UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 22, 2011

Polar Wireless Corp.

(Exact name of registrant as specified in its charter)

| Nevada | | 000-54131 | | 20-4662814 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

100 York Boulevard, Richmond Hill, Ontario L4B 1J8

(Address of principal executive offices)(Zip Code)

4440 PGA Blvd., Suite 600, Palm Beach Gardens, Florida 33410

(Former name or former address, if changed since last report.)

(905) 881-8444

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SAFE HARBOR STATEMENT

This Current Report on Form 8-K (this Report) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 (the Securities Act) and Section 21E of the Securities Exchange Act of 1934 (the Exchange Act). The forward-looking statements are only predictions and provide our current expectations or forecasts of future events and financial performance and may be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “will” or “should” or, in each case, their negative, or other variations or comparable terminology, though the absence of these words does not necessarily mean that a statement is not forward-looking. The forward-looking statements are based on current views with respect to future events and financial performance. Actual results may differ materially from those projected in the forward-looking statements.

Although forward-looking statements in this report reflect the good faith judgment of management, forward-looking statements are inherently subject to known and unknown risks, business, economic and other risks and uncertainties that may cause actual results to be materially different from those discussed in these forward-looking statements. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the Securities and Exchange Commission (the “SEC”) which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, our actual results may vary materially from those expected or projected.

Item 1.01 Entry into a Material Definitive Agreement

Background

On January 5, 2011, Polar Wireless Corp., a Nevada corporation (“Polar”) filed a Current Report on Form 8-K wherein Polar disclosed, among other things, that:

(i) On January 4, 2011, Polar, Polar Wireless Corporation (“Polar Ontario”), an Ontario corporation, and 2230354 Ontario Inc., an Ontario corporation (“223”), executed a binding letter of intent (the “LOI”) which provides for the amalgamation of 223, with and into Polar. To effectuate this amalgamation, shareholders of 223 would exchange their shares of 223 for securities of Polar Ontario;

(ii) The LOI provides, among other items, that, from and after January 4, 2011 until the closing date of the amalgamation, 223 granted to Polar and its subsidiaries a non-transferable, worldwide, royalty-free exclusive right and license to exploit, market, sell and deploy all of the intellectual property and all rights therein currently held by 223; and

(iii) Following the closing of the amalgamation, Polar would have outstanding 68,000,000 shares of common stock and 210,526 shares of Series A Preferred Stock, with shares of the amalgamating companies outstanding exchangeable into an aggregate of 12,000,000 shares of common stock of Polar and 789,474 shares of Series A Preferred Stock.

Previously, 223 and Polar were party to an intellectual property sale agreement dated January 26, 2010 pursuant to which 223 was to sell to Polar the intellectual property relating to 223’s roaming business in consideration of the issuance of restricted shares of Polar’s common stock. Subject to the date of that agreement, 223 and Polar entered into negotiations to effect a broader transaction whereby Polar would acquire 223, including its intellectual property relating to its long distance business and other technology not included in the originally contemplated transaction. The amalgamation transaction supersedes the transaction contemplated by the January 26, 2010 agreement.

This Current Report on Form 8-K discloses the completion of the transactions contemplated by the Current Report on Form 8-K filed on January 5, 2011 and matters relating thereto.

Material Agreements

On June 22, 2011, Polar consummated the transactions referenced in the Background section above. The material agreements Polar entered into in connection with the amalgamation are: (i) the Amalgamation Agreement dated June 22, 2011 among Polar, Polar Ontario and 223, (ii) the Support Agreement dated June 22, 2011 between Polar, Polar Ontario and 2240519 Ontario Limited, an Ontario corporation (“Callco”), (iii) the Exchange Trust Agreement dated June 22, 2011 between Polar, 223 and Callco, and (iv) the Letter Agreement dated June 22, 2011 between Polar and 2231470 Ontario Inc., an Ontario corporation. In addition, immediately prior to entering into the above-referenced agreements, Polar acquired all of the outstanding common shares of Callco from Shane Carroll, a director of Polar, for nominal consideration.

For a description of the various steps involved in the amalgamation transaction and the material agreements entered into in connection therewith, please see Item 2.01 of this Current Report on Form 8-K, which disclosure is incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets

1. Amalgamation of Polar Wireless Corporation, an Ontario corporation, and 2230354 Ontario Inc., an Ontario corporation

The following is a glossary of certain terms used in this Current Report on Form 8-K:

“223” means 2230354 Ontario Inc., a corporation existing under the OBCA.

“223 Shareholder” means a holder of 223 Shares.

“223 Shares” means the common shares in the capital of 223.

“Affiliate” means an affiliate body corporate within the meaning of Section 2(1) of the OBCA.

“Amalgamation” means the amalgamation pursuant to Sections 175 and 176 of the OBCA of 223 and Subco, on the terms and conditions set forth in the Amalgamation Agreement.

“Amalgamation Agreement” means the amalgamation agreement dated June 22, 2011 among 223, Polar and Subco providing for the Amalgamation, in the form set forth in an exhibit to this Current Report on Form 8-K.

“Automatic Exchange Right” means the benefit of the obligations of Polar to effect the automatic exchange of Class A Exchangeable Shares into Polar Shares pursuant to Section 3.11 of the Exchange Trust Agreement in the event of a Polar Liquidation Event.

“Business Day” means any day other than a Saturday, Sunday or civic or statutory holiday in the City of Toronto, Ontario.

“Call Rights” means, collectively, the Liquidation Call Right, the Redemption Call Right and the Retraction Call Right.

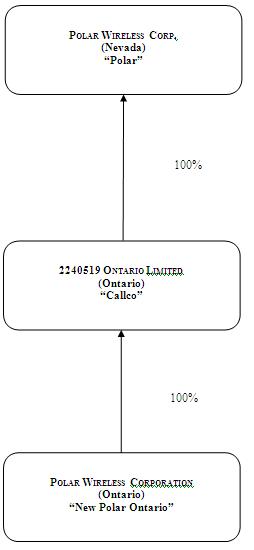

“Callco” means 2240519 Ontario Limited, a wholly-owned subsidiary of Polar existing under the OBCA.

“Class A Exchangeable Shares” means the Class A exchangeable non-voting shares in the capital of New Polar Ontario, having the rights, privileges, restrictions and conditions set out in Appendix 1 to the Amalgamation Agreement.

“Class B Exchangeable Shares” means the Class B exchangeable non-voting shares in the capital of New Polar Ontario, having the rights, privileges, restrictions and conditions set out in Appendix 1 to the Amalgamation Agreement.

“Class A Redemption Price” has the meaning ascribed thereto in Section V.7.1 of the Exchangeable Share Provisions, which amount will be satisfied through the issuance and delivery of one Polar Share for each Class A Exchangeable Share.

“Class A Retraction Price” has the meaning ascribed thereto in Section V.6.1 of the Exchangeable Share Provisions, which amount will be satisfied through the issuance and delivery of one Polar Share for each Class A Exchangeable Share.

“Class B Redemption Price” has the meaning ascribed thereto in Section VI.7.1 of the Exchangeable Share Provisions, which amount will be satisfied through the issuance and delivery of one Polar Preferred Share for each Class B Exchangeable Share.

“Class B Retraction Price” has the meaning ascribed thereto in Section VI.6.1 of the Exchangeable Share Provisions, which amount will be satisfied through the issuance and delivery of one Polar Preferred Share for each Class B Exchangeable Share.

“Effective Date” means June 22, 2011, the date shown on the certificate of amalgamation issued under the OBCA giving effect to the Amalgamation.

“Effective Time” means the commencement of the day on the Effective Date.

“Exchange Right” means the rights of holders of Class A Exchangeable Shares to require Callco to purchase their Class A Exchangeable Shares using one Polar Share for each Class A Exchangeable Share in the circumstances described in Section 5.1 of the Exchange Trust Agreement.

“Exchange Trust Agreement” means the agreement dated June 22, 2011 between Polar, 233 and Callco, as trustee.

“Exchangeable Share Provisions” means the rights, privileges, restrictions and conditions attaching to the Class A Exchangeable Shares and the Class B Exchangeable Shares, as set out in Appendix 1 to the Amalgamation Agreement.

“Insolvency Event” means the institution by New Polar Ontario of any proceeding to be adjudicated a bankrupt or insolvent or to be wound up, or the consent of New Polar Ontario to the institution of bankruptcy, insolvency or winding-up proceedings against it, on the filing of a petition, answer or consent seeking dissolution or winding-up under any bankruptcy, insolvency or analogous laws, including, without limitation, the Companies’ Creditors Arrangement Act (Canada) and the Bankruptcy and Insolvency Act (Canada), and the failure by New Polar Ontario to contest in good faith any such proceedings commenced in respect of New Polar Ontario within 30 days of becoming aware thereof, or the consent by New Polar Ontario to the filing of any such petition or to the appointment of a receiver, or the making by New Polar Ontario of a general assignment for the benefit of creditors, or the admission in writing by New Polar Ontario of its inability to pay its debts generally as they become due, or New Polar Ontario not being permitted, pursuant to solvency requirements of applicable law, to redeem any Retracted Shares pursuant to Section 6.6 of the Exchangeable Share Provisions.

“Liquidation Call Right” means the overriding rights of Callco, in the event of and notwithstanding the proposed liquidation, dissolution or winding-up of New Polar Ontario, to purchase from all, but not less than all, of the holders of Class A Exchangeable Shares all, but not less than all, of the Class A Exchangeable Shares held by each such holder and to purchase from all, but not less than all, of the holders of Class B Exchangeable Shares all, but not less than all, of the Class B Exchangeable Shares held by each such holder, as more particularly described in Section 5.4 of the Exchangeable Share Provisions.

“Liquidation Date” means the effective date of the liquidation, dissolution or winding-up of New Polar Ontario.

“New Polar Ontario” means the amalgamated corporation formed under the OBCA pursuant to the Amalgamation which, among other things, carries on the business of 223 and Subco.

“New Polar Ontario Class A Shares” means the Class A non-voting common shares in the capital of New Polar Ontario, having the rights, privileges, restrictions and conditions set out in Appendix 1 to the Amalgamation Agreement.

“New Polar Ontario Class B Shares” means the Class B non-voting common shares in the capital of New Polar Ontario, having the rights, privileges, restrictions and conditions set out in Appendix 1 to the Amalgamation Agreement.

“New Polar Ontario Liquidation Amount” has the meaning ascribed thereto in the Exchangeable Share Provisions, which amount will be satisfied through the issuance and delivery of one Polar Share for each Class A Exchangeable Share or one Polar Preferred Share for each Class B Exchangeable Share, as the case may be.

“OBCA” means the Business Corporations Act (Ontario), as amended.

“Polar” means Polar Wireless Corp., a corporation existing under the laws of the State of Nevada.

“Polar Control Transaction” has the meaning ascribed thereto in the Exchangeable Share Provisions.

“Polar Liquidation Event” has the meaning ascribed thereto in Section 3.11(b) of the Exchange Trust Agreement.

“Polar Preferred Shares” means the shares of Series A preferred stock, par value US$0.001, of Polar.

“Polar Shares” means the shares of common stock, par value US$0.001, of Polar.

“Redemption Call Right” means (i) in the case of Class A Exchangeable Shares, the overriding right of Callco, in the event of and notwithstanding the proposed redemption of Class A Exchangeable Shares by New Polar Ontario, to purchase from all, but not less than all, of the holders of Class A Exchangeable Shares all, but not less than all, of the Class A Exchangeable Shares held by each such holder, as more particularly described in Section V.7.3 of the Exchangeable Share Provisions, and (ii) in the case of Class B Exchangeable Shares, the overriding right of Callco, in the event of and notwithstanding the proposed redemption of Class B Exchangeable Shares by New Polar Ontario, to purchase from all, but not less than all, of the holders of Class B Exchangeable Shares all, but not less than all, of the Class B Exchangeable Shares held by each such holder, as more particularly described in Section VI.7.3 of the Exchangeable Share Provisions.

“Redemption Date” means the date, if any, established by the board of directors of New Polar Ontario for the redemption by New Polar Ontario of all, but not less than all, of the outstanding Class A Exchangeable Shares or Class B Exchangeable Shares pursuant to V.Article 7 or VI. Article 7, respectively, of the Exchangeable Share Provisions, unless:

| (a) | there are fewer than 10% of the number of Class A Exchangeable Shares or Class B Exchangeable Shares outstanding on the Effective Date still outstanding (other than Class A Exchangeable Shares or Class B Exchangeable Shares held by Polar and its Affiliates and as such number of shares may be adjusted as deemed appropriate by the board of directors of New Polar Ontario to give effect to any subdivision or consolidation of or stock dividend on the Class A Exchangeable Shares or Class B Exchangeable Shares, any issue or distribution of rights to acquire Class A Exchangeable Shares or securities exchangeable for or convertible into Class A Exchangeable Shares or Class B Exchangeable Shares or securities exchangeable for or convertible into Class B Exchangeable Shares, any issue or distribution of other securities or rights or evidences of indebtedness or assets, or any other capital reorganization or other transaction affecting the Class A Exchangeable Shares or Class B Exchangeable Shares), in which case the board of directors of New Polar Ontario may fix the redemption date to such date as they may determine, upon at least 60 days’ prior written notice to the registered holders of the Class A Exchangeable Shares or Class B Exchangeable Shares, as the case may be; or |

| (b) | a Polar Control Transaction occurs, in which case, provided that the board of directors of New Polar Ontario determines, in good faith and in its sole discretion, that it is not reasonably practicable to substantially replicate the terms and conditions of the Class A Exchangeable Shares or the Class B Exchangeable Shares in connection with such Polar Control Transaction and that the redemption of all, but not less than all, of the outstanding Class A Exchangeable Shares or the Class B Exchangeable Shares is necessary to enable the completion of such Polar Control Transaction in accordance with its terms, the board of directors of New Polar Ontario may fix the redemption date to such date as they may determine, upon such number of days prior written notice to the registered holders of the Class A Exchangeable Shares or the Class B Exchangeable Shares as the board of directors of New Polar Ontario may determine to be reasonably practicable in such circumstances, |

provided, however, that the accidental failure or omission to give any notice of redemption under clauses (a) or (b) above to less than 10% of such holders of Class A Exchangeable Shares or Class B Exchangeable Shares, as the case may be, shall not affect the validity of any such redemption.

“Retracted Shares” has the meaning ascribed thereto in Section V.6.1(a) and VI.6.1(a) of the Exchangeable Share Provisions, as applicable.

“Retraction Call Right” means (i) in the case of Class A Exchangeable Shares, the overriding right of Callco, in the event of and notwithstanding a request by a holder of Class A Exchangeable Shares for New Polar Ontario to redeem any or all of the Class A Exchangeable Shares registered in the name of such holder, to purchase all, but not less than all, of the Class A Exchangeable Shares that are the subject of such request directly from such holder, and (ii) in the case of Class B Exchangeable Shares, the overriding right of Callco, in the event of and notwithstanding a request by a holder of Class B Exchangeable Shares for New Polar Ontario to redeem any or all of the Class B Exchangeable Shares registered in the name of such holder, to purchase all, but not less than all, of the Class B Exchangeable Shares that are the subject of such request directly from such holder, in each case, as more particularly described in Section V.7.3 and VI.7.3 of the Exchangeable Share Provisions.

“Retraction Date” has the meaning ascribed thereto in Section V.6.1(b) and VI.6.1(b) of the Exchangeable Share Provisions, as applicable.

“Retraction Request” has the meaning ascribed thereto in Section V.6.1 and VI.6.1 of the Exchangeable Share Provisions, as applicable.

“Subco” means Polar Wireless Corporation, which, immediately prior to the Amalgamation, was an indirect wholly-owned subsidiary of Polar existing under the OBCA.

“Support Agreement” means the agreement dated June 22, 2011 between Polar, New Polar Ontario and Callco.

“Transaction” means the business combination of Polar and 223 effected by way of (a) the Amalgamation, and (b) the redemption of New Polar Ontario Class A Shares for Class A Exchangeable Shares and the redemption of New Polar Ontario Class B Shares for Class B Exchangeable Shares.

“Tax Act” means the Income Tax Act (Canada), as amended.

“Transfer Agent” means Island Stock Transfer Inc.

Information Regarding the Amalgamation

Purpose of the Amalgamation

The purpose of the Amalgamation was to facilitate the indirect acquisition by Polar of all of the outstanding 223 Shares. On the completion of the Amalgamation, 223 become an indirect, wholly-owned subsidiary of Polar.

On consummation of the Transaction, 223 Shareholders received for each of their 223 Shares one Class A Exchangeable Share and 0.0657895 Class B Exchangeable Shares. Each Class A Exchangeable Share may subsequently be exchanged, at the option of the holder, into a Polar Share on a one-for-one basis. Each Class B Exchangeable Share may subsequently be exchanged, at the option of the holder, into a Polar Preferred Share on a one-for-one basis. Holders of Class A Exchangeable Shares will have economic rights substantially identical to those possessed by holders of Polar Shares while holders of Class B Exchangeable Shares will have economic rights substantially identical to those possessed by holders of Polar Preferred Shares. Class A Exchangeable Shares and Class B Exchangeable Shares generally may be received by Canadian residents on a tax-deferred rollover basis (provided appropriate elections are filed with the relevant tax authorities) under the Tax Act. The Class A Exchangeable Shares and Class B Exchangeable Shares will be automatically exchanged upon the occurrence of certain events, including the liquidation, dissolution or winding-up of Polar or New Polar Ontario. Dividends are payable on Class A Exchangeable Shares at the same time and in the economically equivalent amounts per share as dividends on the Polar Shares and dividends are payable on Class B Exchangeable Shares at the same time and in the economically equivalent amounts per share as dividends on the Polar Preferred Shares.

Stock Ownership Following Completion of the Transaction

Assuming that all Class A Exchangeable Shares are exchanged, an aggregate of 12,000,000 Polar Shares will be issued to the former 223 Shareholders in the Transaction. Based upon the number of Polar Shares issued and outstanding as of June 22, 2011, and after giving effect to the issuance of Polar Shares as described in the previous sentence, the former holders of 223 Shares would hold 15% of Polar’s total issued and outstanding common stock.

Terms of the Amalgamation

The Amalgamation effected a series of transactions as a result of which 223 was amalgamated with Subco, a company indirectly wholly-owned by Polar, to form New Polar Ontario. The Amalgamation became effective at the Effective Time. Each holder of 223 Shares received upon the Amalgamation one New Polar Ontario Class A Share and one New Polar Ontario Class B Share for each 223 Share then held by such holder. Immediately following the Amalgamation, each such New Polar Ontario Class A Share and New Polar Ontario Class B Share was automatically redeemed by New Polar Ontario for one Class A Exchangeable Share and 0.0657895 Class B Exchangeable Share, respectively. The terms of the Amalgamation are set out in the Amalgamation Agreement. The following summary of the Amalgamation and the Amalgamation Agreement is qualified in its entirety by the full text of the Amalgamation Agreement.

Upon filing of articles of amalgamation with the Director appointed pursuant to the OBCA, pursuant to the Amalgamation Agreement, at the Effective Time, the following occurred and was deemed to have occurred in the following order without any further act or formality:

| (a) | 223 and Subco were amalgamated and continued as one company under the OBCA and the following provisions applied to New Polar Ontario: |

| (i) | the name of New Polar Ontario became “Polar Wireless Corporation” and the registered office of New Polar Ontario was fixed at 100 York Boulevard, Richmond Hill, Ontario, Canada L4B 1J8; |

| (ii) | the authorized capital of New Polar Ontario became an unlimited number of common shares, an unlimited number of New Polar Ontario Class A Shares, an unlimited number of New Polar Ontario Class B Shares, an unlimited number of Class A Exchangeable Shares and an unlimited number of Class B Exchangeable Shares with the rights, privileges, restrictions and conditions described in Appendix 1 to the Amalgamation Agreement; |

| (iii) | there are no restrictions on the business which New Polar Ontario is authorized to carry on or the powers which New Polar Ontario may exercise; |

| (iv) | the board of directors of New Polar Ontario, until otherwise changed in accordance with the OBCA, consists of a minimum of one and a maximum of 10 directors. The number of directors of New Polar Ontario initially is set at one, with the first director of New Polar Ontario being Robert M. Bent of Toronto, Ontario; and |

| (v) | the by-laws of New Polar Ontario, until repealed, amended or altered, are the by-laws of Subco in effect prior to the Effective Time; |

| (b) | the following procedural steps were taken in order for the Amalgamation to become effective: |

| (i) | each issued and outstanding 223 Share held by a 223 Shareholder was transferred by the holder thereof to New Polar Ontario in exchange for one New Polar Ontario Class A Share and one New Polar Ontario Class B Share for each 223 Share and New Polar Ontario became the registered and beneficial owner of the 223 Shares exchanged as aforesaid; |

| (ii) | all 223 Shares exchanged for New Polar Ontario Class A Shares and New Polar Ontario Class B Shares referred to in paragraph (b)(i) above were cancelled without any repayment of capital in respect thereof; and |

| (iii) | Polar, New Polar Ontario and Callco executed the Exchange Trust Agreement and the Support Agreement, as applicable; and |

| (c) | each 223 Shareholder that received New Polar Ontario Class A Shares and New Polar Ontario Class B Shares under the Amalgamation was removed from the register of holders of 223 Shares and added to the register of holders of New Polar Ontario Class A Shares and New Polar Ontario Class B Shares. |

Information Concerning Subco and Callco

Subco

Immediately prior to the Effective Time, Subco was a direct wholly-owned subsidiary of Callco (and an indirect wholly-owned subsidiary of Polar). Subco was incorporated under the OBCA on January 22, 2010. For a description of the business and affairs of Subco, please see sub-item 2.01 2. of this Current Report on Form 8-K, which disclosure is incorporated herein by reference.

Callco

Immediately prior to the Effective Time, Polar acquired the outstanding shares of Callco for nominal consideration such that Callco became a wholly-owned subsidiary of Polar. Callco was incorporated under the OBCA on June 15, 2010. Callco holds certain rights related to the Class A Exchangeable Shares and Class B Exchangeable Shares. As of June 22, 2011, Callco had no material assets and no liabilities. Following the Effective Date, Callco will not carry on any business except in connection with its role with respect to the Class A Exchangeable Shares and Class B Exchangeable Shares issued in connection with the Transaction.

Retraction, Redemption, Call Rights and Purchase for Cancellation of Class A Exchangeable Shares

Retraction of Class A Exchangeable Shares

Subject to the exercise by Callco of its Retraction Call Right, holders of Class A Exchangeable Shares are entitled at any time following the Effective Time to retract (i.e., require New Polar Ontario to redeem) any or all of the Class A Exchangeable Shares held by such holder for an amount per share equal to the Class A Retraction Price. Holders of Class A Exchangeable Shares may effect such retraction by presenting a certificate or certificates to New Polar Ontario or to the Transfer Agent representing the number of Class A Exchangeable Shares the holder desires to retract together with a duly executed Retraction Request indicating the number of Class A Exchangeable Shares the holder desires to retract and the Retraction Date upon which the holder desires to receive the Class A Retraction Price, and such other documents as may be required to effect the retraction of the Retracted Shares. The retraction of Retracted Shares shall not affect the obligation of New Polar Ontario to pay dividends declared on the Retracted Shares prior to the date of their retraction.

When a holder requests New Polar Ontario to redeem Retracted Shares, Callco will have an overriding Retraction Call Right to purchase on the Retraction Date all, but not less than all, of the Retracted Shares, at a purchase price per share equal to the Class A Retraction Price plus, on the designated payment date therefor, to the extent not paid by New Polar Ontario, the applicable dividend amount, if any. To the extent that Callco pays the applicable dividend amount, if any, in respect of the Retracted Shares, New Polar Ontario shall no longer be obligated to pay any declared and unpaid dividends on such Retracted Shares. Upon receipt of a Retraction Request, New Polar Ontario will immediately notify Callco. Callco must then advise New Polar Ontario within five Business Days as to whether the Retraction Call Right will be exercised. If Callco does not so advise New Polar Ontario, New Polar Ontario will notify the holder as soon as possible thereafter that Callco will not exercise the Retraction Call Right. If Callco advises New Polar Ontario that Callco will exercise the Retraction Call Right within such five Business Day period, then, provided the Retraction Request is not revoked by the holder as described below, the Retraction Request shall thereupon be considered only to be an offer by the holder to sell the Retracted Shares to Callco in accordance with the Retraction Call Right.

A holder may revoke its Retraction Request, in writing, at any time prior to the close of business on the Business Day immediately preceding the Retraction Date, in which case the Retracted Shares will neither be purchased by Callco nor be redeemed by New Polar Ontario. If the holder does not revoke its Retraction Request, then on the Retraction Date the Retracted Shares will be purchased by Callco or redeemed by New Polar Ontario, as the case may be, in each case as set out above.

New Polar Ontario or Callco, as the case may be, will deliver or cause the Transfer Agent to deliver (i) certificates, representing the aggregate number of Polar Shares equal to which the holder is entitled, registered in the name of the holder or in such other name as the holder may request, and (ii) if applicable, a check for the aggregate applicable dividend amount, if any to the holder at the address recorded in the securities register or at the address specified in the holder’s Retraction Request or by holding the same for pick up by the holder at the registered office of New Polar Ontario or the office of the Transfer Agent as specified by New Polar Ontario, in each case less any amounts withheld on account of tax required to be deducted and withheld therefrom.

Pursuant to the terms of the Exchangeable Share Provisions, the Retraction Date will be between 15 to 20 Business Days after the Retraction Request is received. During this time, the market price of Polar Shares may increase or decrease. Any such increase or decrease would affect the value of Polar Shares to be received by the holder on the Retraction Date.

If, as a result of solvency requirements, as set out in the Support Agreement or applicable law, New Polar Ontario is not permitted to redeem all Retracted Shares tendered by a retracting holder, and provided Callco has not exercised its Retraction Call Right with respect to such Retracted Shares, New Polar Ontario will redeem only those Retracted Shares tendered by the holder as would not be contrary to such provisions or applicable law and Callco, on behalf of the holder of any Retracted Shares not so redeemed by New Polar Ontario, will exercise the Exchange Right and will require Polar to purchase such Retracted Shares on the Retraction Date pursuant to the exercise of the Exchange Right.

Redemption of Class A Exchangeable Shares

Subject to applicable law and the exercise by Callco of the Redemption Call Right, on the Redemption Date, New Polar Ontario will redeem all, but not less than all, of the then outstanding Class A Exchangeable Shares for an amount per share equal to the Class A Redemption Price plus, on the designated payment date thereof, all declared and unpaid dividends on each Class A Exchangeable Share held by a holder on any dividend record date which occurred prior to the Redemption Date. The Redemption Date will be established by the board of directors of New Polar Ontario in the circumstances described below under “- Redemption”. New Polar Ontario will, at least 60 days prior to the Redemption Date, or such number of days as the board of directors of New Polar Ontario may determine to be reasonably practicable under the circumstances in respect of a Redemption Date arising in connection with a Polar Control Transaction, provide the registered holders of Class A Exchangeable Shares with written notice of the proposed redemption of the Class A Exchangeable Shares by New Polar Ontario or the purchase of the Class A Exchangeable Shares by Callco pursuant to the Redemption Call Right described below.

On or after the Redemption Date and provided Callco has not exercised its Redemption Call Right, upon the holder’s presentation and surrender of the certificates representing the Class A Exchangeable Shares and such other documents as may be required at the office of the Transfer Agent or the registered office of New Polar Ontario, New Polar Ontario will deliver the Class A Redemption Price plus the aggregate amount of any declared and unpaid dividends to such holder by mailing certificates, representing the aggregate number of Polar Shares to which the holder is entitled, registered in the name of the holder or such other name as the holder may request and, if applicable, a check for the aggregate amount of such declared and unpaid dividends to the holder at the address of the holder recorded in the securities register or by holding the same for pick up by the holder at the registered office of New Polar Ontario or the office of the Transfer Agent as specified in the written notice of redemption, in each case, less any amounts withheld on account of tax required to be deducted and withheld therefrom.

Callco will have an overriding Redemption Call Right to purchase on the Redemption Date all, but not less than all, of the Class A Exchangeable Shares then outstanding (other than Class A Exchangeable Shares held by Polar and its Affiliates) for an amount per share equal to the Class A Redemption Price plus all declared and unpaid dividends, if any. Upon the exercise of the Redemption Call Right, holders will be obligated to sell their Class A Exchangeable Shares to Callco. If Callco exercises the Redemption Call Right, New Polar Ontario’s right and obligation to pay any declared and unpaid dividends in respect of the Class A Exchangeable Shares so purchased by Callco will be fully satisfied by the payment by Callco of such amount.

Redemption

In certain circumstances, New Polar Ontario has the right to require a redemption of the Class A Exchangeable Shares. An early redemption may occur upon (i) there being fewer than 10% of the initial number of Class A Exchangeable Shares outstanding on the Effective Date still outstanding (other than Class A Exchangeable Shares held by Polar and its Affiliates and subject to certain “anti-dilution” adjustments described in the Exchangeable Share Provisions); or (ii) the occurrence of a Polar Control Transaction.

A Polar Control Transaction means any merger, amalgamation, tender offer, material sale of shares or rights or interests therein or thereto or similar transactions involving Polar, or any proposal to do so. If a Polar Control Transaction occurs, provided that the board of directors of New Polar Ontario determines, in good faith and in its sole discretion, that it is not reasonably practicable to substantially replicate the terms and conditions of the Class A Exchangeable Shares in connection with such Polar Control Transaction and that the redemption of all, but not less than all, of the outstanding Class A Exchangeable Shares is necessary to enable the completion of such Polar Control Transaction in accordance with its terms, the board of directors of New Polar Ontario may fix the Redemption Date to such date as the board of directors of New Polar Ontario may determine, upon such number of days prior written notice to the registered holders of Class A Exchangeable Shares as the board of directors of New Polar Ontario may determine to be reasonably practicable in such circumstances.

Purchase for Cancellation

Subject to applicable law, New Polar Ontario may at any time and from time to time purchase for cancellation all or any part of the outstanding Class A Exchangeable Shares at any price by tender to all the holders of record of Class A Exchangeable Shares then outstanding or through the facilities of any stock exchange on which the Class A Exchangeable Shares are listed or quoted at any price per share.

Voting, Dividend and Liquidation Rights of Holders of Class A Exchangeable Shares and Withholding Rights

Polar, 223 and Callco have entered into the Exchange Trust Agreement.

Voting Rights with Respect to New Polar Ontario

Except as required by law, the Support Agreement, the Exchange Trust Agreement and by Article V.10 of the Exchangeable Share Provisions, the holders of Class A Exchangeable Shares are not entitled as such to receive notice of or attend any meeting of shareholders of New Polar Ontario or to vote at any such meeting (see “- Amendment and Approval of Class A Exchangeable Shares” below). Callco is the only voting shareholder of New Polar Ontario.

Dividend Rights

Holders of Class A Exchangeable Shares are entitled to receive, subject to applicable law, dividends: (i) in the case of a cash dividend declared on Polar Shares, in an amount in cash for each Class A Exchangeable Share corresponding to the cash dividend declared on each Polar Share; (ii) in the case of a stock dividend declared on Polar Shares to be paid in Polar Shares, in such number of Class A Exchangeable Shares for each Class A Exchangeable Share as is equal to the number of Polar Shares to be paid on each Polar Share; or (iii) in the case of a dividend declared on Polar Shares in property other than cash or Polar Shares, in such type and amount of property as is the same as, or economically equivalent to (as determined by New Polar Ontario’s board of directors, in good faith and in its sole discretion) the type and amount of property declared as a dividend on each Polar Share. Cash dividends on the Class A Exchangeable Shares are payable in U.S. dollars or the Canadian dollar equivalent thereof, at the option of New Polar Ontario. The declaration date, record date and payment date for dividends on the Class A Exchangeable Shares will be the same as the relevant dates for the corresponding dividends on Polar Shares.

Liquidation Rights with Respect to New Polar Ontario

In the event of the liquidation, dissolution or winding-up of New Polar Ontario or any other proposed distribution of the assets of New Polar Ontario among its shareholders for the purpose of winding-up its affairs, each holder of Class A Exchangeable Shares will have, subject to applicable law, preferential rights to receive from New Polar Ontario for each Class A Exchangeable Share held by such holder the New Polar Ontario Liquidation Amount plus the amount of all declared and unpaid dividends on each such Class A Exchangeable Share held by such holder on any dividend record date which occurred prior to the Liquidation Date. Upon the occurrence of such liquidation, dissolution or winding-up, Callco will have an overriding Liquidation Call Right to purchase all of the outstanding Class A Exchangeable Shares (other than Class A Exchangeable Shares held by Polar or its Affiliates) from the holders thereof on the Liquidation Date for an amount per share equal to the New Polar Ontario Liquidation Amount plus any applicable dividend amount. In the event that Callco exercises its Liquidation Call Right and pays the applicable dividend amount, if any, the right of the holder of the Class A Exchangeable Shares so purchased to receive declared and unpaid dividends from New Polar Ontario shall be fully satisfied and discharged.

Upon the occurrence and during the continuance of an Insolvency Event, a holder of Class A Exchangeable Shares are entitled to instruct Callco to exercise the Exchange Right with respect to any or all of the Class A Exchangeable Shares held by such holder, thereby requiring Polar to purchase such Class A Exchangeable Shares from the holder. As soon as practicable following the occurrence of an Insolvency Event or any event which may, with the passage of time and/or the giving of notice, become an Insolvency Event, New Polar Ontario and Polar will give written notice thereof to Callco. As soon as practicable thereafter, Callco will notify each holder of Class A Exchangeable Shares of such event or potential event and will advise the holder of its rights with respect to the Exchange Right. The purchase price payable by Polar for each Class A Exchangeable Share purchased under the Exchange Right will be satisfied by the issuance of one Polar Share plus, to the extent not paid by New Polar Ontario on the designated payment date thereof, the amount of all declared and unpaid dividends on each such Class A Exchangeable Share held by such holder on any dividend record date which occurred prior to the closing of such purchase and, upon receipt of such amount, the holder shall no longer be entitled to receive any declared and unpaid dividends from New Polar Ontario.

Liquidation Rights with Respect to Polar

In order for the holders of Class A Exchangeable Shares to participate on a pro rata basis with the holders of Polar Shares, on the third Business Day prior to the effective date of a Polar Liquidation Event, each Class A Exchangeable Share will, pursuant to the Automatic Exchange Right, automatically be exchanged for an equivalent number of Polar Shares plus, to the extent not paid by New Polar Ontario on the designated payment date thereof, the amount of all declared and unpaid dividends on each such Class A Exchangeable Share held by such holder on any dividend record date which occurred prior to the date of such exchange and, upon receipt of the amount of such declared and unpaid dividends, the right of the holder of Class A Exchangeable Shares to receive declared and unpaid dividends from New Polar Ontario shall be fully satisfied and discharged. Upon a holder’s request and surrender of Class A Exchangeable Share certificates, duly endorsed in blank and accompanied by such instruments of transfer as Polar may reasonably require, Polar will deliver to such holder certificates representing an equivalent number of Polar Shares, plus a check for the amount of such dividends, if any, for the Class A Exchangeable Shares exchanged by such holder pursuant to the Automatic Exchange Right. For a description of certain Polar obligations with respect to the dividend and liquidation rights of the holders of Class A Exchangeable Shares, see “- Support Agreement”.

Withholding Rights

Polar, New Polar Ontario and the Transfer Agent are entitled to deduct and withhold from any dividends or consideration otherwise payable to any holder of Class A Exchangeable Shares or Polar Shares such amounts as Polar, New Polar Ontario or the Transfer Agent are required or permitted to deduct and withhold with respect to such payment under the Tax Act or any provision of provincial, state, local or foreign tax law.

Any amounts so withheld will be treated for all purposes as having been paid to the holder of the shares in respect of which such deduction and withholding was made, provided that such withheld amounts are actually remitted to the appropriate taxing authority. To the extent that the amount so required or permitted to be deducted or withheld from any payment to a holder exceeds the cash portion of the amount otherwise payable to the holder, Polar, New Polar Ontario and the Transfer Agent may sell or otherwise dispose of such portion of the consideration as is necessary to provide sufficient funds to Polar, New Polar Ontario or the Transfer Agent, as the case may be, to enable it to comply with such deduction or withholding requirement. Polar, New Polar Ontario or the Transfer Agent must notify the holder of any such sale and remit to such holder any unapplied balance of the net proceeds of such sale.

Ranking of Class A Exchangeable Shares

The Class A Exchangeable Shares are entitled to a preference over the common shares and any other shares of New Polar Ontario ranking junior to the Class A Exchangeable Shares with respect to the payment of dividends and the distribution of assets in the event of a liquidation, dissolution or winding-up of New Polar Ontario, whether voluntary or involuntary, or any other distribution of the assets of New Polar Ontario among its shareholders for the purpose of winding-up its affairs.

Certain Restrictions on the Class A Exchangeable Shares

New Polar Ontario will not without the approval of the holders of Class A Exchangeable Shares as set forth below under “- Amendment and Approval of Class A Exchangeable Shares”:

(a) | pay any dividends on the common shares of New Polar Ontario, or any other shares ranking junior to the Class A Exchangeable Shares, other than stock dividends payable in common shares of New Polar Ontario or any such other shares ranking junior to the Class A Exchangeable Shares, as the case may be; |

(b) | redeem, purchase or make any capital distribution in respect of the common shares of New Polar Ontario or any other shares ranking junior to the Class A Exchangeable Shares; |

(c) | redeem or purchase any other shares of New Polar Ontario ranking equally with the Class A Exchangeable Shares with respect to the payment of dividends or on any other liquidation or distribution; or |

(d) | issue any Class A Exchangeable Shares or any other shares of New Polar Ontario ranking equally with, or superior to, the Class A Exchangeable Shares other than by way of stock dividends to the holders of such Class A Exchangeable Shares. |

The restrictions in paragraphs (a), (b), (c) and (d) above will not apply at any time when the dividends on the outstanding Class A Exchangeable Shares corresponding to dividends declared and paid on Polar Shares have been declared and paid in full.

Amendment and Approval of Class A Exchangeable Shares

The rights, privileges, restrictions and conditions attaching to the Class A Exchangeable Shares may be added to, changed or removed only with the approval of the holders thereof together with such other approvals as would be required under the OBCA. Any such approval or any other approval or consent to be given by the holders of Class A Exchangeable Shares will be deemed to have been sufficiently given in accordance with applicable law subject to a minimum requirement that such approval or consent be evidenced by a resolution passed by not less than two-thirds of the votes cast on such resolution at a meeting of the holders of Class A Exchangeable Shares duly called and held at which holders of at least 25% of the outstanding Class A Exchangeable Shares are present or represented by proxy. In the event that no such quorum is present at such meeting within one-half hour after the time appointed therefor, then the meeting will be adjourned to such place and time (not less than 5 days later) as may be designated by the Chairman of such meeting. At such adjourned meeting, the holders of Class A Exchangeable Shares present or represented by proxy may transact the business for which the meeting was originally called and a resolution passed thereat by the affirmative vote of not less than two-thirds of the votes cast on such resolution will constitute the approval or consent of the holders of Class A Exchangeable Shares.

Support Agreement

Pursuant to the Support Agreement, Polar has made the following covenants in favour of New Polar Ontario and Callco for so long as any Class A Exchangeable Shares (other than Class A Exchangeable Shares owned by Polar or its Affiliates) remain outstanding:

| | (a) | Polar will not declare or pay dividends on Polar Shares unless New Polar Ontario is able to declare and pay and simultaneously declares and pays, as the case may be, an equivalent dividend on the Class A Exchangeable Shares; |

| | (b) | Polar will advise New Polar Ontario in advance of the declaration of any dividend on Polar Shares and ensure that the declaration date, record date and payment date for dividends on the Class A Exchangeable Shares are the same as that for the corresponding dividend on Polar Shares; |

| | (c) | Polar will ensure that the record date for any dividend declared on Polar Shares is not less than ten Business Days after the declaration date of such dividend: |

| | (d) | Polar will take all actions and do all things reasonably necessary or desirable to enable and permit New Polar Ontario, in accordance with applicable law, to pay and otherwise perform its obligations with respect to the satisfaction of the applicable New Polar Ontario Liquidation Amount, Class A Redemption Price or Class A Retraction Price in the event of a liquidation, dissolution or winding-up of New Polar Ontario, a Retraction Request by a holder of Class A Exchangeable Shares or a redemption of Class A Exchangeable Shares by New Polar Ontario, as the case may be; |

| | (e) | Polar will take all actions and do all things reasonably necessary or desirable to enable and permit Callco, in accordance with applicable law, to perform its obligations arising upon the exercise by it of the Call Rights, including the delivery of Polar Shares in accordance with the provisions of the applicable Call Right; and |

| | (f) | Polar will not (and will ensure that Callco and its Affiliates do not) exercise its vote as a shareholder of New Polar Ontario to initiate the voluntary liquidation, dissolution or winding-up of New Polar Ontario (or any other distribution of the assets of New Polar Ontario among its shareholders for the purpose of winding-up its affairs) nor take any action or omit to take any action (and will not permit Callco or any of its Affiliates to take any action or omit to take any action) that is designed to result in the liquidation, dissolution, or winding-up of New Polar Ontario or any other distribution of the assets of New Polar Ontario among its shareholders for the purpose of winding-up its affairs. |

The Support Agreement and the Exchangeable Share Provisions provide that, without the prior approval of New Polar Ontario and the holders of the Class A Exchangeable Shares as described above under “- Amendment and Approval of Class A Exchangeable Shares”, Polar will not issue or distribute additional Polar Shares, securities exchangeable for or convertible into or carrying the rights to acquire Polar Shares or rights, options or warrants to subscribe therefore, or other assets to all or substantially all of the holders of Polar Shares, nor change Polar Shares, unless the same or an economically equivalent distribution of or change to the Class A Exchangeable Shares (or in the rights of the holders thereof) is made simultaneously.

The New Polar Ontario board of directors is conclusively empowered to determine, in good faith and in its sole discretion, whether any corresponding distribution of or change to the Class A Exchangeable Shares is the same as or economically equivalent to any proposed distribution of or change to Polar Shares. In the event of any proposed tender offer, share exchange offer, issuer bid, take-over bid or similar transaction with respect to and in connection with which the Class A Exchangeable Shares are not redeemed by New Polar Ontario or purchased by Callco pursuant to the Redemption Call Right, the Polar will use reasonable efforts to take all actions necessary or desirable to enable holders of Class A Exchangeable Shares to participate in such transaction to the same extent and on an economically equivalent basis as the holders of Polar Shares.

New Polar Ontario is required to notify Polar and Callco of the occurrence of certain events, such as the liquidation, dissolution or winding-up of New Polar Ontario, and New Polar Ontario’s receipt of a Retraction Request from a holder of Class A Exchangeable Shares.

Under the Support Agreement, Polar has agreed not to exercise any voting rights attached to the Class A Exchangeable Shares owned by it or any of its Affiliates, including Callco, on any matter considered at meetings of holders of Class A Exchangeable Shares. In addition, Polar has undertaken to waive, and cause its Affiliates to waive, any dividends declared on the Class A Exchangeable Shares which might be payable to Polar and its Affiliates.

With the exception of administrative changes for the purpose of adding covenants which are not prejudicial to the holders of Class A Exchangeable Shares, making certain necessary amendments or curing ambiguities or clerical errors (in each case, provided that the board of directors of each of Polar, New Polar Ontario and Callco are of the opinion that such amendments are not prejudicial to the rights or interests of the holders of Class A Exchangeable Shares), the Support Agreement may not be amended without the approval of the holders of Class A Exchangeable Shares as set forth above under “- Amendment and Approval of Class A Exchangeable Shares”.

Retraction, Redemption, Call Rights and Purchase for Cancellation of Class B Exchangeable Shares

Retraction of Class B Exchangeable Shares

Subject to the exercise by Callco of its Retraction Call Right, holders of Class B Exchangeable Shares are entitled at any time following the Effective Time to retract (i.e., require New Polar Ontario to redeem) any or all of the Class B Exchangeable Shares held by such holder for an amount per share equal to the Class B Retraction Price. Holders of Class B Exchangeable Shares may effect such retraction by presenting a certificate or certificates to New Polar Ontario or to the Transfer Agent representing the number of Class B Exchangeable Shares the holder desires to retract together with a duly executed Retraction Request indicating the number of Class B Exchangeable Shares the holder desires to retract and the Retraction Date upon which the holder desires to receive the Class B Retraction Price, and such other documents as may be required to effect the retraction of the Retracted Shares. The retraction of Retracted Shares shall not affect the obligation of New Polar Ontario to pay dividends declared on the Retracted Shares prior to the date of their retraction.

When a holder requests New Polar Ontario to redeem Retracted Shares, Callco will have an overriding Retraction Call Right to purchase on the Retraction Date all, but not less than all, of the Retracted Shares, at a purchase price per share equal to the Class A Retraction Price plus, on the designated payment date therefor, to the extent not paid by New Polar Ontario, the applicable dividend amount, if any. To the extent that Callco pays the applicable dividend amount, if any, in respect of the Retracted Shares, New Polar Ontario shall no longer be obligated to pay any declared and unpaid dividends on such Retracted Shares. Upon receipt of a Retraction Request, New Polar Ontario will immediately notify Callco. Callco must then advise New Polar Ontario within five Business Days as to whether the Retraction Call Right will be exercised. If Callco does not so advise New Polar Ontario, New Polar Ontario will notify the holder as soon as possible thereafter that Callco will not exercise the Retraction Call Right. If Callco advises New Polar Ontario that Callco will exercise the Retraction Call Right within such five Business Day period, then, provided the Retraction Request is not revoked by the holder as described below, the Retraction Request shall thereupon be considered only to be an offer by the holder to sell the Retracted Shares to Callco in accordance with the Retraction Call Right.

A holder may revoke its Retraction Request, in writing, at any time prior to the close of business on the Business Day immediately preceding the Retraction Date, in which case the Retracted Shares will neither be purchased by Callco nor be redeemed by New Polar Ontario. If the holder does not revoke its Retraction Request, then on the Retraction Date the Retracted Shares will be purchased by Callco or redeemed by New Polar Ontario, as the case may be, in each case as set out above.

New Polar Ontario or Callco, as the case may be, will deliver or cause the Transfer Agent to deliver (i) certificates, representing the aggregate number of Polar Preferred Shares equal to which the holder is entitled, registered in the name of the holder or in such other name as the holder may request, and (ii) if applicable, a check for the aggregate applicable dividend amount, if any to the holder at the address recorded in the securities register or at the address specified in the holder’s Retraction Request or by holding the same for pick up by the holder at the registered office of New Polar Ontario or the office of the Transfer Agent as specified by New Polar Ontario, in each case less any amounts withheld on account of tax required to be deducted and withheld therefrom.

Pursuant to the terms of the Exchangeable Share Provisions, the Retraction Date will be between 15 to 20 Business Days after the Retraction Request is received. During this time, the market price of Polar Preferred Shares may increase or decrease. Any such increase or decrease would affect the value of Polar Preferred Shares to be received by the holder on the Retraction Date.

If, as a result of solvency requirements, as set out in the Support Agreement or applicable law, New Polar Ontario is not permitted to redeem all Retracted Shares tendered by a retracting holder, and provided Callco has not exercised its Retraction Call Right with respect to such Retracted Shares, New Polar Ontario will redeem only those Retracted Shares tendered by the holder as would not be contrary to such provisions or applicable law and Callco, on behalf of the holder of any Retracted Shares not so redeemed by New Polar Ontario, will exercise the Exchange Right and will require Polar to purchase such Retracted Shares on the Retraction Date pursuant to the exercise of the Exchange Right.

Redemption of Class B Exchangeable Shares

Subject to applicable law and the exercise by Callco of the Redemption Call Right, on the Redemption Date, New Polar Ontario will redeem all, but not less than all, of the then outstanding Class B Exchangeable Shares for an amount per share equal to the Class B Redemption Price plus, on the designated payment date thereof, all declared and unpaid dividends on each Class B Exchangeable Share held by a holder on any dividend record date which occurred prior to the Redemption Date. The Redemption Date will be established by the board of directors of New Polar Ontario in the circumstances described below under “- Redemption”. New Polar Ontario will, at least 60 days prior to the Redemption Date, or such number of days as the board of directors of New Polar Ontario may determine to be reasonably practicable under the circumstances in respect of a Redemption Date arising in connection with a Polar Control Transaction, provide the registered holders of Class B Exchangeable Shares with written notice of the proposed redemption of the Class B Exchangeable Shares by New Polar Ontario or the purchase of the Class B Exchangeable Shares by Callco pursuant to the Redemption Call Right described below.

On or after the Redemption Date and provided Callco has not exercised its Redemption Call Right, upon the holder’s presentation and surrender of the certificates representing the Class B Exchangeable Shares and such other documents as may be required at the office of the Transfer Agent or the registered office of New Polar Ontario, New Polar Ontario will deliver the Class B Redemption Price plus the aggregate amount of any declared and unpaid dividends to such holder by mailing certificates, representing the aggregate number of Polar Preferred Shares to which the holder is entitled, registered in the name of the holder or such other name as the holder may request and, if applicable, a check for the aggregate amount of such declared and unpaid dividends to the holder at the address of the holder recorded in the securities register or by holding the same for pick up by the holder at the registered office of New Polar Ontario or the office of the Transfer Agent as specified in the written notice of redemption, in each case, less any amounts withheld on account of tax required to be deducted and withheld therefrom.

Callco will have an overriding Redemption Call Right to purchase on the Redemption Date all, but not less than all, of the Class B Exchangeable Shares then outstanding (other than Class B Exchangeable Shares held by Polar and its Affiliates) for an amount per share equal to the Class B Redemption Price plus all declared and unpaid dividends, if any. Upon the exercise of the Redemption Call Right, holders will be obligated to sell their Class B Exchangeable Shares to Callco. If Callco exercises the Redemption Call Right, New Polar Ontario’s right and obligation to pay any declared and unpaid dividends in respect of the Class B Exchangeable Shares so purchased by Callco will be fully satisfied by the payment by Callco of such amount.

Redemption

In certain circumstances, New Polar Ontario has the right to require a redemption of the Class B Exchangeable Shares. An early redemption may occur upon (i) there being fewer than 10% of the initial number of Class B Exchangeable Shares outstanding on the Effective Date still outstanding (other than Class B Exchangeable Shares held by Polar and its Affiliates and subject to certain “anti-dilution” adjustments described in the Exchangeable Share Provisions); or (ii) the occurrence of a Polar Control Transaction.

A Polar Control Transaction means any merger, amalgamation, tender offer, material sale of shares or rights or interests therein or thereto or similar transactions involving Polar, or any proposal to do so. If a Polar Control Transaction occurs, provided that the board of directors of New Polar Ontario determines, in good faith and in its sole discretion, that it is not reasonably practicable to substantially replicate the terms and conditions of the Class B Exchangeable Shares in connection with such Polar Control Transaction and that the redemption of all, but not less than all, of the outstanding Class B Exchangeable Shares is necessary to enable the completion of such Polar Control Transaction in accordance with its terms, the board of directors of New Polar Ontario may fix the Redemption Date to such date as the board of directors of New Polar Ontario may determine, upon such number of days prior written notice to the registered holders of Class B Exchangeable Shares as the board of directors of New Polar Ontario may determine to be reasonably practicable in such circumstances.

Purchase for Cancellation

Subject to applicable law, New Polar Ontario may at any time and from time to time purchase for cancellation all or any part of the outstanding Class B Exchangeable Shares at any price by tender to all the holders of record of Class B Exchangeable Shares then outstanding or through the facilities of any stock exchange on which the Class B Exchangeable Shares are listed or quoted at any price per share.

Voting, Dividend and Liquidation Rights of Holders of Class B Exchangeable Shares and Withholding Rights

Voting Rights with Respect to New Polar Ontario

Except as required by law, the Support Agreement, the Exchange Trust Agreement and by Article VI.10 of the Exchangeable Share Provisions, the holders of Class B Exchangeable Shares are not entitled as such to receive notice of or attend any meeting of shareholders of New Polar Ontario or to vote at any such meeting (see “- Amendment and Approval of Class B Exchangeable Shares” below).

Dividend Rights

Holders of Class B Exchangeable Shares are entitled to receive, subject to applicable law, dividends: (i) in the case of a cash dividend declared on Polar Preferred Shares, in an amount in cash for each Class B Exchangeable Share corresponding to the cash dividend declared on each Polar Preferred Share; (ii) in the case of a stock dividend declared on Polar Preferred Shares to be paid in Polar Preferred Shares, in such number of Class B Exchangeable Shares for each Class B Exchangeable Share as is equal to the number of Polar Preferred Shares to be paid on each Polar Preferred Share; or (iii) in the case of a dividend declared on Polar Preferred Shares in property other than cash or Polar Preferred Shares, in such type and amount of property as is the same as, or economically equivalent to (as determined by New Polar Ontario’s board of directors, in good faith and in its sole discretion) the type and amount of property declared as a dividend on each Polar Preferred Share. Cash dividends on the Class B Exchangeable Shares are payable in U.S. dollars or the Canadian dollar equivalent thereof, at the option of New Polar Ontario. The declaration date, record date and payment date for dividends on the Class B Exchangeable Shares will be the same as the relevant dates for the corresponding dividends on Polar Preferred Shares.

Liquidation Rights with Respect to New Polar Ontario

In the event of the liquidation, dissolution or winding-up of New Polar Ontario or any other proposed distribution of the assets of New Polar Ontario among its shareholders for the purpose of winding-up its affairs, each holder of Class B Exchangeable Shares will have, subject to applicable law, preferential rights to receive from New Polar Ontario for each Class B Exchangeable Share held by such holder the New Polar Ontario Liquidation Amount plus the amount of all declared and unpaid dividends on each such Class B Exchangeable Share held by such holder on any dividend record date which occurred prior to the Liquidation Date. Upon the occurrence of such liquidation, dissolution or winding-up, Callco will have an overriding Liquidation Call Right to purchase all of the outstanding Class B Exchangeable Shares (other than Class B Exchangeable Shares held by Polar or its Affiliates) from the holders thereof on the Liquidation Date for an amount per share equal to the New Polar Ontario Liquidation Amount plus any applicable dividend amount. In the event that Callco exercises its Liquidation Call Right and pays the applicable dividend amount, if any, the right of the holder of the Class B Exchangeable Shares so purchased to receive declared and unpaid dividends from New Polar Ontario shall be fully satisfied and discharged.

Upon the occurrence and during the continuance of an Insolvency Event, a holder of Class B Exchangeable Shares are entitled to instruct Callco to exercise the Exchange Right with respect to any or all of the Class B Exchangeable Shares held by such holder, thereby requiring Polar to purchase such Class B Exchangeable Shares from the holder. As soon as practicable following the occurrence of an Insolvency Event or any event which may, with the passage of time and/or the giving of notice, become an Insolvency Event, New Polar Ontario and Polar will give written notice thereof to Callco. As soon as practicable thereafter, Callco will notify each holder of Class B Exchangeable Shares of such event or potential event and will advise the holder of its rights with respect to the Exchange Right. The purchase price payable by Polar for each Class B Exchangeable Share purchased under the Exchange Right will be satisfied by the issuance of one Polar Preferred Share plus, to the extent not paid by New Polar Ontario on the designated payment date thereof, the amount of all declared and unpaid dividends on each such Class B Exchangeable Share held by such holder on any dividend record date which occurred prior to the closing of such purchase and, upon receipt of such amount, the holder shall no longer be entitled to receive any declared and unpaid dividends from New Polar Ontario.

Liquidation Rights with Respect to Polar

In order for the holders of Class B Exchangeable Shares to participate on a pro rata basis with the holders of Polar Preferred Shares, on the third Business Day prior to the effective date of a Polar Liquidation Event, each Class B Exchangeable Share will, pursuant to the Automatic Exchange Right, automatically be exchanged for an equivalent number of Polar Preferred Shares plus, to the extent not paid by New Polar Ontario on the designated payment date thereof, the amount of all declared and unpaid dividends on each such Class B Exchangeable Share held by such holder on any dividend record date which occurred prior to the date of such exchange and, upon receipt of the amount of such declared and unpaid dividends, the right of the holder of Class B Exchangeable Shares to receive declared and unpaid dividends from New Polar Ontario shall be fully satisfied and discharged. Upon a holder’s request and surrender of Class B Exchangeable Share certificates, duly endorsed in blank and accompanied by such instruments of transfer as Polar may reasonably require, Polar will deliver to such holder certificates representing an equivalent number of Polar Preferred Shares, plus a check for the amount of such dividends, if any, for the Class B Exchangeable Shares exchanged by such holder pursuant to the Automatic Exchange Right. For a description of certain Polar obligations with respect to the dividend and liquidation rights of the holders of Class B Exchangeable Shares, see “- Support Agreement”.

Withholding Rights

Polar, New Polar Ontario and the Transfer Agent are entitled to deduct and withhold from any dividends or consideration otherwise payable to any holder of Class B Exchangeable Shares or Polar Preferred Shares such amounts as Polar, New Polar Ontario or the Transfer Agent are required or permitted to deduct and withhold with respect to such payment under the Tax Act or any provision of provincial, state, local or foreign tax law.

Any amounts so withheld will be treated for all purposes as having been paid to the holder of the shares in respect of which such deduction and withholding was made, provided that such withheld amounts are actually remitted to the appropriate taxing authority. To the extent that the amount so required or permitted to be deducted or withheld from any payment to a holder exceeds the cash portion of the amount otherwise payable to the holder, Polar, New Polar Ontario and the Transfer Agent may sell or otherwise dispose of such portion of the consideration as is necessary to provide sufficient funds to Polar, New Polar Ontario or the Transfer Agent, as the case may be, to enable it to comply with such deduction or withholding requirement. Polar, New Polar Ontario or the Transfer Agent must notify the holder of any such sale and remit to such holder any unapplied balance of the net proceeds of such sale.

Ranking of Class B Exchangeable Shares

The Class B Exchangeable Shares are entitled to a preference over the common shares and any other shares of New Polar Ontario ranking junior to the Class B Exchangeable Shares with respect to the payment of dividends and the distribution of assets in the event of a liquidation, dissolution or winding-up of New Polar Ontario, whether voluntary or involuntary, or any other distribution of the assets of New Polar Ontario among its shareholders for the purpose of winding-up its affairs.

Certain Restrictions on the Class B Exchangeable Shares

New Polar Ontario will not without the approval of the holders of Class B Exchangeable Shares as set forth below under “- Amendment and Approval of Class B Exchangeable Shares”:

| | (a) | pay any dividends on the common shares of New Polar Ontario, or any other shares ranking junior to the Class B Exchangeable Shares, other than stock dividends payable in common shares of New Polar Ontario or any such other shares ranking junior to the Class B Exchangeable Shares, as the case may be; |

| | (b) | redeem, purchase or make any capital distribution in respect of the common shares of New Polar Ontario or any other shares ranking junior to the Class B Exchangeable Shares; |

| | (c) | redeem or purchase any other shares of New Polar Ontario ranking equally with the Class B Exchangeable Shares with respect to the payment of dividends or on any other liquidation or distribution; or |

| | (d) | issue any Class B Exchangeable Shares or any other shares of New Polar Ontario ranking equally with, or superior to, the Class B Exchangeable Shares other than by way of stock dividends to the holders of such Class B Exchangeable Shares. |

The restrictions in paragraphs (a), (b), (c) and (d) above will not apply at any time when the dividends on the outstanding Class B Exchangeable Shares corresponding to dividends declared and paid on Polar Preferred Shares have been declared and paid in full.

Amendment and Approval of Class B Exchangeable Shares

The rights, privileges, restrictions and conditions attaching to the Class B Exchangeable Shares may be added to, changed or removed only with the approval of the holders thereof together with such other approvals as would be required under the OBCA. Any such approval or any other approval or consent to be given by the holders of Class B Exchangeable Shares will be deemed to have been sufficiently given in accordance with applicable law subject to a minimum requirement that such approval or consent be evidenced by a resolution passed by not less than two-thirds of the votes cast on such resolution at a meeting of the holders of Class B Exchangeable Shares duly called and held at which holders of at least 25% of the outstanding Class B Exchangeable Shares are present or represented by proxy. In the event that no such quorum is present at such meeting within one-half hour after the time appointed therefor, then the meeting will be adjourned to such place and time (not less than 5 days later) as may be designated by the Chairman of such meeting. At such adjourned meeting, the holders of Class B Exchangeable Shares present or represented by proxy may transact the business for which the meeting was originally called and a resolution passed thereat by the affirmative vote of not less than two-thirds of the votes cast on such resolution will constitute the approval or consent of the holders of Class B Exchangeable Shares.

Support Agreement

Pursuant to the Support Agreement, Polar has made the following covenants in favour of New Polar Ontario and Callco for so long as any Class B Exchangeable Shares (other than Class B Exchangeable Shares owned by Polar or its Affiliates) remain outstanding:

| | (a) | Polar will not declare or pay dividends on Polar Preferred Shares unless New Polar Ontario is able to declare and pay and simultaneously declares and pays, as the case may be, an equivalent dividend on the Class B Exchangeable Shares; |

| | (b) | Polar will advise New Polar Ontario in advance of the declaration of any dividend on Polar Preferred Shares and ensure that the declaration date, record date and payment date for dividends on the Class B Exchangeable Shares are the same as that for the corresponding dividend on Polar Preferred Shares; |

| | (c) | Polar will ensure that the record date for any dividend declared on Polar Preferred Shares is not less than ten Business Days after the declaration date of such dividend: |

| | (d) | Polar will take all actions and do all things reasonably necessary or desirable to enable and permit New Polar Ontario, in accordance with applicable law, to pay and otherwise perform its obligations with respect to the satisfaction of the applicable New Polar Ontario Liquidation Amount, Class B Redemption Price or Class B Retraction Price in the event of a liquidation, dissolution or winding-up of New Polar Ontario, a Retraction Request by a holder of Class B Exchangeable Shares or a redemption of Class B Exchangeable Shares by New Polar Ontario, as the case may be; |

| | (e) | Polar will take all actions and do all things reasonably necessary or desirable to enable and permit Callco, in accordance with applicable law, to perform its obligations arising upon the exercise by it of the Call Rights, including the delivery of Polar Preferred Shares in accordance with the provisions of the applicable Call Right; and |

| | (f) | Polar will not (and will ensure that Callco and its Affiliates do not) exercise its vote as a shareholder of New Polar Ontario to initiate the voluntary liquidation, dissolution or winding-up of New Polar Ontario (or any other distribution of the assets of New Polar Ontario among its shareholders for the purpose of winding-up its affairs) nor take any action or omit to take any action (and will not permit Callco or any of its Affiliates to take any action or omit to take any action) that is designed to result in the liquidation, dissolution, or winding-up of New Polar Ontario or any other distribution of the assets of New Polar Ontario among its shareholders for the purpose of winding-up its affairs. |

The Support Agreement and the Exchangeable Share Provisions provide that, without the prior approval of New Polar Ontario and the holders of the Class B Exchangeable Shares as described above under “- Amendment and Approval of Class B Exchangeable Shares”, Polar will not issue or distribute additional Polar Preferred Shares, securities exchangeable for or convertible into or carrying the rights to acquire Polar Preferred Shares or rights, options or warrants to subscribe therefore, or other assets to all or substantially all of the holders of Polar Preferred Shares, nor change Polar Preferred Shares, unless the same or an economically equivalent distribution of or change to the Class B Exchangeable Shares (or in the rights of the holders thereof) is made simultaneously.