UNITED STATES

Securities and Exchange Commission

WASHINGTON, D.C. 20549

(Mark One)

o REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2007

OR

OR

o SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report:

For the transition period from _______________ to _______________

Commission file number 333-143914

COMANCHE CLEAN ENERGY CORPORATION

(Exact name of Registrant as specified in its charter)

(Translation of Registrant's name into English)

Rua do Rocio 84, 11th Floor

Sao Paulo SP CEP 04552-000, Brazil

(Address of principal executive offices)

Thomas Cauchois

Greenwich Administrative Services, LLC

One Dock Street

Stamford, Connecticut 06902

T:203-326-4570, E: tcauchois@comanchecleanenergy.com, F: 203-326-4578

(Name, Telephone, E-mail and/or Facsimile number and Address, of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act: None

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

(Title of Class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

There were 25,359,814 ordinary shares outstanding on June 25, 2008.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. o Yes x No

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

o Large accelerated filer o Accelerated filer x Non-accelerated filer

Indicate by check which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP x International Financial Reporting Standards as issued by the International Accounting Standards Board o Other o

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 o Item 18 o

TABLE OF CONTENTS

| Introduction | |

Part I |

| | | |

| Item 1. | Identity of Directors, Senior Management and Advisers | 5 |

| Item 2. | Offer Statistics and Expected Timetable | 5 |

| Item 3. | Key Information | 5 |

| Item 4. | Information on the Company | 37 |

| Item 4A. | Unresolved Staff Comments | 37 |

| Item 5. | Operating and Financial Review and Prospects | 89 |

| Item 6. | Directors, Senior Management and Employees | 106 |

| Item 7. | Major Shareholders and Related Party Transactions | 114 |

| Item 8. | Financial Information | 118 |

| Item 9. | The Offer and Listing | 119 |

| Item 10. | Additional Information | 119 |

| Item 11. | Quantitative and Qualitative Disclosures About Market Risk | 127 |

| Item 12. | Description of Other Securities Other Than Equity Securities | 127 |

Part II |

| | | |

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 128 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 128 |

| Item 15. | Controls and Procedures | 128 |

| Item 16. | Reserved | 128 |

| Item 16A | Audit Committee Financial Expert | 128 |

| Item 16B | Code of Ethics | 129 |

| Item 16C | Principal Accountant Fees and Services | 129 |

| Item 16D | Exemptions from the Listing Standards for Audit Committees. | 129 |

| Item 16E | Purchases of Equity Securities by the Issuer and Affiliated Purchasers. | 129 |

Part III |

| | | |

| Item 17. | Financial Statements | 130 |

| Item 18. | Financial Statements | 130 |

| Item 19. | Exhibits | 130 |

| | | |

| Financial Statements | F-1 |

| | | |

| Signature Page | 134 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F contains or incorporates by reference forward-looking statements. All statements, other than statements of historical facts, that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future are forward-looking statements. Such statements are characterized by terminology such as “anticipates,” “believes,” “expects,” “future,” “intends,” “assuming,” “projects,” “plans,” “will,” “should” and similar expressions or the negative of those terms or other comparable terminology. These forward-looking statements, which include statements about the growth of the alternative fuels industry; market size, share and demand; performance; our expectations, objectives, anticipations, intentions and strategies regarding the future, expected operating results, revenues and earnings and current and potential litigation are not guarantees of future performance and are subject to risks and uncertainties, including those risks described under the heading “Risk Factors” set forth herein, or in the documents incorporated by reference herein, that could cause actual results to differ materially from the results contemplated by the forward-looking statements.

Investors are cautioned that our forward-looking statements are not guarantees of future performance and the actual results or developments may differ materially from the expectations expressed in the forward-looking statements.

As for the forward-looking statements that relate to future financial results and other projections, actual results will be different due to the inherent uncertainty of estimates, forecasts and projections may be better or worse than projected. Given these uncertainties, you should not place any reliance on these forward-looking statements. These forward-looking statements also represent our estimates and assumptions only as of the date that they were made. We expressly disclaim a duty to provide updates to these forward-looking statements, and the estimates and assumptions associated with them, after the date of this filing to reflect events or changes in circumstances or changes in expectations or the occurrence of anticipated events.

We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. You are advised, however, to consult any additional disclosures we make in our reports on Form 20-F and Form 6-K, or their successors. We also note that we have provided a cautionary discussion of risks and uncertainties under the caption "Risk Factors" in this Annual Report. These are factors that we think could cause our actual results to differ materially from expected results. Other factors besides those listed here could also adversely affect us.

Information regarding market and industry statistics contained in this Annual Report is included based on information available to us which we believe is accurate. We have not reviewed or included data from all sources, and cannot assure stockholders of the accuracy or completeness of the data included in this Annual Report. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services.

PART I

| Item 1. | Identity of Directors, Senior Management and Advisers |

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

3.A. Selected Financial Data

The following selected consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in these statements. The selected consolidated financial data presented below are derived from our audited consolidated financial statements as of December 31, 2006 and for the period from June 8, 2006 (date of inception) to December 31, 2006, and the consolidated financial statements of the Company as of December 31, 2007 and for the twelve months then ended, which are prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”).

| | | | | Jun. 8, 2006 | |

| | | | (date of inception) | |

| | | | to | |

Income Statement Data (000's except shares & per share data) | | | | Dec. 31, 2006 | |

| Net sales | | $ | 7,473 | | $ | - | |

| Income (loss) from operations | | $ | (7,494 | ) | $ | (1,096 | ) |

| Net Income (loss) from continuing operations | | $ | (19,018 | ) | $ | (1,172 | ) |

| Net income (loss) | | $ | (19,018 | ) | $ | (1,172 | ) |

| Comprehensive gain (loss) | | $ | (10,084 | ) | $ | (1,138 | ) |

| Net income (loss) per share | | $ | (3.39 | ) | $ | (586,000 | ) |

| Income (loss) from continuing operations per share | | $ | (3.39 | ) | $ | (586,000 | ) |

| Dividends declared per share | | $ | - | | $ | - | |

| Diluted net income per share | | $ | (3.39 | ) | $ | (586,000 | ) |

| Number of shares, basic and diluted | | | 5,604,859 | | | 2 | |

| | | Comanche | |

Balance Sheet Data ($000's) | | Dec 31, 2007 | | Dec. 31, 2006 | |

| Total assets | | $ | 153,308 | | $ | 1,963 | |

| Net assets | | $ | 32,257 | | $ | (453 | ) |

| Capital stock | | $ | 43,479 | | $ | 685 | |

3.B. Capitalization and Indebtedness

Not applicable.

3.C. Reasons for the Offer and Use of Proceeds

Not applicable.

3.D. Risk Factors

General Risks Relating to Our Business

We are a newly formed company with a newly formed management team and we have acquired assets tied to businesses with limited internal controls.

We will have to develop the necessary internal controls and management information system platforms to support our growth strategy rapidly. This could take longer than expected and may require us to make adjustments to the management team. Hiring additional capable experienced professionals may be difficult and if we are unable to hire qualified personnel on a timely basis our business may be adversely affected.

Our business is essentially an agricultural based business.

Therefore, we are susceptible to a variety of climatic, commoditization, resource, government policy and pestilence risks, all of which could affect our business and results. In addition, as to those feedstocks that we do not grow ourselves, we are subject to the speculation in commodity markets in terms of the cost of certain of our key feedstocks and we are also exposed to the risk of competition for the same feedstocks, to the extent that we are not growing them ourselves. Speculation and competitive pressures can create price volatility of certain crops that could affect our costs of doing business.

We have limited time periods within the year to plant crops and perform maintenance or expansion, so significant delays in the execution of planting or maintenance or expansion, could have a material affect on our anticipated future financial performance.

We are aggressively planting more sugar cane in 2008 to meet our cane planting objectives for our 2009 business plan. In addition, we will be planting feedstock for biodiesel production during 2008 and our ability to meet plan objectives will be dependent on the availability of leased land in locations near to our mills in the case of sugar cane, or with access to logistics in the case of biodiesel feedstocks, and tractors, harvesters, fertilizer and good weather conditions to meet our feedstock objectives. We will need to finish the reconfiguration and first expansion of Canitar in 2008 to begin crushing cane for a partial year. We plan to perform the expansion of Santa Anita, and further maintenance and expansion of Canitar, between harvesting seasons, so we must order equipment that may have long lead times and we will have a limited time period to perform these upgrades.

Harvesting sugar cane manually is a labor-intensive activity, and we are highly dependent on seasonal workers to harvest our plantations.

We might face difficulties in hiring the number of workers we may need, and/or we and the industry might face difficult negotiations with the unions which generally represent all workers in the sector. We expect to migrate to mechanized harvesting, if and when other producers do this. In such case the availability of mechanical harvesters might be subject to a backlog. Also, the changeover to mechanized harvesting may cause tensions with manual sugar cane workers and their unions.

We rely on a limited number of production plants, and any interruption on the production of those plants would affect us.

Interruptions in the operations of the plants might be caused by, among other things, technical difficulties, accidents, operating flaw, weather, natural or environmental disasters, strikes, poor judgment of management, and lack of skill or our personnel, diminishing or interrupting our output and resulting in material losses. Our insurance coverage might not be sufficient to compensate for such losses, or not cover unpredicted events or weather.

Our ethanol and biodiesel products are sold to a small number of customers which may be able to exercise significant bargaining power concerning pricing and other sale terms.

A substantial portion of our ethanol and biodiesel production is sold to a small number of customers that acquire large portions of our production and thus may be able to exercise significant bargaining power concerning pricing and other sale terms. In fiscal year 2007, three of our customers accounted for 92% of our net sales of ethanol. In the same fiscal year, one customer, Petrobras S.A., accounted for 100% of our net sales of biodiesel. In addition, intensive competition in the ethanol and biodiesel industries further increases the bargaining power of our customers.

We are subject to acts of nature.

Lightning, wind, earth movements, floods and other acts of nature could interrupt our production or our markets, and damage our assets. Our insurance coverage might not be sufficient to compensate for such losses, or not cover unpredicted events. For example, on September 28, 2007, lightning struck storage tanks at our Canitar facility that were being used to store ethanol produced at our Santa Anita facility. Although the storage installations were protected by lightning rods and other devices recommended by third party experts and approved by municipal authorities, the strike, which was massive and direct, caused an explosion and fire that destroyed the three tanks and 9 million liters of fuel, and caused the death of one worker and injuries to three other persons.

Our products are flammable and combustible and our production processes involve risk of fire and explosion and other dangers.

Fire or explosion, such as resulted from the lightning strike at our Canitar facility on September 28, 2007 discussed above , or malfunction of equipment, could cause injury or death to employees or other persons, damage to our installations and/ or loss to our finished products or our inventory. Fire, whether naturally occurring or resulting from uncontrolled crop-burning, could cause injury or death to employees or other persons, burn planted crops or could damage agricultural equipment. Such events could also result in civil liability to third parties, or subject us to regulatory sanctions and our management to criminal liability.

Our biodiesel sales contracts expose us to the risk of significant penalties and of cancellation

We have entered into contracts to sell up to 32 million liters of biodiesel in the first nine months of 2008 to Petrobrás S.A. providing for an aggregate sales price of R$69,860,000. Those contracts can be terminated by Petrobrás, and also provide for large penalties in the event of default. If we fail to observe the operating provisions of those contracts, including such matters as meeting environmental or safety requirements, delay or failure in making deliveries, failure to program anticipated deliveries properly, fail to satisfy inspection requirements or delivery or operating standards, or if delivered product fails to meet quality standards, or we fail to pay or reimburse applicable taxes, we could be penalized by up to 0.033% of the contract value for each day of default. If we fail to deliver biodiesel timely, we could be penalized up to 100% of the contracted for value of the undelivered fuel. If we are unable to obtain sufficient adequate feedstock, or if feedstock prices make the production of biodiesel at the prices provided for in the contracts uneconomical, we may be unable to deliver the contracted for product or we may be unable to operate so as to produce the contracted for product because of equipment breakdown or operator error, electricity outage or other circumstances not meeting the definition of an “act of God” within the terms of the contracts. We could thus be exposed to such non-delivery penalties. Also, if Petrobrás were to cancel the contracts in whole or in part after we had acquired feedstock, and we were unable to contract for the sale of biodiesel produced from that feedstock at the same or better price than in the Petrobrás contracts, we would be exposed to the risk of producing at a lesser margin than anticipated or to the risk of loss in the event that we were to resell such feedstock at a lower price than our acquisition price.

Our current contracts for biodiesel are at a fixed price, whereas our feedstock is for the most part purchased at market prices.

Our contracts with Petrobras extend for six months from their date, and are at fixed prices. In 2007 we did not produce any of our feedstock, and although we expect to produce approximately 40% of our feedstock by 2011, we are nonetheless exposed to the risk that the cost of feedstock may be greater than that which we projected at the time that we bid for the Petrobras contracts, and may not be able to or may choose not to hedge against rising cost of feedstock. Future contracts with Petrobras are expected also to be for fixed prices.

The market price for our product is volatile and affected by economic, competitive and political conditions in Brazil and the world.

The market for ethanol, both globally and in Brazil, has historically been volatile in response to domestic and international changes in supply and demand. We expect that the market for biodiesel might be subject to similar fluctuations caused by changes in supply or demand and in response to fuel alternatives. Fluctuations in prices for our products may occur for various reasons, including: domestic and global demand for ethanol, sugar, biodiesel or food oils; variations in the production levels of our competitors; and the availability of substitute goods for the products we produce. The prices we are able to obtain for ethanol or biodiesel will depend on prevailing market prices, which in turn may be affected by reference prices established by producers with greater capacity than we may have to weather adverse market prices. Market conditions, both domestically and internationally, are beyond our control. Like other agricultural commodities, the growing of sugar cane and production of products derived from sugar cane, such as ethanol, or oil seeds and products from oilseeds, such as biodiesel, are subject to price fluctuations resulting from weather, natural disasters, domestic and foreign trade policies, shifts in supply and demand and other factors beyond our control. In addition, approximately 20% to 30% of the total worldwide sugar production is traded on exchanges and is thus subject to speculation, which could affect the price of sugar and derivatively the price of ethanol, which may affect our results of operations in ethanol. There can be no assurance that, among other factors, competition from alternative sources of ethanol or biodiesel, gasoline or diesel, changes in world or Brazilian agricultural or trade policy or developments relating to international trade, including those under the World Trade Organization (“WTO”), will not directly or indirectly result in lower domestic or global fuel, ethanol or biodiesel prices. Any prolonged decrease in ethanol or biodiesel prices could have a material adverse effect on our company and our results of operations. There can also be no assurance that we will be able to maintain sales at generally prevailing market prices for ethanol or biodiesel (to the extent that a sustainable prevailing market price develops) in Brazil without discounts and that we will be able to export sufficient quantities of ethanol to assure an appropriate domestic market balance. In addition, we may hedge against market price fluctuations by fixing the prices of a portion of our sales volume. To the extent that the market price of our products exceeds the fixed price under our hedging policy, our earnings will be lower than they would have been if we had not adopted the hedging policy.

The prevailing price of ethanol and biodiesel is subject to significant fluctuations, which may reduce our profit margins and our inventory policies may affect earnings in any given quarter.

Ethanol and biodiesel are thinly traded, and thus subject to significant volatility of price. They are marketed as independent fuel sources, in the case of ethanol as a substitute for gasoline and as a fuel additive to reduce vehicle emissions from gasoline and as an octane enhancer to improve the octane rating of gasoline with which it is blended, and in the case of biodiesel as a substitute for diesel. As a result, ethanol and biodiesel prices are influenced, among other things, by the supply and demand for gasoline which, in turn, is related to the price of petroleum and our results of operations and financial position may be materially adversely affected if gasoline or petroleum demand or price decreases. Petroleum prices are highly volatile and difficult to forecast due to frequent changes in global politics and the world economy. The industrialized world depends critically on oil from various countries throughout the world, some of which may be politically and economically unstable. Consequently, we cannot predict the future price of oil or gasoline. In recent years, the prices of gasoline, petroleum, ethanol and diesel have all reached historically unprecedented high levels. If the prices of gasoline, diesel and petroleum decline, the demand for, and price of, ethanol and/or biodiesel may also decline. In addition, prices of ethanol tend to be cyclical, reaching lows in mid-harvest and highs post-harvest. To the extent that we carry inventory from one period to another after production instead of selling, it may affect quarterly earnings for any given quarter.

Biodiesel is a new market worldwide, the business is new in Brazil and thus the demand cannot be forecasted with great accuracy.

Our revenue will be derived in part from the production and sales of biodiesel. We expect that sales of biodiesel may constitute approximately 50% of our revenues in 2008, but that such percentage will decline in future years. This industry is brand new in Brazil and the world, so there is not the depth of experience that the ethanol industry has. Furthermore, the industry is dependent on mandates to mix biodiesel into regular diesel both in Brazil and worldwide. To the extent such mandates are eliminated or reduced, our profitability could be diminished. The initial mandate for Brazil took effect in January 2008 and was changed to a 3% mandate effective July 2008. This is a new market and there are many logistical problems in getting the fuel to purchasers, purchasers picking up fuel and other challenges, so there is a possibility that a market may not fully develop until 2008 or beyond.

We will rely on the production and distribution of ethanol and biodiesel as its main business focus, so any factor negatively impacting the biofuels industry may adversely affect our profitability.

Our revenue will be derived primarily from the production and sales of ethanol and biodiesel. Ethanol competes with several other existing products and may compete with other alternatives to be developed in the future for use as an independent fuel source or fuel additives. Biodiesel competes with oil based diesel. We may be unable to move our business focus away from the production of ethanol and biodiesel to other products. Accordingly, an industry shift away from ethanol or biodiesel or the emergence of new competing products, including any developed by the established petroleum industry, may reduce the demand for ethanol and/or biodiesel. A downturn in the demand for ethanol and/or biodiesel may adversely affect our sales and profitability.

We face significant competition in our business, which may adversely affect our market share and profitability.

The ethanol industry is highly competitive, and we anticipate the biodiesel market will also be highly competitive. Domestically, we will compete with numerous small to medium-size producers. Despite increased consolidation, the Brazilian sugar and ethanol industries remain highly fragmented. Our major competitors in ethanol in Brazil are Cosan, Louis Dreyfus, Grupo São Martinho, Vale do Rosario, Carlos Lyra, Grupo Zillo Lorenzetti, Alto Alegre, Grupo Irmaos Biaggi, J. Pessoa & Co. Nova America and Infinity Bio Energy, along with other sugar and ethanol producers in Brazil who market their sugar products through the Copersucar cooperative. Currently, Copersucar is comprised of 32 producers in the States of São Paulo, Minas Gerais and Parana. Today, our major competitors in the biodiesel sector include Brasil Ecodiesel, Agrenco, Granol, ADM, Biocapital and Bertin. Many factors influence our competitive position, including the availability, quality and cost of fertilizer, energy, water, chemical products and labor, and in the case of biodiesel, third party feedstock. A number of our competitors have substantially greater financial and marketing resources, a larger customer base and a greater breadth of products than we do. They may be able to sustain low market prices for a longer time than we can. If we are unable to remain competitive with these producers in the future our market share may be adversely affected.

The agricultural products industry in Brazil is very competitive. Some existing producers may have greater financial and other resources than we do and one or more of these competitors could use their greater resources to gain market share at our expense.

The agricultural industry in Brazil is very competitive and some existing producers have substantially greater production, financial, research and development, personnel and marketing resources than we do. As a result, our competitors may be able to compete more aggressively, influence market conditions, and sustain that competition over a longer period of time. Our lack of resources relative to many of its competitors may cause us to fail to anticipate or respond adequately to new developments and other competitive pressures. This failure could reduce our competitiveness and cause a decline in market share, sales and/or profitability.

Our competitors may open new plants that will expand the Brazilian sugar cane-related industry or biodiesel industry, and such expansion could result in competitive pricing pressures as well as create other risks to our business; moreover, the general expansion of the Brazilian economy may also put pressure on our business.

These risks include, among others: oversupply, inability of infrastructure to sustain larger volumes, and demand for limited production resources. The internal market might not absorb the volume or timing of additional production, bringing prices down and forcing producers to export ethanol or biodiesel. The Brazilian infrastructure for exports is currently limited and requires additional investments. It is also possible that the domestic infrastructure of rail and road might be insufficient to support large scale increases in demand for such infrastructure. There may be limited availability of equipment, or delays in delivering or installing newly contracted equipment due to an increased demand for processing equipment, which could affect our forecasted expansion plan. There may be limited availability of agricultural and industrial workers—the sugar cane industry, for example, employs over 1 million people, and depending on the rate of mechanization of the fields, the industry will have to attract a significant number of workers. We might face difficulties to hire trained experienced industrial workers, and for the production of feedstocks, we will need to attract experienced agricultural workers. It is also possible that the growth of the Brazilian economy generally will create a demand for the same production resources that we require.

Tariffs and regulatory issues for exporting our products could impact our ability to export.

Even though many countries have mandates to consume certain amounts of ethanol, governmental actions to protect the internal market of other countries might affect the anticipated Brazilian exports.

Our biodiesel business is subject to a number of sales, income and other tax exemptions granted by the Brazilian state and federal governments.

These exemptions are granted pursuant to law or special tax zone regulations. However any repeal of such exemptions could materially affect our cost competitiveness in the biodiesel business. Some Brazilian states have not yet developed specific tax legislation for biodiesel, and the entire tax regime at different stages for biodiesel could change. Any changes in such legislation could negatively affect our biodiesel profitability.

A change in the Brazilian Government's policy that biodiesel be added to the sales of all diesel may materially adversely affect our business.

Law 11.097 of January 13, 2005 requires that the biodiesel participation in total diesel sales be at least 2% by January 2008 (250 million gallons). On March 14, 2008, the CNPE (Conselho Nacional de Política Energética) of Brazil increased the minimum percent participation to 3% effective July 1, 2008. The law calls for a 5% participation by 2013. Any changes in these mandates by the Brazilian Government could materially affect our biodiesel business operations by reducing overall demand within Brazil for biodiesel.

We may invest in innovative technologies or alternative feedstock for the production of ethanol and biodiesel, and such investments might not have the anticipated results, leading to a partial or complete loss of such investments. Alternatively, such investment by others in such technological developments could make other sources of ethanol or biodiesel less expensive.

Such technologies or alternative feedstocks could increase plant utilization, lead to different processing technologies to increase the yield from feedstocks, such as cellulosic technology, or make feasible the use of entirely new feedstocks, among others. For example, although at present ethanol produced from sugar cane is competitive with that produced from other feedstocks, various technologies are under development that could improve the efficiency of production from corn or that can make possible the economic production of ethanol from agricultural sources not presently used for ethanol production, and such developments would have an adverse effect on the market for ethanol derived from sugar cane. Similarly, there could be significant technological breakthroughs in the production processes of biodiesel. These technologies could create a vastly different competitive landscape for us and our products.

There could occur technological developments for the production of sugar care ethanol or biodiesel to which we might not have access.

Other producers may have access to such developments, allowing them to produce more efficiently, reducing our competitiveness and causing a decline in market share, sales and/or profitability.

If the increase in ethanol and biodiesel demand expected by us does not occur, or if the demand for ethanol or biodiesel otherwise decreases, there may be excess capacity in these industries.

The potential global growth in the production of ethanol and biodiesel may affect market prices. For example, U.S. domestic ethanol capacity has increased steadily from 1.7 billion gallons per year in January of 1999 to 7.2 billion gallons per year at May 2008 (according to the Renewable Fuels Association). In addition, there is a significant amount of capacity being added to the ethanol industry. This capacity is being added to address anticipated increases in demand. However, demand for ethanol may not increase as quickly as expected or to a level that exceeds supply, or at all. If the ethanol industry has excess capacity and such excess capacity results in a fall in prices, it will have an adverse impact on our results of operations, cash flows and financial condition. Excess capacity may result from the increases in capacity coupled with insufficient demand. Demand could be impaired due to a number of factors, including regulatory developments, technological developments making other fuels more attractive, changes in perception of sugar-can ethanol or biodiesel as less harmful to the environment than other fuels and reduced transportation fuel consumption. Reduced gasoline or diesel consumption could occur as a result of increased gasoline or oil prices. For example, price increases could cause businesses and consumers to reduce driving or acquire vehicles with more favorable gasoline fuel efficiency. The increased production of ethanol or biodiesel may also have other adverse effects. For example, increased ethanol production would likely result in the increased demand for sugar cane and increased biodiesel production would likely result in increased demand for oleaginous crops. This may result in higher market prices for sugarcane and oleaginous feedstocks which, in the event that we are unable to pass such price increases on to customers, will result in lower profits. We cannot predict the future price of ethanol or biodiesel. Any decline in the price of ethanol or biodiesel may adversely affect our sales and profitability. The biodiesel business is new worldwide and although many experts expect the growth to be rapid for a variety of regulatory reasons, overcapacity or lack of expected demand growth could affect our business.

Competition from large producers of other petroleum-based gasoline additives and other competitive products may affect our profitability.

Our ethanol and biodiesel operations will compete with producers of other fuel sources and gasoline additives made from other raw materials having similar octane and oxygenate values as ethanol. Many of our potential competitors, including the major oil companies, have significantly greater resources than we have to develop alternative products and to influence legislation and public perception of ethanol.

A reduction in market demand for ethanol as a clean fuel or a change in the Brazilian Government's policy that ethanol be added to gasoline may materially adversely affect our business.

The Brazilian Government currently requires the use of ethanol as an additive to gasoline. Since 1997, the Brazilian Sugar and Alcohol Interministerial Council (Conselho Interministerial do Acucar e Alcool) has set the percentage of anhydrous ethanol that must be used as an additive to gasoline (currently 25%). According to Datagro, a Brazilian industry consultant, approximately 30%of all fuel ethanol in Brazil is used to fuel automobiles with a blend of anhydrous ethanol and gasoline; 50% is used in vehicles that are powered by hydrous ethanol alone, including flex-fuel vehicles and the balance is used for industrial uses, exports and other uses. Any reduction in the percentage of ethanol required to be added to gasoline or change in the Brazilian Government policy towards ethanol use, as well as the growth in the demand for natural gas and other fuels as an alternative to ethanol may have a material adverse effect on our business.

Governmental regulations or the repeal or modification of tax incentives favoring the use of ethanol may reduce the demand for ethanol and affect our target markets.

Ethanol production is subject to extensive regulation in many countries, including Brazil. We cannot predict in what manner or to what extent current or future governmental regulations or export or import restrictions will harm our business or the ethanol industry in general. The fuel ethanol business benefits significantly from tax incentive policies and environmental regulations existing in Brazil and other countries that favor the use of ethanol in motor fuel blends. These policies and regulations are subject to changes which we are unable to predict. For example, the Brazilian Government has reduced the quantity of ethanol mixed into gasoline from 25 percent to 20 percent, and while the required percentage is at 25% percent as of the date of this Annual Report, decreases in the required percentage may reduce the demand for ethanol in Brazil, at least in the near term. The repeal or substantial modification to policies and regulations that encourage the use of ethanol could have a detrimental effect on the ethanol industry which, in turn, may have an adverse effect on our sales and profitability.

Ethanol prices have been correlated to the price of sugar historically. Accordingly, a decline in the price of sugar could lead to overproduction of ethanol and adversely affect our ethanol business.

The price of ethanol can be associated with the price of sugar. A vast majority of ethanol in Brazil is produced at sugar cane mills that produce both ethanol and sugar. Because some millers are able to alter their product mix in response to the relative prices of ethanol and sugar, this results in the prices of both products being correlated. Moreover, because sugar prices in Brazil are determined by prices in the world market, there can be a strong correlation between Brazilian ethanol prices and world sugar prices. Accordingly, a decline in sugar prices may also have an adverse effect on our ethanol business.

We may be adversely affected by seasonality.

Our business is subject to seasonal trends based on the growing cycles in the regions where we produce in Brazil. The annual sugar cane harvesting period in the Center-South region of Brazil begins in April/May and ends in November/December. This can create fluctuations in our inventory, usually peaking in December to cover sales between crop harvests ( i.e. , January through April), and a degree of seasonality in our gross profit, with sugar and ethanol sales significantly lower in the last quarter of the fiscal year. Similarly, oil crops in the Northeast of Brazil have a certain growing season, and we may need to store material or inventory outside of these seasons. This seasonality could have a material adverse effect on our results of operations for the last quarter of each fiscal year.

We may be adversely affected by the dishonesty of persons or entities who may sell assets or equity interest in businesses to us or of other vendors.

We may rely heavily on the performance and integrity of representations made by the sellers of assets or equity interests in making our acquisition and purchasing decisions. Because there may be generally little or no publicly available information about other entities, we may not be able to confirm independently or verify the information provided for use in such decisions. In addition, we will be relying on the performance and integrity of suppliers, customers or vendors, whose employees or partners may take actions which are not permitted by the relevant agreements. The culture of Brazil has historically been one dominated by military leaders or very strong central powers. Only in the last 20 years or so has there been a tradition of democracy. As a result, strong institutions, including ethical institutions, are not as developed as in, for example, the United States. As a result, there may be a greater degree of corruption in many businesses than in comparable businesses in the United States.

As a holding company, we may face limitations on our ability to receive distributions from our subsidiaries.

We conduct all of our operations through subsidiaries and are dependent upon dividends or other intercompany transfers of funds from our subsidiaries to meet our obligations, including financial obligations. For example, Brazilian law permits the Brazilian government to impose temporary restrictions on conversions of Brazilian currency into foreign currencies and on remittances to foreign investors of proceeds from their investments in Brazil, whenever there is a serious imbalance in Brazil’s balance of payments or there are reasons to expect a pending serious imbalance. The Brazilian government last imposed remittance restrictions for approximately six months in 1989 and early 1990. The Brazilian government may take similar measures in the future. Any imposition of restrictions on conversions and remittances could hinder or prevent us from converting into U.S. dollars or other foreign currencies and remitting abroad dividends, distributions or the proceeds from any sale in Brazil of common shares of our Brazilian subsidiaries. We currently conduct all of our operations through our Brazilian subsidiaries. As a result, any imposition of exchange controls restrictions could reduce the market price of our Ordinary Shares.

Goodwill and licenses are not tangible assets.

As of December 31, 2007 intangible assets comprised approximately 15% of our total consolidated assets. Goodwill alone comprised approximately 6% of our consolidated total assets.

Risks Related to Our Expansion, Acquisition and Development Strategy

The expansion of our business through expansions, acquisitions and strategic alliances poses risks that may reduce the benefits we anticipate from these transactions.

As part of our business strategy, we will initially grow by expansion of the capacity of already acquired assets, and then continue growing by acquiring other ethanol or biodiesel producers or facilities in Brazil or elsewhere that complement or expand our existing operations. We also may enter into strategic alliances to increase our competitiveness. We believe that the ethanol industry in Brazil is highly fragmented and that future consolidation opportunities will continue to be a significant source of our growth. However, our management is unable to predict whether or when any prospective acquisitions or strategic alliances will occur, or the likelihood of a certain transaction being completed on favorable terms and conditions. Our ability to continue to expand our business successfully through expansions, acquisitions or alliances depends on many factors, including our ability to identify acquisitions or access capital markets at an acceptable cost and negotiate favorable transaction terms. Even if we are able to identify expansion or acquisition targets and obtain the necessary financing to make these investments, we could financially overextend ourselves, especially if an investment is followed by a period of lower than projected biofuel prices. Access to capital has been more limited since the beginning of 2008 for many growing companies due to problems with the U.S. capital markets. Our failure to integrate new businesses or manage any new alliances successfully could adversely affect our business and financial performance. Some of our competitors have substantially greater financial and other resources than we do and also may be pursuing growth through acquisitions and alliances. This may reduce the likelihood that we will be successful in completing expansions, acquisitions and alliances necessary for the expansion of our business. In addition, any major acquisition we consider may be subject to antitrust and other regulatory approvals. We may not be successful in obtaining required approvals on a timely basis or at all. Acquisitions also pose the risk that we may be exposed to successor liability relating to actions involving an acquired company, its management or contingent liabilities incurred before the acquisition. The due diligence we conduct in connection with an acquisition, and any contractual guarantees or indemnities that we receive from the sellers of acquired companies, may not be sufficient to protect us from, or compensate us for, actual liabilities. A material liability associated with an acquisition could adversely affect our business and results of operations and reduce the benefits of the acquisition.

There are execution risks related to the expansion plans of our current, or future acquired or greenfield projects that could affect our ability to deliver the anticipated business plan, or increase substantially the anticipated capital expenditures.

Such delays or cost increase might be caused by, among others: availability, delivery and installation of equipment; implementation of engineering services; delays in the analyses by governmental agencies to provide all necessary licenses and permits or difficulty in obtaining of necessary agricultural resources. Despite relying on engineering assessments in determining to expand our current facilities or purchasing other facilities, there may be unexpected technical difficulties in operating the assets as expected, leading to additional investments or delays in meeting the objectives of our business plan with respect to revenues and earnings.

We may be exposed to existing environmental and other liabilities of acquisitions, which could affect our results of operations and financial condition in the future.

Under Brazilian law, there are certain successor liabilities — for example, environmental, tax and employment-related liabilities — for which we may become liable as an acquirer of businesses or assets. Our acquisition agreements may provide for an escrow against, or guarantees regarding, such contingencies, but there can be no assurance, however, that the amount in any such escrow will be sufficient to pay all such liabilities, or that no further such liabilities will become payable after the escrow term has ended, or that the guarantees regarding such contingencies will be enforceable. In such events, we may be obligated to fund such liabilities without recourse to the sellers, and our results of operations and financial condition may be adversely affected.

Potential future business combinations could be difficult to find and integrate, divert the attention of key personnel, disrupt our business, dilute shareholder value and adversely affect our financial results.

Business combinations involve numerous risks, any of which could harm our business, including: difficulties in integrating the operations, technologies, products, existing contracts, accounting processes and personnel of the target and realizing the anticipated synergies of the combined businesses; difficulties in supporting and transitioning customers, if any, of the target company or assets; diversion of financial and management resources from existing operations; the price paid for, or other resources devoted to, the business combination may exceed the value realized, or the value which could have been realized, if we had allocated the purchase price or other resources to another opportunity; risks of entering new markets or areas in which we have limited or no experience or are outside our core competencies; potential loss of key employees, customers and strategic alliances from either our current business or the business of the target; assumption of unanticipated problems or latent liabilities, such as problems with the quality of the products of the target; and inability to generate sufficient revenue to offset acquisition costs. Business combinations also frequently result in the recording of goodwill and other intangible assets which are subject to potential impairments in the future that could harm our financial results. As a result, if we fail to properly evaluate acquisitions or investments, we may not achieve the anticipated benefits of any such business combinations, and may incur costs in excess of what was anticipated. The failure to successfully evaluate and execute business combinations or investments or otherwise adequately address these risks could materially harm our business and financial results.

Potential greenfield developments could tax our management capabilities and other resources, and are uncertain of success.

Proceeding to develop greenfield projects could divert financial and management resources from existing operations or from the expansion efforts related to existing assets. We may develop geographical areas in which soils and other agricultural conditions ultimately do not prove to be optimum for sugar-cane growth, in the case of an ethanol project, or for appropriate feedstocks in the case of a biodiesel project, or where there is not sufficient logistical development or sufficient trained labor to support our proposed projects, or areas in which local, state or federal governments fail to support biofuels development as necessary for our intended developments. Our development costs may exceed the value of any project ultimately developed, or we may fail to in obtaining one or more critical elements for a development, such as obtaining required permits or licenses, access to land, financing, access to markets, or ultimately be unable to generate sufficient revenue to offset development costs. We may fail to execute the proposed development, or not achieve the anticipated benefits or protect against risks inherent in the development, resulting in harm to our financial results or our business generally.

The possible lack of business diversification may adversely affect our results of operations.

While we expect to effect one or more business combinations beyond our initial acquisitions, it is possible that we will not consummate any further business combination. Accordingly, the prospects for our success may be entirely dependent upon the assets acquired through the initial acquisitions. As such, it is possible that we may not have the resources to carry out our intended expansion of the initial assets or to diversify effectively our operations or benefit from the possible spreading of risks or offsetting of losses. In this case, our lack of diversification may subject us to numerous economic, competitive and regulatory developments, any or all of which may have a substantial adverse impact upon the particular industry in which we may operate subsequent to the initial acquisitions, and result in our dependency upon a single or limited number of markets.

Because we will manage our business on a localized basis, our operations and internal controls may be materially adversely affected by inconsistent management practices.

We will manage our business in Brazil with local and regional management retaining responsibility for day-to-day operations, profitability and the growth of the business. Our operating approach may make it difficult for us to implement strategic decisions and coordinated practices and procedures throughout our extended operations, including implementing and maintaining effective internal controls Company-wide. Our decentralized operating approach could result in inconsistent management practices and procedures and adversely affect our overall profitability, and ultimately our business, results of operations, financial condition and prospects.

Our ongoing implementation of new information technology systems is subject to implementation and adequacy risks, which we may not be able to control.

The accounting systems at each of the acquisitions we made are being replaced by an enterprise resource management (“ERP”) information technology system that will control and report on all of our enterprise operations. We are implementing several of the ERP modules to date, including financial and agricultural modules, and are modifying or implementing more over time. However, our ERP system may not be sufficient to fully control our current or anticipated operations over time, or may not meet the requirements that are imposed upon our internal control procedures to accomplish our Sarbanes Oxley Act of 2002 requirements. In addition, ERP systems are dependent upon communications providers, web browsers, telephone systems and other aspects of the Internet infrastructure, which have experienced significant system failures and electrical outages in the past. Our systems are susceptible to outages due to fire, floods, power loss, telecommunications failures, break-ins and similar events. Despite our implementation of network security measures, our servers are vulnerable to computer viruses, break-ins and similar disruptions from unauthorized tampering with our computer systems. Unplanned systems outages or unauthorized access to our systems could materially and adversely affect our business.

Our ability to grow our business could be adversely affected if we are unable to obtain additional financing on acceptable terms.

We will seek additional debt or equity financing to finance future acquisitions or expansions. Such financing may not be available on acceptable terms and our failure to obtain additional financing when needed could negatively impact our growth, financial condition and results of operations. Additional equity financing may be dilutive to the holders of our shares, and debt financing, if available, may involve significant cash payment obligations and covenants that restrict our ability to operate our business. The availability of credit inside Brazil is limited, especially to a new business, and the ability to access credit internationally may be impaired by the condition of global credit markets. Since early 2008, the U.S. capital markets have been in an unsettled state with considerable volatility as a result of the economic slowdown in the U.S. and the problems with housing related assets. As a result, of this current turbulence, our access to financing in the U.S. markets may be limited.

We may incur indebtedness in order to consummate future acquisitions and expansions.

Future acquisitions and expansions may be financed with debt. If we are not able to generate sufficient cash flow from the operations of the acquired companies or the expanded capacity to make scheduled payments of principal and interest on the indebtedness, then we will be required to use our capital for such payments. This will restrict our ability to make additional acquisitions or expansions. We may also be forced to sell an acquired company in order to satisfy indebtedness. We cannot be certain that we will be able to operate profitably once we incur this indebtedness or that we will be able to generate a sufficient amount of proceeds from the ultimate operation of such acquired companies or expanded capacity to repay the indebtedness incurred to make such acquisitions.

Risks Related to Our Cost Structure

We may not be successful at reducing our operating costs and increasing our operating efficiencies.

We have only recently acquired existing businesses and anticipate that we will be able to successfully manage the costs of integration and reduce operating costs by applying processes, equipment, technology and cost controls and increasing our operating efficiencies to achieve improved operating results in the future. We cannot assure you that we will be able to achieve all of the cost savings that we expect to realize from our business initiatives with respect to new and acquired assets. We may be unable to implement one or more of our initiatives successfully or we may experience unexpected cost increases that offset the savings that we achieve. Our failure to realize cost savings may adversely affect our competitiveness and results of operations.

Our results of operations, financial position and business outlook are highly dependent on commodity prices, which are subject to significant volatility and uncertainty, and the availability of supplies and, to the extent that we deploy hedging strategies such strategies could involve risks that affect our performance, so our results could fluctuate substantially.

Our results are substantially dependent on commodity prices, especially prices for ethanol, biodiesel, regular diesel and unleaded gasoline. As a result of the volatility of the prices for these items, our results may fluctuate substantially and we may experience periods of declining prices for its products and increasing costs for its raw materials, which could result in operating losses. Although we may attempt to offset a portion of the effects of fluctuations in prices by entering into forward contracts to supply ethanol or biodiesel or other items or by engaging in transactions involving exchange-traded futures contracts, the amount and duration of these hedging and other risk mitigation activities may vary substantially over time and these activities also involve substantial risks, which could be exacerbated by underlying price movements with an adverse effect on our financial results. In addition, to the extent that we have borrowed money, price declines also increase the risk of losses.

We intend to maintain third-party insurance over a certain range of risks to our business and assets, and our results of operations and financial condition may be affected by the cost of uninsured risks.

We have obtained insurance for our business and assets that we believe is comparable to what other similar companies in Brazil have obtained or can obtain. However, since the Brazilian insurance market is closed and the ability to place insurance is somewhat limited, this may address only a limited range of risks and may not cover a variety of risks that might be covered by other types of businesses in other developed country markets. As a result, our results of operations and financial condition may be affected by the cost of uninsured risks.

Our business is highly sensitive to our cost of producing and/or buying feedstock such as sugar cane (to the extent that we buy sugar cane to achieve more output) or oils to produce biodiesel and we may not be able to pass on increases in cost to our customers .

The principal raw material we use to produce ethanol is sugarcane and for biodiesel is agricultural oil. As a result, changes in the price of feedstocks or the cost of producing our own feedstocks can significantly affect our business. The yield, cost and market price of sugar cane and oil seeds are influenced by weather conditions and other factors affecting crop yields, farmer planting decisions and general economic, market and regulatory factors. These factors include Brazilian Government policies and subsidies with respect to agriculture and international trade, and global and local demand and supply. The cost and availability of agricultural oil in addition is subject to the availability of crushing facilities. The significance and relative effect of these factors on the price of feedstock or the cost of growing crops is difficult to predict. Any event that tends to negatively affect these, such as adverse weather or crop disease, could increase costs and potentially harm our business. The price paid by us for sugarcane from third parties at a facility could increase if an additional ethanol production facility is built in the same general vicinity.

Risks Related to Our Agricultural Operations

We intend to be substantially vertically integrated into our ethanol feedstock and as a result, control and plant a sizeable portion of our sugar-cane needs for feedstock, as such we are subjected to many risks related to agricultural activities. In addition, over time we expect to adopt a similar strategy with respect to our biodiesel operations needs.

Weather conditions affect any agricultural activity. Even though sugar cane is a resilient crop, certain characteristics, such as the yield in terms of tons per hectare, or the sugar content per ton, are affected by weather conditions. A significant change in expected or historical rain patterns for the regions where we have our plantations might diminish our ethanol output. Our ability to harvest and transport sugar cane from the fields to the production facility is reduced or impeded during rainy periods. Therefore, the rainy season of the year defines our harvesting period, and rain-intensive periods during the production period forces us to have idle plants or operate below capacity even during the production period. A significantly rainy year might reduce our ethanol output. Even though we keep agricultural experts to control our sugar cane plantations, uncommon plagues might affect our plantations, impacting our feedstock supply.

We intend to grow our plantations mainly through multi-year land leasing agreements, which in the case of sugar-cane in Sao Paulo state typically have a five or six year term, which is shorter than the useful life of our production facilities, and therefore we are exposed to the risks of relying on the availability, renewal and enforceability of contracts to control our feedstock production. We may pursue similar arrangements for our biodiesel production, although terms may differ. Transportation is an important cost to us, so we must lease our land within a limited area of influence for cane, forcing us to negotiate our leasing contracts with a limited number of properties and land owners, which could result in higher leasing rates. Although for oil crops, this is not as big a factor, it is still important. Therefore, we will focus our strategy on regions where currently there is availability of land for lease. However, competitors might install themselves or expand their area of influence and dispute land with us, changing the market dynamics and affecting either our ability to lease land or the price of the leasing contracts. Due to the high profitability per hectare provided by of the production of ethanol and sugar from sugar cane, we are able to pay higher leasing prices and do not face strong competition from land leasers for alternative uses of the areas. However, market conditions for alternative crops or uses of land might change and affect either our ability to lease land or the price of the leasing contracts. In the Northeast of Brazil there is a similar competitive market for alternative uses for crops such as oilseeds. Delays or difficulties on signing leasing contracts to reach the forecasted controlled areas would affect our expected crushing estimates, or diminish our profitability by forcing us to buy more cane or oil crops from third parties over time. Unexpected delays in planting activities might affect the forecasted expansion of our plantations. Such delays might be caused, among other factors, by weather conditions, availability of seedling cane or oil seeds, availability of agricultural workers or availability of planting equipments to be leased from third parties.

Changes in yields and productivity of our plantations or in the yield of feedstocks, such as cane or oil we acquire from third parties might affect our production costs.

There could be a change in the average production per hectare, in terms of tons of sugar cane or the sugar content in the cane we are processing or oil per crop. Theses factors might be as a result of soil conditions, topography to the extent we use mechanized cutting, weather conditions, or agricultural techniques and varieties used. Our agricultural specialists might not correctly anticipate such changes, having an effect on our costs in a particular season.

We are exposed to market prices for a portion of our raw materials

We do not grow the entirety of the raw materials that we require to produce biofuels according to our business plan. In the case of our projected production of ethanol for 2008, we expect to grow approximately 50% of our projected feedstock needs, increasing to 70% in 2009 and thereafter. Our sugar cane production in 2007 was approximately 25% of our current feedstock needs. Our ability to increase this percentage depends on our ability to lease or purchase land and to develop plantations or to obtain long-term contracts on economic terms.

To the extent that we purchase feedstock at market prices from third parties or our contracts have market pricing provisions, this could have a negative effect on our margins, depending on prices. To the extent that we produce our own feedstock and market prices of feedstock, for whatever reason, fall below our cost of feedstock production, then we may miss an opportunity to improve our margins.

We will rely on a number of land leasing or agricultural partnership agreements in the cane area and contracts with farmers in the biodiesel and cane areas to meet a large portion of our land or feedstock needs.

Interruptions in cane supply by our third party suppliers, or termination or expiration of our leasing or sugarcane partnership agreements, might affect our processing forecasts. Similarly we will be acquiring oils from farmers for our biodiesel area and cane from suppliers to meet the balance of our cane needs. Contract issues or contract defaults could have a materially negative affect on our business. If we are forced to cover needs at market prices in excess of our own estimated internal costs of production, our financial results would be adversely affected.

The agricultural sector is highly susceptible to governmental influence and policies.

Changes in rules or more restrictive rules for the agricultural sector could negatively affect our results. Industry specific increases in taxation, price-control policies, land use restrictions, import-export restrictions or rulings by environmental agencies could broadly affect the agricultural industry, and therefore our results.

Developing and administering agricultural projects that include a social service component may require skills that we do not possess, may be more costly than we project and may expose us to political or social pressures or criticism.

We support the social and economic objectives of the Social Fuel Seal program of the Brazilian Ministry of Agricultural Development, which seeks to encourage purchases of agricultural feedstocks from family farms of twelve hectares or less. Nonetheless, participating in the development of family farm plantations may require skills that our management does not possess, may distract us from our other businesses, may require significant investment, and the recovery of investment of cash and other resources will not be assured. It may occur that family farmers will not be sufficiently trained or otherwise able to produce anticipated quantities or reach or maintain required quality of production, that selected agricultural areas will not be suitable for production or that the crop varieties selected for planting will not be appropriate for the land selected or not suitable for biodiesel production, or that the family farming program will lose its political or community support if it does not, in the near term, obtain its ambitious social and economic goals., or that we will not be able to maintain our certification in the Social Fuel Seal Program.

Currency Considerations

Our future results of operations may be significantly affected by currency fluctuations.

We intend primarily to acquire companies or businesses with assets outside the U.S. and nearly all of our revenues are likely to be generated outside the U.S. As a result, we may be subject to risks relating to fluctuations in currency exchange rates. While we may attempt to reduce the risks associated with exchange rate fluctuations through hedging transactions, we cannot guarantee that, in the event such hedging transactions are implemented, they will be effective or that fluctuations in the value of the currencies in which we may operate will not materially affect our results of operations.

Significant volatility in the value of the real in relation to the U.S. dollar could harm our ability to meet our U.S. dollar-denominated liabilities.

The Brazilian currency has historically suffered frequent devaluations. In the past, the Brazilian Government has implemented various economic plans and utilized a number of exchange rate policies, including sudden devaluations and periodic mini-devaluations, during which the frequency of adjustments has ranged from daily to monthly, floating exchange rate systems, exchange controls and dual exchange rate markets. There have been significant fluctuations in the exchange rates between the Brazilian currency and the U.S. dollar and other currencies. For example, the U.S. dollar/ real exchange rate depreciated from R$1.807 per U.S. $1.00 as of April 30, 2000 to R$2.185 as of April 30, 2001 and to R$2.363 as of April 30, 2002. The exchange rate reached R$3.955 per U.S. $1.00 in October 2002. However, the economic policies initiated by the Brazilian Government in 2003 have helped to restore confidence in the Brazilian market. This has resulted in the appreciation of the real relative to the U.S. dollar to better than R$1.64 per U.S. $1.00 as of June 6, 2008. We are subject to risk brought about by the possibility of a devaluation of the real or a decline in the rate of exchange of U.S. dollars for reals. Unless we fully hedge this devaluation risk, any decrease in the value of the real relative to the U.S. dollar could have a material adverse effect on our business and results of operations. In addition, a devaluation or a less favorable exchange rate would effectively increase the interest expense in respect of our U.S. dollar-denominated debt and may have a material adverse effect on our operations.

Our reporting currency is the U.S. dollar but a substantial portion of our sales is in Brazilian real, so that exchange rate movements may increase our financial expenses and negatively affect our profitability.

Comanche generally invoices its sales in the currency of Brazil, the Real, but reports results in U.S. dollars. The results of Comanche and our Brazilian subsidiaries are translated from Reais into U.S. dollars upon consolidation. When the U.S. dollar strengthens against other currencies, our net sales and net income may decrease.

We are highly dependent on certain members of our management.

Our operations are dependent on certain members of our Board of Directors and some of our executive officers, particularly with respect to business planning, strategy and operations. If any of these key members of our management leaves our company, our business and results of operations may be adversely impacted.

We are dependent upon our officers and other key employees for management and direction, and the loss of any of these persons could adversely affect our operations and results.

Our success will depend to a significant extent upon the efforts and abilities of our officers to implement our proposed expansion strategy and execution of our business plan. The loss of the services of one or more of these key persons could have a material adverse effect upon our results of operations and financial position. Our business will also be dependent upon our ability to attract and retain qualified personnel. Acquiring these personnel could prove more difficult or cost substantially more than estimated. This could cause us to incur greater costs, or prevent us from pursuing our strategy as quickly as we would otherwise wish to do. While we anticipate that we may enter into employment agreements with certain of our officers or other key personnel, no such agreements are currently in place. The loss of any of our key employees could delay or prevent the achievement of our business objectives.

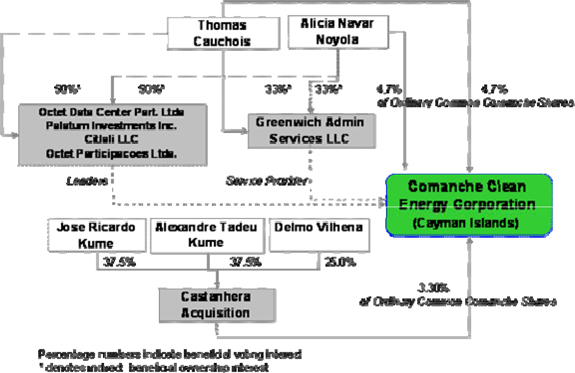

Two of our significant shareholders are directors and officers of the Company and also control certain companies to which we are indebted or which provide services to us; as a result they may make determinations or exercise their vote as a director in a manner which may be adverse to our interests.

Thomas Cauchois and Alicia Noyola each own 1,107,662 of our Ordinary Shares (approximately 4.7% of our outstanding Ordinary Shares each as of June 21, 2008), are each directors and senior officers of the Company. Mr. Cauchois and Ms. Cauchois each directly or indirectly own 50% of the voting interests in Palatum Investments Inc., Octet Data Center Participacoes Ltda. and Citlali LLC and 33.3% of the voting interests in Greenwhich Administrative Services LLC (“GAS”). As of the date of this Annual Report, the Company owed an aggregate of $1,658,000 to such companies, all of which indebtedness is repayable upon demand and accrues interest at rates ranging of 6% or 9% per annum. GAS performs certain financial, bookkeeping, compliance and assistance with auditing for the Company at its cost plus 7.5%. The remaining indebtedness was incurred as a result of advances made to subsidiaries of the Company by the other companies referred to above. As a result of their share ownership and positions with the Company and their ownership of the creditors of the Company referred to above, certain conflicts of interest could arise for Mr. Cauchois and Ms. Noyola which might not be resolved in the Company’s favor.

The Risks of Local and International Liquidity

As our operations are in Brazil, the availability of credit and the rates at which such funds may be borrowed, could affect our future operating results.

There are limited sources of capital available domestically within Brazil. We anticipate the need for future borrowings to achieve our business objectives. To the extent that such borrowings are unavailable from commercial banks or development banks, we may not be able to obtain our business objectives.

The use of credit and level of interest rates could affect our operating results.

Overall, the use of leverage, while providing the opportunity for a higher investments and return, also increases the volatility of our results and the risk of loss.

Risks Relating to the Environment and Environmental Regulation

We are subject to extensive environmental regulation and may be exposed to liabilities as a result of our handling of hazardous materials and potential costs for environmental compliance. We also require permits from Brazilian Governmental authorities with control over certain aspects of our business.