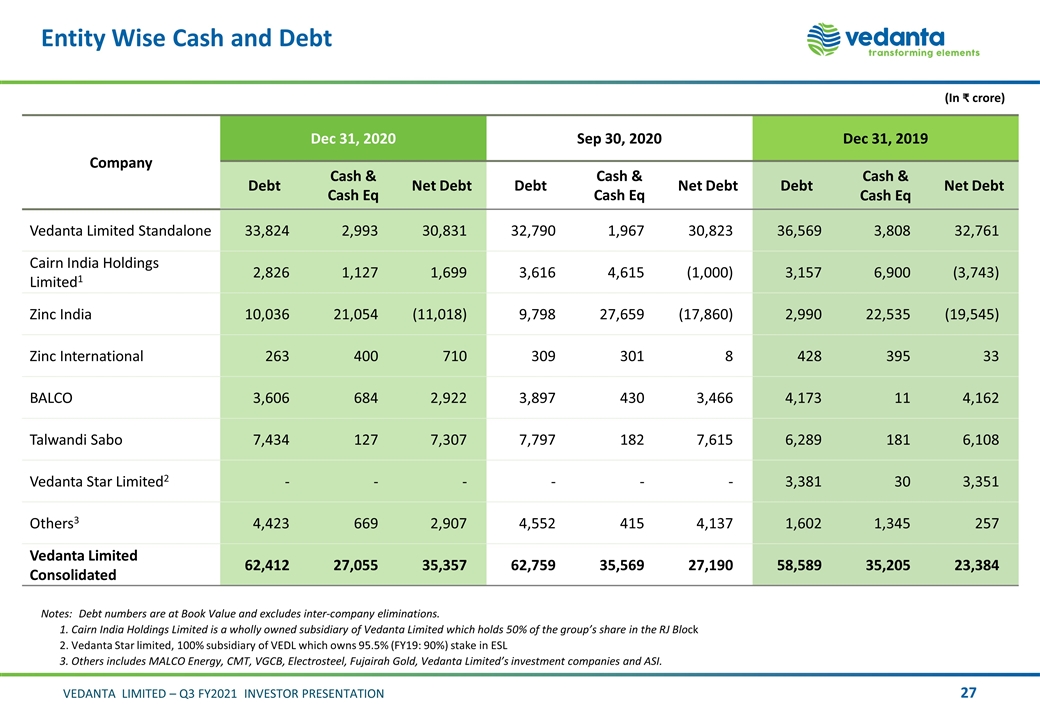

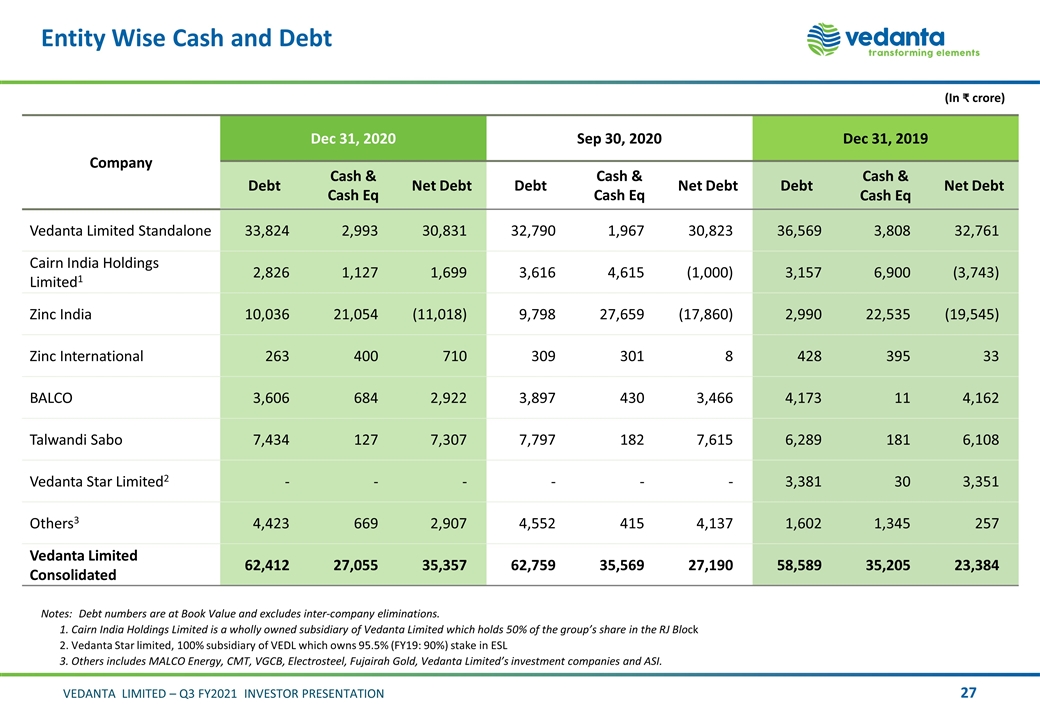

Entity Wise Cash and Debt Company Dec 31, 2020 Sep 30, 2020 Dec 31, 2019 Debt Cash & Cash Eq Net Debt Debt Cash & Cash Eq Net Debt Debt Cash & Cash Eq Net Debt Vedanta Limited Standalone 33,824 2,993 30,831 32,790 1,967 30,823 36,569 3,808 32,761 Cairn India Holdings Limited1 2,826 1,127 1,699 3,616 4,615 (1,000) 3,157 6,900 (3,743) Zinc India 10,036 21,054 (11,018) 9,798 27,659 (17,860) 2,990 22,535 (19,545) Zinc International 263 400 710 309 301 8 428 395 33 BALCO 3,606 684 2,922 3,897 430 3,466 4,173 11 4,162 Talwandi Sabo 7,434 127 7,307 7,797 182 7,615 6,289 181 6,108 Vedanta Star Limited2 - - - - - - 3,381 30 3,351 Others3 4,423 669 2,907 4,552 415 4,137 1,602 1,345 257 Vedanta Limited Consolidated 62,412 27,055 35,357 62,759 35,569 27,190 58,589 35,205 23,384 Notes:Debt numbers are at Book Value and excludes inter-company eliminations. 1. Cairn India Holdings Limited is a wholly owned subsidiary of Vedanta Limited which holds 50% of the group’s share in the RJ Block 2. Vedanta Star limited, 100% subsidiary of VEDL which owns 95.5% (FY19: 90%) stake in ESL 3. Others includes MALCO Energy, CMT, VGCB, Electrosteel, Fujairah Gold, Vedanta Limited’s investment companies and ASI. (In crore)

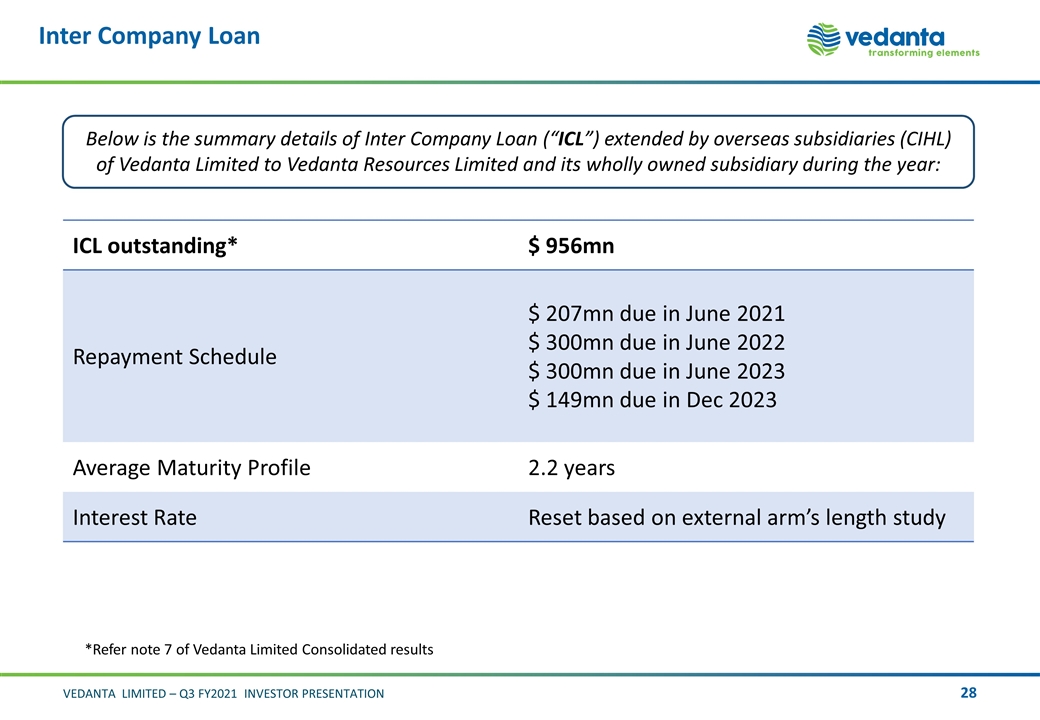

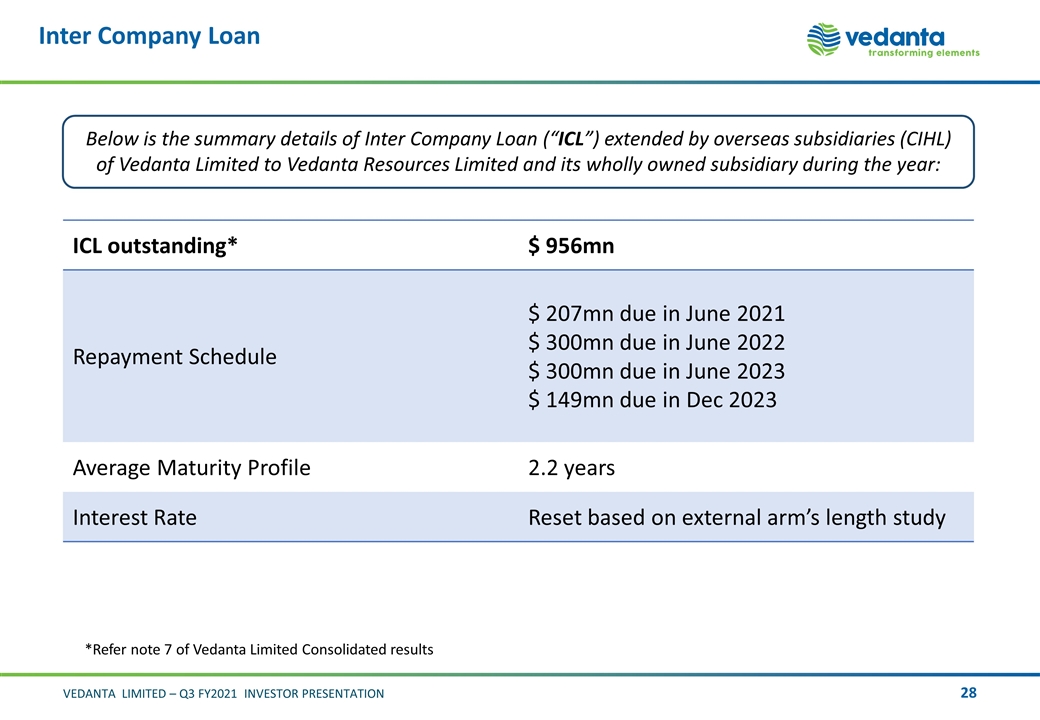

Inter Company Loan Below is the summary details of Inter Company Loan (“ICL”) extended by overseas subsidiaries (CIHL) of Vedanta Limited to Vedanta Resources Limited and its wholly owned subsidiary during the year: ICL outstanding* $ 956mn Repayment Schedule $ 207mn due in June 2021 $ 300mn due in June 2022 $ 300mn due in June 2023 $ 149mn due in Dec 2023 Average Maturity Profile 2.2 years Interest Rate Reset based on external arm’s length study *Refer note 7 of Vedanta Limited Consolidated results

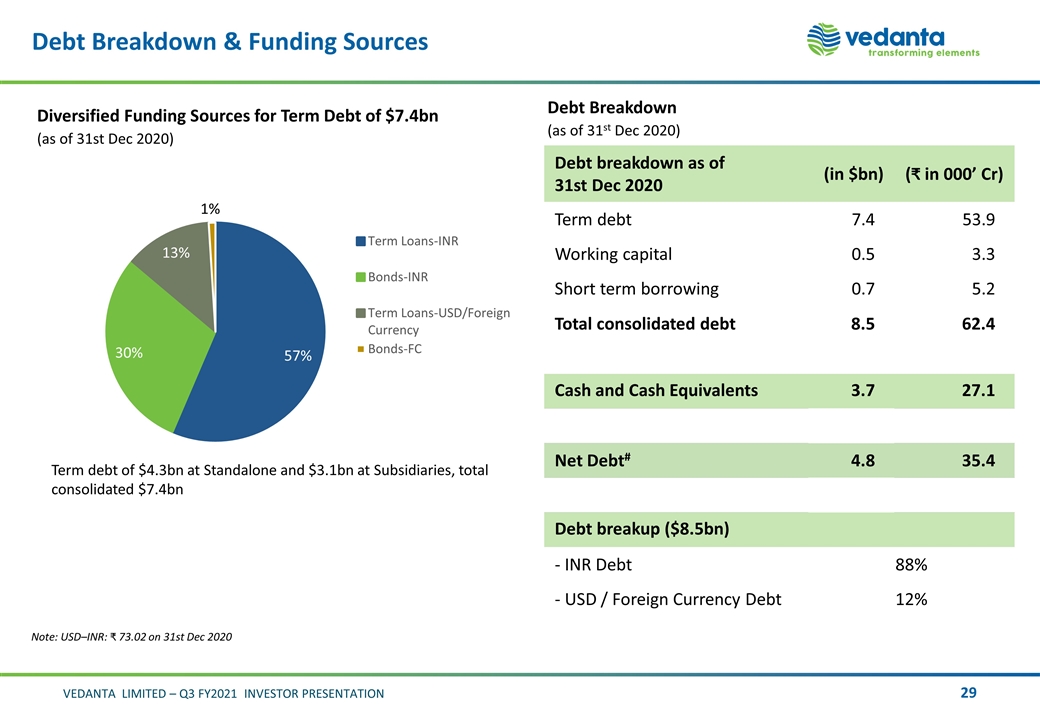

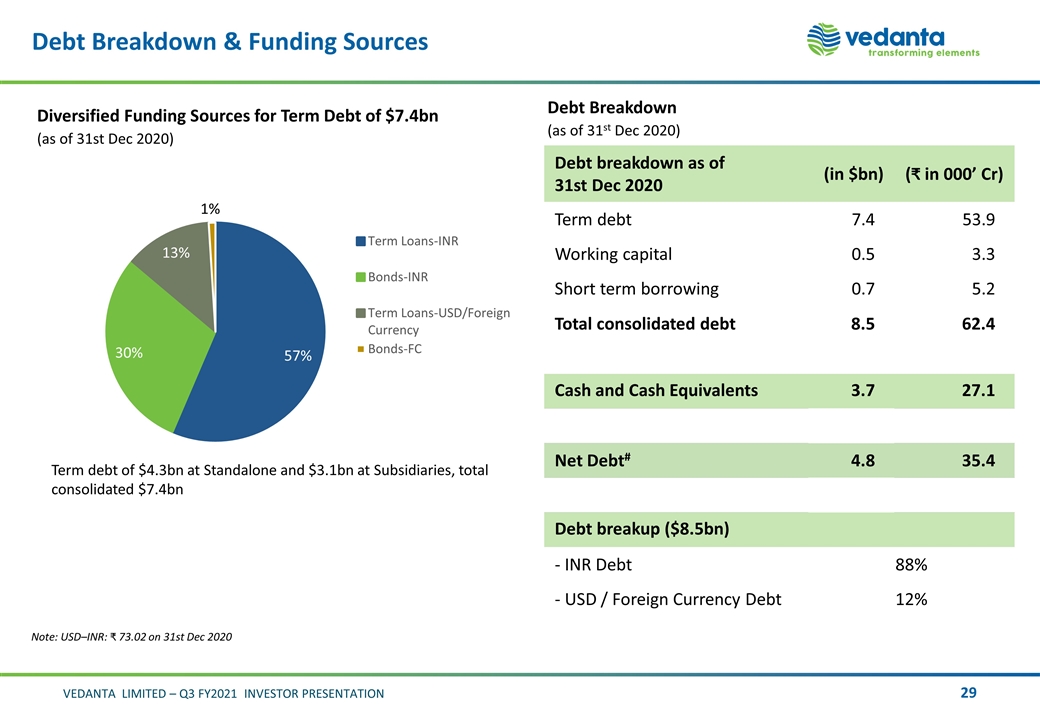

Debt Breakdown & Funding Sources Debt breakdown as of 31st Dec 2020 (in $bn) ( in 000’ Cr) Term debt 7.4 53.9 Working capital 0.5 3.3 Short term borrowing 0.7 5.2 Total consolidated debt 8.5 62.4 Cash and Cash Equivalents 3.7 27.1 Net Debt# 4.8 35.4 Debt breakup ($8.5bn) - INR Debt 88% - USD / Foreign Currency Debt 12% Diversified Funding Sources for Term Debt of $7.4bn (as of 31st Dec 2020) Note: USD–INR: 73.02 on 31st Dec 2020 Term debt of $4.3bn at Standalone and $3.1bn at Subsidiaries, total consolidated $7.4bn Debt Breakdown (as of 31st Dec 2020)

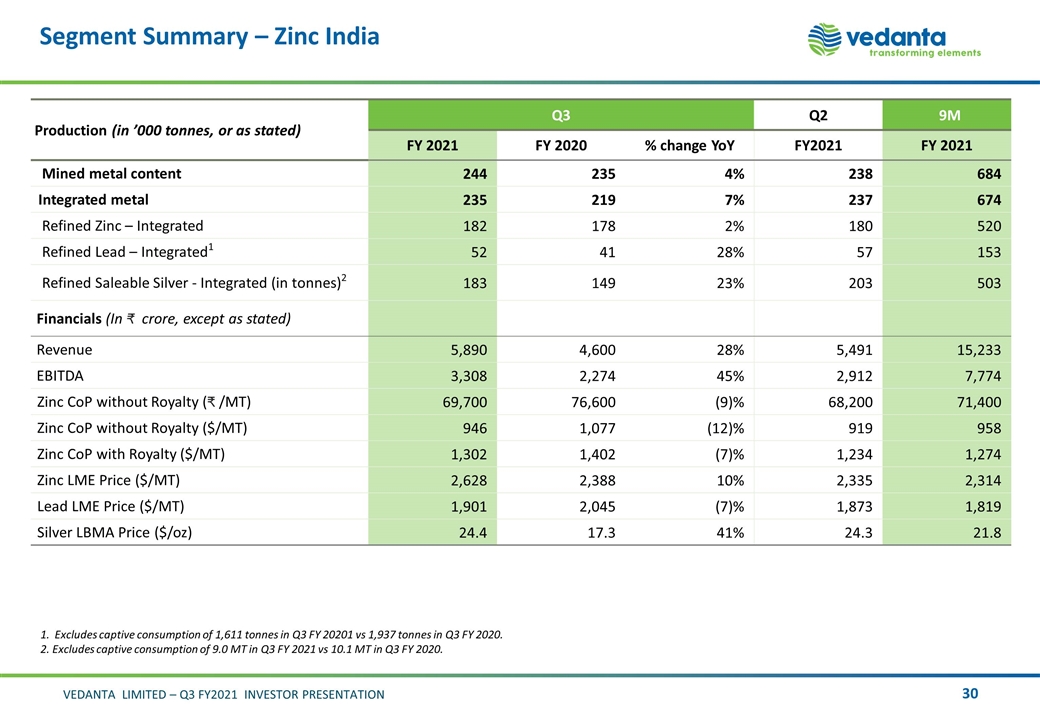

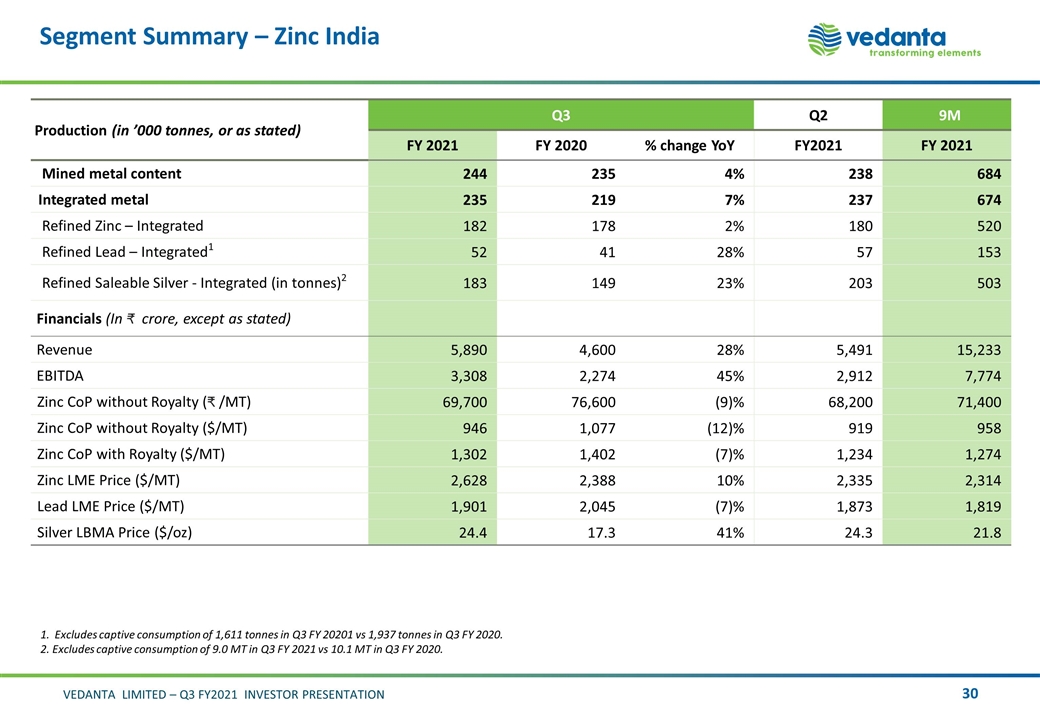

Segment Summary – Zinc India Production (in ’000 tonnes, or as stated) Q3 Q2 9M FY 2021 FY 2020 % change YoY FY2021 FY 2021 Mined metal content 244 235 4% 238 684 Integrated metal 235 219 7% 237 674 Refined Zinc – Integrated 182 178 2% 180 520 Refined Lead – Integrated1 52 41 28% 57 153 Refined Saleable Silver - Integrated (in tonnes)2 183 149 23% 203 503 Financials (In crore, except as stated) Revenue 5,890 4,600 28% 5,491 15,233 EBITDA 3,308 2,274 45% 2,912 7,774 Zinc CoP without Royalty ( /MT) 69,700 76,600 (9)% 68,200 71,400 Zinc CoP without Royalty ($/MT) 946 1,077 (12)% 919 958 Zinc CoP with Royalty ($/MT) 1,302 1,402 (7)% 1,234 1,274 Zinc LME Price ($/MT) 2,628 2,388 10% 2,335 2,314 Lead LME Price ($/MT) 1,901 2,045 (7)% 1,873 1,819 Silver LBMA Price ($/oz) 24.4 17.3 41% 24.3 21.8 1. Excludes captive consumption of 1,611 tonnes in Q3 FY 20201 vs 1,937 tonnes in Q3 FY 2020. 2. Excludes captive consumption of 9.0 MT in Q3 FY 2021 vs 10.1 MT in Q3 FY 2020.

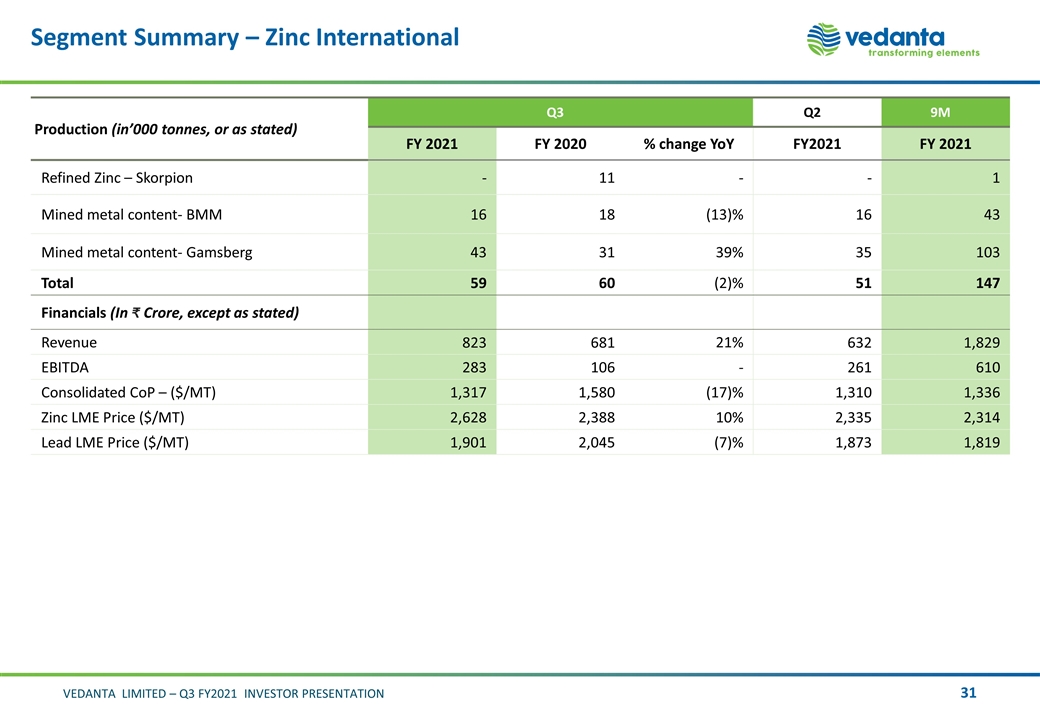

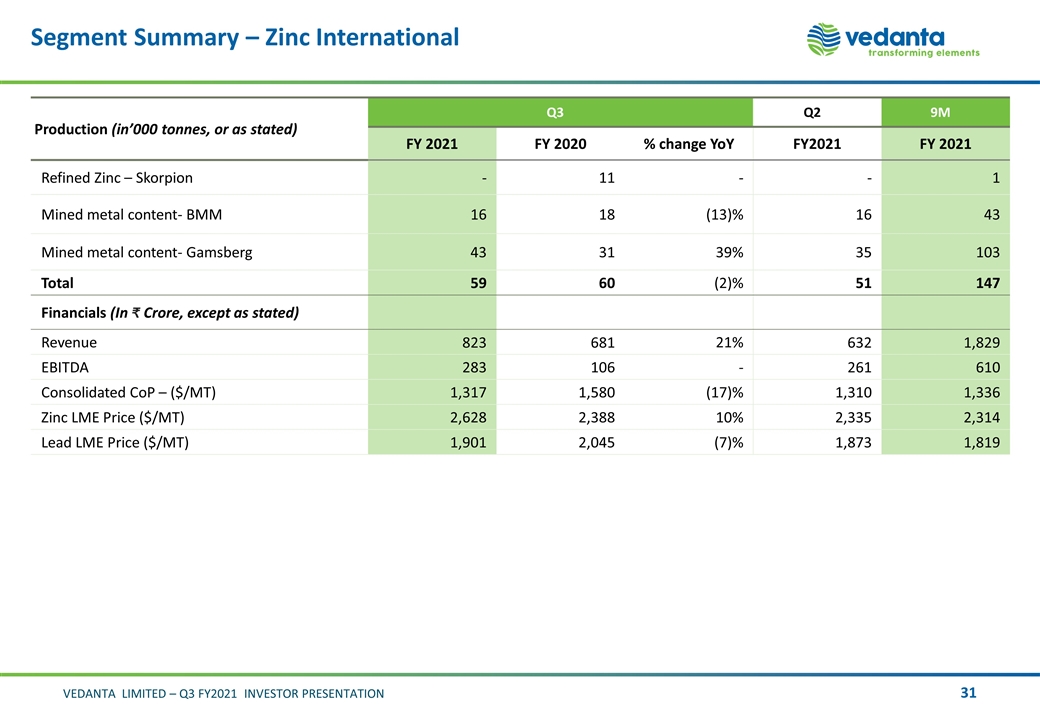

Segment Summary – Zinc International Production (in’000 tonnes, or as stated) Q3 Q2 9M FY 2021 FY 2020 % change YoY FY2021 FY 2021 Refined Zinc – Skorpion - 11 - - 1 Mined metal content- BMM 16 18 (13)% 16 43 Mined metal content- Gamsberg 43 31 39% 35 103 Total 59 60 (2)% 51 147 Financials (In Crore, except as stated) Revenue 823 681 21% 632 1,829 EBITDA 283 106 - 261 610 Consolidated CoP – ($/MT) 1,317 1,580 (17)% 1,310 1,336 Zinc LME Price ($/MT) 2,628 2,388 10% 2,335 2,314 Lead LME Price ($/MT) 1,901 2,045 (7)% 1,873 1,819

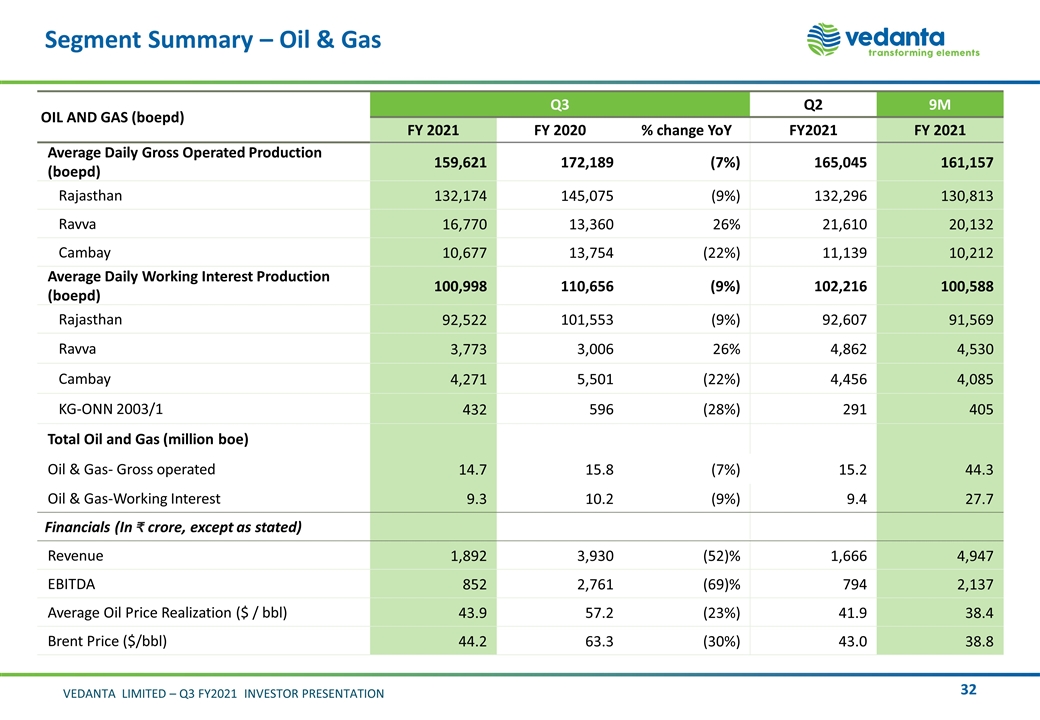

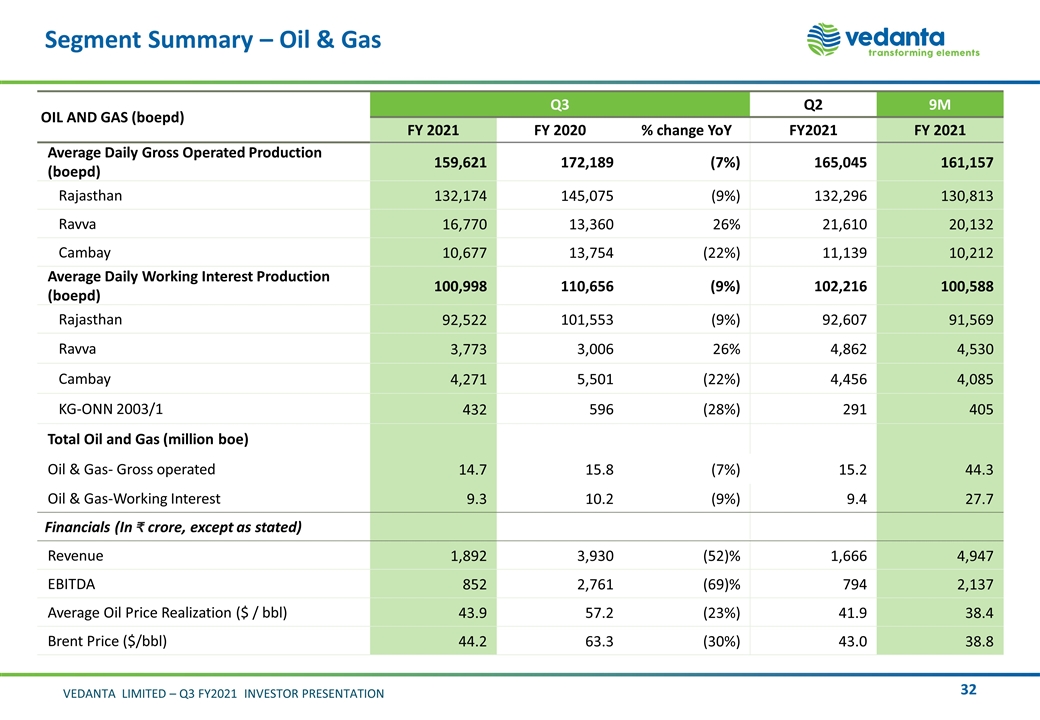

Segment Summary – Oil & Gas OIL AND GAS (boepd) Q3 Q2 9M FY 2021 FY 2020 % change YoY FY2021 FY 2021 Average Daily Gross Operated Production (boepd) 159,621 172,189 (7%) 165,045 161,157 Rajasthan 132,174 145,075 (9%) 132,296 130,813 Ravva 16,770 13,360 26% 21,610 20,132 Cambay 10,677 13,754 (22%) 11,139 10,212 Average Daily Working Interest Production (boepd) 100,998 110,656 (9%) 102,216 100,588 Rajasthan 92,522 101,553 (9%) 92,607 91,569 Ravva 3,773 3,006 26% 4,862 4,530 Cambay 4,271 5,501 (22%) 4,456 4,085 KG-ONN 2003/1 432 596 (28%) 291 405 Total Oil and Gas (million boe) Oil & Gas- Gross operated 14.7 15.8 (7%) 15.2 44.3 Oil & Gas-Working Interest 9.3 10.2 (9%) 9.4 27.7 Financials (In crore, except as stated) Revenue 1,892 3,930 (52)% 1,666 4,947 EBITDA 852 2,761 (69)% 794 2,137 Average Oil Price Realization ($ / bbl) 43.9 57.2 (23%) 41.9 38.4 Brent Price ($/bbl) 44.2 63.3 (30%) 43.0 38.8

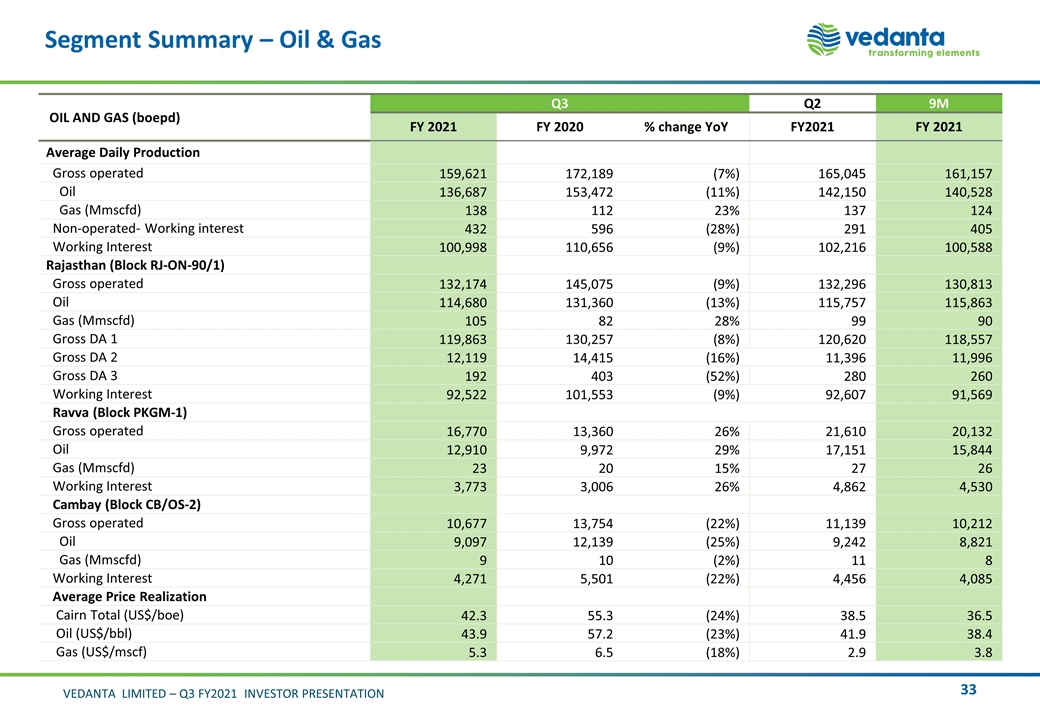

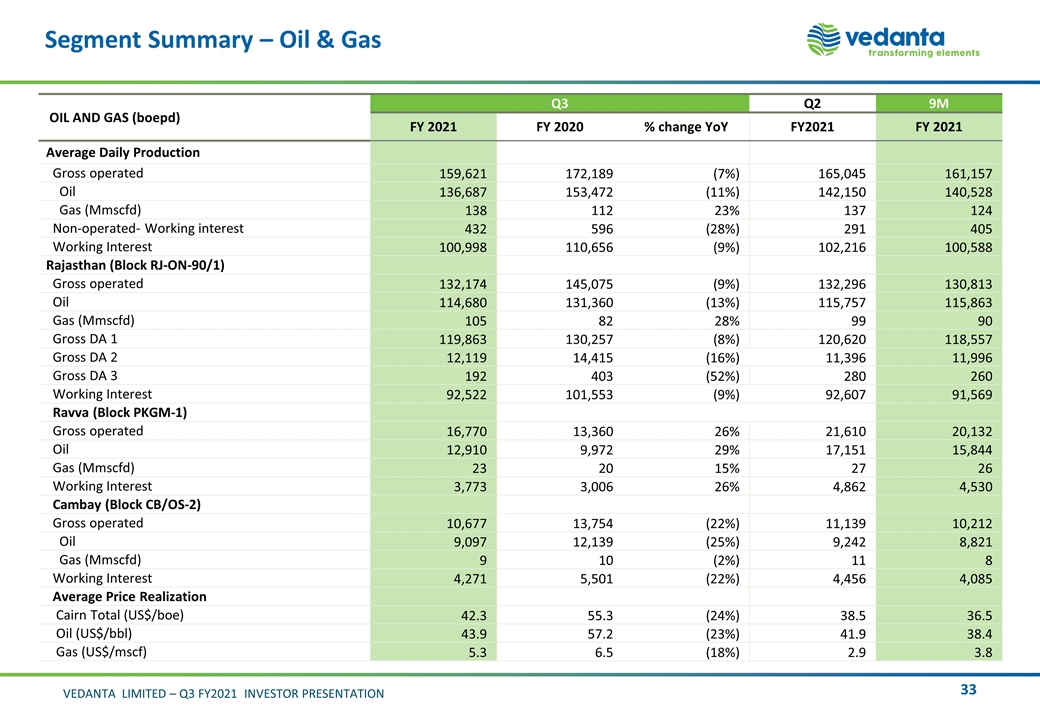

OIL AND GAS (boepd) Q3 Q2 9M FY 2021 FY 2020 % change YoY FY2021 FY 2021 Average Daily Production Gross operated 159,621 172,189 (7%) 165,045 161,157 Oil 136,687 153,472 (11%) 142,150 140,528 Gas (Mmscfd) 138 112 23% 137 124 Non-operated- Working interest 432 596 (28%) 291 405 Working Interest 100,998 110,656 (9%) 102,216 100,588 Rajasthan (Block RJ-ON-90/1) Gross operated 132,174 145,075 (9%) 132,296 130,813 Oil 114,680 131,360 (13%) 115,757 115,863 Gas (Mmscfd) 105 82 28% 99 90 Gross DA 1 119,863 130,257 (8%) 120,620 118,557 Gross DA 2 12,119 14,415 (16%) 11,396 11,996 Gross DA 3 192 403 (52%) 280 260 Working Interest 92,522 101,553 (9%) 92,607 91,569 Ravva (Block PKGM-1) Gross operated 16,770 13,360 26% 21,610 20,132 Oil 12,910 9,972 29% 17,151 15,844 Gas (Mmscfd) 23 20 15% 27 26 Working Interest 3,773 3,006 26% 4,862 4,530 Cambay (Block CB/OS-2) Gross operated 10,677 13,754 (22%) 11,139 10,212 Oil 9,097 12,139 (25%) 9,242 8,821 Gas (Mmscfd) 9 10 (2%) 11 8 Working Interest 4,271 5,501 (22%) 4,456 4,085 Average Price Realization Cairn Total (US$/boe) 42.3 55.3 (24%) 38.5 36.5 Oil (US$/bbl) 43.9 57.2 (23%) 41.9 38.4 Gas (US$/mscf) 5.3 6.5 (18%) 2.9 3.8 Segment Summary – Oil & Gas

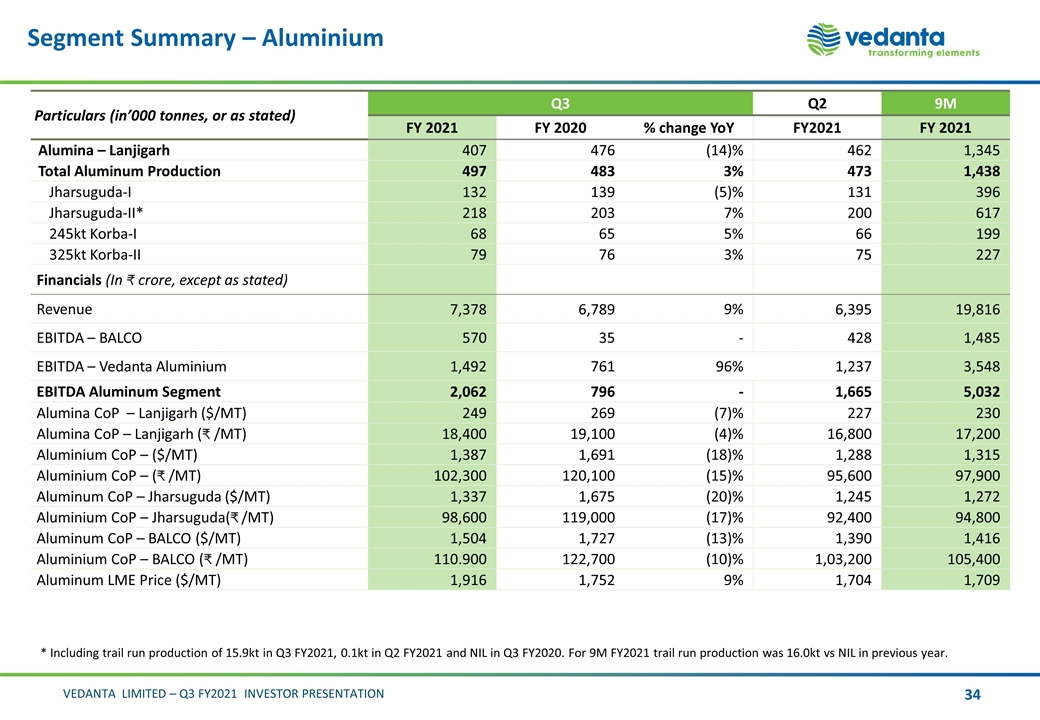

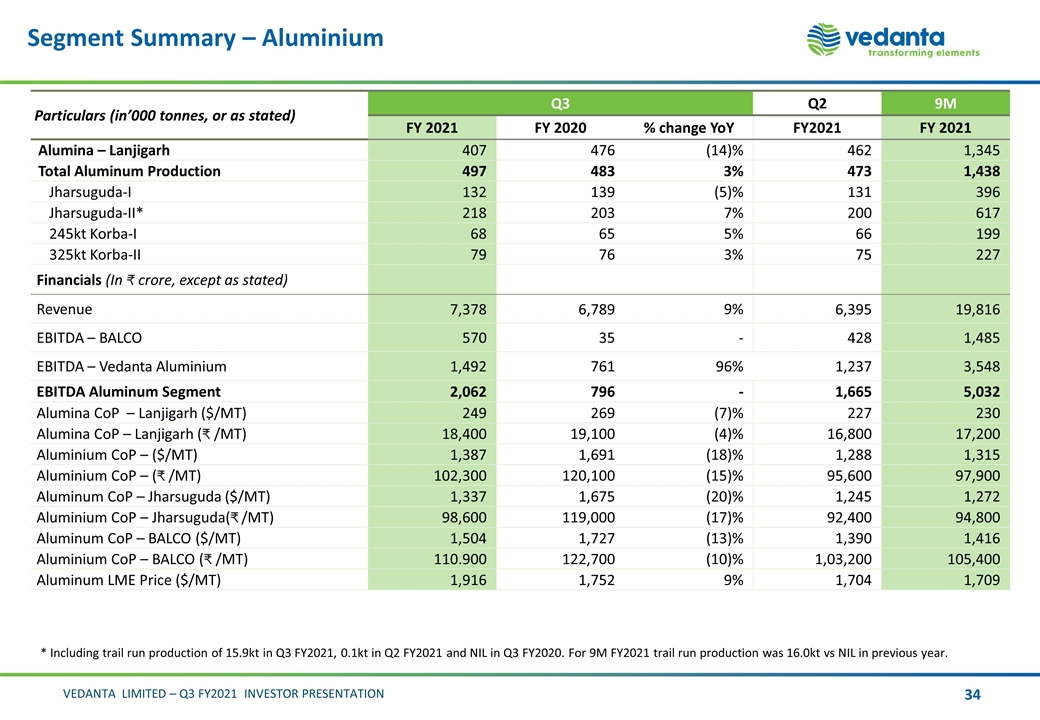

Segment Summary – Aluminium Particulars (in’000 tonnes, or as stated) Q3 Q2 9M FY 2021 FY 2020 % change YoY FY2021 FY 2021 Alumina – Lanjigarh 407 476 (14)% 462 1,345 Total Aluminum Production 497 483 3% 473 1,438 Jharsuguda-I 132 139 (5)% 131 396 Jharsuguda-II* 218 203 7% 200 617 245kt Korba-I 68 65 5% 66 199 325kt Korba-II 79 76 3% 75 227 Financials (In crore, except as stated) Revenue 7,378 6,789 9% 6,395 19,816 EBITDA – BALCO 570 35 - 428 1,485 EBITDA – Vedanta Aluminium 1,492 761 96% 1,237 3,548 EBITDA Aluminum Segment 2,062 796 - 1,665 5,032 Alumina CoP – Lanjigarh ($/MT) 249 269 (7)% 227 230 Alumina CoP – Lanjigarh ( /MT) 18,400 19,100 (4)% 16,800 17,200 Aluminium CoP – ($/MT) 1,387 1,691 (18)% 1,288 1,315 Aluminium CoP – ( /MT) 102,300 120,100 (15)% 95,600 97,900 Aluminum CoP – Jharsuguda ($/MT) 1,337 1,675 (20)% 1,245 1,272 Aluminium CoP – Jharsuguda( /MT) 98,600 119,000 (17)% 92,400 94,800 Aluminum CoP – BALCO ($/MT) 1,504 1,727 (13)% 1,390 1,416 Aluminium CoP – BALCO ( /MT) 110.900 122,700 (10)% 1,03,200 105,400 Aluminum LME Price ($/MT) 1,916 1,752 9% 1,704 1,709 * Including trail run production of 15.9kt in Q3 FY2021, 0.1kt in Q2 FY2021 and NIL in Q3 FY2020. For 9M FY2021 trail run production was 16.0kt vs NIL in previous year.

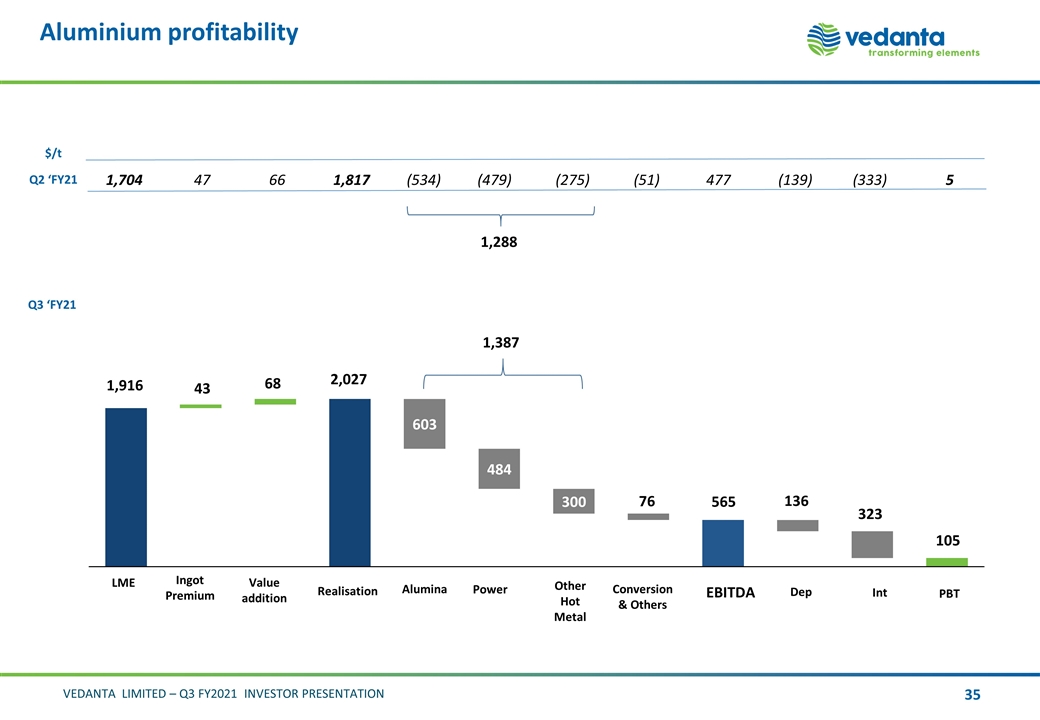

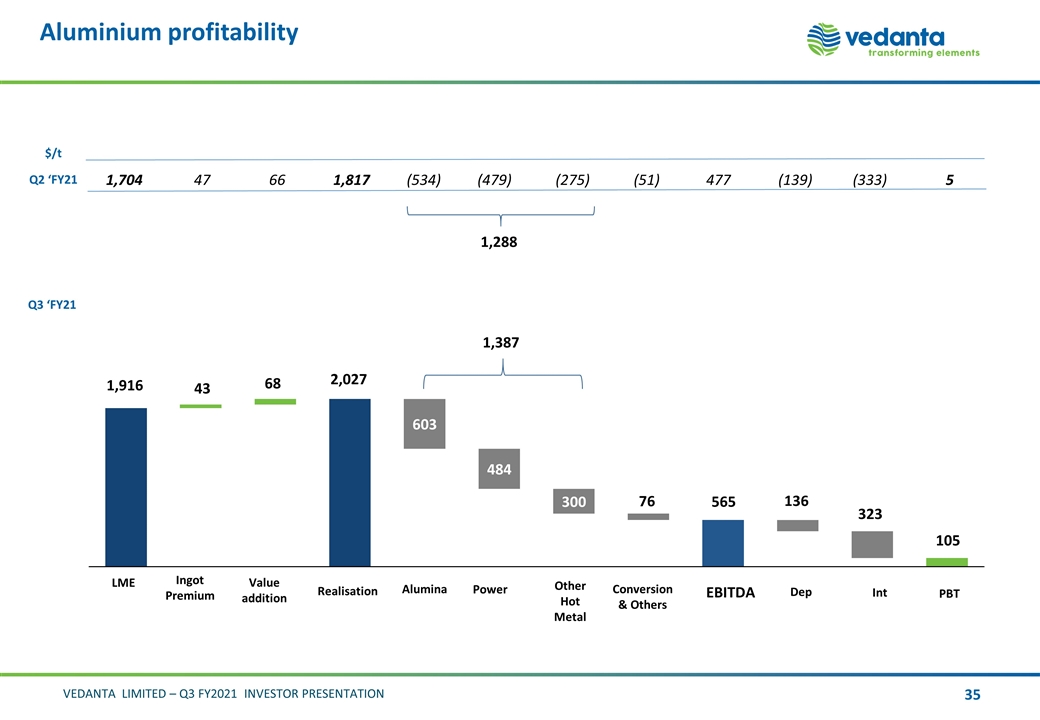

Aluminium profitability Q2 ‘FY21 $/t Q3 ‘FY21 68 43 323 565 105 1,704 47 66 1,817 (534) (479) (275) (51) 477 (139) (333) 5 1,288 1,387

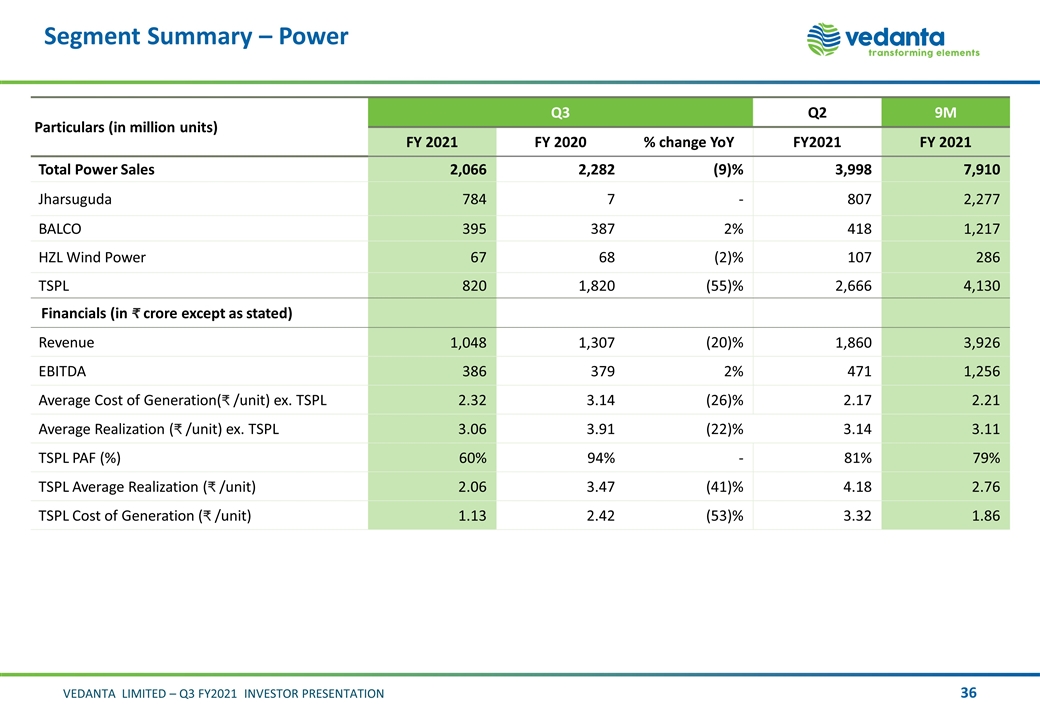

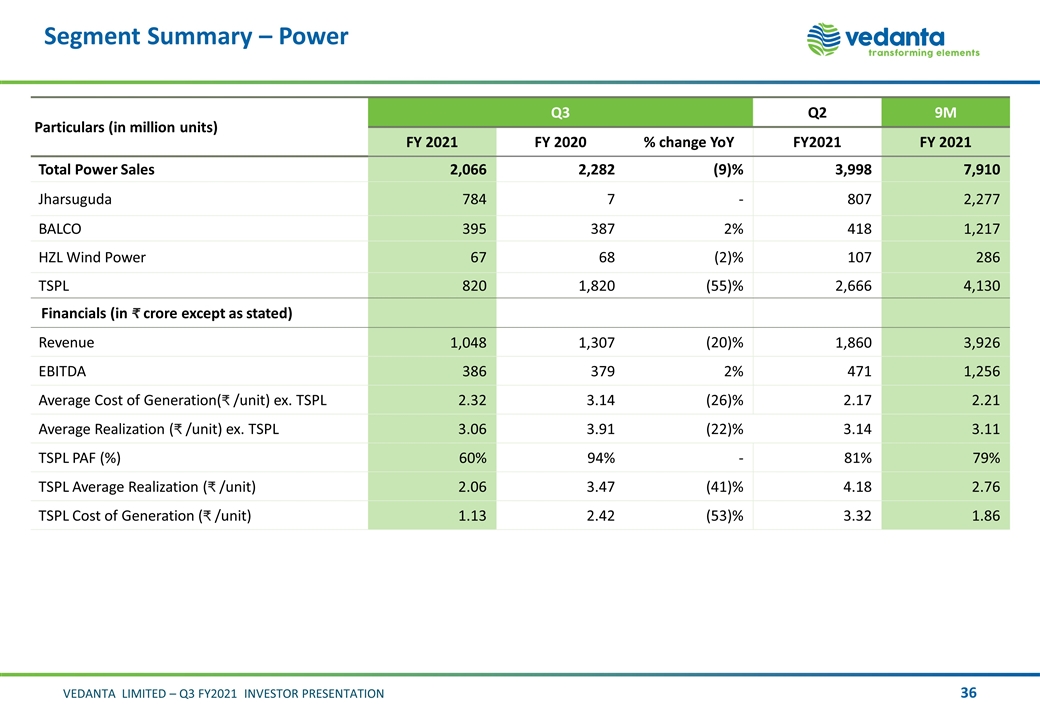

Segment Summary – Power Particulars (in million units) Q3 Q2 9M FY 2021 FY 2020 % change YoY FY2021 FY 2021 Total Power Sales 2,066 2,282 (9)% 3,998 7,910 Jharsuguda 784 7 - 807 2,277 BALCO 395 387 2% 418 1,217 HZL Wind Power 67 68 (2)% 107 286 TSPL 820 1,820 (55)% 2,666 4,130 Financials (in crore except as stated) Revenue 1,048 1,307 (20)% 1,860 3,926 EBITDA 386 379 2% 471 1,256 Average Cost of Generation( /unit) ex. TSPL 2.32 3.14 (26)% 2.17 2.21 Average Realization ( /unit) ex. TSPL 3.06 3.91 (22)% 3.14 3.11 TSPL PAF (%) 60% 94% - 81% 79% TSPL Average Realization ( /unit) 2.06 3.47 (41)% 4.18 2.76 TSPL Cost of Generation ( /unit) 1.13 2.42 (53)% 3.32 1.86

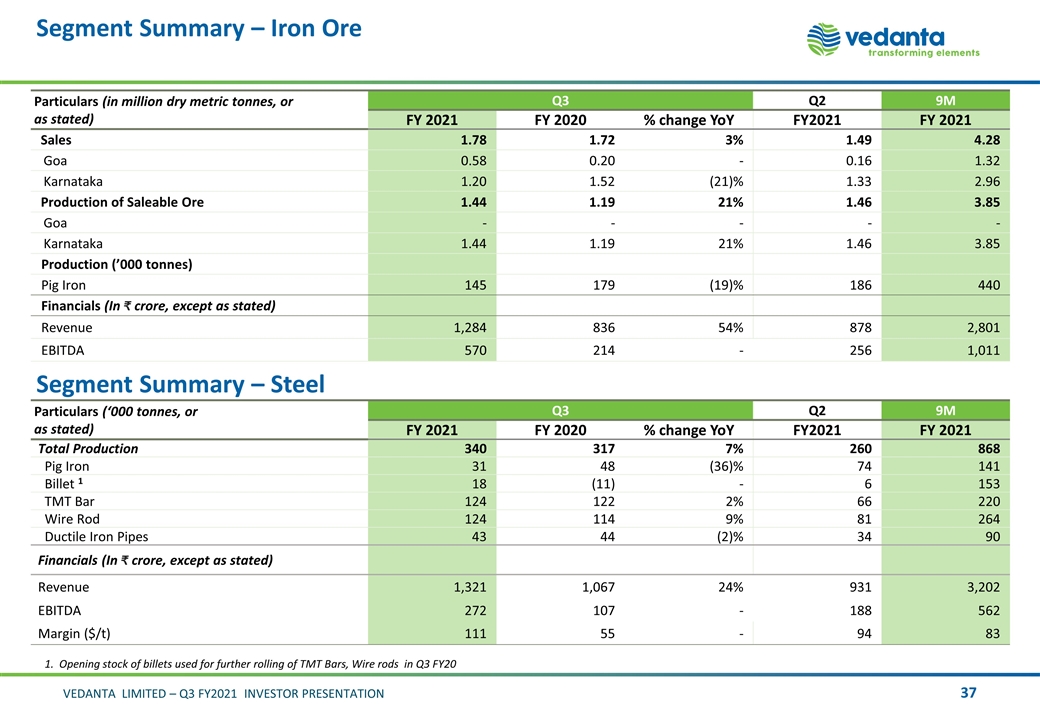

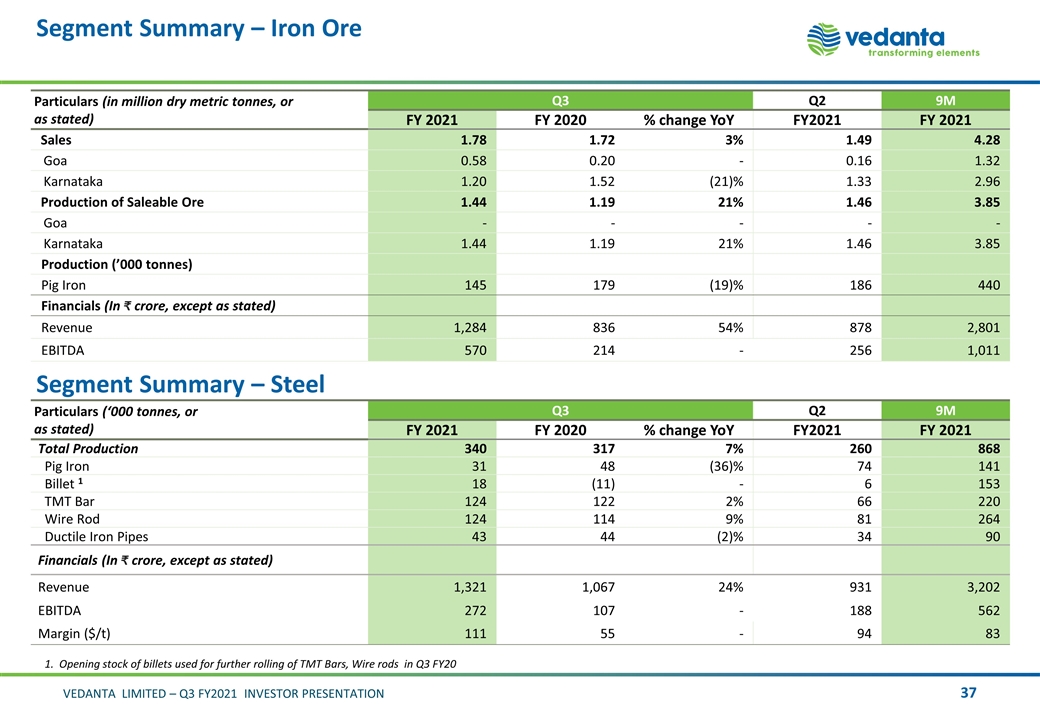

Segment Summary – Iron Ore Particulars (in million dry metric tonnes, or as stated) Q3 Q2 9M FY 2021 FY 2020 % change YoY FY2021 FY 2021 Sales 1.78 1.72 3% 1.49 4.28 Goa 0.58 0.20 - 0.16 1.32 Karnataka 1.20 1.52 (21)% 1.33 2.96 Production of Saleable Ore 1.44 1.19 21% 1.46 3.85 Goa - - - - - Karnataka 1.44 1.19 21% 1.46 3.85 Production (’000 tonnes) Pig Iron 145 179 (19)% 186 440 Financials (In crore, except as stated) Revenue 1,284 836 54% 878 2,801 EBITDA 570 214 - 256 1,011 Segment Summary – Steel Particulars (‘000 tonnes, or as stated) Q3 Q2 9M FY 2021 FY 2020 % change YoY FY2021 FY 2021 Total Production 340 317 7% 260 868 Pig Iron 31 48 (36)% 74 141 Billet 1 18 (11) - 6 153 TMT Bar 124 122 2% 66 220 Wire Rod 124 114 9% 81 264 Ductile Iron Pipes 43 44 (2)% 34 90 Financials (In crore, except as stated) Revenue 1,321 1,067 24% 931 3,202 EBITDA 272 107 - 188 562 Margin ($/t) 111 55 - 94 83 1. Opening stock of billets used for further rolling of TMT Bars, Wire rods in Q3 FY20

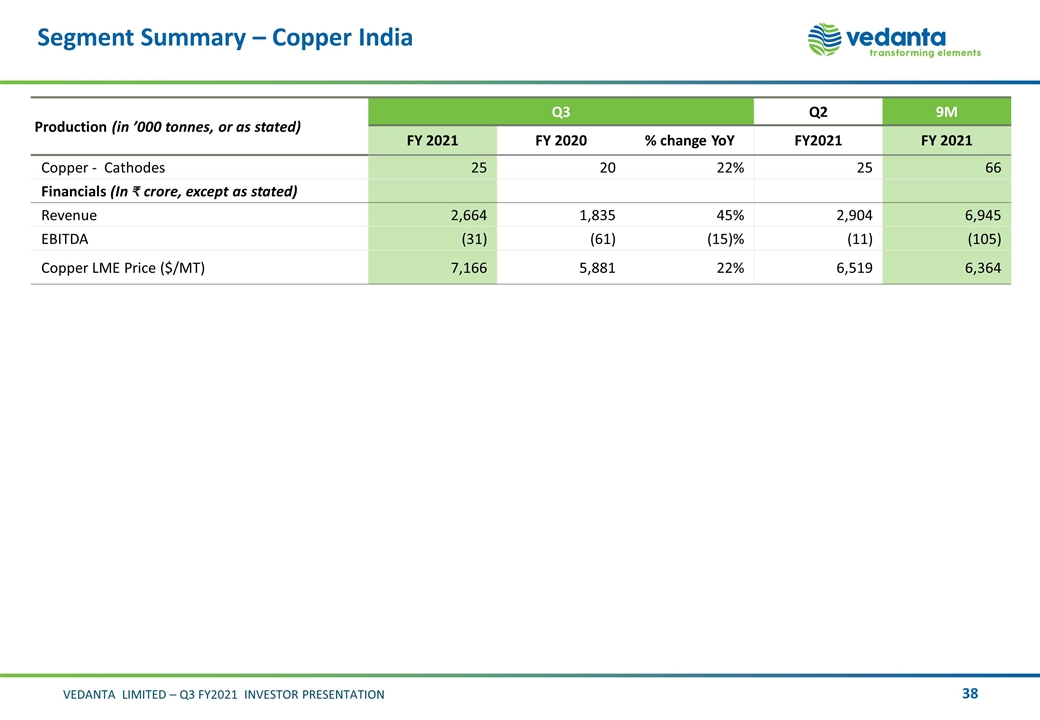

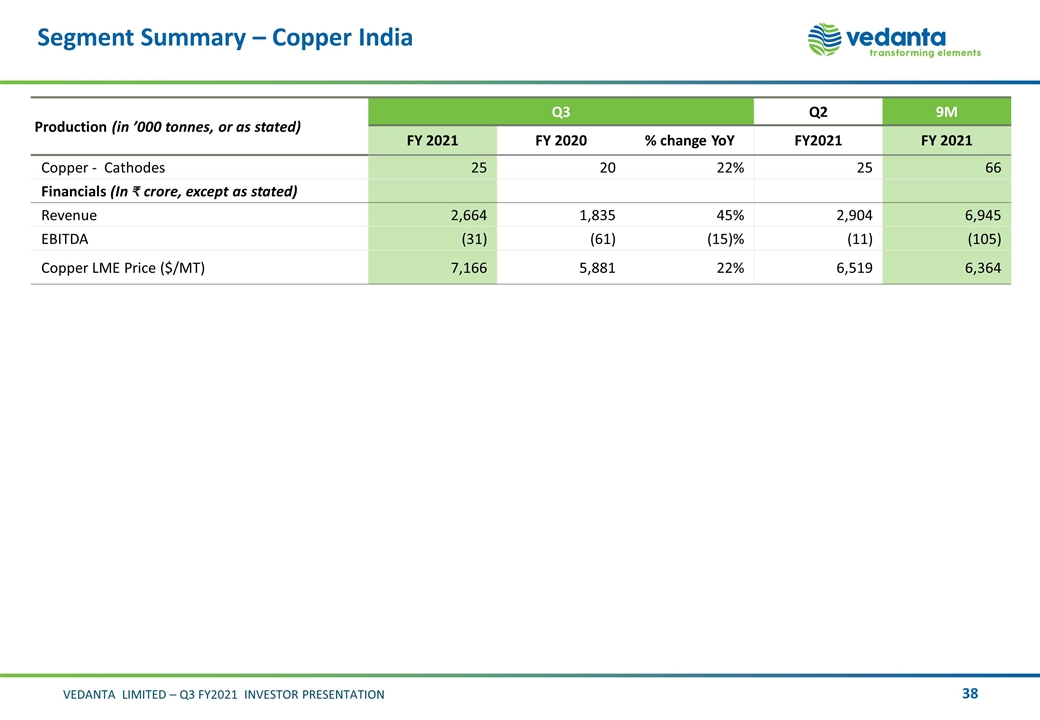

Segment Summary – Copper India Production (in ’000 tonnes, or as stated) Q3 Q2 9M FY 2021 FY 2020 % change YoY FY2021 FY 2021 Copper - Cathodes 25 20 22% 25 66 Financials (In crore, except as stated) Revenue 2,664 1,835 45% 2,904 6,945 EBITDA (31) (61) (15)% (11) (105) Copper LME Price ($/MT) 7,166 5,881 22% 6,519 6,364

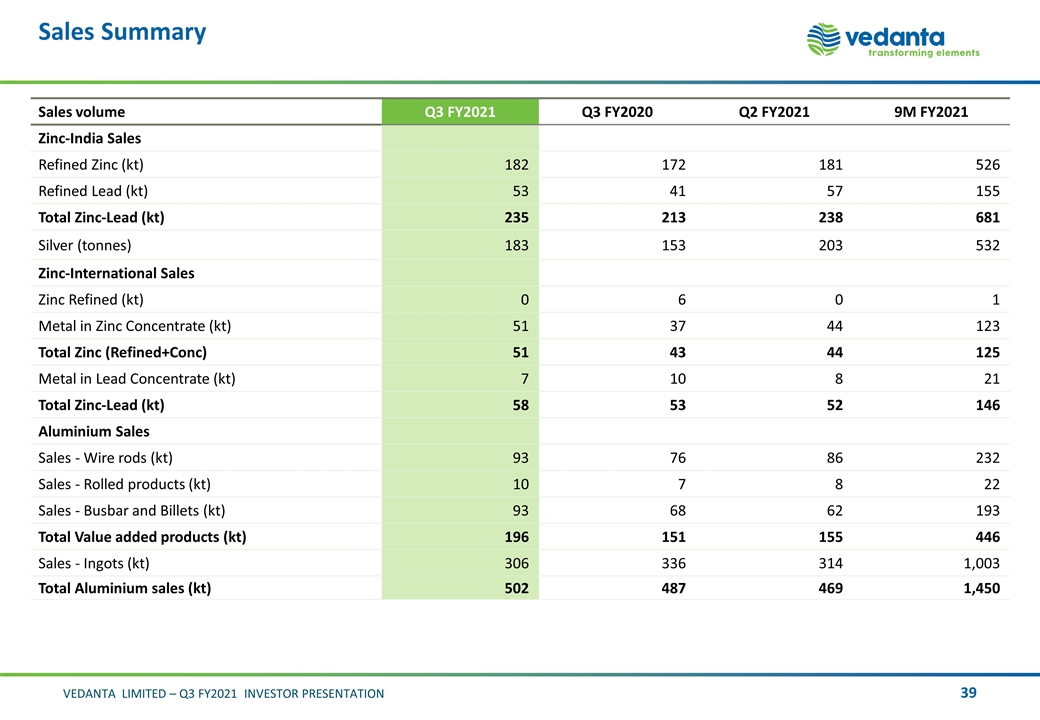

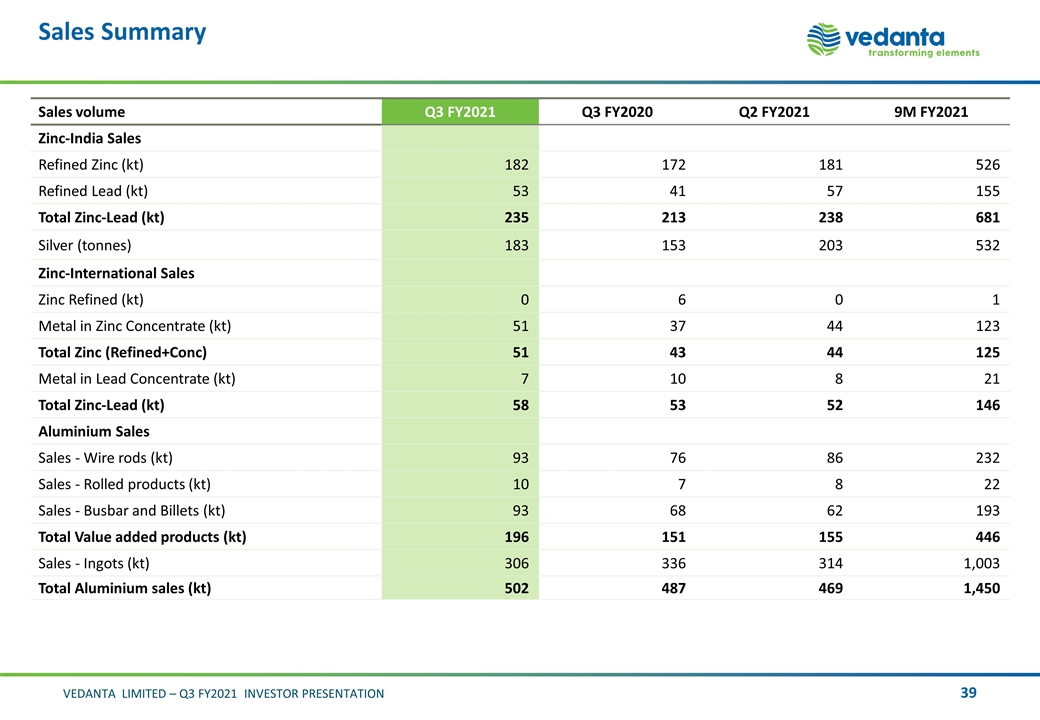

Sales Summary Sales volume Q3 FY2021 Q3 FY2020 Q2 FY2021 9M FY2021 Zinc-India Sales Refined Zinc (kt) 182 172 181 526 Refined Lead (kt) 53 41 57 155 Total Zinc-Lead (kt) 235 213 238 681 Silver (tonnes) 183 153 203 532 Zinc-International Sales Zinc Refined (kt) 0 6 0 1 Metal in Zinc Concentrate (kt) 51 37 44 123 Total Zinc (Refined+Conc) 51 43 44 125 Metal in Lead Concentrate (kt) 7 10 8 21 Total Zinc-Lead (kt) 58 53 52 146 Aluminium Sales Sales - Wire rods (kt) 93 76 86 232 Sales - Rolled products (kt) 10 7 8 22 Sales - Busbar and Billets (kt) 93 68 62 193 Total Value added products (kt) 196 151 155 446 Sales - Ingots (kt) 306 336 314 1,003 Total Aluminium sales (kt) 502 487 469 1,450

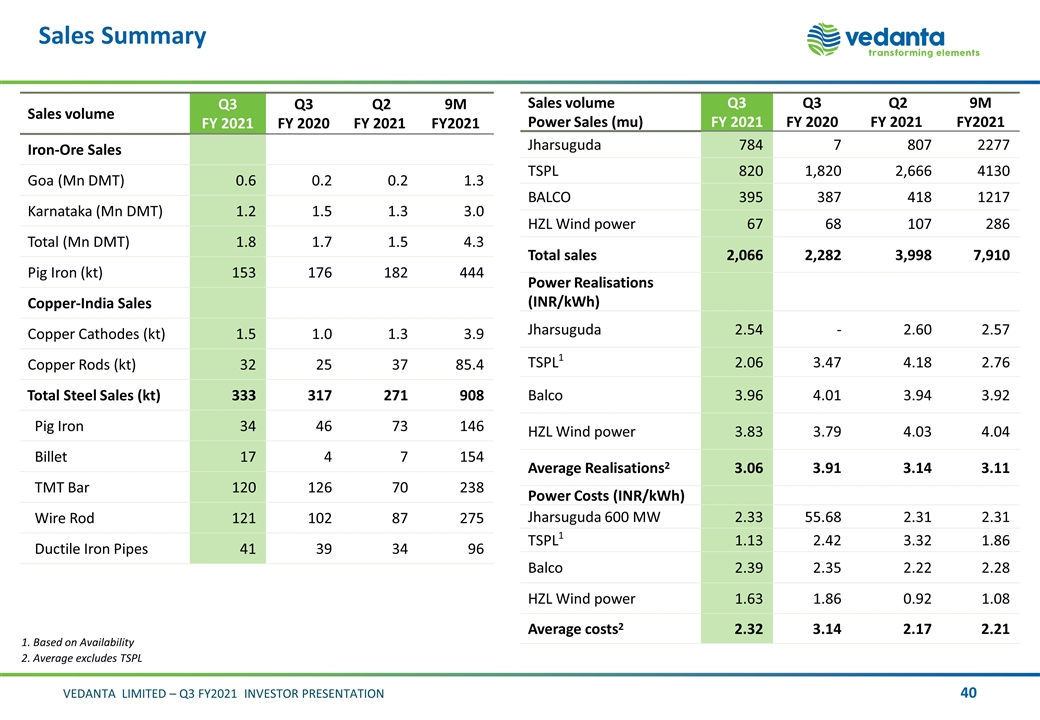

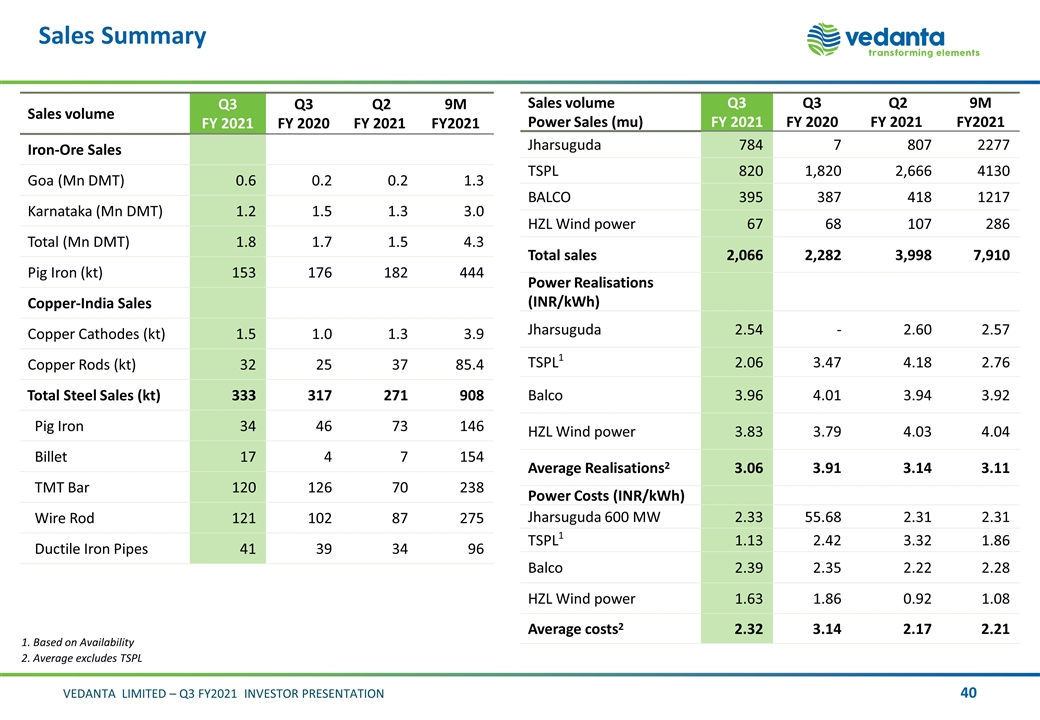

Sales Summary Sales volume Q3 FY 2021 Q3 FY 2020 Q2 FY 2021 9M FY2021 Iron-Ore Sales Goa (Mn DMT) 0.6 0.2 0.2 1.3 Karnataka (Mn DMT) 1.2 1.5 1.3 3.0 Total (Mn DMT) 1.8 1.7 1.5 4.3 Pig Iron (kt) 153 176 182 444 Copper-India Sales Copper Cathodes (kt) 1.5 1.0 1.3 3.9 Copper Rods (kt) 32 25 37 85.4 Total Steel Sales (kt) 333 317 271 908 Pig Iron 34 46 73 146 Billet 17 4 7 154 TMT Bar 120 126 70 238 Wire Rod 121 102 87 275 Ductile Iron Pipes 41 39 34 96 Sales volume Power Sales (mu) Q3 FY 2021 Q3 FY 2020 Q2 FY 2021 9M FY2021 Jharsuguda 784 7 807 2277 TSPL 820 1,820 2,666 4130 BALCO 395 387 418 1217 HZL Wind power 67 68 107 286 Total sales 2,066 2,282 3,998 7,910 Power Realisations (INR/kWh) Jharsuguda 2.54 - 2.60 2.57 TSPL1 2.06 3.47 4.18 2.76 Balco 3.96 4.01 3.94 3.92 HZL Wind power 3.83 3.79 4.03 4.04 Average Realisations2 3.06 3.91 3.14 3.11 Power Costs (INR/kWh) Jharsuguda 600 MW 2.33 55.68 2.31 2.31 TSPL1 1.13 2.42 3.32 1.86 Balco 2.39 2.35 2.22 2.28 HZL Wind power 1.63 1.86 0.92 1.08 Average costs2 2.32 3.14 2.17 2.21 1. Based on Availability 2. Average excludes TSPL

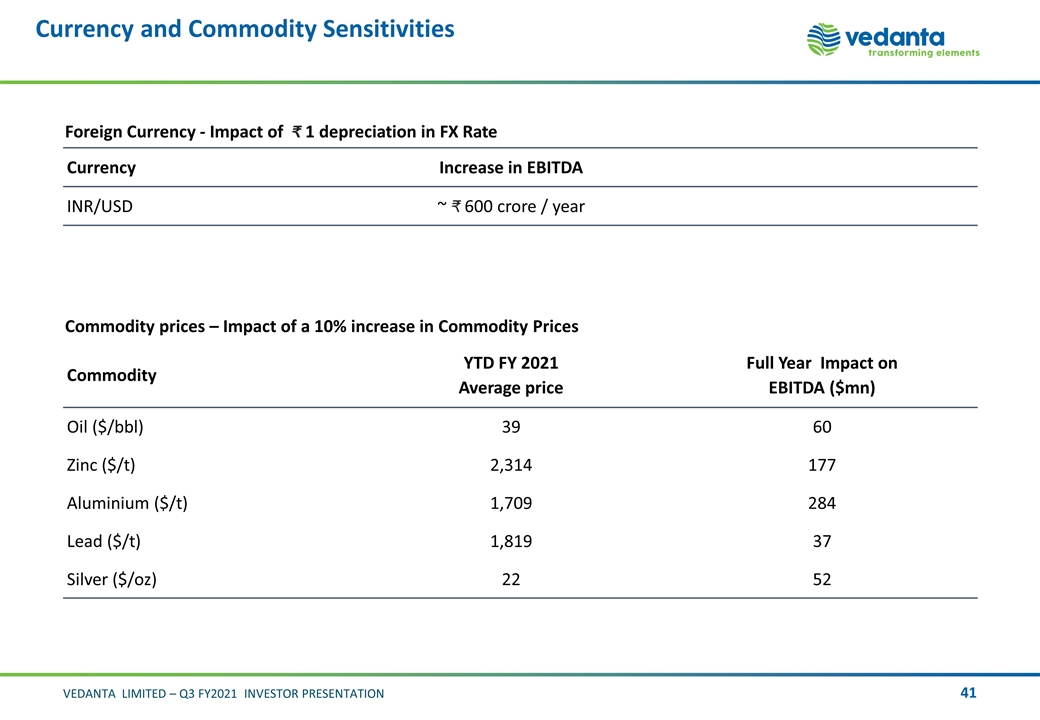

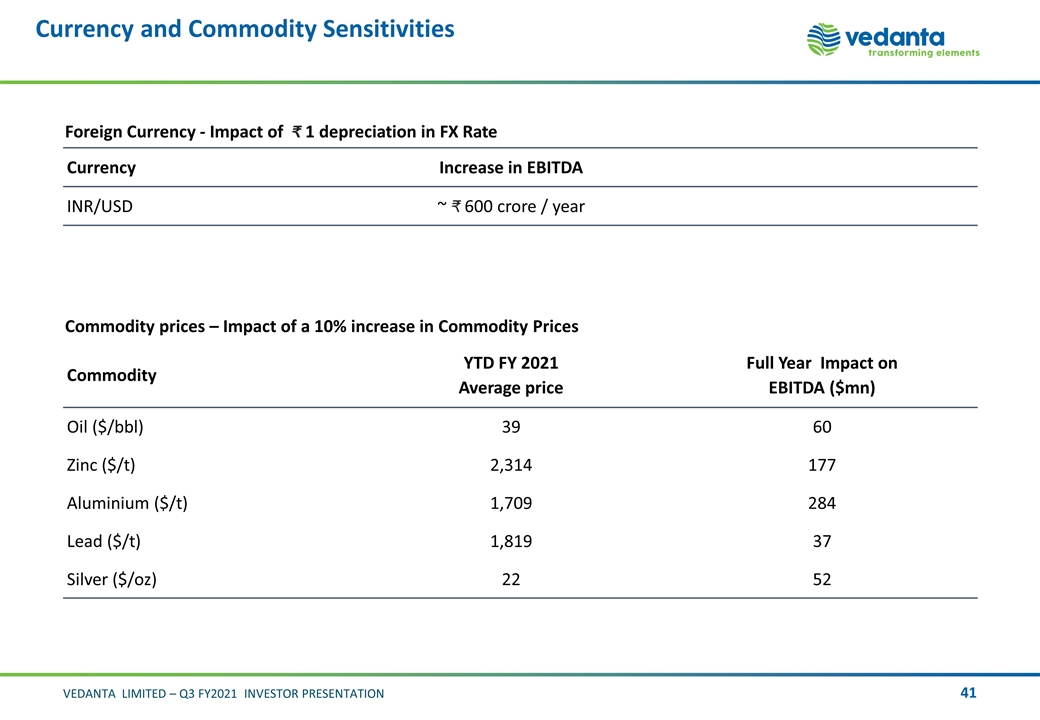

Currency and Commodity Sensitivities Commodity prices – Impact of a 10% increase in Commodity Prices Commodity YTD FY 2021 Average price Full Year Impact on EBITDA ($mn) Oil ($/bbl) 39 60 Zinc ($/t) 2,314 177 Aluminium ($/t) 1,709 284 Lead ($/t) 1,819 37 Silver ($/oz) 22 52 Foreign Currency - Impact of ₹ 1 depreciation in FX Rate Currency Increase in EBITDA INR/USD ~ 600 crore / year

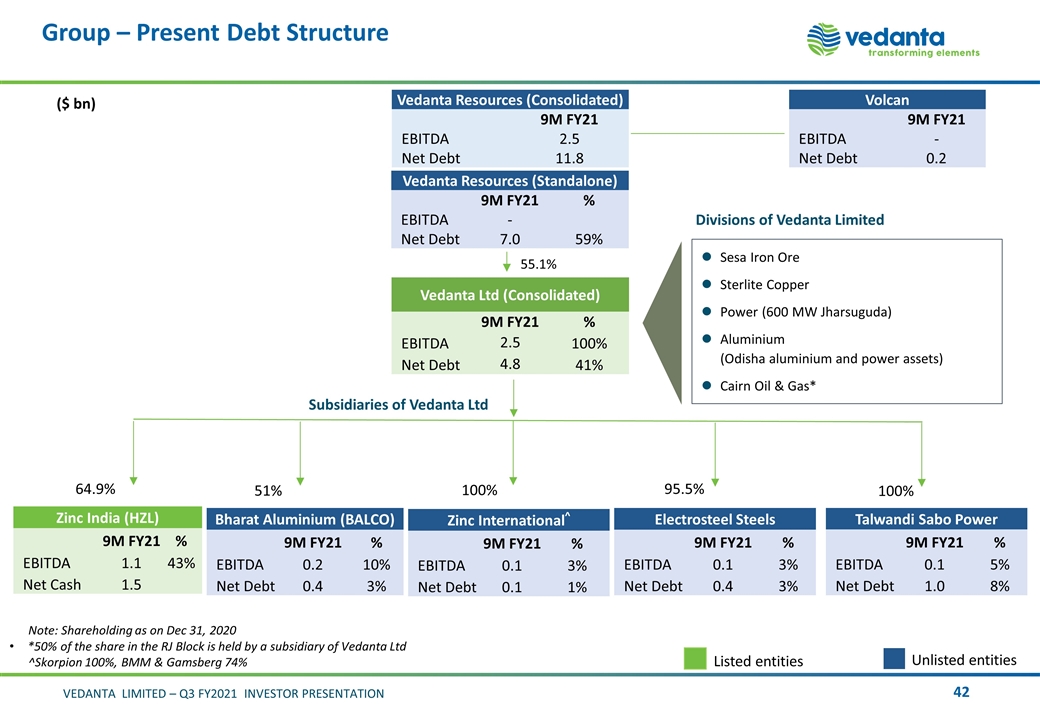

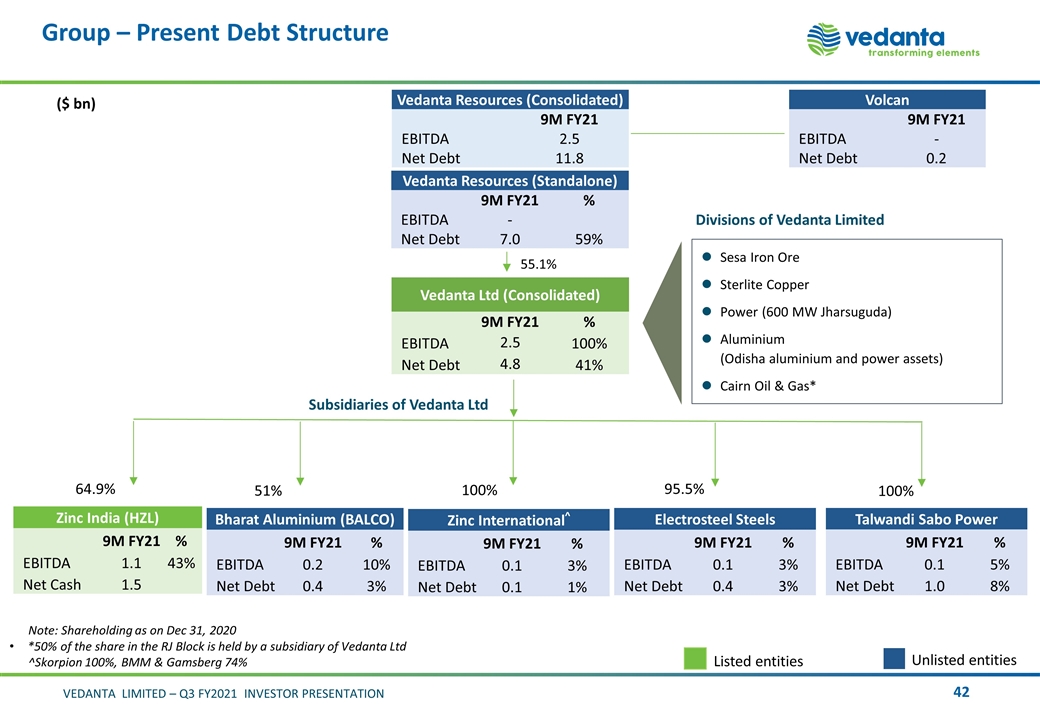

Group – Present Debt Structure 55.1% 64.9% Subsidiaries of Vedanta Ltd Sesa Iron Ore Sterlite Copper Power (600 MW Jharsuguda) Aluminium (Odisha aluminium and power assets) Cairn Oil & Gas* Divisions of Vedanta Limited Unlisted entities Listed entities 95.5% 100% 51% Note: Shareholding as on Dec 31, 2020 *50% of the share in the RJ Block is held by a subsidiary of Vedanta Ltd ^Skorpion 100%, BMM & Gamsberg 74% 100% Vedanta Resources (Consolidated) 9M FY21 EBITDA 2.5 Net Debt 11.8 Vedanta Resources (Standalone) 9M FY21 % EBITDA - Net Debt 7.0 59% Vedanta Ltd (Consolidated) 9M FY21 % EBITDA 2.5 100% Net Debt 4.8 41% Zinc India (HZL) 9M FY21 % EBITDA 1.1 43% Net Cash 1.5 Bharat Aluminium (BALCO) 9M FY21 % EBITDA 0.2 10% Net Debt 0.4 3% Zinc International^ 9M FY21 % EBITDA 0.1 3% Net Debt 0.1 1% Electrosteel Steels 9M FY21 % EBITDA 0.1 3% Net Debt 0.4 3% Talwandi Sabo Power 9M FY21 % EBITDA 0.1 5% Net Debt 1.0 8% Volcan 9M FY21 EBITDA - Net Debt 0.2 ($ bn)

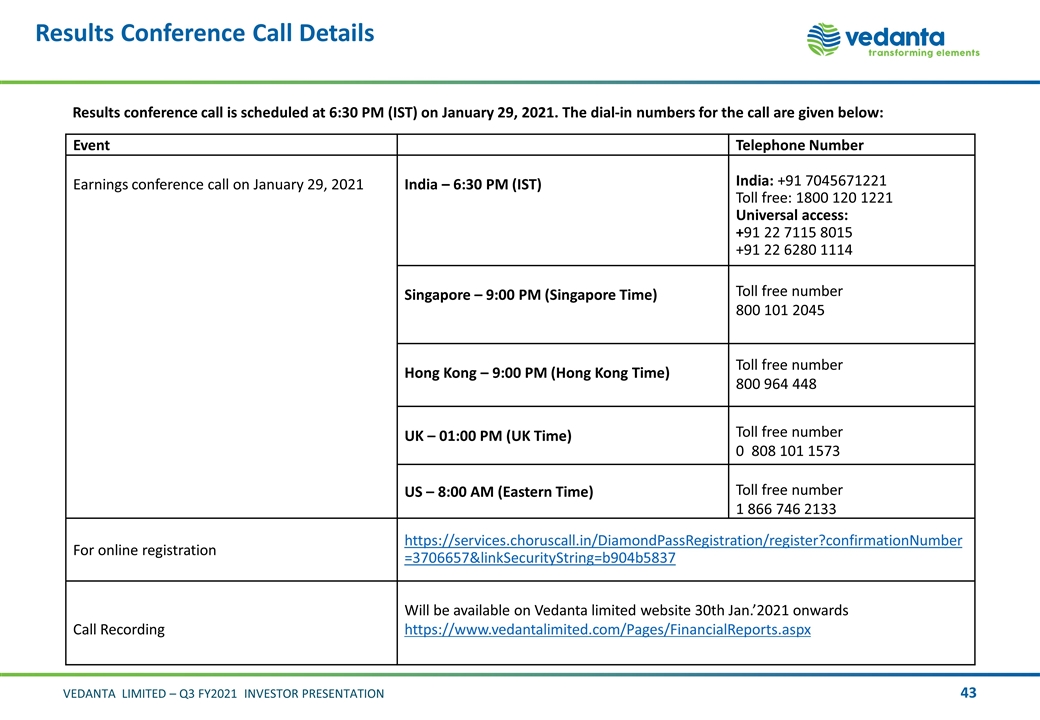

Results Conference Call Details Results conference call is scheduled at 6:30 PM (IST) on January 29, 2021. The dial-in numbers for the call are given below: Event Telephone Number Earnings conference call on January 29, 2021 India – 6:30 PM (IST) India: +91 7045671221 Toll free: 1800 120 1221 Universal access: +91 22 7115 8015 +91 22 6280 1114 Singapore – 9:00 PM (Singapore Time) Toll free number 800 101 2045 Hong Kong – 9:00 PM (Hong Kong Time) Toll free number 800 964 448 UK – 01:00 PM (UK Time) Toll free number 0 808 101 1573 US – 8:00 AM (Eastern Time) Toll free number 1 866 746 2133 For online registration https://services.choruscall.in/DiamondPassRegistration/register?confirmationNumber=3706657&linkSecurityString=b904b5837 Call Recording Will be available on Vedanta limited website 30th Jan.’2021 onwards https://www.vedantalimited.com/Pages/FinancialReports.aspx